Cytonn Weekly #43/2020

By Research Team, Oct 25, 2020

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 81.4%, down from 131.6% the previous week. The highest subscription rate was on the 91-day paper, which came in at 103.4%, down from 215.2% recorded the previous week. The yields on the 91-day and 182-day increased to 6.6% and 7.0%, respectively, from 6.5% and 6.9% last week while the 364-day papers remained unchanged at 7.8%. We are projecting the y/y inflation rate for the month of October 2020 to edge slightly up to between 4.4% - 4.7%, compared to the 4.2% recorded in September due to the increase in petrol prices;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 25 recording gains of 1.1% and 0.1%, respectively, while NSE 20 recorded a loss of 0.7%, taking their YTD performance to losses of 15.1%, 21.6%, and 32.2%, for NASI, NSE 25 and NSE 20, respectively. The NASI performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded by Safaricom and Bamburi which were up 2.8% and 1.9%, respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as EABL, Co-operative Bank, and Standard Chartered Bank, which declined by 3.7%, 3.4% and 3.2%, respectively. During the week, the Association of Kenya Insurers (AKI) released the 2019 Kenya’s Insurance industry report, highlighting that the industry’s total premiums improved by 7.0% to Kshs 231.3 bn in FY’2019 from Kshs 216.1 bn recorded in 2018;

Real Estate

During the week, Unity Homes, a Kenyan-British housing developer, partnered with South Korea’s KumKang Kind, a construction materials company, to fast track delivery of 1,200 units in a Kshs 4.5 bn project dubbed Unity West at Ruiru’s Tatu City. Also, Kenya Power Pension Fund (KPPF) announced plans to put up Kshs 2.3 bn residential apartments on its 1.67- acre plot along Kirichwa Road in Nairobi’s Kilimani area. The Kenya Mortgage Refinance Company (KMRC), signed an agreement that will see the African Development Bank (AfDB) guarantee its first bond issue, planned for the third quarter of next year. In the retail sector, Tuskys Supermarket shut down its Ronald Ngala outlet within Nairobi’s CBD due to mounting rent arrears and supplier debts;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.6%. To invest or withdraw, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.5% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 81.4%, down from 131.6% the previous week. The highest subscription rate was in the 91-day paper, which came in at 103.1%, down from 215.2% recorded the previous week. The subscription for the 182-day paper increased to 72.3% from 71.0%, while that of the 365-day paper dropped to 81.7% from 158.9% recorded the previous week. The yields on the 91-day and 182-day increased to 6.6% and 7.0%, respectively, from 6.5% and 6.9% last week while the 364-day papers remained unchanged at 7.8%. The acceptance rate increased to 97.4%, from 94.9% recorded the previous week, with the government accepting bids worth Kshs 19.0 bn out of the Kshs 19.5 bn worth of bids received.

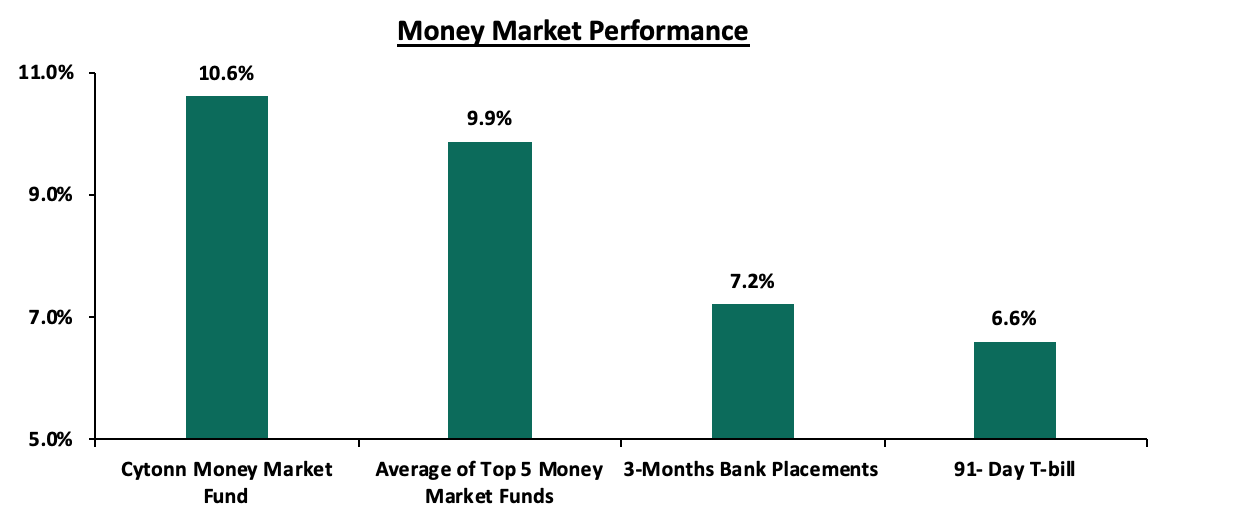

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day increased to 6.6% from 6.5% recorded the previous week. The average yield of the Top 5 Money Market Funds remained constant at 9.9% as recorded the previous week. The yield on the Cytonn Money Market remained constant at 10.6% as recorded the previous week.

Liquidity:

The money markets were relatively liquid during the week, with the average interbank rate increasing marginally to 2.5%, from the 2.4% recorded the previous week. This was supported by government payments, which partly offset tax receipts. The average interbank volumes increased to Kshs 17.9 bn from Kshs 8.0 bn, as recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, commercial banks’ excess reserves came in at Kshs 18.5 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

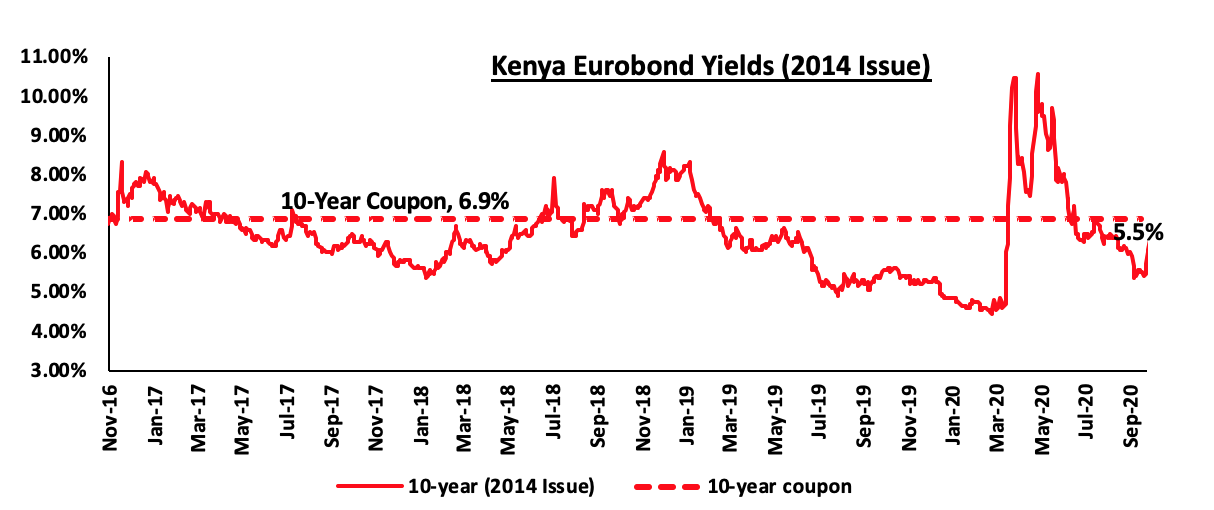

During the week, the yields on all Eurobonds decreased with the yield on the 10-year Eurobond issued in June 2014 decreasing by 0.2% points to 5.5%, from 5.7% recorded the previous week.

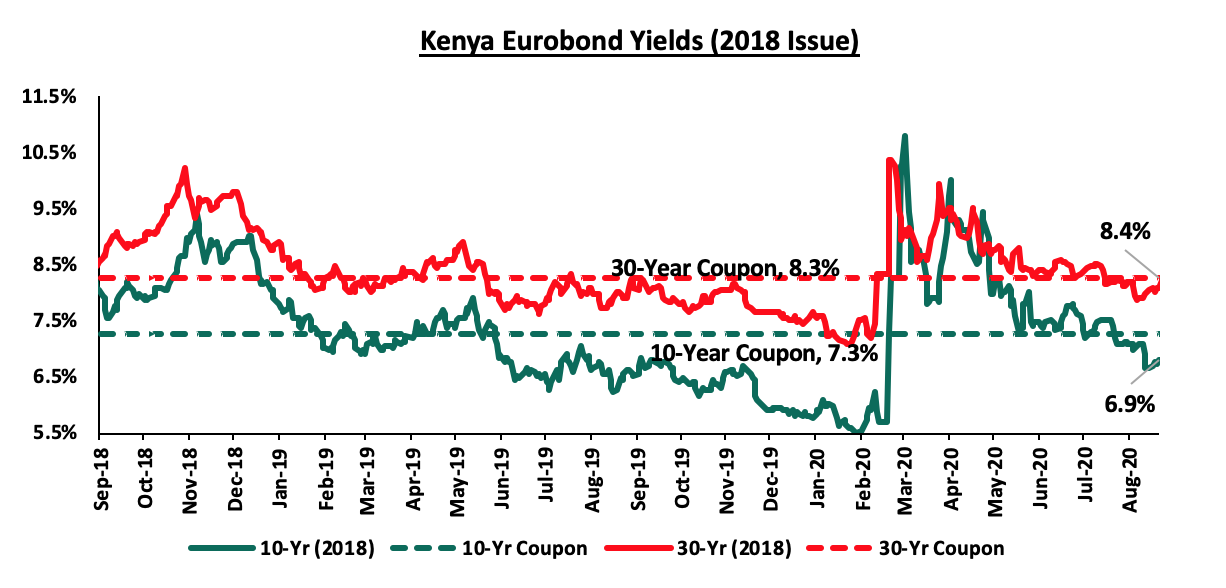

During the week, the yields on the 10-year and 30-year Eurobonds both decreased by 0.2% and 0.1% points to close at 6.9% and 8.4%, from the 7.1% and 8.5% recorded the previous week.

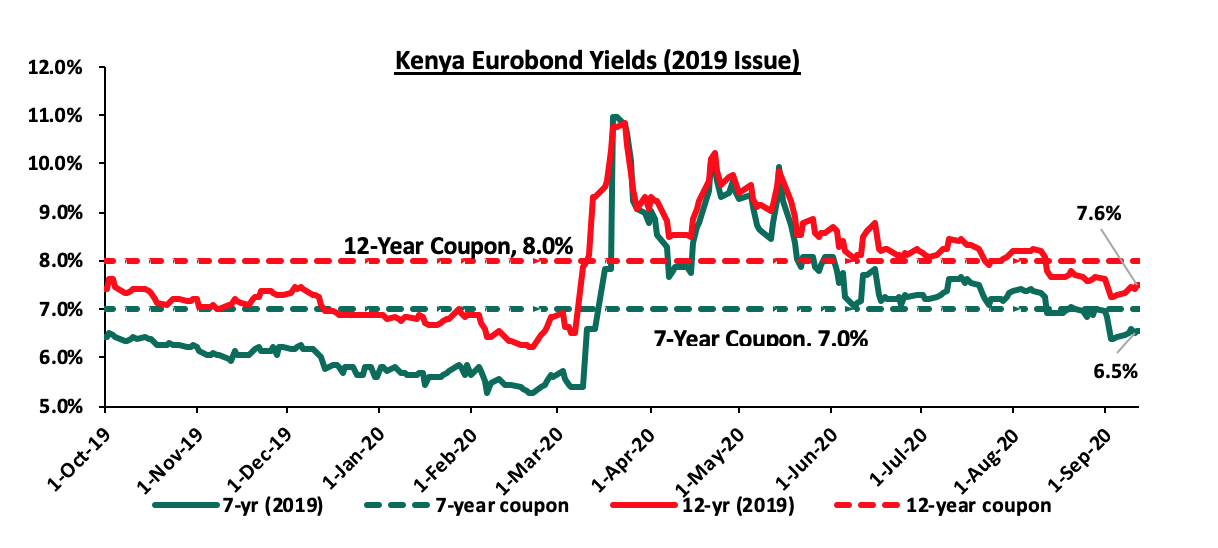

During the week, the yields on the 2019 dual-tranche Eurobond issue decreased with the 7-year decreasing to 6.5%, from 6.7% the previous week. The 12-year Eurobond also decreased by 0.2% points to 7.6%, from the 7.8% recorded the previous week.

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.1% against the US dollar to Kshs 108.8 from Kshs 108.6 recorded the previous week, mainly attributable to the dollar demand from the energy sector. On a YTD basis, the shilling has depreciated by 7.3% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 8.2 bn (equivalent to 5.0-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which has seen a 39.9% decline during Q2’2020, coming in at Kshs 82.2 bn, from Kshs 136.9 bn in Q2’2019, equivalent to 7.0% of GDP from the 10.9% of GDP recorded in Q2’2019.

Inflation Projections:

We are projecting the y/y inflation rate for October 2020 to increase to between 4.4% - 4.7%, compared to the 4.2% recorded in September due to the 1.4% increase in petrol prices.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 63.5 % ahead of its prorated borrowing target of Kshs 130.9 bn having borrowed Kshs 214.0 bn. In our view, the government will not be able to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertainty in the environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

During the week, the equities market recorded mixed performance with NASI and NSE 25 recording gains of 1.1% and 0.1%, respectively, while NSE 20 recorded a loss of 0.7%, taking their YTD performance to losses of 15.1%, 21.6%, and 32.2%, for NASI, NSE 25 and NSE 20, respectively. The NASI performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded in Safaricom and Bamburi of 2.8% and 1.9%, respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as EABL, Co-operative Bank, and Standard Chartered Bank, which declined by 3.7%, 3.4% and 3.2%, respectively.

Equities turnover increased marginally by 0.5% during the week to USD 12.13 mn, from USD 12.08 mn recorded the previous week, taking the YTD turnover to USD 1.2 bn. Foreign investors turned net buyers during the week, with a net buying position of USD 0.1 mn, from a net selling position of USD 4.0 mn recorded the previous week, taking the YTD net selling position to USD 263.1 mn.

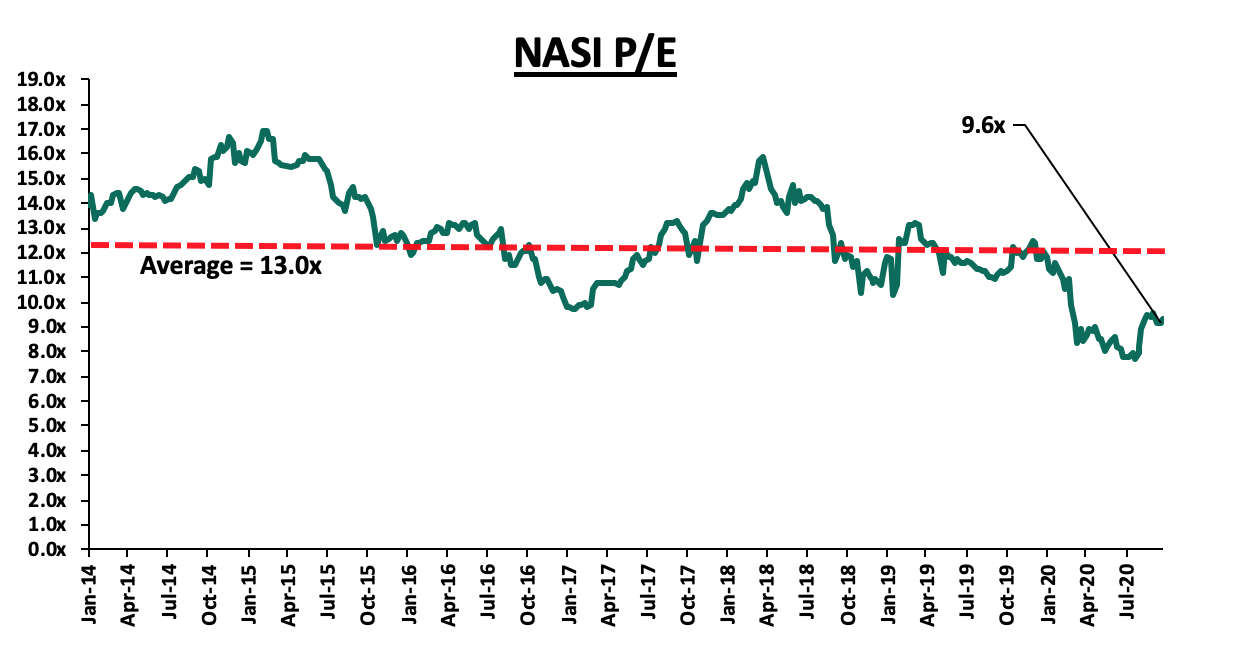

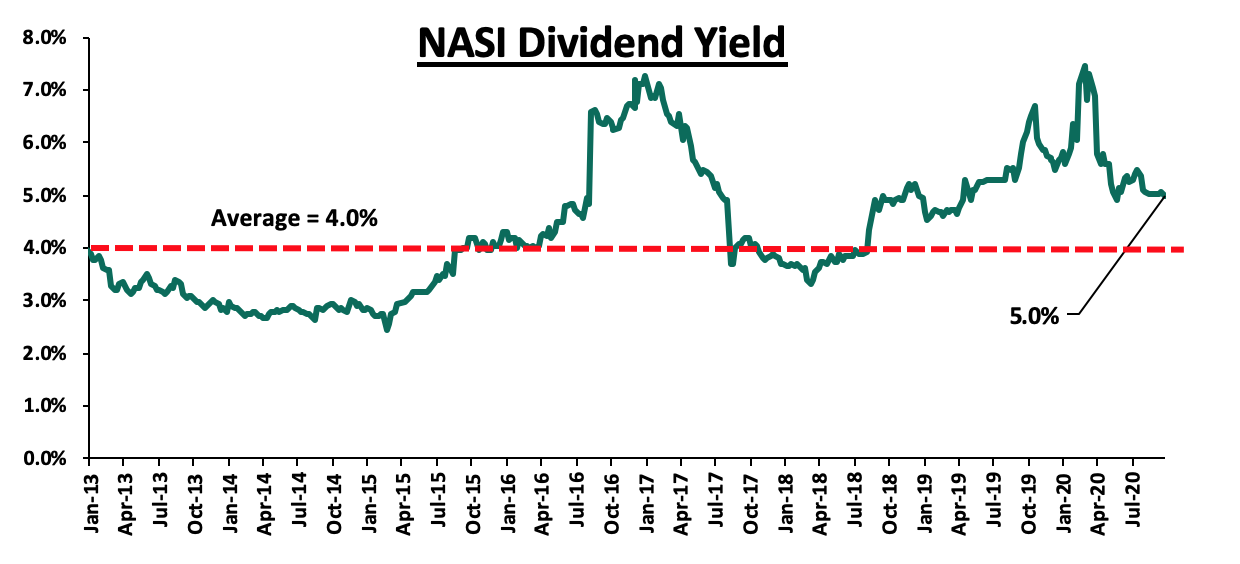

The market is currently trading at a price to earnings ratio (P/E) of 9.6x, 25.8% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, which is 1.0% above the historical average of 4.0%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.6x is 25.2% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Association of Kenya Insurers (AKI) released the 2019 Kenya’s Insurance industry report, highlighting that the industry’s total premiums improved by 7.0% to Kshs 231.3 bn in FY’2019 from Kshs 216.1 bn recorded in 2018. Additionally, general insurance continued to dominate the industry with a market share of 57.7% of the total premium income with total premiums of Kshs 133.5 bn in 2019 up from Kshs 126.6 bn in 2018. Life Insurance on the hand, accounted for 42.3% of the premium income, with premiums of Kshs 97.9 bn in 2019, from Kshs 87.3 bn recorded in 2018.

Other Key take-outs from the report include;

- The sector recorded a decline in the overall insurance penetration rate (which is the ratio of gross direct insurance premium to GDP) to 2.37% from 2.43% recorded in 2018 attributable to the 9.4% growth of GDP at Market prices to Kshs 9.7 tn from Kshs 8.9 tn in 2019, which outpaced the 7.0% growth in total premiums to Kshs 231.3 bn from Kshs 216.1 bn in 2018,

- Net income increased by 14.8% to Kshs 211.8 bn from Kshs 185.0 bn driven by the 39.1% growth in investment income which increased to Kshs 69.9 bn from Kshs 50.2 recorded in 2018,

- During the same period, the loss ratio increased to 82.7% from 82.3% recorded in 2018 despite the tough measures undertaken by market players to reduce fraudulent claims. The expense ratio also increased to 53.8% in FY’2019 from 51.7% in FY’2018, highlighting that the insurance sector has not been efficient in managing costs, and,

- The number of agents increased to 9,262 from 8,955 in 2018 while the licensed brokers declined by 1.4% to 213 from 216 in 2018.

Given the effects emanating from the pandemic, we believe that the insurance sector’s penetration rate is set to be affected given the low demand for insurance products during this time. Additionally, the reduction in the disposable income of some of the individuals coupled with the job losses will greatly affect the life insurance and pension products given that most individuals are struggling to sustain payment of their premiums. Despite the measures taken by the government to cushion individuals against the effects emanating from the pandemic, we believe that the industry’s loss ratio is set to increase in 2020 as more people file for claims while others use their contributions as collateral for loans.

Universe of Coverage:

|

Company |

Price at 16/10/2020 |

Price at 23/10/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

63.0 |

61.0 |

(3.2%) |

(44.0%) |

109.0 |

119.4 |

4.4% |

100.2% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.2 |

2.2 |

(1.3%) |

(27.1%) |

3.0 |

4.0 |

5.0% |

86.0% |

0.2x |

Buy |

|

Sanlam |

12.7 |

12.1 |

(5.1%) |

(29.9%) |

17.2 |

18.4 |

0.0% |

52.7% |

1.2x |

Buy |

|

I&M Holdings*** |

43.5 |

45.0 |

3.4% |

(16.7%) |

54.0 |

57.8 |

5.7% |

34.1% |

0.7x |

Buy |

|

Standard Chartered*** |

157.8 |

152.8 |

(3.2%) |

(24.6%) |

202.5 |

197.2 |

8.2% |

37.3% |

1.2x |

Buy |

|

NCBA*** |

23.0 |

22.8 |

(0.9%) |

(38.3%) |

36.9 |

30.7 |

1.1% |

36.0% |

0.6x |

Buy |

|

Equity Group*** |

35.0 |

34.4 |

(1.7%) |

(35.8%) |

53.5 |

44.5 |

5.8% |

35.4% |

0.9x |

Buy |

|

KCB Group*** |

37.2 |

37.1 |

(0.4%) |

(31.4%) |

54.0 |

46.4 |

9.4% |

34.7% |

0.8x |

Buy |

|

Co-op Bank*** |

11.8 |

11.4 |

(3.4%) |

(30.3%) |

16.4 |

14.2 |

8.8% |

33.3% |

0.8x |

Buy |

|

ABSA Bank*** |

9.6 |

9.5 |

(1.2%) |

(28.8%) |

13.4 |

10.8 |

11.6% |

25.3% |

1.2x |

Buy |

|

Liberty Holdings |

8.0 |

7.8 |

(2.5%) |

(24.6%) |

10.4 |

9.8 |

0.0% |

25.6% |

0.6x |

Buy |

|

Britam |

7.5 |

7.6 |

1.1% |

(15.8%) |

9.0 |

8.6 |

3.3% |

16.8% |

0.8x |

Accumulate |

|

Jubilee Holdings |

275.0 |

275.0 |

0.0% |

(21.7%) |

351.0 |

313.8 |

3.3% |

17.4% |

0.5x |

Accumulate |

|

Stanbic Holdings |

77.0 |

81.3 |

5.5% |

(25.6%) |

109.3 |

84.9 |

8.7% |

13.2% |

0.6x |

Accumulate |

|

HF Group |

3.6 |

4.0 |

9.1% |

(38.7%) |

6.5 |

4.1 |

0.0% |

3.5% |

0.2x |

Lighten |

|

CIC Group |

2.2 |

2.2 |

(2.2%) |

(18.3%) |

2.7 |

2.1 |

0.0% |

(4.1%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Residential Sector

During the week, Unity Homes, a Kenyan-British housing developer, partnered with South Korea’s KumKang Kind, a construction materials company, to fast track delivery of 1,200 units in the Kshs 4.5 bn project dubbed Unity West at Ruiru’s Tatu City. According to online sources, KumKang Kind will use industrial-scale construction technology to build a unit daily thus saving on costs associated with labour, procurement of materials and meeting deadlines. The first 48 units of the project were delivered in August 2020 while the next 48 units were delivered in early October 2020 and officially handed over to owners on 20th October 2020, with the entire 384-unit first phase of the project expected to be completed by the end of 2022. The units are part of a plan by Tatu City to construct more than 30,000 homes within the 5,000-acre mixed-use development.

Below is the summary of the sales prices of the units

|

Tatu City’s Unity West Development |

|||

|

No. of bedrooms |

Unit Size |

Price (Kshs) |

Price per SQM (Kshs) |

|

2 |

60 |

4.75 mn |

79,167 |

|

3 |

112 |

10.5 mn |

93,750 |

|

Average |

|

|

86,459 |

Source: Online Research

The Unity West units are priced at approximately Kshs 86,459 per SQM, in line with the Ruiru market average of Kshs 89,781 according to Cytonn Q3’2020 Markets Review. In terms of performance, Ruiru market recorded an average total return of 6.2%, 0.5% points higher than the market average of 5.7%, with the annual uptake at 20.4%. The relatively good performance is supported by; i) positive demographics as Ruiru hosts a significant working population, ii) ease of accessibility as it served by roads such as Thika Superhighway, Kamiti Road, Northern and Eastern Bypasses, and, iii) availability of amenities such as The Spur Mall, Kenyatta University’s Unicity Mall, education institutions such as Zetech College and connection to the sewer system which is rehabilitated by Ruiru-Juja Water and Sewerage Company.

The table below shows the market performance of apartments within satellite towns in Q3’2020;

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area Residential Apartments Performance Q3’2020 |

||||||||

|

Area |

Average Price Per SQM Q3'2020 |

Average Rent per SQM Q3'2020 |

Average Occupancy Q3'2020 |

Average Uptake Q3'2020 |

Average Annual Uptake Q3'2020 |

Average Rental Yield Q3'2020 |

Average Price Appreciation Q3'2020 |

Total Returns Q3'2020 |

|

Lower Mid-End: Satellite Towns |

||||||||

|

Thindigua |

110,224 |

590 |

96.4% |

93.2% |

18.8% |

5.8% |

2.3% |

8.1% |

|

Syokimau |

69,225 |

362 |

88.3% |

79.9% |

14.2% |

5.5% |

1.4% |

6.8% |

|

Ruiru |

89,781 |

495 |

76.4% |

60.7% |

20.4% |

5.0% |

1.3% |

6.2% |

|

Kikuyu |

81,090 |

416 |

86.0% |

84.4% |

26.5% |

5.7% |

0.1% |

5.8% |

|

Athi River |

58,311 |

340 |

84.6% |

90.1% |

15.3% |

6.2% |

(1.8%) |

4.4% |

|

Kitengela |

60,027 |

325 |

88.1% |

99.5% |

13.6% |

6.0% |

(1.7%) |

4.3% |

|

Ruaka |

100,215 |

520 |

89.9% |

86.2% |

25.6% |

5.3% |

(1.3%) |

4.0% |

|

Average |

81,268 |

436 |

87.1% |

84.8% |

19.2% |

5.6% |

0.0% |

5.7% |

Source: Cytonn Research 2020

Kenya Power Pension Fund (KPPF), announced plans to put up a Kshs 2.3 bn r3esidential apartments on its 1.67- acre plot along Kirichwa Road in Nairobi’s Kilimani area. The development will consist of 124 two bedroomed units with domestic servant quarters, 68 three-bedroomed units with domestic servant quarters and another 68 two-bedroom units without domestic servant quarters (prices undisclosed), which will be made available for sale to the general public. Other residential projects developed by KPPF include Runda park in Runda, Loresho Ridge in Loresho and Bogani Park in Karen. The investor’s focus on the Kilimani market is supported by; i) proximity to Nairobi CBD and Westlands making it a convenient residential location for individuals working within the commercial nodes, ii) good transport network in and out of the area, and, iii) influx of high and middle-income earners in the area thus increased demand for housing. According to Cytonn Q3’2020 Markets Review, apartments in Kilimani recorded an average rental yield of 5.3%, 0.2% points above the market average of 5.1%, with occupancy rates coming in at 87.0%, 2.5% points above the market average of 84.5%. However, the submarket recorded a significant decline in the price of units by (2.3) % due to reduced demand, as developers sought to attract buyers amid the existing oversupply of residential units in the upper mid-end market, and reduced disposable income due to a tough economic environment.

The table below shows the market performance of apartments within the upper mid-end segment in Q3’2020;

(All Values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area Residential Apartments Performance Q3’2020 |

||||||||

|

Area |

Average Price Per SQM Q3'2020 |

Average Rent per SQM Q3'2020 |

Average Occupancy Q3'2020 |

Average Uptake Q3'2020 |

Average Annual Uptake Q3'2020 |

Average Rental Yield Q3'2020 |

Average Price Appreciation Q3'2020 |

Total Returns Q3'2020 |

|

Upper Mid-End |

||||||||

|

Loresho |

112,601 |

541 |

90.0% |

89.0% |

11.4% |

5.4% |

0.8% |

6.1% |

|

Westlands |

172,924 |

775 |

88.2% |

88.1% |

23.3% |

5.8% |

(0.2%) |

5.6% |

|

Parklands |

116,456 |

613 |

91.1% |

81.5% |

15.3% |

5.2% |

0.2% |

5.4% |

|

Kileleshwa |

128,500 |

662 |

79.2% |

84.2% |

18.8% |

4.7% |

(0.5%) |

4.2% |

|

Upperhill |

130,030 |

741 |

71.6% |

77.3% |

18.2% |

4.0% |

0.0% |

4.0% |

|

Kilimani |

134,924 |

904 |

87.0% |

82.3% |

27.3% |

5.3% |

(2.3%) |

2.9% |

|

Average |

132,573 |

706 |

84.5% |

83.7% |

19.0% |

5.1% |

(0.3%) |

4.7% |

Source: Cytonn Research 2020

During the week, Kenya Mortgage Refinance Company (KMRC), a Treasury backed lender, signed an agreement that will see the African Development Bank (AfDB) guarantee its first bond issue, planned for the third quarter of next year. The KMRC green bond will be the second of its kind in Kenya after Acorn holdings’ first issuance in January 2020, and will be placed privately with institutional investors, fund managers and pension funds, but is currently not contemplated to be offered to the public. KMRC initially raised approximately Kshs 40.0 bn from Africa Development Bank, World Bank and equity funding and intends to raise additional funding worth Kshs 2.0 bn from 19 financial institutions comprising of 7 commercial banks, 11 SACCOs and one micro financer (Kenya Women Microfinance Bank), which bought shares and are participating in the programme. We expect that the guarantee by Africa Development Bank will boost investor confidence in financing the facility, which has been lending money to local financial institutions since September at an annual interest rate of 5.0%, enabling them to issue home loans at 7.0%, 6.0% points lower than the market rate of approximately 13.0%. This will see an increase in homeownership by boosting the number of mortgage accounts which stands at 26,504 as of 2018. For more information on the facility, see Cytonn Weekly #34/2020 and Cytonn Weekly #38/2020.

We expect increased activities in the residential sector supported by; i) continued developer focus on the low mid-end market segments fueled by growing demand amid a huge housing deficit, and ii) lending by Kenya Mortgage and Refinance Company (KMRC) which recently began providing the much-needed housing finance to potential home buyers.

- Retail Sector

During the week, Tuskys Supermarket, a local retail chain, shut down its Ronald Ngala outlet within Nairobi’s CBD due to mounting rent arrears and supplier debts. This brings the total number of the troubled retailer’s outlets to 55 having relaunched its Malindi and Kilifi branches and closed a couple of other branches recently such as at Juja City Mall in Juja, at Nairobi’s Greenspan Mall, in Eldoret along Uganda Road, among others. The retailer continues to encounter financial woes despite securing financial support amounting to Kshs 2.0 bn from an undisclosed Mauritius-based private equity fund, which already allegedly injected Kshs 500.0 mn in September 2020 to pay off landlords, suppliers, and other immediate working capital requirements. In our view, the continued shutting down of the retailer’s outlets is an indication that the retailer will need to mobilize more funds to stabilize its operations and ease the financial pressure.

The table below shows the summary of the number of stores of the key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||

|

Name of Retailer |

Initial number of branches |

Number of branches opened in 2020 |

Closed branches |

Current number of Branches |

Branches expected to be opened |

Projected total number of branches |

|

QuickMart |

32 |

3 |

0 |

32 |

0 |

32 |

|

Carrefour |

8 |

1 |

0 |

8 |

3 |

11 |

|

Game Stores |

3 |

1 |

0 |

3 |

0 |

3 |

|

Naivas Supermarket |

66 |

5 |

0 |

66 |

4 |

70 |

|

Chandarana Foodplus |

20 |

1 |

0 |

20 |

0 |

20 |

|

Tuskys |

64 |

2 |

9 |

55 |

0 |

55 |

|

Uchumi |

37 |

0 |

33 |

4 |

0 |

4 |

|

Shoprite |

4 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

65 |

0 |

65 |

0 |

0 |

0 |

|

Choppies |

15 |

0 |

13 |

2 |

0 |

2 |

|

Total |

314 |

13 |

124 |

190 |

7 |

197 |

Source: Online research

Despite the continued exit of troubled retailers such as Tuskys, we expect the entry and expansion of local and international retailers taking up prime retail space left behind will cushion the retail sector’s performance supported by the changing tastes and preferences of consumers and the growing middle class with higher purchasing power. However, we expect this to be constrained by the existing oversupply of space estimated at approximately 2.8 mn SQFT as of 2019, and the growing focus on e-commerce thus affecting demand for physical retail space.

We expect the real estate sector to record increased activity mainly on the residential front as developers focus on the low mid-end market segments fuelled by growing demand amid a huge housing deficit, coupled with the lending being done by the recently operationalized KMRC.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor