Jun 17, 2018

Following the release of the Q1’2018 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the Kenyan Banking Sector to point out any material changes from our FY’2017 Banking Report. In our Q1’2018 Banking Report, we analyze the results of the listed banks in order to determine which banks are the most attractive and stable for investment from a franchise value and from a future growth opportunity perspective.

The report is themed “Diversification and efficiency key to growth amidst tighter regulation. Asset quality remains a concern”, as we assess what factors will be crucial for the sustainable growth and stability of the banking sector, with banks adjusting their business models in an effort to manage tighter regulation and the tough business environment. As a result, we seek to answer the question, “what should banks’ focus on?”, as we look forward to a relatively challenging operating environment for the banking sector due to (i) IFRS 9 having coming into effect in January 2018, and (ii) the interest rate cap. We expect more emphasis on (i) increased focus in asset quality management, and (ii) continued implementation of Non-Funded Income growth strategies.

Below are the key themes that shaped the banking sector in Q1’2018:

- Regulation– The effects of the Banking (Amendment) Act 2015 have continued to be felt in the sector, with banks recording a 2.0% decline in loans and advances to Kshs 1.9 tn in Q1’2018 from Kshs 2.0 tn in FY’2017. This could be attributed to banks’ tightening their credit standards owing to the Banking (Amendment) Act 2015. The amendment stipulates a deposit and loan-pricing framework, with (i) a cap on lending rates at 4.0% above the Central Bank Rate (CBR), and (ii) a floor on the deposit rates at 70% of the CBR. The capping of interest rates constrained banks from lending to SMEs and the private sector, and as a result, they preferred to invest in risk-free government securities that offer higher returns on a risk-adjusted basis. To mitigate the reduced lending, the National Treasury formulated the draft Financial Markets Conduct Bill, which was drafted to assess the whole credit management in the economy. The bill seeks to:

- Ensure better conduct by banks and other lendersin terms of extending credit to retail financial customers. By categorically not defining lenders as banks, this, in our view, might be the introduction of licensing for credit companies that are not banks,

- Provide consumer protection, mainly for retail customers by ensuring their credit contracts are clear and well understood in terms of interest, fees, charges and costs on credit facilities, thereby removing the opacity that has been existent in loan prices.

However, as noted in our focus note The Draft Financial Markets Conduct Bill, 2018, the bill only addresses consumer protection and fails to address the problem of access to credit for the private sector, mainly by SMEs. We are of the view that a lot more still needs to be done to address the fact that banks will most likely still prefer to lend to the risk free government as opposed to lending to a riskier retail customer at the current 13.5%, (4.0% points above the current CBR of 9.5%) as dictated by the Banking (Amendment) Act 2015.

- Revenue Diversification – With banks registering declining interest income and by extension compressed net interest income following the capping of interest rates, much of the focus shifted to diversifying income sources, mainly through non-funded income, as this section of the bank’s revenue is not affected by the interest rate caps. Non-funded income (NFI) grew by 9.5% in Q1’2018, higher than the 5-year average growth of 8.1%, taking its contribution to total income to 37.1%, compared to the 5-year average contribution of 33.4%. We expect this to continue for the rest of the year, as banks seek alternative sources of income to boost profitability under the interest rate cap regime. Banks have been venturing into various NFI growth venture such bancassurance. Notable forays into the bancassurance segment include:

- I&M Holdings having completed a full buyout of Youjays Insurance Brokers for an undisclosed amount,

- Standard Chartered partnering with Sanlam,

- KCB partnering with Liberty Holdings for the education savings plan dubbed Elimisha,

- Barclays acquired First Assurance in 2015 for Kshs 2.2 bn,

- Equity Group Holdings setting up an insurance arm (Equity Insurance Agency) that offers both life and non-life insurance products,

- NIC Group setting up an insurance agency (NIC insurance agency) which provides general insurance products,

- Cooperative Bank’s bancassurance arm that provides Medical insurance, Motor cover, agricultural insurance and life insurance, and

- National Bank of Kenya setting up NBK insurance Agency insurance which provides property insurance, education policies, medical insurance, annuities and agricultural insurance.

We believe revenue expansion by product diversification is one of the core opportunities for the banking sector, in the quest to achieve sustainable growth.

- Asset Quality – The banking sector has witnessed a deterioration in its asset quality over quarter, with the gross non-performing loans ratio rising to 13.9% from 12.5% in FY’2017, much higher than the 5-year average of 8.4%, owing to the challenging operating environment in 2017 whose effects spilled over to the first quarter of 2018 and resulted in an increase in bad loans. The major sectors touted as leading in asset quality deterioration include tourism, manufacturing, retail, agriculture and real estate, all of which were affected by the tough operating environment experienced last year that was occasioned by a volatile political environment and a severe prolonged drought. Owing to deteriorating asset quality, banks have adopted stringent lending policies in a bid to curb the relatively high number of non-performing loans. The stringent lending policies have further contributed to the tightening of the credit standards in the economy. However, banks have also adopted a raft of measures to try to improve their asset qualities. Main strategies include (i) remediation of collapsed businesses and thereby enabling them to service their obligations to the bank, and (ii) Collateralization of bad debt to third parties.

- Efficiency – Banks have focused on improving their operational efficiency, mainly by reducing operation costs, as shown by the cost to income ratio, which improved to 65.4% from 67.3% in FY’2017. A key avenue that banks have been using to reduce their operation costs has been product development centered on leveraging on alternative distribution channels. The use of alternative channels has gained prominence among bank customers due to the convenience it provides. Increased use of alternative channels has also contributed to increased non-funded income in the form of transactional income due to the high number of transactions via these channels. Cost reduction has to be accompanied by revenue expansion for banks to achieve sustainable growth;

- Prudence – With the implementation of IFRS 9, departing from the previous IAS 39, which took effect from 1st January 2018, banks are required to provide for both the non-performing loans and performing loans. This then points to increased provisioning levels by banks. IFRS 9 takes on a forward-looking credit assessment approach. Credit losses under IFRS 9 have to be computed under the Expected Credit Loss (ECL) model, as opposed to the Incurred Credit Loss (ICL) model, that was used under IAS 39 framework. The implementation of IFRS 9 saw the total capital position of banks relative to the risky assets decline by an average of 0.3% after adjusting for IFRS 9, on account of increasing provisions. To operate under this new standard, banks have adopted stringent lending policies, with some banks adopting advanced credit pre-scoring methods. The implementation of IFRS 9 was done to provide the banking sector with additional capital buffers for protection against credit losses thereby improving the stability of the sector as a whole;

- Consolidation – Consolidation in the banking sector picked up at the start of 2017, but slowed as the year progressed. In 2018, only one acquisition deal took place during the quarter. SBM Bank Kenya Ltd completed the acquisition of certain assets and liabilities of Chase Bank Limited, which was under receivership. Following the agreement between the Central Bank of Kenya (CBK), Kenya Deposit Insurance Corporation (KDIC) and SBM Bank Kenya, 75% of the value of all moratorium deposits at Chase Bank will be transferred to SBM Bank Kenya. The remaining 25% will remain with Chase bank Limited. This is a major milestone as this is the first successful instance, in the history of Kenya, of a bank being successfully brought out of receivership. Chase Bank was taken under receivership of the CBK in 2016, with customer deposits in excess of Kshs 100.0 bn. The acquisition will see SBM take control of the 62 Chase Bank branches, significantly increasing the bank’s foothold in the country. SBM Bank has injected Kshs 2.6 bn in Chase Bank, and is planning to inject a further Kshs 6.0 bn after the acquisition to revive the collapsed bank. However, the transaction value is yet to be disclosed. In addition to this, the bank is expected to absorb all the 1,300 former employees of Chase Bank Limited. We shall update with the transaction multiples once the deal is fully finalized and transaction values disclosed. We are however surprised that some of the smaller banks have managed to stay independent this long, as we would have expected weaker banks (that don’t serve a niche, don’t have a clear deposit gathering strategy and have low capital positions), being forced to merge or be acquired as they succumb to sustained effects of the interest rate cap and the implementation of IFRS 9, which affects their profitability and capital levels. Going forward we still expect more consolidation in the industry.

Below is the summary of the transaction metrics of some of the acquisitions that have happened in the banking sector within the last 5 years:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

Diamond Trust Bank Kenya |

Habib Bank Limited Kenya |

2.38 |

100.0% |

1.82 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.75 |

100.0% |

2.75 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.80 |

51.0% |

1.30 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

2.95 |

100.0% |

5.00 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.15 |

75.0% |

2.60 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.08 |

66.0% |

2.50 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.86 |

70.0% |

8.60 |

3.2x |

Nov-13 |

|

Average |

|

|

80.3% |

|

1.8x |

|

Based on the above, we believe the sector is shaping up to a more diversified banking model and prudence in operations, as can be seen through the increase in alternative channels and restructuring in the sector, as banks adjust to the business environment and the current regulatory framework.

Below is a summary of the Q1’2018 results for the eleven listed banks and key take-outs from the results:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Cost of Funds |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Loan Growth |

Growth in Govt. Securities |

IFRS 9 Capital Ratios Effect |

|

NBK |

348.0% |

(14.2%) |

(11.7%) |

3.3% |

(15.8%) |

7.1% |

(12.3%) |

31.0% |

91.3% |

(6.3%) |

(12.0%) |

(9.8%) |

(0.6%) |

|

Stanbic |

79.0% |

17.7% |

17.4% |

3.3% |

17.9% |

7.0% |

55.4% |

49.0% |

73.7% |

13.2% |

11.4% |

83.5% |

(0.6%) |

|

Equity Group |

21.7% |

10.5% |

10.5% |

2.7% |

10.5% |

8.4% |

6.3% |

49.0% |

7.2% |

10.0% |

3.5% |

45.5% |

(0.5%) |

|

KCB Group |

14.0% |

10.9% |

13.0% |

3.1% |

10.0% |

8.2% |

(1.1%) |

32.8% |

(2.3%) |

8.7% |

5.8% |

(10.7%) |

(0.8%) |

|

Barlays Bank |

7.7% |

8.1% |

6.8% |

2.9% |

8.5% |

9.6% |

5.0% |

29.2% |

(6.7%) |

8.4% |

(1.9%) |

35.3% |

1.00% |

|

Co-op Bank |

6.8% |

9.1% |

5.0% |

4.0% |

10.8% |

8.6% |

3.8% |

32.0% |

9.6% |

5.7% |

2.8% |

21.3% |

(0.9%) |

|

DTB |

3.0% |

4.9% |

4.2% |

5.1% |

5.4% |

6.4% |

4.4% |

22.0% |

8.3% |

11.6% |

3.0% |

16.0% |

(1.6%) |

|

NIC Group |

2.2% |

8.2% |

35.9% |

5.2% |

(8.3%) |

6.3% |

5.5% |

29.6% |

1.8% |

22.1% |

(0.4%) |

81.2% |

(0.8%) |

|

I&M holdings |

1.8% |

2.5% |

10.9% |

4.8% |

(2.7%) |

7.4% |

43.9% |

37.0% |

45.9% |

3.5% |

7.6% |

(1.7%) |

(0.2%) |

|

Stanchart |

(12.5%) |

7.7% |

16.4% |

3.6% |

4.5% |

7.8% |

6.5% |

32.0% |

27.0% |

13.2% |

(2.6%) |

12.4% |

(0.5%) |

|

HF Group |

(58.4%) |

(12.8%) |

(13.0%) |

7.2% |

(12.6%) |

5.1% |

64.2% |

28.9% |

(62.7%) |

(6.1%) |

(12.5%) |

(41.4%) |

0.0% |

|

Weighted Average Q1'2018 |

14.4% |

9.3% |

11.4% |

3.4% |

8.1% |

8.1% |

9.5% |

37.1% |

12.2% |

9.4% |

3.2% |

25.0% |

(0.3%) |

|

Weighted Average Q1'2017 |

(8.6%) |

(11.6%) |

(10.3%) |

3.0% |

(10.1%) |

9.2% |

18.6% |

37.8% |

8.7% |

11.7% |

7.1% |

43.1% |

- |

Key takeaways from the table above include:

- The listed banks recorded a 14.4% increase in core EPS, compared to a decline of 8.6% decline in Q1’2017. Only Standard Chartered Bank and Housing Finance Group recorded declines in core EPS, registering declines of 12.5% and 58.4% respectively. HF Group recorded the biggest decline at 58.4%, on the back of a 12.6% decline in Net Interest Income (NII);

- Average deposit growth came in at 9.4%. Thus, the interest expense paid on deposits recorded a higher growth of 11.4% on average, indicating that banks are growing deposits by opening more interest earning accounts. This is also reflected by the increase in the cost of funds to 3.4% from 3.0% in Q1’2017;

- Average loan growth was recorded at 3.2%, with interest income increasing by 9.3%, as banks adapted to the interest rate Cap regime, with increased allocations in government securities;

- Investment in government securities has grown by 25.0%, outpacing loan growth of 3.2%, showing increased lending to the government by banks as they avoid the risky borrowers;

- The average Net Interest Margin in the banking sector currently stands at 8.1%, a decline from the 9.2% recorded in Q1’2017, and,

- Non-funded income has grown by 9.5%, which included a Fee and Commissions growth of 12.2%. This shows that banks are charging more fee income to improve their income on loans above the rate cap maximum;

- The sector saw a decline in total capital relative to risky assets by 0.3% due to implementation of IFRS 9, indicating the implementation of the standard affected the sector’s capital position though not as much as expected. We expect this reduction to increase in the future.

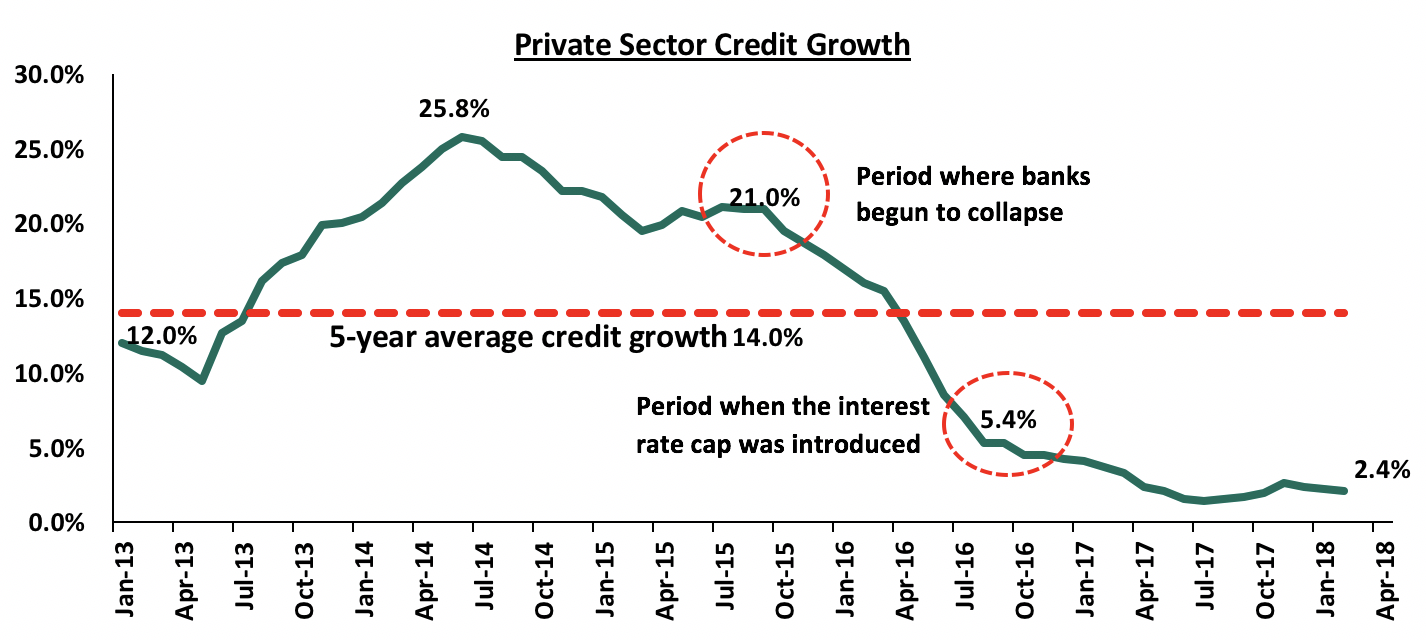

Private sector credit growth continues to remain low, coming in at 2.4% in April 2018, way below the 5-year average of 14.0%, as banks channel funds more actively towards government securities, depriving the private sector of credit.

Rate cap came into effect in August 2016 when private sector credit growth was at 5.4% as highlighted above, with the decline before that as a result of a challenging operating environment

The challenges that the banking sector has been facing, primarily (i) the deteriorating asset quality brought about by a challenging operating environment, and (ii) the capping of interest rates, has led to subdued growth in the credit extended to the private sector. We however noted that the sector in general has adapted to operating in the tough environment, posting a 14.4% increase in core EPS. We believe the key factors banks will consider going forwards are asset quality management, revenue diversification, prudence, and efficiency. To grow profitability amidst the tighter regulated environment, banks will:

- Diversify their income sources by growing their fee-income businesses, bancassurance, asset management and advisory services,

- Be more prudent in loan disbursement, as well as enhancing their risk assessment framework to improve asset quality, so as to tame any rising financial impairments arising from implementation of IFRS 9, and,

- Improve efficiency by leveraging on mobile and internet banking, for cost reduction especially on staff numbers and revenue expansion from transaction income, with all these strategies aimed at improving their profit margins.

We believe the banking sector is well poised to grow in the future, but there is still a need to address the slow growth in credit by effectively removing the interest rate cap and countering any effects by spurring competition in the lending market by stimulating the capital markets by increasing the depth of the markets so as to provide avenues for the use of structured products. We highlighted these and other strategies in our topical: Rate Cap Review Should Focus More on Stimulating Capital Markets

As per our analysis on the banking sector, from a franchise value and from a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics in the table above as well as the operating metrics in the table below in order to carry out a comprehensive review of the banks.

|

Listed Banks Q1'2018 Operating Metrics |

|||||||

|

Bank |

LDR |

CIR |

ROACE |

Deposits Per Branch |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

|

Co-operative |

85.4% |

55.8% |

17.6% |

1.9 |

10.8% |

30.6% |

16.8% |

|

KCB |

84.3% |

55.9% |

20.3% |

1.9 |

9.9% |

58.6% |

14.6% |

|

DTB |

71.4% |

56.3% |

15.1% |

2.0 |

7.1% |

68.3% |

13.2% |

|

Equity |

70.9% |

49.6% |

24.7% |

1.4 |

6.5% |

48.6% |

14.4% |

|

I&M |

90.0% |

52.8% |

16.9% |

4.1 |

13.8% |

39.5% |

17.0% |

|

NIC |

80.5% |

60.7% |

13.4% |

2.9 |

12.9% |

48.0% |

15.1% |

|

Barclays |

85.6% |

64.8% |

16.0% |

2.2 |

7.2% |

71.7% |

14.9% |

|

Stanchart |

49.1% |

61.0% |

14.5% |

6.4 |

14.0% |

75.2% |

15.1% |

|

Stanbic |

74.1% |

71.7% |

6.2% |

5.7 |

7.8% |

50.3% |

12.9% |

|

HF |

113.1% |

94.6% |

0.7% |

1.6 |

16.6% |

39.2% |

15.6% |

|

National Bank |

58.9% |

95.7% |

2.3% |

1.2 |

42.9% |

56.5% |

5.1% |

|

Weighted Average Q1'2018 |

76.8% |

56.6% |

18.4% |

2.8 |

9.5% |

53.4% |

14.9% |

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and Intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 75.0% on Discounted Cash-flow Methods and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess the efficiency, asset quality, diversification, corporate governance and profitability, among other metrics. The overall Q1’2018 ranking is as shown in the table below:

|

CYTONN’S Q1’2018 BANKING REPORT RANKINGS |

|||||

|

Bank |

Franchise Value Total Score |

Intrinsic Value Score |

Weighted Score |

Q1‘2018 Rank |

FY ‘2017 Rank |

|

KCB Group |

53.0 |

4.0 |

23.6 |

1 |

1 |

|

Equity Group |

53.0 |

8.0 |

26.0 |

2 |

2 |

|

I&M Holdings |

62.0 |

3.0 |

26.6 |

3 |

3 |

|

Diamond Trust Bank |

66.0 |

2.0 |

27.6 |

4 |

7 |

|

Barclays Bank |

63.0 |

6.0 |

28.8 |

5 |

6 |

|

Co-operative Bank |

63.0 |

7.0 |

29.4 |

6 |

4 |

|

Stanbic Holdings |

69.0 |

10.0 |

33.6 |

7 |

9 |

|

NIC Group |

83.0 |

1.0 |

33.8 |

8 |

5 |

|

Standard Chartered Bank |

71.0 |

9.0 |

33.8 |

8 |

8 |

|

HF Group |

104.0 |

5.0 |

44.6 |

10 |

11 |

|

National Bank of Kenya |

103.0 |

11.0 |

47.8 |

11 |

10 |

Major changes include:

- Diamond Trust Bank climbed 3 spots to Position 4 from Position 7 in our FY’2017 Banking Sector Report, owing to its good asset quality, with the bank having the second lowest gross NPL ratio at 7.1%, lower than industry average of 9.5%, and good corporate governance structure, ranking second in the Cytonn Corporate Governance Index (CGI),

- NIC Group dropped 3 spots to Position 8 from Position 5 in our FY’2017 Banking Sector Report, due to a low franchise value score caused by low profitability owing to a low Net Interest Margin at 6.3%, and a low Return on Average Common Equity (ROACE) at 13.4%, compared to an industry average of 8.1%, and 18.4%, respectively, and a high Cost to Income Ratio (CIR) of 60.7%, compared to an industry average of 56.6%.

For a comprehensive analysis on the ranking and methodology behind it, see our Cytonn Q1’2018 Banking Sector Report.