Developing Technical Education Institutions with a Focus on Vision 2030, & Cytonn Weekly #27/2018

By Cytonn Research Team, Jul 15, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week with the overall subscription rate coming in at 218.9% up from 146.0% recorded the previous week. Yields on the 91-day, 182 and 364-day papers declined by 2 bps, 20 bps and 4 bps to 7.7%, 9.3% and 10.4%, respectively. According to a report by the African Union Commission titled Africa's Development Dynamics 2018, Africa has been experiencing strong economic growth averaging 4.6% in the last 17 years, with the recent growth being attributed to improved commodity prices, formulation of diversification strategies that have focused on increasing the growth drivers, reducing the dependency on commodity driven economic growth, and improved macroeconomic management;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 25 losing 1.0% and 0.7%, respectively, while NSE 20 gained by 0.6%. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 11.9%, (8.9%) and 9.2%, respectively. Global rating agency Moody’s estimates that Non-Performing Loans (NPLs) in the banking sector are likely to increase on account of delayed impact of the various shocks experienced in the economy last year;

Private Equity

In fundraising, Branch International, a mobile-based Microfinance Institution (MFI) operating in Kenya, Tanzania, Nigeria and California, raised Kshs 350.0 mn (USD 3.5 mn) in capital investment through an issuance of a second commercial paper that was arranged by Barium Capital, a capital-raising advisory firm owned by Centum Investments. The capital investment is expected to grow Branch’s loan book, and comes after their recent capital raise, where they raised Kshs 7.0 bn led by California-based Trinity Ventures in a Series B funding round;

Real Estate

During the week, two real estate firms released reports indicating improved performance in the residential estate sector during H1’2018. According to Hass Consult, total annual returns in the residential sector surged to 11.4%, compared to 4.3% in 2017, due to increased investor confidence while Knight Frank noted that residential rents and prices improved by 0.3% and 0.4%, respectively, in H1’2018 as compared to H2’2017, with the improvement as a result the return of calm after the conclusion of the prolonged electioneering period;

Focus of the Week

Over the recent months, we have seen the Kenyan Government focus on improving the quality of education offered in government-sponsored technical institutions. At the same time, Cytonn has recently ventured into education investment, with its first institution being the Cytonn College of Innovation and Entrepreneurship, a tertiary institution offering diploma and certificate courses, as well as short professional courses, and focusing on developing entrepreneurship skills for its students. This week we focus on actions that, in our view, the government and private investors should take to ensure they provide technical training that will create a workforce that participates in the achievement of the Vision 2030. We also highlight the German Dual VET system, which has successfully implemented technical training in their education system and highlight the impact this has had on their economy and the lessons that education providers in Kenya can learn from them.

- Cytonn Investments will hold an Investments Analyst & Investors Open Day on 19th July 2018 at the Sarova Stanley from 7:30 am to 12:00 pm. The forum targets investments analysts and investors and aims at educating the market on our structured finance business model and our operating environment. If interested in attending the forum, register here

- Caleb Mugendi, Senior Investment Analyst, discussed the acquisition of Chase Bank by SBM Holdings, and the deal by Uber and Taxify to raise fares after a week of strike. Watch him on CNBC Africa here

- Patricia Wachira, Senior Research Analyst, discussed affordable housing which is one of the government's Big Four Agenda. Watch her on Ebru T.V. here

- Moses Njuguna, Distribution Unit Manager, discussed Financial Planning and Investments. Watch him on Njata T.V. here

- The Q2’2018 issue of our quarterly Sharp Cents Magazine is out. Read the issue here or email clientservices@cytonn.com to get a copy

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: IT Network Engineer and Unit Managers- Mt. Kenya Region. Visit the Careers section on our website to apply.

- Cytonn Real Estate is looking for a 0.5-acre land parcel for a joint venture in Lavington, Karen or Kiambu Road. The parcel should be in a good location with frontage to a tarmac road. For more information or leads, email us at rdo@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills were oversubscribed during the week with the overall subscription rate coming in at 218.9% up from 146.0%, recorded the previous week. Yields on the 91-day, 182 and 364-day papers declined by 2 bps, 20 bps and 4 bps to 7.7%, 9.3% and 10.4%, respectively. T-bill yields have continued to decline as a result of increased demand evidenced by the high subscription rates, attributable to improved liquidity, which saw the interbank rate decline to an average of 5.2% in H1’2018 compared to 7.2% recorded in H2’2017. The acceptance rate for T-bills declined to 61.0% from 70.8%, the previous week, with the government accepting Kshs 32.0 bn of the Kshs 52.5 bn worth of bids received. The subscription rates for the 91, 182 and 364-day papers increased to 61.1%, 123.6%, and 377.3%, compared to 18.7%, 77.1%, and 265.9%, respectively, the previous week as investors’ participation remain skewed towards the longer dated papers.

For the month of July 2018, the Kenyan Government has issued a new 20-year Treasury bond (FXD 2/2018/20) with the coupon set at 13.2%, in a bid to raise Kshs 40.0 bn for budgetary support. The government has been trying to increase its local debt maturity profile, having issued a 25-year bond in June, the longest tenor since 2014. The average term to maturity for all government securities has been on the decline, hitting 4.4 years as at April 2018 from an average of 6.2 years in 2009 as stated in the Medium Term Debt Management Strategy for 2018 to 2021, which can expose the government to refinancing risks due to the high maturities of short term debt expected in the 2018/2019 Financial Year. The sale period for the bond ends on 24th July, and we shall give our view on a bidding range in next week’s report.

Liquidity:

The average interbank rate declined to 4.7%, from 6.4%, the previous week, while the average volumes traded in the interbank market decreased by 43.8% to Kshs 14.4 bn, from Kshs 25.6 bn the previous week. The decline in the average interbank rate points to improved liquidity, which the Central Bank of Kenya attributed to support from Government payments that took place during the week.

Kenya Eurobonds:

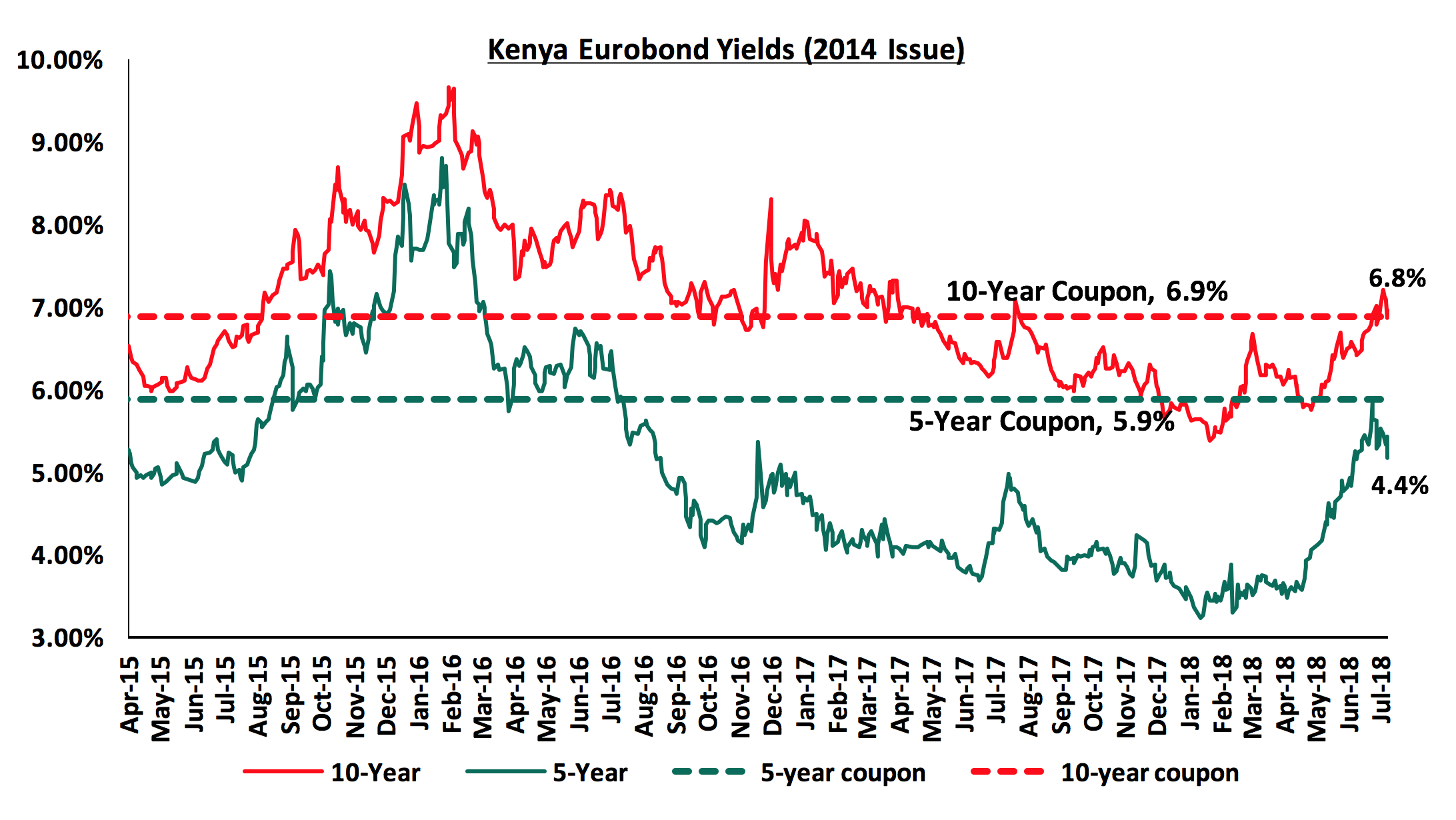

According to Bloomberg, the yield on the 10-year Eurobond issued in 2014 declined by 30 bps to 6.8% from 7.1% the previous week, while the 5-year Eurobond declined by 20 bps to 4.4%, from 4.6% the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.4% points and 2.9% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 1 year and 6 years to maturity.

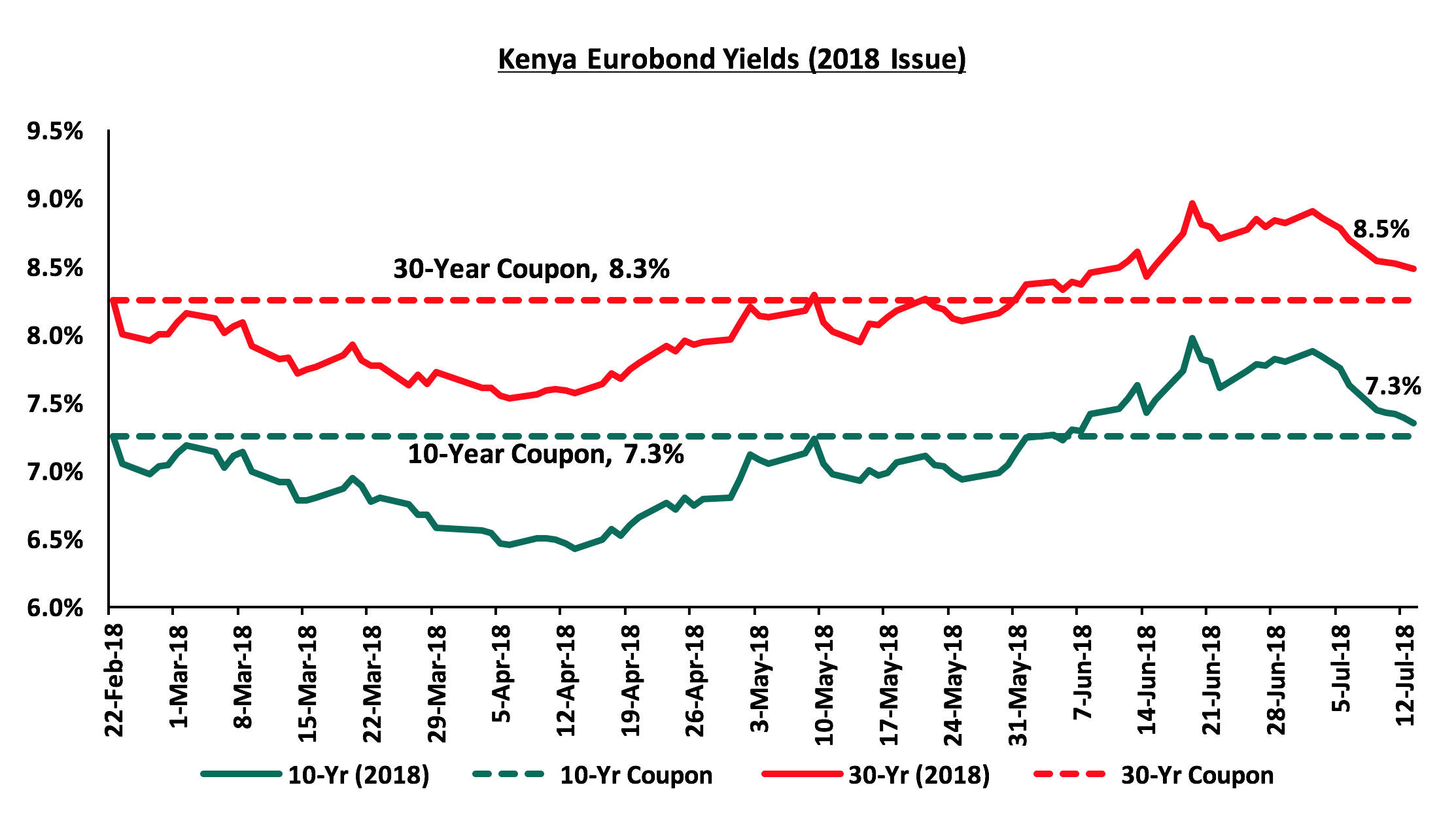

For the February 2018 Eurobond issue, during the week, the yields on the 10-year Eurobond declined by 30 bps to 7.3% from 7.6% the previous week, while the 30-year Eurobonds declined by 20 bps to 8.5%, from 8.7% the previous week. Since the issue date, yield on the 10-year Eurobond has declined marginally by 0.1% points while the yields on the 30-year Eurobond has increased by 0.2% points.

We have noted the Kenyan Eurobond yields have been on the decline in the recent weeks, which has been attributed to improved liquidity in the global markets and lower risk perception as a result of improved investor sentiments based on the stable macroeconomic conditions evidenced by the strong economic growth of 5.7% in Q1’2018, compared to 4.8% in Q1’2017.

The Kenya Shilling:

During the week, the Kenya Shilling remained stable against the US dollar, remaining unchanged at Kshs 100.8 from the previous week. CBK attributed this to an even match in the demand for and supply of the US dollar in the forex market. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, to 8.9% of GDP in Q1’2018 compared to 11.3% in Q1’2017 on account of faster growth of exports at 7.1%, compared to import growth at 6.5%,

- Stronger inflows from principal exports, which include coffee, tea and horticulture, which increased by 9.3% during the month of April to Kshs 21.9 bn from Kshs 20.0 bn in a similar period the previous year, with the exports from coffee, and horticulture increasing by 6.7%, and 25.0% y/y, respectively, while tea exports have declined marginally by 1.6% y/y,

- Improving diaspora remittances, which increased by 16.9% to USD 253.7 mn in May 2018, from USD 217.1 mn in April 2018, with the largest contributor being North America at USD 122.8 mn attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 8.9 bn (equivalent to 5.9 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Weekly Highlights:

During the week, the African Union Commission released their first annual economic report in collaboration with the OECD Development Centre dubbed ‘Africa's Development Dynamics 2018’. These are some of the key take-outs:

- Africa has been experiencing strong economic growth averaging 4.6% over the last 17 years, with the recent growth being attributed to:

- Improved commodity prices,

- Formulation of diversification strategies that have focused on increasing the growth drivers, which reduce dependency on commodity driven economic growth, and

- Improved macroeconomic management.

- Volatility in growth continues to be a concern as most economies are reliant on commodities affected by global prices, which saw the GDP growth in resource-rich countries decline to 1.5% in 2016 after the sharp 58.0% decline in fuel prices, and 37.0% decline in metals and mineral prices. Volatility in different countries in the region varies based on the type of exports, with the resource-rich countries enjoying stronger terms of trade in the recent years due to the improved commodity prices as well as higher economic growth averaging 6.0% since 2000, higher than the 4.0% in non-resource-rich countries. Growth has also remained inconsistent in the continent with only 3 out of the 55 countries being projected to reach the 7.0% annual growth target by 2020, set by the African Union in the Agenda 2063.

- African regional markets are expected to grow driven by,

- The increasing contribution of private consumption to economic growth largely attributed to increased literacy levels and higher purchasing power by Africa’s growing middle class (those spending USD 5-20 per day). This has been viewed as an opportunity that can be tapped by the domestic market, but it also raises the risk of worsening balance of payments due to increased demand for imported goods should the local markets not match competing products from developed markets,

- Improved ease of doing business due to simplified administrative procedures and reduced operational costs, and

- Higher foreign direct investments with total inflows in the region reaching 8.8% of GDP in 2016. The expected growth in regional markets is set to boost Small and Medium Enterprises due to their proximity as well as understanding of the local markets.

- East Africa’s annual economic growth has been more resilient compared to other regions, exceeding 4.0% since 1990, on the back of the service sector, which represents almost 60.0% of GDP. Despite the service sector being the largest contributor to GDP, Agriculture with a contribution to GDP of 20.0% employs 60.0% of the labor force, though the share has been marginally declining with some of the labor force being absorbed in the expanding services sector.

Key to note, the report emphasized on the need for local firms to upgrade their processes as well as technology in order to be able to meet the expected surge in domestic demand due to the new continental free trade area, which was signed on 21st March 2018 in Kigali, that aimed at creating a single continental market and improving intra-regional trade. Africa’s intra-regional trade stands at only 4.1% of GDP compared to 16.6% in Europe and 24.2% in Asia. The African Union also noted that the region is already open to the global economy but the problems lie in the lack of diversification in exports, as the bulk of them are unprocessed commodities, which are cheaper than the processed imports leading to an unfavourable trade balance.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids due to increased demand evidenced by the high subscription rates, attributable to improved liquidity, which saw the interbank rate decline to an average of 5.2% in H1’2018 compared to 7.2% recorded in H2’2017. The government is however likely to remain behind its borrowing target for the better part of the first half of the 2018/19 financial year as per historical data. The 2018/19 budget gives a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. However, the National Treasury has proposed to repeal the interest rate cap, which if repealed can result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles. With the cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

Market Performance:

During the week, the equities market recorded mixed performance with NASI and NSE 25 losing 1.0% and 0.7%, respectively, while NSE 20 gained by 0.6% taking their YTD performance to 0.0%, (10.2%) and 2.9%, for NASI, NSE 20 and NSE 25, respectively. This week’s performance was driven by declines in large cap stocks such as Barclays Bank, Cooperative Bank, Bamburi and Safaricom that declined by 3.4%, 2.3%, 2.0% and 1.7%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 11.9%, (8.9%) and 9.2%, respectively.

Equities turnover decreased by 18.7% to USD 19.6 mn from USD 24.1 mn the previous week. We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters.

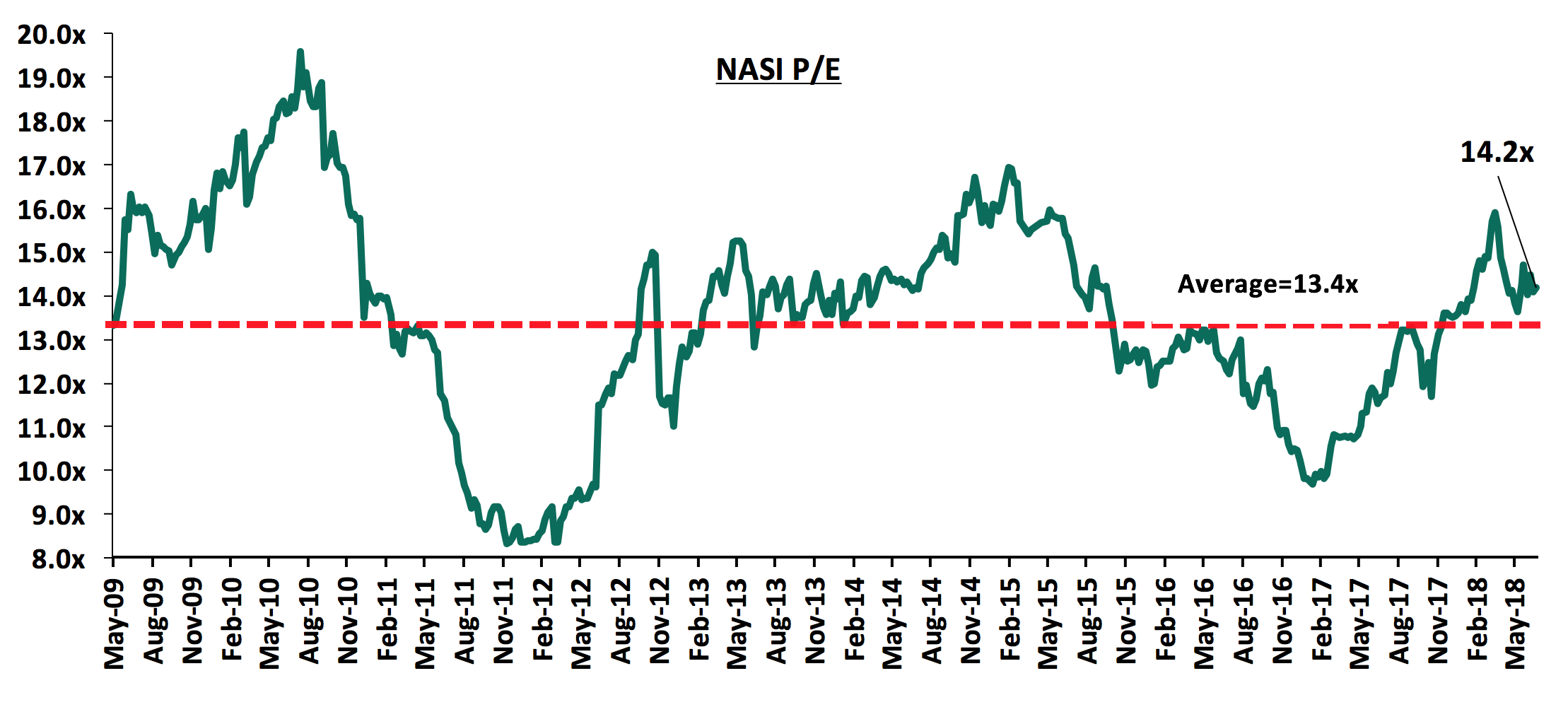

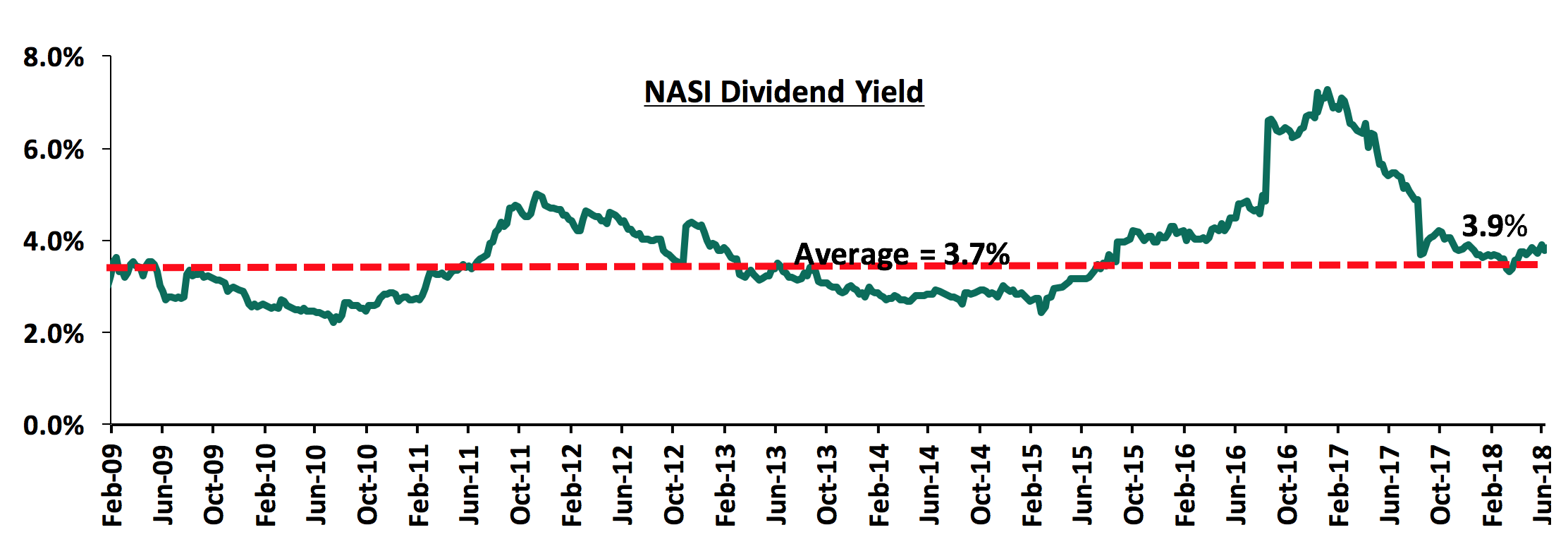

The market is currently trading at a price to earnings ratio (P/E) of 14.2x, which is 6.0% above the historical average of 13.4x, and a dividend yield of 3.9%, higher than the historical average of 3.7%. The current P/E valuation of 14.2x is 44.9% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 71.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly highlights:

Global rating agency Moody’s estimates that Non-Performing Loans (NPLs) in the banking sector are likely to increase on account of delayed impact of the various shocks experienced in the economy last year. This was mainly due to the prolonged electioneering period coupled with a prolonged drought that affected agriculture, the country’s main GDP contributor. The agency estimates that the industry NPL increased to 11.0% in Q1’2018, as the effects of the economic slump experienced in 2017 spilled over to the current year. The sector’s NPL has been steadily increasing since 2015, from the then average of 6.0% to the current estimated 11.0%. However, even with the current improving business environment, the agency does not expect much credit expansion, as loan growth will expand over the next 12-18 months but will remain inhibited by the interest rate cap. Thus, credit growth is expected to remain below 5.0% as banks adopt tighter lending criteria in a bid to tame the high number of NPLs, and owing to the current low risk-adjusted returns from loans as lending rates have been capped at 4.0% above the Central Bank Rate (CBR) and deposits at 70.0% of the CBR. The agency also noted that the banking sector is reaping a lot of benefits from financial technology innovation and rapid uptake of new products developed by banks. We expect credit growth to remain at the low levels of below 5.0%, below the 5-year average of 14.0%, largely due to the interest rate cap. However, with the proposal to repeal the law currently in the finance bill, a repeal would likely spur credit growth and access by the private sector. As we recommended in our focus note, Rate Cap Review Should Focus More on Stimulating Capital Markets the repeal needs to be accompanied with financial markets deepening policies and initiatives that make it easier for new and structurally unique products to be introduced in the capital and financial markets, that would promote the competing sources of financing, so as to avoid a reversion to the initial high borrowing cost regime that led to the enforcement of the cap in the first place.

According to a joint report by Financial Sector Deepening Kenya, The Central Bank of Kenya (CBK) and the Kenya National Bureau of Statistics (KNBS), Kenyans have turned to digital micro-loans. According to the report, six million people have taken digital loans, highlighting the central role mobile lending applications play. The loans are mostly taken for short-term working capital and day-to-day consumption needs, with the main preference for these loans being their convenience and ease of access. However, the report warns that while the popularity of lending apps points to a positive step towards deepening financial inclusion, more research is required to understand the real socio-economic impact of digital credit on low-income segment of the population. We are of the view that with the increased proliferation of mobile devices, micro-loan providers have been able to tap into the credit market leveraging on the convenience and ease of credit access. However, we note that digital borrowers tend to borrow frequently, and it is thus important to ensure methods are put in place to track debt profiles for individuals so as to highlight any socio-economic issues that may arise.

Barclays Africa Group Limited changed its name to Absa Group on Wednesday, as the London-based Barclays Plc exited the African market to concentrate on European and United States markets. Barclays Plc had acquired a majority stake of 56.4% in Absa Group in 2005, gradually increased its stake to 62.0% but reduced to 14.9% after selling to the large institutional investor Public Investment Corporation of South Africa (PIC). The Kenyan banking unit has however stated its intention to continue operations as Barclays Bank of Kenya until 2020, when it will complete the rebranding process. The move to separate with the London based parent company presents an opportunity for the lender to explore new business ideas and products that were initially hampered by the restrictions imposed by the parent group. This will enable the bank to quickly implement new products based on mobile and internet banking that resonate with local markets, and were constrained due to parent company’s involvement. Barclays Bank CEO Jeremy Awori noted that prior to the parent company scaling down its ownership to 14.9%, the bank experienced a lot of challenges in venturing into areas such as Small and Medium Enterprises (SMEs) and real estate asset financing. However, with localized decision-making, the bank is now able to accelerate new product development, implementation and service delivery. We are of the view that with the exit of the London- based parent company, Barclays will be able to compete more favourably with its peers, as it plans to increase its market share in the region by 5 million customers by 2020. The bank has been lagging behind in digital implementation as it launched its mobile banking platform dubbed Timiza app in March 2018, while its competitors KCB, Co-operative Bank and Equity Group had long ventured into this space. Thus, with more localized decision-making, the lender is well poised to quickly exploit any opportunities that arise as well as build on their innovative profile that has seen the bank offer efficient services to its customers.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 6/07/2018 |

Price as at 13/07/2018 |

w/w change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Ghana Commercial Bank*** |

5.0 |

5.0 |

0.0% |

(1.0%) |

(3.8%) |

7.7 |

7.6% |

62.0% |

1.2x |

|

NIC Bank*** |

36.5 |

34.8 |

(4.8%) |

3.0% |

12.4% |

54.1 |

2.7% |

51.0% |

0.9x |

|

I&M Holdings*** |

115.0 |

110.0 |

(4.3%) |

5.8% |

2.8% |

169.5 |

3.0% |

50.4% |

1.2x |

|

Zenith Bank*** |

24.3 |

24.0 |

(1.2%) |

(6.4%) |

8.6% |

33.3 |

11.1% |

48.2% |

1.1x |

|

Diamond Trust Bank*** |

195.0 |

195.0 |

0.0% |

1.6% |

15.4% |

280.1 |

1.3% |

45.0% |

1.1x |

|

Ecobank |

7.6 |

8.0 |

5.3% |

5.3% |

25.7% |

10.7 |

0.0% |

41.2% |

2.2x |

|

KCB Group*** |

46.5 |

47.8 |

2.7% |

11.7% |

23.2% |

60.9 |

6.5% |

37.4% |

1.5x |

|

Union Bank Plc |

6.0 |

6.0 |

0.0% |

(23.7%) |

31.1% |

8.2 |

0.0% |

37.0% |

0.6x |

|

Barclays |

11.4 |

11.5 |

0.9% |

19.3% |

19.9% |

14.0 |

8.8% |

32.2% |

1.4x |

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

(22.0%) |

207.7 |

0.0% |

29.8% |

0.5x |

|

HF Group*** |

8.4 |

8.5 |

1.2% |

(18.3%) |

(11.0%) |

10.2 |

3.8% |

25.2% |

0.3x |

|

Equity Group |

47.8 |

48.8 |

2.1% |

22.6% |

30.0% |

55.5 |

4.2% |

20.4% |

2.4x |

|

Co-operative Bank |

17.1 |

17.0 |

(0.6%) |

6.3% |

21.4% |

19.7 |

4.7% |

19.9% |

1.5x |

|

UBA Bank |

10.4 |

10.0 |

(3.4%) |

(2.9%) |

11.1% |

10.7 |

14.5% |

17.9% |

0.7x |

|

Stanbic Bank Uganda |

32.0 |

32.0 |

0.0% |

17.4% |

17.4% |

36.3 |

3.7% |

17.0% |

2.0x |

|

Bank of Kigali |

288.0 |

290.0 |

0.7% |

(3.3%) |

17.4% |

299.9 |

4.8% |

9.0% |

1.6x |

|

CAL Bank |

1.3 |

1.3 |

0.0% |

20.4% |

74.8% |

1.4 |

0.0% |

7.7% |

1.1x |

|

Stanbic Holdings |

91.0 |

90.0 |

(1.1%) |

11.1% |

17.6% |

85.9 |

5.8% |

0.2% |

1.1x |

|

Standard Chartered |

204.0 |

203.0 |

(0.5%) |

(2.4%) |

(5.6%) |

184.3 |

6.1% |

(3.5%) |

1.6x |

|

Guaranty Trust Bank |

41.5 |

39.8 |

(4.2%) |

(2.5%) |

7.7% |

37.2 |

5.8% |

(4.5%) |

2.3x |

|

SBM Holdings |

7.2 |

7.1 |

(0.8%) |

(4.8%) |

(5.8%) |

6.6 |

4.2% |

(4.7%) |

1.0x |

|

Access Bank |

10.4 |

10.2 |

(1.9%) |

(2.4%) |

4.1% |

9.5 |

3.8% |

(4.8%) |

0.7x |

|

Bank of Baroda |

149.0 |

145.0 |

(2.7%) |

28.3% |

34.3% |

130.6 |

1.7% |

(10.7%) |

1.3x |

|

Standard Chartered |

26.6 |

26.0 |

(2.3%) |

3.0% |

58.9% |

19.5 |

0.0% |

(26.8%) |

3.3x |

|

Stanbic IBTC Holdings |

52.0 |

51.5 |

(1.0%) |

24.1% |

64.5% |

37.0 |

1.1% |

(27.7%) |

2.7x |

|

FBN Holdings |

10.5 |

10.4 |

(1.0%) |

18.2% |

68.3% |

6.6 |

2.4% |

(34.5%) |

0.6x |

|

Ecobank Transnational |

20.5 |

20.4 |

(0.7%) |

19.7% |

44.3% |

9.3 |

0.0% |

(54.7%) |

0.7x |

|

National Bank |

6.5 |

6.2 |

(4.7%) |

(34.2%) |

(39.1%) |

2.8 |

0.0% |

(56.6%) |

0.4x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder **** Stock prices are in respective country currency

|

|||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

Branch International, a mobile-based microfinance institution headquartered in California with operations in Kenya, Tanzania and Nigeria, raised Kshs 350.0 mn (USD 3.5 mn) in capital investment based on its second issued commercial paper in the Kenyan market. The Silicon Valley start-up, founded in 2015, processes loans ranging from Kshs 250 to Kshs 70,000 daily and applies machine learning to create an algorithmic approach to determine credit worthiness via customers' smartphones.

The capital investment arranged by Barium Capital, a capital-raising advisory firm owned by Centum Investments, is expected to grow Branch’s loan book and expand its financial services and lending products in Kenya. Branch International has so far disbursed more than Kshs 10.0 bn (USD 100.0 mn), distributed more than 6.0 mn loans and currently has over 1.0 mn users. It expects to disburse over Kshs 25.2 bn (USD 250.0 mn) in 2018 and plans to expand into new markets such as India.

Previous Branch International investments include another commercial paper issuance of Kshs 200.0 mn (USD 2.0 mn) that was arranged by Centum-owned Nabo Capital in 2017. Additionally, in March this year, the company raised a Kshs 7.0 bn (USD 70.0 mn) Series B investment led by California-based Trinity Ventures to expand its financial offerings to additional countries. For more information, see our Cytonn Weekly #15/2018

In 2017, USD 200.0 mn was raised for Fintech businesses in East Africa, of which 98% of funds raised went to Kenyan companies. So far this year, Kenya has seen increased Fintech investments with Tala, a mobile-based lender, securing a Kshs 6.5 bn Series C investment in April and US-based Digital Financial Services Lab (DFS Lab) injecting an undisclosed seed capital in Cherehani Africa.

With Kshs 3.4 tn having been transacted via mobile cash in 2016 compared to Kshs 2.8 tn in 2015 due to the rise in the number of mobile lending apps, Kenyans, in particular small and micro entrepreneurs, are increasingly turning to these mobile lending solutions to access digital micro-loans mainly for short-term working capital.

We expect the demand for mobile loans to increase and this will be driven by:

- Rapid growth of smartphone adoption in the African market with Kenya surpassing 40 mn mobile subscriptions in 2017,

- Affinity for mobile money in Kenya as 60% of Kenyans have a mobile banking account and receive 90% of remittances through a mobile device,

- The convenience and accessibility to these loans that have a fast processing time, no paperwork or collateral and no late or rollover fees, and,

- Kenyan banks hesitance to lend to smaller, untested businesses, due to the interest rate cap.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

Last week, Cytonn released the Nairobi Metropolitan Area Residential Report 2017/18, a report that seeks to inform on the Real Estate residential sector in Kenya and the best areas of investment for both detached units and apartments. The report showed that the sector recorded annual total returns of 8.2% in 2017/18, which marks a marginal decline of 1.2% points from the 9.4% cumulative returns recorded in 2016/17. This was attributed to stagnation and a decline in prices in selected markets, a spill-over effect of last year’s electioneering period and tight access to financing especially for potential home buyers, with private sector credit growth falling to 2.1% as at April 2018 compared to a 5-year average of 14.0%. Despite the slight decline, we noted that the sector still has pockets of value with some sub-markets recording double-digit returns of between 11.0%-14.0% including Kilimani, Thindigua, Ruaka, Kitisuru and Ruiru. During the past week, two other firms released reports highlighting areas of value in the real estate sector. Hass Consult released their House Price Index Report Q2'2018 and the key take-outs were:

- Asking prices increased by 3.6% q/q and by 5.1% on an annual basis compared to a 3.1% q/q decline and a 2.2% y/y decline recorded during Q2’2017. The increase is attributed to renewed investor confidence following the conclusion of the elections held last year,

- Rental prices also grew by 3.3% q/q compared to a 2.0% q/q decline recorded in 2017, and this was on account of landlords initiating rent escalations that had been halted as confidence restored in the market,

- As a result, total returns comprising of rental yields and price appreciation came in at 11.4%, which is 3 times higher than the returns in 2017 at 4.3%,

- The best performing submarkets for the rental market were as follows:

- For detached units, Kitisuru recorded the highest rental price increase at 2.7% attributable to a relatively low supply of housing compared to the demand for up-market housing, while Lang’ata posted the highest increase at 3.7% for apartments due to its attractiveness to the middle-class being in close proximity to main business hubs such as the CBD and Upperhill,

- In satellite towns, Ruaka outperformed other areas, with rents appreciating by 11.5% annually and 3.9% over the past quarter; this we attribute to the increased demand for housing in Ruaka being one of the fastest growing towns in Kiambu County with a good transport network, serene environment and available social amenities,

- The best performing submarkets in the sale market were:

- Detached units, Gigiri outdid other areas to record a price increase of 2.7% attributable to its prime location in a secure environment thus leading to increased demand especially from expatriates. For apartments, Westlands posted a sales price increase of 2.0%, the highest in the Nairobi region, attributable to accessibility, given its proximity to commercial nodes such as the CBD and Parklands as well as its own status as a recognized commercial zone

- For satellite towns Ngong Town recorded the highest price rise across all typologies with detached units and apartments increasing by 5.8% and 6.9%, respectively, due to it tranquility and ease of accessibility from areas such as Magadi, Kikuyu, Nairobi and Magadi as a result of the construction of the Southern bypass and the ongoing expansion of Ngong road.

- In terms of unit typologies, semi-detached units outperformed other typologies to record a q/q growth of 4.7%, compared to detached typologies and apartments that came in at 3.9% and 1.0%, respectively. We attribute this performance to increased demand for semi-detached units as they tend to be more affordable compared to detached units and offer the privacy of an own-compound as opposed to apartments.

According to Hass Consult, there is restored investor confidence in the market; however, liquidity is still a big challenge due to the effects of the interest rate cap. Comparing the findings to our Nairobi Metropolitan Area Residential Report 2017/18, the total returns according to Hass Consult are 3.2% points higher, which we attribute to differences in sampling and areas covered. The outlook on investment in the sector is positive, supported by; (i) positive demographics, such as Kenya’s population growth rates that average at 2.6% p.a., 1.4% points higher than global averages of 1.2% p.a., high urbanization rates of 4.4% p.a. against global averages of 2.1% p.a., that would mean sustained demand, (ii) a better operating environment with digitization of lands ministries and slashing of statutory fees such as NEMA and NCA, and (iii) a relatively stable economy with GDP growth rates averaging at 5.3% p.a. over the last 5-years and driven by a rising middle-income class with steady incomes, and the intensified focus on affordable housing.

Hass Consult also released their Land Price Index Report Q2’2018, where the key take-outs were:

- Asking land prices in Nairobi suburbs softened recording a growth of 0.2% q/q as compared to a similar period in 2017 where the growth recorded was 2.5%, while in satellite town, land prices grew by 0.5% q/q, 7.6% points lower than the 8.1% growth in Q2’2016. The slow growth is attributable to a constrained operating environment characterized by interest rate caps,

- Kileleshwa was the best performing suburb on a quarterly basis recording a growth of 4.0% between Q1’and Q2’2018, while Ngong was the best performing satellite on an annual basis recording growth of 4.3%, which were all attributable to investors warming up to the area due to infrastructural development such as the expansion of Ngong’ Road, the Southern Bypass and the Standard Gauge Railway (SGR) with a station at Kimuka.

The findings are in tandem with Cytonn Nairobi Metropolitan Area Land Report 2018, where we had indicated that the Nairobi Metropolitan area had recorded slow capital appreciation rates, reducing by 1.2% points from 8.2% to 9.4% in 2018 from 2017. We attribute the slow-down in price growth to increase in supply in lower mid-income segments prompting owners to reduce prices. This was evidenced by the price decline that we saw for lower suburb detached and apartments that reduced by 4.1% and 0.1%, respectively. We however expect renewed growth in land prices given the restored investor appetite that will result in scaling up of development activities, creating demand for land. Overall, the land sector remains a safe investment bet given its long-term potential gains, with a 6-year CAGR of 17.4% since 2011, driven by (i) improved systems such as the digitization of the land’s ministry and the scrapping of land search fees, (ii) shortage of development class land, and iii) improved infrastructure such as sewer lines and roads that have opened up areas for development, for instance Ngong Road and Outer Ring Roads opened up Donholm and Ruaraka for Real Estate development.

During the week, Knight Frank also released their H1’2018 Market Update tracking trends and performance in the residential, retail, commercial office, industrial and hospitality sectors, listed real estate, infrastructure and the institutional market. They key take-outs for each sector were;

- The retail sector posted occupancy rates averaging between 60.0% and 75.0% for new retail centers and 90% for established malls and this was as a result of relatively high demand for retail in prime locations. Prime retail rents remained unchanged at 55 USD/SQM/Month and service charge was Kshs 480.0 – Kshs 615.0 per SQM attributed to increase in supply exceeding demand in some market segments and slow recovery due to the protracted electioneering period,

- In the commercial office sector, prime rents reduced by 7.1% to USD 1.3 per SQFT per month in H1’2017 from USD 1.4 per SQFT monthly between H1’2018. Knight Frank, however, expects improvement during H2’2018 mainly driven by economic recovery and take up of office space in prime locations. Fewer completions were recorded during H1’2018 due to the political environment that was as a result of the elections, with the notable completions being Galleria Office Park and Sanlam Towers,

- In the residential sector, prime rents grew by 0.4% in H1’2018 as compared to a 1.8% decline in H2’2017 as a result of a generally better operating environment,

- In the industrial sector, Knight Frank noted the commitment of Kshs 73.0 bn by the government for ongoing projects such as the Konza Technopolis with an ambitious completion timeline of 2020. Africa Logistics Properties, a logistics and warehouse company, located at the Watermark Business Park along Ndege Rd, Karen, signed a contract with Copia, an E-commerce company in the retail sector for 4,500 SQM of warehousing space, and has currently pre-let 63% of its 50,000 sqm logistics complex, showing the demand for modern warehousing space,

- In infrastructure and policy, Kshs 115.9 bn was allocated, during the Budget Statement, for ongoing road and rail projects, with the SGR taking up Kshs 74.7 bn and the Mombasa Port Development Project allocated Kshs 2.7 bn. The allocation is a 22.4% increment compared to the allocation in 2017/18 of Kshs 204.3 bn, showing the commitment of the government towards improving infrastructure in Kenya.

In our view, the report mirrors our findings and recommendations where we have a positive outlook on the real estate sector supported by a good operating environment indicated by the current stable political environment as well as stable GDP that has averaged at 5.3% for the last 5 years.

Below are other highlights in the various sectors in the real estate market;

Residential Sector:

In the residential sector, Francis Kamande, the Chairman of the National Co-operative Housing Union (NACHU) supported the proposed 15.0% tax waiver on Housing Co-operatives. If implemented, the move will enhance the affordable housing agenda, which falls among the government’s 4 key pillars of focus for the next 5-years. NACHU is an umbrella of savings cooperatives comprising 23,000 savings societies, a capital base comprising clients’ savings of Kshs 1.0 tn, and an asset base of Kshs 1.0 tn spread across the country. In our view, if actualised the 15.0% tax will contribute to reducing the housing deficit, as it will encourage Saccos to unlock their savings, which will be used for development and provision of favourable housing loans to their members.

Infrastructure Sector:

The main highlights were

- The construction of the 530 km Lamu – Isiolo road is set to commence in August, this follows government securing Kshs 62.0 bn in funding from the Development Bank of South Africa. LAPPSSET Chairman Francis Muthaura, highlighted that the 4-year project, which is the biggest of its kind in Africa, will comprise: ports, pipeline, railways, highways, airports, power and water supply as resort cities, and

- Works on the Kshs 1.4 bn, 23 km road that connects Gilgil to Njoro officially commenced. The project dubbed the Soto Mbili- Miti Mingi road was launched by the Principal Secretary for Infrastructure and is set to be complete in 3-year.

The government’s continued investment in infrastructure will not only have a positive impact on the overall economic growth, but is also an enabler to real estate as more areas are opened up for development. We expect further investment in the sector as the Government seeks to advance its agenda, maintain a stable macroeconomic environment and sustain GDP growth at the current year average of 5.0%, this is expected to boost Real Estate development positively and open more areas for Real Estate development.

Listed Real Estate Sector:

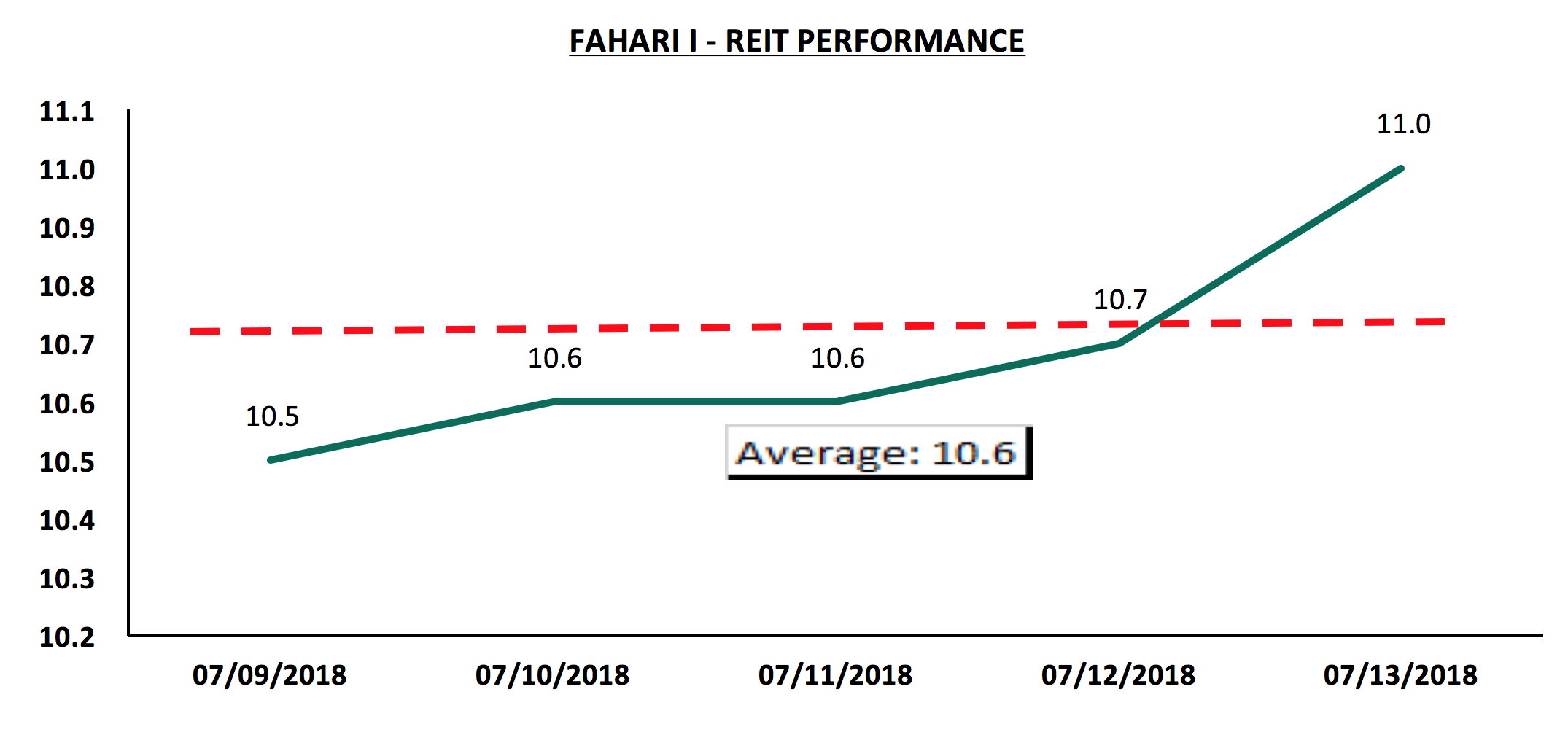

- The Fahari I- REIT, Kenya

During the week, Fahari – I REIT recorded an increase in price, closing at Kshs 11.0 per share, a 2.8% gain from an average of Kshs 10.7 the previous week and 4.8% above its opening price of Kshs 10.5 per share at the beginning of the year. The prices of the REIT have remained relatively stable with low trading volumes, indicating low investor demand on account of poor market sentiments regarding its performance since listing. The REIT is currently trading at a 47.1% discount to its listing price of Kshs 20.8 per share.

We still maintain a negative outlook on Stanlib Fahari I - REITs given: i) the market has generally remained sceptic about the positive performance of the instrument due to poor past trends with the I- REIT never able to attain its listing price of Kshs 20.8 and falling by almost half, 47.1% ii) inadequate investor education and iii) lack of transparency regarding the actual returns that will be generated.

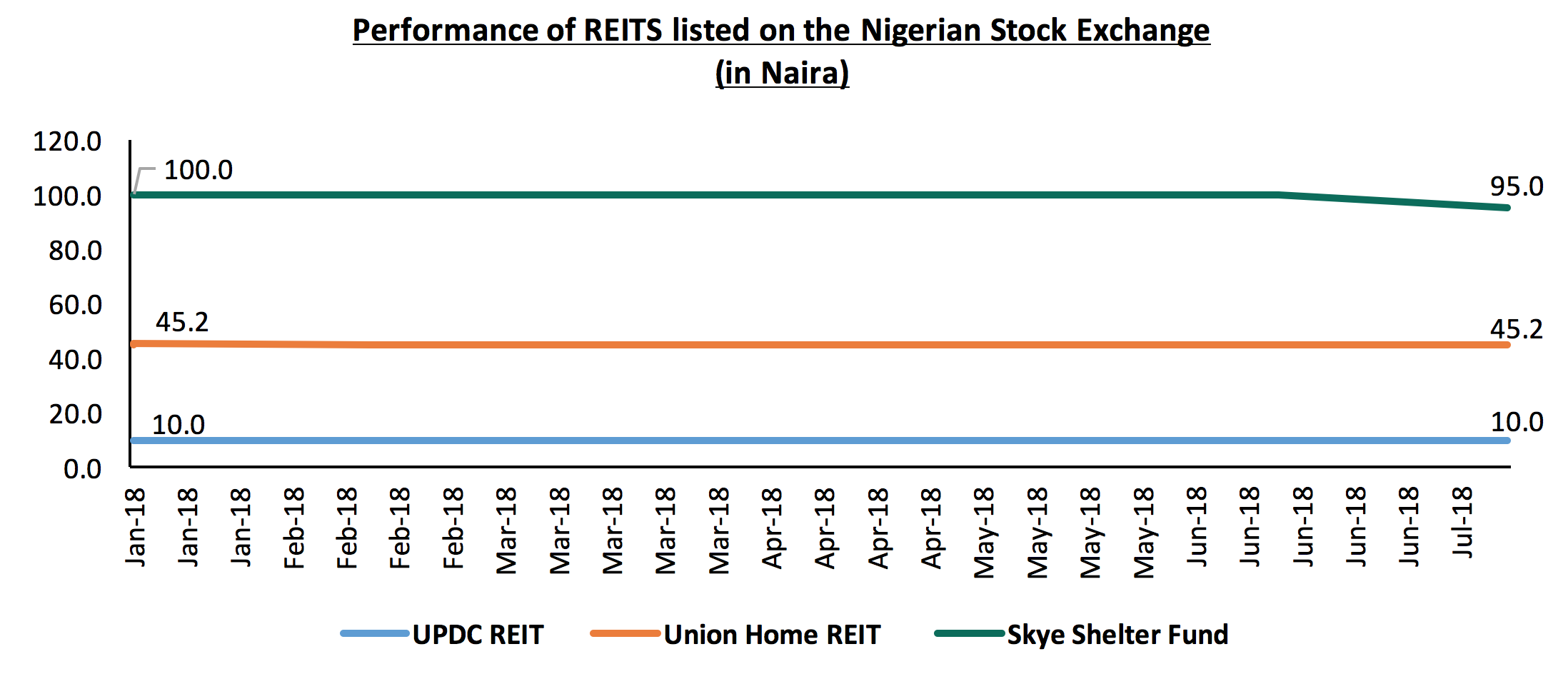

- REITS on the Nigeria Stock Exchange

This week, we introduce other I-REITs in Sub-Saharan Africa to assess their performance over time and benchmark against the Kenyan Fahari – I REIT. We have selected the following REITs listed on the Nigerian stock Exchange;

- The Nigerian Homes Real Estate Investment Trust also known as the Union Homes REIT (UH REIT) was first listed in the Nigerian Stock Exchange (NSE) in 2008 but commenced full operations in February 2009 with a net asset value of N12.8 bn (Kshs 3.5 bn). This amount is 3.6% higher than Kenya’s Fahari I REIT net amount of Kshs 3.4 bn after listing in 2015. The UH REIT invests its funds in a portfolio of both commercial and residential developments in the high-end nodes of Abuja and Lagos and has plans to expand to Ibadan and Jos. The REIT is currently trading at N45.0 (Kshs 12.7),

- UACN Property Development Company (UPDC) was launched in 2013 by UACN Property Development Company, a Real Estate and development company. The REIT was publicly quoted upon listing at N30bn (Kshs 8.3 bn). The REIT ventures in both the commercial and residential property within Lagos, Abuja and Aba. The stock is currently trading at N10 (Kshs 2.8), and,

- The Skye Shelter Fund is Nigeria’s first, publicly quoted closed-ended REIT Scheme. The REIT was launched in 2007. It is a subsidiary of Skye Bank, a Nigerian based tier 1 bank. The fund invests close to 65.0% of its fund in direct property, 25.0% in real estate through: i) real estate backed securities, ii) mortgages, and iii) real estate related equities, and approximately 10% in cash for liquidity purposes. The REIT was first publicly quoted at N2bn (Kshs 558.5 mn). In terms of property investment, the fund focuses on the commercial office, retail and the residential sector. The REIT is currently trading at N95 (Kshs 26.5).

In terms of performance, on a YTD basis the REIT prices have remained unchanged with minimal to no market activity recorded during the period. The UH REIT and UPDC have maintained share prices of N45.0 (Kshs 12.7) and N10.0 (Kshs 2.8) since January while the Skye Shelter REIT price has declined by 5.0% from N 100.0 at the year start and is currently trading at N95.0 (Kshs 26.5). In comparison to their listing prices, we see that UH REIT and Sky Share Fund have shed 10.0% and 5.0% of their value respectively from their list prices of N50.0 (Kshs 13.9) and N100 (27.9). UPDC on the other has maintained its par prices of N10 (Kshs 2.8).

Like in Kenya, REITs in Nigeria are underperforming due to the following reasons: (i) the low investor knowledge about the market which makes it difficult for REITs to generate investor interest, (ii) high interest rate environment, which although viewed temporary fails to work for REIT firms, risk free rates in the area currently stand at approximately 23.0%, (iii) firms operating REITs provide shallow quality assets classes in the region that are not durable, and (iv) poor standards of valuation, the market doesn’t have enough valuers and the few are inconsistent thus provide poor appraisals.

Our outlook for the Real Estate sector in Kenya is positive given: (i) increased interest by major players such as Cytonn Investments, Hass Consult and Knight Frank to educate the market on areas to invest in and caution about areas to invest cautiously, (ii) increased expansionary moves by existing local players such as Massmart who are finding new areas to tap into such as industrial sector attracted by high yields of 6.1% against residential sector 5.5% that increases traction, and (iii) infrastructure investment by State and supported by funding from international players thus open up new areas for development and decongestion of congested areas.

Over the recent months, we have seen the Kenyan Government focus on improving the quality of education offered in government-sponsored technical institutions. Some of the actions the government has taken are (i) increasing budgetary allocation towards the development of the Technical, Vocational Education and Training (TVET) institutions and (ii) proposing to reduce tuition fees for courses offered in TVET institutions. This is motivated by (i) the need to create a workforce that will help in the implementation of the Big Four Agenda in the sectors of manufacturing and affordable housing, and (ii) the need to achieve the Vision 2030 goals on technical training. According to Vision 2030, the government seeks to ensure equitableness and access to Technical, Vocational Education, and Training. This will be achieved by establishing a central body to place government-sponsored students in TVET institutions, building at least one vocational training center per Kenyan Constituency and one technical training center per Kenyan County, incorporating the use of ICT in the dissemination of education and using flexible modes of delivery for the modules, and ensuring enhancement of quality and relevance of skills in industrial development by streamlining management and assessment of industrial attachment. At the same time, Cytonn has recently ventured into Education Investment, with its first institution being the Cytonn College of Innovation and Entrepreneurship, a tertiary institution offering diploma and certificate courses, as well as short professional courses, and focusing on developing entrepreneurship skills for its students.

This week we focus on actions, that in our view, the government and private investors should take to ensure they provide technical training that will create a workforce that participates in the achievement of the Vision 2030. These actions include (i) improvement of education access and relevance, (ii) curriculum change to include technical training in lower education levels, and (iii) including entrepreneurship and innovation in technical training. We also highlight the German Dual VET system, which has successfully implemented technical training in their education system and highlight the impact this has had on their economy and the lessons that education providers in Kenya can learn from them.

In our write-up, we focus on 3 sections, namely, actions towards providing technical training for the achievement of the Vision 2030, a case study of the Germany’s Dual Vet system, and we conclude with ways Kenya can effect changes in technical education institutions to achieve Vision 2030.

Section 1: Actions towards providing technical training for the achievement of the Vision 2030

- Improvement of education access and relevance

In 2016, the number of private technical institutions stood at 411, against 898 public technical institutions. According to Vision 2030, the government aims to improve access to technical education by building nine technical training institutions in nine counties without public TVET institutions. To achieve this, the government has (i) increased its budgetary allocation to the TVET governing body over the years, with the latest increase of 175%, to Kshs 16.5 bn in the 2018/2019 budget from Kshs 6.0 bn in the 2017/2018 budget. The budget increase is to facilitate the construction of new technical training institutions in counties without one, (ii) proposed to reduce the fees charged in technical institutions, thus improving access of training to all students, and (iii) allowed student to apply to join public technical institutions through the Kenya University and Colleges Central Placement Service (KUCCPS).

In addition to what the government has done so far, we believe that the following actions would help in improving access and relevance of the education provided in technical institutions:

- The government should consider Public-Private Partnerships (PPP’s) when developing both infrastructure and curriculum for colleges. Such partnerships will ease the financial burden on both the government and the private investors and provide insights on relevant training as required by the market, and,

- Implement regulation to ensure that the quality of institutions is not compromised. With rising enrolment in technical colleges, (a growth with a CAGR of 7.6% in the last 5-years), the quality of education provided is at risk of being compromised if the infrastructure is not improved to support this growth. Continuous assessment of institutions by the Technical and Vocational Education Training Authority (TVETA) to ensure they meet the required quality and standards should be implemented.

- Implementation of the proposed curriculum change to include vocational training in lower education levels

The government is seeking to conduct a comprehensive curriculum review, reform and digitalization to encourage mentoring, moulding and nurturing talent to align with Vision 2030. The Ministry of Education conducted a review of the 8-4-4 curriculum and introduced the 2-6-3-3-3 curriculum. The curriculum entails that pre-primary will be compulsory for 2-years followed by 6-years in primary school, then 3-years in junior secondary, and 3-years in senior secondary where they will be specializing in fields such as arts and sports sciences, social sciences, and STEM (science, technology, engineering, and mathematics). After completing senior secondary, students will have an option of joining either technical institutions or a university. The change of the curriculum from a merit-based to a competency-based one will produce employable graduates especially in fields such as manufacturing and agriculture that will spur economic growth. In our view, the success of the proposed curriculum will require (i) inclusion of industry players in the development and implementation of the curriculum. This will ensure that the goal of producing employable graduates is achieved, and (ii) training of trainers involved, by both government and private education providers. It will ensure there is transference of information about the latest work place practices to students.

- Including entrepreneurship and innovation in technical training

In the Kenya vision 2030, entrepreneurs fall under the pillar of economic development. It aims to develop various sectors such as agriculture, manufacturing, tourism and IT-enabled services that will seek to alleviate unemployment and poverty, spurring economic growth. With the rising unemployment rate, which the International Labour Organization puts at 11.5%, the younger generation is encouraged to venture into self-employment. In as much as the government has introduced entrepreneurship in technical institutions offering, there is a need to improve on the delivery method for the course to ensure they are practical and are relevant to the discipline being studied. Various institutions have taken steps to restructure their offerings, in order to integrate entrepreneurship. Some of the methods that are being used to ensure that students are well trained on the subject include:

- Early introduction to the subject, as early as primary or secondary school. This will help with creating an interest that can be nurtured into a practice,

- Ensuring that the entrepreneurship courses or units offered are well crafted, are comprehensive and practical,

- Partnering with organizations that are willing to offer opportunities of practical exposure to students on how businesses are run,

- Development of incubation hubs through which students are introduced to mentors and prospective investors, and

- Ensuring that tutors and lecturers responsible for the delivery of content are well versed with the subject and have experience in the field.

Section 2: A case study: Germany’s Dual Vet system

We now look at the case study of a technical and vocational training system that has successfully ensured access of technical training and enhanced the entrepreneurship skills of the younger generation and highlight the lessons that technical education providers in Kenya can learn from Germany. Germany’s Dual VET System has over the years been amended to ensure it provides the best quality of education, vocational guidance and technical training. The system is a combination of theory and practical aspects embedded in a real work environment. Two thirds of the students that leave secondary school go on to join vocational institutions. The apprenticeship scheme provides companies with cheap labour while students are trained, making the country an industrial powerhouse. The training usually begins at secondary school where students study to get qualifications to attend vocational training.

The system provides four options for secondary schools that offer specialized training, therefore influencing their career choices as listed below;

- The first option is mostly academically oriented and therefore caters for the most academically able students, thus enabling them to gain entry requirements to university,

- The second option caters for more vocationally inclined students, and the focus is more on the world of work. After completion, the student can choose to continue into an apprenticeship, attend full-time vocational college or join the first option to gain entry requirements to university,

- The third option caters to those with low ability or social problems. The young people attending this type of school end up in government schemes, unemployed or in further full-time vocational training, and,

- The fourth option encompasses all the three options of secondary schools in one school, but the students learn in separate streams.

The government and private education providers can learn and implement the following lessons from the Dual VET system

- Inclusion of apprenticeship during technical training: In the German dual system, students spend parts of the week at the institution and the other parts in an apprenticeship in one of the small and medium enterprises (SMEs). The system takes from two to three and a half years to complete. The training conducted by SMEs is governed by the Vocational training act of 1969 to ensure standardized training and assessment, regardless of region and industry. Regarding curriculum, the industry gives its input to enable vocational education trainers to know what skill sets are in demand. The government should start a PPP where students in technical institutions are given weekly duties in the country’s emerging SMEs. This will provide cheap labor for the economy while also giving real work practice to the students,

- Quality assurance and quality control: The German dual system ensures access to quality training by requiring a trainer to register with the appropriate chambers in the industry. Germany has compulsory chambers for various occupations such as architects, dentists, engineers, lawyers, notaries, physicians and pharmacists. The chambers are responsible for the implementation and content of training. To ensure quality, the chamber form committees to deal with all issues regarding practice. The Kenya government through TVETA should ensure quality of training provided in technical institutions by continually assessing the quality and relevance of content delivered and the employability of graduates from these institutions. In cooperation with various bodies that regulate professions in the country, the government should implement measures to ensure that trainers are qualified for their roles.

- Involvement of industry players in curiculum development: The industry plays a key role in the development of curricula for the courses. Employers and trade unions are at the forefront of creating new policies and modernizing any training regulation. The industry gives the latest information about the respective field to students in training and enables them to have input in the TVET curriculum development. The implementation of development in curricula in Kenya should involve all the stakeholders, which will ensure the information in the curricula is up to date and is in line with industry practice, and,

- Inclusion of practical entrepreneurship training: In the dual vet system, entrepreneurship aspects are in the school and company training curricula. The vocational education intends to foster global competence within the profession, with the main emphasis being on independence and responsible acting, planning, and reflection. In some cases, training for competencies needed for starting a company or being self-employed is Currently, the Kenyan curriculum in Technical Institutions includes a basic Entrepreneurship course. However, this unit is mainly taught in theory and students rarely get practical exposure and training on entrepreneurship. In our view, education providers should ensure that their students have a practical entrepreneurship training that exposes them to how businesses are started, and run. The government should also encourage private and public companies to integrate some aspects of entrepreneurship in the industrial attachment curricula to ensure they develop practical entrepreneurship skills and promote global competence in students.

Section 3: Conclusion

In conclusion, in order for the technical education provided in Kenya to match what is requirded for Vision 2030, the government and private education providers should ensure that;

- There are sufficient technical institutions in the country to give youth access to technical education while implementing regulation to guarantee the quality of education in the institutions,

- They involve industries in coming up with curriculums to bridge the gap between the education offered and the skill sets needed in the workplace,

- Trainers should also be well experienced in the field of study to ensure the transfer of information is seamless and relevant to the job market, and,

- The entrepreneurship course in the technical institutions is comprehensive and practical while ensuring the trainers involved in delivery of the content are well versed in the field. Also, creation of innovation hubs where students are introduced to investors and mentors would boost the emerging enterprises and ideas.

Public-private partnerships should also be encouraged in the sector, where the Kenyan government focuses on improving access to quality technical education by ensuring every county has a technical training centre and by subsidising the fees to make the technical education accessible, while the private sector is involved in the development of the curriculum, training of students and offering of internships and apprenticeship opportunities to students.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.