Review of the Real Estate Regulation Bill 2023, & Cytonn Weekly #41/2023

By Cytonn Research, Oct 15, 2023

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the second consecutive week, with the overall subscription rate coming in at 180.2%, higher than the oversubscription rate of 138.1% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 37.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 937.4%, higher than the oversubscription rate of 714.5% recorded the previous week. The subscription rate for the 364-day paper decreased to 29.6%, from 31.6% recorded the previous week while the subscription rate for the 182- day paper increased to 27.8%, from 14.1% recorded the previous week. The government accepted a total of Kshs 40.9 bn worth of bids out of Kshs 43.2 bn of bids received, translating to an acceptance rate of 94.7%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day and 91-day papers increasing by 15.0 bps, 4.5 bps and 8.7 bps to 15.3%, 15.0% and 14.9%, respectively;

In the primary bond market, the Central Bank of Kenya released the auction results for the re-opened bonds FXD1/2023/002 with a tenor of 1.9-years and FXD1/2023/005 with a tenor of 4.8 years. The bonds were undersubscribed, receiving bids worth Kshs 12.3 bn against the offered amounts of Kshs 35.0 bn, translating to a 35.1% undersubscription rate. The government accepted bids worth Kshs 6.3 bn, translating to an acceptance rate of 51.3%. The weighted average yields for the accepted bids came in at 17.7% and 18.0% for FXD1/2023/002 and FXD1/2023/005, respectively. The coupon rates for the FXD1/2023/002 and FXD1/2023/005 were 17.0% and 16.8%, respectively;

During the week, the National Treasury gazetted the revenue and net expenditures for the first quarter of FY’2022/2023, indicating that the total revenue collected as at the end of September 2023 amounted to Kshs 540.0 bn, equivalent to 21.0% of the original estimates of Kshs 2,571.2 bn for FY’2023/2024 and is 84.0% of the prorated estimates of Kshs 642.8 bn;

Also, during the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective 15th October 2023 to 14th November 2023. Notably, fuel prices for super petrol, Diesel and Kerosene increased by 2.7%, 2.2% and 1.2% to kshs 217.4, kshs 205.5 and kshs 205.1, respectively, from Kshs 211.6, kshs 200.9 and kshs 202.6 per litre for super petrol, Diesel and Kerosene respectively;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 gaining the most by 0.1%, and NSE 10 gaining by 0.03%, while NASI and NSE 25 declined by 0.1% and 0.04% respectively, taking the YTD performance to losses of 26.7%, 10.9%, and 21.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as DTB-K, NCBA Bank, Safaricom of 2.6%, 0.4% and 0.4% respectively. The losses were however mitigated by gains recorded by stocks such as Bamburi, Standard Chartered Bank-Kenya and EABL of 4.8%, 2.0% and 1.6% respectively;

Real Estate

During the week, chain store Naivas Supermarket opened its 100th outlet located along King’ara road, Lavington, Nairobi. This comes a week after Naivas opened its 99th outlet located along Ronald Ngala Street Tudor, Sabasaba, Mombasa County. In the infrastructure sector, Kenya National Highways Authority (KeNHA) announced plans to set up 26 virtual weighbridges across the country, aimed at enhancing roads monitoring in concerted efforts to minimize road damage;

In regulated Real Estate Funds, under the Real Estate Investment Trusts (REITs) segment, on the Nairobi Securities Exchange (NSE), the trading of ILAM Fahari I-REIT units was suspended, with effect from Friday 6th October upon the conclusion and subsequent lapsing of the conversation offer period by ICEA Lion Asset Managers. On the Unquoted Securities Platform, as at 29 September 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 25.3 and Kshs 21.7 per unit, a 26.6% and 8.2% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 listing price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 16.1%, a 0.1% points increase from the 16.0% recorded the previous week;

Focus of the Week

For several years, the Kenyan Real Estate industry has been marred by controversies of land and housing companies, as well as unscrupulous developers and Real Estate agents who have swindled buyers through failed promises, and undelivered projects. In response to these critical industry issues, the tabling of Real Estate Regulation Bill of 2023 before Senate in August emerged as the culmination of collective efforts by lawmakers to restore order, transparency, and sanity in the sector. Sponsored by Trans-Nzoia Senator Allan Chesang, the Bill aims to establish regulatory measures for Real Estate developers, agents, and projects. Therefore, in our topical this week, we will review the Real Estate Regulation Bill 2023;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 14.49% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 16.09% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

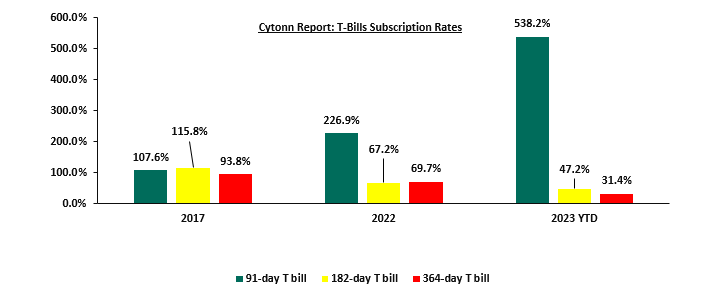

During the week, T-bills were oversubscribed for the second consecutive week, with the overall subscription rate coming in at 180.2%, higher than the oversubscription rate of 138.1% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 37.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 937.4%, higher than the oversubscription rate of 714.5% recorded the previous week. The subscription rate for the 364-day paper decreased to 29.6%, from 31.6% recorded the previous week while the subscription rate for the 182- day paper increased to 27.8%, from 14.1% recorded the previous week. The government accepted a total of Kshs 40.9 bn worth of bids out of Kshs 43.2 bn of bids received, translating to an acceptance rate of 94.7%. The yields on the government papers continued to rise, with the yields on the 364-day, 182-day and 91-day papers increasing by 15.0 bps, 4.5 bps and 8.7 bps to 15.3%, 15.0% and 14.9%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD);

In the primary bond market, the Central Bank of Kenya released the auction results for the re-opened bonds FXD1/2023/002 with a maturity of 1.9-years and FXD1/2023/005 with a maturity of 4.8 years. The bonds were undersubscribed, receiving bids worth Kshs 12.3 bn against the offered amounts of Kshs 35.0 bn, translating to a 35.1% subscription rate. The government accepted bids worth Kshs 6.3 bn, translating to an acceptance rate of 51.3%. The weighted average yield of accepted bids came in at 17.7% and 18.0% for FXD1/2023/002 and FXD1/2023/005, respectively. The coupon rates for the FXD1/2023/002 and FXD1/2023/005 were set at 17.0% and 16.8%, respectively.

Money Market Performance:

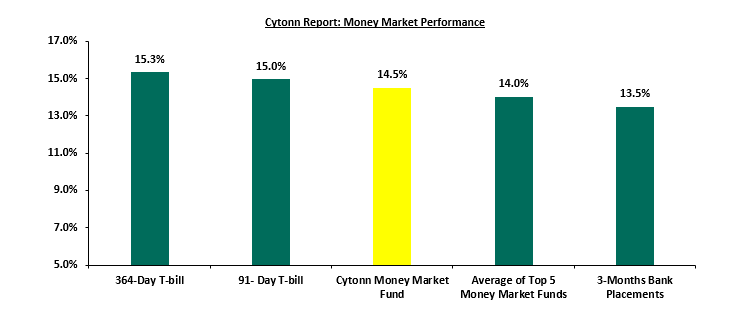

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day and 91-day T-bill increased by 15.0 bps and 8.7 bps to 15.3% and 14.9%, respectively. The yields on the Cytonn Money Market Fund increased by 29.0 bps to 14.5% from 14.2% recorded the previous week, and the average yields on the Top 5 Money Market Funds remained relatively unchanged at 14.0%.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 13th October 2023;

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 13th october 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Cytonn Money Market Fund |

14.5% |

|

2 |

Gencap Money Market Fund |

14.5% |

|

3 |

Enwealth Money Market Fund |

14.0% |

|

4 |

Etica Money Market Fund |

13.8% |

|

5 |

Lofty-Corban Money Market Fund |

13.3% |

|

6 |

Jubilee Money Market Fund |

13.1% |

|

7 |

Nabo Africa Money Market Fund |

13.0% |

|

8 |

Co-op Money Market Fund |

13.0% |

|

9 |

Apollo Money Market Fund |

12.9% |

|

10 |

Madison Money Market Fund |

12.7% |

|

11 |

Kuza Money Market fund |

12.7% |

|

12 |

AA Kenya Shillings Fund |

12.7% |

|

13 |

GenCap Hela Imara Money Market Fund |

12.6% |

|

14 |

Absa Shilling Money Market Fund |

12.4% |

|

15 |

Old Mutual Money Market Fund |

12.2% |

|

16 |

Sanlam Money Market Fund |

12.1% |

|

17 |

KCB Money Market Fund |

11.5% |

|

18 |

Equity Money Market Fund |

11.5% |

|

19 |

ICEA Lion Money Market Fund |

11.5% |

|

20 |

Dry Associates Money Market Fund |

11.2% |

|

21 |

Orient Kasha Money Market Fund |

11.0% |

|

22 |

CIC Money Market Fund |

11.0% |

|

23 |

Mali Money Market Fund |

10.3% |

|

24 |

British-American Money Market Fund |

9.5% |

Source: Business Daily

Liquidity:

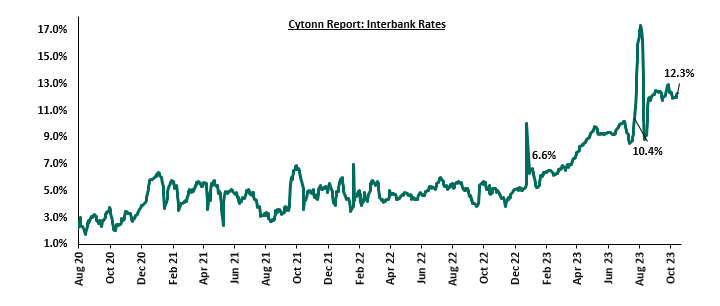

During the week, liquidity in the money markets remained relatively unchanged, with the average interbank rate coming in at 12.0% similar to what was recorded the previous week. The average interbank volumes traded increased by 1.6% to Kshs 27.1 bn from Kshs 26.6 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on a downward trajectory, with the yield on the 10-year Eurobond issued in 2014 decreasing the most by 4.3% points to 14.9%, from 19.3%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 28th Sep 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.7 |

4.4 |

24.4 |

3.6 |

8.6 |

10.7 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

02-Oct-23 |

19.0% |

13.5% |

12.6% |

14.6% |

12.9% |

12.5% |

|

05-Oct-23 |

19.3% |

14.3% |

13.0% |

15.4% |

13.5% |

13.0% |

|

06-Oct-23 |

19.1% |

14.3% |

13.0% |

15.3% |

13.5% |

13.0% |

|

09-Oct-23 |

18.8% |

13.9% |

13.0% |

15.4% |

13.5% |

13.0% |

|

10-Oct-23 |

17.3% |

13.7% |

12.7% |

15.0% |

13.2% |

12.7% |

|

11-Oct-23 |

16.5% |

13.5% |

12.5% |

14.8% |

12.9% |

12.5% |

|

12-Oct-23 |

14.9% |

13.5% |

12.5% |

14.1% |

12.8% |

12.4% |

|

Weekly Change |

(4.3%) |

(0.7%) |

(0.5%) |

(1.3%) |

(0.7%) |

(0.6%) |

|

MTD Change |

(4.1%) |

0.1% |

(0.1%) |

(0.4%) |

0.0% |

0.0% |

|

YTD Change |

2.0% |

3.1% |

1.6% |

3.2% |

2.0% |

2.6% |

Kenya Shilling:

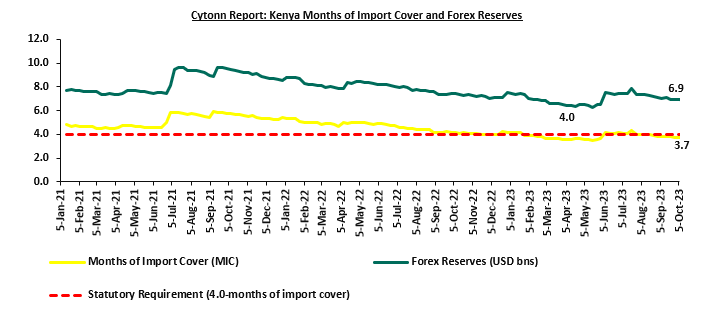

During the week, the Kenya Shilling depreciated against the US Dollar by 0.3% to close at 149.1, from 148.7 recorded the previous week. On a year to date basis, the shilling has depreciated by 20.8% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit which came at 3.7% of GDP in Q2’2023 from 6.0% recorded in a similar period last year,

- The need for government debt servicing continues to put pressure on forex reserves given that 66.8% of Kenya’s external debt is US Dollar denominated as of April 2023, and,

- Dwindling forex reserves currently at USD 6.9 bn (equivalent to 3.7 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 2,766.3 mn in 2023 as of August 2023, 3.4% higher than the USD 2,674.5 mn recorded over the same period in 2022 According to the August 2023 diaspora remittances figures, North America remains the largest source of remittances to Kenya accounting for 57.0% in the period, followed by Europe at 17.3% while the rest of the world accounted for 25.7% of the total remittances, and,

- The tourism inflow receipts which came in at USD 268.1 bn in 2022, an ae82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

The chart below summarizes the evolution of Kenya months of import cover over the years:

Weekly Highlights

- Revenue and Net Exchequer for FY’2023/2024

The National Treasury gazetted the revenue and net expenditures for the third month of FY’2023/2024, ending 29th September 2023. Below is a summary of the performance:

|

FY'2023/2024 Budget Outturn - As at 29th September 2023 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved of the Original Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

2.6 |

|

|

|

|

Tax Revenue |

2,495.8 |

514.3 |

20.6% |

624.0 |

82.4% |

|

Non-Tax Revenue |

75.3 |

23.1 |

30.6% |

18.8 |

122.6% |

|

Total Revenue |

2,571.2 |

540.0 |

21.0% |

642.8 |

84.0% |

|

External Loans & Grants |

870.2 |

57.8 |

6.6% |

217.5 |

26.6% |

|

Domestic Borrowings |

688.2 |

147.2 |

21.4% |

172.1 |

85.5% |

|

Other Domestic Financing |

3.2 |

3.0 |

95.4% |

0.8 |

381.6% |

|

Total Financing |

1,561.6 |

208.0 |

13.3% |

390.4 |

53.3% |

|

Recurrent Exchequer issues |

1,302.8 |

268.1 |

20.6% |

325.7 |

82.3% |

|

CFS Exchequer Issues |

1,963.7 |

384.9 |

19.6% |

490.9 |

78.4% |

|

Development Expenditure & Net Lending |

480.8 |

31.6 |

6.6% |

120.2 |

26.3% |

|

County Governments + Contingencies |

385.42 |

61.11 |

15.9% |

96.4 |

63.4% |

|

Total Expenditure |

4,132.7 |

745.8 |

18.0% |

1,033.2 |

72.2% |

|

Fiscal Deficit excluding Grants |

1,561.6 |

205.8 |

13.2% |

390.4 |

52.7% |

|

Total Borrowing |

1,558.4 |

205.0 |

13.2% |

389.6 |

52.6% |

Amounts in Kshs bn unless stated otherwise

The Key take-outs from the release include;

- Total revenue collected as at the end of September 2023 amounted to Kshs 540.0 bn, equivalent to 21.0% of the original estimates of Kshs 2,571.2 bn for FY’2023/2024 and is 84.0% of the prorated estimates of Kshs 642.8 bn. Cumulatively, tax revenues amounted to Kshs 514.3 bn, equivalent to 20.6% of the original estimates of Kshs 2,495.8 bn and 82.4% of the prorated estimates of Kshs 624.0 bn,

- Total financing amounted to Kshs 208.0 bn, equivalent to 13.3% of the original estimates of Kshs 1,561.6 bn and is equivalent to 53.3% of the prorated estimates of Kshs 390.4 bn. Additionally, domestic borrowing amounted to Kshs 147.2 bn, equivalent to 21.4% of the original estimates of Kshs 688.2 bn and is 85.5% of the prorated estimates of Kshs 172.1 bn,

- The total expenditure amounted to Kshs 745.8 bn, equivalent to 18.0% of the original estimates of Kshs 4,132.7 bn, and is 72.2% of the prorated target expenditure estimates of Kshs 1,033.2 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 268.1 bn, equivalent to 20.6% of the original estimates of Kshs 1,302.8 and 82.3% of the prorated estimates of Kshs 325.7 bn,

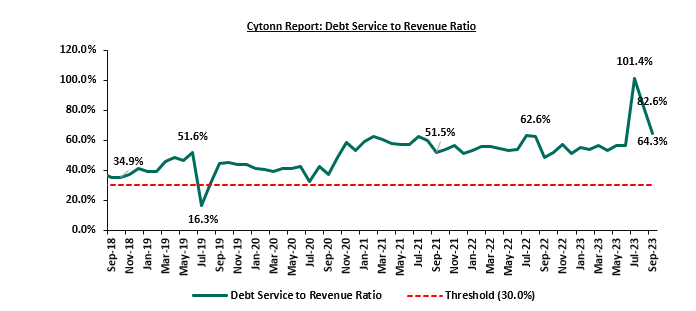

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 384.9 bn, equivalent to 19.6% of the original estimates of Kshs 1,963.7 bn, and are 78.4% of the prorated amount of Kshs 490.9 bn. The cumulative public debt servicing cost amounted to Kshs 347.2 bn which is 19.8% of the original estimates of Kshs 1,751.1 bn, and is 79.3% of the prorated estimates of Kshs 437.8 bn. Additionally, the Kshs 347.2 bn debt servicing cost is equivalent to 64.3% of the actual revenues collected as at the end of September 2023. The chart below shows the debt servicing to revenue ratio;

- Total Borrowings as at the end of September 2023 amounted to Kshs 205.0 bn, equivalent to 13.2% of the original estimates of Kshs 1,558.4 bn for FY’2023/2024 and are 52.6% of the prorated estimates of Kshs 389.6 bn. The cumulative domestic borrowing of Kshs 688.2 bn comprises of Net Domestic Borrowing Kshs 313.7 bn and Internal Debt Redemptions (Rollovers) Kshs 374.5 bn.

The revenue performance continues to be impeded by the poor business environment brought about by the high cost of living amid high fuel prices, the sustained depreciation of the Kenya shilling as well as the difficult business and entrepreneurship environment. This is evidenced by the purchasing managers index for the month of September 2023 coming in at 47.8, from 50.6 recorded in August 2023. As such, we believe that the performance in terms of revenue collection during the coming months will be largely determined by how soon the country’s business environment stabilizes. Notably, the government continues to implement strategies to enhance revenue collection, such as expanding the revenue base and addressing tax leakages, as well as suspending tax relief payments.

- Fuel Prices effective 15th October 2023 to 14th November 2023

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective 15th October 2023 to 14th November 2023. Notably, fuel prices for super petrol, Diesel and Kerosene increased by 2.7%, 2.2% and 1.2% to Kshs 217.4, Kshs 205.5 and Kshs 205.1, respectively, from Kshs 211.6, kshs 200.9 and kshs 202.6 per litre for super petrol, Diesel and Kerosene respectively.

Other key take-outs from the performance include;

- The average landing costs per cubic meter for super petrol, Diesel and Kerosene increased by 3.9%, 7.1% and 5.0% to USD 805.1, USD 845.7, and USD 868.7 in September 2023, UP from USD 774.7, USD 789.9 and USD 827.3 respectively in August 2023, and,

- The Kenyan shilling depreciated against the US Dollar by 2.9% to kshs 153.3 in September 2023, compared to the mean monthly exchange rate of kshs 149.0 recorded in August 2023.

We note that fuel prices in the country have increased significantly based on historical levels despite the governments continued efforts to stabilize fuel prices by extending the existing oil supply deal with the three Gulf based companies namely; Emirates National Oil Corporation, Abu Dhabi National Oil Corporation and Saudi Aramco until December 2024. The high fuel prices in the country are mainly due to the high cost of fuel imports as a result of the increasing oil prices globally, depreciation of the shilling against the US dollar, as well as the high taxation of petroleum products as provided in the finance Act 2023. We project that fuel prices will rise further in the coming months as a result of the continued depreciation of the Kenya shilling against the Dollar which continues to put pressure on the importation costs of petroleum products.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 19.1% behind of its prorated net domestic borrowing target of Kshs 91.2 bn, having a net borrowing position of Kshs 73.8 bn of the domestic net borrowing target of Kshs 316.0 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk

Market Performance:

During the week, the equities market recorded mixed performance, with NSE 20 gaining by 0.1%, and NSE 10 gaining by 0.03%, while NASI and NSE 25 declined by 0.1% and 0.04% respectively, taking the YTD performance to losses of 26.7%, 10.9%, and 21.8% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as DTB-K, NCBA Bank, Safaricom of 2.6%, 0.4% and 0.4% respectively. The losses were however mitigated by gains recorded by stocks such as Bamburi, Standard Chartered Bank-Kenya and EABL of 4.8%, 2.0% and 1.6% respectively.

During the week, equities turnover decreased by 58.2% to USD 3.1 mn from USD 7.5 mn recorded the previous week, taking the YTD total turnover to USD 583.3 mn. Foreign investors became net sellers for the first time in two weeks with a net selling position of USD 0.1 mn, from a net buying position of USD 0.3 mn recorded the previous week, taking the YTD foreign net selling position to USD 281.8 mn.

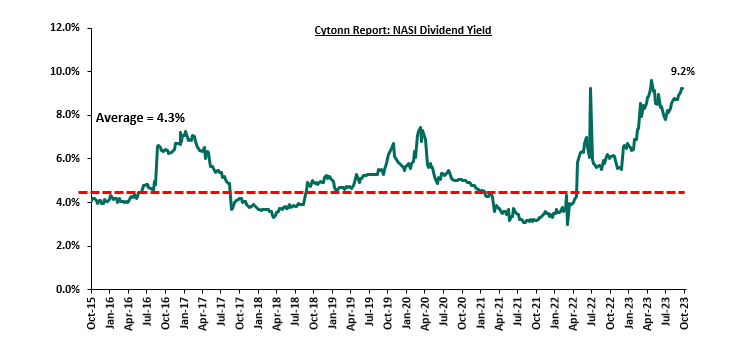

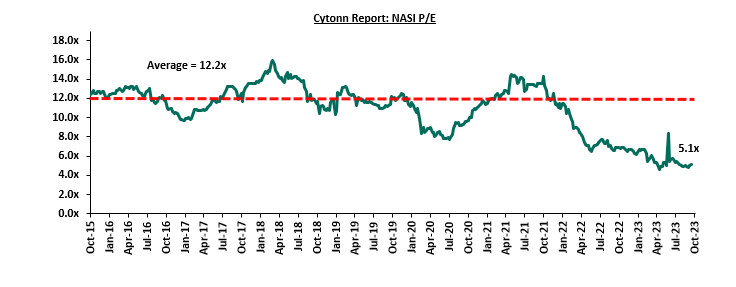

The market is currently trading at a price to earnings ratio (P/E) of 5.1x, 58.2% below the historical average of 12.2x. The dividend yield stands at 9.2%, 4.9% points above the historical average of 4.3%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||

|

Company |

Price as at 06/10/2023 |

Price as at 13/10/2023 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group *** |

21.0 |

20.9 |

0.2% |

(45.5%) |

30.7 |

9.6% |

56.5% |

0.4x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

1.1% |

(4.8%) |

2.5 |

11.2% |

52.2% |

0.1x |

Buy |

|

Liberty Holdings |

3.6 |

4.0 |

11.1% |

(20.6%) |

5.9 |

0.0% |

48.0% |

0.3x |

Buy |

|

Jubilee Holdings |

188.0 |

193.5 |

2.9% |

(2.6%) |

260.7 |

6.2% |

40.9% |

0.3x |

Buy |

|

I&M Group*** |

18.0 |

17.6 |

(2.2%) |

2.9% |

21.8 |

12.8% |

37.0% |

0.4x |

Buy |

|

ABSA Bank*** |

11.9 |

11.9 |

0.0% |

(2.5%) |

14.8 |

11.3% |

35.7% |

1.0x |

Buy |

|

Sanlam |

7.7 |

7.7 |

0.0% |

(19.6%) |

10.3 |

0.0% |

33.6% |

2.2x |

Buy |

|

Britam |

4.7 |

4.5 |

(4.7%) |

(14.0%) |

6.0 |

0.0% |

33.6% |

0.6x |

Buy |

|

Diamond Trust Bank*** |

48.8 |

47.6 |

(2.6%) |

(4.6%) |

58.1 |

10.5% |

32.7% |

0.2x |

Buy |

|

Co-op Bank*** |

11.6 |

11.6 |

0.0% |

(4.1%) |

13.5 |

12.9% |

29.3% |

0.5x |

Buy |

|

Equity Group*** |

36.6 |

36.5 |

(0.3%) |

(19.1%) |

42.6 |

11.0% |

27.8% |

0.8x |

Buy |

|

CIC Group |

2.1 |

2.1 |

2.4% |

11.0% |

2.5 |

6.1% |

24.1% |

0.7x |

Buy |

|

NCBA*** |

39.1 |

39.0 |

(0.4%) |

0.0% |

43.2 |

10.9% |

21.8% |

0.8x |

Buy |

|

Standard Chartered*** |

160.3 |

163.5 |

2.0% |

12.8% |

170.9 |

13.5% |

18.0% |

1.1x |

Accumulate |

|

Stanbic Holdings |

115.0 |

115.0 |

0.0% |

12.7% |

118.2 |

11.0% |

13.7% |

0.8x |

Accumulate |

|

HF Group |

4.2 |

4.2 |

0.5% |

34.6% |

3.2 |

0.0% |

(24.5%) |

0.2x |

Sell |

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Retail Sector

During the week, chain store Naivas Supermarket opened its 100th outlet located along King’ara road, Lavington, Nairobi. This comes a week after Naivas opened its 99th outlet located along Ronald Ngala Street Tudor, Sabasaba, Mombasa County. The opening of this latest store marks a significant achievement in the retailer's ongoing expansion plan dubbed 'Road to 100', which has been in progress for several months. We attribute Naivas’ aggressive expansion witnessed in recent months to the retailer’s desire to broaden its presence and boost its market share, in a bid to stamp market dominance against rival retailers such as Quickmart, and Carrefour. In addition, the retailer disclosed plans to open up two additional outlets which will be situated at along Mwanzi road, Nairobi and Kakamega town.

Naivas, along with other retailers such as Carrefour and QuickMart have opened new outlets in efforts to expand their market footprint leveraging on the low formal retail penetration in Kenya, standing at 30.0% as at 2018, as well as existing gaps left by other retailers such as Nakumatt, Uchumi, Shoprite and Choppies Supermarkets who exited the market. The table below shows the number of stores currently operated by key local and international retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches opened in 2023 |

Closed branches |

Current branches |

|

Naivas |

Hybrid* |

46 |

61 |

69 |

79 |

91 |

9 |

0 |

100 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

4 |

0 |

59 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

2 |

0 |

21 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

0 |

59 |

5 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

16 |

181 |

226 |

|

*51% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

|||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||

Source: Cytonn Research

- Infrastructure Sector

During the week, Kenya National Highways Authority (KeNHA) announced plans to set up 26 virtual weighbridges across the country, aimed at enhancing roads monitoring in concerted efforts to minimize road damage. The weighbridges will be designed to have a system which will include sensors, loops, scanners, Automatic Number Plate Recognition (ANPR), and Closed-Circuit Television (CCTV) cameras. The weighbridges will be installed along the Southern Bypass, two at Sagana, Kirinyaga County, Kamulu, Yatta, Eldoret, Mayoni, Ahero, Kaloleni, Laisamis, Sabaki, Madogo in Garissa, Mwatate, Kibwezi, Malili, Emali, Kajiado, Salgaa, Makutano, Mukumu, Cheptiret, Malaba, Eldama Ravine, Meru and Kamagambo areas. The weighbridges will be controlled remotely, and will allow for vehicles especially on bypasses to remit signals for overloaded vehicles to the control room. This will enable for the flagging of vehicles which are in violation. KeNHA’s push to install additional weighbridges comes at a time when there is growing concern of road damage, occasioned by overloaded trucks.

We expect the project to; i) contribute to ensuring that axle loads applied to roads are not exceeded thus minimizing damage to roads, and bridges, ii) level the playing field for the conduct of transport business in and around the country, iii) drive compliance, considering the road network in Kenya is continuously expanding, and, iv) compliment the enforcement of existing laws put in place such as punishment of transporters by imposition of fines of up to Kshs 400,000 for trucks overloaded beyond 10 tonnes.

- Real Estate Regulated Funds

- Real Estate Investments Trusts (REITs)

In the Nairobi Securities Exchange (NSE), the trading of ILAM Fahari I-REIT units was suspended, with effect from Friday 6th October upon the conclusion and subsequent lapsing of the conversion offer period by ICEA Lion Asset Managers. The trading of ILAM Fahari I-REIT units will remain suspended until 25th October 2023 after which the suspension will be lifted and the REIT units will resume trading on the Unquoted Securities Exchange (USP).

This comes a month after the Capital Markets Authority (CMA) gave its approval for the conversion of ILAM Fahari Income Real Estate Investment Trust (REIT) from the Unrestricted Main Market segment of the Nairobi Securities Exchange (NSE) into the Restricted Market Segment through a Conversion Offering Memorandum. The conversion process entailed buying out non-professional investors who held shares valued below Kshs 5.0 mn at Kshs 11.0 per unit by ICEA Lion Asset Management. The total number of units held by the non-professional investors totaled 36,585,134 units. Following this and approval of the results from the redemption process by the CMA, the I-REIT will be delisted from the Unrestricted Main Investment Market Segment (UMIMS) of the Nairobi Securities Exchange (NSE) on 4th December, 2023 and subsequent quoting of ILAM Fahari I-REIT Units on the Unquoted Securities Platform (USP) on 22nd January, 2024.. For more information, please see our Cytonn Monthly – August 2023, and Cytonn Weekly #36/2023.

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.3 and Kshs 21.7 per unit, respectively, as at 29 September 2023. The performance represented a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.6 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 632.1 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio hampering major investment they had previously made are on top of other general challenges such as; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

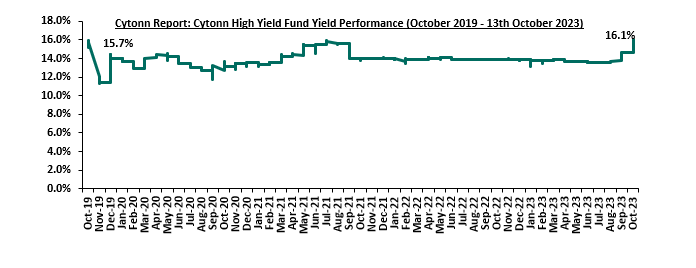

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 16.1% , a 0.1% points increase from 16.0% recorded the previous week. The performance also represented a 2.2% points Year-to-Date (YTD) increase from 13.9% yield recorded on 1 January 2023, and 0.4% points Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 13 October 2023;

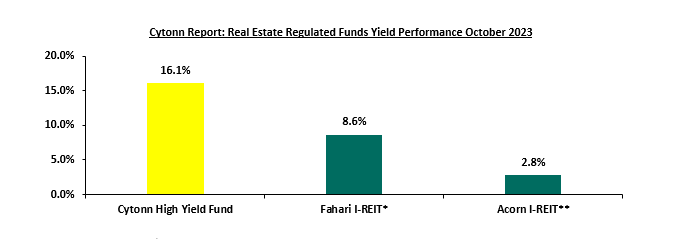

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 16.1%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 8.6%, and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

* As at Friday October 6th 2023

**H1’2023

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate industry to remain resilient in the current tough economic period, supported by factors such as expansion activities by both local and international retailers, and government’s continued emphasis on development of the infrastructural sector. However, the sector's optimal performance is expected to be weighed down by rising construction costs as a result of inflationary pressures, an oversupply of physical space in the commercial office and retail segments resulting in slower uptake of new spaces, and limited investor knowledge in REITs coupled with high minimum investment amounts that are stymying the asset class.

For several years, the Kenyan Real Estate industry has been marred by controversies of land and housing companies, as well as unscrupulous developers and Real Estate agents who have swindled buyers through failed promises, and undelivered projects. Despite the Real Estate sector being a major contributor to the country’s Gross Domestic Product (GDP), and surpassing perennial major contributors to GDP such as transport to become the second largest contributor to the economy, there is still the lack of proper regulation and oversight over developers activities and other stakeholders in the sector. This poses significant challenges that could claw back the gains.

In our topicals namely, Real Estate Developers Regulatory Framework and Off-Plan Real Estate, we highlighted the urgent need for Kenya to establish a regulatory framework that is anchored in law, addressing the unique needs of Real Estate developers, financiers and other stakeholders in the sector including buyers. Additionally, we highlighted the lack of a competent regulatory framework in the off-plan investment sector, as the existing provisions do not fully encompass the specific regulatory needs and protections required for off-plan investments. These gaps in regulation have allowed some developers to exploit the system, leading to various challenges and risks for buyers.

In light of the above concerns, it became imperative to institute legislation that effectively addresses these challenges, thereby ensuring robust consumer protection and the mitigation of a diverse array of risks and uncertainties such as developer non-compliance, fund mismanagement, and unethical practices within the Real Estate and construction sectors. In response to these critical industry issues, the tabling of Real Estate Regulation Bill of 2023 before Senate in August emerged as the culmination of collective efforts of lawmakers to restore order, transparency, and sanity in the sector. Sponsored by Trans-Nzoia Senator Allan Chesang, the Bill aims to establish regulatory measures for Real Estate developers, agents, and projects.

Acknowledging the importance of regulating the sector and recognizing that the Bill is a significant step towards introducing a structured and accountable regulatory framework within Kenya's Real Estate domain, we assert that the Bill suffers from substantial shortcomings, particularly concerning its compatibility with existing Real Estate and construction industry regulations. Therefore, it is of utmost importance that these discrepancies are harmonized with current laws and regulations, necessitating a thorough redrafting of the Bill and further deliberation before its formal enactment. In support of this, key industry stakeholders, including the Estate Agents Registration Board (EARB), the governing body for Real Estate agents in Kenya, and the Institution of Surveyors of Kenya (ISK), have strongly opposed the Bill noting that the proposal to regulate Real Estate professionals alongside developers and land buying companies, who are primarily business entities, is unreasonable and impractical. In our topical this week, we review the Real Estate Regulation Bill 2023 by covering the following;

- Overview of Kenya’s Real Estate Sector,

- Real Estate Regulation Bill 2023 Framework,

- Concerns Raised by Existing Regulatory Authorities and Our View, and,

- Recommendations and Conclusion.

Section I: Overview of Kenya’s Real Estate Sector

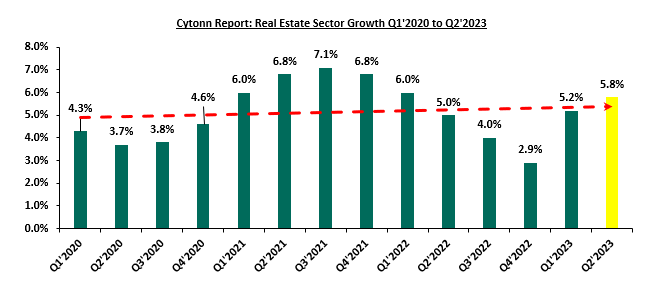

The Kenyan Real Estate sector has been a major contributor to the country’s Gross Domestic Product (GDP) in recent years, expanding at a 5-year Compounded Annual Growth Rate (CAGR) of 5.7% to Kshs 521.1 bn in Q2’2023, from Kshs 394.6 bn in Q3’2018. The positive performance can be attributed to several factors such as; i) rapid population and urbanization rates facilitating demand for Real Estate developments, ii) government and the private sector focus to facilitate the provision of affordable housing, iii) collaborative initiatives by public and private stakeholders to enhance the country’ infrastructure, resulting in the creation of new opportunities for property development in previously untapped areas, iv) increased expansions by international hotel chains in the hospitality sector, v) provision of long-term accessible low-interest home loans to potential buyers by the Kenya Mortgage Refinance Company (KMRC), and, v) rapid expansion drive by both local and international retailers boosting the retail sector.

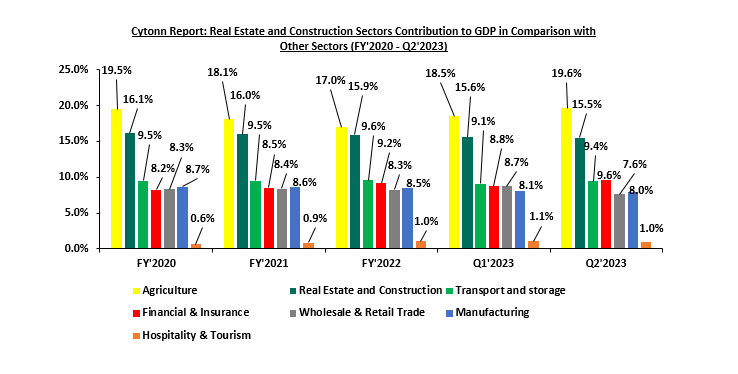

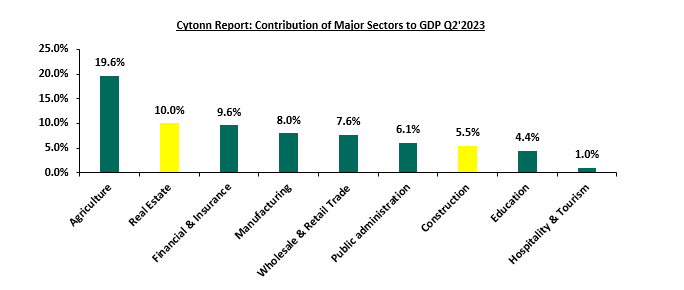

Additionally, the Real Estate and construction sectors collaboratively contributed 15.5% to the total GDP in Q2’2023, only behind the Agricultural sector that contributed 19.6%. This impressive performance of the sectors in Q2’2023, which surpassed perennial major contributors to GDP such as financial services and insurance at 9.6%, transport at 9.4%, manufacturing at 8.0% and trade contributed at 7.6%, underscores the growing importance of these two sectors to the Kenyan economy and signifies a positive outlook. The graph below shows the trend of Real Estate and Construction sectors contribution to GDP between FY’2020 and Q2’2023;

Source: Kenya National Bureau of Statistics (KNBS)

The graph below shows the top sectoral contributors to GDP during Q2’2023, with Real Estate being the second-largest contributor;

Source: Kenya National Bureau of Statistics (KNBS)

However, the Real Estate sector’s growth rate over the years has been fluctuating, registering downward growth trends in FY’2020 on the back of the entry and prevalence of COVID-19 pandemic in the country. Nevertheless, in 2021, the sector experienced a significant rebound in activities following the gradual reopening of the economy majorly occasioned by the lifting of travel restrictions, lockdowns and bans initially instituted to mitigate spread of the virus. The sector’s growth rates experienced a shocks in 2022, declining from 5.0% in Q2’2022 to 2.9% in Q4’2022. This was attributed to the anticipation of the August 2022 elections which saw investors adopt a ‘wait-and-see’ attitude. Notably, the sector rebounded in Q1’2023, growing at a rate of 5.2% on the back of enhanced investor confidence owing to the peaceful conclusion of August polls. Other factors that continued to weigh down on the optimal performance of the sector include an oversupply of 5.8 mn SQFT of commercial office space in the Nairobi Metropolitan Area (NMA), 3.3 mn SQFT in the Nairobi Metropolitan Area (NMA) retail market, 2.1 mn SQFT oversupply in the overall Kenyan retail market as at 2023, and, a subdued REIT market due to limited investor awareness of the investment instrument among other factors. The graph below shows the Real Estate Sector Growth Rate between Q1’2020 and Q2’2023;

Source: Kenya National Bureau of Statistics (KNBS)

Challenges Faced by Various Stakeholders in the Real Estate Sector

The following presents a summary of challenges faced by developers and other key stakeholders during Real Estate development in Kenya. These challenges underscore the need for a regulatory body that will help supervise development activities in a manner that enhances the efficiency of the Real Estate sector in Kenya. These include;

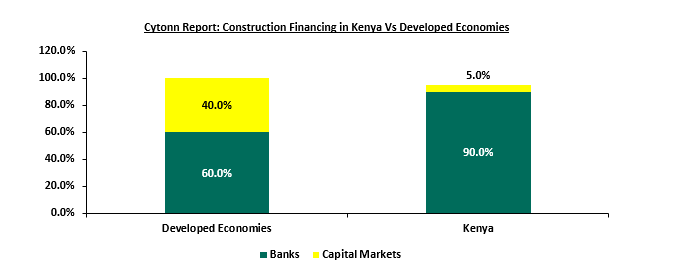

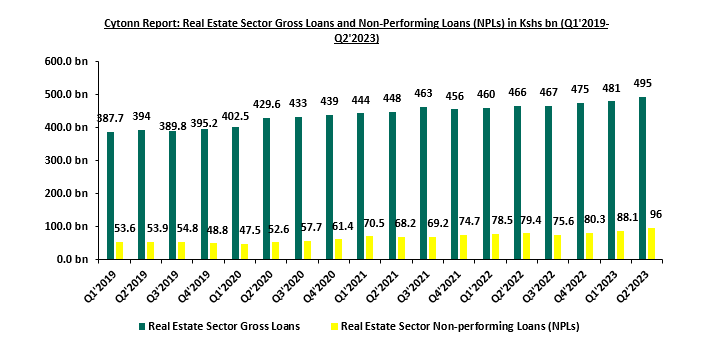

- Challenges in Obtaining Funding for Construction: Due to sub-par performance of the Kenyan capital markets, commercial banks have remained the primary source of funding for Real Estate developers, providing nearly 95.0% of funding for construction activities as opposed to 40.0% in developed countries. This implies that other capital markets contribute only 5.0% of Real Estate development funding, compared to 60.0% in developed economies. The performance of the real estate portfolio has also been wanting with the gross Non-Performing Loans (NPLs) in the sector increasing as at the Q2’2023, the NPL saw an increase of 9.0% to Kshs 96.0 bn in from Kshs 88.1 bn in Q1’2023. This signals continued elevated credit risk, making it difficult for developers to access financing as banks demand more collateral and implement tighter lending requirements such as higher interest rates on the loans. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: Capital Markets Authority (CMA), World Bank

The graph below shows the Gross Loans advanced to the Real Estate sector against Non-Performing Loans in the sector from Q1’2019 to Q2’2023;

- Increasing Total Development Costs: The rising costs of construction in Kenya fueled by elevated inflationary pressures on commodities, supply chain disruptions of the key construction materials from overseas markets, shortage of raw materials used in local production by manufacturing companies continue to increase the total development costs incurred by developers. According to Integrum, the average cost of construction is estimated at Kshs 41,600 to Kshs 100,800 per SQM in 2023 depending on various factors such as location of project and type of development, 22.7% up from a range of between Kshs 34,650 to Kshs 77,500 per SQM in 2022. Worth noting is, construction costs do not include professional fees, development management costs, land acquisition and enhancement costs, marketing costs, financing costs and other incidental and acquisition costs that add up to the total cost of development,

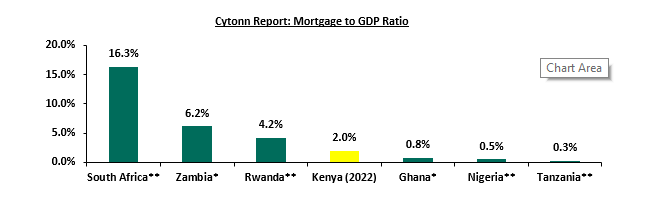

- Inefficiencies in the Mortgage / Off-Take Market: Limited development of the Kenyan mortgage market makes it difficult for developers and investors to sell properties, as homebuyer’s ability to purchase property is weighed down by the inability to access affordable long-term home financing. As such, Kenya’s mortgage-to-GDP ratio remains depressed at 2.0%, compared to other African countries such as South Africa at 16.3%. The Kenya Mortgage Refinancing Company (KMRC), the sole Mortgage Liquidity Facility (MLF) in the country which officially began its lending in 2021, is yet to stamp its dominance in the mortgage market and increase its attractiveness to more stakeholders in the sector. KMRC has only refinanced mortgage loans valued at Kshs 7.6 bn as at June 2023, which was a 484.6% increase from home loans disbursed in 2021 valued at Kshs 1.3 bn, when it began its lending operations. However, notwithstanding, the value of home loans refinanced by the KMRC as at June 2023 remains low at 2.9% of the value of mortgage loans outstanding which stood at Kshs 261.8 bn as at 2022. The graph below shows the mortgage to GDP ratio of Kenya compared to other countries as at 2022;

Figure as of: *(2020) ** (2021)

Source: Centre for Affordable Housing Finance Africa (CAHF)

- Scarcity of Serviced Land: The scarcity in supply of land serviced with sufficient roads, water, and electric supply, sewer lines, and utilities prompts private developers, and buyers (purchasers) to dig deeper into their pockets to provide such basic infrastructure and amenities, necessary to support new developments for their projects. This in turn increases overrun hidden costs incurred during development,

- Lengthy Approval Processes: The lengthy approvals processes in obtaining construction permits and requisite approvals in Kenya makes navigating Real Estate development in the country difficult and exhausting. According to the World Bank, it takes approximately 160 days to obtain necessary construction permits and approvals from pre-construction phase to post-construction. This creates delays in project delivery for both developers and individuals as well as increases costs for development. Notably, the report estimates the total costs required to obtain construction approvals and permits at Kshs 239,563,

- Sub-Standard Buildings: According to Status of The Built Environment Report 2022 Report, 69.8% of the inspected projects by National Construction Authority (NCA) were found to be non-compliant with building codes and regulations. This non-compliance resulted from various factors such as lack of adherence to building codes, poor construction practices, and the use of substandard materials and unqualified contractors. Non-compliance leads to costly delays in project completion, hefty fines, and even collapse of buildings. An audit report by the Nairobi Building Inspectorate (NBI) indicated that out of 14,895 buildings audited across the country, 10,791 were unsafe for occupancy and needed reinforcement or demolition, and 723 of the buildings were deemed dangerous. Only 1,217 were in fair condition and 2,194 were in safe condition. National Construction Authority (NCA’s) 2019 audit report in Kenya, reports there have been over 87 reported cases of collapsed buildings since 2015, with an estimated 200 people dead and 1,000 people injured. As a result, these buildings are continuously endangering lives of purchasers/tenants and could potentially lead to further loss of lives and property,

- Inadequate Consumer Protection in Off-Plan Sale Arrangements: There is a lack of comprehensive legislation specifically addressing off-plan investments, which leaves buyers vulnerable to potentially fraudulent activities or unethical practices by developers as they take advantage of the information asymmetry that exist among most buyers in the housing market. The absence of clear guidelines on issues such as buyer rights has created an imbalance in the relationship between developers and buyers. Furthermore, the lack of oversight and monitoring allows some developers to operate without proper scrutiny, potentially leading to partnering with quack contractors in construction to deliver sub-standard buildings, project delays, or even abandonment of projects,

- Limited Remedies for Breach of Contract: The existing legal framework has not adequately addressed remedies for breaches of contract or non-compliance by developers. Apart from alternative resolution mechanisms that might have been agreed stakeholders in the off-plan development, parties in the transactions are left with very limited options to seek redress in case of project delays, poor construction quality, or other contractual violations,

- Absence of Escrow Accounts: There is absence of mandatory requirements for developers to establish escrow accounts or mechanisms to safeguard buyers' funds or compensate them upon not delivering the projects as stipulated in contracts, posing a significant risk. Without such accounts, developers easily misuse buyers' deposits and fail to deliver the promised properties, leaving buyers with financial losses and unfinished projects, and,

- Increasing Number of Unlicensed Real Estate Agents: The rise of unlicensed Real Estate agents commonly known as ‘brokers’ poses a multifaceted challenge including legal, ethical, and reputational concerns. It is crucial for the sector to address this issue to ensure the protection of consumers, maintain professional standards, and foster trust in the industry.

Section II: Real Estate Regulatory Bill 2023 Framework in Kenya

This section discusses key aspects, including the establishment and operation of the Real Estate Board, the role and functioning of the Registrar and register, the process for registering and licensing Real Estate agents in Kenya, the procedures for registering Real Estate projects, the specific duties assigned to Real Estate developers, and the rights and obligations of Real Estate buyers designed to enhance consumer protection mechanisms. Additionally, we shall address potential offences and the corresponding penalties for those who violate the proposed regulations, along with the repeal of the existing Estate Agents Act, Cap 533.

- Formation and Operationalization of Real Estate Board

The Bill proposes the establishment of a national Real Estate Board under Part II, Section 4 of the proposed Act. The Board will have the powers of; i) suing and can also be sued, ii) acquiring, holding and disposing of movable and immovable property, iii) entering into any contract or other transaction, and doing all such other acts and things which a body corporate may lawfully do, and, iv) exercising the powers and performing the functions conferred to it under the Act.

Composition of the Real Estate Board

The management of the Board shall vest in a Board of Directors consisting of;

- a Chairperson appointed by the Cabinet Secretary of Land, Physical Planning, Housing, and Urbanisation,

- the Principal Secretary for matters land and physical planning or a designated representative,

- the Principal Secretary responsible for housing and urbanization or a designated representative;

- the Principal Secretary for the National Treasury or a designated representative;

- one man and one woman nominated by the Council of County Governors;

- one person nominated by the association representing the largest Real Estate land buyers association in Kenya,

- one person nominated by the association representing the largest Real Estate developers association in Kenya;

- one person nominated by the association representing the largest Real Estate agents in Kenya; and

- a Registrar appointed in accordance with section who shall be an ex officio member of the Board.

The Act will also allow the Cabinet Secretary to appoint a relevant and qualified Chairperson and the members of the Board of Directors, with the notice of the appointments being communicated through the Kenya Gazette. The appointees will hold office for a period of three years and be eligible for reappointment for one further term.

Some of the functions conferred to the Board under the Act include;

- Advise the National and county governments on the regulation and development of the Real Estate sector,

- Register Real Estate agents and Real Estate projects,

- License Real Estate agents,

- Maintain a public database with information on Real Estate agents and Real Estate projects registered under the Act with such details as may be prescribed,

- Maintain a public database with information on Real Estate agents and Real Estate projects whose registration have been revoked, and,

- Establish fixed rates, fees and charges to be levied by real estate agents and developers.

Additionally, the Board will be assigned roles in coming up with recommendations to the relevant government agencies to facilitate the growth and promotion of an efficient and competitive Real Estate sector. Such recommendations will be on; i) guidance to protection of the interests of purchasers, Real Estate agents and developers, ii) creation of a single window system for processing time bound project approvals and clearances to ensure timely completion of projects, iii) creation of an independent, transparent, and robust mechanism for addressing complaints, iv) measures to encourage investment in the Real Estate sector by the private sector, v) measures to encourage construction of affordable buildings and in line with environmentally sustainable and green building standards, and, vi) measures to facilitate amicable conciliation of disputes between the developers and Real Estate buyers through dispute settlement forums set up by the buyers, Real Estate agent or developer associations.

- Formation and Operationalization of the Registrar and Register

The Act will allow the formation of a Registrar of Real Estate Agents and Projects who will be appointed by the Board of Directors and will hold the office for five years and eligible for re-appointment.

The functions of the Registrar under the Act include;

- Maintaining a register of Real Estate agents and Real Estate projects in accordance with the Act and in the way prescribed by the Board of Directors,

- Receiving applications for registration Real Estate agents and Real Estate projects and, with the approval of the Board of Directors,

- Having the powers to recommend the Board of Directors on suspensions or revocations of registration of a Real Estate agent or Real Estate project, and,

- Any other functions that might be assigned by the Board of Directors from time to time.

Additionally, the Registrar will be required to record details such as the date of entry, address, qualifications, and other particulars of each registered person and update on any changes in these details. The registered persons will be issued a Certificate of Registration that will be in force for one year upon which a renewal of the certificate will be made on payment. The Registrar will also have the authority to remove any name from the register as ordered by the Board of Directors. Furthermore, the Registrar will be required to publish in the Gazette the name, address, and qualifications of every person registered under the Act, where the publication will serve as evidence of registration.

One great achievement that has been highlighted by the Act is that the Registrar will be responsible for establishing and maintaining an online digital Real Estate portal. This portal will facilitate the registration of Real Estate agents and projects, providing a platform for; i) interaction between various stakeholders, ii) access to finance, information, innovation, and the global market for Real Estate agents and developers, iii) providing information on clearances, approvals, and registration requirements for Real Estate agents and projects, iv) receiving complaints and comments from the public and other industry stakeholders, and, v) serving as a gateway to all Real Estate services offered by the National and County governments, and, vi) for discharging any other duties as required by the Board.

- Registration and Licensing of Real Estate Agents in Kenya

The Bill outlines the process for registering as a Real Estate agent and obtaining a practicing license in Kenya. The process will begin with an application for a practicing license by a Kenyan individual which shall be submitted to the Board of Directors within 28 days of receipt. The Board will thereafter issue a practicing license if the applicant is registered in accordance with the Act, has complied with any relevant continuing educational and professional development standards for that year, and has met all other requirements prescribed by the Board. Such requirements include; a Kenyan citizenship, and a degree certificate in Real Estate or equivalent from a university recognized in Kenya. The practicing license will be valid from the day it is issued to the 31st day of December of that same year. If issued during the first month of any practicing year, it should be valid from the first day of that month. The Board of Directors will have powers to suspend or cancel a practicing license on several grounds issued under the Act. However, the affected licensees will be accorded opportunities to be heard before suspension or cancelation of their practicing licenses.

- Registration of Real Estate Projects in Kenya

Upon making the Bill into law, the Board will be required to operationalize a web-based online system for submitting applications for project registration within a year of its establishment. The process of registration of Real Estate project will start with the developer applying to the Board. The application must include details such as the developer’s name, address, registration particulars, and past projects. This is in addition to an authenticated copy of approvals and commencement certificates from the relevant Board for the project, sanctioned plans, layout plans, and specifications of the proposed project. The application should also contain details about development works to be executed in the proposed project, proposed facilities, and location details of the project with clear demarcation of land dedicated for the project along with its boundaries. Finally, the application should include proforma of the allotment letter, agreement for sale, and the conveyance deed proposed to be signed with the purchasers; and the number, type and the carpet area of apartments or plots, as the case may be, in the project.

Notably, a developer will not be able to advertise, market, book, sell, offer for sale or invite persons to purchase any plot, apartment or building in any Real Estate project that is not registered in accordance with the Act. If a Real Estate project is to be developed in phases, each phase must be considered a separate Real Estate project and therefore, the developer must obtain registration for each phase separately.

Additionally, a statutory declaration by the developer or an authorized person by the developer will also be needed on regards to the specific Real Estate project or phase of a Real Estate project. The statutory declaration should indicate that;

- The developer has a legal title to the land for the proposed development, with valid documents authenticating such title,

- The land is free from all encumbrances, or details of any encumbrances on the land are provided,

- The developer commits to complete the project or phase within a specified time period,

- For off-plan projects, 70.0% of the amounts realized for the Real Estate project from purchasers will be deposited in a separate account to cover construction and land costs,

- The developer will withdraw amounts from the separate account to cover project costs in proportion to the percentage of project completion,

- Withdrawals from the separate account will be certified by an engineer, an architect, and a chartered accountant in practice to ensure they are in proportion to the percentage of project completion,

- The developer will get their accounts audited within six months after the end of every financial year by a chartered accountant in practice, and,

- The developer will take all pending approvals on time.

Grant or Rejection of the Registration

Upon receipt of an application, the Board will have 14 days to either grant or reject registration. The registration will be valid for the period declared by the developer for project completion. In cases of force majeure, which include natural calamities like war, flood, drought, fire, cyclone, earthquake, et cetera, that affect the regular development and completion of the Real Estate project, the Board will be able to extend the registration for not more than one year.

Revocation of Registration of a Developer Executing a Real Estate Project

The Board will be able to revoke the registration of a developer if the developer defaults on any requirements under the Act, violates any terms or conditions of approval given by the competent authority, is involved in any unfair practice or irregularities, or indulges in fraudulent practices. The Board must give the developer at least 30-days’ notice before revoking the registration. With such, developers will have no opportunity or excuse to deliberately under-develop or totally stall projects.

Upon revocation, the Board will have the powers to; i) debar the developer from accessing its website in relation to that project, their name listed as defaulters, and other government entities are informed about the revocation, ii) consult the appropriate level of government to take action including carrying out the remaining development works by a government entity or by the association of purchasers, and, iii) direct the bank holding the project bank account to freeze the account, or subsequently issue directions to de-freeze the account if necessary for project progress. However, it has to be noted that the association of purchasers will have the first right of refusal for carrying out the remaining development works on the project by the deregistered developer.

- Specified Duties of Real Estate Developers in Kenya

The Bill has gone ahead to clearly specify detailed responsibilities to be followed by every developer in Kenya from across the construction life of a project. These duties include;

- Accountability : The developer will be accountable for all obligations, responsibilities, and functions outlined in the Act, either to purchasers as per the sales agreement or to the association formed by purchasers. This responsibility persists until the apartments, plots, or buildings are conveyed to purchasers or the common areas are transferred to the association of purchasers or the relevant authority,

- Defect Management: The developer will be responsible for addressing structural defects or any other defects, even after the conveyance deed of the apartments, plots, or buildings has been executed,

- Certificate Procurement: The developer must obtain the necessary completion certificate or occupancy certificate from the relevant authority and make it available to purchasers individually or to the association of purchasers, as required by the Act,

- Lease Certificate Compliance: If the Real Estate project is developed on leasehold land, the developer is responsible for obtaining a lease certificate specifying the lease period and certifying that all dues and charges related to the leasehold land have been paid. This certificate must be provided to purchasers,

- Essential Services: The developer must provide and maintain essential services, charging reasonable fees, until the project is completely and permanently handed over to the purchasers. Additionally, the developer must directly pay all service charges to the relevant service providers until the physical possession of the Real Estate project is transferred to the purchasers or the association of purchasers, as applicable. These charges will be collected from the purchasers for the payment of service charges,

- Association Formation: The developer should facilitate the formation of an association of purchasers, ensuring that purchasers have a collective entity to represent their interests after the sale of the project,

- Conveyance Deed: The developer is obligated to execute a registered conveyance deed for apartments, plots, or buildings in favor of purchasers. Additionally, the developer must transfer an undivided proportionate title in the common areas to the association of purchasers or the relevant authority, as required by the Act, and,

- Mortgage Restrictions: After executing an agreement for sale for any apartment, plot, or building, the developer is prohibited from mortgaging or creating a charge on such property. In as much as such actions are taken, developers should not affect the rights and interests of the purchasers who have taken or agreed to take possession of these properties.

Other notable regulations that have been stipulated by the Act to control the activities of the developers and protect the interests of the purchasers include;

- Obligations on the Truthfulness of Project Advertisements: Developers must compensate individuals who sustain losses due to incorrect or false statements in notices, advertisements, or through other forms of marketing. Those affected by such statements can withdraw from the project and receive a full refund along with prescribed interest,

- No Deposit without a Sale Agreement: Developers cannot accept more than 10.0% of the property cost as an advance payment or application fee without entering into a written agreement for sale. The agreement must specify development particulars, payment schedules, the date on which the possession of the apartment, plot or building is to be handed over, the rates of interest payable by the developer to the purchaser and the purchaser to the developer in case of default from either parties, or other prescribed details,

- Obligations in Case of Project Transfer to a Third Party: Developers cannot transfer majority rights and liabilities to a third party without written consent from two-thirds of purchasers and approval from the Board. Upon approval, the third party must fulfill pending obligations, including those in agreements with purchasers,

- Approval of Plans: Developers must build and finish their proposed projects following the plans, layouts, and specifications approved by the relevant authorities. They cannot make any changes to these approved plans, layouts, specifications, or the features and amenities mentioned in them for apartments, plots, or buildings without getting consent from the buyers first. For any other alterations or additions to the approved plans, layouts, and specifications of buildings or common areas within the project, developers need written consent from at least two-thirds of the buyers who have agreed to purchase apartments in that building,

- Defects Liability: If a buyer notifies the developer of any structural defects or issues with work quality, services, or other obligations within 5 years from the possession date, it is the developer's responsibility to fix these problems within 30 days at no extra cost on the clients. If the developer fails to address these defects, affected clients have the right to receive suitable compensation as per the provisions of the Act,

- Insurance of Real Estate Projects: Developers must obtain required insurances, including title insurance and construction insurance, as mandated by the Board. Developers will be responsible for paying insurance premiums before transferring insurance to the association of purchasers upon completion of handing over the project and agreement,

- Transfer of Title: Developers must transfer property title and undivided proportionate titles in common areas to purchasers or associations within a specified period per approved plans. This Transfer must occur within 3 months of obtaining an occupancy certificate. Additionally, necessary documents and plans, including common areas, must be handed over to the association within 30 days after obtaining a completion certificate, and,

- Compensation for Delay or Failure to Complete: Developers must return the amount received from purchasers along with interest if they fail to complete or provide possession within specified timeframes or due to revocation of registration of developer by the Board in accordance to the Act. The interest rates for delay will be prescribed by the Board. The kind of compensation is required for losses due to defective land title or other limitations set by any existing laws.

- Specified Rights and Duties of Real Estate Buyers

The Act has also specified the rights and duties bestowed on a property buyer of a Real Estate property from a developer that enhance consumer protection. Such duties include;

- Information Access: Property buyers must have the right to obtain information about approved plans, layout plans, and specifications approved by competent authorities. This includes other details provided in the Act, its rules, and regulations, or any conditions agreed with the developer through the sales agreement. Additionally, property buyers can know the project's completion schedule, including provisions for water, sanitation, electricity, and other amenities and services,

- Claim Possession: Property buyers have the right to claim possession of their apartments, plots, or buildings, while the association of purchasers can claim possession of common areas, as per the developer's declaration under the Act,

- Access to Documents and Plans: After taking physical possession of their properties, property buyers have the right to receive necessary documents and plans, including those related to common areas, from the developer,

- Payment Obligations: Buyers must make payments within the time as specified in the sales agreement, including registration charges, municipal taxes, water and electricity charges, maintenance charges, ground rent, and other applicable fees,

- Interest for Delayed Payments: Property buyers are liable to pay interest at the prescribed rate for any delay in making payments as agreed upon by the developers towards the above services. However, the interest charges liable to the property buyers can be reduced through mutual agreement between the developer and the purchaser.

- Participation in Association Formation: Every property buyer will be mandated to participate in forming an association of purchasers, and,

- Timely Possession: Purchasers should take physical possession of their properties within 2 months of the issuance of the occupancy certificate and must participate in the registration of the conveyance deed for their apartments, plots, or buildings, in accordance to the act

- Offences and Penalties Accorded to Law Breakers

The Real Estate Regulations Bill 2023 encompasses a range of offenses and corresponding penalties aimed at safeguarding compliance with its provisions and upholding the ethical conduct within the Real Estate industry. Moreover, they serve as a deterrent against any illicit activities or practices within the Real Estate sector, thus safeguarding the interests of both industry stakeholders and the general public. Among the key violations delineated in the Bill are the following:

- Non-registration of Real Estate Projects: Developers found guilty of embarking on Real Estate projects without adhering to the mandatory registration requirements specified by the Act guilty may face penalties that include imprisonment for a duration not exceeding 3 years, a fine amounting to no less than Kshs 5.0 mn, or a combination of both punitive measures,

- Providing false information: Real Estate developers or estate agents found guilty of providing deceptive or inaccurate information to the regulatory Board may be subjected to a fine equivalent to 5.0% of the estimated cost of the implicated Real Estate project, as evaluated and determined by the Board,

- Failure to Comply with Board Orders: where specified parties mentioned in the Act are found guilty of violation of the directives and orders issued by the Board under the Act will be subjected to a daily penalty rate, with cumulative consequences that can extend up to a maximum of Kshs 20.0 mn or 10.0% of the estimated cost of the Real Estate project, as ascertained by the Board,

- Failure to Comply with Court Orders: Any person who fails to adhere to or contravene court orders issued under the provisions of the Act is deemed an offense may result in imprisonment for a period of up to 3 years, a monetary fine not exceeding Kshs 10.0 mn, or a combination of both penalties, and,

- General Offense Penalty: This section addresses committed. Developers convicted of offenses under the Act for which no specific penalties are prescribed elsewhere in the legislation may be liable to a fine of no more than Kshs 1.0 mn.

- Repeal of Estate Agents Act, Cap 533

This section of the Real Estate Regulation Bill, 2023, addresses the transition from the existing Estate Agents Act, Cap. 533, to the new regulatory framework established by the Bill. It outlines several key provisions to ensure a smooth transition and continuity of operations. The Act begins by declaring the repeal of the Estate Agents Act, effectively ending its legal validity and relevance under the new regulatory framework, and immediately ceasing the operations and existence of the Estate Agents Registration Board (EARB) upon the appointment of the new regulatory Board. The new Board of Directors shall be appointed within 3 months of the commencement of the Real Estate Regulation Act. This new Board will assume the responsibilities and authority outlined in the Bill.

However, to ensure continuity in the retention of staff, the Bill notifies that existing staff and employees of the EARB who were not under notice of dismissal prior to the commencement of the new Act will be deemed to be employees of the newly established Board. Any actions, regulations, directives, instructions, administrative measures, contracts, or obligations that were initiated, issued, taken, entered into, or incurred by the EARB before the commencement of the Act will continue to remain in force. This is because these regulations and measures will be considered as if they were made, issued, taken, entered into, or incurred under the new Act. Moreover, all assets and liabilities of the EARB which will be existing before the commencement of the Act will be transferred and managed by the newly established Board under the Real Estate Regulation Act. All ongoing legal matters involving EARB will not be disrupted by the change in regulatory authority as the Real Estate Regulation Board will take over as the responsible party.

Section III: Concerns Raised by Existing Regulatory Authorities and Our View

This section engages in a comparative analysis, contrasting the provisions of the proposed Bill with the roles and functions of existing Real Estate regulatory authorities in Kenya, such as and the Estate Agency Registration Board (EARB) and the Institute of Surveyors of Kenya. The comparative examination aims to identify areas of alignment, potential overlaps, and discrepancies in the responsibilities and functions of these regulatory bodies within the Real Estate sector's regulatory framework. The objective is to ensure clarity and coherence in the regulatory landscape of Kenya's Real Estate industry.