Nairobi Metropolitan Area (NMA) Mixed-Use Developments Report 2024, & Cytonn Weekly #45/2024

By Cytonn Research, Nov 10, 2024

Executive Summary

Fixed Income

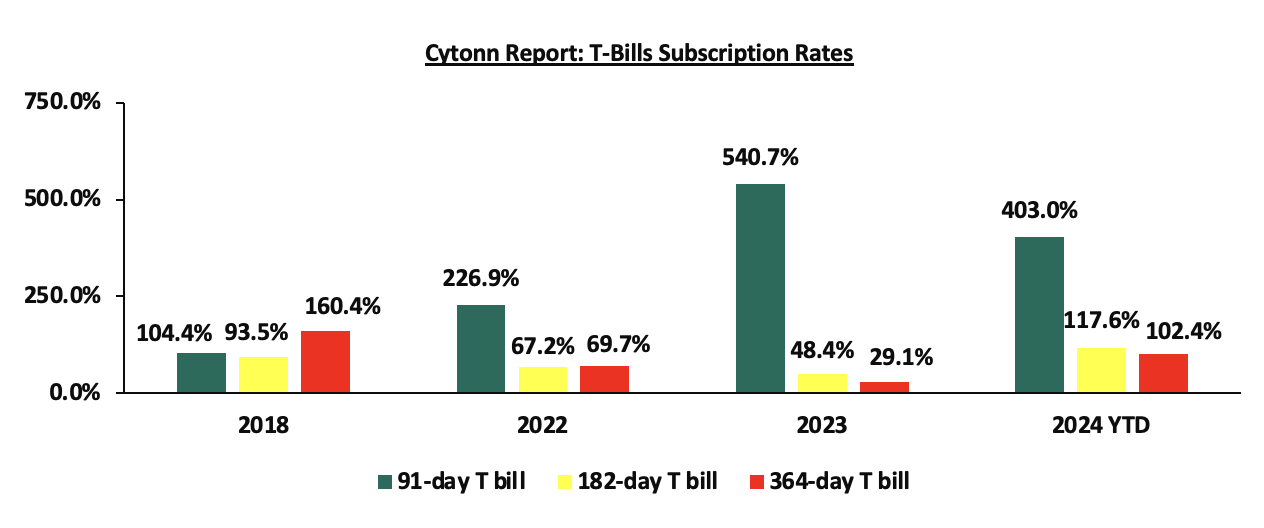

During the week, T-bills were oversubscribed for the sixth consecutive week, with the overall oversubscription rate coming in at 409.9%, higher than the oversubscription rate of 259.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 27.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 686.1%, significantly higher than the oversubscription rate of 375.2% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 427.8% and 281.5% respectively from the 232.4% and 239.2% respectively recorded the previous week. The government accepted a total of Kshs 53.7 bn worth of bids out of Kshs 98.4 bn bids received, translating to an acceptance rate of 54.6%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day, and 91-day papers decreasing by 52.1 bps, 68.3 bps, and 51.6 bps to 14.4%, 13.8%, and 13.4% respectively, from 15.0%, 14.5%, and 14.0% respectively recorded the previous week;

Also, during the week, the Central Bank of Kenya released the auction results for the re-opened bonds, FXD1/2023/010 with a tenor to maturity of 8.2 years, and a fixed coupon rate of 14.2% and FXD1/2022/015 with a tenor to maturity of 12.4 years, and a fixed coupon rate of 13.9%. The bonds were oversubscribed with the overall subscription rate coming in at 132.2%, receiving bids worth Kshs 33.0 bn against the offered Kshs 25.0 bn. The government accepted bids worth Kshs 25.7 bn, translating to an acceptance rate of 77.7%. The weighted average yields of accepted bids for the FXD1/2023/010 and the FXD1/2022/015 came in at 16.0% and 16.3% respectively, which were below our expectation of within a bidding range of 16.25%-16.55% for the FXD1/2023/010 and 16.45%-16.55% for the FXD1/2022/015. Notably, the 16.0% yield on the FXD1/2023/010 was lower than the 16.4% rate recorded on the last sale in June 2024, while the 16.3% yield on the FXD1/2022/015 was higher than the 14.2% recorded the last time it was offered in January 2023. With the Inflation rate at 2.7% as of October 2024, the real return of the FXD1/2023/010 and the FXD1/2022/015 is 13.3% and 13.6% respectively;

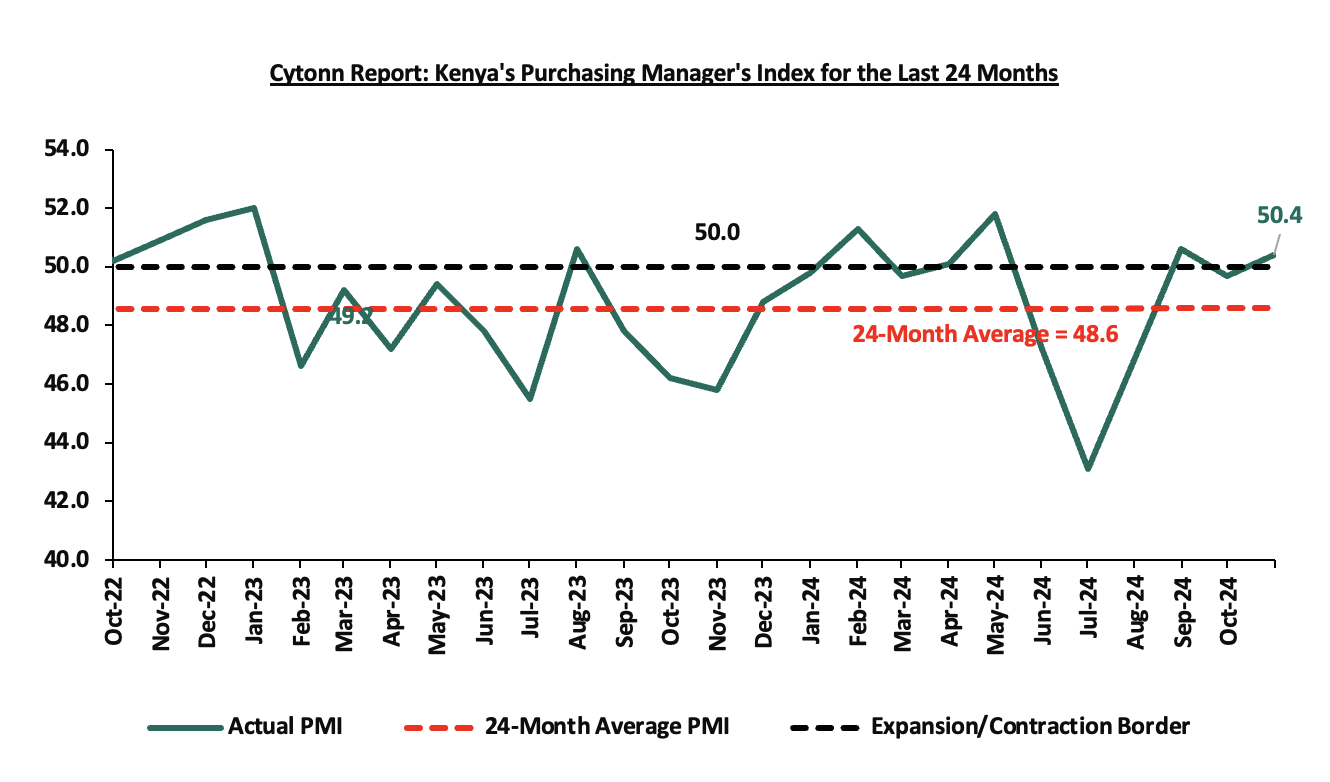

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of October 2024 improved, coming in at 50.4, up from 49.7 in September 2024, signaling a mild recovery in business conditions. This is majorly attributable to a reduction in fuel prices and borrowing costs, which resulted in increased employment for the first time in three months, accelerated purchasing efforts, and mild input cost pressures, prompting a slower increase in the average price charged;

Equities

During the week, the equities market recorded a mixed performance, with NSE 20 gaining by 1.2%, while NASI, NSE 10, and NSE 25 declining by 1.7%, 0.1%, and 0.1% respectively, taking the YTD performance to gains of 35.8%, 33.5%, 27.7% and 25.7% for NSE 10, NSE 25, NSE 20 and NASI respectively. The equities market performance was mainly driven by gains recorded by EABL, Stanbic Bank, and Equity Group of 5.3%, 3.9%, and 1.6% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Safaricom, BAT, and DTB-K of 6.6%, 1.9%, and 1.9% respectively;

During the week, Safaricom Plc released its H1’2025 financial results for the period ending 30th September 2024, highlighting that the profit after tax (PAT) for the Group declined by 63.2% to Kshs 10.0 bn, from 27.2 bn recorded in H1’2024, largely attributable to a 34.6% increase in operating expenses to Kshs 114.4 bn from Kshs 84.9 bn recorded in H1’2024 mainly due to the ongoing operations in Ethiopia, which outpaced the 15.1% growth in total revenue to Kshs 189.4 bn in H1’2025, from Kshs 164.6 bn in H1’2024.

Real Estate

During the week, Purple Dot International Limited, a residential and commercial property developer broke ground on a high-end residential development in Lang’ata, dubbed Marigold II. The development is Situated on a seven-acre plot. Marigold II will consist of 89 townhouses, offering both duplex and triplex units designed to blend modern aesthetics with a sense of community and security

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

In December 2023, we released the Nairobi Metropolitan Area Mixed-Use Developments (MUDs) Report 2023 which highlighted that Mixed-Use Developments recorded an average rental yield of 8.4%, 1.3% points higher than the respective single-use themes which recorded an average rental yield of 7.1% in a similar period in 2023. The relatively better performance was mainly attributed to; i) heightened demand for prime locations attracting clients willing to pay premium rents ii) strategic and prime locations of the developments with the capability to attract prospective clients, and, iii)) the area’s proximity to amenities such as shopping malls enhancing the desirability. This week we update our report with 2024 market research data in order to determine the progress and performance of MUDs against the performance of single-use Residential, Commercial Office, and Retail developments. Mixed-Use Developments in the Nairobi Metropolitan Area (NMA) recorded an average rental yield of 8.6% in 2024, 1.5% points higher than the respective single-use themes which recorded an average rental yield of 7.1% in a similar period the previous year. Additionally, the performance was a 0.2% points y/y increase in the average rental yield to 8.6% in 2024, from the 8.4% recorded in 2023 for MUD themes;

Investment Updates:

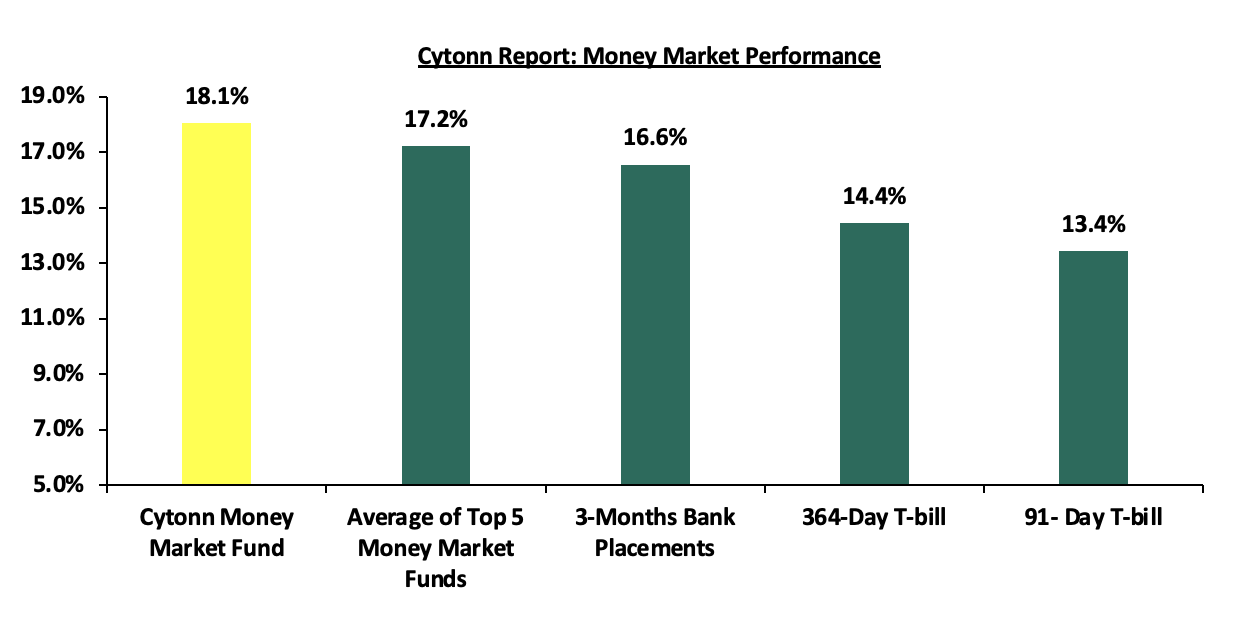

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 18.1 % p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were oversubscribed for the sixth consecutive week, with the overall oversubscription rate coming in at 409.9%, higher than the oversubscription rate of 259.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 27.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 686.1%, significantly higher than the oversubscription rate of 375.2% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 427.8% and 281.5% respectively from the 232.4% and 239.2% respectively recorded the previous week. The government accepted a total of Kshs 53.7 bn worth of bids out of Kshs 98.4 bn bids received, translating to an acceptance rate of 54.6%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day, and 91-day papers decreasing by 52.1 bps, 68.3 bps, and 51.6 bps to 14.4%, 13.8%, and 13.4% respectively from 15.0%, 14.5% and 14.0% respectively recorded the previous week. The chart below shows the yield growth rate for the 91-day paper over the period:

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Also, during the week, the Central Bank of Kenya released the auction results for the re-opened bonds, FXD1/2023/010 with a tenor to maturity of 8.2 years, and a fixed coupon rate of 14.2% and FXD1/2022/015 with a tenor to maturity of 12.4 years, and a fixed coupon rate of 13.9%. The bonds were oversubscribed with the overall subscription rate coming in at 132.2%, receiving bids worth Kshs 33.0 bn against the offered Kshs 25.0 bn. The government accepted bids worth Kshs 25.7 bn, translating to an acceptance rate of 77.7%. The weighted average yields of accepted bids for the FXD1/2023/010 and the FXD1/2022/015 came in at 16.0% and 16.3% respectively, which were below our expectation of within a bidding range of 16.25%-16.55% for the FXD1/2023/010 and 16.45%-16.55% for the FXD1/2022/015. Notably, the 16.0% yield on the FXD1/2023/010 was lower than the 16.4% rate recorded on the last sale in June 2024, while the 16.3% yield on the FXD1/2022/015 was higher than the 14.2% recorded the last time it was offered in January 2023. With the Inflation rate at 2.7% as of October 2024, the real return of the FXD1/2023/010 and the FXD1/2022/015 is 13.3% and 13.6% respectively.

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 16.6% (based on what we have been offered by various banks), and the yields on the government papers were on a downward trajectory, with the yields on the 364-day and 91-day papers decreasing by 52.1 bps and 51.6 bps to 14.4% and 13.4% respectively from 15.0% and 14.0% respectively recorded the previous week. The yields on the Cytonn Money Market Fund closed the week at 18.1%, remaining unchanged from the previous week, while the average yields on the Top 5 Money Market Funds decreased by 15.8 bps to close the week at 17.2%, from 17.4% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 8th November 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 8th November 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or Download the Cytonn App) |

18.1% |

|

2 |

Lofty-Corban Money Market Fund |

17.8% |

|

3 |

Etica Money Market Fund |

17.2% |

|

4 |

Arvocap Money Market Fund |

16.6% |

|

5 |

Kuza Money Market fund |

16.5% |

|

6 |

Jubilee Money Market Fund |

15.5% |

|

7 |

Ndovu Money Market Fund |

15.5% |

|

8 |

Nabo Africa Money Market Fund |

15.4% |

|

9 |

Mali Money Market Fund |

15.2% |

|

10 |

Genghis Money Market Fund |

15.2% |

|

11 |

GenAfrica Money Market Fund |

15.2% |

|

12 |

KCB Money Market Fund |

15.2% |

|

13 |

Faulu Money Market Fund |

15.2% |

|

14 |

Mayfair Money Market Fund |

14.9% |

|

15 |

Sanlam Money Market Fund |

14.9% |

|

16 |

Apollo Money Market Fund |

14.9% |

|

17 |

Madison Money Market Fund |

14.9% |

|

18 |

Enwealth Money Market Fund |

14.6% |

|

19 |

Co-op Money Market Fund |

14.4% |

|

20 |

Absa Shilling Money Market Fund |

14.3% |

|

21 |

Orient Kasha Money Market Fund |

14.3% |

|

22 |

Old Mutual Money Market Fund |

13.9% |

|

23 |

Dry Associates Money Market Fund |

13.9% |

|

24 |

CIC Money Market Fund |

13.5% |

|

25 |

ICEA Lion Money Market Fund |

13.4% |

|

26 |

AA Kenya Shillings Fund |

13.7% |

|

27 |

British-American Money Market Fund |

13.5% |

|

28 |

Stanbic Money Market Fund |

13.3% |

|

29 |

Equity Money Market Fund |

13.2% |

Source: Business Daily

Liquidity:

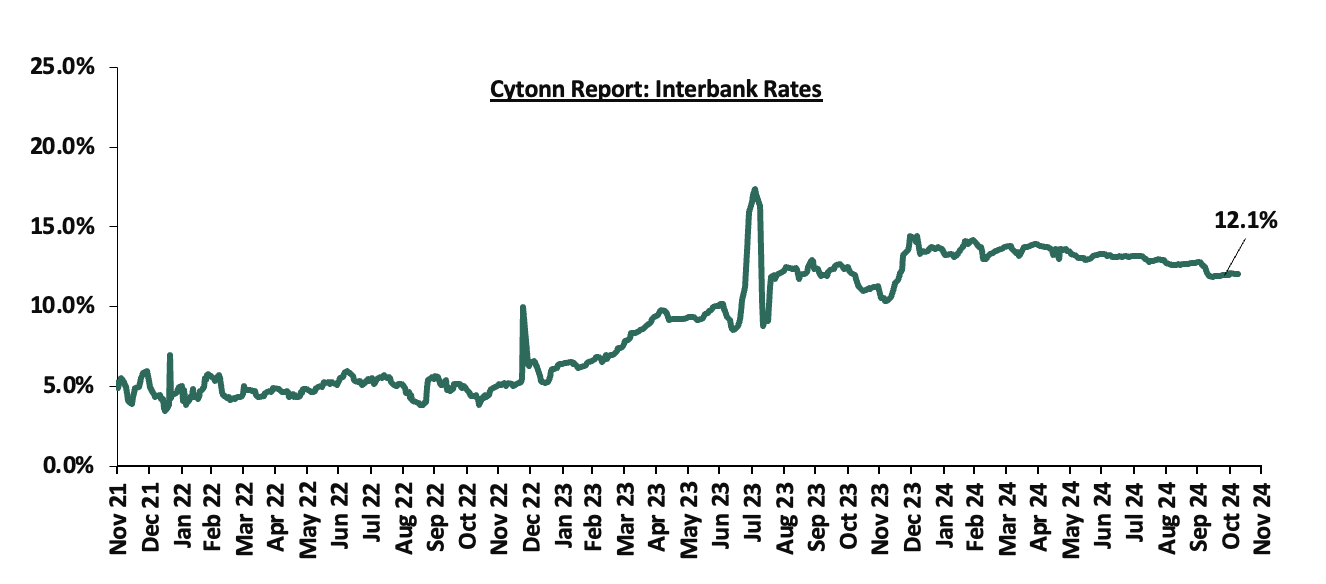

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 7.2 bps, to 12.1% from the 12.0% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased significantly by 75.3% to Kshs 55.2 bn from Kshs 31.5 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, with the yields on the 7-year Eurobond issued in 2024 increasing the most by 7.0 bps to 9.9% from 9.8% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 7th November 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.3 |

23.3 |

2.5 |

7.5 |

9.6 |

6.3 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

01-Oct-24 |

8.6% |

9.9% |

8.3% |

9.6% |

9.4% |

9.5% |

|

31-Oct-24 |

8.9% |

10.1% |

8.2% |

9.9% |

9.7% |

9.8% |

|

01-Nov-24 |

9.1% |

10.2% |

8.3% |

9.9% |

9.8% |

9.9% |

|

04-Nov-24 |

9.1% |

10.2% |

8.3% |

9.9% |

9.8% |

9.9% |

|

05-Nov-24 |

9.2% |

10.2% |

8.5% |

10.0% |

9.9% |

10.0% |

|

06-Nov-24 |

9.2% |

10.3% |

8.5% |

10.0% |

9.9% |

10.0% |

|

07-Nov-24 |

9.0% |

10.2% |

8.3% |

9.9% |

9.8% |

9.9% |

|

Weekly Change |

0.1% |

0.0% |

0.1% |

0.0% |

0.0% |

0.1% |

|

MTD Change |

0.4% |

0.2% |

(0.1%) |

0.3% |

0.3% |

0.3% |

|

YTD Change |

(0.8%) |

0.0% |

(1.8%) |

(0.0%) |

0.3% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated marginally against the US Dollar by 0.4 bps, to remain relatively unchanged at the Kshs 129.2 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 17.7% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,723.0 mn in the 12 months to September 2024, 14.0% higher than the USD 4,142.0 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the September 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 55.4% in the period,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 21.0% in the 12 months to August 2024, compared to a similar period in 2023, and,

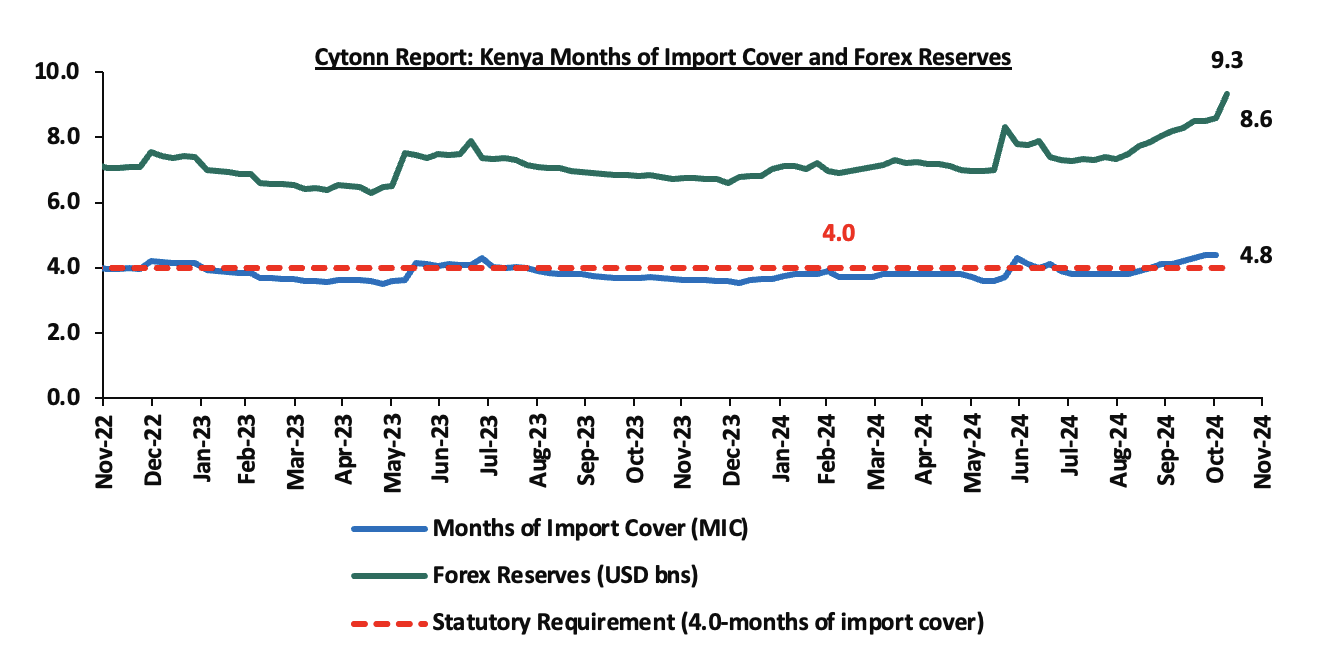

- Improved forex reserves currently at USD 9.3 bn (equivalent to 4.8-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.8% of GDP in Q2’2024 from 3.7% recorded in Q2’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves rose by 8.6% during the week, reaching USD 9.3 bn, equivalent to 4.8 months of import cover from 4.4 months recorded the previous week, and above to the statutory requirement of maintaining at least 4.0-months of import cover. This increase in forex reserves is primarily attributed to the recent disbursement from the International Monetary Fund (IMF). On October 30, 2024, the IMF approved a combined disbursement of around USD 606.1 mn following the successful completion of Kenya’s seventh and eighth reviews under the Extended Fund Facility (EFF), Extended Credit Facility (ECF), and Resilience and Sustainability Facility (RSF) arrangements. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- Stanbic Bank’s October 2024 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of October 2024 improved, coming in at 50.4, up from 49.7 in September 2024, signaling a mild recovery in business conditions. This is majorly attributable to a reduction in fuel prices and borrowing costs, which resulted in increased employment for the first time in three months, accelerated purchasing efforts, and mild input cost pressures, prompting a slower increase in the average price charged.

In October, Kenyan businesses raised their output levels for the third time in three months although only slightly overall. This is attributable to the rise in activity of a third of firms surveyed, however, weighed down by declining activities of 29.0% of firms surveyed. Agriculture, construction and wholesale & retail sectors recorded an expansion but were however weighed down by a decrease in the manufacturing and services sectors.

The businesses surveyed saw an increase in their activity in October attributed to the rising sales and client interests. However, the rise in sales was minimal as many firms continue to struggle with cash flow constraints, tough economic conditions, rising costs, and political uncertainty.

Employment levels improved slightly in October, attributable to the slight rise in output. This marked the first increase since July, which allowed for a fresh depletion of backlogs of work.

In October, capacity-building efforts also involved purchases, with the volume of inputs acquired increasing for the third consecutive month. In anticipation of new customers, businesses increased their input stocks. Inventories grew at a moderate pace, marking the quickest rise seen in over a year.

Increased spending by firms partly mirrored an improvement in output expectations at the beginning of the fourth quarter. Confidence in activity for the upcoming year reached a four-month peak, with factors such as new outlets, revamped marketing strategies, and greater investments frequently cited as expected growth drivers. However, sentiment remained relatively low compared to historical trends.

Despite increased hiring and purchasing activity, Kenyan firms experienced a modest rate of input cost inflation. The y/y inflation in October 2024 declined by 0.9% points to 2.7%, from the 3.6% recorded in September 2024. Although taxes and rising material prices pushed up expenses for several firms, this was somewhat offset by lower fuel prices. The prices for maximum retail fuel prices in Kenya for Super Petrol, Diesel, and Kerosene decreased by Kshs 8.2, Kshs 3.5, and Kshs 6.9 per litre respectively. Consequently, Super Petrol, Diesel, and Kerosene will retail at Kshs 180.7, Kshs 168.1, and Kshs 151.4 per litre respectively, from Kshs 188.8, Kshs 171.6, and Kshs 158.4 per litre respectively the last month. Overall, cost pressures were mild compared to those observed last year.

As a result, average prices charged saw only a slight increase. Notably, a moderate rise in August and a decline in April represented the only occasions in nearly four years where inflationary pressures on selling prices have eased.

The chart below summarizes the evolution of PMI over the last 24 months:

Going forward, we anticipate that the business environment will improve in the short to medium term as a result of the improving economic environment driven by lower interest rates following the easing monetary policy, the stability of the Kenyan Shilling against the USD, and the easing inflation, which is currently at its lowest in years and reduced fuel prices. However, we expect businesses to be weighed down by the high cost of living coupled with the high taxation, which is set to increase input costs.

Rates in the Fixed Income market have been on a downward trend given the continued low demand for cash by the government and the improved liquidity in the money market. The government is 141.2% ahead of its prorated net domestic borrowing target of Kshs 149.2 bn, having a net borrowing position of Kshs 360.0 bn. However, we expect a downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium-term, and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market recorded a mixed performance, with NSE 20 gaining by 1.2%, while NASI, NSE 10, and NSE 25 declining by 1.7%, 0.1%, and 0.1% respectively, taking the YTD performance to gains of 35.8%, 33.5%, 27.7% and 25.7% for NSE 10, NSE 25, NSE 20 and NASI respectively. The equities market performance was mainly driven by gains recorded by EABL, Stanbic Bank, and Equity Group of 5.3%, 3.9%, and 1.6% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Safaricom, BAT, and DTB-K of 6.6%, 1.9%, and 1.9% respectively.

During the week, equities turnover increased by 36.9% to USD 12.0 mn from USD 8.8 mn recorded the previous week, taking the YTD turnover to USD 533.3 mn. Foreign investors remained net sellers for the fifth consecutive week, with a net selling position of USD 1.5 mn, from a net selling position of USD 1.7 mn recorded the previous week, taking the YTD net selling position to USD 3.9 mn.

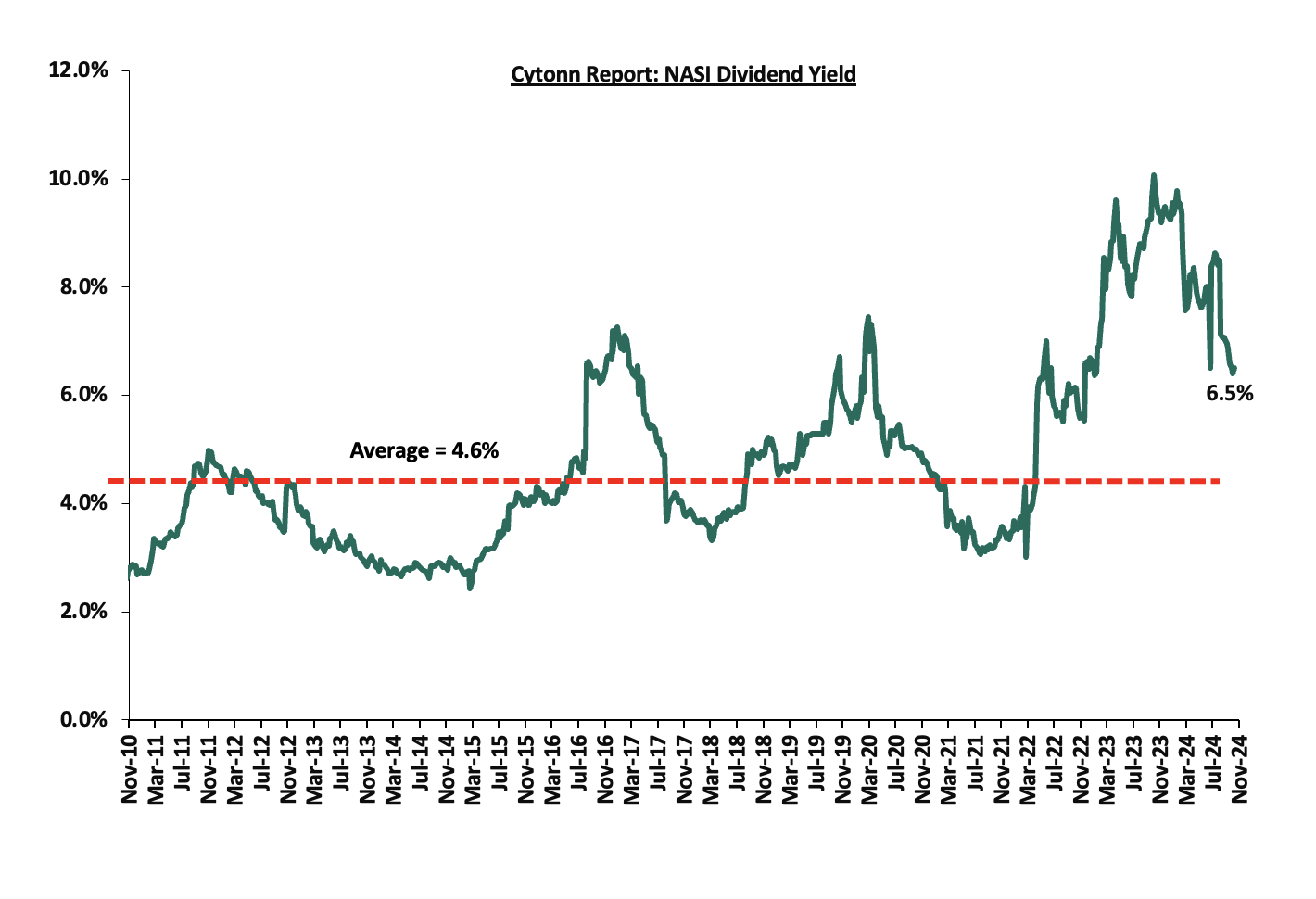

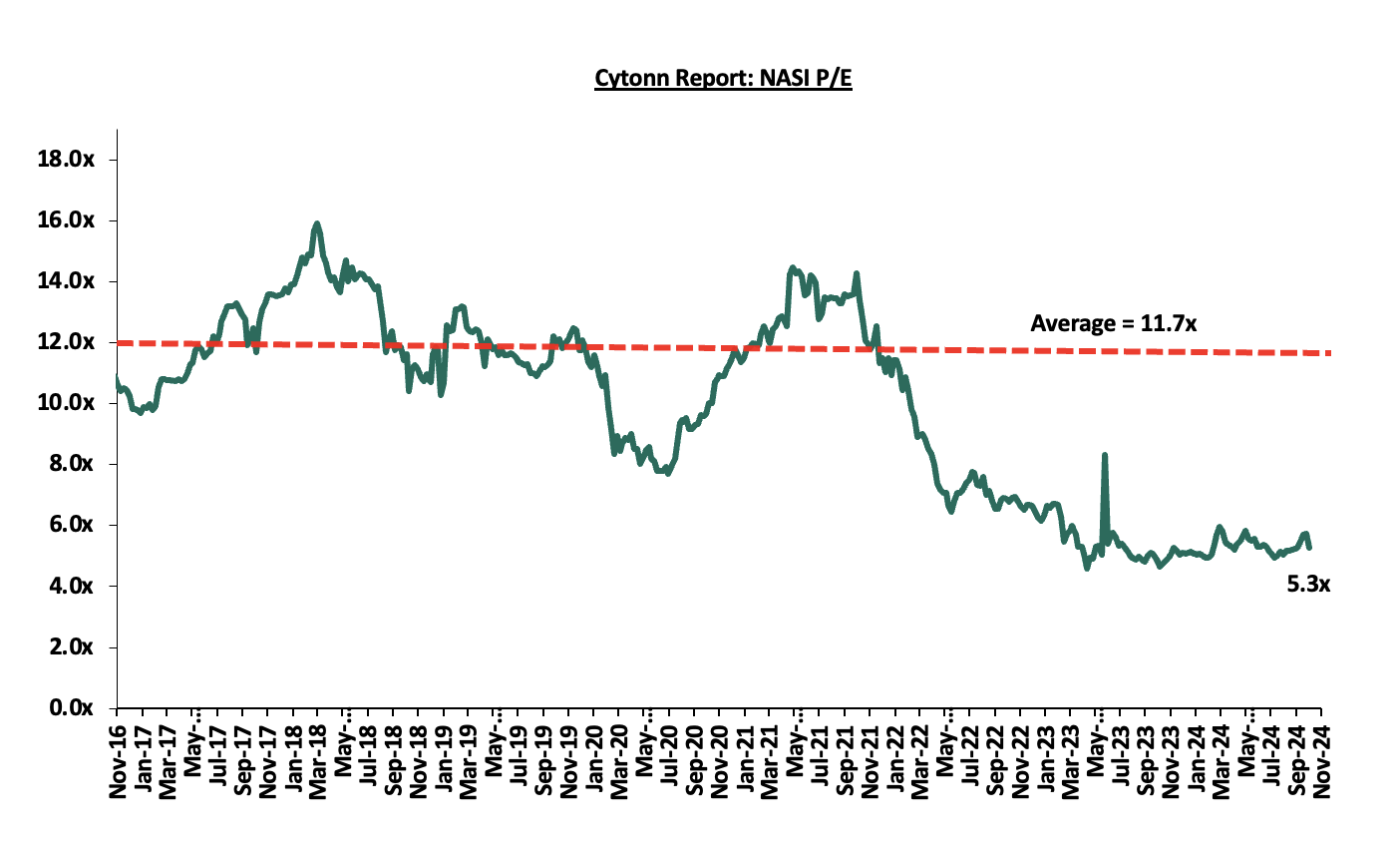

The market is currently trading at a price-to-earnings ratio (P/E) of 3.4x, 71.4% below the historical average of 11.7x, and a dividend yield of 6.5%, 1.9% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.4x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 31/10/2024 |

Price as at 08/11/2024 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Average |

|

Jubilee Holdings |

170.0 |

163.0 |

(4.1%) |

(11.9%) |

185.0 |

260.7 |

8.8% |

68.7% |

0.3x |

Buy |

|

NCBA |

44.1 |

43.3 |

(1.7%) |

11.5% |

2.3 |

55.2 |

11.0% |

38.5% |

0.8x |

Buy |

|

Diamond Trust Bank |

53.0 |

52.0 |

(1.9%) |

16.2% |

34.2 |

65.2 |

9.6% |

35.0% |

0.2x |

Buy |

|

Equity Group |

47.3 |

48.1 |

1.6% |

40.5% |

5.1 |

60.2 |

8.3% |

33.6% |

0.9x |

Buy |

|

Britam |

5.5 |

5.7 |

2.5% |

10.5% |

38.9 |

7.5 |

0.0% |

32.0% |

0.8x |

Buy |

|

Co-op Bank |

14.1 |

14.2 |

0.7% |

25.1% |

11.4 |

17.2 |

10.6% |

31.7% |

0.7x |

Buy |

|

CIC Group |

2.2 |

2.3 |

4.1% |

0.0% |

44.8 |

2.8 |

5.7% |

27.9% |

0.7x |

Buy |

|

ABSA Bank |

15.3 |

15.1 |

(1.6%) |

30.3% |

106.0 |

17.3 |

10.3% |

25.2% |

1.2x |

Buy |

|

Stanbic Holdings |

129.0 |

134.0 |

3.9% |

26.4% |

11.6 |

145.3 |

11.5% |

19.9% |

0.9x |

Accumulate |

|

KCB Group |

38.5 |

39.0 |

1.3% |

77.7% |

22.0 |

46.7 |

0.0% |

19.6% |

0.6x |

Accumulate |

|

Standard Chartered Bank |

232.0 |

231.0 |

(0.4%) |

44.1% |

160.3 |

235.2 |

12.6% |

14.4% |

1.5x |

Accumulate |

|

I&M Group |

28.1 |

28.0 |

(0.4%) |

60.5% |

17.5 |

26.5 |

9.1% |

3.8% |

0.6x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

Weekly Highlights

- Safaricom H1’2025 Financial Results

During the week, Safaricom Plc released its H1’2025 financial results for the period ending 30th September 2024, highlighting that the profit after tax (PAT) for the Group declined by 63.2% to Kshs 10.0 bn, from 27.2 bn recorded in H1’2024, largely attributable to a 34.6% increase in operating expenses to Kshs 114.4 bn from Kshs 84.9 bn recorded in H1’2024 mainly due to the ongoing operations in Ethiopia, which outpaced the 15.1% growth in total revenue to Kshs 189.4 bn in H1’2025, from Kshs 164.6 bn in H1’2024.

The tables below show the breakdown of the group’s financial statements from the report;

|

Cytonn Report: Safaricom PLC Income Statement |

|||

|

Item (All figures in Bns) |

H1'2024 |

H1'2025 |

y/y change |

|

Total Revenue |

164.6 |

189.4 |

15.1% |

|

Operating costs |

(84.9) |

(114.4) |

34.6% |

|

EBITDA |

79.7 |

75.1 |

(5.8%) |

|

EBITDA Margin |

48.4% |

39.6% |

(8.8%) |

|

Depreciation & Amortization |

(38.2) |

(32.9) |

(14.0%) |

|

Operating Profit |

41.9 |

42.6 |

1.6% |

|

Net Finance Costs |

(7.1) |

(10.9) |

53.3% |

|

Profit Before Tax |

46.9 |

33.9 |

(27.9)% |

|

Profit After Tax |

27.2 |

10.0 |

(63.2)% |

|

Earnings Per Share |

0.9 |

0.7 |

(17.7%) |

|

Cytonn Report: Safaricom PLC Balance Sheet |

|||

|

Item (All figures in Bns) |

H1'2024 |

H1'2025 |

y/y change |

|

Current Assets |

76.4 |

74.3 |

(2.8%) |

|

Non-Current Assets |

547.7 |

408.8 |

(25.4%) |

|

Total Assets |

624.1 |

483.1 |

(22.6)% |

|

Current Liabilities |

147.6 |

158.4 |

7.3% |

|

Non-Current Liabilities |

131.0 |

135.1 |

3.1% |

|

Total liabilities |

278.6 |

293.5 |

5.3% |

|

Shareholder funds |

221.9 |

155.3 |

(30.0%) |

|

Minority Interest |

123.7 |

34.3 |

(72.2%) |

|

Total Equity |

345.6 |

189.7 |

(45.1)% |

Key take outs from the report include;

- Total revenue increased by 15.1% to Kshs 189.4 bn in H1’2025, from Kshs 164.6 bn in H1’2024, mainly attributable to the 13.1% increase in service revenue to Kshs 179.9 bn in H1’2025, from Kshs 159.1 bn in H1’2024. Notably, MPESA revenue increased by 16.6% to Kshs 77.2 bn, from Kshs 66.2 bn in H1’2024,

- Voice revenue for the group increased by 4.5% to Kshs 40.9 bn, from Kshs 39.1 in H1’2024, while mobile data revenue increased by 21.5% to Kshs 37.6bn, from Kshs 30.9 in H1’2024,

- Earnings before interest, taxes, depreciation and amortization (EBITDA) decreased by 5.8% to 75.1 bn in HY’2025 from 79.7 bn in H1’2024, owing to a 34.6% increase in operating costs to Kshs 114.4 bn in HY’2025, from Kshs 84.9 bn in H1’2024, which outpaced the 15.1% increase in total revenue. As such, EBITDA margin recorded an 8.8%-point decline to 39.6% in H1’2025 from 48.4% in H1’2024,

- The Ethiopian subsidiary recorded a 159.9% increase in net losses after tax to Kshs 37.5 bn from a net loss of Kshs 14.4 bn in H1’2024, while the Kenyan business recorded a 14.1% increase in net profits to Kshs 47.5 bn, from 41.6 bn in H1’2024. As such, the Group recorded a 63.2% decline in net profit to Kshs 10.0 bn in H1’2025, from Kshs 27.2 bn in H1’2024,

- The balance sheet recorded a contraction as total assets decreased by 22.6% to Kshs 483.1 bn, from Kshs 624.1 bn in H1’2024, mainly driven by a 49.5% decrease in intangible assets-goodwill to Kshs 103.0 bn, from Kshs 203.9 bn in H1’2024, and,

- The Group’s customers grew by 7.8% to 52.0 mn from 48.2 mn in H1’2024, while Safaricom’s market share in Kenya declined to 65.4% as of June 2024, from 66.1% recorded same period last year.

Additionally, its Ethiopian subsidiary recorded a total revenue of Kshs 2.8 bn, with service revenue coming at Kshs 2.6 bn and operating cost at Kshs 28.8 bn leading to a loss after tax of Kshs 37.5 bn which weighed down on the group’s overall performance.

Despite a 17.7% decline in the firm’s core earnings to Kshs 0.70 in H1’2025, from Kshs 0.85 in H1’2024, Safaricom continues to remain a strong long-term proposition, owing to its 65.4% market share in Kenya and over 97.0% market share in mobile money subscribers through M-PESA, with M-PESA recording a 4.1% year on year growth in one-month active customers to 33.5 mn in H1’2025. Additionally, the Ethiopian subsidiary is expected to gain further traction with the firm expecting to tap into the Ethiopian market with a population of more than 133.2 mn people. However, the adverse macroeconomic situation, coupled with the ongoing depreciation of the Ethiopian Birr against the US dollar is likely to weigh on the group’s overall performance during this period when it is aggressively expanding its network in Ethiopia.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.4x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

During the week, Purple Dot International Limited, a residential and commercial property developer broke ground on a high-end residential development in Lang’ata, dubbed Marigold II. The development is situated on a 7-acre plot. Marigold II will consist of 89 townhouses, offering both duplex and triplex units designed to blend modern aesthetics with a sense of community and security. Each of the units will have 4-bedrooms and triplex homes will cost Kshs 42.8 mn while duplex units will cost Kshs 34.8 mn. The development is expected to be completed in June 2025. This project aims to address the growing demand for quality, family-friendly housing in a gated community setup.

Each townhouse in Marigold II is crafted to create a serene living environment that appeals to diverse groups, from young professionals to families. Amenities are tailored to promote both comfort and sustainability, featuring a clubhouse, a gym, steam rooms, a swimming pool, a children’s play area, and ample parking. With eco-friendly features like sound-reduction windows and sensor taps, Marigold II aims to lower energy consumption and align with sustainable living standards. Security is prioritized with 24-hour surveillance, an electric fence, and intercom facilities.

The strategic location of Marigold II in Lang’ata provides easy access to key amenities, including renowned schools, hospitals, and shopping centers like Galleria Mall. This proximity enhances its appeal for residents seeking both convenience and a peaceful living environment close to Nairobi's vibrant city life.

We expect heightened activities in the Real Estate residential sector supported by the government initiatives in the residential sector, especially through the Affordable Housing Agenda and demand for housing driven by the growing population and high urbanization rate currently at 3.7% per annum. The outlook for Kenya’s residential Real Estate sector in 2024 indicates continued growth despite various challenges. The Real Estate market is benefiting from strong demand driven by urbanization, population growth, and government initiatives such as the affordable housing program. However, rising construction costs, high interest rates, and financing constraints due to tightened lending are dampening growth prospects.

- REITs Weekly Performance

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include: i) insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products, ii) lengthy approval processes for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, iv) limiting the type of entity that can form a REIT to only a trust company, and, v) minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, ii) activities by the government under the Affordable Housing Agenda (AHP) which has boosted land prices within the NMA area, iii) heightened activities by private players in the residential sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

In December 2023, we released the Nairobi Metropolitan Area Mixed-Use Developments (MUDs) Report 2023 which highlighted that Mixed-Use Developments recorded an average rental yield of 8.4%, 1.3% points higher than the respective single-use themes which recorded an average rental yield of 7.1% in a similar period in 2023. The relatively better performance was mainly attributed to; i) heightened demand for prime locations attracting clients willing to pay premium rents, ii) strategic and prime locations of the developments with the capability to attract prospective clients, and, iii)) the area’s proximity to amenities such as shopping malls enhancing the desirability.

This week we update our report with 2024 market research data in order to determine the progress and performance of MUDs against the market performance of single-use Residential, Commercial Office, and Retail developments. Therefore, this topical will cover the following:

- Overview of Mixed-Use Developments,

- Mixed-Use Developments Performance Summary in 2024, and,

- Mixed-Use Developments Investment Opportunity and Outlook.

Section I: Overview of Mixed-Use Developments

A Mixed-Use Development (MUD) is an urban development that integrates various real estate functions, including residential, commercial, retail, and hospitality components. By combining these diverse uses, a single development can fulfill multiple purposes within one location, offering enhanced convenience by bringing living, working, and recreational spaces together. This integration of different functions provides easy access to amenities and services, making MUDs increasingly popular in Kenya as they respond to the evolving lifestyles and demands of clients. For the year 2024;

- Centum Real Estate completed the handover of over 24 four-bedroom luxury apartment units as part of its phase two Loft residence project at the Two Rivers mixed-use development. The luxury apartment units were sold for between Kshs 36.0 mn and Kshs 52.0 mn. Additionally, Phase 1 of the project was completed in February last year, with 32 units sold at prices starting from Kshs 55.0 mn. For more information, see Cytonn Q3’2024 Markets Review,

- Madison Life Assurance, in partnership with HF Group, announced the availability of affordable financing options for individuals looking to purchase and build homes at VillaKazi Homes in Athi River, Machakos County. VillaKazi Homes is a master-planned, fully serviced, mixed-use real estate development spanning 100 acres, with a project value of Kshs 3.0 bn featuring over 700 residential units. For more information, see Cytonn Q3’2024 Markets Review,

- JW Marriott an International luxury hotel brand opened JW Marriott Nairobi, marking its second property in Kenya after JW Marriott Masai Mara Lodge opened in February 2023. The hotel which is located in GTC building Westlands, stands as the tallest hotel in the country with 35 stories. For more information, please see our Cytonn Markets Review – Q1’2024.

- Two Rivers International Finance & Innovation Centre (TRIFIC) announced that it has secured an investment of Kshs 6.0 bn from Vantage Capital; an African mezzanine finance investor. The funding will be utilized to fit out its first office tower, the TRIFIC North Tower, occupying 14,975 SQM in the Two Rivers. For more information, see Cytonn Weekly #25/2024, and,

Some of the factors that have been driving the growth of MUDs include;

- Growing Demand: With relatively high urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023. This trend drives a strong demand for development, supporting the expansion and success of Mixed-Use Developments (MUDs). Additionally, the market's need for flexible, integrated spaces that cater to diverse needs has led to the rise of Mixed-Use Developments (MUDs). MUDs offer a comprehensive solution by combining residential, commercial, and recreational components within a single development,

- Change in Urban lifestyle and Consumer preferences: Shifting urban lifestyles and consumer preferences are driving demand for Mixed-Use Developments (MUDs). These developments offer convenient, integrated living experiences that align with modern lifestyles. As a result, Kenya is witnessing a surge in MUD construction,

- Relatively Higher Investment Returns: MUDs offer greater financial potential than single-use developments. By combining various real estate uses, investors can diversify income streams from property sales and leases of office, residential, retail, and recreational spaces,

- Improved Infrastructure: Recent infrastructure developments by the government, such as the Nairobi Expressway and Western Bypass, have facilitated the growth of Mixed-Use Developments. Improved infrastructure enhances connectivity and accessibility, creating favorable conditions for these integrated developments,

- Optimal Land Utilization: MUDs maximize land utilization by integrating multiple functions into a single development. This is especially beneficial in urban areas with limited land availability and growing populations,

- Strategic Locations: MUDs are typically situated in well-connected urban areas, attracting a diverse range of residents and businesses, including high-income individuals seeking convenience,

- Risk Diversification: MUDs offer a diversified investment strategy by combining multiple asset classes. This reduces risk exposure to fluctuations in a single market segment e.g., residential, and,

- Aspect of Sustainability: Mixed-Use Developments seamlessly integrate different real estate classes in a single project and location, optimizing space usage. This reduces commuting needs as residents can live, work, and shop all within one locale, contributing to a more sustainable lifestyle.

Despite the aforementioned factors, there exist various setbacks hindering the development and performance of MUDs such as:

- High Development Costs: Developing and financing Mixed-Use Developments (MUDs) tends to be more expensive than single-use projects, largely due to the complex designs required to ensure smooth integration of varied real estate functions. Balancing appeal with functionality adds challenges for developers seeking funding from banks and other stakeholders. Moreover, construction costs rose in by 6% in H1’2024, driven by inflationary pressures stemming from supply chain disruptions and the depreciation of the Kenyan Shilling. As a result, the cost of importing construction materials has soared, further escalating overall construction expenses,

- Oversupply in Select Real Estate Sectors: Existing oversupply of physical space in select sectors. With approximately 5.8 mn SQFT in the NMA commercial office market, and approximately 3.0 mn SQFT in the Nairobi Metropolitan Area (NMA) retail market, which in turn hinders optimum performance of the developments, and,

- Coordinating Diverse Uses: Successfully integrating the varied uses within MUDs can be challenging, as each real estate component has unique needs and requirements. Achieving the right balance requires careful management, ensuring that tenants complement one another and align with the development’s overall objective which can be complex to implement effectively.

Section II: Mixed-Use Developments Performance Summary in 2024

- Summary of MUDs Performance in Comparison to General Market Performance

Mixed-Use Developments recorded an average rental yield of 8.6% in 2024,1.5% points higher than the respective single-use themes which recorded an average rental yield of 7.1% in a similar period the previous year. The relatively better performance was mainly attributable to changing client preferences and MUDs' attractiveness driven by the diversity in amenities and social offerings they provide to clients.

The residential and retail themes in the MUDs recorded 0.6% and 0.3% points increase in average rental yields to 7.4% and 10.1% respectively in 2024, from 6.8% and 9.8% in 2023. This increase was primarily driven by the addition of prime spaces commanding higher rents and yields, such as the Business Bay Square (BBS) Mall, an increase in uptake within the residential theme evidenced by several project handovers, and aggressive expansion efforts by both local and international retailers such as Carrefour, China square and Naivas, contributed to the growth during the period under review. For the Commercial theme in the MUDs, the average rental yield improved by 0.2% to 8.2% in 2024, from 8.0% in 2023 majorly attributable to an increase in occupancy levels by 1.8% to 79.7% from 77.2% the previous year.

The table below shows the performance of single-use and Mixed-Use development themes between 2023 and 2024;

|

Cytonn Report: Thematic Performance in MUDs Vs. Key Nodes Hosting MUDs Market Performance 2023-2024 |

||||||

|

|

MUD Themes Average |

Market Average |

|

|

||

|

|

Rental Yield % 2023 |

Rental Yield % 2024 |

Rental Yield % 2023 |

Rental Yield % 2024 |

∆ in y/y MUD Rental yields |

∆ in theme Rental Yields |

|

Retail |

9.8% |

10.1% |

8.5% |

8.3% |

0.3% |

(0.2%) |

|

Offices |

8.0% |

8.2% |

7.3% |

7.4% |

0.2% |

0.1% |

|

Residential |

6.8% |

7.4% |

5.7% |

5.9% |

0.6% |

0.2% |

|

Average |

8.4% |

8.6% |

7.1% |

7.2% |

0.2% |

0.1% |

|

*Market performance is calculated from nodes where sampled MUDs exist |

||||||

Source: Cytonn Research

- Mixed-Use Developments Performance per Node

In terms of performance per node, Karen, Limuru Road, and Westlands were the best performing of all sampled nodes with an average yield of 10.6%, 10.0%, and 9.4% respectively,2.0%, 1.4%, and 0.8% higher than the market average of 8.6% in 2024. The strong performance was mainly attributed to: i) A large base of residents with substantial consumer spending power, ii) robust infrastructure supporting investment opportunities, and iii) the availability of prime retail and office spaces commanding higher rents and yields. On the other hand, Mombasa Road recorded the lowest performance with an average rental yield of 6.8%, 1.8% lower than the market average of 8.6%. This performance can be attributed to; i) heavy traffic on Mombasa Road potentially deterring businesses and residents, reducing demand and rental yields, ii) low rental rates attracted by developments, and iii) the area's perception as an industrial hub reducing appeal for high-rent tenants. The table below shows the performance of Mixed-Use Developments by node in 2024;

|

Cytonn Report: Nairobi Metropolitan Area Mixed Use Developments Performance by Nodes 2024 |

|||||||||||

|

Location |

Commercial Retail |

Commercial Office |

Residential |

Average MUD Yield |

|||||||

|

Rent (Kshs/SQFT) |

Occupancy |

Rental Yield |

Rent (Kshs/SQFT) |

Occupancy |

Rental Yield |

Price (Kshs/SQM) |

Rent (Kshs/SQM) |

Annual Uptake |

Rental Yield |

||

|

Karen |

270 |

93.5% |

11.7% |

127 |

85.0% |

9.5% |

|

|

|

|

10.6% |

|

Limuru Road |

325 |

75.0% |

12.4% |

112 |

78.0% |

7.8% |

200,000 |

1,724 |

31.7% |

9.9% |

10.0% |

|

Westlands |

204 |

71.8% |

9.6% |

125 |

78.0% |

9.3% |

303,071 |

3,731 |

12.5% |

9.2% |

9.4% |

|

Kilimani |

180 |

85.6% |

9.7% |

118 |

83.0% |

8.8% |

|

|

|

|

9.3% |

|

Upperhill |

170 |

75.0% |

9.4% |

105 |

85.0% |

8.5% |

|

|

|

|

9.0% |

|

Eastlands |

225 |

85.0% |

9.9% |

85 |

73.0% |

6.2% |

|

|

|

|

8.1% |

|

Thika Road |

197 |

76.7% |

9.1% |

115 |

77.0% |

8.3% |

123,770 |

886 |

14.0% |

6.4% |

7.9% |

|

Mombasa Road |

205 |

75.0% |

8.8% |

140 |

73.0% |

7.4% |

196,203 |

760 |

11.7% |

4.3% |

6.8% |

|

Average |

222 |

79.70% |

10.1% |

116 |

79.0% |

8.2% |

205,761 |

1,775 |

16.80% |

7.50% |

8.6% |

|

*Selling prices used in the computation of rental yields for commercial office and retail themes entailed a combination of both real figures and market estimates of comparable properties in the locations of the Mixed-Use Developments (MUDs) sampled |

|||||||||||

Source: Cytonn Research

- Performance of Real Estate Themes in MUDs versus Single-themed Developments’ Performance

In our Mixed-Use Development analysis, we looked into the performance of the retail, commercial office, and residential themes:

- Retail Space

The average rental yield of retail spaces in Mixed-Use Developments came in at 10.1% in 2024, 1.8% points higher than single-use retail developments that realized an average rental yield of 8.3%. This was mainly attributable to the high rental rates that MUDs generated at Kshs 222 per SQFT when compared to the Kshs 192 per SQFT recorded for the single-use retail spaces owing to the availability of prime quality spaces attracting higher rental rates.

Limuru Road and Karen nodes continued to register the best performance with the average rental yield at 12.4% and 11.7% significantly higher than the market average of 10.1%. This was mainly driven by; i) relatively stable occupancy rates ii) increased and relatively higher rental rates which translates to higher returns, iii) the presence of residents with high incomes and significant purchasing power, and, iv) the availability of sufficient infrastructure and connectivity that effectively supports the MUDs. Conversely, Mombasa Road recorded the lowest rental yields at 8.8%, 1.3% points lower than the market average of 10.1%. This can be attributed to relatively lower rental rates of Kshs 205 in comparison to the market average of Kshs 222 and the popularity of the area as an industrial zone. The table below provides a summary of the performance of retail spaces in MUDs against market performance in 2024;

|

All values in Kshs Unless Stated Otherwise |

||||||

|

Cytonn Report: Performance of Retail in MUDs Vs. Market Performance 2024 |

||||||

|

Location |

MUD Performance |

Market Performance |

||||

|

Rent/SQFT |

Occupancy (%) |

Rental Yield (%) |

Rent/SQFT |

Occupancy (%) |

Rental Yield (%) |

|

|

Limuru Road |

325 |

75.0% |

12.4% |

201 |

82.2% |

8.9% |

|

Karen |

270 |

93.5% |

11.7% |

218 |

87.5% |

9.7% |

|

Eastlands |

225 |

85.0% |

9.9% |

161 |

78.1% |

7.3% |

|

Kilimani |

180 |

85.6% |

9.7% |

198 |

82.2% |

9.8% |

|

Westlands |

204 |

71.8% |

9.6% |

239 |

79.4% |

7.3% |

|

UpperHill |

170 |

75.0% |

9.4% |

|||

|

Thika road |

197 |

76.7% |

9.1% |

160 |

79.3% |

6.3% |

|

Mombasa road |

205 |

75.0% |

8.8% |

169 |

82.9% |

8.6% |

|

Average |

222 |

79.7% |

10.1% |

192 |

81.7% |

8.3% |

Source: Cytonn Research

- Commercial Office Space

The average rental yield for commercial office spaces in MUDs came in at 8.2%, 0.8% points higher than single-use commercial developments which realized an average rental yield of 7.4% in 2024. The performance by MUDs was largely attributed to the high rental rates chargeable per SQM within the developments driven by; i) Strategic locations attracting multinationals and international organizations, boosting demand for these spaces, and, ii) High rental rates for prime Grade A offices are driven by their exceptional quality, and sustainability features.

In terms of submarket performance, Karen, Westlands, and Kilimani were the best-performing nodes posting average rental yields of 9.5%, 9.3%, and 8.8% attributable to; i) the presence of high-end business parks Sarit, GTC, the Hub and Galleria, offering high rental rates and returns, ii) quality and ample infrastructure improving accessibility to the nodes, iii) quick access to the CBD, and, iv) increasing demand for these spaces. In contrast, Eastlands exhibited the lowest performance among nodes, with an average rental yield of 6.2%, primarily due to: i) lower-quality office spaces with lower rental rates, and, ii) Insufficient infrastructure to adequately support MUDs. The table below shows the performance of office spaces in MUDs against the single-use themed market in 2024;

|

All Values are in Kshs Unless Stated Otherwise |

||||||

|

Cytonn Report: Performance of Commercial Offices in MUDs Vs. Market Performance 2024 |

||||||

|

Location |

MUD Performance |

Market Performance |

||||

|

Rent/SQFT |

Occupancy (%) |

Rental Yield (%) |

Rent/SQFT |

Occupancy (%) |

Rental Yield (%) |

|

|

Karen |

127 |

85% |

9.5% |

115 |

80.9% |

7.8% |

|

Westlands |

125 |

78% |

9.3% |

119 |

76.3% |

8.6% |

|

Kilimani |

118 |

83% |

8.8% |

102 |

82.7% |

7.8% |

|

UpperHill |

105 |

85% |

8.5% |

100 |

73.4% |

6.7% |

|

Thika road |

115 |

77% |

8.3% |

88 |

76.6% |

6.3% |

|

Limuru Road |

112 |

78% |

7.8% |

95 |

81.6% |

8.4% |

|

Mombasa road |

140 |

73% |

7.4% |

80 |

77.0% |

6.1% |

|

Eastlands |

85 |

73% |

6.2% |

|

|

|

|

Average |

116 |

79% |

8.2% |

100 |

78.4% |

7.4% |

Source: Cytonn Research

- Residential Space

In 2024, residential units within MUDs recorded an average rental yield of 7.5%, marking a 1.6% higher compared to the single-use residential market average of 5.9%. The stable performance was primarily influenced by an increase in asking rents to Kshs 1775 per SQM from Kshs 1603 per SQM in 2023. Additionally, there was an improvement in unit uptakes by 0.7% to 17.5% from 16.8%. Notable projects delivered include Centum Real Estate's handover of over 24 four-bedroom luxury apartment units as part of its phase two Loft residence project at the Two Rivers mixed-use development.

Regarding sub-market performance, Limuru Road and Westlands emerged as the top-performing nodes with an average rental yield of 9.9% and 9.2%, respectively, attributed to; i) improved infrastructure easing access to these nodes, ii) availability of amenities enhancing desirability of apartments in the nodes, presence of tenants willing to pay premium rents, and, iii) presence of upscale developments commanding higher rental rates. Conversely, Mombasa Road ranked as the least performing node, registering an average rental yield of 4.3%, mainly due to the lower prices and rental rates associated with developments within the specific area. The table below summarizes the performance of residential spaces in MUDs against the single-themed market in 2024:

|

All Values are in Kshs Unless Stated Otherwise |

||||||||

|

Cytonn Report: Performance of Residential Units in MUDs Vs. Market Performance 2024 |

||||||||

|

Location |

MUD Performance |

Market Performance |

||||||

|

Price/SQM |

Rent/SQM |

Annual Uptake |

Rental Yield % |

Price/SQM |

Rent/SQM |

Annual Uptake |

Rental Yield % |

|

|

Limuru Road |

200,000 |

1,724 |

31.7% |

9.9% |

104,309 |

651 |

10.1% |

5.8% |

|

Westlands |

303,071 |

3,731 |

12.5% |

9.2% |

138,590 |

748 |

15.4% |

6.3% |

|

Thika Road |

123,770 |

760 |

14.0% |

6.4% |

82,565 |

410 |

12.8% |

6.0% |

|

Mombasa Road |

196,203 |

886 |

11.7% |

4.3% |

84265 |

427 |

12.2% |

5.3% |

|

Average |

205,761 |

1,775 |

17.5% |

7.5% |

102,432 |

559 |

12.6% |

5.9% |

Source: Cytonn Research

Section III: Mixed-Use Developments Investment Opportunity and Outlook

The table below summarizes our outlook on Mixed-Use Developments (MUDs), where we look at the general performance of the key sectors that compose MUDs i.e., retail, commercial office, and residential, and investment opportunities that lie in the themes;

|

Cytonn Report: Mixed-Use Developments (MUDs) Outlook |

|||

|

Sector |

2024 Sentiment and Outlook |

2024 Outlook |

|

|

Retail |

|

Neutral |

|

|

Office |

|

Neutral |

|

|

Residential |

|

Neutral |

|

|

Outlook |

Given that all our metrics are neutral, we retain a NEUTRAL outlook for Mixed-Use Developments (MUDs), supported by the remarkable returns compared to single-use themes, changing client preferences, and MUDs attractiveness driven by the diversity in amenities and social offerings they provide to clients.

However, the existing oversupply of the NMA office market at 5.8 mn SQFT, and 3.0 mn SQFT in the NMA retail market, is expected to weigh down the performance. Karen, Limuru Road, and Westlands nodes provide the best investment opportunities, with the areas providing the highest average MUD yields of 10.6%, 10.0%, and 9.4% respectively, compared to the market average of 8.6%. |

||

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.