Cytonn Monthly - July 2019

By Cytonn Research Team, Aug 4, 2019

Executive Summary

Fixed Income

During the month of July, T-bill auctions recorded an oversubscription, with the overall rate coming in at 134.8%, compared to 137.0% recorded in June 2019. The subscription rates for the 91-day and 182-day came in at 131.1% and 64.0%, higher than the 86.4% and 33.0% recorded in June, respectively, while the 364-day came in at 207.0%, lower than the 371.3% recorded in the previous month. The yields on the 91-day and 182-day both declined by 0.1% points to 6.6% and 7.4%, respectively, from 6.7% and 7.5% in June, respectively, while the yield on the 364-day paper increased by 0.2% points to 9.0% from 8.8% in June. The Monetary Policy Committee (MPC) met on 24th July to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the prevailing monetary policy stance leaving the Central Bank Rate (CBR) unchanged at 9.0, which was in line with our expectations. The y/y inflation for the month of July rose to 6.3%, from 5.7% recorded in June, in line with our projections of a rise to 6.2%-6.6%, mainly due to the base effect;

Equities

During the month of July, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 0.9%, 0.2%, and 0.1%, respectively, taking their YTD performance to gains/(losses) of 6.5%, (7.3%), and 0.9%, respectively. During the week, Equity Group Holdings released their H1’2019 financial results, recording a 9.1% increase in core earnings per share to Kshs 3.2, from Kshs 2.6 in H1’2018;

Private Equity

During the month of July, there was private equity activity in the financial services sector, fundraising and education sector, with (i) Interswitch, a Nigeria-based payments firm that is owned 60.0% by Helios Investment Partners, announcing that it has hired advisors, including JPMorgan Chase & Co., Citigroup Inc. and Standard Bank Group Ltd to resurrect plans for a stock-market listing in London and Lagos later this year, (ii) Investment firm, Centum, through its real estate arm Centum Real Estate, signing a refinancing deal with Nedbank Corporate and Investment Bank (CIB), the Nedbank property finance division, and (iii) Investisseurs & Partenaires (I&P), a Sub-Saharan impact investing firm based in Paris, France, announcing plans to invest EUR 70.0 mn (Kshs 8.1 bn) in Africa’s education sector with the aim of addressing the challenges of access, equity, quality and adequacy of education in Africa;

Real Estate

During the month of July, four real estate sector reports were released, namely; (i) Quarterly Gross Domestic Product Report Q1'2019 by Kenya National Bureau of Statistics (KNBS), (ii) Status of the Built Environment Jan - Jun 2019 by Architectural Association of Kenya (AAK), (iii) Hass Consult Property Sales and Rental Index Q2’2019, and (iv) Hass Consult Land Price Index Q2'2019. In the residential sector, Indian development firm, Shapoorji Pallonji Real Estate (SPRE) and UK private equity investor-developer Actis, announced their plans to begin development of a 624-units, middle-class, residential development on a 4.5-acre parcel of land at the Garden City mixed-use development. In the retail sector, fast-food chain Big Square, and supermarkets, Naivas & Game Stores, opened retail outlets in Mountain View, Ongata Rongai and Kisumu, respectively;

- Ian Kagiri, Investment Analyst was interviewed at CNBC on Nairobi Securities Exchange turnover drop. Watch Ian here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- Cytonn Money Market Fund closed the week at an average yield of 11.0% p.a. To subscribe, just dial *809#

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

T-bills & T-bonds Primary Auction

During the month of July, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 134.8%, a rise from 131.7% recorded in the month of June 2019. The subscription rates for the 91-day and 182-day came in at 131.1%, and 64.0%, higher than the 86.4% and 33.0% registered in June, respectively, while the 364-day came in at 207.0%, lower than the 317.3% registered in the previous month. The yields on the 91-day and 182-day both declined by 0.1% points to 6.6% and 7.4%, respectively, from 6.7% and 7.5% in June, respectively, while the yield on the 364-day paper increased by 0.2% points to 9.0% from 8.8% in June. The T-bills acceptance rate came in at 95.6% during the month, compared to 99.3% recorded in June, with the government accepting a total of Kshs 123.6 bn of the Kshs 129.4 bn worth of bids received. The Central Bank remained disciplined in rejecting expensive bids in order to ensure stability of interest rates.

During the week, T-bills recorded an oversubscription, with the subscription rate coming in at 113.5%, up from 108.4% the previous week. The oversubscription is partly attributable to favorable liquidity in the money market during the week supported by government payments. The yield on the 91-day and 364-day papers increased by 0.1% points and 0.2% points, respectively, to 6.6% and 9.0% from 6.5% and 8.8% recorded the previous week, respectively, while the 182-day paper remained unchanged at 7.4%. The acceptance rate declined to 89.1% from 96.1%, recorded the previous week, with the government accepting Kshs 24.3 bn of the Kshs 27.2 bn bids received.

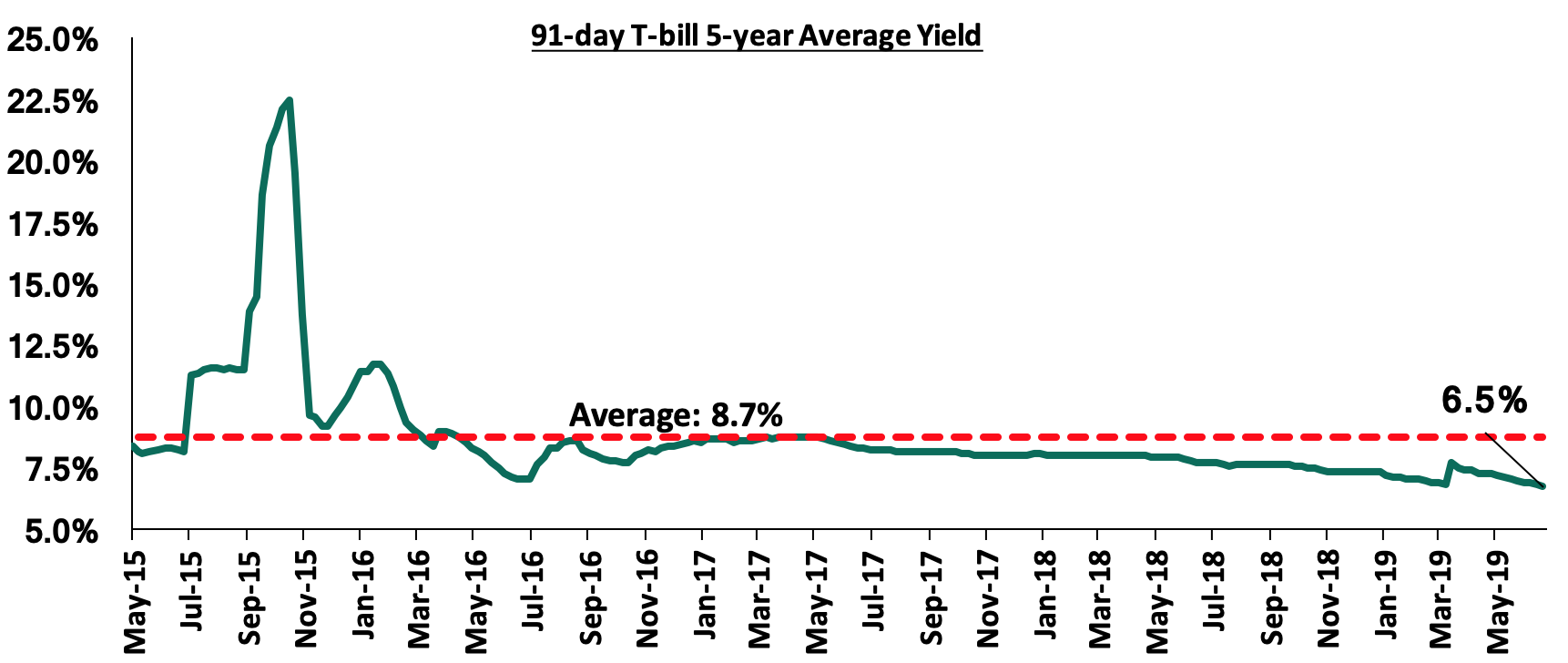

The 91-day T-bill is currently trading at a yield of 6.6%, which is below its 5-year average of 8.7%. The lower yield on the 91-day paper is mainly attributable to the low-interest-rate environment that has persisted since the passing of the law capping interest rates. We expect this to continue in the short-term given:

- The discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above the market, for both T-bills and T-bonds, and,

- The maintaining of the Central Bank Rate (CBR) at 9.0% by the Monetary Policy Committee in their July 2019 meeting.

During the month of July, the government issued a 15-year tenor bond with issue number FXD 3/2019/15. The issue was oversubscribed with the performance rate coming in at 216.7%. The bond generated total bids of Kshs 86.6 bn, with the accepted yield coming in at 12.3%, and the government accepting Kshs 50.6 bn, an acceptance rate of 58.4%.

For the month of August, the government is set to issue a 10-year bond (FXD 3/2019/10) and re-open a 20-year bond (FXD 1/2019/20) for a total of Kshs 50.0 bn for budgetary support. The government has adopted an approach of a blended issue of a medium-tenor and long-tenor bond, in a bid to plug in the budget deficit while at the same time trying to reduce the maturity risk. The market is expected to maintain a bias towards the 10-year bond as per recent trends are mainly driven by the perception that risks may not be adequately priced on the longer end of the yield curve, which is relatively flat due to saturation of long-term bonds. We will give our bidding range in next week’s report.

In the money markets, 3-month bank placements ended the week at 8.8% (based on what we have been offered by various banks), 91-day T-bill at 6.5%, the average of Top 5 Money Market Funds at 10.1%, with Cytonn Money Market closing the week at an average yield of 11.0% per annum.

Secondary Bond Market:

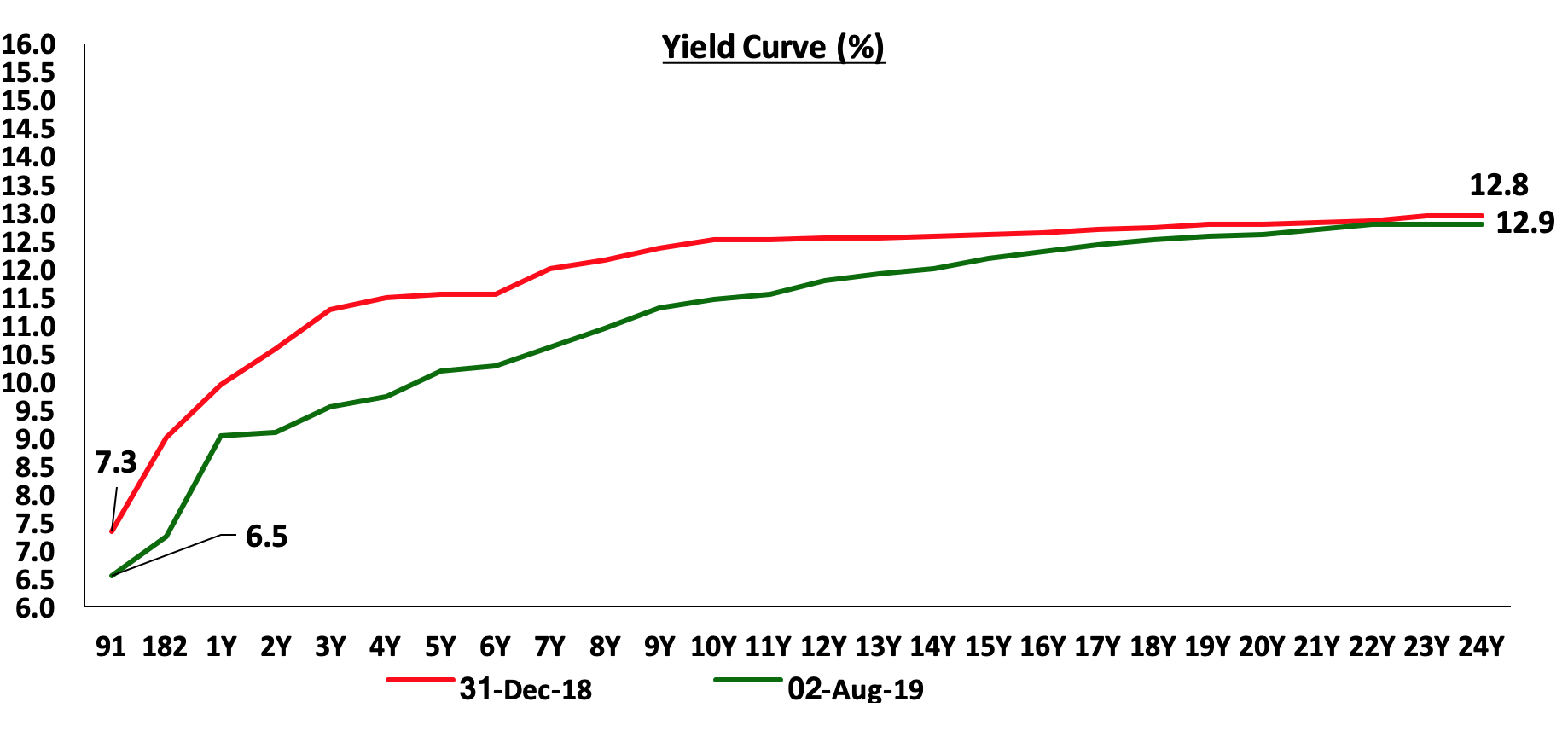

The yields on government securities in the secondary market remained relatively stable during the month of July as the Central Bank of Kenya continued to reject expensive bids in the primary market. On a YTD basis, government securities on the secondary market have gained with yields declining across the board, which has, in turn, led to price appreciation.

Liquidity:

The average interbank rate declined to 2.3% during the month of July, from 3.1% in June, pointing to improved liquidity conditions in the money market supported by government payments, which offset tax payments. During the week, the average interbank rate remained stable at 2.5% from the previous week. The average interbank volumes increased by 2.6% points to Kshs 8.7 bn, from Kshs 8.5 bn recorded the previous week.

Kenya Eurobonds:

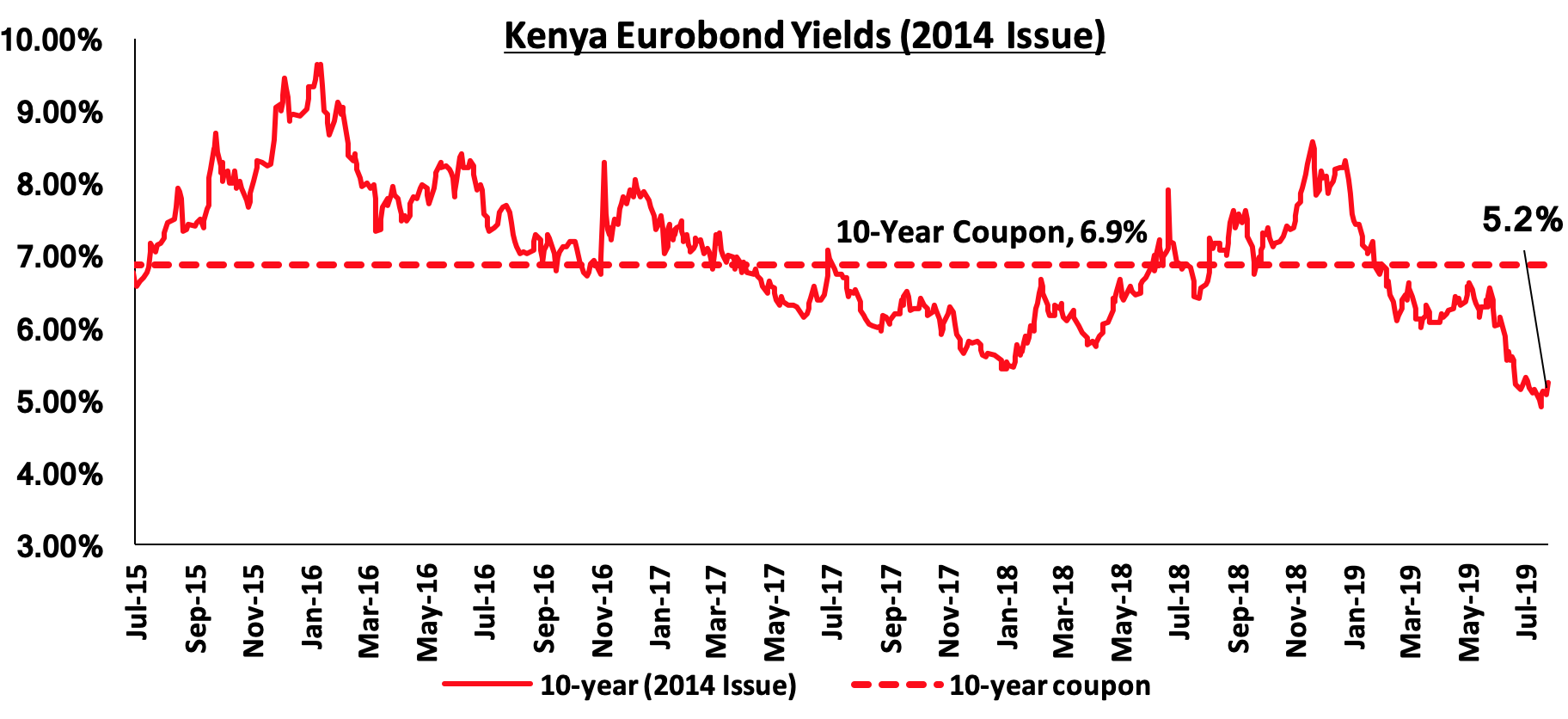

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.8% points to 5.2% in July, from 5.9% in June 2019. The decline is attributable to increased demand for emerging market fixed-income securities in the wake of the pause by the US Fed on its three-year cycle of tightening its monetary policy, having lowered the Fed Rate in July for the 1st time since 2008 to a range of 2.0% - 2.25%, which has made returns from fixed income securities more attractive as highlighted in our H1’2019 SSA Eurobond Performance Note. During the week, the yield on the 10-year Eurobond increased by 0.2% points, to 5.2%, from 5.0% the previous week.

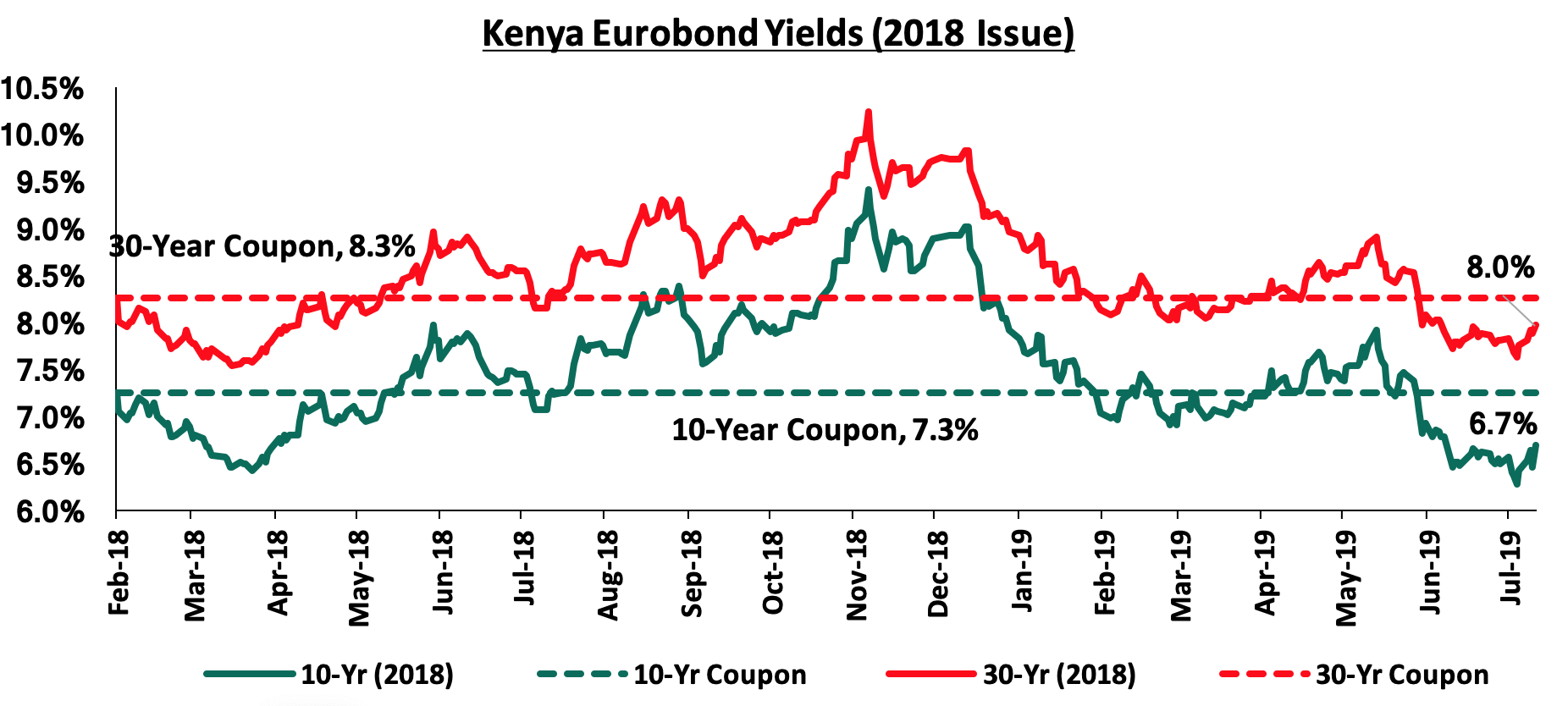

During the month, the yields on the 10-year and 30-year Eurobond issued in February 2018 declined by 0.7% points and 0.5% points to close at 6.5% and 7.8%, from 7.2% and 8.3% in June 2019, respectively. During the week, the yield on the 10-year Eurobond declined by 0.2% points to 5.2%, from 5.0% recorded in the previous week, while those of the 30-year Eurobond rose by 0.1% points to 8.0%, from 7.9% recorded in the previous week.

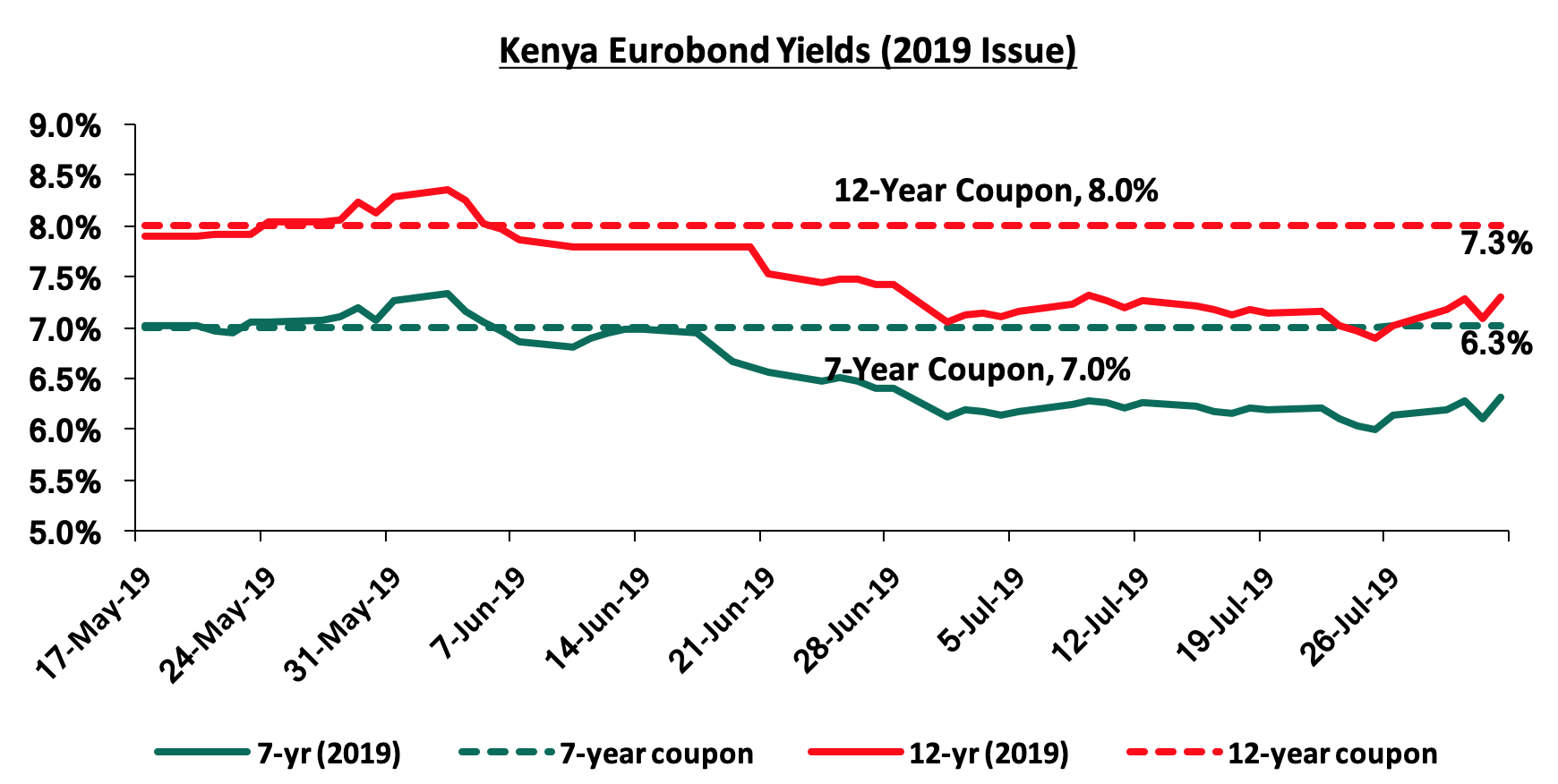

During the month, the yields on the newly issued dual-tranche Euro-bond with 7-years and 12-year tenors declined by 0.6% points and 0.7% points to 6.2% and 7.1%, from 6.8% and 7.8% recorded in June 2019, respectively. During the week, the yields on the 7-year and 12-year Eurobond increased by 0.2% points and 0.3% points to 6.3% and 7.3%, from 6.1% and 7.0% recorded in the previous week, respectively.

Kenya Shilling:

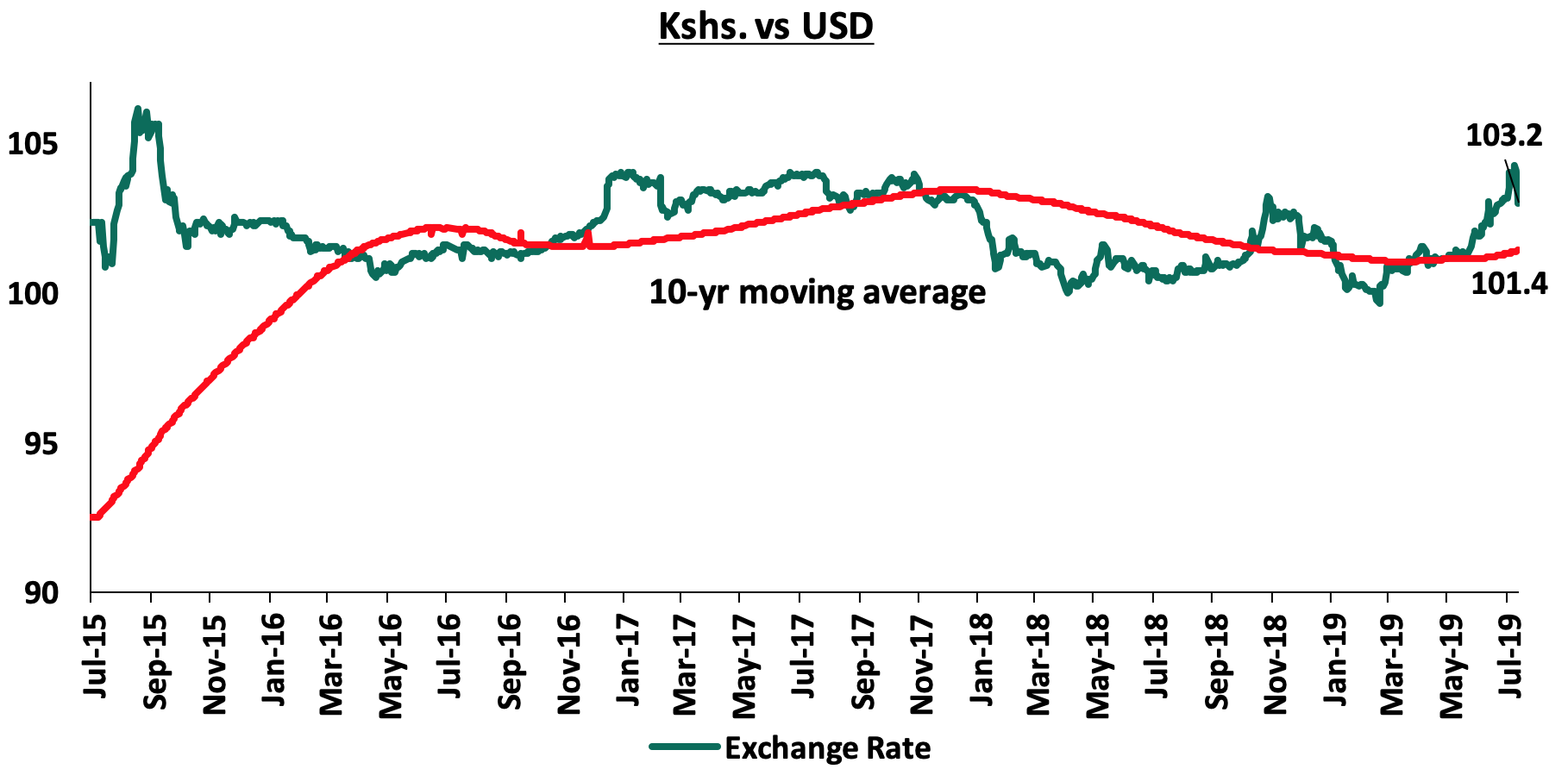

The Kenya Shilling depreciated by 1.4% points against the US Dollar during the month of July to Kshs 103.2, from Kshs 101.7 at the end of June. This was driven by increased dollar-demand from oil and merchandise importers. During the week, the Kenya Shilling appreciated by 0.8% against the US Dollar to close at Kshs 103.0, from Kshs 103.8 in the previous week, supported by inflows from diaspora remittances, which outweighed dollar demand from merchandise importers. The shilling also hit a 3-year low of Kshs 104.2, during the month partly driven by market uncertainty following the announcement that the Treasury Cabinet Secretary would be charged with financial misconduct. On an YTD basis, the shilling has depreciated by 2.4% against the US Dollar in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that the current account deficit narrowed to 4.2% of GDP in 12-months to June 2019, from 5.4% recorded in June 2018. The decline has been attributed to the resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food;

- Improving diaspora remittances, which have increased cumulatively by 13.6% in the 12 months to June 2019 to USD 2.8 bn, from USD 2.4 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.6 bn (equivalent to 6.0 months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Inflation:

The y/y inflation for the month of July rose to 6.3%, from 5.7% recorded in June, in line with our projections of a rise to 6.2%-6.6%, mainly due to the base effect. Month-on-month inflation, however, declined by (0.4%) which was attributable to:

- A 1.0% decline in the food and non-alcoholic drinks’ index, due to a decrease in prices of potatoes, sukuma wiki (kales), tomatoes, cabbages and milk, which decreased by 11.7%, 3.8%, 1.9%, 2.8%, and 0.6%, respectively.

A 0.2% increase was however recorded in the transport index on account of the increase in the pump price of petrol during the same period. There was also a 0.8% increase in the price of cigarettes. Housing, water, electricity, gas and other fuels’ index increased by 0.1% as a result of an increase in prices of electricity with the cost of 50KWh and 200 kWh of electricity increasing by 0.6% and 0.4%, on July 2019, respectively.

|

Major Inflation Changes in the Month of July 2019 |

|||

|

Brand Commodity Group |

Price Change m/m (July-19/Jun-19) |

Price Change y/y (July-19/July-18) |

Reason |

|

Food and Non-Alcoholic Beverages |

(1.0%) |

8.5% |

The m/m decline was due to a decline in prices of potatoes, sukuma wiki (kales), tomatoes, cabbages, and milk. |

|

Alcoholic Beverages, Tobacco and Narcotics |

0.8% |

9.6% |

The m/m increase was due to an increase in the price of cigarettes. |

|

Housing, Water, Electricity, Gas and other Fuels |

0.1% |

4.1% |

The m/m increase is due to an increase in prices of electricity. |

|

Overall Inflation |

(0.4%) |

6.3% |

The m/m decline was due to a 1.0% decrease in the food index which has a CPI weight of 36.0% |

Monetary Policy:

The Monetary Policy Committee (MPC) met on 24th July 2019 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC retained the prevailing monetary policy stance leaving the Central Bank Rate (CBR) unchanged at 9.0%, in line with our expectations citing that inflation expectations remained well anchored within the target range and that the economy was operating close to its potential. As such, the MPC concluded that the current policy stance was still appropriate, but noted that there was a need to remain vigilant on possible spillovers of recent food and fuel prices, the ongoing demonetization, and the increased uncertainties in the external environment.

We expect monetary policy to remain relatively stable in 2019, as the CBK awaits the direction of the discussion on the possible repeal or modification of the interest rate cap, which has weakened the transmission of monetary policy. As per the assessment by the Monetary Policy Committee in 2018, under the interest rate capping environment, monetary policy procedures bring about perverse outcomes. For instance, loosening the monetary policy stance by reducing the CBR in a bid to stimulate credit expansion in the current environment would lead to a lower adjustment in lending rates. As a result, individuals with credit risk above the capped rate would be shunned by banks, resulting in a contraction in private sector credit growth, a counteractive reaction to the intention of the looser monetary policy stance.

The Federal Reserve Bank (Fed) of the U.S through its Federal Open Market Committee (FOMC), has decided to lower its benchmark policy rate to the range of 2.0%-2.25% during its 31 July meeting, from 2.25%-2.50% in its 20 June meeting. The decision was based on expansion of economic activity, strong labor market conditions and inflation. The Fed also highlighted that overall inflation on a 12-month basis for the month ending June 2019 was at 1.6%, which is below the Fed’s target of 2.0%.

Monthly Highlights:

The Kenya National Bureau of Statistics (KNBS) released the Q1’2019 Gross Domestic Product (GDP) report indicating that the country’s economic activity experienced relatively slower growth, expanding by 5.6%, compared to the 6.5% growth recorded in Q1’2018, but in line with the 5-year average growth rate of 5.6%. The table below shows differences in y/y growth of major sectors of the economy, as we seek to look at sectoral performance in Q1’2019:

|

Sector |

Contribution Q1'2018 |

Contribution Q1'2019 |

Q1'2018 Growth |

Q1'2019 Growth |

Weighted Growth Rate Q1' 2018 |

Weighted Growth Rate Q1'2019 |

Variance of Growth (% Points) |

|

Agriculture and Forestry |

26.1% |

26.3% |

7.5% |

5.3% |

2.0% |

1.4% |

(2.2%) |

|

Taxes on Products |

10.3% |

10.2% |

5.7% |

5.3% |

0.6% |

0.5% |

(0.4%) |

|

Manufacturing |

9.9% |

9.7% |

3.8% |

3.2% |

0.4% |

0.3% |

(0.6%) |

|

Real Estate |

8.2% |

8.1% |

5.3% |

4.2% |

0.4% |

0.3% |

(1.1%) |

|

Wholesale and Retail Trade |

6.8% |

6.7% |

5.9% |

5.3% |

0.4% |

0.4% |

(0.6%) |

|

Education |

6.8% |

6.7% |

4.9% |

5.4% |

0.3% |

0.4% |

0.4% |

|

Transport and Storage |

6.1% |

6.2% |

8.5% |

6.7% |

0.5% |

0.4% |

(1.8%) |

|

Financial & Insurance |

5.9% |

5.9% |

5.2% |

5.0% |

0.3% |

0.3% |

(0.2%) |

|

Construction |

5.0% |

5.0% |

6.6% |

5.6% |

0.3% |

0.3% |

(1.0%) |

|

Information and Communication |

4.0% |

4.2% |

12.5% |

10.5% |

0.5% |

0.4% |

(2.1%) |

|

Public Administration |

3.6% |

3.6% |

6.2% |

6.5% |

0.2% |

0.2% |

0.3% |

|

Electricity and Water Supply |

2.5% |

2.5% |

6.5% |

6.1% |

0.2% |

0.2% |

(0.5%) |

|

Professional Administration |

2.1% |

2.0% |

4.0% |

4.8% |

0.1% |

0.1% |

0.8% |

|

Health |

1.5% |

1.5% |

4.6% |

4.0% |

0.1% |

0.1% |

(0.6%) |

|

Accommodation & Food Services |

1.4% |

1.5% |

13.1% |

10.1% |

0.2% |

0.1% |

(3.0%) |

|

Other Services |

1.2% |

1.2% |

4.2% |

3.2% |

0.1% |

0.0% |

(1.1%) |

|

Mining and Quarrying |

1.1% |

1.1% |

2.4% |

2.2% |

0.0% |

0.0% |

(0.2%) |

|

Financial Services Indirectly Measured |

(2.4%) |

(2.3%) |

0.2% |

(3.5%) |

(0.0%) |

0.1% |

(3.7%) |

|

GDP at Market Prices |

100.0% |

100.0% |

6.5% |

5.6% |

6.5% |

5.6% |

(1.0%) |

We expect the 2019 GDP growth to slow down to a range of 5.7% - 5.9% from 6.3% in 2018, due to the delayed long rains with most parts of the country expected to experience depressed rainfall that is set to lead to a decline in agricultural production. Consequently, this will have an adverse effect on the manufacturing sector, as the major growth driver in the sector is agro-processing. For a more comprehensive analysis, see the Q1’2019 Quarterly GDP Review and Outlook Note.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’ 2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rate environment as additional borrowing for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Markets

During the month of July, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 0.9%, 0.2%, and 0.1%, respectively. The decline recorded in NASI was driven by declines in large-cap stocks such as NIC Group, Diamond Trust Bank, and Safaricom, whose declines of 5.7%, 2.6%, and 2.1%, respectively, outweighed the gains made by KCB Group, BAT, Equity Group Holdings and EABL of 4.6%, 3.0%, 2.7%, and 2.5%, respectively. For this week, the market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by 0.4%, 2.5%, and 0.7%, respectively, taking their YTD performance to gains/(losses) of 5.6%, (8.7%) and 0.9%, respectively. The decline in NASI was largely due to losses recorded in large-cap counters such as Bamburi and NIC Group, which recorded losses of 7.2% and 1.7%, respectively.

Equities turnover increased by 4.6% during the month to USD 108.3 mn, from USD 103.6 mn in June 2019. Foreign investors remained net sellers for the month, with a net selling position of USD 20.6 mn, a 133.3% increase from June’s net selling position of USD 8.8 mn. For this week, equities turnover decreased by 8.9% to USD 21.3 mn, from USD 23.4 mn the previous week, bringing the year to date (YTD) turnover to USD 882.8 mn. Foreign investors were net buyers for the week, with a net buying position of USD 2.1 mn, as compared to last week’s net selling position of USD 4.3 mn.

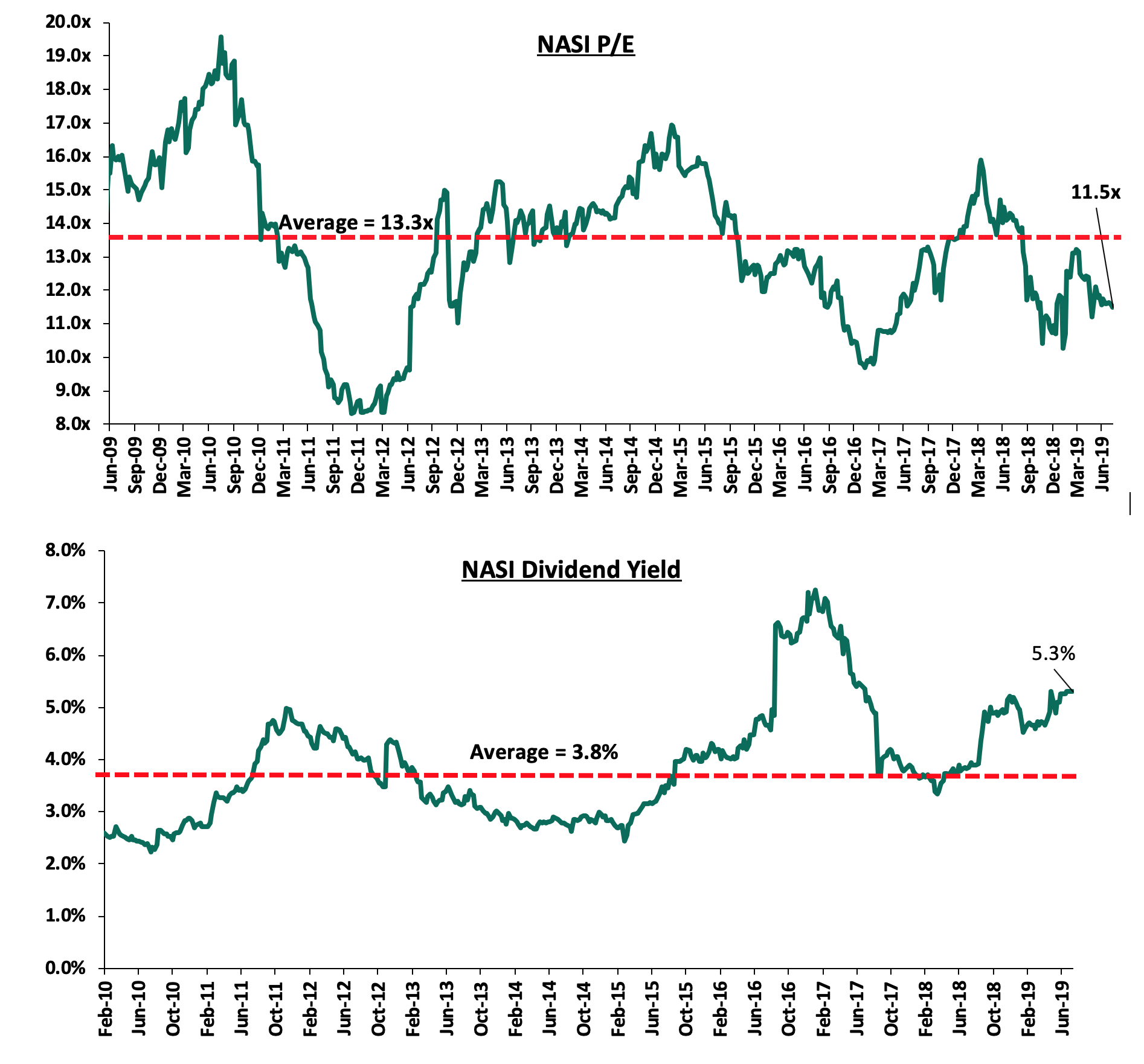

The market is currently trading at a price to earnings ratio (P/E) of 11.5x, 13.5% below the historical average of 13.3x, and a dividend yield of 5.3%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.5x is 18.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 38.6% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Earnings Releases

Equity Group Holdings released their H1’2019 financial results, recording a 9.1% increase in core earnings per share to Kshs 3.2 from Kshs 2.6 in H1’2018, faster than our projections of a 7.3% increase to Kshs 3.1. The performance was driven by a 14.8% increase in total operating income, despite the 19.4% increase in total operating expenses. The variance in core earnings per share growth against our expectations was largely due to the faster 14.8% growth in total operating income to Kshs 37.6 bn from Kshs 32.8 bn in H1’2018, which outpaced our expectation of an 8.4% increase to Kshs 35.5 bn. Highlights of the performance from H1’2018 to H1’2019 include:

- Total operating income recorded a 14.8% increase to Kshs 37.6 bn, from Kshs 32.8 bn in H1’2018. This was driven by a 25.6% growth in Non-Funded Income (NFI) to Kshs 16.5 bn, from Kshs 13.2 bn in H1’2018, coupled with a 7.6% growth in Net Interest Income to Kshs 21.1 bn, from Kshs 19.6 bn in H1’2018,

- Interest income increased by 9.2% to Kshs 27.7 bn, from 25.4 bn in H1’2018. The interest income on loans and advances increased by 8.8% to Kshs 18.6 bn from Kshs 17.1 bn in H1’2018. Interest income on government securities also increased by 7.4%, rising to Kshs 8.5 bn from Kshs 7.9 bn in H1’2018. The slightly stronger growth in interest income on loans as compared to interest from government securities is indicative of the benefits accruing to Equity Group Holding’s owing to increased lending to the private sector, with the loans extended to the private sector rising by 16.7% in H1’2019 compared to the 3.8% growth recorded in H1’2018. The yield on interest earning assets, however, declined by 0.4% points to 11.0%, from 11.4% in H1’2018, owing to declining yields on government securities,

- Interest expense rose by 14.3% to Kshs 6.6 bn from Kshs 5.8 bn in H1’2018, following the 11.1% increase in the interest expense on customer deposits to Kshs 5.2 bn from Kshs 4.7 bn in H1’2018, coupled with an 84.0% increase in interest expense on placements to Kshs 0.4 bn from Kshs 0.2 bn in H1’2018. In addition, other interest expenses increased by 16.3% to Kshs 1.0 bn from Kshs 0.9 bn in H1’2018. The cost of funds however declined to 2.6%, from 2.7% in H1’2018, owing to a faster increase in interest bearing liabilities that rose by 15.3% to Kshs 514.5 bn, from Kshs 446.3 bn in H1’2018. The Net Interest Margin (NIM) thus declined to 8.5%, from 8.8% in H1’2018,

- Non-Funded Income (NFI) recorded a 25.6% increase to Kshs 16.5 bn from Kshs 13.2 bn in H1’2018. The growth was mainly driven by the 80.7% increase in other income to Kshs 4.7 bn from Kshs 2.6 bn in H1’2018 given the successful execution of the Equity’s 3.0 innovative business strategy, which is centered on digitization and virtualization. The growth was also supported by the 16.1% growth in other fees and commissions to Kshs 7.3 bn, from Kshs 6.3 bn in H1’2018, and a 20.2% growth in forex trading income to Kshs 1.8 bn, from Kshs 1.6 bn in H1’2018, with management noting that the forex income segment benefitted from increased remittances from the diaspora. The growth in NFI was however weighed down by the 1.1% decline in fees and commissions on loans to Kshs 2.75 bn, from Kshs 2.78 bn in H1’2018, which may be attributed to continued effects of the implementation of the Effective Interest Rate (EIR) model under IFRS 9, which requires banks to amortize the fees and commissions on loans throughout the tenor of a loan,

- The revenue mix shifted to 56:44 from 60:40 funded to non-funded income, owing to the faster growth in NFI as compared to growth in NII,

- Total operating expenses rose by 19.4% to Kshs 20.6 bn, from Kshs 17.3 bn in H1’2018, largely driven by a 16.7% increase in Loan Loss Provisions (LLP) to Kshs 0.9 bn from Kshs 0.8 bn in H1’2018, coupled with a 22.1% growth in other operating expenses to Kshs 13.8 bn from Kshs 11.3 bn in H1’2018. Staff costs also increased by 13.8% to Kshs 5.9 bn, from Kshs 5.2 bn in H1’2018,

- The Cost to Income Ratio (CIR) deteriorated to 54.8%, from 52.8% in H1’2018. Without LLP, the cost to income ratio also deteriorated to 52.4%, from 50.4% in H1’2018,

- Profit before tax increased by 9.8% to Kshs 17.0 bn, up from Kshs 15.5 bn in H1’2018. Profit after tax recorded an 8.9% growth to Kshs 12.0 bn, from Kshs 11.0 bn, with the difference in growth attributable to the marginal increase in the effective tax rate to 29.3% from 28.8% in H1’2018,

- The balance sheet recorded an expansion as total assets grew by 17.8% to Kshs 638.6 bn, from Kshs 542.0 bn in H1’2018. Growth was supported by a 16.7% growth in loans and advances to Kshs 320.9 bn, from Kshs 275.0 bn in H1’2018, coupled with a 13.0% growth in government Securities to Kshs 179.6 bn, from Kshs 158.9 bn in H1’2018,

- Total liabilities recorded a 17.6% growth to Kshs 535.9 bn, from Kshs 455.7 bn in H1’2018, supported by a 16.5% growth in customer deposits which rose to Kshs 458.6 bn, from Kshs 393.7 bn in H1’2018, coupled with the 139.5% growth in other liabilities to Kshs 20.5 bn, from Kshs 8.5 bn in H1’2018,

- The comparable growth in both loans and deposits led to a marginal increase in the loan to deposit ratio to 70.0%, from 69.9% in H1’2018,

- Gross Non-Performing Loans (NPLs) increased by 19.6% to Kshs 29.2 bn in H1’2019, from Kshs 24.5 bn in H1’2018. The NPL ratio thus deteriorated to 8.8% in H1’2019 from 8.5% in H1’2018. The deterioration in asset quality was largely attributed to various segments such as large enterprises, Small and Medium Enterprises (SMEs) and Agriculture, which had NPLs of 10.6%, 10.2% and 6.1%, respectively. The group’s Tanzania subsidiary contributed 25.7% of the NPLs, with South Sudan and Kenya contributing 12.9% and 8.7%, respectively. General Loan Loss Provisions decreased by 1.7% to Kshs 9.4 bn, from Kshs 9.6 bn in H1’2018. Thus, the NPL coverage deteriorated to 73.7% in H1’2019 from 79.9% in H1’2018,

- Shareholder’s funds recorded a 17.9% growth to Kshs 101.8 bn, from Kshs 86.3 bn in H1’2018, supported by an 18.4% increase in retained earnings to Kshs 89.4 bn, from Kshs 75.5 bn in H1’2018,

- Equity Group remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 17.5%, 7.0% points above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio came in at 19.5%, exceeding the statutory requirement of 14.5% by 5.0% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 18.4%, while total capital to risk-weighted assets came in at 20.4%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.5%, and a Return on Average Equity (ROaE) of 22.1%.

Key Take-Outs:

- The bank’s geographical diversification strategy has continued to emerge as a net positive, with the bank’s various subsidiaries in Uganda, DRC, Rwanda, Tanzania and South Sudan cumulatively contributing 19.0% of the bank’s total profitability and 27.0% of the group’s total asset base. Equity Group Holdings opened a commercial representative office in Addis Ababa, Ethiopia, and expected to commence operations in July.

- The bank’s Non-Funded Income bucked its declining trend, growing by 25.6% y/y, largely aided by a recovery in transactional income, as management indicated that the bank was now monetizing its transactional channels. With the banks’ NFI contribution to total income currently at 44.0%, it is way above the current industry average of 33.2%, and,

- The bank’s asset quality deteriorated, with the NPL ratio deteriorating to 8.8% in H1’2019, from 8.5% in H1’2018. The main sectors that contributed to the NPLs are large enterprises and SMEs. In terms of the regional distribution of NPLs, the regions with the highest NPLs were Tanzania at 25.7% of their loan book, followed by South Sudan at 12.9% of their loan book. With the interest rate cap set to remain in place in Kenya, the bank has ramped up its loan disbursement to its customers in the region and will have to improve on its credit assessment in these markets in order to bring down the high NPL ratios in some of its regional subsidiaries.

For more information, please see our Equity Group Holdings Earnings Note.

Monthly Highlights

Barclays Bank of Kenya announced that three of its branches namely, Bamburi, Maragua and Supplies, were up for sale, valued at Kshs 65.0 mn. This is in line with the lender’s strategy of deepening digital channels to accommodate the changing pattern of customer preferences towards alternate channels. Previously, in FY’2017, the lender closed 13 branches as part of its consolidation strategy and drive to achieve operational efficiencies. For a more detailed analysis, please see our Cytonn Weekly #27/2019.

The Kenya Bankers Association (KBA) released the State of Banking Industry Report 2019. The report gives the various factors that shaped the banking sector’s performance in 2018, the emerging trends, and the outlook for the sector going forward. For more information please see more detailed analysis here Cytonn Weekly #28/2019

KCB Group released the offer document for the intended 100% acquisition of the National Bank of Kenya (NBK), and timelines for the acquisition. The expected timelines are as follows:

- Both the Central Bank of Kenya (CBK) and the Competition Authority of Kenya (CAK) are expected to grant their approvals by 30th July 2019,

- The offer has a closing date of 30th August 2019,

- The settlement of the swap transaction, where the swap ratio will be 1 KCB share for 10 NBK shares, will be done on the 12th September 2019 with the listing of additional KCB shares set for 16th September 2019.

For more details, please see our Cytonn Weekly #28/2019

The Banking Amendment Bill was tabled in the National Assembly. The Bill seeks to seal the loopholes in the wordings of the Banking (Amendment) Act 2015. In March 2019, the High Court suspended the Banking (Amendment) Act 2015 in a ruling that declared Section 33B (1) and (2) of the Banking Act unconstitutional, and gave the National Assembly one year to amend the anomalies, failure to which will mean a reversion to a free-floating interest rates regime. For more details, please see our Cytonn Weekly #30/2019

Universe of Coverage

|

Banks |

Price as at 26/07/2019 |

Price as at 02/08/2019 |

m/m change |

w/w change |

YTD Change |

Target Price* |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

114 |

114 |

(3.2%) |

0.0% |

(27.2%) |

228.4 |

96.2% |

0.6x |

Buy |

|

CRDB |

105.0 |

100.0 |

(9.1%) |

(4.8%) |

(33.3%) |

207.7 |

88.8% |

0.3x |

Buy |

|

UBA Bank |

5.5 |

5.9 |

(3.2%) |

7.3% |

(23.4%) |

10.7 |

87.0% |

0.4x |

Buy |

|

Zenith Bank |

18.5 |

18.4 |

(7.6%) |

(0.5%) |

(20.4%) |

33.3 |

83.0% |

0.8x |

Buy |

|

KCB Group*** |

39.8 |

40.0 |

4.6% |

0.6% |

6.8% |

60.4 |

66.7% |

1.1x |

Buy |

|

GCB Bank |

5.0 |

5.0 |

1.0% |

1.0% |

8.7% |

7.7 |

64.2% |

1.2x |

Buy |

|

I&M Holdings |

53.0 |

52.0 |

(5.9%) |

(1.9%) |

22.4% |

81.5 |

54.9% |

1.0x |

Buy |

|

Access Bank |

6.5 |

6.2 |

0.8% |

(4.6%) |

(8.8%) |

9.5 |

52.6% |

0.4x |

Buy |

|

Co-operative Bank |

12.1 |

12.0 |

(3.6%) |

(1.2%) |

(16.4%) |

17.1 |

50.5% |

1.0x |

Buy |

|

Equity Group |

40.3 |

40.3 |

3.2% |

0.0% |

15.5% |

53.7 |

42.7% |

1.7x |

Buy |

|

NIC Group |

29.8 |

29.3 |

(3.3%) |

(1.7%) |

5.2% |

42.5 |

42.3% |

0.6x |

Buy |

|

CAL Bank |

1.0 |

1.0 |

1.0% |

1.0% |

1.0% |

1.4 |

40.0% |

0.8x |

Buy |

|

Barclays Bank |

10.5 |

10.7 |

1.9% |

2.4% |

(2.3%) |

12.8 |

32.7% |

1.3x |

Buy |

|

Stanbic Bank Uganda |

29.0 |

29.0 |

0.0% |

0.0% |

(6.5%) |

36.3 |

29.1% |

2.1x |

Buy |

|

SBM Holdings |

5.5 |

5.5 |

(2.2%) |

0.7% |

(7.7%) |

6.6 |

23.0% |

0.8x |

Buy |

|

Guaranty Trust Bank |

28.7 |

27.9 |

(13.7%) |

(2.6%) |

(19.0%) |

37.1 |

21.4% |

1.7x |

Buy |

|

Stanbic Holdings |

98.5 |

98.5 |

(0.5%) |

0.0% |

8.5% |

113.6 |

20.6% |

1.1x |

Buy |

|

Ecobank |

8.5 |

8.5 |

0.0% |

0.0% |

13.3% |

10.7 |

19.2% |

1.9x |

Accumulate |

|

Union Bank Plc |

6.4 |

7.0 |

0.0% |

9.4% |

25.0% |

8.2 |

16.4% |

0.7x |

Accumulate |

|

Standard Chartered |

196.0 |

197.0 |

0.6% |

0.5% |

1.3% |

200.6 |

9.5% |

1.4x |

Hold |

|

Bank of Kigali |

274.0 |

275.0 |

0.0% |

0.4% |

(8.3%) |

299.9 |

8.5% |

1.5x |

Hold |

|

FBN Holdings |

5.6 |

5.6 |

(13.0%) |

0.0% |

(29.6%) |

6.6 |

5.7% |

0.3x |

Hold |

|

Bank of Baroda |

128.0 |

128.0 |

(0.6%) |

0.0% |

(8.6%) |

130.6 |

3.4% |

1.1x |

Lighten |

|

Standard Chartered |

19.0 |

19.0 |

0.0% |

0.0% |

(9.5%) |

19.5 |

2.3% |

2.4x |

Lighten |

|

National Bank |

3.9 |

3.9 |

(7.0%) |

0.0% |

(27.6%) |

3.9 |

(4.8%) |

0.2x |

Sell |

|

Stanbic IBTC Holdings |

38.1 |

38.1 |

(5.1%) |

0.0% |

(20.5%) |

37.0 |

(6.5%) |

2.0x |

Sell |

|

Ecobank Transnational |

8.5 |

7.6 |

(25.5%) |

(10.6%) |

(55.3%) |

9.3 |

(15.6%) |

0.3x |

Sell |

|

HF Group |

4.0 |

4.1 |

2.2% |

1.3% |

(26.9%) |

2.9 |

(27.7%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in ****Stock prices indicated in respective country currencies |

|||||||||

Below is a summary of our SSA universe of coverage:

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations to support the positive performance.

During the month of July, there was private equity activity in the financial services sector, fundraising, and education sector:

Financial Services

- Interswitch, a Nigeria-based payments firm that is owned 60.0% by Helios Investment Partners, announced that it has hired advisors, including JPMorgan Chase & Co., Citigroup Inc., and Standard Bank Group Ltd to resurrect plans for a stock-market listing in London and Lagos later this year. According to Reuters, the value of the financial technology company is speculated to be between USD 1.3 bn and USD 1.5 bn. For more information, see our Cytonn Weekly #30

- Actis, a UK based private equity investor, took over the management rights of the Abraaj Private Equity Fund IV (APEF IV), a global buyout fund, and Abraaj Africa Fund III (AAF III), a Sub-Saharan investment fund. APEF IV has made investments worth USD 1.6 bn (Kshs 165.2 bn) in the Middle East and Africa while AAF III has a portfolio of investments in Africa. This transaction follows the collapse of Abraaj Group, a global private equity firm based in the United Arab Emirates (UAE), following the liquidation case the firm currently faces. For more information, see our Cytonn Weekly #29

- Sterling Capital, a Kenyan-based investment bank acquired a 20.0% stake in Afvest, a Nairobi-based emerging markets private equity firm, for an undisclosed value. Afvest focuses on early-stage businesses in the financial services, energy, agri-processing, and technology sectors. This acquisition is in line with the two firms’ strategy of investing in early-stage businesses and entrepreneurs with the potential to generate high returns. For more information, see our Cytonn Weekly #28

- TLG Capital, a frontier markets Investment Company based in England, announced a USD 10.0 mn investment in Tanzania based Platcorp Holdings Limited, the holding company of Platinum Credit - a Kenyan micro-finance company, through its Credit Opportunities Fund (COF). Platcorp Holdings Limited focuses on investments in its microfinance and non-banking subsidiaries. For more information, see our Cytonn Weekly #27

Fundraising

- Investment firm Centum, through its real estate arm Centum Real Estate, signed a refinancing deal with Nedbank Corporate and Investment Bank (CIB), the Nedbank property finance division. They managed to raise Kshs 6.5 bn from the South Africa-based firm. These funds will allow the firm to consolidate the debt facilities for the Two Rivers development, which is the firm’s biggest project. The development is currently in its second phase, which will utilize the 102 acres the company owns on Limuru Road in Nairobi, near the affluent neighborhoods of Runda, Nyari, Gigiri, and Muthaiga. For more information, see our Cytonn Weekly #30

- OPay, a Nigerian based mobile payment platform, has raised USD 50.0 mn (Kshs 5.1 bn) in its first round of funding. The startup, founded by Norwegian browser company Opera in 2018, aims to use the capital for expansion to other African Markets including Tanzania, Ghana and South Africa where Opera reaches 120 mn customers across the region and to support Opera’s commercial network in Nigeria which includes ORide, a motorcycle ride-hailing app, and food, a food delivery service application. For more information, see our Cytonn Weekly #28

- Rent-to-Own (RTO), a Zambia based asset-financing company, secured a EUR 1.0 mn (Kshs 116.0 mn) investment from the seed capital and business development facility of the Dutch Good Growth Fund (DGGF), managed by Triple Jump B.V, a Netherlands-based impact investment manager. Rent-to-Own provides high-impact assets to small-scale entrepreneurs and smallholder farmers in rural Zambia. This follows last year’s seed round funding of USD 1.1 mn (Kshs 113.2 mn), which was led by AAHL Venture Partners, an African impact investing venture capital firm, with participation from Small Foundation and Jordan Engineering, through its investment arm, Serenity Investments. For more information, see our Cytonn Weekly #28

- Lulalend, a South African digital lender, raised USD 6.5 mn in its Series A round funding, which was co-led by the International Finance Corporation (IFC) and Quona Capital. The startup, based in Cape Town, provides short-term loans to small and medium-sized businesses (SMEs) that are often unable to obtain working capital. The funds raised will be used to build its staff capacity and strengthen its balance sheet, in order to provide financing to more SMEs in South Africa by expanding its loan book to USD 100.0 mn. For more information, see our Cytonn Weekly #27

Education

- In the education sector, Investisseurs & Partenaires (I&P), a Sub-Saharan impact investing firm based in Paris, France, has announced plans to invest EUR 70.0 mn (Kshs 8.1 bn) in Africa’s education sector with the aim of addressing the challenges of access, equity, quality and adequacy of education in Africa. I&P currently has the following investments in the educational sector. For more information, see our Cytonn Weekly #29

During the week, the Capital Markets Authority (CMA) admitted three Fintech firms into the Regulatory Sandbox to test their innovative solutions. The Regulatory Sandbox is a tailored regulatory environment meant for conducting limited scale, live tests of innovative products, solutions, and services. This initiative by the CMA seeks to provide a conducive environment for the development of a variety of innovative emerging technologies and business models that have the potential of contributing towards the deepening and broadening of the capital markets in the country. Another objective of the initiative is to enable innovative products and services to be deployed and tested in a live environment before their release to the open markets. This allows the authority to understand emerging technologies and come up with regulations that promote investor empowerment and protection.

The firms admitted to the program are Innova Limited, who have come up with a cloud-based data analytics platform meant to serve investors, fund managers, custodian banks, actuaries, pension administrators and regulators, and Pezesha, who have an internet-based crowd-funding platform for SMEs. The authority highlights its intentions to treat all non-public information received in connection with the regulatory Sandbox as confidential and proprietary to the concerned firms, hence, the third firm chose to remain anonymous. The admission of the three firms is solely based on meeting requirements published under the Regulatory Sandbox Policy Guidance Note.

In our view, the CMA has taken a proactive approach in terms of regulation with the Regulatory Sandbox. This is positive for the Fintech sector since the regulations put in place are intended to promote investor protection and the growth of the sector, which has had a considerable amount of activity throughout the year.

During the week, mobile lender, Branch International, through Barium Capital, announced the issuance of its fourth commercial paper and full repayment of its previous issue worth Kshs 500.0 mn. Barium Capital, which is a wholly-owned subsidiary of Centum PLC, offers transaction advisory services specializing in capital raising and mergers and acquisition advisory services. As of 2018, the company’s debt was 1.9 times the company’s equity. To date, the firm has been able to raise Kshs 16.5 bn from the private capital market.

Since its launch in 2015, Branch has become one of the first technology companies that have been able to successfully raise debt in both the local market and international markets. In international markets, the company raised Kshs 17.0 bn earlier this year from investors such as the Foundation Capital, Visa, International Finance Corporation, Trinity Ventures, and Andreessen Horowitz. As for local markets; (i) in 2017, they issued commercial papers worth Kshs 200.0 mn, (ii) in 2018, they issued commercial papers worth Kshs 350.0 mn, and (iii) in May 2019, they issued commercial papers worth Kshs 500.0 mn. These funds will be used to expand their services in Kenya where they have disbursed more than Kshs 30.0 bn since its launch.

In our view, the Fintech sector in the country is positioned for growth aided by the CMA’s intentions to spur growth in the sector and considering the recent performance of firms such as Branch International.

We maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

During the month, real estate saw overall increased activity in the residential sector and retail sectors, while the commercial office sector and other themes remained sluggish.

- Industry Reports

|

Coverage |

Report |

Key Take-outs |

|

Real Estate & Infrastructure |

|

|

|

General Real Estate |

Status of The Built Environment Jan-Jun 2018 (AAK noted that the report will be published on a later date) |

|

|

Residential Sector |

|

|

|

Land Sector |

|

Based on the above real estate research reports, we retain our neutral outlook for the real estate sector mainly constrained by commercial real estate space surplus in the market, inaccessibility and unaffordability of off-take financing and slow credit growth at 3.4% as at February 2019, compared to a 5-year average of 12.0%. The sector, however, exhibits pockets of value in select sectors driven by; (i) the improving macroeconomic environment, (ii) continued National Government support for the affordable housing initiative, and (iii) the continued infrastructural improvement.

- Residential Sector

During the month, activity in the residential sector was mostly focused on the Affordable Housing Initiative (AHI) as shown below:

- An Indian firm, Shapoorji Pallonji Real Estate (SPRE) and UK private equity investor-developer Actis, announced that they are set to begin development of a 624-units, middle-class, residential development on a 4.5-acre parcel of land at the Garden City Mall, along Thika Road. The construction of the first phase of the project, dubbed Mida Vida Homes, is set to commence in Q3’2019. The phase will consist of 208 units, of 1, 2 and 3-bedroom units, priced at Kshs 6 mn, Kshs 9 mn and Kshs 14 mn, respectively (the unit sizes are yet to be disclosed). For more information, see our Cytonn Weekly #27/2019

- Stima Investment Cooperative, a local investments company, was appointed as the lead sales agent of Pangani Heights, one of the seven Nairobi Urban Regeneration Projects under the affordable housing initiative. The development set on 5.2-acres along Ring Road Ngara, was launched in December 2018 and was awarded to Technofin Kenya as the lead developer. The project construction is expected to begin in August 2019 and will consist of 1,434 units, comprising of social and low-cost housing units. For more information, see our Cytonn Weekly #28/2019

- Shelter Afrique a Pan-African finance institution signed a memorandum of understanding (MOU) with Terwilliger Centre for Innovation in Shelter (TCIS), the financing arm of Habitat for Humanity International, which will see TCIS back Shelter Afrique in mobilizing capital for affordable housing. For more information, see our Cytonn Weekly #30/2019.

In the mid-end segment, Cytonn Real Estate, the development affiliate of Cytonn Investments, handed over the first phase of its Ruaka project, The Alma, upon completion and full uptake of the 16 one-bedrooms, 70 two-bedroom and 27 three-bedroom units selling at Kshs 6.3 mn, Kshs 9.9 mn and Kshs 12.9 mn, respectively. For more information, see our Cytonn Weekly #29/2019.

We expect the residential sector to continue recording activities owing to; (i) improved business environment, which is bound to attract foreign investors, (ii) improved infrastructure, and, (iii) the National Government’s commitment towards the Affordable Housing Initiative

- Commercial Sector

In the commercial sector, Kenya Ports Authority (KPA) announced plans to put up an office building, to be located in Mombasa. According to the state agency, the building will have a total built-up area of 75,000 SQM. The KPA Office Tower Complex, which is currently at the tendering process, is set to have 1,000 parking bays covering 18,000 SQM, 12,000 SQM of conference facilities, 15,000 SQM of commercial spaces, 12,000 SQM lettable office space while KPA will occupy 9,000 SQM. For more information, see our Cytonn Weekly #29/2019.

Kenya’s retail sector was vibrant during the month, attracting interest from the renowned international retailers as well as the robust expansion of local retailers as shown below:

- Fast-food chain Big Square, opened their 13th branch at Shell Service Station in Mountain View, with some of the other branches being in the Nairobi CBD, Lavington and along Lang’ata Road. The South African owned eatery joins other food chains such as KFC and Java Coffee that have continued to expand their footprint in the Kenyan market. For more information, see our Cytonn Weekly #27/2019

- Game Stores, a subsidiary of South Africa’s retail company Massmart Holdings, opened its third outlet in Kenya and its first outside Nairobi, at the Kisumu Mega City Mall. The store will be situated on the ground floor, previously occupied by Nakumatt, which has since moved to the first floor. For more information, see our Cytonn Weekly #30/2019,

- Naivas Supermarkets, a local supermarket chain, opened their latest outlet in Ongata Rongai, Kajiado County. The 8,000 SQFT store is the retailer’s 53rd store in Kenya. For more information, see our Cytonn Weekly #28/2019,

With the increased commercial space supply in the Nairobi Metropolitan Area (NMA), we expect declined activities in the sector, with developers expected to shift focus to counties such as Mombasa, boosted by ongoing infrastructural developments and the national economic expansion, which has a spill-over effect as companies expand to the nation’s largest cities including Mombasa, hence increasing demand for commercial real estate.

- Land Sector

Nairobi City Council announced that it would cap the new land rates at 1.0% of the current value of the plots as opposed to using the 1980 valuation, where property owners pay land rates at 25.0% of the unimproved site value. The specific rates will be based on the current value of undeveloped land and the new fees will be effective in January 2020. For more information, see our Cytonn Weekly #30/2019.

Private equity firm Fusion Capital has partnered with real estate firm, Optiven Group to sell 70 prime residential plots located on Gatanga Road, Thika (the details are yet to be disclosed). This follows a similar partnership last year when two parties partnered to sell a 100 -acre land development called Amani Ridge in Ruiru, Kiambu County. Thika market has attracted many investors supported by (i) increased housing demand in satellite towns driven by increased urbanization rate at 4.4% against a global average of 2.1%, (ii) high capital appreciation with land prices in the area growing by a 7-year CAGR of 10.7% p.a, and (iii) infrastructural development in the area such as connectivity via the Thika- Nairobi highway and a railway station providing access to the 131km of railway line available in the county.

Other highlights during the month;

- Investment firm Centum, through its real estate arm Centum Real Estate, signed a refinancing deal with Nedbank Corporate and Investment Bank (CIB), the Nedbank property finance division. The Kshs 6.5 bn from Nedbank, will allow the firm to consolidate the debt facilities for the Two Rivers development which is currently in its second phase, which will utilize the 102 acres of land the company owns on Limuru Road in Nairobi, near the affluent neighborhoods of Runda, Nyari, Gigiri and Muthaiga. Centum Real Estate is currently the master developer in three projects namely; the Pearl Marina Development in Entebbe Uganda, Vipingo Development and Two Rivers Development, both in Kenya. The firm intends to put up 3,000 residential units across the three sites with the first phase of 1,200 units already under construction. The company highlighted that it had experienced challenges in the sector due to limited access to credit occasioned by the capping of the interest rates. For more information, see our Cytonn Weekly #30/2019,

- The National Government designated 9,000 acres of land in Naivasha, Mombasa and Machakos as special economic zones. This move would allow the areas to benefit from special tax (yet to be disclosed) and infrastructure that facilitate storage and export.

- Listed Real Estate

Stanlib Fahari I-REIT released their H1’2019 earnings, registering a 16.2% growth in earnings to Kshs 0.42 per unit, from Kshs 0.36 per unit in H1’2018. Total income rose by 10.8% to Kshs 193.5 mn, from Kshs 174.6 mn in H1’2018, while net profit grew by 16.2% to Kshs 76.4 mn, from Kshs 65.8 mn in H1’2018. The performance was driven by a 26.3% growth in rental income to Kshs 170.7 mn, from Kshs 135.1 mn in H1’2018, as the REIT positively benefitted from rental income contribution as a result of increased occupancies by its properties, including the Grade A office, 67 Gitanga Place, which was acquired in May 2018. The REIT did not recommend an interim distribution of dividends for the period ended 30th June 2019. It was noted that a full distribution will be declared in line with the requirements of the REITs Regulations to distribute a minimum of 80% of distributable earnings within four months after the end of the financial year, which ends on 31st December 2019.

We project a FY’2019 dividend yield of 7.9%, assuming the market maintains an average price of Kshs 9.2 per unit and the dividend payout ratio remains at the 3-year average (2016 -2018) of 96.5%, with the dividend yield in line with the commercial real estate market average of 8.0%, with 8.2% rental yield for retail space and 7.9% yield for office space in H1’2019. However, the expected high yield is attributable to its declining stock price closing at Kshs 9.2 per unit as at 28th June 2019 in comparison to Kshs 11.3 as at 29th June 2018, representing an 18.6% loss of value.

For a more comprehensive analysis on the REIT H1’2019 performance, see our Stanlib Fahari I-REIT Earnings Note - 2019.

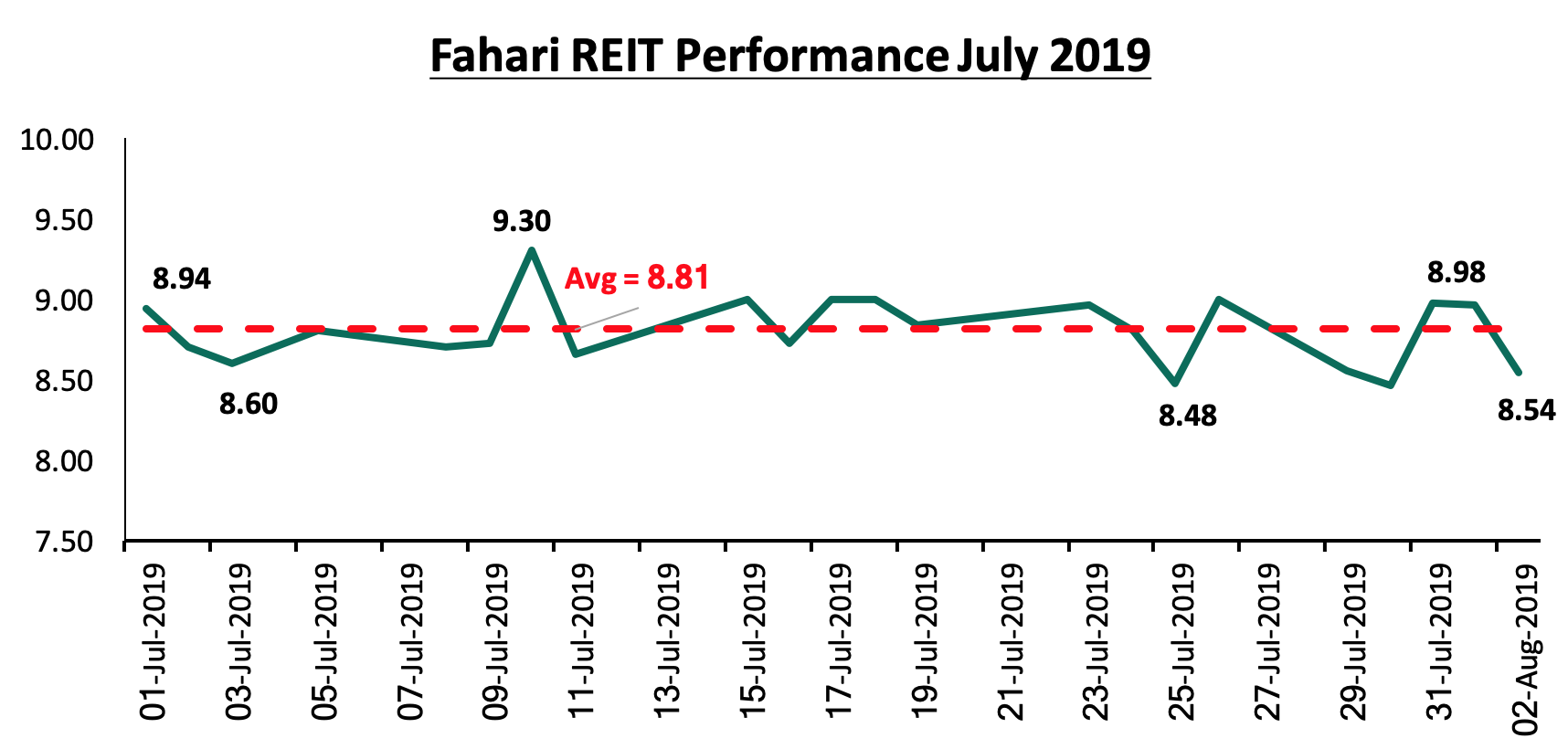

On the bourse, the REIT’s performance has been on a decline since its listing at Kshs 20.0 in November 2015. Stanlib Fahari I-REIT share price declined by 2.4% to close at Kshs 8.98 per share at the end of July, from Kshs 9.2 per share at the end of June. On average, the REIT traded at Kshs 8.81 per share in July, a 6.3% decline from an average of Kshs 9.4 per share in H1’ 2019. The REIT closed the week at Kshs 8.54 per share. The instrument has continued to trade in low prices and volumes, due to; (i) opacity of the exact returns from the underlying assets, (ii) inadequate investor knowledge, and (iii) lack of institutional support for REITs.

Our outlook for Stanlib’s listed real estate is neutral supported by favorable projected dividend yield, in line with the real estate performance.

We expect the real estate sector to continue recording increased activities in the residential, retail and listed real estate sectors supported by the National Government’s commitment to the Affordable Housing initiative, the continued demand for commercial space in prime locations and increasing demand for alternative sources of capital in the real estate industry.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.