Investment Options for Your Pension Upon Retirement, & Cytonn Weekly #34/2019

By Research Team, Aug 25, 2019

Executive Summary

Fixed Income

T-bills were undersubscribed during the week, with the overall subscription rate declining to 71.6%, from 86.8% recorded the previous week. During the week, the National Treasury released the budgetary review for the fourth quarter of the 2018/2019 financial year highlighting a 9.2% increase in revenue collection and a 12.9% increase in total expenditure. We are projecting the Y/Y inflation rate for the month of August to decline to a range of 5.7%-6.1%, compared to 6.3% recorded in July, driven by a decline in food and non-alcoholic beverages index as well as the transport index. For the month of September, the government is set to re-open two 15-year bonds (FXD 1/2018/15) and (FXD 2/2019/15) for a total of Kshs 50.0 bn for budgetary support;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 1.0%, 2.5% and 1.2%, respectively, taking their YTD performance to gains/losses of 6.6%, (12.6%) and 0.1%, for NASI, NSE 20 and NSE 25, respectively. The Institute of Certified Public Accountants of Kenya (ICPAK) issued a proposal to the National Assembly Finance Committee pushing for a two-year extension of the rate cap law arguing that its full benefits are yet to be realized. Diamond Trust Bank, NIC Group and Co-operative Bank released their H1’2019 results, recording core EPS growths of 11.0%, 8.6% and 4.6%, respectively;

Private Equity

Tala, a California-based FinTech company with operations in Kenya, has raised Kshs 11.4 bn (USD 110.0 mn) in a Series D financing round (the fourth round of capital injection from external investors) led by RPS Ventures, a California based venture capital firm. Tala will use the capital raised to expand operations in the markets it currently operates in and enter the Indian market after running a successful pilot programme;

Real Estate

During the week, the Central Bank of Kenya (CBK) gazetted the Mortgage Refinancing Companies’ (MRC) Regulations paving the way for licensing of the Kenya Mortgage Refinancing Company (KMRC). In the hospitality sector, ACME Dream Ltd, a China-based conglomerate firm, announced plans to build a 25-room luxury hotel near the Jomo Kenyatta International Airport (JKIA), while Diani Reef Beach Resort announced plans to construct an additional 114 rooms to increase its capacity to 257 rooms;

Focus of the Week

You have been saving and investing for decades during your working years to have a comfortable retirement, and to be able to enjoy your golden years. Thus at retirement, your accumulated retirement benefits might be your single biggest asset. What you end up doing with these benefits is one of the most crucial financial decisions of your life, as the choice that you make will determine your lifestyle during retirement. Our focus this week seeks to shed more light on the options available at retirement, and the suitability of these options.

- Following the licensing of our regulated affiliate, Cytonn Asset Managers Limited, we are transitioning to an agency model and are looking for agents for our regional markets – Kisumu, Nakuru, Mt. Kenya and Mombasa, if you have an existing financial services sales business and interested in being an agent in any of these regions, please email us at ifa@cytonn.com;

- Cytonn Money Market Fund closed the week at an average yield of 11.0% p.a. To subscribe, just dial *809#;

- Wacu Mbugua, a Research Analyst at Cytonn was on NTV to discuss the property market in Kenya. Watch Wacu here;

- Cytonn Asset Managers Limited (CAML) held a training for Sacco officials, with the theme of the training being revenue diversification. Read the event note here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved over 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tour and for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.com to reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

T-bills were undersubscribed during the week, with the overall subscription rate decreasing to 71.6%, from 86.8% recorded the previous week. The yield on the 91-day and 364-day papers remained unchanged at 6.4% and 9.2%, respectively, while the yield on the 182-day paper fell by 0.1% points to 7.0% from 7.1% recorded the previous week. The acceptance rate for all treasury bills bid decreased to 89.2%, from 99.6% the previous week, with the government accepting Kshs 15.3 bn of the Kshs 17.2 bn worth of bids received, lower than the weekly quantum of Kshs 24.0 bn. The 91-day paper recorded improved subscription to 129.5%, from 68.8% recorded the previous week, while the 182-day and 364-day papers recorded a downturn in subscription to 12.3% and 107.9% from 29.4% and 151.5% recorded the previous week, respectively.

For the month of September, the Government is set to re-open two 15-year bonds, (FXD 1/2018/15) and (FXD 2/2019/15) for a total of Kshs 50.0 bn for budgetary support. The Government has issued the two medium-tenor bonds, in a bid to plug in the budget deficit, while at the same time trying to reduce the maturity risk profile of government debt. We expect the bonds to be oversubscribed as per recent trends, mainly driven by the perception that risks may not be adequately priced on the longer end of the yield curve, which is relatively flat due to saturation of long-term bonds, which has resulted in a lot of interest in the short and medium term bonds. We will give our bidding range in next week’s report.

In the money markets, 3-month bank placements remained unchanged, ending the week at 8.6% (based on what we have been offered by various banks). The 91-day T-bill was also unchanged, ending the week at 6.4%, while the average of Top 5 Money Market Funds came in at 9.5% compared to 9.6% last week, with the Cytonn Money Market Fund closing the week at 11.0%, compared to 11.1% last week.

The table below is an extract showing the growth of money market funds of the fund managers who have released their H1’2019 results so far;

|

No. |

Fund Managers |

H1'2018 Money Market Fund(Kshs mn) |

FY’2018 Money Market Fund (Kshs mn) |

H1'2019 Money Market Fund(Kshs mn) |

Annualized H1'2019 growth |

|

1 |

Cytonn Money Market Fund |

19.7 |

62.8 |

306.9 |

777.4% |

|

2 |

Commercial Bank of Africa |

4,238.3 |

4,946.9 |

5,837.0 |

36.0% |

|

3 |

CIC Asset Managers |

15,204.9 |

19,756.7 |

23,279.2 |

35.7% |

|

4 |

ICEA Lion |

5,253.8 |

5,916.3 |

6,438.6 |

17.7% |

|

5 |

British American Asset |

5,267.8 |

5,871.1 |

6,303.6 |

14.7% |

|

6 |

Stanlib Kenya |

2,267.9 |

2,141.0 |

1,890.1 |

(23.4%) |

|

7 |

Alpha Africa |

- |

- |

30.5 |

- |

|

Total |

32,252.4 |

38,694.8 |

44,055.4 |

32.7% |

Liquidity:

Liquidity in the market improved during the week, with the average interbank rate dropping to 3.3% from 3.6% recorded the previous week supported by government payments, which partly offset tax payments. Commercial banks’ excess reserves stood at Kshs 8.3 bn in relation to the 5.25% cash reserves requirement (CRR). The average volumes traded in the interbank market rose by 88.5% to Kshs 16.1 bn from Kshs 8.5 bn the previous week.

Kenya Eurobonds:

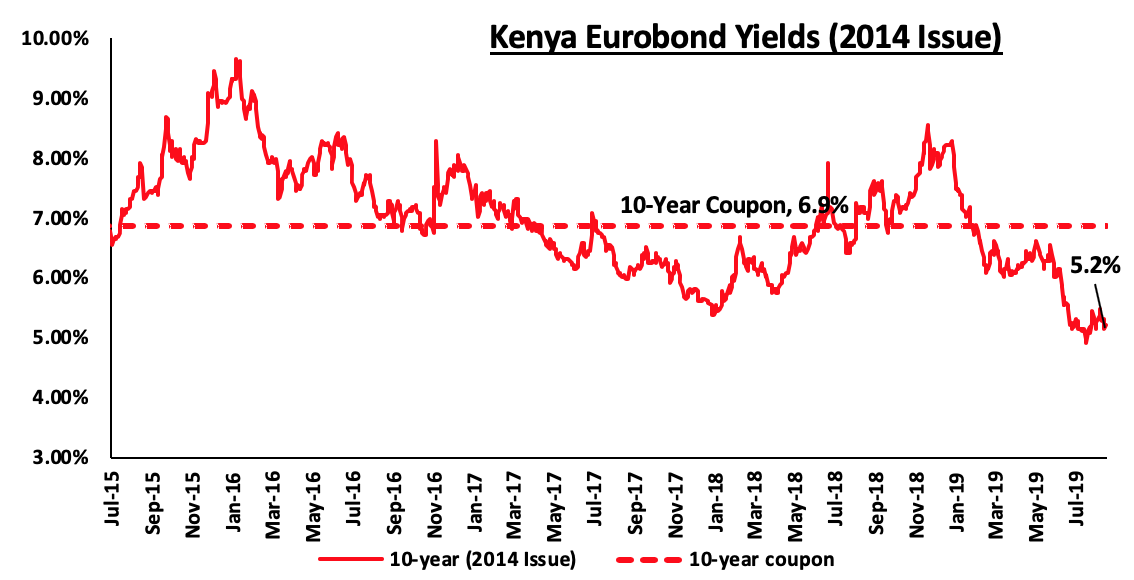

The yield on the 10-year Eurobond issued in 2014 fell by 0.1% points to 5.2%, from 5.3% recorded the previous week. The continued decline in yields has been attributed to increased demand for emerging market fixed-income securities in the wake of the pause by the US Fed on its three-year cycle of tightening its monetary policy, which had made returns from fixed income securities more attractive as highlighted in our H1'2019 SSA Eurobond Performance Note.

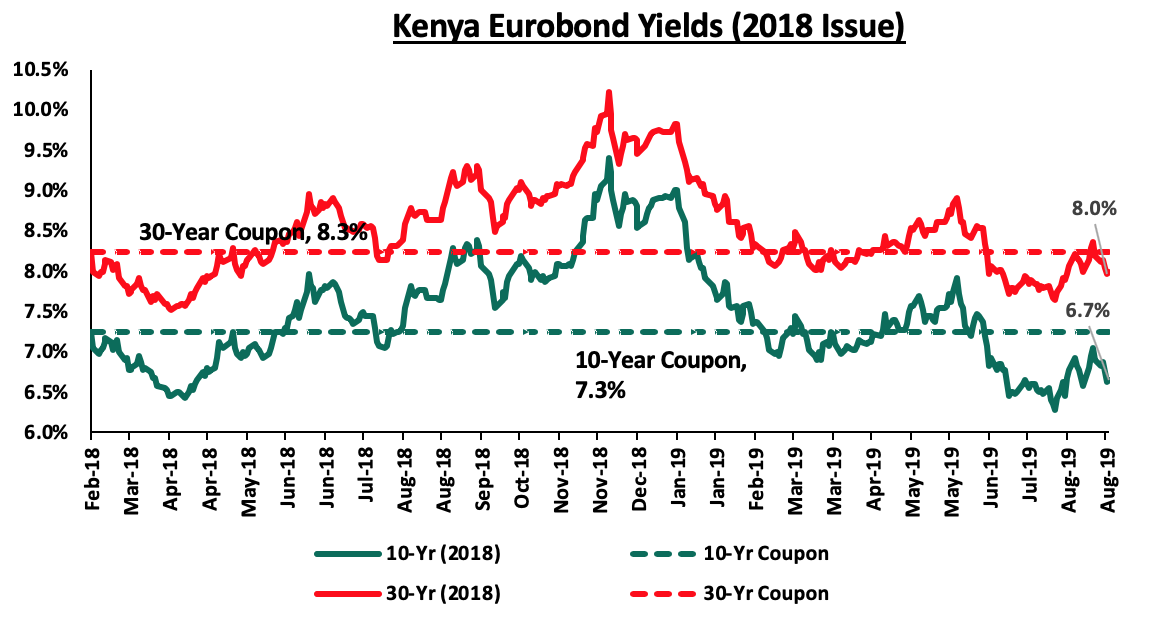

For the February 2018 Eurobond issue, yields on both the 10-year Eurobond and the 30-year Eurobond dropped by 0.2% points to 6.7% and 8.0%, from 6.9% and 8.2% recorded the previous week, respectively.

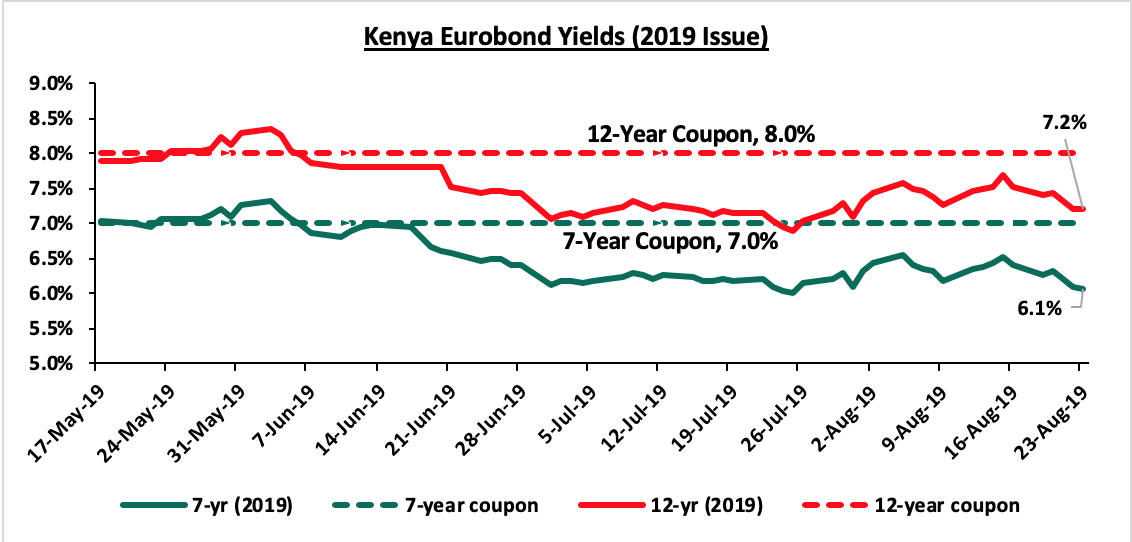

For the newly issued dual-tranche Eurobond with 7-years and 12-years tenor, priced at 7.0% for the 7-year tenor and 8.0% for the 12-year tenor, respectively, the yields on both the 7-year bond and the 12-year bond dropped by 0.3% points to 6.1% and 7.2% from 6.4% and 7.5% recorded the previous week, respectively.

The Kenya Shilling:

During the week, the Kenya Shilling appreciated marginally against the US Dollar to close at Kshs 103.1, from Kshs 103.3 recorded the previous week, supported by inflows from diaspora remittances and portfolio investors buying government debt amid dollar demand from merchandise importers. The Kenya Shilling has depreciated by 1.2% year to date, in comparison to the 1.3% appreciation in 2018. Despite the recent depreciation, we still expect the shilling to remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that the current account deficit narrowed to 4.2% of GDP in the 12-months to June 2019, from 5.4% recorded in June 2018. The decline has been attributed to the resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food,

- Improving diaspora remittances, which have increased cumulatively by 13.6% in the 12-months to June 2019 to USD 2.8 bn, from USD 2.4 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.4 bn (equivalent to 5.9-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlights

The National Treasury released the budgetary review for the 2018/2019 financial year. Below are the key take-outs:

Amounts in Kshs bns unless stated otherwise

|

Q4’ FY 2018/2019 Budget Outturn |

|||||

|

Item |

FY'2017/2018 |

FY'2018/2019 |

|||

|

Collected/Spent |

Collected/Spent |

Target |

% met |

Change y/y |

|

|

Total revenue |

1,522.4 |

1,671.1 |

1,794.3 |

93.1% |

9.8% |

|

External grants |

26.5 |

19.7 |

34.7 |

56.7% |

-25.6% |

|

Total revenue & external grants |

1,548.9 |

1,690.8 |

1,829.0 |

92.4% |

9.2% |

|

Recurrent expenditure |

1,349.7 |

1,496.2 |

1,574.1 |

95.1% |

10.9% |

|

Development expenditure & Net Lending |

469.7 |

542.0 |

598.1 |

90.6% |

15.4% |

|

County Governments + Contingencies |

327.3 |

367.7 |

369.7 |

99.5% |

12.4% |

|

Total expenditure |

2,146.7 |

2,405.9 |

2,541.9 |

94.7% |

12.1% |

|

Fiscal deficit excluding grants |

(597.7) |

(715.2) |

(712.8) |

|

19.6% |

|

Deficit(excluding grants) as % of GDP |

7.0% |

7.5% |

7.5% |

|

|

|

Net foreign borrowing |

355.0 |

414.5 |

391.2 |

106.0% |

16.8% |

|

Net domestic borrowing |

273.7 |

303.7 |

255.4 |

118.9% |

10.9% |

|

Other domestic financing |

2.6 |

2.9 |

3.9 |

73.3% |

9.7% |

|

Total borrowing |

631.3 |

721.1 |

650.5 |

110.8% |

14.2% |

|

GDP Estimate |

8,524.7 |

9,510.4 |

9,510.4 |

|

|

- Revenue collection: Total revenue collected in FY’2018/2019 amounted to Kshs 1.7 tn, a 9.2% increase from Kshs 1.5 tn collected during the same period the previous year, meeting 93.1% of the budgetary target for the year of Kshs 1.8 tn. Ordinary revenue collection from taxes excluding Appropriation in Aid was at Kshs 1.5 tn a 9.7% increase from Kshs 1.4 tn collected in FY’2017/2018, against a target of Kshs 1.6 tn, thus the Kenya Revenue Authority managed to meet 94.3% of the set target as per the budget, equivalent to 17.9% of GDP,

- Expenditure: Total expenditure amounted to Kshs 2.4 tn, a 12.1% increase from Kshs 2.1 tn recorded the same period last year. This was 94.7% of the Kshs 2.5 tn target, with a significant share of the expenditure being on recurrent expenditure, which accounted for 62.2% of total expenditure, a slight decline from 62.9% in FY’2017/2018. Development expenditure only accounted for 22.5%. Total expenditure was, however, 6.3% lower than the targeted expenditure as per the budget, an indication that the austerity measures undertaken by the government were taking effect. The lower expenditure was mainly attributed to lower expenditure recorded in operation and maintenance, pension and wages and salaries expenditures, which came in at Kshs 590.9 bn, Kshs 70.8 bn, and Kshs 417.5 bn, respectively, against target expenditures of Kshs 647.4 bn, Kshs 84.8 and Kshs 428.0 bn, respectively.

We are of the view that revenue mobilization still remains a concern, with the government having managed to meet 93.1% of its target, although it was an improvement from the 91.7% recorded in FY’2017/2018. The key concern, however, remains on the expenditure side, which has continued to grow faster recording a 12.1% growth, compared to the 9.8% growth in revenue collection. This has led to widening of the fiscal deficit to Kshs 715.2 bn, 7.5% of GDP from Kshs 597.7 bn, 7.0% of GDP in FY’2017/2018. This in effect has led to increased total government borrowing, both foreign and domestic to plug in the deficit, with domestic borrowing having increased by 10.9% to Kshs 303.7 bn from Kshs 273.7 bn in FY’2017/2018, while foreign borrowing has increased by 16.8% to Kshs 414.5 bn, from Kshs 355.0 bn in FY’2017/2018. In the Budget Statement for the fiscal year 2019/20, of interest were the various measures put in place to improve revenue collection, with the Government having an ambitious target of Kshs 2.1 tn from Kshs 1.9 tn as per the revised FY’2018/2019 revised Budget. In order to achieve this, the CS of the National Treasury highlighted the following changes and proposals through which the government will widen the tax net in order to increase revenue collection, and consequently mitigate the rise in the fiscal deficit;

- Increase in capital gains tax rate (CGT) - The CS increased capital gains tax charged on property transfer from 5.0% to 12.5%. CGT, the tax chargeable on the entire gain accruing to a company or an individual upon the transfer of property situated in Kenya, was re-introduced in 2015 after being suspended in 1985. Transfer of property necessitated by the restructuring of corporate entities will, however, be exempt from this tax to allow for the seamless restructuring of corporate entities with the aim of increasing efficiency and market penetration. We expect the increased CGT rate to result in increased government revenue collection from the real estate sector,

- Re-introduction of the turnover tax- The CS re-introduced the turnover tax at the rate of 3.0% on the gross turnover accounted for every month, which will affect taxpayers whose business income does not exceed Kshs 5.0 mn per annum. The turnover tax will apply in addition to the presumptive tax that was introduced through the Finance Act 2018. We, however, do not expect the turnover tax to lead to increased revenues owing to non-compliance by the largely informal sector, which had initially led to it being scrapped off as the target (informal sector), proved hard to police, coupled with high administrative costs and capacity constraints,

- Withholding Tax- In a bid to expand the tax base and increase revenue collection, the CS proposed to add the following services, for the purposes of withholding tax, as part of professional services. They include; security services, cleaning and fumigation, catering services offered outside hotel premises, transportation of goods excluding air transport services, and sales, promotion, marketing, and advertising. We expect that through this initiative, the government will enhance tax compliance by widening the tax net. However, this will be accompanied by a subsequent increase in administrative burdens to be incurred in the collection and remittance of the withholding tax,

- Introduction of excise duty on betting activities- the CS proposed the introduction of excise duty on betting activities charged at 10.0% of the amount wagered. This measure aims to curb the negative social effects brought about by betting in the country, and

- Increased excise duty on cigarettes, wines, and spirits- the CS proposed to increase the excise duty rates on cigarettes, wines, and spirits by 15.0% in addition to the inflationary increase, effective as from 1st July 2019. This increase in the excise duty rate on cigarettes, wines, and spirits, is on account of a decline in the excise duty revenue over the years.

We still expect the Government to find it difficult to meet its ambitious revenue target of Kshs 2.1 tn for the current fiscal year, which is 10.5% higher than the previous fiscal year revenue target of Kshs 1.9 tn. This has also seen the Government adjusting its domestic borrowing target for the FY’2019/2020 upwards by 5.9% to Kshs 300.3 bn from the initial Kshs 283.5 bn, through a gazette notice during the week, which we deduce might be in anticipation of a shortfall in tax receipts during the year.

Inflation Projections:

We are projecting the Y/Y inflation rate for the month of August to come in within the range of 5.7% - 6.1%, compared to 6.3% recorded in July. The Y/Y inflation for the month of August is expected to decline due to:

- A decline in the food and non-alcoholic beverages index, which has a weighting of 36.0%, mainly driven by a decline recorded in food prices such as tomatoes and potatoes with the prices of maize flour, which is a key commodity remaining unchanged during the month,

- A decline in the transport index following the 2.5% and 3.2% declines in petrol and diesel prices, respectively during the month,

- We however expect a rise in the housing, water, electricity, gas and other fuels during the month owing to the 1.9% rise in kerosene prices.

Going forward, we expect the inflation rate to remain within the Government set range of 2.5% - 7.5%.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 1.0%, 2.5% and 1.2%, respectively, taking their YTD performance to gains/losses of 6.6%, (12.6%) and 0.1%, for NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by declines in Co-operative Bank, Bamburi Cement, Safaricom PLC and Standard Chartered Bank, which fell by 3.8%, 2.8%, 2.4% and 1.4%, respectively.

Equities turnover increased by 14.4% during the week to USD 29.5 mn, from USD 25.8 mn the previous week, taking the YTD turnover to USD 945.4 mn. Foreign investors remained net buyers for the week, with a net buying position of USD 11.6 mn, from USD 22,762.3 the previous week.

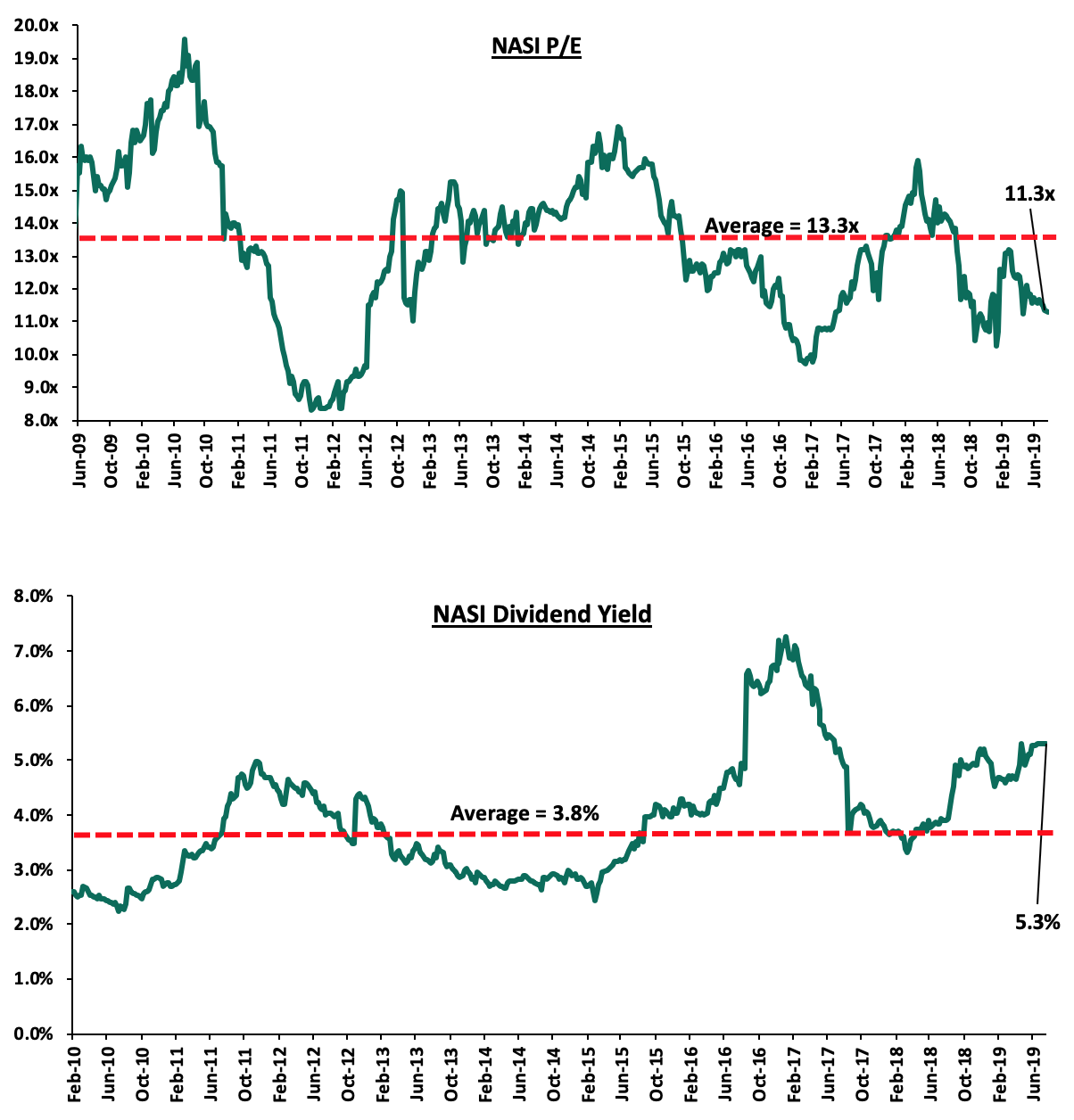

The market is currently trading at a price to earnings ratio (P/E) of 11.3x, 15.0% below the historical average of 13.3x, and a dividend yield of 5.3%, 1.5% points above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.3x is 16.5% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 36.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

During the week, the Institute of Certified Public Accountants of Kenya (ICPAK) issued a proposal to the National Assembly Finance Committee during public hearings on the Finance Bill pushing for a two-year extension of the rate cap law arguing that its full benefits are yet to be realized. The ICPAK public tax committee chairman, Mr. Phillip Mwema, noted that the rate cap law had instilled discipline among borrowers, without affecting the operations of banks and the banking industry at large, which continues to be profitable. On the contrary, a section of the National Assembly Finance Committee rallies behind the proposal by the Treasury and the Kenya Bankers Association (KBA), to have the rate cap law reviewed in order to allow banks to price loans based on the risk profile of borrowers, and as a result, boost private sector lending whose growth has remained below 5.0% in the regime of capped interest, with banks unable to price a majority of Micro, Small and Medium Enterprises within the set margins.

There is a proposal in the Finance Bill 2019 to make the following amendments to Section 33B of the Banking Act:

- A bank or a financial institution shall set the maximum interest chargeable for a loan facility in Kenya at no more than four percentage points per annum above the Central Bank Rate of Kenya,

- When a bank or financial institution issues a credit facility to a micro and small enterprise, or an unsecured individual member of the public, the bank or financial institution may set an interest rate at no more than six percentage points per annum above the four percentage points set under subsection (i), and

- A person shall not enter into an agreement or arrangement to borrow or lend directly or indirectly at an interest rate in excess of that prescribed by law.

Given the strong resistance by MPs against attempts to repeal the rate cap law in the Finance Bill 2018, we are not overly optimistic about a possible reversion of the law. However, we expect a possible review in the form of a change in the benchmark from the Central Bank Rate (CBR), and an increase in the margin. We continue to advocate for a repeal or at least a significant review of the Banking (Amendment) Act, 2015, given the current regulatory framework has hampered credit growth, evidenced by the continued decline of private sector credit growth, which came in at 5.2% as at June 2019, below the 5-year average of 11.2%.

Earnings Releases

Diamond Trust Bank H1’2019 results

Diamond Trust Bank released their H1’2019 financial results, recording an 11.0% growth in core earnings per share to Kshs 13.9 from Kshs 12.5 in H1’2018, higher than our expectation of a 6.3% increase to Kshs 13.3. Performance was driven by cost-cutting measures and efficiency evidenced by a 14.4% decrease in total operating expenses to Kshs 6.2 bn from Kshs 7.3 bn, which outpaced the decline in total revenue that fell 4.0% to Kshs 12.2 bn from Kshs 12.7 bn. Highlights of the performance from H1’2018 to H1’2019 include:

- Total operating income decreased by 4.0% to Kshs 12.2 bn, from Kshs 12.7 bn in H1’2018. This was due to a 7.5% decrease in Net Interest Income (NII) to Kshs 9.2 bn from Kshs 9.9 bn in H1’2018, despite the 8.5% growth in Non-Funded Income (NFI) to Kshs 3.0 bn, from Kshs 2.7 bn in H1’2018,

- Interest income decreased by 6.6% to Kshs 16.3 bn from Kshs 17.5 bn in H1’2018. The interest income on loans and advances decreased by 10.4% to Kshs 9.9 bn from Kshs 11.1 bn in H1’2018. Interest income on government securities decreased by 0.6% to Kshs 6.27 bn in H1’2019, from Kshs 6.31 bn in H1’2018. The yield on interest earning assets declined to 10.3% in H1’2019, from 11.1% in H1’2018, due to declining yields on government securities, and lower interest on loans due to a relatively lower Central Bank Rate (CBR) currently at 9.0%,

- Interest expense decreased by 5.5% to Kshs 7.2 bn from Kshs 7.6 bn in H1’2018, as interest expense on customer deposits decreased by 11.4% to Kshs 6.1 bn, from Kshs 6.8 bn in H1’2018. Interest expense on deposits from other banking institutions increased by 6.1% to Kshs 394.6 mn, from Kshs 371.9 mn in H1’2018. The cost of funds decreased to 4.8% from 5.0% in H1’2018. The Net Interest Margin declined to 5.8% from 6.3% in H1’2018,

- Non-Funded Income increased by 8.5% to Kshs 3.0 bn, from Kshs 2.7 bn in H1’2018. The increase in NFI was driven by a 59.1% increase in other income to Kshs 0.3 bn from Kshs 0.2 bn in H1’2018, coupled with a 25.3% increase in forex trading income to Kshs 1.0 bn from Kshs 0.8 bn in H1’2018. Fees and commissions on loans decreased by 15.6% to Kshs 0.6 bn from Kshs 0.7 bn in H1’2018, while other fees rose marginally by 2.1% to Kshs 1.1 bn from Kshs 1.0 bn in H1’2018. The revenue mix shifted to 76:24 funded to non-funded income in H1’2019, from 78:22 in H1’2018, owing to the increase in NFI coupled with the decrease in NII,

- Total operating expenses decreased by 14.4% to Kshs 6.2 bn from Kshs 7.3 bn, largely driven by a 68.1% decrease in loan loss provision (LLP) to Kshs 0.5 bn in H1’2019, from Kshs 1.7 bn in H1’2018. However, staff costs increased by 6.2% to Kshs 2.2 bn in H1’2019, from Kshs 2.1 bn in H1’2018. Other operating expenses declined by 1.1% to Kshs 3.47 bn from Kshs 3.51 bn in H1’2018,

- The cost to income ratio improved to 51.2%, from 57.4% in H1’2018. Without LLP, however, the cost to income ratio deteriorated to 46.8% from 44.2% in H1’2018,

- Profit before tax increased by 10.2% to Kshs 6.0 bn, up from Kshs 5.4 bn in H1’2018. Profit after tax increased by 10.0% to Kshs 4.1 bn in H1’2019, from Kshs 3.8 bn in H1’2018, as the effective tax rate increased slightly to 30.6%, from 30.5% in H1’2018.

Balance Sheet:

- The balance sheet recorded a marginal decrease with total assets coming in at Kshs 375.9 bn from Kshs 376.1 bn in H1’2018. This decrease was largely driven by a 14.4% decrease in government securities to Kshs 108.4 bn in H1’2019, from Kshs 126.8 bn in H1’2018,

- The loan book contracted by 3.8% to Kshs 190.8 bn in H1’2019, from Kshs 198.2 bn in H1’2018. Growth was registered in other assets which grew by 59.4% to Kshs 13.4 bn, from Kshs 8.4 bn in H1’2018,

- Total liabilities fell by 2.4% to Kshs 313.4 bn, from Kshs 321.1 bn in H1’2018, driven by a 53.6% decrease in placements to Kshs 8.7 bn, from Kshs 18.7 bn in H1’2018, coupled with a 22.0% decrease in borrowings to Kshs 13.2 bn, from Kshs 16.9 bn in H1’2018,

- Deposits increased by 0.5% to Kshs 283.1 bn from Kshs 281.8 in H1’2018. Deposits per branch increased by 5.1% to Kshs 2.2 bn from Kshs 2.1 bn in H1’2018, with the branches decreasing to 131 in H1’2019 from 137 in H1’2018,

- The faster growth in deposits compared to the loan growth led to a decline in the loan to deposit ratio to 67.4% from 70.4% in H1’2018,

- Gross non-performing loans decreased by 1.0% to Kshs 15.1 bn in H1’2019, from Kshs 15.3 bn in H1’2018. However, the NPL ratio deteriorated to 7.6% in H1’2019, from 7.3% in H1’2018, owing to the faster decline in loans, which contracted by 3.8%. General loan loss provisions decreased by 36.7% to Kshs 5.4 bn, from Kshs 8.5 bn in H1’2018. The NPL coverage thus decreased to 50.3% in H1’2019, from 70.7% in H1’2018 due to the decrease in general loan loss provisions,

- Shareholders’ funds increased by 13.9% to Kshs 56.9 bn in H1’2019, from Kshs 50.0 bn in H1’2018,

- DTB Kenya Limited is currently sufficiently capitalized with a core capital to risk weighted assets ratio of 18.9%, 8.4% above the statutory requirement. In addition, the total capital to risk weighted assets ratio was 21.1%, exceeding the statutory requirement by 6.6%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 19.6%, while total capital to risk weighted assets came in at 21.8%, indicating that the bank’s total capital relative to its risk-weighted assets decreased by 0.7% due to the impact of IFRS 9,

- DTB currently has a return on average assets of 2.0% and a return on average equity of 13.9%.

Key Take-Outs:

- The bank recorded a relatively weaker earnings performance with total operating income declining by 4.0%. This was largely due to the depressed performance of funded income, with the bank recording declining interest income on loans and advances and government securities. The expansion from the bottom line was largely due to a faster decline in total operating expenses, which was largely derived from the steep 68.1% decline in Loan Loss Provisions (LLP).

- The bank recorded an improved performance on the NFI income segment, which recorded an 8.5% growth y/y, largely supported by the 59.1% growth in other income, coupled with the 25.3% growth in forex trading income. Consequently, NFI contribution to total income rose to 24.5% from 22.6% in H1’2019. This however remains below the current industry average of 36.8%.

For more information, please see our Diamond Trust Bank Earnings Note.

NIC Group H1’2019 results

NIC Group released their H1’2019 financial results, recording an 8.6% growth in core earnings per share, driven by a 12.5% increase in operating income to Kshs 8.2 bn from Kshs 7.3 bn, despite the 18.0% increase in operating expenses to Kshs 5.2 bn from Kshs 4.4 bn. Highlights of the performance from H1’2018 to H1’2019 include:

- Total operating income increased by 12.5% to Kshs 8.2 bn in H1’2019 from Kshs 7.3 bn in H1’2018. This was driven by a 7.7% increase in Net Interest Income (NII) to Kshs 5.5 bn from Kshs 5.1 bn in H1’2018, coupled with a 23.9% increase in Non-Funded Income (NFI) to Kshs 2.7 bn from Kshs 2.1 bn in H1’2018,

- Interest income increased marginally to Kshs 9.7 bn from Kshs 9.6 bn in H1’2018. Interest income on government securities increased by 3.8% to Kshs 3.4 bn in H1’2019 from Kshs 3.3 bn in H1’2018. The yield on interest earning assets however declined to 10.8% in H1’2019 from 10.9% in H1’2018, due to declining yields on government securities, and lower interest on loans due to a relatively lower Central Bank Rate (CBR) currently at 9.0%,

- Interest expense decreased by 7.0% to Kshs 4.1 bn from Kshs 4.4 bn in H1’2018, as interest expense on customer deposits decreased by 8.7% to Kshs 3.3 bn from Kshs 3.7 bn in H1’2018. The cost of funds fell to 5.1% from 5.4% in H1’2018. The Net Interest Margin remained at 6.0%,

- Non-Funded Income increased by 23.9% to Kshs 2.7 bn from Kshs 2.1 bn in H1’2018. The increase in NFI was driven by a 29.3% increase in Fees and commissions to Kshs 0.8 bn from Kshs 0.6 bn in H1’2018, coupled with a 67.8% increase in other income to Kshs 0.6 bn from Kshs 0.4 bn in H1’2018. Forex trading income also rose by 7.6% to Kshs 735.0 mn from Kshs 683.0 mn in H1’2018. The revenue mix shifted to 67:33 funded to non-funded income from 70:30 in H1’2018, owing to the increase in NFI coupled with the decline in NII,

- Total operating expenses increased by 18.0% to Kshs 5.2 bn from Kshs 4.4 bn, largely driven by a 29.6% increase in loan loss provision (LLP) to Kshs 1.4 bn in H1’2019 from Kshs 1.1 bn in H1’2018. Staff costs also increased by 9.1% to Kshs 1.9 bn in H1’2019 from Kshs 1.7 bn in H1’2018,

- The cost to income ratio deteriorated to 63.9% from 60.9% in H1’2018. Without LLP, the cost to income ratio also deteriorated to 46.3% from 45.6% in H1’2018,

- NIC Group incurred an exceptional item of Kshs 255.2 mn following the integration, advisory and legal expenses related to the merger with CBA,

- Profit before tax and exceptional items increased by 4.0% to Kshs 3.0 bn from Kshs 2.8 bn in H1’2018. Profit after tax declined by 4.2% to Kshs 1.9 bn in H1’2019 from Kshs 2.0 bn in H1’2018,

- The bank declared an Interim dividend of Kshs. 0.25 per share, which will be paid in October 2019. Assuming a final dividend payout of Kshs 1.25, the dividend yield translates to 4.4% at the current price of Kshs 28.4.

Balance Sheet

- The balance sheet recorded an expansion with total assets growth of 6.6% to Kshs 214.1 bn from Kshs 201.0 bn in H1’2018. This growth was largely driven by an 8.1% increase in government securities to Kshs. 60.3 bn from Kshs. 55.7 bn in H1’2018,

- The loan book expanded by 3.1% to Kshs 118.5 bn in H1’2019 from Kshs 115.0 bn in H1’2018,

- Total liabilities rose by 4.6% to Kshs 176.4 bn from Kshs 168.7 bn in H1’2018, driven by a 3.5% increase in customer deposits to Kshs 152.3 bn from Kshs 147.1 bn in H1’2018. Deposits per branch increased by 6.1% to Kshs 3.7 bn from Kshs 3.6 bn in H1’2018, with the branches decreasing to 41 in H1’2019 from 42 in H1’2018,

- The faster growth in deposits compared to the growth in loans led to a slight decline in the loan to deposit ratio to 77.8% from 78.2% in H1’2018,

- Gross non-performing loans increased by 12.3% to Kshs 18.1 bn in H1’2019 from Kshs 16.2 bn in H1’2018. Consequently, the NPL ratio deteriorated to 14.3% in H1’2019 from 13.1% in H1’2018. General Loan loss provisions decreased by 25.0% to Kshs 5.1 bn from Kshs 6.8 bn in H1’2018. Consequently, the NPL coverage deteriorated to 44.5% in H1’2018 from 52.2% in H1’2018,

- Shareholders’ funds increased significantly by 17.7% to Kshs 37.4 bn in H1’2019 from Kshs 31.8 bn in H1’2018, mainly driven by a 17.1% increase in retained earnings to Kshs 30.9 bn from Kshs 26.4 bn reported in H1’2018,

- NIC Group is currently sufficiently capitalized with a core capital to risk weighted assets ratio of 20.4%, 9.9% above the statutory requirement. In addition, the total capital to risk weighted assets ratio was 21.9%, exceeding the statutory requirement by 7.4%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 19.4%, while total capital to risk weighted assets came in at 20.8%,

- NIC Group currently has a return on average assets of 2.1% and a return on average equity of 12.0%.

Key Take-Outs:

- NIC Group’s non-funded income increased by 23.9% for the period ending 30th June 2019. This shows improved diversification with the bank improving its alternative sources of income, but assuming the change is sustainable, which is too early to tell. This led to an increment in the bank’s NFI contribution to total income to 32.5%, which is still lower than the industry average of 36.8%,

- The bank’s NPL Ratio declined to 14.3% as the gross non-performing loans increased by 12.3%, outpacing loan growth of 3.1%. Despite this, the bank’s provisions also decreased by 25.0%. This performance in NPL’s shows the continued deterioration in the quality of loans that local banks hold and consequently, the increasing level of risk that that comes with high NPLs,

- The Bank has a relatively low ROA of 2.1% and an ROE of 12.0% in H1’2019 compared to the market average of 17.5%. This was mainly driven by the decline in profits during the period under review.

For more information, please see our NIC Group Earnings Note.

Co-operative Bank H1’2019 Results

Co-operative Bank released their H1’2019 financial results, recording a 4.6% growth in core earnings per share to Kshs 1.1 bn, from Kshs 1.0 bn in H1’2018. The performance was driven by a 5.5% increase in total operating income, which outpaced the 5.2% increase in total operating expenses. Highlights of the performance from H1’2018 to H1’2019 include:

- Total operating income increased by 5.5% to Kshs 23.0 bn from Kshs 21.8 bn in H1’2018, driven by a 25.1% increase in Non-Funded Income to Kshs 8.8 bn from Kshs 7.0 bn in H1’2018, which outweighed the 3.8% decline in Net Interest Income to Kshs 14.3 bn from Kshs 14.8 bn in H1’2018,

- Interest income declined by 1.7% to Kshs 20.4 bn, from Kshs 20.8 bn in H1’2018. This was driven by a 9.1% decline in interest income from loans and advances to Kshs 14.7 bn from Kshs 16.1 bn in H1’2018, which outweighed the 21.7% increase in interest income from government securities to Kshs 5.5 bn from Kshs 4.5 bn in H1’2018. The yield on interest-earning assets thus declined to 11.9%, from 12.2% in H1’2018,

- Interest expense rose by 3.5% to Kshs 6.2 bn, from Kshs 6.0 bn in H1’2018, largely due to a 38.8% rise in other interest expenses to Kshs 794.9 mn from Kshs 572.8 mn. Interest expense on customer deposits however remained flat at Kshs 5.4 bn, while interest expenses on placement liabilities declined by 26.2% to Kshs 21.0 mn, from Kshs 28.4 mn in H1’2018. The cost of funds declined to 3.7%, from 3.9% in H1’2018, owing to an 8.8% increase in interest bearing liabilities to Kshs 346.6 bn, from Kshs 318.6 bn in H1’2018, which grew faster than the 3.5% increase in interest expense. The Net Interest Margin (NIM) declined to 8.4%, from 8.6% in H1’2018, due to the decline in NII despite the rise in the average interest earning assets,

- Non-Funded Income rose by 25.1 % to Kshs 8.8 bn from Kshs 7.0 bn in H1’2018. The increase was mainly driven by the 38.1% increase in total fees and commissions to Kshs 7.1 bn, from Kshs 5.1 bn in H1’2018, which management attributed to increased usage of the firm’s alternative transaction channels. The improvement in NFI was however weighed down by the 22.1% decline in forex trading income to Kshs 1.0 bn from Kshs 1.2 bn in H1’2018. As a consequence, the revenue mix shifted to 62:38, from 68:32 in H1’2018 owing to the fast growth in NFI coupled with the decline in NII,

- Total operating expenses increased by 5.2% to Kshs 12.6 bn, from Kshs 12.0 bn in H1’2018, largely driven by the 8.1% rise in Loan Loss Provisions (LLP) to Kshs 1.2 bn from Kshs 1.1 bn in H1’2018, coupled with the 3.1% increase in other operating expenses to Kshs 5.7 bn, from Kshs 5.5 bn in H1’2018, and the 6.8% increase in staff costs to Kshs 5.7 bn, from Kshs 5.3 bn in H1’2018,

- The Cost to Income Ratio (CIR) improved marginally to 54.8%, from 54.9% in H1’2018. Without LLP, the cost to income ratio also improved to 49.6% from 49.9% in H1’2018,

- Profit before tax increased by 4.6% to Kshs 10.4 bn, up from Kshs 10.0 bn in H1’2018. Profit after tax grew by 4.6% as well to Kshs 7.5 bn in H1’2019, from Kshs 7.1 bn in H1’2018.

Balance Sheet

- The balance sheet recorded an expansion as total assets increased by 7.8% to Kshs 429.6 bn, from Kshs 398.4 bn in H1’2018. Growth was supported by a 14.2% growth in government securities to Kshs 95.0 bn, from Kshs 83.1 bn, coupled with the 2.6% increase in the loan book to Kshs 257.6 bn from Kshs 251.1 bn in H1’2018,

- Total liabilities rose by 8.4% to Kshs 357.2 bn from Kshs 329.6 bn in H1’2018, driven by a 9.0% increase in customer deposits to Kshs 323.6 bn, from Kshs 297.0 bn in H1’2018. Deposits per branch increased by 8.3% to Kshs 2.1 bn from Kshs 1.9 bn in H1’2018, despite the number of branches increasing to 156 from 155 in H1’2018 as deposits grew at a faster rate,

- Borrowings rose by 16.5% to Kshs 21.5 bn from Kshs 18.4 bn in H1’2018,

- The fast 9.0% growth in deposits which outpaced the 2.6% growth in loans, led to a decline in the loan to deposit ratio to 79.6%, from 84.6% in H1’2018,

- Gross Non-Performing Loans (NPLs) increased by 8.3% to Kshs 30.6 bn in H1’2019, from Kshs 28.2 bn in H1’2018. The NPL ratio thus deteriorated to 11.2% in H1’2019, from 10.9% in H1’2018. Management attributed the deterioration in asset quality to players in the manufacturing sector, agriculture, real estate and trade sectors. General Loan Loss Provisions increased by 37.8% to Kshs 10.9 bn, from Kshs 7.9 bn in H1’2018. Thus, the NPL coverage improved to 51.4% in H1’2019 from 31.0% in H1’2018,

- Shareholders’ funds increased by 4.4% to Kshs 71.0 bn in H1’2019 from Kshs 68.0 bn in H1’2018, supported by a 4.8% increase in the retained earnings to Kshs 62.2 bn, from Kshs 59.4 bn in H1’2018,

- Co-operative Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 16.0%, 5.5% points above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio came in at 16.3%, exceeding the statutory requirement of 14.5% by 1.8% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 16.4%, while total capital to risk-weighted assets came in at 16.7%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.2%, and a Return on Average Equity (ROaE) of 18.8%.

Key Take-Outs:

- The bank’s asset quality deteriorated, with the NPL ratio deteriorating to 11.2%, from 10.9% in H1’2018. The main sectors that contributed to the NPLs were trade, personal consumer, manufacturing and real estate, which contributed 33.0%, 19.0%, 14.0% and 11.0% of the NPLs, respectively. We note that the bank has maintained its stringent credit standards, with management noting that they continue to cherry pick loans to issue, in a bid to tame the rising NPL,

- The bank recorded a strong NFI growth y/y, supported by an improvement in the fee and commission income. Transactional income segment recorded an improvement aided by a 4.5% increase in the number of agency banking transactions to 23.0 mn from 22.0 mn in H1’2018, which lead to an 8.7% increase in revenue to 250.0 mn from 230.0 mn. The bank’s mobile banking platform recorded a 26.3% increase in the number of transactions to 24.0 mn from 19.0 mn, and as a consequence, commission income increased by 133.6% to Kshs 1.9 bn, from Kshs 782.0 mn in H1’2018. This led to an increment in the bank’s NFI contribution to total income to 38.0%, which is higher than the industry average of 36.8%.

For more information, please see our Co-operative Bank Earnings Note.

The table below summarizes the performance of listed banks that have released their H1’2019 results:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Stanbic Holdings |

14.4% |

10.5% |

5.2% |

19.5% |

5.1% |

10.1% |

47.8% |

53.2% |

10.3% |

8.1% |

74.4% |

15.0% |

15.3% |

|

Diamond Trust Bank |

11.0% |

(6.6%) |

(5.5%) |

(7.5%) |

5.8% |

8.5% |

24.5% |

(15.6%) |

0.5% |

14.4% |

67.4% |

(3.8%) |

13.9% |

|

Equity Group |

9.1% |

9.2% |

14.3% |

7.6% |

8.5% |

25.6% |

44.0% |

16.1% |

16.5% |

13.0% |

70.0% |

16.7% |

22.1% |

|

NIC Group |

8.6% |

0.9% |

(7.0%) |

7.7% |

6.0% |

23.9% |

32.5% |

29.3% |

3.5% |

8.1% |

77.8% |

3.1% |

12.0% |

|

KCB Group |

5.0% |

4.3% |

1.6% |

5.2% |

8.2% |

14.7% |

34.1% |

3.5% |

7.3% |

20.3% |

85.0% |

13.6% |

22.7% |

|

Co-operative Bank |

4.6% |

(1.7%) |

3.5% |

(3.8%) |

8.4% |

25.1% |

38.0% |

38.1% |

9.0% |

14.2% |

79.6% |

2.6% |

18.8% |

|

H1'2019 Mkt Weighted Average* |

8.8% |

2.8% |

2.0% |

4.8% |

6.0% |

18.0% |

36.8% |

20.8% |

7.9% |

13.0% |

75.7% |

7.9% |

17.5% |

|

H1'2018 Mkt Weighted Average** |

19.0% |

7.9% |

12.0% |

6.4% |

8.1% |

6.9% |

34.3% |

4.6% |

10.0% |

14.9% |

73.8% |

3.8% |

19.5% |

|

*Market cap weighted as at 23/08/2019 |

|||||||||||||

|

**Market cap weighted as at 31/08/2018 |

|||||||||||||

Key takeaways from the table above include:

- The six listed Kenyan banks that have released recorded an 8.8% average increase in core Earnings Per Share (EPS), compared to an increase of 19.0% in H1’2018. Consequently, the Return on Average Equity (RoAE) decreased to 17.5%, from 19.5% in H1’2018,

- The sector recorded weaker deposit growth, which came in at 7.9%, slower than the 10.0% growth recorded in H1’2018. Interest expenses also increased at a slower pace of 2.8%, compared to 7.9% in H1’2018, indicating banks have been able to mobilize relatively cheaper deposits,

- Average loan growth came in at 7.9%, which was faster than the 3.8% recorded in H1’2018, indicating that there was an improvement in credit extension to the economy. Government securities on the other hand recorded a growth of 13.0% y/y, which was faster compared to the loans, but a decline from the 14.9% recorded in H1’2018. This highlights that banks are beginning to adjust their business models back to private sector lending as opposed to investing in government securities, as the yields on government securities declined during the year. Interest income increased by 2.8%, slower than the increase of 7.9% recorded in H1’2018. Consequently, the Net Interest Income (NII) grew by 4.8% compared to a growth of 6.4% in H1’2018,

- The average Net Interest Margin in the banking sector currently stands at 6.0%, down from the 8.1% recorded in H1’2018, despite the Net Interest Income increasing by 4.8% y/y. The decline was mainly due to the 13.8% increase in allocation to relatively lower yielding government securities, coupled with the decline in yields on loans due to the 100 bps decline in the Central Bank Rate (CBR), and,

- Non Funded Income grew by 18.0% y/y, faster than the 6.9% recorded in H1’2018. The growth in NFI was boosted by the total fee and commission income which improved by 20.8%, compared to the 4.6% growth recorded in H1’2018, owing to the faster loan growth.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

Banks |

Price as at 16/08/2019 |

Price as at 23/08/2019 |

w/w change |

YTD Change |

Target Price |

Dividend Yield |

Upside/ Downside |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

119.0 |

118.8 |

(0.2%) |

(24.1%) |

228.4 |

2.2% |

96.1% |

0.6x |

Buy |

|

CRDB |

100.0 |

100.0 |

0.0% |

(33.3%) |

207.7 |

0.0% |

88.8% |

0.3x |

Buy |

|

UBA Bank |

5.6 |

6.0 |

8.1% |

(22.1%) |

10.7 |

14.2% |

86.7% |

0.4x |

Buy |

|

Zenith Bank |

16.6 |

18.6 |

12.0% |

(19.3%) |

33.3 |

14.5% |

82.8% |

0.8x |

Buy |

|

KCB Group *** |

39.8 |

40.0 |

0.5% |

6.8% |

60.4 |

8.8% |

66.7% |

1.1x |

Buy |

|

GCB Bank |

5.0 |

4.5 |

(9.1%) |

(2.2%) |

7.7 |

8.4% |

65.0% |

1.1x |

Buy |

|

I&M Holdings |

49.0 |

46.0 |

(6.1%) |

8.2% |

81.5 |

7.6% |

55.8% |

0.8x |

Buy |

|

Access Bank |

6.1 |

6.7 |

9.9% |

(2.2%) |

9.5 |

6.0% |

52.2% |

0.4x |

Buy |

|

Co-operative Bank |

11.9 |

11.5 |

(3.8%) |

(19.9%) |

17.1 |

8.7% |

50.8% |

1.0x |

Buy |

|

Equity Group *** |

39.2 |

39.9 |

1.7% |

14.3% |

53.7 |

5.0% |

42.8% |

1.7x |

Buy |

|

NIC Group |

28.2 |

28.4 |

0.5% |

2.0% |

42.5 |

4.4% |

42.4% |

0.6x |

Buy |

|

CAL Bank |

1.0 |

1.0 |

(1.0%) |

1.0% |

1.4 |

0.0% |

40.0% |

0.8x |

Buy |

|

Barclays Bank *** |

10.8 |

10.7 |

(0.9%) |

(2.7%) |

12.8 |

10.3% |

32.8% |

1.3x |

Buy |

|

Stanbic Bank Uganda |

28.8 |

28.8 |

(0.2%) |

(7.3%) |

36.3 |

4.1% |

29.1% |

2.0x |

Buy |

|

SBM Holdings |

5.7 |

5.7 |

1.4% |

(3.7%) |

6.6 |

5.2% |

22.8% |

0.8x |

Buy |

|

Guaranty Trust Bank |

26.0 |

27.3 |

5.0% |

(20.8%) |

37.1 |

8.8% |

21.6% |

1.7x |

Buy |

|

Stanbic Holdings |

98.5 |

93.5 |

(5.1%) |

3.0% |

113.6 |

6.3% |

21.0% |

1.0x |

Buy |

|

Ecobank |

8.5 |

7.8 |

(8.3%) |

3.3% |

10.7 |

0.0% |

19.2% |

1.7x |

Accumulate |

|

Union Bank Plc |

6.8 |

7.0 |

2.9% |

25.0% |

8.2 |

0.0% |

16.4% |

0.7x |

Accumulate |

|

Standard Chartered |

197.0 |

194.0 |

(1.5%) |

(0.3%) |

200.6 |

6.4% |

9.6% |

1.4x |

Hold |

|

Bank of Kigali |

274.0 |

273.0 |

(0.4%) |

(9.0%) |

299.9 |

5.1% |

8.5% |

1.5x |

Hold |

|

FBN Holdings |

4.7 |

5.0 |

7.5% |

(37.1%) |

6.6 |

5.0% |

6.2% |

0.3x |

Hold |

|

Bank of Baroda |

128.0 |

130.0 |

1.6% |

(7.1%) |

130.6 |

1.9% |

3.4% |

1.1x |

Lighten |

|

Standard Chartered |

19.0 |

18.1 |

(4.8%) |

(13.9%) |

19.5 |

0.0% |

2.3% |

2.3x |

Lighten |

|

National Bank |

3.8 |

3.8 |

1.3% |

(28.6%) |

3.9 |

0.0% |

(4.8%) |

0.2x |

Sell |

|

Stanbic IBTC Holdings |

32.0 |

35.0 |

9.4% |

(27.0%) |

37.0 |

1.7% |

(6.4%) |

1.8x |

Sell |

|

Ecobank Transnational |

6.0 |

7.8 |

30.3% |

(54.4%) |

9.3 |

0.0% |

(15.6%) |

0.3x |

Sell |

|

HF Group |

3.5 |

3.8 |

7.7% |

(32.1%) |

2.9 |

0.0% |

(27.7%) |

0.2x |

Sell |

|

Average |

|

|

2.1% |

|

|

|

|

1.0x |

|

|

High |

|

|

30.3% |

|

|

|

|

2.3x |

|

|

Low |

|

|

(9.1%) |

|

|

|

|

0.2x |

|

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in ****Stock prices indicated in respective country currencies |

|||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations to support the positive performance.

Tala, a California-based FinTech company with operations in Kenya, has raised Kshs 11.4 bn (USD 110.0 mn) in a Series D financing round (the fourth round of capital injection from external investors) led by RPS Ventures, a California-based venture capital firm. Other investors in the round include GGV Capital, and previous investors IVP (Institutional Venture Partners), Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures. The new investment builds on PayPal Ventures’ strategic investment in Tala, announced in November 2018, for more information see our Cytonn Monthly - November 2018. This funding round brings the total amounts raised by Tala to over Kshs 22.6 bn (USD 219.4 mn) as shown below;

All amounts in USD mn unless otherwise stated

|

Funding Round |

Amount Raised |

Lead Investor |

Announcement Date |

|

Series D |

110.0 |

RPS Ventures |

21-Aug-19 |

|

Corporate Round |

Undisclosed |

PayPal Ventures |

22-Oct-18 |

|

Series C |

50.0 |

Revolution Growth |

17-Apr-18 |

|

Debt Financing |

15.0 |

|

17-Apr-18 |

|

Series B |

30.0 |

IVP (Institutional Venture Partners) |

22-Feb-17 |

|

Convertible Note |

3.0 |

|

1-Sep-16 |

|

Series A |

10.0 |

Data Collective VC |

3-Sep-15 |

|

Venture Round |

Undisclosed |

|

27-Jan-15 |

|

2nd Seed Round |

1.2 |

|

29-Aug-13 |

|

1st Seed Round |

0.2 |

|

21-Dec-12 |

|

Total |

219.4 |

|

|

Source: Crunchbase

Tala currently operates in Kenya, Tanzania, the Philippines, and Mexico, and successfully ran a pilot programme in India. Tala analyzes device and behavioral data to instantly underwrite consumers and create a personalized loan offer. Tala offers loan amounts between Kshs 1,000.0 and Kshs 50,000.0, at weekly and monthly interest rates of 11.0% and 15.0%, implying annualized rates of 572.0% and 180.0% respectively, to a mobile wallet or via a payment method of the customers’ choice. The company has delivered more than Kshs 103.2 bn (USD 1.0 bn) in credit to more than four million customers, leveraging off their mobile technology, which allows their service to be accessed by anyone with an Android smartphone in markets where it operates. Tala will use the capital raised to expand operations in the markets it operates in and enter the Indian market after running a successful pilot programme.

The continued increase in investments and funding of mobile lending apps is an indicator of the positive investor sentiment in the FinTech sector. One of the biggest drivers in this sector is the provision of access to credit, which we expect to grow, fueled by the expected increase in demand for mobile loans, driven by:

- Rapid growth of smartphone adoption in the African market with Kenya having 51.0 mn mobile subscriptions as at March 2019,

- Affinity for mobile money in Kenya with 32.1 mn active mobile money subscribers as at March 2019 with 60% of Kenyans have a mobile banking account and receiving 90% of remittances through a mobile device,

- The convenience and accessibility to these loans that have fast processing time, no paperwork or collateral and no late or rollover fees, and

- Kenyan banks hesitance to lend to smaller, untested businesses, due to the interest rate cap.

Private equity investments in Africa remain robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

- Residential Sector

During the week, the Central Bank of Kenya (CBK) gazetted regulations aimed at guiding operations of Mortgage Refinancing Companies (MRCs) in Kenya. As per the regulations, shareholders, with the exception of public entities and multilateral development banks, are limited to maximum ownership of 25.0%. To protect the facility from a decline in the value of the collateral, which might be brought about by market fluctuations, Mortgage Refinancing Companies are required by the CBK Act to address this by over-collateralization of refinancing loans by 120.0% of the level of advances, which translates to a Loan to Value of about 83.3%. For capital requirements, minimum core capital of Mortgage Refinancing Companies (MRCs) is set at Kshs 1.0 bn, which is the same level as that of commercial banks.

This marks a great milestone for Kenya’s undeveloped secondary mortgage market and generally paves way for the actual operationalization of the Kenya Mortgage Refinancing Company (KMRC), delayed by lack of a license despite having secured Kshs 37.2 bn from the World Bank and the African Development Bank (AfDB), alongside pledges from Shelter Afrique and 19 local institutions. Once operational, KMRC is expected to revitalize the mortgage market through long-term funding by linking the primary mortgage market with the capital market. This should enable the lending institutions to increase mortgage tenures from the current average of 12-years to about 20-years, thus relieving borrowers of heavy repayment pressures and generally increasing the pool of mortgage borrowers to include low-income earners. According to our KMRC Note, increase in tenures will reduce payments by at least 14.0% with the prevailing interest rates of about 13.6%.

- Hospitality Sector

During the week, ACME Dream Ltd, a Chinese conglomerate firm, announced plans to build a 25-room, luxury hotel in Embakasi, Nairobi. The hotel, which will be on 5.2-acres, will be in close proximity to the Jomo Kenyatta International Airport (JKIA), is expected to cost approximately Kshs 1.4 bn inclusive of the land cost (delivery timelines undisclosed). Nairobi’s vibrant hospitality sector boosted by presence of good quality infrastructure, growth of business tourism due to government’s aggressive marketing of the Meeting, Incentives, Conferences and Exhibition (MICE) sector, and an overall vibrant tourism sector, has continued to attract international hotel investors seeking to tap into the growing number of international tourists.

Also, during the week, Diani Reef Beach Resort in Mombasa County announced plans to construct an additional 114 rooms to increase its capacity to 257 rooms from the current 143 rooms. The hotel, which was feted by World Travel Awards as Africa’s Leading Beach Resort in 2018 and awarded the five-star status by Kenya’s Tourism Regulatory Authority in 2019, has also expanded its conference facilities to tap into the growing number of delegates. According to KNBS Economic Survey 2019, the number of hotel bed-nights occupied in the Coastal Beach area rose by 22.2% from 2.7 mn in 2017 to 3.3 mn in 2018. The rebound in Mombasa’s hospitality scene is attributable to improved security, better infrastructure especially with the Standard Gauge Railway and the Dongo Kundu Bypass, and better hotel facilities with hoteliers improving their facilities so as to tap into the growing number of visitors in the region especially ahead of the December-April peak seasons. Additionally, Diani’s sandy beach remains one of the most renowned beaches in the world attracting a continuous flow of tourists throughout the year.

We expect moderate growth in the real estate sector driven by the continued focus on the provision of affordable housing for the low and lower-middle-income segment of the market and growth of the hospitality sector supported by improved infrastructure and vibrant tourism sector.

For many, the idea of retirement means transitioning into a more relaxed lifestyle, and having time to enjoy all the things we did not have time for before retirement, such as our hobbies, family and friends, travel, and recreational activities. It is therefore important to protect what you have saved or invested to ensure that you will have enough income throughout your retirement; after all, you worked hard to get to retirement.

To guarantee income upon retirement, it is important to join a Retirement Benefits Scheme while still in your working years and contribute towards your retirement. On retirement, one should aim to have an income replacement ratio of about 75%. Currently, the average income replacement ratio in Kenya is below 40% and there is need for people to enhance their retirement savings. Depending on the type of Retirement Benefits Scheme you belong to, you may access your retirement benefits as either a lump sum, or a combination of a lump sum and periodic payments, depending on whether you were in a pension scheme or a provident fund:

- Members of pension schemes can access up to one third of their retirement benefits as a lump sum, and the balance can either be utilized to buy an annuity, or is transferred into an Income Drawdown Fund.

- On the other hand, members of provident funds access the whole of their retirement benefits as a lump sum.

For more information on the difference between pension funds and provident funds, see our note on Pension Funds vs Provident Funds.

Once you receive your retirement benefits, you have many options at your disposal. You might decide to take your lump sum, purchase a rental property and enjoy rental income, you might decide to use your benefits to start a business, or even take that hard-earned vacation that you have been waiting for; the options are endless. However, as you do this, keep in mind that the retirement benefits are supposed to provide for you for the rest of your life and cater for any unforeseen emergencies or needs. It is therefore important to choose an option that will protect your savings and afford you a sustainable income throughout your retirement years. Currently, most people are not comfortable with their retirement savings with statistics showing that 40% of retirees continue to work after retirement with the number of retirees who are financially independent at retirement being less than 5%. It is therefore important that as a retiree, one consider a passive way of investment as source of their retirement income. The two main options recommended for members are: (i) purchasing an annuity, or (ii) transferring your benefits into an Income Drawdown Fund. This note seeks to analyze these two options and as such, we will cover;

- Definition of the Terms ‘Income Drawdown’ and ‘Annuity’ and How They Work,

- Comparisons Between Income Drawdown Funds and Annuities, and

- Conclusion and Factors to Consider When Choosing Between an Income Drawdown Fund and an Annuity.

Section I. Definition of the Terms ‘Income Drawdown’ and ‘Annuity’, and How They Work

- Income Drawdown

An income drawdown is an option that allows members of Retirement Benefits Schemes to access their accumulated retirement benefits as a regular income, through reinvesting their benefits in an Income Drawdown Fund registered by the Retirement Benefits Authority (RBA), from which periodic payments are drawn. At the point of retirement, the member transfers their accumulated benefits to the Income Drawdown Fund. The member then draws regular payments from this fund for a minimum of 10-years. The member, depending on their retirement needs, determines the frequency and amount of the withdrawals. Once the member makes a withdrawal, the fund balance remains invested and continues to earn a return. This option allows a member to benefit from income generated from investing his retirement benefits and in turn, it expected to translate into higher regular payouts to the member.

How Income Drawdowns Work

- Upon retirement, the member transfers their accumulated benefits into an Income Drawdown Fund registered by the RBA. Currently funds registered by RBA include: -

- Cytonn Income Drawdown Fund,

- Enwealth Kesho Hela Income Drawdown Fund,

- Octagon Income Drawdown Fund,

- Platinum Drawdown by Britam,

- Milele Income Drawdown by GenAfrica, and,

- Zimele Income Drawdown Plan.

- The member then draws regular payments from this fund depending on his or her needs and can be as frequent as monthly, quarterly, half-yearly or yearly. The maximum amount that a member can withdraw is 15% of the fund balance per annum, and this is to protect and ensure the funds are not exhausted during the lifetime of the member thereby providing cover from the risks associated with their longevity.

- The remaining balance is invested by the Fund Manager and continues to earn interest.

- The minimum drawdown period is 10-years as per regulations. On expiry of the drawdown period, the member has the following options:

- Purchase an annuity with the remaining fund balance, or

- Continue with the drawdown arrangement, or

- Access the fund balance as a lump sum.

- Annuity

An annuity is a contract between an insurance company and an individual where in return for a lump sum of money, in this case your accumulated retirement benefits, the insurance company/approved issuer will give you a periodic income with the choice of monthly, quarterly, half-yearly or yearly.

How Annuities Work

- At retirement, a member chooses an insurance provider to purchase an annuity. Annuities are strictly provided by insurance companies and the 2018 issue of the Pensioner Magazine by RBA lists 19 insurance companies that offer annuities. Upon retirement, a member is allowed up to 12 months to make a decision on which annuity provider to go with.

- Once the member chooses the provider, they then choose the annuity type that suits their needs. There are different types of annuities and one should engage an adviser when making this decision. It is good to note that unlike in an Income Drawdown Fund, you cannot change the annuity once you choose for the rest of your life. The options available include but are not limited to;

- Single Life Annuity - This choice allows you to receive payments your entire life and is limited to the lifetime of the annuitant with no survivor benefit. If an annuitant dies soon after taking the annuity, the beneficiaries do not get anything from the insurance company.

- Life Annuity with a Guaranteed Period - These are similar to single life annuities but with a minimum period that the annuity will last, say 10-years. If the annuitant dies before the end of the period, the payments for the rest of that time will go to his/her beneficiary. However, adding the fixed period results to lowering the amount of your regular payments.

- Joint and Survivor Annuity - A joint and survivor annuity guarantees payments will last the lives of both the annuitant and another person, typically a spouse. This choice reduces the amount of each payment you receive.

- Systematic Annuity Withdrawal - In this method, you choose the amount of the payments and how many payments you want to receive. This option does not include a guarantee it will last your entire life. It is entirely dependent on the amount of money in your annuity account.

- The amount of income payment you will receive will depend on several factors including:

- The amount paid to purchase the annuity,

- Age at the time of purchase, and,

- The benefits options chosen.

Insurance companies may use other subjective factors when determining your income such gender, as women tend to live longer than men meaning their annuity rates are lower than the rates for men.

- Like in an Income Drawdown Fund, you can also choose to have your income paid every month, quarterly, half-yearly or yearly.

For annuities, the more conditions you have, such as including a guaranteed period, adding a spouse to the annuity, etc. the lower the monthly payments that you will receive.

Section II. Comparisons Between Income Drawdown Funds and Annuities

- Flexibility - Income Drawdown Funds are widely considered more flexible than annuities. With an Income Drawdown Fund, you choose how much you want to withdraw from your fund and the frequency. You can also change the amount of drawdown at a frequency that will be agreed on with your provider. An annuity provides certainty in retirement, but lacks the flexibility that income drawdown provides. Once you purchase an annuity there is no turning back, and you cannot change it.

- Investment Income - An Income Drawdown Fund allows a member to benefit from income generated from investing their lump sum and this is expected to translate to higher regular payouts to the member. It offers stable investment returns since the funds are invested conservatively with the aim of preserving capital, and achieving modest growth over the long-term to ensure that at the end of the drawdown period, you have funds left in your account to continue providing for you during retirement. Based on the returns offered by the fund manager and the drawdown percentage, your fund could end up growing and thus offering even higher payout and growing your retirement savings to last even longer. It is therefore important to select an Income Drawdown Fund that offers you attractive returns. The table below show the difference in your fund value after 10 years depending of the returns offered by different Income Drawdown Funds, all other factors held constant.

Income Drawdown Fund Value after Drawdown Period- Based on Returns from Different Funds

Fund A

Fund B

Fund C

Annual Interest Rate

10.0%

11.0%

12.0%

Annual Withdrawal Percentage

11.0%

11.0%

11.0%

Initial Fund Value

5,000,000

5,000,000

5,000,000

Monthly Drawdown Amount for 10-Years

45,833

45,833

45,833

Fund Value After 10-Years

4,146,479

5,000,000

5,958,494

Values in Kshs

For annuities, the interest rate is determined at the point of purchase, usually being the prevailing interest rates, currently the rates for the 1-year government papers being about 9.2%, and is used when determining the periodic payments.

- Longevity - With an Income Drawdown Fund, there are no guarantees the income you draw will be last life, as when you reinvest your retirement benefits they become vulnerable to market performance. Annuities, on the other hand, can be used to guarantee an income for a given time period. A lifetime annuity is used to provide a regular income for life, and will continue paying out no matter how long you live.

- Inheritance - Income Drawdown Funds give the member the opportunity to leave an inheritance in the event of demise as the beneficiaries you nominate can inherit whatever money is left in your Income Drawdown Fund. On the other hand, the type of annuity you purchase will determine whether it continues to pay out after you die. If you purchase a single-life annuity, it will only pay an income to you, the sole beneficiary, and after you die all remaining funds will be kept by the insurer.

- Risk. Income Drawdown Funds are considered riskier compared to annuities. There is a risk of running out of money if your investment returns are not able to sustain your withdrawals.

The factors listed above can be summarized as in the table below;

|

|

Income Drawdown Fund |

Annuity |

|

Flexibility |

More flexible |

No flexibility |

|

Investment Income |

Investment Income could translate to a bigger fund after the drawdown period |

No investment income |

|

Longevity |

Income is not guaranteed to last as the invested fund may be affected by market performance |

Some annuities can pay out for the rest of your life no matter how long you live |

|

Risk |

More risky |

Less risky |

|

Inheritance |

In case of death, your fund balance is accessed by your nominated beneficiaries |

If you die soon after retirement, all remaining funds will be kept by the insurer |

Section III. Conclusion and Factors to Consider When Choosing Between an Income Drawdown Fund and an Annuity

It would be misleading to generally conclude that one option is better than the other is, and therefore suitable for all members. As such, it is important to seek professional advice when making this important decision because your standard of living in retirement depends on it. People have different needs at retirement and should make decisions that suit their needs. The features of the two options covered in this focus note are to guide you and enable you to formulate a retirement plan that will enable you to enjoy a sustainable lifestyle in retirement. Some factors that you can consider when making this decision include:

- Dependents - As seen when comparing income drawdown and annuities, income drawdown is more suitable for members who have dependents as it allows for inheritance. In case of death, a member may leave their funds to their beneficiaries. On the other hand, the type of annuity that you choose determines whether the payment is only to the annuitant or the spouse in case of death;

- Size of the Retirement Pot - We would recommend income drawdown for members with a large fund at retirement. RBA had initially set this at a minimum of Kshs 5.0 mn but this has since been removed from the guidelines. Our opinion is that with a large fund at retirement, say more than Kshs 1 mn, a member will be in a position to take up investment risk and at the same time enjoy the higher returns and higher payout compared to annuities. Members with smaller funds at retirement, say below Kshs 1 mn, cannot afford to take the risk and should join annuities;

- Health Status - The status of your health will most likely determine how long you will live post retirement; good health will mean that you are likely to live long after retirement. You do not want a scenario where you outlive your retirement savings. One might therefore consider a combination of annuity and income drawdown, the annuity would ensure certainty that you have income no matter how long you live, income drawdown will give you a better payout translating to improved life at retirement;

- Other Income Sources - Retirees with other income sources, such as property and investments are able to take up more risks and therefore the income drawdown may be the better option;

- Risk Appetite – Retirees have varying risk appetite. With the normal retirement age in Kenya being between 50 years and 75 years, people who retire at 50 are able to take up more risk and should join an Income Drawdown Fund, while those who retire later than 70 years are not able to take up much risk.

For more information on Options for Your Pension Upon Retirement, email us at pensions@cytonn.com

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.