The Fight Against Corruption in Kenya…Yet Another Chapter, & Cytonn Weekly #29/2018

By Cytonn Research Team, Jul 29, 2018

Executive Summary

Fixed Income

T-bills were undersubscribed during the week, with the overall subscription rate coming in at 88.2%, a decline from 207.6% recorded the previous week; the undersubscription can be attributed to banks seeking funds for VAT remittances during the week. Yields on the 91-day, 182-day and 364-day papers declined by 4.8 bps, 8.3 bps, and 15.0 bps to 7.6%, 9.1% and 10.1%, respectively, with Central Bank of Kenya (CBK) being cautious and not accepting aggressive bids from the market. The Monetary Policy Committee (MPC) is set to meet on Monday 30th July 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). We are of the view that the MPC will keep rates on hold and adopt a wait and see approach as they monitor the effects of the rate cut to 9.5% in March, as well as await the National Assembly’s decision on the interest rate cap from the proposed amendment of the Banking (Amendment) Act, 2016. See our July MPC Note here;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 20 gaining 0.1% and 0.2%, respectively, while NSE 25 remained flat at 0.0%. For the last twelve months (LTM), NASI and NSE 25 have gained 8.9% and 6.3%, respectively, while NSE 20 has declined by 11.8%. KCB Group has submitted a revised bid to acquire certain assets and liabilities of Imperial Bank Limited, which is under receivership;

Private Equity

In the financial services sector, Dubai based Badoer Investments Limited has invested Kshs 100.0 mn (USD 1.0 mn) into Sumac Microfinance Bank, a Kenyan SME lender with two branches in Nairobi, one in Kiambu and another in Nakuru. Badoer will take up a 15.6% stake in the SME lender for their Kshs 100 mn investment, valuing Sumac at Kshs 641.0 mn (USD 6.4 mn);

Real Estate

This week, in the retail sector, South African retailer Shoprite announced plans to open a new outlet in the Mombasa City Mall, taking over space previously occupied by Nakumatt, as part of its plans to open 7-outlets across the country by 2019. In the commercial office sector, Britam Tower, a 32-storey building with a Gross Lettable Area (GLA) of 350,000 SQFT, is letting in Upperhill. In the residential sector, Housing Finance (HF) Group Limited, a mortgage provider in Kenya, intends to offload its home loans book, with the aim of benefiting from government plans to construct 500,000 affordable housing units in the next 5-years;

Focus of the Week

This year, several events have brought corruption in Kenya to the forefront. Corruption in Kenya has been rampant for over 4-decades, and has been a large inhibitant to Kenya’s development. According to the Ethics and Anti-Corruption Commission, Kenya is losing an estimated Kshs 608.0 bn to corruption yearly. We last covered the topic in November 2015, and see the focus here, and given the prevailing environment, this week we focus on the topic again, covering (i) Kenya’s history with corruption, (ii) the corruption scene in Kenya today, (iii) strides made so far in the fight against corruption, (iv) challenges in the fight against corruption in Kenya, (v) we look at Rwanda and Botswana, Sub-Saharan Africa countries, that are winning in the fight against corruption and look at what Kenya can learn from them , and (vi) opportunities for improvement.

- On 21st July 2018 and 28th July 2018, Cytonn held their Q3’2018 Market Outlook and Company Updates Event at The Alma in Ruaka and The Capital Club in Westlands, respectively. The quarterly forums provide extensive insights into our outlook of the macroeconomic and operating environment while also providing an opportunity for us to directly engage with our clients and receive feedback on how we can improve our products and services. See Event Note

- Moses Njuguna, Distribution Unit Manager, discussed Financial Planning. Watch Moses on Njata T.V here

- The Q2’2018 issue of our quarterly Sharp Cents Magazine, themed Sustainable Finance is out. Read the issue here or email clientservices@cytonn.com to get a copy

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for IT Network Engineer and Unit Managers- Mt. Kenya Region. Visit the Careers section on our website to apply.

- Cytonn Real Estate is looking for a 0.5-acre land parcel for a joint venture in Lavington, Karen or Kiambu Road. The parcel should be in a good location with frontage to a tarmac road. For more information or leads, email us at rdo@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills were undersubscribed during the week, with the overall subscription rate coming in at 88.2%, a decline from 207.6% recorded the previous week due to reduced liquidity, which the Central Bank of Kenya (CBK) attributed to banks seeking funds for VAT remittances during the week. Yields on the 91-day, 182-day and 364-day papers declined by 4.8 bps, 8.3 bps, and 15.0 bps to 7.6%, 9.1%, and 10.1%, respectively, with Central Bank of Kenya (CBK) being cautious and not accepting aggressive bids from the market. The acceptance rate for T-bills improved to 99.3% from 71.8% the previous week, with the government accepting Kshs 21.0 bn of the Kshs 21.2 bn worth of bids received. The subscription rates for the 91-day, 182-day and 364-day papers declined to 50.6%, 58.6% and 133.0% from 105.9%, 137.9% and 318.1%, respectively, with the 364-day paper still recording the highest performance. Investors’ participation remains skewed towards the longer-dated paper, which has been attributed to the lack of short term bond issuances in the primary market leading to the shift in focus to the 364-day paper.

The Kenyan Government issued a new 20-year Treasury bond (FXD 2/2018/20) with the coupon rate set at 13.2% in a bid to raise Kshs 40.0 bn for budgetary support. The issue had a lacklustre performance, with the overall subscription rate coming in at 34.7% while the weighted average rate of accepted bids came in at 13.4%, in line with our expectations of 13.3% - 13.5%. The government accepted Kshs 10.5 bn out of the Kshs 13.9 bn worth of bids received, translating to an acceptance rate of 75.8%. Despite the government’s effort to increase the local debt maturity profile by issuing longer dated bonds, there has been low appetite for the issues. We attribute this to the uncertainties in the interest rate environment due to the tabling of the Finance Bill 2018 that proposes the repeal of interest rate cap, which if passed, might result into an upward pressure on interest rates.

Liquidity:

The average interbank rate increased to 4.1%, from 3.2%, the previous week, while the average volumes traded in the interbank market increased by 13.0% to Kshs 16.9 bn from Kshs 15.0 bn the previous week. The increase in the average interbank rate points to declined liquidity, which the CBK attributed to banks seeking funds for VAT remittances during the week.

Kenya Eurobonds:

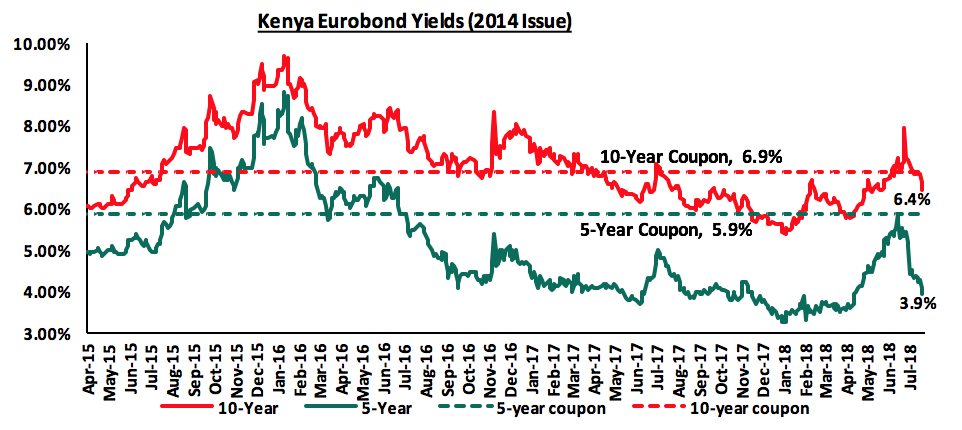

According to Bloomberg, the yield on the 5-Year and 10-year Eurobonds issued in 2014 declined by 0.3% points and 0.4% points to 3.9% and 6.4% from 4.2% and 6.8% the previous week, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.9% points and 3.2% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 1-year and 6-years to maturity.

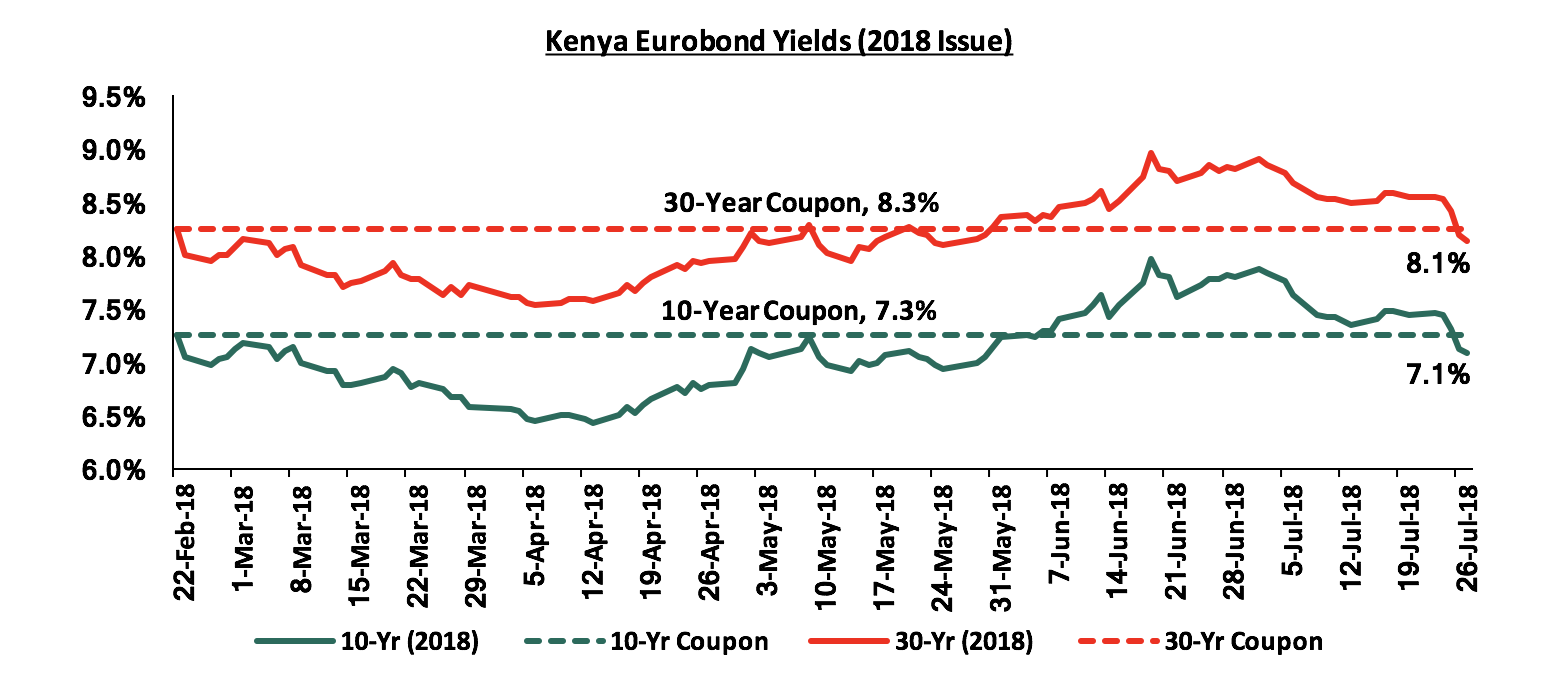

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds declined by 0.3% points and 0.4% points to 7.1% and 8.1% from 7.4% and 8.5% the previous week, respectively. Since the issue date, the yields on both the Eurobonds have declined by 0.2% points.

Yields on all the Kenyan Eurobond yields continued to decline during the week, which has been attributed to improved liquidity in the global markets and lower risk perception as a result of improved investor sentiments based on the stable macroeconomic conditions. This is evidenced by strong economic growth of 5.7% in Q1’2018, compared to 4.8% in Q1’2017.

The Kenya Shilling:

During the week, the Kenya Shilling gained by 0.3% against the US dollar to close at Kshs 100.5, from Kshs 100.7 the previous week, supported by inflows from diaspora remittances amidst tightened liquidity in the money markets. The Kenyan shilling has gained by 2.6% year to date, and in our view the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, to 8.9% of GDP in Q1’2018 compared to 11.3% in Q1’2017 on account of the faster growth of exports at 7.1%, compared to imports growth of 6.5%,

- Stronger inflows from principal exports, which include coffee, tea and horticulture, which increased by 9.3% during the month of April to Kshs 21.9 bn from Kshs 20.0 bn in a similar period the previous year, with the exports from coffee and horticulture increasing by 6.7% and 25.0% y/y, respectively, while tea exports have declined marginally by 1.6% y/y,

- Improving diaspora remittances, which increased by 16.9% to USD 253.7 mn in May 2018, from USD 217.1 mn in April 2018, with the largest contributor being North America at USD 122.8 mn attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 8.8 bn (equivalent to 5.9 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Weekly Highlights:

The Monetary Policy Committee (MPC) is set to meet on Monday 30th July 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). Key factors to consider include:

- Inflation has averaged 4.2% in the first 6-months of 2018 compared to 9.8% experienced in a similar period in 2017, and is expected to remain within the government target of 2.5% - 7.5%, despite the expectations of upwards inflationary pressure in H2’2018,

- The currency has appreciated by 0.4% since the last meeting on May 28th, 2018, and,

- The macroeconomic environment remains relatively stable despite the low private sector credit growth, which came in at 2.8% in April 2018.

We are of the view that the MPC will adopt a wait and see approach as they monitor the effects of the March rate cut to 9.5%, as well as await the National Assembly’s decision on the interest rate cap from the proposed amendment of the Banking (Amendment) Act, 2016 by repealing Section 33B. We therefore expect the MPC to hold the CBR at 9.5%. For a comprehensive analysis, read our Cytonn Note on the MPC Meeting for July 2018.

According to data from the Kenya National Bureau of Statistics (KNBS), foreign currency deposits rose by 9.5% in the month of May 2018 to Kshs 514.9 bn, from Kshs 470.2 bn in April, and by 16.6% y/y from Kshs 441.6 bn in a similar period in 2017. This is a new high, being the first time the foreign currency deposits have crossed the Kshs 500 bn level, which has been attributed to increased inflows from abroad as individuals continued to take advantage of the tax amnesty granted on foreign income. The Tax Procedures Act had been amended in 2016 with the introduction of Section 37B, which granted amnesty on foreign income that had been earned on or before 31st December 2016 and was subject to taxation in Kenya. The section was later amended on 3rd April 2017, extending the deadline to allow full amnesty provided the foreign income was declared and funds realized were transferred to Kenya no later than 30th June 2018; failure to which they could be remitted within 5-years thereof but would be subjected to a 10% penalty. In the 2018/2019 financial year budget reading, the Cabinet Secretary for National Treasury proposed the extension of the amnesty to 30th June 2019 amidst concerns that it would lead to inflows of illicit cash including proceeds from corruption. The increase in foreign currency deposits has also been reflected in the increased diaspora remittances, which also increased by 57.1% year on year in the month of May to USD 253.7 mn from USD 161.5 mn in May 2017. The increased inflows have led to the strengthening of the Kenyan Shilling against the US Dollar, which has gained by 2.6% year to date as well as maintained the high forex reserves experienced during the year that are currently at USD 8.8 bn (equivalent to 5.9 months of import cover).

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids as it is currently 136.3% ahead of its pro-rated borrowing target for the current financial year. The 2018/19 budget gives a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s budget of Kshs 297.6 bn which the government surpassed. The lower borrowing target may result in reduced pressure on domestic borrowing. However, the National Treasury has proposed to repeal the interest rate cap, which if repealed can result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles. With the cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments.

Market Performance:

During the week, the equities market recorded mixed performance with NASI and NSE 20 gaining 0.1% and 0.2%, respectively, while NSE 25 remained flat at 0.0%, taking their YTD performance to 0.7%, (10.5%) and 2.0%, for NASI, NSE 20 and NSE 25, respectively. This week’s performance was driven by gains in large cap stocks such as BAT, Safaricom, EABL and Diamond Trust Bank (DTB) that gained by 3.3%, 2.7%, 2.7% and 2.0%, respectively. For the last twelve months (LTM), NASI and NSE 25 have gained 8.9% and 6.3%, respectively, while NSE 20 has declined by 11.8%. Equities turnover decreased by 13.2% to USD 17.7 mn from USD 20.4 mn the previous week. We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters.

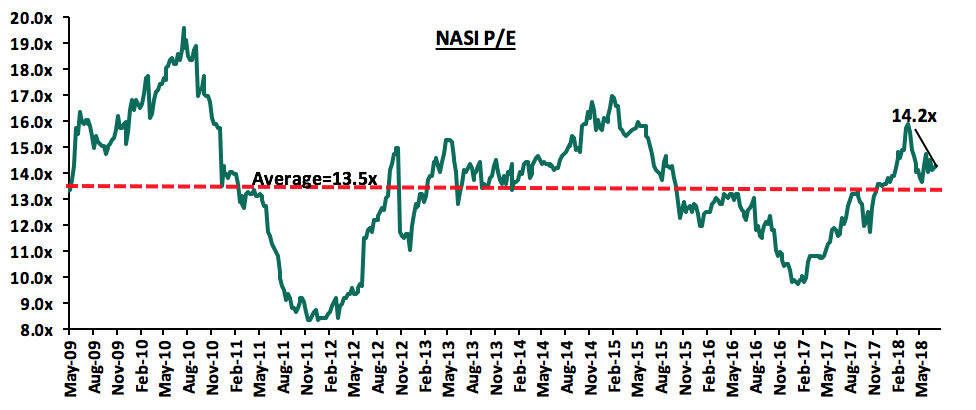

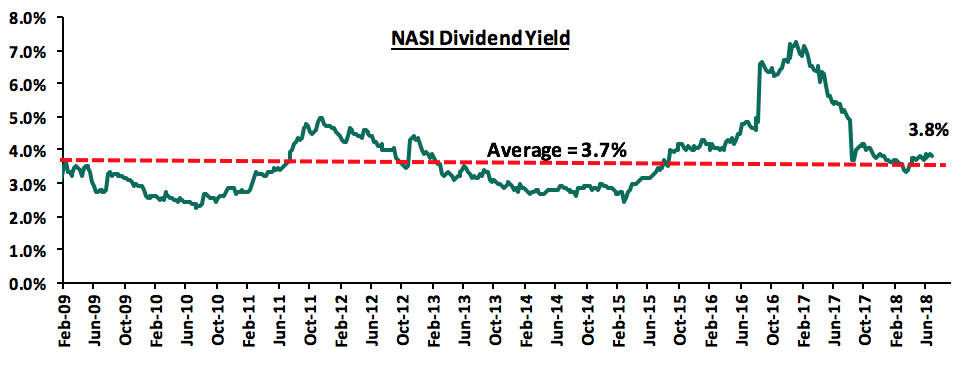

The market is currently trading at a price to earnings ratio (P/E) of 14.2x, which is 5.2% above the historical average of 13.5x, and a dividend yield of 3.8%, slightly higher than the historical average of 3.7%. The current P/E valuation of 14.2x is 44.9% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 71.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly highlights:

Banks have been venturing into the digital lending space, in a bid to take advantage of the increased adoption of digital banking, whose main selling point is the convenience it provides for customers. New initiatives include:

- Listed lender HF Group has ventured into the increasingly popular mobile-based lending segment via an app dubbed HF Whizz, which will enable their customers to borrow between Kshs 1,000 and Kshs 50,000 at a monthly interest rate of 1.1%, and a facilitation fee of 6.6%, which is above average, with most institutions charging between 1.5% and 3.0%. The bank’s customers will also be able to transfer up to Kshs 200,000 daily, in addition to making deposits directly to their bank accounts. The bank tailored the mobile app for smartphone users as opposed to using USSD code, due to the smartphone-based app’s superior value-added options such as expense tracking and budget management,

- Commercial Bank of Africa (CBA) also launched a digital banking platform that allows the bank’s customers to borrow up to Kshs 3.0 mn, which is currently the highest among all digital platforms. The payment period of the maximum borrowable amount has been capped at 3-years. Customers also have access to an overdraft facility of up to Kshs 100,000, which is contingent on their financial track record. The loan service has been appended to the bank’s platform called “Loop”, which was launched in March 2017. Customers will be able to perform Loop to Loop transfers for free while payments done via the Safaricom Paybill and Buy Goods services will attract no additional bank charges. Furthermore, the transaction charges for Loop to M-pesa have been reduced by 44.0% while charges for Loop to ATM have been reduced by 40.0%, and,

- UBA Kenya also released an interactive chat banker platform that enables the bank’s customers to make use of social media platforms to conduct bank transactions. Through the app dubbed “Leo”, Facebook users can open accounts, transfer money to other accounts, top up airtime and request for mini statements via the platform. The creation of the social-media based platform was informed by smartphone users spending 80.0% of their time on three apps: WhatsApp, Facebook and YouTube. Since its launch in the Nigerian market, the app has had over 35.0 mn conversations, with over 500,000 transactions carried out. The Pan African bank has launched the service in 15 countries.

We note that competition in the digital banking space has become rife, with several players launching innovative products to tap into the market. The biggest selling point for these products has been the convenience provided. This has created a new revenue source for banks, who earn both transactional income and interest income from the mobile lending space, which is currently unregulated. This improves banks’ overall efficiency as well as diversifies their revenue sources, thereby providing sustainable growth.

Six government agencies have issued a warning to members of the public about engaging with rogue digital credit providers, citing that many of the providers are operating illegally. The joint statement by the Capital Markets Authority (CMA), Central Bank of Kenya (CBK), Insurance Regulatory Authority (IRA), Ministry of Trade, Industry and Cooperatives, Retirement Benefits Authority (RBA), and Sacco Societies Regulatory Authority (SASRA), has warned that these services, which are available online, include online pyramid schemes, credit and savings schemes, as well as mobile loan applications, which are available in Google Play and the Apple App Store. The agencies advised members of the public to deal only with genuine and licensed institutions. The notice highlighted that some of the institutions require individuals to save first before qualifying for the loans, promising to deliver unusually high returns in the process. Some of the institutions rely on investment strategies that may require the institutions to recruit more members in order to earn benefits. Some have no registered premises, websites and addresses. We note that it is the high time that regulation is enacted to regulate the activities of the digital lending space, given the exponential growth in the segment’s uptake by the public. Information of legitimate and licensed digital loan providers needs to be readily available to the members of the public, which will go a long way to ensure they engage with credible entities. In addition to this, it is vital that the government comes up with a regulatory framework tailored for the mobile lending segment, so as to protect the consumers of these products, whose prominence keeps on growing.

KCB Group offered its second bid to acquire a stake in the troubled lender Imperial Bank Limited (IBL), which is under receivership. Diamond Trust Bank (DTB), which had also expressed interest, pulled out of the deal, putting KCB in pole position to acquire a stake in the troubled lender. IBL was put under receivership in August 2015, with a loan book of Kshs 41.0 bn and deposits of Kshs 58.0 bn. KCB Group had submitted an offer in April, whose details were not disclosed, but both banks were tasked with revising their offers, with DTB declining to participate further. Kenya Deposit Insurance Corporation (KDIC) highlighted that it had received the revised proposal from KCB, while the other bidder had withdrawn from the process. The Central Bank of Kenya (CBK) and KDIC will engage KCB in discussions with the aim of maximizing the value for depositors. In April, the bidders were tasked to disclose the oversight frameworks they planned to implement, the type of transaction they intended to proceed with, and the financial resources that could be deployed to compete the transaction. The impending resolution of the matter, which could possibly result in the bank’s removal from receivership, will be welcomed by customers, whose deposits have been locked in the bank since August 2015. We note that the process needs to be expedited, as the transaction falls way behind the expected timelines shared by the CBK, who, in September 2017, had scheduled to have a winning bidder by February 2018. If successful, this would mark the second instance a bank is brought out of receivership, after the recently concluded deal that saw SBM Kenya complete the acquisition of certain assets and Liabilities of Chase Bank Limited (under Receivership).

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 20/07/2018 |

Price as at 27/07/2018 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/(Downside)** |

P/TBv Multiple |

|||

|

Ghana Commercial Bank*** |

5.0 |

5.1 |

1.0% |

0.2% |

7.7 |

7.6% |

61.7% |

1.2x |

|||

|

NIC Bank*** |

34.8 |

34.8 |

0.0% |

3.0% |

54.1 |

2.9% |

58.6% |

0.8x |

|||

|

Zenith Bank*** |

23.0 |

23.7 |

3.0% |

(7.6%) |

33.3 |

11.7% |

56.6% |

1.0x |

|||

|

I&M Holdings*** |

114.0 |

106.0 |

(7.0%) |

1.9% |

169.5 |

3.1% |

51.8% |

1.1x |

|||

|

Diamond Trust Bank*** |

196.0 |

200.0 |

2.0% |

4.2% |

280.1 |

1.3% |

44.2% |

1.1x |

|||

|

Union Bank Plc |

5.8 |

5.6 |

(3.4%) |

(28.2%) |

8.2 |

0.0% |

40.5% |

0.6x |

|||

|

KCB Group*** |

48.3 |

47.5 |

(1.6%) |

11.1% |

60.9 |

6.2% |

32.4% |

1.5x |

|||

|

Ecobank Ghana |

8.2 |

8.2 |

0.5% |

8.0% |

10.7 |

0.0% |

31.3% |

2.3x |

|||

|

Barclays |

11.5 |

11.6 |

0.4% |

20.3% |

14.0 |

8.7% |

30.4% |

1.4x |

|||

|

CRDB |

160.0 |

160.0 |

0.0% |

0.0% |

207.7 |

0.0% |

29.8% |

0.5x |

|||

|

UBA Bank |

9.6 |

9.7 |

1.6% |

(5.8%) |

10.7 |

15.7% |

27.7% |

0.6x |

|||

|

HF Group*** |

8.5 |

8.5 |

0.0% |

(18.3%) |

10.2 |

3.8% |

23.8% |

0.3x |

|||

|

Co-operative Bank |

16.8 |

17.0 |

1.2% |

6.3% |

19.7 |

4.8% |

22.0% |

1.5x |

|||

|

Equity Group |

49.5 |

50.0 |

1.0% |

25.8% |

55.5 |

4.0% |

16.2% |

2.5x |

|||

|

Stanbic Bank Uganda |

33.0 |

33.0 |

0.0% |

21.1% |

36.3 |

3.5% |

13.5% |

2.1x |

|||

|

CAL Bank |

1.3 |

1.3 |

(2.3%) |

16.7% |

1.4 |

0.0% |

8.5% |

1.1x |

|||

|

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

299.9 |

4.8% |

8.2% |

1.6x |

|||

|

Guaranty Trust Bank |

38.0 |

39.6 |

4.2% |

(2.8%) |

37.2 |

6.3% |

4.3% |

2.1x |

|||

|

Stanbic Holdings |

92.0 |

90.5 |

(1.6%) |

11.7% |

85.9 |

5.7% |

(0.9%) |

1.1x |

|||

|

Access Bank |

10.1 |

10.1 |

(0.5%) |

(3.8%) |

9.5 |

4.0% |

(2.0%) |

0.7x |

|||

|

Standard Chartered |

204.0 |

204.0 |

0.0% |

(1.9%) |

184.3 |

6.1% |

(3.5%) |

1.6x |

|||

|

Bank of Baroda |

140.0 |

140.0 |

0.0% |

23.9% |

130.6 |

1.8% |

(4.9%) |

1.2x |

|||

|

SBM Holdings |

7.3 |

7.3 |

0.0% |

(2.1%) |

6.6 |

4.1% |

(6.5%) |

1.0x |

|||

|

Stanbic IBTC Holdings |

48.8 |

48.7 |

(0.3%) |

17.2% |

37.0 |

1.2% |

(23.0%) |

2.5x |

|||

|

FBN Holdings |

9.1 |

10.0 |

10.5% |

13.6% |

6.6 |

2.8% |

(24.0%) |

0.5x |

|||

|

Standard Chartered |

26.0 |

26.0 |

0.0% |

3.0% |

19.5 |

0.0% |

(25.2%) |

3.3x |

|||

|

National Bank |

5.6 |

5.8 |

4.5% |

(38.0%) |

2.8 |

0.0% |

(49.5%) |

0.4x |

|||

|

Ecobank Transnational |

20.7 |

20.6 |

(0.5%) |

20.9% |

9.3 |

0.0% |

(55.1%) |

0.7x |

|||

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder **** Stock prices are in respective country currency |

|||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

Badoer Investments Limited, a Dubai-based investment firm, has bought a 15.6% stake in Sumac Microfinance Bank for Kshs 100.0 mn (USD 1.0 mn). Sumac Microfinance Bank is a Kenyan SME lender with a client base of 10,000 members and currently operates in Nairobi, Kiambu and Nakuru. The deal values Sumac Microfinance Bank at Kshs 641.03 mn (USD 6.41 mn). The Microfinance Institution (MFI) currently has a loan book worth Kshs 1.0 bn (USD 10.0 mn). The funding will be mainly used as capital as it looks to grow its loan book and for expansion with plans to open offices in Eldoret, Kisumu and Meru, as the MFI moves to tap into the agribusiness market in Kenya. This continues Sumac’s recent funds mobilization, having raised Kshs 330.0 mn this year through debt (Kshs 153.0 mn financing from Mexican fund manager Triple Jump, Kshs 102.0 mn from the Regional MSME Investment Fund for sub-Saharan Africa, Kshs 45.0 mn from the Development Bank of Kenya and Kshs 30.0 mn from the Micro Enterprise Support Programme Trust).

In February 2018, Luxembourg-based private equity firm Fonds European de Financement Solidaire (Fefisol) invested Kshs 100.0 mn in Musoni Microfinance Limited for an undisclosed stake, highlighting global capital interest in micro lending in sub Saharan Africa. Increase in credit lending agencies in Kenya, especially the digital platforms have diversified the source of funds in the country, which has enabled borrowers to tap into alternative avenues of funding that are more flexible and pocket friendly. The interest rate cap has made it even more difficult for risky clients especially SMEs to acquire funding (the current private sector credit growth is at 2.8% against a 5-year average of 14.0%) thus driving more clients from commercial banks to Microfinance Institutions.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest across various sectors, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and a stable macroeconomic environment will continue to boost deal flow into African markets.

The real estate sector continues to attract positive investor sentiments, as seen through increased activity across all real estate themes, as investors conveniently position themselves in a bid to benefit from the high returns from the sector. This week, in the retail sector, Shoprite, a South African retail outlet, announced plans to open a new store in Mombasa City Mall. The move will see Shoprite take over space that was previously occupied by struggling local retailer Nakumatt, and is part of its 2-year strategy to open 7-outlets across the country, 2 of which are expected to be opened before the end of 2018, at Westgate mall and Garden City mall in Nairobi. Shoprite joins other international retailers who have entered the Kenyan market attracted by positive fundamentals such as (i) attractive levels of GDP growth, which has averaged at 5.5% over the last 5-years and we forecast a 5.8% GDP growth for 2018, (ii) the growing middle class with increased purchasing power, (iii) shifting consumer habits that have driven the development of new shopping malls as Kenyans increasingly visit formal retail centers, (iv) Kenya’s positioning as a regional and continental hub, hence witnessing an increase in multinationals operating in the country, and (v) a relatively high formal retail penetration rate of 35.0%, only 2nd to South Africa, which has a penetration of 60.0%, according to Oxford Business Group.

The table below highlights key international retailers dealing in household products in Kenya and their attempts to increase foothold over time:

|

International Retailers (Household Products) in Kenya |

|||||

|

Retailer |

Country of Origin |

Nature of Store |

No of Stores Opened |

Branches Opened |

Branches Planned to be Opened |

|

Carrefour |

France |

Supermarket |

5 |

Two Rivers Mall, Thika Road Mall, The Hub Karen, Sarit Centre and The Junction Mall |

Village Market, Galleria Mall |

|

Shoprite |

South Africa |

Supermarket |

0 |

|

Westgate Mall, Garden City, Mombasa City Mall and 4 undisclosed |

|

Choppies |

Botswana |

Supermarket |

11 |

Kiambu Mall, Nairobi CBD, Nakuru, South Field Mall, Kisii etc |

Signature Mall |

|

Game |

South Africa |

Supermarket |

2 |

Garden City Mall, The Waterfront Karen |

|

|

Miniso |

Japan |

Household and consumer goods |

3 |

Village Market, Thika Road Mall, The Junction |

The Hub Karen, South Field Mall |

Source: Cytonn Research 2018

We expect the continued expansion by retailers to result in increased demand for retail space. In 2017, according to Cytonn’s Kenya Retail Sector Real Estate Report 2017, the sector’s performance had softened, with rental yields declining by 0.4% points to 8.3% in 2017 from 8.7% in 2016, attributable to a 2.7% points decline in occupancy rates to 80.2% from 82.9%, respectively. This was attributed to increased supply in some submarkets such as Nairobi, which recorded a 41.6% increase in supply and a tough economic environment lowering retailers returns, hence a reduction in expansion measures by retailers. Despite the expansion of retailers, we expect the performance of the sector to remain flat, given the increasing supply which is expected to grow by a 3-year CAGR of 7.3% to 6.9 mn SQFT in 2020.

In the commercial office sector, Britam Tower, a 32-storey building, owned by British-American Investments Company (Britam), is letting in Upperhill. The building whose construction started in September 2013, brought into the Upperhill market a total of 350,000 SQFT of office space. According to Cytonn Nairobi Commercial Office Report 2018, Upperhill, classified as a high rise commercial office zone, recorded a flat yield of 9.0% in 2016 and 2017, while occupancy declined by 7.8% points from 89.8% in 2016 to 82.0% in 2017, and rent decreased by 2.9% from Kshs 102 per SQFT to Kshs 99 per SQFT in 2016 and 2017, respectively. The decline in rents and occupancy was as a result of the increase in office space, through completion of projects such as Britam Towers in 2017, KCB Towers and UAP Tower in 2016. According to the report, on overall, the Nairobi office market had a total oversupply of 4.7 mn SQFT as at 2017, and recorded decreased occupancy by 3.4% points from 88.0% in 2016 to 84.6% in 2017, and rent charges dropped during the same period by 1.9% from Kshs 103 per SQFT to Kshs 101 per SQFT, attributable to increased supply, coupled by the slowed down economic environment in 2017, due the prolonged electioneering period and the interest cap that negatively affected credit supply. As per the Cytonn Annual Market Outlook 2018, we expect the occupancy and rent charges in the office sector to decline further in 2018, given the increase in office space and therefore a decline in rental yields.

Other highlights in the week include;

- The first group of 20 National Construction Authority (NCA) staff have concluded the recently launched Concrete Technology Training Course, at Jomo Kenyatta University of Agriculture and Technology (JKUAT’s) Center for Sustainable Materials, Research and Technology (SMARTEC). The intensive course is aimed at adopting the latest sustainable technologies in the construction industry and achieving efficiency in construction. In our view, the course will facilitate the implementation of the affordable housing pillar of the Kenyan Government’s Big Four Agenda by provision of sustainable low-cost construction methods;

- Nairobi has been ranked the 97th most expensive home rental city in the world, according to Bloomberg World Airbnb cost Index 2018, with the average daily rate of a house accommodating two adults coming in at USD 53.0. This marks a 3.0% drop compared to the USD 54.6 recorded in 2017, attributable to the prolonged electioneering period in 2017, which prompted home owners to reduce their rates to attract international tourists. Other African cities that were ranked in the index included; Cape Town, which recorded a rate of USD 127.0, coming in 1st in the continent and 27th globally, Lagos at a cost of USD 103.0, which is 2nd in the continent and 43rd globally, Abuja at USD 91.0 coming in at 54th globally, Harare at USD 65.0 and 85th globally and Johannesburg that was 5th in the continent and 92nd globally. The index ranks cities based on their average daily rate of renting a private home through Airbnb, an online platform that enables individuals to lease or rent private accommodations like apartments, hostels and homestays for a short-term period;

- In the residential sector, Housing Finance (HF) Group Limited, a mortgage provider in Kenya, intends to offload its home loans book, with the aim of benefiting from government plans to construct 500,000 affordable housing units in the next 5-years. HF plans to sell its existing loans to the Kenya Mortgage Refinancing Company (KMRC), then use the proceedings to provide new housing loans as low as Kshs 2.5 mn for about 200 new housing units over the next year. KMRC is a financial institution that is meant to support long-term lending activities by Primary Mortgage Lenders (PML) such as banks, credit unions and mortgage brokers, with the core function being to act as an intermediary between PMLs and the bond market. It enhances liquidity by sourcing funds from the capital markets and providing it to the PML. In our view, KMRC will have a significant impact on enhancing affordability of housing units by enabling PMLs to lend for longer tenors and thus have lower instalments. However, the key conditions necessary for the success of same include; i) transparent and effective regulation of KMRC by a regulatory body, ii) governance rules designed to ensure its efficiency, especially with the government as the biggest shareholder, iii) a clear and efficient land titling process, iv) sufficient support from the private sector, especially in regards to bond issuance, v) attainment of a stable and lower interest rates environment, especially on government instruments, which may crowd out MRC from accessing the needed funding, and vi) provision of affordable homes. For more details on the structure and operations of KMRC, see Cytonn Weekly #14/2018.

Listed Real Estate

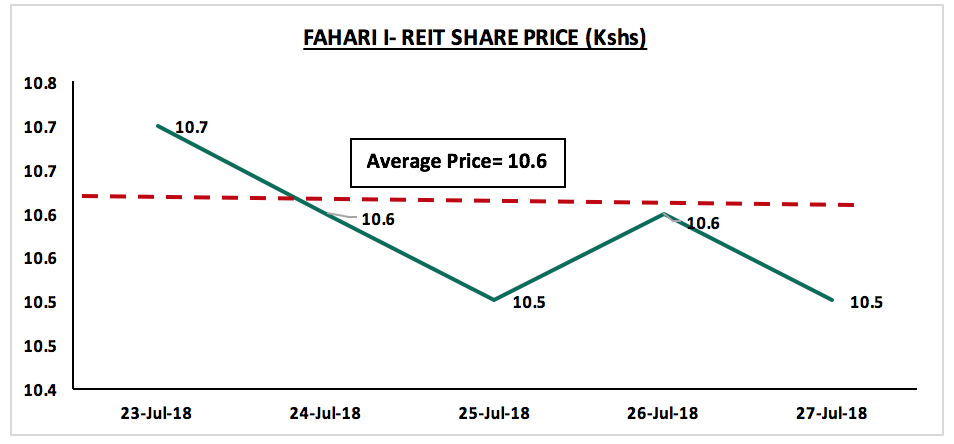

During the week, the Fahari I-REIT recorded a slight drop in performance closing at Kshs 10.5 per share compared to the closing price of Kshs 10.6 per share last week, indicating continued lack of investor appetite for the instrument. With the current share price of Kshs. 10.6, assuming the dividend per share and the dividend payout ratio remain constant at Kshs 0.8 and 91.0% respectively, the Fahari I-REIT will have a yield of 7.1%. We attribute the poor performance to i) inadequate investor knowledge, ii) opacity of the exact returns from the underlying assets, iii) the negative sentiments currently engulfing the sector given the poor performance of Fahari, and iv) lack of institutional support for REITs.

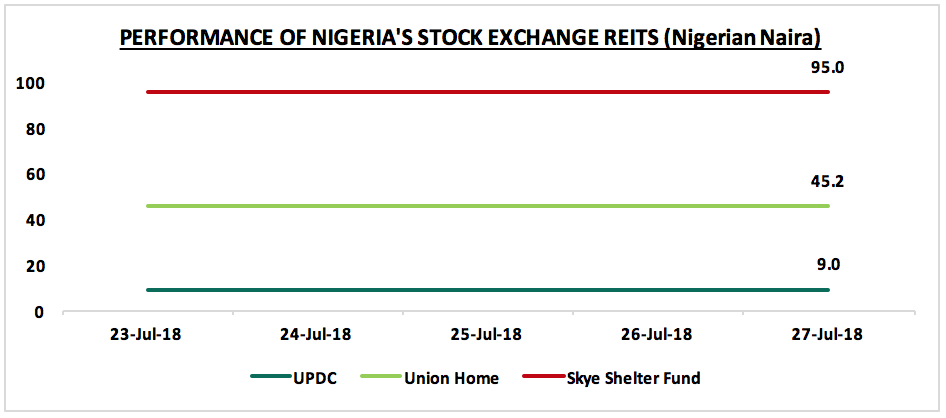

West Africa

REITs market in Nigeria continue to flat line. The three REITs in the market plateaued this week, an indication of stalled demand for the REITs attributable to shallow investor knowledge, poor market regulation amidst a high-interest rate environment; and therefore, we expect the performance to continue on this trend for the long term.

Our outlook for the real estate sector remains positive given the continued traction of economic activities evidence by; i) the growing number of international retailers in the Kenyan market, and ii) continued government focus on the 4 pillars, among them being the affordable housing agenda.

Transparency International defines corruption as the “abuse of entrusted power for private gain”. Corruption can be classified as grand, petty and political, depending on the amount of money lost and the sector where it occurs.

- Grand corruption consists of acts committed at a high level of government that distort policies or the central functioning of the state, enabling leaders to benefit at the expense of the public good,

- Petty corruption refers to everyday abuse of entrusted power by low and mid-level public officials in their interactions with ordinary citizens, who often are trying to access basic goods or services in places like hospitals, schools, police departments, and other agencies, and,

- Political corruption is a manipulation of policies, institutions and rules of procedure in the allocation of resources and financing by political decision makers, who abuse their position to sustain their power, status and wealth.

All the above types of corruption exist in Kenya, and have been rampant for over 4-decades, and have been a large inhibitant to Kenya’s development. According to the Ethics and Anti-Corruption Commission, Kenya is losing an estimated Kshs 608.0 bn to corruption yearly, which is 7.8% of Kenya’s GDP.

The Kenyan President, Uhuru Kenyatta, has been vocal in his appeal to Kenyans to join efforts in the fight against corruption and has also recently taken decisive steps to combat corruption. He has essentially changed leadership at all the key law enforcement agencies that are responsible for fighting corruption. This year he called for a lifestyle audit of all public servants including himself and the Deputy President, William Ruto. He also directed all procurement officers in public entities to step aside and undergo fresh vetting. The Kenyan President also directed the relevant institutions mandated with investigating and prosecuting economic crimes to do a thorough job and ensure those found culpable are held accountable. This shows that the President is focused on the fight against corruption. The political will to fight corruption seems stronger than at any other time in our history, hence the reason to revisit the topic. In November 2015, we wrote a focus on corruption where we looked at what Kenya could learn from Singapore on corruption; we highlighted political will to fight corruption as the most important factor in the fight against corruption. For more information, see Cytonn Weekly 47/2015

This week we start by explaining why corruption is an important topic for Cytonn to discuss. We then focus on; (i) Kenya’s history with corruption, (ii) the corruption scene in Kenya today, (iii) strides made in the fight against corruption, (iv) challenges in the fight against corruption in Kenya, (v) we look at Rwanda and Botswana, Sub-Saharan Africa countries, that are winning in the fight against corruption and look at what Kenya can learn from them, and (vi) opportunities for improvement.

Corruption is an important topic for Cytonn because like anything else, it affects the external environment in which we operate in. Corruption affects the external environment in the following ways;

- On the political front, corruption is a major obstacle to democracy and the rule of law. In a democratic system, offices and institutions lose their legitimacy when they’re misused for private advantage. This is harmful in established democracies, but even more so in newly emerging ones. It is extremely challenging to develop accountable political leadership in a corrupt climate,

- Economically, corruption depletes national wealth. Corrupt politicians invest scarce public resources in projects that will line their pockets rather than benefit communities, and prioritize high-profile projects such as dams, power plants, pipelines and refineries over less spectacular but more urgent infrastructure projects such as schools, hospitals and roads. Corruption also hinders the development of fair market structures and distorts competition, which in turn deters investment,

- Corruption corrodes the social fabric of society. It undermines people's trust in the political system, in its institutions and its leadership. A distrustful or apathetic public can then become yet another hurdle to challenging corruption,

- Human capital channeled towards entrepreneurship and innovation is at the core of economic progress of any society. Corruption can demoralize creativity and innovation when it seems like society rewards the corrupt rather than those who toil to create ideas and new products and services,

- The Organization for Economic Co-operation and Development (OECD) studies have confirmed a strong negative correlation between perceived corruption and levels of output. To achieve higher standards of living, we need long periods of economic growth, which cannot happen without high levels of output, and,

- Environmental degradation is another consequence of corrupt systems. The lack of, or non-enforcement of, environmental regulations and legislation means that precious natural resources are carelessly exploited, and entire ecological systems are ravaged. From mining, to logging, to carbon offsets, companies continue to pay bribes in return for unrestricted destruction.

Section 1: Kenya’s History with Corruption:

According to a report published by openAfrica, Kenya has had a long history with corruption that spans over 4-decades. Corruption has been present in all government regimes since independence. The table below highlights some of the corruption allegations and cases since 1965:

Source: Odipo Dev Research as published by openAfrica

|

Year |

Corruption Allegations / Cases |

Estimated Cost |

|

1965 |

Ngei Maize Scandal |

N/A |

|

1986 |

Turkwell Hydroelectric Power Station |

Kshs 6.0 bn |

|

1991 |

Golden Berg Scandal |

Kshs 158.3 bn |

|

1999 |

Kenya Air Force Helicopter servicing contract |

Kshs 360.0 mn |

|

2005 |

Anglo-Leasing |

Kshs 3.5 bn (Eur 30.0 mn) |

|

2007 |

Egerton University |

Kshs 500.0 mn |

|

2007 |

Charterhouse Bank Ltd |

Kshs 150.5 bn (USD 1.5 bn) |

|

2008 |

Grand Regency |

Kshs 4.0 bn |

|

2009 |

Sale of Imported Maize |

Kshs 150.0 mn |

|

2009 |

Triton Oil Scandal |

Kshs 7.6 bn |

|

2009 |

Nairobi Cemetery Land Scandal |

Kshs 160.0 mn |

|

2010 |

Chicken Gate Scandal |

Kshs 50.0 mn |

|

2010 |

Armored personnel carriers from OTT Technologies |

Kshs 1.6 bn |

|

2012 |

Japan Embassy Land |

Kshs 1.4 bn |

|

2013 |

KAA Shops Saga |

Kshs 11.0 bn |

|

2014 |

Eurobond Cash Unaccounted For |

Kshs 215.0 bn |

|

2015 |

NYS Kshs 791 mn scandal (NYS First Scandal) |

Kshs 791.0 mn |

|

2015 |

Imperial Bank Collapse |

Kshs 34.0 bn |

|

2015 |

Ministries Fail to Account for Kshs 40 bn |

Kshs 40.0 bn |

|

2015 |

Geothermal Development Company (GDC) Procurement Scandal |

Kshs 1.7 bn |

|

2015 |

Karen Land Saga |

Kshs 8.0 bn |

|

2015 |

Bungoma Wheelbarrow Procurement Scandal |

Kshs 1.0 mn |

|

2016 |

Health Ministry Kshs 5.0 bn Scandal |

Kshs 5.0 bn |

|

2016 |

Nairobi Unable to Account For More Than Kshs 20.0 Bn |

Kshs 20.0 bn |

|

2016 |

Kilifi County Graft Scandal |

Kshs 2.0 bn |

|

2016 |

Audit: Nairobi Fails to Account for Kshs 238.0 mn Parking Fees |

Kshs 238.0 mn |

|

2016 |

Audit Raises Red Flag on Defective Military Aircraft |

Kshs 1.5 bn |

|

2016 |

NSSF Shares Scandal |

Kshs 1.6 bn |

|

2016 |

Youth Fund Scandal |

Kshs 180.0 mn |

|

2018 |

Audit Uncovers Kshs 11.0 bn hole at Health Ministry |

Kshs 11.0 bn |

|

2018 |

NYS Kshs 9.0 bn scandal (NYS Second Scandal) |

Kshs 9.0 bn |

|

2018 |

NCPB Maize Scandal |

Kshs 1.9 bn |

|

2018 |

Kenya Power Corruption Scandal |

Kshs 470.0 mn |

|

2018 |

Kenya Pipeline Corruption Scandal |

Kshs 647.0 mn |

|

|

Total |

Kshs 698.1 bn |

Section 2: The Corruption Scene in Kenya Today

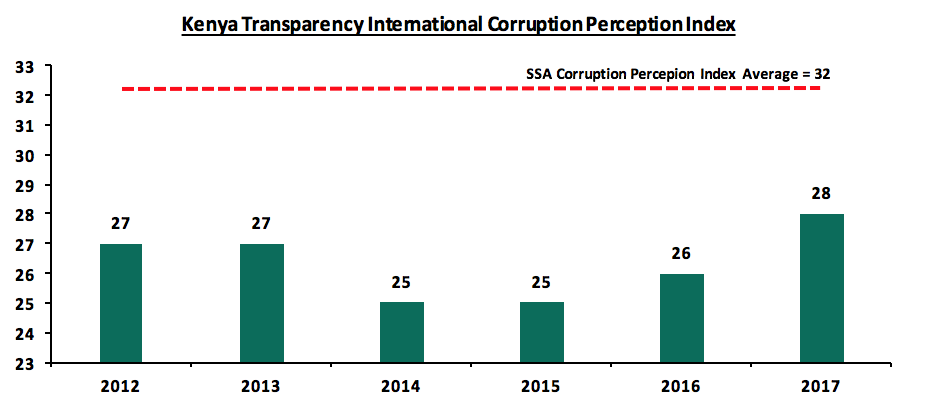

Corruption in Kenya only seems to be getting worse with more and more corruption scandals coming to light every day, such as the recent NYS, KPLC, and KPC corruption cases. However, data from Transparency International’s Corruption Perception Index shows that the situation is getting better. In its 2017 ranking, Kenya ranked 143 out of 180 countries surveyed. This was an improvement from the 2016 ranking of 145. Kenya’s CPI score also improved in 2017 to a score of 28 from the previous 26. In Sub-Saharan Africa (SSA) Kenya ranked 28 out of the 49 countries that were surveyed. Kenya was also below the SSA regional average of 32. A higher score in the index reflects less corruption and better measures to prevent corruption.

The Transparency International Corruption Perception Index scores countries on how corrupt their public sectors are seen to be. The index, which ranks 180 countries by their perceived levels of public sector corruption according to experts and businesspeople, uses a scale of 0 to 100, where 0 is highly corrupt and 100 is very clean. The index draws upon 13 data sources which capture the assessment of experts and business executives on a number of corruption behaviours in the public sector which include; bribery, diversion of public funds, use of public office for private gain, nepotism in civil service, and state capture. The data sources also look at the mechanisms available to prevent corruption in a country, such as; (i) the government’s ability to enforce integrity mechanisms, (ii) the effective prosecution of corrupt officials, (iii) red tape and excessive bureaucratic burden, (iv) the existence of adequate laws on financial disclosure, (v) conflict of interest prevention and access to information and, (vi) legal protection for whistle-blowers, journalists and investigators.

The major areas of concern with regard to corruption in Kenya today are;

- Fund Misappropriation - Where funds that are budgeted for particular initiatives and programs are embezzled. This has had the effect of causing delays in projects and programs. The embezzlement of funds has also caused foreign donors to suspend aid and discourages them from funding projects and programs in the country,

- Kenyan Public Procurement - Subject to rampant corruption and bribery, most of the corruption scandals in Kenya today are associated to procurement. According to the Global Competitiveness Report 2017-2018, companies report that bribes and irregular payments are highly common in the process of awarding public contracts,

- Public Service - The competitiveness of Kenya’s business environment is impeded by rampant public service corruption. Complying with administrative requirements takes a lot of time and is plagued by red tape where bribes have to be given to get licenses,

- Land Administration - There is a very high risk of corruption in Kenya’s land administration. According to Transparency International Kenya Annual Report 2014, Kenyans report a high likelihood of bribery demands in meetings with land service officials, and corrupt practices reportedly occur in almost 20% of all interactions. Possession of a land title does not guarantee property ownership, making land-grabbing and seizures by powerful elite common as a result of pervasive corruption and impunity. Fake land title deeds are frequently used and disappearances of title deeds from the Registrar’s office are common; houses built on illegally acquired property are often demolished without prior notice, and,

- Customs Administration - Companies face a high risk of corruption in Kenya’s customs administration. According to the Global Enabling Trade Report 2016, rampant corruption at Kenya’s ports and border points is the most problematic factor for international trade, followed by tariffs, burdensome import procedures and crime. Corruption at the points of entry have serious consequences as a result many counterfeit goods enter the market affecting trade. More recently goods that are not fit for human consumption are also finding their way through our borders as a result of corruption which is hazardous to the Kenyan population.

Section 3: Strides Made in the Fight Against Corruption:

Kenya has made significant strides by instituting legislation criminalizing corruption;

- Anti-Corruption and Economic Crimes Act 2003 and Penal Code criminalize corruption, active and passive bribery, bribing of foreign officials, money laundering, abuse of office, extortion, conflict of interest, bid rigging and bribery involving agents.

- Bribery Act of 2016 criminalizes primarily private sector bribery, broadly defined as “offering, promising, or giving a financial or other advantages to another person”, which may include facilitation payments. The Act imposes a duty on public and private entities to have appropriate anti-bribery procedures in place.

- Public Officers Ethics Act 2003 sets rules for transparency and accountability, as well as gifts and hospitality. Every public officer is required to declare their income, assets and liabilities every two-years.

- Public Procurement and Disposal Act prohibits corruption in public procurement.

- Finance Act 2006 provides for measures against tax fraud and guidelines on tax administration; it also provides sanctions on corrupt practices.

- Service Commissions Act has a Code of Regulations for civil servants that requires meritocratic recruitment and promotion of public officials.

- Access to Information Act 2016 provides a framework to facilitate access to information held by private bodies and promote routine and systematic information disclosure by both public service and private service.

The Kenyan Government, while strengthening its mechanisms for crime detection and prosecution, has also empowered its citizens in addressing and reporting corruption issues. The Anti-Corruption and Economic Crimes Act and the Witness Protection Act provides for protection of whistle-blowers and forbids any disciplinary action to be taken against any private or public employee who assists an investigation or discloses information for such an investigation.

Kenya has also ratified;

- African Union Convention on Preventing and Combating Corruption, which addresses corruption in the public and private sectors. It represents a consensus on what African countries should do in the areas of prevention, criminalization, international cooperation and asset recovery, and,

- United Nations Convention Against Corruption (UNCAC), which introduces a comprehensive set of standards, measures and rules that all countries can apply in order to strengthen their legal and regulatory regimes to fight corruption.

Kenya had shown great commitment by strengthening its institutions to fight corruption. The country has already established a multi-agency framework that brings together relevant law enforcement agencies in its fight against corruption. The multi-agency framework on corruption in Kenya includes;

- Asset Recovery Agency,

- Directorate of Criminal Investigations,

- Ethics and Anti-Corruption Commission,

- Central Bank of Kenya,

- Financial Reporting Center,

- Kenya Revenue Authority,

- Directorate of Public Prosecution, and,

- Office of Attorney General.

The government through the multi-agency and multidisciplinary approach also seeks to introduce into the education curricula of the country studies on leadership, ethics and integrity for all its citizens. Accordingly, all new civil servants will receive education on corruption and economic crimes while being inducted into service. The government is also working on the ratification of UNCAC through the International Anti-Corruption Academy (IACA) to pave way for advanced training of anti-corruption officers, judicial officials as well as prosecutors to effectively deal with the vice of corruption.

As can be seen above, Kenya has a myriad of laws, regulation, frameworks and agencies required to combat corruption

Section 4: Challenges in the Fight Against Corruption in Kenya

According to the Ethics and Anti-Corruption Commission 2016-2017 annual report, the challenges faced in the fight against corruption include;

- Inadequate financial capacity and budget constraints. Since the EACC relies on funding from the government, the money allocated to the commission to carry out its activities is not enough to meet the demand for the commissions’ services country wide,

- Inadequate capacity in terms of human resources as there is need to further devolve the commissions services to respond to an increasing number of corruption reports. The shortage of staff was also aggravated by a high staff turnover attributed to the remuneration package not been enhanced over the last 13-years,

- A slow judicial process and adverse court decisions. The judicial process and the adjudication of cases is still slow, with some corruption cases stretching back more than 10 years. EACC was affected by adverse judicial decisions that stopped investigations or prosecutions. This results in the cases investigated by the commission taking too long to be heard in court or having investigations or prosecutions terminated by the courts,

- Weak legal framework, such as the Ethics and Anti-Corruption Commission Act, 2011, and the Leadership and Integrity Act, 2012, that have been watered down by legislators. There is also no political goodwill to fight corruption and unethical conduct in Kenya,

- The lack of the National Policy on Anti-corruption as it has not been finalized, which has made the efforts of the commission and other organization uncoordinated and varied. Areas that would have benefited from an integrated approach such as investigations and asset recovery are affected,

- The Commission does not have powers to enforce implementation of its corruption prevention recommendations. Additionally, the inability to enforce codes of conduct in the public service has made it difficult to curb corruption in the public sector,

- There has been politicization of the leadership and integrity mandate of the commission,

- County Governments have been reluctant to mainstream the integrity and anti-corruption agenda,

- There is an entrenched corruption and unethical culture in the public service, and,

- There is also a lack of proper wealth declaration management and administrative procedures and the society appears to tolerate corruption and unethical conduct.

Section 5: Case study of Rwanda and Botswana

Botswana and Rwanda are two countries in Sub-Saharan Africa that have made major strides in the fight against corruption. Botswana ranked the best country in Sub-Saharan Africa according to the Transparency International Corruption Perception Index with a score of 61, with Rwanda coming in third with a score of 55. These countries ranked better than Italy, Greece and Hungary with Botswana outperforming Spain in the index. We seek to see what has made them successful in the fight against corruption and see what Kenya can learn from them. Factors attributed to the success of fighting corruption in Botswana and Rwanda include;

- Political Will to Fight Corruption - This is one factor that both Rwanda and Botswana has with their current and former presidents, who have strong political will. Political will is critical because combating corruption effectively requires the government to provide the anti-corruption agencies with the necessary powers, budget, personnel and independence to enforce the anti-corruption laws impartially. In Botswana, Sir Seretse Khama, Botswana’s first president did not tolerate corruption and corruption was discouraged by a rigorous system of accounting controls and strict enforcement of civil service codes requiring honesty and reinforcing that the state was not a source of personal income even leading by example by living a modest life. In his Government, they prosecuted prominent cabinet ministers and officials, two of them being his relatives. Khama’s policy of zero tolerance for corruption was continued by his successors and contributed to Botswana’s success in fighting corruption. In Rwanda, Paul Kagame decided to transform Rwanda by urging the population to reject corrupt practices and report corrupt people. Kagame also enforced the anti-corruption laws by dismissing those found guilty of corruption offences and introduced a strict code of conduct for officials that require them to disclose their assets yearly. The degree of political will in Botswana and Rwanda is manifested in the provision of legal powers, financial and human resources and operational independence of their anti-corruption agencies,

- Anti - Corruption Agencies – Rwanda and Botswana abolished the ineffective colonial government’s method of using the police to curb corruption and adopted the use of a single Anti-corruption agency to fight corruption. It is important to note that having a single anti-corruption agency does not guarantee success in combating corruption unless it has the powers, budget, personnel and independence to perform its functions impartially as a watchdog. Botswana has a type A anti-corruption agency which is dedicated solely to performing anti-corruption functions. Rwanda on the other hand has a type B anti-corruption agency which has to perform both corruption and non-corruption related functions. In both countries, the anti-corruption agencies are given the necessary support by the government to enforce their mandate,

- Establishment of a Public Service Commission – Botswana and Rwanda both have Public Service Commissions to cater for the needs of the civil servants that ensure that all civil servants are hired based on merit and they abide by the laws and civil servants code of conduct. Professional, merit-based civil service that is paid and trained well and rewarded for competence is the bedrock on which any anti-corruption reforms must be built on.

Section 6: Opportunities for Improvement:

- Political Will: It appears that political will is the single most important ingredient to fight corruption. It has worked in Botswana and Rwanda, and in other countries like Singapore. Luckily, for Kenya the Kenyan President has recently demonstrated a political will to fight the vice, but the sustainability for the long haul remains to be seen. It is also important that this political will is shared by all coalitions of the government and the opposition for it to cascade nationally,

- We need to develop and publicize a system where the public can anonymously report corrupt activities,

- Inculcate a sense of anticorruption spirit in the public, especially given that we tend to look at corruption from a tribal prism, where we look aside when our own is corrupt. In Singapore, the rallying cry against corruption was that if you want to fight corruption, you have to be prepared to send your friends and relatives to jail; in Kenya we have to be prepared to send our own tribe to jail, and

- We need to see real and high-level convictions to restore public confidence in the system and also to make the price high for high level participants.

Conclusion

Kenya has the legal frameworks necessary to fight corruption, and luckily, we now have a president that is demonstrating the political will to fight corruption, and quite frankly has the space to do so given that he is not running for office again. What we need is to sustain that will until the people believe it is not a passing phase or cloud, demonstrate convictions in the cases being prosecuted to make the price too costly and painful, and inculcate of a sense of anti-corruption in our society.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.