Aug 26, 2018

This week we revisit the interest rate cap topic following the proposed amendments to the Finance Bill, 2018, tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its second reading. According to the chair of the committee, the proposed amendments were based on deliberations of the committee and the comments received during public awareness and stakeholder participation forums conducted between 1st – 3rd August 2018, following the first reading of the Finance Bill, 2018 on 3rd July 2018. The Finance Bill, 2018, during its first reading, proposed the repeal of section 33B of the Banking Act, which would result in the elimination of the Central Bank’s powers to enforce an interest rate cap in banks and other financial institutions. However, based on the committee’s deliberations and input from the public, the committee is now of the view that, (i) the upper limit on interest rate charged on borrowers, which is capped at 400 basis points above the CBR, should be maintained, stating that there is no justification for the repeal of the cap, as banks have not shown efforts to address the issue of high credit risk pricing, and (ii) the floor set for deposit rates paid to depositors at 70% of the CBR should be repealed.

In light of the above amendments to the bill, we revisit the issue of the interest rate cap, focusing on:

- Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

- A Review of the Effects It Has Had So Far in Kenya

- A Highlight of the Finance Bill 2018 and The Proposal by Parliament to Maintain a Cap on the Lending Rates

- Our Views on the Steps That Should Be Taken to Stimulate Capital Market Alternatives

Section I: Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

The enactment of the Banking (Amendment) Act, 2015, that capped lending rates at 4.0% above the Central Bank Rate (CBR), and deposit rates at 70.0% of the CBR, came against a backdrop of low trust in the Kenyan banking sector about credit pricing due to various reasons;

- First, the period was marred with several failures of banks such as Chase Bank Limited, Imperial Bank Limited and Dubai Bank, due to isolated corporate governance lapses. The failure of these banks rendered depositors helpless and unable to access their deposits in these banks. The fact that no single prosecution was ongoing at the time, for alleged malpractices that led to the collapse of some of the banks such as Imperial Bank, only served to infuriate depositors who had their deposits locked in these institutions,

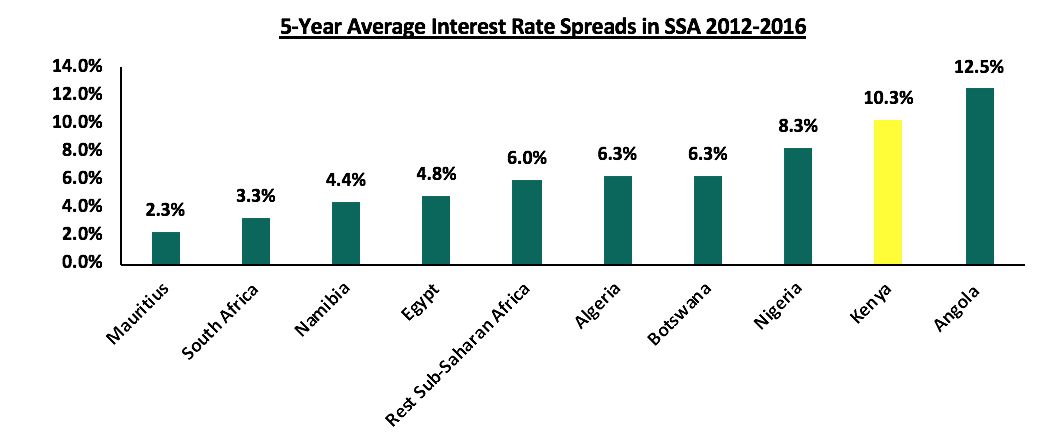

- The total cost of credit was high at approximately 21.0% per annum, yet on the other hand, the interest earned on deposits placed in banks was low, at approximately 5.0% per annum. This led to a high spread between the lending rates and deposit rates as shown in the graph below,

- Credit accessibility was also subdued under this regime of expensive debt, as a lot of individuals opted out of seeking debt from commercial banks, owing to the opacity involved in the loan terms. Thus most individuals and entities opted for alternative sources of funding such as “soft loans” other than from banks, and,

- Banks are the primary source of business funding in the country, providing 95.0% of funding, with other alternative sources such as the capital markets providing a combined 5.0%, compared to developed markets where banks provide only 40.0% of the credit in the economy. This skewed source of funding in Kenya was in favor of the banks, as they would price loans on their terms, as opposed to the optimal market rate. This low level of competition from alternative sources of funding in part contributed to high interest rate charges levied by banks.

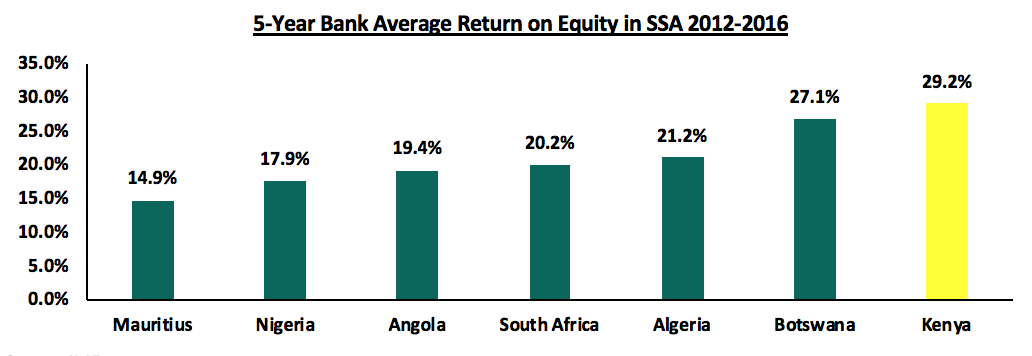

This fuelled anger from the Kenyan public, who accused banks of unfair practice in the quest for extremely high profits at the expense of borrowers and savers. As a result, banks in Kenya had been making one of the highest profits in the region, as shown in the charts below for the period between 2012 and 2016:

Source: World Bank

Source: IMF

This culminated in the interest rate cap bill being tabled in parliament, and due to its populist nature was passed and signed into law by the President on August 24th, 2016, and it was enforced from September 14th 2016.

Our view has always been that the interest rate cap regime would have adverse effect on the economy, and by extension, to the Kenyan People. We have previously written about this in six focus notes, namely:

- Interest Rate Cap is Kenya’s Brexit - Popular But Unwise, dated 21st August 2016, three days before the signing into law of the interest rate cap, where we first expressed our view that the interest rate cap would have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, plus we noted the lack of compelling evidence of any economy where interest rate capping was successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing alternative products and channels,

- Impact of the Interest Rate Cap, dated 28th August 2016, four days after the interest rate cap bill was signed into law, where we highlighted the immediate effects of the interest rate cap, as banking stocks lost 15.6% in 2-days. Here, we re-iterated our stance on the negative effects of the interest rate cap, while identifying the winners and losers of the Banking (Amendment) Act, 2015,

- The State of Interest Rate Caps, dated 14th May 2017, 9-months after the interest rate cap was signed into law, where we assessed the interest rate cap and its effects on private sector credit growth, the banking sector and the economy in general, following concerns raised by the IMF. We noted that the law had the effect of (i) inhibiting access to credit by SMEs and other “small borrowers” whom banks cited as being unable to fit within the 4.0% risk premium, and (ii) contributed to subduing of private sector credit growth, which was recorded at 4.0% in March 2017. We suggested that policymakers review the legislation, highlighting that there existed, and continues to exist, opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow, and consequently improve private sector credit growth,

- Update on Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated 23rd July 2017, approximately 1-year after the Banking (Amendment) Act, 2015 was signed into law, where we analyzed the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was higher than the legislated 14.0%, as banks loaded excessive additional charges, while noting that the large banks, which control a substantial amount of the banking sector loan portfolio, were the most expensive. We suggested (i) a repeal or modification of the interest rate cap, (ii) increased transparency, (iii) improved and more accommodating regulation, (iv) consumer education, and (v) diversification of funding sources into alternatives,

- The Total Cost of Credit Post Rate Cap, dated 14th January 2018, where we analyzed the true cost of credit, initiatives put in place to make credit cheaper and more accessible, the impact of the interest rate cap on private sector credit growth, and what more can be done do remedy the effects of the interest rate cap, and

- Rate Cap Review Should Focus More on Stimulating Capital Markets, dated 13th May 2018, where we revisited the interest rate cap following an announcement by the Treasury that they were in the process of completing a draft proposal that will address credit management in the economy.

Section II: A Review of the Effects It Has Had So Far in Kenya

As detailed in our focus note Rate Cap Review Should Focus More on Stimulating Capital Markets, the interest rate cap has had the following four key effects to Kenya’s economy since its enactment:

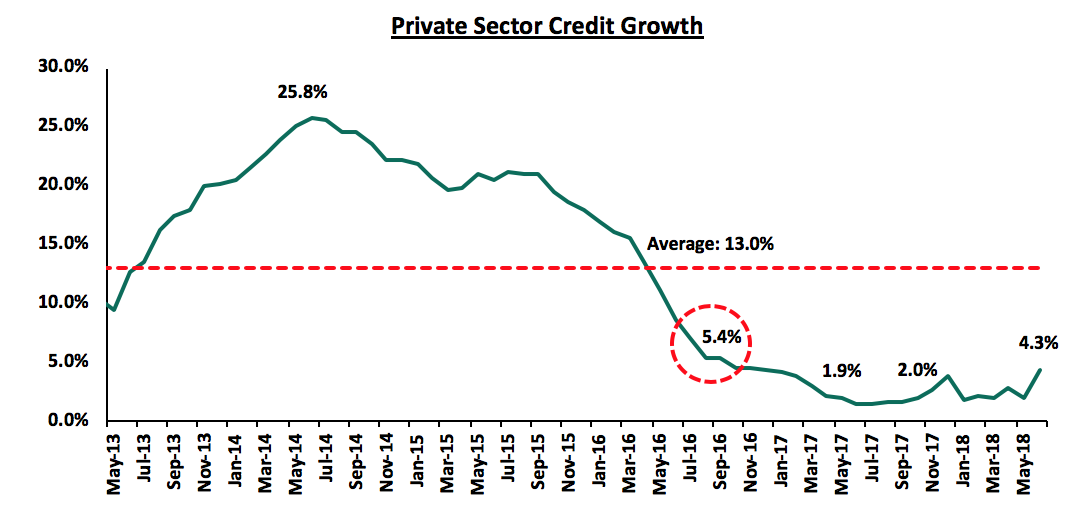

- Drop in the Private Sector Credit Growth: Private sector credit growth in Kenya has been declining, and the enactment of the Banking (Amendment) Act, 2015, had the adverse effect of further subduing credit growth. The law capped lending rates at 4.0% points above the CBR. This made it difficult for banks to price some of the borrowers within the set margins, a majority being SMEs, as they were perceived “risky borrowers”. Banks thus invested in asset classes with higher returns on a risk-adjusted basis, such as government securities. As can be seen from the graph below, private sector credit growth touched a high of 25.8% in June 2014, and has averaged 13.0% over the last five-years, but dropped to 2.0% levels after the capping of interest rates, rising slightly to 4.3% in June 2018

- Reduced Loan Accessibility: Immediately after the enactment of the Banking (Amendment) Act, 2015, banks saw an increase in demand for loans, as the number of loan applications increased by 20.0% in Q4’2016 according to the CBK Credit Officer Survey of October-December 2016. This was due to borrowers attempting to get access to cheaper credit. However, this demand was not matched with supply of loans by banks as evidenced by:

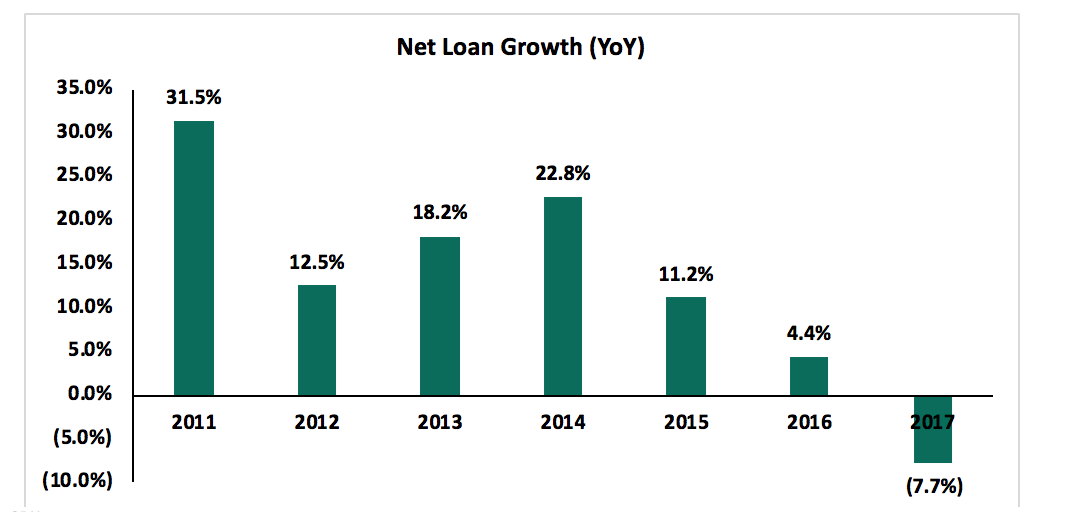

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth has been declining since the enactment of the interest rate cap, having come from a growth of 11.2% in 2015, to a decline of 7.7% as of December 2017, as shown in the graph below.

- Decline in the number of loan accounts: The number of loan accounts in large banks (Tier I) declined by 27.8%, the largest among the three tiers, followed by Tier II banks with a decline of 11.1% between October 2016 and June 2017.

- Increase in average loan size: The average loan size increased by 36.0% to Kshs 548,000 from Kshs 402,000 between October 2016 and June 2017. This points to lower credit access by smaller borrowers, while also demonstrating that credit was extended to larger and more “secure” borrowers.

- Decrease in average loan tenures: The average loan tenure declined by 50.0% to 18-24 months compared to 36-48 months prior to the introduction of the interest rate cap. This is due to bank’s increasing their sensitivity to risk, thereby opting to extend only short-term and secured lending facilities to borrowers, rather than longer-terms loans to be used for investments, according to the latest survey by the Kenya Bankers Association (KBA) on the effects of the Banking (Amendment) Act, 2015.

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth has been declining since the enactment of the interest rate cap, having come from a growth of 11.2% in 2015, to a decline of 7.7% as of December 2017, as shown in the graph below.

- Review of Bank’s Operating Models to Mitigate Effects of the Rate Cap Legislation: The enactment of the Banking (Amendment) Act, 2015, saw banks changing their business and operating models to compensate for reduced interest income (their major source of income) as a result of the capped interest rates. Thus, banks adapted to this tough operating environment by adopting new operating models through:

- Increased focus on Non-Funded Income (NFI), evidenced by the fact that the proportion of non-interest income to total income stood at 28.4% in September 2016, and has risen to the current average of 35.4%, for listed commercial banks that have released their H1’2018 financial results,

- Increased focus on transactional accounts as increased their focus to growing their transactional accounts as opposed to interest earning accounts,

- Increased lending to the government rather than individuals and the private sector, given the higher risk-adjusted returns offered by government debt, and

- Banks also stepped up their cost rationalization efforts by increasing the use of alternative channels by mainly leveraging on technology such as mobile money and internet banking to improve efficiency and consequently reduce costs associated with the traditional brick and mortar approach. This led to the closure of branches and staff layoffs in a bid to retain the profit margins in the tough operating environment, due to depressed interest income.

- Weakening of Monetary Policy Effectiveness: The Banking (Amendment) Act, 2015, has made it difficult for the Central Bank to conduct its monetary policy function. This is majorly because any alteration to the CBR would directly affect the deposit and lending rates. Expansionary monetary policy is difficult to implement since lowering the CBR has the effect of lowering the lending rates and as a consequence, banks find it even more difficult to price for risk at the lower interest rates, leading to pricing out of even more risky borrowers, and hence further reducing access to credit. On the other hand, if the CBK was to employ a contractionary monetary policy, so as to reduce inflation and credit growth for example, then raising the CBR would have the converse effect of increasing the supply of credit in the economy since banks would be able to admit riskier borrowers.

Section III: A Highlight of the Finance Bill 2018 and The Proposal by Parliament to Maintain the Rate Cap

Having now been in effect for 24-months, we have seen various efforts put in place to review the law given the significant evidence that its intended objectives have not been achieved. The efforts noted include:

- In March 2018, the International Monetary Fund (IMF) announced its decision to withdraw the USD 1.5 bn stand-by credit and precautionary facility to Kenya, citing failure to meet conditions previously agreed upon for the facility to be extended, key among these being lowering of the budget deficit to 3.7% of GDP by the fiscal year 2018/19 (projections as per the Draft 2018 BPS indicated a deficit of 6.0%). To have the facility extended, the National Treasury and the President endorsed the repeal of the cap, stating that it had contributed towards crowding out the private sector from accessing credit.

- Development on The Draft Financial Markets Conduct Bill by Treasury, which would address credit management in the economy. The draft Bill focused on reducing the cost of credit, and present some consumer protection policies. However, as Highlighted in our Focus Note, The Draft Financial Markets Conduct Bill, 2018, the bill failed to address bank dominance , funding reliance, and the need to focus on expanding capital markets as an alternative to funding which in our view are necessary, accompaniments to a review of the law, and

- The development of The Finance Bill 2018, which sought various amendments to the tax regime and the repeal of interest rate capping. However, following the second reading of the bill in parliament, the committee on Finance and planning in the National Assembly is of the view that, (i) the upper limit on interest rate charged on borrowers, which is capped at 400 basis points above the CBR, should be maintained, stating that there is no justification for the repeal of the cap, as banks have not shown efforts to address the issue of high credit risk pricing, and (ii) the floor set for deposit rates paid to depositors at 70% of the CBR should be repealed.

In our view, the proposal by the committee to maintain the interest rate cap based only on the lack of efforts by the banks to address the issue of high credit risk pricing, fails to consider other stakeholders who have been negatively affected by the law, and echoes our consistent view that the repeal has always been more focused on banks. As highlighted in the next section, any successful review or repeal of the law should be accompanied by policies to manage bank dominance, reduce the funding reliance on banks and should focus on expanding capital markets as an alternative sources of funding.

Section IV: Steps that Should Be Taken to Expand Capital Markets as an Alternative to Banks

Considering the effects of the interest rate cap, we maintain the view that the law should be repealed or reviewed to give banks flexibility in pricing loans. In our view, the review or repeal of the law should be accompanied by the following recommendations that will address the existing bank dominance, reduce the funding reliance we have on banks and support the expansion of capital markets as an alternative to banks:

- Legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation: A lot of legislative action has focused on the banks, yet we also need legislation to promote competing products that will diversify funding sources, which will enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly. This can be done through the promotion of initiatives for competing and alternative products and channels, in order to make the banking sector more competitive. In developed economies, 40% of business funding comes from the banking sector, with 60% coming from non-bank institutional funding. In Kenya, 95% of all funding is bank funding, and only 5% from non-bank institutional funding, showing that the economy is highly dominated by the banking sector and should have more alternative and capital market products for funding businesses. Alternative investment managers and the capital markets regulators need to look at how to enhance non-bank funding, such as high yield investment vehicles, such as High Yield Solutions. The products offer investors with cash to invest at a rate of about 18% to 19% per annum, equivalent to what the fund takers, such as real estate developers, would have to pay to get funds from the banks. Instead of a saver taking money to the bank and getting negligible returns, they can just invest in a funding vehicle where the business would pay them the same 18% to 19% per annum that they would pay to get the same money from the bank. For the saver, it helps improve their rate from low rates, at best 7% per annum, to as high as 18% per annum, and for the business seeking funding, it helps them access funding much faster to grow their business. Promoting alternative funding is also essential to the affordable housing piece of the “Big Four” government agenda, which requires capital markets funding,

- Consumer protection: The implementation of a strong consumer protection, education agency and framework, to include robust disclosures on cost of credit, free and accessible consumer education, enforcement of disclosures on borrowings and interest rates, while also handling issues of contention and concerns from consumers,

- Promote capital markets infrastructure: Efficient capital markets infrastructure is necessary in both regulated and private markets. The Capital Markets Authority (CMA) could aid in enhancing the capital markets’ depth in various ways such as (i) making it easier for new and structurally unique products to be introduced in the capital and financial markets, (ii) institute predictable deadlines for processing submissions from market applicants and expedite processing of applications, (iii) push for a one stop shop for applicants such that an approval from the authority on products such as REITS would suffice, as opposed to current structure where applicants have to chase other approvals from other agencies such as KRA.

- Addressing the tax advantages that banks enjoy: Level the playing field by making tax incentives available to banks to be also available to non-bank funding entities and capital markets products such as unit trust funds and private investment funds. For example, providing alternative and capital markets funding organizations with the same withholding tax incentives that banking deposits enjoy, of a 15% final withholding tax so that depositors don’t feel that they have to go to a bank to enjoy the 15% withholding tax; alternatively, normalize the tax on interest for all players to 30% to level the playing field,

- Consumer education: Educate borrowers on how to be able to access credit, the use of collateral, and the importance of establishing a strong credit history,

- The adoption of structured and centralized credit scoring and rating methodology: This would go a long way to eliminate any biases and inconsistencies associated with accessing credit. Through a centralized Credit Reference Bureau (CRB), risk pricing is more transparent, and lenders and borrowers have more information regarding credit histories and scores, thus enabling banks price customers appropriately, spurring increased access to credit,

- Increased transparency: This can be achieved through a reduction of the opacity in debt pricing. This will spur competitiveness in the banking sector and bring a halt to excessive fees and costs. Recent initiatives by the CBK and Kenya Bankers Association (KBA), such as the stringent new laws and cost of credit website being commendable initiatives,

In conclusion, a free market, where interest rates are set by the forces of demand and supply coupled with increased competition from non-bank financial institutions for funding, will see a more self-regulated environment where the cost of credit reduces, as well as increased access to credit by borrowers that have been shunned under the current regime. Consequently, a repeal is necessary, but the repeal needs to be comprehensive and contain the 7 elements above for it to be effective, but the center-piece of the legislation should be stimulating capital markets to reduce banking sector dominance, yet this key piece seems to be missing in the current Finance Bill 2018.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.