Real Estate Investment Trusts, REITS, as an Investment Alternative, & Cytonn Weekly #52

By Research Team, Dec 29, 2019

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 17.0%, the lowest recorded in the last two-years, down from 64.1% the previous week. The undersubscription is partly attributable to declined investor activity associated with the festive season, coupled with the reduced participation by banks since the repeal of the interest rate cap, with their focus now shifting to private sector lending. The yield on the 91-day and 364-day paper remained unchanged at 7.2% and 9.8%, respectively while the yield on the 182-day paper increased to 8.2% from the 8.1% recorded the previous week. The acceptance rate increased to 100.0%, from 99.4% recorded the previous week, with the government accepting Kshs 4.1 bn of the Kshs 4.1 bn worth of bids received;

Equities

During the week, the equities market was on an upward trajectory with NASI, NSE 20 and NSE 25 recording gains of 0.9%, 2.4% and 1.1%, respectively, taking their YTD performance to gains/(losses) of 17.8%, (6.6%) and 14.4%, for the NASI, NSE 20 and NSE 25, respectively. During the week, the Nairobi Securities Exchange announced the listing of Barclays Bank of Kenya’s (BBK) single stock futures to the derivatives market, NEXT. Barclays Bank will be the sixth single stock listed at NEXT after Safaricom, KCB Group, Equity Bank, KenGen and EABL, which all listed on the launch of the derivative market in July 2019;

Real Estate

During the week, Naivas Supermarket opened its 60th outlet in Westside Mall in Nakuru Town following the exit of Nakumatt Holdings. On the statutory front, the National Assembly passed the Central Bank of Kenya (Mortgage Refinance Companies) Regulations 2019, but annulled two sections which gave the Central Bank of Kenya (CBK) the legislative powers to issue guidelines on mortgage refinance companies. In the infrastructure sector, the National Government announced plans to construct Mau Mau Road, a 540-km road project that will connect Kiambu, Murang’a, Nyandarua and Nyeri Counties;

Focus of the Week

There have been a number of challenges that have hindered the Real Estate Investment Trust (REIT) market in Kenya from taking off, compared to more developed markets such as South Africa, with the main challenge being lack of adequate investor information both around the structure and the investment process of REITs. In this regard, this week we look at REITs both as a funding method for real estate developers, as well as an alternative asset class for investors.

- Weekly Rates:

-

- Cytonn Money Market Fund closed the week at an average yield of 10.8% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 15.1% p.a. To subscribe, email us at sales@cytonn.com;

- David King’oo, Senior Risk and Compliance Associate, attended an interview on NTV to discuss debt management. Watch David here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 17.0%, the lowest recorded in the last two years, down from 64.1% the previous week. This is down from an average of 125.4% from January 2019 to November 7th 2019 before the repeal of the rate cap; and 98.2% points lower than the YTD average of 115.2%. The undersubscription is partly attributable to declined investor activity associated with the festive season, coupled with the reduced participation by banks since the repeal of the interest rate cap, with their focus now shifting to private sector lending. The yield on the 91-day and 364-day paper remained unchanged at 7.2% and 9.8%, respectively. The yield on the 182-day paper increased to 8.2% from the 8.1% recorded the previous week. The acceptance rate increased to 100.0%, from 99.4% recorded the previous week, with the government accepting Kshs 4.1 bn of the Kshs 4.1 bn worth of bids received.

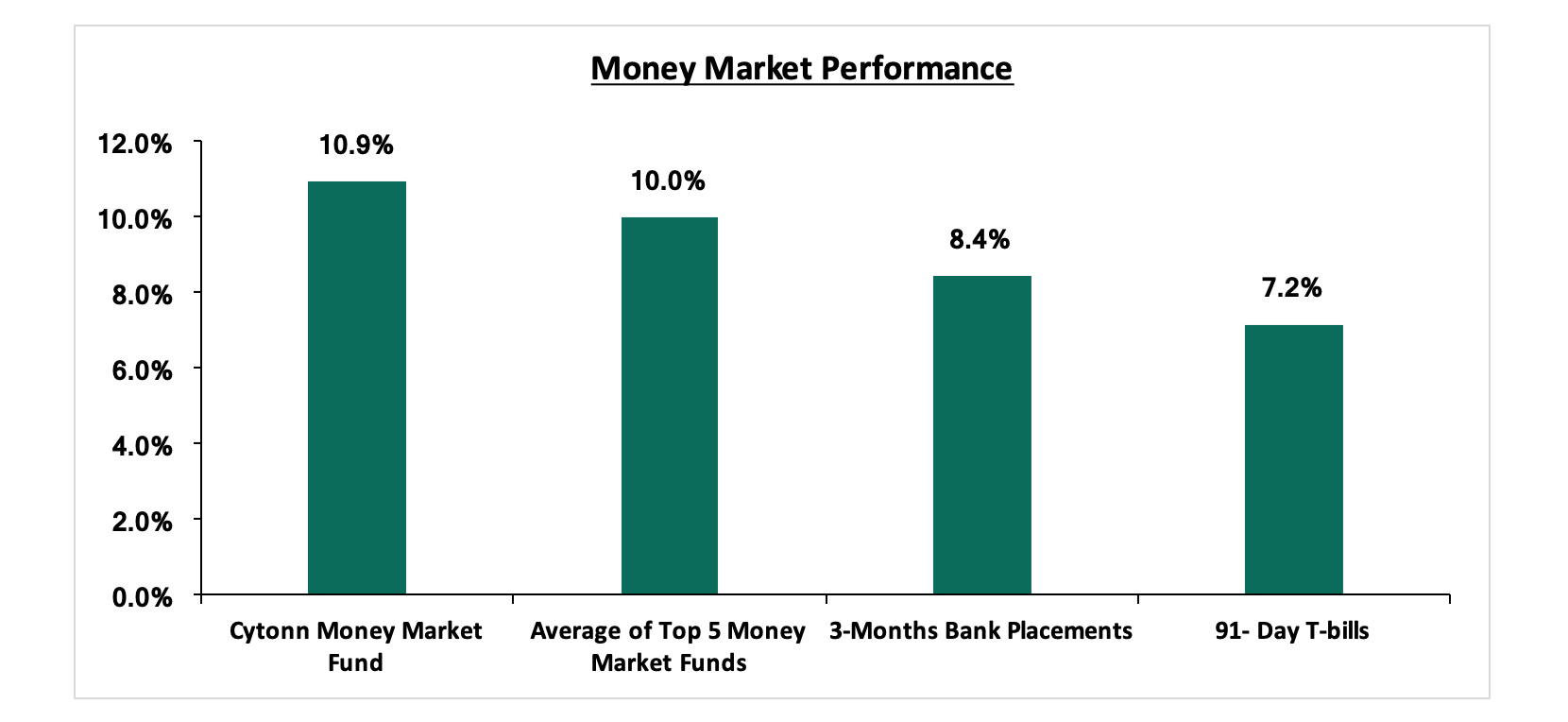

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.2%, while the average of Top 5 Money Market Funds came in at 10.0%, unchanged from the previous week. The yield on the Cytonn Money Market remained unchanged at 10.9% recorded the previous week.

Liquidity:

During the week, the average interbank rate increased marginally to 5.6%, from 5.5% recorded the previous week, pointing to tightening of liquidity in the money markets. Commercial banks’ excess reserves came in at Kshs 17.2 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes increased by 14.8% to Kshs 21.3 bn, from Kshs 18.5 bn recorded the previous week.

Kenya Eurobonds:

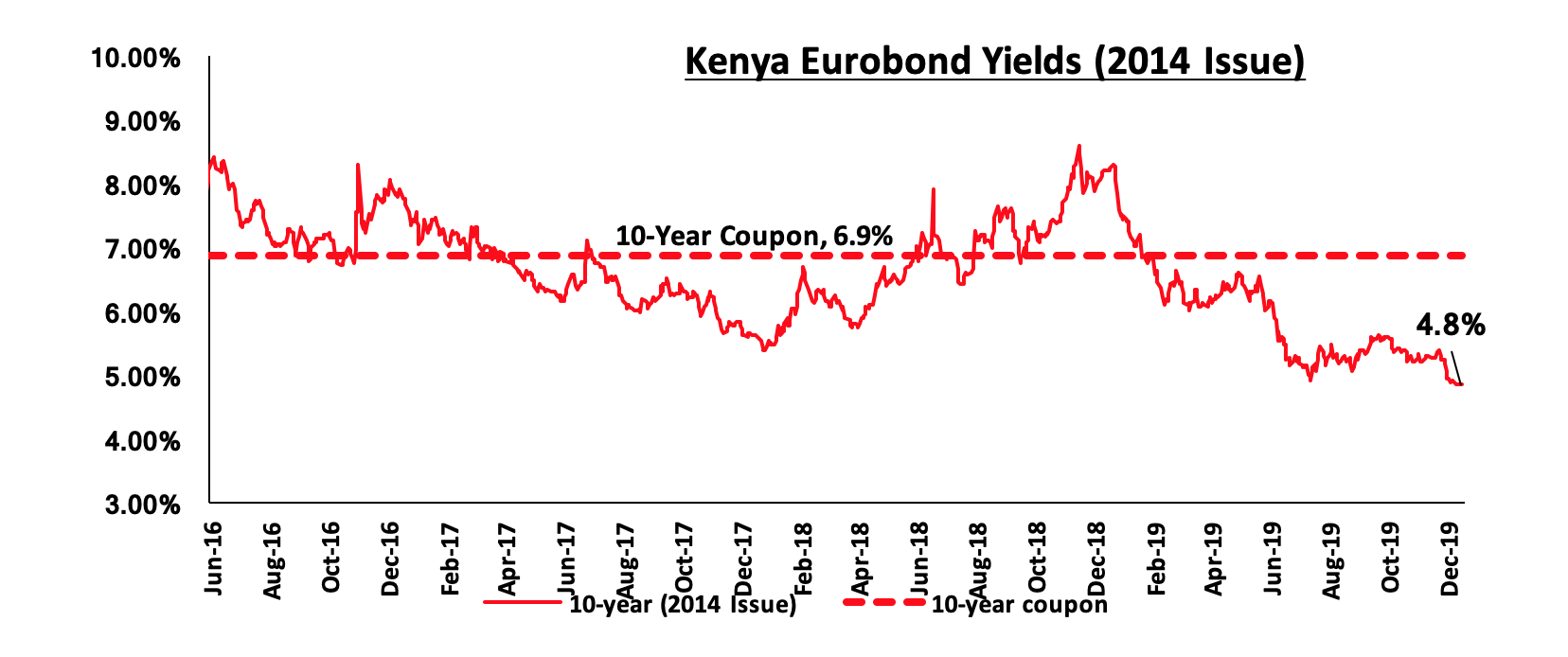

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.1% points to 4.8%, from 4.9% recorded the previous week, an indication that investors are attaching lower risk premium on the country, attributed to the release of the country’s credit rating by Fitch Ratings, which was “B+”, highlighting the country’s stable outlook.

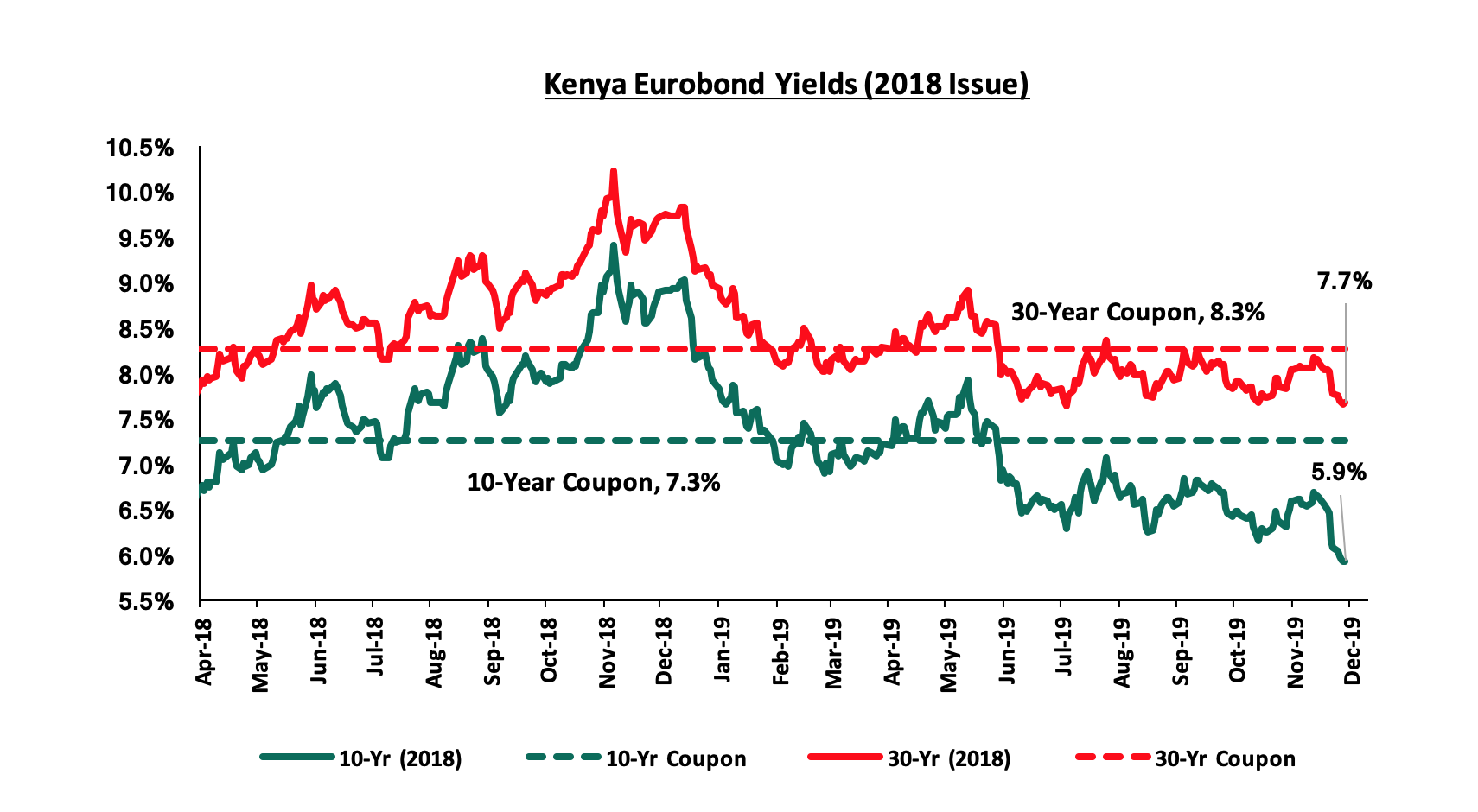

During the week, the yields on the 10-year Eurobond and the 30-year Eurobond both remained unchanged at 5.9% and 7.7%, respectively.

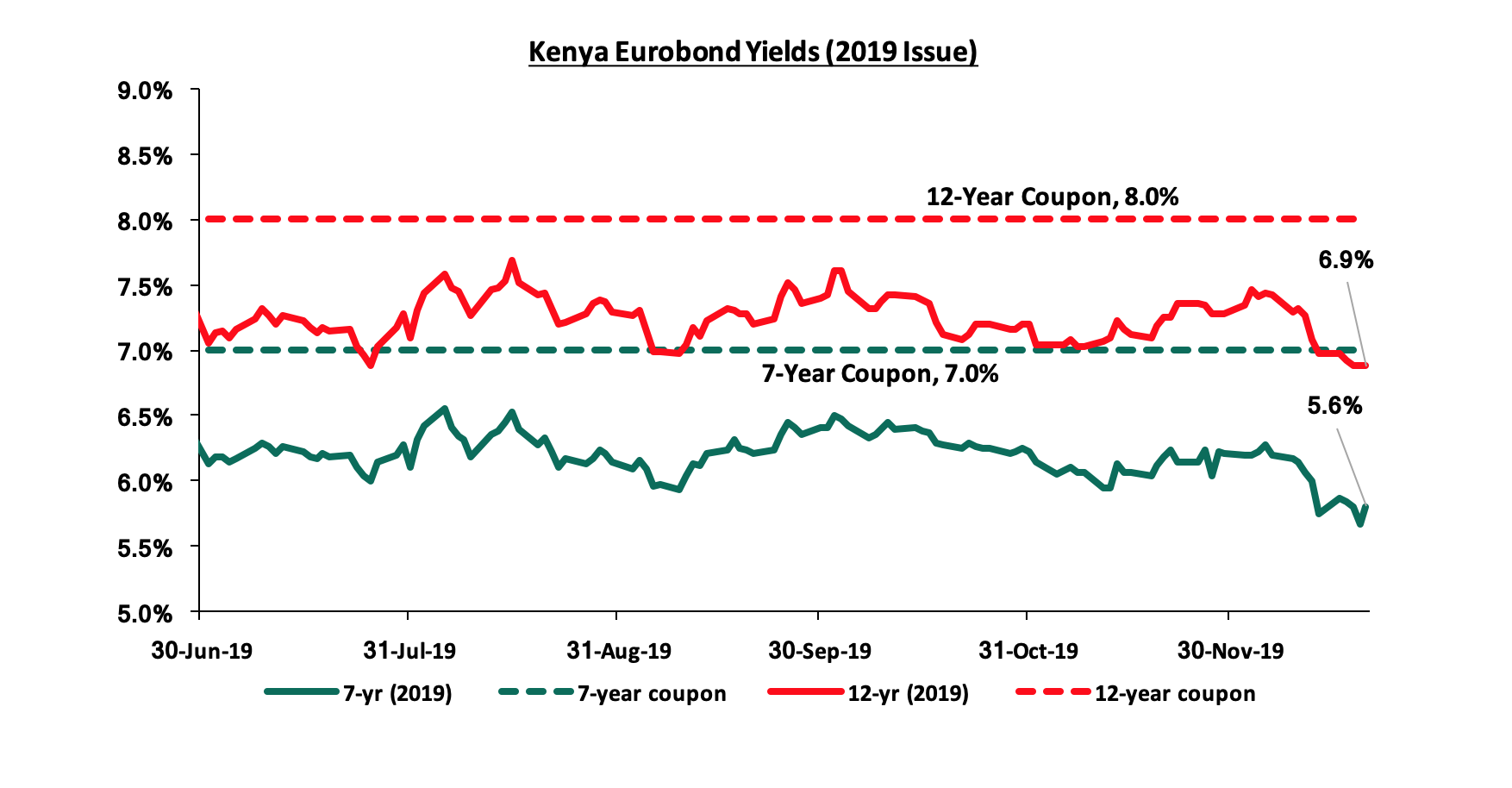

During the week, the yield on the 7-year Eurobond decreased by 0.2% points to 5.6%, from 5.8% recorded the previous week, while the yield on the 12-year Eurobond remained unchanged at 6.9%.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.1% against the US Dollar to close at Kshs 100.8, from 100.7 recorded the previous week, mostly supported by inflows from tourism and diaspora remittances amid slow demand from importers. On a YTD basis, the shilling has appreciated by 1.1% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit in Q2’2018 was equivalent to 6.2% of GDP, from 7.6% recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit balance (a scenario where imports are greater than exports) by 1.7% and a rise in secondary income transfers (transfers recorded in the balance of payments whenever an economy provides or receives goods, services, income or financial items) by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 5.0% in the 12-months to November 2019 to USD 2.8 bn, from USD 2.7 bn recorded in a similar period of review in 2018,

- Foreign capital inflows, with investors looking to participate in the equities market,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 5.6% ahead of its domestic borrowing target, having borrowed Kshs 164.6 bn against a pro-rated target of Kshs 155.9 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trajectory with NASI, NSE 20 and NSE 25 recording gains of 0.9%, 2.4% and 1.1%, respectively, taking their YTD performance to gains/(losses) of 17.8%, (6.6%) and 14.4%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains recorded by large-cap stocks in the banking sector such as Diamond Trust Bank Kenya, NCBA and Barclays, with gains of 9.9%, 7.2%, and 1.5%, respectively.

Equities turnover decreased by 84.9% during the week to USD 6.3 mn, from USD 41.8 mn recorded the previous week, taking the YTD turnover to USD 1,492.8 mn. Foreign investors remained net buyers for the week, with a net buying position of USD 0.3 mn, a 96.0% drop from a net buying position of USD 6.7 mn recorded the previous week.

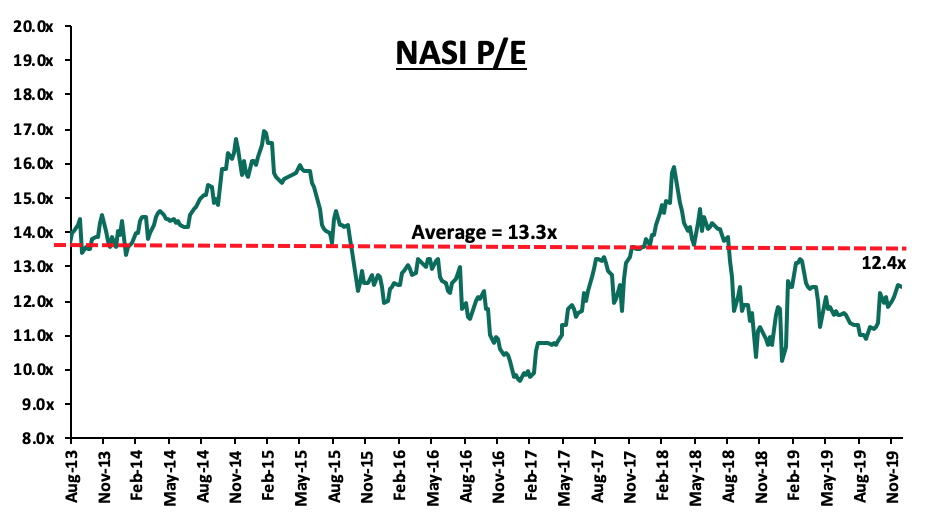

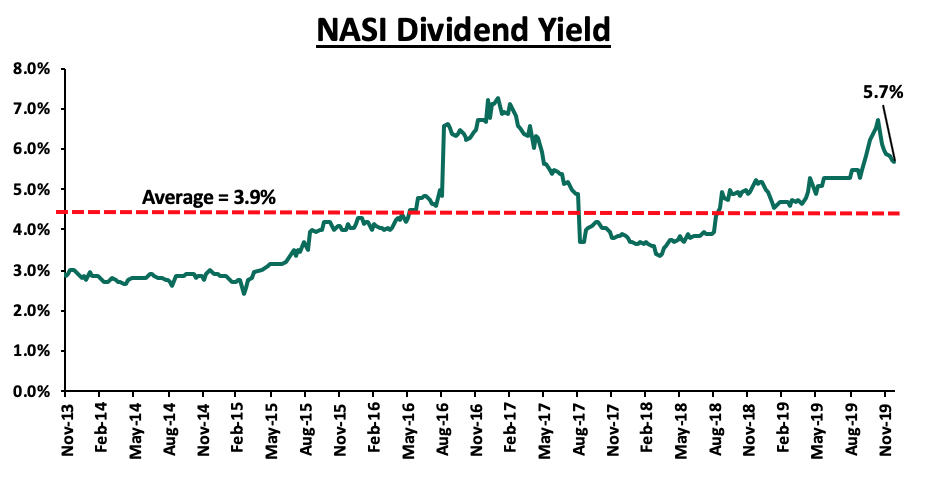

The market is currently trading at a price to earnings ratio (P/E) of 12.4x, 6.5% below the historical average of 13.3x, and a dividend yield of 5.7%, 1.8% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.4x is 27.8% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 49.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Nairobi Securities Exchange announced the listing of Barclays Bank of Kenya’s (BBK) single stock futures to the derivatives market, NEXT. Barclays Bank will be the sixth single stock listed at Next after Safaricom, KCB Group, Equity Bank, KenGen and EABL which all listed on the launch of the derivative market in July 2019. Single stock futures are futures contracts where the underlying security is an equity stock listed on the NSE, where one commits to buy or sell a single equity at a future date. These instruments give investors exposure to price movements on an underlying stock. BBK’s investors will be required to pay an initial margin of Kshs 1,800.0 for one contract resulting to an exposure of 1,000 Barclays Bank Shares with the stocks having a three month expiry period from the day of trading. According to the Capital Market Soundness report Q3’2019, 349 contracts, worth Kshs 12.8 mn, were traded during the quarter under review with a majority of liquidity concentrated around Safaricom and banking counters, mainly KCB Group and Equity Bank. Safaricom accounted for 55.0% of the market’s turnover while KCB accounted for 18.0%, followed by NSE 25 index at 17.0% while Equity Bank stood at 8.0%, during the quarter. In Q4’2019, 148 contracts, worth Kshs 7.1 mn, have been traded so far in the derivatives market, a 57.6% decline from the 349 recorded in Q3’2019 taking the total number of contracts traded in the derivatives market since inception to 497, with a total value of Kshs 19.9 mn. The NEXT derivatives market is expected to provide new opportunities to investors enabling them to diversify, manage risk and allocate capital efficiently. However, it still remains extremely small.

We believe increasing the number of single stock futures traded on the derivatives market will be beneficial in further opening Kenya’s financial markets to domestic and international investors, which will, in turn, positively influence the performance of the economy. Thus, we recommend that the following should be taken into consideration;

- Investor Education – Investors, both foreign and domestic, would need to be informed of the workings of the derivatives market and the current offerings to ensure there is a larger rate of uptake in the derivatives market, and,

- Products Offered in the Derivatives Exchange - Given that the agricultural sector is the main backbone of the economy; it would be advisable to include a commodity derivatives market to support the entire agriculture value chain.

Universe of Coverage

|

Banks |

Price at 20/12/2019 |

Price at 27/12/2019 |

w/w change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.88 |

3.09 |

7.3% |

4.8 |

14.6% |

69.9% |

0.3x |

Buy |

|

Diamond Trust Bank |

108.25 |

119.00 |

9.9% |

189.0 |

2.2% |

61.0% |

0.6x |

Buy |

|

I&M Holdings*** |

50.25 |

53.00 |

5.5% |

75.2 |

7.4% |

49.2% |

0.9x |

Buy |

|

Jubilee Holdings |

341.00 |

350.00 |

2.6% |

453.4 |

2.6% |

32.1% |

1.1x |

Buy |

|

KCB Group*** |

53.25 |

53.25 |

0.0% |

64.2 |

6.6% |

27.1% |

1.4x |

Buy |

|

Sanlam |

17.15 |

18.00 |

5.0% |

21.7 |

0.0% |

20.6% |

0.7x |

Buy |

|

Co-op Bank*** |

15.75 |

15.90 |

1.0% |

18.1 |

6.3% |

20.1% |

1.4x |

Buy |

|

Standard Chartered |

200.75 |

200.00 |

(0.4%) |

211.6 |

9.5% |

15.3% |

1.5x |

Accumulate |

|

Equity Group*** |

53.00 |

52.00 |

(1.9%) |

56.7 |

3.8% |

12.9% |

2.0x |

Accumulate |

|

Barclays Bank*** |

13.10 |

13.30 |

1.5% |

13.0 |

8.3% |

6.0% |

1.7x |

Hold |

|

NCBA |

34.15 |

36.60 |

7.2% |

37.0 |

4.1% |

5.2% |

0.8x |

Hold |

|

Liberty Holdings |

9.72 |

10.35 |

6.5% |

10.1 |

4.8% |

2.1% |

0.9x |

Lighten |

|

Stanbic Holdings |

102.00 |

111.00 |

8.8% |

103.1 |

4.3% |

(2.8%) |

1.2x |

Sell |

|

CIC Group |

2.89 |

2.89 |

0.0% |

2.6 |

4.5% |

(4.2%) |

1.1x |

Sell |

|

Britam |

8.48 |

8.58 |

1.2% |

6.8 |

0.0% |

(21.3%) |

0.9x |

Sell |

|

HF Group |

5.92 |

5.92 |

0.0% |

4.2 |

0.0% |

(29.1%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Retail Sector

During the week, Naivas Supermarket opened its latest outlet in Westside Mall in Nakuru Town, which was previously occupied by Nakumatt Holdings. This marks Naivas’ third location in Nakuru and 60th outlet nationwide following recent openings in Mombasa and Ngong Town. The move is in line with the retailer’s expansion strategy aimed at widening its market share by tapping into Kenya’s rapidly-growing urban cities and satellite towns, in the wake of increased competition from retailers such as Tuskys and Quickmart. The sector has continued to record increased activities, in major towns such as Nakuru attributed to:

- Positive demographics in Nakuru with the population growing at an average of 3.0% p.a., compared to the Kenyan average of 2.2% p.a.,

- Improving infrastructure with the expansion of the Nakuru-Nairobi Highway, which has encouraged a growth in mall space as this encourages tenancy and footfall,

- The availability of relatively low- priced retail spaces. According to Cytonn Kenya Real Estate Retail Report 2019, Nakuru recorded average rent prices of Kshs 59.2 per SQFT, compared to the market average of Kshs 118.0 per SQFT

Despite the low rents, Nakuru town does not offer an attractive opportunity for investors due to its poor performance recording rental yields of 4.5% in 2019, 2.5% points less than the market average of 7.0%. This is mainly attributed to competition due to lower rental rates offered from more established mixed-use developments (MUDs) that are in the market such as CK Patel and Shoppers Paradise.

The table below shows the retail performance of key urban cities in 2019:

(all values in Kshs unless stated otherwise)

|

Kenya Retail Performance in Key Urban Cities 2019 |

|||

|

Region |

Rent per SQFT |

Occupancy Rate (%) |

Rental Yield (%) |

|

Mt. Kenya |

129.8 |

80.0% |

8.6% |

|

Nairobi |

168.6 |

75.1% |

8.0% |

|

Eldoret |

131.0 |

82.3% |

7.9% |

|

Mombasa |

122.8 |

73.3% |

7.3% |

|

Kisumu |

96.9 |

75.8% |

5.6% |

|

Nakuru |

59.2 |

77.5% |

4.5% |

|

Average |

118.0 |

77.3% |

7.0% |

|

· Nakuru recorded average rent prices of Kshs 59.2 per SQFT, compared to the market average of Kshs 118.0 per SQFT. This was mainly attributed to competition due to lower rental rates offered from more established mixed-use developments (MUDs) that are in the market such as CK Patel and Shoppers Paradise |

|||

Source: Cytonn Research 2019

We expect the retail sector to remain vibrant with local retailers such as Naivas, Quickmart and international retailers such as Carrefour and Game continuing to expand to take advantage of the relatively low formal penetration rates, especially in regions outside Nairobi as well as to take up prime spaces that are vacated by struggling retailers.

- Statutory Reviews

The Kenya Mortgage Refinancing Company (KMRC) was established under the Companies Act and licensed by the CBK to provide long-term funding to primary mortgage lenders. Section 57(2) of the Central Bank of Kenya Act 2013 empowered the CBK to come up with Mortgage Refinance Companies Regulations 2019. On 3rd December 2019, the National Assembly passed the Central Bank of Kenya (Mortgage Refinance Companies) Regulations 2019. The regulations are intended to guide the operation of the Kenya Mortgage Refinancing Company (KMRC), providing a framework for licensing, capital adequacy, liquidity management, corporate governance, risk management as well as reporting requirements of Mortgage Refinance Companies (MRCs). However, the Assembly annulled two sections that were mentioned to contravene with section 13 (m) of the Statutory Instruments Act that states legislative powers should not be inappropriately delegated:

- Section 26 (2), which gave the Central Bank of Kenya (CBK) the powers to approve the opening, relocation & closure of any branch of a mortgage refinance company, and,

- Section 42, which gave the Central Bank of Kenya (CBK) the powers to issue guidelines on group structures of mortgage refinance companies.

In our view, the adoption of the Mortgage Refinance Companies Regulations is a positive step towards the operationalization of the Kenya Mortgage Refinancing Company (KMRC), save for the grey areas occasioned by the two annulled sections. The annulled sections may delay operationalization of the Kenya Mortgage Refinancing Company (KMRC) as there is no authority prescribed to provide guidelines in which place a mortgage refinance company may be opened, relocated or closed.

Once operational, we expect the KMRC to (i) increase the amounts of money available for mortgage lending, and, (ii) lengthen typical mortgage tenors in Kenya from the current average of 12-years to 20-years, bringing down monthly payments by 14%, assuming current average interest rates of 13.6% and therefore assisting with affordability. For more information on the Kenya Mortgage Refinancing Company (KMRC), read our topical here.

- Infrastructure Sector

During the week, the National Government announced plans to construct a 540-km road project that will connect Kiambu, Murang’a, Nyandarua, and Nyeri Counties and will consist of a network of over 80 feeder roads. The Kshs 30.0 bn project dubbed ‘Mau Mau Road’ is expected to start in January 2020 and will be completed in two years starting at Gataka, Limuru in Kiambu County and ending at Ihuru area in Nyeri County. The road is expected to reduce traffic congestion along the Nairobi-Nyeri highway, which experiences frequent snarl-ups because of several feeder roads to several counties such as Nanyuki, Meru, and Isiolo.

The continued provision of infrastructure and revamping of old roads in the recent years has opened up new areas for investment and helped reduce development costs for developers boosting prices for existing properties, evidenced by growth prices in areas like Juja and Ruaka towns, where land prices appreciated by 8.7% and 4.3% p.a., respectively, attributable to speculation stemming from expected infrastructural developments, such as Thika Road and the Northern by-pass, respectively.

We expect the project to enhance the accessibility of remote areas in the four counties opening up the areas for real estate development, enhancing demand for property in the respective areas, and resulting in an increase in property value.

We expect growth in the real estate sector to be fueled by (i) increased foreign direct investments, (ii) improvement in infrastructure that will open up areas for development in addition to the improving socio-economic environment, and, (iii) continued efforts towards the affordable housing initiative by increasing the availability and affordability of housing finance, thus boosting homeownership. The investment opportunity for retail mall developers is in markets such as Mombasa and Kiambu attributed to low retail space supply.

Following the licencing of Cytonn Asset Managers as a Real Estate Investment Trust (REIT) Manager by the Capital Markets Authority (CMA) in February 2019, Cytonn Investments Management Plc embarked on the process of structuring a REIT for two of its projects, The Ridge in Ridgeways and RiverRun Estates in Ruiru. This move was aimed at bringing access to high-yielding investments to investors in the regulated markets as well as diversifying funding sources for Cytonn’s real estate pipeline.

In this regard, this week we look at REITs both as a funding method for real estate developers, as well as an alternative asset class for investors.

This focus will cover the topic as outlined below:

- Introduction to REITs, where we cover the definition of REITs, and look at the various types of REITs, as well as a brief overview of the structure of REITs,

- History of REITs, where we lay out the development of the REIT market since inception, both globally and in Africa,

- The Case for REITS for Investors & Developers, where we outline the benefits of REIT structure, both as an asset class and a funding vehicle, and the demerits associated with this,

- Challenges Facing REIT Adoption in Kenya,

- Case Study of the South African REIT Market,

- How to Boost the REIT Market in Kenya.

Section I: Introduction to REITs

REITs are regulated investment vehicles that enable collective investment in real estate, where investors pool their funds and invest in a trust with the intention of earning profits or income from real estate, as beneficiaries of the trust. REITs source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the shareholders at the end of a financial year.

A typical REIT structure includes 4 key parties, namely;

- The Promoter – The promoter pools all resources to structure a REIT. For instance, in the proposed Cytonn D-REIT, Cytonn Investments Management Plc is the promoter of the REIT,

- The REIT Manager – The REIT Manager is tasked with the role of allocating the funds to the real estate assets that yield a favourable return to investors,

- The Trustee – The Trustee’s role is to act on behalf of beneficiaries, usually the investors in the REIT, by assessing the feasibility of the investment proposal put forward by the REIT Manager and ensuring that the assets of the scheme are invested in accordance with the Trust Deed, appointing the key parties and consultants in a REIT, and ensuring that distributions from the assets of the REIT are made in accordance with the Offering Memorandum, and,

- Property/Project Manager – The Project Manager’s role is the development management of the ongoing developments in the REIT while the Property Manager’s role is the management of the completed real estate developments acquired by the REIT.

There exist three types of REITs namely;

- Income REITs (I-REITs) - This is a form of REITs in which investors pool their resources for purposes of acquiring long-term income-generating real estate including residential, commercial and other themes. Investors gain through capital appreciation and rental income. Dividends are usually distributed to unit-holders at the agreed duration, with the appreciation realised upon sale of the units at a higher value.

- Development REITs (D-REITs) – A D-REIT is a type of REIT in which resources are pooled together for purposes of running development and construction projects. This may include residential or commercial projects. A D-REIT can be converted to an I-REIT once the development is complete where the investors in a D-REIT can choose to sell, reinvest or lease their shares or convert their shares into an I-REIT.

- Islamic REITs - An Islamic REIT is a unique type of REIT that invests primarily in income-producing, Shari’ah-compliant real estate. A fund manager is required to conduct a compliance test before investing in real estate to ensure it is Shari’ah compliant and that non-permissible activities are not conducted in the estate.

Section II: History of REITs

REITs were created in the United States in 1960, to give all investors the opportunity to invest in large-scale, diversified portfolios of income-producing real estate, in the same way they typically invest in other asset classes, through the purchase and sale of liquid securities. At this time, REITs primarily consisted of mortgage companies, and witnessed a significant expansion in the two decades that followed, owing to the increased use of REITs as funding vehicles in land development and construction deals. The US REIT market is the largest in the world. Currently there are in excess of 200 listed REITs existing in the US.

The second market to implement the REIT structure was Australia, with the first property trust being listed in 1971. Canada followed suit by adopting the REIT structure in 1993. The United Kingdom, however, despite being a major powerhouse in the world economy, only introduced REITs into their listed property system in early 2007. This delayed implementation was majorly due to criticism by key market players, alluding to the presence of many mechanisms of property ownership, thus scepticism as to whether another vehicle was required.

In Africa, Ghana was the first to implement the REIT structure, with The Home Finance Company establishing the first REIT in Ghana in August 1994. This was followed by Nigeria, with the Union Homes Hybrid Real Estate Investment Trust being launched in September 2008. South Africa, despite only having been launched in May 2013, has proven to be the most successful REIT market in Africa. In Kenya, the first REIT, Fahari I-REIT by Stanlib, was approved by the Capital Markets Authority in October 2015, and has been the only operational REIT to date.

Section III: The Case for REITS for Investors & Developers

The main benefit that developers stand to benefit from REITs is the easier access to relatively lower cost capital, allowing them to develop institutional grade real estate. By selling stabilised assets to REITs, property developers can unlock capital that can be more effectively deployed in new development projects.

Investors stand to benefit from REITs, given that they have been total return investments where the investor gets both the capital appreciation and yield. They historically have provided high dividends plus the potential for moderate, long-term capital appreciation. Additionally, REITs have offered investors liquidity, portfolio diversification and strong corporate governance. However, it is important to note that past performance may not be indicative of future results for any investments, including REITs.

The benefits of REITs for Investors include;

- Diversification - REITs, fixed income securities and equities have different long-term investment characteristics creating diversification when combined within a single portfolio. This diversification creates the opportunity for blended portfolio to earn higher returns while reducing the potential for negative or low returns.

- Low Cost Exposure to Real Estate - REITs offer access to the property market with professional investment management at a relatively low transaction and management cost. A professional, dedicated management team responsible for the day-to-day operation of the business, provides the investor with expertise beyond his or her knowledge base.

- Transparent Investment Vehicle - Investors are able to understand exactly what they are invested in, from the actual assets, costs and returns.

- Accessibility – A REIT can more easily be bought or sold. Investors do not have to deal with the complexity of selling a physical property. REITs allow an interested real estate investor to buy units (shares) and be a part owner of a real estate asset without having to deploy a lot of capital, compared to buying an entire piece of property.

- Tax Exemption – REITs in Kenya have a number of tax benefits, among them being;

- A listed REIT also allows underlying owners of the real estate assets to enjoy corporate tax exemption, currently at 30% per annum. The only taxation is on distribution of profits to the unit-holders, which would be subject to withholding tax (“WHT”) at the rate of 5% for resident and 10% for non-resident unit-holders,

- The amendment of Section 20 of the Income Tax Act as per Finance Bill 2019 also saw REITs’ investee companies being exempted from income tax. This will allow REITs to invest more in companies that develop real estate, rather than going though the process of transferring properties to the REIT,

- Transfer of properties to a REIT also attracts a stamp duty exemption, as per Section 96A (1) (b) of the Stamp Duty Act.

- No Shareholder Liability - As is the case with equity investments in other publicly traded companies, shareholders have no personal liability for the debts of the REITs in which they invest.

- Liquidity – REITs offer a liquidity advantage over direct investment in privately traded underlying real estate assets. This advantage of a listed REIT extends to the owners of real estate as well since they do not have to sell the entire asset if they are looking for a little liquidity.

- REITs Deliver Income & Long-term Growth - REITs offer strong long-term total returns. Excellent long-term performance and strong diversification attributes make REITs a natural component of a well-balanced efficiently performing portfolio. REITs own tangible assets and often sign their tenants to long-term lease contracts. Because of this, REITs tend be some of the most stable companies on the market.

Section IV: Challenges Facing REIT Adoption in Kenya

There are a number of factors that have led to the slow development of the REIT market in Kenya. These include;

- Inadequate Investor Knowledge - Being a relatively new market segment, there is inadequate investor awareness or education of REITs hence low investment in the market. Inadequate investor knowledge was one of the main reasons attributed to the low subscription rate (29%) and consequent poor performance of Stanlib Fahari I-REIT, as well as the failed issuance of the Fusion D-REIT in 2016,

- Negative Investor Sentiments - Investor sentiments on Kenyan REITs is currently negative mainly due to the general poor performance of the market. For instance, in 2018, the equities market was on a downward trend, with NASI, NSE 25 and NSE 20 declining by 18.0%, 17.1% and 23.7%, respectively, as a result of declines in most large cap stocks, with 8 companies issuing profit warnings as compared to 6 in 2017, while 2 companies, namely Deacons and ARM Cement, were suspended from trading at the Nairobi Securities Exchange,

- Need for a Broader Pool of Trustees – Currently, Kenya has only three institutions certified as REIT trustees. In South Africa a Public Company, an approved company or institution or a bank can be a trustee, thus there is a wider pool of trustees. There is a need to have more corporate trustees apply for REIT trustee licences, and thus there is need to review this minimum share capital requirement, which will include other appropriate players, and in turn make it easier to bring REITs into the market,

- High Minimum Amount Investable in all Real Estate Investment Trusts (REIT) - The current regulations define the minimum subscription amount per investor at Kshs 5.0 mn for a Development REIT (D-REIT), which is too high to attract significant interest from investors,

- Opacity of Exact Returns for Underlying Assets - Despite the best efforts of the regulator to promote transparency in the operation and administration of REITs in Kenya, there exists a gap in the determination of returns from individual assets held by these trusts. This means that investors are not able to tell the exact yields of underlying assets owned by a REIT and this is mainly caused by lack of a clear framework on determination of returns as well as valuation standards especially with regards to investment grade commercial assets,

- Capping of Interest Rates - Capping of interest rates has generally slowed down real estate growth as banks have slowed credit to the sector amidst tightened credit standards as well as uncertainty in the sector and reversal of the interest cap law. Lack of cheap financing in the country has contributed to the slow growth of REITs e.g. Stanlib Fahari I-REIT has faced challenges in raising additional capital through debt financing and noted interest capping as one of the factors that contributed to slow growth of the property market in 2017. It remains to be seen, however, if a repeal of the interest rate cap law will revitalise the real estate industry in Kenya, thus boosting the REIT market,

- Shallow Investment-Grade Asset Pipeline - The pool of available investment grade real estate assets in Kenya that have the ability to generate attractive and sustainable returns is shallow. For instance, Stanlib Fahari I-REIT had to apply for regulatory exemption to extend the deadline for acquiring real estate assets after failing to meet the 75% of real estate income-generating assets threshold within 2 years of the REIT’s authorization to operate. Low supply of investment-grade properties for sale in the market was also a key factor that contributed to the acquisition of Stanlib Fahari I–REIT’s properties in Nairobi’s Industrial Area, a generally low performing zone in the property market, amidst pressure to beat CMA’s deadline to invest at least 75% of the REIT’s total net asset value in real estate within 2 years of its authorization,

- Inconsistent Income - Rental income may be inconsistent over the investment period, attributable to various factors such as termination of lease agreements and failure to renew the same or secure tenants in good time for income continuity. Efficient management of REITs becomes a key factor in the realization of good returns.

Section V: Case Study of the South African REIT Market

The main markets that have REITs in Africa include South Africa, Kenya, Ghana and Nigeria. South Africa has the most developed REIT market with 23 active REITs with a market cap of ZAR 400.0 bn (USD 26.1 bn).

The South African listed property sector is now one of the largest sectors on the JSE by market capitalisation and continues to grow in liquidity. There are now four REITs among the top 40 companies on the JSE, with some global REIT giants in South Africa, such as GRIT, competing with peers from established economies. The listed property sector has been the best performing asset class over last 14 years on the JSE despite the challenging macroeconomic factors in that country.

In South Africa, most investment properties are owned by financial institutions, pension/provident funds including government and parastatal funds, and by property holding vehicles listed on the JSE. In addition to the listed property sector, there are several substantial unlisted companies, and many small to medium-sized unlisted and private companies in that market. Many private property owning companies build up portfolios of investment-grade properties across the various subsectors like retail, office or industrial, with a small component of mixed-use and residential. In terms of value, retail property comprises the bulk of the investment at 60% of the total, with office/commercial properties coming in second at 25%, according to Investment Property Databank Index (IPD) South Africa Annual Property Index.

Factors Driving the Success of the South African REIT Market

Some of the factors that have led to the rapid development of the REIT Market in the South African industry include;

- Presence of Already Developed Capital Markets – Even before the adoption of the REIT structure, the capital markets in the country were already well established. Not only did this make it easier for investment managers in structuring offerings for investors, given that they had built expertise, but it also boosted the uptake given that investors already had sufficient confidence in the capital markets,

- Diverse Property Offerings – The property sector in South Africa is well diversified, with large institutional developers in all the real estate subsectors, who have built a strong track record in real estate delivery, while at the same time giving attractive returns. This has had a snowball effect, by encouraging lenders and investors to commit capital to this sector, further spurring the growth of this sector,

- A Diverse Pool of Trustees – In Kenya, REIT trustees have to have a minimum share capital of Kshs 100.0 mn, thus restricting it majorly to banks. Even then, there are only 3 banks that are authorized as Trustees. In South Africa a Public Company, an approved company or institution or a bank can be a trustee, thus there is a wider pool of trustees,

- Minimum Investments – In South Africa, listed REITs all have to comply by the Johannesburg Stock Exchange (JSE) Rules. According to the JSE, there is no limitation of a minimum amount of capital needed to invest, only a minimum of one share, unlike in Kenya where a minimum capital outlay by an investor in a D-REIT is Kshs 5.0 mn. Taking the median income in Kenya of Kshs 50,000.0, the minimum for a REIT is 100 times their median income. In this regard, these low income investors that need protection by the Regulators, are cut out of the regulated real estate investment bracket, thus end up being exposed to risky real estate investments which do not fall under regulation, but accommodate this lower bracket of income earners, and,

- Good Corporate Governance – Good regulation practices and corporate governance have acted as an incentive to both local and foreign investors, who have the assurance that their funds are being properly administrated and utilised.

The success in implementation of alternatives in the South African industry did not go without a host of challenges, such as (i) fluctuation in the real estate industry, where the property market in South Africa took a hit following the 2008 global economic crisis, and, (ii) competition with higher returns in Asia and other African markets.

Section VI: How to Boost the REIT Market in Kenya

The REIT Market in Kenya has potential for growth, but this will only be possible if a supportive framework is set up. The following measures can be implemented to revitalise the REIT market;

- Teaming Up of the Market Players and the Regulators to Offer Constant Training to the Investing Public - This training should include training the real estate developers on how they can harness the capital markets as a source of capital for development,

- Broaden the Pool of Trustees - Currently, Kenya has only three institutions certified as REIT trustees. In order to make the REIT market more vibrant, we need to widen our pool of investment fund trustees to include capable professionals or corporates. For example, in the UK a Chartered Accountant can register with the Financial Conduct Authority to be a trustee, and in South Africa, an insurance company can also be a trustee,

- Reduce the Minimum Investment to a Reasonable Level - In order to attract capital into capital market vehicles such as Real Estate Investment Trusts (REITs) for real estate development, the minimum investment amount needs to be amended. The current regulations define the minimum subscription amount per investor at Kshs 5.0 mn for a Development REIT (D-REIT), which is too high to attract significant interest from investors. An amount of Kshs 1.0 mn ensures the investor is sophisticated while also allowing a larger pool of investors to participate,

- Development of Institutional Grade Real Estate Assets – Currently, inadequate urban planning has given rise to a defined gap in the real estate market for real estate that is more than just a provision of housing, and that can give returns to investors. In this regard, development of institutional grade real estate assets would provide strong underlying assets for REITs, which can support the returns to investors,

- Continuous Improvement on the Regulation and Government Support for REITs e.g. providing regulations that assist in real estate uptake to help increase cash flows into the property market,

- Collaboration of Key Players in the Real Estate and Investment Sectors will Play a Major Role in Harnessing Broad Support with Regards to Issuance of REITs in the Country . Promotion of club deals at an early stage in the structuring of REIT offerings could go a long way to attract institutional support for successful REIT offerings, and,

- Industry Players Should Seek Ways of Enhancing Investor Confidence in Kenyan REITs e.g. through;

- Increasing the amount of principal or other leverage instruments by promoters prior to a REIT offering to give investors some comfort that the promoters believe in the REIT,

- Providing minimum return guarantees for investors, and,

- Promoting clearer and more transparent financial statements of publicly real estate firms, listed properties and REITs in general.

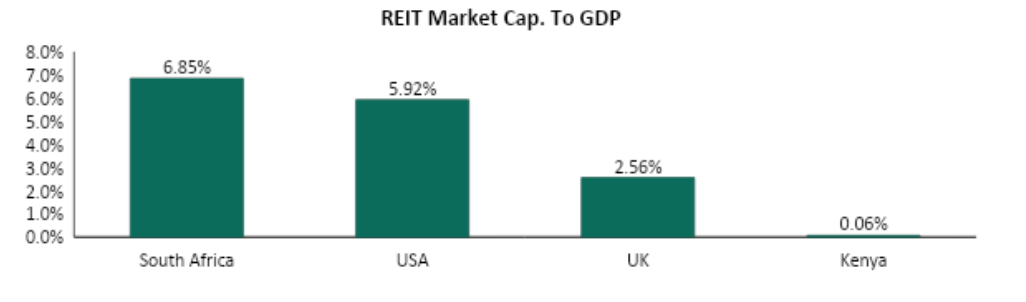

In summary, there is a lot of opportunity in the REIT market in Kenya, as evidenced by the low REIT Market Cap to GDP, at less than 0.1%, compared to more developed markets such as South Africa, at 6.9%. Should the investments in real estate be packaged into securities that enable the public an opportunity to own real estate, this will open REITs up to investors and in turn lead to deepening of our capital markets.

It will however require the collective efforts of developers, investment managers, regulators, government and other key players to create a success story for REITs in Kenya, similar to what has been witnessed in South Africa. We still hold that if measures to increase public awareness and educate the masses on REITs as an asset class are taken, this will boost returns of the underlying asset, which is real estate as an investment instrument.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.