Kenya Retail Report 2023, & Cytonn Weekly #30/2023

By Research Team, Jul 30, 2023

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed for the first time in four weeks, with the overall subscription rate coming in at 38.1%, down from an oversubscription rate of 164.5% recorded the previous week. Investors preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.1 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 176.8%, albeit lower than the 711.6% recorded the previous week. The subscription rate for the 364-day and 182-day papers decreased to 7.1% and 13.6%, respectively, from 23.8% and 86.4% recorded the previous week. The government accepted a total of Kshs 8.9 bn worth of bids out of Kshs 9.1 bn of bids received, translating to an acceptance rate of 97.2%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 2.0 bps, 7.0 bps, and 11.9 bps to 12.7%, 12.4%, and 12.4%, respectively;

We are projecting the y/y inflation rate for July 2023 to come in at the range of 7.8%-8.2% with a bias towards an increase from the 7.9% recorded in June 2023, mainly on the back of increased fuel and food prices;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20, and NSE 25 declining by 4.8%, 2.2%, and 4.4%, respectively, taking the YTD performance to losses of 17.3%, 5.8%, and 12.7% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Equity Group, Safaricom, BAT, and EABL of 8.7%, 7.8%, 4.9% and 4.5%, respectively. The losses were, however, mitigated by gains recorded by stocks such as Standard Chartered Bank of 1.4%;

Real Estate

During the week, Hass Consult, a consulting and Real Estate development firm based in Kenya, published its House Price Index Q2’2023 Report, highlighting that the average q/q selling prices for all properties registered a 0.5% decline in Q2’2023, compared to a 3.3% increase in Q2’2022, while on a y/y basis, the average selling prices for properties depreciated by 1.8%, compared to the 10.5% increase that was recorded in Q2’2022. Additionally, Hass Consult released its Land Price Index Q2’2023 Report, highlighting that the average q/q selling prices for land in the Nairobi suburbs slightly declined by 0.1% compared to a 0.2% gain realized in Q2’2022. Consequently, y/y basis, the performance represented a 1.2% increase, compared to the 1.0% growth recorded in Q2’2022;

In the retail sector, chain store Naivas Supermarket opened two new outlets located at Kisii Retail Centre mall along Hospital Road, Kisii, and at The Festival mall along the Mombasa-Malindi Highway, bringing the retailer’s number of operating outlets countrywide to 97. Additionally, chain store Quickmart Supermarket opened a new outlet located in Eastlands next to Total Petrol Station, along Kangundo Road, Nairobi, bringing the retailer’s number of operating outlets countrywide to 59;

In the industrial sector, Tatu City Limited, Chandaria Properties, M&T Construction and Steel Structures broke ground for the construction of ‘The Link’, a warehousing and logistics park, located in Tatu City, Kiambu County;

In Regulated Real Estate Funds, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share in the Nairobi Securities Exchange, remaining relatively unchanged from what was recorded the previous week. On the Unquoted Securities Platform as at 28 July 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 21.6 per unit, a 19.5% and 8.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.6%, remaining relatively unchanged from what was recorded the previous week;

Focus of the Week

This week, we update our Kenya Retail Report 2022 with the Kenya Retail Report 2023 themed “Retail Expansion with Focus into Untapped Markets”, in which we discuss the progress and performance of the Kenyan retail sector. This will be based on research that was conducted on nine nodes within the Nairobi Metropolitan Area (NMA), in addition to other key urban cities in Kenya including Kisumu, Nakuru, Mombasa, Eldoret, and the Mount Kenya Region. Based on this, we shall identify the market performance in terms of rents, occupancy rates, and rental yields, while updating on the key factors in the market driving their performance. According to the report, the Kenyan retail sector displayed a stable overall performance, with the average rental yield coming in at 7.5% in 2023, a 0.7% points increase from 6.8% recorded in 2022. Notably, the average occupancy rate increased by 2.1% points, reaching 79.4% in 2023 from 77.3% in 2022, mainly driven by the rapid expansion of both local and foreign retailers;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 12.35% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.56% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

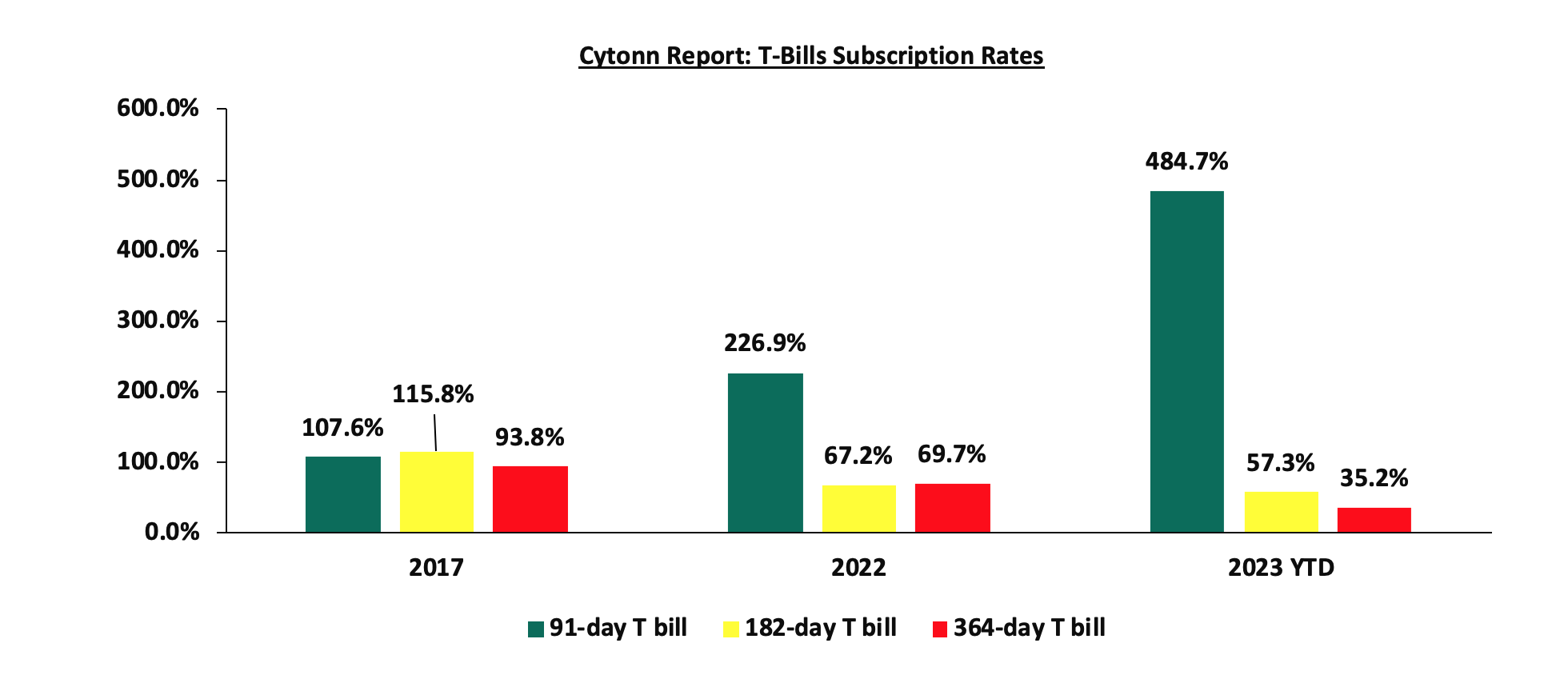

During the week, T-bills were undersubscribed for the first time in four weeks, with the overall subscription rate coming in at 38.1%, down from an oversubscription rate of 164.5% recorded the previous week. Investors preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.1 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 176.8%, albeit lower than the 711.6% recorded the previous week. The subscription rate for the 364-day and 182-day papers decreased to 7.1% and 13.6%, respectively, from 23.8% and 86.4% recorded the previous week. The government accepted a total of Kshs 8.9 bn worth of bids out of Kshs 9.1 bn of bids received, translating to an acceptance rate of 97.2%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day, and 91-day papers increasing by 2.0 bps, 7.0 bps, and 11.9 bps to 12.7%, 12.4%, and 12.4%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Money Market Performance:

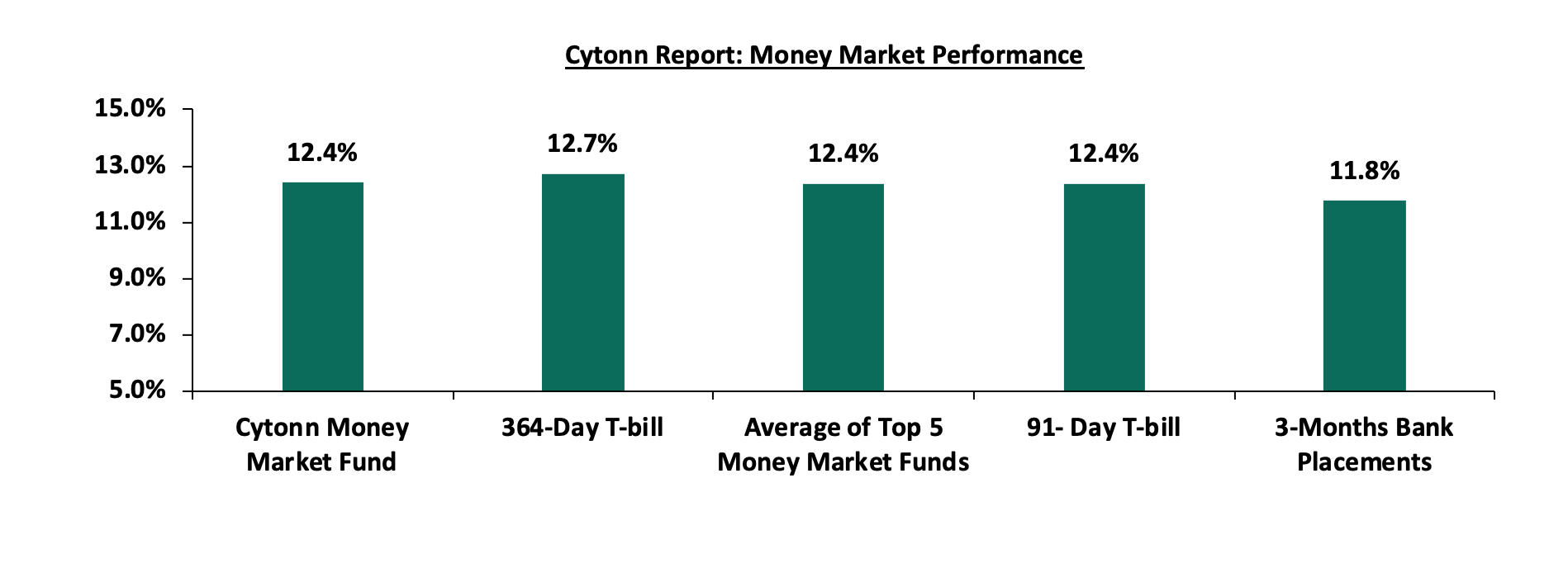

In the money markets, 3-month bank placements ended the week at 11.8% (based on what we have been offered by various banks), while the yields on the 364-day and 91-day paper increased by 2.0 bps and 11.9 bps to 12.7% and 12.4% respectively. The yield of Cytonn Money Market Fund increased by 28.0 bps to 12.4% from 12.1% recorded the previous week. Additionally, the average yields of Top 5 Money Market Funds increased by 39.6 bps to 12.4% from 12.0% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 28 July 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 28th July 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

12.5% |

|

2 |

Enwealth Money Market Fund |

12.4% |

|

3 |

Lofty-Corban Money Market Fund |

12.4% |

|

4 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

12.4% |

|

5 |

GenAfrica Money Market Fund |

12.1% |

|

6 |

Madison Money Market Fund |

11.8% |

|

7 |

Jubilee Money Market Fund |

11.7% |

|

8 |

Old Mutual Money Market Fund |

11.3% |

|

9 |

Kuza Money Market fund |

11.1% |

|

10 |

Apollo Money Market Fund |

11.1% |

|

11 |

ICEA Lion Money Market Fund |

11.0% |

|

12 |

Nabo Africa Money Market Fund |

10.8% |

|

13 |

AA Kenya Shillings Fund |

10.7% |

|

14 |

GenCap Hela Imara Money Market Fund |

10.7% |

|

15 |

Co-op Money Market Fund |

10.7% |

|

16 |

Sanlam Money Market Fund |

10.6% |

|

17 |

KCB Money Market Fund |

10.5% |

|

18 |

NCBA Money Market Fund |

10.4% |

|

19 |

Dry Associates Money Market Fund |

10.4% |

|

20 |

CIC Money Market Fund |

10.0% |

|

21 |

Absa Shilling Money Market Fund |

10.0% |

|

22 |

Orient Kasha Money Market Fund |

9.8% |

|

23 |

British-American Money Market Fund |

9.6% |

|

24 |

Mali Money Market Fund |

9.1% |

|

25 |

Equity Money Market Fund |

8.5% |

Source: Business Daily

Liquidity:

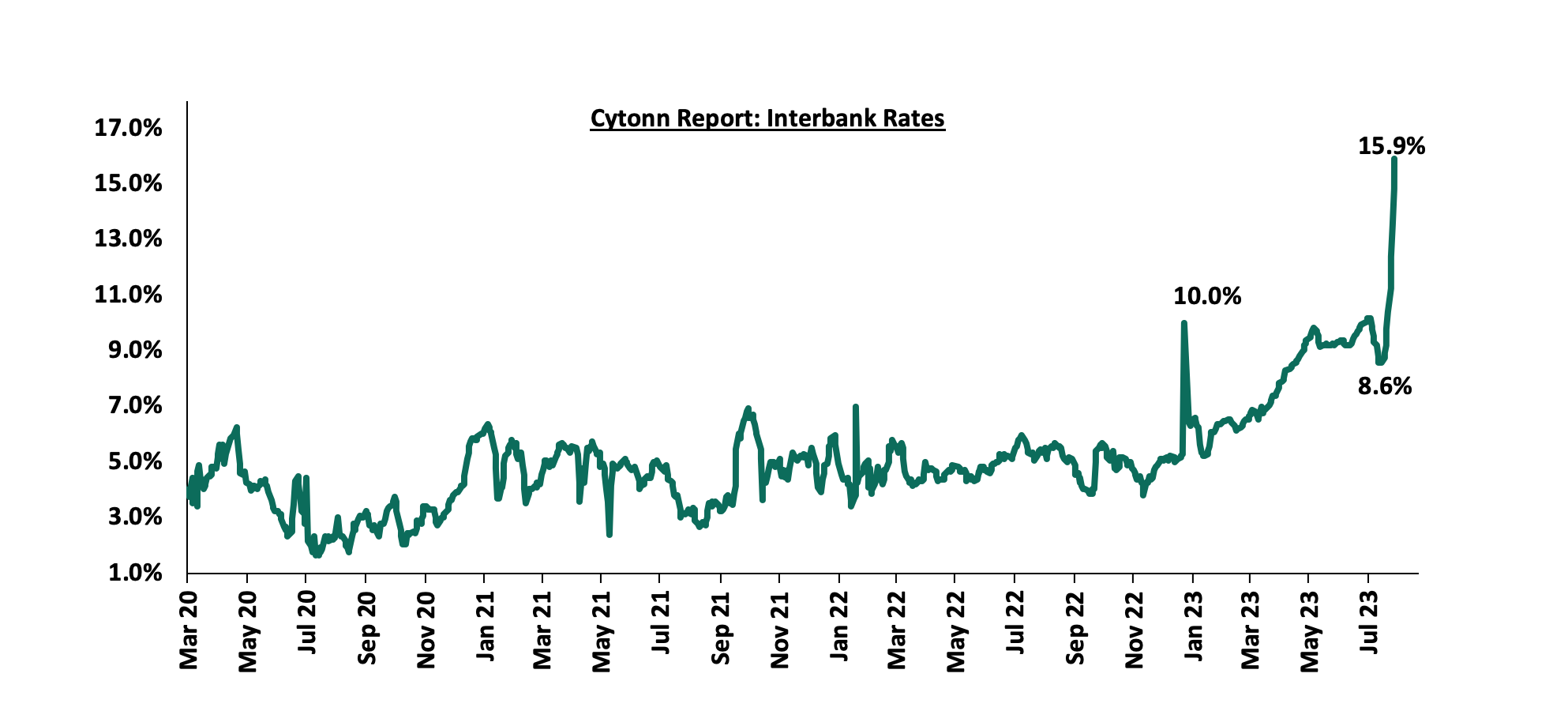

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 13.6% from 9.4% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased by 48.7% to Kshs 11.2 bn from Kshs 21.8 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Source: CBK

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yield on the 7-year Eurobond issued in 2019 decreasing the most by 0.6% points to 11.4% from 12.0% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 27th July 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.9 |

4.6 |

24.7 |

3.8 |

8.9 |

10.5 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

03-Jul-23 |

12.5% |

11.0% |

11.0% |

11.2% |

11.0% |

10.3% |

|

20-Jul-23 |

12.8% |

11.4% |

11.3% |

12.0% |

11.3% |

10.8% |

|

21-Jul-23 |

12.7% |

11.4% |

11.3% |

12.0% |

11.3% |

10.8% |

|

24-Jul-23 |

12.5% |

11.3% |

11.2% |

11.9% |

11.2% |

10.7% |

|

25-Jul-23 |

12.9% |

11.2% |

11.2% |

11.7% |

11.1% |

10.6% |

|

26-Jul-23 |

12.9% |

11.1% |

11.1% |

11.6% |

11.0% |

10.6% |

|

27-Jul-23 |

12.6% |

10.9% |

11.0% |

11.4% |

10.9% |

10.5% |

|

Weekly Change |

(0.2%) |

(0.5%) |

(0.3%) |

(0.6%) |

(0.4%) |

(0.3%) |

|

MTD Change |

0.1% |

(0.0%) |

(0.0%) |

0.2% |

(0.1%) |

0.2% |

|

YTD Change |

(0.3%) |

0.5% |

0.1% |

0.5% |

0.1% |

0.6% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

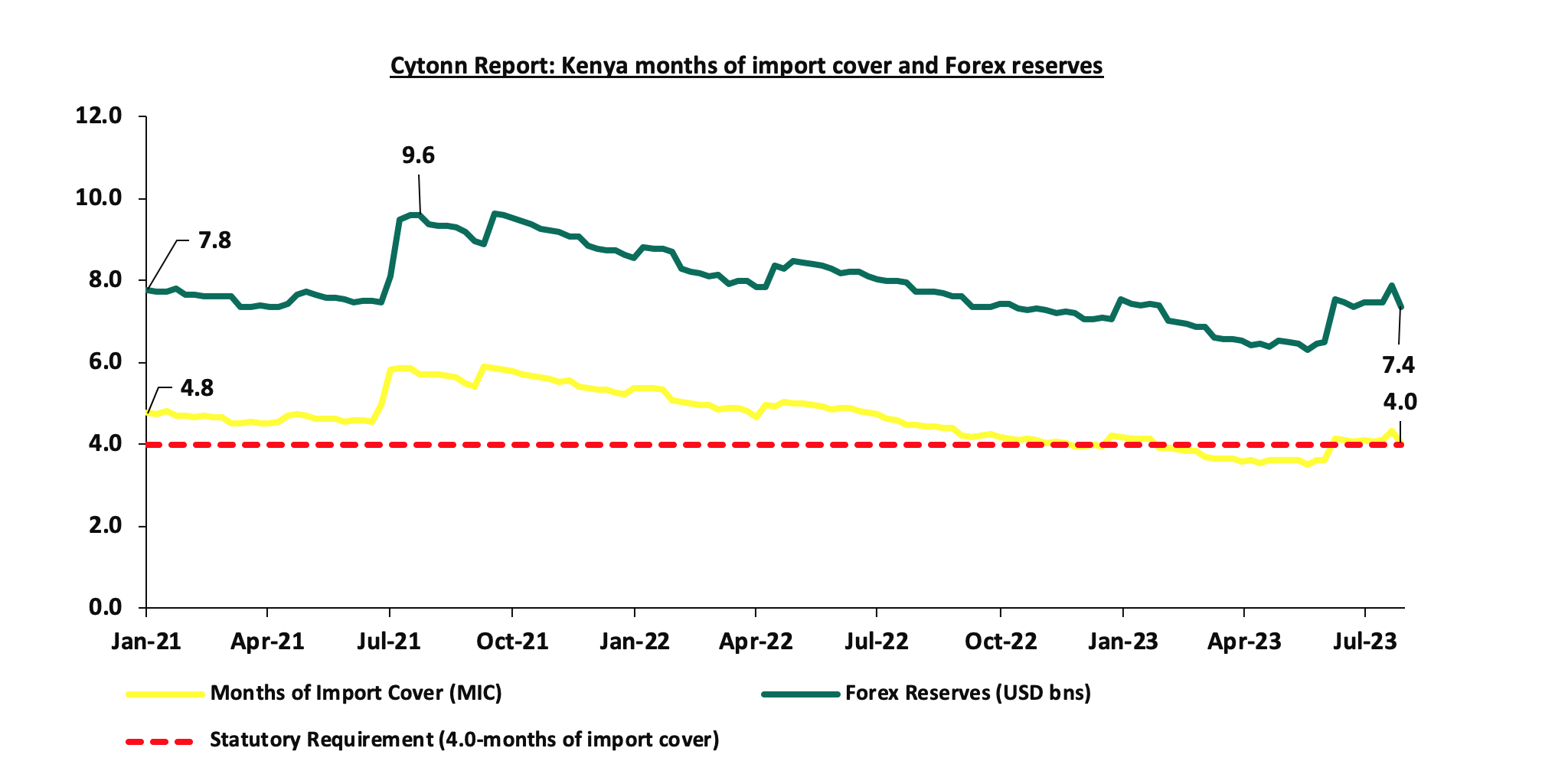

During the week, the Kenya Shilling remained under pressure, having depreciated by 0.4% against the US dollar to close the week at Kshs 142.3 from Kshs 141.8 recorded the previous week, partly attributable to the persistent high dollar demand from importers, especially in the oil and energy sectors. On a year-to-date basis, the shilling has depreciated by 15.3% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit, which came at 2.3% of GDP in Q1’2023 from 4.2% recorded in a similar period last year, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 66.8% of Kenya’s external debt is US Dollar denominated as of April 2023, and,

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 2,033.8 mn in 2023 as of June 2023, albeit 0.5% lower than the USD 2,044.6 mn recorded over the same period in 2022, and,

- The tourism inflow receipts which came in at Kshs 268.1 bn in 2022, a significant 82.9% increase from Kshs 146.5 bn inflow receipts recorded in 2021.

- Sufficient forex reserves currently at USD 7.4 bn (equivalent to 4.03-months of import cover), which is slightly above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya months of import cover over the years:

Weekly Highlights:

- July 2023 Inflation Projection

We are projecting the y/y inflation rate for July 2023 to come in at the range of 7.8%-8.2% with a bias towards an increase from the 7.9% recorded in June 2023. The key drivers include:

- Increased Fuel Prices – Following the effect of the doubling of VAT on fuel prices to 16.0% from 8.0% effective 1st July 2023, fuel prices increased by 7.4% on average to Kshs 195.5, Kshs 179.7, and Kshs 173.4 per litre for Super Petrol, Diesel, and Kerosene, respectively. However, despite the Energy and Petroleum Regulatory Authority (EPRA) reviewing the prices effective 15th July with prices for Super Petrol and Kerosene decreasing by 0.4% and 2.3% to Kshs 194.7 and Kshs 169.5 per litre respectively, and Diesel remaining unchanged at 179.7 per litre, the prices still remain elevated based on historical levels. As a result, given that fuel is a major input to most sectors, we expect the high prices to weigh on the inflation basket in the short term, and,

- Increasing food prices – This was evidenced by the 10.3% y/y increase in the prices of food and non-alcoholic beverages as of June 2023, partly attributable to the high costs of production. Notably, the high cost of production in the country is partly attributed to the sustained depreciation of the Kenya Shilling against hard currencies, which has inflated the import bill. As a result, manufacturers pass on the cost to consumers through hikes in commodity prices. Given that the index constitutes 32.9% of the inflation basket, we expect the prevailing high food prices to exert pressure on the inflation rate.

Going forward, we expect inflationary pressures in the country to remain above the CBK’s target range of 2.5% to 7.5% in the short to medium term, underpinned by the doubled VAT on petroleum products to 16.0% from 8.0% following the lifting of the suspension of the Finance Bill 2023. Additionally, the sustained depreciation of the Kenyan shilling against major currencies is also expected to underpin inflationary pressures in the country as manufacturers pass on the high cost of importation to consumers through hikes in consumer prices in order to maintain their margins. However, the Monetary Policy Committee's (MPC) decision to increase the Central Bank Rate (CBR) to 10.5% in June 2023 is expected to anchor inflation in the medium to long term.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 0.7% ahead its prorated net domestic borrowing target of Kshs 49.3 bn, having a net borrowing position of Kshs 49.6 bn of the domestic net borrowing target of Kshs 598.3 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on a downward trajectory, with NASI, NSE 20, and NSE 25 declining by 4.8%, 2.2%, and 4.4%, respectively, taking the YTD performance to losses of 17.3%, 5.8%, and 12.7% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Equity Group, Safaricom, BAT, and EABL of 8.7%, 7.8%, 4.9%, and 4.5%, respectively. The losses were, however, mitigated by gains recorded by stocks such as Standard Chartered Bank of 1.4%.

During the week, equities turnover increased significantly by 437.1% to USD 30.4 mn from USD 5.7 mn recorded the previous week, taking the YTD total turnover to USD 506.7 mn. Foreign investors turned net sellers for the first time in seven weeks with a net selling position of USD 23.4 mn, from a net buying position of USD 1.5 mn recorded the previous week, taking the YTD foreign net selling position to USD 277.3 mn.

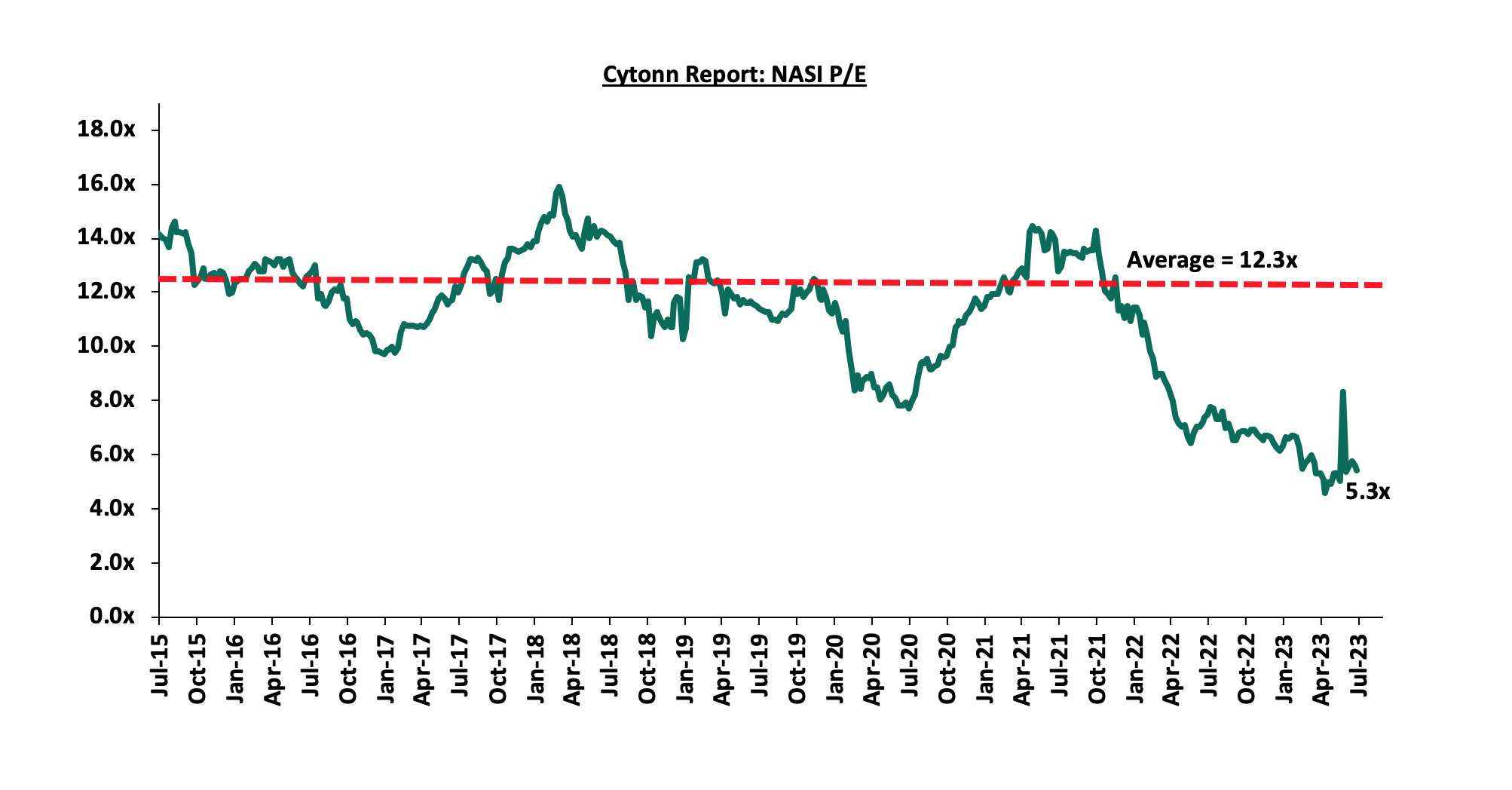

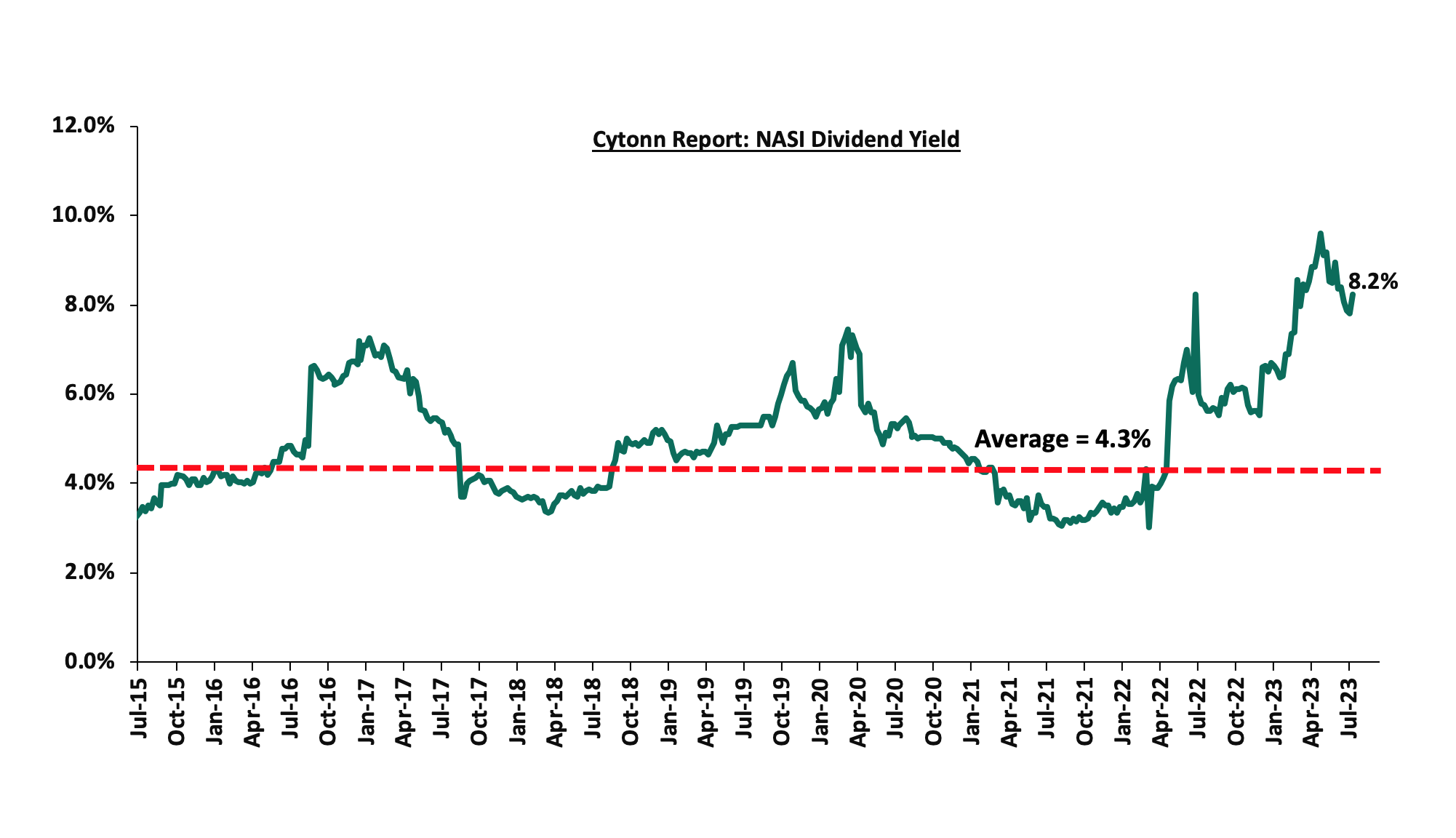

The market is currently trading at a price to earnings ratio (P/E) of 5.3x, 56.6% below the historical average of 12.3x. The dividend yield stands at 8.2%, 3.9% points above the historical average of 4.3%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 21/07/2023 |

Price as at 28/07/2023 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Liberty Holdings |

4.3 |

3.6 |

(15.0%) |

(27.8%) |

5.9 |

0.0% |

62.6% |

0.3x |

Buy |

|

KCB Group*** |

29.6 |

28.6 |

(3.4%) |

(25.6%) |

41.3 |

7.0% |

51.5% |

0.5x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

(0.6%) |

(3.7%) |

2.5 |

11.1% |

50.6% |

0.1x |

Buy |

|

Jubilee Holdings |

185.3 |

185.0 |

(0.1%) |

(6.9%) |

260.7 |

6.5% |

47.4% |

0.3x |

Buy |

|

Co-op Bank*** |

12.0 |

11.9 |

(0.8%) |

(2.1%) |

15.0 |

12.7% |

38.8% |

0.6x |

Buy |

|

Sanlam |

8.2 |

7.4 |

(9.5%) |

(22.5%) |

10.3 |

0.0% |

38.7% |

2.1x |

Buy |

|

NCBA*** |

38.6 |

38.4 |

(0.5%) |

(1.5%) |

48.9 |

11.1% |

38.5% |

0.8x |

Buy |

|

Equity Group*** |

44.5 |

40.6 |

(8.7%) |

(9.9%) |

51.2 |

9.9% |

35.9% |

0.9x |

Buy |

|

Diamond Trust Bank*** |

47.8 |

46.1 |

(3.5%) |

(7.5%) |

54.6 |

10.8% |

29.2% |

0.2x |

Buy |

|

ABSA Bank*** |

12.4 |

12.4 |

0.4% |

1.6% |

14.7 |

10.9% |

29.2% |

1.0x |

Buy |

|

Standard Chartered*** |

162.5 |

164.8 |

1.4% |

13.6% |

183.9 |

13.4% |

25.0% |

1.1x |

Buy |

|

HF Group |

4.8 |

4.7 |

(2.5%) |

47.6% |

5.8 |

0.0% |

24.9% |

0.2x |

Buy |

|

Britam |

5.2 |

5.0 |

(3.7%) |

(4.0%) |

6.0 |

0.0% |

19.6% |

0.7x |

Accumulate |

|

CIC Group |

2.2 |

2.2 |

0.0% |

15.2% |

2.5 |

5.9% |

19.5% |

0.7x |

Accumulate |

|

Stanbic Holdings |

119.0 |

120.0 |

0.8% |

17.6% |

127.9 |

10.5% |

17.1% |

0.9x |

Accumulate |

|

I&M Group*** |

18.9 |

18.7 |

(1.1%) |

9.4% |

19.5 |

12.1% |

16.4% |

0.4x |

Accumulate |

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Industry Report

During the week, Hass Consult, a consulting and Real Estate development firm based in Kenya, published its House Price Index Q2’2023 Report. The report highlights the performance of the residential Real Estate sector in the Nairobi Metropolitan Area (NMA). The following are the main findings of the report:

- The average q/q selling prices for all properties registered a 0.5% decline in Q2’2023, compared to a 3.3% increase in Q2’2022. The performance was mainly subdued by corrections of 0.6% and 1.2% in detached and semi-detached house prices, respectively. However, the performance was supported by a 1.3% increase in the selling prices of apartments. On a y/y basis, the average selling prices for properties dropped by 1.8%, compared to the 10.5% increase that was recorded in Q2’2022. The decline in property prices is attributable to uncertainty in the market owing to prospects of higher taxation and a higher cost of financing, resulting in reduced consumer confidence stalling speculative demand for Real Estate,

- The overall asking rents of housing units in the NMA during Q2’2023 slightly increased by 0.1% q/q, compared to the 1.1% q/q growth recorded in Q2’2022, attributed to slower growth in the rental market, and landlords offering rent incentives to attract customers. On a y/y basis, the average asking rent declined by 2.1%, compared to the 2.4% increase recorded in Q2’2022. The decline in performance was attributable to decreased rents in detached and semi-detached houses, registering y/y corrections of 3.2% and 5.4% in Q2’2023, as landlords made adjustments to support occupancy rates amid renters preferring more affordable apartments, whose average rents grew by 3.0% y/y,

- Apartments recorded the highest y/y increase in asking rents of 1.8% in Q2’2023, with detached and semi-detached units realizing price corrections of 0.3% and 0.9% respectively, with the declines attributed to the progressive expansion of the middle class preferring to rent apartments due to their affordability,

- In the Nairobi Suburbs detached and semi-detached houses, Lang’ata was the best performing node, having recorded a y/y sale price appreciation of 12.8% for its houses, fuelled by; i) its affordability compared to neighbouring affluent nodes such as Karen, ii) good and improved accessibility owing to the ample infrastructure network, including the Southern-Bypass, and expansion of Lang’ata road, and, iii) its close proximity to the Central Business District (CBD) and other business nodes in Nairobi. Conversely, house prices in Spring Valley recorded a significant y/y price decline of 8.3% primarily attributed to a decrease in demand for houses in the area for affordable choices in neighbourhoods such as Nyari Estate,

- In the Nairobi Suburbs apartments, Lang’ata remained to be the best performing region recording a y/y capital appreciation of 15.5% due to: i) its close proximity to the Nairobi CBD and prime neighbourhoods such as Karen, ii) convenient access to social amenities such as shopping centres including Galleria, the Hub, Waterfront, and recreational facilities such as the Nairobi National Park, and, iii) a well-established infrastructure network enhancing seamless accessibility through Lang'ata Road, Ngong Road, Mombasa Road, the Southern Bypass, and Wilson Airport for air travel. On the other hand, Upperhill realized the highest y/y price correction of 13.5% attributed to city residents opting for more serene neighbourhoods away from the noise pollution and traffic congestion prevalent in the area, and its transformation into a business district leading to a shift in demand from residential to commercial properties,

- In the satellite towns, houses in Ngong’ recorded the highest y/y price appreciation at 18.0% driven by increased demand resulting from; i) improved infrastructure development such as the Ngong’ Road thus enhancing accessibility, ii) growing middle income population in the area supporting demand, iii) proximity to commercial, social, and recreational amenities such as Milele Mall, Waterfront Karen, and The Hub, and iv) its close proximity to prime areas such as Karen, leading to spill over pricing effects. Conversely, houses in Limuru realized the highest y/y price correction of 11.2% attributed to reduced demand owing to the region’s location which is far from Nairobi CBD and other major urban business nodes, and main transportation hubs such as the Jomo Kenyatta International Airport (JKIA), Standard Gauge Railway (SGR), among others, and,

- In satellite towns’ apartments, Ngong’ recorded the highest y/y price appreciation of 6.8% attributed to increased demand for apartments in the area facilitated by; i) growing middle income population in the area supporting demand, ii) its close proximity to the Central Business District (CBD), and iii) its affordability in terms of selling and rental prices compared to neighbouring areas. On the other hand, Kitengela realized the highest y/y price correction of 12.4% attributed to stiff competition faced from neighbourhoods such as Athi River, Mlolongo, and Syokimau, which are strategically located along the Mombasa-Nairobi Highway enhancing accessibility and demand by buyers as well as their closer proximity to amenities such as Crystal Rivers and Signature malls, and the Nairobi CBD.

The findings of the report are in line with our Cytonn H1’2023 Markets Review, highlighting that the residential market in NMA recorded a q/q decline in performance with the average total returns to investors coming at 6.0% during H1’2023, registering a 0.1% points decrease from the 6.1% average total returns recorded in Q1’2023. The performance was supported by the ongoing infrastructural developments such as the Kenol-Marua Highway, which have significantly improved accessibility to areas along the development, leading to increased demand of residential units. On the other hand, the overall performance was weighed down by the continued increase in construction costs on the back of the high inflation, and low penetration rate of mortgage financing to buyers.

Hass Consult also released the Land Price Index Q2’2023 Report which highlights the performance of Real Estate land sector in the Nairobi Metropolitan Area (NMA). The following were the key take outs from the report:

- The average q/q selling prices for land in the Nairobi suburbs slightly declined by 0.1% compared to a 0.2% gain realized in Q2’2022. On a y/y basis, the performance represented a 1.2% increase, compared to the 1.0% growth recorded in Q2’2022. Consequently, q/q and y/y land prices in satellite towns of Nairobi increased by 1.2% and 5.1% respectively, compared to the 4.1% and 10.5% growth respectively, recorded in Q2’2022. The sustained improvement in performance continues to demonstrate the sector’s resilience, with demand growing on the back of emerging opportunities in retail, manufacturing, and logistics needed to serve the rapidly urbanizing towns as well as the Nairobi CBD,

- Spring Valley was the best performing node in the Nairobi suburbs with a y/y price appreciation of 17.3%. This was attributed to increase in demand for land in the region owing to; i) adequate infrastructure, ii) adequate commercial, social, and recreational amenities such as Sarit Centre, and Westgate Shopping Malls, and, iii) proximity to Nairobi CBD and other prime and rising urban nodes such as Westlands. On the other hand, land in Upperhill recorded the highest y/y price correction of 3.3%. This was due to continuous decline in demand for development land attributed a general shift in trend by developers to satellite towns due to scarcity of affordable land for development in the area, and,

- For satellite towns, Ngong was the best performing node with a y/y capital appreciation of 20.7%, followed by Syokimau which recorded a y/y capital appreciation of 17.0%. The improvement in performance in Ngong was driven by i) infrastructural development, ii) increased demand for land due to its affordability, and, iii) its close proximity to the Nairobi CBD and major urban nodes. On the other hand, land prices in Syokimau continued to appreciate on the back of the Standard Gauge Railway (SGR) infrastructural development. Conversely, Ongata Rongai was the worst performing node with a y/y price correction of 13.5% driven by reduced demand for land in the area, resulting from competition from developing neighbourhoods that are relatively closer to the Nairobi CBD.

The findings of the report are also in line with our Cytonn H1’2023 Markets Review, which highlighted that the overall average selling prices for land in the NMA appreciated by 4.5% to Kshs 128.5 mn per acre in H1’2023, from Kshs 128.4 mn per acre recorded in H1’2022. This was mainly attributed to; i) government’s continued focus on the development of infrastructure such as roads, railways, water and sewer lines which has improved and opened up areas for investment, ultimately increasing property prices, ii) limited supply of land especially in urban areas which has contributed to exorbitant prices, iii) increased construction activities particularly in the residential sector fueled by the government’s affordable housing agenda which has boosted demand for land, and, iv) positive demographics driving demand for land upwards, facilitated by high population and urbanization growth rates of 1.9% and 3.7%, above the global averages of 0.9% and 1.6% respectively in 2021.

- Retail Sector

- Naivas Supermarket Opens 96th and 97th Outlets

During the week, chain store Naivas Supermarket opened two new outlets located at Kisii Retail Centre mall along Hospital Road, Kisii, and at the newly opened Festival mall along the Mombasa-Malindi Highway, bringing the retailer’s number of operating outlets countrywide to 97. Naivas will take up anchor tenancy for the two newly constructed malls, signifying retailer investor confidence and appetite into untapped market gaps in other urban regions away from the national capital. The decision to open the two outlets was mainly driven by;

- the positive population demographics of both Kisii and Mombasa Counties which has been boosting the demand for commodities and services,

- the strategic locations of Kisii Retail Centre located near Daraja Mbili market, and The Festival mall being close to the Malindi International airport, contributing to high footfall to both malls,

- providing shopping accessibility for pedestrian shoppers within the busy Kisii business district and ample convenience for car-driving shoppers along the Mombasa-Malindi highway, and,

- Naivas’ aggressive expansion strategy aimed at stamping market dominance in emerging and economically growing regions within the country. Simultaneously, the strategy aims to intensify competition with rival retailers such as Quickmart and Carrefour in highly competitive areas, thus persistently solidifying their position in the retail industry.

Naivas has announced plans to open three more outlets in the next two months, with one of them disclosed to be located in Kakamega. The move comes in line with the retailer’s sustained goal to achieve 100 stores within the year, geared by its impressive performance, as it has grown to be one of Kenya’s most valuable companies currently at an estimated market capitalization of Kshs 53.5 bn. This has attracted investor interest particularly from foreign sources, such as with the Mauritian IBL Group announcing plans to acquire up to 51.0% stake in Naivas through Mambo Retail Limited, which is expected to further grow the capacity of Naivas to continue increasing its market share in the Kenyan retail market.

- Quickmart Supermarket Opens 59th Outlet

Additionally, during the week, retail chain store Quickmart Supermarket opened a new outlet located in Eastlands next to Total Petrol Station, along Kangundo Road, Nairobi, bringing the retailer’s number of operating outlets countrywide to 59. The move to open the store was informed by;

- the growing population of middle-income earners within Eastlands that is boosting the demand for commodities and services,

- the drive by Quickmart to provide a more accessible shopping experience to residents living along Kangundo Road, owing to shifting consumer preferences towards shopping convenience, away from the busy Nairobi CBD, and,

- Quickmart’s aggressive drive to expand and increase its market share in competition to other retailers such as Naivas and Carrefour, while taking up the gap left by troubled retailers such as Uchumi and Nakumatt that left the market.

The table below shows the number of stores currently operated by key local and international retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches opened in 2023 |

Closed branches |

Current branches |

|

Naivas |

International* |

46 |

61 |

69 |

79 |

91 |

6 |

0 |

97 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

4 |

0 |

59 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

1 |

0 |

20 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

0 |

59 |

5 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

12 |

181 |

222 |

|

*51% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

|||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||

Source: Cytonn Research

We expect to see a continued increase in activities in the Kenyan retail industry supported by; i) ongoing expansion efforts by retailers as they compete for a bigger share of the market coupled with increased capital investments by foreign entities in the Kenyan retail market, ii) the growing demand for goods, services, and retail space driven by favorable demographics in the country, and, iii) infrastructural developments enhancing accessibility in regions offering new opportunities for retail investment. However, the tough economic conditions on the back of inflation that are weighing down on consumer purchasing power, and the oversupply of retail spaces, currently estimated at 3.3 mn SQFT in the Nairobi Metropolitan Area (NMA) and 2.1 mn SQFT in the larger Kenyan retail sector (excluding NMA) are expected to continue subduing the optimal performance of the sector.

- Industrial Sector

During the week, Tatu City Limited, Chandaria Properties, M&T Construction and Steel Structures broke ground for the construction of ‘The Link’, a warehousing and logistics park, located in Tatu City, Kiambu County. The facility will offer quality warehouse spaces ranging across 800 SQM to 8,000 SQM, targeting Small and Medium Enterprise (SME) businesses in the Tatu City Special Economic Zone (SEZ). Upon completion, the warehousing and logistics park will stimulate the growth and development of the industrial sector through the provision of an ideal environment for businesses to thrive in various sectors, thereby contributing to Kenya’s overall economy. This will be supported by the various SEZ amenities including low corporate tax, zero-rated VAT and exemption from import duty and utilities such as 24-hour power and water supply, high-speed fibre internet, good road infrastructure and security services.

We expect Kenya’s industrial sector to continue realizing growth and development activities, driven by; i) increased demand of warehouses in the retail sector driven by the rising demand for space to store e-commerce goods meant for convenient delivery to consumer across the country, ii) the government's accelerated focus on spurring the production of agricultural and horticultural products, with aim to improve the volumes of Kenya-farmed produce exported to international markets, iii) Kenya's recognition as a regional hub hence attracting investments, iv) increased financial capital injection for growth of MSMEs in the country by foreign Private Equity (PE) funds and multilateral organisations such as World Bank, with the facilitations managed by local financial institutions, and, v) improvement of infrastructure such as the Standard Gauge Railway (SGR) project, the Thika Superhighway, and various Bypasses connecting Jomo Kenyatta International Airport (JKIA) and other regions in the country which are expected to support the output of SEZs such Tatu City.

- Real Estate Regulated Funds

- Real Estate Investment Trusts (REITs)

During the week, ILAM Fahari I-REIT released their H1’2023 financial results highlighting that the I-REIT recorded a 0.2% decline in profits earned to Kshs 86.0 mn, from Kshs 86.2 mn in H1’2022. Below is a summary of the ILAM Fahari I-REIT’s H1’2023 performance;

Figures in Kshs mn Unless Stated Otherwise

|

Balance Sheet |

H1’2022 |

H1’2023 |

∆ (H1'22/ H1’23) |

|

Total Assets |

3.7 |

3.6 |

(3.3%) |

|

Total Equity |

3.5 |

3.4 |

(4.1%) |

|

Total Liabilities |

0.1 |

0.2 |

(16.8%) |

Figures in Kshs mn Unless Stated Otherwise

|

Income Statement |

H1’2022 |

H1’2023 |

∆ (H1'22/ H1’23) |

|

Rental Income |

171.8 |

179.5 |

4.5% |

|

Income from Other Sources |

14.5 |

16.5 |

13.7% |

|

Operating Expenses |

100.1 |

110.0 |

9.8% |

|

Profit Before Tax |

86.2 |

86.0 |

(0.2%) |

|

Basic EPS (Kshs) |

0.5 |

0.5 |

(0.2%) |

|

Ratios Summary |

H1’2022 |

H1’2023 |

∆ (H1'22/ H1’23) (% points) |

|

ROA |

2.3% |

2.4% |

0.1% |

|

ROE |

2.4% |

2.5% |

0.1% |

|

Debt Ratio |

4.0% |

4.9% |

0.9% |

|

PBT Margin |

51.2% |

48.4% |

(2.8%) |

|

Rental Yield |

5.3% |

6.1% |

0.8% |

The key take-outs include;

- The basic earnings per unit came in at Kshs 0.5 in H1’2023, remaining relatively unchanged from H1’2022. The performance was mainly due to a 0.2% decline in ILAM Fahari's net earnings to Kshs 86.0 mn in H1’2023, from Kshs 86.2 mn recorded in H1’2022. The overall performance was mainly weighed down by a 9.8% increase in the total operating expenses to Kshs 110.0 mn in H1’2023, from Kshs 100.1 mn in H1’2022, which outpaced the 6.3% growth in total operating income to kshs 194.4 mn in H1’2023 from Kshs 182.9 mn in H1’2022,

- Rental income grew by 4.5% to Kshs 179.5 mn in H1’2023, from Kshs 171.8 mn recorded in H1’2022, mainly due to rent escalations in line with the lease agreements with Greenspan Mall’s anchor tenant, Naivas Supermarket, as well as other tenants, coupled with the management working on a leasing strategy to increase occupancy levels,

- The rental yield increased by 0.8% points to 6.1% in H1’2023 from 5.3% in H1’2022 attributable to the 4.5% growth in rental income relative to the 10.6% decline in investment property value to 3.3% in H1’2023 from 3.3% in H1’2022,

- Total assets reduced by 3.3% to Kshs 3.6 bn in H1’2023 from Kshs 3.7 bn in H1’2022, as a result of 10.6% decline in investment property to Kshs 2.9 bn from Kshs 3.3 bn in H1’2022, coupled with a 33.8% decline in investment securities to Kshs 192.2 mn in H1’2023, from Kshs 290.2 mn recorded in H1’2022,

- During the H1'2023 period, the REIT manager ILAM did not recommend an interim dividend, and,

- In April 2023, the REIT manager ILAM paid the first and final divided of Kshs 65 cents per unit with respect to the 2022 fiscal year,

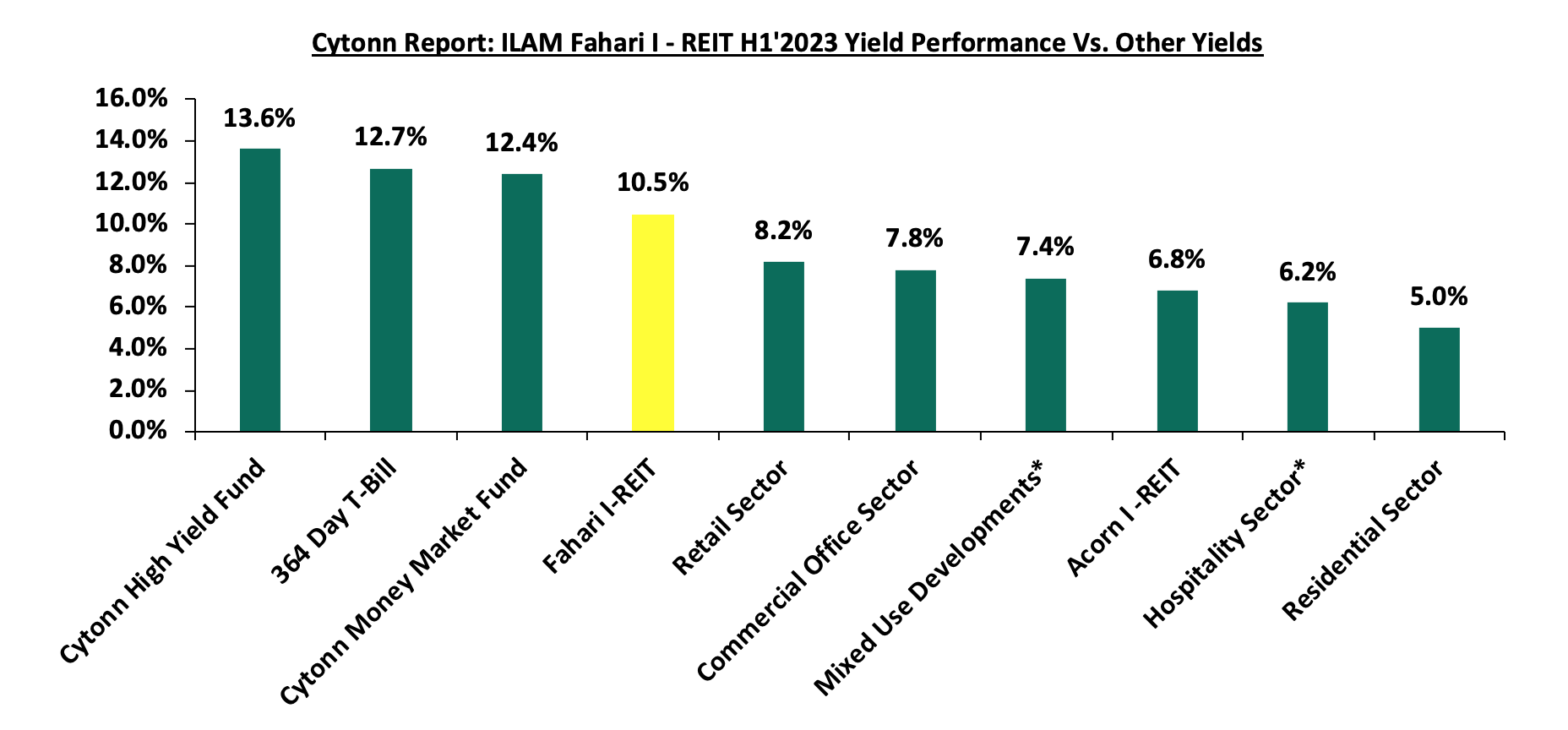

- The current dividend yield stands at 10.5%, as at 28 July 2023.

The chart below shows the comparison of ILAM Fahari I-REIT’s yield performance versus other yields;

*FY’2022

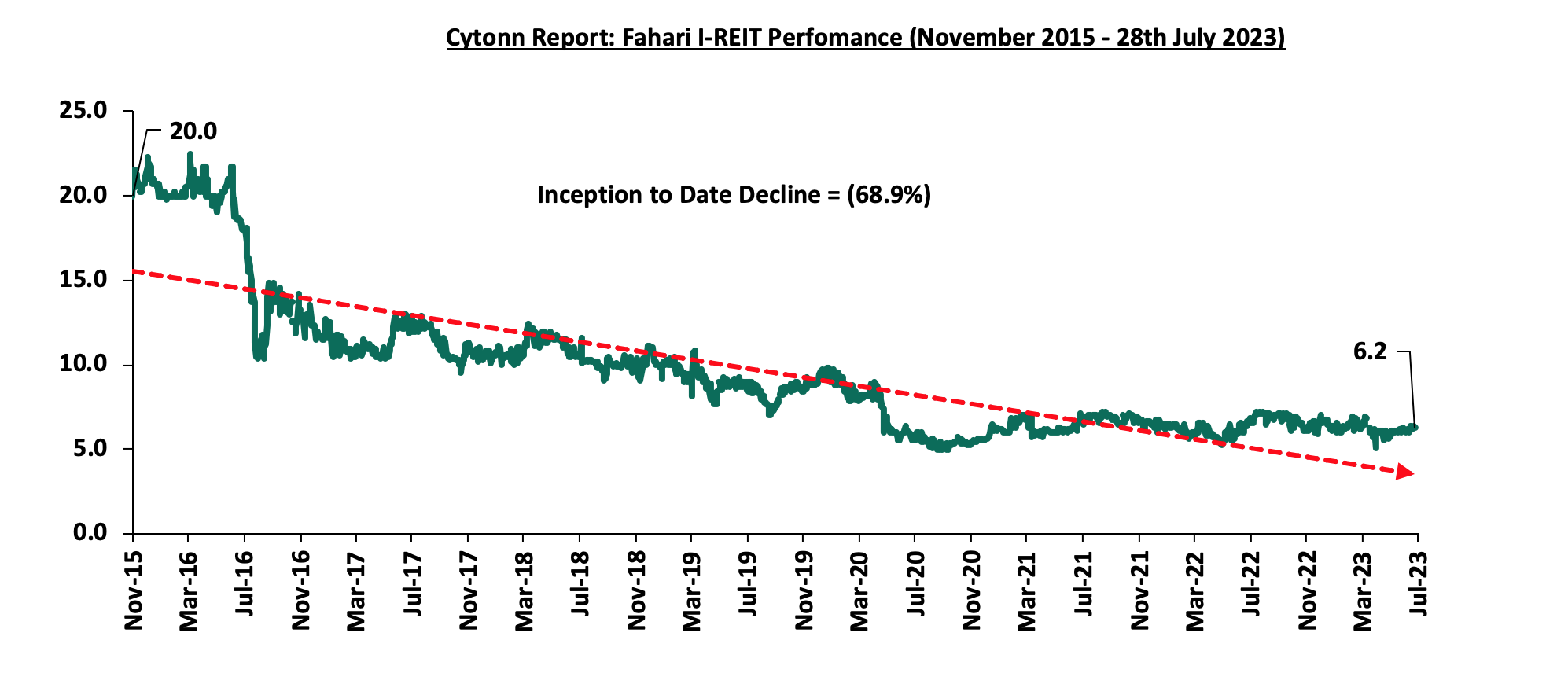

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.2 per share, remaining relatively unchanged from what was recorded the previous week. The performance represented an 8.3% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3 January 2023. In addition, the performance represented a 68.9% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.5%. The graph below shows Fahari I-REIT’s performance from November 2015 to 28 July 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 21.6 per unit, respectively, as at 21 July 2023. The performance represented a 19.5% and 8.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.2 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 624.4 mn, respectively, since inception in February 2021.

REITs provide numerous advantages, including; access to larger capital pools, consistent and prolonged profits, tax exemptions, diversified portfolios, transparency, liquidity, and flexibility as an asset class. Despite these benefits, the performance of the Kenyan REITs market remains limited by several factors, such as; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

- Cytonn High Yield Fund (CHYF)

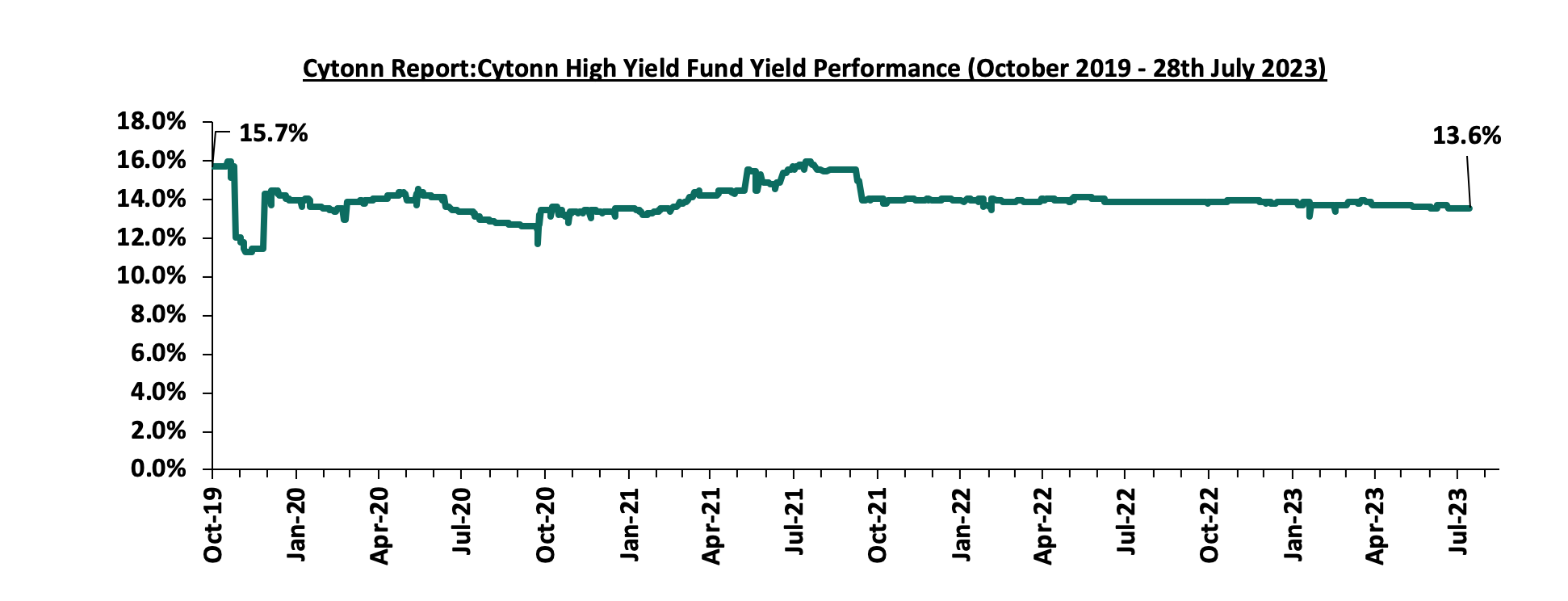

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 13.6%, remaining relatively unchanged from the previous week. The performance also represented a 0.3% points Year-to-Date (YTD) decline from 13.9% yield recorded on 1 January 2023, and 2.1% points Inception-to-Date (ITD) decline from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from October 2019 to 28 July 2023;

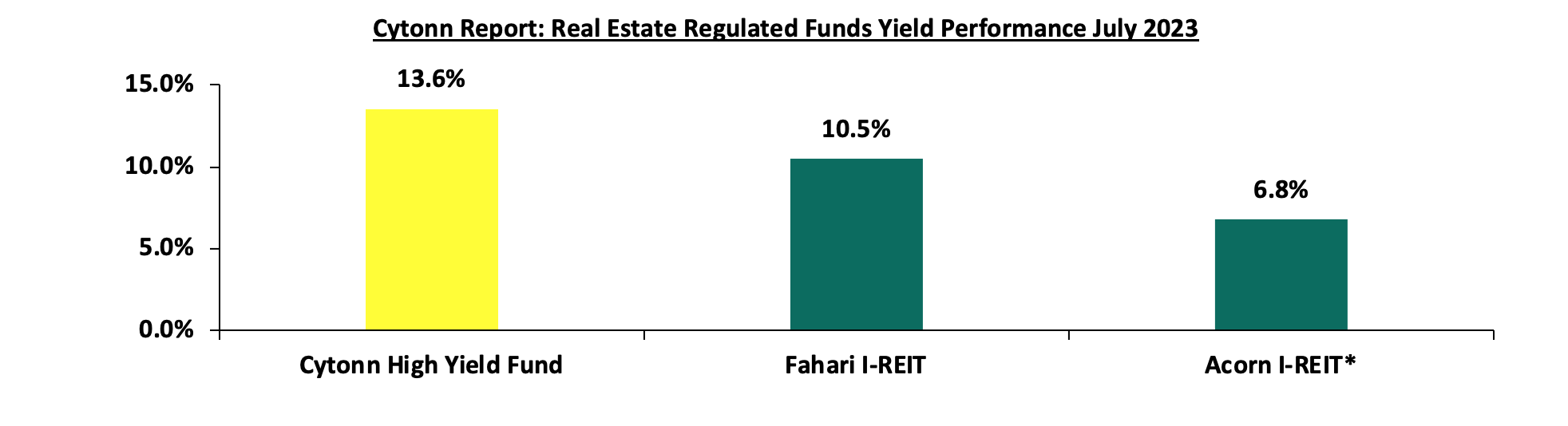

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 13.6%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.5%, and 6.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds:

*FY’2022

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate sector to remain on an upward trajectory, mainly driven by factors such as; i) positive national demographic trends facilitating increased demand for developments, ii) aggressive expansion drive by both local and international retailers to increase market share, and, iii), investor appetite in the logistics industry which is geared to grow the industrial sector. On the other hand, the oversupply of space in select Real Estate sectors, including commercial office and retail, leading to slower uptake of new spaces, ii) escalating construction costs due to rising inflation, and iii) limited investor knowledge and interest in REITs, are expected to weigh down on the sector's optimal performance.

In August 2022, we published the Kenya Retail Report 2022, themed “Accelerated Retail Investments,” which highlighted that the Kenyan retail sector’s overall performance remained stable, with the average rental yield coming in at 6.8% in 2022, unchanged from what was recorded in 2021. The average occupancy rate however declined by 1.1% points to 77.3% in 2022, from 78.4% that was recorded in 2021, mainly attributed to the addition of new malls into the market such as the Global Trade Centre (GTC) and Meru Greenwood malls among others, which in turn weighed down the overall absorption rate.

This week, we update our Kenya Retail Report 2022 with the Kenya Retail Report 2023 themed “Retail Expansion with Focus into Untapped Markets” in which we discuss the progress and performance of the Kenyan retail sector. This will be based on research that was conducted on nine nodes within the Nairobi Metropolitan Area (NMA), in addition to other key urban cities in Kenya, including Kisumu, Nakuru, Mombasa, Eldoret, and the Mount Kenya Region. Based on this, we shall identify the market performance in terms of rents, occupancy rates, and rental yields, while updating on the key factors in the markets driving their performance. Therefore, we shall cover the topical as follows;

- Overview of the Kenya Retail Sector in 2023,

- Kenya Retail Sector Performance Summary in 2023,

- Retail Space Demand Analysis,

- Retail Space Investment Opportunity, and,

- Retail Sector Outlook.

Section I: Overview of the Kenya Retail Sector in 2023

The Kenya retail sector registered increased market activities in 2023 evidenced by the aggressive expansion by major local and international retailers, and developments. Some of the retailers who have been on an aggressive expansion drive during the year include; i) Naivas supermarket which opened new stores spread across Nairobi, Malindi, and Kisii Counties, plans to open another outlet in Kakamega, ii) QuickMart supermarket which opened new stores in Nairobi’s Kileleshwa and Eastlands and in Nyali, Mombasa, and, iii) Carrefour which opened a new outlet in Nairobi’s Eastleigh, in a bid to stamp market dominance.

The table below shows a summary of the number of stores of the key local and international retailer supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches opened in 2023 |

Closed branches |

Current branches |

|

Naivas |

International* |

46 |

61 |

69 |

79 |

91 |

6 |

0 |

97 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

4 |

0 |

59 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

1 |

0 |

20 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

0 |

59 |

5 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

12 |

181 |

222 |

|

*51% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

|||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||

Source: Cytonn Research

Other franchises that have embarked on expansion in Kenya include:

- ChicKing, an international fast-food chain, in partnership with M/s Crispy Limited, a local franchise, opened a restaurant outlet located in Mombasa along Nyerere Avenue, the first outlet in Kenya and the East African market,

- Simbisa Brands, Zimbabwe’s largest fast-food restaurant operator, which runs quick-service restaurants such as Chicken Inn, Pizza Inn, Bakers Inn, and Creamy Inn, opened 25 new outlets in Kenya since 2022, ending up with 275 outlets as at March 2023,

- Chicken Cottage, a UK fast-food chain announced a partnership deal in 2022 with Express Kitchen, a subsidiary of AAH Limited to open 50 outlets at Hass Petroleum’s service stations in Kenya, Rwanda, Tanzania and Uganda, and,

- Java House, an international restaurant chain, who also owns 360 Degrees Artisan Pizza, Kukito, and Planet Yogurt food chains, opened a new outlet located at Eastleigh, Nairobi in June 2023. Java House also plans to open three outlets at Nairobi’s Jomo Kenyatta International Airport, Moi International Airport in Mombasa and in Machakos within the year.

In addition, there are various upcoming retail developments in the pipeline such as The Cove, The Beacon, Lana Plaza, ParkPlace Avenue, Crystal Rivers, and Britam mall in the NMA. This is supported by factors which are driving growth in the sector, including;

- Improved Accessibility - The government's focus on infrastructural developments in road and railway projects has opened up areas for investments, thereby increasing growth and expansion of retailers to provide convenience to consumers in the improved regions,

- Positive National Demographics - The demand for goods and services has been steadily rising due to Kenya’s relatively high urbanization and population growth rates of 3.7% p.a and 1.9% p.a, respectively, against the global average of 1.6% p.a and 0.9% p.a, respectively as at 2021,

- Presence of Gaps in the Market - Retailers such as Naivas, QuickMart and Carrefour, among others, have continued an aggressive expansion drive to take up new and previously occupied spaces by troubled retailers such as Uchumi, Tuskys, and Nakumatt retail chains that left the market. This is as Kenya’s formal retail penetration is still low, standing at approximately 30.0% according to the Nielsen Report 2018,

- Sustained Foreign Investor Appetite - Kenya's reputation as a regional investments hub has continued to attract multinational companies and retailers to the country, further increasing the demand for retail space, and,

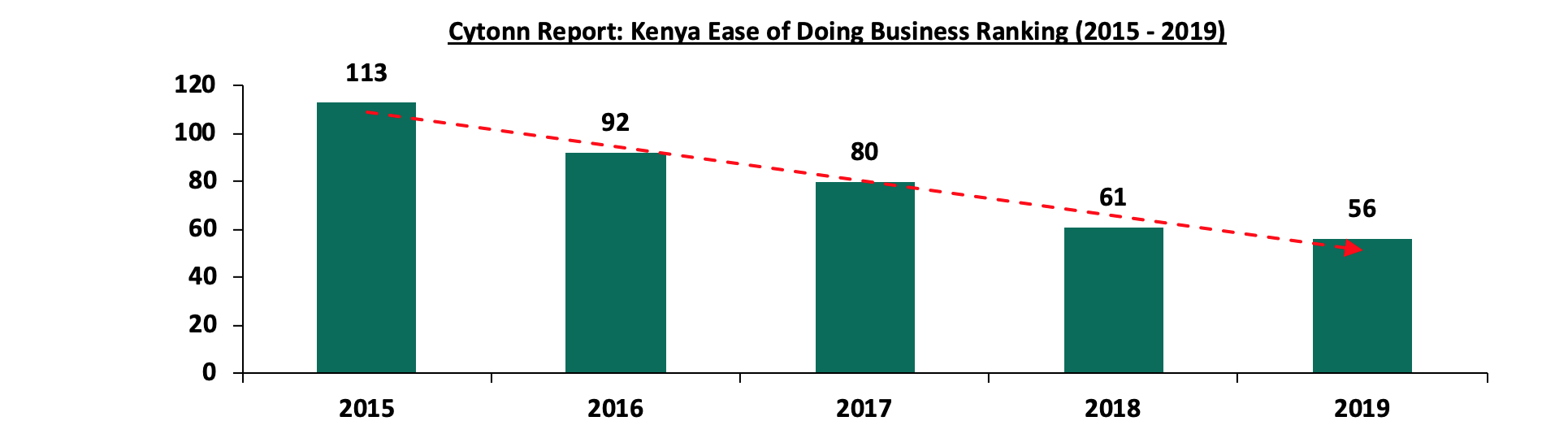

- Better Ease in Doing Business - The ease of doing business in Kenya has significantly improved, leading to enhanced investor confidence. According to the World Bank, Kenya's ranking in terms of ease of doing business was 56 in 2019, a notable improvement compared to its position at 113 five years prior. The graph below shows Kenya’s ranking performance between 2015 and 2019;

Despite the above factors driving the growth of the retail market, various challenges continue to impede the overall performance of the sector which include;

- Rising Construction Costs - Construction costs have been steadily rising, currently standing at an average of Kshs 41,600 per SQM in 2023, which is a 20.1% increase from Kshs 34,650 per SQM recorded in 2022. The increase is mainly on the back of inflationary pressure, discouraging optimal development activities in the sector,

- Constrained Access to Development Financing - Access to adequate credit has remained a challenge, given the increasing loan default rates in the property sector as financial institutions such as commercial banks continue to tighten their lending terms. According to the Central Bank of Kenya, the gross Non-Performing Loans (NPLs) in the Real Estate sector increased by 12.2% to Kshs 88.1 bn in Q1’2023, from Kshs 78.5 bn in Q1’2022,

- Subdued Consumer Purchasing Power - Retailers have encountered difficulties in maintaining sales amid restrained consumer spending. This is on the back of inflation which stood at 7.9% in June 2023, coupled by pressure on the Kenya Shilling, which has depreciated by 15.3% on a year-to-date basis against the dollar, adding to the 9.0% depreciation recorded in 2022, and,

- Oversupply of Space - There exists an oversupply of physical space, with approximately 3.3 mn SQFT in the NMA retail market, with the rest of the Kenyan retail market having an oversupply of approximately 2.1 mn SQFT, causing slowed uptake of retail spaces in the sector, and thereby leading developers to halt their plans awaiting the absorption of the existing spaces.

Section II: Kenya Retail Sector Performance Summary in 2023

Our research context delves into the performance of the retail market in the Nairobi Metropolitan Area (NMA) and key urban cities in Kenya. The Kenyan retail sector displayed a stable overall performance, with the average rental yield coming in at 7.5% in 2023, 0.7% points increase from 6.8% recorded in 2022. Notably, the average rent per SQFT increased by 7.1% to Kshs 130 in 2023 from Kshs 122 in 2022, owing to; i) an improved business environment in post COVID-19 era and post electioneering period that resulted to increased transaction volumes, ii) upward revision of rental charges in most community and neighbourhood malls in towns outside NMA driven by heightened demand from retailers expanding their businesses into newly developing economic regions of the country, and, iii) addition of high end malls that attracted higher rental rates such as the Business Bay Square and Broadwalk Mall in Nairobi, Greenwood Mall in Meru and Kilele Mall in Murang’a. Moreover, the average occupancy rate increased by 2.1% points, reaching 79.4% in 2023 compared to 77.3% in 2022. This increase was mainly driven by the rapid expansion of both local and foreign retailers, such as Simbisa brands, Carrefour, Naivas, and Quickmatt. These retailers tapped into newer market opportunities and occupied substantial spaces in the newly established malls, including Broadwalk and Meru Greenwood, among others. Additionally, the expansion of these retailers into spaces previously occupied by troubled retailers like Nakumatt and Tuskys, significantly improving the occupancy rates of these malls and contributing to the overall resilience of the retail market.

- Retail Sector Performance in Kenya Over Time

The Kenyan retail sector has remained stable over time, showing resilience in performance regarding rental yields, with the average rent per SQFT showing promising signs of rebounding to pre-COVID-19 levels of above Kshs 130 per SQFT. However, it is important to note that the sector has experienced a negative Compounded Annual Growth Rate (CAGR) of 2.4% over the past seven years, dropping to Kshs 130 per SQFT in 2023 from Kshs 155 in 2016. This decline can be attributed to the increased supply of retail spaces, leading landlords to offer rent discounts to attract and retain clients while also addressing the surplus space. The situation was exacerbated during the active 2-year period of the COVID-19 pandemic and the 2017 and 2022 electioneering periods. The average occupancy rate also declined by 3.5% points to 79.4% in 2022, from 82.9% that was recorded in 2016, mainly attributed to exit of local and foreign retailers in the market that had occupied large spaces for their businesses such as Nakumatt, Tuskys, Uchumi, The Game, Shoprite, Choppies and many more, and, ii) the addition of new malls into the market during the period consequently increasing the oversupply of the retail spaces in the sector and further weighed down the overall absorption rate.

The performance of the sector across the key cities is as summarized below;

All Values in Kshs Unless Stated Otherwise

|

Cytonn Report: Kenya’s Retail Performance Summary-2023 |

|||||||||

|

Item |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

∆ Y/Y 2022/2023 |

|

Asking rents (Kshs/SQFT) |

155 |

141 |

132 |

118 |

115 |

118 |

122 |

130 |

7.1% |

|

Average Occupancy (%) |

82.9% |

80.2% |

86.0% |

77.3% |

76.6% |

78.4% |

77.3% |

79.4% |

2.1% points |

|

Average Rental Yields |

8.7% |

8.3% |

8.6% |

7.0% |

6.7% |

6.8% |

6.8% |

7.5% |

0.7% points |

Source: Cytonn Research

- Nairobi Metropolitan Area (NMA) Retail Market Performance

The NMA retail market recorded an average rental yield of 8.2% in 2023, 0.3% points higher than the 7.9% that was recorded in 2022. The performance was driven by; i) 0.9% increase in average rental charges to Kshs 177 per SQFT in 2023 from Kshs 175 per SQFT in 2022, and, ii) 1.8% points improvement in average occupancy rates which came in at 79.2% in 2023, from 77.4% in 2022.

- Performance by Nodes

Kilimani, Karen, and Westlands stood out as the best performing nodes, with average rental yields of 10.1%, 9.7%, and 9.1% respectively, surpassing other nodes. The exceptional performance of was attributed to the availability of high-quality retail spaces that command high rents, as well as the presence of quality infrastructure services in those areas. Conversely, Eastlands continued to register the least average rental yield of 6.0% due to; i) lower average rents of Kshs 128 per SQFT, as compared to the market average of Kshs 177 per SQFT, ii) poor quality infrastructure which is unsustainable for the retail spaces and hindering sufficient accessibility, iii) heavy presence of informal retail spaces that quickly adapt to market trends and service stations with value added amenities offering opportunities for better quality retail spaces, one-stop-shop approach, convenience and cheaper rates for price sensitive clients increasingly cause stiffer competition, and, iv) relatively lower demand shown by a low average occupancy rate of 75.6%, compared to the market average of 79.2%. Additionally, prime retail spaces in the satellite towns have exhibited the highest occupancy rate and rental yield attributed to population growth in the regions prompting retailers to extend their services beyond the city centre and tap opportunities in satellite towns. This shift of focus aims to bring convenience to residents in the nearest and most accessible way. This is also on the back of reduced rents by the retail space owners to attract more clients in the region amid increased demand for consumer goods, services and entertainment facilities.

The table below shows the submarket performance of nodes in the Nairobi Metropolitan Area (NMA):

All Values in Kshs Unless Stated Otherwise

|

Cytonn Report: Nairobi Metropolitan area (NMA) 2023 Retail Performance |

|||||||||

|

Area |

Rent (Kshs)/SQFT 2023 |

Occupancy % 2023 |

Rental Yield 2023 |

Rent Kshs/SQFT 2022 |

Occupancy 2022 |

Rental Yield 2022 |

∆ in Rental Rates |

∆ in Occupancy (% points) |

∆ in Rental Yield (% points) |

|

Kilimani |

190 |

84.7% |

10.1% |

187 |

83.8% |

9.8% |

2.0% |

0.9% |

0.3% |

|

Westlands |

216 |

77.6% |

9.1% |

214 |

75.7% |

8.7% |

1.0% |

1.9% |

0.4% |

|

Karen |

217 |

82.4% |

9.7% |

216 |

80.2% |

9.4% |

0.5% |

2.2% |

0.3% |

|

Kiambu road |

202 |

74.0% |

8.7% |

202 |

72.8% |

8.6% |

0.0% |

1.2% |

0.1% |

|

Ngong Road |

170 |

81.0% |

7.8% |

168 |

80.5% |

7.7% |

1.0% |

0.5% |

0.1% |

|

Mombasa road |

156 |

79.9% |

7.5% |

154 |

78.9% |

7.4% |

1.1% |

1.0% |

0.1% |

|

Thika Road |

165 |

80.7% |

7.5% |

165 |

78.7% |

7.3% |

0.0% |

2.0% |

0.2% |

|

Satellite towns |

138 |

78.8% |

6.8% |

134 |

72.2% |

6.2% |

2.5% |

6.6% |

0.6% |

|

Eastlands |

128 |

75.6% |

6.0% |

131 |

73.0% |

5.9% |

(2.8%) |

2.6% |

0.1% |

|

Average |

177 |

79.2% |

8.2% |

175 |

77.4% |

7.9% |

0.9% |

1.8% |

0.3% |

Source: Cytonn Research

- Performance by Class

The research aims to evaluate the performance of malls within each class and understand the factors contributing to their rental yields and occupancy rates. The analysis focuses on how rental charges, occupancy rates, and rental rates vary within each class compared to the overall market averages. In this research analysis, malls have been categorized into three distinct classes based on their lettable areas. The classifications are as follows:

- Regional Centers / Destination Malls: These malls have larger lettable areas, ranging from 400,000 to 800,000 square feet (SQFT), and typically house multiple anchor tenants. Notable examples include Sarit Centre, Two Rivers Mall, Garden City Mall, Business Bay Square, and Next Gen Mall,

- Community Centers: This category comprises the second largest malls, with lettable areas ranging from 125,001 to 400,000 SQFT, and they too can accommodate more than one anchor tenant. Examples include Thika Road Mall, Valley Arcade, Gateway Mall, the Village Market, and,

- Neighborhood Centers: The smallest of the three classes, these malls have lettable areas around 20,000 SQFT, allowing them to host only one anchor tenant. Examples include The Well, Ciata City Mall, and Unicity Mall, among others.

In terms of performance by class, destination malls emerged as the top performers, boasting an average rental yield of 11.5%. This exceptional performance can be attributed to their ability to command high rental charges, averaging at Kshs 284 per SQFT, which was 60.4% higher than the market average of Kshs 177 per SQFT. These malls often charge premium rents, primarily in United States Dollars (USD) currency, due to their offering of high-quality retail spaces and excellent facilities, along with the attractive presence of international retailers. As a result, they also enjoy higher footfall from shoppers. Moreover, they recorded the highest occupancy rates of 83.6% against the grand average 79.2% in the NMA due to their limited supply and increased demand by major local brands and multinational business conglomerate seeking to establish their presence in the region.

Community malls came in second recording an average rental yield of 8.4%, 0.2% points higher than the market average of 8.2%, with average occupancy rate and rental charges coming in at 81.2% and Kshs 178 per SQFT, respectively against a market average of 79.4% and Kshs 177 per SQFT, respectively as a result of an persistent improved demand for cheaper retail spaces compared to destination malls within similar regions. The increased demand for the spaces has been primarily driven by new tenants who were previously not considered as viable clients such as opticians, pharmacies, fashion designers, electrical and electronics home appliances brands, hospitals, financial institutions, fitness centers, beauty product brands, and many others. This diversified tenant mix has contributed to the sustained growth and popularity of community malls, solidifying their position as attractive options for both tenants and customers alike.

Neighborhood malls recorded the lowest average rental yields averaging at 7.2%, 1.0% points lower than the market average of 8.2%, attributed to lower average rental rates averaging Kshs 153 per SQFT compared to the market average of Kshs 177 per SQFT. Average occupancy rates came in at 76.2% against the market average of 79.4% as a result of a slowdown in demand for physical retail spaces in these malls.

The summary of performance by class is as shown below:

All Values in Kshs unless stated otherwise

|

Cytonn Report: Retail Market Performance in Nairobi by Class 2023 |

|||

|

Class |

Average of rent (Kshs) |

Average of occupancy rate |

Average of rental yields |

|

Destination |

284 |

83.6% |

11.5% |

|

Community |

178 |

81.2% |

8.4% |

|

Neighbourhood |

153 |

76.2% |

7.2% |

|

Grand Total |

177 |

79.2% |

8.2% |

- Retail Market Performance in Key Urban Cities in Kenya

Key urban cities in Kenya recorded increased average rental yields by 0.7% points to 7.5% in 2023 from 6.8% recorded in 2022 attributable to; i) increase in average occupancy rates by 2.2% points to 79.4% in 2023 from 77.3% in 2022, and, ii) 7.1% growth in average rental rates to Kshs 130 per SQFT in 2023 from Kshs 122 per SQFT in 2022.

Nairobi was the best performing region with average rental yields coming in at 8.2% in 2023, 0.7% points higher than the market average of 7.5%, driven by; i) the increased average rental charges which came in at Kshs 177 per SQFT from Kshs 173 per SQFT, and, ii) increased demand for high quality retail spaces thus increasing the average occupancy rates to 79.2% in 2023 from 75.9% recorded in 2022.

Eldoret recorded the least average rental yields coming in at 6.7% against the market average of 7.5% in 2023 and 0.1% points increase from 6.6% recorded in 2022, due to the unchanged rental rates which remained at Kshs 132 per SQFT and a very marginal increase in average occupancy rates by 0.1% points to 86.2% in 2023 from 86.1% recorded in 2022.

Mount Kenya was the most improved region, attributable to the significant improvement in occupancy rates and rental charges of the newly existing malls in the region such as the Meru Greenwood mall, Kilele mall among others. This saw an increase in the average rental yield by 2.5% points to 7.8% in 2023, from 5.3% recorded in 2022.

The performance of the key urban centers in Kenya is as summarized below:

All values in Kshs unless stated otherwise

|

Cytonn Report: Summary of Retail Performance in Key Urban Cities in Kenya 2022/2023 |

|||||||||

|

Region |

Rent 2023 |

Occupancy Rate 2023 |

Rental yield 2023 |

Rent 2022 |

Occupancy Rate 2022 |

Rental yield 2022 |

∆Y/Y in Rental Rates |

∆Y/Y in Occupancy Rate |

∆Y/Y in Rental Yield |

|

Nairobi |

177 |

79.2% |

8.2% |

173 |

75.9% |

7.8% |

2.3% |

3.3% |

0.4% |

|

Nakuru |

79 |

80.5% |

7.9% |

73 |

81.3% |

7.4% |

8.6% |

(0.8%) |

0.5% |

|

Mombasa |

127 |

82.6% |

7.8% |

110 |

84.0% |

7.0% |

15.5% |

(1.4%) |

0.8% |

|

Kisumu |

107 |

79.7% |

7.0% |

108 |

79.7% |

7.0% |

(0.4%) |

0.0% |

0.0% |

|

Eldoret |

132 |

86.2% |

6.7% |

132 |

86.1% |

6.6% |

0.0% |

0.1% |

0.1% |

|

Mount Kenya |

161 |

68.3% |

7.8% |

138 |

56.7% |

5.3% |

16.3% |

11.7% |

2.4% |

|

Average |

130 |

79.4% |

7.5% |

122 |

77.3% |

6.8% |

7.1% |

2.2% |

0.7% |

Source: Cytonn Research

Section III: Retail Space Demand Analysis

To explore investment opportunities in the retail market and bridge existing gaps, our research focused on assessing the demand for retail space in different urban regions across Kenya. The main objective is to inform developers about both undersupplied and oversupplied areas. To achieve this, we conducted a comprehensive analysis, considering the current retail spaces available and those in the development pipeline. This data was then compared to the existing demand, taking into account the population of each region.

By employing this approach, we were able to calculate crucial metrics such as the net space uptake per person in square meters, the size of the shopping population, and the current retail market occupancy rates. These metrics played a key role in identifying regions with potential investment opportunities in the retail sector. To further enhance our analysis, we used Kilimani's average uptake as a benchmark to estimate the net space uptake for the various regions under consideration. This enabled us to make informed comparisons and draw valuable insights into the retail market dynamics in different parts of Kenya:

- Total Demand/Gross Uptake: This metric quantifies the overall retail space required by the population in the region. It is calculated by multiplying the net space uptake per person by the total shopping population.

- Net Demand/Uptake: This metric measures the gross uptake of retail space, excluding the occupancy rates of malls in the region. It is derived by multiplying the gross uptake by the respective market occupancy rates.

- Supply: The supply metric accounts for the total existing malls and those in the pipeline in the region. To assess the market's condition and identify potential gaps, we calculate the over/undersupply by subtracting the supply from the demand or net uptake.

Furthermore, our analysis is based on certain key assumptions:

- Number of persons per household: We assume an average household size of 3.6 in urban areas, as per data from the Kenya Population and Housing Census 2019.

- Percentage of shopping population: We consider the shopping population to include individuals aged 14 years and above.

(If the figure is positive, then the market has an undersupply i.e, demand is more than supply and if it is a negative figure then the market has an oversupply, i.e. supply is more than demand).

The retail space demand across key regions in Kenya is as shown below;

|

Cytonn Report: Demand Analysis 2023 |

||||||||||

|

Region |

2019 |

Urban Population |

Urban population 2019 |

Shopping People |

Net Space Uptake per pax in SQM (Based on Uptake per pax in Kilimani) |

Occupancy (2 year Average) |

Gross Space Uptake per Pax SQFT (Required Space Kilimani) |

Net Uptake SQFT (Space Required) for each market |

Current supply (SQFT) |

GAP at current market performance (SQFT) |

|

Kiambu |

2.1 |

60% |

1.3 |

0.7 |

1.9 |

72.5% |

2.1 |

1.5 |

0.9 |

0.6 |

|

Mt Kenya |

2.8 |

38% |

1.1 |

0.6 |

1.5 |

68.3% |

1.7 |

1.2 |

0.4 |

0.5 |

|

Mombasa |

1.3 |

100% |

1.3 |

0.8 |

1.9 |

82.6% |

2.1 |

1.8 |

1.4 |

0.2 |

|

Kajiado |

1.1 |

41% |

0.5 |

0.3 |

0.7 |

78.5% |

0.7 |

0.6 |

0.3 |

0.2 |

|

Machakos |

1.3 |

52% |

0.7 |

0.4 |

1.0 |

75.8% |

1.1 |

0.8 |

0.3 |

0.1 |

|

Nakuru |

2.2 |

45% |

1.0 |

0.6 |

1.4 |

80.5% |

1.6 |

1.3 |

0.6 |

(0.1) |

|

Uasin Gishu |

1.3 |

44% |

0.6 |

0.3 |

0.8 |

86.2% |

0.9 |

0.8 |

0.4 |

(0.1) |

|

Kisumu |

1.2 |

50% |

0.6 |

0.3 |

0.9 |

79.7% |

1.0 |

0.8 |

1.0 |

(0.2) |

|

Nairobi |

4.6 |

100% |

4.6 |

2.7 |

6.7 |

80.3% |

7.4 |

5.9 |

8.3 |

(3.3) |

|

Total |

18.0 |

11.6 |

6.7 |

16.8 |

79.4% |

18.6 |

14.6 |

12.8 |

(2.1) |

|

|

Based on the analysis, Kenya retail sector and the NMA realized a 4.5% decline and 8.7% increase in the market gap to 2.1 mn and 3.3 mn per SQFT when compared to the 2.2 mn and 3.0 mn SQFT recorded in 2022. This is attributed to increase in demand for existing retail spaces and reduced growth in number of malls in the pipeline in other towns and significant increase in number of malls and those in the pipeline in NMA. |

||||||||||

Source: Cytonn Research

Based on our demand analysis, Nairobi, Kisumu, Uasin Gishu and Nakuru are the most oversupplied retail markets by 3.3 mn SQFT, 0.2 mn SQFT, 0.95 mn SQFT, and 0.94 mn SQFT, respectively, with average occupancy rates of 80.3%, 79.7%, 86.2% and 80.5%, respectively.

Section IV: Retail Space Investment Opportunity

We analyzed the various urban regions in Kenya in order to determine the investment opportunity within the Real Estate retail market of the country. This was based on three metrics which include the rental yields, the retail spaces required, and the household purchasing power, with allocations of 30.0%, 30.0% and 40.0% weights, respectively:

- Rental Yield- This is a measure of the value of the profit that an investor generates from an investment as a percentage of its value hence the higher the better. The weighted score for rental yields was 30.0%, and the area with the highest yield was ranked with the highest score of 9 whereas the area with lower yields was given the lowest score of 1,

- Household Expenditure - This measures the consumption expenditure of the target population hence the higher the better as well. The weighted score for this was at 40.0% and the area with the highest expenditure was given the highest score at 9, and the lowest given the lowest score at 1, and,

- Retail Space Demand - This measures the amount of retail space required by a particular region hence the higher the better as it increases occupancy rates of the available developments. 30.0% was the allocated weight for this and the area with the highest demand was given the highest score at 9 as well whilst the area with the lowest demand was allocated the lowest score at 1.