Master-Planned Communities, & Cytonn Weekly #06/2020

By Cytonn Research Team, Feb 9, 2020

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the subscription rate coming in at 217.4%, up from 135.9% the previous week. The oversubscription is partly attributable to favourable liquidity in the money market during the week due to the ongoing government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 311.6%. During the week, the African Development Bank (AfDB) released their African Economic Outlook 2020, highlighting the economic projections and prospects for each of the 54 countries and the continent as a whole. As per the report, Kenya’s economy grew by an estimated 5.9% in 2019, lower than the 6.0% seen in 2018, mainly attributable to unfavourable weather and reduced government investment. The economy is expected to expand by 6.0% in 2020 and 6.2% in 2021. Also, according to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the Kenyan private sector business activity declined at the start of the year, amid the softest uplift in new orders since April 2019. The seasonally adjusted PMI index came in at 49.7, down from the 53.3 seen in December 2019, pointing towards a slight decline in business conditions, attributed to the contraction of overall activity levels with firms reporting that lack of money in households led to softer demand pressure;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 recording gains of 4.0%, 0.1% and 2.6%, respectively, taking their YTD performance to gains/ (losses) of 1.3%, (2.0%) and 0.6%, for the NASI, NSE 20 and NSE 25, respectively. During the week, Standard Chartered Bank Kenya and insurer Sanlam introduced a new funeral cover, Farewell Insurance Plan, which will give policyholders an option of cashing in part of their premiums paid. Policyholders can be reimbursed up to six-months’ worth of premiums, after making payments for four-years;

Real Estate

During the week, Kenya Bankers Association released their Housing Price Index Q4’2019 Report, which highlighted that residential house prices recorded a 0.6% decline in Q4’2019, attributed to the sluggish economy. In the residential sector, the Principal Secretary for Housing and Urban Development, Mr. Charles Hinga announced that the Shauri Moyo and Starehe affordable housing projects in Nairobi’s Eastlands were set for commissioning subject to the transfer of title deeds from the National Treasury for the land on which they will sit, while for the Park Road project in Ngara, priority for the application to buy of Phase 1 housing units will be given to civil servants who vacated the Old Park Road Estate. In the retail sector, Tendam Group, a Spanish fashion retailer, opened its first Kenyan outlet at the Westgate shopping mall in Westlands, while Quickmart, a local retailer opened its 27th outlet in Roysambu, along Kamiti Road;

Focus of the Week

Home buyers in the residential and hospitality markets, which have experienced tremendous change over the years, are now keen on serene locations and developments that provide them with lifestyle amenities such as retail center, gym, clubhouse, and a swimming pool; with the choice of housing having shifted from the traditionally preferred bungalows to Master-Planned Communities with comprehensive offerings. The concept has been gaining significant popularity in the Kenyan market, during the week, Cytonn’s master-planned development affiliate, Superior Homes Kenya, launched their hospitality master-planned community, Pazuri at Vipingo, situated at the exclusive Vipingo Ridge. Therefore, for this week, we shall focus on the master-planned concept, by looking into what it refers to and the pros and cons of these communities.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.1% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.6% p.a. To subscribe, email us at sales@cytonn.com;

- On Saturday 8th February 2020, Superior Homes Kenya, Cytonn Investments master-planned development affiliate, launched their latest development to Cytonn Clients. The development is located at Vipingo Ridge, called Pazuri at Vipingo. Pazuri at Vipingo is a master-planned holiday estate located at the luxurious Vipingo Ridge coastal retreat, offering lifestyle holiday homes with world-class amenities. For more information on Pazuri at Vipingo click here and also email us at sales@cytonn.com;

- Rodney Omukhulu, Assistant Investment Analyst at Cytonn Investments, was interviewed by CNBC as they talked about the performance of the private sector. Watch Rodney here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the subscription rate coming in at 217.4%, up from 135.9% the previous week. The oversubscription is partly attributable to favourable liquidity in the money market during the week due to the ongoing government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 311.6%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic target and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yield on the 91-day, 182-day, and 364-day papers remained unchanged at 7.3%, 8.2% and 9.9%, respectively. The acceptance rate rose to 53.6%, from 95.0% recorded the previous week, with the government accepting Kshs 28.0 bn of the Kshs 52.2 bn bids received.

During the week, the National Treasury announced that it will issue a 15-year (FXD1/2020/15) and a 25-year (re-open – FXD1/2018/25) with an effective tenor of 23.3-years, with a total value of Kshs 50.0 bn for Budgetary Support purposes. The period of sale is from 3rd February 2020 to 18th February 2020. As per the historical trend, we expect the market to maintain a bias towards the 15-year bond mainly driven by the perception that risks may not be adequately priced on the longer end of the yield curve, which is relatively flat due to saturation of long-term bonds. Our recommended bidding ranges are 12.6% - 12.8% and 13.2% - 13.4%, for the 15-year and 25-year bonds, respectively, given that bonds with the same tenor are currently trading at 12.5% and 13.1%, respectively.

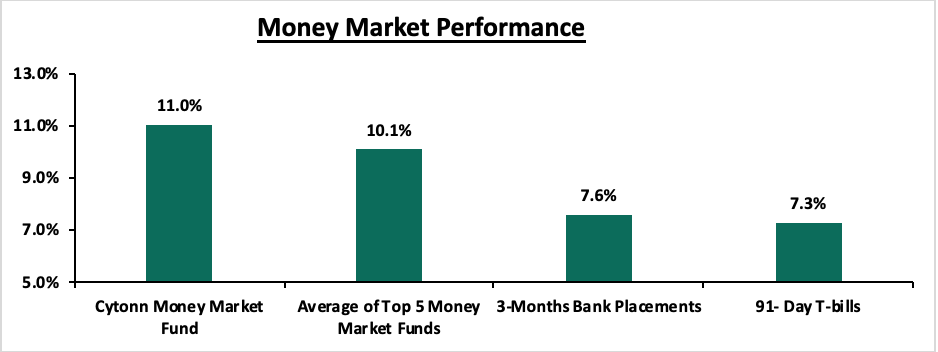

In the money markets, 3-month bank placements ended the week at 7.6% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.3%, while the average of Top 5 Money Market Funds came in at 10.1%, unchanged from the previous week. The yield on the Cytonn Money Market came in at 11.1%, unchanged from the previous week.

Liquidity:

During the week, the average interbank rate increased to 4.9%, from 4.4% recorded the previous week, pointing to tightening liquidity in the money markets. Commercial banks’ excess reserves came in at Kshs 21.6 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes increased by 17.6% to Kshs 13.2 bn, from Kshs 11.2 bn recorded the previous week.

Kenya Eurobonds:

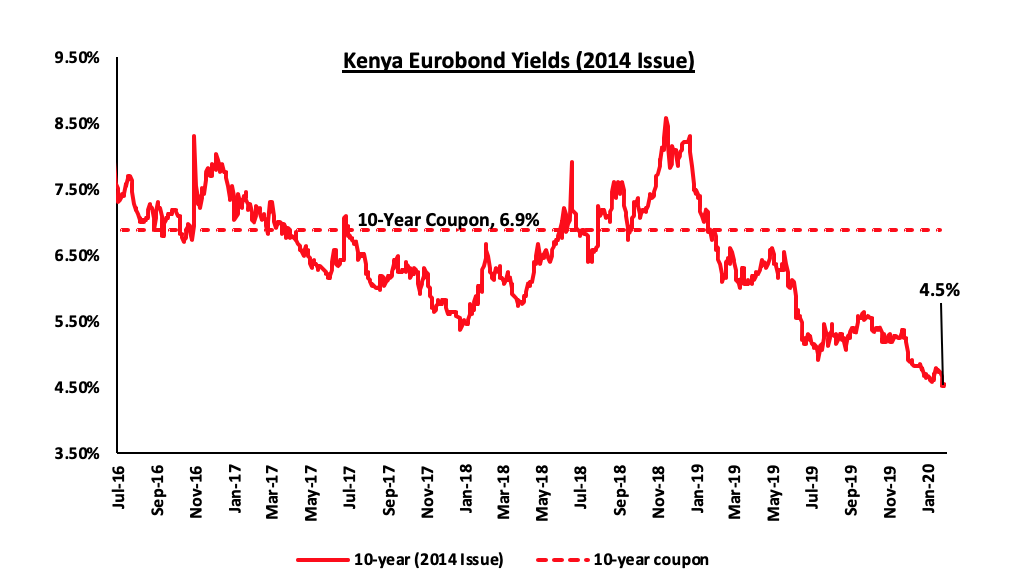

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 decreased marginally to 4.5%, from 4.7% recorded the previous week. This is an indication that investors are not attaching a higher risk premium on the country.

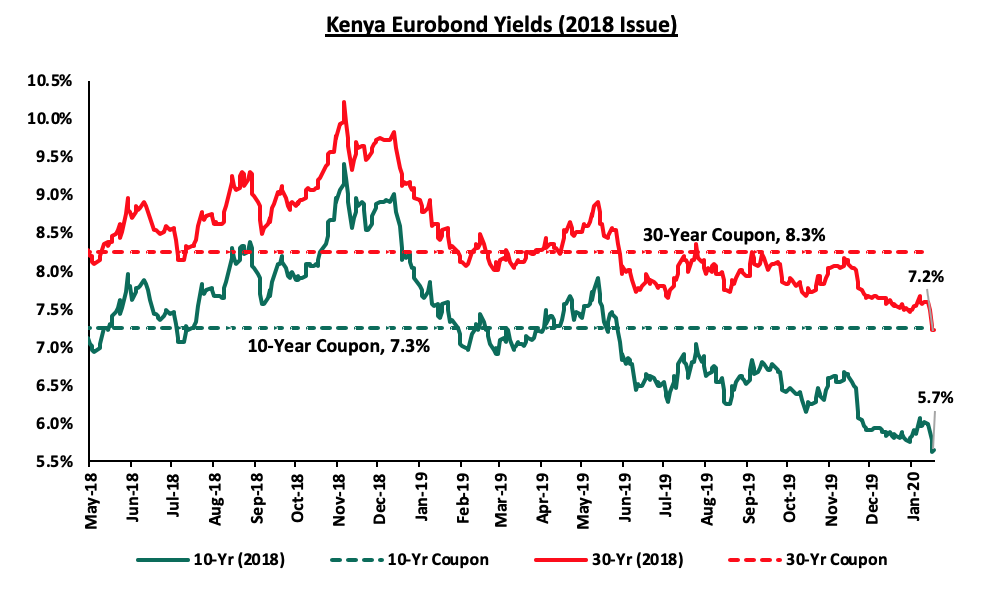

During the week, the yields on the 10-year Eurobond decreased to 5.7%, from 6.0% seen the previous week, while that of the 30-year Eurobond decreased to 7.2%, from 7.6% recorded the previous week.

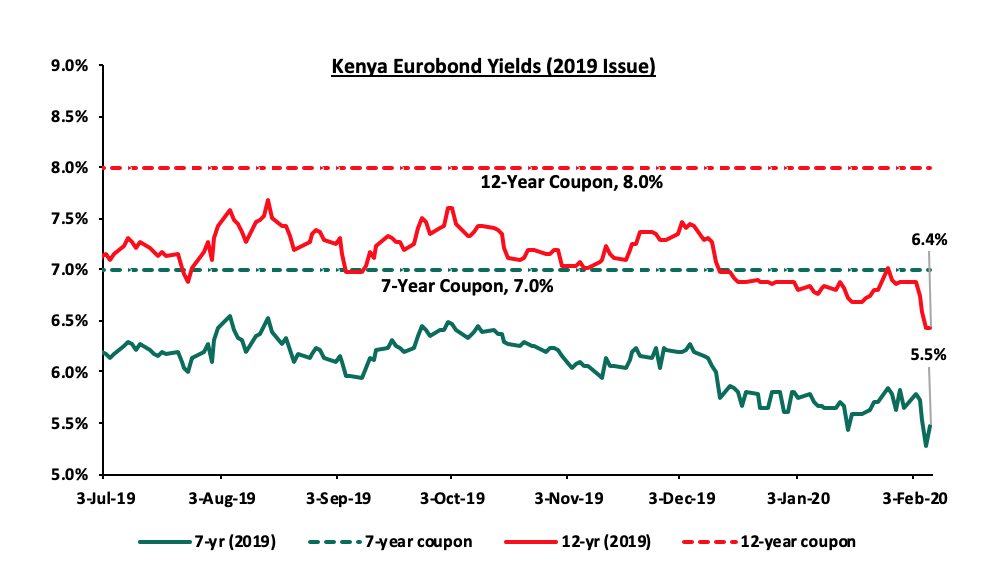

During the week, the yield on the 7-year Eurobond decreased by 0.1% points to 5.5%, from 5.6% recorded the previous week. The yield on the 12-year Eurobond also decreased by 0.5% points to 6.4%, from 6.9% recorded the previous week.

Kenya Shilling:

The Kenya Shilling appreciated by 0.1% against the US Dollar during the week to Kshs 100.4, from Kshs 100.6 recorded last week, mostly supported by inflows from diaspora remittances and offshore investors buying government debt exceeding the dollar demand from importers. On an YTD basis, the shilling has appreciated by 0.7% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar in the short term with a bias to a 2.4% depreciation by the end of 2020, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit was equivalent to 4.6% of GDP in 2019, from 5.0% recorded in 2018. This was mainly driven by lower imports of SGR-related equipment, resilient diaspora remittances which cumulatively stood at USD 2.8 bn in December 2019, a 3.7% increase from the USD 2.7 bn recorded in December, and strong receipts from transport and tourism services with preliminary data indicating that the number of tourists landing in the country stood at 132,019 in month of December, which was a 9.0% increase, compared to the 121,070 recorded in November 2019,

- High levels of forex reserves, currently at USD 8.5 bn (equivalent to 5.2-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Foreign capital inflows, with investors looking to participate in the domestic equities market, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

We, however, expect pressure on the Kenyan shilling to arise from:

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July, which has seen cumulative diaspora remittances increase by a 3.7% in the 12-months to December 2019 to USD 2.8 bn, from USD 2.7 bn in 2018.

Weekly Highlight:

During the week, the African Development Bank (AfDB) released their African Economic Outlook 2020, highlighting the economic projections and prospects for each of the 54 countries and the continent as a whole. According to the report, Kenya’s economy grew by an estimated 5.9% in 2019, lower than the 6.0% seen in 2018, mainly attributable to unfavourable weather and reduced government investment. The economy is expected to expand by 6.0% in 2020 and 6.2% in 2021, mainly driven by

- Increased crude oil production and exports,

- Continuing foreign direct investment,

- Benefits from the African Continental Free Trade Agreement, and,

- The government’s commitment to the Big Four Agenda targeted towards the health, housing, agriculture and manufacturing sector.

The AfDB also noted that the country’s fiscal deficit had narrowed to an estimated 7.5% of GDP in 2019, supported by the ongoing fiscal consolidation and greater domestic resources mobilization. Public debt, on the other hand, rose to 58.0% from the 57.0% seen in 2018. The continuous increase in public debt saw the International Monetary Fund elevate Kenya’s debt stress rating from low to moderate in 2018.

In summary, the report affirms that the macroeconomic stability in Kenya is expected to continue with inflation expected to remain within the government’s set target of 2.5% - 7.5% and with the consensus GDP growth as per the 8 firms below expected to come in at 6.0%.

|

|

Kenya 2020 Annual GDP Growth Outlook |

|

|

No. |

Organization |

Q1’2020 |

|

1. |

Central Bank of Kenya |

6.2% |

|

2. |

Citigroup Global Markets |

6.2% |

|

3. |

International Monetary Fund |

6.1% |

|

4. |

African Development Bank |

6.0% |

|

5 |

World Bank |

6.0% |

|

6. |

National Treasury |

6.0% |

|

7. |

African Development Bank (AfDB) |

6.0% |

|

8. |

Cytonn Investments Management PLC |

5.7% |

|

9. |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

|

|

Average |

6.0% |

In our view, we expect the country’s GDP growth to come in at around 5.6% - 5.8% mainly driven by an improvement in private sector credit growth, stable growth of the agricultural sector, and public infrastructural investments. The risks abound to economic growth include;

- The country’s debt sustainability with the public debt to GDP ratio currently estimated at 62.0%, efforts by the Kenyan Government to reduce country’s fiscal deficit, which is currently at 6.2% of GDP, which might adversely affect economic growth due to reduced government spending, and,

- The current locust invasion which also poses a systematic risk to agricultural production and food security and could ultimately lead to higher inflation that could slow down economic growth.

According to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the Kenyan private sector business activity declined at the start of the year, amid the softest uplift in new orders since April 2019. The seasonally adjusted PMI index came in at 49.7, down from the 53.3 seen in December 2019, pointing towards a decline in business conditions since a reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Overall activity levels contracted with firms reporting that lack of money in households led to softer demand pressure. New orders grew at a much softer rate than in December as a result of weaker customer demand as a result of poor cash flow in the economy. Input buying was also restrained as the softer demand led to a much weaker increase in purchases, despite this, stock levels continued to grow sharply. Selling prices increased for the second month as a result of a steady rise in input costs. We expect the business environment to improve going forward on the back of the ongoing clearance of private sector arrears and recent reforms such as the repeal of the Interest Rate Cap and the MPC actions from the last two meetings which saw the benchmark rate reduce to 8.25% from 9.00%.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 23.6% ahead of its domestic borrowing target, having borrowed Kshs 235.6 bn against a pro-rated target of Kshs 190.6 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 recording gains of 4.0%, 0.1% and 2.6%, respectively, taking their YTD performance to gains/ (losses) of 1.3%, (2.0%) and 0.6%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as Safaricom, Equity, Standard Chartered Bank Kenya and EABL of 8.0%, 4.0%, 4.0% and 3.5%, respectively.

Equities turnover increased by 43.2% during the week to USD 35.6 mn, from USD 24.8 mn recorded the previous week, taking the YTD turnover to USD 157.5 mn. Foreign investors turned net buyers for the week, with a net buying position of USD 1.1 mn from a net selling position of USD 3.9 mn recorded the previous week.

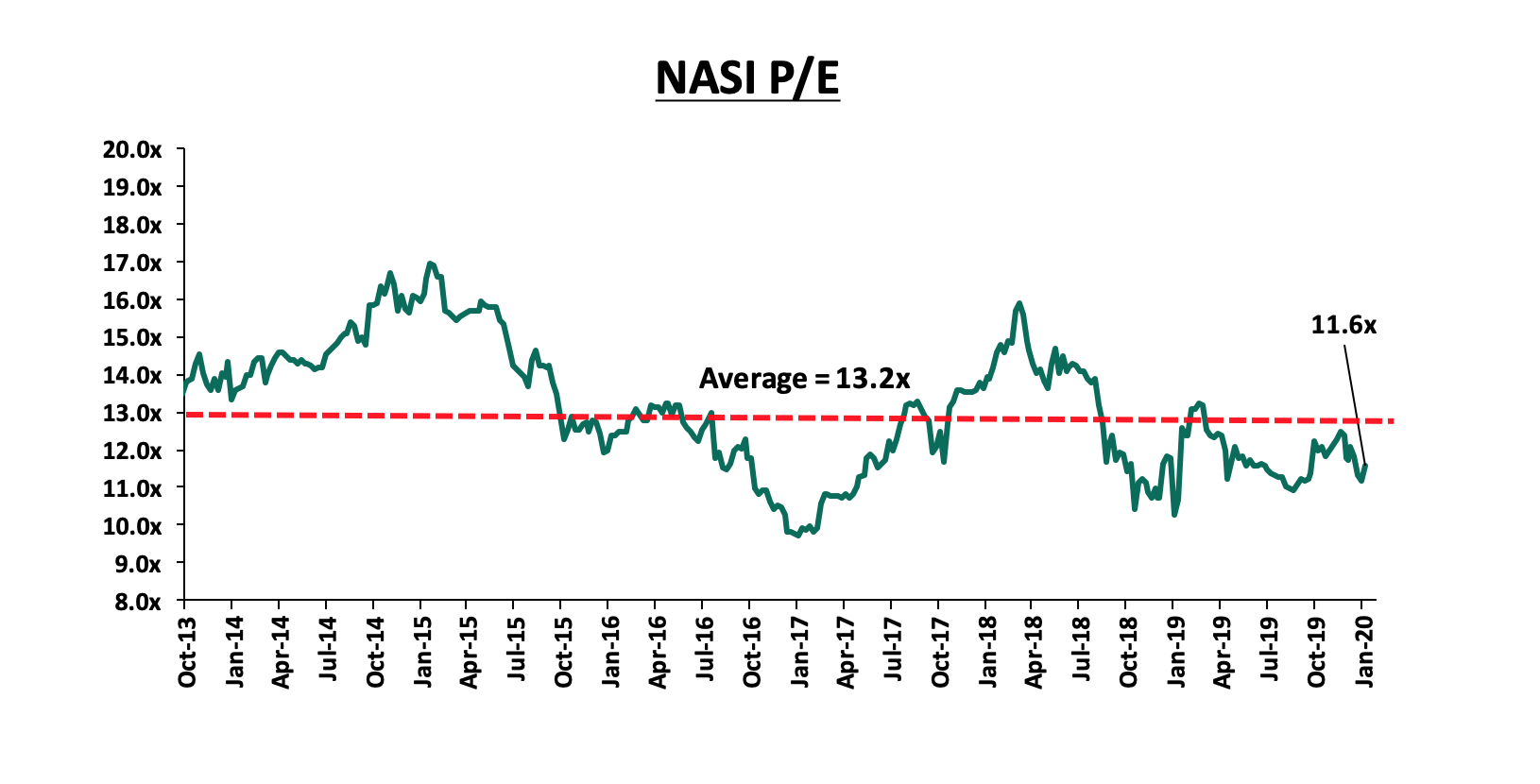

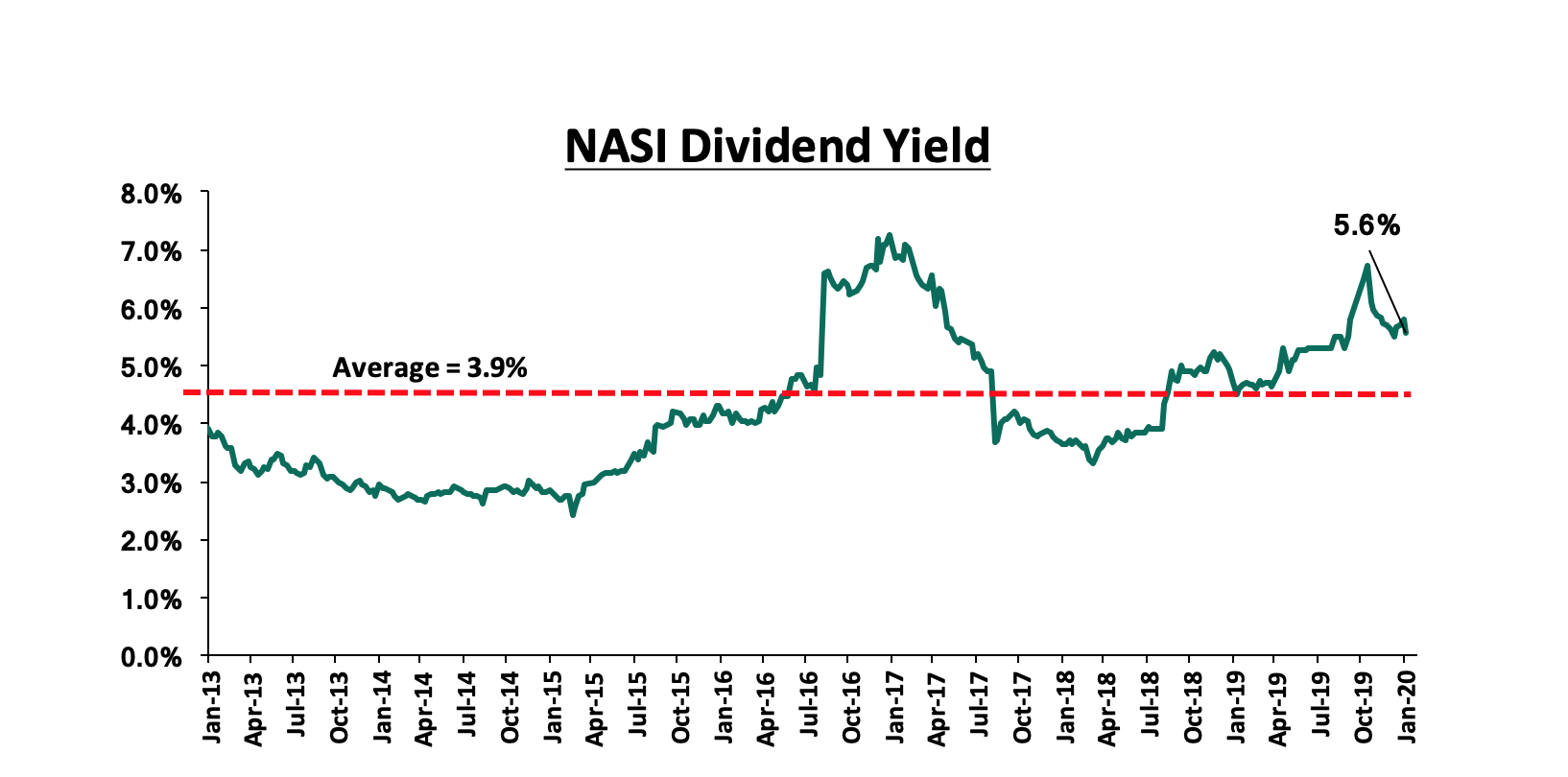

The market is currently trading at a price to earnings ratio (P/E) of 11.6x, 12.1% below the historical average of 13.2x, and a dividend yield of 5.6%, 1.7% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.6x is 19.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 39.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Standard Chartered Bank Kenya and insurer Sanlam introduced a new funeral cover, Farewell Insurance Plan, which will give policyholders an option of cashing in part of the premiums paid. Policyholders can be reimbursed up to six-months’ worth of premiums after making payments for four-years. As noted in our H1’2019 Listed Insurance Report, the insurance sector has benefited from convenience and efficiency through the adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks in efforts to deepen insurance penetration levels, which is still low at 2.4% of GDP as of 2019, compared to the 2018 continental average of 3.5%. The insurance sector continues to undergo transition mainly on the digital transformation and regulatory front, which is critical for stability and sustainability of a conducive business environment for one of the key sectors of Kenya’s economy. We are of the view that insurance companies have a lot they can do to register considerable growth and improve the level of penetration in the country. On that premise, we recommend that;

- The synergy between banks and insurance companies to offer Bancassurance services should continue, so as to boost penetration levels in the country. Insurance companies should leverage more on the penetration of bank products to push insurance products to consumers, and,

- Insurance companies should continue adopting mobile and digital underwriting platforms that enhance convenience to customers in taking insurance policies thus raising the uptake of insurance products. The integration of digital platforms to allow for policy payments will enhance the collection of insurance premiums, given the high level of mobile phone penetration in the country, at 91.0% in 2019, which will help eliminate premium undercutting. Technology and innovation capabilities are set to continue being the key drivers of growth for Sub-Saharan Africa in the coming years.

Universe of Coverage

|

Banks |

Price at 31/01/2020 |

Price at 07/02/2020 |

w/w change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.0 |

3.0 |

(0.3%) |

3.0 |

4.8 |

15.1% |

75.6% |

0.3x |

Buy |

|

Diamond Trust Bank |

112.0 |

114.5 |

2.2% |

109.0 |

189.0 |

2.3% |

67.3% |

0.6x |

Buy |

|

I&M Holdings*** |

55.0 |

55.5 |

0.9% |

54.0 |

75.2 |

7.0% |

42.5% |

0.9x |

Buy |

|

KCB Group*** |

52.3 |

51.3 |

(1.9%) |

54.0 |

64.2 |

6.8% |

32.1% |

1.4x |

Buy |

|

Jubilee Holdings |

360.0 |

352.0 |

(2.2%) |

351.0 |

453.4 |

2.6% |

31.4% |

1.1x |

Buy |

|

Co-op Bank*** |

15.3 |

14.9 |

(2.6%) |

16.4 |

18.1 |

6.7% |

28.6% |

1.3x |

Buy |

|

Sanlam |

17.6 |

17.7 |

0.9% |

17.2 |

21.7 |

0.0% |

22.6% |

0.7x |

Buy |

|

Equity Group*** |

50.0 |

52.0 |

4.0% |

53.5 |

56.7 |

3.8% |

12.9% |

2.0x |

Accumulate |

|

Standard Chartered |

198.0 |

206.0 |

4.0% |

202.5 |

211.6 |

9.2% |

11.9% |

1.6x |

Accumulate |

|

Liberty Holdings |

10.3 |

9.5 |

(7.8%) |

10.4 |

10.1 |

5.3% |

11.2% |

0.8x |

Accumulate |

|

NCBA |

36.1 |

36.4 |

0.8% |

36.9 |

37.0 |

4.1% |

5.8% |

0.8x |

Hold |

|

CIC Group |

2.9 |

2.6 |

(8.7%) |

2.7 |

2.6 |

5.0% |

5.7% |

0.9x |

Hold |

|

Barclays Bank*** |

13.1 |

13.4 |

2.3% |

13.4 |

13.0 |

8.2% |

5.6% |

1.7x |

Hold |

|

Stanbic Holdings |

114.0 |

105.3 |

(7.7%) |

109.3 |

103.1 |

4.6% |

2.5% |

1.1x |

Lighten |

|

Britam |

8.8 |

8.7 |

(1.1%) |

9.0 |

6.8 |

0.0% |

(22.0%) |

0.9x |

Sell |

|

HF Group |

5.6 |

5.8 |

2.9% |

6.5 |

4.2 |

0.0% |

(27.1%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industry Reports

During the week, Kenya Bankers Association released its Housing Price Index Q4’2019 Report, which highlighted that residential house prices recorded a 0.6% decline in Q4’2019, and apartments continue to dominate the real estate market fuelled by their affordability, compared to detached units. The other key take-outs from the report included;

- Residential house prices contracted by 0.6% in Q4’2019, compared to 2.3% in Q3’2019, attributed to slow demand given the sluggish economy and thus a resultant low disposable income. In addition, the limited access to credit has prevented willing home buyers from purchasing homes in the wake of increasing supply and thus vendors have been forced to drop their asking prices with the aim of attracting buyers,

- Apartments continue to dominate the market with a total market share of 74.0%, while bungalows and maisonettes registered a market share of 9.0% and 17.0%, respectively. The relatively high market share of apartments is mainly supported by the affordability of the units as opposed to bungalows and maisonettes, and,

- Nevertheless, the market share of apartments declined by 11.0% points from 85.0% in Q3’2019, to 74.0% in Q4’2019, attributed to a change of preference as some home buyers prefer low-density developments, as opposed to the high-density developments, which do not offer privacy.

As per the Cytonn Annual Markets Review 2019, there was y/y slowdown in the residential house price, with appreciation coming in at 1.1% in 2019, compared to 4.2% in 2018. The slowdown in performance was attributed to slow private sector credit growth before the interest rate cap law was repealed and slow property demands as home homebuyers’ spending power remained low amid a tough economic environment. In terms of residential segments, apartments recorded a price appreciation of 1.2%, 0.1% points higher than detached units, which recorded a price appreciation of 1.1%. The better performance of the apartment segment was mainly supported by the fact that apartments are relatively more affordable recording an average price of Kshs 97,675 per SQM, as compared to detached at Kshs 141,968 per SQM, thus more preferred by home buyers.

We expect the uptake of residential units to remain subdued as the negative effects of a sluggish economy continue to persist into 2020. However, we expect better performance particularly in the lower mid-end and low-end segments as investor appetite for the same continues, enabled by the continued government support in the form of incentives to developers and buyers, in addition to the growing demand for affordable housing units.

- Residential Sector

During the week, the Principal Secretary for Housing and Urban Development, Mr. Charles Hinga announced that the Shauri Moyo and Starehe affordable housing projects in Nairobi’s Eastlands were set for commissioning subject to the transfer of title deeds of the land from the National Treasury. This follows communication from the Housing and Urban Development Department, that civil servants who vacated Old Park Road Estate in Nairobi’s Ngara area would be given first priority in purchasing residential units from the Phase 1 of the Park Road housing project, which has 228 units. The said units were handed over to the National Government in January 2020, with the second and third phases of 260-units and 882-units, respectively, scheduled for completion in June and December 2020, respectively.

The above is an indication of the National Government’s continued focus on the provision of affordable housing mainly for the low and middle-income earners, with the program seeking to construct 500,000 units by 2022, in counties such as Nairobi, Nakuru, and Kiambu. In addition to setting out the land for development, the government has also continued to bring forth tax and policy reforms aimed at boosting both the supply and demand of the affordable housing units. Some of the incentives that the government has recently introduced to support the initiative include:

For Developers:

- A reduction in the Import Declaration Fee (IDF) from 2.0% to 1.5% on any input that will be made to construct houses under the affordable housing initiative,

- Exemption of companies implementing the affordable housing projects from the application of thin capitalization rules, and,

- Value Added Tax exemption for goods supplied for direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones (SEZ).

For Home Buyers:

- Inclusion of Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions which can hold deposits of a Home Ownership and Savings Plan (HOSP), in addition to the adoption of investment guidelines issued by the Capital Markets Authority (CMA) to guide the investment of deposits held in a registered HOSP,

- Stamp duty exemption on the transfer of a house constructed under the affordable housing scheme from the developer to the National Housing Corporation, and,

- Exemption from income tax of withdrawals from the National Housing Development Fund to purchase a house from a first-time owner.

We expect a continued focus on the affordable housing initiative to result in increased development activities especially in the lower mid-end and low-end submarkets. We also anticipate more potential homeowners will join the program given the significantly reduced financial burden in the strive towards homeownership, and developers and other private sector players taking up affordable housing projects as they are bound to maximize on the reduced development costs.

- Retail Sector

During the week, Tendam Group, a Spanish fashion retailer, opened its first Kenyan outlet at the Westgate shopping mall in Westlands. The retail store will consist of ‘Women’s Secret’ and ‘Springfield’ brands that will specialize in men's and women's fashion. The entry of the retailer into the market is an indication that Westlands’ retail sector continues to attract international investors, with others such as Hugo Boss and Mango having gained a foothold in the market in 2019. The entry is supported by; (i) Westlands’ positioning as an affluent neighborhood hosting middle to high- income earners with relatively high purchasing power, (ii) growing demand for international brands from the expanding middle class, and (iii) the supply of high-quality retail spaces that meet international standards. The same is reflected in the performance of the submarket, as it was ranked as the best performing retail submarket in the Nairobi Metropolitan Area recording average rental yields of 10.3%, 2.5% points higher than the 2019 market average of 7.8%, according to Cytonn’s Real Estate Annual Markets Review 2019 Note.

Quicksmart, a local retailer, opened its latest outlet along Kamiti Road in Roysambu, off the Nairobi-Thika Superhighway, marking its 27th location nationwide following recent openings in Ongata Rongai and along Waiyaki Way. In September 2019, Quick Mart Limited and Tumaini Self Service merged their operations, under the brand name Quick Mart, in order to; (i) gain a stronger footing in Kenya’s competitive formal retail space, (ii) strengthen operational efficiencies in order to gain a competitive edge, and (iii) expand their market share by tapping into the growing population and middle class.

The above developments are an indication of the local and international retailers’ confidence in Kenya’s retail consumer market thus guiding the continuous alignment of their expansion strategies aimed at tapping into the Nairobi outskirts, especially the rapidly urbanizing areas such as Roysambu with the aim of leverage on the growing middle class, ease of accessibility and the availability of relatively low priced retail spaces. According to our Real Estate Annual Markets Review 2019 Note, the sector recorded an average yield of 7.8%, with Westlands and Thika recording rental yields of 10.3% and 7.1%, respectively, as summarized in the table below:

|

Nairobi Metropolitan Area (NMA) Retail Submarket Performance 2019 |

|||

|

Location |

Rent Kshs/SQFT FY' 2019 |

Occupancy FY’ 2019 |

Rental Yield FY' 2019 |

|

Westlands |

215 |

82.8% |

10.3% |

|

Karen |

222 |

80.0% |

9.5% |

|

Kilimani |

167 |

87.4% |

8.8% |

|

Ngong Road |

181 |

80.5% |

8.3% |

|

Kiambu Road |

180 |

67.6% |

7.2% |

|

Thika road |

173 |

72.8% |

7.1% |

|

Eastlands |

150 |

71.7% |

6.8% |

|

Mombasa road |

156 |

66.8% |

6.3% |

|

Satellite Towns |

136 |

73.3% |

5.9% |

|

Average |

176 |

75.9% |

7.8% |

|

|||

Source: Cytonn Research 2019

Despite the existing retail office oversupply of approximately 2.0 mn SQFT of space, we expect the continued entry and expansion of both local and international retailers to cushion the sector in 2020, with a projected rental yield of 7.4%, according to the Cytonn 2020 Market Outlook.

We expect the real estate sector to continue recording several activities fuelled by; (i) the continued government focus on the affordable housing initiative, (ii) increased entry and expansion of both local and international retailers into the Kenya retail market, and, (iii) the existing housing demand within the low and middle segments of the residential market.

Homebuyers in the residential and hospitality markets, which have experienced tremendous change over the years, are now keen on serene locations and developments that provide them with comprehensive lifestyle amenities such as retail center, gym, clubhouse, open community spaces, and a swimming pool; with the choice of housing having shifted from the traditionally preferred bungalows to Master-Planned Communities. When you think of a master-planned community, what comes to mind? Things like massive developments, security, safety and exclusivity will probably feature somewhere on that list. But what else lies behind those beautiful gates and the seemingly perfect quaint homes?

The concept has been gaining significant popularity in the Kenyan market, during the week, Cytonn’s master-planned development affiliate, Superior Homes Kenya, launched their hospitality master-planned community, Pazuri at Vipingo, situated at the exclusive Vipingo Ridge. Therefore, for this week, we shall focus on the master-planned concept, by looking into;

- An Introduction to Master-Planned Communities (MPCs)

- Master-Planned Communities in Kenya & Factors Driving Them

- The Pros & Cons of Having a Master-Planned Community

- Summary of Thematic Performance in Mixed-Use Developments in Comparison to Single-Use Themes Performance

- Future of Master- Planned Communities in Kenya & Conclusion

- An Introduction to Master Planned Communities (MPCs)

A master-planned community is a large-scale residential neighborhood with a large number of recreational and commercial amenities, such as golf courses, tennis courts, lakes, parks, playgrounds, swimming pools, commercial stores, and restaurants. Some master-planned communities may have schools, office parks, large shopping centers and other businesses that add value to the entire development and provide a live-work-play environment for those that frequent or live in those communities.

- Master-Planned Communities in Kenya & Factors Driving Them

In the past, neighborhoods were built with only the “neighborhood” in mind. Little to no thought was given—and still isn’t in many instances—to the surrounding area. This means the schools, parks, shopping, banking, and other regular needs developed after or during the same time, but there wasn't any synergy between them. In addition, amenities such as grocery stores, banks, restaurants, retail, schools, parks, and all the other things were an independent afterthought.

However, in the recent years, Kenya’s real estate market has registered the development of master-planned communities, with developers aiming to offer a more comprehensive community, with some the key master-planned Communities in Kenya being;

- Pazuri at Vipingo: This is master-planned estate located 35 KM north of Mombasa on the Mombasa to Malindi highway. The development comprising 372 units is located on a 105-acre plot and has three house types with a choice of two, three and four-bedroom units with all bedrooms ensuite. The units are of 132.5 SQM, 191.8 SQM and 226 SQM, priced at Kshs 12.98 mn, 16.98 mn and 20.98 mn, respectively, and this translates to Kshs 93,108 per SQM. The amenities within the development include the 18-hole golf course, a clubhouse, tennis courts, stables and beach club,

- Green Park Estate: The 650-unit development is located in Athi River off Mombasa Highway. The development comprises of 4 bedroom detached and semi-detached units priced between Kshs 18.4 mn and Kshs 34.9 mn, depending on the design, unit and land size. The amenities include; a clubhouse, Swimming pool, Gym, Tennis court, Football pitch, School and boreholes, among others,

- Tilisi Development: It is a 400-acre mixed-use and master-planned development located 30 KM from the Nairobi CBD, off the Nakuru- Nairobi highway. The project comprises of light industrial, residential, educational, medical, recreational, hospitality, commercial and retail uses, and commenced construction in 2017. The residential development in Tilisi consisting of 186 units of 3, 4 and 5 bedroom villas set on eighth, quarter and half-acre plots, with price points of Kshs 19.0 mn to Kshs 60.0 mn,

- RiverRun Estates: RiverRun Estates is a master-planned development to be undertaken on a 100-acre parcel in Ruiru, Kiambu County. The residential development consists of 3 & 4 bedroom maisonettes and 2 & 3 bedroom apartments. The development provides green spaces, outdoor play areas and recreational facilities including swimming pools, a water park, and access to a dam with a water frontage of 800m and clubhouse facilities. The development also offers approximately 1,000 SQM of retail space and 24-hour CCTV surveillance and ample recreational amenities.

|

Master- Planned Developments Summary |

||||

|

Name of development |

Residential Unit Sizes (SQM) |

Residential Unit Price (Kshs) |

Price per SQM (Kshs) |

Amenities/Facilities |

|

Pazuri at Vipingo |

2 bedroom (villas)= 132.5 SQM |

13.0 mn |

93,108 |

An 18-hole golf course, a clubhouse, tennis courts, stables and beach club |

|

3 bedroom (villas)= 191.8 SQM |

17.0 mn |

|||

|

4 bedroom (villas)= 226.0 SQM |

21.0 mn |

|||

|

Green Park Estate in Athi River |

3 bedroom quarter villa=157 SQM |

9.6 mn |

103,772 |

A clubhouse, swimming pool, gym, tennis court, football pitch, school and boreholes |

|

3 bedroom semi- detached maisonette (1/8 acre)= 157 SQM |

14.0 mn |

|||

|

4 bedroom bungalow (1/4 acre)=146 SQM |

18.4 mn |

|||

|

4 bedroom super bungalow (1/4 acre)=184 SQM |

23.1 mn |

|||

|

4 bedroom villa (1/4 acre)=320 SQM |

37.7 mn |

|||

|

RiverRun Estate in Ruiru |

Villa (1/4 acre)= 250 SQM |

29.6 mn |

Outdoor play areas and recreational facilities including swimming pools, a water park, access to a dam with a water frontage of 800m and clubhouse facilities |

|

|

|

Townhouses (1/8 acre)= 190 SQM |

20.5 mn |

108,289 |

|

|

|

Semi Detached (1/16 acre)= 140 SQM |

13.8 mn |

||

|

Tilisi Development in Limuru |

The residential estate comprises of 3, 4 and 5 bedroom villas with price points of Kshs 19.0 mn to Kshs 60.0 mn, depending on the size of the unit |

The project comprises of light industrial, residential, educational, medical, recreational, hospitality, commercial and retail uses |

||

Source: Cytonn Research

Some of the major factors supporting the growth of Master Planned Communities include:

- Relatively Higher Developer Returns: Over the past two years, rental yields in sole use high-end residential properties have slowed down owing to an oversupply in the wake of relatively low demand. This downturn in performance has resulted in less speculative investment leading to an upturn in the new trend of Master-Planned Communities which promise better-diversified portfolio and returns from a project mix comprising of sectors that perform differently in the market,

- Demographic Growth: According to the World Bank, Kenya’s urban population grows at an average annual rate of 4.3%. This is in comparison to the Sub-Saharan and global rates of 4.1% and 1.2%, respectively. The rapid population growth calls for innovative real estate solutions that promote operational synergies and accommodate the population pressures with themes that complement each other,

- Growth of the Middle Class: Kenya’s middle class continues to grow which means increased disposable income and demand for convenient lifestyles such as the ability to live, work and play in an environment that meets business, residential and social demands of modern lifestyles. This has created a niche for developers to connect workstations and residences promoting productivity and peak functionality to end buyers,

- Benefits of Economies of Scale to the Developer and the Buyer- Due to relatively large scale, amenities and key utilities are easily provided at a relatively lower unit cost, with the benefit passing to the end-user in fewer prices. For instance, the provision of sewer, and,

- Lack of Key Facilities in Upcoming Development areas – Lack of facilities such as trunk sewer, water, and amenities like retail and schools has seen developers create master-plan communities and dedicate these services to their occupants at affordable prices.

- The Pros & Cons Of Having A Master Planned Community

The benefits of master-planned developments include;

- High Returns to Investors- As mentioned in the introduction, master-planned communities may include several themes within the same development i.e. residential apartments, detached units, a hospitality facility, and retail space. According to Cytonn Research, themes within such a mixed-use concept attract better returns to investors, unlike single-themed developments. Therefore, investors in master-planned developments leverage from the relatively good returns achieved from the developments. For example, residential single-themed units recorded rental yields of approximately 5.0%, compared to 5.4% recorded by residential units within mixed-use developments in 2019,

- Security: Homeowners prefer living in a compound with a perimeter wall and manned gates reducing the chances of crimes such as robbery and kidnapping. In addition, parents also feel safer with children playing in a safe environment provided within master-planned communities,

- Affordability: Buying a house in Master-Planned Communities is considerably cheaper than a stand-alone house. In addition, economies of scale are achieved by constructing several houses thereby units in gated communities are considerably cheaper than putting up single units,

- Sharing Services and Facilities: Common services such as solar-powered panels, boreholes, swimming pools and gyms can be shared among residents making them more accessible and affordable to homeowners,

- Lifestyles: Master-Planned Communities provide for proximity to various social amenities that homeowners put into consideration such as schools, gyms and swimming pools, shopping malls and medical clinics thereby bringing convenience to the residents’ doorstep,

- Beautiful Landscaping- In these developments, the common areas are meticulously cared for by a dedicated team of landscapers. In addition, these communities often include amenities such as walking, jogging and biking trails, playgrounds, among other amenities,

- Competitive Prices- Given that the homes within a master-planned community are similar from floor plan to the floor plan, the prices can be competitive. This thus means that investors are bound to reap good returns from the housing units in addition to gaining from the capital appreciation over time,

- Stabilized Values- Given that the property is within a controlled development set up, there is guaranteed stability of the property prices as the property owners must keep their houses in good condition that matches the neighborhood standards, thus one neighbor can't devalue another's property,

- Quality Neighbourhoods- Typically, these neighborhoods are developed by top-notch contractors with years of experience. That translates into quality construction, which is a huge benefit for investors.

Despite the above benefits, there exist a few cons of master-planned developments and these include;

- Less Freedom for Decorating and Design- For some, Master-Planned Communities guidelines regarding home’s exteriors, landscaping, and maintenance how-to's and must-do’s, represent too much control and some homeowners feel they are being deprived of their right to freedom of expression,

- High Density- Planned communities host a great number of similar properties, which could mean that there is not much space left for a back or a front yard. This raises the density rates in high levels and may result in traffic and congestion problems, and,

- Limited Privacy- Since planned communities host a great number of properties and people into a relatively small area for some developments, residents live very close to one another and there is limited privacy.

- Summary of Thematic Performance in Mixed-Use Developments in Comparison to Single Use Themes Performance

In terms of performance, in 2019, Mixed-Use Developments recorded average rental yields of 7.3%, 0.4% points higher than the respective single-use retail, commercial office and residential themes with 6.9%. The retail, offices and residential spaces in these developments recorded rental yields of 8.4%, 7.9%, and 5.4%, respectively, compared to the single-use average of 8.0%, 7.7%, and 5.0%, respectively. This is attributed to increasing popularity for differentiating the mixed-use concepts due to convenience as a result of incorporated working, shopping, and living spaces.

The table below shows the performance of single-use and mixed-use development in 2019:

|

Thematic Performance of Mixed-Use Developments in 2019 |

||||

|

|

Mixed-Use Themes Average |

Single-Use Themes Average |

||

|

Themes |

Rental Yield % 2019 |

Rental Yield % 2019 |

||

|

Retail |

8.4% |

8.0% |

||

|

Commercial Office |

7.9% |

7.7% |

||

|

Residential |

5.4% |

5.0% |

||

|

Average |

7.3% |

6.9% |

||

|

||||

Source: Cytonn Research 2019

- The Future of Master Planned Communities and Conclusion

The benefits mentioned above outweigh the challenges and this has continued to drive the popularity of master-planned communities in the Kenya real estate sector with Kenyans no longer just buying a home but a lifestyle as a well. Therefore, we expect the market to witness increased development of such communities in the coming years as investors aim to gain from the relatively high returns achievable. In terms of demand, we expect the availability of a more comprehensive lifestyle for homebuyers in Master-Planned Communities to continue fuelling the uptake of property within such developments. Given the relatively large parcels of land required for Master-Planned Communities, we expect to witness more of the developments coming up in satellite towns where development land is available in bulk unlike within the Central Business District, in addition to the affordability of land in the Nairobi outskirts, coupled by the improving infrastructure which enhances accessibility and supports liveability.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.