Cytonn Q3’2024 Markets Review

By Cytonn Research, Oct 6, 2024

Executive Summary

Global Markets Review

According to the World Bank's June 2024 Global Economic Prospects report, the global economy is projected to grow at 2.6% in 2024, matching the 2.6% growth recorded in 2023. This forecast marks a slight downward revision from earlier projections, reflecting continued economic headwinds, particularly for emerging markets. The World Bank’s growth projection is 0.6% points lower than the IMF’s 2024 forecast of 3.2%. The divergence is attributable to global inflationary pressures and continued tightening by central banks for much of 2023. However, recent developments indicate that some central banks, such as those in the United States and England, have begun to cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.5% growth in 2024, remaining unchanged from the 1.5% expansion recorded in 2023. However, emerging markets and developing economies are projected to expand by 4.0% in 2024, marginally downwards from an estimated growth of 4.2% in 2023;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.4% in 2024, which is 0.8% higher than the 2.6% growth estimate recorded in 2023. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens as the region’s public debt to GDP ratio is expected to remain high at 57.0% in 2024, albeit a decline from 60.0% in 2023. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and increased interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability;

In Q3’2024, some of the select Sub-Saharan currencies depreciated against the US Dollar, mainly attributable to the elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, and monetary policy tightening by advanced economies. The high interest rates in developed countries have led to massive capital outflows as investors, both institutional and individual seek to take advantage of the higher returns offered in developed economies. Further, the elevated inflationary pressures in most economies in the region put pressure on the value of local currencies due to expensive importation;

Kenya Macroeconomic Review

According to the Kenya National Bureau of Statistics (KNBS) Q2’2024 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 4.6% growth in Q2’2024, slower than the 5.6% growth recorded in Q2’2023. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing, and Forestry sector which grew by 4.8% in Q2’2024, lower than the 7.8% expansion recorded in Q2’2023. All sectors in Q2’2024, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q2’2023 with Accommodation and Food Services, Financial & Insurance, and Construction Sectors recording the highest declines of 16.2%, 8.1%, and 5.6% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q2’2023 were Financial Services Indirectly Measured, Agriculture and Forestry, and Real Estate sectors, of 4.0%, 3.0%, and 2.1% points respectively. The slowed growth in the economy could be attributed to the still elevated fuel prices which made production more expensive and negatively impacted the business environment and the unrest caused by the anti-finance bill protests in June 2024;

Fixed Income

During the quarter, T-bills were oversubscribed, with the overall oversubscription rate coming in at 109.4%, down from 114.1% in Q3’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 189.4 bn against the offered Kshs 56.0 bn, translating to an oversubscription rate of 338.3%, lower than the oversubscription rate of 570.7% recorded in the previous year same period. Overall subscriptions for the 182-day and 364-day papers increased significantly to 77.6% and 49.6% from 27.1% and 18.4% in Q3’2023, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day, and 91-day papers increasing by 3.4%, 3.5%, and 7.7% points to 15.9%, 16.7%, and 16.9%, from 13.2%, 13.2%, and 13.5%, respectively, recorded in Q3’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid the high risk attached to government debt, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 88.3%, albeit lower than the 95.5% recorded in Q3’2023, with the government accepting a total of Kshs 324.5 bn out of the Kshs 367.5 bn worth of bids received;

During the week, T-bills were oversubscribed, with the overall oversubscription rate coming in at 224.8%, a reversal from the undersubscription rate of 87.2% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 17.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 433.8%, higher than the oversubscription rate of 173.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 202.1% and 164.0% respectively from the 54.4% and 85.7% respectively recorded the previous week. The government accepted a total of Kshs 29.2 bn worth of bids out of Kshs 54.0 bn bids received, translating to an acceptance rate of 54.2%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day, and 91-day papers decreasing by 7.1 bps, 8.9 bps, and 3.3 bps to 16.7%, 16.5%, and 15.7% respectively from 16.8%, 16.6% and 15.7% respectively recorded the previous week;

During the quarter, the government re-opened six bonds and issued two tap sales, seeking to raise Kshs 145.0 bn during the quarter. The bonds were generally oversubscribed, receiving bids worth Kshs 199.3 bn against the offered Kshs 145.0 bn, translating to an oversubscription rate of 144.5%. The government accepted Kshs 150.3 bn of the Kshs 199.3 bn worth of bids received, translating to an average acceptance rate of 80.5%. Additionally, in the primary bond market, the government is looking to raise Kshs 30.0 bn through the reopened two-year fixed coupon bonds FXD1/2016/10 and FXD1/2022/010 with the tenor to maturity of 1.8 years and 7.6 years respectively and fixed coupon rates of 15.0% and 13.5% respectively. Our expected bidding ranges for the reopened bonds are 17.0%-17.3% and 16.9%-17.2% respectively;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q2’2024 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 4.6% growth in Q2’2024, slower than the 5.6% growth recorded in Q2’2023. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.8% in Q2’2024, lower than the 7.8% expansion recorded in Q2’2023. All sectors in Q2’2024, except Mining and Quarrying; and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q2’2023 with Accommodation and Food Services; Financial & Insurance; and Construction Sectors recording the highest declines of 16.2%, 8.1%, and 5.6% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q2’2023 were Financial Services Indirectly Measured, Agriculture and Forestry, and Real Estate sectors, of 4.0%, 3.0%, and 2.1% points respectively;

During the week, the Kenya National Bureau of Statistics released the Q2’2024 Balance of Payment Report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s balance of payments position deteriorated by 45.0% in Q2’2024, coming in at a surplus of Kshs 84.1 bn, from a surplus of Kshs 152.9 bn in Q2’2023, and a significant improvement from the Kshs 36.0 bn deficit recorded in Q1’2024;

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of September 2024 declined, coming in at 49.7, down from 50.6 in August 2024, signaling a deterioration in business conditions. This is attributable to the slowdown in business activity and reduced intake of new business intakes, owing to challenging economic conditions. This also implied that the uptick in August was due to some recovery after disruptions by the protests;

Equities

During the quarter, the equities market recorded a mixed performance with NSE 20, NSE 25, and NSE 10 gaining by 7.2%,1.3%, and 0.7% respectively, while NASI declined by 2.2%, taking the YTD performance to gains of 23.4%, 21.4%, 17.7% and 16.4% for NSE 10, NSE 25, NSE 20 and NASI respectively. The equities market performance during the quarter was driven by gains recorded by large caps such as Bamburi, KCB Group, and Standard Chartered Bank of 40.6%, 11.0%, and 8.2%, respectively. The gains were however weighed down by losses recorded by Safaricom and BAT of 13.3%, and 2.9% respectively;

During the week, the equities market recorded a mixed performance, with NSE 10, NSE 25, and NASI gaining by 2.1%, 1.5%, and 1.1%, respectively, while NSE 20 declined by 0.3%, taking the YTD performance to gains of 26.0%, 23.5%, 17.8% and 17.5% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance was mainly driven by gains recorded by East African Breweries Limited (EABL), NCBA Group, and cooperative Bank of 5.3%, 3.6%, and 3.4% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Bamburi and Safaricom of 0.4%, and 0.3%, respectively;

Real Estate

In Q3’2024, Kenya’s Real Estate sector recorded notable growth in terms of activity compared to a similar period in 2023, attributable to continued investments flowing into the sector. During Q3’2024, the NMA residential sector recorded a slight improvement in performance, with the average total returns coming in at 6.1%, a 0.1%-point increase from 6.0% recorded in Q3’2023. The performance is primarily attributable to an increase in the residential market average y/y rental yield which came in at 5.4% in Q3’2024, a 0.1% increase from 5.3% recorded in Q3’2023. The average rental yield for the NMA retail sector was stable at 8.2%, this performance can be linked to the increase in the average rental prices by 1.6% to Kshs 185, up from Kshs 182 in Q3’2023, and an increase in the average occupancy rates by 2.7% to 81.4% from 78.7% in Q3’2024, and the increase in average sales price which rose by 3.6% to Kshs 21,381 from Kshs 20,643 in Q3’2023;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 18.14% p.a while the Cytonn Money Market Fund (USD) closed the week at a yield of 7.23%. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank's June 2024 Global Economic Prospects report, the global economy is projected to grow at 2.6% in 2024, matching the 2.6% growth recorded in 2023. This forecast marks a slight downward revision from earlier projections, reflecting continued economic headwinds, particularly for emerging markets. The World Bank’s growth projection is 0.6% points lower than the IMF’s 2024 forecast of 3.2%. The divergence is attributable to global inflationary pressures and continued tightening by central banks for much of 2023. However, recent developments indicate that some central banks, such as those in the United States and England, have begun to cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.5% growth in 2024, remaining unchanged from the 1.5% expansion recorded in 2023. However, emerging markets and developing economies are projected to expand by 4.0% in 2024, marginally downwards from an estimated growth of 4.2% in 2023.

The stabilization in global economic growth in 2024 as compared to 2023 is majorly attributable to;

- The recovery in global trade supported by a pickup in goods trade. Services-trade growth is expected to provide less of a tailwind this year, given that tourism has nearly recovered to pre-pandemic levels. However, the trade outlook remains lackluster compared to recent decades, partly reflecting a proliferation of trade-restrictive measures and elevated trade policy uncertainty, and,

- A decrease in inflation rates making progress toward central bank targets in advanced economies and Emerging Markets and Developing Economies (EMDEs), but at a slower pace than previously expected. Core inflation has remained stubbornly high in many economies, supported by rapid growth of services prices. As such, by the end of 2026, global inflation is expected to settle at an average rate of 2.8%, broadly consistent with central bank targets.

The global economy is showing signs of improvement, with inflationary pressures easing and several central banks moving from rate hikes to rate cuts. This shift is expected to support economic recovery, although growth remains uneven across regions.

Global Commodities Market Performance:

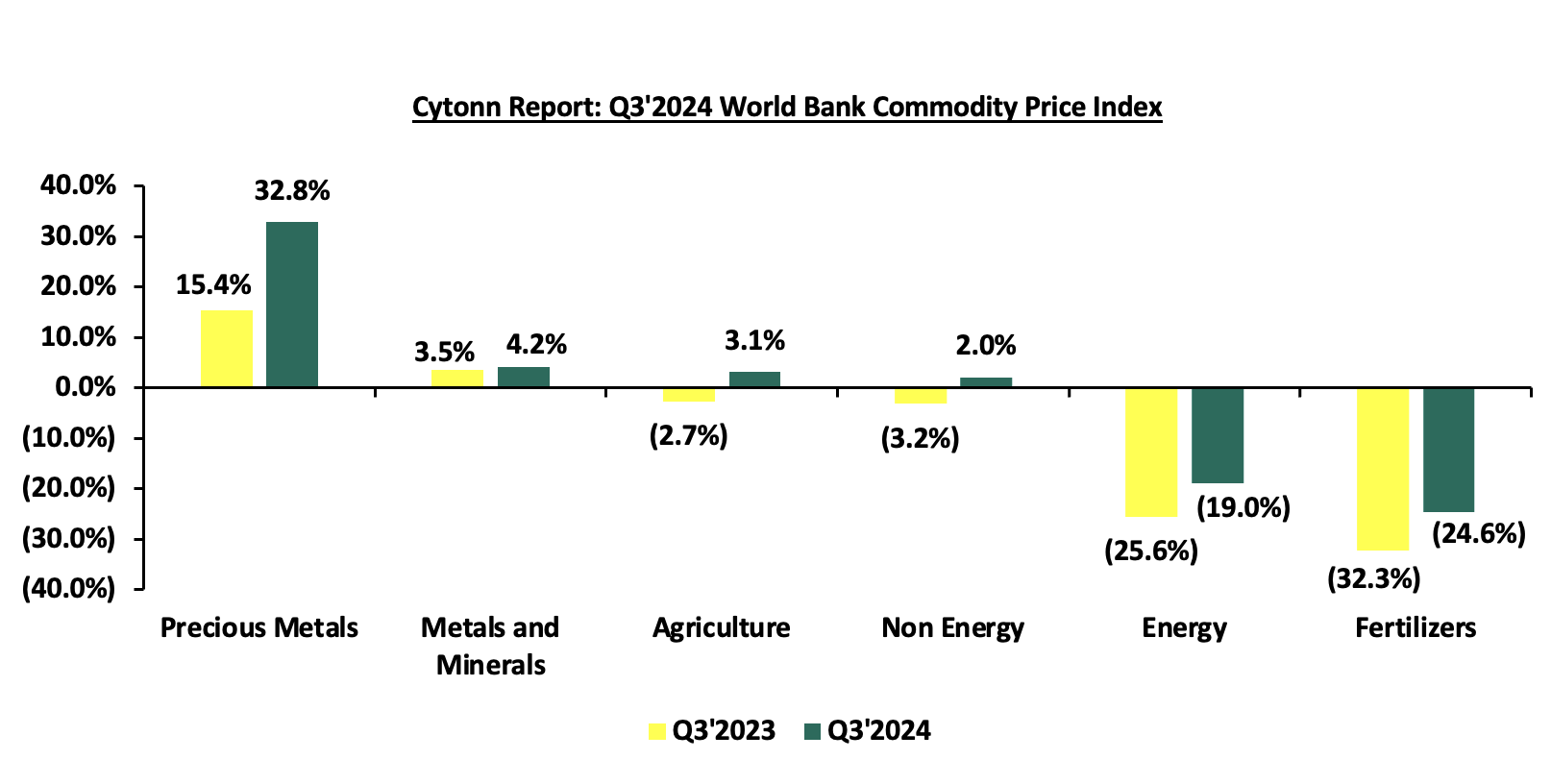

Global commodity prices registered mixed performance in Q3’2024, with prices of fertilizers declining by 24.6%, which is an improvement compared to the 32.3% decrease recorded in Q3’2023, mainly as a result of the stabilization in fertilizer trade volumes and improved availability of primary nutrients like nitrogen, phosphorus, and potassium. On the other hand, prices of Precious Metals, Metals & Minerals, Agriculture, and Non-Energy increased by 32.8%, 4.2%, 3.1%, and 2.0% respectively, on the back of increased global demand coupled with easing supply chain constraints. Below is a summary performance of various commodities;

Source: World Bank

Global Equities Market Performance:

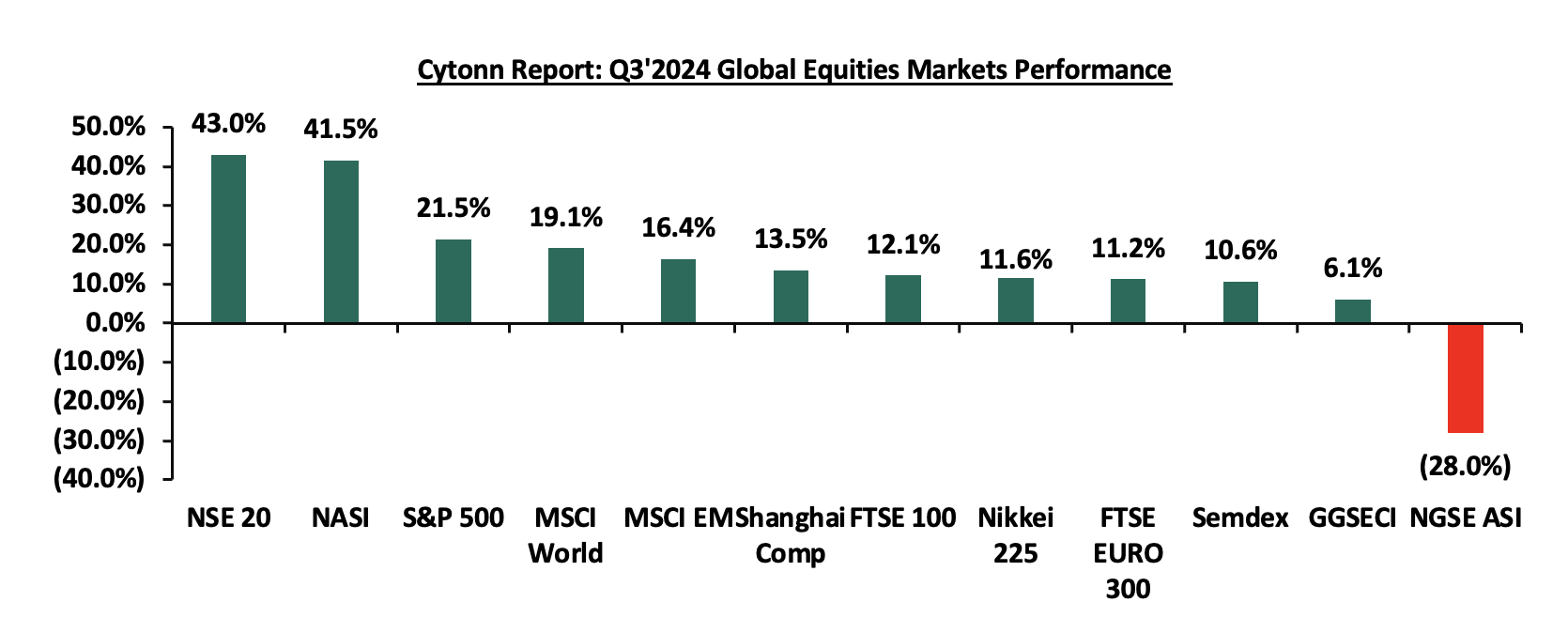

The global stock market recorded mixed performance in Q3’2024, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, NSE 20 was the best performer during the period, recording a gain at 43.0% in Q3’2024 largely driven by gains in the large-cap stocks in the financial sector following improved earnings during the period, well supported by easing inflation and a stronger Shilling. NGSE ASI was the largest decliner, recording losses of 28.0% with the performance being skewed by the weakened Nigerian Naira following a recent decision by the Central Bank of Nigeria to adopt a floating exchange rate regime. Below is a summary of the performance of key indices as at the end of Q3’2024:

*Dollarized performance

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.4% in 2024, which is 0.8% higher than the 2.6% growth estimate recorded in 2023. The expected recovery is primarily driven by private consumption growth as declining inflation boosts the purchasing power of household incomes. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens as the region’s public debt to GDP ratio is expected to remain high at 57.0% in 2024, albeit a decline from 60.0% in 2023. The public debt is expected to remain high due to increased debt servicing costs as a result of continued currency depreciation and high interest rates in developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures, which could worsen public finance, increase public debt, and weigh down on debt sustainability.

Currency Performance:

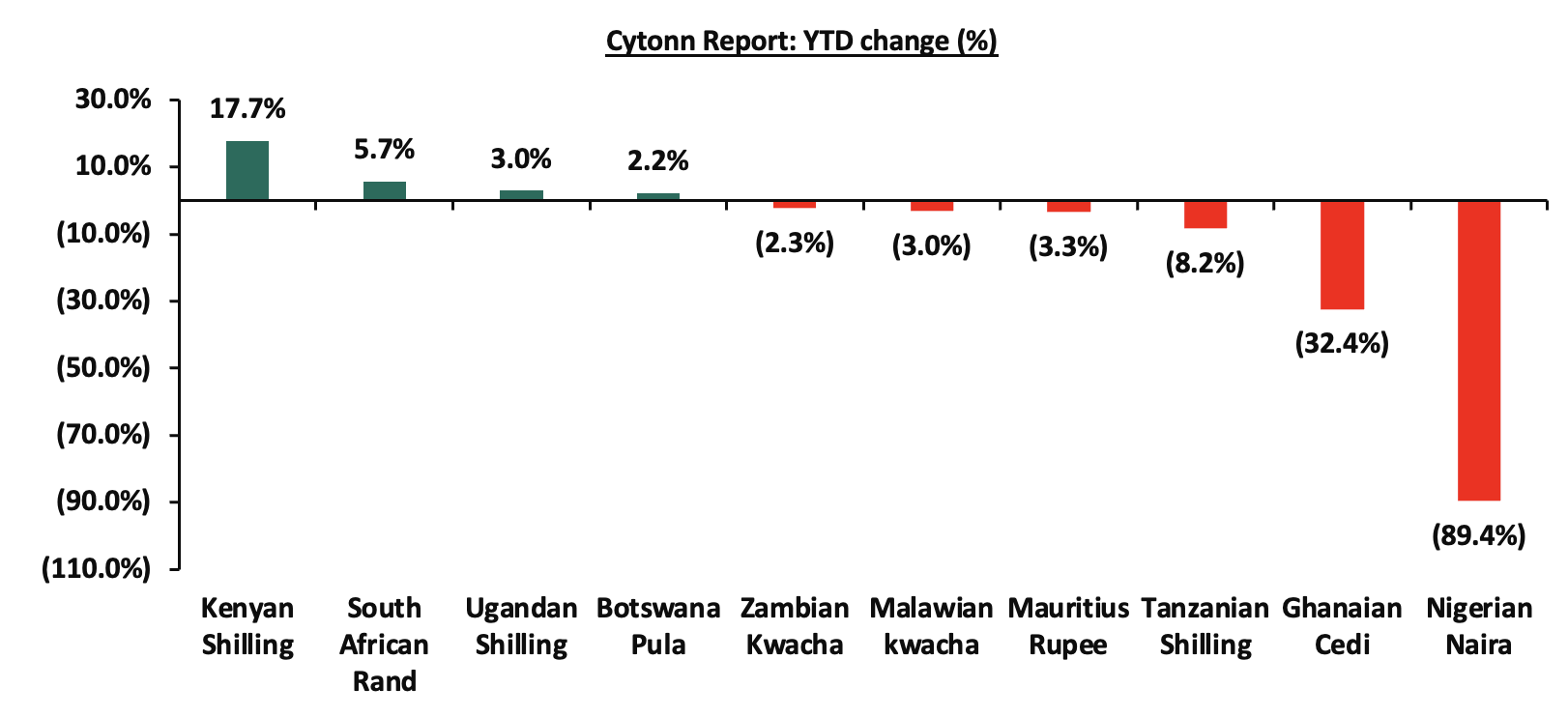

In Q3’2024, most of the select Sub-Saharan currencies depreciated against the US Dollar, primarily due to elevated inflationary pressures in the region, high debt servicing costs that continued to deplete foreign exchange reserves, and monetary policy tightening by advanced economies. High interest rates in developed countries resulted in significant capital outflows as investors, both institutional and individual, sought higher returns offered in these economies. Additionally, the rising inflation across most Sub-Saharan economies exerted pressure on local currencies due to the increasing cost of imports. However, the Kenyan Shilling emerged as the best performer among the selected currencies, appreciating by 17.7% against the USD on a year-to-date basis, closing Q3'2024 at Kshs 129.2, from Kshs 157.0 at the beginning of the year. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Sep-23 |

Jan-24 |

Sep-24 |

y/y change (%) |

YTD change (%) |

|

Kenyan Shilling |

148.1 |

157.0 |

129.2 |

12.8% |

17.7% |

|

South African Rand |

18.9 |

18.3 |

17.3 |

8.8% |

5.7% |

|

Senegal CFA Franc |

617.0 |

589.3 |

582.8 |

5.6% |

1.1% |

|

Botswana Pula |

13.8 |

13.3 |

13.0 |

5.4% |

2.2% |

|

Ugandan Shilling |

3755.0 |

3790.7 |

3678.0 |

2.1% |

3.0% |

|

Mauritius Rupee |

44.3 |

44.3 |

45.8 |

(3.2%) |

(3.3%) |

|

Tanzanian Shilling |

2505.0 |

2524.1 |

2730.0 |

(9.0%) |

(8.2%) |

|

Zambian Kwacha |

21.0 |

25.8 |

26.4 |

(25.8%) |

(2.3%) |

|

Ghanaian Cedi |

11.6 |

11.9 |

15.8 |

(36.4%) |

(32.4%) |

|

Malawian kwacha |

1080.0 |

1683.4 |

1733.7 |

(60.5%) |

(3.0%) |

|

Nigerian Naira |

768.0 |

881.0 |

1669.0 |

(117.3%) |

(89.4%) |

Source: Yahoo Finance

The chart below shows the year-to-date performance of different sub-Saharan African countries in Q3’2024;

Source: Yahoo Finance

Key take outs from the above table and chart include:

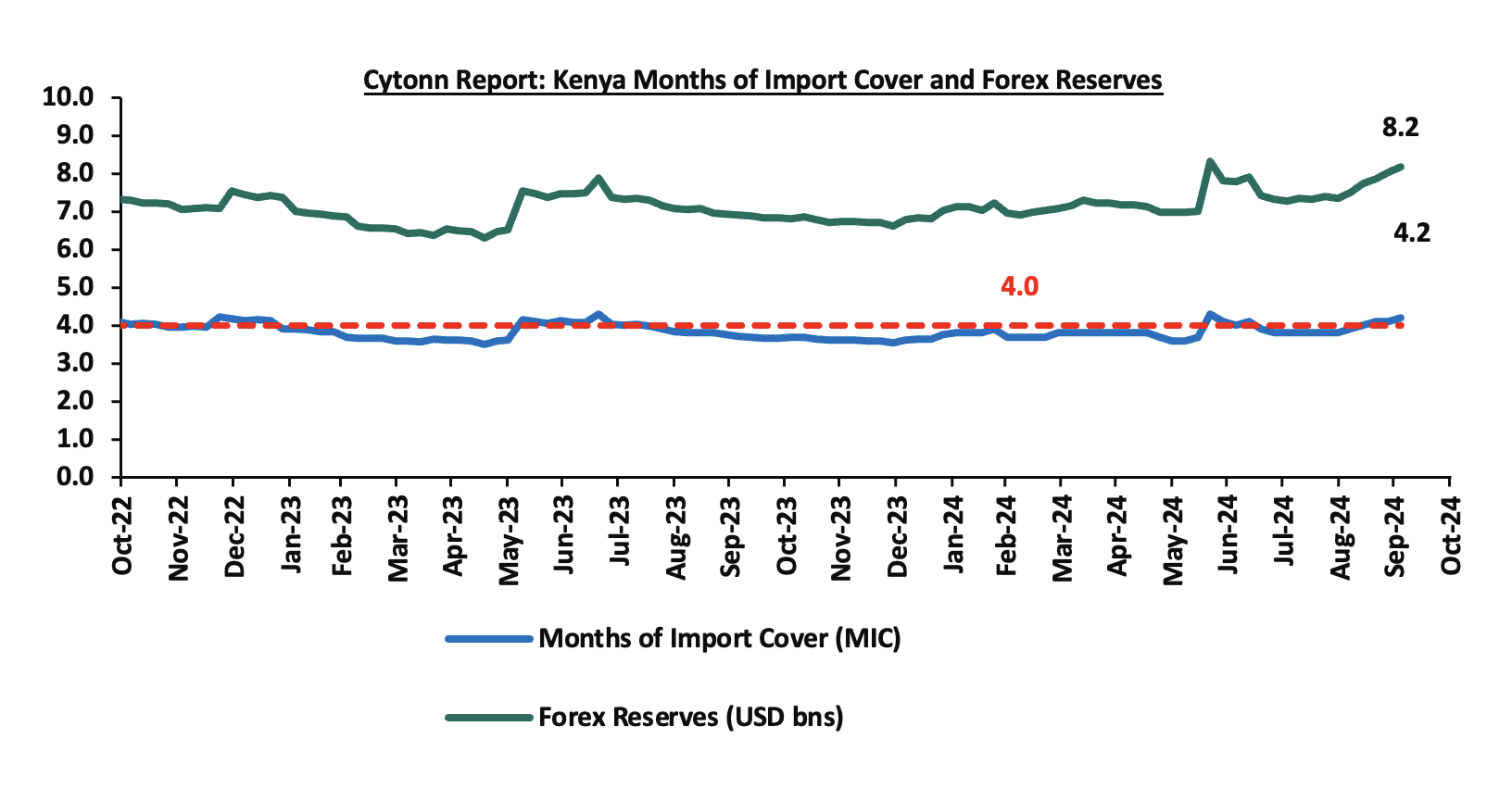

- The Kenyan Shilling was the largest gainer against the USD Dollar, gaining by 17.7% year to date to close at Kshs 129.2 as at the end of September from the Kshs 157.0 recorded at the beginning of the year. The shilling's strength has been supported by several factors, including the government’s Eurobond buyback in February, which alleviated debt risk. Additionally, foreign reserves have improved by 20.8%, currently standing at USD 8.2 bn—equivalent to 4.2 months of import cover—exceeding the statutory requirement of at least 4.0 months. This improvement is bolstered by increased dollar inflows into the country, including the World Bank funding of USD 1.2 bn under the Development Policy Operations (DPO), which is partly aimed at addressing the upcoming June 2024 Eurobond maturity payment. Furthermore, the US Federal Reserve's decision to cut its benchmark interest rate by 50 basis points to a range of 4.75%-5.00% has also contributed to a favorable environment for the Kenyan Shilling, and,

- The Nigerian Naira was the worst performing currency in Q3’2024, depreciating by 89.4%, mainly as a result of acute foreign-exchange scarcity and instability arising from lower crude production and a lack of economic diversification,

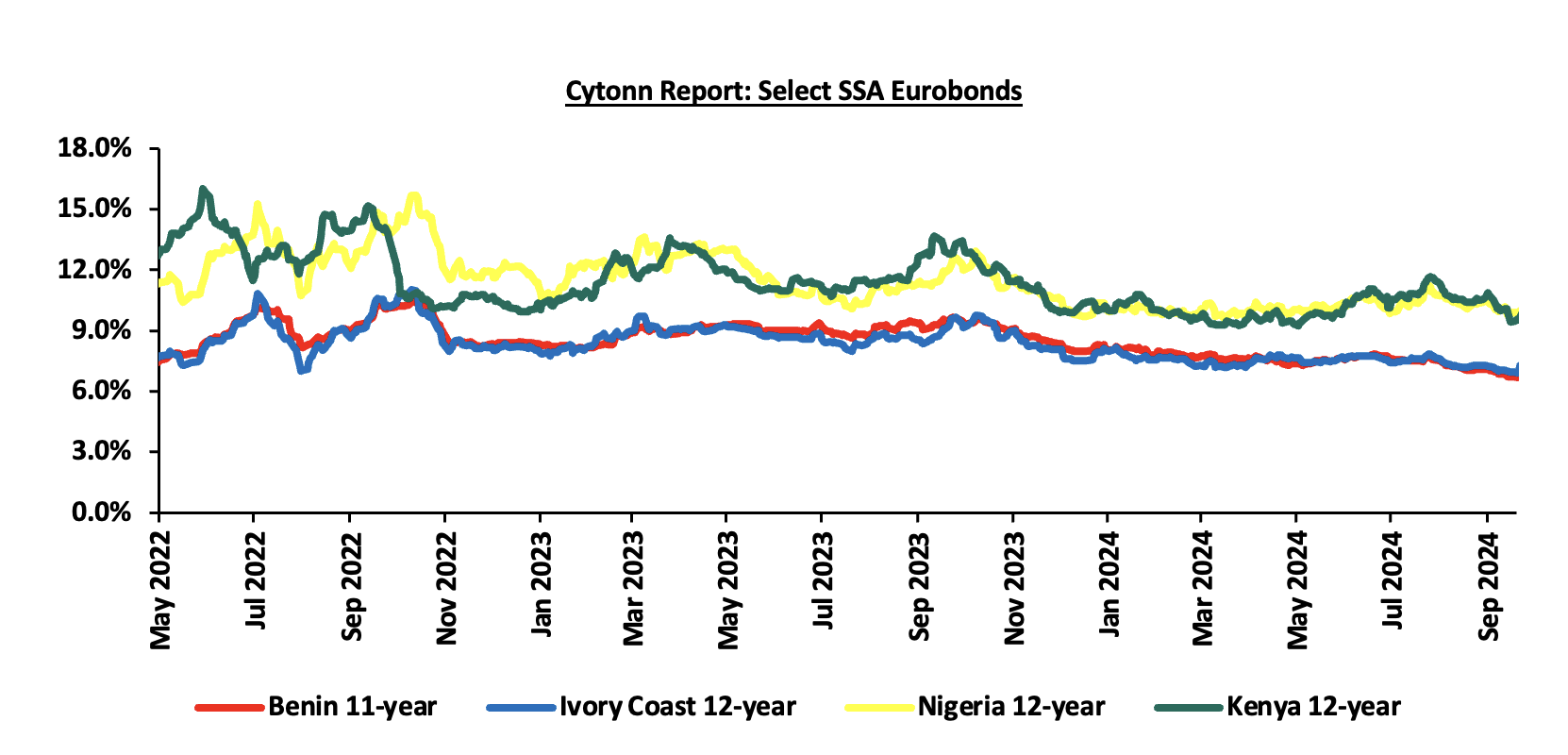

African Eurobonds:

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the nine months to end of Q3’2024 being Ivory Coast, Benin, Kenya, Senegal and Cameroon raising a total of USD 2.6 bn, USD 0.8 bn, USD 1.5 bn, USD 0.8 bn and USD 0.6 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from different countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The yields of the Ivory Coasts’ 12-year Eurobond maturing in 2032 increased marginally by 0.6% points to 6.9% as at the end of September 2024 from 7.5% recorded in December 2023. Similarly, the Yields of the Kenya’s 12-year Eurobond maturing in 2032 increased by 0.9% points to 9.5% as at the end of September 2024 from 10.4% in December 2023, partly attributable to improved investor confidence following the successful buy-back of the 2024 Eurobond maturity, increased IMF Credit funding and the strengthening of the Kenyan shilling against the dollar having gained by 17.7% on a year-to-date. Below is a graph showing the Eurobond secondary market performance of select Eurobonds issued by the respective countries:

Source: Bloomberg, CBK

Equities Market Performance:

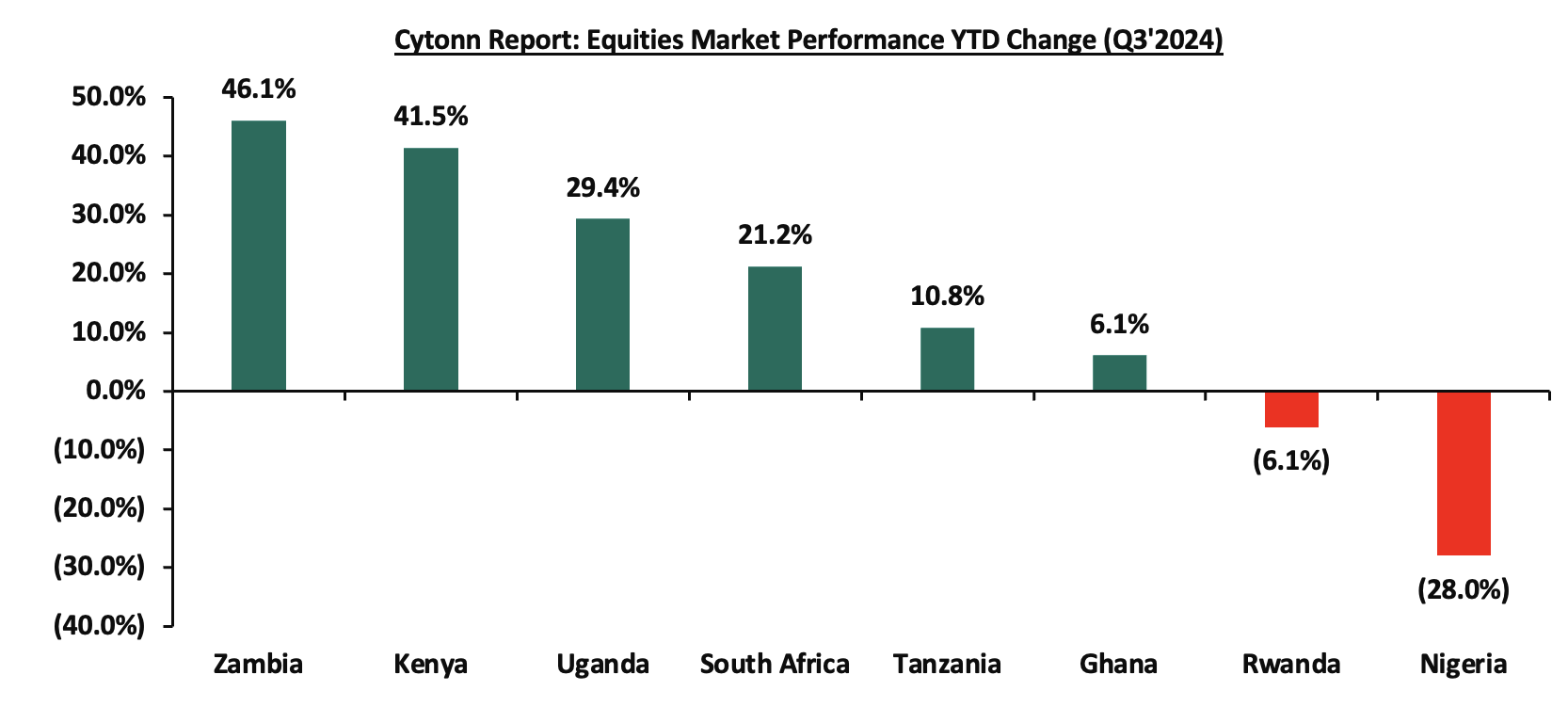

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q3’2024, with Zambia’s stock market (LASILZ) being the best performing market gaining by 46.1% YTD increased foreign investor sentiments following improved macro-economic conditions in Zambia following debt restructuring reforms. Nigeria’s NGSEASI was the worst performing stock market, declining by 28.0% YTD, mainly attributable to increased capital flight with investors chasing higher returns from advanced economies following hiking of interest rates as well as deterioration in investor confidence in country on the back of macroeconomic uncertainties occasioned by the high inflation at 32.2% as of August 2024 and continued weakening of the Nigerian Naira which has depreciated by 89.4% on year-to-date basis in 2024. Below is a summary of the performance of key indices:

|

Cytonn Report: SSA Equities Market Performance Q3’2024 (Dollarized*) |

||||||

|

Country |

Index |

Sep-23 |

Jan-24 |

Sep-24 |

Last 12 months |

YTD Change |

|

Zambia |

LASILZ |

452.4 |

428.8 |

626.5 |

38.5% |

46.1% |

|

Kenya |

NASI |

0.6 |

0.6 |

0.8 |

28.9% |

41.5% |

|

Uganda |

USEASI |

0.3 |

0.2 |

0.3 |

18.9% |

29.4% |

|

South Africa |

JALSH |

3,826.7 |

4,136.4 |

5,015.1 |

31.1% |

21.2% |

|

Tanzania |

DARSDEI |

0.7 |

0.7 |

0.8 |

8.8% |

10.8% |

|

Ghana |

GSECI |

274.7 |

261.6 |

277.6 |

1.1% |

6.1% |

|

Rwanda |

RSEASI |

0.1 |

0.1159 |

0.11 |

(23.0%) |

(6.1%) |

|

Nigeria |

NGEASI |

86.4 |

83.4 |

60.1 |

(31.7%) |

(28.0%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

Dollarized performance

GDP growth in the Sub-Saharan Africa region is expected to slow down, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) Q2’2024 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 4.6% growth in Q2’2024, slower than the 5.6% growth recorded in Q2’2023. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.8% in Q2’2024, lower than the 7.8% expansion recorded in Q2’2023. All sectors in Q2’2024, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q2’2023 with Accommodation and Food Services, Financial & Insurance, and Construction Sectors recording the highest declines of 16.2%, 8.1%, and 5.6% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q2’2023 were Financial Services Indirectly Measured, Agriculture and Forestry, and Real Estate sectors, of 4.0%, 3.0%, and 2.1% points respectively. The slowed growth in the economy could be attributed to the still elevated fuel prices which made production more expensive and negatively impacted the business environment and the unrest caused by the anti-finance bill protests in June. The Kenyan Economy is projected to grow at an average of 5.3% in 2024 according to various organizations as shown below:

|

Cytonn Report: Kenya 2024 Growth Projections |

||

|

No. |

Organization |

2024 GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

5.5% |

|

3 |

World Bank |

5.2% |

|

4 |

Fitch Solutions |

5.2% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.3% |

|

Source: Cytonn Research

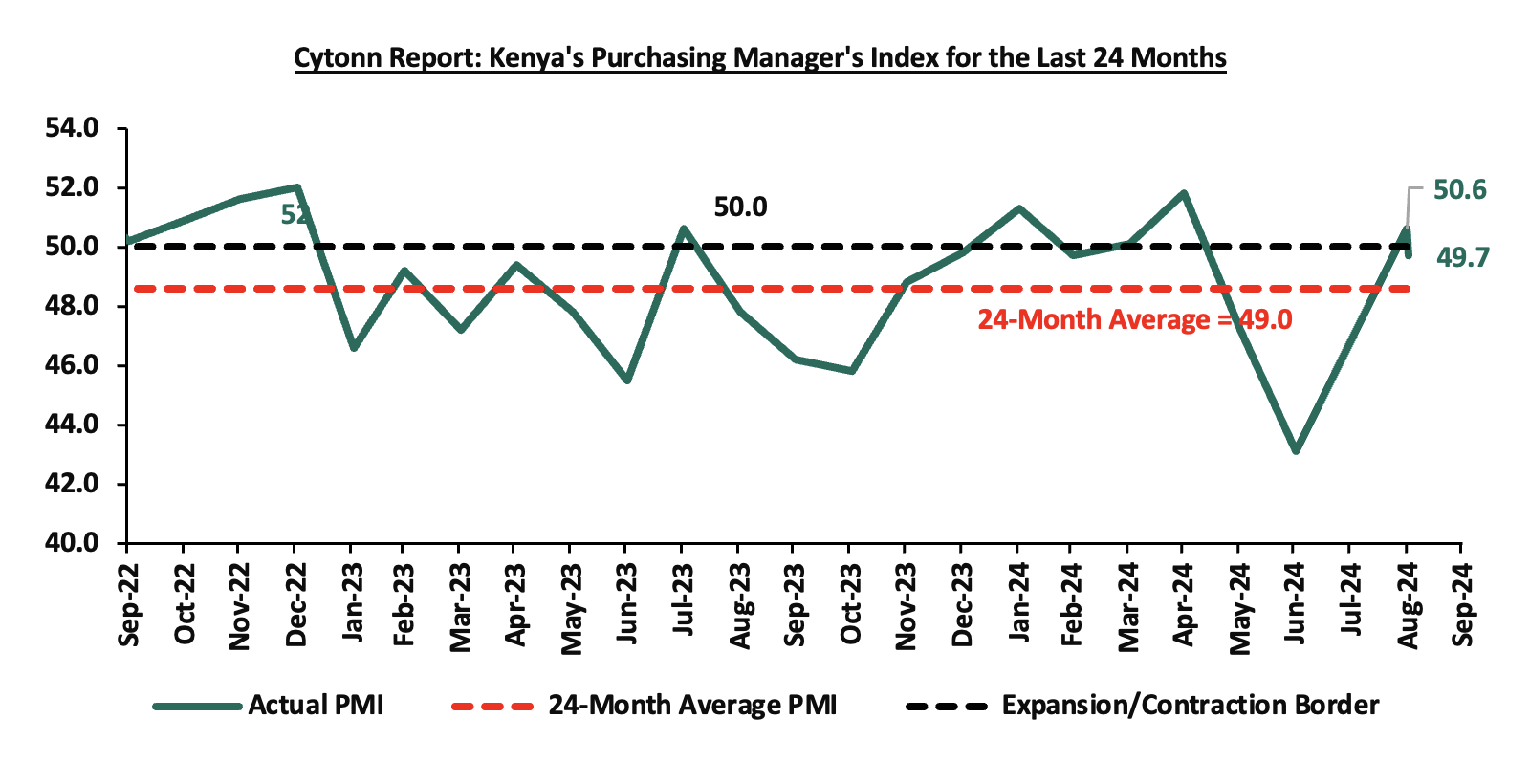

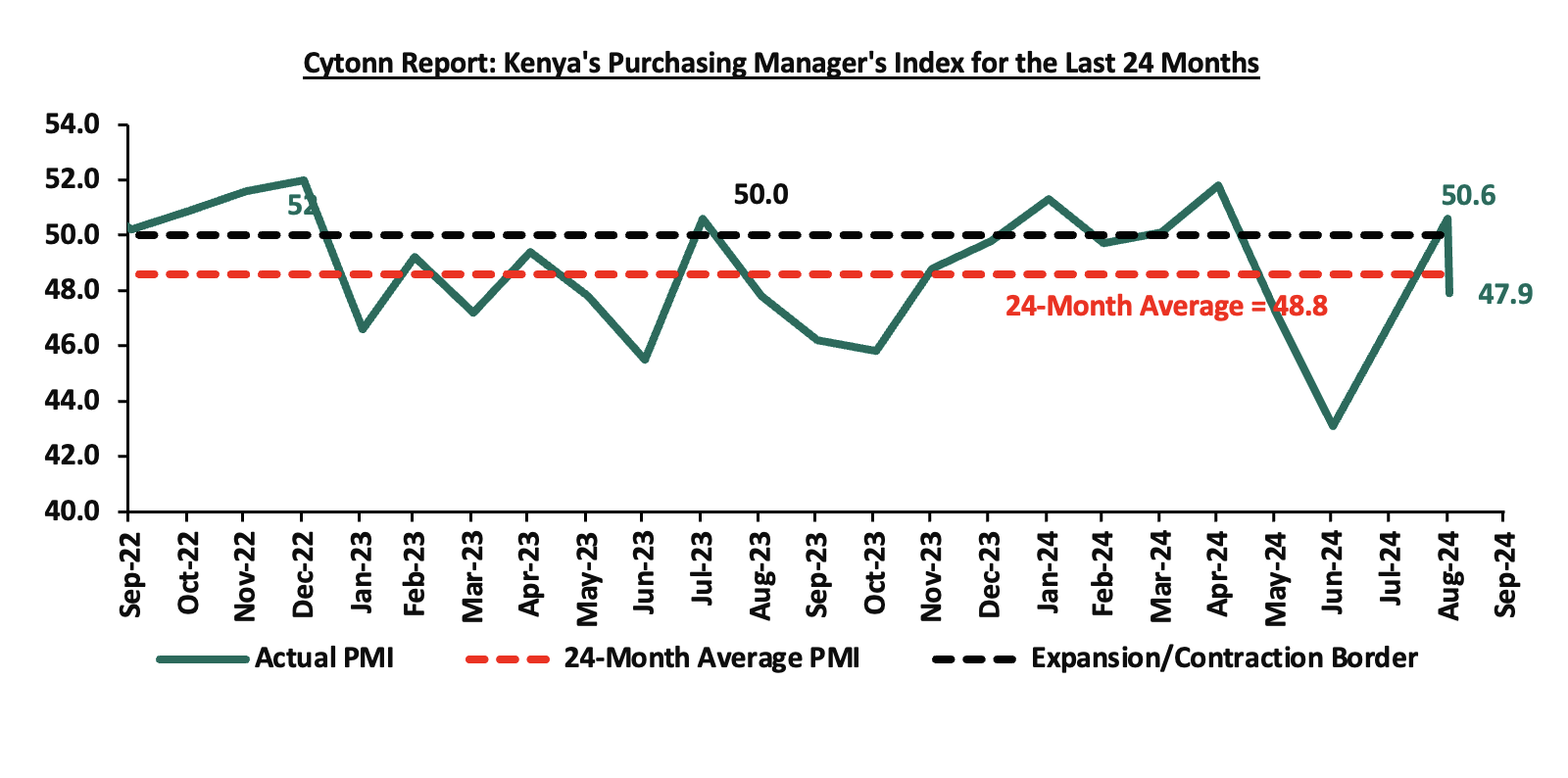

Key to note, Kenya’s general business environment slightly deteriorated in Q3’2024, with the average Purchasing Manager’s Index for the last three months coming at 47.8, compared to 48.0 recorded in a similar period in 2023. The deterioration was mainly on the back of anti-finance bill protests which paralyzed economic activity in the month of July, with July PMI coming in at a low of 43.1. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

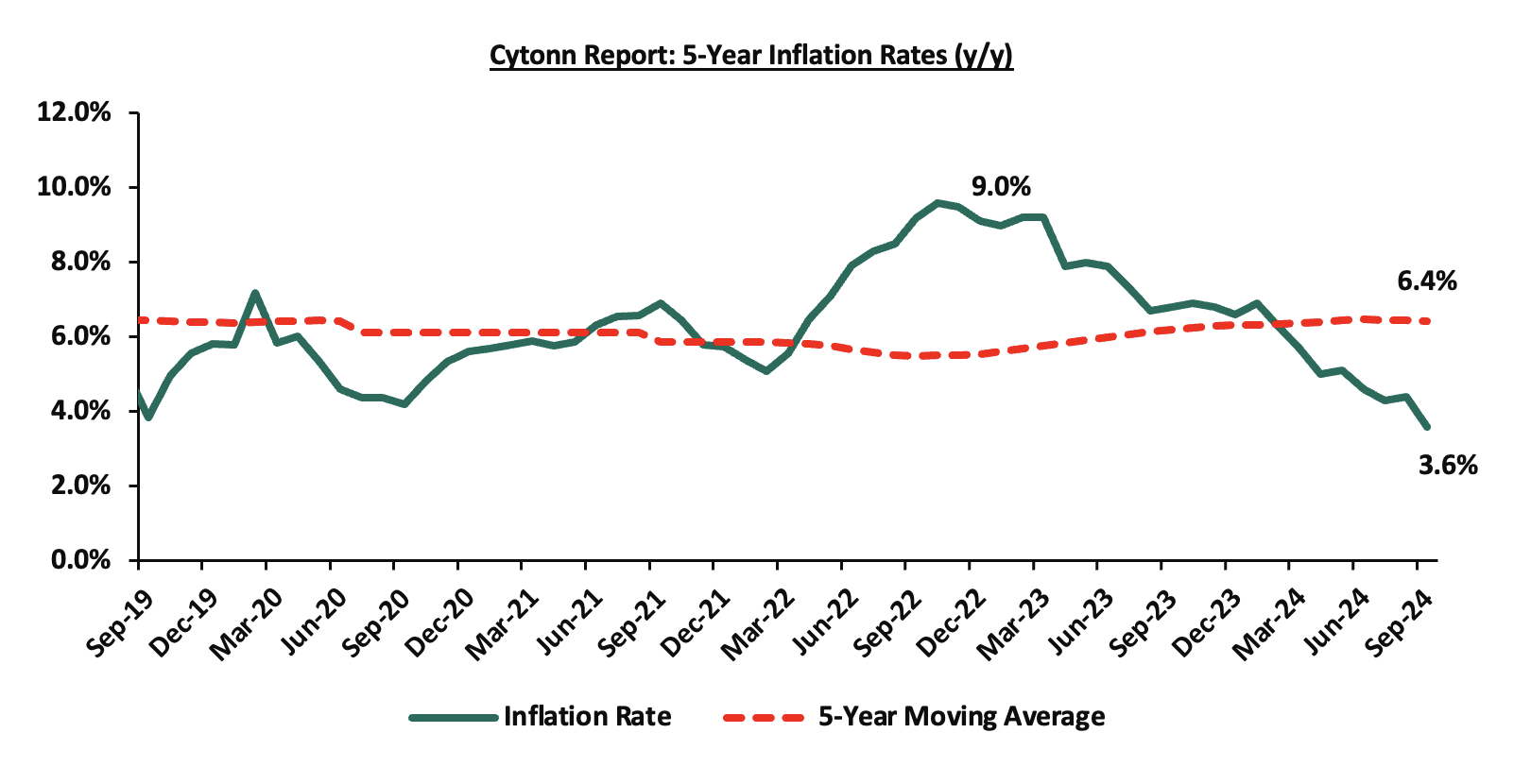

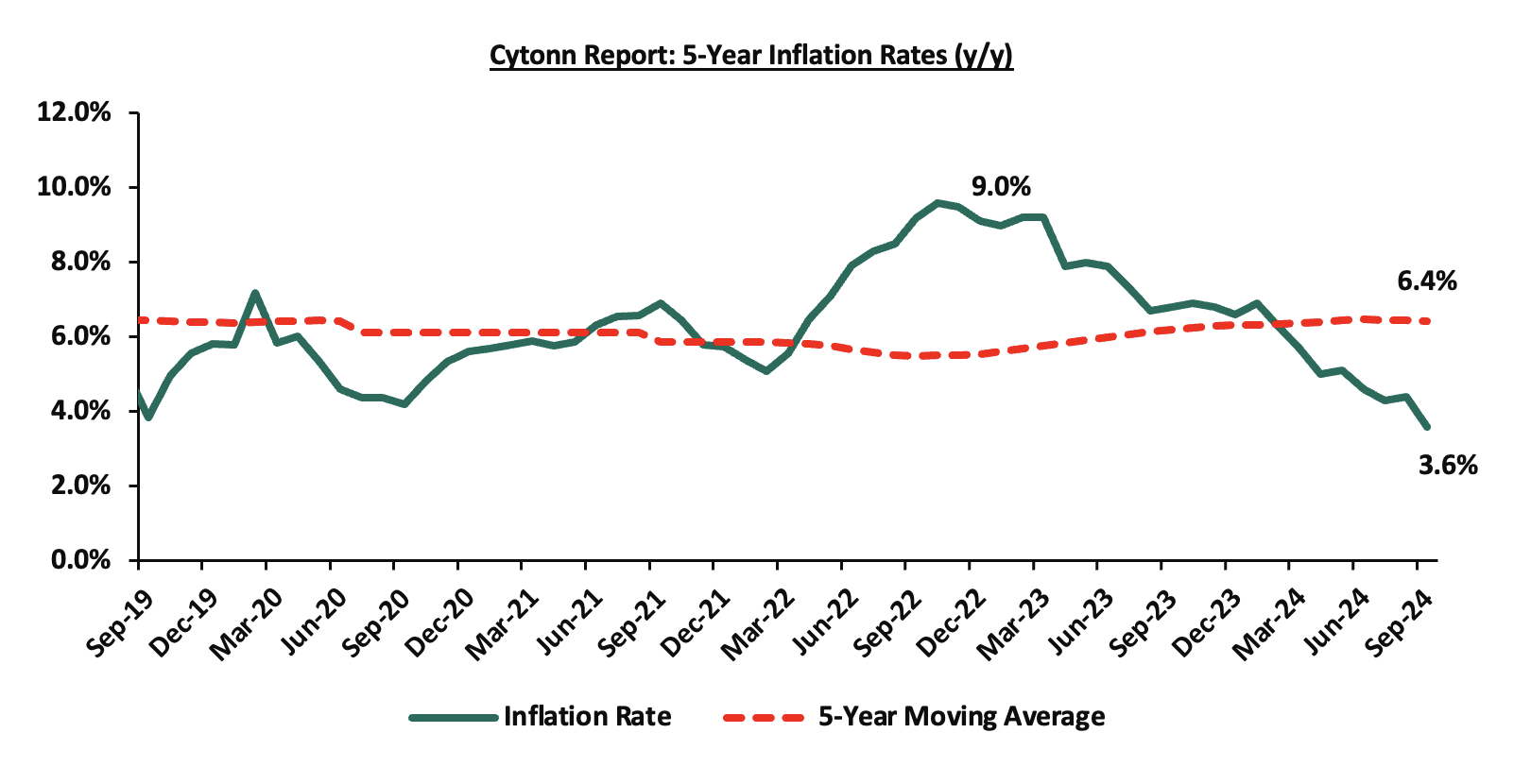

Inflation:

The average inflation rate decreased to 4.1% in Q3’2024, compared to 6.9% in Q3’2023, attributable to an appreciating Shilling, and stabilized fuel prices. Notably, the maximum allowed price for Super Petrol and Diesel in September remained unchanged from the prices announced for the month of August, while the maximum price allowed for Kerosene decreased by Kshs 3.4 per litre. Consequently, Super Petrol and Diesel will continue to retail at Kshs 188.8 and Kshs 171.6 per litre respectively, while Kerosene will retail at Kshs 158.3 per litre. Inflation for the month of September 2024 eased to 3.6%, from 4.4% recorded in August 2024, mainly driven by a 0.1% decrease in the Housing, water, electricity, gas and other fuels category. Below is a chart showing the inflation trend for the last five years:

For the last 15 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling and reduced fuel and electricity prices. The risk, however, remains the fuel prices that still remain elevated, and the monetary policy that has now begun to loosen, with the MPC on 6th August, cutting the CBR rate by 25 bps to 12.75% from 13.00%. In their meeting this month, we expect further cuts that would increase the money supply and, therefore, may drive inflation upwards.

Going forward, we expect the inflationary pressures to remain within the CBK’s preferred target, mainly on the back of stronger Shilling, and reduced fuel and electricity prices. However, the loosening monetary policy and the still elevated, though stabilizied fuel prices remain a risk for the inflation rate.

September 2024 Inflation

The y/y inflation in September 2024 decreased by 0.8% points to 3.6%, from the 4.4% recorded in August 2024. This was in line with our expectation of a decrease, but slightly above our projected range of 4.1% to 4.4%. Our decision was mainly driven by reduced electricity prices for September and the stable fuel prices for the month. The headline inflation in September 2024 was majorly driven by increase in prices of commodities in the following categories; Food & Non-Alcoholic Beverages, Housing, Water, Electricity, Gas & other fuels, and Transport by 5.1%, 2.6%, and 0.5% respectively. The table below shows a summary of both the year-on-year and month-on-month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – September 2024 |

|||

|

Broad Commodity Group |

Price change m/m (September-2024/August -2024) |

Price change y/y (September-2024/September-2023) |

Reason |

|

Food and non-alcoholic beverages |

0.4% |

5.1% |

The m/m increase was supported by decrease in prices of sugar, wheat flour and milk by 2.8%, 2.1%, and 0.6%, respectively However, the decrease was mainly driven by decrease in prices of commodities such as oranges, potatoes, and fresh fish by 5.2%, 2.3% and 2.1% respectively. |

|

Transport |

0.1% |

0.5% |

The m/m increase recorded in the transport Index was mainly on the back of a 6.2 bps increase in bus fares while the prices of diesel and petrol remained unchanged from their August 2024 prices of Kshs 171.6 and Kshs 188.8 per litre respectively. |

|

Housing, water, electricity, gas and other fuels |

(0.1%) |

2.6% |

The m/m performance was mainly driven by the decrease in prices of Electricity of 200 kWh and 50 kWh by 68.8 bps and 77.0 bps respectively together with Kerosene prices which dropped by Kshs 3.4 per litre to retail at Kshs 158.4 per litre |

|

Overall Inflation |

0.2% |

3.6% |

The m/m increase was mainly attributable to the 0.4% increase in Food and non-alcoholic beverages. |

Notably, September’s overall headline inflation declined again after slightly rising in August. Furthermore, it has remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the fifteenth consecutive month. The decrease in headline inflation in September 2024 comes amid the maximum allowed price for Super Petrol and Diesel remaining unchanged from the prices announced for the previous month, while the maximum price allowed for Kerosene decreased by Kshs 3.4 per litre. Consequently, Super Petrol and Diesel will continue to retail at Kshs 188.8 and Kshs 171.6 per litre respectively, while Kerosene will retail at Kshs 158.3 per litre. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, lower electricity prices and reducing fuel prices. The risk, however, lies in the fuel prices which despite their decline over the last months, still remain elevated compared to historical levels. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting lower inflation rates. Key to note is that the Monetary Policy Committee cut the Central Bank Rate by 25 bps to 12.75% from 13.0% in its August 2024 meeting, with the aim of easing the monetary policy and maintaining exchange rate stability. The committee is expected to meet again on Tuesday 8th October 2024, and is expected to cut the rates further on the need to support the economy. This expected further cut may hinder the easing of inflation.

The Kenyan Shilling:

The Kenyan Shilling slightly appreciated against the US Dollar by 0.3% in Q3’2024, to close at Kshs 129.2, from Kshs 129.5 as at the end of H1’2024, mainly attributable to increased foreign inflows during the quarter, and the US Fed cut in mid-September which made the dollar less attractive compared to other currencies, the Kenyan shilling included. During the week, the Kenya Shilling appreciated against the US Dollar by 1.3 bps to remain relatively unchanged from the Kshs 129.2 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,645.0 mn in the 12 months to August 2024, 12.7% higher than the USD 4,120.0 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the August 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% in the 12 months to June 2024, from the arrivals recorded during a similar period in 2023, and,

- High Forex reserves currently at USD 8.2 bn (equivalent to 4.2-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, but lower than the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 0.7% of GDP in Q2’2024 from 0.9% recorded in Q1’2024, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.9% of Kenya’s external debt was US Dollar-denominated as of March 2024.

Monetary Policy:

The Monetary Policy Committee (MPC) met once in Q3’2024, where the Central Bank Rate was cut by 25 bps to 12.75% from the 13.00% that had been maintained in the June meeting, noting that its previous interventions had successfully mitigated exchange rate pressures, and anchored inflation with inflation coming at 4.4% and 3.6% in August and September 2024 respectively, remaining within the CBK target range of 2.5%-7.5%. Below are some of the Key highlights from the June meeting:

- The overall inflation eased by 0.3% points to 4.3% in July 2024, from 4.6% in June 2024, positioning it at below the mid-point of the preferred CBK range of 2.5%-7.5%, mainly driven by the decline in fuel inflation. Fuel inflation decreased to 4.5% in July 2024 from 6.4% in June 2024, largely attributable to a downward adjustment in pump prices and lower electricity tariffs. The food inflation remained unchanged at 5.6% in July and June 2024, attributable largely to declines in prices of key non-vegetable food items i.e. maize, sugar, and wheat flour, that offset the price increase of a few vegetables i.e tomatoes, Irish potatoes, and cabbages. The non-food non-fuel inflation slightly decreased to 3.3% in July 2024 from 3.4% in June 2024, reflecting the impact of the monetary policy measures. We expect the overall inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, reduced fuel prices and reduced electricity prices,

- The recently released Quarterly Gross Domestic Product Report, for Q1’2024 showed continued strong performance of the Kenyan economy, with real GDP growing by 5.0%, although slower than the growth of 5.5% recorded in a similar period in 2023. This was attributable to strong growth in the agriculture sector due to favourable weather conditions that boosted crop and livestock production and resilient performance of the services sector, particularly wholesale and retail trade, accommodation and food services, financial and insurance, information and communication, and real estate. The economy is expected to continue to strengthen in 2024, supported by a resilient services sector, sustained performance in agriculture, and enhanced exports. However, this positive outlook is tempered by potential risks, including geopolitical tensions,

- Goods exports increased by 5.0% in the 12 months to June 2024, compared to a similar period in 2023, reflecting a rise in exports of agricultural commodities and re-exports. Receipts from tea and fruits and vegetables exports increased by 4.6% and 12.1% respectively, while re-exports grew by 56.5% in the period. Notably, exports increased 11.8% in the first half of 2024 compared to the same period in 2023. Imports declined by 3.3% in the 12 months to June 2024 compared to a similar period in 2023, mainly reflecting lower imports across all categories except sugar, machinery and transport equipment, crude materials, and miscellaneous manufactures. However, imports increased by 3.6% in the first six months of 2024 compared to the same period in 2023. Tourist arrivals improved by 27.2% in the 12 months to June 2024, compared to a similar period in 2023. Remittances totalled USD 4,535.5 mn in the 12 months to June 2024 and were 12.9% higher compared to USD 4,017.1 mn in a similar period in 2023. The current account deficit is estimated at 3.7% of GDP in the 12 months to June 2024, down from 4.2% of GDP in a similar period in 2023, and is projected at 4.0% of GDP in 2024, reflecting improvement in exports of agricultural products, sustained remittances, recovery in imports supported by stable exchange rate and effects of regional trade integration initiatives,

- The CBK foreign exchange reserves, which currently stand at USD 7,340 mn representing 3.8 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans increased to 16.3% in June 2024 compared to 16.1% in April 2024, attributable to the 1.5% decrease in gross loans, that outpaced the 0.7% decrease in gross non-performing loans (NPLs) between the two periods. Decreases in NPLs were noted in the agriculture, real estate, manufacturing, transport and communication, trade, and building and construction sectors. Banks have continued to make adequate,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about the impact of the recent protests on economic activities, the high cost of doing business, and the impact of geopolitical uncertainties on the economy. Despite this, they remained optimistic that economic growth would remain resilient and improve in 2024, supported by increased agricultural production, and a stable macroeconomic activity reflected in the low inflation rate and stability in the exchange rate,

- The Survey of the Agriculture Sector for July 2024 revealed an expectation by respondents that inflation was expected to remain unchanged or decrease in the next three months due to an expected rise in food supply due to expected harvests, stable exchange rate, and lower fuel prices,

- Global growth is expected to continue to recover, attributable to strong growth in the United States and improved growth in several large and emerging markets, particularly India and China. Additionally, headline inflation rates have moderated, with central banks in some major economies lowering their interest rates. Food inflation has continued to decline due to an improved supply of key food items, particularly sugar and cereals. International oil prices have moderated but the risk premium from the Middle East conflict has increased following the recent escalation,

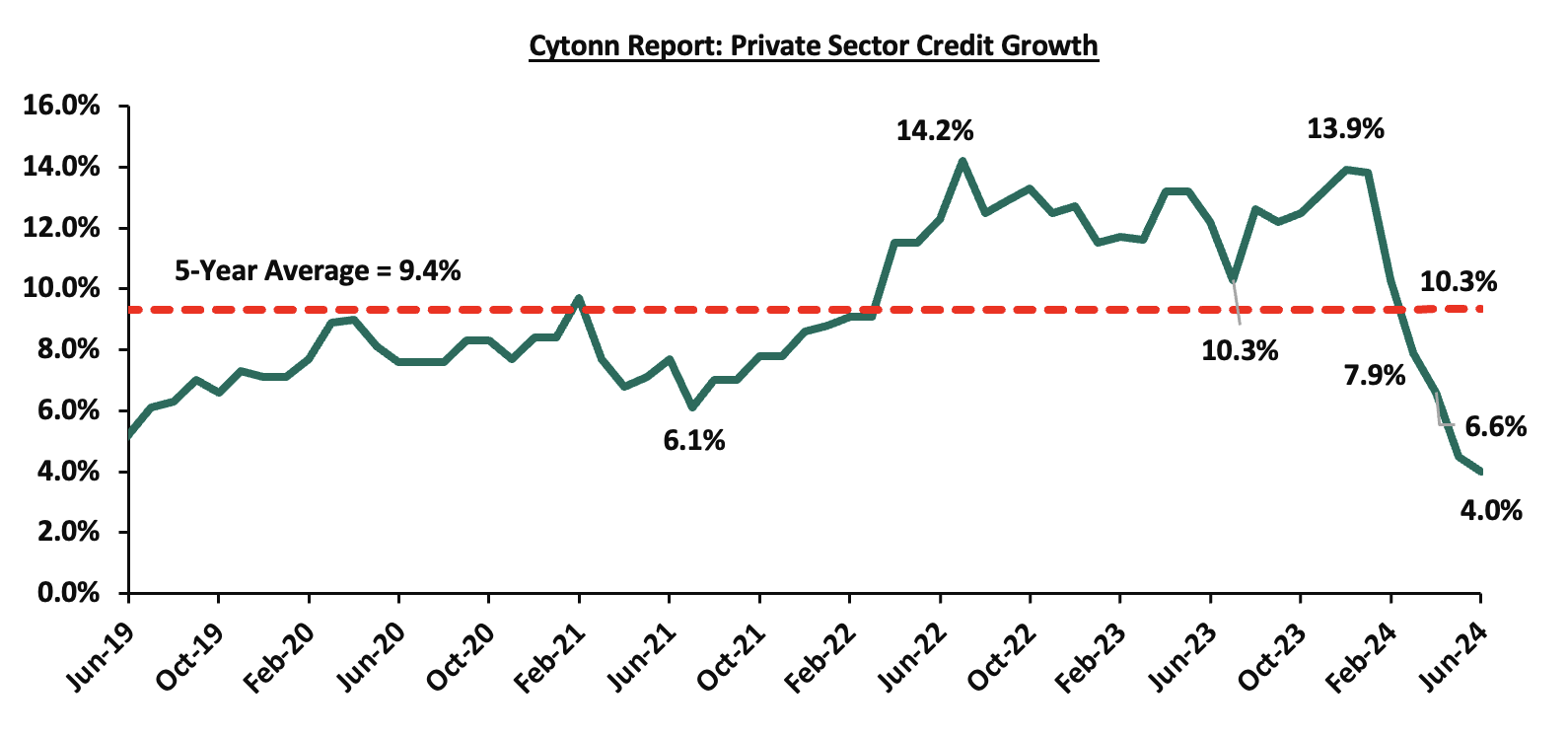

- Growth in private sector credit decreased to 4.0% in June 2024 from 4.5% in May 2024, mainly attributed to exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling. In June, local currency loans increased by 10.2%, while foreign currency loans, which make up around 26.0% of total loans, decreased by 13.3%. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee acknowledged the results of implementing the FY’2024/25 Government Budget and the FY’2024/25 Supplementary Budget I. These measures are anticipated to further support fiscal consolidation, reducing the fiscal deficit to 4.3% of GDP in FY’2024/25, from 5.6% of GDP in FY’2023/24. This medium-term fiscal consolidation is expected to decrease debt vulnerabilities and improve the debt/GDP ratio, steering it toward a more sustainable position.

The MPC noted that its previous measures have successfully reduced overall inflation to below the mid-point of the target range of 2.5%-7.5%, stabilized the exchange rate, and anchored inflationary expectations. The Committee also noted a moderation in NFNF inflation, while central banks in several major economies have started to ease their interest rates in response to easing inflationary pressures, with signs that others may soon follow suit. Consequently, the MPC concluded that there was scope for a gradual easing of monetary policy, while maintaining exchange rate stability, which we expect to gradually ease the interest rates in the country. The MPC will closely monitor the impact of its policy measures, as well as developments in the global and domestic economy, and stands ready to take further action as necessary in line with its mandate. We anticipate that the reduction in the CBR rate will start to lower borrowing costs, leading to increased spending and an uptick in the business environment as well as reduced debt servicing costs for the government, as the MPC closely monitors inflation and exchange rate stability to ensure the continuation of the current trend of stability and eased inflation. The Committee will meet again on 8th October 2024.

Fiscal Policy:

The total Kenyan budget for the FY’2024/2025 National Budget increased by 7.2% to Kshs 4.0 tn from the Kshs 3.7 tn in FY’2023/2024 while the total revenue inclusive of grants increasing by 15.9% to Kshs 3.4 tn from the Kshs 2.9 tn in FY’2023/2024. The increase is mainly due to an 18.8% increase in ordinary revenue to Kshs 2.8 tn for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/2024 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target.

However, following the withdrawal of the 2024 Finance bill that sought to increase revenue by Kshs 302.0 bn, the National Treasury, earlier than is usual, presented the Supplementary Estimates I for the Fiscal Year 2024/25 to the National Assembly.

The table below summarizes the overall change in the FY’2024/25 budget estimates.

|

Cytonn Report: FY’2024/25 Supplementary Budget Estimates I (Kshs bn) |

|||||

|

Item |

FY'2023/24 Supplementary Budget II

|

Original Approved Estimates FY’2024/25 |

Supplementary Estimates FY’2024/25 |

% Change between original and current estimates |

% Change between supplementary and 23/24 estimates |

|

Recurrent Expenditure |

1,719.9 |

1,632.1 |

1,598.0 |

(2.1%) |

(7.1%) |

|

Development Expenditure |

669.3 |

746.3 |

624.0 |

(16.4%) |

(6.8%) |

|

Ministerial National Government Expenditure |

2,389.2 |

2,378.4 |

2,222.0 |

(6.6%) |

(7.0%) |

|

Consolidated Fund Services |

1,057.7 |

1,213.5 |

1,237.2 |

2.0% |

17.0% |

|

County Equitable Allocation |

425.1 |

400.1 |

411.0 |

2.7% |

(3.3%) |

|

Total Expenditure |

3,872.0 |

3,992.0 |

3,870.2 |

(3.1%) |

(0.1%) |

Source: The National Treasury

Key take outs from the table include;

- The recurrent expenditure (Costs incurred to cover regular government expenses such as salaries, operational costs and maintenance costs) decreased by 2.1% to Kshs 1,598.0 bn in the Supplementary Estimates I from Kshs 1,632.1 bn in the original estimates, an indication of the government's initiative to cut expenditure cuts while still to boosting public services, responding to economic growth and ensuring the well-being of its citizens,

- Development expenditure (Costs incurred in order to create assets that will provide long term public infrastructure such as roads, hospitals, and schools) declined by 16.4% to Kshs 624.0 bn in the supplementary estimates from Kshs 746.3 bn in the original estimates, a detriment to the sectors such as infrastructure, energy, water and health that require heavy development financing,

- Consequently, the Ministerial National Government expenditure estimates for the FY’2024/25 Supplementary Budget I is set to decrease by 6.6% to Kshs 2,222.0 bn from Kshs 2,378.4 bn in the original estimates, translating to a reduction of Kshs 156.4 bn in expenses for the government. This decline is mainly attributed to budget rationalization aimed at reducing expenditure in various sectors and public services,

- Consolidated Fund Services (CFS) (refers to the Consolidated Fund established in the Kenya’s constitution into which development partners deposit funds before disbursing to the Exchequer accounts for projects such as servicing of public debt, and subscription to International Organizations) has increased by 2.0% to Kshs 1,237.2 bn from Kshs 1,213.5 bn in the original estimates, and,

- The County Equitable Share (allocation on national government revenue to county governments) increased by 2.7% to Kshs 411.0 bn from Kshs 400.1 bn in the original approved estimates.

For the FY’2023/2024, the government was not able to meet the revenue collection for FY’2023/24, collecting Kshs 2.4 tn, translating to a shortfall of 4.5% against its revenue target of Kshs 2.8 tn. Notably, for the FY’2024/2025, from the figures released by the National Treasury for revenue and net expenditures collected as at the end of August 2024, total revenue collected amounted to Kshs 331.6 bn, equivalent to 12.6% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 75.6% of the prorated estimates of Kshs 438.6 bn.

Going forward, we believe that the coming months’ revenue collection performance will largely depend on how quickly the country’s business climate stabilizes. We therefore expect the government to cut on its expenditure, mostly the development expenditure in order to finance the growing debt maturities and the ballooning recurrent expenditure.

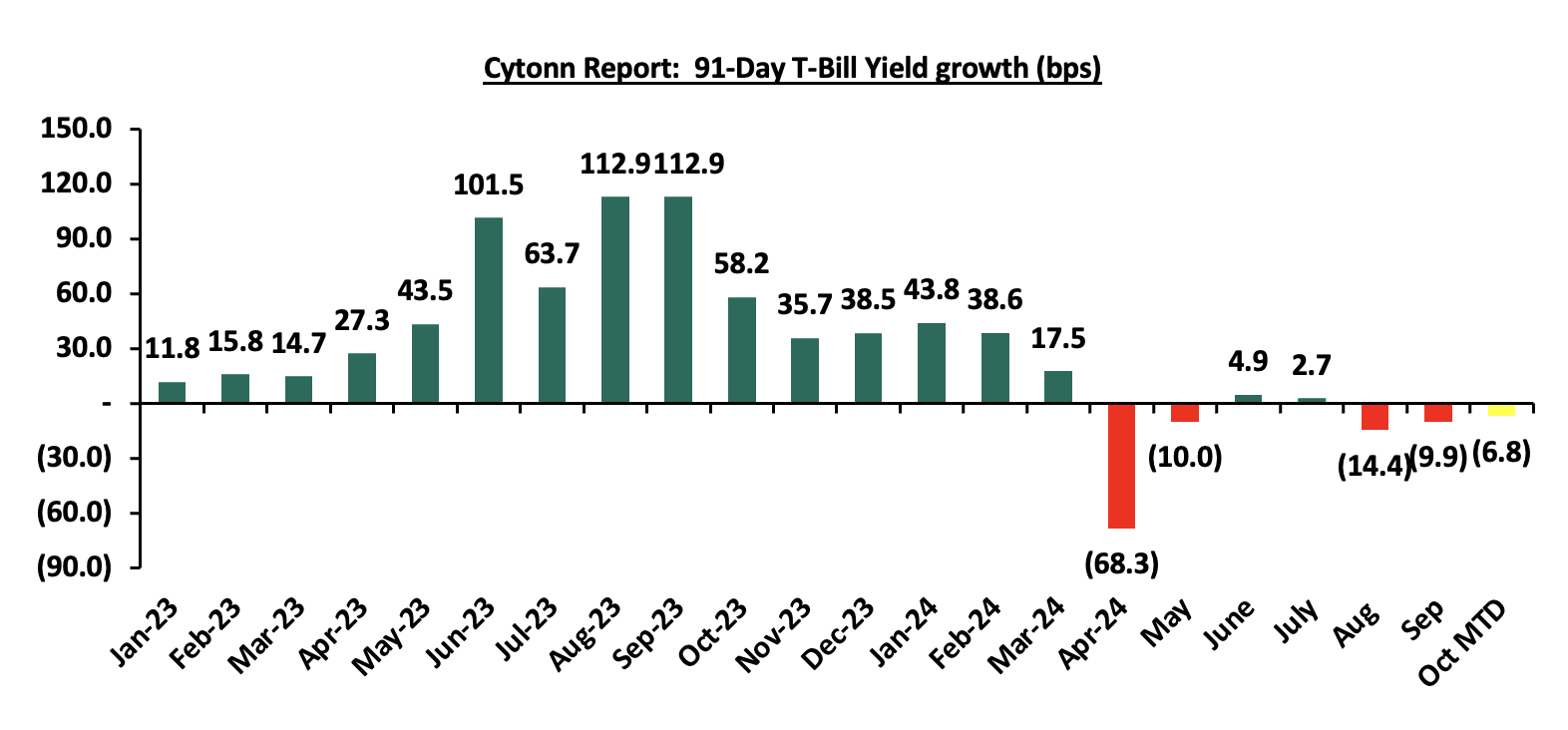

During the quarter, T-bills were oversubscribed, with the overall oversubscription rate coming in at 109.4%, down from 114.1% in Q3’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 189.4 bn against the offered Kshs 56.0 bn, translating to an oversubscription rate of 338.3%, lower than the oversubscription rate of 570.7% recorded in the previous year same period. Overall subscriptions for the 182-day and 364-day papers increased significantly to 77.6% and 49.6% from 27.1% and 18.4% in Q3’2023, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day, and 91-day papers increasing by 3.4%, 3.5%, and 7.7% points to 15.9%, 16.7%, and 16.9%, from 13.2%, 13.2%, and 13.5%, respectively, recorded in Q3’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid the high risk attached to government debt, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 88.3%, albeit lower than the 95.5% recorded in Q3’2023, with the government accepting a total of Kshs 324.5 bn out of the Kshs 367.5 bn worth of bids received. The chart below shows the yield growth rate for the 91-day paper in 2023 and during the year:

During the week, T-bills were oversubscribed, with the overall oversubscription rate coming in at 224.8%, a reversal from the undersubscription rate of 87.2% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 17.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 433.8%, higher than the oversubscription rate of 173.0% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 202.1% and 164.0% respectively from the 54.4% and 85.7% respectively recorded the previous week. The government accepted a total of Kshs 29.2 bn worth of bids out of Kshs 54.0 bn bids received, translating to an acceptance rate of 54.2%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 7.1 bps, 8.9 bps and 3.3 bps to 16.7%, 16.5% and 15.7% respectively from 16.8%, 16.6% and 15.7% respectively recorded the previous week.

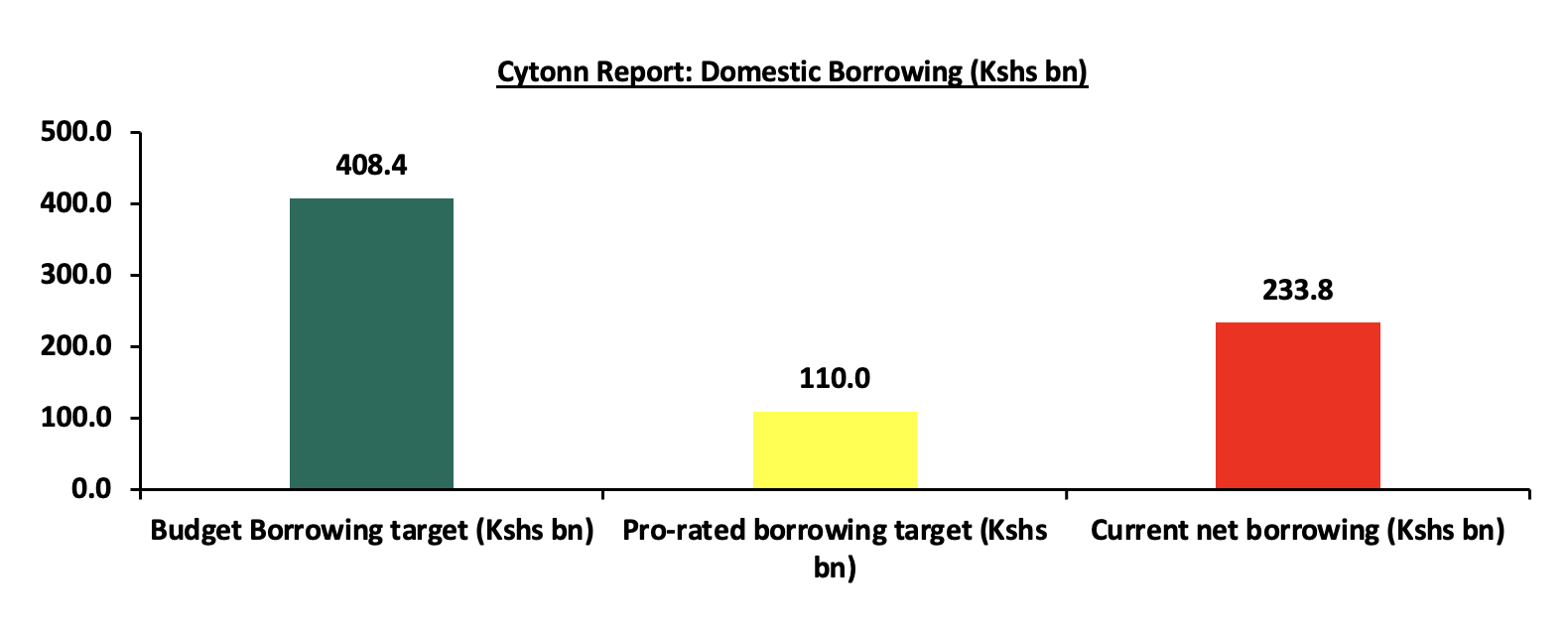

So far in the current FY’2024/25, government securities totalling Kshs 505.0 bn have been advertised. The government has accepted bids worth Kshs 504.0 bn, of which Kshs 353.7 bn and Kshs 150.3 bn were treasury bills and bonds, respectively. Total redemptions so far in FY’2024/25 equal to Kshs 270.2 bn, with treasury bills accounting for Kshs 270.2 bn. As a result, currently, the government has a domestic borrowing surplus of Kshs 233.8 bn, which is 42.7% of the total net domestic borrowing target of Kshs 408.4 bn for FY’2024/25. The chart below shows government’s current borrowing position:

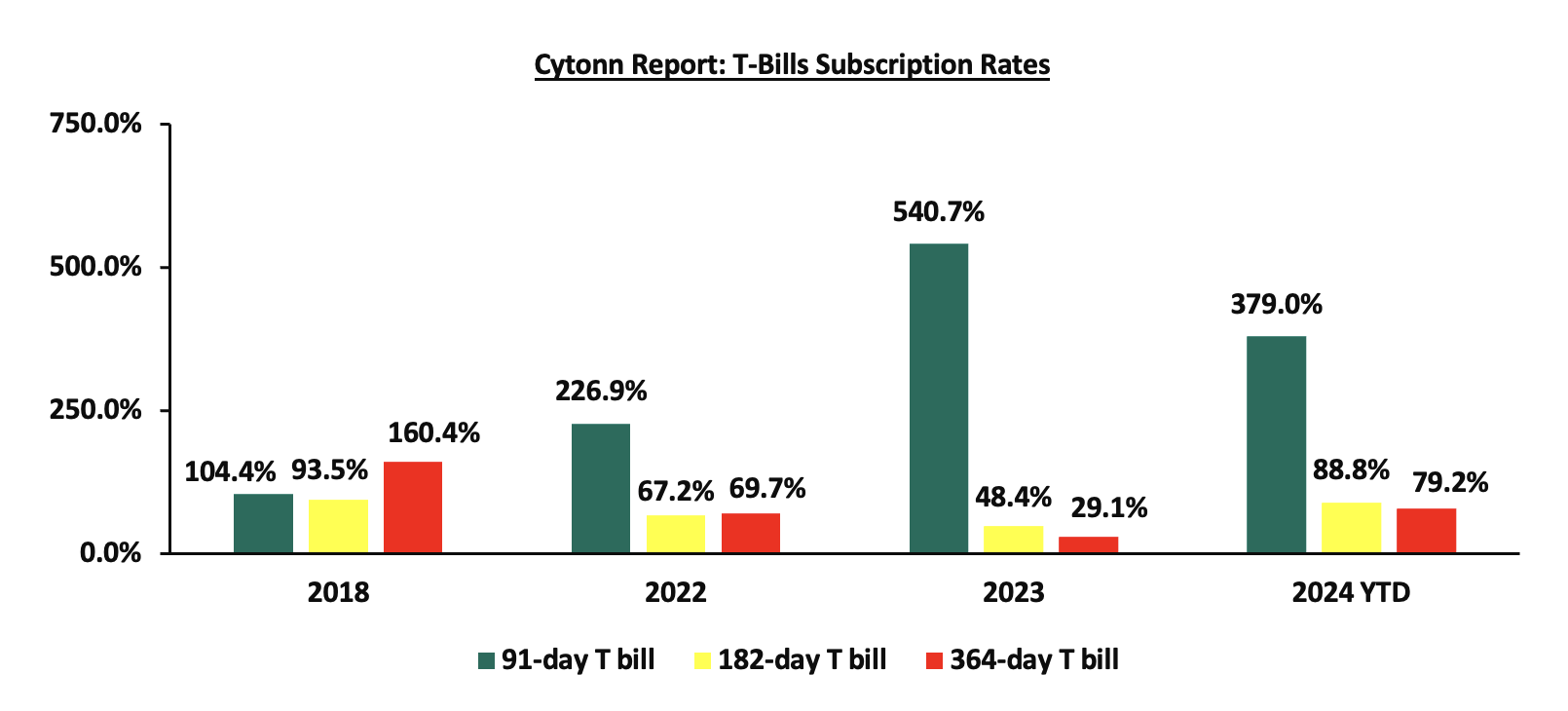

The chart below compares the overall average T-bills subscription rates obtained in 2018, 2022, 2023, and 2024 Year to Date (YTD):

Primary T-bond Auctions in Q3’2024:

During the quarter, the government re-opened six bonds and issued two tap sales, seeking to raise Kshs 145.0 bn during the quarter. The bonds were generally oversubscribed, receiving bids worth Kshs 199.3 bn against the offered Kshs 145.0 bn, translating to an oversubscription rate of 144.5%. The government accepted Kshs 150.3 bn of the Kshs 199.3 bn worth of bids received, translating to an acceptance rate of 80.5%. The table below provides more details on the bonds issued during the quarter:

|

Cytonn Report: Bond Issuances in Q3’2024 |

||||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

|

08/07/2024 |

FXD1/2023/002 -Tapsale |

1.2 |

17.0% |

20.0 |

0.5 |

0.5 |

17.1% |

2.4% |

99.8% |

|

|

22/07/2024 |

FXD1/2024/010 – Re-opened |

9.7 |

16.0% |

30.0 |

9.8 |

14.7 |

16.6% |

48.9% |

66.5% |

|

|

FXD1/2008/020 – Re-opened |

3.9 |

13.8% |

18.3% |

|||||||

|

19/08/2024 |

IFB1/2023.6.5 |

5.8 |

17.9% |

50.0 |

88.7 |

126.3 |

18.3% |

252.6% |

70.2% |

|

|

IFB1/2023/17 |

||||||||||

|

|

15.7 |

14.4% |

17.7% |

|||||||

|

02/09/2024 |

IFB1/2023/17- Tapsale

|

15.7

|

14.4% |

15.0 |

32.0 |

35.2 |

17.7% |

234.6% |

91.0% |

|

|

23/09/2024 |

FXD1/2016/020 - Re-opened |

12.0 |

14.0% |

30.0 |

19.3 |

22.6 |

17.3% |

75.5% |

85.1% |

|

|

FXD1/2024/010 - Re-opened |

9.5 |

16.0% |

16.9% |

|||||||

|

Q3’2024 Total |

|

|

145.0 |

150.3 |

199.3 |

|

|

|

||

|

Q3’2023 Total |

|

|

176.0 |

146.3 |

206.8 |

|

|

|

||

|

Q3’2024 Average |

9.4 |

15.5% |

|

|

|

17.5% |

144.5% |

80.5% |

||

|

Q3’2023 Average |

3.5 |

16.3% |

|

|

|

17.2% |

138.7% |

87.3% |

||

Source: CBK

In the primary bond market, the government is looking to raise Kshs 30.0 bn through the reopened two-year fixed coupon bonds FXD1/2016/10 and FXD1/2022/010 with the tenor to maturity of 1.8 years and 7.6 years respectively and fixed coupon rates of 15.0% and 13.5% respectively. Our expected bidding ranges for the reopened bonds are 17.0%-17.3% and 16.9%-17.2% respectively;

Secondary Bond Market Activity:

- Bond Turnover

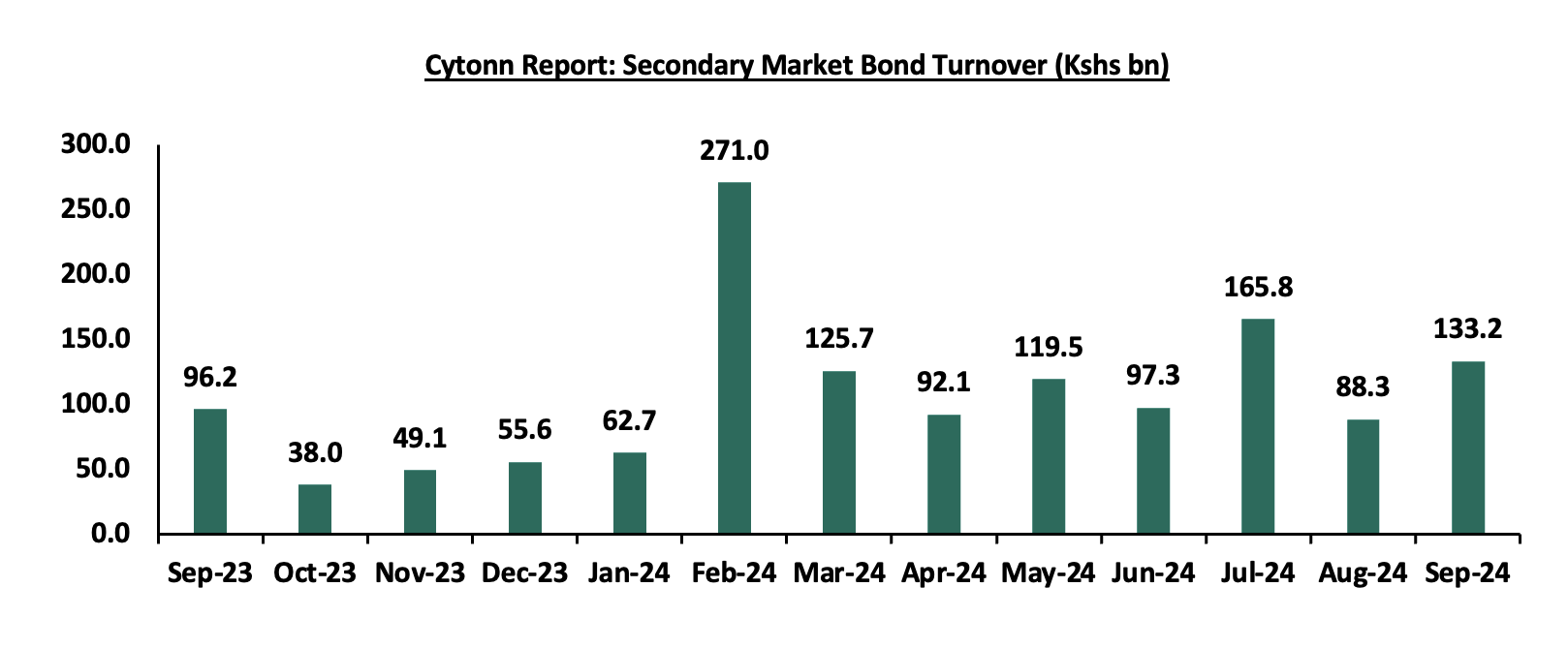

In the secondary bond market, activity increased significantly, with the turnover increasing by 84.0% to Kshs 387.4 bn, from Kshs 210.5 bn in Q3’2023, pointing towards increased activities by commercial banks in the secondary bond market. Similarly, on a year-on-year basis, the bond turnover increased by 38.4% to Kshs 133.2 in September 2024, from Kshs 96.2 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

- Yield Curve

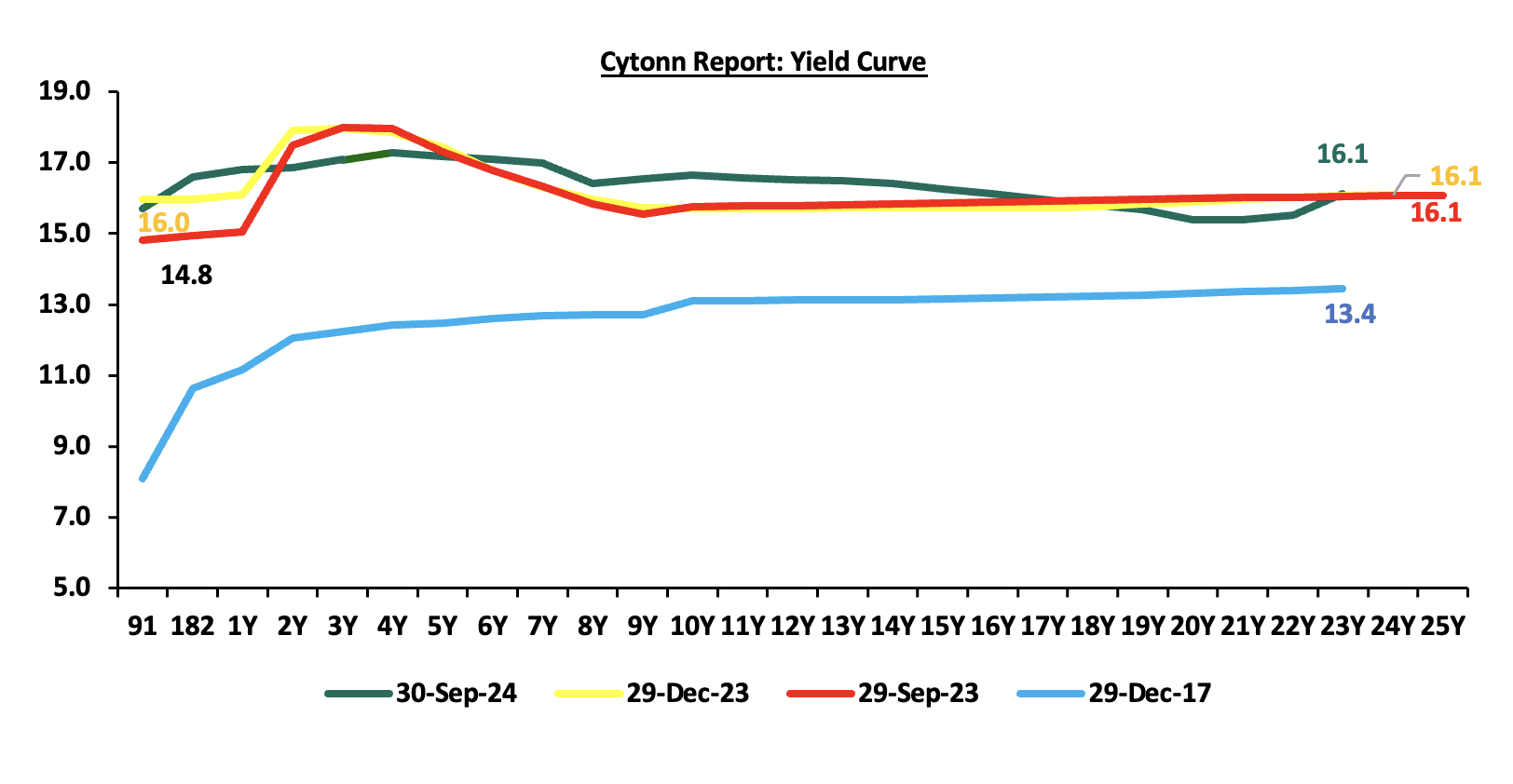

During Q3’2024, yields on the government securities were on an upward trajectory compared to the same period in 2023. We observe a humped yield curve for the medium-term bonds in the 3 to 7-year maturity range, an indication of the prevailing uncertainty in the market regarding both medium-term interest rates and inflation. Investors, apprehensive about the economic outlook in the near to medium term, are demanding higher yields for bonds in the 3 to 7-year maturity range to compensate for the perceived risks as they anticipate potential fluctuations in economic conditions in the Kenyan market on the back of the government’s debt sustainability concerns. The chart below shows the yield curve movement during the period:

Money Market Performance:

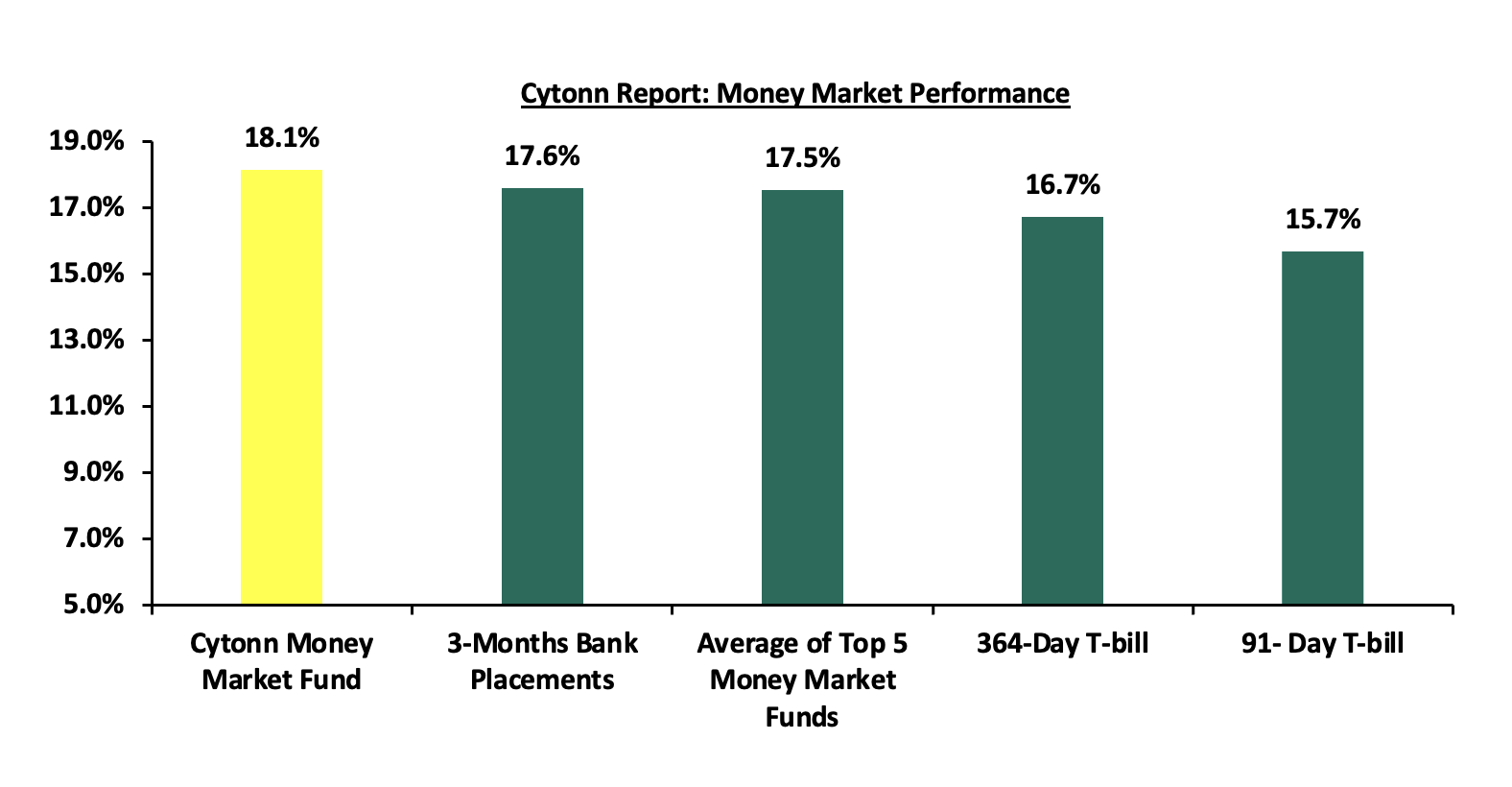

In the money markets, 3-month bank placements ended the week at 17.6% (based on what we have been offered by various banks), and the yields on the government papers were on a downward trajectory, with the yields on the 364-day and 91-day papers decreasing by 7.1 bps and 3.3 bps respectively, to 16.7% and 15.7% respectively from 16.8% and 15.7% respectively recorded the previous week. The yields on the Cytonn Money Market Fund decreased marginally by 1.0 bps to close the week at 18.1% from 18.2% the previous week, while the average yields on the Top 5 Money Market Funds decreased by 7.2 bps to 17.5% from the 17.6% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 4th October 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 4th October 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

18.1% |

|

2 |

Lofty-Corban Money Market Fund |

18.0% |

|

3 |

Etica Money Market Fund |

17.4% |

|

4 |

Arvocap Money Market Fund |

17.1% |

|

5 |

Kuza Money Market fund |

17.0% |

|

6 |

GenAfrica Money Market Fund |

16.5% |

|

7 |

Nabo Africa Money Market Fund |

16.0% |

|

8 |

Enwealth Money Market Fund |

16.0% |

|

9 |

Jubilee Money Market Fund |

15.7% |

|

10 |

Madison Money Market Fund |

15.6% |

|

11 |

Ndovu Money Market Fund |

15.5% |

|

12 |

Co-op Money Market Fund |

15.4% |

|

13 |

KCB Money Market Fund |

15.3% |

|

14 |

Mali Money Market Fund |

15.2% |

|

15 |

Sanlam Money Market Fund |

15.1% |

|

16 |

Absa Shilling Money Market Fund |

15.0% |

|

17 |

Apollo Money Market Fund |

15.0% |

|

18 |

Orient Kasha Money Market Fund |

14.8% |

|

19 |

AA Kenya Shillings Fund |

14.6% |

|

20 |

Stanbic Money Market Fund |

14.5% |

|

21 |

Genghis Money Market Fund |

14.4% |

|

22 |

Dry Associates Money Market Fund |

14.1% |

|

23 |

Old Mutual Money Market Fund |

14.0% |

|

24 |

ICEA Lion Money Market Fund |

13.8% |

|

25 |

CIC Money Market Fund |

13.7% |

|

26 |

Equity Money Market Fund |

13.3% |

|

27 |

British-American Money Market Fund |

13.1% |

|

28 |

Mayfair Money Market Fund |

11.9% |

Source: Business Daily

Liquidity:

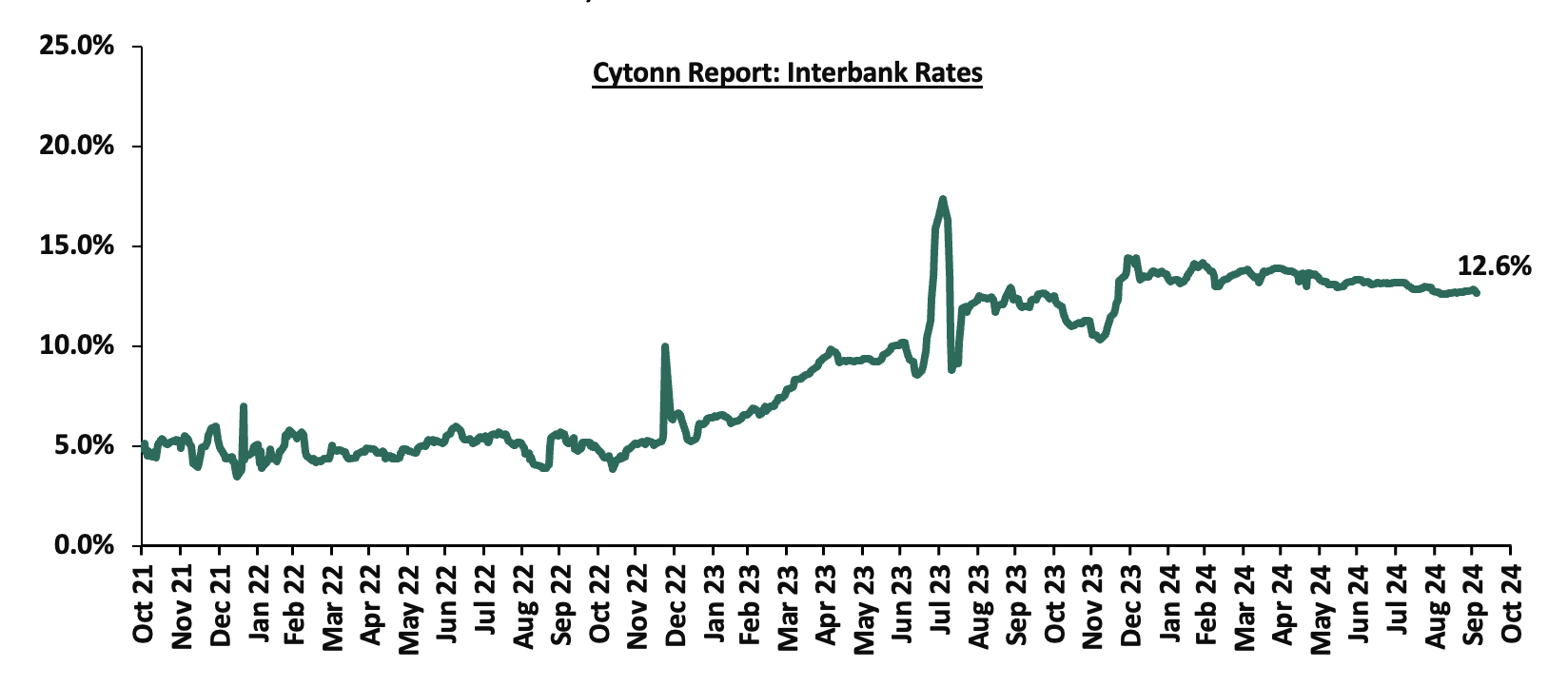

During the quarter, liquidity in the money market tightened, with the average interbank rate increasing by 1.1% points to 13.0% from 11.9% in Q3’2023, partly attributable to tax remittances that offset government payments. The average volumes traded in the interbank market increased by 15.4% to Kshs 26.0 bn, from Kshs 22.6 bn recorded in Q3’2023.

During the week, liquidity in the money markets tightened, with the average interbank rate increasing marginally by 1.8 bps to 12.8% from 12.7% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased marginally by 1.0% to Kshs 17.9 bn from Kshs 18.1 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the quarter, the yields on Eurobonds were on a downward trajectory, with the 7-year Eurobond issued in 2019 decreasing the most by 2.0% points to 8.3% from 10.3% recorded at the start of the quarter. However, during the week, the yields on Kenya’s Eurobonds were on an upward trajectory, with the yields on the7-year Eurobond issued in 2024 increasing the most by 0.5% points to 9.9% from the 9.4% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 3rd October 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.4 |

23.4 |

2.6 |

7.6 |

9.7 |

6.4 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

01-Jul-24 |

10.6% |

11.1% |

10.3% |

11.0% |

11.0% |

11.1% |

|

26-Sep-24 |

8.5% |

9.9% |

8.3% |

9.4% |

9.4% |

9.4% |

|

27-Sep-24 |

8.6% |

9.9% |

8.3% |

9.5% |

9.4% |

9.4% |

|

30-Sep-24 |

8.6% |

9.9% |

8.3% |

9.6% |

9.4% |

9.5% |

|

01-Oct-24 |

8.6% |

10.1% |

8.3% |

9.5% |

9.4% |

9.5% |

|

02-Oct-24 |

8.8% |

10.2% |

8.6% |

9.7% |

9.6% |

9.7% |

|

03-Oct-24 |

9.0% |

10.2% |

8.7% |

9.8% |

9.7% |

9.9% |

|

Weekly Change |

0.5% |

0.3% |

0.4% |

0.4% |

0.3% |

0.5% |

|

QTD Change |

(1.9%) |

(1.1%) |

(2.0%) |

(1.5%) |

(1.6%) |

(1.5%) |

|

YTD Change |

(0.8%) |

(0.0%) |

(1.4%) |

(0.1%) |

0.2% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the quarter, the Kenya Shilling gained against the US Dollar by 0.3%, to close at Kshs 129.2, from Kshs 129.5 recorded at the start of the quarter. On a year-to-date basis, the shilling has appreciated by 17.7% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

During the week, the Kenya Shilling gained against the US Dollar by 1.3 bps, to close at Kshs 129.2, from Kshs 129.2 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,645.0 mn in the 12 months to August 2024, 12.7% higher than the USD 4,120.0 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the August 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% in the 12 months to June 2024, from the arrivals recorded during a similar period in 2023, and,

- Improved forex reserves currently at USD 8.2 bn (equivalent to 4.2-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, but lower than the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.2% of GDP in Q1’2024 from 3.0% recorded in Q1’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.9% of Kenya’s external debt is US Dollar-denominated as of March 2024.

Key to note, during the quarter, Kenya’s forex reserves increased by 3.2% to close at USD 8.0 bn from the USD 7.8 recorded at the start of the quarter. Moreover, during the week, the reserves increased by 2.0% to close the week at USD 8.2 bn from the USD 8.0 bn recorded last week, equivalent to 4.2 months of import cover, an increase from the previous week’s 4.1 months, and remained above the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- Kenya Q2’2024 GDP Growth Highlight

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q2’2024 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 4.6% growth in Q2’2024, slower than the 5.6% growth recorded in Q2’2023. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 4.8% in Q2’2024, lower than the 7.8% expansion recorded in Q2’2023. All sectors in Q2’2024, except Mining and Quarrying; and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to Q2’2023 with Accommodation and Food Services; Financial & Insurance; and Construction Sectors recording the highest declines of 16.2%, 8.1%, and 5.6% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in Q2’2023 were Financial Services Indirectly Measured, Agriculture and Forestry and Real Estate sectors, of 4.0%, 3.0% and 2.1% points respectively.

The key take-outs from the report include;

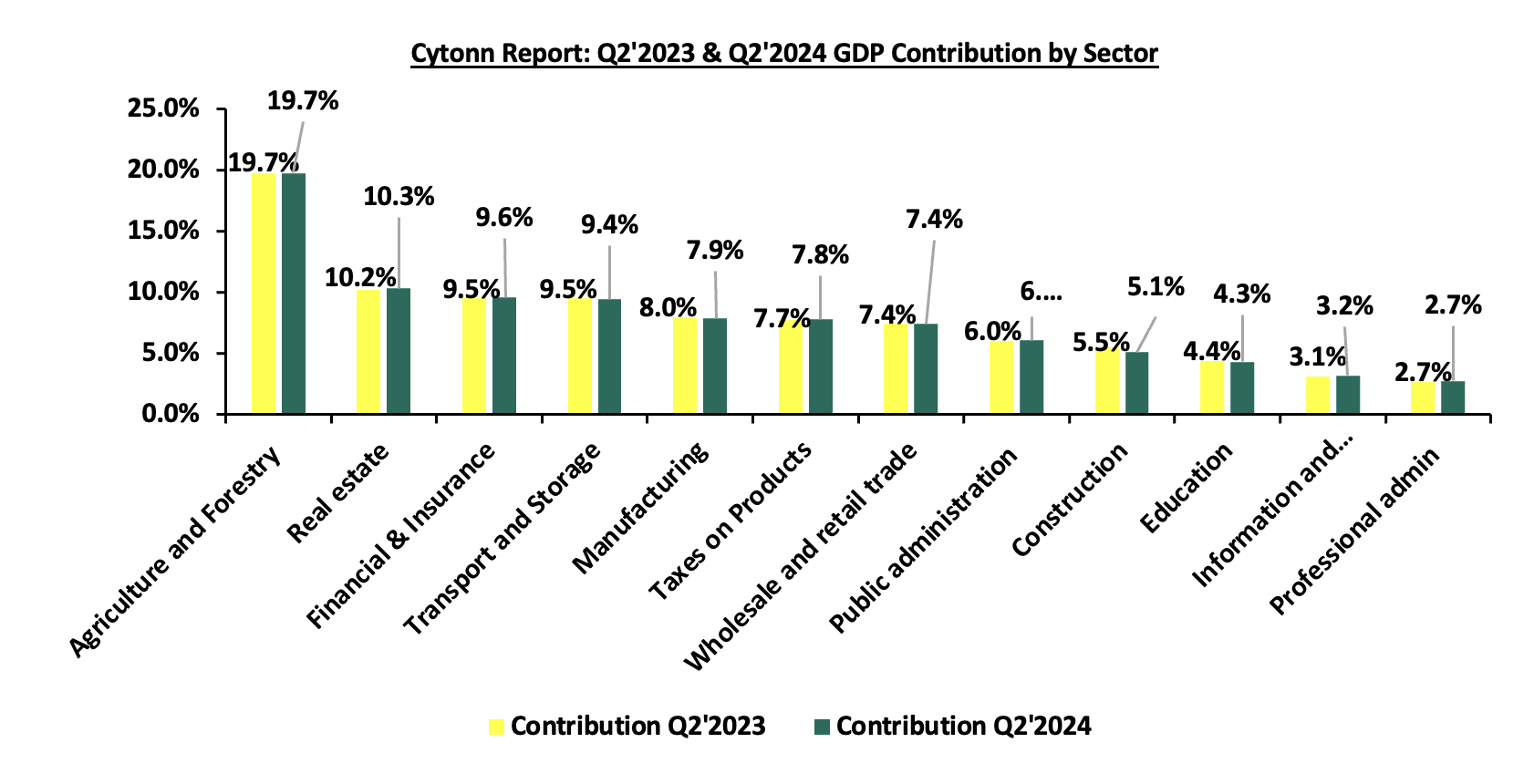

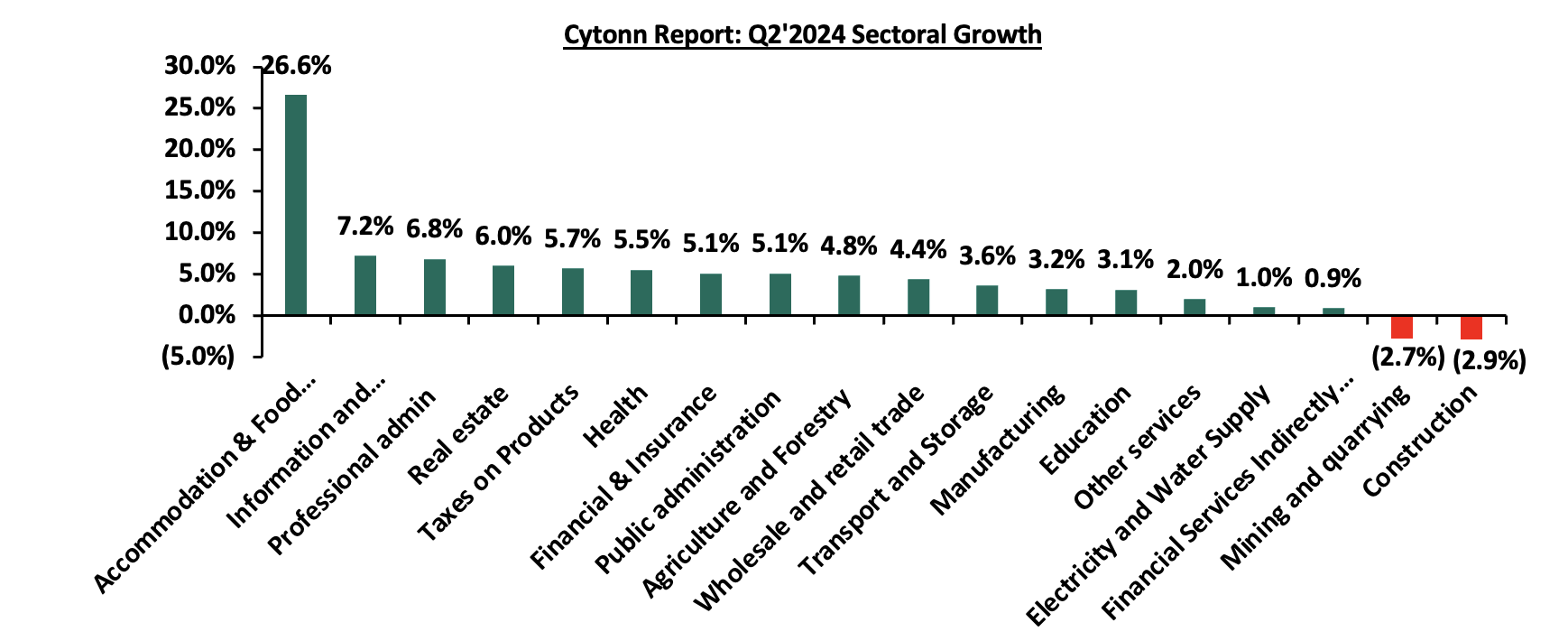

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was the Accommodation and Food Services sector, increasing by 0.3% points to 1.5% in Q2’2024 from 1.2% in Q2’2023, while the Construction sector was the biggest loser, declining by 0.4% points to 5.1% in Q2’2024, from 5.5% in Q2’2023. Real Estate was the second largest contributor to GDP at 10.3% in Q2’2024, up from 10.2% recorded in Q2’2023, indicating sustained growth. The Accommodation and Food Services sector recorded the highest growth rate in Q2’2024 growing by 26.6%, slower than the 42.8% growth recorded in Q2’2023.

- The chart below shows the top contributors to GDP by sector in Q2’2024:

Source: KNBS Q2’2023 and Q2’2024 GDP Report

- Slowed growth in the Agricultural Sector: Agriculture and Forestry recorded a growth of 4.8% in Q2’2024. The performance was a decrease of 3.0% points, from the expansion of 7.8% recorded in Q2’2023,

- Reduced growth in the Financial and Insurance Services Sector: The Financial and Insurance sector registered a growth decline of 8.1% points to 5.1% in Q2’2024 compared to 13.2% in Q2’2023, attributable to the rise in cost of credit during the period. However, the contribution to GDP increased marginally to 9.6%, from 9.5% in Q2’2023,

- Decelerated growth in the electricity supply sector - The Electricity and Water Supply sector recorded a slowed growth of 1.0% in Q2’2024 compared to a 2.8% growth in a similar period of review in 2023, with, the sectoral contribution to GDP marginally decreasing by 0.1% points in Q2’2024, to 2.2% from 2.3% recorded in Q2’2023. The slowed growth in the sector was due to a decline in total electricity generation, which decreased by 1.5% to 3,041.5 mn KWh from 3,088.6 mn Kwh. The sector’s growth was supported by an increase in hydroelectric power,

- Significant growth in the Accommodation and Food Service sector: Accommodation and Food Services sector is the only sector that recorded double-digit growth in Q2’2024, having expanded by 26.6%, albeit slower than the 42.8% recorded in Q2’2023. Additionally, the contribution to GDP increased by 0.3% points, to 1.5% in Q2’2024, compared to 1.2% recorded in Q2’2023.

The chart below shows the different sectoral GDP growth rates for Q2’2024

Source: KNBS Q2’2024 GDP Report

In the near term, we expect the economy to grow at a slower pace given the restrained business activity resulting from the challenging economic environment, driven by increasing taxes and elevated costs of living. However, recent economic developments, including the Central Bank of Kenya's (CBK) decision to lower the Central Bank Rate (CBR) in its August 2024 meeting by 25.0 bps to 12.75% and the anticipated further reduction in the October 2024 and subsequent meetings, will provide a more accommodative monetary policy stance. This shift, combined with the significant easing of inflation, currently at 3.6% as of September 2024, and a stronger Shilling is expected to alleviate some pressure on the cost of credit, thereby improving access to affordable borrowing. The lower CBR is likely to support investment spending by both individuals and businesses, contributing positively to economic activity. Inflation remains well within the CBK's target range of 2.5%-7.5%, and while risks of rising fuel prices persist due to global geopolitical tensions, the overall inflation outlook is more favorable. Despite this, consumer purchasing power remains somewhat constrained, which may limit demand for goods and services, moderating economic growth. On a positive note, the agricultural sector, Kenya's largest contributor to GDP, is expected to continue supporting growth due to favorable rainfall, while easing inflationary pressures and a strengthening Shilling provide further optimism for the economic outlook.

- Kenya Q2’2024 Balance of Payments Highlight

During the week, the Kenya National Bureau of Statistics released the Q2’2024 Balance of Payment Report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s balance of payments position deteriorated by 45.0% in Q2’2024, coming in at a surplus of Kshs 84.1 bn, from a surplus of Kshs 152.9 bn in Q2’2023, and a significant improvement from the Kshs 36.0 bn deficit recorded in Q1’2024.

Balance of Payments

Kenya’s balance of payment (BoP) position deteriorated by 45.0% in Q2’2024, with a surplus of Kshs 84.1 bn, from a surplus of Kshs 152.9 bn in Q2’2023, and a significant improvement from the Kshs 36.0 bn deficit recorded in Q1’2024. The y/y negative performance in BoP was mainly driven by a 40.0% decline in the financial account balance to a surplus of Kshs 198.3 bn in Q2’2024, from a surplus of Kshs 330.7 bn in Q2’2023. The performance was however supported by a 34.5% improvement in the current account balance to a deficit of Kshs 104.1 bn from a deficit of Kshs 159.0 bn in Q2’2023. The table below shows the breakdown of the various balance of payments components, comparing Q2’2023 and Q2’2024:

|

Cytonn Report: Kenya Balance of Payments |

|||

|

Item |

Q2’2023 |

Q2’2024 |

Y/Y % Change |

|

Current Account Balance |

(159.0) |

(104.1) |

34.5% |

|

Capital Account Balance |

4.9 |

8.0 |

64.4% |

|

Financial Account Balance |

330.7 |

198.3 |

(40.0%) |

|

Net Errors and Omissions |

(23.7) |

(18.1) |

23.5% |

|

Balance of Payments |

152.9 |

84.1 |

(45.0%) |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) narrowed by 34.5% to Kshs 104.1 bn from Kshs 159.0 bn in Q2’2023. The y/y narrowing of the current account was brought about by the 3.7% narrowing in Merchandise trade deficit to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn in Q2’2023 driven by the 10.9% growth in merchandise exports to Kshs 276.2 bn, from Kshs 249.1 bn in Q2’2023 which outpaced the 2.3% increase in merchandise imports to Kshs 617.5 bn from Kshs 603.4 bn recorded in a similar period in 2023,

- The capital account balance (shows capital transfers receivable and payable between residents and non-residents, including the acquisition and disposal of non-produced non-financial items), which includes foreign direct investments (FDIs), increased by 64.4% to a surplus of Kshs 8.0 bn in Q2’2024 up from a surplus of Kshs 4.9 bn in Q2’2023,

- The financial account balance (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by foreign buyers) recorded a surplus of Kshs 198.3 bn in Q2’2024, a decrease of 40.0% from the surplus of Kshs 330.7 bn recorded in Q2’2023. During the review period, the government did not receive credit and loans from the International Monetary Fund (IMF),

- Consequently, the Balance of Payments (BoP) position deteriorated to a surplus of Kshs 84.1 bn in Q2’2024, from a surplus of Kshs 152.9 bn recorded in Q2’2023.

Current Account Balance

Kenya’s current account deficit narrowed by 34.5% to Kshs 104.1 bn in Q2’2024 from the Kshs 159.0 bn deficit recorded in Q2’2023. The y/y contraction registered was driven by:

- The narrowing of the merchandise trade account deficit (the value of import goods exceeds the value of export goods, resulting in a negative net foreign investment) by 3.7% to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn recorded in Q2’2023,

- A 59.1% improvement in the secondary trade balance to a surplus of Kshs 43.6 bn from a surplus of Kshs 27.4 bn in Q2’2023, and,

- The narrowing of the primary income deficit (the earnings that residents of a country receive from their investments abroad and the compensation they receive for providing labor to foreign entities) by 34.6% to Kshs 45.6 bn in Q2’2024, from Kshs 69.8 bn recorded in Q2’2023.

The table below shows the breakdown of the various current account components on a year-on-year basis, comparing Q2’2024 and Q2’2023:

|

Cytonn Report: Current Account Balance |

|||

|

Item |

Q2’2023 |

Q2’2024 |

Y/Y % Change |

|

Merchandise Trade Balance |

(354.3) |

(341.2) |

3.7% |

|

Services Trade Balance |

27.4 |

43.6 |

59.1% |

|

Primary Income Balance |

(69.8) |

(45.6) |

34.6% |

|

Secondary Income (transfer) Balance |

237.7 |

239.2 |

0.6% |

|

Current Account Balance |

(159.0) |

(104.1) |

34.5% |

All values in Kshs bns

Kenya's balance of payments deteriorated in Q2’2024, mainly on the back of a 40.0% decline in the financial account to a surplus of Kshs 198.3 bn in Q2’2024, from a surplus of Kshs 330.7 bn in Q2’2023 reflecting significant outflows of financing from the country. This follows the depletion of reserve assets by Kshs 33.2 bn, and the government did not receive credit and loans from the International Monetary Fund (IMF) during the period under review. The current account deficit (value of goods and services imported exceeds the value of those exported) narrowed by 34.5% to Kshs 104.1 bn from Kshs 159.0 bn in Q2’2023. The y/y narrowing of the current account was brought about by the 3.7% narrowing in Merchandise trade deficit to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn in Q2’2023 driven by the 10.9% growth in merchandise exports to Kshs 276.2 bn, from Kshs 249.1 bn in Q2’2023 which outpaced the 2.3% increase in merchandise imports to Kshs 617.5 bn from Kshs 603.4 bn recorded in a similar period in 2023. Additionally, the secondary income balance saw a marginal increase, bolstered by strong growth in diaspora remittances. Looking ahead, the outlook for Kenya's current account is optimistic, as continued growth in key export sectors and sustained diaspora remittances are expected to further improve the current account balance. Efforts to diversify exports and enhance value addition in agricultural products, along with prudent fiscal and monetary policies, will be crucial in sustaining this positive trajectory. Furthermore, the ongoing strengthening of the Kenyan Shilling against most trading currencies is expected to lower the import bill hence narrowing the current account deficit. We expect that the current administration’s focus on fiscal consolidation will improve the balance of payments performance by minimizing the costs of servicing external debts. Additionally, the favorable weather conditions and government intervention through subsidy programs are set to boost agricultural production in the country, thereby increasing the export of agricultural products, and supporting the current account. We anticipate that the balance of payments will continue being stable with the help of multiple trade agreements, such as the one between Kenya and the EU and the one among the EAC, SADC, and COMESA, as the agreements will boost the amount and variety of exports that are needed and offer more opportunities to sell them.

- Stanbic Bank’s September 2024 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of September 2024 declined, coming in at 49.7, down from 50.6 in August 2024, signaling a deterioration in business conditions. This is attributable to the slowdown in business activity and reduced intake of new business intakes, owing to challenging economic conditions.

The businesses surveyed saw a small decline in their activity by the end of the quarter, which matched a drop in new orders. This business activity reduction was attributed to reduced cashflows for the various firms which led to them taking less work. The pace of contraction was, however, marginal, with most respondents continuing to see improved sales and higher customer turnout.

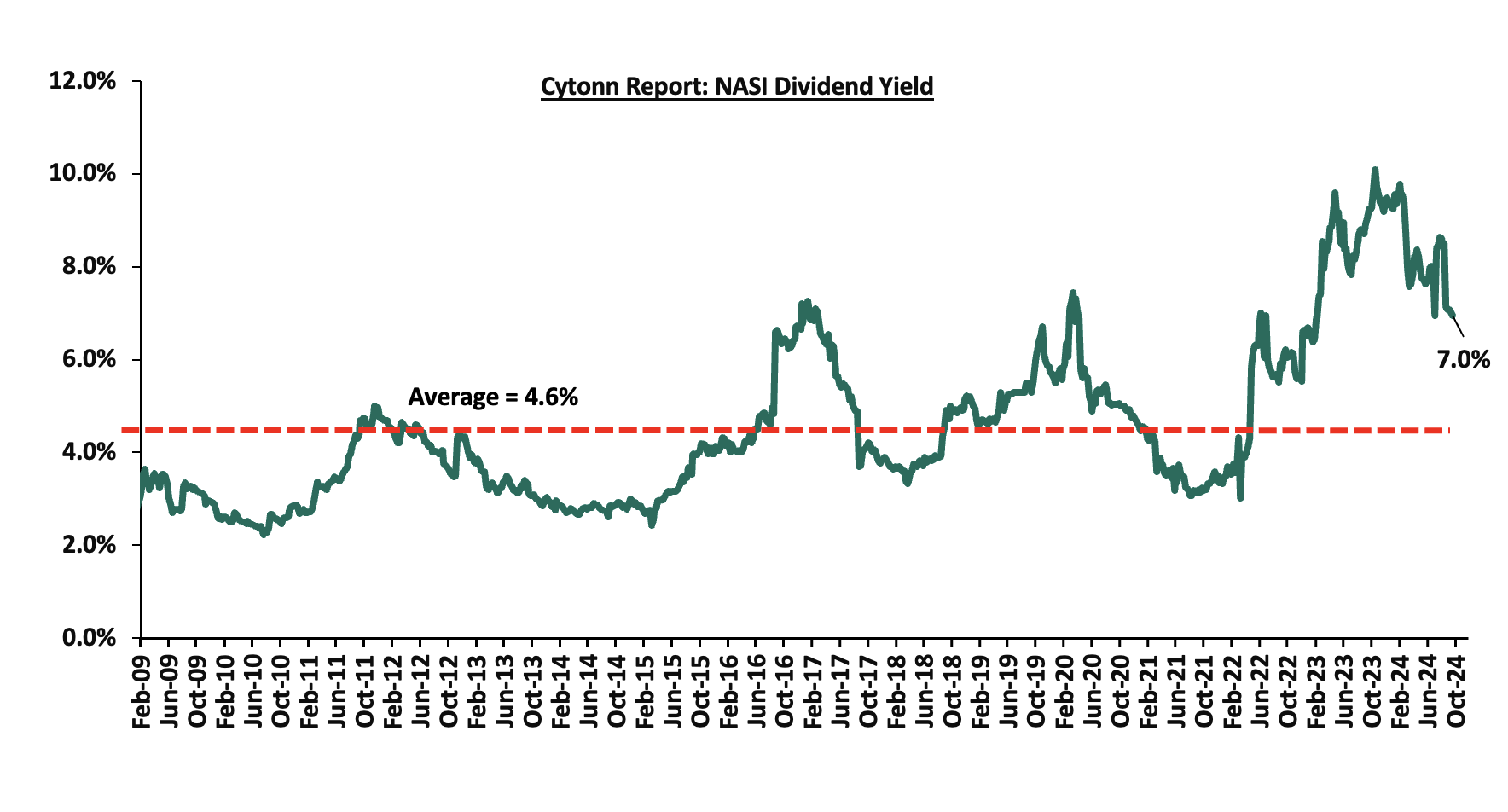

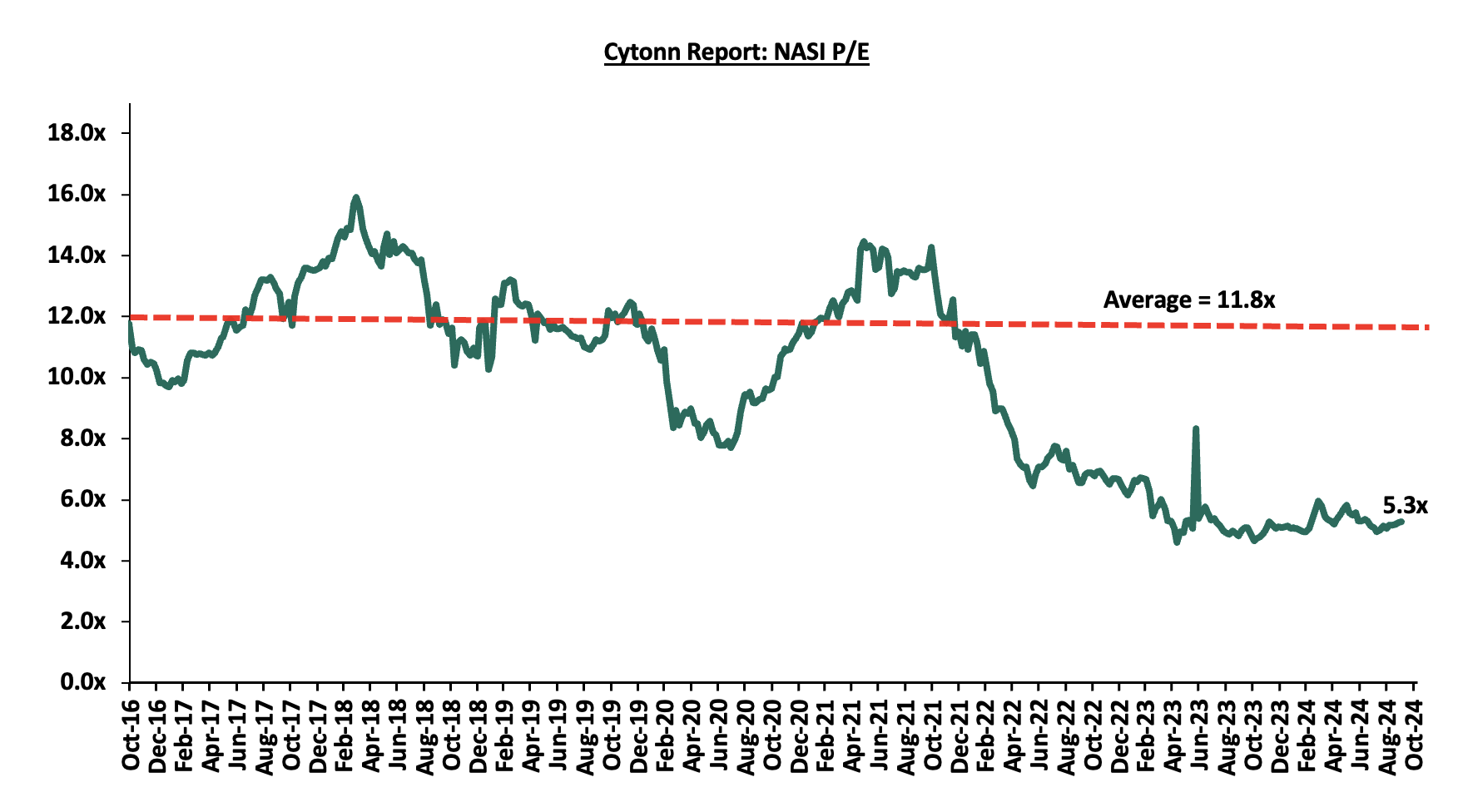

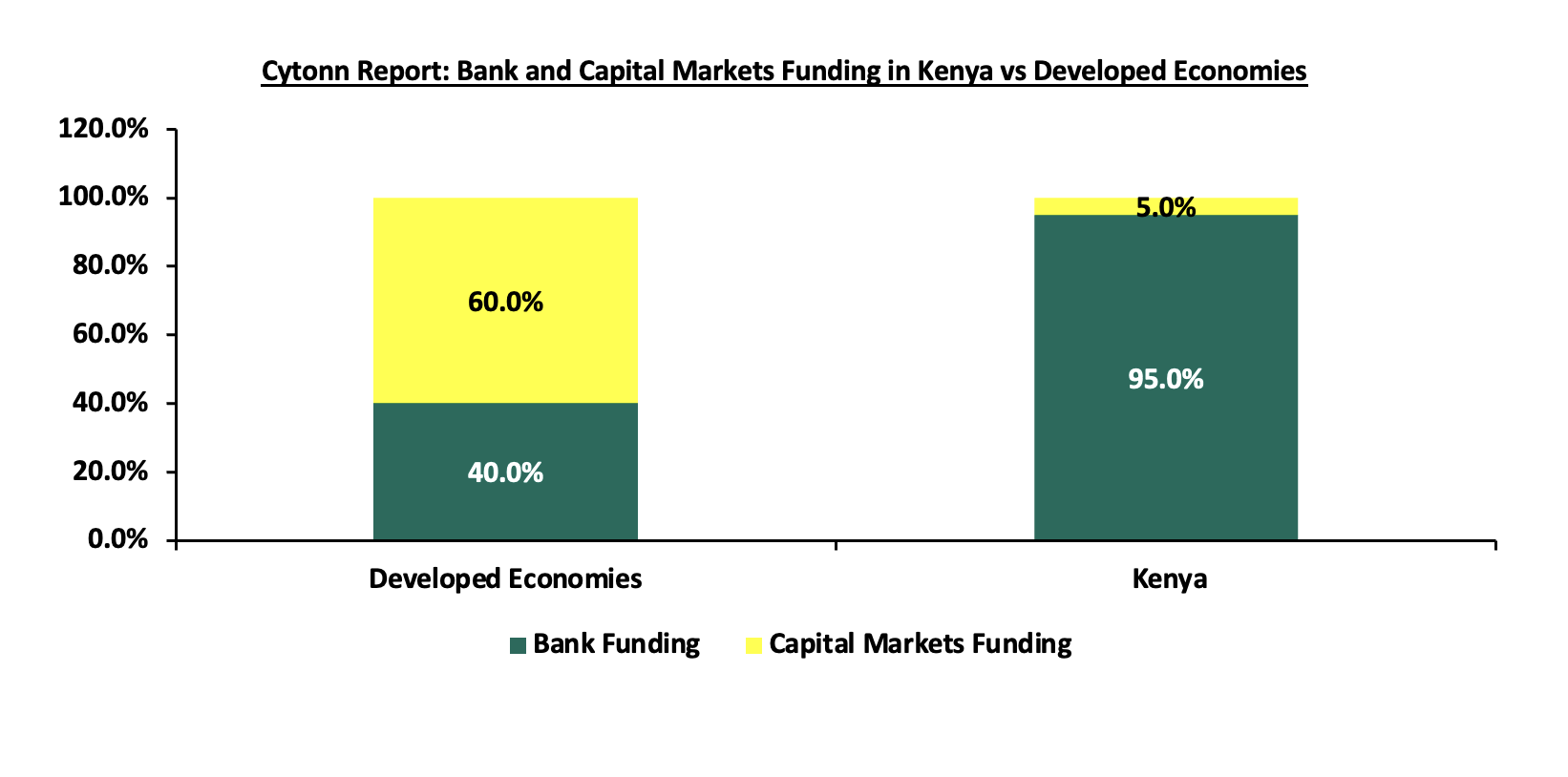

The service sector also recorded reduced activity, majorly on the back of contraction in activity in agriculture, wholesale, and retail segments. Manufacturing and construction firms, however, registered higher sales. Input prices rose, albeit at a modest pace, supported by a slight reduction in average lead times. The modest rise in input prices was mainly attributable to the stable but elevated fuel prices, with the prices for the maximum allowed price for Super Petrol and Diesel remaining unchanged from the prices announced for August 2024, while the maximum price allowed for Kerosene decreased by Kshs 3.4 per litre. Consequently, Super Petrol and Diesel retailed at Kshs 188.8 and Kshs 171.6 per litre respectively, while Kerosene retailed at Kshs 158.3 per litre in September. However, overall inflationary pressures were relatively mild compared to historical trends. Notably, the y/y inflation in September 2024 declined by 0.8% points to 3.6%, from the 4.4% recorded in August 2024. This led to the weakest uptick in total business expenses in the current four-month inflation sequence.