Cytonn Markets Review – Q1’2024

By Cytonn Research, Mar 31, 2024

Executive Summary

Global Markets Review

According to the January 2024 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 3.1% in 2024, unchanged from the growth of 3.1% recorded in 2023. The latest projection is 1.2% points higher than the IMF’s earlier projection of 2.9% growth, with the upward revision being on account of greater-than-expected resilience in the United States and several large emerging market and developing economies, as well as fiscal support in China. Global headline inflation is expected to fall to an estimated 5.8% in 2024 from 6.8% recorded in 2023 as the Central Banks around the world continue to maintain tightened monetary policies;

Sub-Saharan Africa Region Review

According to the International Monetary Fund (IMF), the Sub-Saharan economy is projected to grow at a moderate rate of 3.8% in 2024, 0.5% points higher than the estimated economic growth of 3.3% in 2023. Notably, the projection is an upward revision from the initial IMF Regional outlook projection of 3.3%. The upward revision of regional growth by the IMF is mainly a result of the expected easing of inflationary pressures in line with the ongoing reduction of global inflation as the central banks around the world continue to tighten the monetary policies aimed at bringing down the inflation rate to the target ranges. However, the growth is expected to be significantly weighed down by sustained supply constraints worsened by the geopolitical tensions arising from the Middle East conflicts as well as the Russia-Ukraine invasion given that most countries in Sub-Saharan Africa are net importers, adverse weather conditions that have undermined agricultural productivity, and elevated risk of debt distress in the region;

Kenya Macro Economic Review

The Kenyan economy recorded an average growth of 5.5% in the period between January to September 2023, with Q3’2023 GDP coming in at 5.9%, adding to the 5.4% and 5.3% growth recorded in Q2’2023 and Q1’2023 respectively. The average GDP growth of 5.5% marked an improvement from the 5.2% average growth recorded in a similar period in 2022. Notably, the average inflation rate eased to 6.3% in Q1’2024, compared to 9.1% in Q1’2023, attributable to a decrease in the price of food and beverages following the favorable weather conditions that have boosted agricultural production, resulting in increased food supplies. As a result, Kenya’s general business environment improved in Q1’2024, with the average Purchasing Manager’s Index for the quarter coming at 50.6, compared to 49.3 recorded in a similar period in 2022;

Fixed Income

During the quarter, T-bills were oversubscribed, with the overall subscription rate coming in at 132.6%, up from 130.0% in Q4’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 276.9 bn against the offered Kshs 56.0 bn, translating to an oversubscription rate of 494.4%, lower than the oversubscription rate of 602.7% recorded in the previous quarter. Overall subscriptions for the 182-day and 364-day papers increased to 56.3% and 64.3% from 45.7% and 22.0% in Q4’2023, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day, and 91-day papers increasing by 119.4 bps, 118.3 bps, and 114.0 bps to 16.7%, 16.6%, and 16.4%, from 15.5%, 15.4% and 15.3%, respectively, recorded in Q4’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation and tight liquidity positions, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 88.8%, albeit lower than the 91.9 recorded in Q4’2023, with the government accepting a total of Kshs 395.6 bn out of the Kshs 445.7 bn worth of bids received;

During the week, T-bills were undersubscribed, with the overall undersubscription rate coming in at 66.0%, a reversal from the oversubscription rate of 102.8% recorded the previous week, Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 5.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 134.5%, lower than the oversubscription rate of 291.2% recorded the previous week. The subscription rates for the 182-day paper and 364-day paper decreased to 27.0% and 77.5% respectively, from 40.9% and 89.4% respectively recorded the previous week. The government accepted a total of Kshs 13.5 bn worth of bids out of Kshs 15.8 bn of bids received, translating to an acceptance rate of 85.3%. The yields on the government papers recorded mixed performances, with the yield of the 364-day paper increasing marginally by 0.1 bps to remain relatively unchanged at 17.0%, while the 182-day and 91-day papers decreased marginally by 2.6 bps and 0.2 bps to 16.9%, and 16.7%, respectively;

During the week, the Kenya National Bureau of Statistics released data for the y/y inflation rates for the month of March. Inflation in the month eased by 0.6% points to 5.7%, from the 6.3% recorded in February 2024. This was according to our expectations and projection that it would come within a range of 5.7% to 6.1%;

During the week, Zambia’s Ministry of Finance and National Planning announced that the country had reached an agreement on debt restructuring terms with the steering committee on debt restructuring. Zambia had defaulted on its USD 3.5 bn Eurobond back in November 2020 and has been working on getting their debt restructured under the G20’s Common Framework;

Equities

During Q1’2024, the equities market was on an upward trajectory, with NSE 10 gaining the most by 27.3%, while NSE 25, NASI, and NSE 20 gained by 25.0%, 22.8%, and 16.7% respectively. The equities market performance was driven by gains recorded by large cap stocks such as Equity Group, KCB, and Cooperative Bank which gained by 40.1%, 37.2%, and 31.6%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as EABL and Cooperative Bank, which declined by 5.5% and 3.3%, respectively;

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 5.1%, while NASI, NSE 25, and NSE 20 gained by 5.0%, 4.7%, and 3.9% respectively, taking the YTD performance to gains of 26.8%, 24.6%, 23.0% and 16.1% for NSE 10, NSE 25, NASI and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as KCB Group, DTB-K, and Safaricom, of 17.6%, 7.8%, and 6.0% respectively;

During the week, five of the listed banks released their FY’2023 results. I&M Group released its FY’2023 financial results, with its Core Earnings per Share (EPS) increasing by 15.2% to Kshs 8.1, from Kshs 7.0 in FY’2022. NCBA Group Kenya released its FY’2023 financial results, with its Core Earnings per Share (EPS) increasing by 55.7% to Kshs 13.0, from Kshs 8.4 in FY’2022. Diamond Trust Bank Kenya released its FY’2023 financial results, with its Core Earnings per Share (EPS) increasing by 14.7% to Kshs 27.9, from Kshs 24.3 in FY’2022. Equity Group Holdings released its FY’2023 financial results, with its Core Earnings per Share (EPS) decreasing by 5.1% to Kshs 11.6, from Kshs 12.2 in FY’2022, and HF Group released its FY’2023 financial results, with its Core Earnings per Share (EPS) increasing by 46.2% to Kshs 1.0, from Kshs 0.7 in FY’2022;

Also, during the week, Britam Holdings released their FY’2023 results. This was the second time the company was releasing their results under the new IFRS 17 reporting system. Britam’s Profit After Tax (PAT) increased by 97.5% to Kshs 3.3 bn, from Kshs 1.7 bn recorded in FY’2022;

Real Estate

In Q1’2024, Kenya’s Real Estate sector recorded notable growth in terms of activity compared to a similar period in 2023, attributable to continued investments flowing into the sector. In the Nairobi Metropolitan Area (NMA), the residential sector recorded a slight downturn in performance, with the average total returns coming in at 6.0%, a 0.1%-point decline from 6.1% recorded in Q1’2023. The commercial office sector recorded average rental yields of 7.6% in Q1’2024 remaining relatively unchanged from Q1’2023. The retail sector recorded average rental yields of 8.1% in Q1’2024, representing a 0.1% points y/y increase from 8.0% recorded in Q1’2023. The land sector recorded an average annualized capital appreciation of 4.3% in Q1’2024, with un-serviced land prices in satellite towns realizing the highest capital appreciation at 8.2% y/y;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 17.06% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the January 2024 World Economic Outlook Report by the International Monetary Fund (IMF), the global economy is projected to grow at a rate of 3.1% in 2024, unchanged from the growth of 3.1% recorded in 2023. The latest projection is 1.2% points higher than the IMF’s earlier projection of 2.9% growth, with the upward revision being on account of greater-than-expected resilience in the United States and several large emerging market and developing economies, as well as fiscal support in China. Global headline inflation is expected to fall to an estimated 5.8% in 2024 from 6.8% recorded in 2023 as the Central Banks around the world continue to maintain tightened monetary policies. Notably, advanced economies are expected to record a 1.5% growth in 2024, which is a slight decline from the 1.6% expansion recorded in 2023. However, the emerging markets and developing economies are projected to expand by 4.1% in 2024, marginally upwards from an estimated growth of 4.0% in 2023;

The expected sustained global economic growth in 2024 is majorly attributable to;

- Easing global inflation - Global headline inflation is expected to fall to an estimated 5.8% in 2024 from 6.8% recorded in 2023 as the Central Banks around the world continue to maintain tightened monetary policies. At the same time, the high-interest rates aimed at fighting inflation and a withdrawal of fiscal support in most economies are expected to weigh on growth in 2024, and,

- Slower-than-expected withdrawal of fiscal support - Governments in major economies might withdraw fiscal policy support more slowly than expected for 2024/25 by the IMF, implying higher-than-projected global growth in the near term. However, such delays could in some cases exacerbate inflation and, with elevated public debt, result in higher borrowing costs and a more disruptive policy adjustment, with a negative impact on global growth later on.

However, the global growth is expected to be weighed down by;

- Persistent supply chain constraints worsened by the ongoing Gaza and Israel conflict which could escalate further into the wider region which produces about 35.0% of the world’s oil exports and 14.0% of its gas exports. Consequently, the ongoing war in Ukraine risks generating fresh adverse supply shocks to the global recovery, with spikes in food, energy, and transportation costs,

- Tight global financial conditions occasioned by the high cost of borrowing which have increased risks of debt distress in emerging economies as most advanced economies continue to tighten their monetary policies, and,

- A slower-than-expected decline in core inflation in major economies due to persistent labour market tightness and renewed tensions in supply chains which could trigger a rise in interest rate expectation. Such developments could increase financial stability risks, tighten global financial conditions, trigger flight-to-safety capital flows, and strengthen the US dollar against other currencies.

The global economy is expected to remain subdued in the short term and gradually recover in the medium term mainly as a result of easing inflationary pressures as the impact of tightened monetary policies continues to transmit in most economies.

Global Commodities Market Performance

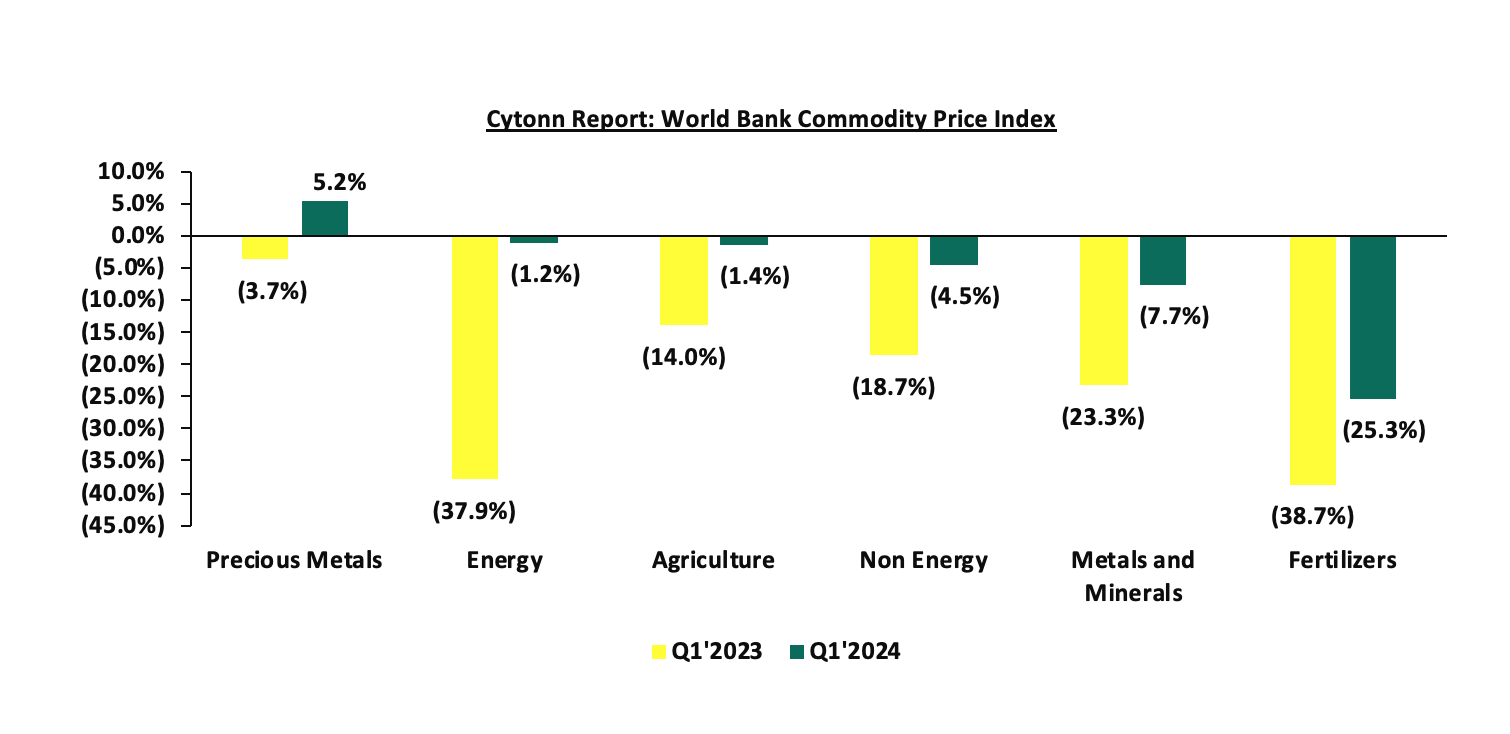

Global commodity prices recorded a mixed performance in Q1’2024, with prices of fertilizers declining the most, by 25.3% compared to the 38.7% decrease recorded in Q1’2023, mainly as a result of weaker global demand. Similarly, prices of metals and minerals, non-energy, agriculture, and energy declined by 7.7%, 4.5%, 1.4%, and 1.2%, respectively, on the back of reduced global demand coupled with easing supply chain constraints. Notably, Oil prices have been under downward pressure declining by 1.2% in Q1’2024, amid a weak global economic activity coupled with slowed global demand on the back of the easing supply chain constraints which had been worsened by the Russia-Ukraine conflict. Oil prices are expected to decline further in 2024 but remain above the pre-pandemic levels on the back of supply disruption concerns in the aftermath of the Middle East conflict and Slower-than-expected growth.

Global Equities Market Performance:

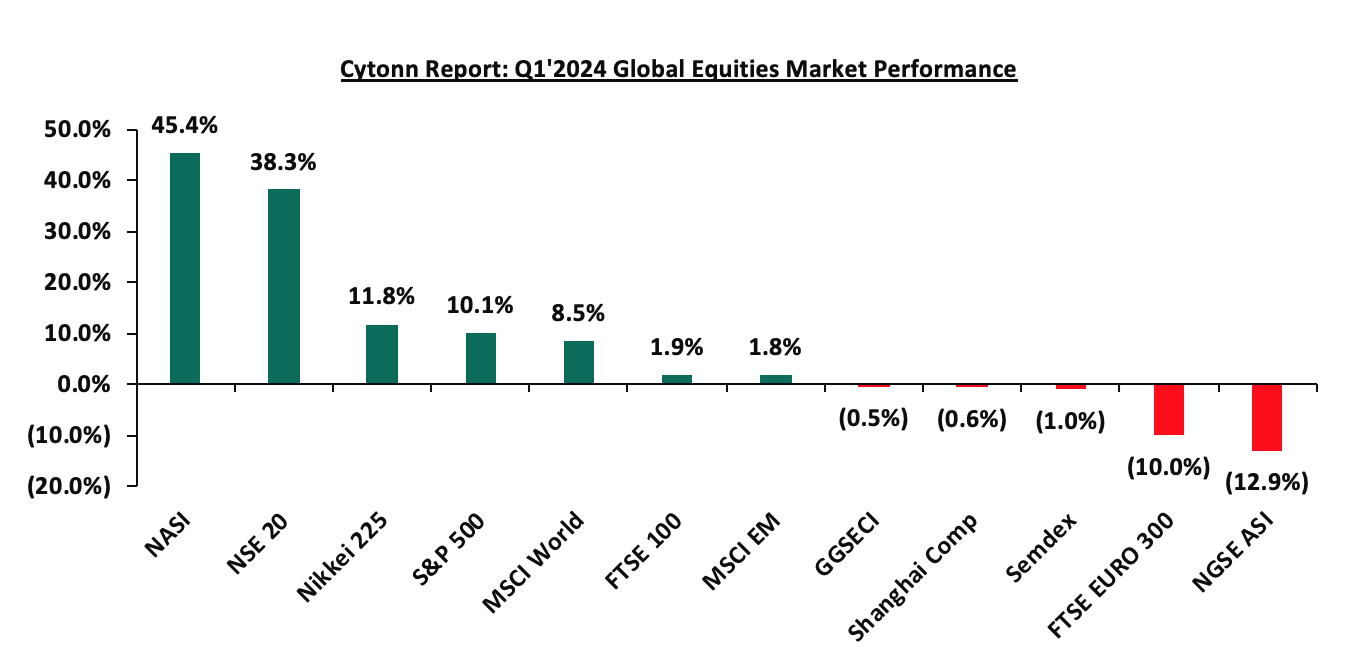

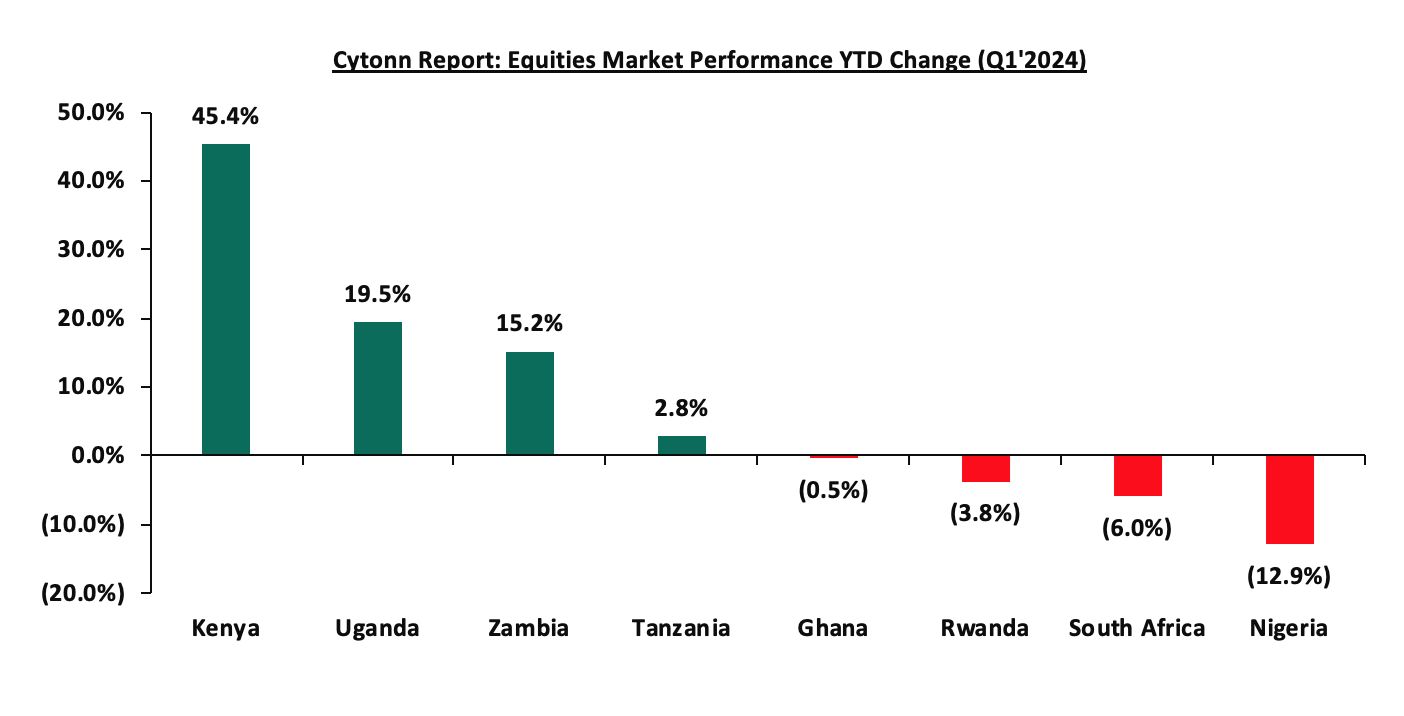

The global stock market recorded mixed performance in Q1’2024, with most indices gaining attributable to the eased capital flights which had persisted in 2023 following interest rate hikes in advanced economies aimed at curbing the inflationary pressures. Notably, in dollarized form, NASI was the largest gainer, gaining by 45.4% in Q1’2024 largely driven by gains in the large-cap stocks in the financial sector following improved earnings during the period as well as the improved business conditions in the country as evidenced by the Purchasing Managers Index (PMI) which came in at 51.3 in February 2024. Additionally, the Kenyan economy has been supported by the eased inflationary pressures and the strengthening of the Kenyan shilling having gained by 18.0% against the dollar on a YTD basis. Consequently, most indices in the developed countries recorded gains during the quarter largely attributable to increased investor sentiments as a result of continued economic recovery following the eased inflationary pressures coupled with investor preference for the stock markets in the developed countries. Notably, Nikkei 225 recorded the largest gain in developed economies at 11.8% in Q1’2024 driven by gains recorded by blue-chip financial companies as well as companies in the technological sector. On the contrary, most of the stocks in the developing economies were on a downward trajectory with the Nigerian stock exchange declining the most by 12.9% as investors have continued to attach a higher risk premium to the country mainly attributable to the high inflation at 31.7% as of February 2024 and continued weakening of the Nigerian currency which has depreciated by 19.0% on year-to-date basis in 2024. Below is a summary of the performance of key indices

The index values are dollarized for ease of comparison

According to the International Monetary Fund (IMF), the Sub-Saharan region’s economy is projected to grow at a moderate rate of 3.8% in 2024, 0.5% points higher than the estimated economic growth of 3.3% in 2023. Notably, the projection is an upward revision from the initial IMF Regional outlook projection of 3.3%. The upward revision of regional growth by the IMF is mainly a result of the expected easing of inflationary pressures in line with the ongoing reduction of global inflation as the central banks around the world continue to tighten the monetary policies aimed at bringing down the inflation rate to the target ranges. However, the growth is expected to be significantly weighed down by sustained supply constraints worsened by the geopolitical tensions arising from the Middle East conflicts as well as the Russia-Ukraine invasion given that most countries in Sub-Saharan Africa are net importers, adverse weather conditions that have undermined agricultural productivity, and elevated risk of debt distress in the region.

Currency Performance

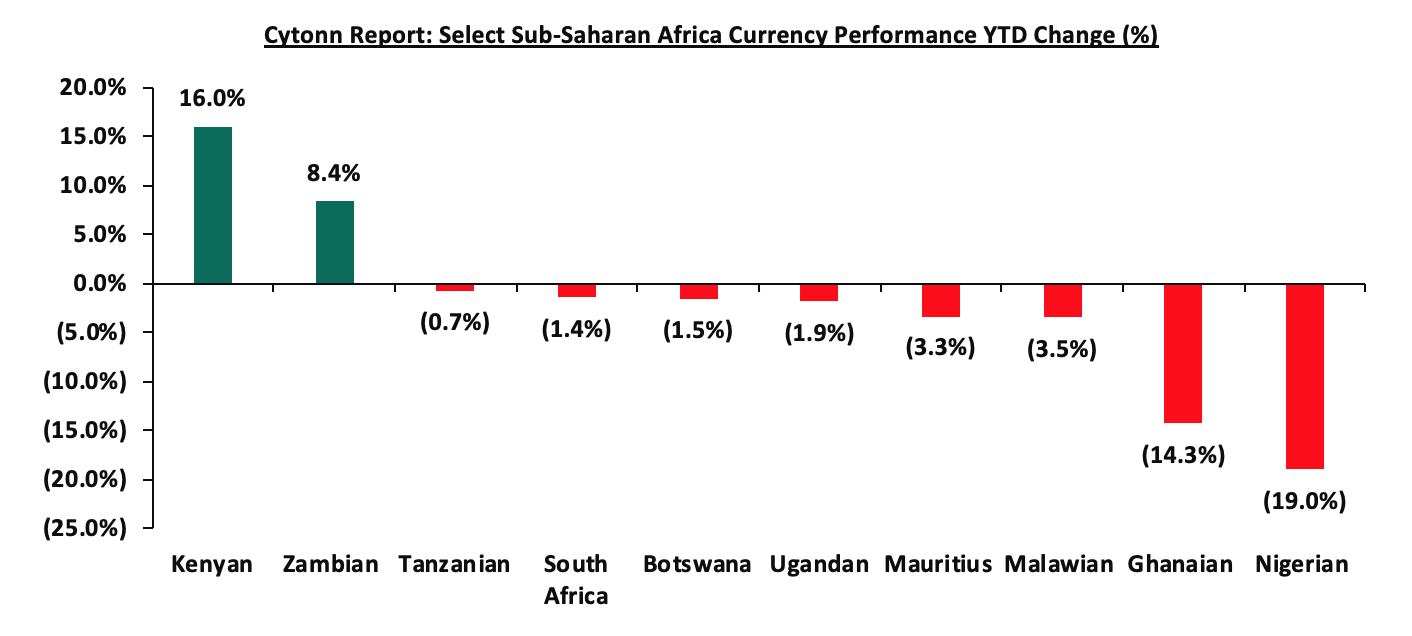

In Q1’2024, most of the select Sub-Saharan currencies depreciated against the US Dollar, similar to the trend witnessed in FY’2023. The depreciation trend is attributable to the elevated inflationary pressures in the region, high debt servicing costs that continue to dwindle foreign exchange reserves, and the tightened monetary policies by advanced economies such as the United States Federal Reserve and the European Central Bank. The high interest rates in developed countries have led to massive capital outflows as investors both institutional and individual seek to take advantage of the higher returns offered in developed economies. Further, the elevated inflationary pressures in most economies in the region put pressure on the value of local currencies due to expensive importation. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Mar-23 |

Jan-24 |

Mar-24 |

Last 12 Months change (%) |

YTD change (%) |

|

Kenyan Shilling |

132.4 |

157.0 |

131.8 |

0.5% |

16.0% |

|

Zambian Kwacha |

21.2 |

27.1 |

24.8 |

(17.2%) |

8.4% |

|

Tanzanian Shilling |

2335.0 |

2540.0 |

2557.5 |

(9.5%) |

(0.7%) |

|

South African Rand |

17.8 |

18.7 |

18.9 |

(6.5%) |

(1.4%) |

|

Botswana Pula |

13.0 |

13.5 |

13.7 |

(5.6%) |

(1.5%) |

|

Ugandan Shilling |

3770.0 |

3815.0 |

3885.9 |

(3.1%) |

(1.9%) |

|

Mauritius Rupee |

45.4 |

44.8 |

46.3 |

(2.1%) |

(3.3%) |

|

Malawian kwacha |

1022.5 |

1683.4 |

1742.0 |

(70.4%) |

(3.5%) |

|

Ghanaian Cedi |

12.3 |

11.6 |

13.2 |

(7.3%) |

(14.3%) |

|

Nigerian Naira |

459.8 |

1191.9 |

1418.6 |

(208.5%) |

(19.0%) |

Source: Yahoo Finance

Key take outs from the table include:

- The Kenyan shilling was the largest gainer against the dollar on year-to-date basis gaining by 16.0% to close at Kshs 131.8 as at the end of March from the Kshs 157.0 recorded at the beginning of the year. The shilling was supported by the increased dollar inflows into the country following the IMF funding as well as increased activity in the international bond markets which boosted the country’s foreign reserves. Notably, the Kenyan economy has continued to improve during the period under review with the Purchasing Managers Index (PMI) having crossed the 50.0 points threshold to 51.3 as of February 2024, and,

- Nigeria Naira was the worst-performing currency in Q1’2024 and the largest decliner over the last twelve months, depreciating by 19.0% and 208.5%, respectively, mainly as a result of the recent decision by the Central Bank of Nigeria to adopt a floating exchange rate regime, where the currency value of the Naira is allowed to vary according to the foreign exchange market coupled with the impacts of the heightened inflationary pressures in the country with current inflation rate coming at a high of 31.7% as of February 2024.

The chart below shows the year-to-date performance of different Sub-Saharan African countries in Q1’2024

African Eurobonds

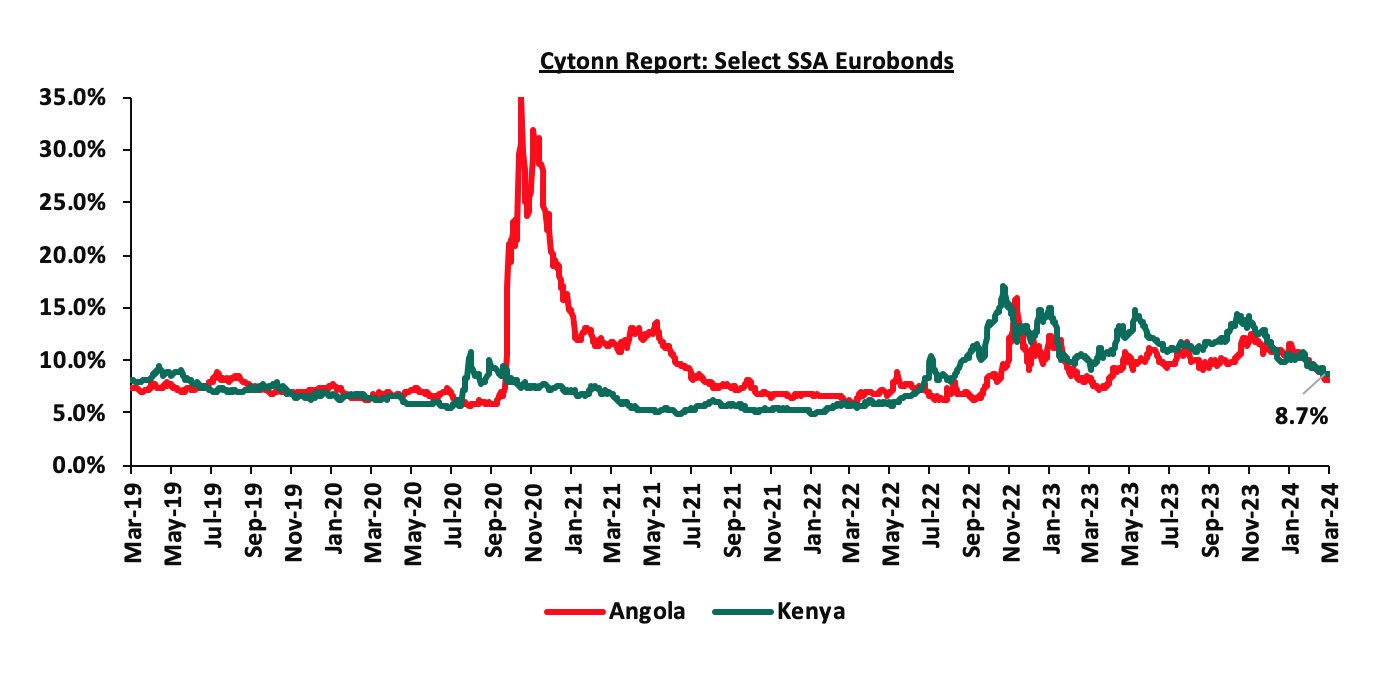

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the first quarter of 2024 being Ivory Coast, Benin, and Kenya raising a total of USD 2.6 bn, USD 0.8 bn, and USD 1.4 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield-hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from different countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The yields of Angola’s 10-year Eurobond maturing in 2025 declined by 2.1% points to 8.2% from 10.3% recorded in December 2023. Similarly, the Yields of Kenya’s 10-year Eurobond maturing in 2028 declined by 1.8% points to 8.7% from 10.5% in December 2023, partly attributable to improved investor confidence following the successful buy-back of the 2024 Eurobond maturity, increased IMF Credit funding and the strengthening of the Kenyan shilling against the dollar having gained by 16.0% in Q1’2024. Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries;

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in Q1’2024, with Kenya’s stock market (NASI) being the best-performing market gaining by 45.4% YTD driven by gains in the large-cap stocks in the financial sector following improved earnings during the period as well as the improved business conditions in the country as evidenced by the Purchasing Managers Index (PMI) which came in at 51.3 in February 2024. On the other hand, the Nigerian stock market was the worst performing in the period under review mainly attributable to increased capital flight with investors chasing higher returns from advanced economies following the hiking of interest rates as well as deterioration in investor confidence in the country on the back of macroeconomic uncertainties occasioned by the high inflation at 31.7% as of February 2024 and continued weakening of the Nigerian Naira which has depreciated by 19.0% on year to date basis in 2024. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance Q1’2024 (Dollarized*) |

||||||

|

Country |

Index |

Mar-23 |

Jan-24 |

Mar-24 |

Last 12 Months change (%) |

YTD change (%) |

|

Kenya |

NASI |

0.9 |

0.6 |

0.9 |

0.7% |

45.4% |

|

Uganda |

USEASI |

0.3 |

0.2 |

0.3 |

(9.3%) |

19.5% |

|

Zambia |

LASILZ |

386.9 |

455.5 |

524.8 |

35.7% |

15.2% |

|

Tanzania |

DARSDEI |

0.7 |

0.7 |

0.7 |

(5.0%) |

2.8% |

|

Ghana |

GSECI |

235.7 |

263.0 |

261.8 |

11.1% |

(0.5%) |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(13.7%) |

(3.8%) |

|

South Africa |

JALSH |

4,289.8 |

4,137.9 |

3,891.5 |

(9.3%) |

(6.0%) |

|

Nigeria |

NGEASI |

118.2 |

84.9 |

73.9 |

(37.5%) |

(12.9%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD Performance of the sub-Saharan Equities Market;

GDP growth in the Sub-Saharan African region is expected to record moderate growth, in line with the rest of the global economy. Additionally, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of the continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital

Economic Growth

The Kenyan economy recorded an average growth of 5.5% in the period between January to September 2023, with Q3’2023 GDP coming in at 5.9%, adding to the 5.4% and 5.3% growth recorded in Q2’2023 and Q1’2023 respectively. The average GDP growth of 5.5% marked an improvement from the 5.2% average growth recorded in a similar period in 2022. The performance in Q3’2023 was mainly driven by the 6.7% growth in the agricultural sector due to the favourable weather conditions, which led to more agricultural output as evidenced by the 28.0% increase in tea output to 138.8 thousand metric tonnes coupled with the 84.3% growth in fruit exports to 59.6 thousand metric tonnes in the quarter under review. All sectors in Q3’2023 recorded positive growths, with varying magnitudes across activities. Most sectors recorded improved growth compared to Q3’2022 with Accommodation and Food Services, Agriculture, Forestry and Fishing, and Mining and Quarrying Sectors recording the highest growth improvements of 9.1% points, 8.0% points, and 5.6% points, respectively. Other sectors that recorded expansion in growth rate, from what was recorded in Q3’2022 were Financial and Insurance Services, Information and Communication, and Real Estate sectors, of 5.1%, 2.7%, and 2.2% points respectively.

In 2024, the Kenyan economy is projected to grow at an average of 5.3%, supported by resilient services and agricultural sectors. The table below shows the projections of Kenya’s 2024 GDP by various organizations:

|

Cytonn Report: Kenya 2024 growth Projections |

||

|

No. |

Organization |

2023 GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

5.5% |

|

3 |

World Bank |

5.2% |

|

4 |

Fitch Solutions |

5.2% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.3% |

|

Source: Cytonn Research

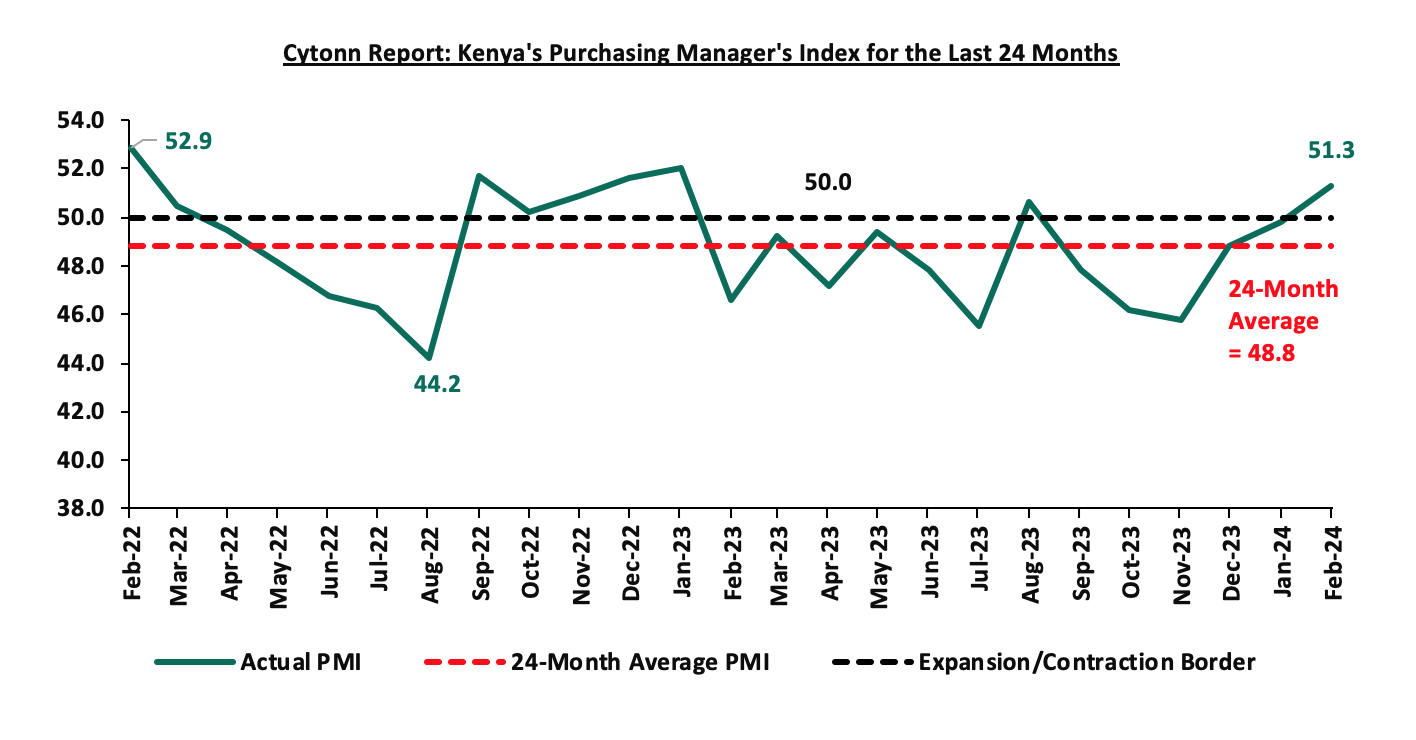

Key to note, Kenya’s general business environment improved in Q1’2024, with the average Purchasing Manager’s Index for the quarter coming at 50.6, compared to 49.3 recorded in a similar period in 2023. The improvement was mainly on the back of eased inflationary pressures experienced in the country, with the inflation rate averaging 6.6% in Q1’2024, significantly lower than the 9.1% recorded over a similar period in 2023. After five months of PMI remaining the contractionary zone, the private sector showed signs of recovery in February, with the PMI coming in at 51.3, up from 49.8 recorded in January evidenced by the increase in output and new orders as well as businesses hiring more workers and purchasing more goods. However, the economy continues to be under inflationary pressures with the fuel prices still remaining high relative to global fuel prices, despite the ongoing appreciation of the Kenyan shilling, having gained by 15.8% against the US Dollar, to close the quarter at Kshs 131.8 from Kshs 156.5 recorded at the end of 2023. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signal an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Inflation:

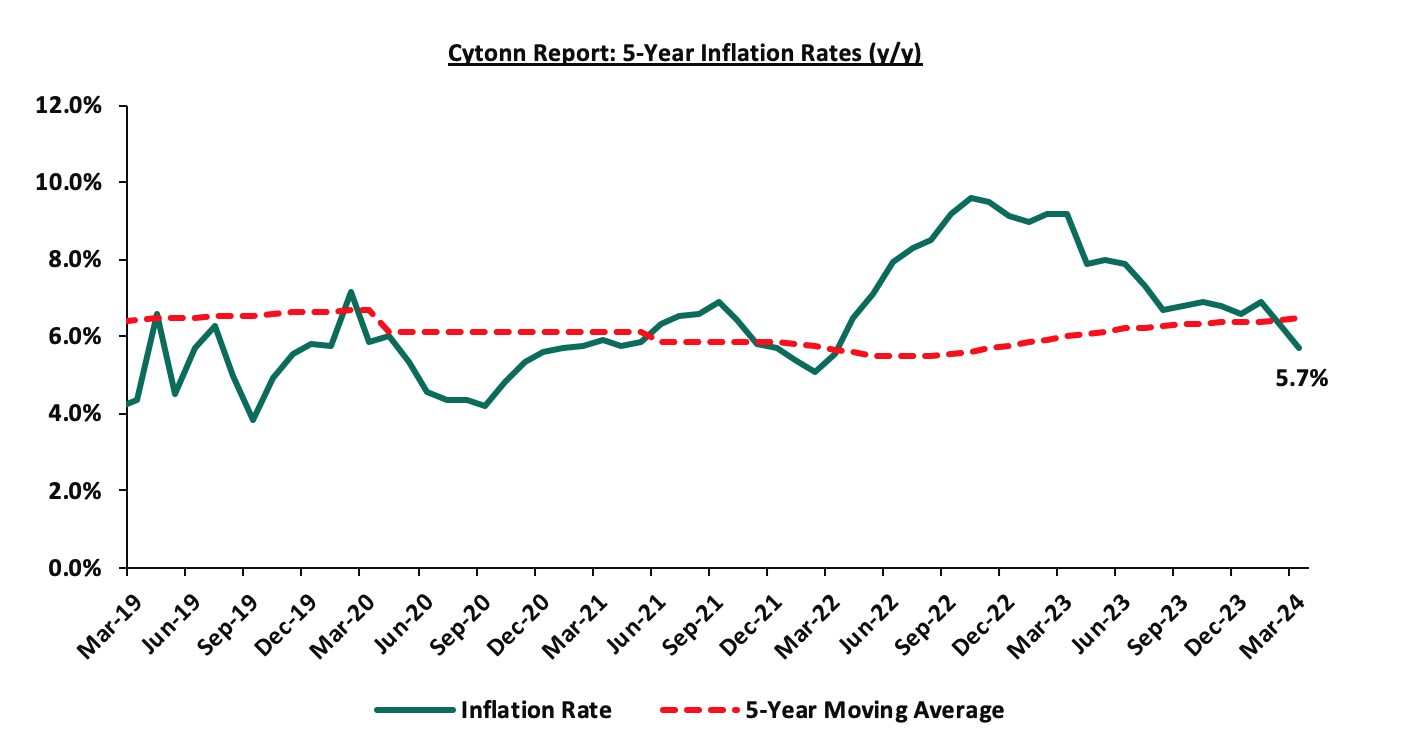

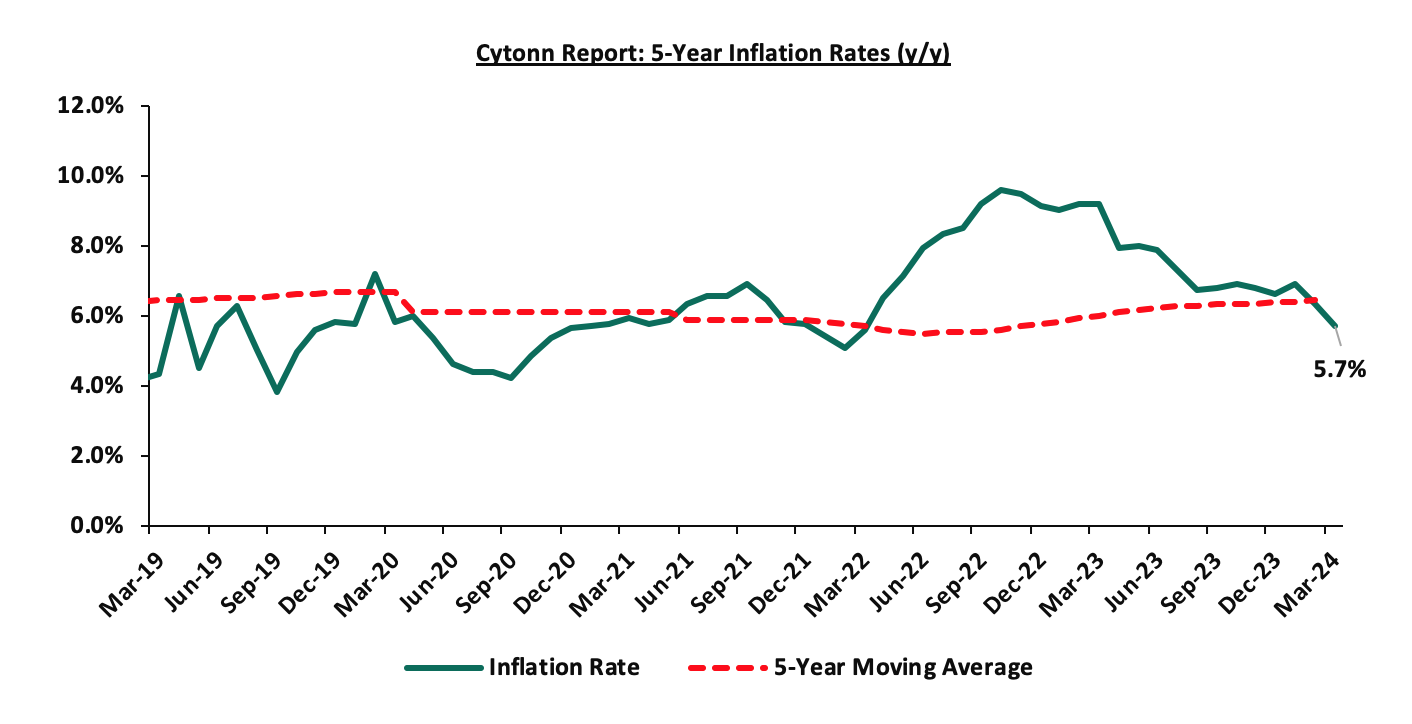

The average inflation rate eased to 6.3% in Q1’2024, compared to 9.1% in Q1’2024, attributable to a decrease in the price food and beverages, reduced fuel prices and the strengthening of the Kenya Shilling in the period under review. Notably, fuel prices decreased by 4.0%, 3.1% and 2.8% in March 2024 to Kshs 199.2, Kshs 190.4, and Kshs 188.7, from Kshs 207.4, Kshs 196.5, and Kshs 194.2 per liter at the beginning of the year for Super petrol, Diesel, and Kerosene, respectively. Below is a chart showing inflation trend for the last five years:

March 2024 Inflation

The y/y inflation in March 2024 eased by 0.6% points to 5.7%, from the 6.3% recorded in February 2024. This was according to our expectations and projection that it would come within a range of 5.7% to 6.1%. The headline inflation in March 2024 was majorly driven by increase in prices of commodities in the following categories, transport; housing, water, electricity, gas and other fuels; and food and non-alcoholic beverages by 9.7%, 8.0% and 5.8%, respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – 2024 |

|||

|

Broad Commodity Group |

Price change m/m (March-2024/February-2024) |

Price change y/y (March-2024/March-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

0.4% |

5.8% |

The m/m increase was mainly driven by the increase in prices of commodities such onions, mangoes and potatoes by 11.1%, 8.0%, and 7.7%, respectively. However, the increase was weighed down by decrease in prices of maize flour loose, sifted, sugar and fortified maize flour by 9.6%, 5.8%, 5.3 and 5.1%, respectively. |

|

Housing, Water, Electricity, Gas and Other Fuel |

0.2% |

8.0% |

The m/m performance was mainly driven by the increase in prices of gas/LPG by 1.4%. It was, however, supported by decrease in the 2.3% decrease price of kerosene per litre, coupled with the 0.3% and 0.4% reduction in the prices of 200kWh and 50 kWh of electricity |

|

Transport cost |

(0.6%) |

9.7% |

The m/m decrease in transport Index was recorded majorly due to the drop in prices of petrol and diesel by 3.5% and 2.6% respectively. |

|

Overall Inflation |

0.2% |

5.7% |

The m/m increase was mainly supported by the 0.4% increase in Food and Non-Alcoholic Beverages. |

Notably, March’s overall headline inflation was on the decline for the second consecutive month and has remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the ninth consecutive month. The decrease in headline inflation in March 2024 comes following the decline in the Petrol, Diesel and Kerosene prices which decreased by Kshs 7.2, Kshs 5.1 and Kshs 4.5 each respectively, to retail at Kshs 199.2, Kshs. 190.4 and Kshs. 188.7 per litre respectively, for the period between 15th March 2024 to 14th April 2024. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflationary pressures to ease and move close to the preferred CBK target of 5.0%, mainly on the back of a strengthened currency, tight monetary policy, reduced fuel prices and reduced electricity prices. The risk, however, lies on fuel prices which despite their decline in March 2024, still remain elevated compared to global prices. With fuel being a major input in most businesses, we expect that this will continue exerting inflationary pressure on the economy, leaving the rate close to the upper bound of the CBK target range. Key to note is that the Monetary Policy Committee raised the Central Bank Rate to 13.0% in February 2024, from the previous 12.5% with the aim of anchoring the inflation rate and is expected to meet again on 3rd April 2024. In our view, the rate will be pegged on whether the shilling will sustain its appreciation against the dollar, resulting to a decline in the import bill and costs passed to consumers through hiked consumer prices.

The Kenyan Shilling:

The Kenyan Shilling gained against the US Dollar by 15.8% in Q1’2024, to close at Kshs 131.8, from Kshs 156.5 as at the end of 2023. On a year-to-date basis, the shilling has appreciated by 16.0% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,329.7 mn in the 12 months to February 2024, 7.5% higher than the USD 4,026.2 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the February 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period, and,

- The tourism inflow receipts which came in at USD 333.9 mn in 2023, a 24.6% increase from USD 268.1 mn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 30.7% to 192,000 in the 12 months to December 2023, from 161,000 recorded during a similar period in 2022.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

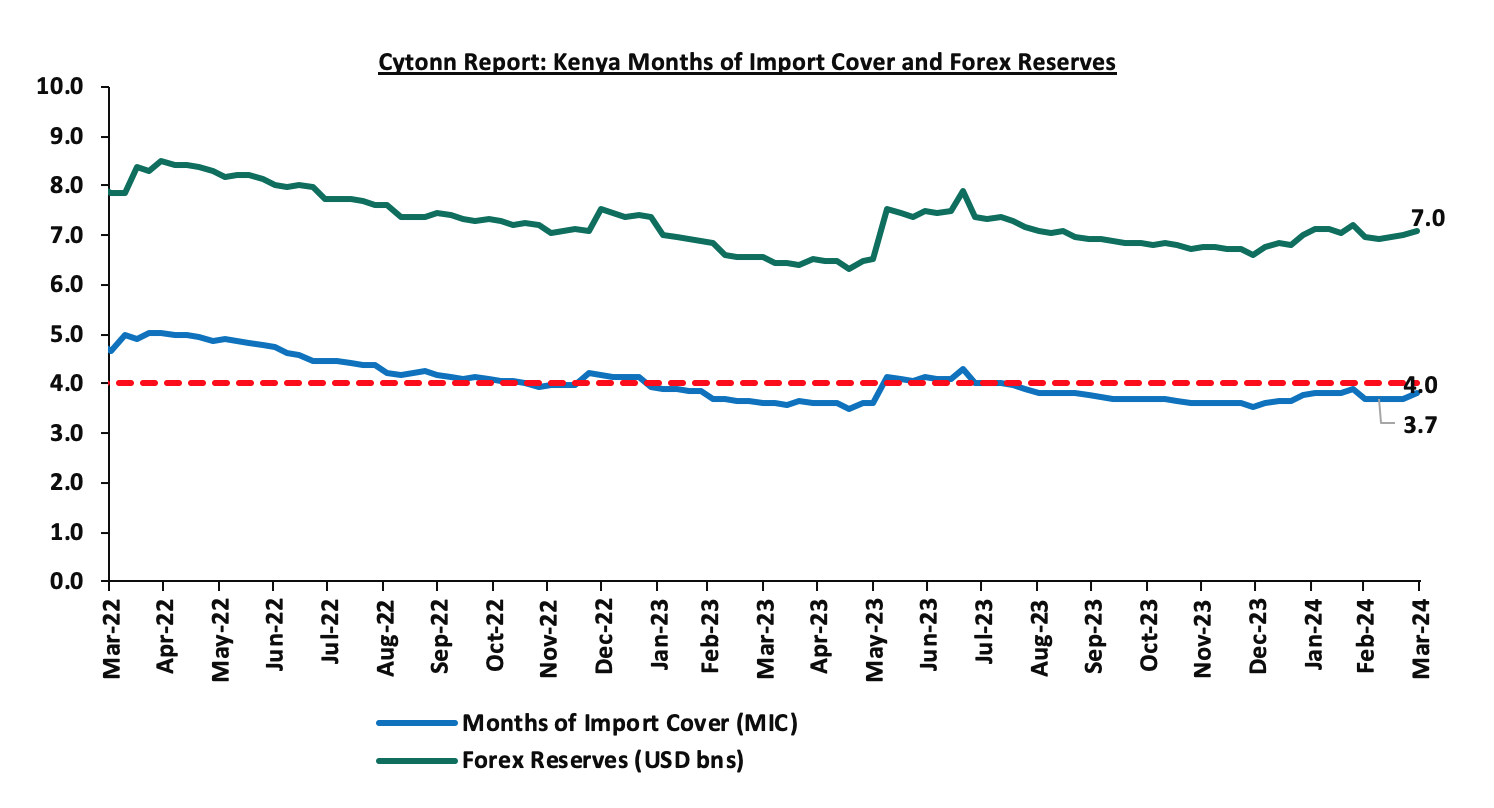

- Dwindling forex reserves, currently at USD 7.1 bn (equivalent to 3.8 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

Monetary Policy:

The Monetary Policy Committee (MPC) met once during Q’12024, on February 6, 2024, to review the outcome of its previous policy decisions against a backdrop of continued global uncertainties, moderating global oil prices, an improved global growth outlook as well as the heightened geopolitical tensions. The MPC decided to raise the CBR rate by 0.5% points to 13.0% from 12.5%,. Below are some of the key highlights from the February meeting:

- The overall inflation tightened to 6.9% in January 2024, from 6.6% in December 2023, to remain on the higher bound of the preferred CBK range of 2.5%-7.5%, mainly driven by an increase in fuel inflation. Fuel inflation increased to 14.3% in January 2024 from 13.7% in December 2023, largely attributable to higher electricity tariffs. The food inflation increased slightly to 7.9% in January 2024 from 7.7% in December 2023, attributable largely to higher prices of a few non-vegetable food items, following a decline in food supply partly due to seasonal factors. The increase was however mitigated by a decrease in the prices of a few vegetables, particularly mangoes and tomatoes. The non-food non-fuel inflation slightly increased to 3.6% in January 2024 from 3.4% in December 2023. We expect the overall inflation to tighten further in the short-term, on the back of increased landing fuel prices resulting from the depreciation of the Shilling against the dollar,

- The recently released GDP data for the third quarter of 2023 showed continued strong performance of the Kenyan economy, with real GDP growing by 5.9%. This was attributable to a strong rebound in the agriculture sector due to favourable weather conditions and resilient performance of the services sector. Leading indicators of economic activity pointed to continued strong performance in the fourth quarter of 2023. Despite the global uncertainties, the economy is expected to continue to strengthen in 2024, supported by resilient services sector, the rebound in agriculture, and implementation of measures to boost economic activity in priority sectors by the Government,

- Goods exports declined by 2.2% in the 12 months to December 2023, compared to a 9.3% growth in a similar period in 2022. Receipts from manufactured exports increased by 11.3%, attributable to increased regional demand. Imports declined by 10.6% in the 12 months to December 2023 compared to a growth of 7.3% in a similar period in 2022, mainly reflecting lower imports across all categories except food and crude materials. Tourist arrivals improved by 30.7% in the 12 months to December 2023, compared to a similar period in 2022. Remittances totalled USD 4,190.0 mn in the 12 months to December 2023 and were 4.0% higher compared to a similar period in 2022. The current account deficit is estimated at 3.9% of GDP in the 12 months to December 2023, and is projected at 4.0% of GDP in 2024, reflecting the expected recovery in imports, resilient remittances and expected rebound in agricultural exports. Going forward for this year, the MPC expects a widening of the current account to a current account deficit of USD 4.9 bn, to be mostly funded by inflows of capital and to have a residual deficit of USD 111.0 mn,

- The CBK foreign exchange reserves, which stood at USD 7,101.0 mn in February representing 3.8 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans decreased to 14.8% in December 2023 compared to 15.3% in October 2023. Decreases in NPLs were noted in the energy and water, manufacturing, agriculture, building and construction, and transport and communication sectors. However, banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about low demand for goods, weakening of the Kenya shilling and high interest rates. Despite this, they remained optimistic that economic growth would remain resilient and improve in 2024, supported by increased agricultural production, easing global inflation, a resilient private sector and focus by the government on key sectors including agriculture,

- The Survey of the Agriculture Sector revealed an expectation by respondents that the prices of key food items were expected to increase in the next three months due to high import costs as a result of the depreciation of the currency’s value,

- Global growth is expected to increase by 0.1% points to 3.2% in 2024 from 3.1% in 2023, attributable to a higher-than-expected growth in the United States, continued strengthening of the Chinese economy and a high growth in several large and emerging markets. Additionally, headline inflation rates in advanced economies have continued to ease, but remain above their respective core inflationary targets due to tight monetary policy and lower commodity prices of particularly oil and food,

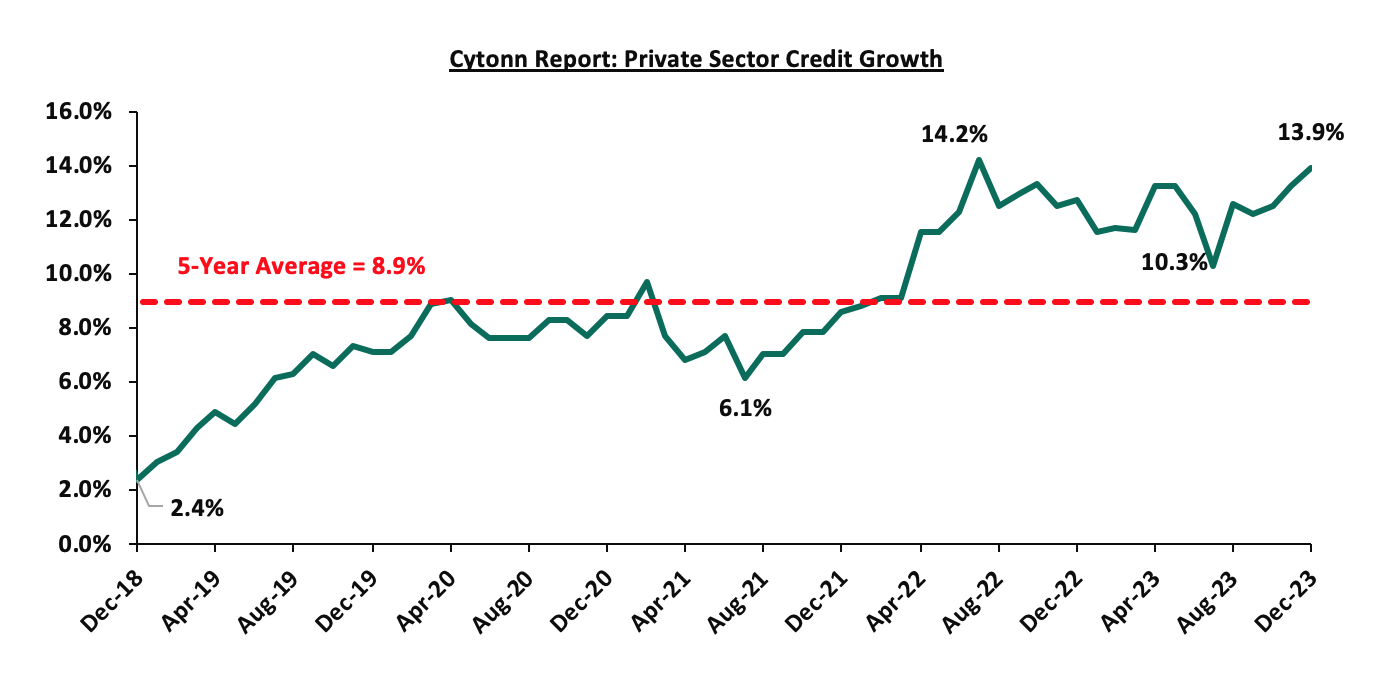

- Growth in private sector credit increased to 13.9% in December 2023 from 13.2% in November, mainly attributed to credit growth in the manufacturing, transport and communication, trade, and consumer durables sectors which grew by 20.9, 20.8%, 13.1% and 9.9% respectively. The number of loan applications and approvals remained strong, reflecting sustained demand, particularly for working capital requirements. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee noted the ongoing implementation of the FY2023/24 Government Budget, as well as the revised budget for the fiscal year which continues to reinforce fiscal consolidation. Notably, with fiscal deficit is expected to decline from 5.6% in 2023 to around 3.0% in the next three years.

The MPC noted the impact of the continued, albeit reduced, depreciation of the Kenyan Shilling against the dollar on domestic prices of goods and its ripple effect on the cost of living and purchasing power of consumers. In addition to the inflation tightening to 6.9% in January 2024, the committee noted that all key components of inflation had increased in January. Additionally, the Committee noted that the proposed action will ensure that inflationary pressures remain anchored and downward towards the 5.0% mid-point of the target range, as well as addressing residual pressures on the exchange rate. The MPC therefore decided to raise the Central Bank Rate (CBR) to 13.00%, from 12.50% and concluded that it will closely monitor the impact of the policy measures as well as developments in the global and domestic economy and stands ready to further tighten monetary policy as necessary to ensure price and exchange rate stability are achieved, in line with its mandate. The Committee will meet again on Wednesday 3rd April 2024.

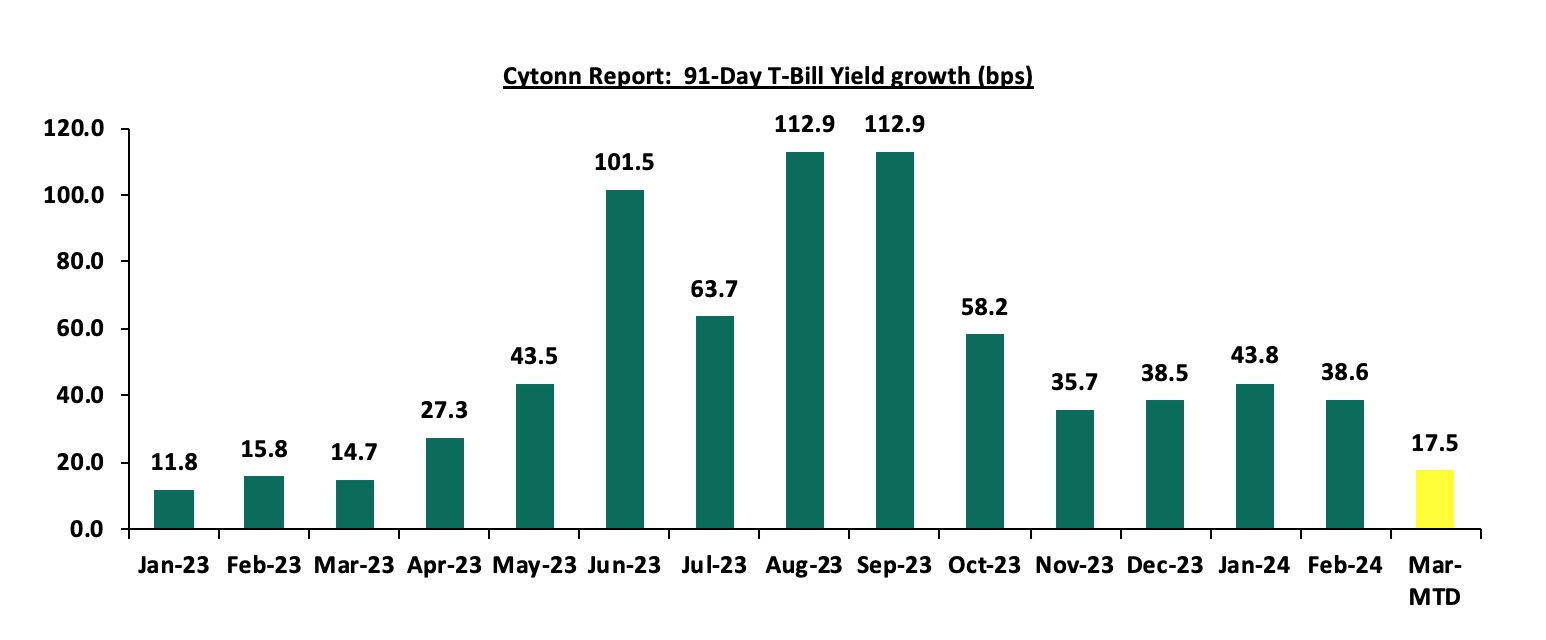

During the quarter, T-bills were oversubscribed, with the overall subscription rate coming in at 132.6%, up from 130.0% in Q4’2023. Investors’ preference for the 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 276.9 bn against the offered Kshs 56.0 bn, translating to an oversubscription rate of 494.4%, lower than the oversubscription rate of 602.7% recorded in the previous quarter. Overall subscriptions for the 182-day and 364-day papers increased to 56.3% and 64.3% from 45.7% and 22.0% in Q4’2023, respectively. The yields on all the papers were on an upward trajectory with the average yields on the 364-day, 182-day, and 91-day papers increasing by 119.4 bps, 118.3 bps, and 114.0 bps to 16.7%, 16.6%, and 16.4%, from 15.5%, 15.4%, and 15.3%, respectively, recorded in Q4’2023. The upward trajectory in yields is mainly on the back of investors attaching higher risks amid high inflation and tight liquidity positions, hence the need to demand higher returns to cushion against the possible loss. The acceptance rate during the period came in at 88.8%, albeit lower than the 91.9 recorded in Q4’2023, with the government accepting a total of Kshs 395.6 bn out of the Kshs 445.7 bn worth of bids received. The chart below shows the yield growth rate for the 91-day paper in 2023 and 2024 YTD;

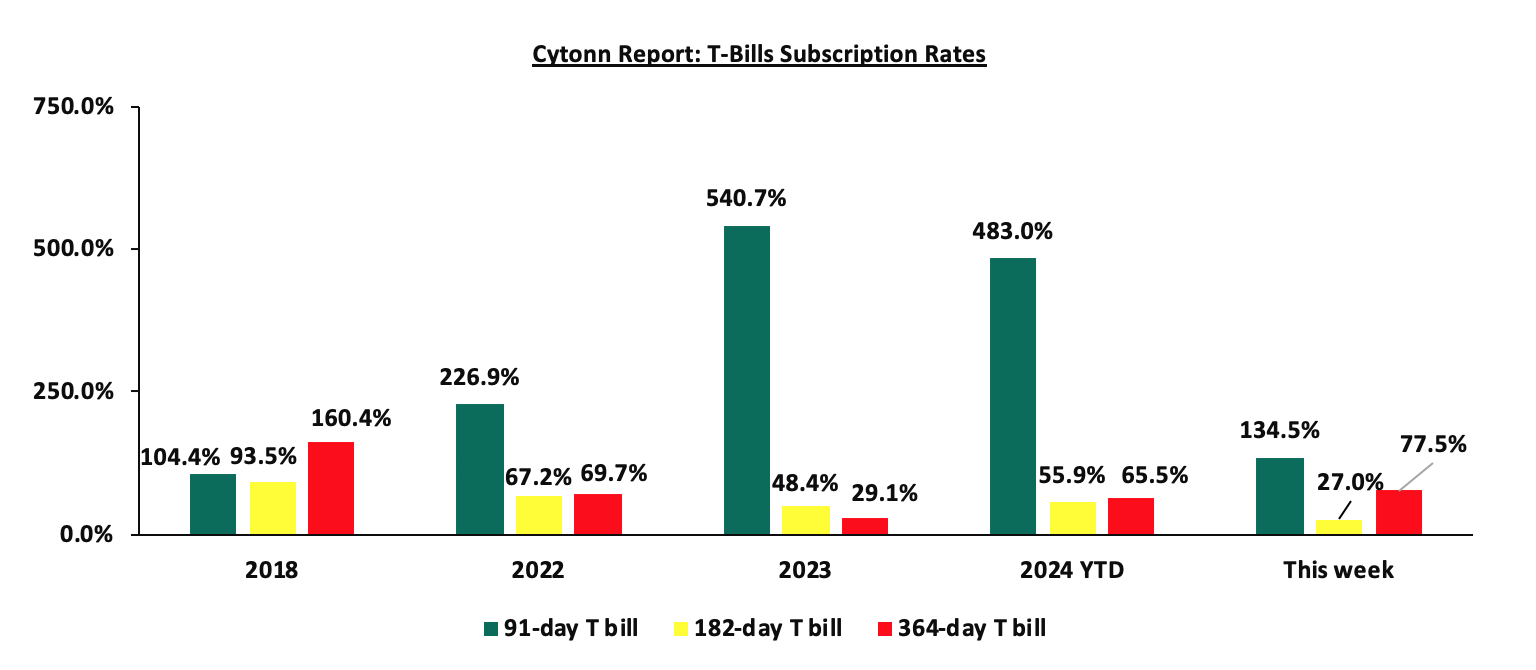

During the week, T-bills were undersubscribed, with the overall undersubscription rate coming in at 66.0%, a reversal from the oversubscription rate of 102.8% recorded the previous week, Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 5.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 134.5%, albeit lower than the oversubscription rate of 291.2% recorded the previous week. Notably, the subscription rates for the 182-day paper and 364-day paper decreased to 27.0% and 77.5% respectively, from 40.9% and 89.4% respectively recorded the previous week. The government accepted a total of Kshs 13.5 bn worth of bids out of Kshs 15.8 bn of bids received, translating to an acceptance rate of 85.3%. The yields on the government papers recorded mixed performances, with the yield of the 364-day paper increasing marginally by 0.1 bps to remain relatively unchanged at 17.0%, while the 182-day and 91-day papers decreased marginally by 2.6 bps and 0.2 bps to 16.9%, and 16.7%, respectively. The chart below compares the overall average T-bills subscription rates obtained in 2018, 2022, 2023, and 2024 Year to Date (YTD) and this week:

Primary T-bond auctions in Q1’2024:

In the primary bond market, the government issued two new Treasury bonds and one infrastructure bond, re-opened three, and offered two of them on tap sale, seeking to raise Kshs 200 bn during the quarter. The bonds were generally oversubscribed, receiving bids worth Kshs 440.5 bn against the offered Kshs 200.0 bn, translating to an oversubscription rate of 220.2%. The government accepted Kshs 334.6 bn of the Kshs 440.5 bn worth of bids received, translating to an acceptance rate of 76.0%. Additionally, the government is seeking to raise Kshs 25.0 bn through the tap sale of two bonds, FXD1/2023/005 and FXD1/2024/010, with a period of sale of Wednesday 27th March 2024 to Thursday 4th April 2024. The bids shall be priced at the average rate of accepted yield for the initial values which stood at 18.4% and 16.5% for FXD1/2023/005 and FXD1/2024/010, respectively. The table below provides more details on the bonds issued during the quarter:

|

Cytonn Report: Q1’2024 Kenya Bond Issuances |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

15/01/2024 |

FXD1/2023/005 (re-opened) |

4.5 |

16.8% |

35.0 |

25.0 |

37.2 |

18.8% |

106.1% |

67.3% |

|

FXD1/2024/003 |

2.9 |

18.4% |

18.4% |

||||||

|

22/01/2024 |

FXD1/2023/005 - Tapsale |

4.5 |

16.8% |

15.0 |

11.8 |

11.9 |

18.8% |

79.1% |

99.1% |

|

FXD1/2024/003 - Tapsale |

2.9 |

18.4% |

18.4% |

||||||

|

19/02/2024 |

IFB/2024/8.5 |

8.5 |

18.5% |

70.0 |

241.0 |

288.7 |

18.5% |

412.4% |

83.5% |

|

11/03/2024 |

FXD1/2024/03 (re-opened) |

2.9 |

18.4% |

40.0 |

34.3 |

43.1 |

18.4% |

107.7% |

79.6% |

|

25/03/2024 |

FXD1/2024/005 (re-opened) |

4.5 |

16.8% |

40.0 |

22.6 |

59.7 |

18.4% |

149.3 |

37.8 |

|

FXD1/2024/010 |

10.0 |

16.0% |

16.5% |

||||||

|

Q1'2024 Total |

|

|

200.0 |

334.6 |

440.5 |

|

|

|

|

|

Q1'2024 Average |

5.1 |

17.8% |

40.0 |

66.9 |

88.1 |

18.3% |

170.9% |

60.5% |

|

|

Q4'2023 Average |

4.1 |

16.9% |

31.3 |

20.8 |

25.3 |

17.8% |

106.2% |

78.2% |

|

Source: CBK

Secondary Bond Market Activity:

- Bond Turnover

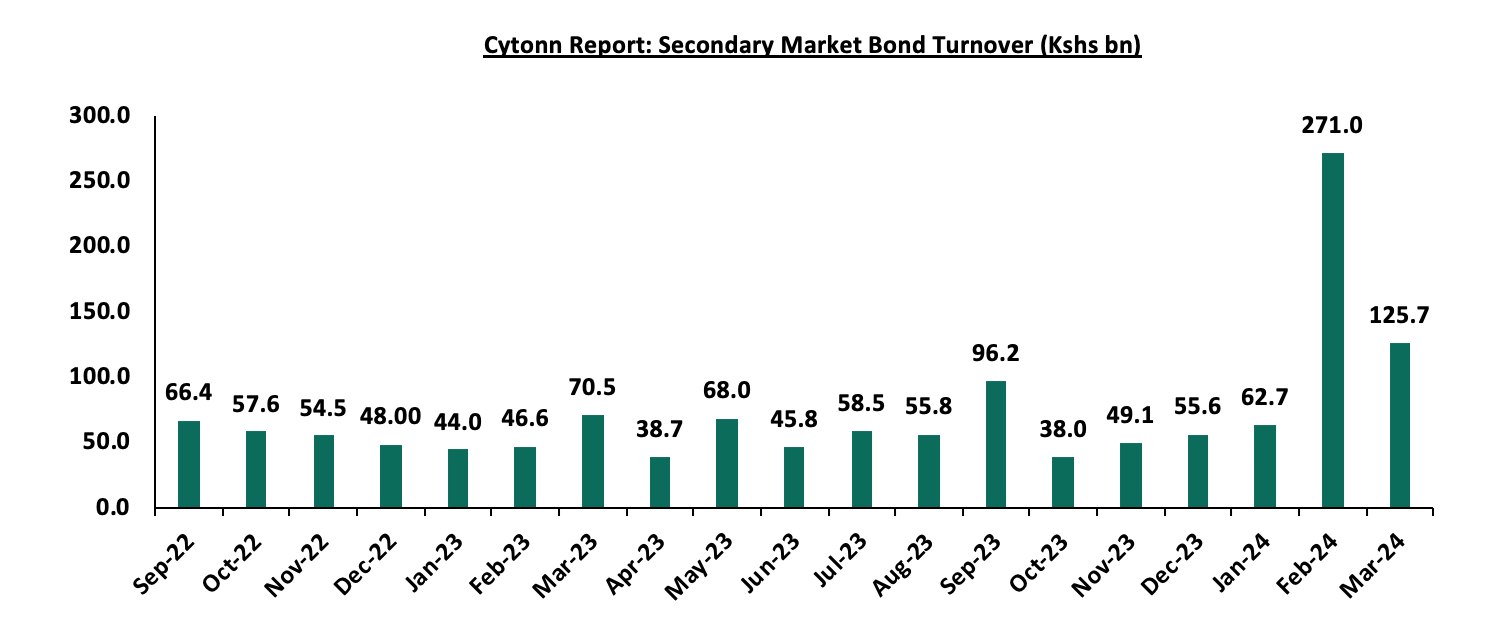

In the secondary bond market, activity increased significantly, with the turnover increasing by 254.2% to Kshs 505.4 bn, from Kshs 142.7 bn in Q4’2023, partially attributable to the increased allocation to treasury bonds by local institutional investors as they sought higher yield in the market. The chart below shows the bond turnover over the last one year:

- Yield Curve

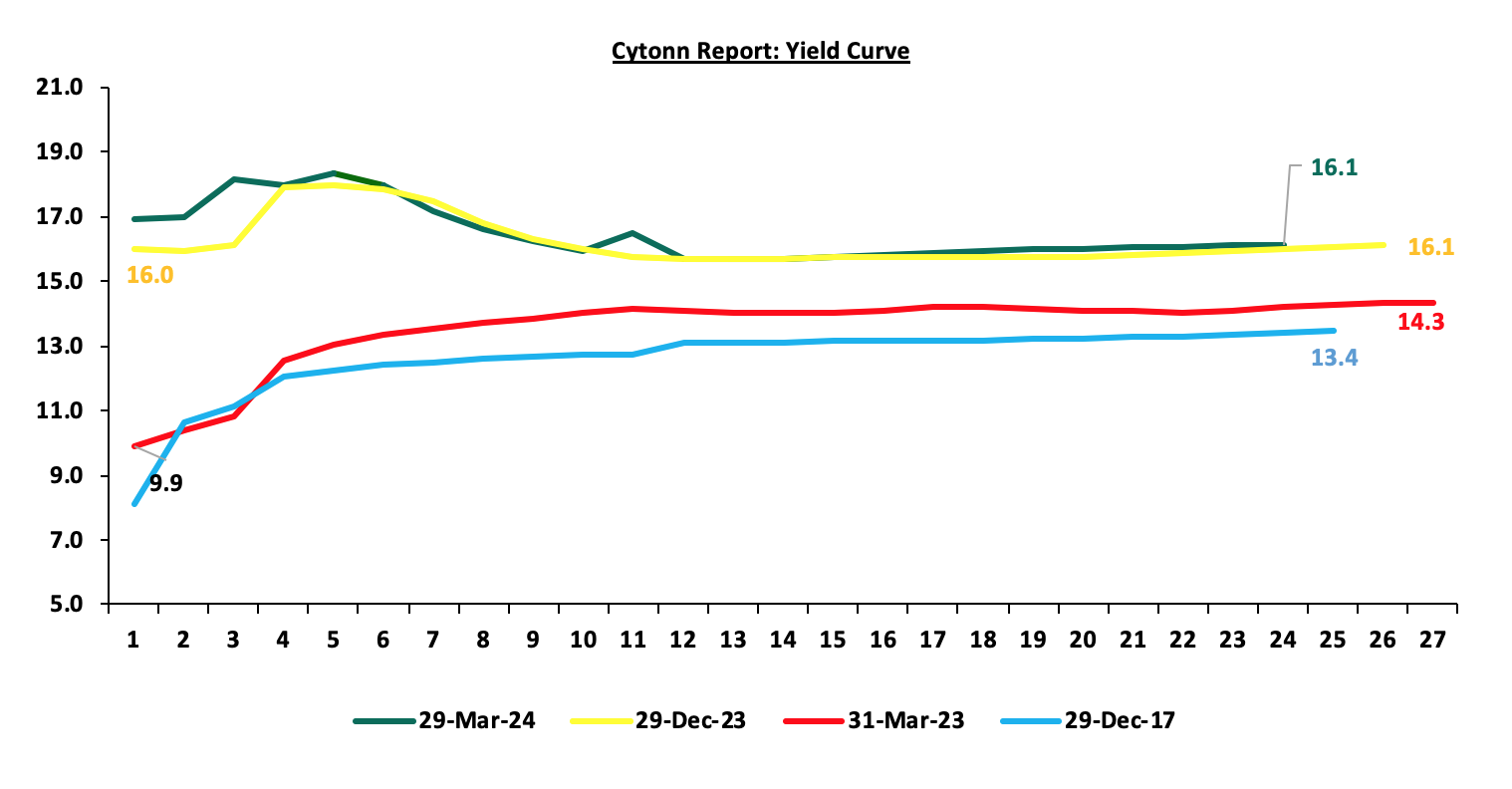

The yield curve was on an upward trajectory in Q1’2024 with a notable increase in the yields of the shorter-term bonds. We observe a slightly humped yield curve for the short to medium-term bonds, an indication of the prevailing uncertainty in the market regarding both medium-term interest rates and inflation. Investors, apprehensive about the economic outlook in the near to medium term are demanding higher yields for bonds to compensate for the perceived risks, The chart below shows the yield curve movement during the quarter;

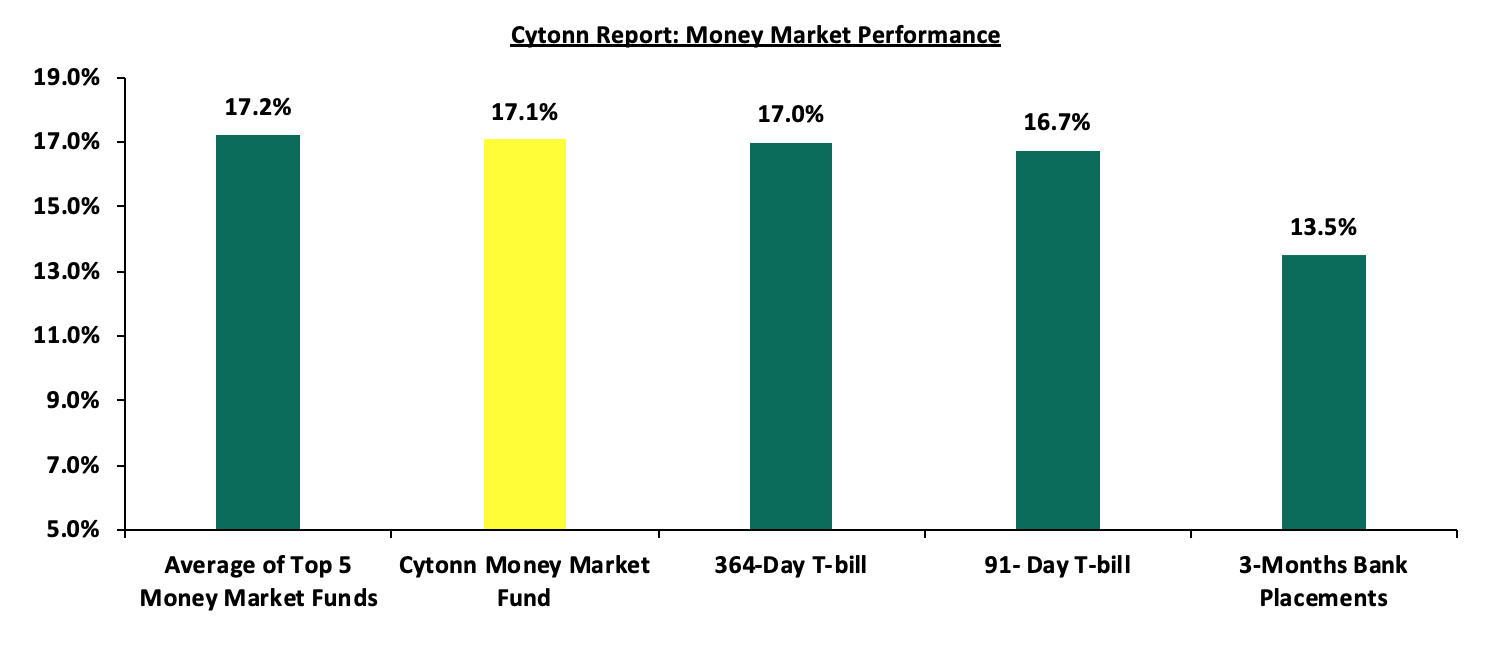

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day increased marginally by 0.1 bps to remain relatively unchanged at 17.0% while that of the 182-day and 91-day papers decreased by 2.6 bps and 0.2 bps to 16.9% and 16.7%, respectively. The yields of the Cytonn Money Market Fund decreased marginally by 1.0 bps to 17.06% from the 17.07% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased marginally by 13.4 bps to close the week at 17.3 from the 17.2% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 29th March 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 29th March 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

18.1% |

|

2 |

Lofty-Corban Money Market Fund |

18.0% |

|

3 |

Cytonn Money Market Fund (Dial *809# or download the cytonn app) |

17.1% |

|

4 |

GenAfrica Money Market Fund |

16.9% |

|

5 |

Nabo Africa Money Market Fund |

16.8% |

|

6 |

Kuza Money Market fund |

16.3% |

|

7 |

Enwealth Money Market Fund |

16.1% |

|

8 |

Madison Money Market Fund |

15.9% |

|

9 |

Apollo Money Market Fund |

15.9% |

|

10 |

Absa Shilling Money Market Fund |

15.5% |

|

11 |

Co-op Money Market Fund |

15.4% |

|

12 |

Jubilee Money Market Fund |

15.3% |

|

13 |

KCB Money Market Fund |

15.3% |

|

14 |

GenCap Hela Imara Money Market Fund |

15.2% |

|

15 |

Mali Money Market Fund |

14.9% |

|

16 |

Sanlam Money Market Fund |

14.8% |

|

17 |

Mayfair Money Market Fund |

14.0% |

|

18 |

AA Kenya Shillings Fund |

13.7% |

|

19 |

Orient Kasha Money Market Fund |

13.7% |

|

20 |

Old Mutual Money Market Fund |

13.7% |

|

21 |

Dry Associates Money Market Fund |

13.6% |

|

22 |

CIC Money Market Fund |

13.2% |

|

23 |

ICEA Lion Money Market Fund |

12.3% |

|

24 |

British-American Money Market Fund |

10.0% |

|

25 |

Equity Money Market Fund |

9.6% |

Source: Business Daily

Liquidity:

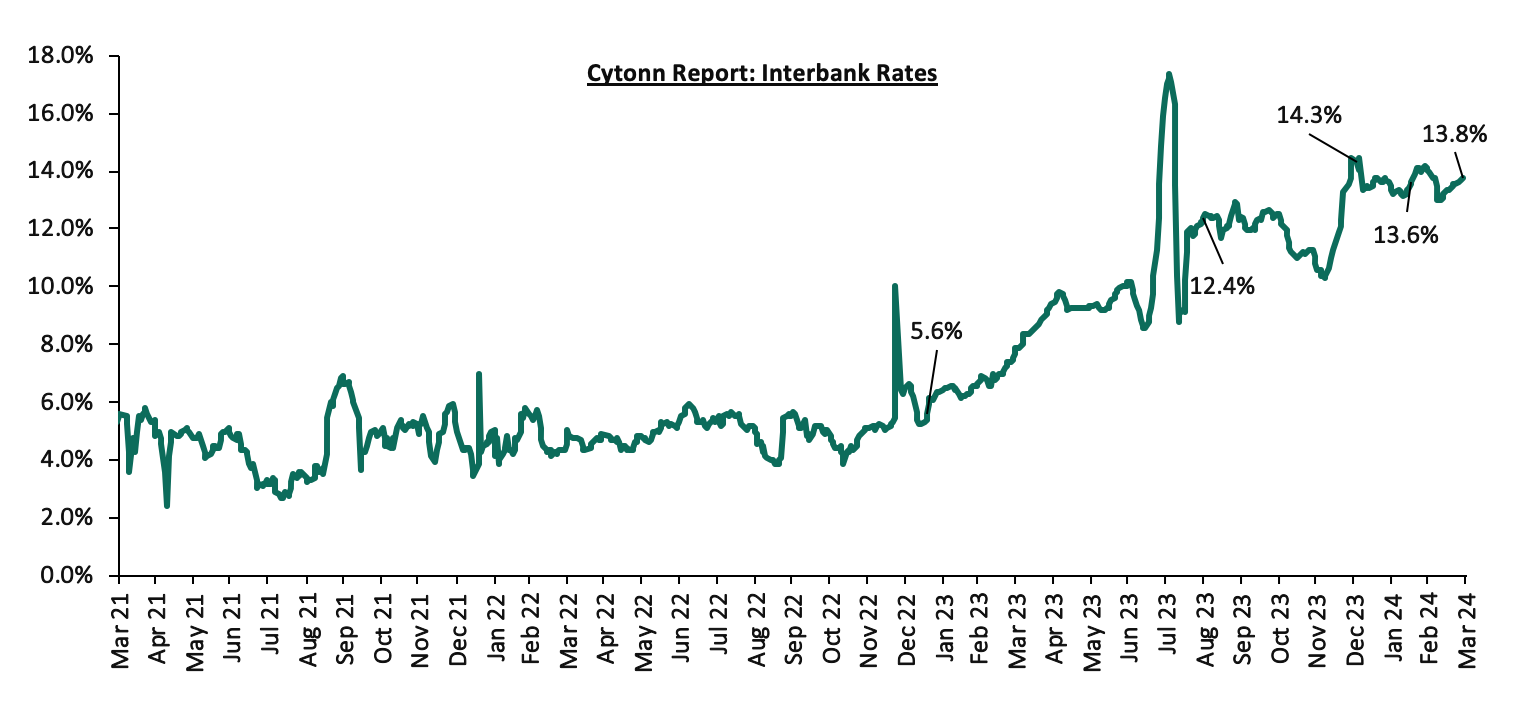

During the quarter, liquidity in the money market tightened, with the average interbank rate increasing by 1.8% points to 13.6% from 11.8% the previous quarter, partly attributable to tax remittances that offset government payments. The average volumes traded in the interbank market increased by 8.8% to Kshs 23.5.4 bn, from Kshs 21.6 bn recorded in the previous quarter.

During the week, liquidity in the money markets tightened, with the average interbank rate increasing by 19.8 bps to 13.7% from 13.5% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased significantly by 31.9% to Kshs 23.9 bn from Kshs 35.0 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the quarter, the yields on Eurobonds were on a downward trajectory, with the 7-year Eurobond issued in 2019 decreasing the most by 1.7% points to 8.4% from 10.1% recorded at the start of the quarter. The decline in yields is partly attributable to reduced credit risk and positive investor sentiment following the successful buyback of the USD 2.0 bn Eurobond maturing in June 2024.

During the week, the yields on Kenya’s Eurobonds recorded mixed performances, with the yields on the13-year Eurobond issued in 2021 decreasing the most by 0.1% points to remain relatively unchanged at the 9.3% recorded the previous week, while the yield on the 7-year bond issued in 2019 increased marginally by 0.01% points to remain relatively unchanged at 8.4%. The table below shows the summary of the performance of the Kenyan Eurobonds as of 29th March 2024;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Date |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

6-year issue |

|

Years to Maturity |

3.9 |

23.9 |

3.1 |

8.1 |

10.2 |

5.9 |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

01-Mar-24 |

9.5% |

10.3% |

9.2% |

9.9% |

9.8% |

9.8% |

|

21-Mar-24 |

8.7% |

9.9% |

8.4% |

9.3% |

9.3% |

9.3% |

|

22-Mar-24 |

8.7% |

9.9% |

8.4% |

9.3% |

9.3% |

9.3% |

|

25-Mar-24 |

8.7% |

9.9% |

8.5% |

9.3% |

9.3% |

9.3% |

|

26-Mar-24 |

8.7% |

9.8% |

8.4% |

9.3% |

9.3% |

9.2% |

|

27-Mar-24 |

8.7% |

9.8% |

8.4% |

9.3% |

9.3% |

9.2% |

|

28-Mar-24 |

8.7% |

9.8% |

8.4% |

9.3% |

9.3% |

9.2% |

|

Weekly Change |

(0.0%) |

(0.1%) |

0.0% |

0.0% |

(0.1%) |

(0.1%) |

|

MTD Change |

(0.8%) |

(0.5%) |

(0.7%) |

(0.6%) |

(0.6%) |

(0.6%) |

|

Q/Q Change |

(1.1%) |

(0.4%) |

(1.7%) |

(0.6%) |

(0.2%) |

- |

|

YTD Change |

(1.1%) |

(0.4%) |

(1.7%) |

(0.6%) |

(0.2%) |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the quarter, the Kenya Shilling gained against the US Dollar by 16.0%, to close at Kshs 131.8, from Kshs 157.0 recorded at the start of the quarter. On a year-to-date basis, the shilling has appreciated by 16.0% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

During the week, the Kenya Shilling gained against the US Dollar by 0.8%, to close at Kshs 131.8, from Kshs 132.9 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,329.7 mn in the 12 months to February 2024, 7.5% higher than the USD 4,026.2 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the February 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period, and,

- The tourism inflow receipts which came in at USD 333.9 mn in 2023, a 24.6% increase from USD 268.1 mn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 30.7% to 192,000 in the 12 months to December 2023, from 161,000 recorded during a similar period in 2022.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

- Dwindling forex reserves, currently at USD 7.0 bn (equivalent to 3.7 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

Key to note, during the quarter, Kenya’s forex reserves increased by 4.6% to close at USD 7.1 bn from the USD 6.8 recorded at the start of the quarter. Moreover, during the week, the reserves increased marginally by 0.9% to close the week at USD 7.1 bn from the USD 7.0 bn recorded last week, equivalent to 3.8 months of import cover, an increase from the previous week’s 3.7 months, but remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Q1’2024 Highlights:

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of December 2023 improved slightly, coming in at 48.8, up from 45.8 in November 2023, signalling a modest improvement in operating conditions across Kenya. Please see our Cytonn Weekly 01/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2024 to 14th February 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 5.0, Kshs 5.0 and Kshs 4.8 respectively and retailed at Kshs 207.4, Kshs 196.5 and Kshs 194.2 per litre respectively from the December 2023 prices of Kshs 212.4, Kshs 201.5 and Kshs 199.1 respectively. Please see our Cytonn Weekly 02/2024,

- During the quarter, The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023. Please see our Cytonn Weekly 03/2024,

- The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2023/2024, ending 29th December 2023. Total revenue collected as at the end of December 2023 amounted to Kshs 1,092.1 bn, equivalent to 42.4% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 84.8% of the prorated estimates of Kshs 1,288.4 bn. December’s 84.8% attainment of the revenue target was a 2.6%-points improvement from the performance in November where the government achieved 82.2% of the revenue targets. Please see our Cytonn Weekly 03/2024,

- During the quarter, Ivory Coast (Côte d’Ivoire) became the first Sub-Saharan Africa (SSA) country to tap into the international capital markets, issuing two bonds with respective maturities of 8.5 years and 12.5 years, maturing on 30th January 2033 and 30th January 2037 respectively. This was the first issue in the SSA region since 2022, when rising global interest rates and geopolitical tensions made foreign currency debt prohibitively expensive for most African borrowers. Notably, the sovereign raised a total of USD 2.6 bn from the two tranches, with the two issues recording an oversubscription of over USD 8.0 bn. The coupon rates for the 8.5-year (maturity 2033) and the 12.5-year (maturity 2037) were fixed at 7.625% and 8.250% respectively, with the coupons being payable semi-annually in arrears. Please see our Cytonn Weekly #04/2024,

- The Monetary Policy Committee met on February 6, 2024, to review the outcome of its previous policy decisions against a backdrop of continued global uncertainties, moderating global oil prices, an improved global growth outlook as well as heightened geopolitical tensions. The MPC decided to raise the CBR rate by 0.5% points to 13.0% from 12.5% on account of inflation remaining sticky in the economy as well as continued pressures on the exchange rate, albeit reduced. Please see our Cytonn Weekly 06/2024,

- Kenya announced it was going through with the earlier announced plan of buying back the 10-year tenor USD 2.0 bn Eurobond issued in 2014. In the announcement, Kenya stated that the buyback plan would be financed by the issuance of a new Eurobond. This followed successful issues by Ivory Coast and Benin which raised USD 2.6 bn and USD 750.0 mn respectively, marking the return of the Sub-Saharan region to the international Eurobonds market after nearly two years of absence. Please see our Cytonn Weekly 06/2024,

- During the quarter, Benin became the second country in the Sub-Saharan Africa (SSA) region to tap into the international capital markets in 2024, issuing their debut dollar bond with a tenor of 14 years and a coupon rate of 8.375%. Notably, the bond was oversubscribed with the overall subscription rate coming in at 666.7% having received bids worth USD 5.0 bn against the offered USD 750.0 mn; Please see our Cytonn Weekly 06/2024,

- The Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of January 2024 improved slightly, coming in at 49.8, up from 48.8 in December 2023, signalling a modest and softer downturn in operating conditions across Kenya’s business environment; Please see our Cytonn Weekly 06/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released its monthly statement on the maximum retail fuel prices in Kenya, effective from 15th February 2024 to 14th March 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 1.0 each, and retailed at Kshs 206.4, Kshs 195.5 and Kshs 193.2 per litre respectively from the January 2024 prices of Kshs 207.4, Kshs 196.5 and Kshs 194.2 respectively; Please see our Cytonn Weekly 07/2024,

- During the month, The Government, through the Ministry of National Treasury & Planning announced the successful pricing of a new USD 1.5 bn Eurobond. The new issuance (KENINT 2031) attracted a yield of 10.375% and a coupon rate of 9.75%, in line with our expectations which were informed by the prevailing market conditions, Kenya’s credit ratings, and the unique nature of the buyback and issue plan. Interest payments for the bond are to be paid semi-annually on February 16th and August 16th starting August 2024; Please see our Cytonn Weekly 07/2024,

- The Government, on 15th February 2024, announced the results of the Tender offer of its USD 2.0 bn 10-year tenor Eurobond issued in 2014. The buyback offer received tenders worth 1.5 bn against the offered 1.4 bn, translating to an oversubscription rate of 106.1%, with Kenya accepting bids worth USD 1.4 bn, slightly below the offered USD 1.5 bn. This translated to an acceptance rate of 97.0%; Please see our Cytonn Weekly 07/2024,

- The global ratings agency, S&P Global affirmed Kenya's long-term sovereign credit rating at 'B' with a negative outlook and assigned a 'B' long-term issue rating to the proposed U.S. dollar-denominated Eurobonds. This came in following the buyback of the 10-year tenor USD 2.0 bn Eurobond tenders issued in 2014 and the new issuance of the KENINT 2031 Eurobond priced at USD 1.5 bn. In addition, the global ratings agency, Moody’s announced its revision of the Kenyan banks’ outlook to negative from stable on the back of the high volume of non-performing loans (NPLs), which have thrown a pall over the sector's strong profitability and liquidity. Please see our Cytonn Weekly 07/2024,

- The National Treasury gazetted the revenue and net expenditures for the seventh month of FY’2023/2024, ending 31st January 2024 highlighting that total revenue collected as at the end of January 2024 amounted to Kshs 1,261.0 bn, equivalent to 48.9% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 83.9% of the prorated estimates of Kshs 1,503.1 bn; Please see our Cytonn Weekly 07/2024,

- Yields on the Government securities had been on an upward trajectory with the 91-day paper yielding 16.6% from 9.4% in January 2023. Going forward, we anticipate a very modest increase in yields on the government papers before they stabilize in the remaining months of FY’2023/24. The increase will be muted going forward due to the positive investor sentiment brought about by the successful offering of the Eurobond, which helped alleviate the fears of possible default by the government. Please see our Cytonn Weekly 08/2024,

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI)-Kenya highlighting that the index for the month of February 2024 improved, coming in at 51.3, up from 49.8 in January 2024. The index was also at its highest level in over a year, with positive directional influences seen in all five of its sub-components. The upturn of the general business environment was mainly attributable to eased inflationary pressures, appreciating Shilling, and reduced fuel prices. Please see our Cytonn Weekly 10/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th March 2024 to 14th April 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 7.2, Kshs 5.1, and Kshs 4.5 each respectively, and will retail at Kshs 199.2, Kshs 190.4 and Kshs 188.7 per litre respectively, from the February 2024 prices of Kshs 206.4, Kshs 195.5 and Kshs 193.2 respectively. Please see our Cytonn Weekly 11/2024,

- The National Treasury gazetted the revenue and net expenditures for the eighth month of FY’2023/2024, ending 29th February 2024. Total revenue collected as at the end of February 2024 amounted to Kshs 1,424.9 bn, equivalent to 55.3% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024, and was 82.9% of the prorated estimates of Kshs 1,717.8 bn. Please see our Cytonn Weekly 11/2024, and,

- Ghanaian authorities and international bondholders were poised to engage in crucial talks that week to navigate the complexities of restructuring approximately USD 13.0 bn of defaulted global debt. This effort marked the start of formal talks to restructure Ghana’s debt to private international bondholders. Please see our Cytonn Weekly 11/2024.

Weekly Highlights

- Zambia Eurobond Restructuring Deal

During the week, Zambia’s Ministry of Finance and National Planning announced that the country had reached an agreement on debt restructuring terms with the steering committee on debt restructuring. Zambia had defaulted on its USD 3.5 bn Eurobond back in November 2020 and has been working on getting their debt restructured under the G20’s Common Framework.

Pursuant to this agreement, Bondholders will be invited to exchange their Bonds for new fixed-income instruments. The new instruments will have an average weighted maturity period of 1 and 8 years under the Base Case and Upside Case treatments respectively. In this arrangement, bondholders will make substantial concessions of approximately USD 840.0 mn in claims forgone and another USD 2.5 bn in cash relief during the IMF program period. This USD 2.5 bn cashflow relief implies that Zambia will have more flexibility in managing its finances because it won't have to make as many debt payments during the specified period.

The government of Zambia has also accepted some non-financial terms in the new agreement. First, they have committed to a Most favored creditor clause which would ensure the government does not give preferential or better treatment to any of the creditors. In case that happens, those same terms will be extended to all creditors.

Also included is the Loss Reinstatement Clause which states that if Zambia defaults on its debt again during the time when the IMF program is still active, the Bondholders can get back some of the concessions they made. It's a way to protect Bondholders from additional losses if Zambia doesn't meet its obligations. There is also an additional requirement for Zambia to keep creditors updated throughout the process.

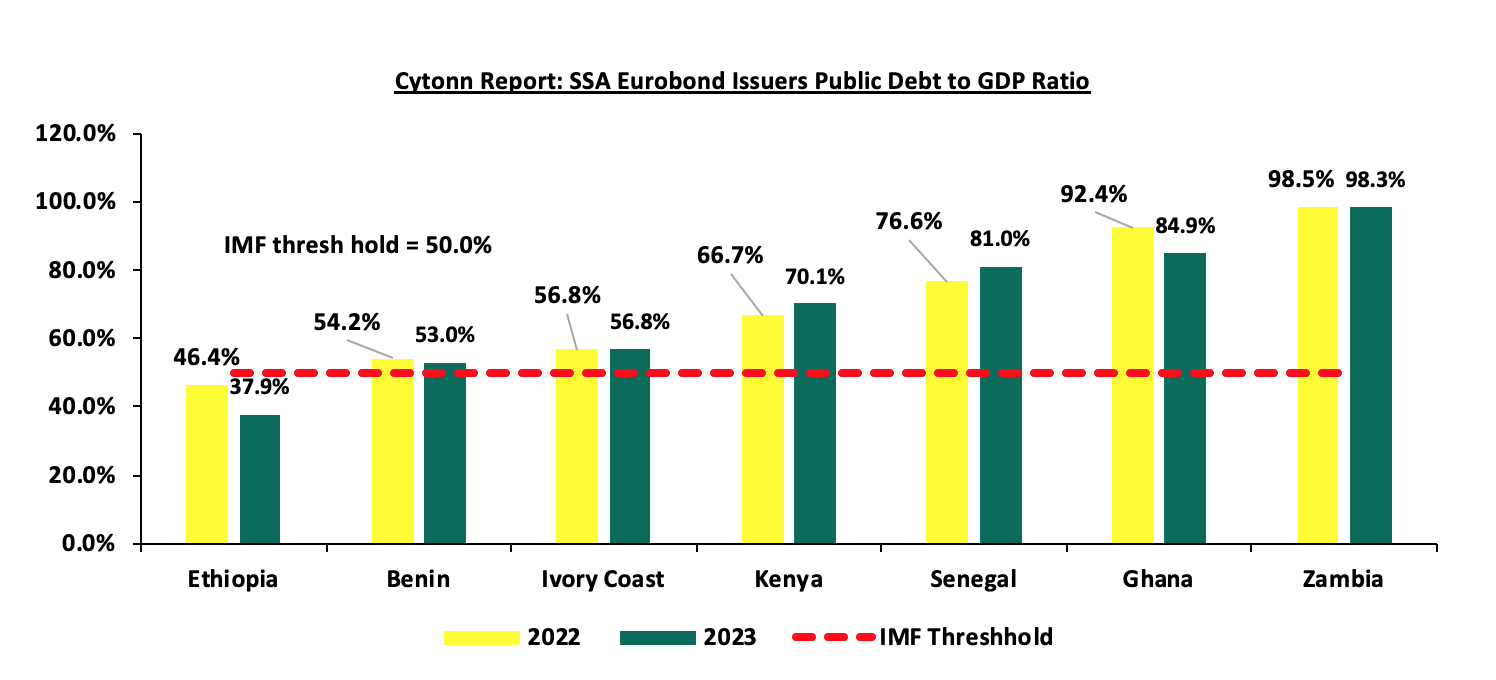

Following this news, Zambia’s existing dollar bonds strengthened, with the 2027 note up 1.8 cents to 73.85 cents on the dollar. According to Moody’s, S&P Global, and Fitch Zambia’s Credit Ratings currently stand at CCC- (Negative), CCC+ (Stable), and CCC+ (NR) respectively. Zambia’s high public debt-to-GDP ratio of 98.3%, which is 48.3% points higher than the IMF recommended threshold of 50.0%, has been a source of concern for the country’s debt sustainability. The graph below shows the public debt to GDP ratio of select SSA countries:

Source: IMF, CBK

This debt restructuring agreement represents a significant step towards addressing Zambia's debt challenges, providing necessary relief to the government involving important concessions from Bondholders. Implementation of the restructuring will be a critical next step that we’ll keep monitoring.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market, but now seem to have peaked and have started declining, albeit marginally. The government is 8.6% ahead of its prorated net domestic borrowing target of Kshs 356.1 bn, having a net borrowing position of Kshs 386.9 bn out of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. Therefore, we expect a continued soft upward readjustment of the yield curve in the short and medium term, with the government looking to maintain the fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During Q1’2024, the equities market was on an upward trajectory, with NSE 10 gaining the most by 27.3%, while NSE 25, NASI, and NSE 20 gained by 25.0%, 22.8%, and 16.7% respectively. The equities market performance was driven by gains recorded by large cap stocks such as Equity Group, KCB, and Cooperative Bank which gained by 40.1%, 37.2%, and 31.6%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as EABL and Cooperative Bank, which declined by 5.5% and 3.3%, respectively

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 5.1%, while NASI, NSE 25, and NSE 20 gained by 5.0%, 4.7%, and 3.9% respectively, taking the YTD performance to gains of 26.8%, 24.6%, 23.0% and 16.1% for NSE 10, NSE 25, NASI and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as KCB Group, DTB-K, and Safaricom, of 17.6%, 7.8%, and 6.0% respectively.

During Q1’2024, equities turnover increased significantly by 70.7% to USD 130.4 mn, from USD 76.4 mn in Q4’2023. Foreign investors remained net sellers during the quarter, with a net selling position of USD 16.4 mn, from a net selling position of USD 14.2 mn in Q4’2023.

During the week, equities turnover increased significantly by 87.6% to USD 35.8 mn from USD 19.1 mn recorded the previous week, taking the YTD total turnover to USD 130.4 mn. Foreign investors became net sellers for the second consecutive week with a net selling position of USD 7.4 mn, from a net selling position of USD 0.9 mn recorded the previous week, taking the YTD foreign net selling position to USD 16.4 mn.

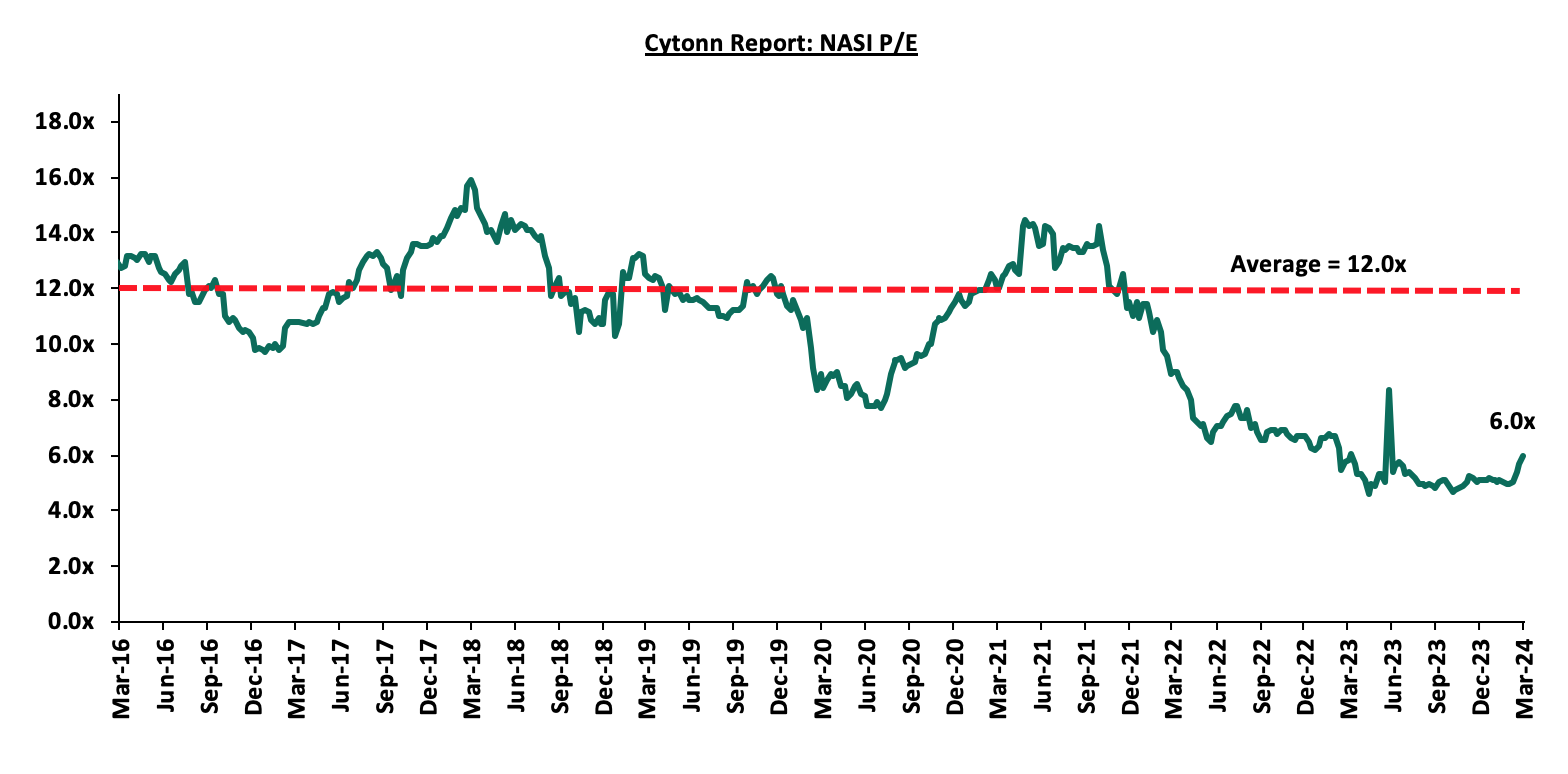

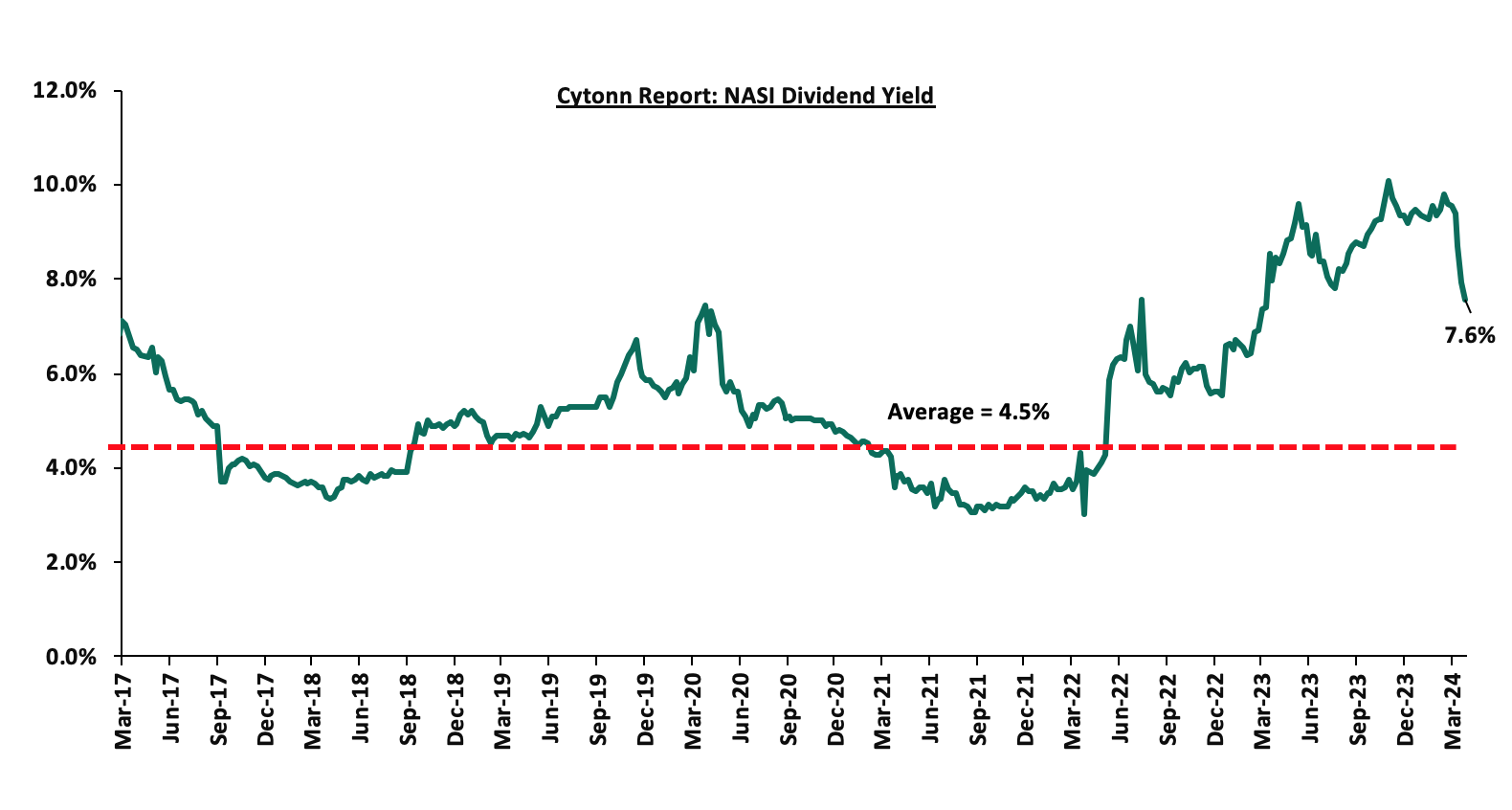

The market is currently trading at a price-to-earnings ratio (P/E) of 6.0x, 50.2% below the historical average of 12.0x. The dividend yield stands at 7.6%, 3.1% points above the historical average of 4.5%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||||

|

Company |

Price as at 22/03/2024 |

Price as at 28/03/2024 |

w/w change |

q/q change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Sanlam |

6.3 |

6.5 |

2.5% |

7.7% |

7.7% |

6.0 |

10.3 |

0.0% |

59.3% |

1.8x |

Buy |

|

I&M Group*** |

20.9 |

22.1 |

5.8% |

26.0% |

26.4% |

17.5 |

28.6 |

11.6% |

41.3% |

0.5x |

Buy |

|

Equity Group*** |

45.4 |

47.2 |

4.0% |

40.1% |

37.9% |

34.2 |

61.6 |

8.5% |

39.1% |

1.0x |

Buy |

|

Co-op Bank*** |

14.9 |

15.0 |

0.7% |

31.6% |

32.2% |

11.4 |

19.3 |

10.0% |

38.7% |

0.7x |

Buy |

|

Jubilee Holdings |

195.0 |

197.5 |

1.3% |

6.8% |

6.8% |

185.0 |

260.7 |

6.1% |

38.1% |

0.3x |

Buy |

|

ABSA Bank*** |

14.0 |

14.0 |

(0.4%) |

21.8% |

20.8% |

11.6 |

17.2 |

11.1% |

34.4% |

1.1x |

Buy |

|

Diamond Trust Bank*** |

51.0 |

55.0 |

7.8% |

22.1% |

22.9% |

44.8 |

67.8 |

9.1% |

32.4% |

0.2x |

Buy |

|

Standard Chartered*** |

187.8 |

197.8 |

5.3% |

22.1% |

23.4% |

160.3 |

232.1 |

14.7% |

32.0% |

1.3x |

Buy |

|

NCBA*** |

41.8 |

43.8 |

4.8% |

12.5% |

12.7% |

38.9 |

52.2 |

9.7% |

28.9% |

0.9x |

Buy |

|

Stanbic Holdings |

123.0 |

126.5 |

2.8% |

16.3% |

19.3% |

106.0 |

145.3 |

12.1% |

27.0% |

0.9x |

Buy |

|

KCB Group*** |

25.6 |

30.1 |

17.6% |

37.2% |

36.9% |

22.0 |

37.2 |

0.0% |

23.8% |

0.5x |

Buy |

|

Kenya Reinsurance |

2.0 |

2.2 |

8.9% |

17.6% |

19.5% |

1.9 |

2.5 |

9.0% |

22.6% |

0.2x |

Buy |

|

Britam |

5.6 |

5.0 |

(11.0%) |

4.4% |

(2.7%) |

5.1 |

6.0 |

0.0% |

19.4% |

0.7x |

Accumulate |

|

CIC Group |

2.2 |

2.2 |

0.0% |

(0.4%) |

(2.6%) |

2.3 |

2.5 |

5.8% |

17.9% |

0.7x |

Accumulate |

|

Liberty Holdings |

5.0 |

5.5 |

9.2% |

48.5% |

42.0% |

3.9 |

6.1 |

0.0% |

11.3% |

0.4x |

Accumulate |

|

HF Group |

4.4 |

4.2 |

(4.3%) |

21.0% |

22.0% |

3.5 |

3.9 |

0.0% |

(7.4%) |

0.2x |

Sell |

|

Target Price as per Cytonn Analysts’ estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||||

Earnings Releases

- I&M Group FY’2023 Financial Performance

During the week, I&M Group released their FY’2023 Financial Results. Below is a summary of their FY’2023 performance:

|

Balance Sheet Items |

FY'2022 |

FY'2023 |

y/y change |

|

Government Securities |

68.1 |

78.1 |

14.7% |

|

Net Loans and Advances |

238.6 |

311.3 |

30.5% |

|

Total Assets |

437.3 |

579.7 |

32.6% |

|

Customer Deposits |

312.3 |

416.7 |

33.4% |

|

Total Liabilities |

355.7 |

484.0 |

36.1% |

|

Shareholders’ Funds |

76.5 |

88.2 |

15.2% |

|

Balance Sheet Ratios |

FY'2022 |

FY'2023 |

% points change |

|

Loan to Deposit Ratio |

76.4% |

74.7% |

(1.7%) |

|

Government Securities to Deposit Ratio |

21.8% |

18.7% |

(3.1%) |

|

Return on average equity |

14.4% |

15.0% |

0.7% |

|

Return on average assets |

2.6% |

2.6% |

(0.0%) |

|

Dividend Yield |

12.5% |

11.6% |

(0.9%) |

|

Dividend Payout Ratio |

32.1% |

31.6% |

(0.5%) |

|

Income Statement |

FY'2022 |

FY'2023 |

y/y change |

|

Net Interest Income |

22.9 |

28.6 |

24.8% |

|

Net non-Interest Income |

12.7 |

14.1 |

10.4% |

|

Total Operating income |

35.7 |

42.7 |

19.7% |

|

Loan Loss provision |

(5.2) |

(6.9) |

31.0% |

|

Total Operating expenses |

(21.3) |

(27.2) |

27.5% |

|

Profit before tax |

15.0 |

16.7 |

11.3% |

|

Profit after tax |

11.6 |

13.3 |

15.2% |

|

Core EPS |

7.0 |

8.1 |

15.2% |

|

Income Statement Ratios |

FY'2022 |

FY'2023 |

% points change |

|

Yield from interest-earning assets |

11.0% |

13.0% |

2.0% |

|

Cost of funding |

4.2% |

5.4% |

1.2% |

|

Net Interest Margin |

6.7% |

7.4% |

0.6% |

|

Net Interest Income as % of operating income |

64.3% |

67.1% |

2.8% |

|

Non-Funded Income as a % of operating income |

35.7% |

32.9% |

(2.8%) |

|

Cost to Income Ratio |

59.8% |

63.7% |

3.9% |

|

CIR without LLP |

45.1% |

47.6% |

2.5% |

|

Cost to Assets |

3.7% |

3.5% |

(0.2%) |

|

Capital Adequacy Ratios |

FY'2022 |

FY'2023 |

% points change |

|

Core Capital/Total Liabilities |

22.6% |

19.2% |

(3.4%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

14.6% |

11.2% |

(3.4%) |

|

Core Capital/Total Risk Weighted Assets |

16.3% |

14.5% |

(1.8%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

5.8% |

4.0% |

(1.8%) |

|

Total Capital/Total Risk Weighted Assets |

20.5% |

18.9% |

(1.6%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

6.0% |

4.4% |

(1.6%) |

|

Liquidity Ratio |

46.1% |

44.7% |

(1.4%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

26.1% |

24.7% |

(1.4%) |

Key take-outs