Impact of COVID-19 on Kenya’s Real Estate Sector, & Cytonn Weekly #23/2020

By Research Team, Jun 7, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 209.1%, up from 102.5% the previous week. The oversubscription is partly attributable to the favourable liquidity in the money markets as evidenced by the average interbank rate declining to 3.2% from 3.5%, recorded the previous week, as well as the continued preference for shorter-dated papers. The subscription rates for the 91-day, 182-day, and 364-day papers all increased to 255.6%, 213.0%, and 186.5%, respectively, from 81.3%, 58.4%, and 155.0% recorded the previous week. During the week, the National Treasury announced that it will reopen two bonds namely, FXD3/2019/5 and FXD4/2019/10 with effective tenors of 4.5-years and 9.4-years respectively for a total value of Kshs 40.0 bn for budgetary support. According to Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI), the economic prospects have improved as the seasonally adjusted PMI index came in at 36.7 for the month of May 2020, up from the 34.8 seen in April 2020. The National Treasury is set to release the 2020/2021 fiscal year (FY) budget on 11th June 2020. According to the Estimates of Revenue and Expenditure for FY’2020/21, total revenue collected is expected to decline by 2.1% to Kshs 1.85 tn from the Kshs 1.89 tn as per the FY’2019/2020 supplementary budget estimates II, while total expenditure is set to decline by 2.2% to Kshs 2.71 tn from Kshs 2.74 tn;

Equities

During the week, the equities market recorded mixed performance, with NASI gaining by 1.5%, while both NSE 25 and NSE 20 declined by 0.1% and 0.4%, respectively, taking their YTD performance to losses of 16.4%, 21.9%, and 26.9%, for NASI, NSE 25 and NSE 20, respectively. During the week, Britam Holdings sold 21.6 mn shares of Equity Group valued at Kshs 695.5 mn at the current price of Kshs 32.2 per share as at 5th June 2020, in an effort to comply with the Insurance Regulatory Authority (IRA), Guidelines to the Insurance Industry on Management of Investment, published in November 2015. According to the regulations, an insurer transacting general insurance business shall not invest more than 10.0% of the total assets of the insurer in any corporation, commodity or group of related corporations. During the week, KCB Group in the 49th Annual General Meeting (AGM) disclosed that the total loans restructured due to the Coronavirus pandemic had risen to above Kshs 120.0 bn as at May 2020, equivalent to 21.7% of its net loans, which stood at Kshs 553.9 bn in Q1’2020;

Real Estate

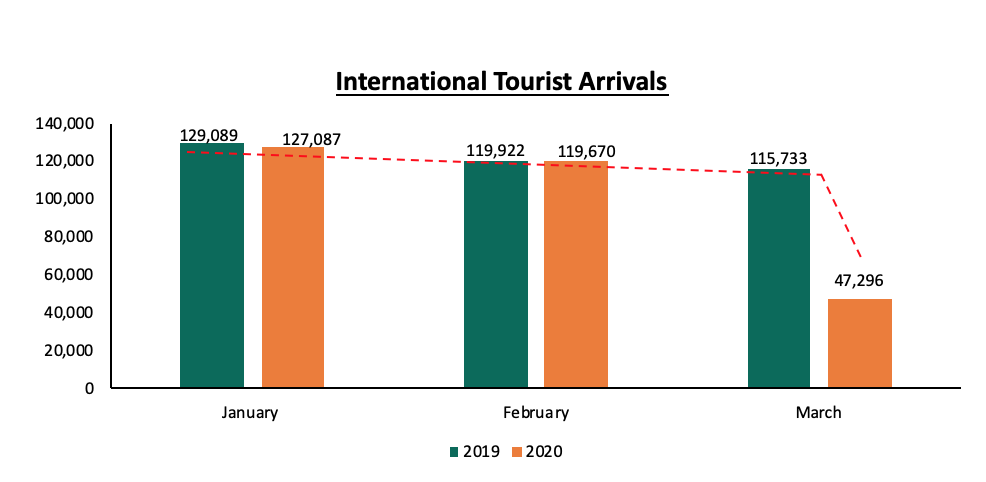

During the week, Kenya National Bureau of Statistics released the Leading Economic Indicators Report April 2020, according to which, the total number of visitors arriving through Jomo Kenyatta (JKIA) and Moi International Airports (MIA) decreased by 60.5% in March 2020 to 47,296 persons from 119,670 persons in February 2020. The hospitality sector recorded activity with various hotels including Villa Rosa Kempinski, Radisson Blu and Trademark Hotel announcing plans to resume restaurant operations including dine-in option and home delivery. Kingdom Hotel Investment, an international hotel and resort real estate investment company that is focused on emerging markets and owned by Saudi Prince Al-Waleed bin Talal sold its stake in Fairmont the Norfolk and Fairmont Mara Safari Club to Nepalese conglomerate, Chaudhary Group, for Kshs 2.8 bn. And in the infrastructure sector, the State Department for Infrastructure announced plans to build a 0.6km Likoni bridge to be completed by November 2020;

Focus of the Week

On 15th March 2020, we wrote about the Impact of Coronavirus to the Kenyan Economy where we analysed the resultant effect of COVID-19 on the Kenyan economy given the negative impact that the pandemic is having on international trade, the financial and commodity markets, and the global macroeconomic environment; and, The Potential Effects of COVID–19 on Money Market Funds, where we highlighted the macro-economic environment in the country and the effects on the fixed-income market and how things stand, having reported the first infection on 13th March 2020. This week, we focus on the impact COVID-19 has had on the real estate sector where various emerging trends have shown varied implications on the different sectors of real estate.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.7% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.2% p.a. To invest, email us at sales@cytonn.com;

- Edwin H. Dande, Chief Executive Officer at Cytonn Investments, was on Metropol TV to discuss fintech in money markets and what it means for retail investors. Watch Edwin here;

- Rodney Omukhulu, Assistant Investments Analyst at Cytonn Investments, was on CNBC Africa to discuss the Covid-19 induced decline in April tax collections in Kenya. Watch Rodney here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The aim of the training is to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 209.1%, up from 102.5% the previous week. The oversubscription is partly attributable to the favourable liquidity in the money markets as evidenced by the average interbank rate declining to 3.2% from 3.5%, recorded the previous week, as well as the continued preference to shorter-dated papers by investors still keen on the primary market, during this period of economic uncertainty emanating from the effects of COVID-19 pandemic. The subscription rates for the 91-day, 182-day, and 364-day papers all increased to 255.6%, 213.0%, and 186.5%, respectively, from 81.3%, 58.4%, and 155.0% recorded the previous week. The yields on all the papers remained unchanged, which saw the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day papers come in at 7.3%, 8.2%, and 9.2%, respectively, similar to what was recorded the previous week. Central bank is keen on maintaining interest rates low and as a result, the acceptance rate declined to 35.4%, from 58.5% recorded the previous week, with the government accepting only Kshs 17.8 bn of the Kshs 50.2 bn worth of bids received.

During the week, the National Treasury announced that it will reopen two bonds namely, FXD3/2019/5 and FXD4/2019/10 with effective tenors of 4.5-years and 9.4-years respectively for a total value of Kshs 40.0 bn for budgetary support purposes. The period of sale is from 04th June 2020 to 16th June 2020. As per the historical trend, we expect the market to maintain a bias towards FXD3/2019/5 mainly attributable to its short tenor. Our recommended bidding range is 11.4% - 11.6% for FXD3/2019/5 and 12.3% - 12.5% for FXD4/2019/10 given that bonds with the same tenor are currently trading at 11.4% and 12.2%, respectively, on the yield curve.

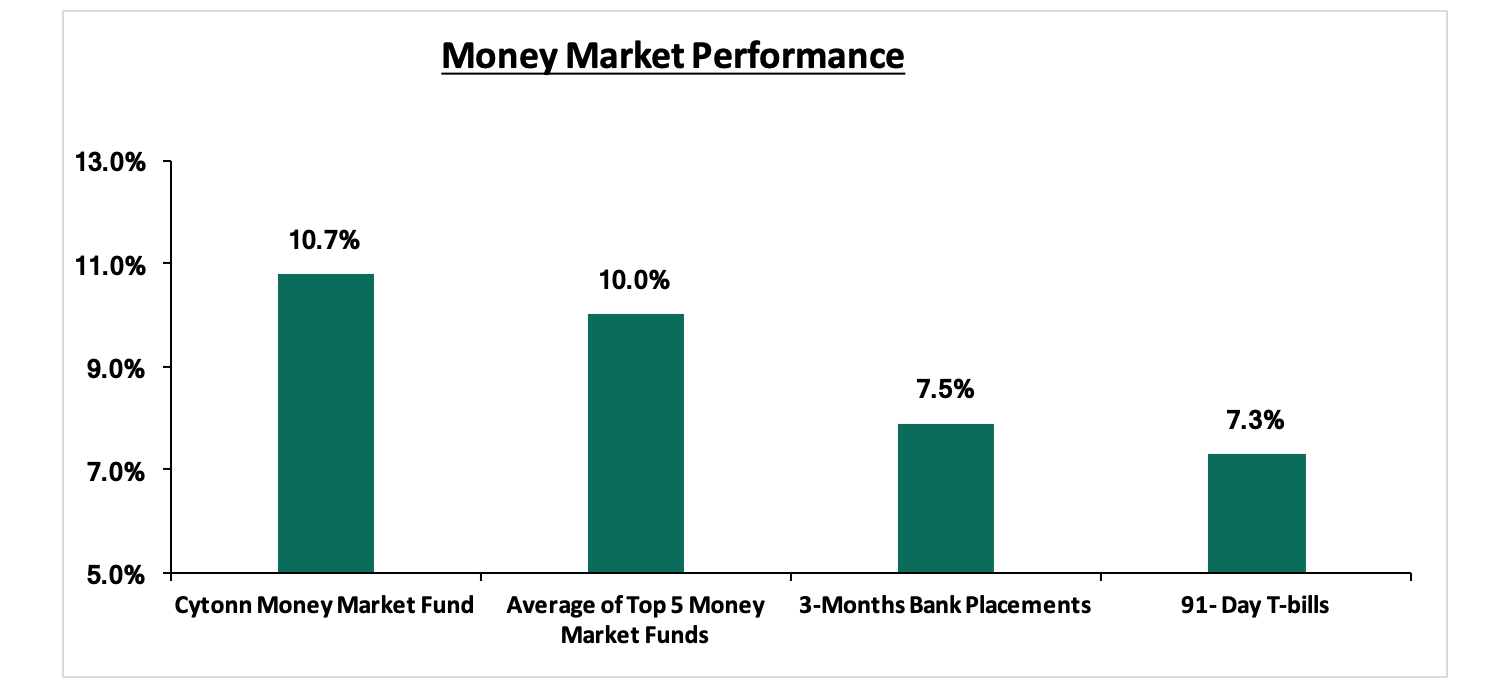

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.3%, similar to what was recorded the previous week. The average yield of Top 5 Money Market Funds remained unchanged at 10.0%, recorded the previous week. The yield on the Cytonn Money Market declined by 0.1% points to close the week at 10.7% from 10.8% recorded the previous week. Below is the summary table of the rates on various money market instruments.

Liquidity:

During the week, liquidity increased in the money market with the average interbank rate declining to 3.2% from 3.5% recorded the previous week supported by government payments. The week also saw the Interbank rate record a 10 month low of 3.1% on the 4th June 2020. The average interbank volumes declined by 38.2% to Kshs 12.3 bn, from Kshs 19.9 bn recorded the previous week. As per the Central Bank of Kenya weekly bulletin, commercial banks’ excess reserves came in at Kshs 32.9 bn in relation to the 4.25% cash CRR. The favourable liquidity in recent weeks has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic.

Kenya Eurobonds:

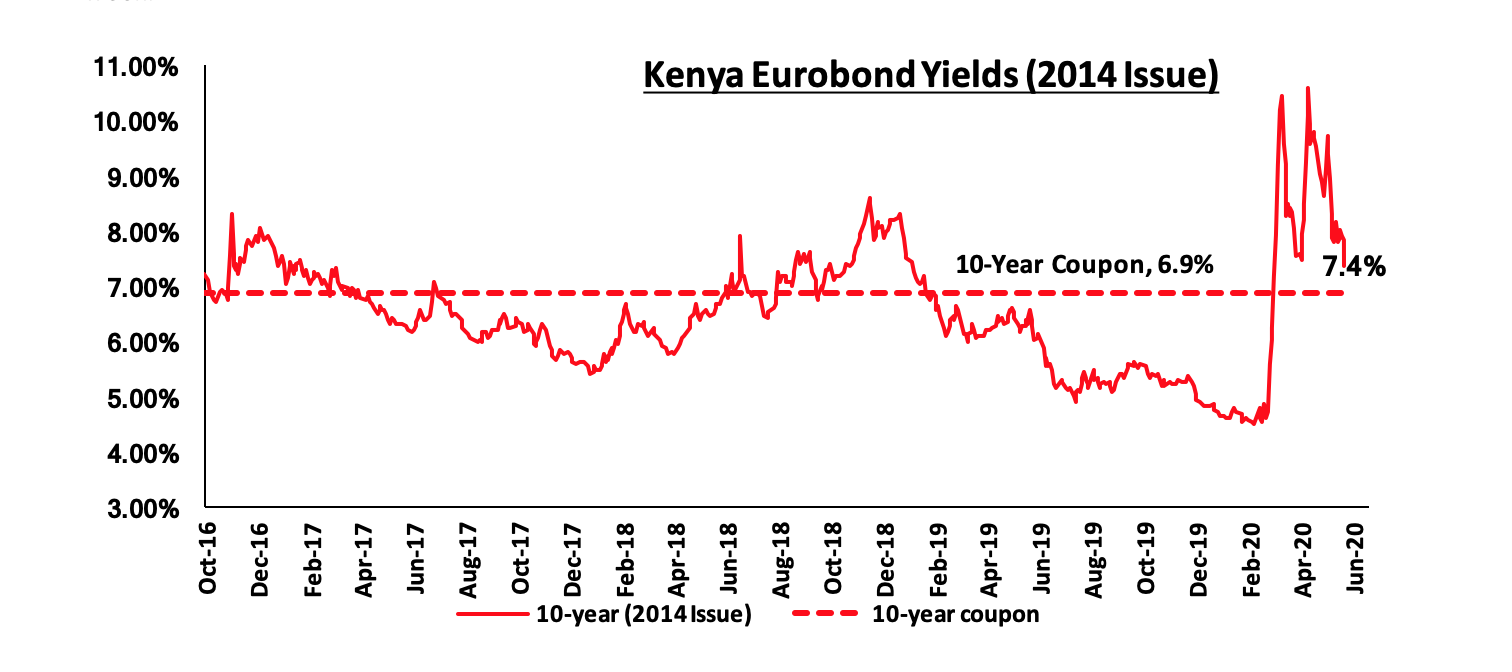

During the week, Eurobond yields maintained the declining trend over the past few weeks. This has mainly been driven by the market correction attributable to improved investor sentiments as the market reacted to the news by the World Bank that they had approved USD 1.0 bn funding to support the economy as well as the Rapid Credit Facility (RCF) which reaffirmed investors’ confidence despite the recent downgrade by Moody’s where Kenya’s sovereign credit outlook was changed to negative from stable. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.6% points to 7.4%, from 8.0% recorded the previous week.

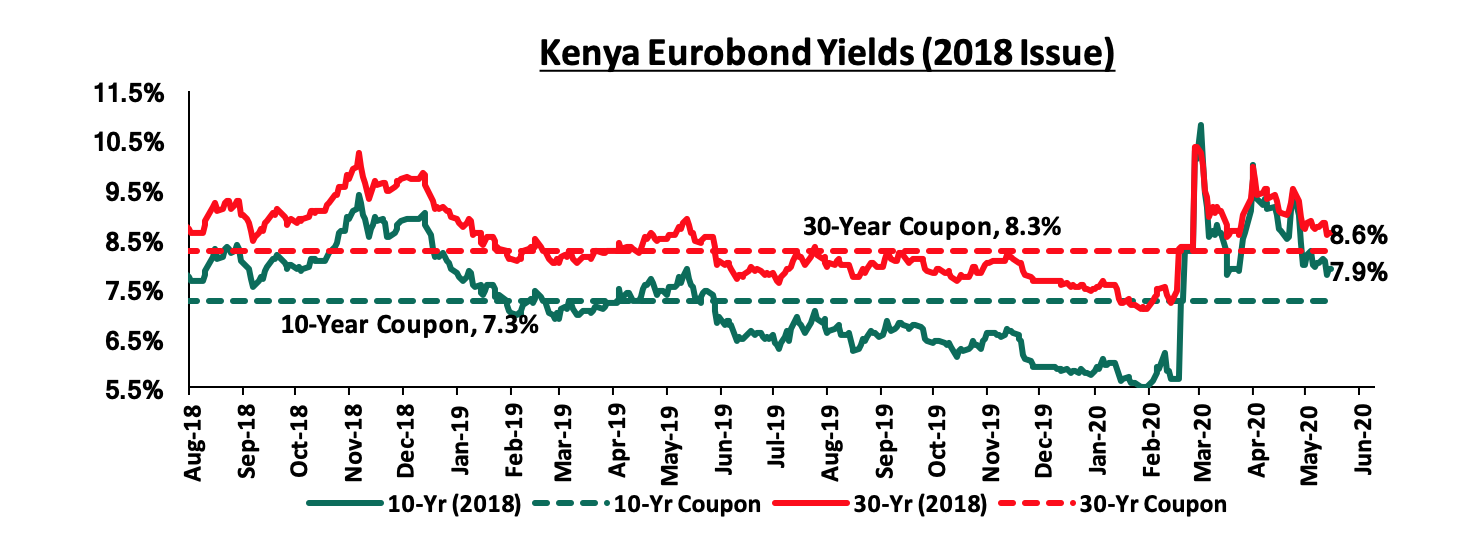

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 declined by 0.1% points and 0.2% points to 7.9% and 8.6%, respectively, from 8.0% and 8.8% recorded previous week, respectively.

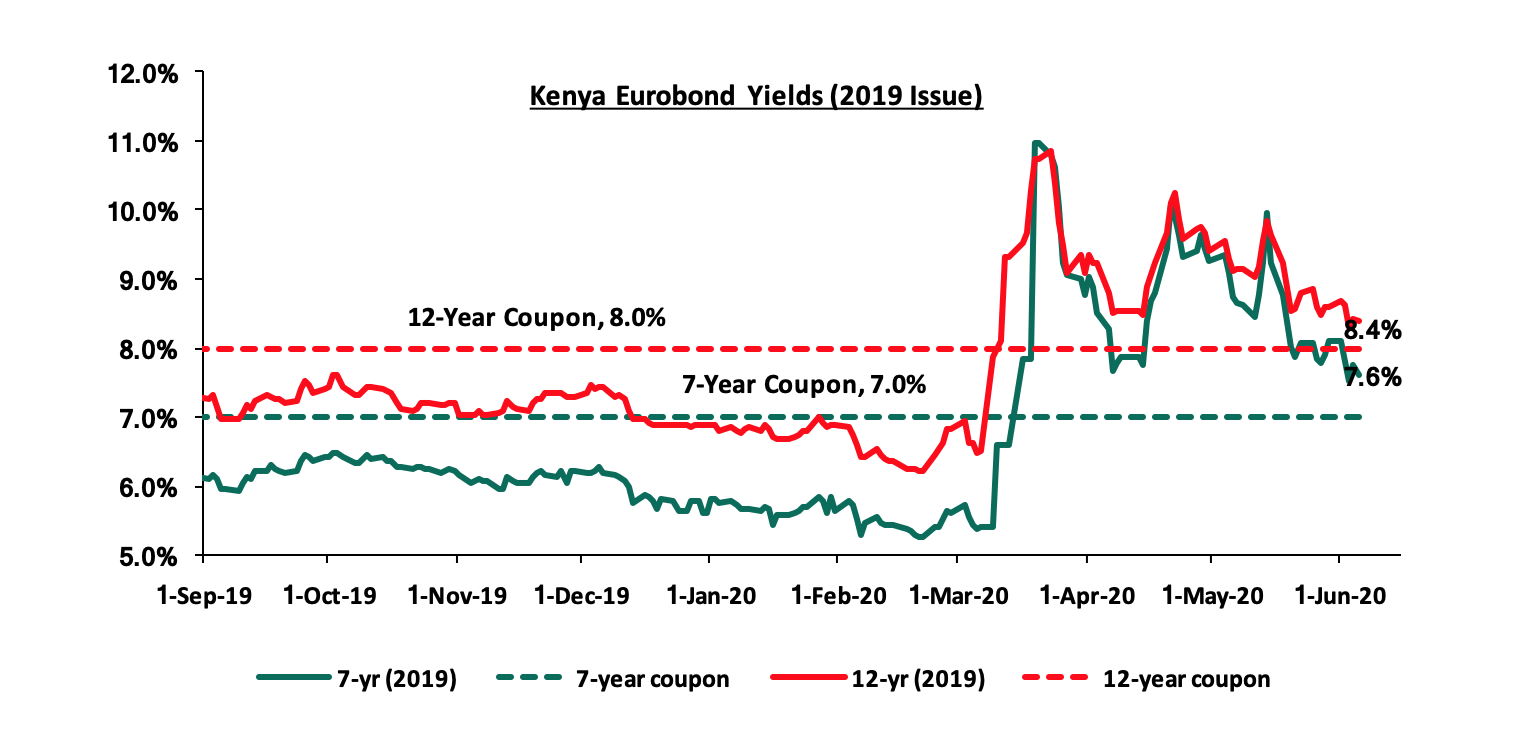

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 declined by 0.5% points and 0.2% points, to 7.6% and 8.4%, respectively, from 8.1% and 8.6% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.8% against the US Dollar to close the week at Kshs 106.1, from Kshs 106.9, recorded the previous week supported by inflows from remittances, agricultural exports as well as horticulture exports amid low dollar demand from merchandise importers. On an YTD basis, the shilling has depreciated by 4.7% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens,

- Increased demand as merchandise and energy sector importers beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances evidenced by the 9.0% decline to USD 208.2 mn in April 2020, from USD 228.8 seen the previous month, mainly due to the decline in economic activities globally, coupled with increased prices of household items leading to lower disposable income. Key to note, the Central Bank of Kenya (CBK) expects a 12.0% decline in remittances in 2020.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.2 mn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

According to Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI), released earlier in the week the seasonally adjusted PMI index came in at 36.7 for the month of May 2020, up from the 34.8 seen in April 2020, pointing towards a decline in business conditions but at a slower pace compared to April. Key to note, a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Overall activity levels contracted as output levels declined due to a decline in demand as well as shortages of inputs due to travel restrictions affecting major counties. A majority of businesses reduced employees’ wages due to low demand amid a worsening business outlook. Sentiments on business expectations for the next 12-months fell sharply due to the uncertainty brought about by the coronavirus dropping to the lowest levels since August 2016. The input prices reduced in May for the first time since January 2015 due to reduced employment costs and a decline in purchasing levels. Export sales also declined due to lockdowns and reduced purchasing power of consumers witnessed across the globe.

We expect the subdued demand to prolong given the current lockdowns across the globe and the slowdown in business activities worldwide. Locally, most businesses are struggling to meet their expenses amid the subdued revenues. The pandemic has affected key industries in the country such as tourism and the hospitality industry leading to near closure of the sectors thus causing massive layoffs, effectively reducing people’s purchasing power. Businesses may also find it hard to access credit facilities from financial institutions given the high risk.

The National Treasury is set to release the 2020/2021 fiscal year (FY) budget on 11th June 2020. As such, a lot of pre-budget discussions are taking place ahead of the official release and we will release our pre-budget analysis note on 9th June 2020 with our views before the budget is officially released. Below is a summary of the budget estimates as per the Estimates of Revenue and Expenditure for 2020/21 and the Medium Term outlook paper submitted to the National Assembly on 29th April 2020:

|

Item |

FY'2019/2020 (Revised) |

FY'2020/2021 |

Change y/y |

|

Total revenue |

1,893.9 |

1,854.1 |

(2.1%) |

|

Grants |

44.6 |

36.1 |

(19.1%) |

|

Total revenue & external grants |

1,938.5 |

1,890.2 |

(2.5%) |

|

Total expenditure |

2,774.4 |

2,712.9 |

(2.2%) |

|

Fiscal deficit including grants |

(835.9) |

(822.7) |

(1.6%) |

|

Deficit(excluding grants) as % of GDP |

5.6% |

7.6% |

|

|

Net foreign borrowing |

333.5 |

349.8 |

4.9% |

|

Net domestic borrowing |

373.2 |

386.2 |

3.5% |

|

Total borrowing |

706.8 |

736.0 |

4.1% |

|

Borrowing as a % of GDP |

6.9% |

6.5% |

|

|

Source: Budget Summary, 2020 |

|

|

|

The key take-outs from the table include:

- Revenue

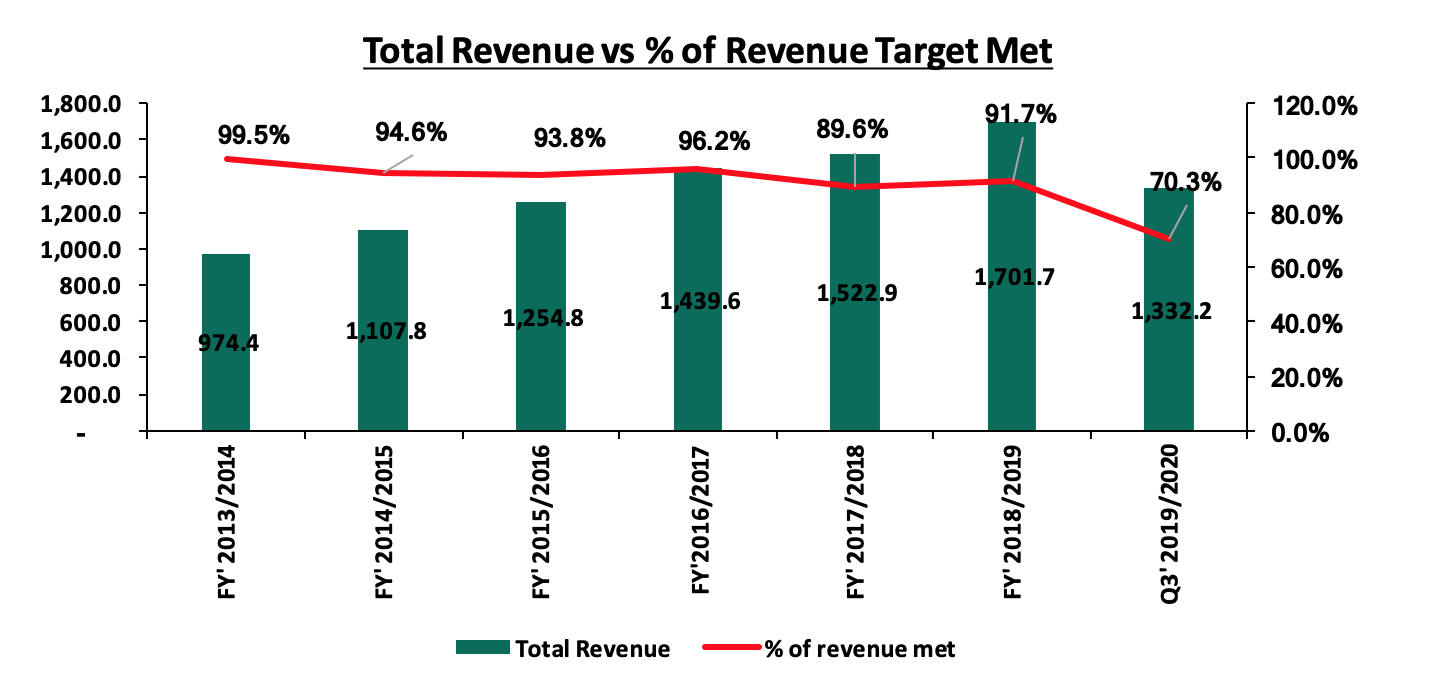

Total revenue collections are expected to decline by 2.1% to Kshs 1.85 tn from the Kshs 1.89 tn as per the FY’2019/2020 supplementary budget estimates II, mainly driven by a 1.3% decline in ordinary revenue to Kshs 1.62 tn from an estimated Kshs 1.64 tn in the supplementary budget estimates II, a downward readjustment from Kshs 1.9 tn as per the FY’2019/2020 initial printed estimates. Key to note, as at 31st March 2020 ordinary revenue receipts stood at Kshs.1.2 tn equivalent to 70.3% of the target during the period of review and consequently, the revenue target for FY’2019/2020 and it is doubtful that KRA will meet its target given the current economic conditions and fiscal measures put in place by the government to cushion citizens and businesses against the effects of the Coronavirus pandemic earlier in the year. In recent years there has been an underperformance in revenue collections as highlighted in the chart below, and the Government has not been able to meet its revenue target with the worst year being FY’2017/2018 where it only managed to raise 89.6% of the targeted total revenue mainly due to a shortfall of Kshs 195.0 bn in ordinary revenue.

The continued underperformance has been attributed to ambitious revenue targets set by the Government masking the true budget deficit position. The Kshs 1.85 tn revenue estimate is, however a Kshs 0.28 bn downward revision from Kshs 2.13 tn as per the 2020 Budget Policy Statement which in effect shows the reality of subdued revenue but still ambitious given the current economic conditions. The decline in tax revenue is expected to be driven mainly by:

- The projected decline in ordinary revenue by 1.3% to Kshs 1.62 tn from Kshs 1.64 tn in FY’2019/2020 estimate mainly due to the projected decline in revenue from income tax by 7.0% to Kshs 0.69 tn from Kshs 0.74 tn in FY 2019/2020 estimate. The lower income tax revenue is expected to be as a result of the fiscal measures such as lowered resident income tax rate from 30.0% to 25.0% implemented to help cushion citizens against the adverse effects of the coronavirus pandemic, the increased unemployment that is to affect the PAYE, and,

- Revenue from Value Added Tax (VAT) is also expected to decline due to the lowering of the VAT rate from 16.0% to 14.0% as well as lower consumer spending due to constrained cash flow caused by declining household income. VAT from imports could also be negatively impacted due to lockdowns in major international markets.

- Expenditure

As per the budget books estimates, total expenditure is set to decline by 2.2% to Kshs 2.71 tn from Kshs 2.74 tn as per the revised FY’2019/20 Budget. The key highlights from the expenditure estimates include:

- Recurrent Expenditure:

The recurrent expenditure is set to decline by 2.3% to Kshs 1.22 tn from Kshs 1.25 tn as per the revised FY’2019/20 Budget. Ministerial recurrent expenditure is expected to decrease by 3.1% to Kshs 1,202.2 bn in FY’2020/2021 from Kshs 1,241.1 bn in FY’2019/2020. Major outlays in form of recurrent expenditure are expected to go to Teachers Service Commission, Ministry of Defence, State Department for University Education, and State department for Interior who will receive Kshs 264.0 bn, 106.2 bn, 107.0 bn, and, 128.0 bn respectively translating to 52.0% of the recurrent expenditure budget.

- Development Expenditure:

The development expenditure is set to decline by 5.4% to Kshs 584.3 bn from Kshs 617.9 bn in FY’2019/2020 with the key ministries impacted being the State Department of Transport, Ministry of Treasury, State Department for Planning, and Housing and Urban Development, whose expenditure has been slashed by Kshs 44.0 bn, 19.0 bn, 19.0 bn, and 17.0 bn respectively. The state department of infrastructure, State Department of Water and Sanitization, Ministry of Energy, and Ministry of Health are set to receive Kshs 121.6bn, 69.7 bn, 67.0 bn, and 49.0 bn for their development needs. With reduced revenue, 50.0% of development expenditure will need to be financed by loans and grants. In FY’2019/2020 budget outturn, total expenditure funded by foreign debt was Kshs 164.6 bn against a budgeted figure of Kshs 225.3 bn reflecting a 73.1% absorption rate. The low uptake can be attributed to lower availability of funding as the foreign funding which is normally directed at development ended Q3’2019/2020 at 98.4 bn compared to the revised target of Kshs 455.0 bn.

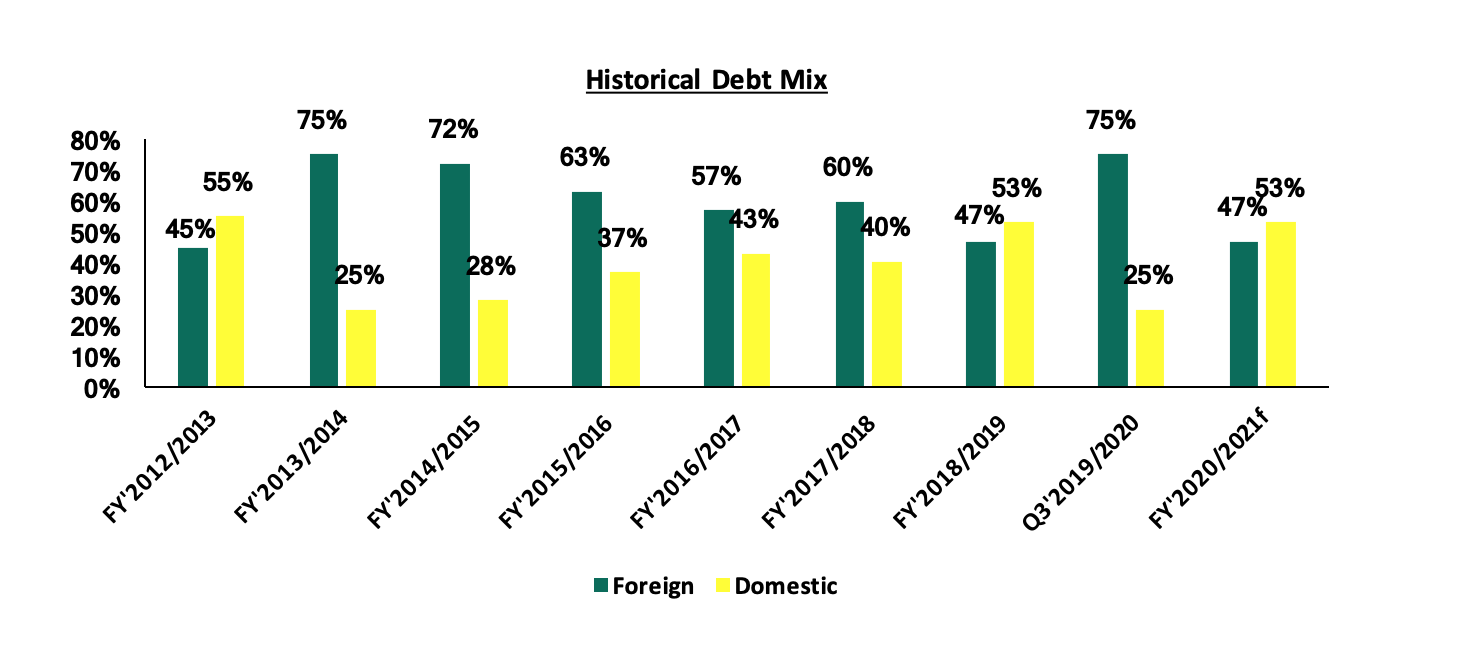

- Public Debt

The projected decline in ordinary revenue receipts is expected to contribute to the widening of the fiscal deficit. The fiscal deficit (excluding grants) as a share of GDP, is expected to come in at 7.6% in FY’2020/2021 from 7.2% in FY 2019/2010. The 2020/21 fiscal deficit (inclusive of grants) which will total approximately Kshs. 823.2 bn will be financed by both foreign and domestic borrowing. According to the budget estimate, net foreign financing is projected at Kshs. 349.8 bn in 2020/21, which is a 4.9% increase to Kshs 333.5 in FY 2019/20. However, a decrease in programme and concessional loans in FY 2020/21 will be replaced by more expensive semi concessional loans which may result in higher debt service expenditure in the medium term. Net domestic borrowing is expected to increase by 3.5% to Kshs 386.2 bn from Kshs 373.2 bn in FY’2019/2020. Key to note, public debt requirement mix remains unchanged, comprising of 53% foreign debt and 47% similar to the revised FY’2018/2019 budget.

During FY’2020/2021, the government is expected to repay foreign debt worth Kshs 174.1 bn, which is a 41.1% increase from Kshs 121.5 bn in FY’2019/2020. The increase in Consolidated Fund Services (CFS) expenditures is mainly as a result of an increase in public debt servicing expenses which will form 88.0% of the total CFS expenditure. Total interest payments and redemptions are expected to increase by 17.7% to Kshs 0.9 tn in FY’2020/2021 from Kshs 0.8 tn in FY’2019/2020. Interest expense on the domestic debt will cost Kshs. 308.4 bn while foreign debt interest expenses will total approximately Kshs. 154.7 bn indicating that domestic debt is more expensive than foreign debt. Below is a chart with the debt mix as per recent years’ budget estimates:

Amid subdued revenue, the CFS expenditure is expected to consume 55.0% of the projected revenue as compared to 46% in 2019/2020.CFS expenditure is non-discretionary expenditure and this could tighten the government's fiscal position especially in the current environment. The decline on the expenditure side is very minimal as compared to the revenue side declines and as such the fiscal deficit is now expected to rise to 7.6% of GDP in FY’2020/2021 from a pre-COVID-19 target of 4.9% of GDP, further thwarting the fiscal consolidation efforts.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 17.8% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 300.3 bn against a prorated target of Kshs 365.5 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market recorded mixed performance, with NASI gaining by 1.5%, while both NSE 20 and NSE 25 declined by 0.4% and 0.1%, respectively, taking their YTD performance to losses of 16.4%, 26.9%, and 21.9%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by gains recorded by large-cap stocks such as Standard Chartered Bank, Safaricom, EABL, NCBA and Co-operative bank of 4.2%, 3.3%, 3.1%, 3.0% and 2.4% respectively. The gains were however weighed down by losses recorded by other large-cap stocks such as ABSA, Equity and Bamburi of 6.9%, 6.0% and 4.7%, respectively.

Equities turnover declined by 2.3% during the week to USD 21.6 mn, from USD 22.2 mn recorded the previous week, taking the YTD turnover to USD 715.3 mn. Foreign investors remained net sellers during the week, with the net selling position declining by 23.5% to USD 5.7 mn, from a net selling position of USD 7.5 mn recorded the previous week, taking the YTD net selling position to USD 205.6 mn.

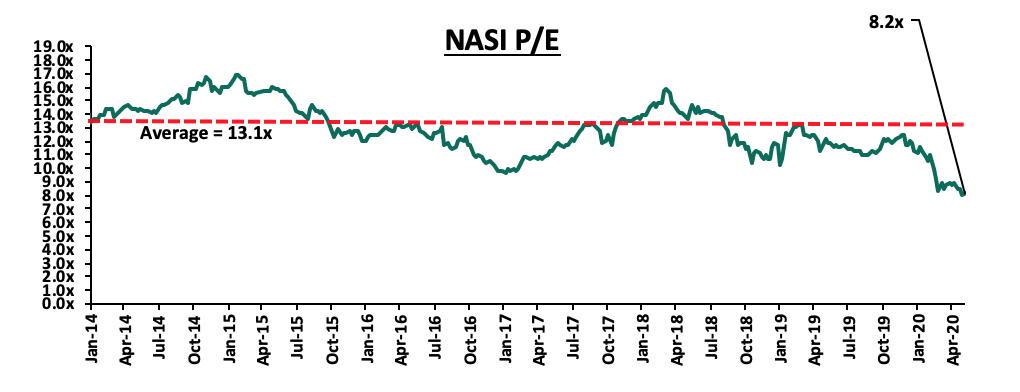

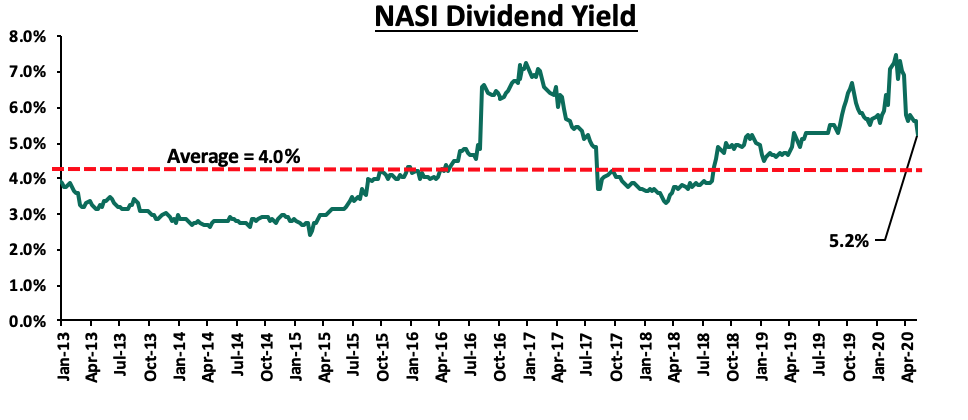

The market is currently trading at a price to earnings ratio (P/E) of 8.2x, 37.3% below the historical average of 13.1x. The current average dividend yield is at 5.2%, 1.2% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 8.2x is 2.4% above the most recent valuation trough of 8.0x experienced in the last week of May 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Britam Holdings sold 21.6 mn shares of Equity Group valued at Kshs 695.5 mn at the current price of Kshs 32.2 per share as at 5th June 2020, in an effort to comply with the Insurance Regulatory Authority (IRA), Guidelines to the Insurance Industry on Management of Investment, published in November 2015. According to the regulations:

- An insurer transacting general insurance business shall not invest more than 10.0% of the total assets of the insurer in any corporation, commodity or group of related corporations, and,

- An insurer transacting long-term business shall not invest more than 5.0% of the total assets of the insurer in any company, commodity or group of related companies. Where the company or group of related companies is a bank or financial institution, the maximum limit for the investment shall be 10.0%.

Before the sale, the amount invested in Equity Group stood at 11.7% of the total assets, which was above the 10.0% limit. Following the sale, the amount invested in Equity holdings now forms 6.7% of Britam’s total assets, and Britam will therefore, be compliant. We expect to see increased pressure on the company’s bottom line on account of the reduced exposure given that the insurers' profits in FY’2019 were supported by equities investments.

During the week, KCB Group held their 49th Annual General Meeting (AGM) during which, the group disclosed that the total loans restructured due to the Coronavirus pandemic had risen by 50.0% to above Kshs 120.0 bn, from Kshs 80.0 bn recorded at the beginning of May 2020 as highlighted in our Cytonn Weekly #20/2020. The amounts restructured are equivalent to 21.7% of KCB’s net loans, which stood at Kshs 553.9 bn in Q1’2020. Mr Joshua Oigara, the groups’ Chief Executive Officer (CEO), highlighted that the major beneficiaries of the loan restructuring were Small and Medium Enterprises (SMEs), homebuyers and large firms whose income had been impacted by the pandemic. The loan restructuring by KCB involves placing moratoriums on both interest and principal payments for three months, in effect giving a reprieve to its customers who found it difficult to repay their loans due to the impact caused by the pandemic. In our view, restructuring the loans will ensure working capital is available to their customers as they mitigate the tough operating environment as a result of the ongoing COVID-19 pandemic, which has affected their customers’ business operations. However, given the impact of the pandemic on the economy, we expect a rise in non-performing loans because of persistent inactivity in businesses as the pandemic strains the financial health of the borrowers. To cover this, we expect to see a rise in the group’s Loan Loss Provisions (LLP), which stood at Kshs 2.9 bn in Q1’2020 from Kshs 1.2 bn recorded in Q1’2019, as the group continues to provide cover for downgraded facilities, with the expectation of higher defaulting risks across the affected sectors.

Universe of Coverage:

We are currently reviewing our target prices for the Banking sector and the Insurance sector coverage, which will be included in our next weekly report.

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

I. Industry Reports

During the week, the Kenya National Bureau of Statistics released the Leading Economic Indicators Report April 2020. According to the report, the quantity of cement produced increased by 12.1% in Q1‘2020 totalling 1.64 mn tons from 1.46 mn tons in the same period in 2019. The quantity of cement consumed also increased by 11.6% to 1.63 mn tons in Q1’2020 from 1.46 mn tons in Q1’2019. We attribute the steady growth of cement demand to ongoing government infrastructure projects.

The total number of visitors arriving through Jomo Kenyatta (JKIA) and Moi International Airports (MIA) decreased by 60.5% to 47,296 persons in March 2020 from 119,670 persons in February 2020. Overall, tourist arrivals reduced by 19.4% in Q1’2020 totalling 294,503 persons compared to 364,744 persons in Q1’2019.

Source: KNBS

The staggering decline is attributable to the spread of the Coronavirus disease, which has seen nations across the world impose travel restrictions to curb the pandemic. This has been characterized by airport closures, flight suspensions and nationwide lockdowns in various countries with high levels of infections. With Kenya effecting a ban on international flights towards the end of March 2020 and the subsequent halt of tourist activities in the country, we expect the situation to only improve once the pandemic is contained. However, we expect the sector to continue being supported by the government’s efforts such as the recent launch of virtual safaris and the economic stimulus package meant to cushion the sector’s players.

II. Hospitality

The hospitality sector in Kenya is set to begin its cautious recovery from the adverse effects of the Coronavirus pandemic. This is as more hotels during the week resumed their restaurant activities including dine-in and deliveries. They include top tier hotels such as Villa Rosa Kempinski, Ole Sereni, Hemingways Watamu, Radisson Blu Arboretum and Trademark Hotel, while others such as Pride Inn announced plans to reopen by Mid-June. This is following the government’s approval in May 2020 for restaurants located in major towns to resume operations albeit under strict new safety measures, which include (i) spacing dining tables at least 1.5 metres apart, (ii) limiting the number of persons per table to 4 per 10 SQM, and (iii) strict client and staff temperature monitoring. This is a positive step for hotel investors who have been grappling with revenue drops, and we expect this coupled by the plan by East African airlines such as RwandAir, Kenya Airways and Air Tanzania to resume passenger flights, to put hotels back on a recovery path, albeit slowly as social distancing and curfews remain in place. The sector has also been receiving backup from the government evidenced by the recent formation of the National Tourism and Hospitality Protocols Taskforce meant to develop tourism and hospitality protocols and guidelines in response to COVID-19 pandemic and to support tourism operations. Additionally, the tourism sector received the biggest boost from the government’s stimulus package plan with hotels and other hospitality facilities set to receive soft loans through the Tourism Finance Corporation (TFC), while a total of Kshs 2.0 bn will be set aside to support the renovation of facilities and the restructuring of business operations by actors in the industry.

Also during the week, Chaudhary Group, a Nepalese multinational conglomerate acquired majority ownership of The Fairmont the Norfolk and Fairmont Mara Safari Club from Kingdom Hotel Investment, an international hotel and resort real estate investment company that is focused on emerging markets, which is owned by Saudi billionaire Prince Al-Waleed bin Talal. According to online sources, the deal was worth Kshs 2.8 bn. Despite the negative effects of Coronavirus on the hospitality sector, this affirms Kenya’s attractiveness particularly to high-net-worth global investors keen on tapping into the vibrant sector of top-notch hospitality facilities mainly driven by Kenya’s position as the ultimate gateway to East and Central Africa, vibrant tourism sector, improved infrastructure, and attractive supply and demand opportunities.

III. Infrastructure

During the week, the State Department of Infrastructure revealed plans to put up a 0.6km bridge at the Likoni Channel in Mombasa. The bridge, whose construction has been necessitated by the need to keep pedestrians in social distancing, will go a long way in easing congestion at the Likoni Ferry Channel as well as complimenting the planned Mombasa Gate Bridge project, thus, easing delays for travellers between North and South Coast regions. The project will be implemented by China Road and Bridge Corporation (CRBC) and the State Department for Infrastructure through its implementing agency, the Kenya National Highways Authority (KeNHA), at an estimated cost of Kshs 1.5 bn and is expected to be complete by November this year. We expect the continued improvement in infrastructure at the Coast to continue stimulating tourism in the region by removing bottlenecks such as long delays thereby enabling tourists to travel quickly and affordably within the region with increased ease.

We remain neutral on the real estate sector’s outlook. We expect the sector to continue recording activities as the economy cautiously reopens following the COVID-19 closures, coupled with improved infrastructure, foreign investments and continued government efforts to cushion businesses through positive policy reforms and economic stimulus packages.

On 15th March 2020, we wrote about the Impact of Coronavirus to the Kenyan Economy where we analysed the resultant effect on the Kenyan economy given the negative impact that the pandemic is having on international trade, the financial and commodity markets, and the global macroeconomic environment; and, The Potential Effects of COVID – 19 on Money Market Funds, where we highlighted the macro-economic environment in the country and the effects on the fixed-income market, having reported the first infection on 13th March 2020. This week, we focus on the impact COVID-19 has had on the real estate sector where various emerging trends have shown varied implications on the different sectors of real estate. We shall therefore cover:

- Brief Analysis of the Real Estate Performance in Q1’2020,

- Effects of COVID-19 on the Real Estate Sector,

- Case Study – United Arab Emirates,

- Future of Real Estate Post-COVID-19, and,

- Conclusion and Recommendations.

I. Brief Analysis of the Real Estate Performance in Q1’2020

The real estate sector, just like the country’s economy, was poised for growth in 2020 having began to show signs of recovery in 2019 from the sluggish growth experienced in 2017 and 2018. This was evidenced by the sector’s growth, which came in at 5.3% in 2019, 1.2% points higher than 4.1% in 2018 according to KNBS Economic Survey 2020. In terms of performance, according to our Cytonn Q1'2020 Markets Review, the real estate sector recorded moderate activity with average rental yields improving marginally in the residential and commercial office sectors to 5.2% and 7.8%, respectively, from 5.0% and 7.5% in Q4’2019 as the retail sector registered 0.1% points drop in rental yields to 7.7% in Q1’2020, from 7.8% in Q4’2019. It is, however, important to note that, while the first Kenyan case of Coronavirus was reported in March 2020, its effects on the real estate sector had not been fully felt by the end of Q1’2020.

II. Effects of COVID-19 on the Real Estate Sector

COVID-19 has caused unprecedented disruption to the Kenyan economy over the past few months. The immediate impact on the sector has been:

- Reduction of the labour force and disruption of supply chains, which is expected to translate to longer development periods,

- A slowdown in building approvals as public offices such as City Hall remain closed,

- Reduced construction activities by developers in a bid to reserve their cash at a time when market liquidity is likely to decline,

- Little to no collections as Lands Registry was closed hence banks and mortgage buyers not releasing funding,

- A slowdown in collections for those who have purchased off-plan real estate on instalment plans, and,

- Reduced funding to the sector due to general risk aversion during the pandemic.

Real estate sectors namely; residential, office, retail, and, hospitality particularly have been hit by lockdown measures and diminishing disposable income by a majority of Kenyans in the following ways:

Residential Sector

- Lower Rents and Prices - Decline in income will ultimately lead to homebuyers and renters having lower funds to spend on their monthly housing costs, thus decline in effective housing demand leading to lower home prices and lower market rents. We expect occupancy rates and uptake to record flat growth, largely attributable to restrictions on individual contact or movement during this pandemic.

Office Sector

- Reduced Occupancy Rates - Office buildings' occupancies are set to decline as companies resort to make working remotely a permanent feature. The market turbulence will see businesses scaling down operations and might, therefore, lead to increased vacancy rates in the near term,

- Reduced foreign investments - Firms globally have put on hold expansion as they adopt a wait and see approach, leading to a drop in office space demand, and,

- Collections - Challenges in the collection of rents and as such the yields in commercial offices are expected to fall in the near term.

Retail Sector

- Shops’ Closures - Retailers such as Shoprite, Naivas, and, Tuskys have shut down some of their branches as an attempt to cushion themselves against the impact of the Coronavirus amidst declining revenues from reduced footfall, and,

- Increased Focus on E-commerce – There has been increased sales of fast-moving consumer goods by retailers through e-commerce firms such as Jumia, as most Kenyans continue to stay at home so as to adhere to the government’s social distancing rules.

Hospitality Sector

- Closure of Major Hotels - The hospitality sector has been the hardest hit owing to its heavy reliance on tourism and the MICE (Meetings, Incentives, Exhibitions and Conferencing) sectors. In 2019, Kenya’s international tourist arrivals from Europe and Asia accounted for the majority share in 2018 at 56.8% and 13.9%, respectively. Travel restrictions, which have completely stopped international tourist arrivals, have led to the closure of various popular hotels such as Sarova Hotels and Fairmont Hotels,

- Lay Offs – For hotels still in operation, reservations are low as locals shy away from hotel stays in a bid to cut down on consumer discretionary spending. This has led to a majority of hotel staff getting laid off, and,

- Marginal Revenues for Serviced Apartments - Unlike hotels which tend to attract short-stay visitors, serviced apartments revenues will continue to be sustained by the presence of long-stay visitors in the near-term.

Construction Sector

- Disruption of Supply Chains – There has been a negative impact on the supply chains as most developers source for construction materials from nations such as China. We expect this to translate to longer development periods owing to a shortage of resources and ultimately reduced building completions,

- Lack of Project Finance - Decline in project financing will be apparent as lenders would be uneasy to finance construction projects owing to the current uncertainty in the economy coupled with delayed project completion dates thus, it will take longer for them to get returns on their investment,

- Reduction of Labor - The pandemic’s direct impact in the real estate sector has been the immediate reduction in the labour force as construction sites adhere to guidelines issued by the National Construction Authority (NCA) requiring contractors on-site to reduce the number of workers to a level that can allow workers keep at least a metre apart, and,

- Absorption of Surplus Space - In the short term, we expect the slowdown in construction activities to help accelerate the movement of existing property inventory, thus, facilitating a demand-supply equilibrium in sectors experiencing oversupplies such as the retail sector.

What the Government Has Done so Far

The government continues to adopt policy reforms geared towards cushioning the real estate sector through bills and regulations such as;

- The Central Bank through the Monetary Policy Committee announced various monetary measures such as; lowering of the Central Bank Rate (CBR) to 7.0%, and, lowering of the Cash Reserve Ratio (CRR) by 1% to 4.25%, to increase the available cash for on lending,

- The Central Bank has provided flexibility for loan classification and provisioning for loans that were performing on 2ndMarch but need to be restructured because of COVID-19. These measures are expected to increase the supply of credit to the private sector and therefore improve their cash flows,

- The government also recently announced a Kshs 53 bn 8-point stimulus programme which, among others, seeks to offer soft loans to hotels and related establishments through the Tourism Finance Corporation (TFC) thus stimulating the hospitality sector,

- The Tax Laws (Amendment) Act 2020 amendment to the Retirement Benefits Act, which will allow the use of pension savings towards purchasing a residential home in addition to securing a mortgage loan, at a time when household incomes have been adversely affected by the economic downturn,

- The Business Laws Amendment Act 2020 recognizes the use of advanced electronic signatures and electronic signatures as a valid mode of execution of documents in Kenya. This is poised to improve the ease at which land transactions are carried out, at a time when government offices such as lands registries remain closed, and,

- The Pandemic Response and Management Bill 2020, which proposes a loans and mortgages moratorium preventing lenders from imposing penalties or credit reference bureau listing for borrowers unable to meet their monthly payment obligations, and a directive for landlords to enter into tenancy agreements with tenants unable to meet their rent obligations until after the pandemic.

In our view, the steps taken by the government are positive and could help stimulate the growth of the real estate sector in the long-run. However, it faces various headwinds in its plan to actualize some of its ambitions especially in the wake of weak revenue collections and huge budget deficits which have resulted in various fiscal consolidation measures such as a reduction in funds meant for the affordable housing initiative.

III. Case Study – United Arab Emirates

Abu Dhabi is the largest of the seven emirates that comprise the UAE in terms of both its landmass and economy. Its Real estate and construction sectors are strong contributors to economic diversification accounting for 14.4% of Abu Dhabi's GDP in 2018 while recording 34.4% of the total stock of foreign direct investment in Abu Dhabi in the same year. The Abu Dhabi government rolled out a 16-point strategy to help limit the adverse impact of the COVID-19 pandemic, with some of the measures aimed at directly cushioning the real estate sector.

|

Abu Dhabi's Strategy to Mitigate the Adverse Impact of COVD-19 on the Real Estate Sector |

|

|

Action |

Relevant Real Estate Sector |

|

· Suspension of real estate registration fees until the end of 2020 · Reduction of industrial land leasing fees by 25% on new contracts · Allocating USD 1.4 bn to subsidize water and electricity for citizens and |

All |

|

· Suspension of tourism and municipality fees for the tourism and entertainment sectors until the end of 2020 · Rebates of up to 20% on rental values for restaurants, tourism and entertainment sectors |

Hospitality |

|

· Exempting all commercial and industrial activities from Tawtheeq fees till the end of 2020 (Tawtheeq is a system under which the government regulates tenancy contracts for rental properties in Abu Dhabi. It helps formalise tenancy agreements in Abu Dhabi and ensures transparency between the landlord and tenant, to avoid any future disputes.) |

office, Retail, and, Industrial |

|

· Allocating USD 817 mn to the SME credit guarantee scheme managed by Abu Dhabi Investment Office to stimulate financing by local banks and enhance SME’s ability to navigate the current market environment |

All |

|

· Waiving current commercial and industrial penalties |

All |

|

· Establishing a new committee headed by the Department of Finance, with members from the Department of Economic Development and local banks to review lending options to support local companies |

office, Retail, Hospitality, and, Industrial |

Across the globe, various governments have initiated various measures aimed at cushioning the real estate sector.

|

Response Measures by Various Countries |

|

|

Country |

Measure |

|

Spain |

· Three-month moratorium on mortgage payments for the most vulnerable, including households, self-employed, and, homeowners who have rented out their mortgaged properties · Automatic moratorium on rent payments for vulnerable tenants whose landlord is a large public or private housing holder during the COVID-19 crisis period · Suspension of interest and repayment of loans granted by the Secretariat of State for Tourism for one year with no need for prior request |

|

Egypt |

· Energy costs have been lowered for the entire industrial sector · Real estate tax relief has been provided for industrial and tourism sectors · As part of a USD 6.2 bn stimulus announced to stimulate the economy, USD 3.1 bn will be directed towards the tourism sector |

|

Czech Republic |

· The state will cover 50% of rents of businesses after mandating a reduction of 30% from landlords · The loan to value limit (LTV) on new mortgage loans has been relaxed from 80% to 90%, and providers may apply a 5% exemption to mortgages with higher LTVs |

|

Australia |

· Under the Homebuilder Programme, the government will provide all eligible owner-occupiers (not just first home buyers) with a grant of USD 17,400 to build a new home or substantially renovate an existing home. Homebuilder applicants will be subject to eligibility criteria, including income caps of USD 87,000 for singles and USD 140,000 for couples based on their latest assessable income. The program is expected to provide around 27,000 grants at a total cost of around USD 474 mn |

Source: International Monetary Fund (IMF)

IV . Future of Real Estate Post-COVID-19

The scale at which the Coronavirus has spread across the world has been immense. Its implications on economies and health have been dire, leading to an abrupt change in people’s way of life. This is expected to continue over a sustained period thus influencing occupiers and end users of real estate in unprecedented and unique ways, which are expected to have implications for the real estate sector such as;

a. Residential Sector

- In the long term, middle-income households may opt to buy housing units in anticipation of situations due to the sense of security that physical assets provide during such shocks as the current global pandemic,

- We also expect huge demand for affordable housing with most aspiring homebuyers tipped to reduce their housing budgets while the pandemic is expected to lead to households seeking functionality based on their current needs only.

b. Office Sector

- Occupancy rates in office buildings are expected to decline as companies resort to make working remotely a permanent feature,

- We expect tenants to seek safeguards against instances such as the current situation in future lease contracts with the inclusion of clauses allowing landlords and tenants to discuss options and come to an arrangement short of termination either through rent-free periods, deferrals or other concessions that benefit both parties, and,

- We expect uptake of serviced offices to pick after the pandemic as they offer companies preconfigured space on flexible terms which will then give them an option to scale down accordingly in the event of another global shock.

c. Retail Sector

- Before the pandemic, some consumers were already shifting their spending away from physical stores. This long-term trend may accelerate even faster after the crisis. As such, we expect to see retailers invest in their e-commerce infrastructure, and,

- Some retailers may opt to go completely cashless underpinned by Kenya’s prevalent use of mobile money transactions, according to World Bank’s Mobile Money and Digital Financial Inclusion report, 3 in every 4 Kenyan adults use digital payments, translating to 80% of the adult population, which is approximately twice the average in other developing economies.

d. Hospitality Sector

- In the medium term, majority of demand is expected to come from local tourists and virtual tourism,

- As the hospitality sector starts to recover, travel patterns are expected to shift toward drive-to-resort destinations and less dense markets where tourists can be in open spaces and avoid large groups of people, and,

- The COVID-19 experience could also permanently change habits by business persons as video conferences prove cheaper and more convenient alternatives, this may affect the demand for hotels.

e. Industrial Sector

- Higher demand for warehousing space from retailers is expected, with increased online shopping,

- With the current disruption in supply chains, we expect to see local sourcing of inputs by industries and some retailers thus creating demand for extra storage space, and,

- However, we might see a de-globalising tendency as some international companies might opt to mitigate business risks by shutting down local subsidiaries.

V. Conclusion and Recommendations

Overall, the impact of the pandemic on the real estate sector will be determined by its duration. The market is expected to experience a slow recovery post-COVID-19 as uptake will be subdued due to depressed income levels and changed priorities by prospective investors. The government is expected to continue putting in place sound fiscal policies to cushion businesses and people’s disposable incomes.

In our view, to stimulate the real estate sector, the following steps should be taken;

- With the ban on international flights expected to be upheld, the tourism sector should repackage their products to appeal to a wider scope of domestic tourists,

- With massive jobs on the line and the anticipated economic downturn, we expect the government and the lending sector to come up with prudent measures to prevent massive loan defaulting by homebuyers such as increasing the current mortgage relief, modifying the loan repayment due dates, waiving of various incidental fees as well as a moratorium on any property auctions,

- There should be more public-private partnerships between the national government, county governments, and, private developers geared towards developing more affordable housing units especially as the national government faces reduced tax revenue collections that will result in fewer resources being deployed towards the big four agenda, and,

- Commercial office properties may consider leasing out their office space as serviced offices to attract budding SMEs and international companies in the wake of reduced occupancies in traditional offices.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.