Cytonn H1’2023 Markets Review

By Research Team, Jul 2, 2023

Executive Summary

Global Markets Review

According to the World Bank’s June 2023 Global Economic Prospects, the global economy is projected to grow at a rate of 2.1% in 2023, 1.0% points slower than the estimated growth of 3.1% recorded in 2022. The latest projection is 0.8% points lower than the IMF’s earlier projection of 2.9% growth, with the downward revision being on the back of the continued tightening of monetary policies by the Central Banks around the world aimed at curbing the elevated inflationary pressures. Notably, advanced economies are expected to record a 0.7% growth in 2023, which is a significant decline from the 2.6% expansion recorded in 2022. However, emerging markets and developing economies are projected to expand by 4.0% in 2023, marginally upwards from an estimated growth of 3.7% in 2022;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.2% in 2023, which is 0.5% lower than the 3.7% growth estimate recorded in 2022. The expected slowdown in the regional economic growth is mainly on the back of adverse weather conditions that have undermined agricultural productivity, weak external demand, tight global financial conditions, and high inflationary pressures in most countries in the region. The challenges have continued to exacerbate fiscal deficits in most countries, leading to increased debt sustainability concerns in Sub-Saharan Africa as the region’s public debt to GDP ratio remained high at 56.0% in 2022, albeit a decline from 60.0% in 2021. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and increased interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability;

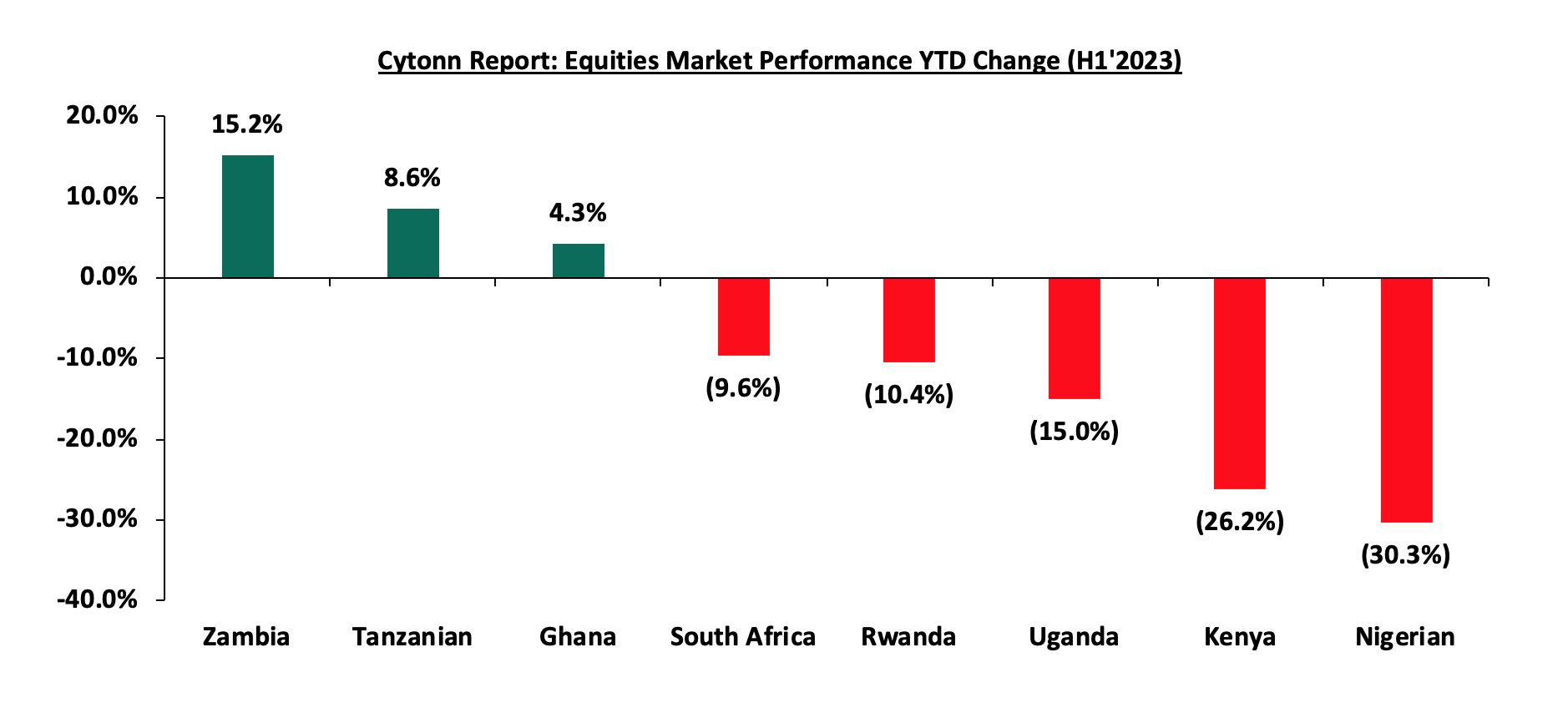

In H1’2023, most of the select Sub-Saharan currencies depreciated against the US Dollar, mainly attributable to the high debt servicing costs that continue to dwindle foreign exchange reserves and monetary policy tightening by advanced economies. Additionally, Sub-Saharan Africa (SSA) stock markets recorded mixed performance in H1’2023, with Zambia’s stock market (LASILZ) being the best performing market, gaining by 15.2% YTD driven by the rallying of commodity prices due to easing global supply chain constraints, with the country being the main exporter of Copper to countries such as China, Switzerland, and Singapore;

Kenya Macroeconomic Review

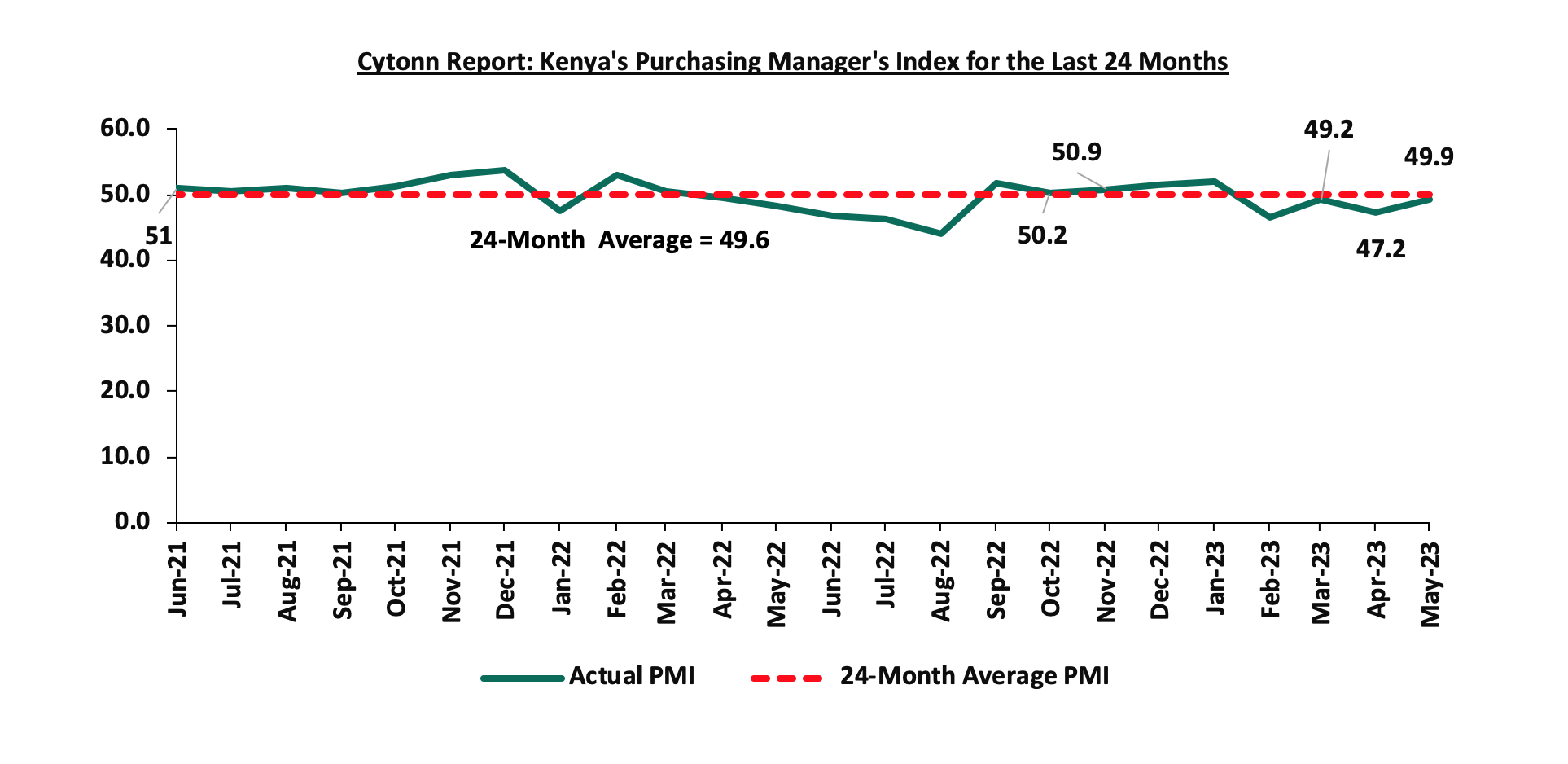

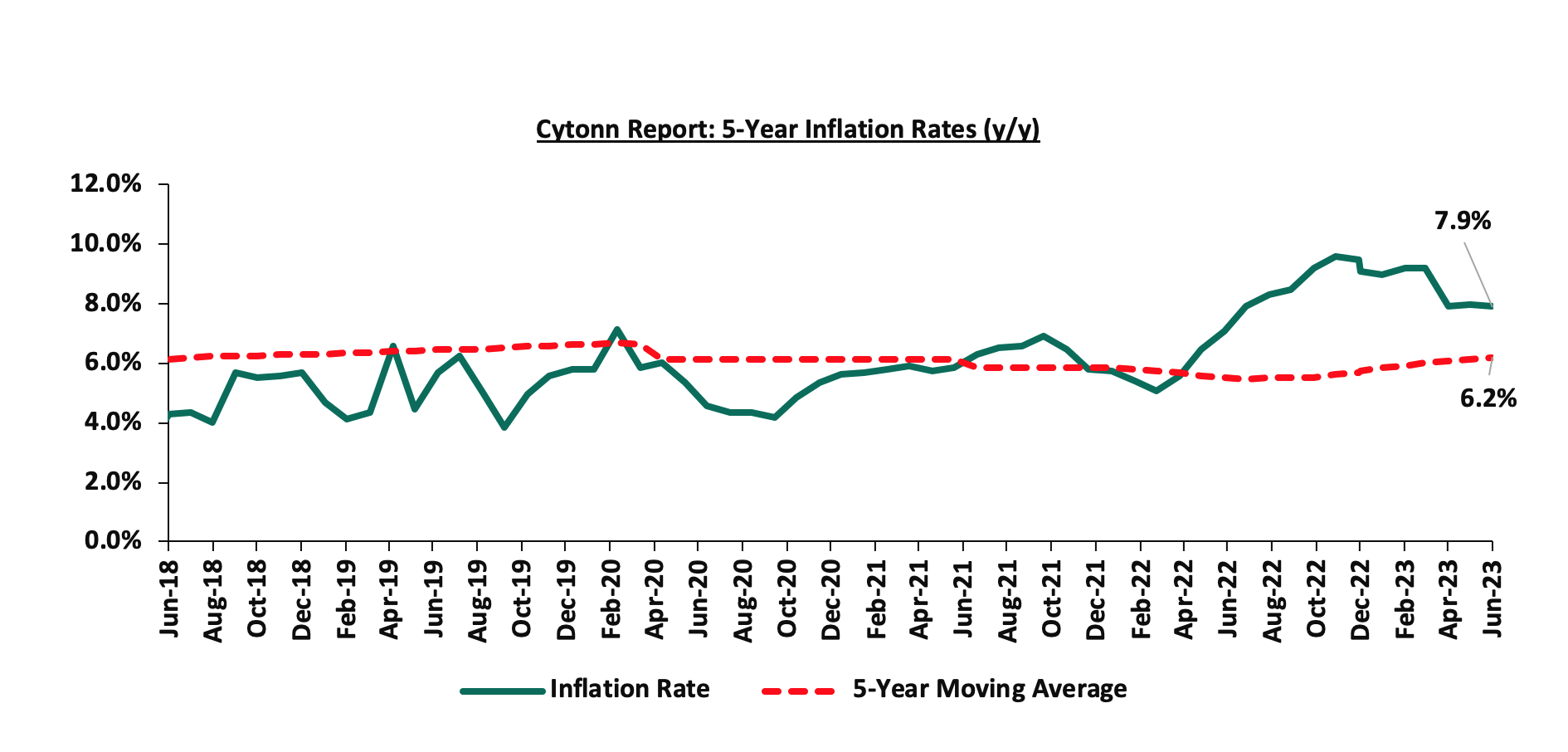

According to the Kenya National Bureau of Statistics (KNBS) Economic Survey 2023, the Kenyan economy recorded a 4.8% expansion in FY’2022, lower than the 7.6% growth recorded in FY’2021. The performance was supported by growth in most economic sectors such as Financial and insurance, Information and communication, and Transportation and storage, which grew by 12.8%, 9.9%, and 5.6% respectively. The overall growth was however curtailed by the 1.6% contraction in the Agriculture, Forestry and Fishing sectors, largely attributable to the drought experienced in most parts of the country in 2022. The average inflation rate for the first half of 2023 came in at 8.5%, higher than the 6.3% recorded in H1’2022, mainly as a result of high food and fuel prices. As a result, the business environment deteriorated in H1’2023, with the average Purchasing Managers Index (PMI) coming in at 48.9 in the first five months of 2023, down from the 49.7 recorded in the same period in 2022, as consumers cut back on spending;

Fixed Income

During H1’2023, T-bills were oversubscribed, with the overall subscription rate coming in at 121.7%, up from 89.3% in H1’2022. Investors preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 481.8 bn against the offered Kshs 100.0 bn, translating to an oversubscription rate of 481.8%, higher than the oversubscription rate of 109.0% recorded in H1’2022. Overall subscription rates for the 364-day and 182-day papers came in at 37.9% and 61.3%, lower than the 101.7% and 69.0%, respectively, recorded in H1’2022. The average yields on the 364-day, 182-day, and 91-day papers increased by 1.2% points, 2.1% points and 2.7% points to 11.0%, 10.5%, and 10.2% in H1’2023, respectively, from 9.7%, 8.4%, and 7.5%, respectively, in H1’2022. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation, currency depreciation, and tight liquidity positions, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 91.6%, albeit lower than the 92.7% recorded in H1’2022, with the government accepting a total of Kshs 668.3 bn out of the Kshs 730.0 bn worth of bids received;

During the week, T-bills remained undersubscribed for the third consecutive week, with the overall subscription rate coming in at 39.5 %, a decrease from the under-subscription rate of 63.9% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 5.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 144.5%, albeit lower than the 275.3% recorded the previous week. The subscription rate for the 364-day paper declined to 15.1%, from 23.4% recorded the previous week, while the subscription rate for the 182-day paper increased to 22.0%, from 19.9% recorded the previous week. The government rejected expensive bids, accepting a total of Kshs 5.5 bn worth of bids out of Kshs 9.5 bn bids received, translating to an acceptance rate of 58.2%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day and 91-day papers increasing by 22.3 bps, 8.4 bps, and 11.9 bps to 12.2%, 11.9%, and 11.9%, respectively;

Equities

During Q2’2023, the equities market was on a downward trajectory, with NASI, NSE 20, and NSE 25 declining by 5.1%, 2.9% and 8.0%, respectively, taking the H1’2023 performance to losses of 16.0%, 6.0%, and 13.0% for NASI, NSE 20, and NSE 25, respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as KCB Group, Equity Group, and Bamburi of 17.5%, 15.9%, and 10.3%, respectively;

During the week, the equities market recorded mixed performance, with NASI and NSE 20 declining by 0.2% and 0.5%, while NSE 25 gained by 0.4%, taking their YTD performance to losses of 16.0%, 6.0%, and 13.0% for NASI, NSE 20, and NSE 25 respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Co-operative Bank and Standard Chartered bank of 0.8% each, while KCB Group and NCBA Bank declined by 0.7% and 0.3%, respectively. The losses were however mitigated by gains recorded by East African Breweries Limited (EABL) and Equity Group of 2.0% each, while British American Tobacco gained by 1.8%;

Real Estate

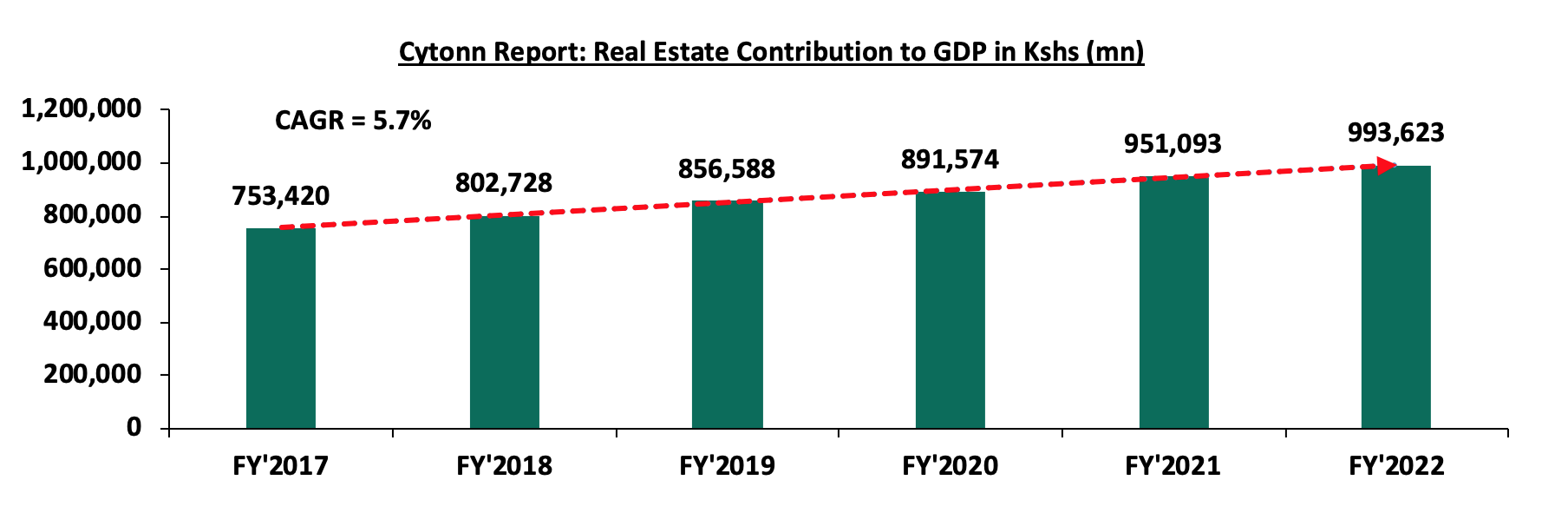

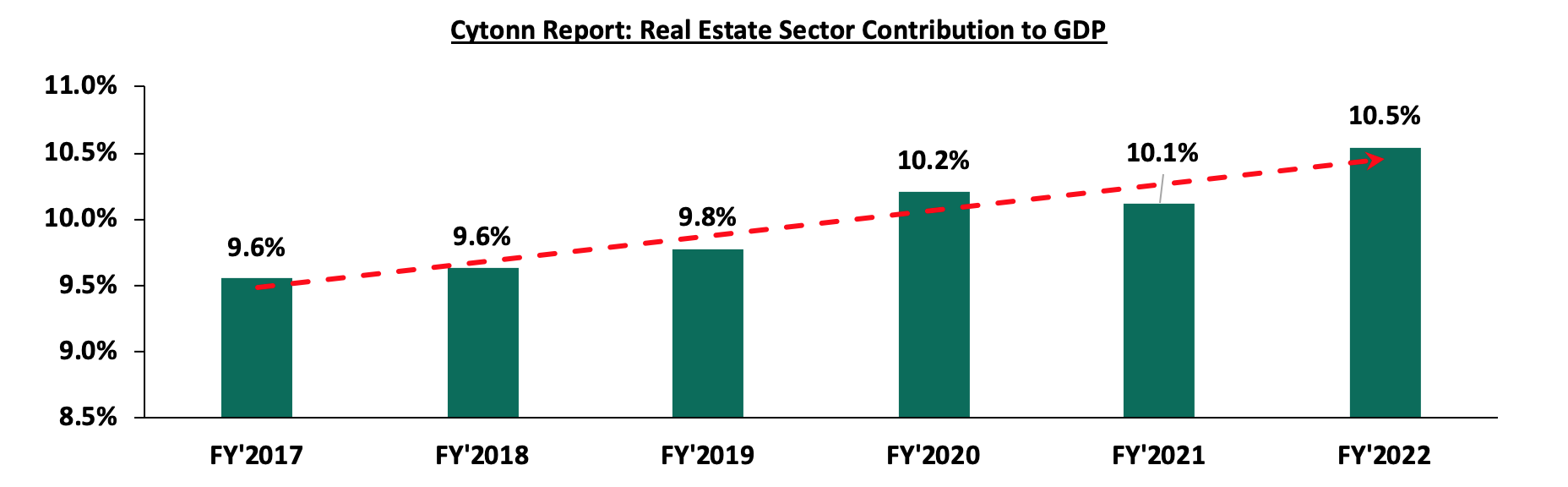

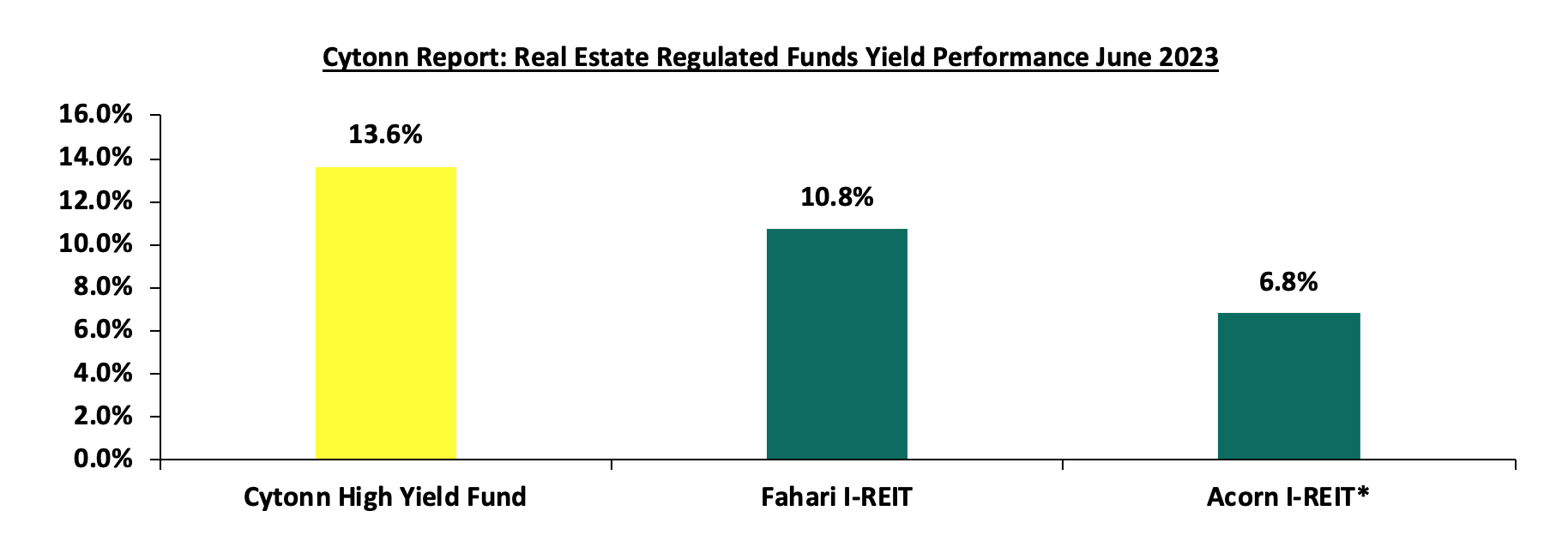

In H1’2023, the Real Estate sector in Kenya witnessed increased activity in terms of developments and property transactions, in comparison to the similar period in 2022, attributable to continued investments flowing into the sector. In light of this, the year-on-year (y/y) gross loans advanced to the Real Estate sector increased by 4.6% to Kshs 481.0 bn in Q1’2023, from Kshs 460.0 bn in Q1’2022, attributable to increased construction activities in the sector according to the Central Bank of Kenya (CBK). In the Nairobi Metropolitan Area (NMA), the residential sector recorded improved performance with a 0.2% points y/y increase in average total returns to 6.0%, from the 5.8% recorded in H1’2022. The commercial office sector recorded average rental yields of 7.8% in H1’2023, representing a 0.4% points y/y increase from 7.4% recorded in H1’2022. The retail sector recorded average rental yields of 8.2% in H1’2023, representing a 0.4% points y/y increase from 7.8% recorded in H1’2022. The land sector recorded an average annualized capital appreciation of 4.5% in H1’2023, with the average prices per acre in the NMA coming in at Kshs 128.5 mn in H1’2023, from Kshs 128.4 mn recorded in H1’2022;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.93%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

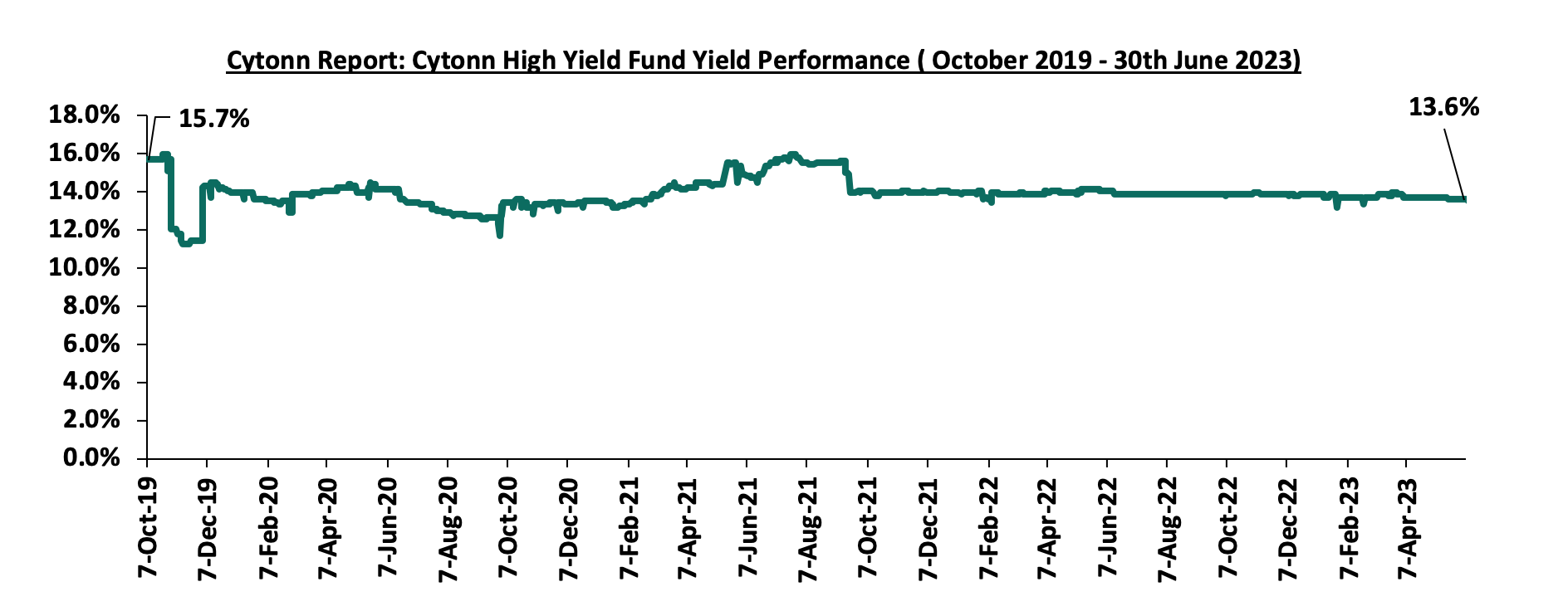

- Cytonn High Yield Fund closed the week at a yield of 13.56% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank’s June 2023 Global Economic Prospects, the global economy is projected to grow at a rate of 2.1% in 2023, 1.0% points slower than the estimated growth of 3.1% recorded in 2022. The latest projection is 0.8% points lower than the IMF’s earlier projection of 2.9% growth, with the downward revision being on the back of the continued tightening of monetary policies by the Central Banks around the world aimed at curbing the elevated inflationary pressures. Notably, advanced economies are expected to record a 0.7% growth in 2023, which is a significant decline from the 2.6% expansion recorded in 2022. However, the emerging markets and developing economies are projected to expand by 4.0% in 2023, marginally upwards from an estimated growth of 3.7% in 2022.

The expected slowdown in global economic growth in 2023 as compared to 2022 is majorly attributable to;

- The headline inflation remains elevated despite a recent deceleration due to falling energy prices, necessitating the hiking of interest rates by central banks around the world with the aim of anchoring inflation. As such, the global inflation is forecasted to gradually ease to 5.5% in 2023 from 7.3% in 2022, and,

- Tight global financial conditions occasioned by high cost of borrowing which have increased the risk of debt distress in emerging economies as most advanced economies continue to tighten their monetary policies.

The global economy is expected to remain subdued in the short term, mainly as a result of persistent inflationary pressures as well as tight monetary policies, which are expected to curtail economic growth.

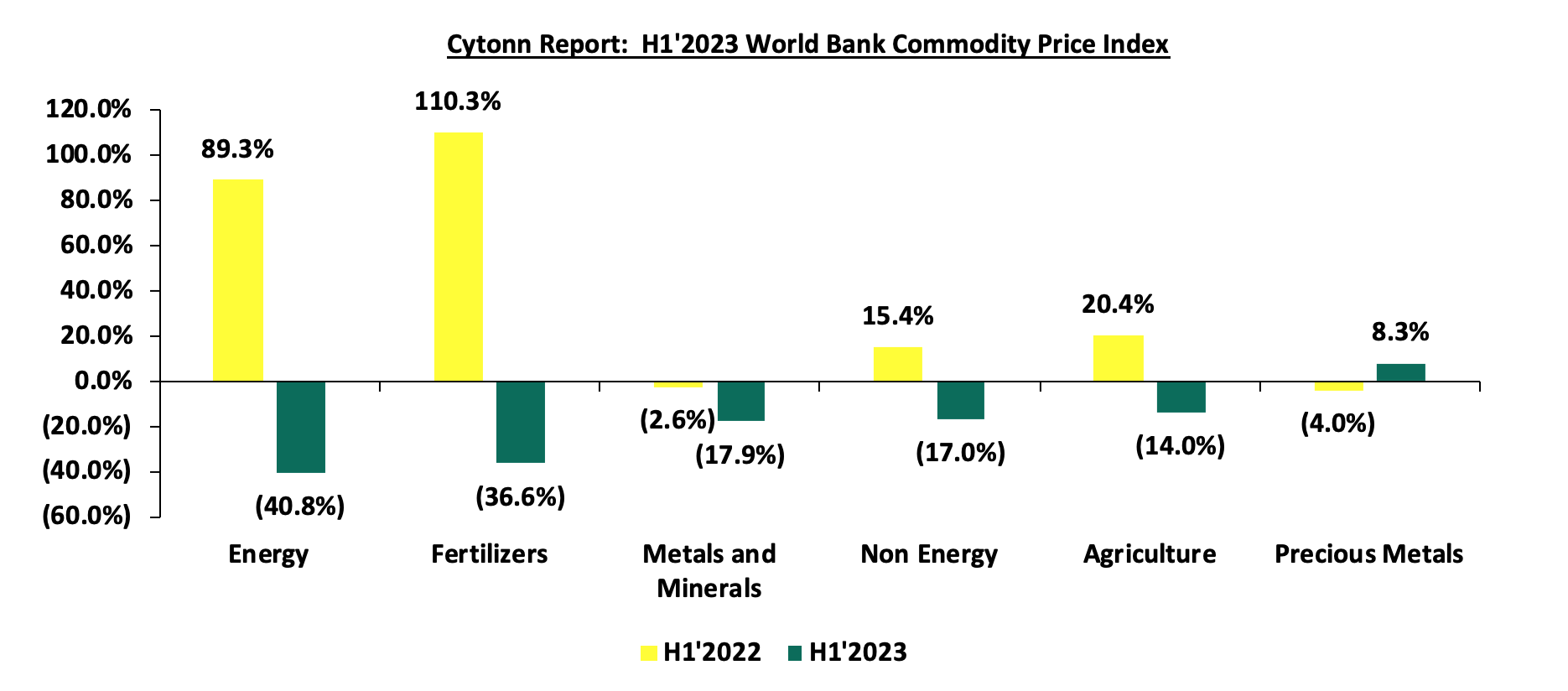

Global Commodities Market Performance:

Global commodity prices registered mixed performance in H1’2023, with prices of energy declining the most by 40.8% compared to the 89.3% increase recorded in H1’2022, mainly as a result of weaker global demand. Similarly, prices of fertilizers, Metals and Minerals, Non-energy and Agriculture declined by 36.6%, 17.9%, 17.0% and 14.0%, respectively, on the back of reduced global demand coupled with easing supply chain constraints. On the other hand, Precious Metal prices recorded an increase of 8.3% in H1’2023 compared to a decline of 4.0% in H1’2022, mainly attributable to mismatch between demand and supply. Below is a summary performance of various commodities;

Source: World Bank

Global Equities market performance:

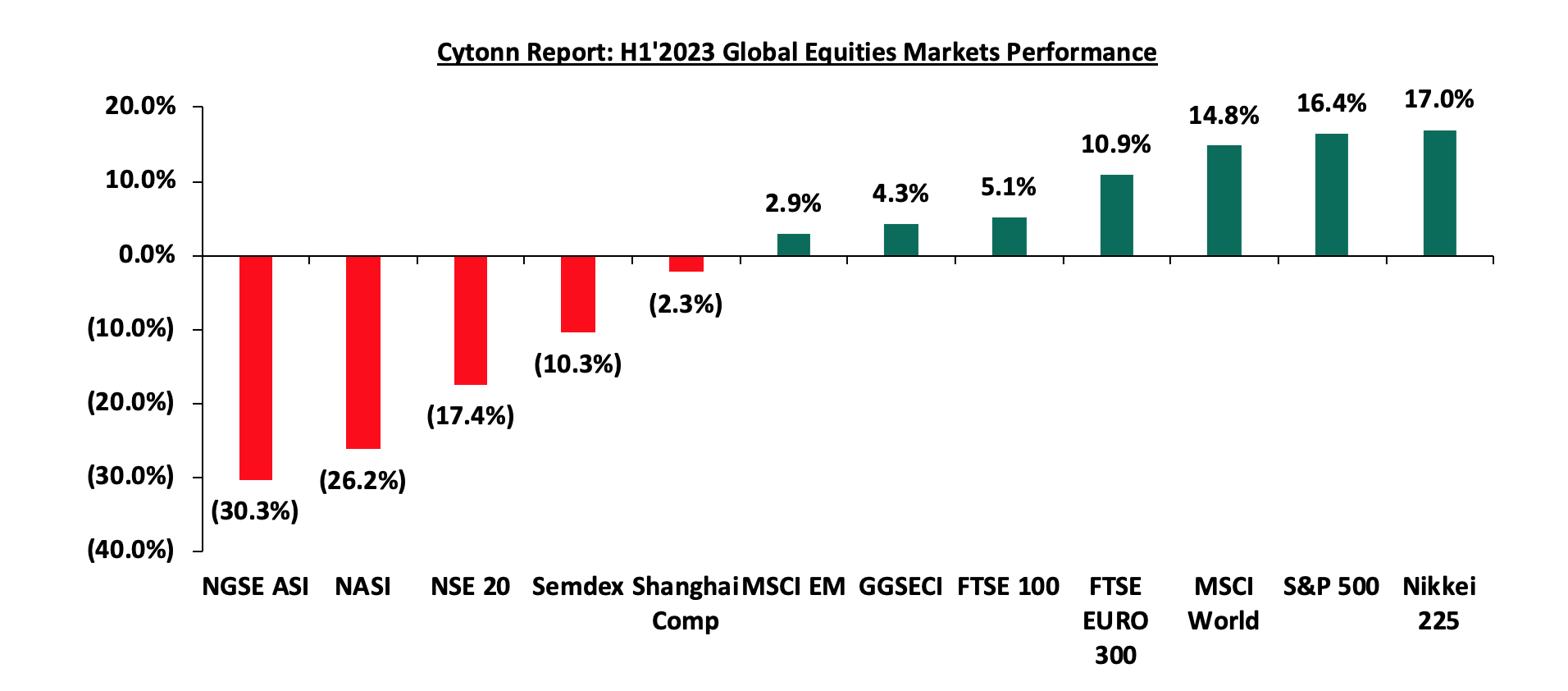

Global stock market recorded mixed performance in H1’2023, with most indices in developing economies declining attributable to capital flights following interest rate hikes in advanced economies aimed at curbing the inflationary pressures. Consequently, investors have resorted to place their investments in less risky markets, such as government papers and other investments alternatives. On the other hand, most indices in the developed countries recorded gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, Nikkei 225 recorded the largest gain at 17.0% in H1’2023 driven by gains recorded by companies in automotive industry as a result of easing supply chain constraints which has increased investor sentiments on the industry’s stocks. NGSE ASI was the largest decliner, recording losses of 30.3% with the performance being skewed by the weakened Nigerian Naira following recent decision by the Central Bank of Nigeria to adopt floating exchange rate regime. NASI was the second largest decliner, recording losses of 26.2%, mainly due to capital flight as foreign investors sold off their investments in the Kenyan equities market. Additionally, investors have continued to attach a higher risk premium to the country as a result of deteriorated business environment as evidenced by the average Purchasing Managers Index (PMI) of 48.9 in the first five months of 2023, mainly attributable to the high inflation rate which has remained above the government’s target of 2.5%-7.5% for the past one year as well as the continued weakening of the Kenyan Shilling which has depreciated by 13.9% on a year to date basis in 2023. Below is a summary of the performance of key indices:

*Dollarized performance

According to the World Bank, the Sub Saharan economy is projected to grow at a moderate rate of 3.2% in 2023, which is 0.5% lower than the 3.7% growth estimates recorded in 2022. The expected slowdown in the regional economic growth is mainly on the back of adverse weather conditions that have undermined agricultural productivity, weak external demand, tight global financial conditions and high inflationary pressures in most countries in the region. The challenges have continued to exacerbate fiscal deficits in most countries leading to increased debt sustainability concerns in Sub-Saharan Africa as the region’s public debt to GDP ratio, remained high at 56.0% in 2022, albeit a decline from 60.0% in 2021. The public debt is expected to remain high due to increased debt serving costs as a result of continued currency depreciations and increased interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures which could worsen public finance, increase public debt and weigh down on debt sustainability.

Currency Performance:

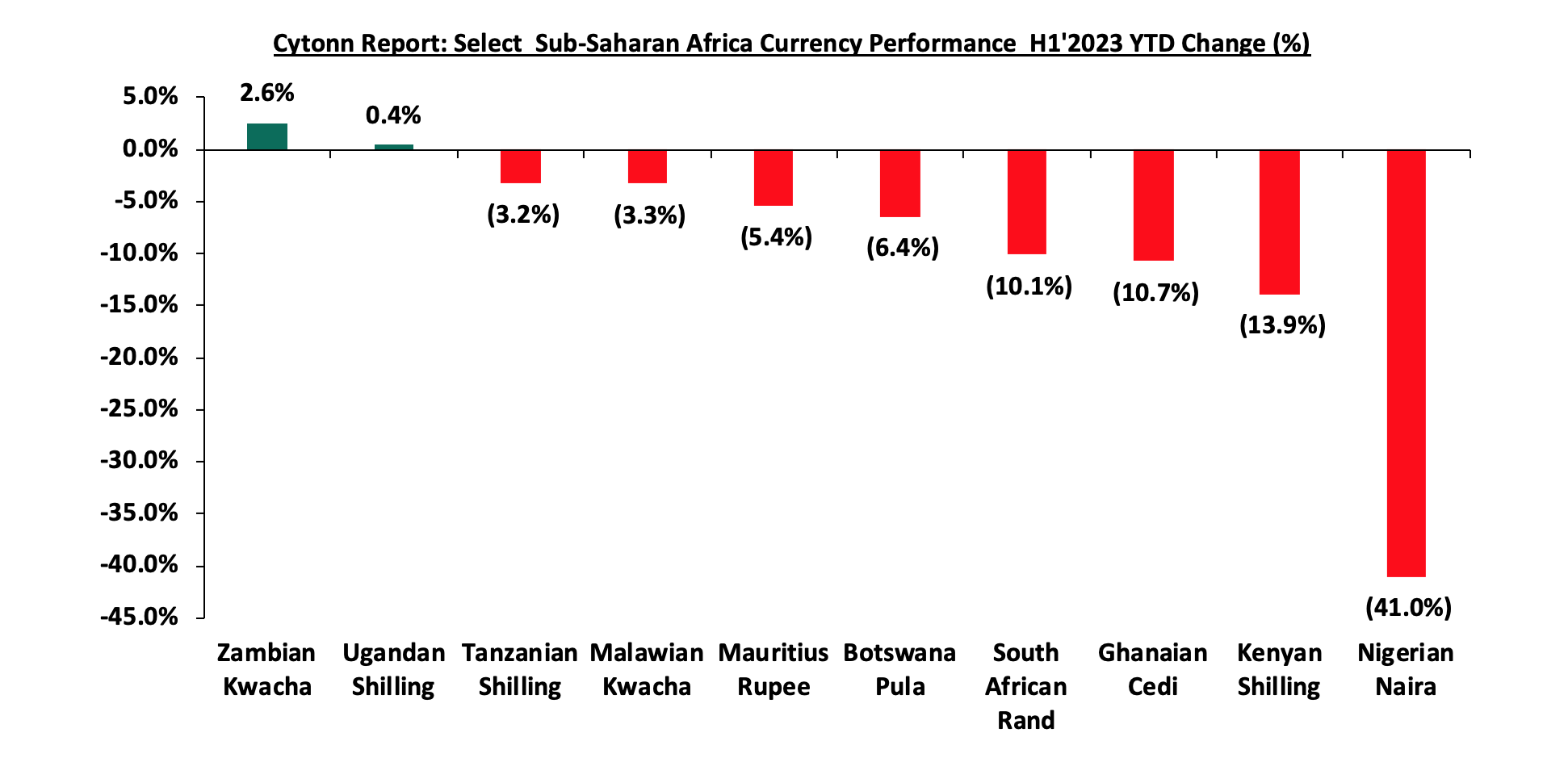

In H1’2023, most of the select Sub-Saharan currencies depreciated against the US Dollar, mainly attributable to the elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, and monetary policy tightening by advanced economies. The high interest rates in developed countries have led to massive capital outflows as investors, both institutional and individual seek to take advantage of the higher returns offered in developed economies. Further, the elevated inflationary pressures in most economies in the region puts pressure on the value of local currencies due to expensive importation. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: H1’2023 Select Sub Saharan Africa Currency Performance vs USD |

|

||||

|

Currency |

Jun-22 |

Jan-23 |

Jun-23 |

Last 12 Months change (%) |

YTD change (%) |

|

Zambian Kwacha |

17.1 |

18.1 |

17.6 |

(3.0%) |

2.6% |

|

Ugandan Shilling |

3,715.1 |

3,678.1 |

3,662.1 |

1.4% |

0.4% |

|

Tanzanian Shilling |

2,333.0 |

2,332.0 |

2,409.0 |

(3.2%) |

(3.2%) |

|

Malawian Kwacha |

1,022.0 |

1,009.0 |

1,043.0 |

(2.0%) |

(3.3%) |

|

Mauritius Rupee |

43.5 |

43.0 |

45.4 |

(4.3%) |

(5.4%) |

|

Botswana Pula |

12.1 |

12.6 |

13.5 |

(9.9%) |

(6.4%) |

|

South African Rand |

16.2 |

16.9 |

18.8 |

(13.8%) |

(10.1%) |

|

Ghanaian Cedi |

7.9 |

9.8 |

11.0 |

(27.8%) |

(10.7%) |

|

Kenyan Shilling |

117.8 |

123.4 |

140.5 |

(19.3%) |

(13.9%) |

|

Nigerian Naira |

414.6 |

447.6 |

758.8 |

(45.4%) |

(41.0%) |

Source: Yahoo Finance

The chart below shows the year to date performance of different sub-Saharan African countries in H1’2023;

Source: Yahoo Finance

Key take outs from the above table and chart include:

- The Zambian kwacha was the largest gainer against the USD Dollar, gaining by 2.6% year to date, mainly attributable to positive investor confidence following Zambia’s improved macroeconomic performance and strong trade surplus driven by higher copper price earnings on the back of easing global supply chain constraints,

- Nigeria Naira was the worst performing currency in H1’2023 and the largest decliner over the last twelve months, depreciating by 41.0% and 45.4%, respectively, mainly as a result of the recent decision by the Central Bank of Nigeria to adopt floating exchange rate regime, where the currency value of the Naira is allowed to vary according to the foreign exchange market, and,

- The Kenya Shilling depreciated by 13.9% in H1’2023 to close at Kshs 140.5 against the US Dollar, compared to Kshs 123.4 recorded at the beginning of the year, driven by increased dollar demand from importers, especially in the oil and energy sectors, the ever-present current account deficit, and the need for government debt servicing, which has continued to put pressure on the country’s forex reserves.

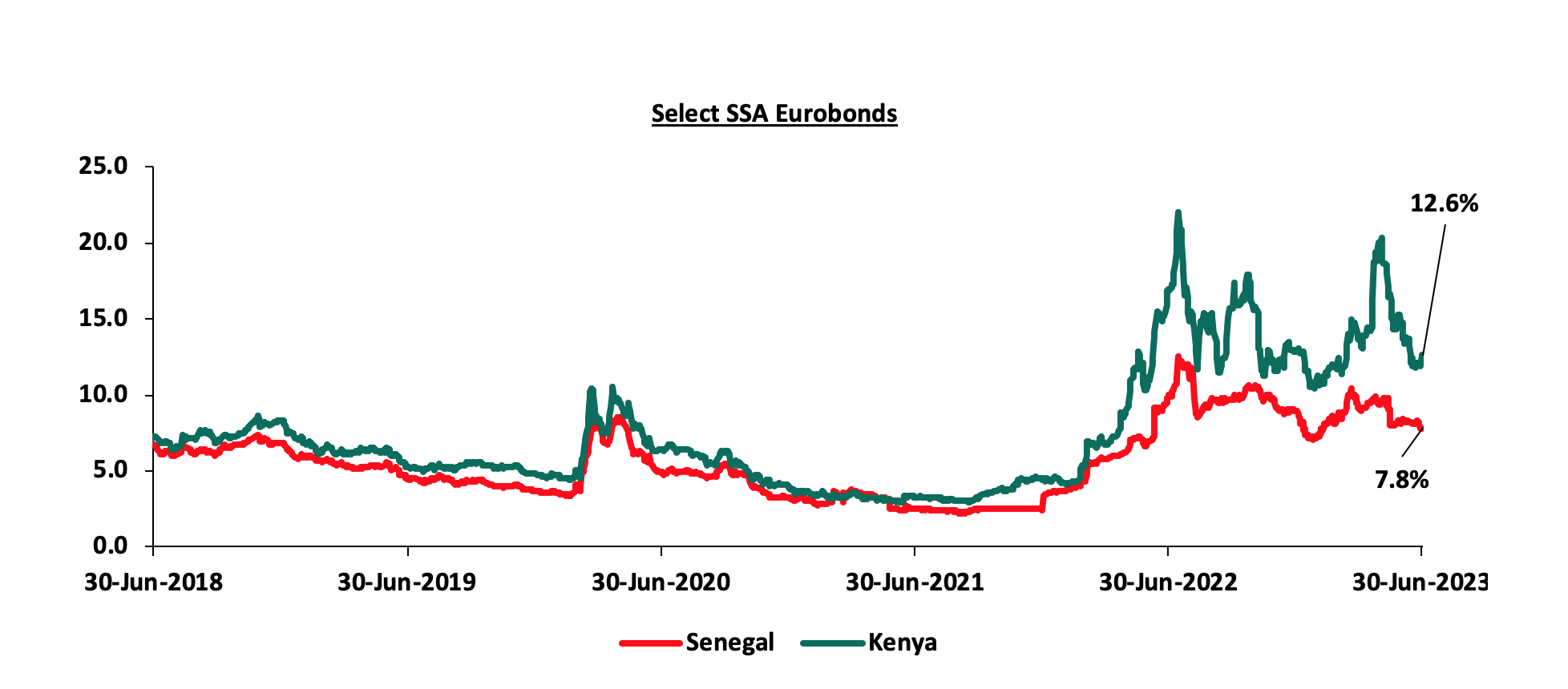

African Eurobonds:

Africa’s appetite for foreign-denominated debt has continued to decline in recent times, with no issuer during H1’2023, with most countries shying away from the Eurobonds market due to sustained high yields and tough macroeconomic conditions. The significant increase in yields was partly attributable to investors attaching a higher risk premium to Sub-Saharan Countries, driven by the region’s elevated inflationary pressures, public debt distress, and continued depreciation of local currencies. Yields on the Kenyan and Senegal Eurobonds remained elevated despite recording marginal declines of 0.3% points and 1.1% points in H1’2023 to 12.6% and 7.8%, respectively, from 12.9% and 8.9% recorded at the end of December 2022. Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Source: S&P Capital

Equities Market Performance:

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in H1’2023, with Zambia’s stock market (LASILZ) being the best performing market gaining by 15.2% YTD driven by the rallying of commodity prices due to easing global supply chain constraints with the country being the main exporter of Copper to countries such as China, Switzerland and Singapore. Nigeria’s NGSEASI was the worst performing stock market, declining by 30.3% YTD, with the index being weighed down by the devaluation of the Nigerian Naira following the recent decision by the Central Bank of Nigeria to adopt floating exchange rate regime. Kenya’s NASI was the second worst performing stock market, declining by 26.2% at the end of H1’2023, mainly attributable to increased capital flight with investors chasing higher returns from advanced economies following hiking of interest rates as well as deterioration in investor confidence in the country. This is mainly on the back of macroeconomic uncertainties occasioned by the high inflation rate of 7.9% as of June 2023 and the continued weakening of the Kenyan Shilling which has depreciated by 13.9% on a year to date basis in 2023. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance H1’2023 (Dollarized*) |

||||||

|

Country |

Index |

Jun-22 |

Jan-23 |

Jun-23 |

Last 12 Months change (%) |

YTD change (%) |

|

Zambia |

LASILZ |

398.6 |

406.2 |

468.1 |

17.4% |

15.2% |

|

Tanzanian |

DARSDEI |

1.6 |

1.6 |

1.7 |

7.7% |

8.6% |

|

Ghana |

GGSECI |

318.1 |

245.2 |

255.6 |

(19.7%) |

4.3% |

|

South Africa |

JALSH |

4,197.9 |

4,408.4 |

3,984.9 |

(5.1%) |

(9.6%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(14.5%) |

(10.4%) |

|

Uganda |

USEASI |

0.3 |

0.3 |

0.3 |

(9.4%) |

(15.0%) |

|

Kenya |

NASI |

1.0 |

1.0 |

0.8 |

(23.6%) |

(26.2%) |

|

Nigerian |

NGSEASI |

124.5 |

115.3 |

80.4 |

(35.5%) |

(30.3%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

GDP growth in Sub-Saharan Africa region is expected to slow down, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) Economic Survey 2023 the Kenyan economy recorded a 4.8% expansion in FY’2022, lower than the 7.6% growth recorded in FY’2021. The performance was supported by growth in most economic activities such as Financial and insurance, Information and communication and Transportation and storage which grew by 12.8%, 9.9% and 5.6%, respectively. The overall growth was however weighed down by the 1.6% contraction in the Agriculture, Forestry and Fishing sector, attributable to the drought experienced in most parts of the country in 2022. Despite the decline in the economic growth, the relatively high growth highlighted the economy’s resilience following multiple shocks such as supply chain constraints, soaring global fuel prices, elevated inflationary pressures and currency depreciation. The Kenyan Economy is projected to grow at an average of 5.2% in 2023 according to various organizations as shown below:

|

Cytonn Report: Kenya 2023 growth Projections |

||

|

No. |

Organization |

2023 GDP Projections |

|

1 |

International Monetary Fund |

5.1% |

|

2 |

National Treasury |

6.1% |

|

3 |

World Bank |

5.0% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.0% |

|

Average |

5.2% |

|

Source: Cytonn Research

Key to note, Kenya’s general business environment deteriorated in the first half of 2023, with the average Purchasing Manager’s Index for the first five months of the year coming at 48.9, compared to 49.7 recorded in a similar period in 2022. The deterioration was mainly on the back of the elevated inflationary pressures experienced in the country, which have seen consumers cut back on spending, coupled with aggressive depreciation of the Kenyan shilling which has contributed significantly to the fall in production output by most businesses. Additionally, the Moody’s Credit Rating agency downgraded Government of Kenya’s long-term foreign currency and local-currency issuer ratings and senior unsecured debt ratings to B3 from B2 with a negative outlook. The downgrade was on the back of increased liquidity risk partly attributable to reduced investor appetite of longer dated government securities and the rising cost of domestic issuance with investors demanding higher rates from government issuance. The downgrade indicates increased material default risk with very limited margin of safety amid tighter liquidity as well as high debt servicing obligations in the next fiscal year. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signal an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Inflation:

The average inflation rate increased to 8.5% in H1’2023, compared to 6.3% in H1’2022, attributable to high fuel and food prices. Notably, fuel prices increased by 22.9%, 28.3% and 35.6% in June 2023 to Kshs 195.5, Kshs 179.7, and Kshs 173.4, from Kshs 159.1, Kshs 140.0, and Kshs 127.9 per liter in June 2022 for Super petrol, Diesel, and Kerosene, respectively. Inflation for the month of June 2023 marginally eased to 7.9%, from 8.0% recorded in May 2023, mainly driven by a 1.3% increase in the food and non-alcoholic beverages index. Below is a chart showing inflation trend for the last five years:

For the last 13 months, Kenya’s inflation has persistently remained above the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, despite efforts by the Monetary Policy Committee (MPC) to contain the rise by raising the Central Bank Rate (CBR) by cumulative of 300.0 bps to 10.5% in June 2023 from the 7.5% CBR rate that was set in July 2022. Going forward, we expect the inflationary pressures to remain elevated in the short to medium term, mainly on the back of high food and fuel prices, which are key components of the headline inflation index. Additionally, the complete removal of the fuel subsidy, coupled with the increase in VAT on petroleum products to 16.0% from 8.0% in the new Finance Act 2023 is expected to add more pressure on the fuel prices in the country.

June 2023 Inflation

The year-on-year inflation rate in the month of June 2023 eased to 7.9%, from the 8.0% inflation rate recorded in the month of May 2023, while the monthly inflation rate for June 2023 was 0.8%. This was in line with our expectation of the inflation rate to come in within a range of 7.7%-8.1%. The headline inflation was largely driven by increase in prices of commodities in the following categories; food and non-alcoholic beverages; housing, water, electricity, gas, and other fuels; and transport. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – June 2023 |

|||

|

Broad Commodity Group |

Price change m/m (May-2023/June-2023) |

Price change y/y (May-2022/June-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

1.3% |

10.3% |

The m/m increase was mainly driven by increase in price commodities such as carrots, onions, tomatoes and maize grain-loose. The increase was, however, mitigated by drop in prices of commodities such potatoes, avocado, kales and cabbages |

|

Housing, Water, Electricity, Gas and Other Fuel |

0.6% |

9.4% |

The m/m change was mainly due to increase in prices of electricity. The increase was, however, mitigated by the drop in prices of LPG gas |

|

Overall Inflation |

0.8% |

7.9% |

The m/m was mainly driven by 1.3% increase in prices of food and non-alcoholic Beverages |

Inflationary pressures in the country continue to remain elevated and above the Central Bank of Kenya target range of 2.5%-7.5% for a thirteenth consecutive month to June 2023, with commodities under food and non-alcoholic beverages being the largest contributors of inflation. The sustained inflationary pressures continue despite the monetary policy committee intervening with subsequent hikes in the Central Bank Rate, raising the CBR rate by a cumulative of 300.0 bps since July 2022 to 10.50% in June 2023. Going forward, we expect the inflationary pressures in the country to remain elevated in the short to medium term due to high fuel and electricity prices following the increase on VAT on petroleum products to 16.0% in the Finance Act 2023 from 8.0% that was introduced in 2018, with fuel prices being a major contributor to the headline inflation. Additionally, the sharp rise in sugar prices witnessed in the month of June, coupled with the introduction of excise duty on imported sugar at the rate of Kshs 5.0 per kg is expected to exacerbate the food inflation. Further, we are of the view that the eventual slowdown in inflationary pressure is pegged on removing the impediments on the supply and production chain so as to match the supply and demand side thereby easing food supply deficit in the country.

The Kenyan Shilling:

The Kenyan Shilling depreciated against the US Dollar by 13.9% in H1’2023, to close at Kshs 140.5, from Kshs 123.4 as at the end of FY’2022, partly attributable to increased dollar demand from importers, especially in the energy, oil and manufacturing sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. During the week, the Kenya Shilling depreciated against the US Dollar by 0.1% to close at 140.5, from 140.4 the previous week. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit estimated at 4.9% of GDP in twelve months to January 2023, from 5.6% recorded in a similar period last year, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.3% of Kenya’s external debt was US Dollar denominated as of March 2023

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 1,688.0 mn in 2023 as of May 2023, albeit 1.8% lower than the USD 1,718.6 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the May 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 55.4% in the period, followed by Europe at 17.7% while the rest of the world accounted for 26.8% of the total,

- High Forex reserves currently at USD 7.5 bn (equivalent to 4.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, albeit lower than EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn (Kshs 138.6 bn) World Bank loan facility received in June 2023 under the Development Policy Operation (DPO) and are expected to be boosted further by the expected USD 410 mn (Kshs 56.7 bn) from the International Monetary Fund (IMF) and the USD 500.0 mn (Kshs 69.6 bn) commercial loan secured from a syndicate of global banks consisting of American Citibank, British Standard Chartered Bank, Stanbic Bank, and South Africa’s RMB Holdings Ltd, and,

- The tourism inflow receipts came in at KSHS 268.1 bn in 2022, a significant 82.9% increase from KSHS 146.5 bn inflow receipts recorded in 2021

Monetary Policy:

The Monetary Policy Committee (MPC) met four times in H1’2023 and for the first time since May 2016, the Central Bank Rate was set at 10.5% in the Fourth sitting in June 2023. The MPC noted that the sustained elevated inflationary pressures in the country on the back of high fuel and commodity prices. Below are some of the Key highlights from the meeting:

- Overall Inflation increased to 8.0% in May 2023 from 7.9% in April 2023 on the back of high food and fuel prices in the country. Food inflation rose to 10.2% in May 2023 from 10.1% in April 2023, mainly due to increases in the prices of for sugar. However, the food inflation was slowed down by the decrease in the price of some key food items such as vegetables attributable to improved supply due to long rains and lower global food prices. Additionally, fuel inflation remained elevated at 13.6% in May 2023 from 13.2% in April 2023 attributable to the government’s decision to completely remove fuel subsidy program coupled with the upward adjustments of electricity prices. We expect the inflation to remain elevated in the near term partly attributed to the high electricity prices, the removal of fuel subsidy and associated second round effect,

- The leading economic indicators pointed to a strong performance of the Kenyan economy in the first half of 2023 driven by the activities in the service sector and the recovery of the Agriculture sector. The economy is expected to remain resilient in 2023 supported by continued strong performance of the services sector and expected recovery in agriculture sector,

- The Central Bank of Kenya forex reserve which currently stand at USD 7.5 bn representing a 4.1 months of import cover, continues to provide adequate cover against any short term shocks in the foreign exchange markets

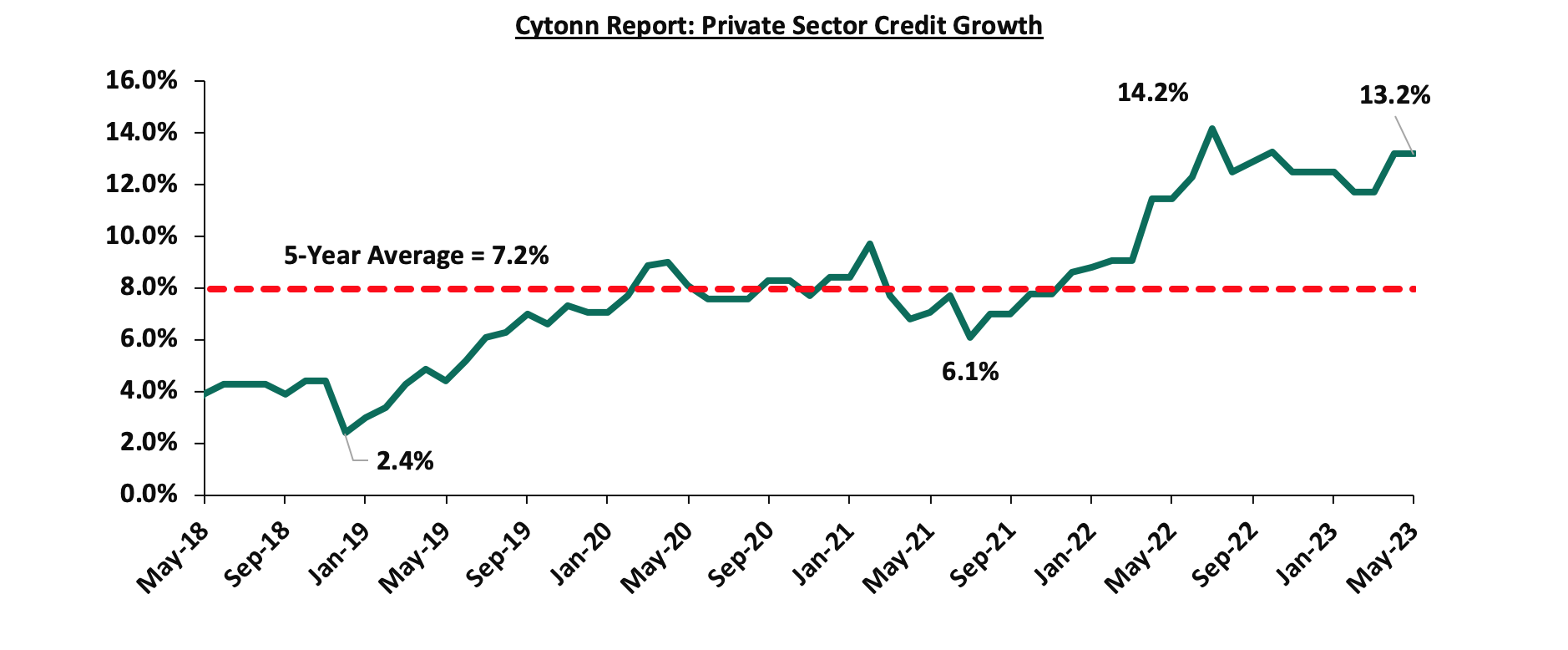

- Private sector credit growth stood at 13.2% in May 2023, similar to what was recorded in April 2023. Key sectors that recorded strong credit growth were transport and communication, manufacturing, trade, and Consumer durables of 22.0%, 19.3%, 15.4%, and 11.9%. Consequentially, the number of loan application and approval remained strong, reflecting increased demand and resilient economic activities. The chart below shows the movement of the private sector credit growth of the last five years:

- Goods exports remained strong having grown by 5.5% in the 12 months to May 2023 compared to 12.1% recorded in a similar period in 2022. Notably, receipts from tea and manufacturing goods exports increased by 10.2% and 25.4%, respectively during the period. The increase in receipts from tea exports is attributed to improved prices due to increased demand from traditional markets. In addition, imports declined by 2.3% in the 12 months to May 2023 compared to 20.4% growth recorded in a similar period in 2022, on the back of lower imports of infrastructure related equipment due to completion of major projects. Remittances stood at USD 4.0 bn in 12 months to May 2023 and were 0.1% higher compared to what was recorded in the same period in 2022,

- The banking sector remains resilient and stable with strong liquidity and capital adequacy ratios, despite the deterioration in asset quality. The Gross Non-Performing loans to gross loans ratio increased to 14.9% in May 2023, compared to 14.6% in April 2023. The increase in non-performing loans was noted in sectors such as Manufacturing, trade, real estate and transport and communication sector. However, banks have continued to make adequate provisioning for the NPLs, and,

- The Committee noted the ongoing implementation of the FY2022/23 Government Budget, particularly the recent strong tax revenue collection reflecting enhanced tax administration efforts, evidenced by the revenue collections of Kshs 1,812.2 bn in the FY’2022/2023 as at the end of May, equivalent to 82.7% of the revised estimates of Kshs 2,192.0 bn for FY’2022/2023 and was 90.2% of the prorated estimates of Kshs 2,009.3 bn. The committee also noted the proposed FY2023/24 budget is expected to support the envisaged fiscal consolidation.

The MPC concluded that following the sustained inflationary pressures, the elevated global risks and their potential impact on the domestic economy, there was a need for further tightening of the monetary policy in order to anchor inflation within its target range of 2.5% to 7.5%. Going forward, we expect the inflationary pressures to remain elevated in the short term, mainly on the back of high food and fuel prices. Additionally, the implementation of the Finance Act 2023 which contains a number of tax adjustments such as increase in VAT on petroleum products to 16.0% from the 8.0%, as well as introduction of excise duty of Kshs 5.0 per kg on imported sugar is expected to worsen fuel and food prices with businesses transferring the added cost to the consumers. The Committee will meet again in July 2023, but will closely monitor the impact of the policy measures as well as development in domestic and global economy and take additional measures as necessary.

Fiscal Policy:

The total Kenyan budget for the FY’2023/2024 National Budget increased by 8.7% to Kshs 3.7 tn from the Kshs 3.4 tn in FY’2022/2023 while the total revenue inclusive of grants increasing by 15.7% to Kshs 3.0 tn from the Kshs 2.6 tn in FY’2022/2023. The increase is mainly due to a 17.3% increase in ordinary revenue to Kshs 2.6 tn for FY’2023/2024, from the Kshs 2.2 tn in FY’2022/2023 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2023/2024, on the back of the current operating environment with the business environment deteriorating to an average PMI for the first 5 months in 2023 coming at 48.9 below the 50-mark threshold, mainly occasioned by high inflationary pressures and the rising interest rates. For more information, see our note on Kenya’s FY’2023/2024 Budget Review.

For the FY’2022/2023, we do not expect the government to meet its revenue collection target having collected Kshs 1,812.7 bn, equivalent to 82.7% of the revised estimates of Kshs 2,192.0 bn for FY’2022/2023 and 90.2% of the prorated estimates of Kshs 2,009.3 bn in the first eleven months of FY’2022/2023. Notably, the total expenditure amounted to Kshs 2,601.6 bn, equivalent to 72.0% of the revised estimates of Kshs 3,612.3 bn, and 86.4% of the prorated expenditure estimates of Kshs 3,010.3 bn, an indication of modest spending by the government. The total borrowings as at the end of May 2023 amounted to Kshs 776.4 bn, equivalent to 55.2% of the revised estimates of Kshs 1,407.1 bn and 60.2% of the prorated estimates of Kshs 1,289.9 bn.

Going forward, we believe that the Tax adjustments in the adopted finance act 2023 will widen the tax base revenue for the government and the full implementation of the act will enable the government enhance the revenue collections.

H1’2023 Highlights:

- The Kenya Revenue Authority released the draft regulations for the Excise Duty (Excisable Goods Management Systems)(Amendment) Regulations, 2023 having reviewed the previous Excise Duty (Excisable Goods Management Systems)(Amendment) Regulations, 2017, under the Excise Duty Act No. 23 of 2015, seeking to increase the stamp duty fees on various commodities. For more information, please see our Cytonn Weekly #03/2023,

- The National Treasury presented the Supplementary Budget for FY’2022/23 to the National Assembly, seeking to slightly increase the gross total budget by 0.4% to Kshs 3,373.3 bn, from the previous estimates of Kshs 3,358.6 bn. Mainly due to an increase in the recurrent expenditure by 6.6% to Kshs 1,496.9 bn in the Supplementary estimates from Kshs 1,403.9 bn in the Original estimates. On the other hand, Development expenditure was set to reduce by 14.9% to Kshs 609.1 bn in the supplementary estimates from Kshs 715.4 bn in the original estimates. For more information, please see our Cytonn weekly #06/2023,

- S&P Global Ratings downgraded Kenya’s outlook to negative from stable, signaling increased risks of defaults in debt repayments amid weakening liquidity position aggravated by sustained decline in foreign exchange reserves as well as high debt servicing obligations in the next fiscal year. Furthermore, the constrained access to international capital markets has heightened Kenya’s medium term fiscal and external refinancing risks. For more information, please see our February 2023 Cytonn Monthly,

- The Central Bank of Kenya announced the issuance of the Foreign Exchange Code (the FX Code) on 22 March 2023 to commercial banks, in a move to regulate wholesale transactions of the foreign exchange market in Kenya. For more information, please see our Cytonn Weekly #12/2023,

- The Central Bank of Kenya announced the issuance and usage of the Kenya Quick Response Code Standard 2023 (KE-QR Code Standard 2023) which is aimed at guiding banks and payment service providers that are approved and regulated by the Central Bank in issuing of Quick Response Codes to consumers and businesses that accept digital payments. For more information, please see our Cytonn Weekly #18/2023,

- The Moody’s Credit Rating agency downgraded Government of Kenya’s long-term foreign currency and local-currency issuer ratings and senior unsecured debt ratings to B3 from B2 with a negative outlook. This indicated increased material default risk with very limited margin of safety amid tighter liquidity. For more information, please see our Cytonn Weekly #19/2023,

- The International Monetary Fund (IMF) announced that it had reached a staff level agreement with Kenyan authorities to conclude the fifth reviews of Kenya’s economic program under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) arrangements. This will allow Kenya to access financing of USD 410.0 mn (Kshs 56.7 bn) once the formal review is completed by July 2023. For more information, please see our Cytonn Weekly #21/2023,

- The World Bank approved a USD 1.0 bn (Kshs 138.6 bn) loan under the Development Policy Operation (DPO) to provide low cost budget financing, as well as to support key policy and institutional reforms for Kenya’s near term objectives of fiscal consolidations and long term goal of green and inclusive growth. For more information, please see our May 2023 Cytonn Monthly,

- The Kenya National Bureau of Statistics (KNBS) released the y/y inflation for May 2023, which came in at 8.0%, up from the 7.9% recorded in April 2023. This was in line to our expectations of an increase to within a range of 7.9% to 8.3%. For more information, please see our May 2023 Cytonn Monthly,

- Stanbic Bank released its monthly Purchasing Manager’s Index (PMI), highlighting that the index for the month of May 2023 came in at 49.2, up from 47.4 in April 2023, showing some slight improvement in business environment but still a contraction. This is the fourth consecutive month of sustained deterioration in the business environment. For more information, please see our Cytonn Weekly #23/2023,

- The government of Kenya secured a commercial loan of USD 500.0 million (Kshs 69.6 billion) to ease its financial distress According to the director-in-charge of debt management at the National Treasury, the loan was tapped from a syndicate of global banks consisting of American Citibank, British Standard Chartered Bank, Stanbic Bank, and South Africa’s RMB Holdings Ltd. For more information, please see our Cytonn Weekly #23/2023,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15 June 2023 to 14 July 2023. Notably, retail fuel prices for Diesel and Super Petrol per litre declined by 0.7% and 0.4% to Kshs 167.28 and Kshs 182.04, from Kshs 168.40 and 182.70 respectively. However, the retail price per litre for Kerosene increased by Kshs 0.2% to Kshs 161.48 from Kshs 161.13. For more information, please see our Cytonn Weekly #24/2023, and,

- The National Treasury gazetted the revenue and net expenditures for the eleven months of FY’2022/2023 ending 31 May 2023, highlighting that revenue collected as at the end of May 2023 amounted to Kshs 1,812.2 bn, equivalent to 82.7% of the revised estimates of Kshs 2,192.0 bn and 90.2% of the prorated estimates of Kshs 2,009.3 bn. For more information, please see our Cytonn Weekly #24/2023.

Weekly Highlights:

- Finance Act 2023

The Cabinet Secretary for the National Treasury tabled the Finance Bill 2023 to the parliament for discussion and was assented into law by the President of Kenya on 27 June 2023. As highlighted in our Cytonn Weekly #25/2023, the proposed tax measures in the Finance Bill 2023, were expected to add Kshs 379.2 bn to the exchequer for the fiscal year 2023/24. After discussion and consideration by the parliament, the bill was passed by Parliament following the third reading. Below, we highlight the key tax changes in the assented Finance Act as a follow up to our previous highlight;

Under the Income Tax Act;

- Introduction of withholding tax (WHT) on Payments made in respect of digital content monetization. The Finance Bill 2023 had proposed introduction of 15.0% WHT on collections made by digital content creators, however the finance committee made an amendment to the clause by capping the WHT at 3.0%. The government move to introduce the WHT on digital content is attributable to the growing popularity of digital content creation in Kenya due to increase access to internet, digital marketing and the growing youthful population, as such it will enable the government to widen its tax base,

- The Finance Bill 2023, introduced a new contribution to the National Housing Development Fund (NHDF). Initially, the bill had proposed a 3.0% deduction from employees’ basic monthly salary with the employer matching the contribution. However, the finance committee recommended a downward revision of the rate to 1.5% deduction from employees’ basic monthly salary, with the employer matching the contribution. Additionally, the committee proposed the removal of the maximum limit of individual contributions, and the contributors will not access their contributions at the end of the 7 years as earlier proposed,

- Introduction of a new tax at a rate of 15.0% for repatriated profit for non-residents who do not distribute dividends in Kenya, equivalent to the rate charged on dividend paid to non-residents,

- The Finance Bill 2023 proposed to change the bands for Turnover Tax (ToT) to a range of Kshs 500,000.0 to Kshs 25.0 mn from the current Kshs 1.0 mn to Kshs 50.0 mn. Additionally, the bill proposes to increase the turnover tax to 3.0%, from the current 1.0%. The move by the government to increase the turnover tax is mainly to increase its revenue,

- The bill also proposed reduction of the rate of Residential Rental Income tax to 7.5% from the current 10.0% in a bid to promote compliance of property owners and boost the government’s revenue collection,

- The Finance bill 2023 proposed to introduce a 5.0% WHT on payments made to residents’ persons or permanent establishments in respect to sales promotions, marketing and services. The move is to enhance compliance in the industry by tracking the revenues earned by the respective service providers and enhance compliance, and,

- The Finance Bill 2023, proposed to introduce two new tax band; i) 32.5% for monthly incomes between Kshs 500,000.0 and 800,000.0, and, ii) 35.0% for monthly incomes above Kshs 800,000.0. A move aimed at increasing the tax revenue to support the fiscal budget. However, with majority of Kenyans earning less than Kshs 100,000.0 per month, its impact on the tax revenue will be very negligible.

Under the Excise Duty Act;

- The Finance Bill 2023 proposed to repeal annual inflation adjustment, which currently the commissioner general has the power to adjust the specific rate of excise duty once per year to consider inflation. The proposal is a welcomed move since it will provide much-needed certainty for business planning,

- The finance bill 2023 proposed the introduction of excise duty on imported sugar at the rate of Kshs 5.0 per kg excluding the sugar imported or purchased locally for use in the manufacture of pharmaceutical products,

- The Finance bill 2023, proposed an introduction of 15.0% excise duty on fees charged on the advertisement on alcoholic beverages, betting, gaming, and lottery and prize competition, a move aimed at discouraging consumption of the services deemed inimical to citizens,

- The Finance bill 2023 proposed the introduction of excise duty on imported fish at Kshs 100,000.0 per metric ton or 10.0% of the value, a move aimed at protecting the local fishing industry,

- The bill proposed to introduce a fine of Kshs 5.0 mn or a jail term not exceeding 3 years upon conviction to offenses relating to excise stamps. A proposal aimed at curbing illicit trade in excisable goods and encourage compliance that may support revenue collection by the government, and,

- The bill proposed to decrease excise duty on telephone, internet, and fees charged on money transfer services agencies and other financial services to 15.0% from the current 20.0%. This proposal is aimed at increasing the affordability of mobile devices and promote accessibility to these services.

Under the Value Added Tax Act;

- The Finance Bill 2023 proposed to subject petroleum products excluding liquid petroleum gas (LPG) to a VAT at a standard rate of 16.0%, up from the 8.0% introduced in 2018, this was after a transition clause that provided for an exemption of VAT for such products for a period of 2 years expired. The proposed move is expected to increase the cost of production, given that fuel is a major input in most businesses. As such the cost of living is expected to rise given that producers will pass the cost to consumers through hike in consumer prices. On the other hand, the bill proposed the zero rate on LPG products to lower their cost, and,

- The bill also proposed the removal of VAT for Aircraft, parts and engines as part of the government's bid to support the aviation sector and improve the profitability of the airlines

Given the tight fiscal space, the Finance Bill 2023 aims to shore tax revenue which is expected to support the 3.7 tn budget for FY’2023/2024. The government intends to mobilize ordinary revenue of Kshs 2.6 tn, 17.3% increase from the 2.2 tn in FY’2022/23. As such, the government will have a fiscal deficit inclusive of grants of Kshs 718.0 bn. However, we expect the increase and introduction of additional taxes in addition to the changes in National Health Insurance Fund (NHIF) contributions and the new contribution requirement in the National Social Security Fund (NSSF) to severely impact households’ disposable income.

- Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their addendum to monthly statement on the maximum retail fuel prices in Kenya that was released on 14 June 2023. The move was in line with the expected implementation of the Finance Act 2023 which has revised the VAT on Petroleum products to 16.0% from 8.0% effective 1 July 2023. Notably, fuel prices for Super petrol, Diesel, and Kerosene increased to Kshs 195.5, Kshs 179.7 and Kshs 173.4, from Kshs 182.0, Kshs 167.3, and Kshs 161.5 respectively.

Fuel prices in the country remain elevated, despite global fuel prices dropping by 11.6% to USD 74.3 per barrel as of 29 June 2023, from a high of USD 84.1 per barrel recorded on 1 April 2023 and the average landed costs declining during the month of May except for Diesel. Notably, the elevated fuel prices are mainly on the back of the government’s decision to completely remove the fuel subsidy program which cushioned consumers against the high fuel prices, coupled with the continued currency depreciation being experienced in the economy, hence elevating the cost of fuel importation.

Going forward, we maintain the view that the government needs to implement long term strategies to resuscitate the currently weakening Kenyan shilling given that the global fuel prices and the average landing cost of fuel are dropping yet the effect is not reflecting the fuel prices in the country as the fuel prices continue to rise. Additionally, the rise in fuel prices in the country is expected to underpin inflationary pressures in the country, as fuel is a major input in most businesses

Money Markets, T-Bills Primary Auction:

During H1’2023, T-bills were oversubscribed, with the overall subscription rate coming in at 121.7%, up from 89.3% in H1’2022. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 481.8 bn against the offered Kshs 100.0 bn, translating to an oversubscription rate of 481.8%, higher than the oversubscription rate of 109.0% recorded in H1’2022. Overall subscription rates for the 364-day and 182-day papers came in at 37.9% and 61.3%, lower than the 101.7% and 69.0%, respectively, recorded in H1’2022. The average yields on the 364-day, 182-day, and 91-day papers increased by 1.2% points, 2.1% points and 2.7% points to 11.0%, 10.5%, and 10.2% in H1’2023, respectively, from 9.7%, 8.4%, and 7.5%, respectively, in H1’2022. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation, currency depreciation, and tight liquidity positions, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 91.6%, albeit lower than the 92.7% recorded in H1’2022, with the government accepting a total of Kshs 668.3 bn out of the Kshs 730.0 bn worth of bids received;

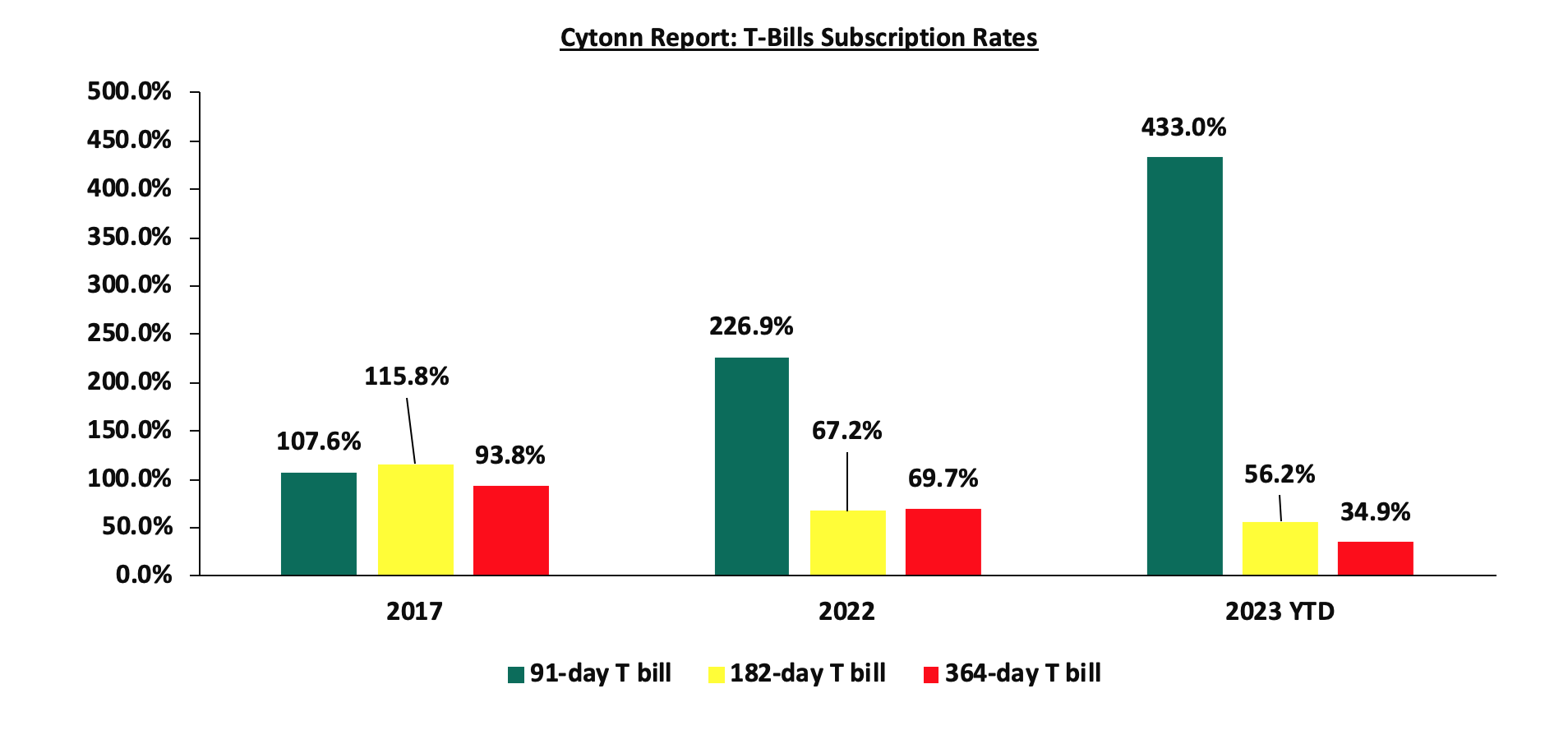

During the week, T-bills remained undersubscribed for the third consecutive week, with the overall subscription rate coming in at 39.5 %, a decrease from the under-subscription rate of 63.9% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 5.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 144.5%, albeit lower than the 275.3% recorded the previous week. The subscription rate for the 364-day paper declined to 15.1%, from 23.4% recorded the previous week, while the subscription rate for the 182-day paper increased to 22.0%, from 19.9% recorded the previous week. The government rejected expensive bids, accepting a total of Kshs 5.5 bn worth of bids out of Kshs 9.5 bn bids received, translating to an acceptance rate of 58.2%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day and 91-day papers increasing by 22.3 bps, 8.4 bps, and 11.9 bps to 12.2%, 11.9%, and 11.9%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

Primary T-Bond Auctions in H1’2023

During H1’2023, the Government issued four new bonds, reopened five, and issued nine bonds on tap-sale, seeking to raise Kshs 375.0 bn. The bonds were generally oversubscribed, receiving total bids worth Kshs 477.7 bn translating to an overall subscription rate of 127.4%. The government rejected expensive bids and only accepted bids worth Kshs 442.0, translating to an acceptance rate of 92.5%. The table below provides more details on the bonds issued during the period:

|

Cytonn Report: Bonds Issued in H1’2023 |

|||||||||

|

Issue Date |

Bond Auctioned |

Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised/Accepted (Kshs bn) |

Total bids received (Subscription) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

16/01/2023 |

FXD1/2020/005 (re-opened) |

2.4 |

11.7% |

50.0 |

31.5 |

41.6 |

12.9% |

83.3% |

75.7% |

|

FXD1/2022/015 (re-opened) |

14.3 |

13.9% |

14.3% |

||||||

|

20/01/2023 |

FXD1/2020/005 - Tapsale |

2.4 |

11.7% |

10.0 |

17.6 |

18.0 |

12.9% |

180.2% |

97.8% |

|

FXD1/2022/015 - Tapsale |

14.3 |

13.9% |

14.2% |

||||||

|

13/02/2023 |

FXD1/2017/10 (re-opened) |

4.4 |

13.0% |

50 |

16.7 |

19.5 |

13.9% |

38.9% |

86.1% |

|

FXD1/2023/10 |

10.0 |

14.2% |

14.2% |

||||||

|

20/02/2023 |

FXD1/2017/10 - Tapsale |

4.4 |

13.0% |

10 |

12.2 |

12.5 |

13.9% |

124.6% |

97.9% |

|

FXD1/2023/10 - Tapsale |

10.0 |

14.2% |

14.2% |

||||||

|

03/08/2023 |

IFB1/2023/017 |

17.0 |

14.4% |

50.0 |

50.9 |

59.8 |

14.4% |

119.5% |

85.1% |

|

|

IFB1/2023/017-Tapsale |

17.0 |

14.4% |

20.0 |

12.7 |

12.7 |

14.4% |

63.6% |

100.0% |

|

05/04/2023 |

FXD2/2018/10 (Re-opened) |

5.7 |

12.5% |

20.0 |

3.4 |

3.6 |

14.4% |

17.9% |

94.1% |

|

17/04/2023 |

IFB1/2023/017-Tapsale |

17.0 |

14.4% |

10.0 |

5.1 |

5.1 |

14.4% |

51.2% |

100.0% |

|

24/04/2023 |

FXD1/2022/03-Re-opened |

2.1 |

11.8% |

30.0 |

1.8 |

7.3 |

14.4% |

24.4% |

24.0% |

|

15/05/2023 |

FXD1/2023/003 |

3.0 |

14.2% |

20.0 |

20.3 |

20.7 |

14.2% |

103.7% |

97.8% |

|

22/05/2023 |

FXD1/2023/003-Tapsale |

3.0 |

14.2% |

10.0 |

10.6 |

10.6 |

14.2% |

106.0% |

100.0% |

|

29/05/2023 |

FXD1/2023/03 - Tapsale |

3.0 |

14.2% |

20.0 |

27.2 |

27.2 |

14.2% |

136.0% |

100.0% |

|

19/06/2023 |

IFB1/2023/07 |

7.0 |

15.8% |

60.0 |

213.4 |

220.5 |

15.8% |

367.5% |

96.8% |

|

26/06/2023 |

FXD1/2023/03 - Tapsale |

2.9 |

14.2% |

15.0 |

18.6 |

18.6 |

14.2% |

123.7% |

100.0% |

|

H1’2023 Total |

|

|

375.0 |

442.0 |

477.7 |

|

|

|

|

|

H1'2022 Total |

|

|

456.5 |

406.2 |

487.6 |

|

|

|

|

|

H1'2023 Average |

8.1 |

13.8% |

|

|

|

14.2% |

127.4% |

92.5% |

|

|

H1'2022 Average |

12.1 |

12.9% |

|

|

|

13.3% |

106.8% |

86.9% |

|

Secondary Bond Market Activity:

- Bond Turnover:

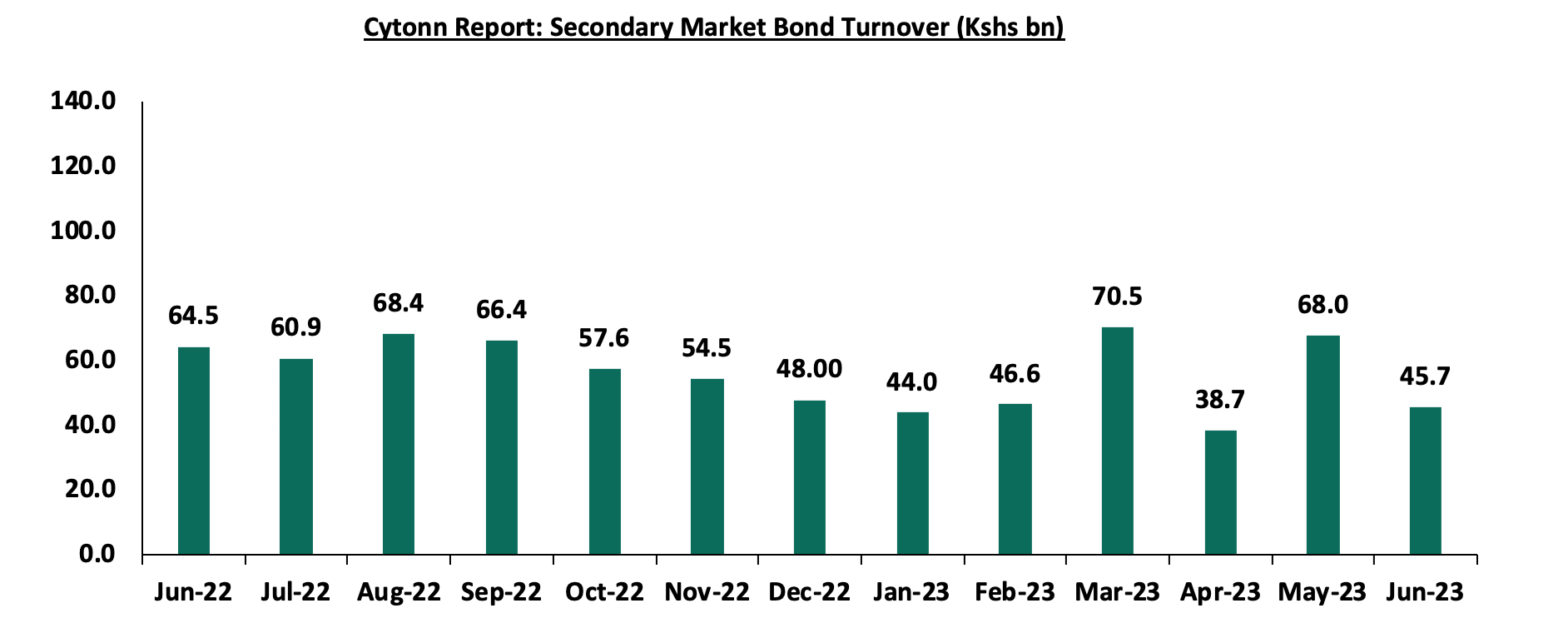

The secondary bond market recorded decreased activity, with the turnover decreasing by 17.7% to Kshs 313.6 bn from Kshs 381.1 bn in H1’2022, pointing towards decreased activities by commercial banks in the secondary bond market. The chart below shows the bond turnover over the past 12 months;

- Yield Curve:

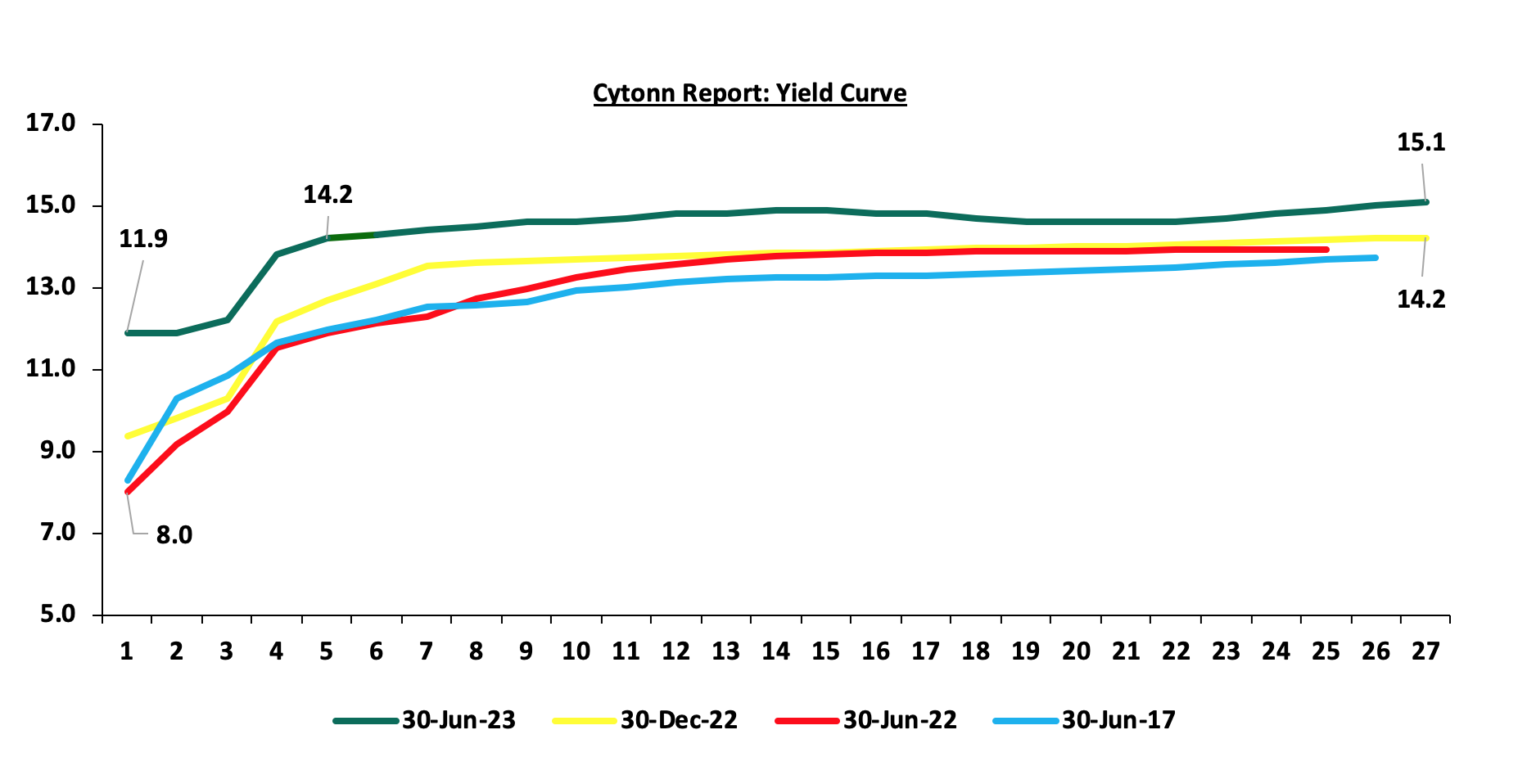

During H1’2023, the yields on government securities were on an upward trajectory as a result of the elevated inflationary pressures, leading to investors attaching higher risk premiums. Additionally, Short-term rates have climbed mainly on the back of rising interest rates. The chart below shows the yield curve movement during the period:

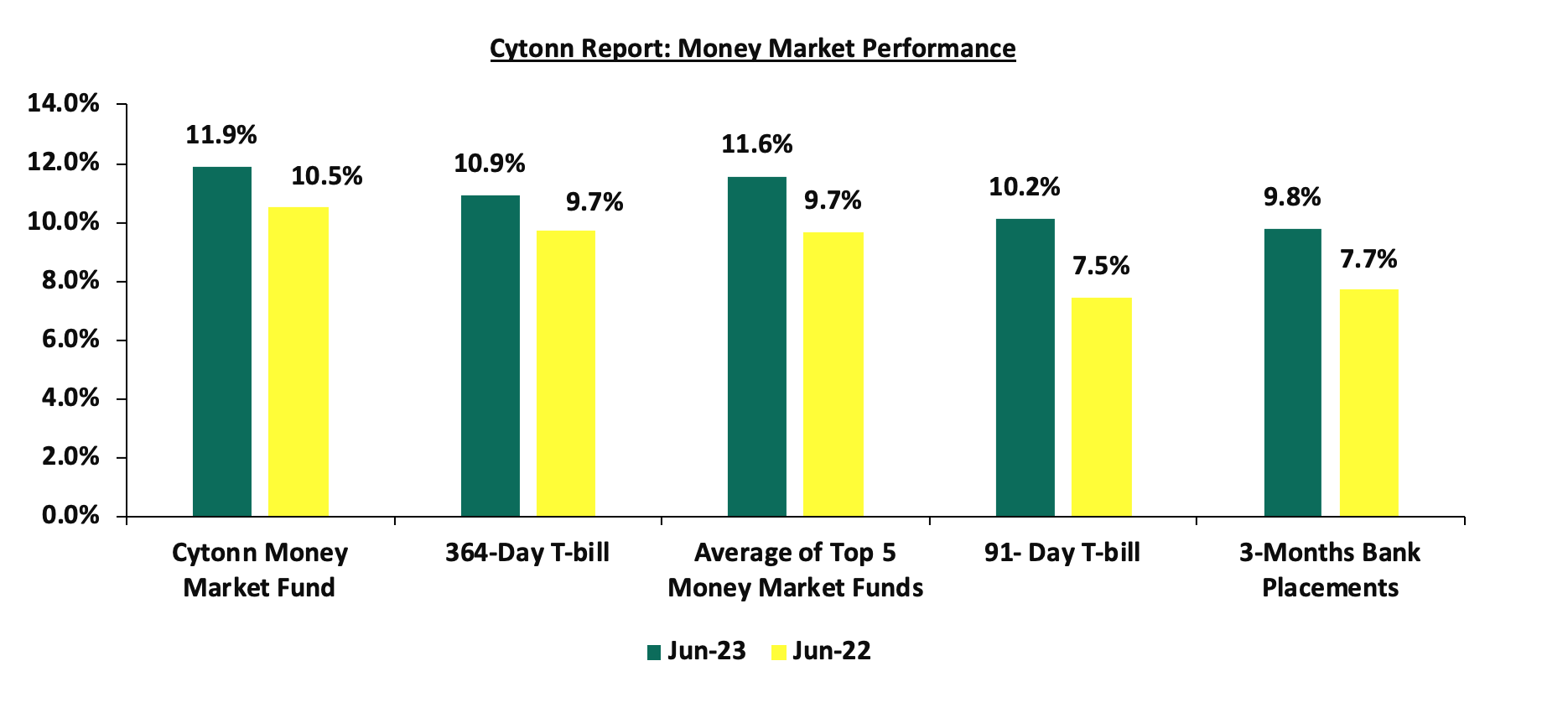

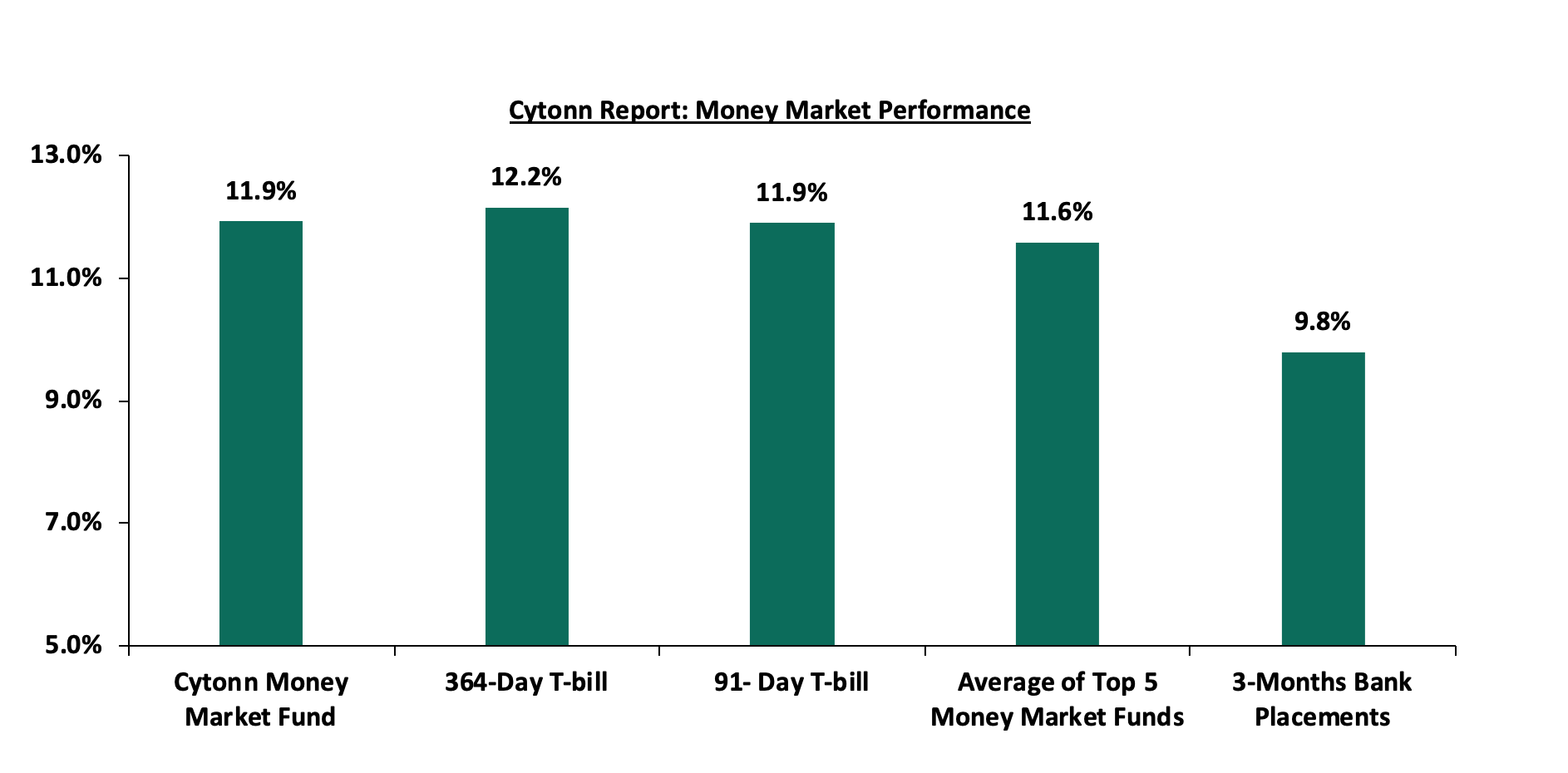

Money Market Performance

The 3-month bank placements recorded 9.8% at the end of H1’2023, 2.1% points higher than the 7.7% recorded at the end of H1’2022 (based on what we have been offered by various banks). The average 91-day T-bill rate increased by 2.7% points to 10.2% in H1’2023 from 7.5% in H1’2022, and the average Top 5 Money Market Funds increased by 1.9% points to 11.6%, from 9.7% in H1’2022. The yield on the Cytonn Money Market (CMMF) increased by 1.4% points to 11.9% in H1’2023, from 10.5% recorded at the end of H1’2022.

During the week, 3-month bank placements ended the week at 9.8% (based on what we have been offered by various banks), and the yields on the 364-day and 91-day T-bill increased by 22.3 bps and 11.9 bps to 12.2% and 11.9%, respectively. The yields of the Cytonn Money Market Fund increased by 14.0 bps to 11.9% from 11.8% recorded the previous week, and the average yields on the Top 5 Money Market Funds increased by 3.8 bps to remain relatively unchanged at 11.6% from what was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 30th June 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 30th June 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

12.0% |

|

2 |

Enwealth Money Market Fund |

11.9% |

|

3 |

Cytonn Money Market Fund (dial *809# or download the Cytonn app) |

11.9% |

|

4 |

Jubilee Money Market Fund |

11.1% |

|

5 |

GenAfrica Money Market Fund |

11.0% |

|

6 |

Dry Associates Money Market Fund |

10.9% |

|

7 |

Kuza Money Market fund |

10.8% |

|

8 |

Apollo Money Market Fund |

10.7% |

|

9 |

GenCap Hela Imara Money Market Fund |

10.7% |

|

10 |

AA Kenya Shillings Fund |

10.6% |

|

11 |

Co-op Money Market Fund |

10.5% |

|

12 |

KCB Money Market Fund |

10.5% |

|

13 |

Old Mutual Money Market Fund |

10.3% |

|

14 |

Sanlam Money Market Fund |

10.3% |

|

15 |

NCBA Money Market Fund |

10.2% |

|

16 |

Nabo Africa Money Market Fund |

10.1% |

|

17 |

ICEA Lion Money Market Fund |

10.1% |

|

18 |

Zimele Money Market Fund |

9.9% |

|

19 |

Madison Money Market Fund |

9.9% |

|

20 |

CIC Money Market Fund |

9.6% |

|

21 |

British-American Money Market Fund |

9.6% |

|

22 |

Absa Shilling Money Market Fund |

9.5% |

|

23 |

Orient Kasha Money Market Fund |

9.2% |

|

24 |

Mali Money Market Fund |

8.8% |

|

25 |

Equity Money Market Fund |

8.2% |

Source: Business Daily

Liquidity:

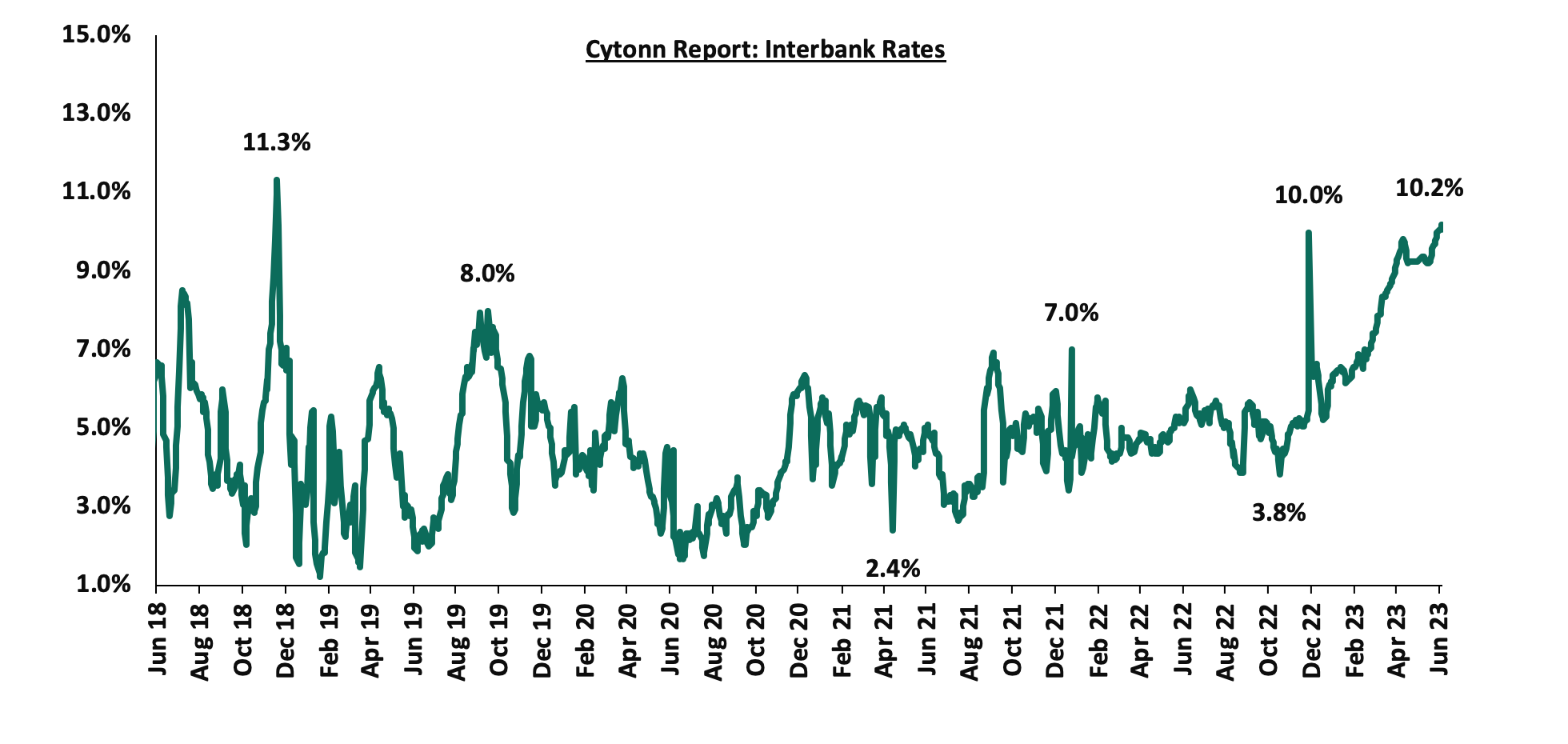

In H1’2023, liquidity in the money markets tightened, as evidenced by the increase in the interbank rate to 7.8%, from 4.7% H1’2022, partly attributable to tax remittances that offset government payments. Additionally, the average volumes traded in the interbank market increased by 34.3% to Kshs 21.1 bn, from Kshs 15.7 bn recorded in H1’2022.

Similarly, during the week, liquidity in the money markets tightened, with the average interbank rate rising to 10.1% from 9.8% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 34.4% to Kshs 17.1 bn from Kshs 12.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During H1’2023, the yields on Eurobonds recorded mixed performance, with the yield on the 10-Year Eurobond issued in 2014 declining by 0.3% points to 12.6% from 12.9% recorded at the beginning of the year, while the yields on the 10-year Eurobond issued in 2018 gained the most by 0.6% points to 11.1% from 10.5% recorded at the beginning of the year. On a year on Year basis, the yields on all Eurobonds were on a downward trajectory, with the yield of the 7-year Eurobond issued in 2019 declining the most having declined by 4.7% points to 11.4% from 16.1% recorded at the end of H1’2022. The downward trajectory of the yields is mainly on the back of improved investors’ confidence in the international bond market, amid the government commitment to strong austerity measures and assurance to investors of its capacity to meet its obligations.

Similarly, during the week, the yields on Eurobonds recorded mixed performance, with the yield on the 10-Year Eurobond issued in 2014 declining by 0.1% points to 12.6% from 12.7% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 29 June 2023;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

1.1 |

4.8 |

24.8 |

4.0 |

9.0 |

11.1 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

30-Jun-22 |

17.0% |

14.7% |

13.7% |

16.1% |

13.8% |

12.7% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

22-Jun-23 |

12.7% |

11.1% |

11.0% |

11.3% |

11.0% |

10.3% |

|

23-Jun-23 |

12.5% |

11.1% |

11.0% |

11.4% |

11.1% |

10.3% |

|

26-Jun-23 |

12.5% |

11.1% |

11.1% |

11.4% |

11.1% |

10.4% |

|

27-Jun-23 |

12.6% |

11.1% |

11.1% |

11.3% |

11.1% |

10.3% |

|

28-Jun-23 |

12.6% |

11.1% |

11.1% |

11.3% |

11.1% |

10.3% |

|

29-Jun-23 |

12.6% |

11.1% |

11.1% |

11.4% |

11.1% |

10.3% |

|

Weekly Change |

(0.1%) |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

|

Y/Y change |

(4.4%) |

(3.6%) |

(2.6%) |

(4.7%) |

(2.7%) |

(2.4%) |

|

YTD change |

(0.3%) |

(0.6%) |

(0.2%) |

(0.5%) |

(0.3%) |

(0.4%) |

Source: Central Bank of Kenya (CBK)

Rates in the Fixed Income market have been on an upward trend given the continued government demand for cash and the highly tightened liquidity in the money market. The government closed FY’2022/2023 34.3% above of its domestic net borrowing target of Kshs 428.3 bn, having a net borrowing position of Kshs 568.7 bn. Revenue collections are lagging behind, with total revenue as of May 2023 coming in at Kshs 1.8 tn in FY’2022/2023, equivalent to 82.7% of its revised target of Kshs 2.2 tn and 90.2% of the prorated target of Kshs 2.0 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Due to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During Q2’2023, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 5.1%, 2.9% and 8.0%, respectively, taking their H1’2023 to losses of 16.0%, 6.0% and 13.0% for NASI, NSE 20 and NSE 25 respectively. The equities market performance during the quarter was driven by losses recorded by large caps such as KCB Group, Equity Group and Bamburi of 17.5%, 15.9% and 10.3%, respectively.

Equities turnover declined by 2.7% in H1’2023 to USD 453.4 mn, from USD 466.0 mn in H1’2022. Foreign investors remained net sellers in H1’2023 with a net selling position of USD 52.0 mn, from a net selling position of USD 105.9 mn recorded in H1’2022.

During the week, the equities market recorded mixed performance with NASI and NSE 20 declining by 0.2% and 0.5%, while NSE 25 gained by 0.4%, taking their YTD performance to losses of 16.0%, 6.0% and 13.0% for NASI, NSE 20 and NSE 25 respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Co-operative Bank and Standard Chartered bank of 0.8% each, while KCB Group and NCBA Bank declined by 0.7% and 0.3% respectively. The losses were however mitigated by gains recorded by East African Breweries Limited (EABL) and Equity Group of 2.0% each, while British American Tobacco gained by 1.8%.

During the week, equities turnover declined by 41.1% to USD 4.2 mn from USD 7.1 mn recorded the previous week, taking the YTD turnover to USD 453.4 mn. Foreign investors remained net buyers, with a net buying position of USD 1.1 mn, from a net buying position of USD 0.5 mn recorded the previous week, taking the YTD net selling position to USD 52.0 mn.

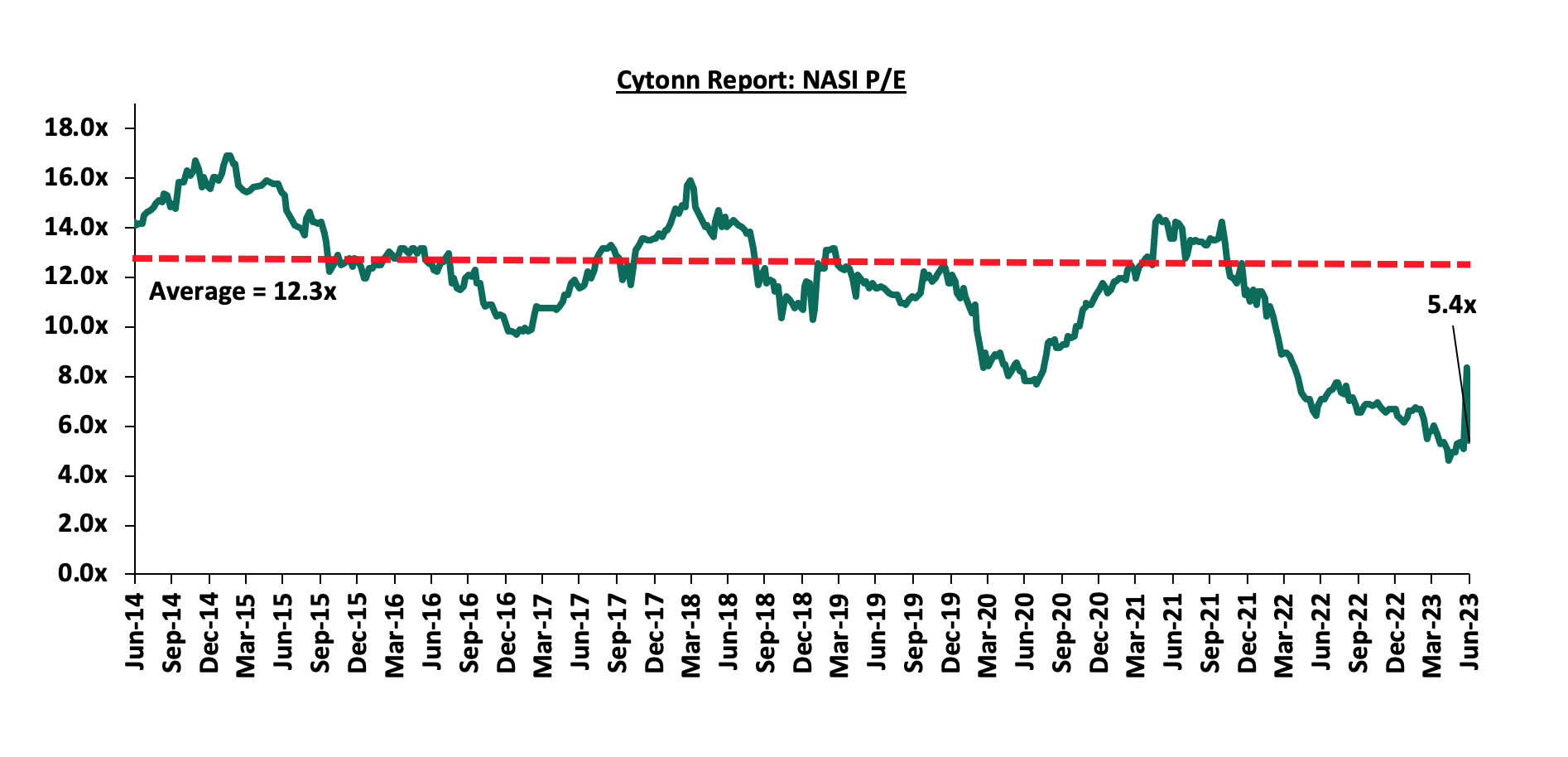

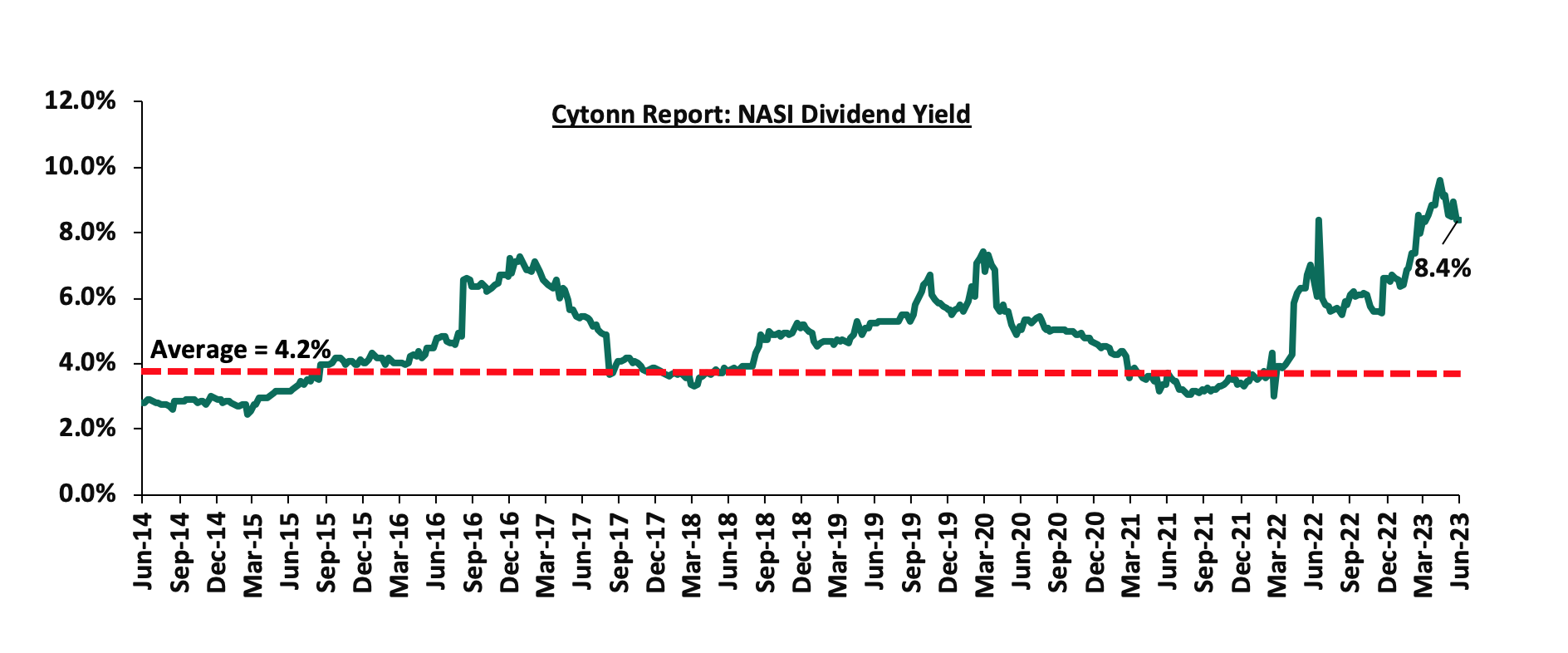

The market is currently trading at a price to earnings ratio (P/E) of 5.4x, 56.3% below the historical average of 12.3x, and a dividend yield of 8.4%, 4.2% points above the historical average of 4.2%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Listed Banks’ FY’2022 and Q1’2023 Performance

During the first half of 2023, the listed banking sector released their FY’2022 and Q1’2023 results, recording y/y earnings growth of 26.6% and 25.0% in their core EPS in FY’2022 and Q1’2023, respectively. For more information, please see our FY’2022 and Q1’2023 Banking Sector Reports.

Kenya Listed Insurance FY’2022 Performance

During the first half of 2023, the listed insurance sector released their FY’2022 results, recording weighted Core EPS growth of 377.4%, compared to a weighted growth of 89.2%, in FY’2021. The sustained growth in earnings was attributable to increased premiums during the period following continued recovery by the sector from the impacts of the COVID-19 pandemic, coupled with higher yields from government papers. For more information, please see our Kenya Listed Insurance FY’2022 Report.

Key Half-Year Highlights:

During the first half of 2023;

- Centum Investment Plc announced that it had terminated the Share Purchase Agreement (SPA) to sell its 83.4% stake in Sidian Bank Limited to Access Bank Plc. The termination was due to the lapse of time arising from expiry of the Long Stop Date and the two parties could not agree to extend the duration, as well as the set conditions between the two parties having not been met. For more information, please see our Cytonn Weekly #02/2023,

- The Insurance Regulatory Authority of Kenya (IRA) released the Quarterly Insurance Industry Report for the period ending 30 September 2022 highlighting that the industry’s profits after tax declined by 3.3% to Kshs 6.2 bn in Q3’2022, from Kshs 6.4 bn recorded in Q3’2021. For more information, please see our Cytonn Weekly #03/2023,

- East African Breweries Plc (EABL) released their H1’2023 financial results for the period ending 31st December 2022, recording a stagnation in the Profits After Tax (PAT) at Kshs 8.7 bn as was recorded in a similar period last year. For more information, please see our Cytonn 2023 Markets Outlook,

- Equity Group Holdings Plc, through Equity Bank Kenya Limited (EBKL) announced that it had completed the acquisition of certain assets and liabilities of Spire Bank Limited after obtaining all the required regulatory approvals. For more information, please see our Cytonn Monthly January 2023,

- The Nairobi Stock Exchange (NSE) amended the trading rules for equity securities to allow for block trades, aimed at boosting liquidity in the bourse, after receiving approval from the Capital Markets Authority (CMA). For more information, please see our Cytonn Monthly January 2023,

- The Central Bank of Kenya (CBK) released the Commercial Banks’ Credit Survey Report for the quarter ended December 2022, highlighting that the banking sector’s loan book recorded a 15.6% y/y growth, with gross loans increasing to Kshs 3.7 tn in Q4’2022, from Kshs 3.2 tn in Q4’2021. For more information, please see our Cytonn Weekly #06/2023,

- British American Tobacco Kenya Plc released their FY’2022 financial results, recording a 6.3% growth in Profits after Tax (PAT) to Kshs 6.9 bn, from Kshs 6.5 bn recorded in FY’2021, majorly attributed to the 5.5% increase in Gross Sales to Kshs 42.2 bn in FY’2022 from Kshs 40.0 bn recorded in FY’2021. For more information, please see our Cytonn Weekly #07/2023,

- The Central Bank of Kenya (CBK) announced that Premier Bank Limited Somalia (PBLS) had completed acquisition of 62.5% shareholding of First Community Bank Limited (FCB) effective 27 March 2023 For more information, please see our Cytonn Weekly #11/2023,

- Diageo UK, through its wholly-owned indirect subsidiary Diageo Kenya, announced that it had successfully completed the partial tender offer to acquire an additional 15.0% stake in East African Breweries Plc (EABL). For more information, please see our Cytonn Weekly #12/2023,

- Safaricom Plc released its FY’2023 financial performance for the year ended 31 March 2023, recording a 22.2% decline in Profit After Tax (PAT) to Kshs 52.5 bn from Kshs 67.5 bn in FY’2022, majorly attributed to a 34.2% increase in operating expenses to Kshs 74.1 bn in FY’2023, up from Kshs 55.2 bn in FY’2022. The increase in operating expenses was mainly driven by injection of Kshs 55.8 bn capital investment expenditure into Safaricom’s subsidiary in Ethiopia during the fourth quarter of FY’2023. For more information, please see our Cytonn Weekly #19/2023,

- The Central Bank of Kenya (CBK) released the Commercial Banking Sector Credit Survey report for the quarter ended March 2023, highlighting that the banking sector’s loan book recorded a 13.9% y/y growth, with gross loans increasing to Kshs 3.9 tn in Q1’2023, from Kshs 3.1 tn in Q1’2022. For more information, please see our Cytonn Weekly #19/2023,

- The Central Bank of Kenya (CBK) announced the acquisition of 20.0% stake of Credit Bank Plc by Shorecap III, LP a Private Equity fund registered under the laws of Mauritius effective 15 June 2023. For more information, please see our Cytonn Weekly #21/2023,

- Equity Group Holdings Plc (EGH) announced that it had entered into a binding agreement with Government of Rwanda, Rwanda Social Security Board and other investors of Compagnie Generale De Banque (Cogebanque) Plc Limited to acquire a 91.9% stake in the Rwanda based lender. For more information, please see our Cytonn Weekly #24/2023, and,

- The Central Bank of Kenya (CBK) released the Quarterly Economic Review for the period ending 31 March 2023, highlighting that the banking sector remained stable and resilient during the period on the back of strong liquidity and capital adequacy, with the total assets increased by 2.7% to Kshs 6.8 tn in March 2023, from Kshs 6.6 tn in December 2022. For more information, please see our Cytonn Weekly #25/2023.

Universe of Coverage:

|

Company |

Price as at 23/06/2023 |

Price as at 30/06/2024 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

180.0 |

180.0 |

0.0% |

(9.4%) |

260.7 |

6.7% |

51.5% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

(0.6%) |

(3.7%) |

2.5 |

11.1% |

50.6% |

0.1x |

Buy |

|

KCB Group*** |

29.5 |

29.3 |

(0.7%) |

(23.6%) |

41.3 |

6.8% |

47.6% |

0.5x |

Buy |

|

Liberty Holdings |

3.6 |

4.1 |

12.5% |

(19.6%) |

5.9 |

0.0% |

46.2% |

0.3x |

Buy |

|

Equity Group*** |

37.5 |

38.3 |

2.0% |

(15.1%) |

51.2 |

10.5% |

44.2% |

0.8x |

Buy |

|

Sanlam |

8.0 |

7.3 |

(8.5%) |

(23.8%) |

10.3 |

0.0% |

41.0% |

2.1x |

Buy |

|

CIC Group |

1.9 |

1.9 |

0.0% |

(0.5%) |

2.5 |

6.8% |

38.4% |

0.6x |

Buy |

|

NCBA*** |

39.0 |

38.9 |

(0.3%) |

(0.3%) |

48.9 |

10.9% |

36.7% |

0.8x |

Buy |

|

ABSA Bank*** |

11.8 |

11.8 |

0.4% |

(3.3%) |

14.7 |

11.4% |

35.8% |

1.0x |

Buy |

|

Co-op Bank*** |

12.3 |

12.2 |

(0.8%) |

0.8% |

15.0 |

12.3% |

34.8% |

0.6x |

Buy |

|

Standard Chartered*** |

161.8 |

160.5 |

(0.8%) |

10.7% |

183.9 |

13.7% |

28.3% |

1.1x |

Buy |

|

I&M Group*** |

17.0 |

17.1 |

0.9% |

0.3% |

19.5 |

13.2% |

27.0% |

0.4x |

Buy |

|

Stanbic Holdings |

112.0 |

111.3 |

(0.7%) |

9.1% |

127.9 |

11.3% |

26.3% |

0.8x |

Buy |

|

Diamond Trust Bank*** |

49.6 |

49.9 |

0.6% |

0.0% |

54.6 |

10.0% |

19.5% |

0.2x |

Accumulate |

|

Britam |

5.2 |

5.0 |

(3.5%) |

(3.5%) |

6.0 |

0.0% |

18.9% |

0.7x |

Accumulate |

|

HF Group |

5.0 |

5.0 |

0.4% |

59.4% |

5.8 |

0.0% |

15.7% |

0.2x |

Accumulate |

|