Nov 17, 2024

In analyzing the Industrial Nairobi Metropolitan Area (NMA) we discuss the following;

- Overview of the Real Estate sector in Kenya,

- Overview of the Industrial sector in Kenya,

- Key trends, Opportunities and Challenges facing Industrial Real Estate Sector in NMA,

- Summary Performance of the NMA Industrial Sector in 2024,

- Conclusion and Outlook for the NMA Industrial Real Estate sector.

Section I: Overview of the Real Estate Sector in Kenya

The Real Estate sector in Kenya has grown over the years to become one of the largest contributors to the country’s Gross Domestic Product (GDP), supported by factors such as; i) positive demographics including higher urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, ii) government’s sustained efforts to promote infrastructural development, opening up new areas for investments, iii) emphasis to provide affordable housing by the government through programs such as the Affordable Housing Program (AHP), iv) increased investment by both local and foreign investors, and, v) increased accessibility to low-interest loans provided by entities such as Kenya Mortgage Refinance Company (KMRC) among others.

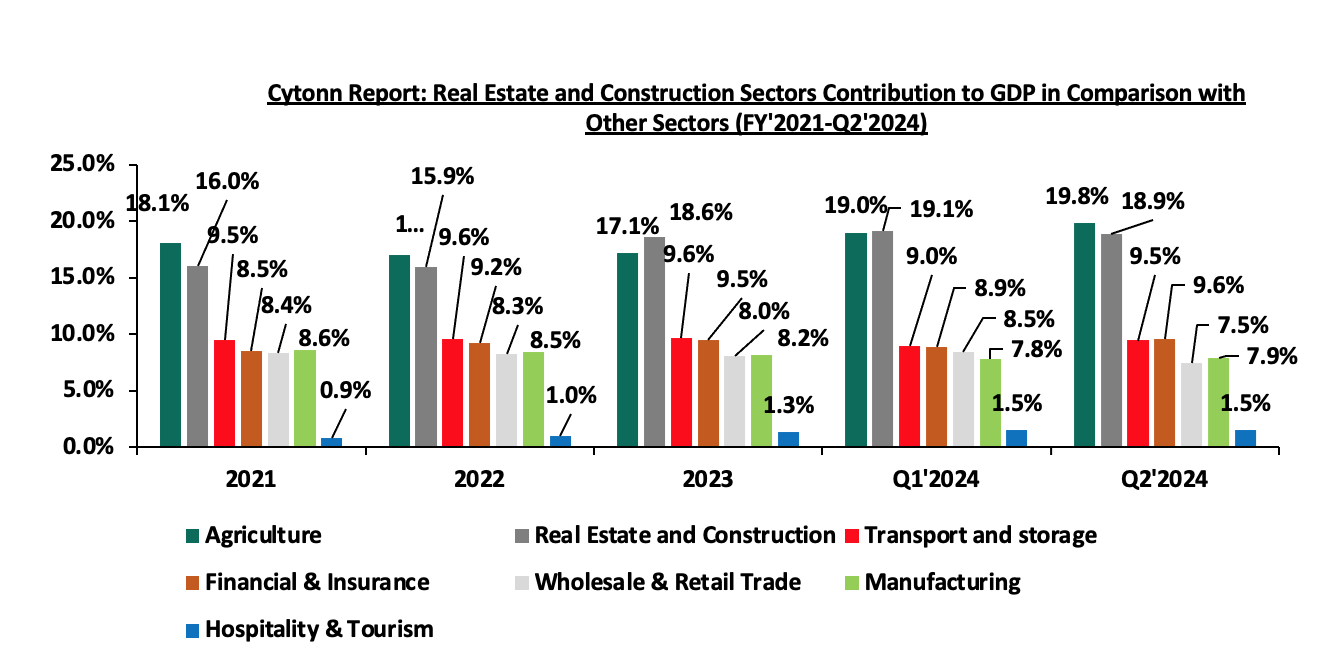

As we assess the growth in the Kenyan property market, it is imperative to recognize the growth achieved by the Real Estate sector, collaboratively with the construction sector, given their interdependence and inherent correlation. Construction and Real Estate sectors jointly contributed to 18.9% to the country’s GDP in Q2’2024, subsequently being the second largest contributors after Agriculture which contributed 19.8%. The performance surpassed major and perennial sector contributors including transport at 9.5%, financial services and insurance at 9.6%, and manufacturing which contributed 7.9%. The performance of the two sectors confirms their importance to the Kenyan economy, and additionally draws a positive outlook. The graph below shows the trend of the Real Estate and Construction sectors contribution to GDP between FY’2021 and Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

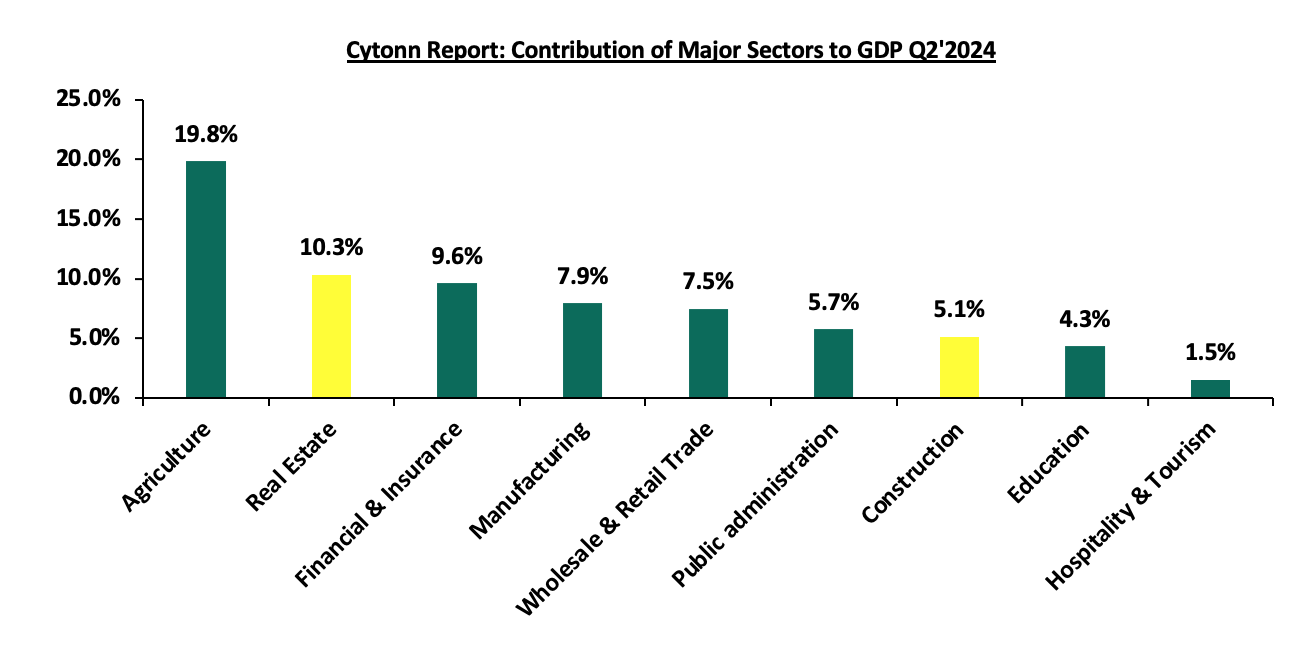

Below is a graph highlighting the top sectoral contributors to GDP in Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

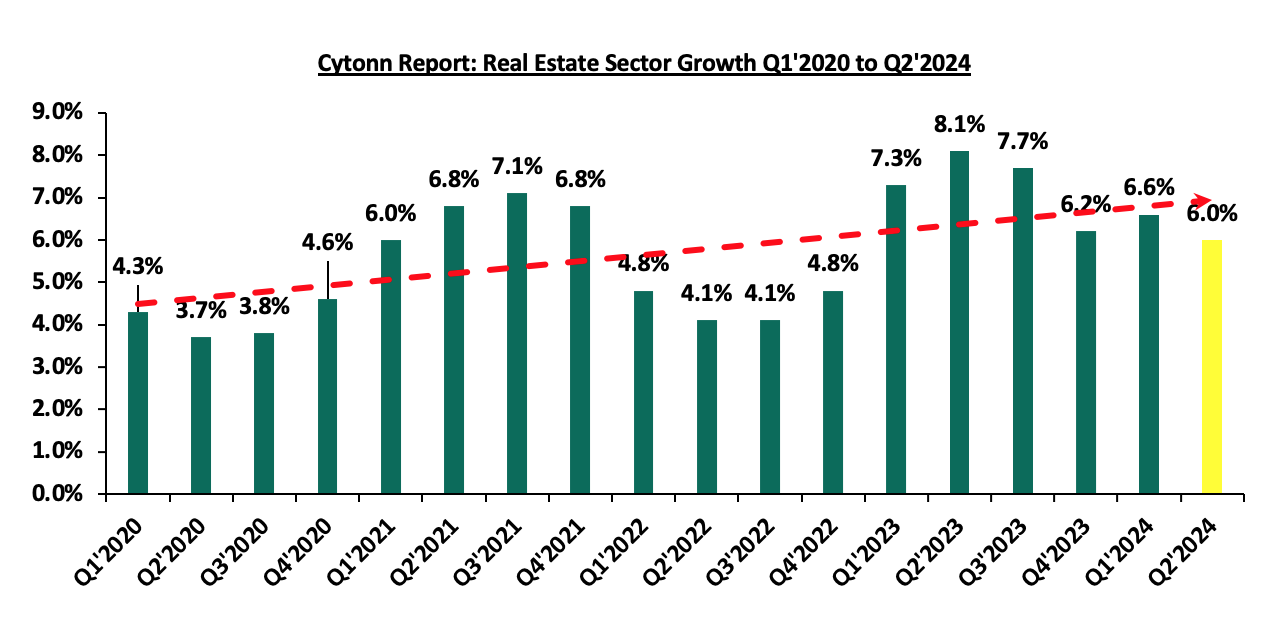

Despite the growth in the sector, the sector has also experienced some setbacks ranging from macro-economic factors to sector specific factors over the years. In FY’2020, the sector experienced the hardest shock from the unprecedented COVID-19 pandemic. However, the sector has since made a turnaround in FY’2021 as the business world embarked on reopening driven by mass administration of COVID-19 vaccine and ease of travel restrictions and lockdowns. In 2022, however, the sector’s witnessed a turnaround in performance, reverting to a downward trajectory. Notably, the sector’s growth declined to 4.8% in Q4’2022 from 6.8% in Q4’2021, attributable to the August general elections. In the period leading to the elections, investors faced uncertainty as they assessed the country’s political environment. However, the electioneering period concluded peacefully which boosted investors’ confidence, and paved way for the resumption of business activities in 2023 as evidenced by the 7.3 % average growth rate recorded in FY’2023.

The sector’s growth, however, declined in the subsequent quarters due to the tough macro-economic conditions including rising interest rates, which led to expensive borrowing, further dampening demand for mortgages and lending to developers, and inflationary pressures, particularly in building materials and labour costs, increased project costs, reducing the profitability of new developments and slowing down ongoing projects. The Real Estate sector in 2024 posted steady growth of 6.0% in Q2’2024, which is 2.1% points slower than the 8.1% growth registered in Q2’2023. This growth can be attributed to the increasing need for housing in the country. However, the growth remained subdued compared to Q2’2023 due to the sustained increase in the cost of construction materials, which posed a hurdle to investors and reduced the number of activities in the sector during the period under review, as well as a diminishing purchasing power by consumers Despite this, the value of approved building plans in the Nairobi Metropolitan Area (NMA), a major contributor to the Real Estate market in the country, increased y/y basis by 136.1% to Kshs 59.8 bn in Q2’2024, from Kshs 25.3 bn recorded in Q2’2023. The graph below shows the Real Estate Sector Growth Rate between Q1’2020 and Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

Section II: Overview of the Industrial Sector in Kenya

The Nairobi Metropolitan Area has been on the front line and a major contributor to the Industrial Real Estate Sector accounting for approximately 90.0% of the country’s industrial space. Known for its high concentration of industrial project in areas like Nairobi, Kiambu, Machakos and Kajiado; with Nairobi County holding the largest share at 66.0%, largely due to its status as the capital city. Kiambu follows, housing key industrial investments such as Tatu City, Nairobi Gate Industrial Park (NGIP), Tilisi, and Northlands City. These areas have attracted major industrial projects like ALP West in Tilisi and ALP North in Tatu City, bolstering Kiambu’s market share. The growth in the area has been driven by several factors such as the surge in e-commerce, demand for high-quality facilities, favorable demographics, enhanced infrastructure, government-led initiatives aligned with Vision 2030 and Nairobi’s role as East Africa’s business hub which has attracted foreign investments.

The Special economic zones sectors include free port zones, free trade zones, ICT parks, business service parks, Industrial parks, livestock and agricultural zones among others. Such zones are located at Konza Technopolis and Tatu Cuty SEZ. These zones enjoy various benefits such as;

- Tax and Fiscal incentives- Businesses in SEZs often enjoy reduced corporate tax rates, exemptions from customs duties, VAT, and import/export levies. For example, Kenya provides tax holidays for firms operating in SEZs,

- Infrastructure development- SEZs provide modern infrastructure, including transport links, utilities, and telecommunications, which support industrial and commercial activities,

- Simplified regulations-SEZs streamline bureaucratic procedures with "one-stop-shop" services for licensing, permitting, and approvals, reducing administrative burdens on businesses,

- Increased Foreign Direct Investment (FDI)- SEZs attract FDI by providing a stable, predictable environment with business-friendly policies and guaranteed protection for investors,

- Export promotion-SEZs focus on export-driven industries, allowing businesses to operate competitively in global markets, often with preferential trade agreements, and,

- Economic diversification-SEZs enable countries to diversify away from traditional sectors by fostering new industries and technologies.

Nairobi Metropolitan Area (NMA) Industrial Sub-Sectors

- Manufacturing

Manufacturing is a core sub-sector of industrial Real Estate, encompassing facilities like factories, assembly plants, and production hubs. These properties are purpose-built to house machinery, assembly lines, and other production infrastructure, making them critical to supply chains. Industrial parks and zones, such as Kenya's SEZs and EPZs, often integrate manufacturing with warehousing and logistics to optimize production and distribution. Key features of these facilities include high ceilings, reinforced floors, and advanced utilities tailored for large-scale operations. Manufacturing hubs not only drive demand for industrial Real Estate but also attract investment, support SMEs, and facilitate regional trade, making them integral to economic growth.

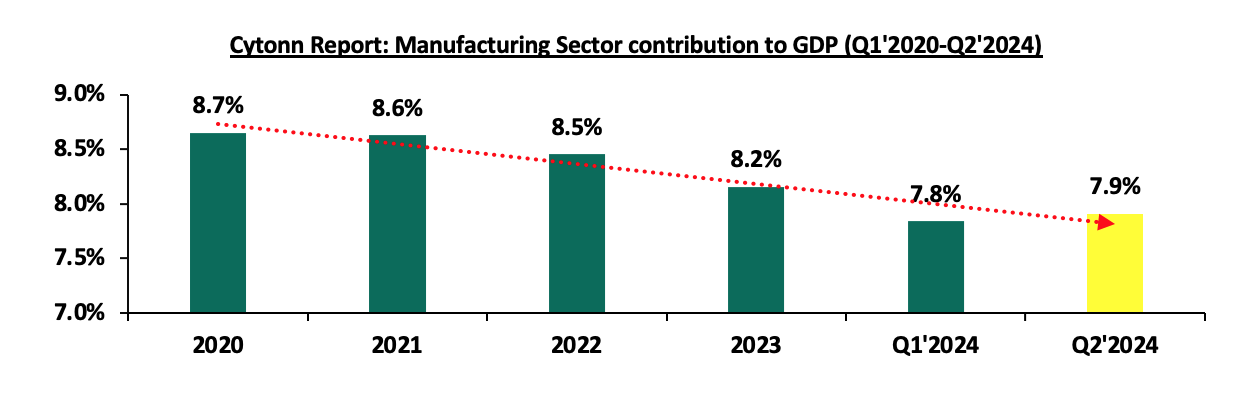

The manufacturing industry has seen gradual decline in performance, having the contribution to GDP decrease by 0.8% to 7.9% in Q2’2024 from 8.7% average recorded in 2020. The manufacturing subsector accounted for about 7.9% of GDP in Q2’2024, falling short of the government’s target of 15.0%. The graph below shows the manufacturing sector contribution to GDP from FY’2020 to Q2’2024

Source: Kenya National Bureau of Statistics (KNBS)

The reduced performance in manufacturing can be attributed to i) high costs of production driven by harsh economic conditions, both locally; such as increased taxes and globally; due to supply chain disruption caused by geopolitical factors such as the Russia-Ukraine war and the Israel-Palestine war, ii) competition from imports, as some companies find it cost-effective to import goods rather than produce them locally, and, iii) decreasing purchasing power in the country hence a reduced demand of manufactured commodities. Despite the reduced growth, the industry is being promoted by the below activities;

- Textiles and Apparel- Benefiting from the African Growth and Opportunity Act (AGOA) with the U.S. and preferential market access within East Africa, textile exports have grown significantly. In 2024, export processing zones (EPZs) focusing on garment manufacturing, particularly for export to the U.S., have attracted major global brands. However, local challenges, like higher production costs compared to Asia, continue to limit the sector’s full potential. Kenya’s industrial sector is experiencing a dynamic transformation, propelled by strategic initiatives such as Special Economic Zones (SEZs) and Export Processing Zones (EPZs). These initiatives are crucial for attracting investment and fostering industrial growth. The government’s sanctioning of Tilisi Logistics Park as an EPZ in January 2024 marks a significant milestone. This move aligns with the broader strategy to enhance Kenya’s industrial capacity and export potential. Furthermore, the inauguration of a 100,000 SQM Textile Park within Nairobi Gate Industrial Park, designated as an SEZ, underscores the sector’s expansion. The Textile Park is anticipated to generate over 5,000 jobs and contribute significantly to the country’s GDP, estimated to add KShs 10.0 Bn annually by 2025.

- Agro-processing-With agriculture as Kenya's largest economic sector, agro-processing is an essential part of the industrial chain. Companies are focusing on value addition in tea, coffee, and horticultural products to increase their export value. For example, Kenyan tea companies have invested in new packaging facilities to export ready-to-drink tea products rather than raw tea, increasing value and market reach.

- Pharmaceuticals-Kenya aims to become East Africa's pharmaceutical manufacturing hub, especially in the wake of the COVID-19 pandemic, which highlighted the need for local drug production. Several local and foreign investors have shown interest in setting up manufacturing plants for essential drugs and vaccines, encouraged by government tax incentives.

- Data Centres

The growing need for rapid adoption of cloud services, fintech applications, and digital transformation among businesses has driven demand for data centers in the Nairobi Metropolitan Area providing a substantial boost to the growth of Industrial Real Estate growth. Companies like Safaricom, Microsoft, Amazon Web Services and the top tier lenders; are fueling the need for local data storage facilities to enhance speed and reduce latency. The sector has been supported by major investments such as Liquid Intelligent Technologies opened one of Africa’s largest data centers in Nairobi and Africa Data Centres (ADC) continues to expand its footprint in Nairobi, capitalizing on the region's connectivity and demand. There is an increasing need to i focus on hyperscale data centers to support multinational and regional clients. Additionally, the sector’s growth is supported by Nairobi’s advanced fiber-optic connectivity, supported by undersea cables (TEAMS and SEACOM) which positions the city as a data hub. The availability of affordable electricity and cooling systems in cooler areas like Limuru also enhances viability. On the other hand, the growth in the sector is challenged by factors such as i) high initial capital requirements, iii) dependency on a reliable power grid; outages can easily disrupt operations, and iv) regulatory gaps in data security and management in Kenya.

- Ware Housing and Logistics/Ecommerce

The industrial Real Estate market in Nairobi has witnessed a notable increase in prime warehouse rental prices, driven by high demand from sectors such as e-commerce, fast-moving consumer goods (FMCG), and agribusiness. During the first half of 2024, rental rates for prime warehouses in Nairobi grew exponentially reaching KShs 775 per SQM and achieving a rental yield of 9.5% on average, making Nairobi the second most expensive city in Africa for prime industrial rents after Kampala which recorded rental rate of Kshs 904.2 per SQM and a rental yield of 12.5% on average. Prime warehouse occupancy in Nairobi reached 85.0% in 2024, up from 78% in 2023 signifying 9.0% Y/Y growth. This highlights the absorption of new space amid robust demand. Warehousing solutions for e-commerce businesses focus on urban centers like Embakasi, Mlolongo, and Syokimau, near key transport routes such as SGR, Airport and major road connections. Developers have responded to the demand surge by constructing more speculative projects. An additional 400,000 square meters of warehouse space is expected to be completed by 2024 to address the growing requirements

The sub-sector has been performing well due to factors such as i) surge in E-commerce supported by platforms like Jumia, Kilimall, Jambo Shop and Glovo who needs warehouses to sell to their customers, ii) shift in modern warehousing from traditional go-downs due to the increased need in automation and climate-controlled environments and, iii) strategic location to areas with manager developments like Tatu City Industrial pack and Infinity park in Athi River. The sector is however being undermined by factors such as i) limited availability of Grade-A warehousing, ii) increasing land prices in prime areas like Mlolongo and JKIA, iii) poor road infrastructure in emerging warehousing zones.

- Slaughter Houses

Slaughterhouses are a vital component of industrial Real Estate in Nairobi Metropolitan Area (NMA), where the growing middle class has fueled a rising demand for meat consumption. These facilities play a critical role in meeting this demand by ensuring efficient processing, storage, and distribution of meat products. Major hubs like Kiamaiko, Bama, Neema and Nyonjoro serve as significant slaughter points, processing high volumes of livestock daily. . These facilities often cater to both local and export markets, especially for halal-certified meat, which adheres to strict religious guidelines. Several slaughterhouses operate with outdated infrastructure, leading to concerns over hygiene and public health. Regulatory bodies such as the National Environment Management Authority (NEMA) have raised concerns about effluent management and the environmental footprint of these facilities. Which highlights a gap for high quality slaughter houses in the area.

The sub-sector growth is undermined by i) lack proper systems to handle waste, leading to pollution of nearby rivers and water bodies ii) densely populated areas like Kiamaiko face logistical challenges due to limited space, poor road networks, and the proximity of slaughterhouses to residential zones, iii) regulatory crackdowns and temporary closures can destabilize the livelihoods of workers and trader’s dependent on these facilities. Striking a balance between enforcement and economic stability remains a challenge.

- Special Economic Zones (SEZs) and Export Processing Zones (EPZs)

Another important sub-sector of industrial Real Estate in Nairobi Metropolitan Area (NMA) is the Special Economic Zones (SEZs) and Export Processing Zones (EPZs). Both investment promotion programs that aim to build export-led economic development through industrialization. They offer incentives to investors, such as corporate tax holidays, duty, and VAT exemptions. However, they differ in their objectives, investment requirements, and approach: Also known as free zones, EPZs focus on manufacturing for export. This model has been widely used in developing countries for almost four decades. They usually combine residential and multiuse commercial and industrial activity.

The performance of this sector is promoted by factors such as; i) SEZs like Tatu City and Konza Technopolis, are attracting both local and international investors due to tax incentives and infrastructure readiness, ii) EPZ in Athi River remains one of the largest hubs, hosting over 100 companies focused on textiles, food processing, and assembly. These zones are primarily export-oriented, leveraging preferential trade agreements like AGOA (African Growth and Opportunity Act), iii) diversification in operations; beyond textiles, new EPZ entrants focus on pharmaceuticals, electronics, and processed foods. On the other hand, challenges like i) Over-dependence on AGOA, which faces periodic renewal risks, ii) high costs of compliance with export standards, especially for smaller firms, and iii) limited capacity to handle large-scale manufacturing due to infrastructure gaps.

Section III: Key trends, Opportunities and Challenges facing Industrial Real Estate Sector in NMA

- Key Trends in 2024

The industrial Real Estate sector in Kenya in 2024 has been defined by a number of trending factors including;

- The demand for quality internet services in Kenya, driven by the country's population, which ranks first globally for time spent on social media, according to Visual Capitalist. This demand is further driven by the growing adoption of remote working, which gained popularity during the COVID-19 pandemic, and the rise of e-learning. These factors have compelled Internet Service Providers to enhance their services, leading to increased demand for data centers and, consequently, growth in industrial Real Estate,

- Rising demand for warehousing and logistics facilities-The rise of e-commerce, driven by platforms like Jumia and global players like Amazon, has significantly increased demand for modern logistics and warehousing spaces. Businesses are focusing on proximity to key transport corridors, such as the Nairobi-Mombasa Road and the Nairobi Expressway, to facilitate efficient distribution,

- Industrial parks development large-scale developments, like Tatu Industrial Park and Infinity Industrial Park, are setting a benchmark for planned industrial zones offering modern infrastructure. Increased interest from multinational companies looking for regional hubs, particularly due to Nairobi's strategic location in East Africa.

- Adoption of green building practices. Developers are incorporating sustainable construction practices,including energy-efficient designs and solar energy systems, to align with global ESG (Environmental, Social, Governance) goals, as well as reducing over reliance on hydro-electricity, and

- Government incentives and policy support. Initiatives like the Special Economic Zones (SEZs) and Export Processing Zones (EPZs) offer tax incentives to attract investors into industrial real estate. Public-private partnerships are being promoted to fast-track industrial infrastructure development.

- Challenges Facing the Industrial Sector

- High acquisition land and construction costs to establish the Industrial Real Estate infrastructures such as warehouses. Prime land within the Nairobi metropolitan area is becoming increasingly expensive, driving developers to seek peripheral areas like Machakos and Kiambu counties. Inflation and fluctuating material costs have impacted project and products affordability,

- Inadequate infrastructure in peripheral areas remains a challenge in the sector. While central locations are well-connected, newer industrial zones face challenges such as poor road networks, unreliable power supply, and limited water access,

- Regulatory barriers and compliance Costs: Regulatory and bureaucratic hurdles such as lengthy approval processes and inconsistencies in land tenure systems discourage investment and zoning regulations sometimes conflict with market needs, limiting flexibility in land use. Industrial firms face lengthy approval processes, particularly in sectors like pharmaceuticals and food production, where stringent standards apply. While government agencies like the Kenya Bureau of Standards (KEBS) maintain quality, the process can be slow and costly. For example, obtaining certifications for export products can take months, delaying market entry, and,

- Over-reliance on foreign investment where a significant portion of funding for industrial projects comes from foreign investors, leaving the sector vulnerable to global economic shifts.

Below are some of the highlights witnessed throughout the year;

- Taita-Taveta County is set to achieve an economic milestone with the approval of a Kshs 11.0 bn steel plant by Devki Steel Mills Limited and will be completed within eight months. The plant is set to be constructed in Manga area, Voi. Narendra Raval of Devki Steel Mills was officially handed a 500-acre parcel of land to commence the construction of the plant. For more information, please see our Cytonn monthly August 2024, and

- President Ruto's visit to the U.S. resulted in the signing of an agreement between G42 and Microsoft to build a data center worth Kshs 131.0 bn (USD 1.0 bn) at the KenGen Green Park in Olkaria. The data center will run on 100.0% renewable geothermal power from the Olkaria Geothermal fields in Naivasha, Nakuru County. G42, in collaboration with other partners, will design and construct the state-of-the-art facility, which will provide access to Microsoft Azure through a new East Africa Cloud Region. For more information, please see our Cytonn Weekly #21/2024.

Section V: Summary Performance of the NMA Industrial Sector in 2024:

- Performance of Industrial Spaces in Kenya by regions

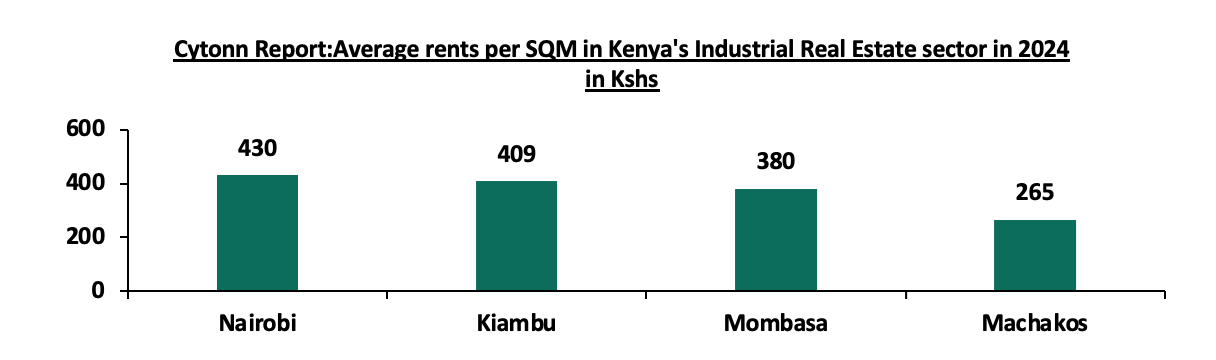

Average rental prices for Industrial spaces in the Nairobi Metropolitan Area (NMA) came in at KSHs 430 per SQM and selling prices on average are at KSHs 75,000 per SQM this performance is attributable to factors such as i) good infrastructures such as the SGR and road networks such as bypasses, major highways and various airports, ii) stable political environment, iii) strategic location and market access that is ,Proximity to major markets and It serves as a gateway to East African markets, with strong connections to other urban centers in the region through the East African Community (EAC) and African Continental Free Trade Area (AfCFTA), iv) the Nairobi region benefits from relatively reliable power and water supply compared to remote areas, despite nationwide challenges with energy costs, v) as a hub for education and innovation, Nairobi has a concentration of universities, technical institutions, and vocational training centers, vi) industries benefit from access to a pool of skilled professionals in fields such as manufacturing, technology, and engineering, and vii) the region hosts some of Kenya’s largest Special Economic Zones (SEZs) and Export Processing Zones (EPZs), including those in Athi River and the upcoming Konza Technopolis. These zones offer tax incentives, reduced import/export tariffs, and infrastructure tailored to industrial activities. The graph below shows average rental prices within the Kenyan Industrial Real Estate Sector in 2024

Source: Cytonn Research

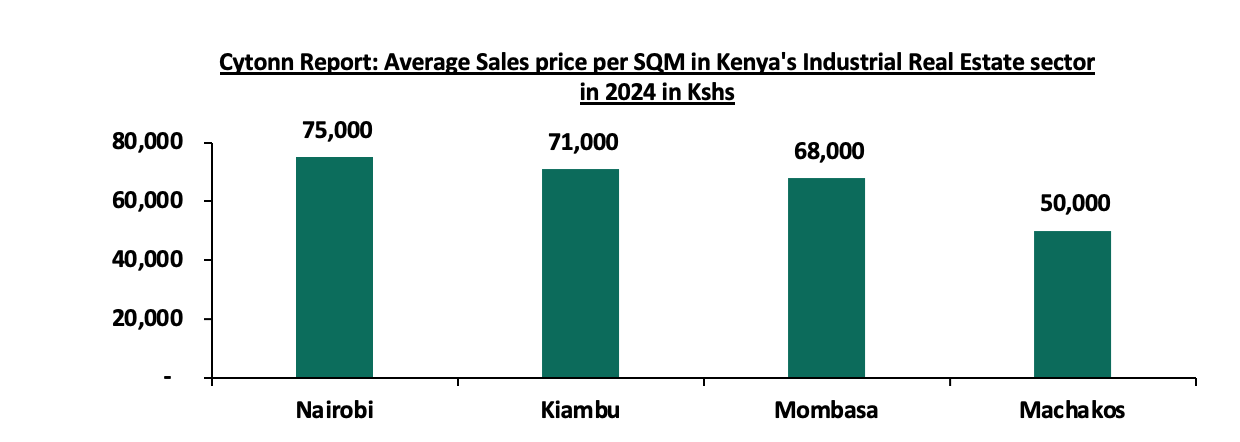

The graph below shows average sale prices within the Kenyan Industrial Real Estate Sector in 2024;

Source: Cytonn Research

- Performance of Industrial spaces in NMA by nodes

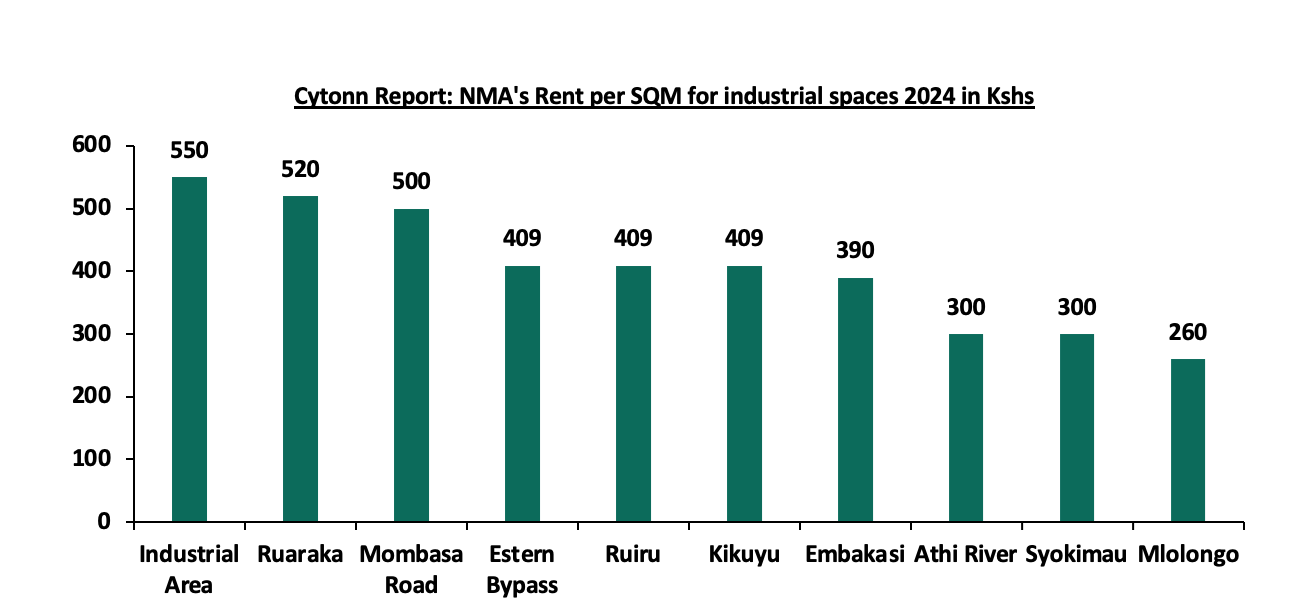

Industry Area, Ruaraka and Mombasa road areas, attract high rental and selling prices. Industry area has the highest average rent per Month of Kshs 550.0 per SQM and selling price of Kshs 80,000 Per SQM contributable to factors such as proximity to the Jomo Kenyatta International Airport (JKIA), increased road and rail network such as the Mombasa road, Eastern by pass, SGR and the Nairobi express way. On the other hand, Mlolongo is the least performing node with monthly rates of Kshs 260 per SQM and selling price per SQM of Kshs 40,000 attributable to the distance from the CBD, increased freight costs, and limited road access. The graph below compares rental performance of various nodes;

Source: Cytonn Research

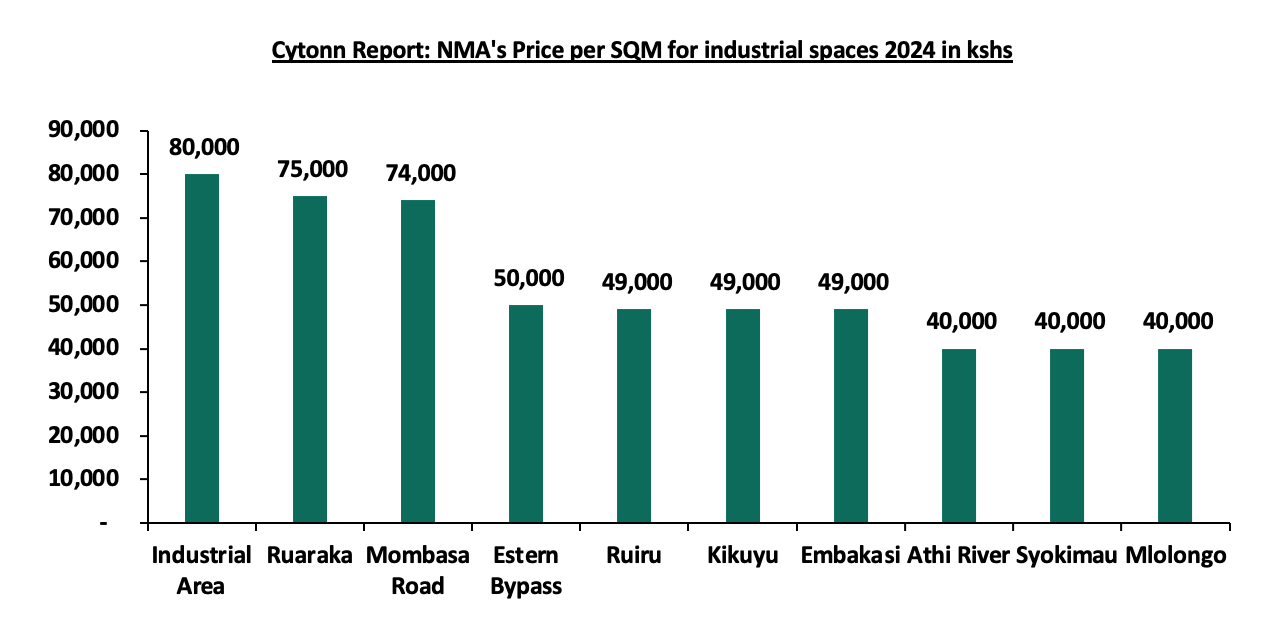

The graph below compares various nodes performance in terms of selling prices within Nairobi Metropolitan Area (NMA);

Source: Cytonn Research

Section VI: Conclusion and Outlook for the NMA Industrial Real Estate sector

The industrial Real Estate sector in Kenya in 2024 is on neutral since the sector faces a mix of challenges and opportunities. Sustained government support, increased regional trade, and continued investment in green energy and technology adoption are essential to ensure its growth. If these initiatives are maintained and bottlenecks addressed, NMA industrial sector is well-positioned to become a regional hub for manufacturing and innovation in the coming decade.

The industrial real estate sector in the Nairobi metropolitan area is experiencing significant growth, driven by evolving market demands and government support. While challenges such as high costs and infrastructural gaps persist, strategic planning, technological adoption, and focus on sustainable practices can unlock vast opportunities. Stakeholders, including developers, investors, and policymakers, should collaborate to address these challenges and leverage Nairobi’s strategic position as a regional hub.

We maintain a neutral outlook for the sector. Going forward, we expect the sector to continue on an upward trajectory driven by: i) the rising demand for data centers in the country, ii) an increasing demand for cold rooms, especially in the Nairobi Metropolitan Area, iii) demand for quality warehouses due to the growing e-commerce business in the country, iv) support from the government, as evidenced by the establishment of Special Economic Zones (SEZ) and Export Processing Zones (EPZ), v) increased development activities by industry players such as ALP Africa Logistics, vi) Kenya’s continued recognition as a regional hub, hence attracting international investors, and, vii) efforts by the government to support agricultural and horticultural products in the international market.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.