Kenya Currency and Interest Rates Review 2025 & Cytonn Weekly #08/2025

By Cytonn Research, Feb 23, 2025

Executive Summary

Fixed Income

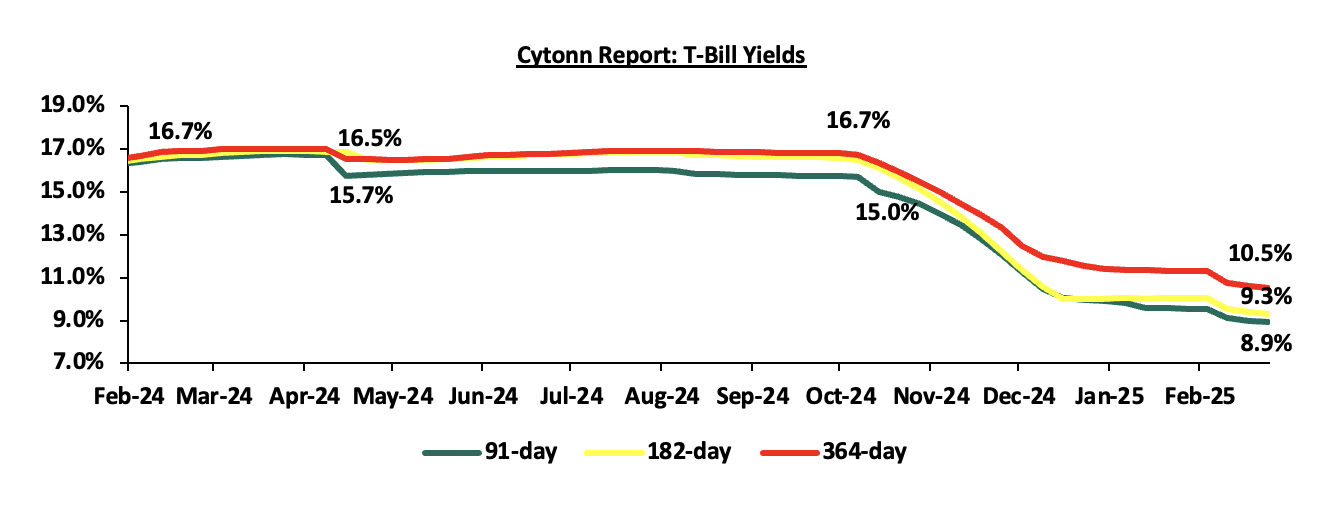

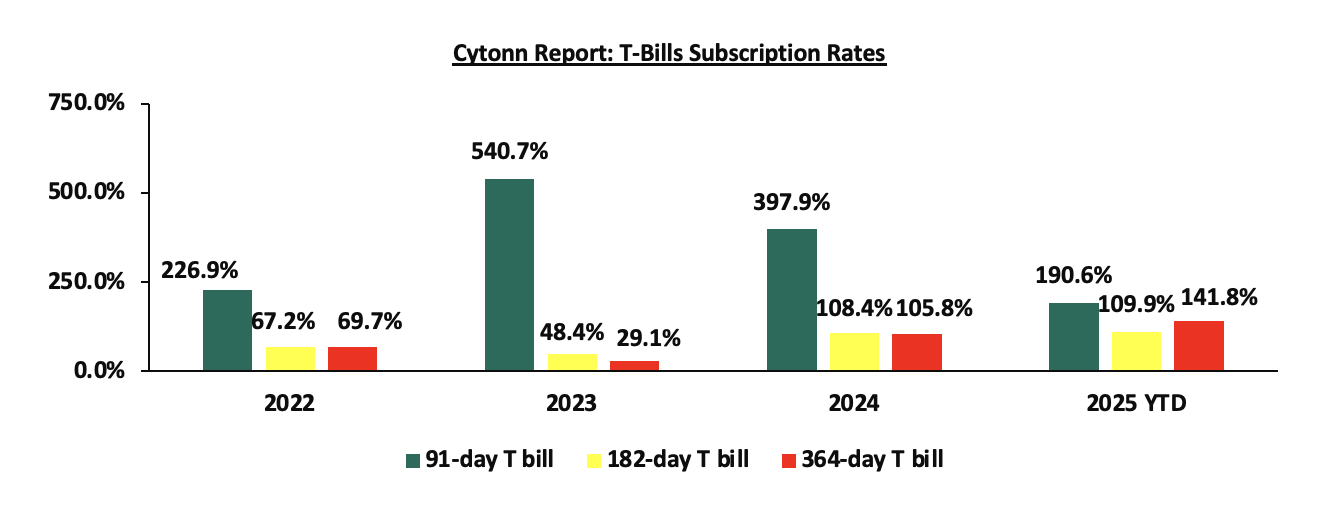

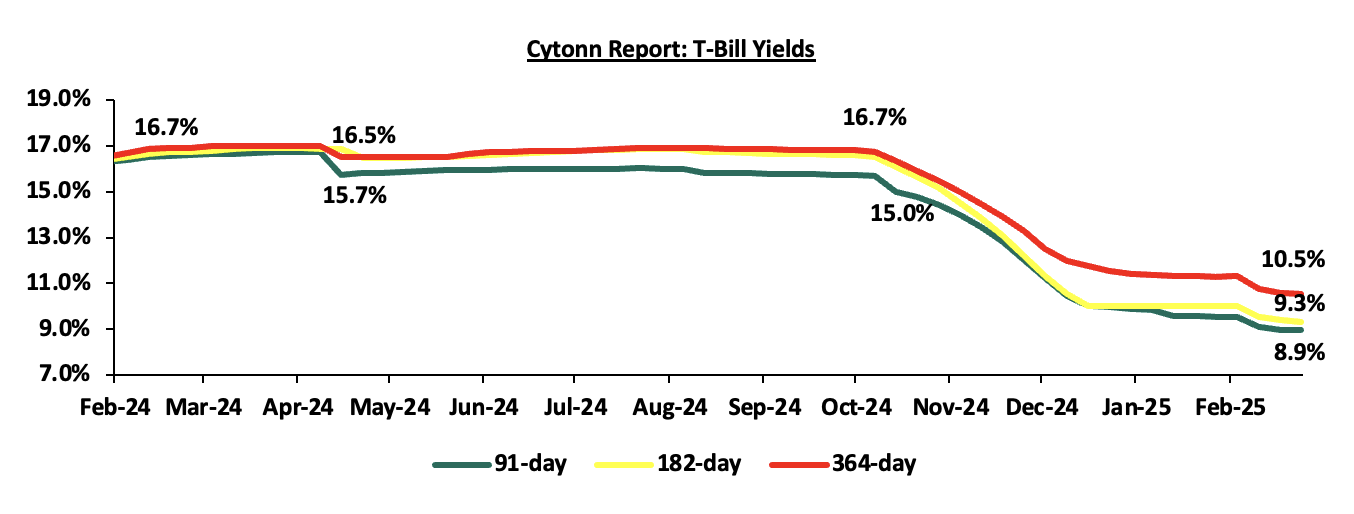

During the week, T-bills were oversubscribed for the third consecutive week, with the overall subscription rate coming in at 137.3%, albeit lower than the subscription rate of 184.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 113.1%, a reversal from the undersubscription rate of 63.2% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 123.6% and 160.6% respectively from the to 236.2% and 181.1% recorded the previous week. The government accepted a total of Kshs 32.90 bn worth of bids out of Kshs 32.94 bn bids received, translating to an acceptance rate of 99.9%. The yields on the government papers were on a downward trajectory with the yields on the 182-day paper decreasing the most by 9.8 bps to 9.3% from 9.4% recorded the previous week, while the yields on the 91-day and 364-day papers decreased by 2.2 bps and 6.8 bps respectively to 8.9% and 10.5%, from 9.0% and 10.6% respectively recorded the previous week;

Also, during the week, the Central Bank of Kenya released the auction results for the buyback of the treasury bonds FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.8%, 11.7% and 12.5% respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds. The weighted average yield for the accepted bids for the FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 came in at 9.1%, 8.9% and 9.1% respectively. The yields are largely in line with the T-bill rates making the refinancing cost to the same.

In the primary bond market, the government is looking to raise Kshs 25.0 bn through the reopened bond; FXD1/2018/25 with a tenor to maturity of 18.3 years and a fixed coupon rate of 13.4%. The period of sale opened on Friday, 21st February 2025, and will close on 5th March 2025. Our bidding range for the reopened bond is 13.85%-14.55%. The bond is currently trading at 13.34% in the secondary market;

During the week, the National Treasury gazetted the revenue and net expenditures for the seven months of FY’2024/2025, ending 31st January 2025, highlighting that the total revenue collected as at the end of January 2025 amounted to Kshs 1,352.8 bn, equivalent to 51.4% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 88.1% of the prorated estimates of Kshs 1,535.0 bn. The revenue collections are behind due to the elevated cost of living exacerbated by high taxes. The total expenditure amounted to Kshs 1,994.8 bn, equivalent to 47.4% of the revised estimates of Kshs 4,207.9 bn, and is 81.3% of the prorated target expenditure estimates of Kshs 2,454.6 bn;

Also, we are projecting the y/y inflation rate for February 2025 to increase marginally to the range of 3.4% - 3.5% mainly on the back of the decrease in the Central Bank Rate (CBR) by 50.0 bps to 10.75% from 11.25%, lowering borrowing costs and increasing consumer spending therefore driving up demand-driven price pressures and depreciation of the Kenya Shilling against the US Dollar. We, however, expect that inflation rate will, be supported by reduced electricity prices and stable fuel prices;

Equities

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 1.3%, while NSE 20, NSE 10 and NSE 25 gained by 0.8%,0.5% and 0.3% respectively, taking the YTD performance to gains of 8.9%, 6.0%, 3.2% and 2.5% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such DTB Kenya, Safaricom and Co-operative Bank of 4.0%, 3.9%, and 3.0% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as KCB Bank, EABL and Equity Bank of 2.8%, 1.9%, and 1.4% respectively.

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) December 2024 Reports, which highlighted the performance of major economic indicators.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 14th February 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 14th February 2025, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

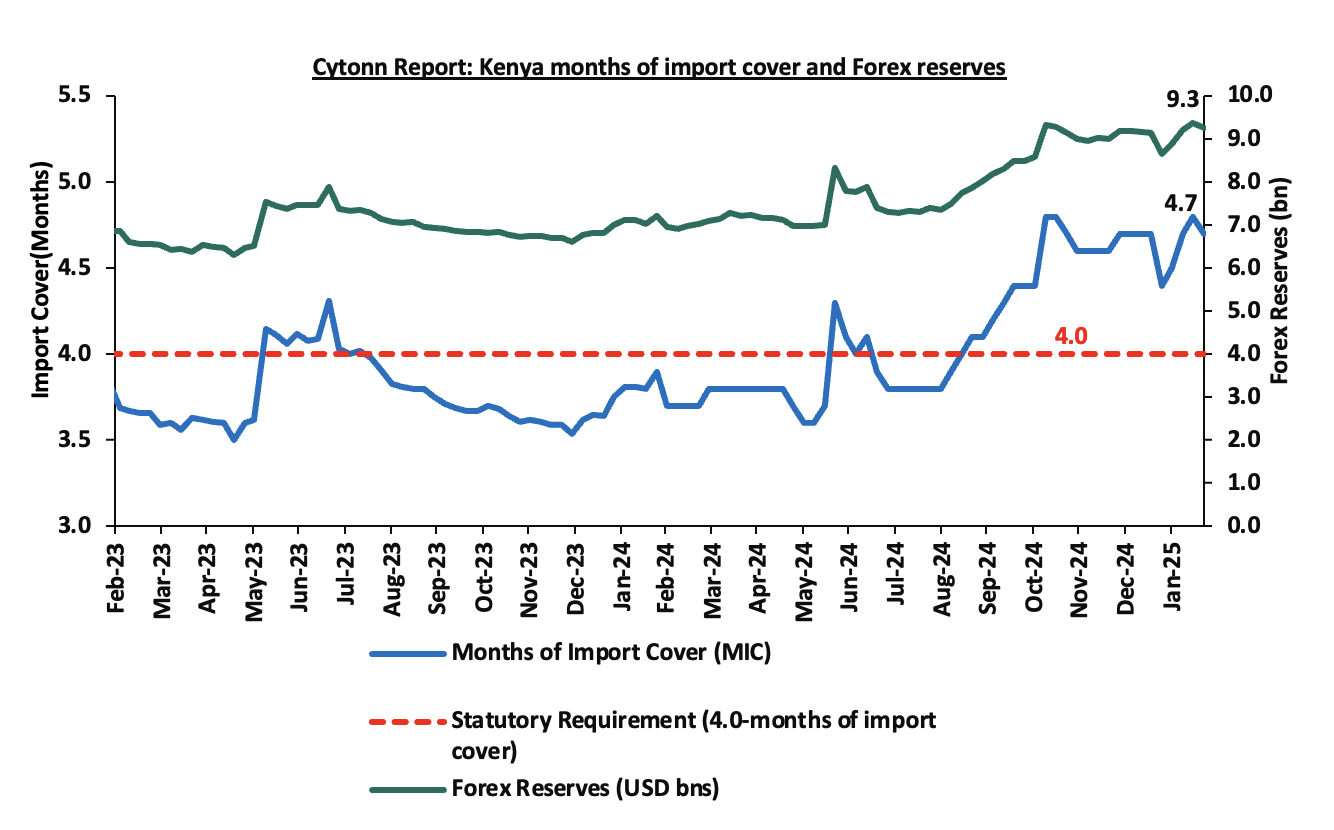

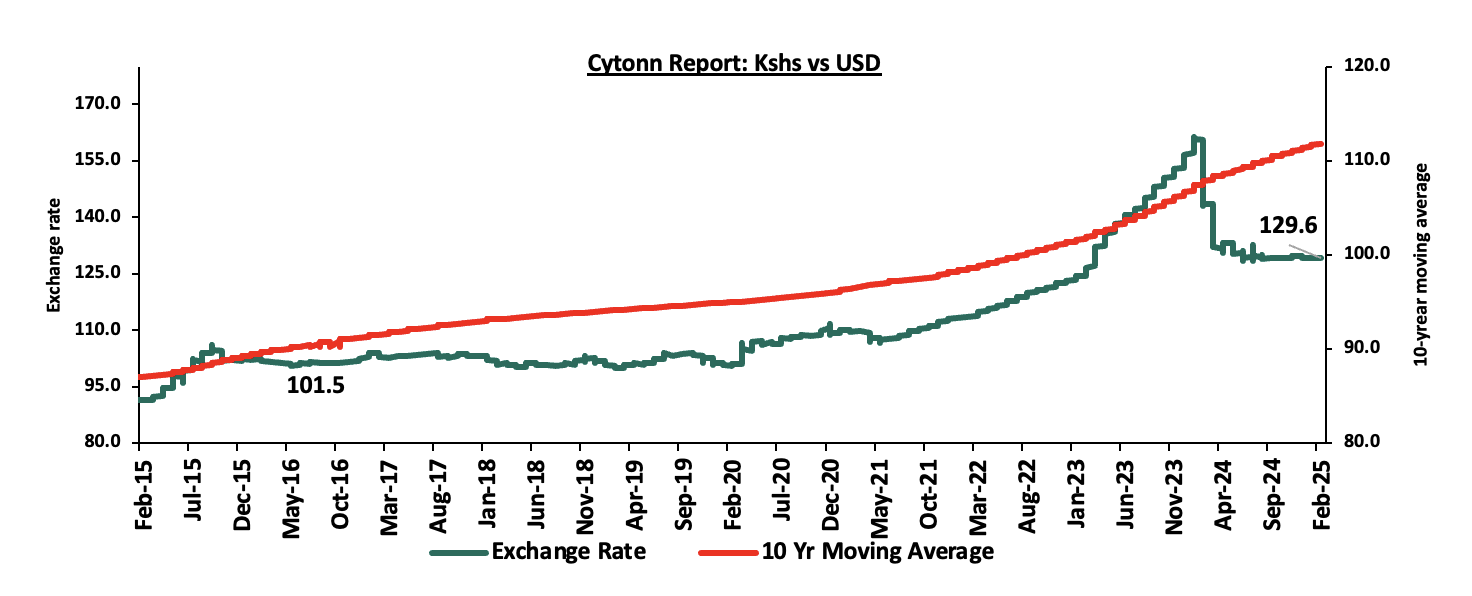

The Kenyan Shilling has experienced a marginal depreciation on Year-to-Date of 0.22% bps against the US Dollar, closing the week at Kshs 129.6 as of February 21, 2025, compared to Kshs 129.3 at the beginning of the year. This is a contrast to the 17.4% appreciation in 2024. In 2023, 2022, and 2021 the currency depreciated by 26.8%, 9.0%, and 3.6% respectively. The appreciation experienced in 2024 and the current stability of the Shilling is supported by improved forex reserves currently at USD 9.3 bn (equivalent to 4.7-months of import cover), an increase of 28.2% from USD 7.2 bn (equivalent to 3.9-months of import cover) recorded in a similar period in 2024, and an 18.0% increase in diaspora remittances to USD 4,945.0 mn in 2024 higher than USD 4,190.0 mn recorded in 2023.

The Kenyan macroeconomic environment challenges have alleviated as evidenced by credit rating outlook revision by Moody’s. In January 2025, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of easing liquidity risks and improved debt affordability. The improved debt affordability is largely attributable to the reduction in domestic borrowing costs, evident in the sharp decline of yields for short-dated papers. Fitch Ratings affirmed Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B-' with a Stable Outlook in January 2025. This rating is supported by robust medium-term growth prospects, a diverse economy, and recent improvements in Kenya’s monetary policy framework. However, the rating is limited by weak governance, high debt servicing costs, a large informal sector that restricts government revenue, and significant external debts. Despite increased efforts to reduce the budget deficit, fiscal consolidation remains a challenge. Additionally, an affirmed rating reduces concerns and improves investor confidence, leading to a reduced flight from the local currency. Over the past twelve months, Kenya’s Eurobond yields have been on a downward trajectory, decreasing by a cumulative average of 50.7 bps reflecting improved investor confidence and a more favourable economic outlook. Investors are getting lower returns due to reduced perceived risks, in turn decreasing demand for foreign currencies and, consequently, the appreciation of the Kenyan Shilling. The currency stability, anchored inflationary pressures, reduced credit risk, coupled with reduced Central Bank Rates has led to decreased yields on government securities;

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 16.15 % p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were oversubscribed for the third consecutive week, with the overall subscription rate coming in at 137.3%, albeit lower than the subscription rate of 184.4% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 113.1%, a reversal from the undersubscription rate of 63.2% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 123.6% and 160.6% respectively from the to 236.2% and 181.1% recorded the previous week. The government accepted a total of Kshs 32.9 bn worth of bids out of Kshs 32.9 bn bids received, translating to an acceptance rate of 99.9%. The yields on the government papers were on a downward trajectory with the yields on the 182-day paper decreasing the most by 9.8 bps to 9.3% from 9.4% recorded the previous week, while the yields on the 91-day and 364-day papers decreased by 2.2 bps and 6.8 bps respectively to 8.9% and 10.5% from 9.0% and 10.6% respectively recorded the previous week;

The charts below show the yield performance of the 91-day, 182-day and 364-day papers from February 2024 to February 2025:

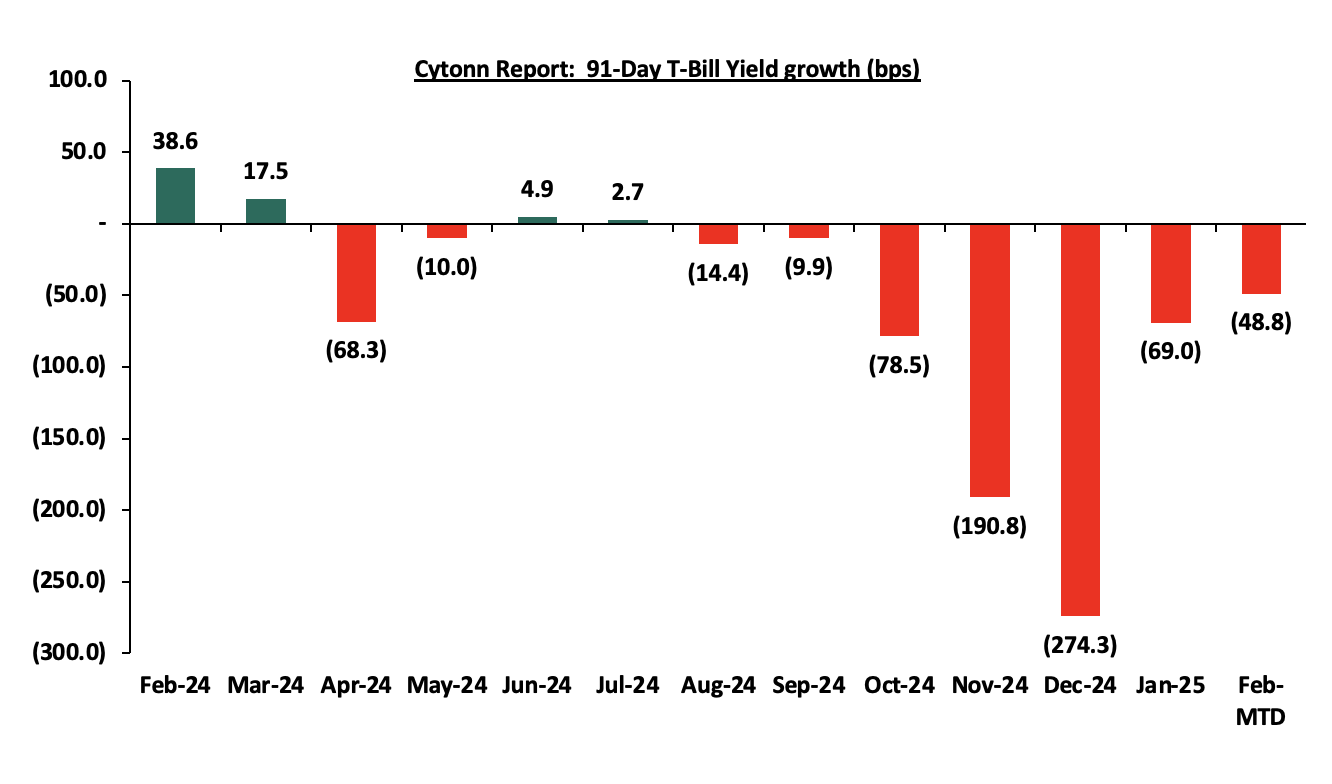

The chart below shows the yield growth for the 91-day T-bill:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

In the primary bond market, the Central Bank of Kenya released the auction results for the buyback of the treasury bonds FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.8%, 11.7% and 12.5% respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds.

The government is looking to raise Kshs 25.0 bn through the reopened bond; FXD1/2018/25 with a tenor to maturity of 18.3 years and a fixed coupon rate of 13.4%. The period of sale opened on Friday, 21st February 2025, and will close on 5th March 2025. Our bidding range for the reopened bond is 13.85%-14.55%.

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 10.9% (based on what we have been offered by various banks), and the yields on the government papers were on a downward trajectory with the yields on the 364-day and 91-day papers decreasing by 6.8 bps and 2.2 bps to 10.5% and 8.9% respectively, from 10.6% and 9.0% recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 10.0 bps to 16.2% from the 16.3% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 6.6 bps to close the week at 15.6%, from the 15.7% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 21st February 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 21st February 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Gulfcap Money Market Fund |

16.3% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

16.2% |

|

3 |

Ndovu Money Market Fund |

15.5% |

|

4 |

Mali Money Market Fund |

15.2% |

|

5 |

Etica Money Market Fund |

15.0% |

|

6 |

Kuza Money Market fund |

14.8% |

|

7 |

Lofty-Corban Money Market Fund |

14.0% |

|

8 |

Genghis Money Market Fund |

13.7% |

|

9 |

Orient Kasha Money Market Fund |

13.4% |

|

10 |

Arvocap Money Market Fund |

13.2% |

|

11 |

Dry Associates Money Market Fund |

13.1% |

|

12 |

Apollo Money Market Fund |

13.0% |

|

13 |

British-American Money Market Fund |

12.9% |

|

14 |

Jubilee Money Market Fund |

12.7% |

|

15 |

GenAfrica Money Market Fund |

12.7% |

|

16 |

Enwealth Money Market Fund |

12.7% |

|

17 |

Madison Money Market Fund |

12.7% |

|

18 |

Old Mutual Money Market Fund |

12.6% |

|

19 |

Sanlam Money Market Fund |

12.5% |

|

20 |

Nabo Africa Money Market Fund |

12.2% |

|

21 |

Faulu Money Market Fund |

12.1% |

|

22 |

Co-op Money Market Fund |

12.0% |

|

23 |

ICEA Lion Money Market Fund |

11.9% |

|

24 |

CIC Money Market Fund |

11.8% |

|

25 |

Absa Shilling Money Market Fund |

11.0% |

|

26 |

KCB Money Market Fund |

11.0% |

|

27 |

AA Kenya Shillings Fund |

10.9% |

|

28 |

Mayfair Money Market Fund |

9.8% |

|

29 |

Ziidi Money Market Fund |

9.5% |

|

30 |

Stanbic Money Market Fund |

9.2% |

|

31 |

Equity Money Market Fund |

6.8% |

Source: Business Daily

Liquidity:

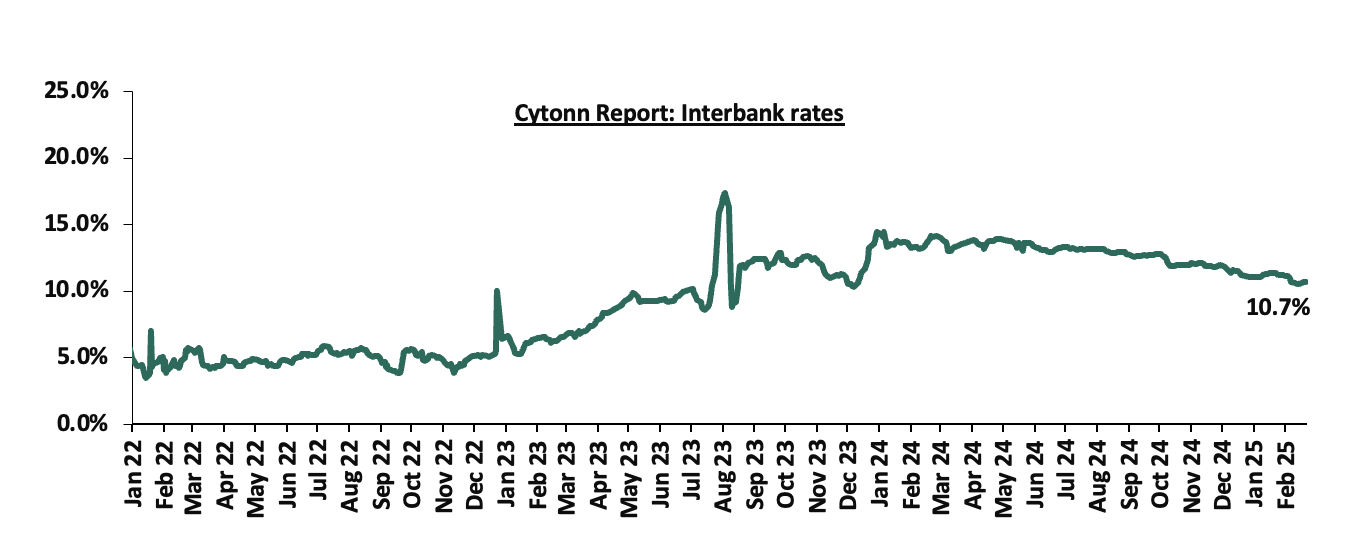

During the week, liquidity in the money markets tightened, with the average interbank rate increasing by 12.1 bps, to 10.7% from 10.5% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 27.9% to Kshs 19.6 bn from Kshs 15.4 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds recorded a mixed performance, with the yield on the 7-year Eurobond issued in 2019 increasing marginally by 1.5 bps to remain unchanged at 8.2% recorded the previous week, while the 10-year Eurobond issued in 2018 decreased the most by 4.2 bps to 8.6% from the 8.7% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 13th February 2025;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

2018 |

2019 |

2021 |

2024 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Years to Maturity |

3.0 |

23.0 |

2.2 |

7.2 |

9.3 |

6.0 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

01-Feb-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

13-Feb-25 |

8.7% |

10.2% |

8.2% |

9.8% |

9.9% |

9.9% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

14-Feb-25 |

8.6% |

10.1% |

8.1% |

9.7% |

9.8% |

9.8% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

17-Feb-25 |

8.6% |

10.1% |

8.1% |

9.7% |

9.8% |

9.8% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

18-Feb-25 |

8.5% |

10.1% |

8.2% |

9.7% |

9.9% |

9.8% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

19-Feb-25 |

8.6% |

10.2% |

8.2% |

9.8% |

9.9% |

9.9% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20-Feb-25 |

8.6% |

10.2% |

8.2% |

9.8% |

9.9% |

9.9% |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Weekly Change |

(0.0%) |

- |

0.0% |

(0.0%) |

(0.0%) |

(0.0%) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MTD Change |

(0.4%) |

(0.1%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

YTD Change |

(0.4%) |

(0.1%) |

(0.3%) |

(0.3%) |

(0.2%) |

(0.2%) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenyan Shilling depreciated against the US Dollar by 27.8 bps, to close the week at Kshs 129.6, from the Kshs 129.2 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 21.5 bps against the dollar, compared to the 17.4% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,960.2 mn in the twelve months to January 2025, 16.6% higher than the USD 4,252.9 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the January 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.9% in the period,

- The tourism inflow receipts which came in at USD 352 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 14.6% to 2,394,376 in 2024 from 2,089,259 in 2023, and,

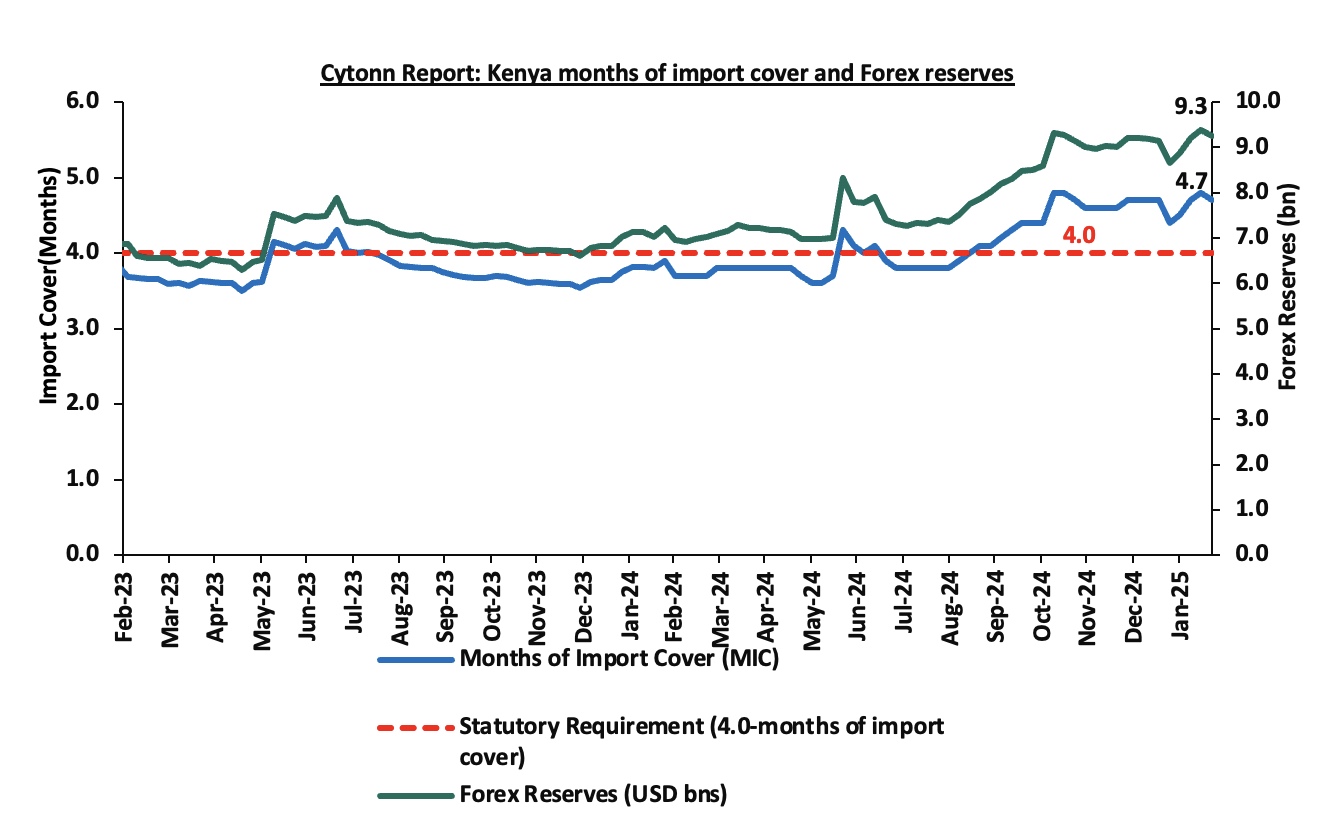

- Improved forex reserves currently at USD 9.3 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in Q3’2024, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves decreased by 1.3% during the week, to USD 9.3 bn from the USD 9.4 bn recorded in the previous week, equivalent to 4.7 months of import cover compared to 4.8 months of import cover recorded last week, and above the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- January 2025 Exchequer Release

During the week, the National Treasury gazetted the revenue and net expenditures for the seven months of FY’2024/2025, ending 31st January 2025, highlighting that the total revenue collected as at the end of January 2025 amounted to Kshs 1,352.8 bn, equivalent to 51.4% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 88.1% of the prorated estimates of Kshs 1,535.0 bn. The revenue collections are behind due to the elevated cost of living exacerbated by high taxes. The total expenditure amounted to Kshs 1,994.8 bn, equivalent to 47.4% of the revised estimates of Kshs 4,207.9 bn, and is 81.3% of the prorated target expenditure estimates of Kshs 2,454.6 bn. Below is a summary of the performance:

|

FY'2024/2025 Budget Outturn - As at 31st January 2025 |

||||||

|

Amounts in Kshs Billions unless stated otherwise |

||||||

|

Item |

12-months Original Estimates |

Revised Estimates |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

|

1.2 |

|

|

|

|

Tax Revenue |

2,745.2 |

2,475.1 |

1,251.9 |

50.6% |

1,443.8 |

86.7% |

|

Non-Tax Revenue |

172.0 |

156.4 |

99.8 |

63.8% |

91.2 |

109.4% |

|

Total Revenue |

2,917.2 |

2,631.4 |

1,352.8 |

51.4% |

1,535.0 |

88.1% |

|

External Loans & Grants |

571.2 |

593.5 |

111.8 |

18.8% |

346.2 |

32.3% |

|

Domestic Borrowings |

828.4 |

978.3 |

526.9 |

53.9% |

570.7 |

92.3% |

|

Other Domestic Financing |

4.7 |

4.7 |

4.4 |

94.8% |

2.7 |

162.5% |

|

Total Financing |

1,404.3 |

1,576.5 |

643.2 |

40.8% |

919.6 |

69.9% |

|

Recurrent Exchequer issues |

1,348.4 |

1,307.9 |

759.0 |

58.0% |

763.0 |

99.5% |

|

CFS Exchequer Issues |

2,114.1 |

2,137.8 |

888.9 |

41.6% |

1,247.1 |

71.3% |

|

Development Expenditure & Net Lending |

458.9 |

351.3 |

139.3 |

39.7% |

204.9 |

68.0% |

|

County Governments + Contingencies |

400.1 |

410.8 |

207.6 |

50.5% |

239.7 |

86.6% |

|

Total Expenditure |

4,321.5 |

4,207.9 |

1,994.8 |

47.4% |

2,454.6 |

81.3% |

|

Fiscal Deficit excluding Grants |

1,404.3 |

1,576.5 |

642.0 |

40.7% |

919.6 |

69.8% |

|

Total Borrowing |

1,399.6 |

1,571.8 |

638.7 |

40.6% |

916.9 |

69.7% |

Amounts in Kshs bn unless stated otherwise

The Key take-outs from the release include;

- Total revenue collected as at the end of January 2025 amounted to Kshs 1,352.8 bn, equivalent to 51.4% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 88.1% of the prorated estimates of Kshs 1,535.0 bn. Cumulatively, tax revenues amounted to Kshs 1,251.9 bn, equivalent to 50.6% of the revised estimates of Kshs 2,475.1 bn and 86.7% of the prorated estimates of Kshs 1,443.8 bn,

- Total financing amounted to Kshs 643.2 bn, equivalent to 40.8% of the revised estimates of Kshs 1,576.5 bn and is equivalent to 69.9% of the prorated estimates of Kshs 919.6 bn. Additionally, domestic borrowing amounted to Kshs 526.9 bn, equivalent to 53.9% of the revised estimates of Kshs 978.3 bn and is 92.3% of the prorated estimates of Kshs 570.7 bn,

- The total expenditure amounted to Kshs 1,994.8 bn, equivalent to 47.4% of the revised estimates of Kshs 4,207.9 bn, and is 81.3% of the prorated target expenditure estimates of Kshs 2,454.6 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 759.0 bn, equivalent to 58.0% of the revised estimates of Kshs 1,307.9 and 99.5% of the prorated estimates of Kshs 763.0 bn,

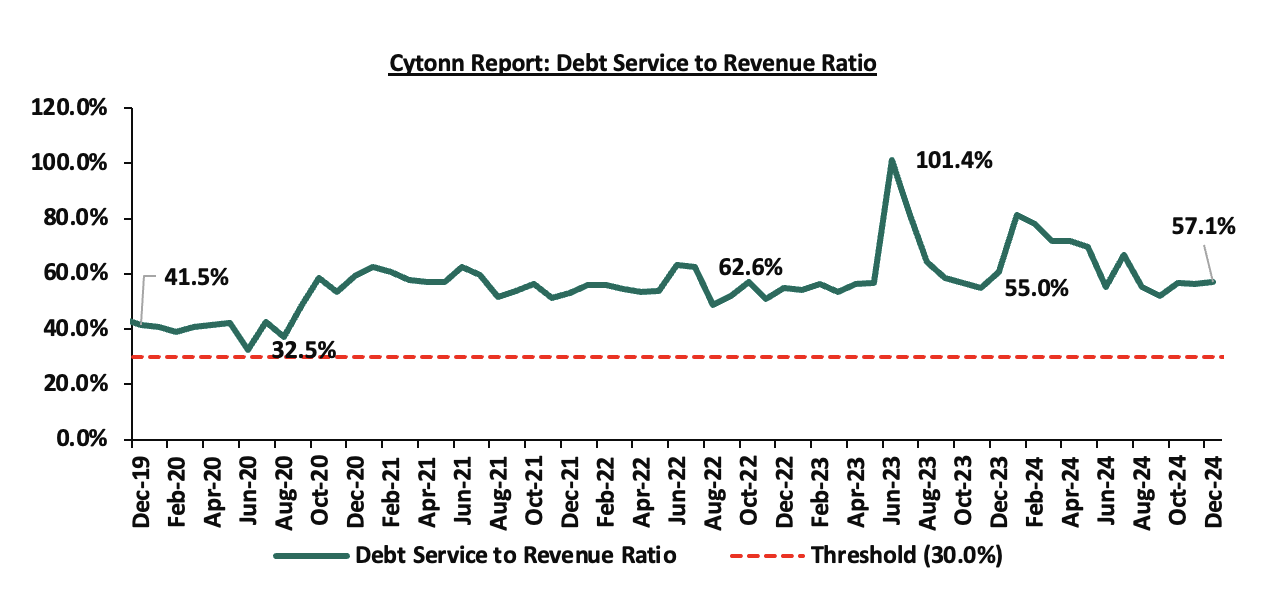

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 888.9 bn, equivalent to 41.6% of the revised estimates of Kshs 2,137.8 bn, and are 71.3% of the prorated amount of Kshs 1,247.1 bn. The cumulative public debt servicing cost amounted to Kshs 772.8 bn which is 40.5% of the revised estimates of Kshs 1,910.5 bn, and is 69.3% of the prorated estimates of Kshs 1,114.4 bn. Additionally, the Kshs 772.8 bn debt servicing cost is equivalent to 57.1% of the actual cumulative revenues collected as at the end of January 2025. The chart below shows the debt servicing cost to revenue ratio over the period;

- Total Borrowings as at the end of January 2025 amounted to Kshs 638.7 bn, equivalent to 40.6% of the revised estimates of Kshs 1,571.8 bn for FY’2024/2025 and are 69.7% of the prorated estimates of Kshs 926.6 bn. The cumulative domestic borrowing of Kshs 978.3 bn comprises of Net Domestic Borrowing Kshs 408.4 bn and Internal Debt Redemptions (Rollovers) Kshs 569.9 bn.

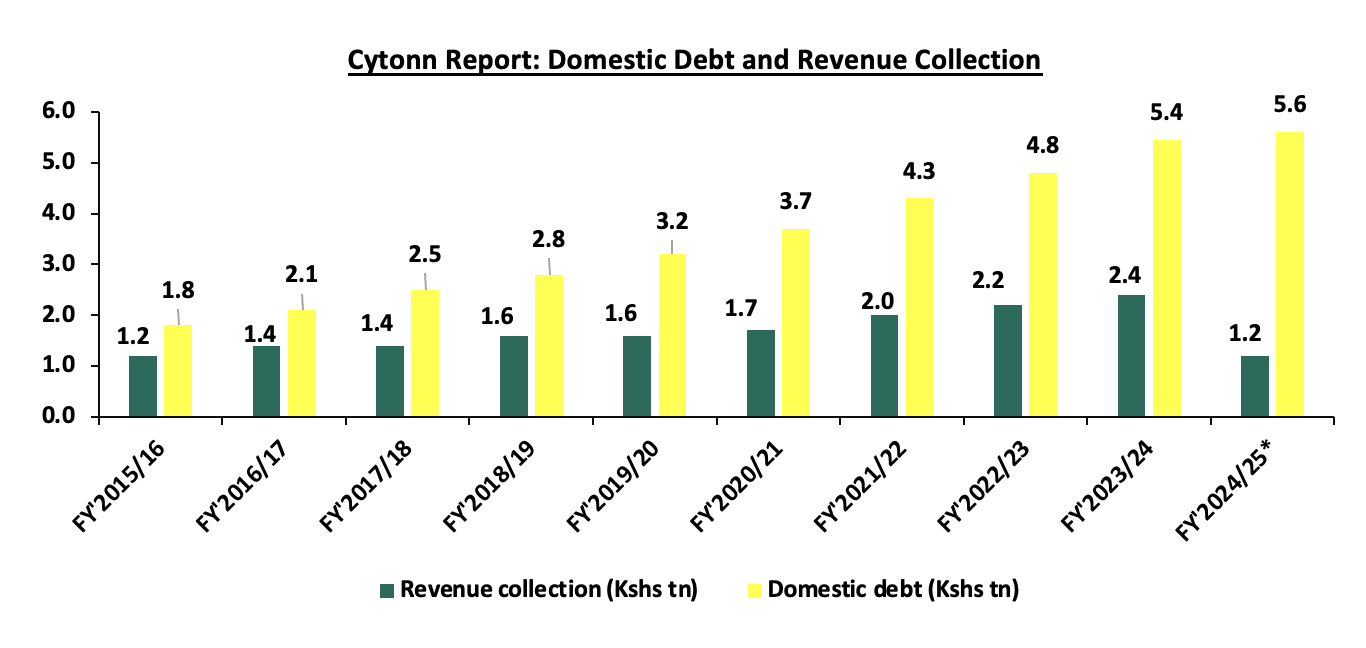

The government missed its prorated revenue targets for the seventh consecutive month in FY’2024/2025, achieving only 88.1% of the revenue targets in January 2025. This shortfall is largely due to the challenging business environment, exacerbated by high taxes and the elevated cost of living, despite an easing of inflationary pressures, with the year-on-year inflation for January 2025 rising marginally by 0.3% points to 3.3%, up from 3.0% in December 2024. However, the cost of living and cost of credit remains high, negatively impacting revenue collection due to the challenging business environment, with the PMI decreasing marginally to 50.5 in January from 50.6 in December 2024. Despite efforts to enhance revenue collection, such as broadening the tax base, curbing tax evasion, and suspending tax relief payments, the government has yet to fully benefit from these strategies. Future revenue collection will largely depend on the stabilization of the country’s business climate, and how quickly the activity in the private sector picks up, which is expected to be supported by a stable Shilling, continued easing of inflation, and a reduction in the cost of credit. This is in line with the Monetary Policy Committee’s (MPC) recent decision to lower the Central Bank Rate (CBR) by 50.0 basis points to 10.75%, down from 11.25%, following their meeting on February 5th, 2025.

- February Inflation projection

We are projecting the y/y inflation rate for February 2025 to increase marginally to the range of 3.4% - 3.5% mainly on the back of:

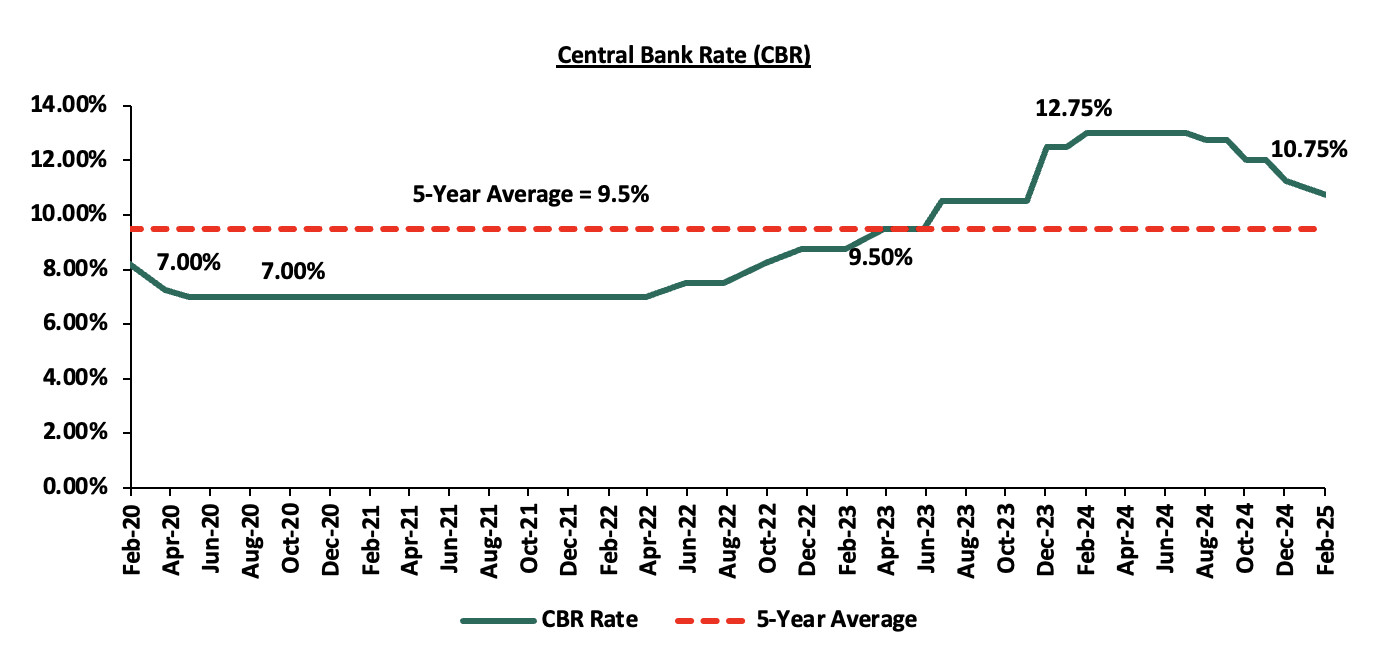

- The decrease in the Central Bank Rate (CBR) by 50.0 bps to 10.75% from 11.25% – In 2025, the CBK Monetary Policy Committee has continued to reduce the Central Bank Rate (CBR) with a 50.0 bps cut in February, lowering it to 10.75% from 11.25% in December 2024. In their previous meeting on 5th December 2024, they implemented a more significant reduction, cutting the CBR by 75.0 bps to 11.25%. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy.

- Depreciation of the Kenya Shilling against the US Dollar – The Kenya Shilling has recorded a 28.3 bps month-to-date depreciation as of 21st February 2025 to Kshs 129.6 from Kshs 129.2 recorded at the beginning of the month. This depreciation in the exchange rate, though slight, could increase inflationary pressures.

We, however, expect that inflation rate will, however, be supported by:

- Reduced electricity prices – In February 2025, electricity prices decreased marginally on the back of a drop in fuel cost charges and forex adjustment charges. EPRA set the fuel cost charge at Kshs 3.4, down from Kshs 3.5 in January 2025, while the forex adjustment was lowered to Kshs 0.7 from Kshs 0.8 in January 2025. With electricity being one the major inputs of inflation, this decrease is expected to reduce production costs for businesses as well as decrease electricity costs for households and thus easing inflation.

- Stable Fuel Prices in January– In their last fuel prices release, EPRA announced that the maximum allowed price for Super Petrol, Diesel and Kerosene remained unchanged at Kshs 176.6, Kshs 167.1, and Kshs 151.4 per litre respectively effective from 15th February 2025 to 14th March 2024. This stability in fuel prices is likely to stabilize pressure on consumers’ purchasing power as well as business operational costs, since fuel is a major input cost for businesses, and,

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by the stable fuel prices, decreased energy costs and stability in the exchange rate. However, risks remain, particularly from the potential for increased demand-driven inflation due to accommodative monetary policy. The decision to lower the CBR to 10.75% during the latest MPC meeting will likely increase money supply, in turn increasing inflation, especially with further cuts expected in the coming meetings. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 166.5% ahead of its prorated net domestic borrowing target of Kshs 267.0 bn, and 74.3% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 408.4 bn, having a net borrowing position of Kshs 711.7 bn. However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 1.3%, while NSE 20, NSE 10 and NSE 25 gained by 0.8%,0.5% and 0.3% respectively, taking the YTD performance to gains of 8.9%, 6.0%, 3.2% and 2.5% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such DTB Kenya, Safaricom and Co-operative Bank of 4.0%, 3.9%, and 3.0% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as KCB Bank, EABL and Equity Bank of 2.8%, 1.9%, and 1.4% respectively.

During the week, equities turnover increased by 5.3% to USD 16.0 mn, from USD 15.2 mn recorded the previous week, taking the YTD total turnover to USD 126.3 mn. Foreign investors became net buyers for the first time in five weeks, with a net buying position of USD 0.7 mn, from a net selling position of USD 1.1 mn recorded the previous week, taking the YTD foreign net selling position to USD 16.0 mn, compared to a net selling position of USD 16.9 mn in 2024.

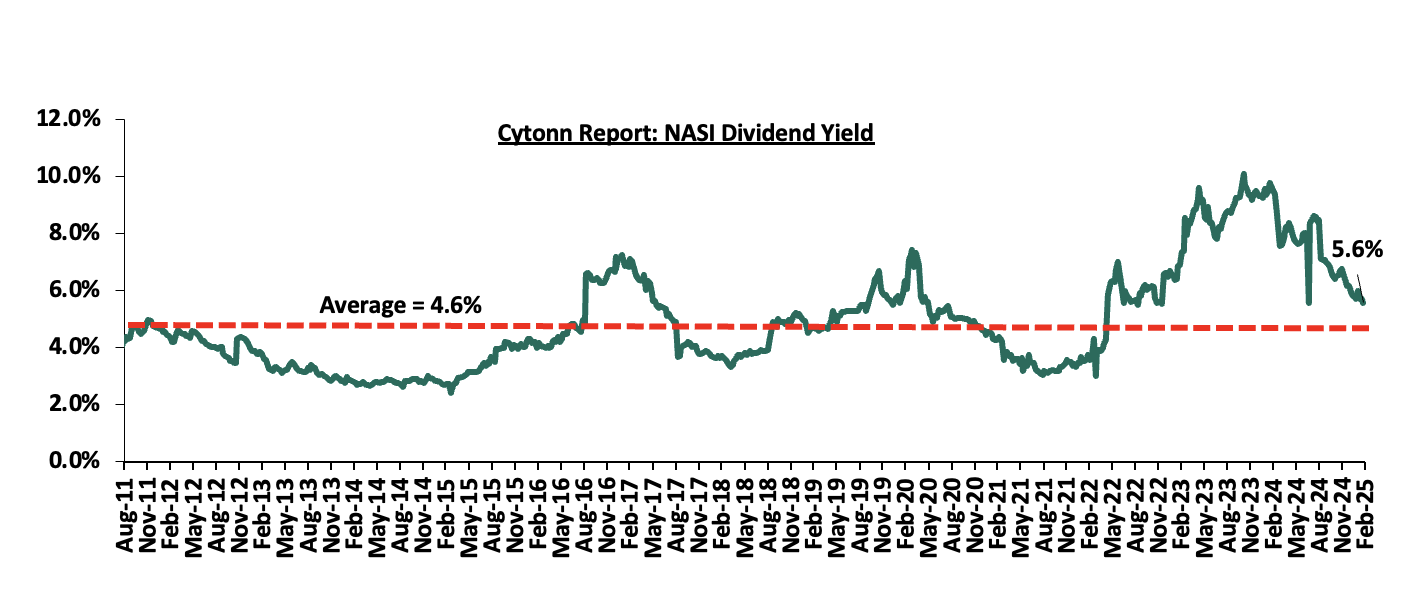

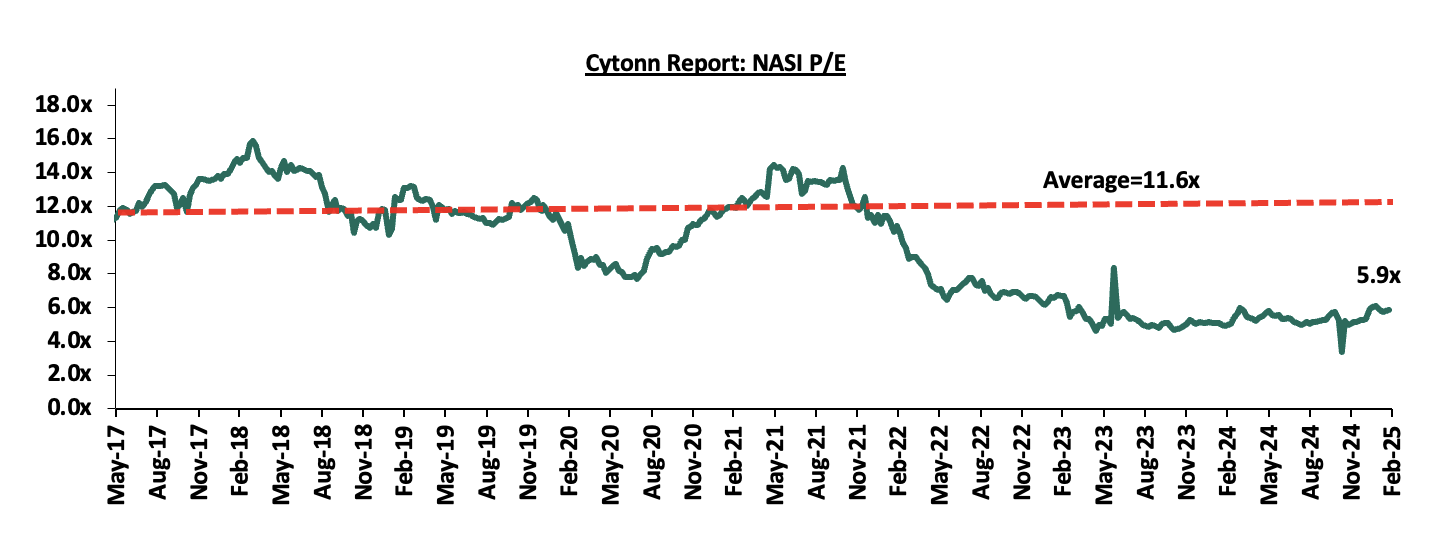

The market is currently trading at a price-to-earnings ratio (P/E) of 5.9x, 49.6% below the historical average of 11.6x. The dividend yield stands at 5.6%, 1.1% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 14/02/2026 |

Price as at 21/02/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Equity Group |

47.7 |

47.0 |

(1.4%) |

(2.1%) |

48.0 |

60.2 |

8.5% |

36.6% |

0.9x |

Buy |

|

Jubilee Holdings |

200.0 |

204.3 |

2.1% |

16.9% |

174.8 |

260.7 |

7.0% |

34.6% |

0.3x |

Buy |

|

Co-op Bank |

16.5 |

17.0 |

3.0% |

(2.6%) |

17.5 |

18.8 |

8.8% |

19.4% |

0.8x |

Accumulate |

|

NCBA |

49.8 |

49.3 |

(1.1%) |

(3.4%) |

51.0 |

53.2 |

9.6% |

17.7% |

0.9x |

Accumulate |

|

KCB Group |

45.2 |

44.0 |

(2.8%) |

3.7% |

42.4 |

50.3 |

0.0% |

14.4% |

0.7x |

Accumulate |

|

Standard Chartered Bank |

290.0 |

293.0 |

1.0% |

2.7% |

285.3 |

291.2 |

9.9% |

9.3% |

2.0x |

Hold |

|

ABSA Bank |

18.5 |

19.0 |

2.4% |

0.5% |

18.9 |

19.1 |

8.2% |

9.0% |

1.5x |

Hold |

|

Stanbic Holdings |

150.0 |

148.0 |

(1.3%) |

5.9% |

139.8 |

145.3 |

10.4% |

8.5% |

1.0x |

Hold |

|

Britam |

7.1 |

7.3 |

2.8% |

25.8% |

5.8 |

7.5 |

0.0% |

2.5% |

1.0x |

Lighten |

|

CIC Group |

2.9 |

2.9 |

0.7% |

34.1% |

2.1 |

2.8 |

4.5% |

2.1% |

0.9x |

Lighten |

|

I&M Group |

36.1 |

35.4 |

(1.9%) |

(1.8%) |

36.0 |

32.3 |

7.2% |

(1.4%) |

0.7x |

Sell |

|

Diamond Trust Bank |

74.8 |

77.8 |

4.0% |

16.5% |

66.8 |

71.1 |

6.4% |

(2.1%) |

0.3x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

We are “Bullish” on the Equities markets in the short term due to current cheap valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to the persistent foreign investor outflows.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Industry Report

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) December 2024 Reports, which highlighted the performance of major economic indicators. Key highlights related to the Real Estate sector include;

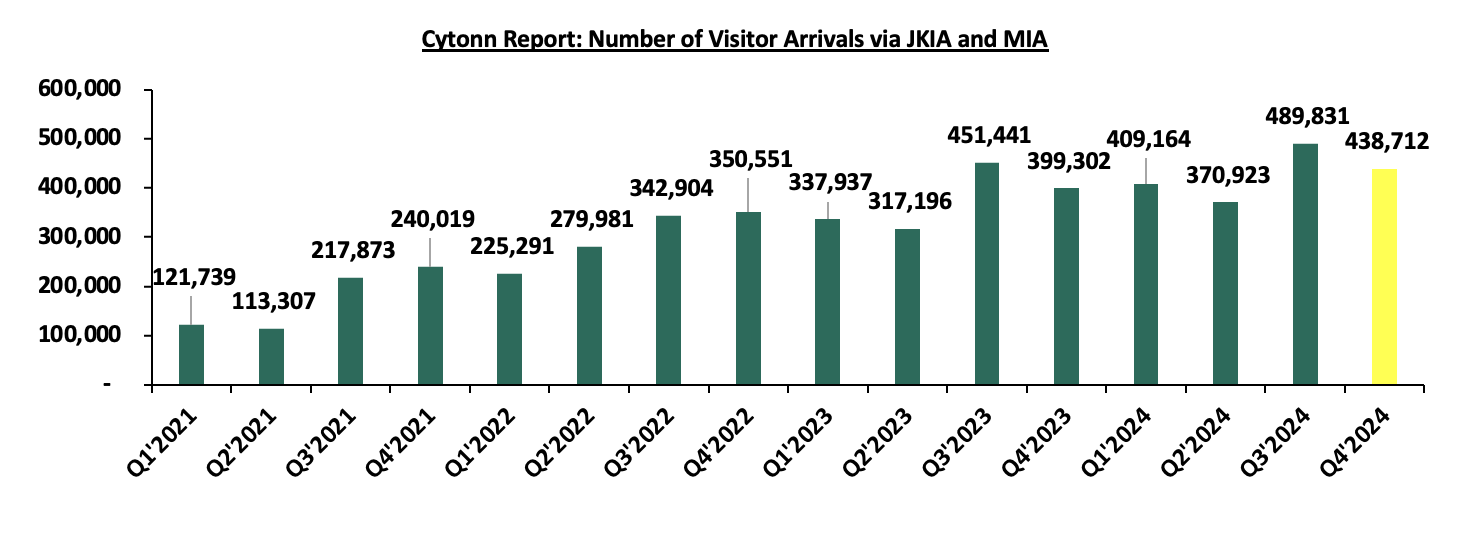

- In December 2024, the number of arrivals was 166,961, reflecting a 29.1% increase from 129,335 arrivals recorded in November 2024. On a year-on-year basis, this represented a 16.0% increase compared to 143,942 arrivals in December 2023. The improved performance can be attributed to several factors; i) recovery in global tourism industry coupled with a strong marketing campaign, ii) visa openness following the introduction of the Electronic Tourist Authorization (eTA) at the beginning of the year, iii) improvements in air connectivity through introduction of new routes and more frequencies by major airlines and the introduction of direct flights by three new airlines—IndiGo (Mumbai-Nairobi), Fly Dubai (Dubai-Mombasa), and Airlink (Johannesburg-Nairobi), iv) the creation of specialized tourism offerings such as cruise, adventure, cultural, and sports tourism, and, v) expanded global promotion of Kenya's tourism by the Ministry of Tourism and the Kenya Tourism Board using platforms like Magical Kenya. On a q/q basis, the performance represented a 10.4% decrease to 438,712 in Q4’2024 from 489,831 arrivals recorded in Q3’2024. The performance can be attributed to the global economic uncertainties and seasonal fluctuations. The chart below shows the number of international arrivals in Kenya between Q1’2021 and Q4’2024;

Source: Kenya National Bureau of Statistics (KNBS)

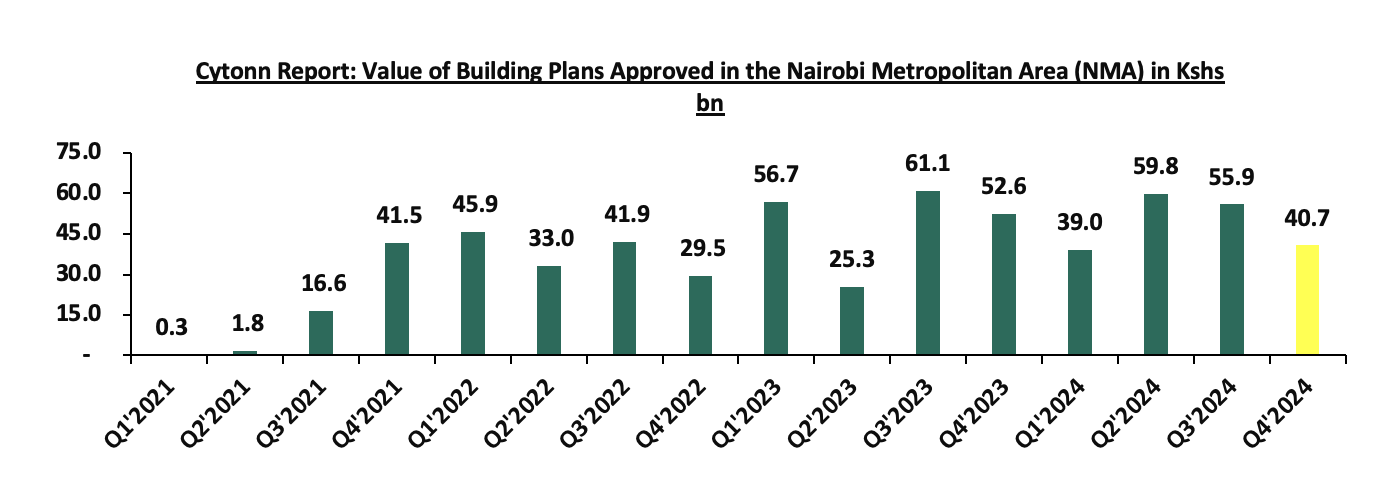

- The total value of building plans approved in the Nairobi Metropolitan Area (NMA) decreased on y/y basis by 22.5% to Kshs 40.7 bn in Q4’2024, from Kshs 52.6 bn recorded in Q4’2023. In addition, on a q/q basis, the performance represented a 27.1% decrease from Kshs 55.9 bn recorded in Q3’2024. The decrease in performance was attributable to; i) increased prices of construction materials such as reinforced steel and cement which increased by 10.7% in 2024 to Kshs 830 from Kshs 750 recorded in 2023, ii) political demonstrations disrupted construction and business activities, negatively affecting investor confidence and decision-making regarding new projects, and, iii) developers and investors shifted strategies, emphasizing operational efficiency and sustainability rather than embarking on new large-scale developments, iv) Increase in Non-Performing loans in the sector have led the lending institutions to raise the cost of borrowing. The chart below shows the value of building plans approved in the Nairobi Metropolitan Area (NMA) between Q1’2021 and Q4’2024;

Source: Kenya National Bureau of Statistics (KNBS)

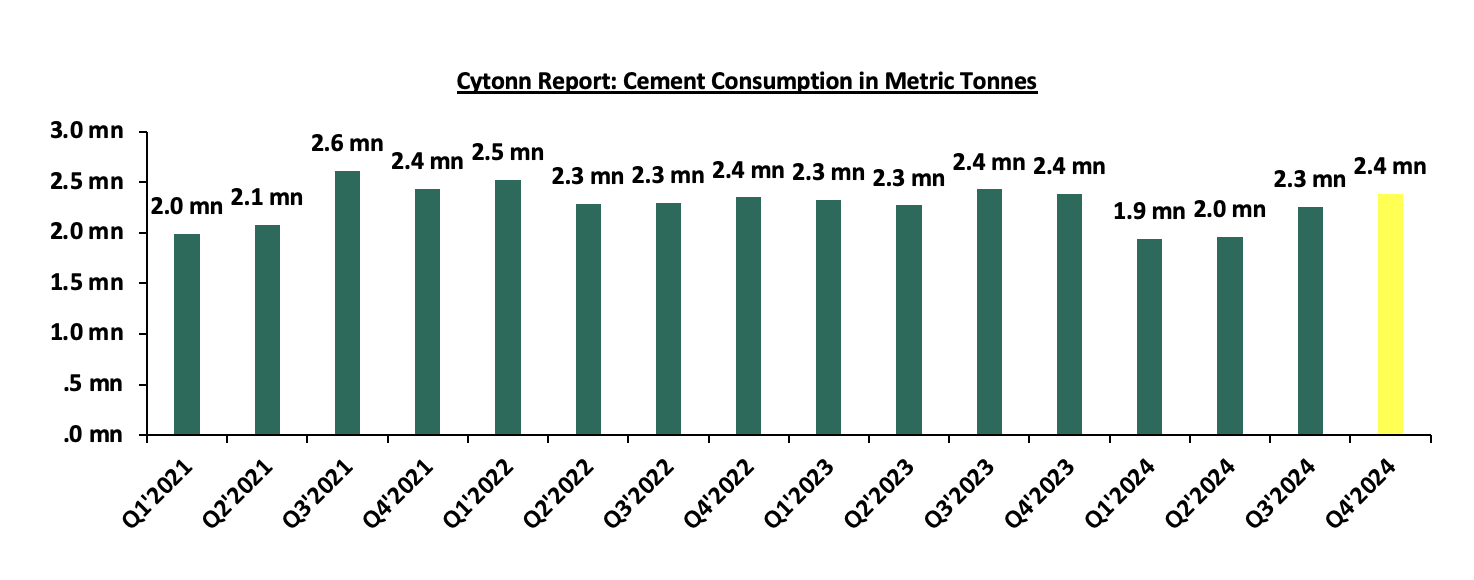

- The consumption of cement came in at 2.4 mn metric tonnes in Q4’2024, a 5.7% increase from 2.3 mn metric tonnes recorded in Q3’2024. On a y/y basis, the performance represented a 3.7% increase from 2.3 mn metric tonnes recorded in Q4’2023. The increase in performance was attributable to; i) surge in domestic construction and infrastructure development

ii) increased government-led infrastructure investments, iii) strategic focus on stimulating domestic economic activity through public works projects, and, iv) eased costs of the construction, which decreased by 6.8% during the quarter to Kshs 66,375 per SQM from an average of Kshs 71,200 per SQM recorded in 2023. However, the improvement in construction cost remains subdued due to the increase in building materials such as cement which increased by 10.7% in 2024 to Kshs 830 from Kshs 750 recorded in 2023. The chart below shows cement consumption in metric tonnes in Kenya between Q1’2021 and April 2024;

Source: Kenya National Bureau of Statistics (KNBS)

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 14th February 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.8 mn and Kshs 35.6 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 791.5 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 14th February 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.8% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023,, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector iv) increased investment by local and international investors in the retail sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

The Kenyan Shilling has experienced a marginal depreciation of 21.5 bps on a Year-to-Date against the US Dollar, closing the week at Kshs 129.6 as of February 21, 2025, compared to Kshs 129.3 at the beginning of the year. This is a contrast to the 17.4% appreciation in 2024 while in 2023, 2022, and 2021 the currency depreciated by 26.8%, 9.0%, and 3.6% respectively. The appreciation experienced in 2024 and the current stability of the Shilling is supported by improved forex reserves currently at USD 9.3 bn (equivalent to 4.7-months of import cover), an increase of 28.2% from USD 7.2 bn (equivalent to 3.9-months of import cover) recorded in a similar period in 2024, and an 18% increase in diaspora remittances to USD 4,945.0 mn in 2024 higher than USD 4,190.0 mn recorded in 2023 and the ease in inflation, with the current inflation rate as of January 2025 coming in at 3.3%, within the CBK target range of 2.5%-7.5%.

The interest rates have seen significant decreases over the last seven months with the 91-day treasury bill rates getting to a low of 9.0%, the lowest since September 2022. In the Eurobond market, the rates have been low with Eurobonds trading at rates of below 11.0% in February 2025. Interest rates have declined due to reduced government borrowing pressure, driven by improved liquidity conditions, eased inflation, increased external funding, and a shift in debt management strategies. The Kenyan macroeconomic environment challenges have alleviated as evidenced by credit rating outlook revision by Moody’s. In January 2025, Moody’s announced its revision of Kenya’s credit outlook to positive from negative, while maintaining the credit rating at Caa1, on the back of a likelihood of an ease in liquidity risks and improved debt affordability. The improved debt affordability is largely attributable to the reduction in domestic borrowing costs, evident in the sharp decline of yields for short-dated papers. Similarly, Fitch Ratings affirmed Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B-' with a Stable Outlook in January 2025;

We have previously covered the topic as summarized below;

- In January 2024, we covered Currency and Interest Rates Review, with our outlook on the currency being a 16.4% depreciation mainly on the back of the ever-present current account deficit with Kenya being a net importer, which was to increase US Dollar demand in the market, and the persistent US Dollar demand by importers, mainly in the oil and energy sector as well as manufacturers, while the US Dollar supply remains low resulting to a shortage of USD in the Kenyan market. On the interest rates, we expected an upward readjustment on the yield curve due to the increased pressure on the government to meet its budgetary deficit by borrowing more domestically, coupled with uncertainties about the economy occasioned by elevated inflationary pressures which had resulted in high credit risk hampering lending to businesses and individuals.

With the shilling having appreciated by 17.4% at the end of 2024 and the continuous downward readjustment on the yield curve, we saw the need to revisit the topic of currency and interest rates outlook, in order to shed some light on how the Kenyan shilling and the interest rates are expected to behave in 2025. In this focus, we shall be doing an in-depth analysis of the factors that are expected to drive the performance of the Kenyan shilling and the interest rates and thereafter give our outlook for 2025 based on these factors. We shall cover the following:

- Historical Performance of the Kenyan Shilling and Drivers,

- Evolution of the Interest Rate Environment,

- Currency Outlook,

- Factors Expected to Drive the Interest Rate Environment, and,

- Conclusion and Our View Going Forward.

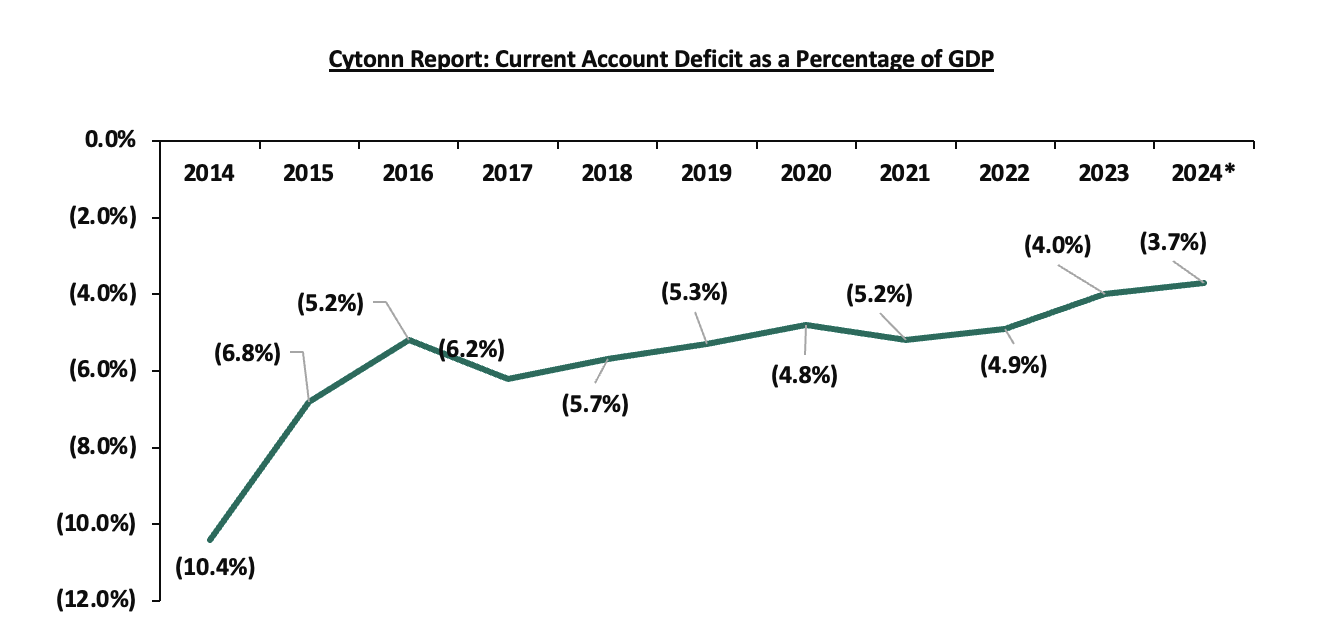

Section I: Historical Performance of the Kenyan Shilling

The Kenyan shilling has depreciated at a 10-year CAGR of 3.5% to close at Kshs 129.6 as of 21st February 2025 from Kshs 91.6 over the same period in 2015, mainly attributable to challenges within the country’s macroeconomic environment. Over the last years we have seen the country run a fiscal deficit which has led to the government borrowing both locally and internationally and continues to witness a persistent current account deficit, recorded at 4.0% of GDP as of Q3’2024 projected at 3.7% of GDP for FY’2024, which continues to weigh down the Shilling. The current account deficit is largely due to the high imports of petroleum products and the manufacturing equipment. However, in 2024, the shilling appreciated for the first time in six years, closing the year at Kshs 129.3 against the US Dollar as compared to the Kshs 157.0 at the beginning of the year translating to appreciation of 17.4%, and a contrast to the 26.8% depreciation in 2023, majorly attributable to the Eurobond buyback in February 2024, alleviating credit risk and improving investor confidence, and the improved forex reserves. The chart below illustrates the performance of the Kenyan Shilling against the US Dollar over the last 10 years:

Source: Cytonn Research

The following are the factors that have continued to support the shilling;

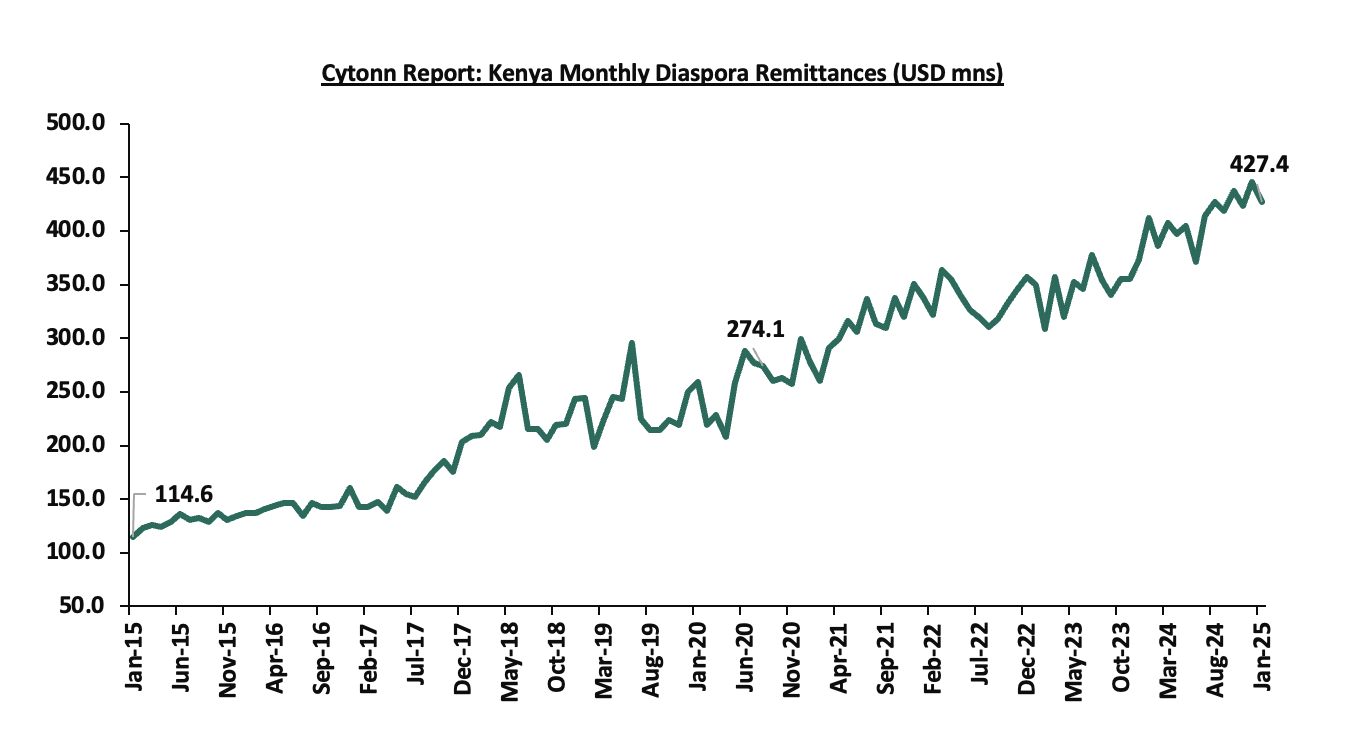

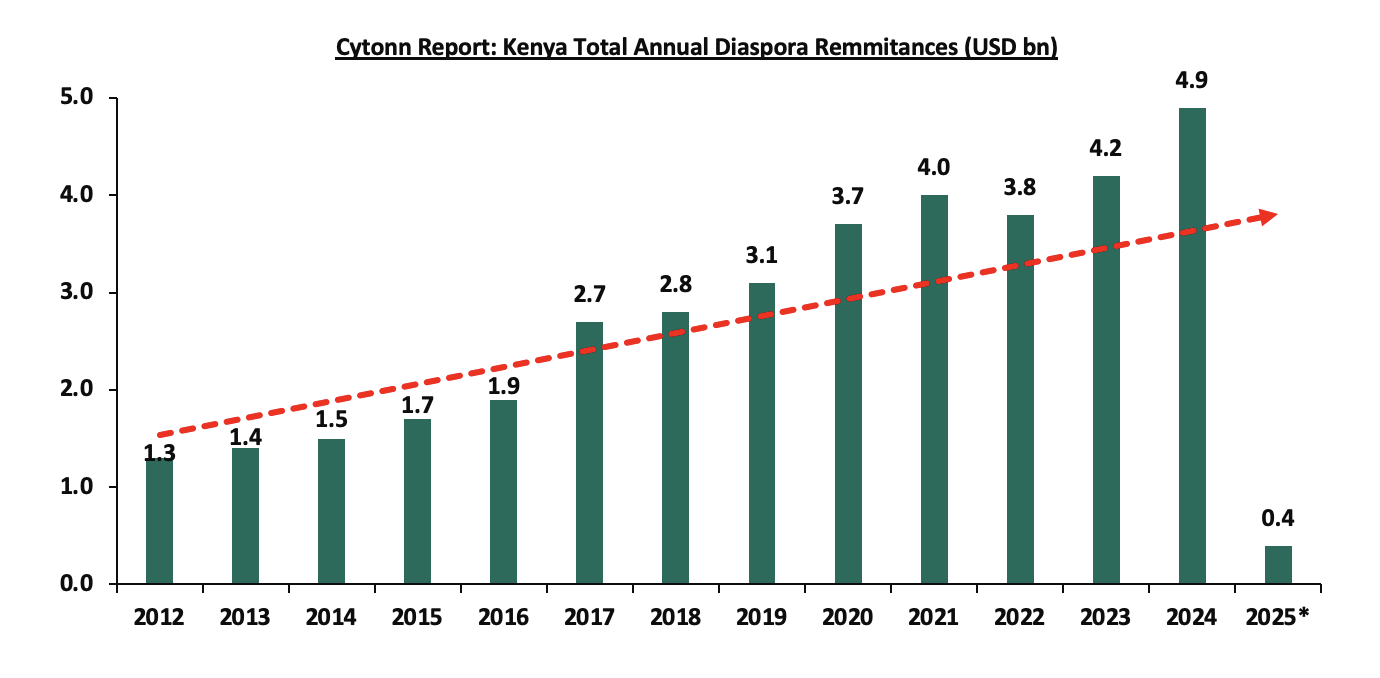

- Strong diaspora remittances, with monthly diaspora remittances having grown at a 10-year CAGR of 14.1% to USD 427.4 mn in January 2025, from USD 114.6 mn recorded in January 2015. In the 12 months to January 2025, the Diaspora remittances stood at a cumulative USD 4,960.2 mn which is 16.6% higher than the USD 4,252.9 mn recorded over the same period in 2024. The continued growth in diaspora remittance is mainly attributable to the recovery of the of the global economy, increasing Kenyan population in the diaspora and advancing technology that has facilitated easier transfer of money. The charts below show the trend of the evolution of monthly and annual Diaspora Remittances;

Source: Central Bank of Kenya

Source: Central Bank of Kenya, * figure as of January 2025

- The narrowing of the current account deficit due to the increased value and volumes of the country’s principal exports relative to the import bill, with total exports increasing by 6.0% in Q3’2024, compared to a 5.0% growth in imports over the same period. It is good to note that there has been a positive trend with the current account deficit coming at 4.0% of GDP in Q3’2024, and projected at 3.7% of GDP for FY’2024. Notably, exports of coffee grew the most by 26.8% in Q3’2024, to Kshs 12.0 mn from Kshs 9.5 mn in Q3’2023. Also, in Q3’2024, tea exports and horticulture contributed Kshs 44.7 mn and Kshs 50.3 mn, respectively, to the total export value of Kshs 282.4 mn. This however, marked an 11.4% decline in tea export earnings from Kshs 50.4 mn in a similar period last year, while horticulture saw a 3.1% increase from Kshs 48.8 mn in Q3’2023,

- Kenya has continued to receive financing from the International Monetary Fund and the world Bank which have supported the Kenyan shilling by boosting the forex reserves. Notably, the government received USD 215.0 mn from the World Bank loan to build resilient and responsive health systems projects in March 2024, as well as USD 485.8 mn from the International Monetary Fund (IMF) in October 2024 under the 38-month Extended Fund Facility (EFF) and USD 120.3mn from Extended Credit Facility (ECF) following the completion of the seventh review and eight review

- The Central Bank of Kenya (CBK) has been actively selling US dollars to the market to smooth out the volatility of the Kenyan shilling. By selling dollars, the CBK matches the demand in the market, mainly by importers, which has continued to shield the Shilling from pressure and helps maintain a stable exchange rate

- Improving forex reserves having increased by a significant 28.2% to USD 9.3 bn (equivalent to 4.7 months of import cover) as of 21st February 2025, from USD 7.2 bn (equivalent to 3.8 months of import cover) in a similar period in 2024. Notably, for the last six months, forex reserves have remained above the statutory requirement of maintaining at least 4.0-months of import cover. The increase is largely attributed to decreased debt service obligations due to the continued appreciation of the Kenyan shilling. The chart below shows the trend of the evolution of the forex reserves:

However, the shilling remains under pressure due to;

- The existence of an ever-present current account deficit, coming in at 4.0% of GDP as of Q3’2024.The persistent current account deficit highlights the country's dependence on imports. The chart below highlights the trend in the current account deficit as a percentage of GDP for the last 10 years:

Source: Kenya National Bureau of Statistics (KNBS), 2024* data as of Q3’2024

- The low interest rates as evidenced by the expansionary monetary policy stance adopted by the MPC. The Monetary Policy Committee reduced the Central Bank Rate (CBR) by 50.0 bps to 10.75% in February 2025, from 11.25%, and a cumulative 225.0 bps cut from the high of 13.00% in July 2024, signalling easing of policy stance to stir economic activity, noting that its previous measures had contributed to a stronger Shilling and reduced inflationary pressures. Lower interest rates tend to reduce capital inflows as foreign investors demand for local assets reduces, which might put pressure on the Shilling due to limited supply of foreign currency,

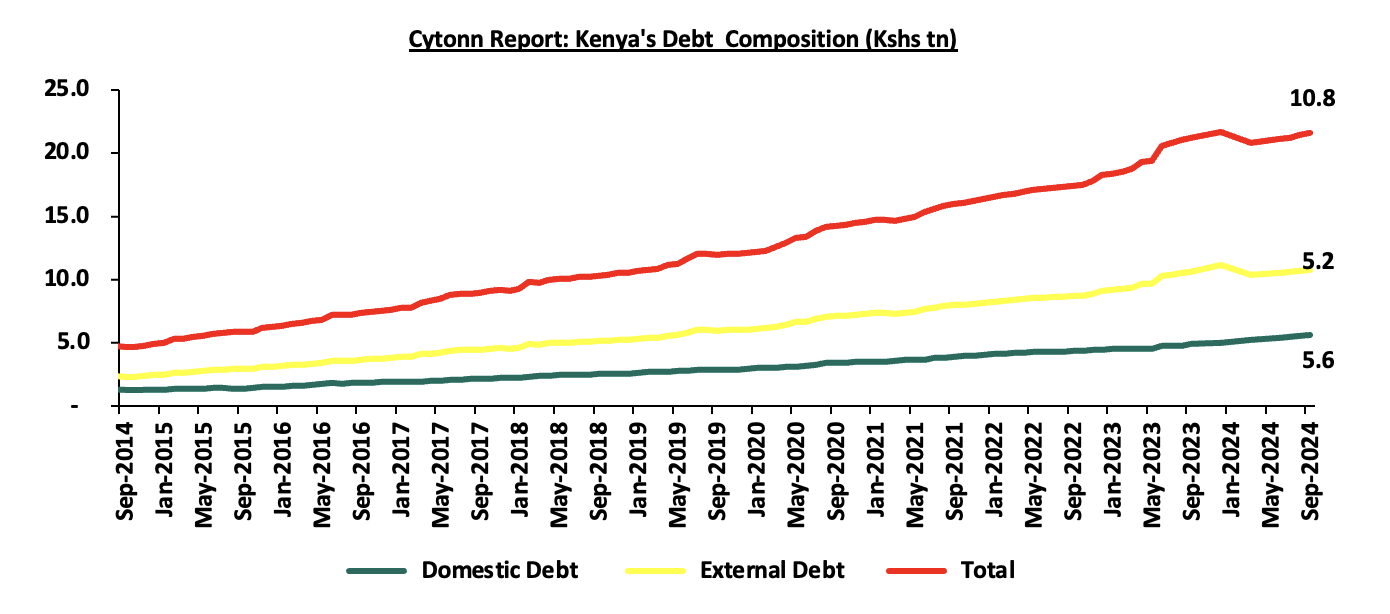

- The high debt levels in the country with the Kenya’s public debt having grown at a 10-year CAGR of 16.2% to Kshs 10.8 tn in September 2024, from Kshs 2.3 tn in September 2014, with external debt accounting for 49.3% of the total debt. This continues to put pressure on our foreign reserves due to the burden of high debt servicing costs and hence continues to weigh down on the Kenyan shilling. The chart below highlights the trend in the country’s debt composition:

Source: CBK

Section II: Evolution of the Interest Rate Environment in Kenya

Interest rates in Kenya are primarily influenced by the Central Bank of Kenya (CBK) through the Central Bank Rate (CBR), which guides the cost of borrowing and liquidity in the economy. The Monetary Policy Committee (MPC) adjusts the CBR based on inflation, exchange rates, and economic growth trends. Commercial banks use this benchmark to set lending and deposit rates, affecting credit availability and overall economic activity.

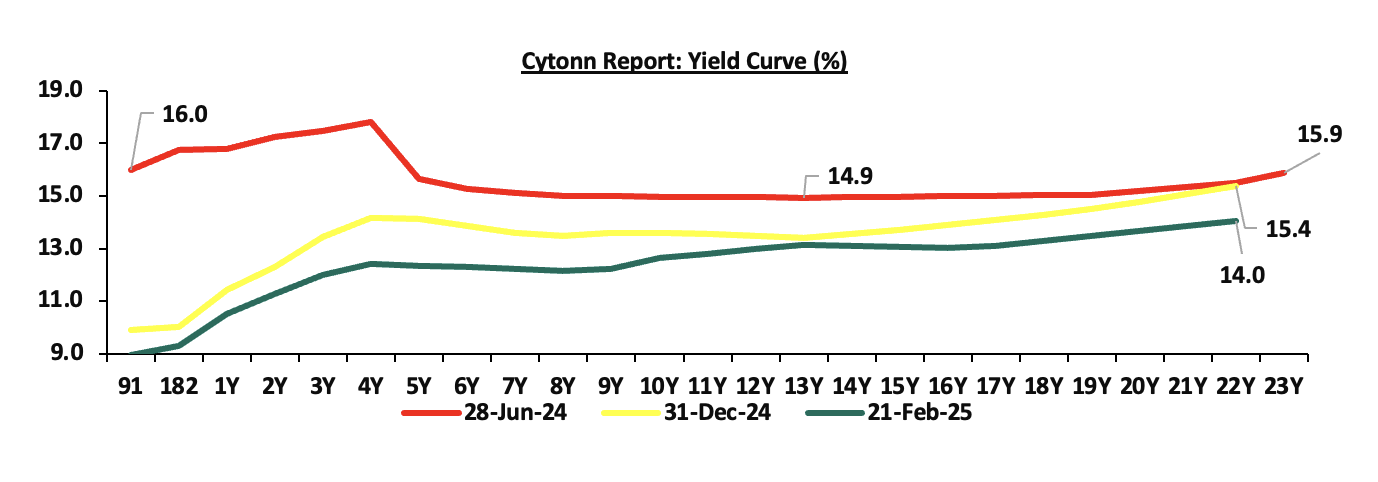

In FY’2024, interest rates faced mixed performance but generally ended the year on a downward trajectory with rates on the 91-day paper falling by 608.8 basis points cumulatively, to close the year at 9.9%, down from the rate of 16.0% recorded at the beginning of the year. However, interest rates recorded highs of 16.0%, 16.9%, and 16.9% for the 91-day, 182-day and 364-day papers respectively in July 2024 before the downward trend. The significant decrease in interest rates is attributed to investors perceiving lower risks due to reduced credit risk on the country, eased inflation, currency appreciation, and improved liquidity positions. During the first half of 2024, the yields on government securities were on an upward trajectory primarily due to the government’s amplified borrowing needs and investors’ pursuit of higher returns to mitigate the impact of the inflation rates observed in the first half of the year. The second half of the year saw a decline in yields as liquidity positions improved and investors demand for the securities improved. Notably, the government’s ability to meet coupon payments and successfully redeem the 10-year Eurobond maturing in June 2024 provided much-needed confidence in Kenya’s fiscal management. The yield curve has since evolved from a humped curve in June 2024, with short- to medium-term yields significantly higher than long-term yields, indicating heightened risk perception and demand for shorter-term securities, to a more normalized yield curve by December 2024, with long term bonds having highest yields. The graph below shows the yield curve over the period:

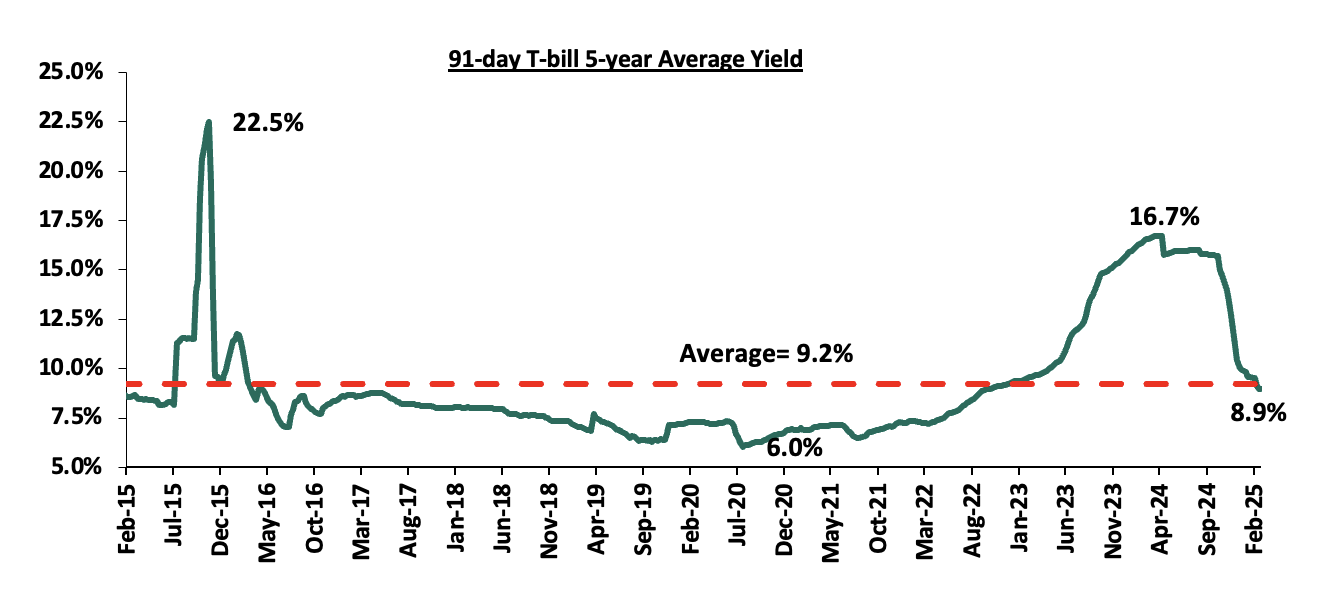

Over the last 10-year yields on government papers have remained steady for the most part, with the yields on the 91-day paper averaging 9.2%. However, Kenya’s interest rates witnessed high volatility in the years 2015 and 2016 and 2024 with the 91-day paper hitting a record high of 22.5% in October 2015 attributed to the tight monetary policy stance adopted by the Central Bank of Kenya, with the Monetary Policy Committee (MPC) raising the CBR to 10.0% in June 2015 from 8.5% in order to anchor inflationary expectations and curtail demand pressures in the economy, and, 16.0% in July 2024, attributable to the tight monetary policy with CBR at 13.0%. However, following an ease in inflationary pressures and a stronger Shilling, the CBK has since adopted an expansionary monetary policy stance by cutting the Central Bank Rate (CBR) and Cash Reserve Ratio (CRR) in a bid to support the economy through reduced cost of borrowing and improved liquidity. The chart below highlights the trend in the 91-day T-bill weighted average yield for the last 10 years:

The yields on the government papers continue to decline in 2025, with the yields on the 91-day paper recording a YTD decline of 87.8 bps to 8.9% as of 20th February 2025, from the 9.8% recorded at the start of the year. The yields on the 364-day and 182-day papers have declined by 84.5 bps and 71.4 bps respectively on a YTD basis to 10.5% and 9.3% as of 20th February 2025, from the 11.4% and 10.0% respectively recorded at the start of the year. The chart below shows the yield performance of the 91-day, 182-day and 364-day papers from February 2024 to February 2025:

The Kenyan macroeconomic environment has shown slight improvement mainly as a result of the contained inflationary pressures and appreciation of the Kenyan Shilling that have supported business production levels. Business conditions in the Kenyan private sector recorded an improvement during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for 2024 averaging at 49.6, 1.5% points higher than the average of 48.1 recorded during a similar period in 2023, and currently at 50.5 as of January 2025, above the expansionary zone of 50.0. Additionally, we expect the reduced borrowing costs to increase lending to the private sector, hence increasing activity and growth in the economy. Despite this, cost of living still remains high in the country partly on the back of increased taxation, impeding on revenue collection and as such, we expect revenue collection to slightly lag behind the revised target. The revised budget expenditure stands at Kshs 4,851.1 bn against revenue collection projection of Kshs 3,115.5 bn for the FY’2024/25.

Despite the ongoing decrease in interest rates, there remains a concern on the sustainability of the lower yields, given the high government debt maturities, which necessitates the government to borrow. Our view is that the government should take the following measures to alleviate the possible strain on the interest rate:

- Shift financing strategies to focus on concessional financing, while limiting the use of commercial borrowing. This approach will help reduce pressure, improving the shilling's appreciation, as concessional funds offer lower interest rates and extended repayment periods,

- Continue to prioritize domestic borrowing in the short to medium term due to the cost advantage of domestic debt over foreign currency-denominated debt. Given the higher interest rates and currency risks linked to external borrowing, domestic financing offers a more economical alternative for the government. The domestic debt to external debt mix stood at 51.9% to 48.1% as of September 2024 a shift from 46.5% to 53.5% in September 2023.

- The government should implement measures to curb corruption, enhance transparency, and strengthen governance structures. A corruption-free environment attracts foreign direct investment, boosts economic efficiency, and reinforces confidence in a stable interest rate environment

- Continue implementing measures to reduce the debt service-to-revenue ratio, which stood at 57.1% as of January 2025, 27.1% points higher than the recommended threshold of 30.0%, and 15.2% points lower than average FY2023/24’s debt service ratio of 72.3%. This decrease is mainly due to efforts to enhance revenue collection, such as broadening the tax base, curbing tax evasion, and suspending tax relief payments, though the government has yet to fully benefit from these strategies,

- Implement measures to attract Foreign Direct Investment (FDI) and strengthen the country’s economic position. A steady inflow of foreign capital boosts foreign exchange reserves, reducing reliance on domestic borrowing and easing pressure on interest rates

- Diversify project funding by eliminating barriers to Public-Private Partnerships (PPPs) and joint ventures. This approach encourages greater private sector participation in financing development projects, particularly in infrastructure, reducing the reliance on extensive government borrowing,

- Control government spending by focusing on core functions and eliminating corruption and wasteful expenditures at both county and central government levels, and,

- Ensure the continuity of macroeconomic stability by controlling inflation and maintaining a stable exchange rate through Central Bank policies that shape the interest rate environment. Prudent monetary policies and effective liquidity management enhance stability and predictability, fostering investor and lender confidence while positively influencing interest rates.

Section III: Currency Outlook

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

• The improvement of the country’s balance of payments is likely to put less pressure on the shilling. Notably, Kenya’s balance of payment (BoP) position improved significantly by 113.5% in Q3’2024, with a surplus of Kshs 17.8 bn, from a deficit of Kshs 131.5 bn in Q3’2023, and a 78.9% decline from the Kshs 84.1 bn surplus recorded in Q2’2024.This was caused by a significant improvement in the financial account due to the , attributable to increased inflows of debt securities and other investments, in spite of the reduced loan disbursements to general government, a trend likely to continue in 2025. As such, we expect increased foreign direct investment leading to increased inflows and hence supporting the shilling. • We expect the gradual improvement in the export sector as Kenya’s trading partners continue to reopen, seeing the current account deficit coming at 4.0% of GDP in Q3’2024. • However, we expect the country’s reliance on imports coupled with high global commodity prices to continue weighing down on the country’s Balance of payments. However, we expect the stable Shilling to keep the import bill in check. |

Neutral |

|

Government Debt |

• We expect the government to borrow aggressively from the domestic market as it aims to plug in the fiscal deficit, which is projected to come in at Kshs 864.1 bn in the FY’2024/25 Supplementary Budget Estimates II, 4.9% of the GDP. The government intends to plug this fiscal deficit through Kshs 280.1 bn in external financing and Kshs 584.0 bn in domestic borrowing. Borrowing domestically is less costly for the government than acquiring debt denominated in foreign currencies, which not only carry higher interest rates but also come with the added risk of currency fluctuations. • Similarly, we expect the level of foreign borrowing will also increase in 2025 due to the following reasons; (i) Disbursement of concessional loans from the IMF under the Extended Credit Facility arrangement (EFF/ECF) and the Resilience Sustainability Facility (RSF) programme, coupled with funding from the World Bank under the Development Policy Operation (DPO) arrangement, and (ii) Disbursement of commercial loans from commercial lenders such as the Trade & Development Bank (TDB) and the African Development Bank, • The high debt levels will continue to expose the shilling to exchange rate shocks and will, in turn, emanate pressure on the shilling to weaken during the repayment period. |

Negative |

|

Forex Reserves |

• The forex reserves have significantly increased by 28.2% to USD 9.3 bn (equivalent to 4.7 months of import cover) as of 21st February 2025, from USD 7.2 bn (equivalent to 3.8 months of import cover) recorded in a similar period in 2024. The increase is largely attributed to the increased foreign capital inflows. Additionally, we expect the reserves to be supported by improving diaspora remittance inflows which came in at USD 4,960.2 mn in the 12 months to January 2025 which is 16.6% higher than the USD 4,252.9 mn recorded over the same period in 2024 and the increasing exports especially in the agricultural sector with government having subsidized key inputs such as fertilizers. This will in turn support the stability of the Kenyan Shilling • However, we expect the elevated debt levels witnessed in the country to put forex reserves under pressure as most of it will be used to finance the debt maturities,

|

Positive |

|

Monetary Policy |

• Inflation rates have remained within the government’s target of 2.5% - 7.5% for nineteen consecutive months coupled with the stable fuel prices in the country as a result of the previous measures by the MPC to curb inflationary pressures. Notably, in its latest sitting, the MPC lowered the CBR by 50.0 basis points a move which it termed as aiming to boost private sector growth and support economic activity and growth. The impact of this is expected to support economic activity, while still ensuring exchange rate stability. • Consequently, we expect to see continuous downward pressure on the interest rates as the ripple effects of the decreased CBR continue to reflect in economy in the short to medium term. |

Neutral |

From the above currency drivers, 1 is negative (Government Debt), 2 are neutral (Balance of payment and Monetary Policy), while 1 is positive (Forex Reserves) indicating a more stable outlook for the currency.

Section III: Factors Expected to Drive the Interest Rate Environment

- Monetary Policy

The monetary policy committee has continued to play a crucial role in determining the interest rates levels in the country. In 2024, notable changes in interest rates were noted in July when short-term government securities rates peaked at 16.0%, 16.9%, and 16.9% for 91-day, 182-day and 364-day papers respectively. The yields on the short-term papers then began to decline, gaining momentum following the Central Bank's decision to reduce the base lending rate to 11.25% by December 2024, a cumulative 175 .0 bps from the existed 13.00% in July 2024, which saw the rates decline to close 2024 at 9.9%, 10.0%, and 11.4% for 91-day, 182-day and 364-day papers respectively. In its December meeting, the MPC noted that its previous measures had contained inflation which stood at a low of 2.7% as of October 2024, nearing the lower end of the target range of 2.5%-7.5%. In its latest meeting held in February 2025, the MPC cut the CBR further by 50.0 bps to 10.75%. Short-term paper yields declined after the CBK cut the base lending rate to 11.25% by December 2024 175 bps drop from 13.00% in July, closing the year at 9.9%, 10.0% and 11.4% for the 91-day, 182-day and 364-day papers respectively. The MPC attributed the cut in December 2024 to contained inflation, which fell to 2.7% in October 2024, nearing the 2.5%-7.5% target range. In February 2025, the CBR was cut further by 50 bps to 10.75%. The policy rate influences the cost of borrowing for banks and consequently, affects the rates at which they lend to businesses and individuals. This, in turn, creates a ripple effect on the overall interest rate environment, including the yields on government securities. Since then, the rates for short-term government papers have declined, reaching 8.9%, 9.3%, and 10.5% for 91-day, 182-day, and 364-day papers, respectively as of 20th February 2025.

The Central Bank is expected to continue with the expansionary monetary policy stance in the medium term with the intention to revive private sector growth and boost economic activity and has initiated on-site inspections of commercial banks to ensure they reduce lending rates in line with recent monetary policy changes. As such, we expect to see continued downward pressure on the interest rates attributable to investors perceiving lower risks due to eased inflation, currency appreciation, and improved liquidity positions. The following is a graph highlighting the Central Bank Rate for the last 5 years;

Source: CBK

- Fiscal policies

The government continues to put in place measures to broaden the revenue base and rationalize expenditures in order to reduce the fiscal deficits. The FY’2024/25 budget primarily aims to achieve growth-friendly fiscal consolidation by safeguarding the country’s debt sustainability through targeted expenditure rationalization and enhanced revenue mobilization. Notably, the government projects to narrow the fiscal deficit to 4.9% of GDP in FY’2024/25, from the 5.7% of GDP in FY’2023/24. However, the upward revision of taxes comes at a time when the cost of living is high, weighing down on the projected revenue performance. As such, we expect this will significantly affect revenue collection necessitating borrowing to plug in the budget deficit. Below is a chart showing the revenue collections and domestic borrowings over the last 10 financial years:

Source: National Treasury, KRA, * Domestic Debt Figures as of September 2024, *Revenue collection as of December 2024

- Liquidity

The MPC lowered the Cash Reserve Ratio (CRR) to 3.25% from 4.25% in their February 2025 sitting and this marked the first time since March 2020 when the MPC lowered the Cash Reserve Ratio (CRR) to 4.25% from 5.25% aiming to support the economic recovery from the ripple effects of Coronavirus pandemic. The latest cut in February 2025 aimed to support the lowering of lending rates, complement the reduction in the CBR, and address banks’ reluctance to lower their lending rates in line with CBR cuts. By reducing the CRR from 4.25% to 3.25%, the MPC freed up liquidity that banks had previously been required to hold with the Central Bank. This increased the money supply in the interbank market and commercial lending. Liquidity in the money market tightened in 2024, as evidenced by the interbank rates recording an average of 13.0% in 2024, compared to an average of 9.8% in 2023, with average interbank volumes however increasing by 19.1% to Kshs 26.7 bn in 2024, from Kshs 21.6 bn in 2023. In an ideal situation, ample liquidity in the money market, the lowering of commercial banks’ lending rates, and deposit rates would lead to increased money supply in the economy and an increase in consumers’ purchasing power. The low Cash Reserve Ratio has played a big role in maintaining favourable liquidity in the money market as well increases the supply of money by commercial banks. We expect liquidity to improve in 2025 driven by increased access to credit as banks gradually increase their lending to the private sector and the continued adoption of risk-based lending by banks. However, due to uncertainties in the economy, there still exists a high credit risk which hampers lending to businesses and individuals.

Outlook:

|

Driver |

Outlook |

Effect on Interest Rates |

|

Fiscal Policies |

• The government is expected to continue borrowing in order to offset the budget deficit and finance debt maturities. The total T-bonds and T-bill maturities so far stand at Kshs 212.7 bn and Kshs 438.8 bn, respectively for the remaining FY’2024/25 which is likely to put pressure on rates |

Negative |

|

Monetary Policy |

• We expect the MPC to continue with the easing of the monetary policy in the short term in a bid to foster private sector credit growth and support the economy, given that inflation remains within the government’s target and the Shilling has stabilized. This is evidenced by the recent actions taken by the MPC where it reduced the CBR by 50.0 basis points to 10.75% from 11.25%. • As such, the yields on government securities are likely to adjust further downwards as investors attach a lower premium to meet their required real rate of return, |

Positive |

|

Liquidity |

• We expect liquidity to continue being supported by the Low Cash Reserve Ratio (CRR) currently at 3.25% from 4.25% previously. • Additionally, we expect liquidity to improve in 2025 driven by increased access to credit as banks gradually increase their lending to the private sector and the continued adoption of risk-based lending by banks. • The huge maturities from government securities are expected to increase liquidity |

Positive |

From the above indicators, 1 of the drivers is negative (fiscal policies), and 2 are positive (Monetary policies and liquidity). We therefore believe that the interest rate environment remains optimistic and will likely adjust further downwards.

Section IV: Conclusion and Our View Going Forward

Based on the factors discussed above and factoring in the uncertainties in the Kenyan macroeconomic environment;

- We expect the Kenya Shilling to trade within the range of between Kshs 134.4 and Kshs 140.5 against the USD by the end of 2025 based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively, with a bias of a 4.6% depreciation mainly driven by:

- The ever-present current account deficit with Kenya being a net importer, which will increase US Dollar demand in the market,

- The low interest rates as evidenced by the expansionary monetary policy stance adopted by the MPC. The lower interest rates will lead to reduced capital inflows as foreign investor demand for local assets reduces, and,

- The persistent US Dollar demand by importers, mainly in the oil and energy sector as well as manufacturers.

- We expect a stability on the yield curve with our sentiments being on the back of the improved liquidity in the money markets, allowing for cheaper borrowing for budgetary support, funding of infrastructure projects, and payment of domestic maturities. Further, we expect the yield curve to normalize in the short to medium- term as the government turns to increased external borrowing alleviating pressure on the domestic market.

Concerns about the future performance of the Kenyan shilling have eased, driven by reduced pressure on the currency and improved foreign exchange reserves. However, the high national debt will continue to exert pressure on the shilling. As we anticipate continued currency stability, economic improvement is expected, reflected in a declining import bill. Despite the implementation of an eased monetary policy, marked by the MPC's reduction of the Central Bank rate to 10.75% in February 2025 from 11.25%, we still expect inflationary pressures to be contained in the short-term, remaining within the CBK’s target range of 2.5%-7.5%. The current stability of the Kenyan shilling is likely to be sustained in the immediate future, contingent on the government’s ability to effect proactive measures that further sustain the strong Shilling. These measures encompass strategic interventions and policies aimed at maintaining the stability of the currency and fostering economic resilience. They include:

- Formulate policies to encourage Foreign Direct Investments (FDIs): The government should prioritize creating an attractive investment environment for foreign investments by improving transparency in all required regulations as well as reducing hurdles in the process. This would include targeting sectors that enjoy global interest like the Renewable Energy sector and Sustainable Energy Development Goals (SEDG), and could include incentives for the same. This would majorly increase the foreign exchange reserves thus reducing the pressure on the foreign currency in the Kenyan markets,

- Promotion of Tourism through Implementing robust marketing campaigns to attract international tourists and enhancing the tourism infrastructure which will help increase the inflow of dollars and hence boost our Foreign Exchange Reserves

- Dramatically cut Spending: The government should contain expenditure by limiting expenditure to the core activities of the government as well as reducing wasteful spending at both the County and Central government levels

- Reduce corruption: The government should adopt measures to reduce corruption, improve transparency, and strengthen governance structures. A corruption-free environment attracts foreign direct investment, enhance economic efficiency, and instils confidence in the stability of the Kenyan Shilling.

- Stimulate the capital markets to attract foreign investors: The government should focus on improving the capital markets by implementing policies that encourage foreign investment, streamlining regulatory frameworks, and introducing investor-friendly initiatives. A vibrant capital market attracts foreign capital as well as enhances liquidity and diversifies investment options, contributing positively to currency stability.

- Maintaining a sustainable debt level: The government should find a harmonious equilibrium between engaging in foreign borrowing to boost foreign reserves and preserving a favourable credit standing with creditors. This delicate balance is crucial for maintaining the country's attractiveness to investors, facilitating capital inflows and financial stability.

- Reduction of commercial loans: There is need for the government to reduce the share of commercial loans in order to reduce debt servicing costs. This is mainly because commercial loans attract higher interest rates as compared to concessional borrowings.

- Building an export-driven economy: The government can do this by formulating and implementing robust export-oriented policies and manufacturing to increase exports aimed at reducing the current account while reducing overreliance on imports to preserve the country’s foreign exchange reserves,

- Alternative projects financing strategies: The government should diversify the sourcing of funding for infrastructure projects in the country to further shift to alternative financing strategies such as Public-Private Partnerships (PPPs), joint ventures and stimulation of the capital markets. This will attract more private sector involvement in funding development projects such as infrastructure instead of borrowing, and,

- Improve the Ease of Doing Business: Improving the ease of doing business will make it easier for entrepreneurs to form business ventures, which will eventually grow, employ people and contribute to tax revenues, and,

- Encourage export and revenue diversification: The government should shift from complete over-reliance on traditional agricultural sector exports like tea, horticulture and coffee, through diversification in promoting value-added processing and manufacturing to increase export revenue. Notably, the manufacturing sector contribution to GDP remains low, coming in at only 8.1% in Q4’2023, hence the government should put in policies to grow the sector like incentives which would in turn increase exports as well as preserving the foreign exchange reserves, aiding in stabilizing the exchange rate.