Cytonn Monthly January 2020

By Research Team, Feb 2, 2020

Executive Summary

Fixed Income

During the month of January, T-bill auctions recorded an oversubscription, with the overall rate coming in at 164.1%, compared to 56.2% recorded in the month of December 2019. The subscription rates for the 91-day paper came in at 86.2%, which was higher than the 65.4% recorded in December. The subscription rates for the 182-day and 364-day came in at 50.0% and 230.5%, higher than the 24.6% and 57.1% recorded in December 2019, respectively. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 230.5%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic borrowing target, and as such a bias to shorter-dated papers to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yields on the 91-day, 182-day paper and 364-day paper recorded increases of 60, 50, and 30 bps, respectively, to close at 7.2%, 8.2%, and 9.8%, respectively, in January. The y/y inflation for the month of January decreased marginally to 5.78%, from 5.82% recorded in December 2019. M/M inflation, however, came in at 0.3%, mainly attributable to a 0.4% increase in the food and non-alcoholic drinks’ index, due to an increase in prices of significant food items including onions, spinach, and carrots which increased by 5.3%, 4.4% and 3.2%, respectively. The Monetary Policy Committee (MPC) met on 27th January 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC lowered the CBR by 25 bps to 8.25% from 8.5% citing that inflation had remained well anchored within the target range with the economy operating below its potential level. During the week, the United Nations Conference on Trade and Development (UNCTAD) released the World Economic Situation and Prospects 2020 report, which indicated that Kenya’s GDP growth for 2020 is projected at 5.5%;

Equities

During the month of January, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 decreasing by (2.6%), (2.0%) and (1.9%), respectively. The decrease recorded in NASI was driven by declines in large-cap stocks such as Bamburi, Co-operative Bank, Equity Group and Safaricom, which recorded declines of (9.4%), (6.7%), (6.5%) and (3.3%), respectively. During the week, the market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by (1.8%), (1.6%), and (1.3%), respectively, taking their YTD performance to losses of (2.6%), (2.0%) and (1.9%), respectively. During the week, SBM Bank (Kenya) Limited filed a petition under the Insolvency Act 2015 to liquidate East African Cables (EAC), which is unable to pay its obligations owed to the lender amounting to Kshs 285.0 mn. The listed firm has had banking facilities with other lenders such as Standard Bank Plc (Kenya & Tanzania), Stanchart, Ecobank Kenya and Equity Bank, and in a statement to stakeholders, EAC revealed that it has successfully completed the restructuring of 82.0% of its total debt obligations and has made significant progress to complete the remaining phase, including debt owed to SBM Bank. However, the legal action brought against the company is an indication of the financial strain it is undergoing in meeting its obligations having recorded consecutive losses for the last three years to 2018;

Real Estate

During the month, various real estate industry reports were released, namely the Leading Economic Indicators (LEI) December 2019, Hass Property Sales and Rental Index Q4’2019, and Hass Land Index Q4’2019. In the residential sector, China State Construction handed over the 228 2-bedroom units of the first phase of the Park Road affordable housing project in Ngara to the Kenyan National Government and the United Kingdom Climate Investment (UKCI) pledged to invest GBP 30 mn (Kshs 3.9 bn) towards affordable green housing in Kenya. In the retail sector, Spur Corporation Ltd, a South African restaurant chain, announced plans to open two additional outlets in Kenya in 2020, as part of its expansion strategy, and Naivas Limited, a local retailer, signed a deal to sell 30.0% of its business to Paris-based private equity fund, Amethis Finance, for an undisclosed amount. In the hospitality sector, Pride Inn, a local hospitality group, revealed plans to undertake its first management facility, Azure Hotel, a Kshs 1.2 bn five-star hotel in Westlands.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.1% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.7% p.a. To subscribe, email us at sales@cytonn.com;

- Rodney Omukhulu, Assistant Investment Analyst at Cytonn Investments, was interviewed by CNBC as they discussed the Central Bank of Kenya Monetary Policy Committee lowering of the Central Bank Rate from 8.50% to 8.25%, and the impact it will have on the economic growth. Watch Rodney here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of January, T-bill auctions recorded an oversubscription, with the overall rate coming in at 164.1%, compared to 56.2% recorded in the month of December 2019. The subscription rates for the 91-day came in at 86.2%, which was higher than the 65.4% recorded in December. The subscription rates for the 182-day and 364-day came in at 50.0% and 230.5%, higher than the 24.6% and 57.1% recorded in December, respectively. We note that there was pent up demand for the 364-day paper, having recorded the highest subscription rate of the 3 papers, at 230.5%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic borrowing target, and as such a bias to shorter-dated papers to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yields on the 91-day, 182-day paper and 364-day paper recorded increases of 60 bps, 50 bps, and 30 bps, respectively, to close at 7.2%, 8.2%, and 9.8%, respectively, in January. The T-bills acceptance rate came in at 84.2% during the month, as compared to 79.8% recorded in December, with the government accepting a total of Kshs 132.6 bn of the Kshs 157.5 bn worth of bids received. The Central Bank remained disciplined in rejecting expensive bids in order to ensure the stability of interest rates.

During the week, T-bills were oversubscribed, with the subscription rate coming in at 135.9%, down from 145.9% the previous week. The oversubscription is partly attributable to favourable liquidity in the money market during the week due to government payments. The yield on the 91-day, 182-day, and 364-day papers remained unchanged at 7.3%, 8.2% and 9.9%, respectively. The acceptance rate rose to 95.0%, from 77.0% recorded the previous week, with the government accepting Kshs 31.0 bn of the Kshs 32.6 bn bids received.

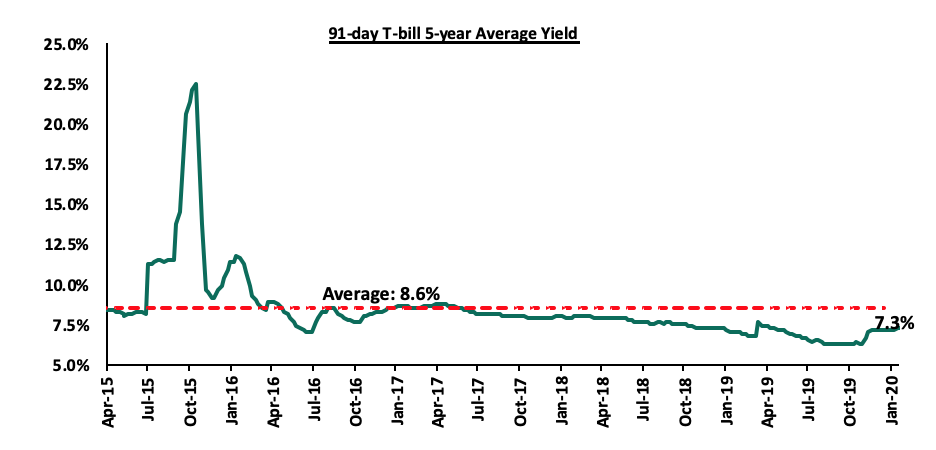

The 91-day T-bill is currently trading at a yield of 7.3%, which is below its 5-year average of 8.6%. The yield has, however, increased surpassing the 2019 average of 6.9% mainly attributable to the repeal of interest rate cap, which has seen banks prefer lending to the private sector, forcing the government to accept expensive bids in order to secure funds from investors.

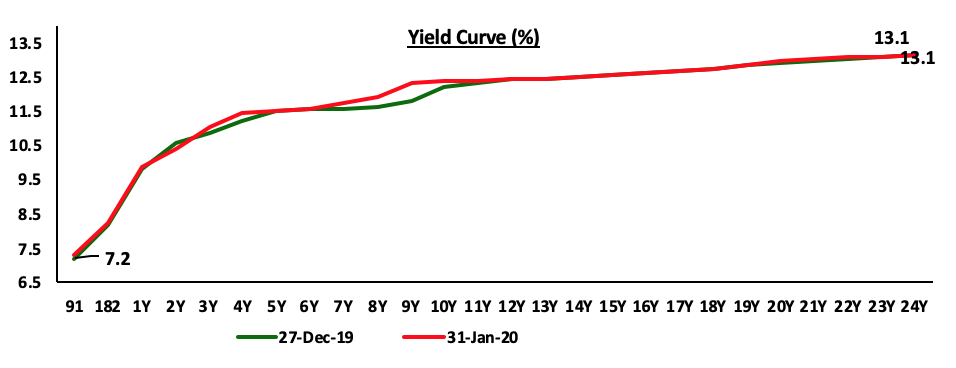

For the month of January, the Kenyan Government reopened two bonds namely, FXD1/2019/5 and FXD1/2019/10 with an effective tenor of 4.1 and 9.1 years, respectively, and coupon rates of 11.3% and 12.4%, respectively, in a bid to raise Kshs 50.0 bn for budgetary purposes. The overall subscription rate came in at 139.9%, with the government accepting Kshs 63.7bn of the Kshs 69.9 bn bids received. Further to this, we note that there was pent up demand on the FXD1/2019/5, which received bids worth Kshs 44.5 bn of the Kshs 69.9 bn worth of bids received for both bonds, in line with our expectations that investors will be attracted to the shorter-term paper due to its relatively shorter tenor, thus reduced duration risk, coupled with the high liquidity in the market. The yield on the 5-year bond came in at 11.5%, in line with our bidding range of 11.3%-11.5% while the yield on the 10-year bond came in at 12.5%, not in line with our bidding range of 12.1%-12.3%. The government accepted Kshs 63.7 bn out of the Kshs 69.9 bn worth of bids received, translating to an acceptance rate of 91.1%. We note that this was higher than the quantum of Kshs 50.0 bn for the issue, emphasizing the government’s aggressiveness in accepting money in an effort to meet its domestic borrowing target.

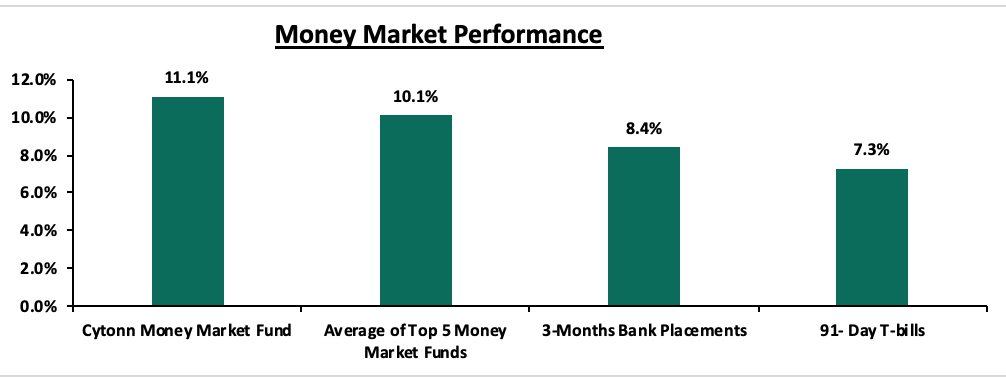

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.3%, while the average of Top 5 Money Market Funds came in at 10.1%, which was similar to what was recorded in the previous week. The Cytonn Money Market Fund closed the week at 11.1%, from 11.2% recorded the previous week.

Secondary Bond Market:

The yields on government securities in the secondary market remained relatively stable during the month of January, as the Central Bank of Kenya continued to reject expensive bids in the primary market. On an YTD basis, government securities on the secondary market have lost value given increasing yields across the board, as yields and prices have an inverse relationship.

Liquidity:

Liquidity in the money markets remained favourable during the month of January with the average interbank declining to 4.4%, from 5.8% recorded in December, supported by Government open market activities, which offset tax payments. During the week, the average interbank rate rose to 4.4% from 3.9% recorded the previous week, pointing to tightening liquidity in the money markets. The average interbank volumes rose by 35.9% to Kshs 17.9 bn, from Kshs 13.2 bn recorded the previous week.

Kenya Eurobonds:

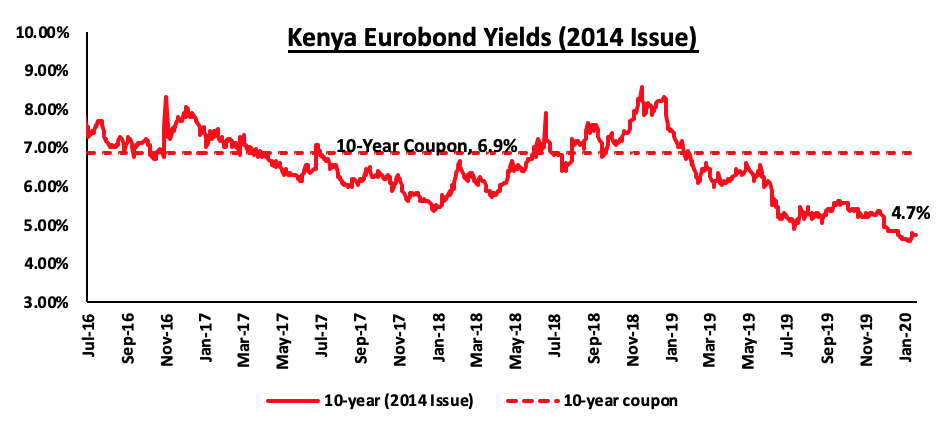

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 decreased by 0.1% points to 4.7% in January, from 4.8% in December 2019. During the week, the yield on the 10-year Eurobond decreased by 0.1% points to 4.7% from 4.8% recorded the previous week. We attribute the decline across the Eurobonds to the adoption of a looser monetary policy regime in the Eurozone and the United States, thus leading to a decline in yields in advanced economies. As a result, there was increased investor interest in Africa’s debt market, which increased demand pushing the prices up and consequently the yield down.

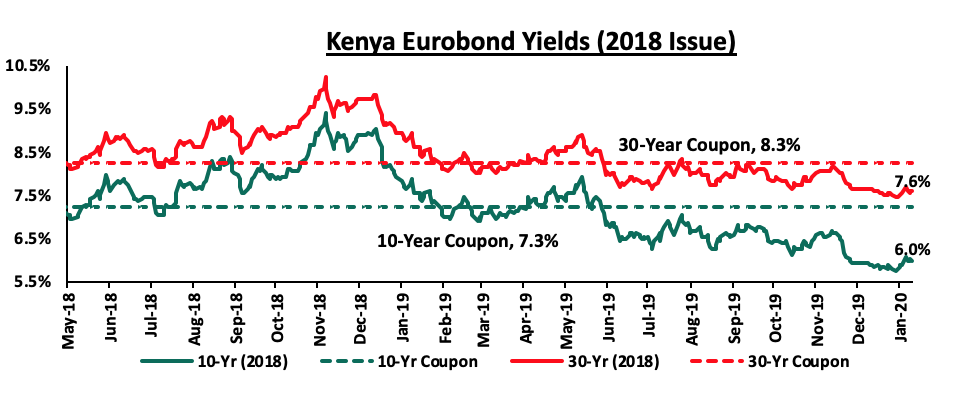

During the month, the yields on the 10-year issued in February 2018 increased by 0.1% points to close at 6.0% from 5.9% in December. The 30-year Eurobond issued in February 2018 declined by 0.1% points to close at 7.6% from 7.7% in December. During the week, the yield on the 10-year Eurobond increased by 0.1% points to close at 6.0% from 5.9% recorded the previous week. The 30-year Eurobond remained unchanged at 7.6%.

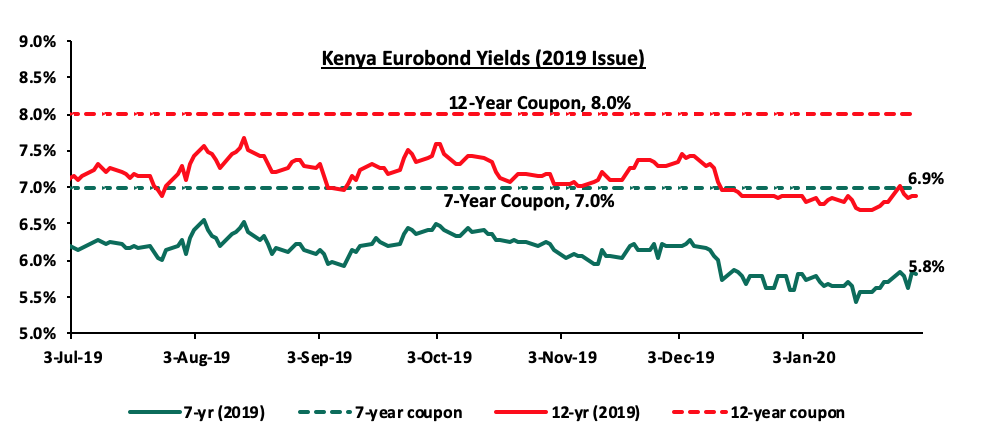

During the month, the yields on the newly issued dual-tranche Eurobond with 7-years increased by 0.2% points to 5.8% from 5.6% in December 2019. The 12-year Eurobond remained unchanged at 6.9%. During the week, the yields on both the 7-year and 12-year Eurobond increased by 0.1% points to 5.8% and 6.9%, from 5.7% and 6.8% recorded the previous week.

Kenya Shilling:

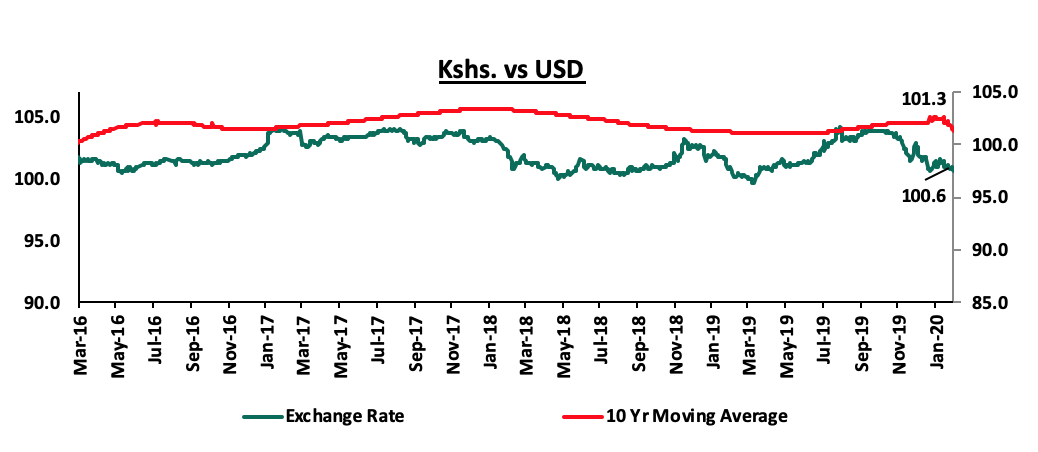

The Kenya Shilling appreciated by 0.7% against the US Dollar during the month of January to Kshs 100.6, from Kshs 101.3 at the end of December, mostly supported by inflows from tourism and diaspora remittances amid slow demand from importers. During the week, the Kenya Shilling appreciated against the US Dollar by 0.3% to close at Kshs 100.6, from Kshs 100.9 recorded in the previous week. On an YTD basis, the shilling has appreciated by 0.7% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar in the short term with a bias to a 2.4% depreciation by the end of 2020, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit was equivalent to 4.6% of GDP in 2019, from 5.0% recorded in 2018. This was mainly driven by lower imports of SGR-related equipment, resilient diaspora remittances which cumulatively stood at USD 2.8 bn in December 2019, a 3.7% increase from the USD 2.7 bn recorded in December, and strong receipts from transport and tourism services with preliminary data indicating that the number of tourists landing in the country stood at 132,019 in month of December, which was a 9.0% increase, compared to the 121,070 recorded in November 2019,

- High levels of forex reserves, currently at USD 8.5 bn (equivalent to 5.2-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Foreign capital inflows, with investors looking to participate in the domestic equities market, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

We, however, expect pressure on the Kenyan shilling to arise from:

- Increased oil imports bill, as a result of the U.S - Iran diplomatic row, which has seen average crude oil prices increase by 9.9% to an eight-month high to USD 72.0 a barrel in Jan 2020, from USD 65.5 a barrel in December 2019, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July, which has seen cumulative diaspora remittances increase by a 3.7% in the 12-months to December 2019 to USD 2.8 bn, from USD 2.7 bn in 2018.

|

Major Inflation Changes in the Month of October 2019 |

|||

|

Broad Commodity Group |

Price change m/m (January-20/December-19) |

Price change y/y (January-20/January-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.4% |

9.6% |

The m/m increase was due to an increase in prices of commodities such as onions, spinach, and carrots |

|

Transport Cost |

(0.0%) |

4.2% |

The m/m decline was mainly on account of the readjustment of public transport prices after the end of the festive period in December |

|

Housing, Water, Electricity, Gas and other Fuels |

0.5% |

2.7% |

The m/m increase was mainly as a result of an increase in the cost of house rent, kerosene, and gas |

|

Overall Inflation |

0.3% |

5.8% |

The m/m increase was due to a 0.4% increase in the food index which has a CPI weight of 36.0% |

The y/y inflation for the month of January decreased marginally to 5.78%, from 5.82% recorded in December 2019, which was in line with our projections of 5.7% - 6.1%. Month-on-month inflation also increased by 0.3%, which was attributable to:

- A 0.4% increase in the food and non-alcoholic drinks’ index, due to an increase in prices of significant food items including onions, spinach, and carrots, which increased by 5.3%, 4.4% and 3.2%, respectively,

- A 0.5% increase in the housing, water, electricity, gas and other fuels index, as a result of an increase in prices of some cooking fuels such as kerosene and house rent, which increased by 1.6% and 2.4% respectively, and,

- A marginal decline (0.04%) in the transport index on account of the readjustment of public transport prices after the end of the festive period in December.

Going forward, we expect the inflation rate to remain within the government set range of 2.5% - 7.5%. We, however, expect inflationary pressure to arise from increased fuel prices due to increased external uncertainties arising from the ongoing geopolitical events. Risks are also abounded on food inflation due to the locust invasion, which could have a negative impact on agricultural output.

Monthly Highlight:

The Monetary Policy Committee (MPC) met on 27th January 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC lowered the CBR by 25 bps to 8.25% from 8.50%, which was not in line with our expectations in our MPC- January 2020 Note where we had expected the MPC to maintain the CBR rate at 8.50% since there remains some opacity in terms of response from the banks and consumers. From the last MPC briefing, the Central Bank of Kenya (CBK) Governor had indicated that following the interest rate cap repeal, re-learning by banks and consumers was essential so that the market can react appropriately to any changes in monetary policy.

The rate cut was as a result of inflation remaining well anchored within the target range and the economy operating below its potential level, as evidenced by:

- Month on month inflation remained within the 2.5% - 7.5% target range, largely driven by stable food prices and lower electricity prices. Inflation stood at 5.8% in December, an increase from 5.6% recorded in November 2019, due to temporary effects of the increase in food prices and transport cost during the festive season,

- Stability in the foreign exchange market supported by the narrowing of the current account deficit to 4.6% of GDP in 2019, from 5.0% in 2018, driven by strong receipts from transport and tourism services, resilient diaspora remittances and lower imports of food and SGR related equipment. The foreign exchange market has also been supported by adequate forex reserves currently at USD 8.5 bn (equivalent to 5.2-months of import cover), that continue to provide adequate cover and a buffer against short-term shocks in the foreign exchange market, and,

- Improving private sector credit growth, despite being below historical averages, coming in at 7.1% in the 12-months to December. Strong growth in credit to the private sector was being observed in the consumer durables (26.0%), manufacturing (9.2%) and trade (8.9%).

As such, the MPC concluded that due to the tightening of fiscal policy, there was room for accommodative monetary policy to support economic activity. The committee also pointed out that there was a need to remain vigilant on possible effects of the increased uncertainties in the external environment. We maintain our expectations of a total 50 bps cut by the end of the year, to boost economic growth amid fiscal policy tightening.

During the week, the United Nations Conference on Trade and Development (UNCTAD) released the World Economic Situation and Prospects 2020 report, which indicated that Kenya’s GDP growth for 2020 is projected at 5.5%, the slowest pace in the last three years. The slow growth is mainly expected as a result of structural obstacles, including infrastructure gaps, skill shortages and low export diversification. The UNCTAD report also provides room for growth based on the robust private consumption, higher credit growth and rising public and private investments that will likely open up investment opportunities contributing to the GDP growth.

The table below shows the projected GDP growth rate for the year 2020. With the Central Bank of Kenya giving the highest projection of 6.2%.

|

|

Kenya 2020 Annual GDP Growth Outlook |

|

|

No. |

Organization |

Q1’2020 |

|

1. |

Central Bank of Kenya |

6.2% |

|

2. |

Citigroup Global Markets |

6.2% |

|

3. |

International Monetary Fund |

6.1% |

|

4. |

African Development Bank |

6.1% |

|

5 |

World Bank |

6.0% |

|

6. |

National Treasury |

6.0% |

|

7. |

Cytonn Investments Management PLC |

5.7% |

|

8. |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

|

|

Average |

6.0% |

In our view, we expect the country’s GDP growth to come in at around 5.6% - 5.8% mainly supported by an improvement in private sector credit growth, stable growth of the agricultural sector, and public infrastructural investments. There are several risks abound to economic growth which include; debt sustainability with the public debt to GDP ratio currently estimated at 62.0%, efforts by the Kenyan Government to reduce country’s fiscal deficit, which is currently at 6.2% of GDP, which might adversely affect economic growth due to reduced government spending as well as the current locust invasion which poses a systematic risk to agricultural production and food security and eventually lead to higher inflation that could slow down economic growth.

During the month, the Treasury released the Draft 2020 Budget Policy Statement, which highlights the current performance of the country’s economy and gives a medium-term outlook, in preparation for the FY2020/21 Budget for comments from the general public. The Budget Policy Statement (BPS) is a government policy document that sets out the strategic priorities, policy targets as well as a summary of the government’s spending plans in preparation for the FY 2020/21 Budget. It is prepared by the National Treasury and submitted to the Cabinet for approval. Upon approval, the BPS is submitted for deliberations in Parliament where a resolution will be passed to adopt it, with or without amendments. For more information see our Cytonn Weekly #04/2020.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 26.9% ahead of its domestic borrowing target, having borrowed Kshs 234.6 bn against a pro-rated target of Kshs 184.8 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the month of January, the equities market was on a downward trend, with NASI, NSE 20 and NSE 25 decreasing by (2.6%), (2.0%) and (1.9%), respectively. The decrease recorded in NASI was driven by declines in large-cap stocks such as Bamburi, Co-operative Bank, Equity Group, and Safaricom which recorded declines of (9.4%), (6.7%), (6.5%) and (3.3%), respectively, owing to price correction in banking stocks and foreign selling mainly in Safaricom. During the week, the market was on a downward trend, with NASI, NSE 20 and NSE 25 declining by (1.8%), (1.6%), and (1.3%), respectively, taking their YTD performance to losses of (2.6%), (2.0%) and (1.9%), respectively. The decline in NASI was largely due to losses recorded in large-cap counters such as DTBK, Stanchart, Equity Group and Safaricom, which recorded losses of (4.1%), (3.4%), (2.9%), and (2.7%), respectively.

Equities turnover increased by 6.1% during the month to USD 122.0 mn, from USD 114.9 mn in December 2019. Foreign investors remained net buyers for the month, with a net buying position of USD 5.2 mn, compared to December’s net buying position of USD 10.6 mn. During the week, equities turnover decreased by 11.8% to USD 24.8 mn, from USD 28.2 mn the previous week, bringing the year to date (YTD) turnover to USD 122.0 mn. Foreign investors were net sellers during the week, with a net selling position of USD 3.9 mn, from last week’s net buying position of USD 1.6 mn.

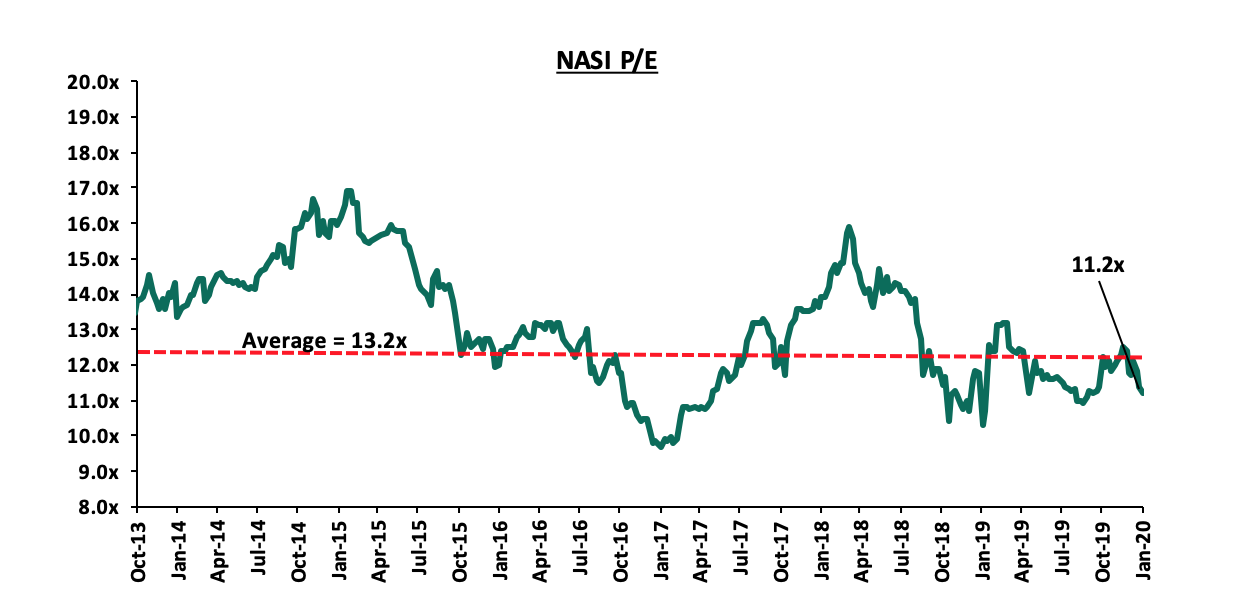

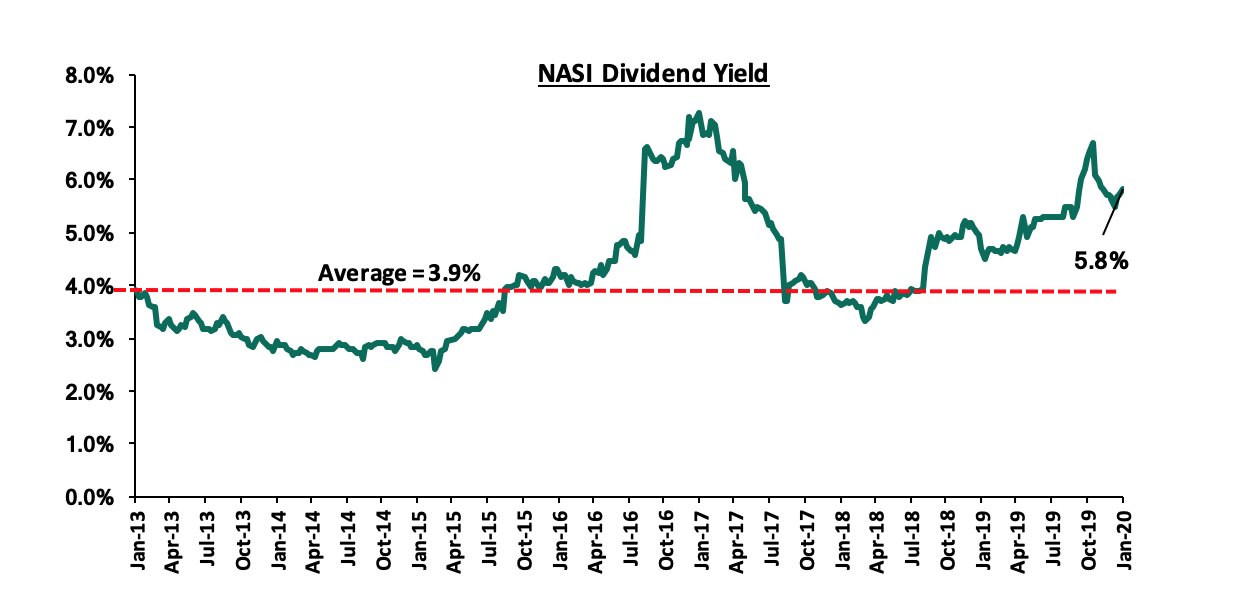

The market is currently trading at a price to earnings ratio (P/E) of 11.2x, 15.8% below the historical average of 13.2x, and a dividend yield of 5.8%, above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.2x is 15.5% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 34.9% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights

- Following the acquisition of National Bank of Kenya (NBK) by KCB Group in 2019, KCB further injected Kshs 5.0 bn into the subsidiary, which was in breach of various capital adequacy ratios. According to NBK’s Q3’2019 financial results, its core capital liabilities ratios, core capital risk-weighted assets ratio and total capital risk-weighted ratio were 6.8%, 9.0% and 11.6% below the minimum statutory requirements of 8.0%, 11.0% and 15.0%, respectively. Prior to the capital injection, with a Non-Performing Loan (NPL) ratio of 47.9% in Q3’2019, NBK’s bad debts stood at Kshs 31.4 bn. Hence, before capitalization, KCB Group indicated that it would set up effective loan portfolio management measures to maintain a favourable loan portfolio quality as well as employing aggressive strategies to recover key NPLs, with NBK’s Managing Director, Paul Russo indicating that the lender was pursuing the top 30 debtors who owed it about Kshs 22.0 bn. We expect that with the injection, NBK will be well-capitalized to continue its operations separately. KCB Group’s profitability, on the other hand, will be affected as it cleans up NBK’s books. For more information, please see Cytonn 2020 Markets Outlook.

- The Central Bank of Kenya gave a go-ahead to Nigerian lender, Access Bank Plc. to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount, with Access Bank Plc. targeting to enhance its corporate and retail banking business in Kenya through the acquisition. Access Bank is Nigeria’s largest lender by assets with an asset base of USD 16.1 bn (equivalent to Kshs 1.6 tn). Once completed, this will be the first bank acquisition in 2020, with the deal expected to be completed in February 2020, and will be in line with our expectation of consolidation in the Kenyan banking sector as highlighted in our Q3’2019 Banking Sector Report. For a more detailed analysis, please see Cytonn Weekly #03/2020.

- Jubilee Holdings announced plans to lay off 52 employees as it completes splitting of its insurance business in Kenya to increase efficiency and management focus and to comply with the revised 2010 Insurance Act, cap 487, which requires all composite companies to have separate entities, by separating short-term underwriting business from the long-term underwriting business. For more information, please see Cytonn Weekly #04/2020.

- During the week, SBM Bank (Kenya) Limited filed a petition under the Insolvency Act 2015 to liquidate East African Cables (EAC), which is unable to pay its obligations owed to the lender amounting to Kshs 285.0 mn. The listed firm has had banking facilities with other lenders such as Standard Bank Plc (Kenya & Tanzania), Stanchart, Ecobank Kenya and Equity Bank, and in a statement to stakeholders, EAC revealed that it has successfully completed the restructuring of 82.0% of its total debt obligations and has made significant progress to complete the remaining phase, including debt owed to SBM Bank. However, the legal action brought against the company is an indication of the financial strain it is undergoing in meeting its obligations having recorded consecutive losses for the last three years to 2018. TransCentury, the mother company of EAC also dealing with financial turbulence, recorded a negative equity position of Kshs 3.0 bn as per its H1’2019 financial results. It’s group-wide non-current liabilities totalled to Kshs 6.8 bn, while net finance costs stood at Kshs 322.3 mn in the period under review. Similarly, loan defaults have seen listed companies such as Mumias Sugar being suspended and placed under receivership by KCB Group for defaulting on loans amounting to Kshs 12.5 bn owed to the bank and other creditors. According to Moody’s, commercial banks’ earnings will come under pressure in 2020 because of increased exposure to high Non-Performing Loans largely due to the accumulation of payment arrears by the government and financial problems affecting a cross-section of corporates. As the tough operating environment continues to persist, we expect commercial banks’ asset quality to be affected.

Universe of Coverage

|

Banks |

Price at 24/01/2020 |

Price at 31/01/2020 |

w/w change |

m/m change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.0 |

3.0 |

0.0% |

(1.0%) |

3.0 |

4.8 |

15.0% |

75.0% |

0.3x |

Buy |

|

Diamond Trust Bank |

116.8 |

112.0 |

(4.1%) |

2.8% |

109.0 |

189.0 |

2.3% |

71.1% |

0.5x |

Buy |

|

I&M Holdings*** |

57.5 |

55.0 |

(4.3%) |

1.9% |

54.0 |

75.2 |

7.1% |

43.8% |

0.9x |

Buy |

|

KCB Group*** |

51.8 |

52.3 |

1.0% |

(3.2%) |

54.0 |

64.2 |

6.7% |

29.6% |

1.4x |

Buy |

|

Jubilee Holdings |

360.0 |

360.0 |

0.0% |

2.6% |

351.0 |

453.4 |

2.5% |

28.4% |

1.2x |

Buy |

|

Co-op Bank*** |

15.6 |

15.3 |

(2.2%) |

(6.7%) |

16.4 |

18.1 |

6.6% |

25.2% |

1.3x |

Buy |

|

Sanlam |

17.3 |

17.6 |

1.4% |

2.0% |

17.2 |

21.7 |

0.0% |

23.6% |

0.7x |

Buy |

|

Equity Group*** |

51.5 |

50.0 |

(2.9%) |

(6.5%) |

53.5 |

56.7 |

4.0% |

17.4% |

1.9x |

Accumulate |

|

Standard Chartered |

205.0 |

198.0 |

(3.4%) |

(2.2%) |

202.5 |

211.6 |

9.6% |

16.5% |

1.5x |

Accumulate |

|

Barclays Bank*** |

13.1 |

13.1 |

(0.4%) |

(2.2%) |

13.4 |

13.0 |

8.4% |

8.0% |

1.7x |

Hold |

|

NCBA |

36.5 |

36.1 |

(1.1%) |

(2.0%) |

36.9 |

37.0 |

4.2% |

6.6% |

0.8x |

Hold |

|

Liberty Holdings |

10.4 |

10.3 |

(0.5%) |

(0.5%) |

10.4 |

10.1 |

4.9% |

2.6% |

0.9x |

Lighten |

|

CIC Group |

2.9 |

2.9 |

(1.7%) |

7.1% |

2.7 |

2.6 |

4.5% |

(3.5%) |

1.0x |

Sell |

|

Stanbic Holdings |

100.8 |

114.0 |

13.2% |

4.3% |

109.3 |

103.1 |

4.2% |

(5.4%) |

1.2x |

Sell |

|

Britam |

9.2 |

8.8 |

(5.2%) |

(2.7%) |

9.0 |

6.8 |

0.0% |

(22.9%) |

0.9x |

Sell |

|

HF Group |

5.7 |

5.6 |

(1.8%) |

(13.3%) |

6.5 |

4.2 |

0.0% |

(25.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industry Reports

During the month, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) December 2019, highlighting the continued growth of the hospitality sector. The key take-outs were as follows:

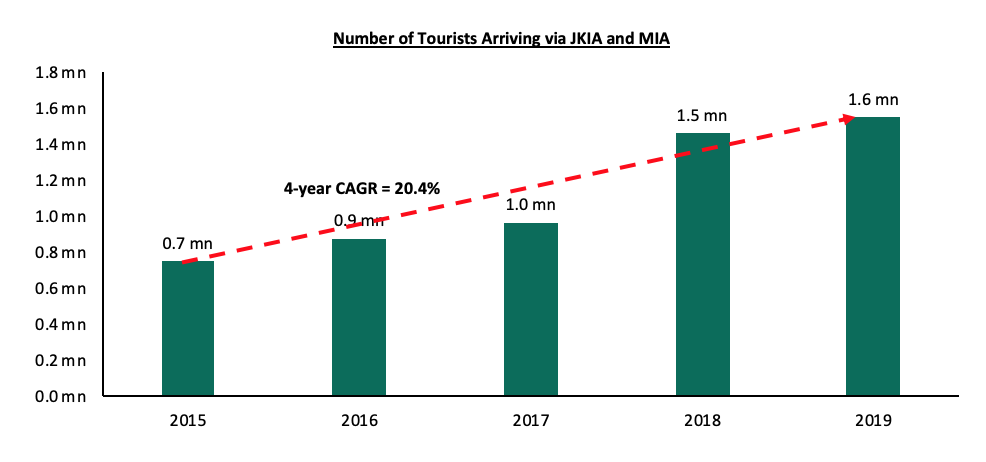

- The total number of visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) increased by 6.2% to 1.6 mn persons in 2019, from 1.5 mn persons in 2018, attributed to the calm political environment and improved security, which has continued to boost tourists’ confidence in the country, thus making it a preferred travel destination for both business and holiday travelers,

Source: Kenya National Bureau of Statistics (KNBS)

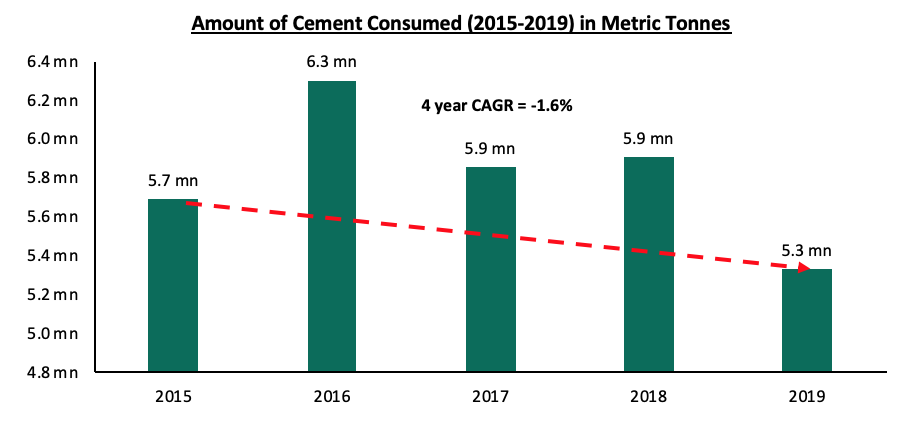

- The quantity of cement consumed dropped by 9.7% to 5.3 mn metric tonnes in 2019, from 5.9 mn metric tonnes in 2018. The reduction in consumption of cement illustrates reduced activities in the construction sector, which were crippled by the tough economic environment and delay in the processing of construction permits as raised by the Architectural Association of Kenya (AAK).

Source: Kenya National Bureau of Statistics (KNBS)

During the month, Hass Consult, a local real estate agency, released the Hass Property Sales and Rental Index Q4’2019. As per the report, the residential sector’s performance was constrained by the existing oversupply in some areas and a tough economic environment. The sector recorded a q/q price growth of 1.2%, and an annual price decline of 3.5%, with semi-detached houses recording an annual price growth of 6.2% and a q/q growth of 1.5%. Other key take-outs were as follows;

-

- In the detached unit market, Ridgeways and Muthaiga recorded the highest annual price growth in the suburb category, at 10.8% and 8.4%, and a q/q change of 2.9% and 0.5%, respectively,

- In Satellite Towns, Limuru and Kiambu posted the highest annual growth at 9.5% and 4.5%, and a q/q growth at 3.3% and 0.6%, respectively,

- The detached markets recorded an overall price decline of 7.1% and a marginal q/q growth of 1.4%. Juja registered the lowest growth with prices declining at an average annual and quarterly rate of 9.6% and 1.9%, respectively,

- In terms of rents, detached units in Westlands recorded the highest annual and quarterly increase in asking rents at 5.1% and 0.9%, respectively,

- In the apartments market, Westlands and Upperhill registered the highest annual growth in asking prices at 2.7% and 2.6%, respectively, and a q/q growth/(decline) of 0.4% and (0.6%), respectively. This is in comparison to the overall average price appreciation of apartments at annual and q/q rates of 5.6% and 1.7%, respectively,

- Apartments in Lang’ata registered the highest annual growth in asking rents at 15.9% and q/q growth at 4.8%,

- In Satellite Towns, apartments recorded the highest price growth in Ngong and Athi River at 9.2% and 9.1%, respectively, while Ngong and Thika towns registered the highest annual growth in rents at 18.6% and 10.6%, respectively, while Ongata Rongai posted the highest q/q rent growth at 4.0%.

The report is in tandem with the Cytonn Annual Markets Review 2019, according to which, while prices declined across the market by 1.3% annually, with the tough economic environment exerting pressure on the prices and market uptake, rental yields notably improved across the residential market with apartments and detached units recording average rental yields of 5.6% and 4.3% in 2018, respectively, from 5.2% and 4.2% in 2019, respectively. This is attributable to an increase in occupancy rates to an average of 85.7% in comparison to 2018's 81.0%, as more individuals continued to opt for rental properties amidst the heightened need for affordable products in the market. We expect the growing appetite for affordable homes to stimulate uptake in the low and mid-end areas such as Thindigua/Ridgeways, Athi River, as well as upper-mid end areas such as Runda Mumwe fuelled by the relatively high returns of 8.2%, 7.6%, and 7.6%, respectively, in comparison to the overall residential market average of 6.1%.

The firm also released the Hass Land Index Q4’2019, according to which asking land prices appreciated annually and quarterly by 1.7% and 0.4%, respectively. The key take-outs from the report were as follows;

-

- Land prices in Nairobi suburbs rose marginally over the quarter at 0.4% and 1.7% y/y. Spring Valley recorded the highest annual and quarterly growth at 8.5% and 2.6%, respectively, as it continues to benefit from the Westlands Link Road, which has made the area more accessible. On the other hand, Riverside registered the lowest annual growth with prices declining by 9.2%, while Parklands had the lowest quarterly growth with prices declining by 2.4% on the back of a decline in development activities in these nodes, attributed to the existing oversupply of commercial office and retail space, and,

- Land prices in satellite towns recorded an annual growth of 6.9% and a q/q growth of 1.9%. Kitengela posted the highest annual growth at 10.7%, while Ongata Rongai recorded the highest growth over the quarter at 1.4%. Mlolongo and Syokimau recorded the lowest annual and quarterly growth where asking land prices grew/(declined) by 2.8% and (0.8%), respectively.

This is in line with our Cytonn Annual Markets Review 2019, according to which land in satellite areas recorded the highest annual appreciation at 7.5%, in comparison to Nairobi suburbs’ average of 0.7%. We expect the continued focus on affordable housing to boost land asking prices in Satellite Towns such as Ruiru, Ruaka and Syokimau supported by the ongoing infrastructural improvements such as the construction of the 17.4-km Western Bypass that starts from Gitaru and links the Northern Bypass to the Southern Bypass and terminates at Ruaka, in Kiambu County.

- Residential Sector

During the month, China State Construction handed over the 228 2-bedroom units of the first phase of Park Road affordable housing project in Ngara to the Kenyan National Government. The 1,370-unit project sits on a 7.9-acre parcel of land in Ngara, Nairobi, with Phase 2 expected to be completed by June 2020. Once complete, the project will comprise of 30 SQM 1-bed, 40 SQM 2-bed and 60 SQM 3-bed social housing units selling at Kshs 1.5 mn, Kshs 2.0 mn and Kshs 3.6mn, respectively, which translates to Kshs 53,056 per SQM, in addition to 60 SQM 2-bed and 80 SQM 3-bed affordable housing units selling at Kshs 3.0 mn and 4.0 mn, respectively, which translates to Kshs 50,000 per SQM. For more information, see Cytonn Weekly #03/2020.

United Kingdom Climate Investment (UKCI), a joint venture between the Green Investment Group, a UK-based specialist developer and investor of green infrastructure, and the United Kingdom Government’s Department for Business, pledged to invest GBP 30 mn (Kshs 3.9 bn) towards affordable green housing in Kenya, a major boost for the Kenyan Government’s affordable housing agenda. The pledge will be delivered through a locally managed vehicle that also seeks to raise between Kshs 8.0 bn and Kshs 25.0 bn, from Kenyan and international institutional investors, to be geared towards alleviating the affordable housing shortage while embedding green design standards and stimulating institutional investment in sustainable buildings locally. With the affordable housing initiative’s estimated total cost of Kshs 1.3 tn, the investment will provide a significant impetus to the programme, which aims to deliver 500,000 units by 2022. For more information, see Cytonn Weekly #04/2020.

- Retail Sector

During the month, Spur Corporation Ltd, a South African restaurant chain, announced plans to open two additional outlets in Kenya in 2020, as part of its expansion strategy. The restaurant chain currently has 7 outlets in Kenya which comprise of 5 steak houses, a restaurant and a pizzeria. This is an indication of the continued expansion efforts by international retailers aimed at increasing their local foothold in the country. For more information, see Cytonn Weekly #03/2020.

Local retailer, Naivas Limited signed a deal to sell 30.0% of its business to Paris-based private equity fund, Amethis Finance, for an undisclosed amount. The PE firm, which has presence across Africa in cities such as Accra, Abidjan and Casablanca aims to grant entrepreneurs access to external growth opportunities while improving their efficiency and governance, and therefore, we expect that the move will boost the local retailer’s expansion strategy that has seen it open 57 branches across the country, while also help it avoid corporate governance and management issues that have plagued retail giants such as Nakumatt, Choppies, and Uchumi. For more information, see Cytonn Weekly #04/2020.

- Hospitality Sector

The hospitality sector continued to exhibit investor interest during the month with Avani Hotels & Resorts, a Thai hospitality chain, announcing plans to open their first property in East Africa. The 15-floor property dubbed “Avani Nairobi Suites” is currently under development by Fedha Group, and will be in Westlands. It will consist of 90 1-bedroom, 20 2-bedroom and 10 3-bedroom serviced apartments.

Pride Inn, a local hospitality group, revealed plans of undertaking its first management facility, Azure Hotel, a Kshs 1.2 bn five-star hotel with 164-rooms located in Westlands. Currently, Pride Inn operates various own-facilities in Westlands, Nairobi and others in Mombasa. For more analysis, see Cytonn Weekly #04/2020.

- Listed Real Estate

During the month, Acorn Group, a Kenyan real estate developer, listed its Kshs 4.3 billion green bond on the Nairobi Securities Exchange (NSE) and the London Stock Exchange (LSE). The green bond is intended to finance the developer’s sustainable and climate-resilient student accommodation in Kenya. Acorn Group has already put up approximately 1,000 hostel units located in Parklands, Jogoo Road and Ruaraka under the Qwetu brand. For more analysis, see Cytonn Weekly #03/2020.

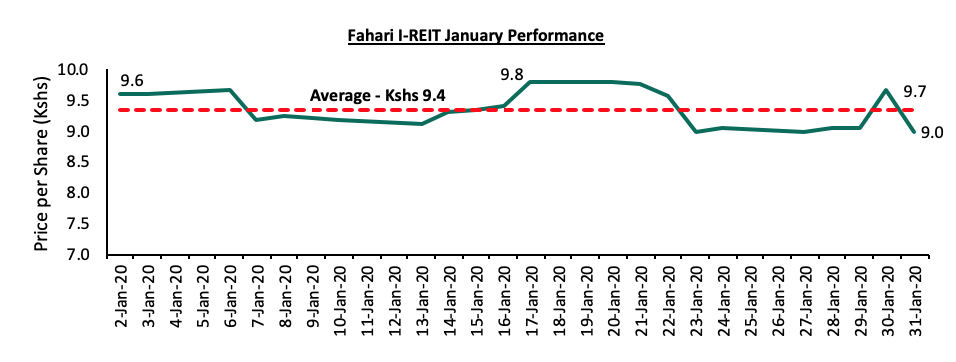

On the bourse, Stanlib Fahari I-REIT share price per share declined by 4.5% to close at Kshs 9.0 at the end of January, from Kshs 9.4 at the end of December 2019. On average, the REIT traded at Kshs 9.4 per share, a 5.6% increase from an average of Kshs 8.9 per share in December 2019. The instrument has continued to trade in low prices and volumes, constrained by negative market sentiments around REITs performance, inadequate investor knowledge and lack of institutional support for REITs.

We expect the real estate sector to continue recording increased activities in the residential, retail and listed real estate sectors supported by National Government’s commitment towards the Affordable Housing Initiative, the continued demand for office and retail space in prime locations and the increasing availability of alternative sources of capital in the real estate industry.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.