The Draft CMA Investments Regulations 2021, & Cytonn Weekly #37/2021

By Cytonn Research, Sep 19, 2021

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 54.6%, down from the 72.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 3.3 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 83.8%, a decrease from the 172.5% recorded the previous week. The subscription rate for the 182-day paper declined to 68.0%, from 77.0%, while that of the 364-day paper increased slightly to 29.5%, from the 28.3% recorded the previous week. The yields on the 91-day and 364-day papers increased by 8.9 bps and 6.8 bps to 6.9% and 7.8%, respectively, while the yields on the 182-day paper declined by 0.3 bps to 7.3%. The government accepted all the Kshs 13.1 bn worth of bids received, translating to an acceptance rate of 100.0%.

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum wholesale and retail petroleum prices effective 15th September 2021 to 14th October 2021, highlighting that the prices of Super Petrol, Diesel and Kerosene had increased to Kshs 134.7, Kshs 115.6 and Kshs 110.8 respectively. Also, during the week, the National Treasury gazetted the revenue and net expenditures for the first two months of FY’2021/2022, highlighting that total revenue collected as at the end of August 2021 amounted to Kshs 272.4 bn, equivalent to 15.3% of the original estimates of Kshs 1,775.6 bn and is 84.1% ahead of the prorated estimates of Kshs 148.0 bn;

Equities

During the week, the equities market recorded mixed performance, with NASI and NSE 25 recording gains of 1.4% and 1.7%, respectively, while NSE 20 declined marginally by 0.1%, taking their YTD performance to gains of 20.2%, 17.7% and 10.1% for NASI, NSE 25 and NSE 20, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Equity Group, KCB Group and Safaricom, which gained by 4.4%, 4.2% and 1.6%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT, Diamond Trust Bank (DTB-K) and Bamburi, which declined by 2.6%, 2.0% and 1.6%, respectively. During the week, Liberty Holdings Limited (Liberty), completed the acquisition of 84.2 mn shares in Liberty Kenya Holdings Plc (LK), which represents 15.7% of the company. The acquisition has increased the company’s stake to 73.5% from the current 57.7%, retaining Liberty’s status as the largest shareholder;

Real Estate

During the week, French retailer Carrefour, announced plans to take up six new stores spaces in Uganda currently occupied by South African retailer Shoprite supermarket, in Uganda’s Acacia Mall, Village Mall, Victoria Mall, Lugogo Mall, Clock Tower, and Arena Mall, by the end of the year after Shoprite’s planned exit. In the infrastructure sector, Kenya’s East African Community Principal Secretary, Dr. Kevit Desai, announced that the upgrading of the old 460 Km Naivasha-Malaba meter gauge railway linking Kenya to Uganda will be completed in October 2021;

Focus of the Week

Recently, the Cabinet Secretary for the National Treasury and Planning, through the Capital Markets Authority (CMA), published two draft regulations; the Capital Markets (Collective Investment Schemes) Regulations 2021 and the Capital Markets (Collective Investment Schemes) (Alternative Investment Funds) Regulations 2021. The proposed CIS regulations seek to update the current Collective Investment Scheme regulations, 2001, given the change in market dynamics, as well as address the emerging issues. In light of this recent publication, and the importance of CIS’s to Kenyan investors, we have done an analysis of the draft Regulations highlighting the key positives and main areas of improvement;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.57%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.00% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training Monday through Saturday, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- As of 1st of September 2021, Cytonn CHYS and CPN Investors have converted Kshs 2.5 billion of their investment funds from the two illiquid funds into real estate, translating to a 20.0% resolution of the debt owed by the two funds. For more information, please see the Cytonn CHYS and CPN Conversion 2.5 bn Real Estate article;

- Any CHYS and CPN investors still looking to convert is welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Money Markets, T-Bills Primary Auction:

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 54.6%, down from the 72.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 3.3 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 83.8%, a decrease from the 172.5% recorded the previous week. The subscription rate for the 182-day paper declined to 68.0%, from 77.0%, while that of the 364-day paper increased slightly to 29.5%, from the 28.3% recorded the previous week. The yields on the 91-day and 364-day papers increased by 8.9 bps and 6.8 bps to 6.9% and 7.8%, respectively, while the yields on the 182-day paper declined by 0.3 bps to 7.3%. The government accepted all the Kshs 13.1 bn worth of bids received, translating to an acceptance rate of 100.0%.

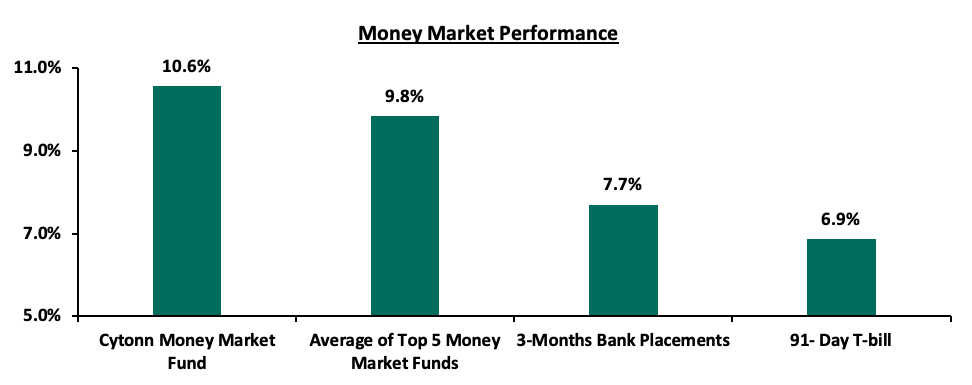

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 8.9 bps to 6.9%. The average yield of the Top 5 Money Market Funds remained at 9.8%, as was recorded the previous week. The yield on the Cytonn Money Market Fund also remained unchanged at 10.6% as was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 17th September 2021:

|

Money Market Fund Yield for Fund Managers as published on 17th September 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.05% |

10.57% |

|

2 |

Nabo Africa Money Market Fund |

9.70% |

10.18% |

|

3 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

4 |

Sanlam Money Market Fund |

9.09% |

9.51% |

|

5 |

Madison Money Market Fund |

8.61% |

9.06% |

|

6 |

CIC Money Market Fund |

8.69% |

8.99% |

|

7 |

Apollo Money Market Fund |

9.10% |

8.95% |

|

8 |

GenCapHela Imara Money Market Fund |

8.45% |

8.82% |

|

9 |

Orient Kasha Money Market Fund |

8.37% |

8.73% |

|

10 |

Co-op Money Market Fund |

8.32% |

8.68% |

|

11 |

Dry Associates Money Market Fund |

8.31% |

8.64% |

|

12 |

British-American Money Market Fund |

8.18% |

8.49% |

|

13 |

ICEA Lion Money Market Fund |

8.02% |

8.35% |

|

14 |

NCBA Money Market Fund |

8.02% |

8.32% |

|

15 |

Old Mutual Money Market Fund |

7.80% |

8.09% |

|

16 |

AA Kenya Shillings Fund |

6.56% |

6.76% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing by 0.5% points to 4.1%, from 3.6% recorded the previous week, partly attributable to the banks trading cautiously in the interbank market in order to meet their CRR requirements for the cycle ending 14th September. The average interbank volumes increased by 21.6% to Kshs 17.2 bn, from Kshs 13.7 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with the yields on the 7-year bond issued in 2019 increasing by 0.1% points to 4.8%. Yields on the 10-year bond issued in 2018, 30-year bond issued in 2018, 12-year bond issued in 2019 and 12-year bond issued in 2021 remained unchanged at 5.0%, 7.2%, 6.2% and 6.1%, respectively. On the other hand, the yields on the 10-year bond issued in 2014 declined by 0.1% points to 3.0%. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-20 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

- |

|

31-Aug-21 |

3.1% |

5.0% |

7.1% |

4.6% |

6.0% |

5.9% |

|

10-Sep-21 |

3.1% |

5.0% |

7.2% |

4.7% |

6.2% |

6.1% |

|

13-Sep-21 |

3.1% |

5.1% |

7.2% |

4.7% |

6.2% |

5.9% |

|

14-Sep-21 |

3.0% |

5.1% |

7.2% |

4.7% |

6.2% |

6.0% |

|

15-Sep-21 |

3.1% |

5.1% |

7.2% |

4.7% |

6.2% |

6.0% |

|

16-Sep-21 |

3.0% |

5.0% |

7.2% |

4.8% |

6.2% |

6.1% |

|

Weekly Change |

(0.1%) |

0.0% |

0.0% |

0.1% |

0.0% |

0.0% |

|

MTD Change |

(0.1%) |

0.1% |

0.1% |

0.1% |

0.1% |

0.1% |

|

YTD Change |

(0.9%) |

(0.2%) |

0.2% |

(0.1%) |

0.3% |

- |

Source: CBK Weekly Bulletin

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.2% against the US dollar to close the week at Kshs 110.1, from Kshs 109.9 recorded the previous week, mainly attributable to increased dollar demand from the energy sector. On a YTD basis, the shilling has depreciated by 0.8% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect the shilling to remain under pressure for the remainder of 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- The widened current account position which increased by 0.5% points to 5.4% of GDP in the 12 months to August 2021, from 4.9% of GDP for a similar period in 2020, and,

- Demand from energy importers as they beef up their hard currency positions in the prevailing elevated global oil prices.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.6 bn (equivalent to 5.9 months of import cover), which is above the statutory requirement of maintaining at least 4.0 months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- Improving diaspora remittances evidenced by a 14.2% y/y increase to USD 312.9 mn in August 2021, from USD 274.1 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlight

- Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum wholesale and retail petroleum prices in Kenya effective 15th September 2021 to 14th October 2021. Notably, this was the first time in six months that Diesel and Kerosene prices had increased. Below are the key take-outs from the statement:

- Super Petrol prices increased by 6.0% to Kshs 134.7 per litre, from Kshs 127.1 per litre, while diesel prices increased by 7.4% to Kshs 115.6 per litre, from Kshs 107.7 per litre. Kerosene prices also increased by 13.2% to Kshs 110.8 per litre, from Kshs 97.9 per litre. These are the highest pump prices ever witnessed in the country,

- The performance in fuel prices was attributable to:

- Removal of fuel subsidies of Kshs 7.1 on Super Petrol, Kshs 9.9 on Diesel and Kshs 11.4 on Kerosene,

- The increase in the average landed cost for Kerosene by 1.0%, to USD 498.2 per cubic meter in August 2021, from Kshs 493.5 in July 2021,

- The increase in the Free on Board (FOB) price of Murban crude oil in August 2021 by 8.5% to USD 72.3 per barrel, from USD 66.7 per barrel in July 2021, and,

- The Kenyan shilling depreciated by 1.2% against the dollar to close at Kshs 109.9 in August 2021, from Kshs 108.6 in July 2021.

Global fuel prices have also increased by 2.5% in the first two weeks of September 2021, and by 45.9% to USD 73.3 on a YTD basis, from USD 50.2 at the end of 2020. The rise in global prices is attributable to the rise in demand for oil in tandem with the reopening of global economies.

We expect pressure on the inflation basket going forward given the increased fuel prices following the removal of the fuel subsidy under the Petroleum Development levy. The subsidy policy had been very effective in the past couple of months in lowering fuel inflation as prices remained relatively unchanged despite the global fuel prices fluctuations. However, we believe that the stabilization was unsustainable given that the treasury had to compensate the Oil Marketing Companies, a certain amount of what was lost following the subsidy. EPRA has not yet explained the rationale behind the subsidy removal but Parliament has summoned the Cabinet Secretaries (CSs) for Petroleum and Energy on Tuesday on the same. Given the alarming rise in the fuel prices, we believe that this will play a role in the Monetary Policy Committee’s (MPC) decision as they meet on 28th September to review the benchmark rate. The main role of the MPC is to maintain price stability. We believe that given the spike in the fuel prices, inflation is likely to edge up in the coming months. We shall be giving a comprehensive view on the monetary policy expectations in the coming week.

- Revenue and Net Exchequer for FY’2021/2022

During the week, the National Treasury gazetted the revenue and net expenditures for the first two months of FY’2021/2022, ending 31st August 2021. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 31st August 2021 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

|

21.3 |

|

|

|

|

Tax Revenue |

1,707.4 |

247.2 |

14.5% |

284.6 |

86.9% |

|

Non-Tax Revenue |

68.2 |

3.9 |

5.7% |

11.4 |

34.2% |

|

Total Revenue |

1,775.6 |

272.4 |

15.3% |

295.9 |

92.0% |

|

External Loans & Grants |

379.7 |

1.7 |

0.5% |

63.3 |

2.7% |

|

Domestic Borrowings |

1,008.4 |

200.3 |

19.9% |

168.1 |

119.2% |

|

Other Domestic Financing |

29.3 |

4.0 |

13.6% |

4.9 |

81.5% |

|

Total Financing |

1,417.4 |

206.0 |

14.5% |

236.2 |

87.2% |

|

Recurrent Exchequer issues |

1,106.6 |

159.0 |

14.4% |

184.4 |

86.2% |

|

CFS Exchequer Issues |

1,327.2 |

186.1 |

14.0% |

221.2 |

84.1% |

|

Development Expenditure & Net Lending |

389.2 |

32.8 |

8.4% |

64.9 |

50.5% |

|

County Governments + Contingencies |

370.0 |

29.6 |

8.0% |

61.7 |

48.0% |

|

Total Expenditure |

3,193.0 |

407.5 |

12.8% |

532.2 |

76.6% |

|

Fiscal Deficit excluding Grants |

(379.7) |

69.2 |

(18.2%) |

(63.3) |

(109.3%) |

|

Total Borrowing |

1,388.1 |

202.0 |

14.6% |

231.3 |

87.3% |

The key take-outs from the report include:

- Total revenue collected as at the end of August 2021 amounted to Kshs 272.4 bn, equivalent to 15.3% of the original estimates of Kshs 1,775.6 bn and is 92.0% of the prorated estimates of Kshs 295.9 bn. Cumulatively, Tax revenues amounted to Kshs 247.2 bn, equivalent to 14.5% of the target of Kshs 1,707.4 bn and are 86.9% of the prorated estimates of Kshs 284.6 bn,

- Total financing amounted to Kshs 206.0 bn, equivalent to 14.5% of the original estimates of Kshs 1,417.4 tn and is 87.2% of the prorated estimates of Kshs 236.2 bn. Additionally, domestic borrowing amounted to Kshs 200.3 bn, equivalent to 19.9% of the original estimates of Kshs 1.0 tn and is 19.2% ahead of the prorated estimates of Kshs 168.1 bn,

- The total expenditure amounted to Kshs 407.5 bn, equivalent to 12.8% of the original estimates of Kshs 3,193.0 bn, and is 76.6% of the prorated expenditure estimates of Kshs 532.2 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 159.0 bn, equivalent to 14.4% of the original estimates and 86.2% of the prorated estimates of Kshs 184.4 bn, and development expenditure amounted to Kshs 32.8 bn, equivalent to 8.4% of the original estimates of Kshs 389.2 bn and is 50.5% of the prorated estimates of Kshs 64.9 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their target of Kshs 1,327.2 bn after amounting to Kshs 186.1 bn, equivalent to 14.0% of the target, and are at 84.1% of the prorated amount of Kshs 221.2 bn. The cumulative public debt servicing cost amounted to Kshs 162.4 bn which is 13.9% of the original estimates of Kshs 1,169.2 bn, and is 83.2% of the prorated estimates of Kshs 194.9 bn,

- Total Borrowings as at the end of August 2021 amounted to Kshs 202.0 bn, equivalent to 14.6% of the Kshs 1,388.1 bn target and are 87.3% of the prorated estimates of Kshs 231.3 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The strong revenue performance in the first two months of the current fiscal year is commendable and can be attributed to both the economic recovery as the Covid-19 measures are relaxed and the effectiveness of the KRA in tax collection. Additionally, the implementation of the Finance Act 2021 which brought changes to the Excise Duty Tax, Income Tax as well as the Value Added Tax is set to expand the tax base and consequently enhance revenue collection.

Rates in the fixed income market have remained relatively stable due the sufficient levels of liquidity in the money market. The government is 76.9% ahead of its prorated borrowing target of Kshs 152.0 bn having borrowed Kshs 268.9 bn of the Kshs 658.5 bn borrowing for the FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRAs collection of Kshs 247.2 bn in revenues during the first two months of the current fiscal year, which is equivalent to 86.9% of the prorated revenue collection target. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.

Markets Performance

During the week, the equities market recorded mixed performance, with NASI and NSE 25 recording gains of 1.4% and 1.7%, respectively, while NSE 20 declined marginally by 0.1%, taking their YTD performance to gains of 20.2%, 17.7% and 10.1% for NASI, NSE 25 and NSE 20, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Equity Group, KCB Group and Safaricom, which gained by 4.4%, 4.2% and 1.6%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT, Diamond Trust Bank (DTB-K) and Bamburi which declined by 2.6%, 2.0%, and 1.6%, respectively.

During the week, equities turnover increased by 22.0% to USD 22.2 mn, from USD 18.2 mn recorded the previous week, taking the YTD turnover to USD 884.8 mn. Foreign investors remained net buyers, with a net buying position of USD 1.9 mn, from USD 2.2 mn recorded the previous week, taking the YTD to a net selling position to USD 7.2 mn.

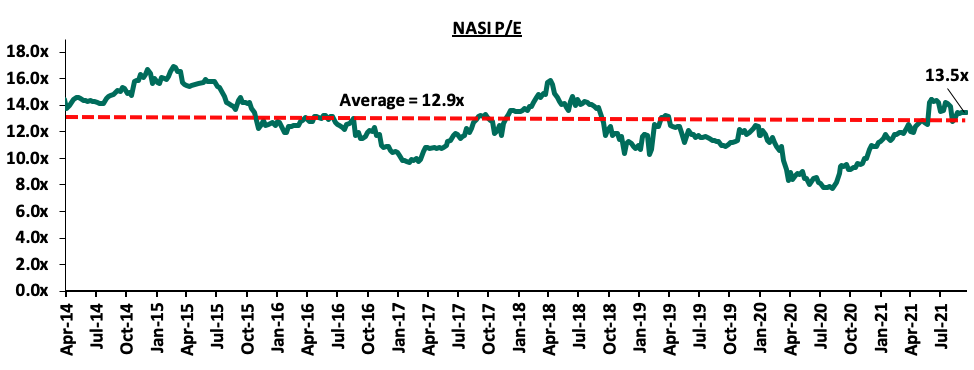

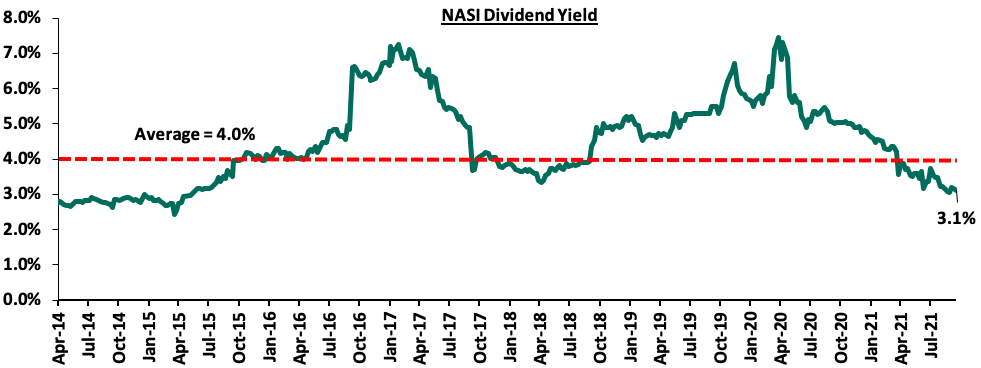

The market is currently trading at a price to earnings ratio (P/E) of 13.5x, 4.1% above the historical average of 12.9x, and a dividend yield of 3.1%, 0.9% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.5x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, which is currently 61.5% of the market, the market is trading at a P/E ratio of 12.3x and a PEG ratio of 1.4x. The current P/E valuation of 13.5x is 74.8% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight:

During the week, Liberty Holdings Limited (Liberty), a financial services and property holding company completed the acquisition of 84.2 mn shares in Liberty Kenya Holdings Plc (Liberty Kenya), which represents 15.7% of the company’s issued share capital. This follows the June 2021 announcement of Liberty Holdings intention to buy 49.5 mn ordinary shares from the Conrad N. Hilton Foundation, Kimberlite Frontier Africa Master Fund, L.P. and Vanderbilt University (the KFAMF Acquisition), and a further 34.7 mn ordinary shares from Coronation Africa Frontiers Fund and Coronation All Africa Fund (the Coronation Acquisition), which represented 9.3% and 6.5% of the company’s shareholding, respectively. For more information, please see Cytonn Weekly#09/2021.

The completed acquisition has increased Liberty Holding’s stake to 73.5% (393.6 mn ordinary shares), from the current 57.7% (309.3 mn ordinary shares), retaining Liberty Holding’s status as the largest shareholder of Liberty Kenya. For the 15.7% acquisition, Liberty Holdings paid a cash consideration of Kshs 926.6 mn translating to a price of Kshs 11.0 compared to the market price of Kshs 8.0. They therefore paid a 37.5% premium to the market. The stock is currently trading at a price to book of 0.6x, lower than the 1.1x industry average. In our view, the acquisition by Liberty Holdings demonstrates increased confidence in Liberty Kenya's growth in the region and is in line with their strategy of growing the insurance business in the African continent more so the East African market. The move will result in Kenya and the wider East African region becoming a greater area of focus based on total capital invested and is likely to mean that the operating companies will attract higher priority attention to support and accelerate the operational changes required for the growth that is expected to trickle down to investors in the medium to long term.

Universe of Coverage:

|

Company |

Price as at 10/09/2021 |

Price as at 17/09/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Group*** |

22.5 |

22.7 |

0.7% |

(49.5%) |

44.9 |

32.0 |

9.9% |

51.2% |

0.3x |

Buy |

|

ABSA Bank*** |

10.4 |

10.4 |

(0.5%) |

8.7% |

9.5 |

13.8 |

0.0% |

33.3% |

1.2x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.5 |

0.4% |

9.5% |

2.3 |

3.1 |

7.9% |

30.4% |

0.3x |

Buy |

|

NCBA*** |

27.7 |

27.7 |

0.0% |

3.9% |

26.6 |

31.0 |

5.4% |

17.5% |

0.7x |

Accumulate |

|

Standard Chartered*** |

135.0 |

134.5 |

(0.4%) |

(6.9%) |

144.5 |

145.4 |

7.8% |

15.9% |

1.1x |

Accumulate |

|

KCB Group*** |

46.6 |

48.6 |

4.2% |

26.4% |

38.4 |

53.4 |

2.1% |

12.0% |

1.1x |

Accumulate |

|

Co-op Bank*** |

13.4 |

13.5 |

1.1% |

7.6% |

12.6 |

14.1 |

7.4% |

11.9% |

0.9x |

Accumulate |

|

Stanbic Holdings |

89.3 |

91.0 |

2.0% |

7.1% |

85.0 |

96.6 |

1.9% |

8.0% |

0.9x |

Hold |

|

Equity Group*** |

51.0 |

53.3 |

4.4% |

46.9% |

36.3 |

57.5 |

0.0% |

8.0% |

1.5x |

Hold |

|

Sanlam |

9.9 |

11.5 |

15.9% |

(11.5%) |

13.0 |

12.4 |

0.0% |

7.8% |

1.0x |

Hold |

|

Diamond Trust Bank*** |

64.0 |

62.8 |

(2.0%) |

(18.2%) |

76.8 |

67.3 |

0.0% |

7.3% |

0.3x |

Hold |

|

Liberty Holdings |

7.6 |

8.0 |

4.7% |

3.9% |

7.7 |

8.4 |

0.0% |

5.0% |

0.6x |

Hold |

|

Jubilee Holdings |

359.3 |

350.3 |

(2.5%) |

27.0% |

275.8 |

330.9 |

2.6% |

(3.0%) |

0.7x |

Sell |

|

Britam |

8.3 |

8.3 |

(0.2%) |

18.9% |

7.0 |

6.7 |

0.0% |

(19.5%) |

1.5x |

Sell |

|

HF Group |

3.8 |

3.9 |

3.4% |

24.8% |

3.1 |

3.1 |

0.0% |

(20.9%) |

0.2x |

Sell |

|

CIC Group |

2.8 |

2.7 |

(3.2%) |

28.4% |

2.1 |

1.8 |

0.0% |

(33.6%) |

0.9x |

Sell |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to the counter trading ex-bonus issue |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.5x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

- Retail Sector

During the week, French retailer Carrefour, announced plans to take up six new stores spaces in Uganda currently occupied by South African retailer Shoprite supermarket, in Uganda’s Acacia Mall, Village Mall, Victoria Mall, Lugogo Mall, Clock Tower, and Arena Mall, by the end of the year after Shoprite’s planned exit. Carrefour which entered the African market in 2013 when it opened its first branch in Egypt, has been on an aggressive expansion spree and has since opened thirty five branches in Egypt, sixteen in Kenya, two in Uganda, and others in Tunisia, Morocco and Cameroon. Its expansion drive has mainly been supported by; i) e-commerce presence in the market increasing their popularity and demand for goods, ii) mergers & acquisition strategies which have helped to streamline its operations, iii) strong brand reputation through its quality products and services, and, iv) improving infrastructure opening up areas for investment opportunities and access by target customers. The expansion into Uganda can be supported by Uganda’s high population growth rate at 3.0% against the world’s 1.1% facilitating need for more goods and retail spaces, coupled with Shoprite’s announcement to exit the East African Market in 2020 as a result of financial constraints and losses generated, thus leaving prime retail spaces for uptake by the retailer. In our view, Carrefour’s continued expansion spree is expected to help cushion the overall performance of the African retail market by taking up spaces previously occupied by troubled retailers. This is inclusive of Kenya as it was first East African country that the French retailer based its operations in May 2016, and currently has sixteen branches having recently opened two branches in Kisumu County.

The table below shows the summary of the number of stores of the Key local and international retailer supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened |

Projected number of branches FY’2021 |

|

Naivas |

Local |

46 |

61 |

69 |

6 |

0 |

75 |

4 |

79 |

|

QuickMart |

Local |

10 |

29 |

37 |

4 |

0 |

41 |

4 |

45 |

|

Chandarana Foodplus |

Local |

14 |

19 |

20 |

1 |

0 |

21 |

2 |

23 |

|

Carrefour |

International |

6 |

7 |

9 |

5 |

0 |

16 |

0 |

16 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

1 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

0 |

0 |

3 |

0 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

257 |

313 |

334 |

17 |

178 |

173 |

12 |

182 |

|

Source: Online Research

- Infrastructure

During the week, Kenya’s East African Community Principal Secretary, Dr. Kevit Desai, announced that the upgrading of the old 460 Km Naivasha-Malaba meter gauge railway linking Kenya to Uganda will be completed in October 2021. The rehabilitation was to cost Kshs 3.5 bn and the work began in January 2021 after failing to start in July 2020, and was expected to take one year. Upon its completion in October 2021, the railway line will link the Standard Gauge Railway at Naivasha thus enabling seamless transport of goods from Mombasa to Malaba border, and into Kampala through the Uganda century old meter gauge railway which is currently being renovated as well. Moreover, the completion of the railway will also; i) spur trade activities in the neighboring areas through eased transportation of goods, ii) gear real estate investment activities in the surrounding regions by enhancing efficient supply chains, and, iii) benefit investors by boosting prices of surrounding land and properties.

The infrastructure sector continues to register tremendous development activities supported by government effort in initiating and implementing projects that aim to make Kenya an intra-regional hub for trade in East Africa such as; i) Lamu Port-South Sudan-Ethiopia Transport (LAPSSET) corridor whose first berth was completed and launched in May 2021, ii) Garsen- Minjilla- Mokowe road upgrade linking Lamu and Tana River Counties which was completed in May 2021, and, iii) Nairobi Express Way project expected to be completed in February 2022. We therefore expect the sector to continue recording remarkable progress due to the additional 0.6% budgetary allocation to Kshs 182.5 bn for the FY’2021/22 from Kshs 181.4 bn allocation for FY’2020/21, aimed at developing quality and adequate roads, coupled with the government’s partnership strategies such as Public Private Partnerships (PPPs) to facilitate the construction and completion of various projects in a timely and cost effective way.

The graph below shows the budget allocation to the infrastructure sector over the last nine financial years:

Source: National Treasury

Kenya’s real estate sector performance is expected to improve mainly driven by infrastructural developments which is a major facilitator of real estate activities by opening up areas for investment opportunities as well as boosting tourism activities and property prices.

The Cabinet Secretary for the National Treasury and Planning, through the Capital Markets Authority (CMA), published two draft regulations; the Capital Markets (Collective Investment Schemes) Regulations 2021 and the Capital Markets (Collective Investment Schemes) (Alternative Investment Funds) Regulations 2021. The draft regulations were published with the aim of seeking comments from the stakeholders and the general public by 24th September 2021. The proposed CIS regulations seek to update the current Collective Investment Scheme regulations given the changes in the market dynamics since the last published Regulations in 2001, as well as address emerging issues. Additionally, the draft Alternative Investment Funds’ (AIFs) regulations seek to create a regulatory environment for privately pooled funds whose investors seek higher returns by investing in specified alternative asset classes.

It is in light of the recently published draft regulations; the first review of the CIS regulations in 20 years and only a year since the release of the Guidance to Collective Investment Schemes on valuation, performance measurement and reporting, that we do an analysis of the draft Regulations. We shall do this in three sections;

- Historical Performance of Collective Investment Schemes,

- Analysis of Key Aspects of the CIS and AIF Draft Regulations, and,

- Conclusion

Section I: Historical Performance of Collective Investment Schemes

Collective Investment Schemes (CIS’s), have gained popularity in the Kenyan market in recent times due to their relative affordability, high liquidity, and access to a wider range of investment securities even with limited capital. The most recent data from the Capital Markets Authority highlights that the total Assets under Management (AUMs) of Unit Trust Funds in Kenya recorded a 45.5% growth to Kshs 111.1 bn in Q1’2021, from Kshs 76.3 bn in Q1’2020.

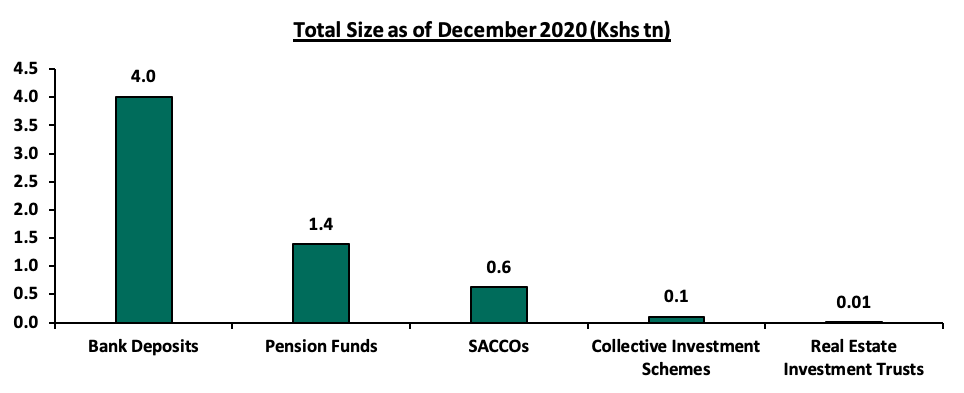

Over the past 4 years, the UTFs AUM has grown at a CAGR of 16.4% to Kshs 104.7 bn in FY’2020, from Kshs 57.1 bn recorded in FY’2016. However, even at Kshs 111.1 bn, the industry is dwarfed by asset gatherers such as bank deposits at Kshs 4.0 tn and pension industry at Kshs 1.4 tn as of the end of 2020. Below is a graph showing the sizes of different saving channels and capital market products in Kenya asof December 2020:

Sources: CMA, RBA, CBK, SASRA and REIT Financial Statements

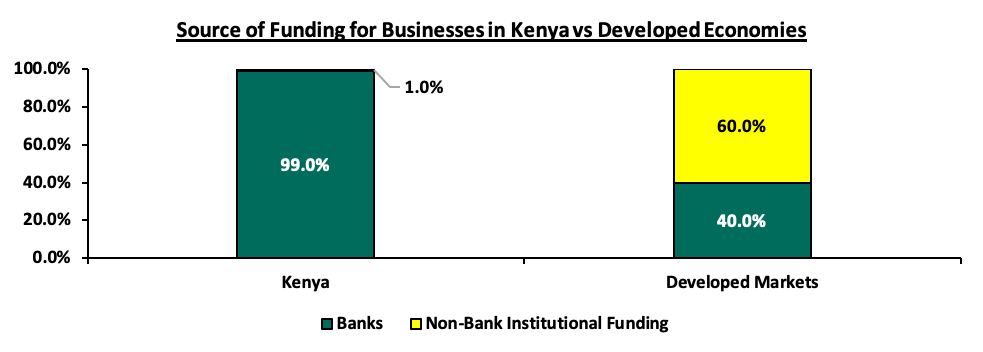

We have also seen a continued over-reliance on bank funding in Kenya, with businesses relying on banks for 99.0% of their funding while a mere 1.0% of the funding comes from the capital markets. This makes funding difficult to access, and when accessed, it's expensive. According to World Bank data, in well-functioning economies, businesses rely on banks for just 40.0% of their funding with the larger percentage, 60.0%, coming from capital markets as shown in the graph below.

The solution is to stimulate capital markets as a complementary alternative to banking markets, and hence why we believe that the intended revision of the current CIS regulations has come at an opportune time.

Section II: Analysis of Key Aspects of the CIS and AIF Draft Regulations

In this section, we shall highlight the positives and areas of improvement we have identified from the draft CIS and AIF regulations as well as our key conceptual issues.

Some of the key conceptual issues include:

- A Regulatory Impact Assessment (RIA) should have been done before drafting of the new Regulations - A RIA is a document created before a new agency regulation is introduced. It provides a detailed and systematic appraisal of the potential impact of a new regulation in order to assess whether the regulation is likely to achieve the desired objectives. As it is, the current public participation phase has not been contextualized, the public is reviewing draft regulations without even knowing the problem being addressed and how the proposed regulations will achieve the intended objective. Examples of government agencies that have done a RIA include the Ministry of Lands, EPRA, Competitions Authority of Kenya, the National Treasury among others, before they introduced new regulations and in accordance with the provisions of Part III of the Statutory Instruments Act (No. 23 of 2013),

- There is a lack of harmony between the proposed regulations, the Act and other Regulations or Guidance within the Capital Markets Framework leading to inconsistencies and contradictions. For instance, the definition of Collective Investments Schemes in the draft CIS regulations are beyond what is included in the Act with the inclusion of new terms such as Deemed CIS and Savings Club. The Capital Markets Act defines a collective investment scheme as;

“an investment company, a unit trust, a mutual fund or other scheme whether or not established or organized in Kenya which-- Collects and pools funds from the public or a section of the public for the purpose of investment;

- Is managed by or on behalf of the scheme by the promoter of the scheme

While the draft CIS regulations define a collective investment scheme as;

“an arrangement or scheme, in whatever form including a unit trust, an investment company, a closed end investment fund, a savings club falling within the provisions of sub-regulation (c), in pursuance of which members of the public are invited or permitted to invest money or other assets in a portfolio and in terms of which:

- investors contribute money or other assets to and, in exchange, hold a participatory interest in a portfolio of the scheme through shares, units or any other form of participatory interest,

- the investors share the risk and the benefits of investment in proportion to their participatory interest in a portfolio of the scheme or on any other basis determined in the constitutive document,

- the persons who are to participate as mentioned in subparagraph (ii), referred to as “participants”, do not have day-to-day control over the management of the property in question, whether or not they have the right to be consulted or to give directions.

Provided that any pooling of funds under any scheme or arrangement, which is not registered as required in terms of these regulations, involving property in the amount of Kshs 1.0 million shillings or more shall be deemed to be a collective investment scheme”.

The draft regulations also provide for the definition of an Alternative Investment Fund as a collective investment scheme formed as a trust, limited liability partnership or a company, which acts as a privately pooled investment vehicle for two or more investors. Retirement funds, family trusts, employee schemes and holding schemes, however, cannot be deemed as or apply to become an alternative investment fund,

- The Draft Regulations exceed the scope of what should be in the Regulation –The scope of the Regulations should be on the eligibility, disclosure and operational requirements of approved/licensed CIS. The draft regulations however exceed this scope, for example some of the powers in the draft regulations, such as seizing and selling assets is not contemplated in the Act, which is clear on the sanction powers of CMA, an

- Some of the regulations do not take into account previous lessons learned and not customized to address matters unique to Kenya’s markets and may end up being shelf regulations and not utilized. For example, the draft AIF Regulations exclude Property Funds that invest directly in immoveable property, despite real estate being a popular Alternative Investment Class. The draft CIS regulations also have difficulty providing for real estate funds, as their provisions for Special Funds under Rule 90 restrict Alternative Investments to 10.0%. If a fund is a special fund, then it means that the allocation to that particular asset class should be the dominant one but in this case it is even lower than what a normal CIS can invest in one particular asset class and even security.

- The Positives from the Draft Regulations

Under this section we shall discuss the key positives we have identified from the two draft CIS and AIF regulations:

- The eligibility criteria for a CIS Trustee has been expanded to include any company with a minimum issued and paid-up capital of ten million shillings, and has the sufficient and necessary financial, technical and operational resources and experience. The previous criteria where all Trustees were banks constrained capital market growth given the conflict of interest that arose where banking markets were in competition with the Capital Market. We believe that the expansion of the CIS Trustee eligibility criteria will reduce the current dependency on banking institutions to provide trustee services increasing competition and efficiency of the provision of trustee services,

- Mandatory independence of Trustee and Fund Manager – The current CIS regulations allow a fund manager that is either a holding company or a subsidiary of a scheme’s trustee or custodian to invest up to 10.0% of their funds in the related parties. The proposed draft CIS have removed this particular provision requiring that the Trustee shall ensure that there is segregation between the scheme and the trustee’s related parties. This independence will likely enhance prudence in the management of scheme funds,

- The fund manager shall be required to contribute at least 2.5% of the stated initial capital of each scheme or Kshs 1.0 mn, whichever is lower - we believe this is in a bid to reinforce and improve the fund management practices in the industry as Fund Managers have more skin in the game, and,

- Codification of the use of International Financial Reporting Standards (IFRS) as the primary valuation methodology – The draft CIS regulations require that schemes value their AUM daily and in accordance with the definition of fair value as set out in the relevant International Financial Reporting Standards (IFRS) on valuation. We believe this is a good thing for harmonization of standards in line with international principles as well as providing guidelines on how CIS can engage in short selling.

From the draft AIF regulations, we note that the recognition of Limited Liability Partnerships (LLPs), in addition to investment companies and trusts, as investment vehicles for AIFs allows for more flexibility in the formation of such funds.

- Areas of Improvement from the Draft Regulations

Draft Collective Investment Schemes (CIS) Regulations 2021

- Trustee’s replacement - The draft CIS regulations provide that upon the retirement of a trustee and in the event that the Trustee fails to find a replacement within 6 months, the Trustee may recommend to unitholders in an AGM to dissolve the fund or transfer the unit holders to another fund. We believe that this is an unnecessary measure and that the Trustee’s office should not remain vacant after a Trustees’ retirement, as is typical with trusteeships and past jurisprudence on this topic. A Trustee should be able to recommend a dissolution or to transfer in the interest of investors, but not just because of vacuum created by a regulatory provision,

- Deemed CIS - Under the draft CIS regulations, all pooled funds that have scheme property of over Kshs 1.0 mn are to be deemed a CIS, without due consideration to private offers and other private arrangements. This provision as is, could be taken to mean that even private offers that have property over Kshs 1.0 mn now come under CMA’s ambit contrary to the provisions of Section 30A the Act which exempts offers that meet Section 21 of the Capital Markets (Securities) (Public Offers, Listings and Disclosures) Regulation, 2002. We believe that this provision needs to be amended to also set out a minimum number of investors required and have a better definition to avoid overlapping with the private offers regulation. The definition of property is confusing as it could be taken to mean actual physical assets yet in the draft CIS regulations property refers to all assets under a CIS including cash and cash equivalents,

- Disclosure – The draft CIS regulations does not deal with the issue of disclosure where CIS funds should publish their detailed portfolio contents quarterly as global best practice. We recommend the publishing of detailed portfolio holdings by all CIS’ quarterly and the information be available to the public as well to help both investors and prospects make better informed decisions. Instances where investors have lost money in money market funds is mainly because they were not aware the funds were exposed to investments like Nakumatt Commercial paper or Chase Bank deposits,

- Special Funds investment limits are highly limiting - The general 10.0% restriction on investment in unlisted securities, down from 25.0% removes the viability of special funds. Essentially it means that these draft Regulations can only accommodate the traditional Money Market Funds, Balanced Funds, Fixed Income and Equity Funds. The limits are summarized as follows:

- Investments in unlisted securities – 10%,

- Investment in a money market fund or another fund of similar constituent assets -10%,

- Off-shore - 10%,

- Other Alternative Investments - 10%,

- Securities by any single bank or financial institution - 25%, and,

- Investment in a related company - 10%.

We believe that capping investments in unlisted securities at 10.0% will limit the room for Fund Managers to provide a better value proposition for investors more so those with specific investment objectives. The investment restrictions imply that these funds do not really offer investors a specialized CIS fund with access to private markets,

- The Safekeeping of scheme property is included as a Trustee’s function - We believe that this is primarily a custodial function and should be handled by the CIS’ custodians. Further, the draft regulations state that the trustee may not delegate to the custodian the function of being custodian of documents of title or documents evidencing title to property of the scheme, unless the arrangements with the custodian prevent the custodian from releasing the documents into the possession of a third party without the consent of the trustee, and,

- We believe that the valuation methodology should be referenced to specific asset class provisions in the draft CIS regulations and more clarity provided on who appoints the valuer.

Draft Alternative Investment Funds (AIFs) Regulations 2021

- Capping of the number of investors - The capping of maximum investors to 20 may limit the uptake of these funds. Larger funds with more investors serve to boost investor confidence and limiting the number of investors will likely lead to creation of unnecessarily many AIFs or see continued preference for private offers as opposed to the regulated AIFs. We recommend removing the upper limit to allow AIFs onboard as many like-minded and interested investors as possible,

- Minimum investment amount - The set minimum investment amount of Kshs 1.0 mn into AIFs seems prohibitive and restrictive to investors, especially in a country like Kenya where the median income is around Kshs 50,000. Setting the minimum investment amount at 20 times the median income is unreasonably high more so in this current operating environment. While noting the sophisticated nature of such funds and the possibility of an AIF being an infrastructure fund which may require high amounts of capital, we recommend reducing the minimum investment amount to Kshs 100,000 similar to what is contained in the Section 21 of the Capital Markets (Securities) (Public Offers, Listings and Disclosures) Regulation, 2002 to allow more Kenyans to enjoy the benefits that come with investing in AIFs,

- Minimum value of the fund – The time required to attain the minimum fund value of Kshs 10.0 mn is unclear. We also note that there are no provisions for measures to be taken when a fund fails to reach the minimum of Kshs 10.0 mn or if the fund’s value in the future dips below the Kshs 10.0 mn, due to market movements, external market factors or client withdrawals etc.,

- Valuation of assets – The regulations require that AIFs to undertake a valuation every 6 months which we believe to be too frequent and given that the costs of the valuation will be likely borne by the fund; this translates to reduction in investors’ funds. We recommend that the valuation of assets be done once every financial year,

- Disclosure – The draft AIF Regulations do not provide for the disclosure of investments reports in their Transparency clause 20. We recommend the Regulations should require fund managers to disclose their investment holdings every quarter similar to the current requirements for the currently regulated CIS’s like Money market funds. Disclosure of such information is critical for current and potential investors to better assess the performance of an AIF and make informed decision regarding their investments. The requirement, in our view, should be coupled with guidelines on the valuation of different assets in order to achieve uniformity in the sector,

- AIF name is confusing - Alternative investments means all funds other than the conventional ones yet in AIF they are referred in the draft AIF regulations as Debt funds, Equity and equity linked investments, Hedge funds, or infrastructure. Some of the asset classes left out as per the draft regulations include Real Estate, Commodities, Private Equities (including venture Capital) etc. We believe that since the regulations seek to regulate investments in the alternative investment space, the funds should be allowed to invest in the asset classes they deem fit as long they fall under the Alternative Investment docket,

- Capital raising – The draft AIF regulations, in Section 12 and 14, provides for the regulations on capital raising requiring that AIFs may only raise funds from investors by private placement through an approved private placement memorandum. We note that the definition of private placement and the mode of distribution of the private placement memorandums to prospective investors remain unclear and presents a gray area that needs to be addressed, and,

- There is a lack of clarity in the following clauses:

- Regulation 8 (4) d is unclear with regards to the registration of AIFs,

- Section 14 (2) makes reference to a Second Schedule containing the AIF fees; the Second Schedule has not been provided in the Regulations, and,

- The definition of a holding company as outline in Section 3(1) (d) is unclear.

- Confusion on how an AIF is at one considered a private placement but also coming under the ambit of CMA. Once an offer is a private placement and it meets Section 21 of the Capital Markets (Securities) (Public Offers, Listings and Disclosures) Regulation, 2002, it falls outside the ambit of CMA.

- Areas of Improvement not contemplated under the Draft Regulations

- The draft AIF regulations should just be part of the CIS regulations and be deemed Sector Funds, it is not clear why AIF has been de-scoped from the CIS draft. The current capital markets regulations require that funds must diversify. Consequently, one has to seek special dispensation in form of sector funds such as a financial services fund, a technology fund or a real estate UTF fund,

- The Trustees eligibility should be included in the CMA Act and have it applied to all CMA products including REITs, CIS, and Bonds trustees, as has been done in the RBA Act. This will allow for more harmony and improve the REITs market in the process which requires that a Trustee must have a minimum capital requirement of Kshs 100.0 mn essentially limiting the eligibility to banks and large insurance firms and eliminating fund managers and corporate trustees,

- We need to allow CIS Funds to have as many custodians as is appropriate for their investors, similar to what Pensions Funds have. Multiple custodians allow for flexibility, increased service availability as different banks offer different additional services, ability to cater to client preference for specific custodians, and, improved services due to the competition between the multiple custodians,

- Read as a whole, the draft regulations are not only contradicting but trying to get rid of private markets / offers, and,

- Generally, there is a need to include market stabilization tools as part of the regulations/Act that help Fund Managers meet fund obligations during times of distress – such as mass withdrawals.

Section III: Recommendations

Based on global best practices and the Kenyan market setting, we believe the following measures will help in bolstering the capital markets and increase the uptake of Collective Investment Schemes in Kenya:

- Maximum number of investors in an AIF – We recommend removal of the capping of the number of investors for an alternative investment fund, similar to the other types of CIS. This is informed by some of the private offers in the country that have thousands of investors and that invest in alternative asset classes and may want to register as an AIF,

- Definition and Tenor of Alternative Investment Funds – The definition of an AIF under the draft AIF regulations seems to leave out other alternative investment classes already in existence in the market and does not leave room for other classes that may be arise in the future. We recommend expanding the definition of an AIF to funds that makes investments in “any other asset class outside the allowable investment or exceeds the set investment limits under the conventional CIS regulations”. We have seen this in jurisdictions such as in India which define an AIF as a privately pooled investment vehicle which collects funds from investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors and is not covered under the other existing regulations.

Further, India has categorized AIFs into three different categories:

-

- Category I Alternative Investment Fund – this category involves companies or funds that invest in start-up or early stage ventures or social ventures or SMEs or infrastructure or other sectors or areas which the government or regulators consider as socially or economically desirable and shall include venture capital funds, SME Funds, social venture funds, infrastructure funds and such other AIF as may be specified,

- Category II Alternative Investment Fund - this category involves companies or funds that do not fall in Category I and III and which does not undertake leverage or borrowing other than to meet day-today operational requirements and as permitted in these regulations. This category includes private equity funds or debt funds for which no specific incentives or concessions are given by the government or any other Regulator,

- Category III Alternative Investment Fund this category involves companies or that employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives. Category III AIF may be either open ended or close ended providing flexibility of fund or scheme tenure. However, Category I and II are closed ended and have a minimum tenure of three years.

In our view, Kenya can borrow from India’s definition of an AIF as it has more flexibility. For instance, Category III allows for open-ended AIFs that may invest in any type of investment included in their investment policy. This allows for more flexibility and leaves room for fund managers to offer better value by structuring various investment strategies. Key to note, the lack of a defined tenor for Category III also increases the flexibility of such AIFs as opposed to what we have in the current draft AIF regulations,

- Deemed CIS – It is still unclear what CMA wishes to cure by providing for Deemed CIS’. In our view, this not only exceeds their mandate but will also likely result in confusion in the market especially for the many informal groups that invest together and have over Kshs 1.0 mn. We recommend that this provision be removed all together and if it is to be introduced, it should be introduced in the act and specifically indicate which pooled funds or arrangements shall be affected and indicate the compliance period to be provided for said arrangements already in the market. The main issue here is the ambiguity and the generalization that this proposed provision contains. A regulation, in our view, should be clear and not leave room for misinterpretation,

- Special Funds – In our view, the provision for special funds as is, is quite limiting and may end up not being utilized. We recommend this be replaced by sector funds, including property funds, which should have their own definition, investment limits and valuation methodology, and,

- Private Offers – Private offers in the country provide a key role in deepening the capital markets due to their (i) relatively higher returns in comparison to traditional investments products, (ii) Low correlation of to the factors affecting traditional investments’ returns, and, (iii) Provision of greater selection of investment options. However, it seems that the draft AIF regulations will likely stifle the continued offering of unregulated products due their restrictions on the number of investors and the minimum investment amounts. It is not clear if the intention is to get rid of private offers altogether and replace them with Alternative Investment Funds or if the draft AIF regulations are made to be complementary to private offers. The draft AIF regulations as they are, stifle the market instead of catering for all type of investors – those who prefer regulated products and those who prefer unregulated products. We believe that in order to catalyze the growth of our capital markets, there needs to be a synergy between the regulated and the unregulated markets as this will lead to a more inclusive capital market. To understand more on unregulated products, please see our Cytonn Weekly #25/2021.

Section III: Conclusion

Having analyzed the proposed regulations, we have identified 5 positives and 15 areas of improvement. Consequently, it’s our view that proceeding with the regulations as proposed would not be good for the market. We recommend that the CMA first does and publishes a Regulatory Impact Assessment to contextualize draft regulation and also take into account comments from the public to produce revised drafts that have more positive than negatives to the market. As published, the current drafts likely impact negatively on our capital markets not to mention the likely of facing a lot of legal challenges.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.