Feb 19, 2023

The Kenyan shilling has recorded a Year to date depreciation of 1.8% against the US Dollar to close at Kshs 125.6 as at 17th February 2022, from Kshs 123.4 on 3rd January 2023, adding to a 9.0% depreciation in 2022 and further depreciation of 3.6% and 7.7% in 2021 and 2020 respectively. Key to note, this is the lowest the Kenyan shilling has gone against the dollar. The continued depreciation has been mainly driven by an ever present current account with of Kenya being a net importer and the import bill being in US Dollars. Being a net importer has also left Kenya susceptible to external shocks that have inflated the import bill and negatively affected the shilling such as the high global crude oil prices occasioned by persistent supply chain constraints worsened by the ongoing Russia-Ukraine conflict. The inflated import bill has led to increased dollar demand from importers against a lower supply of hard currency. Additionally, the aggressive public debt accumulation, especially external debt at a 10-year CAGR of 19.0% to Kshs 4.8 tn in December 2022, from Kshs 0.8 tn in the same period in 2012 has continued to exert pressure on the Kenyan shilling, due to the increased servicing costs, considering that 69.3% of the external debt stock is in US Dollars. Currency depreciation coupled uncertainties such as elevated inflationary pressures on the Kenyan economy has seen government securities yields increase as investors attach higher premiums to compensate for the additional risk. Notably, in December 2022, Fitch Ratings downgraded Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B’ from 'B+' with a Stable Outlook. The downgrade was mainly attributable to Kenya's persistent fiscal and external deficits, high public debt and high external financing costs which presently constrain access to international capital markets. This week we shall do an in-depth analysis of the factors that are expected to drive the performance of the Kenya shilling and the interest rates and thereafter give our outlook for 2023;

We have previously covered the topic as summarized below;

- In our Currency Outlook covered in May 2022, our outlook on currency was 4.7% depreciation by end of 2022 mainly driven by high global oil prices, persistent supply chain bottleneck constraints and ever present current account deficit,

- In May 2021, we released our topical on Currency and Interest Rates Outlook-2021, with our outlook on currency being a 0.6% appreciation by end of 2021. The expected appreciation was on account of gradual improvement in the export sector as Kenya’s trading partners continued to reopen their economies coupled with stable forex reserves on the back of increasing diaspora remittance inflows as well as continued investor capital inflows and debt relief from other institutions. On the interest rates, we expected an upward readjustment on the yield curve due to the increased pressure on the government to plunge in the budget deficit coupled with the increased demand by investors for higher yields due to the perceived risk in the country ahead of 2022 general election, and,

- In our Currency and Interest Rates Outlooktopical which was covered in May 2020, our outlook on the currency was a 5.5% depreciation by the end of 2020, driven by the reduced exports earning due to the lockdown measures put in place by Kenya’s trade partners coupled with the high fiscal deficit seen during the period. On the interest rates, we expected a slight upward readjustment on the yield curve due to increased demand by investors for higher yields arising from the perceived risk in the country.

With the shilling having depreciated by 1.8% on a YTD basis in 2023 and the continuous upward readjustment of on the yield curve, we saw the need to revisit the topic on currency and interest rates outlook, in order to shed some light on how the Kenyan shilling and the interest rates are expected to behave in 2023. In this focus, we shall be doing an in-depth analysis of the factors that are expected to drive the performance of the Kenyan shilling and the interest rates and thereafter give our outlook for 2023 based on these factors. We shall cover the following:

- Historical Performance of the Kenyan Shilling and drivers,

- Evolution of the Interest Rate Environment,

- Factors Expected to Drive the Interest Rate Environment, and,

- Conclusion and Our View Going Forward

Section I: Historical Performance of the Kenyan Shilling

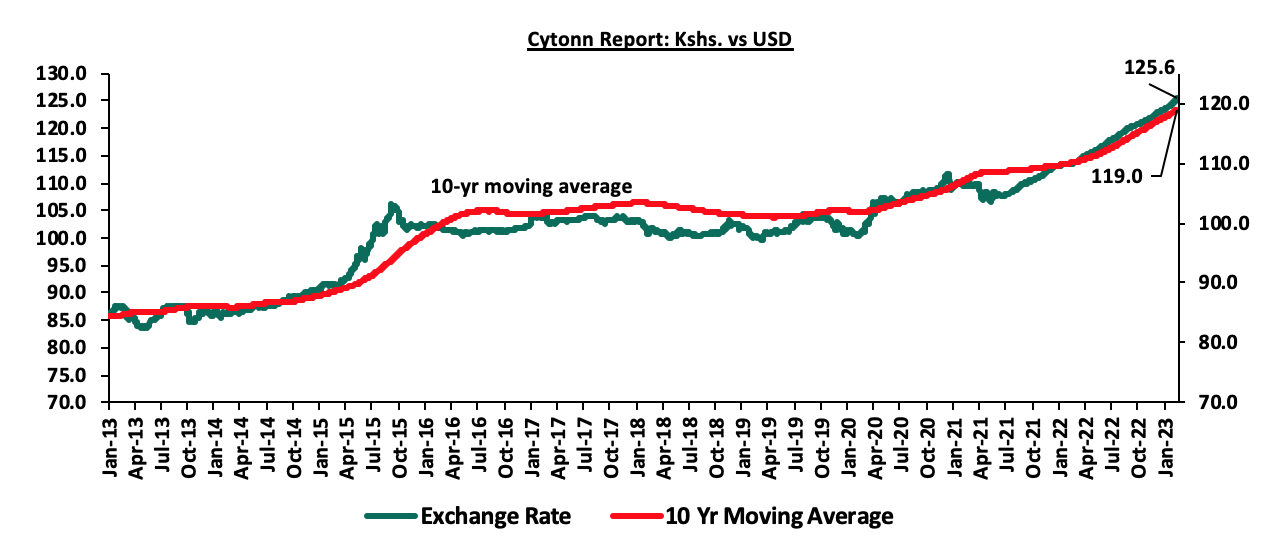

Over the last 10 years, the Kenyan shilling has depreciated at a 10-year CAGR of 3.7% to an all-time low of Kshs 125.6 in February 2023 from Kshs 87.3 over the same period in 2013, mainly attributable to various factors such as an ever present current account deficit, increasing debt levels and the rising prices of commodities such as crude oil prices as Kenya remains a net importer. The economic disruptions occasioned by the COVID-19 pandemic in 2020 significantly caused volatility of the Kenyan shilling which led to a depreciation of 7.7% in 2020 followed by a further 3.6% in 2021. In 2022, the shilling depreciated for a fifth consecutive year, closing the year at Kshs 123.4 against the dollar as compared to Kshs 113.1 at the beginning of the year, translating to a depreciation of 9.0%. The weakening of the shilling was mainly attributable to increased dollar demand from commodity and energy sector importers as a result of the high global crude oil prices occasioned by supply chain constraints worsened by the geopolitical pressures at a time when the economy was recovering from the impacts of COVID-19 pandemic which had stifled demand in the economy. In 2023, on a YTD basis, the shilling has depreciated by 1.8% against the USD, to close at Kshs 125.6, from Kshs 123.4 recorded on 3rd January 2023. The continued depreciation in 2023 is mainly attributable to sustained dollar demand by importers especially in the oil and energy sector against a low supply of dollar currency leading to shortage of US Dollars in the Kenyan market. The chart below illustrates the performance of the Kenyan Shilling against the US Dollar over the last 10 years:

Source: Central Bank of Kenya

Below are some of the factors that has been supporting the shilling;

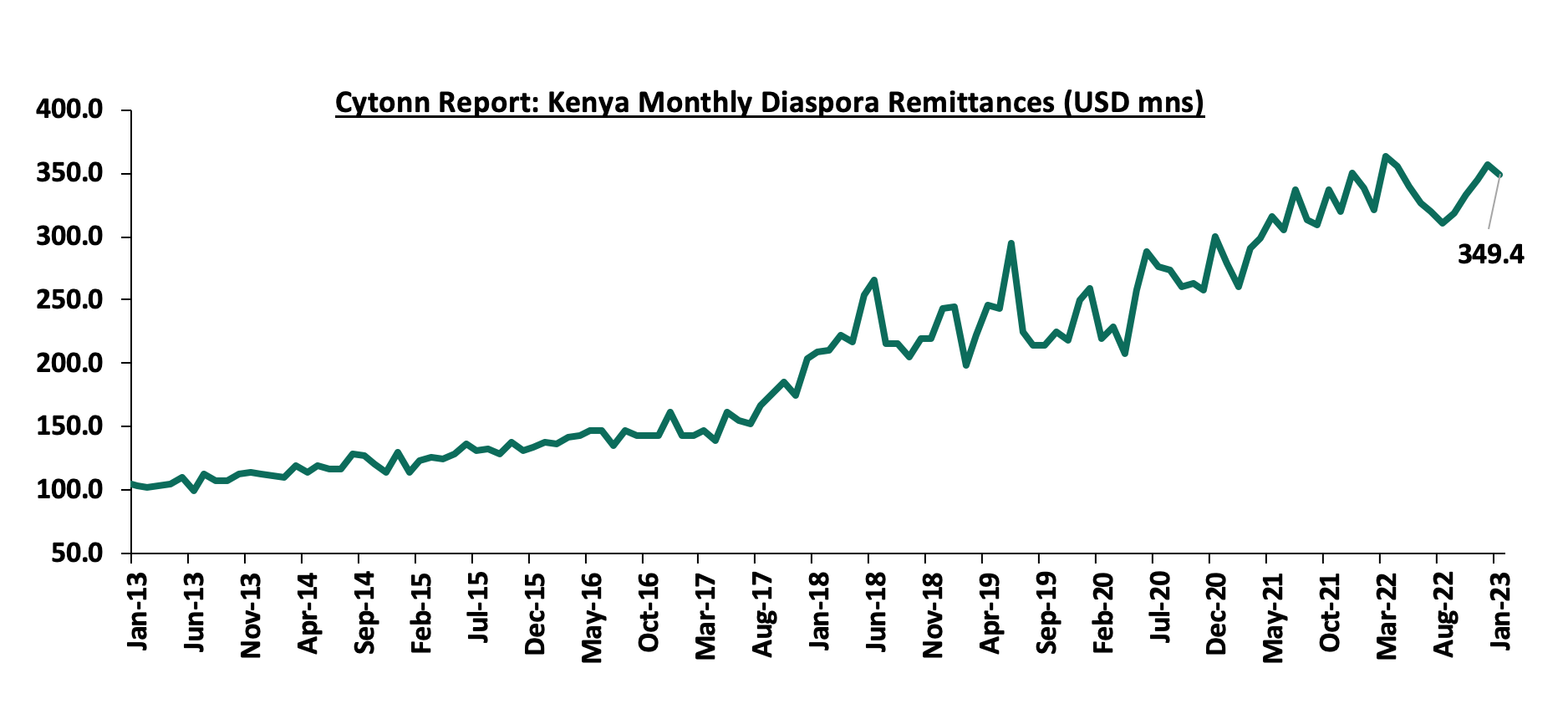

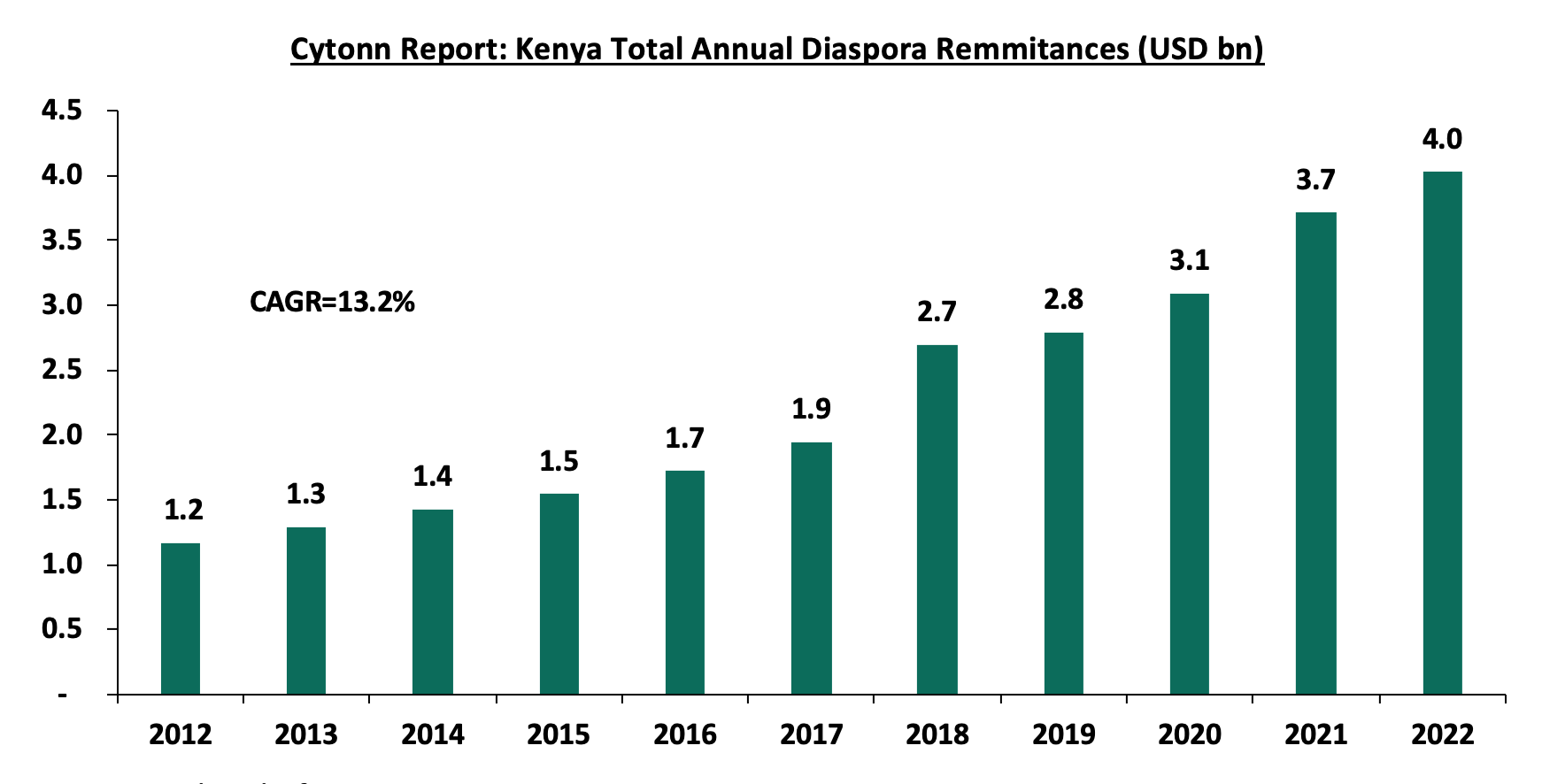

- Strong diaspora remittances, with monthly diaspora remittances having grown at a 10-year CAGR of 13.0% to USD 349.4 mn in January 2023, from USD 103.0 mn recorded in January 2013. Additionally, the total annual diaspora remittances have grown at a 10-year CAGR of 13.2% to USD 4.0 bn in 2022, from USD 1.2 bn in 2012. The continued growth in diaspora remittance is mainly attributable to the increasing Kenyan population in the diaspora and advancing technology that has facilitated easier transfer of money. The charts below show the trend of the evolution of monthly and annual Diaspora Remittances:

Source: Central Bank of Kenya

Source: Central Bank of Kenya

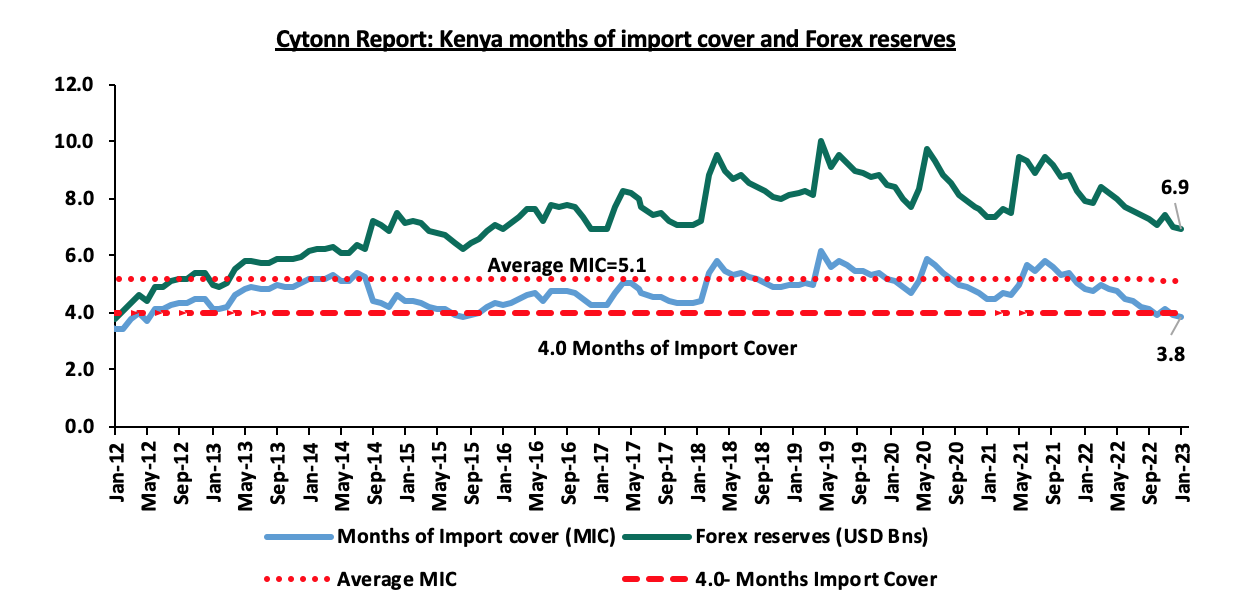

- The sufficient forex reserves held by the Central bank which have been above the statutory target of 4.0-months import cover in the last 10 years, with an average of USD 7.3 bn and 5.1-months average import cover. However, despite the Forex reserves being adequate for a long time, they have dropped by 21.6% to USD 6.9 bn (equivalent to 3.8 months of import cover) in February 2023, from USD 8.8 bn (equivalent to 5.1 months of import cover) recorded in January 2022. The drop is largely attributed to increased debt service obligations due to the continued depreciation of the Kenyan shilling. The chart below shows the trend of the evolution of the forex reserves:

Source: Central Bank of Kenya

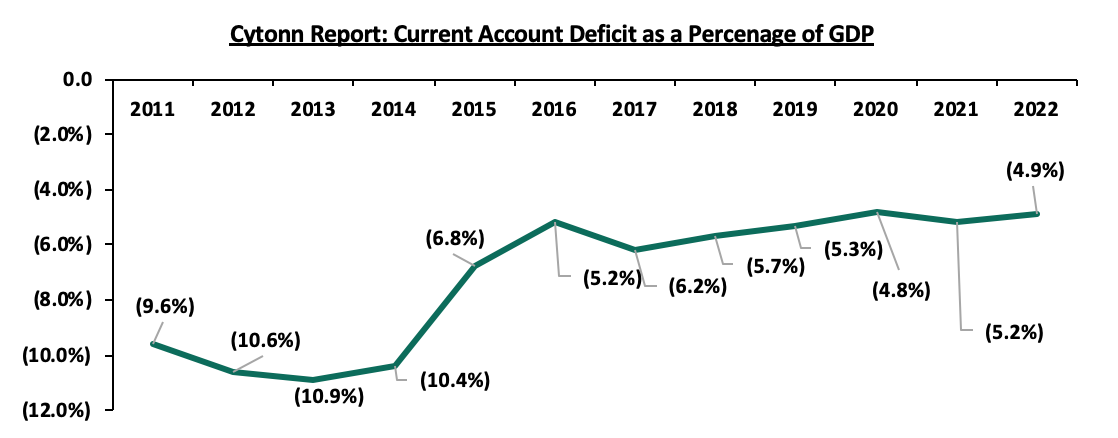

- The value of the country’s principal exports has continued to grow over time consequently increasing foreign inflows which support the local currency. Notably, in Q3’2022, the value of horticulture and tea exports contributed Kshs 40.3 mn and Kshs 34.5 mn, respectively out of the total value of exports of Kshs 200.5 mn. The current account deficit as a percentage of the Gross Domestic product (GDP), has also continued to narrow with the deficit estimated to have narrowed to a deficit of 4.9% by the end of 2022, from a deficit of 5.2% in FY’2021,

- Before the onset of the Coronavirus pandemic, the country attracted huge foreign investment as evidenced by the Foreign Direct Investments (FDI) flows into the country, which had grown significantly by 8-year CAGR of 16.0% to USD 1.1 bn in 2019, from USD 0.3 bn in 2011. However, after economic disruptions caused by the COVID-19 pandemic which resulted in reduced investor activities, FDI flows into the country have declined in two consecutive years to USD 0.7 bn and USD 0.4 bn in 2020 and 2021, respectively,

- Kenya has continued to receive financing from the World Bank and other bilateral lenders such as the International Monetary Fund (IMF) which have supported the Kenyan shilling by boosting the forex reserves. Notably, the government received USD 750.0 mn World Bank loan facility in March 2022, as well as USD 235.6 mn and USD 447.4 mn funding from the International Monetary Fund (IMF) disbursed under the fourth and fifth tranches of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) in July and December 2022, respectively. Further, through the Special Drawing Rights, IMF disbursed an additional USD 14.6 mn (Kshs 26.6 bn) as buffer from the drought effects, which supported the forex reserves despite the continued depreciation of the Kenyan currency, and,

- Tightened monetary policy with the Monetary Policy Committee (MPC) continually hiking the central Bank rate by a cumulative 1.75% points to 8.75% from the previous 7.00% in a bid to anchor inflation which has surpassed government’s target range of 2.5%-7.5% and also strengthen the Kenyan shilling from further aggressive depreciation

Despite the above factors, the Kenyan shilling has been put under significant pressure by;

- High global crude oil prices attributable to the persistent supply chain constraints and high demand with fuel being an integral input in most sectors in the economy. Consequently, this increased dollar demand by oil and energy importers, as well as, manufacturers against a low supply of dollar currency. The high dollar demand has caused shortage of US Dollars in the Kenyan market further inflating the country’s import bill and consequently weakening the shilling,

- Existence of an ever-present current account deficit estimate at 4.9% of GDP in 2022, despite improving by 0.3% points from 5.2% recorded in 2021. The ever-present current account deficit signifies country’s reliance on imports and with the high global commodity prices, it has resulted in increased demand for foreign currency which weighs down on the local currency. The chart below highlights the trend in the current account deficit as a percentage of GDP for the last 10 years:

Source: Kenya National Bureau of Statistics (KNBS)

- A deterioration in Kenya’s trade imbalance as a result of adverse macroeconomic conditions in the country. According to the Kenya National Bureau of Statistics Q3’2022 Balance of Payments Report, Kenya’s balance of payments deteriorated by 283.9% in Q3’2022, coming in at a deficit of Kshs 112.7 bn, from a deficit of Kshs 29.3 bn in Q3’2021. The deterioration was brought by a 5.5% widening of the Current Account deficit to Kshs 193.4 bn, from Kshs 183.4 bn in Q3’2021, driven by a 15.8% deterioration in trade imbalance to Kshs 373.1 bn, from Kshs 322.0 bn in Q3’2021. Consequently, with Kenya being a net importer, the shilling has continued to weaken as a result of increasing import bill mainly attributable to the high global commodity prices,

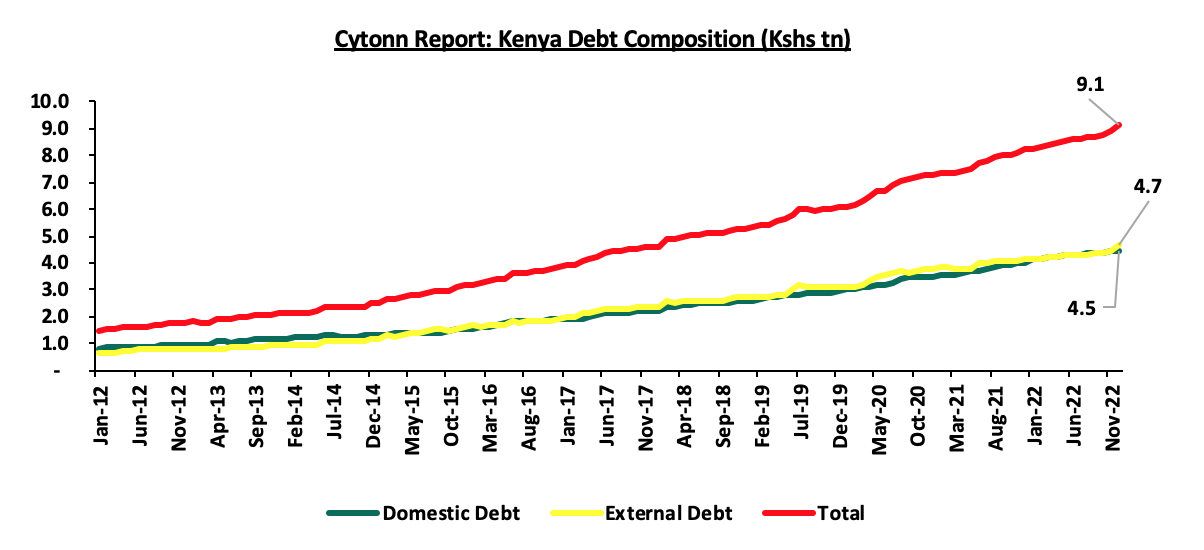

- High debt levels and increasing debt servicing costs with Kenya’s public debt having grown exponentially at a 10-year CAGR of 17.7% to Kshs 9.1 tn in December 2022, from Kshs 1.8 tn in December 2012, with external debt contributing 51.1% of the total debt. Consequently, the increasing debt servicing costs mainly on the back of the continued weakening of the shilling have put pressure on forex reserves given that 69.3% of Kenya’s External Debt was US dollar denominated as of October 2022. Additionally, the projected amounts that is expected to be used for foreign debt servicing in FY’2023/2024 stands at Kshs 475.6 bn, which are likely to put more pressure forex reserves as most of it will be used to repay the debts. The chart below highlights the trend in the country’s debt composition:

Source: The National Treasury

- High debt servicing costs mainly as a result of continued appreciation of the dollar and aggressive depreciation of the shilling on the back of the monetary policy tightening by United States Federal reserve. Consequently, this has resulted in continued dwindling of the country’s forex reserves given that 69.3% of Kenya’s External Debt was US dollar denominated as of October 2022.

Section II: Evolution of the Interest Rate environment in Kenya

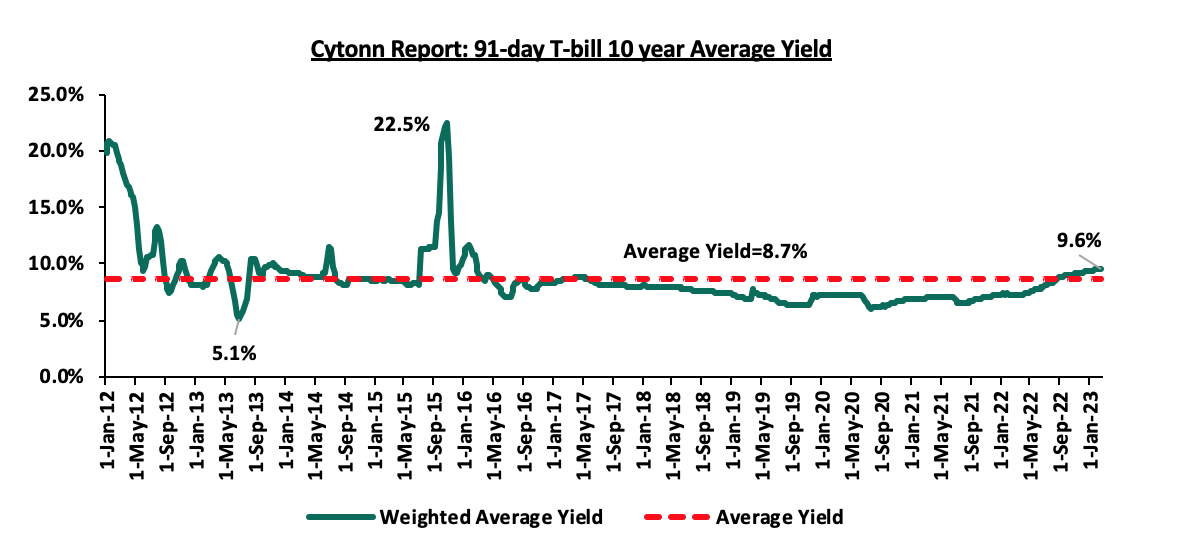

The Interest rates in Kenya witnessed high volatility between 2012 and 2015 as evidenced by the significant increase in yields on the government papers. Key to note is that the yield on government papers largely follow what is happening in the economy and in times of expected high borrowing, lending rates tend to shoot up. In October 2015, the yields on the 91-day papers significantly increased to 22.5%, the highest yields from the last highest yields of 20.8% recorded in January 2012. The high borrowing target coupled with the high cost of credit environment saw the government offer attractive rates on its papers.

For the period between 2016 and 2020, the yield on government papers remained relatively stable at average yield of 7.7% for the 91-day paper. However, after the economic disruptions occasioned by the COVID-19 pandemic, the yields have been rising with the yields on the 91-day papers increasing by 2.1% points to close 2022 at 9.4%, from 7.3% at the beginning of the year. The continuous rise in the yields is mainly attributable to ever present fiscal deficit at an average of 8.1% of GDP in the last ten financial years, meaning that the government has to continuously borrow to meet its functions. Additionally, the continued rise in the yields in government papers is as a result of investors attaching a higher risk premium to the country, driven by the elevated inflationary pressures, high public debt and currency depreciation that have put the country’s macroeconomic environment at risk. The chart below highlights the trend in the 91-day T-bill weighted average yield for the last 10 years:

Source: Central Bank of Kenya

The Kenyan macroeconomic environment remains subdued mainly as a result of the elevated inflationary pressures and aggressive depreciation of the Kenyan Shilling that have suppressed business production levels. As such, we expect revenue collection to lag behind and an increase in domestic borrowing in a bid to bridge the fiscal deficit which will in turn create uncertainty in the country’s interest rate environment. However, we expect the interest rate environment to be supported by financing from concessional multilateral loans from the IMF reducing the government’s need to borrow externally.

We believe that in order for the government to ease pressure on the interest rate, they should:

- Shift financing strategies to prioritize concessional financing, and to use commercial borrowing in limited amounts. This will ease pressure given the current depreciation of the shilling and also given that the concessional funding have low interest rates and longer repayment periods,

- Focus on borrowing domestically in the short and medium term, given that domestic debt provides the government with a cheaper source of debt compared to foreign currency-denominated debts that have higher interest rates and have currency risks attached to them,

- Continue implementation of measures to reduce debt service to revenue ratio which was estimated at 51.1% as of December 2022, 21.1% points higher than the recommended threshold of 30.0%, and 1.1% points higher than FY2020/2021’s debt service ratio of 50.0%, attributable to increased debt service obligations mainly on the back of the depreciated local currency, and,

- Diversification of funding of projects by removing bottlenecks to Private Public Partnerships (PPPs) and joint ventures in order to attract more private sector involvement in funding development projects such as infrastructure instead of borrowing.

Currency outlook

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

|

Negative |

|

Government Debt |

|

Negative |

|

Forex Reserves |

|

Negative |

|

Monetary Policy |

|

Neutral |

From the above currency drivers, 3 are negative (Balance of payment, Government Debt Forex Reserves), while 1 is neutral (Monetary Policy) indicating a negative outlook for the currency.

Section III: Factors expected to drive the Interest Rate environment

- Fiscal Policies

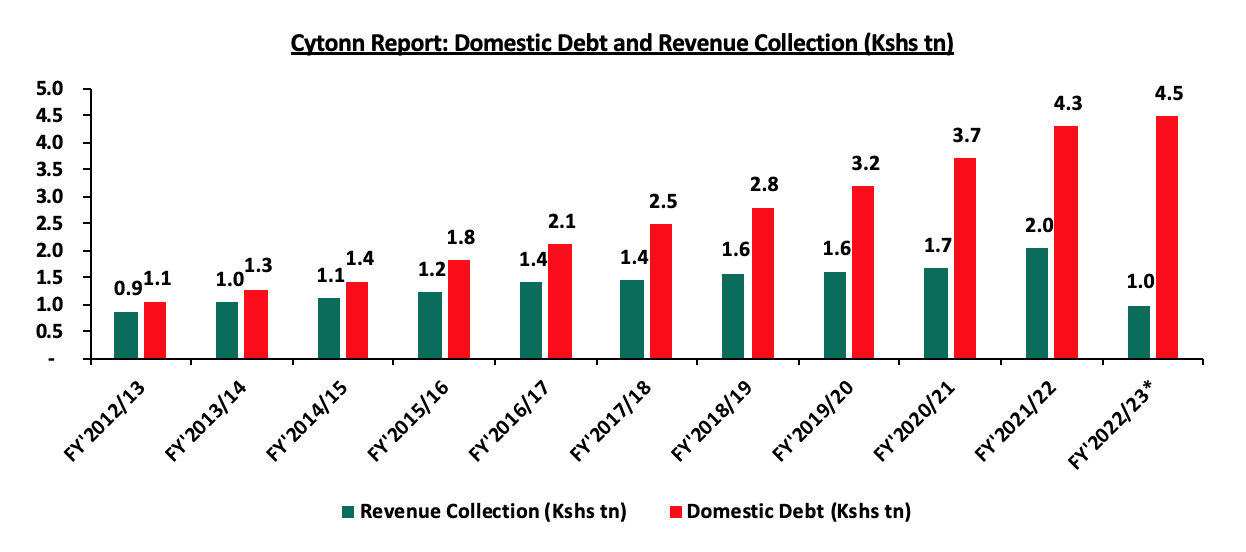

The government has continued to put in place measures to enhance revenue collection and we expect continued improvement given the raft of measures the new administration has put in place to boost tax collection such as the draft regulations for the Excise Duty Regulations 2023. Additionally, Kenya Revenue Authority (KRA) has also embarked on various efforts to raise more revenue through its strategies in the Budget Policy Statement, 2023 such as reducing the Value Added Tax (VAT) gap to 19.8% from 38.9%, minimizing Corporate Income Tax gap to 30.0% from the current 32.2% recorded in FY’2022/23, integrating KRA tax system with telecommunication companies, and expanding the tax base to include the informal sector targeting the SMEs. Consequently, the expected improvement in revenue collection will help lower the budget deficit and reduce the need for aggressive borrowing. Notably, KRA collected a total revenue of Kshs 2.03 tn, against the revised target of Kshs 1.98 tn in FY’2021/2022, translating to a performance rate of 102.8%. However, the upward revision of taxes comes at a time when the business environment remains subdued, underpinned by the elevated inflationary pressures and the aggressive depreciation of the Kenyan shilling that has suppressed business production levels weighing down on the projected revenue performance. As such, we expect this will significantly affect revenue collection necessitating borrowing to plug in the budget deficit, with projected total borrowing at Kshs 689.2 bn in the FY’2023/24, representing a 4.3% of the GDP. Below is a chart showing the revenue collections and domestic borrowings over the last 10 financial years:

Source: National Treasury, Central Bank of Kenya, * Figures as of December 2022

- Liquidity

The MPC lowered the Cash Reserve Ratio (CRR) to 4.25% from 5.25% in their March 2020 sitting, which has since remained unchanged aimed at supporting the economic recovery from the ripple effects of Coronavirus pandemic. As a result, liquidity in the money market has remained relatively favorable as evidenced by the interbank rates at an average of 4.9% in 2022, compared to an average of 4.7% in 2021, with average interbank volumes increasing significantly by 74.7% to Kshs 18.6 bn in 2022, from Kshs 10.7 bn in 2021. In an ideal situation, ample liquidity in the money market, the lowering of commercial banks’ lending, and deposit rates would lead to increased money supply in the economy and an increase in consumers’ purchasing power.

The low Cash Reserve Ratio has played a big role in maintaining favorable liquidity in the money market as well increases the supply of money by commercial banks. We expect liquidity to improve in 2023 driven by increased access to credit as banks gradually increase their lending to the private sector and the continued adoption of risk-based lending by banks. However, due to uncertainties in the economy occasioned by elevated inflationary pressures, there still exists a high credit risk which hampers lending to businesses and individuals. As such, we expect to see more money flow into government securities, which will provide huge relief on government yields due to reduced credit competition from the private sector. Additionally, liquidity in the money market is expected to remain favorable as the Central Bank will have to settle T-bonds and T-bill maturities worth Kshs 214.4 bn and Kshs 448.0 bn, respectively for the FY’2022/23.

- Monetary Policy

The Monetary Policy Committee (MPC) has met once in 2023, where it retained the Central Bank Rate (CBR) at 8.75% after increasing the CBR by a cumulative 1.75% points in 2022 to 8.75% from the previous 7.00%. The hiking of the CBR in 2022 was aimed at anchoring inflation which is currently above the government’s target range of 2.5%-7.5% and also strengthen the weakening Kenyan shilling. Consequently, yields on government securities were on an upward trajectory mainly driven by investors’ demand for higher yield to cushion themselves against the high inflation rates recorded throughout the year coupled with increased borrowing appetite by the government. The Central Bank is expected to continue with the restrictive monetary policy stance in the medium term with the intention to anchor inflation back to CBK’s target range of 2.5%-7.5%. As such, we expect to see continued upward pressure on the interest rates as the government compensates investors for the increased risks posed by currency depreciation and elevated inflation.

Outlook:

|

Driver |

Outlook |

Effect on Interest Rates |

|

Fiscal Policies |

|

Negative |

|

Monetary Policy |

|

Neutral |

|

Liquidity |

|

Neutral |

From the above basis, 1 of the drivers is negative (fiscal policies), and 2 are neutral (Monetary policies and liquidity). We therefore believe that the interest rate environment remains uncertain and will likely adjust upwards.

Section IV: Conclusion and our view going forward

Based on the factors discussed above and factoring in the uncertainties in the Kenyan macroeconomic environment;

- We expect the Kenya Shilling to trade within the range of between Kshs 130.2 and Kshs 134.4 against the USD in 2023 based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively, with a bias of a 6.4% depreciation mainly driven by:

- The ever present current account deficit with Kenya being a net importer, which will increase dollar demand in the market, and,

- The currently high global crude oil prices that have weighed in on the dollar demand from oil and energy importers who will have to increase the amounts they pay for oil imports and hence depleting dollar supply in the market.

- We expect a continued upward readjustment on the yield curve with our sentiments being on the back of:

- Increased pressure on the government to meet its budget deficit by borrowing more domestically. The government is likely to accept expensive bids and in turn destabilize the interest rate environment, and,

- Uncertainties about the economy occasioned by elevated inflationary pressures which have resulted in high credit risk which hampers lending to businesses and individuals.

Concerns remain high on the future performance of the shilling given the current pressures as well as the dwindling country’s forex reserves and the rising debt level. As such, we expect to see continued depreciation of the Kenyan shilling which will consequently have a negative impact on the economy as a result of increased import bill. Additionally, despite the tightened monetary policy, we expect inflation to remain high in the short term given the high fuel and fuel prices. Despite the fact that the current pressure on the Kenyan shilling is unlikely to abate in the near term, there are actionable steps that can be taken by the Government to mitigate further depreciation of the shilling. These include;

- Formulate policies to enhance a more diversified economy- There is need to enact policies to promote diversification of the economy with a key focus on improving the Kenya’s manufacturing sector in order to create an economy that is less dependent on agriculture. Key to note, the manufacturing sector contributes less than 10.0% to the country’s GDP, despite the fact that it could contribute more given the various opportunities available. This will consequently improve the country’s current account deficit through increased exports as well as preserve the country’s foreign exchange reserves, which will go a long way stabilizing the exchange rate,

- Enhancing fiscal consolidation- This will address the high fiscal deficit arising from the higher government expenditure as compared to the revenue collections which has continued to be the main driver of the high borrowing levels. The government can bridge the deficit gap by instituting austerity measures, reducing amounts extended to recurrent expenditure and focus on developments that will give back to the economy. These will reduce the government’s need for aggressive borrowing and in turn stabilize the exchange rate,

- Reduction of commercial loans. There is need for the government to reduce the share of commercial loans in order to reduce debt servicing costs. This is mainly because commercial loans attract higher interest rates as compared to concessional borrowings. Reduced debt service amounts would greatly help to bring down demand for the dollar and stabilize the exchange rate,

- Building an export driven economy. The government can do this by formulating and implementing robust export oriented policies and manufacturing to increase exports aimed at reducing the current account while reducing overreliance on imports to preserve the country’s foreign exchange reserves,

- Alternative projects financing strategies. The government should diversify sourcing of funding for infrastructure projects in the country to further shift to alternative financing strategies such as Public-Private Partnerships (PPPs), joint ventures and stimulate capital markets. This will attract more private sector involvement in funding development projects such as infrastructure instead of borrowing, and,

- Formulation of diaspora friendly policies. The Government should work in close conjunction with banks and other investments institutions to allow for favourable accounts for diaspora citizens, which will encourage them to remit more money back to the country hence cushioning the shilling against further depreciation. This can be done by reducing money transfer costs by exploring alternative channels for remitting money by leveraging on digitization and technology and explore alternative channels,

- Improve Ease of Doing Business. Improving the ease of doing business will make it easier for entrepreneurs to form business ventures, which will eventually grow, employ people and contribute to tax revenues.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor