Cytonn Monthly-October 2021

By Research Team, Oct 31, 2021

Executive Summary

Fixed Income

During the month of October, T-bills remained undersubscribed, with the overall subscription rate coming in at 57.9%, down from 67.3% recorded in September 2021, mainly attributable to the tightened liquidity in the money market. Overall subscription rates for the 91-day, 182-day and 364-day papers came in at 97.5%, 62.1% and 37.9%, down from 119.2%, 72.8% and 40.9% in September 2021. The yields on the 91-day, 182-day and 364-day papers increased by 12.0 bps, 10.8 bps and 38.2 bps to 7.0%, 7.4% and 8.1%, respectively. In the Primary Bond Market, the government re-opened three bonds namely; FXD1/2013/15, FXD1/2019/15 and FXD1/2021/25 in a bid to raise Kshs 60.0 bn for budgetary support. The bonds were undersubscribed with the subscription rate coming in at 92.5% attributable to the tightened liquidity in the money market. The inflation rate for the month of October declined to 6.5%, from 6.9% in September, mainly driven by the decline in the fuel prices;

Equities

During the month of October, the equities market was on a downward trajectory, with NSE 20, NSE 25, and NASI declining by 3.4%, 1.6% and 0.2%, respectively. The equities market performance was driven by losses recorded by banking stocks such as NCBA, Co-operative Bank, KCB and Diamond Trust Bank (DTB-K), of 7.3%, 6.4%, 6.0% and 5.6%, respectively. The losses were however mitigated by gains recorded by Safaricom of 1.7%. During the month, the Central Bank of Kenya (CBK) released the Commercial Banks’ Credit Survey Report for the quarter ended June 2021, highlighting that the banking sector’s loan book recorded a 6.9% y/y growth, with gross loans increasing to Kshs 3.1 tn in June 2021, from Kshs 2.9 tn in June 2020. On a q/q basis, the loan book increased by 2.3% from Kshs 3.0 tn in March 2021;

Real Estate

During the month, two industry reports were released; Knight Frank’s Africa Logistics Industrial Review H1’2021 report, and Central Bank of Kenya’s (CBK) Monetary Policy Committee Hotels Survey-September 2021. In the residential sector, the Kenya Mortgage Refinance Company (KMRC), announced that it is awaiting approval from the Capital Markets Authority (CMA) to raise Kshs 10.0 bn from investors through a corporate bond to be issued by December 2021, to support financing of low cost homes through mortgages. In the retail sector, Naivas Supermarket, a local retailer, opened a new outlet in Nairobi CBD at Uchumi City Centre along Agha Khan Walk, taking up 20,000 SQFT prime space previously occupied by Uchumi Supermarket, and bringing its total outlets to 77. In the hospitality sector, Nairobi was voted as Africa’s leading business travel destination in the 28th World Travel Awards supported by availability of conferencing facilities such as KICC, top rated accommodation facilities, infrastructure, and, stable political and macro-economic environment;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.60%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.99% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training Monday through Saturday, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- The court ordered the placement of the CHYS and CPN into administration to allow for proper reorganization of the two funds that have been facing some liquidity challenges. For more information, click here;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Kenya’s 2022 Election Campaign Promises Tracker

Election Watch:

Kenya’s next Presidential Elections are set to be held in August 2022 and with less than a year left, we have seen the political temperatures in the country continue to rise. As such, we shall be analyzing the economic campaign promises made by the politicians and the impact these promises will have in the economy. To read more on the same, click here;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of October, T-bills remained undersubscribed, with the overall subscription rate coming in at 57.9%, down from 67.3% recorded in September 2021, mainly attributable to the tightened liquidity in the money market with the average interbank rate increasing by 0.5% points to 5.3%, from 4.8% recorded in September. Overall subscription rates for the 91-day, 182-day and 364-day papers came in at 97.5%, 62.1% and 37.9%, down from 119.2%, 72.8% and 40.9% in September 2021. The yields on the 91-day, 182-day and 364-day papers increased by 12.0 bps, 10.8 bps and 38.2 bps to 7.0%, 7.4% and 8.1%, respectively. For the month of October, the government accepted a total of Kshs 52.1 bn, out of the Kshs 55.6 bn worth of bids received, translating to a 93.7% acceptance rate.

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 66.0%, down from 74.2% recorded the previous week, partly attributable to the tightened liquidity in the money market coupled with the investor’s shift to the EABL corporate bond market in search of higher yields. EABL's recently issued corporate bond recorded an oversubscription of 344.5% as they were seeking to raise Kshs 11.0 bn and received bids worth Kshs 37.9 bn. The 182-day paper recorded the highest subscription rate, receiving bids worth Kshs 7.4 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 74.2%, an increase from the 65.3% recorded the previous week. The subscription rate for the 91-day paper declined to 66.0% from 163.0% while the subscription rate for the 364-day paper increased to 57.9%, from 47.6% recorded the previous week. The yields on the 91-day, 182-day and 364-day papers increased by 2.0 bps, 6.9 bps and 13.4 bps, to 7.0%, 7.6% and 8.5%, respectively. The government continued to reject expensive bids, accepting bids worth Kshs 13.9 bn out of the Kshs 15.8 bn bids received, translating to an acceptance rate of 87.9%.

In the Primary Bond Market, the government re-opened three bonds namely; FXD1/2013/15, FXD1/2019/15 and FXD1/2021/25 for the month of October, which recorded a subscription rate of 92.5%. The undersubscription was attributable to the tightened liquidity in the money market during the month. The government sought to raise Kshs 60.0 bn for budgetary support, received bids worth Kshs 55.5 bn and accepted bids worth Kshs 52.0 bn, translating to a 93.8% acceptance rate. Investors preferred the longer-tenure issue i.e. FXD1/2021/25, which received bids worth Kshs 28.7 bn, representing 51.7% of the total bids received, owing to its higher yield. The coupons for the three bonds were; 11.3%, 12.3% and 13.9%, and the weighted average yield rates during the issue were; 11.9%, 12.8% and 13.8%, for FXD1/2013/15, FXD1/2019/15 and FXD1/2021/25, respectively.

For the month of November, the government re-opened one bond, FXD1/2019/20, with an effective tenor of 17.5 years and issued a new 5-year bond, FXD1/2021/5. The government is seeking to raise Kshs 50.0 bn for budgetary support and the period of sale for the issues is 25th October to 9th November 2021. The coupon rate for FXD1/2019/20 is 12.9%, while that of FXD1/2021/5 will be market determined. We expect an oversubscription on the bond owing to the renewed investor confidence in the bond market despite the tightening liquidity. Our recommended bidding range for the bond is: 13.1%-13.2% for FXD1/2019/20 and 10.5% -10.9% for FXD1/2021/5 within which bonds of a similar tenor are trading.

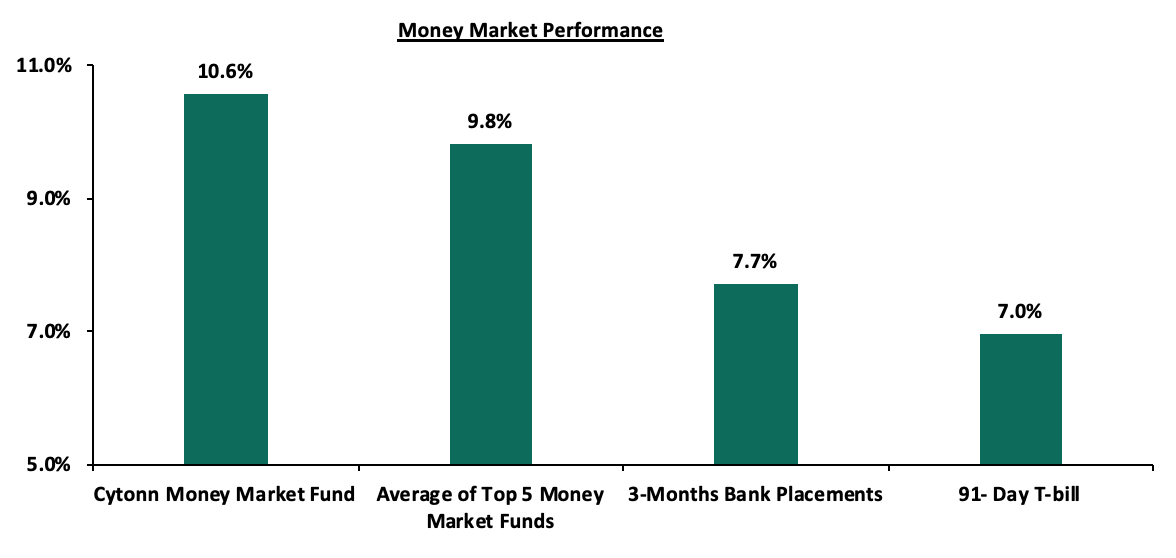

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 2.0 bps to 7.0%. The average yield of the Top 5 Money Market Funds remained relatively unchanged at 9.8% while the yield on the Cytonn Money Market Fund increased marginally by 0.02% points to 10.56%, from 10.54% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 29th October 2021:

|

Money Market Fund Yield for Fund Managers as published on 29th October 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.08% |

10.60% |

|

2 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

3 |

Nabo Africa Money Market Fund |

9.26% |

9.70% |

|

4 |

Sanlam Money Market Fund |

9.10% |

9.53% |

|

5 |

Madison Money Market Fund |

8.85% |

9.25% |

|

6 |

CIC Money Market Fund |

8.73% |

9.04% |

|

7 |

Apollo Money Market Fund |

9.10% |

8.95% |

|

8 |

GenCapHela Imara Money Market Fund |

8.41% |

8.78% |

|

9 |

British-American Money Market Fund |

8.19% |

8.50% |

|

10 |

Co-op Money Market Fund |

8.16% |

8.50% |

|

11 |

Dry Associates Money Market Fund |

8.08% |

8.38% |

|

12 |

NCBA Money Market Fund |

8.04% |

8.37% |

|

13 |

ICEA Lion Money Market Fund |

8.01% |

8.34% |

|

14 |

Orient Kasha Money Market Fund |

7.91% |

8.23% |

|

15 |

Old Mutual Money Market Fund |

7.25% |

7.49% |

|

16 |

AA Kenya Shillings Fund |

6.50% |

6.69% |

Source: Business Daily

Secondary Bond Market:

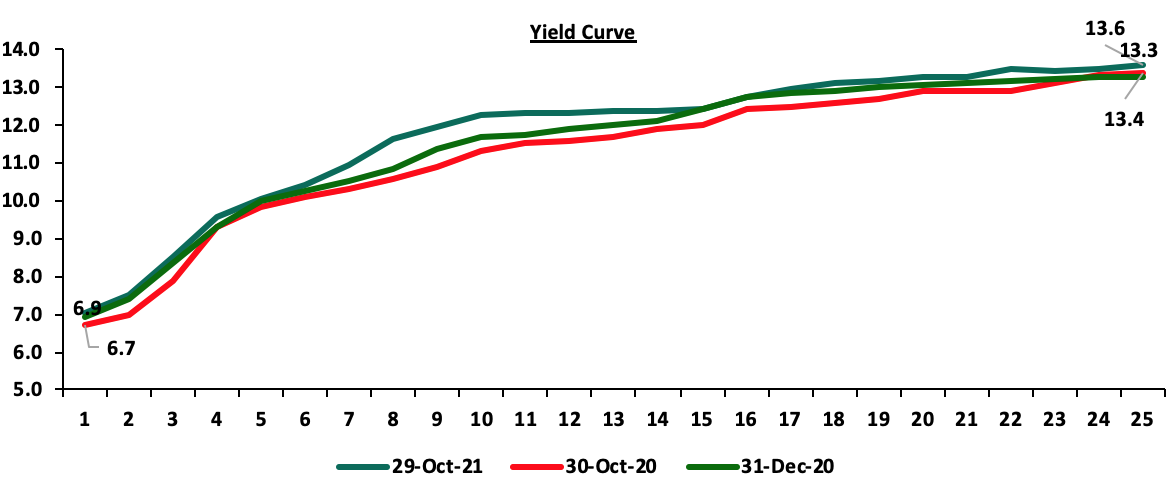

In the month of October, the yields on government securities in the secondary market remained relatively stable with the FTSE NSE bond index declining marginally by 0.1%, to close the month at Kshs 96.7, bringing the YTD performance to a decline of 1.3%. The secondary bond turnover declined by 44.5% to Kshs 63.6 bn, from Kshs 114.7 bn recorded in September. On a year on year basis, bonds turnover increased by 30.8% to Kshs 740.2 bn, from Kshs 566.1 bn worth of T-bonds transacted over a similar period last year. The chart below is the yield curve movement during the period;

Liquidity:

Liquidity in the money markets tightened in the month of October, with the average interbank rate increasing to 5.3%, from 4.8% recorded in September. During the week, liquidity in the money market tightened as well, with the average interbank rate increasing to 4.9%, from 4.6% recorded the previous week, partly attributable to tax remittances which offset government payments. The average interbank volumes traded declined by 12.6% to Kshs 10.2 bn, from Kshs 11.6 bn recorded the previous week.

Kenya Eurobonds:

During the month, the yields on the Eurobonds were on an upward trajectory with the 10-year Eurobond issued in 2014 and 7-year issued in 2019 both increasing by 0.5% points to 3.7% and 5.5%, from 3.2% and 5.0%, respectively, while the 10-year Eurobond issued in 2018 and 12-year bond issued in 2019 both increased by 0.3% points to 5.7% and 6.8%, from 5.4% and 6.5%, respectively. Similarly, the 30-year Eurobond issued in 2018 increased by 0.4% points to 7.9%, from 7.5%, while the 12-year issued in 2021 increased by 0.1% points to 6.6%, from 6.5% recorded in September 2021.

During the week, the yields on Eurobonds recorded mixed performance, with the 10-year bond issued in 2018 decreasing by 0.1% points to 5.7%, from 5.8% recorded the previous week. On the other hand, the yields on the 10-year bond issued in 2014, the 30-year issued in 2018, 7-year issued in 2019 and 12-year bonds issued in 2019 and 2021 remained relatively unchanged at 3.7%, 7.9%, 5.5%, 6.8% and 6.6%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-20 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

- |

|

30-Sep-21 |

3.2% |

5.4% |

7.5% |

5.0% |

6.5% |

6.5% |

|

22-Oct-21 |

3.7% |

5.8% |

7.9% |

5.5% |

6.8% |

6.6% |

|

25-Oct-21 |

3.6% |

5.8% |

7.9% |

5.5% |

6.8% |

6.7% |

|

26-Oct-21 |

3.6% |

5.8% |

7.9% |

5.5% |

6.8% |

6.6% |

|

27-Oct-21 |

3.6% |

5.7% |

7.9% |

5.4% |

6.7% |

6.6% |

|

28-Oct-21 |

3.7% |

5.7% |

7.9% |

5.5% |

6.8% |

6.6% |

|

Weekly Change |

0.0% |

(0.1%) |

0.0% |

0.0% |

0.0% |

0.0% |

|

M/m Change |

0.5% |

0.3% |

0.4% |

0.5% |

0.3% |

0.1% |

|

YTD Change |

(0.2%) |

0.5% |

0.9% |

0.6% |

0.9% |

- |

Source: Reuters

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 0.7% against the US Dollar to close the month at Kshs 111.2, from Kshs 110.5 recorded at the end of September 2021, mostly attributable to increased dollar demand from energy and merchandise importers. During the week, the Kenyan shilling depreciated marginally by 0.1% against the US dollar to close the week at Kshs 111.2, from Kshs 111.1 recorded the previous week. On a YTD basis, the shilling has depreciated by 1.9% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect the shilling to remain under pressure for the remainder of 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.2 bn (equivalent to 5.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July, 2021 coupled with the USD 407.0 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June, 2021, and,

- Improving diaspora remittances evidenced by an 18.8% y/y increase to USD 309.8 mn in September 2021, from USD 260.7 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlights:

- October Inflation

The y/y inflation for the month of October declined to 6.5%, from the 6.9% recorded in September, in line with our expectations. This is the first decline since April 2021 when the inflation rate declined to 5.8%, from 5.9%. On a m/m basis, the inflation rates increased by 0.5%, driven by a 1.1% increase in food & non-alcoholic beverages coupled with a 0.7% increase in housing, water, electricity, gas and other fuels. Notably, the transport index was the only decliner on a m/m basis, declining by 0.4%, attributable to the recent decline in fuel prices with Super Petrol prices decreasing by 3.7% to Kshs 129.7 per litre, from Kshs 134.7 per litre. Diesel and Kerosene prices also declined by 4.3% and 6.6% to Kshs 110.6 and Kshs 103.5 per litre, from Kshs 115.6 and Kshs 110.8 per litre, respectively. The table below shows a summary of both the year on year and month on month commodity groups’ performance;

|

Major Inflation Changes – October 2021 |

|||

|

Broad Commodity Group |

Price change m/m (October-21/September-21) |

Price change y/y (October-21/ October-20) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.1% |

10.6% |

The m/m increase was mainly contributed by increase in prices of tomatoes, oranges and sugar among other food items. The increase was however mitigated by a decline in prices of spinach, beans and potatoes |

|

Housing, Water, Electricity, Gas and other Fuel |

0.7% |

5.8% |

The m/m increase was as a result of increase in the price electricity, cooking gas and single room house rent

|

|

Transport Cost |

(0.4%) |

8.2% |

The m/m decline was as a result of the decrease in prices of super petrol and diesel in the month of October |

|

Overall Inflation |

0.5% |

6.5% |

The m/m increase was due to a 1.1% increase in the Food & Non-Alcoholic Beverages index as compared to the 0.1% increase in the month of September |

Source: KNBS

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5%. Despite the decline in October’s inflations rates, we anticipate inflation pressures to remain elevated in the short term as global fuel prices continue to rise due to supply bottlenecks.

Monthly Highlights:

- The Kenya Revenue Authority (KRA) released the Q1’2021/2022 Revenue Performance highlighting that the total revenue collected was Kshs 476.6 bn, against the target of Kshs 461.7 bn, representing an out-performance rate of 103.2% partly attributable to improved business performance following the relaxation of COVID-19 containment measures. For more information, see our Cytonn Weekly #40/2021,

- The headline Purchasing Manager’s Index (PMI) for the month of September 2021 decreased to 50.4 from 51.1 recorded in August 2021, indicating that the growth in Kenya’s business activities slowed down following the high inflation rates in September and the hike in fuel prices which affected the demand for goods. For more information, see our Cytonn Weekly #40/2021,

- The Kenya National Bureau of Statistics released the Q1’2021 Balance of Payments Report highlighting that Kenya’s balance of payments deteriorated in Q1’2021, coming in at a deficit of Kshs 59.4 bn, from a deficit of Kshs 47.4 bn in Q1’2020. The deterioration was due to the 16.6% increase in the Current Account Balance to Kshs 142.0 bn, from Kshs 121.7 bn in Q1’2020 due to merchandised trade deficit and lower inflows from the services sector. For more information, see our Cytonn Weekly #41/2021, and,

- The National Treasury gazetted the revenue and net expenditures for the first three months of FY’2021/2022, highlighting that total revenue collected as at the end of September 2021 amounted to Kshs 463.5 bn, equivalent to 26.1% of the Kshs 1,775.6 bn budgeted amounts and is 104.4% ahead of the prorated estimates of Kshs 443.9 bn while the total expenditure amounted to Kshs 675.5 bn, equivalent to 21.2% of the original estimates of Kshs 3,193.0 bn, and is 84.6% of the prorated expenditure estimates of Kshs 798.3 bn. For more information, see our Cytonn Weekly #42/2021.

Rates in the fixed income market have remained relatively stable due to the tightened but sufficient levels of liquidity in the money markets. The government is 23.3% ahead of its prorated borrowing target of Kshs 227.9 bn having borrowed Kshs 281.1 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRAs collection of Kshs 476.6 bn in revenues during the first quarter of the current fiscal year, which is equivalent to 103.2% of the prorated revenue collection target. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.

Markets Performance

During the month of October, the equities market was on a downward trajectory, with NSE 20, NSE 25, and NASI declining by 3.4%, 1.6% and 0.2%, respectively. The equities market performance was driven by losses recorded by banking stocks such as NCBA, Co-operative Bank, KCB and Diamond Trust Bank (DTB-K), of 7.3%, 6.4%, 6.0% and 5.6%, respectively. The losses were however mitigated by gains recorded by Safaricom which gained by 1.7%.

During the week, the equities market recorded mixed performance, with NASI and NSE 25 declining by 0.4% and 0.3%, respectively, while NSE 20 gained marginally by 0.03%, taking their YTD performance to gains of 17.0%, 4.7% and 12.9% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by banking stocks such as ABSA, Diamond Trust Bank (DTB-K) and Standard Chartered Bank (SCB-K) which gained by 1.5%, 0.9% and 0.6%, respectively. The gains were however weighed down by losses recorded by large cap stocks such as NCBA, Co-operative Bank, EABL and BAT which declined by 3.6%, 2.0%, 1.9%, and 1.3%, respectively.

Equities turnover increased by 0.6% during the month to USD 92.6 mn, from USD 92.1 mn recorded in September 2021. Foreign investors remained net sellers during the month, with a net selling position of USD 9.2 mn, compared to September’s net selling position of USD 8.5 mn.

During the week, equities turnover declined by 39.3% to USD 17.5 mn, from USD 28.9 mn recorded the previous week, taking the YTD turnover to USD 1.0 bn. Foreign investors turned net sellers, with a net selling position of USD 1.9 mn, from a net buying position of USD 0.3 mn recorded the previous week, taking the YTD net selling position to USD 28.2 mn.

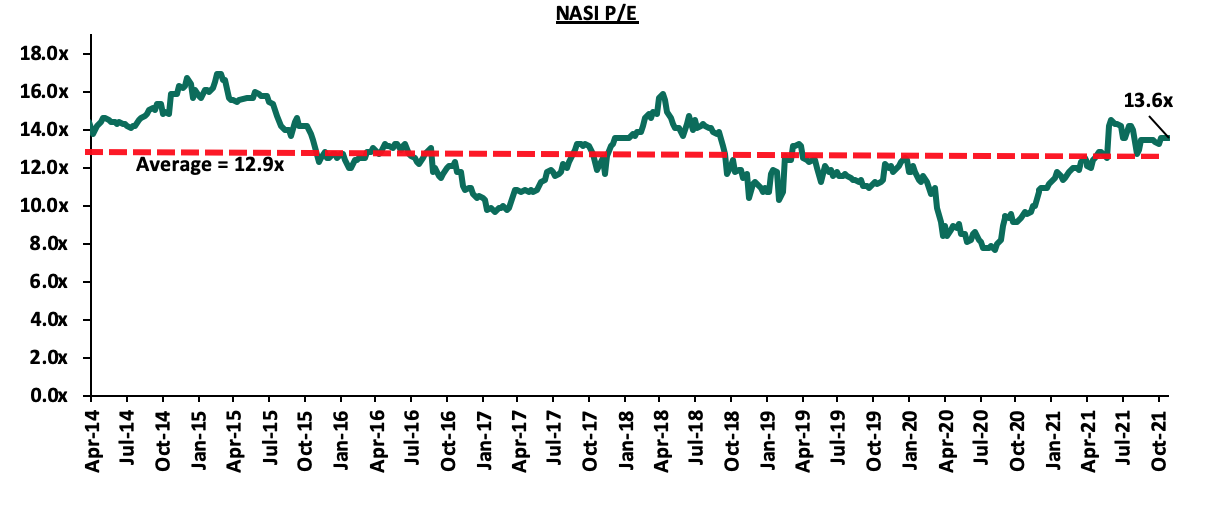

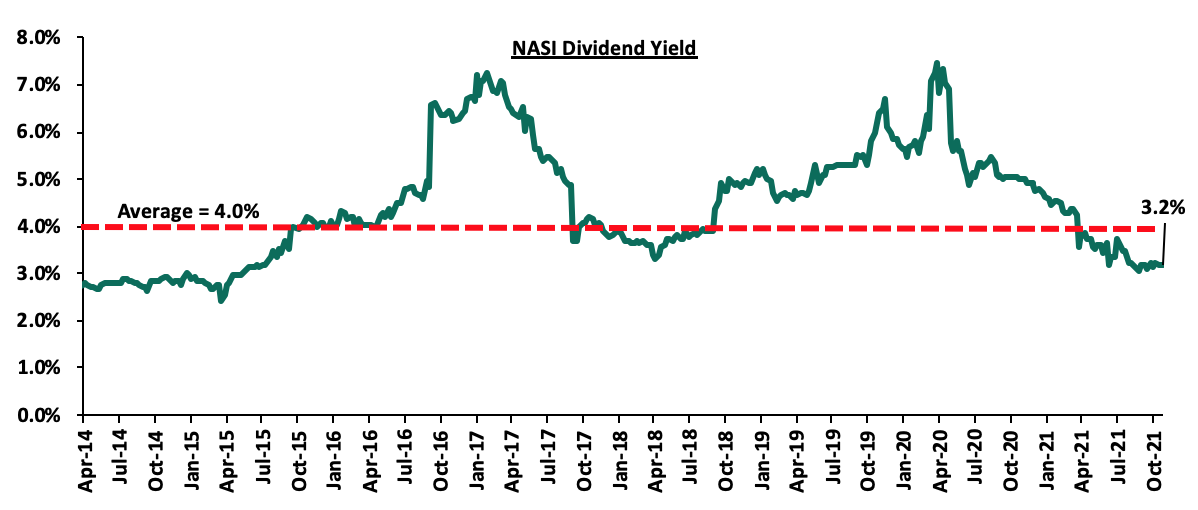

The market is currently trading at a price to earnings ratio (P/E) of 13.6x, 5.0% above the historical average of 12.9x, and a dividend yield of 3.2%, 0.8% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.5x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, which is currently 62.6% of the market, the market is trading at a P/E ratio of 11.3x and a PEG ratio of 1.3x. The current P/E valuation of 13.6x is 76.4% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly highlights

- The Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended June 2021. The quarterly Credit Officer Survey is undertaken by the CBK to identify the potential drivers of credit risk in the banking sector. For the quarter ended 30th June 2021, 38 operating commercial banks and 1 mortgage finance company participated in the Commercial Banks Credit Officer Survey. The report highlights that the banking sector’s loan book recorded a 6.9% y/y growth, with gross loans increasing to Kshs 3.1 tn in June 2021, from Kshs 2.9 tn in June 2020. On a q/q basis, the loan book increased by 2.3% from Kshs 3.0 tn in March 2021. For more information, please see our Cytonn Weekly #41/2021, and,

- Fitch Ratings, a global credit rating agency, assigned Sanlam Life Insurance Limited (Sanlam Life), an insurance provider in Kenya, an Insurer Financial Strength (IFS) rating and Issuer Default Rating (IDR) of `B+’ and its holding company, Sanlam Kenya Plc, a Long-term Issuer Default Rating (IDR) of `B’ with both Rating outlooks being stable. The Insurer financial strength rating on the Fitch Ratings scale ranges from a low of B to a high of AAA. For more information, please see our Cytonn Weekly #41/2021.

Weekly highlights:

- Memorandum of Understanding between the CMA, NSE and the KEPFIC

During the week, the Capital Markets Authority (CMA) and the Nairobi Securities Exchange (NSE) announced the signing of a Memorandum of Understanding (MOU) with the Kenya Pension Funds Investment Consortium (KEPFIC) to support infrastructure projects financing and development through the capital markets. Through the partnership, the NSE, CMA and KEPFIC will seek avenues to deploy pension funds’ investments into infrastructure projects using available capital markets products such as Green bonds, Asset Backed Securities (ABS) and Real Estate Investment Trusts (REITs). This follows the amendment of the Retirement Benefits Authority Regulations Act in September 2020, to introduce Debt instruments for financing of infrastructure or affordable housing projects approved under the Public Partnership Act, as a distinct investment category, with a maximum allowable investment limit of 10.0%.

Pension funds are increasingly moving into new asset classes in a search for higher and stable returns, and better diversification of their investments. Infrastructure is one type of investment being frequently discussed, given its potential to match long-term pension assets and provide diversification. Pension fund exposure to infrastructure has been majorly via listed companies, or real estate portfolios, where the average asset allocation to real state has been 18.8% over the last 8 years. However, there has been a push by the World Bank, National Treasury of Kenya and some of the large pension schemes to invest in public private partnerships (PPPs).

It remains to be seen how the pension industry will take advantage of the new asset class and the returns they are likely to get to boost the welfare of their members, especially in light of (i) the capital intensive nature of infrastructural developments which is likely to lock out the small and medium size pension schemes that have low financial power and prefer more liquid investments, and, (ii) the slow uptake of new asset classes in the past by pension schemes – REITs investments have been below 0.1% of the industry total for the past 8 years while Commercial Papers, still averages 0.001% of the total industry allocation since its introduction as a separate asset class in 2016. In our view, the announced MoU is a step in the right direction in providing the necessary framework for the new infrastructure investment asset class but is likely to benefit only a few large schemes that have the sufficient assets to invest in long term capital intensive project.

- Nairobi Securities Exchange rolls out day trading

During the week, the Nairobi Securities Exchange (NSE) announced that it has received approval from the Capital Markets Authority to roll out day trading at the bourse, which will begin on November 22nd 2021. Day trading refers to the practice of purchasing and selling a security within a single day or trading session or multiple times over the course of the day. The move is part of the NSE’s strategy to enhance market liquidity while increasing activity and turnover and follows the launch of the Unquoted Securities Platform (USP) earlier this year. As an incentive to enhance uptake of the program, investors who participate in day trades will be levied 0.114% on the second leg of transactions, as compared to the normal 0.12% levied on normal trades. Day trading is mainly expected to favor short-term investors who will be looking to take advantage of instant price movements due to various triggers such as corporate announcements and release of financial results. In our view, we expect the recent strategies launched by the bourse to achieve the intended goal of increasing market turnover and enhance liquidity in the equities markets.

Universe of coverage:

|

Company |

Price as at 22/10/2021 |

Price as at 29/10/2021 |

w/w change |

m/m change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Group*** |

21.5 |

21.5 |

(0.2%) |

(5.9%) |

(52.2%) |

44.9 |

32.0 |

10.5% |

59.7% |

0.6x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.4 |

(1.2%) |

(3.2%) |

4.8% |

2.3 |

3.1 |

8.3% |

36.4% |

0.3x |

Buy |

|

ABSA Bank*** |

10.1 |

10.2 |

1.5% |

(3.3%) |

7.1% |

9.5 |

13.8 |

0.0% |

35.3% |

1.1x |

Buy |

|

NCBA*** |

25.0 |

24.1 |

(3.6%) |

(7.3%) |

(9.4%) |

26.6 |

31.0 |

6.2% |

34.9% |

0.6x |

Buy |

|

KCB Group*** |

44.2 |

44.0 |

(0.6%) |

(6.0%) |

14.5% |

38.4 |

53.4 |

2.3% |

23.8% |

1.0x |

Buy |

|

Co-op Bank*** |

12.8 |

12.5 |

(2.0%) |

(6.4%) |

(0.4%) |

12.6 |

14.1 |

8.0% |

20.8% |

0.9x |

Buy |

|

Standard Chartered*** |

129.3 |

130.0 |

0.6% |

(0.2%) |

(10.0%) |

144.5 |

145.4 |

8.1% |

19.9% |

1.0x |

Accumulate |

|

Equity Group*** |

50.0 |

49.7 |

(0.5%) |

(2.1%) |

37.1% |

36.3 |

57.5 |

0.0% |

15.7% |

1.4x |

Accumulate |

|

Diamond Trust Bank*** |

58.3 |

58.8 |

0.9% |

(5.6%) |

(23.5%) |

76.8 |

67.3 |

0.0% |

14.6% |

0.3x |

Accumulate |

|

Sanlam |

11.7 |

11.5 |

(1.3%) |

0.0% |

(11.5%) |

13.0 |

12.4 |

0.0% |

7.8% |

1.0x |

Hold |

|

Stanbic Holdings |

90.0 |

94.0 |

4.4% |

2.2% |

10.6% |

85.0 |

96.6 |

4.0% |

6.8% |

0.9x |

Hold |

|

Liberty Holdings |

7.8 |

8.0 |

3.1% |

(1.5%) |

3.9% |

7.7 |

8.4 |

0.0% |

5.0% |

0.6x |

Hold |

|

Jubilee Holdings |

350.0 |

360.0 |

2.9% |

2.9% |

30.6% |

275.8 |

330.9 |

2.5% |

(5.6%) |

0.7x |

Sell |

|

Britam |

7.5 |

8.0 |

6.1% |

(1.5%) |

13.7% |

7.0 |

6.7 |

0.0% |

(15.8%) |

1.5x |

Sell |

|

HF Group |

3.8 |

3.8 |

1.3% |

(1.6%) |

21.3% |

3.1 |

3.1 |

0.0% |

(18.6%) |

0.2x |

Sell |

|

CIC Group |

2.6 |

2.6 |

(2.7%) |

(14.1%) |

21.3% |

2.1 |

1.8 |

0.0% |

(29.7%) |

0.9x |

Sell |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to the counter trading ex-bonus issue |

|||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.5x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent relaxation of lockdown measures in the country to have a positive impact on the economic outlook.

- Industry Reports

During the month, two industrial reports were released and below were the key take outs;

|

Theme |

Report |

Key Take outs |

|

General Real Estate |

i. The industrial sector continues to outperform other real estate sectors with average rental yields coming in at 12.0% in H1’2021, and, ii. The rental rates for prime industrial spaces in Nairobi realized a 27.7% improvement to Kshs 666.0 ($6.0) per SQM in 2021 from Kshs 521.7 ($4.7) per SQM recorded in 2018. The rental yields came in at 8.5% compared to the 4.8%, 6.9%, and 7.6% yields realized for the residential, commercial office and retail sectors, respectively, in H1’2021. For more information please see our Cytonn Weekly #42/2021 |

|

|

Hospitality |

i. The number of operational hotels came in at 96.0%, representing a stagnation since July 2021, ii. Local guests continued to account for majority of clientele population at 79.5% for accommodation and 78.9% for restaurant services between August and September 2021, and, iii. The average bed occupancy in September 2021 was at 38.0%, a 8.0% points increase from 30.0% in July. For more information please see our Cytonn Weekly #40/2021 |

We expect the industrial sector to continue performing well mainly attributed to; i) increased demand for urban logistic facilities as a result of improving appetite for industrial stock by investors, ii) improving infrastructure enhancing accessibility, and, iii) uptick in online retail sales necessitating uptake of warehouses. We also anticipate that the number of bed occupancies and operational hotels will continue to increase attributed to increased tourist activities from the reopening of the economy.

- Residential Sector

During the week, the Kenya Mortgage Refinance Company (KMRC), announced that it is awaiting approval from the Capital Markets Authority (CMA) to raise Kshs 10.0 bn from investors through the issuance of a corporate bond by December 2021, to support financing of low cost homes through mortgages. The issue will be made through tranches and the funds will be used in financing Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and Savings and Credit Cooperatives (SACCOs) at a 5.0% rate for onward lending at single digit rates. Other details on the bond issue are expected to follow upon approval by CMA. Upon its successful subscription, and given the KMRC average cap loan size of Kshs 3.5 mn for areas in and out of the Nairobi Metropolitan Region, the funds will service about 2,860 mortgages which is still low given the current demand for housing at 2.0 mn units.

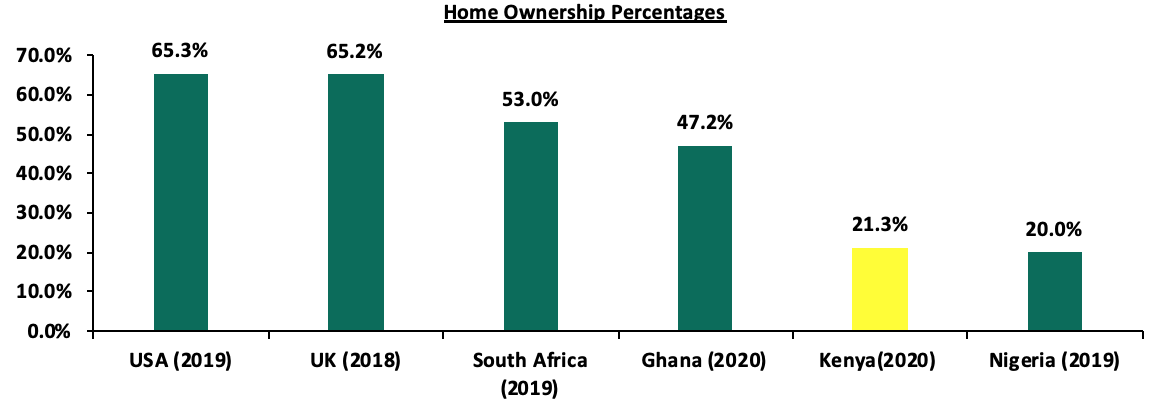

This is expected to boost home ownership in Kenya which has remained low at 21.3% in urban areas as at 2020, which is low compared to other African countries such as Ghana with a 47.2% urban home ownership rate in the same period. The low home ownership rate is attributed to; i) high property prices, ii) lack of real estate finance to fund large scale developments due to an under developed and non-supportive capital market, iii) the increasing number of Non-Performing Loans (NPLS) in the real estate sector, which increased by 14.8 % to Kshs 70.5 bn in Q1’2021 from Kshs 61.4 bn recorded in Q4’2020 leading to tighter underwriting standards, iv) exclusion of self-employed citizens due to lack of the credit information on criteria threshold for mortgage products, v) the tough economic times reducing savings and disposable income, and, vi) the high initial deposits required to access mortgages.

The graph below shows the home ownership percentages of different countries compared to Kenya;

Source: Centre for Affordable Housing Africa, Federal Reserve Bank

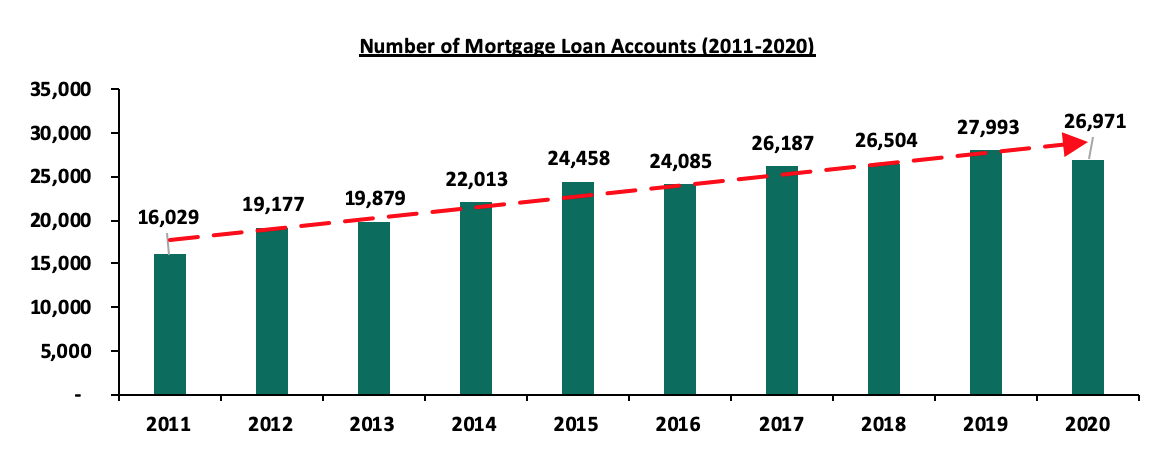

The mortgage market has also not been performing well evidenced by the 3.7% decline in the number of mortgage loans accounts to 26,971 in December 2020 from 27,993 in December 2019 according to the Central Bank of Kenya- Bank Supervision Annual Report 2020. From the assumed mortgage loan size of Kshs 3.5 mn, this funding is therefore expected to bring the number of mortgages to about 29,831 with an addition of 2,860 mortgage accounts, which represents a 10.6% increase. In terms of overall value of mortgage loans, there was a 2.1% decline from Kshs 237.7 bn in December 2019 to Kshs 232.7 bn in December 2020 attributed to fewer mortgage loans advanced by banks due to the effect of the Covid-19 and depressed economy that caused an increase in mortgage defaults.

The graph below shows the number of mortgage loan accounts in Kenya over the last 10 years;

Source: Central Bank of Kenya (CBK)

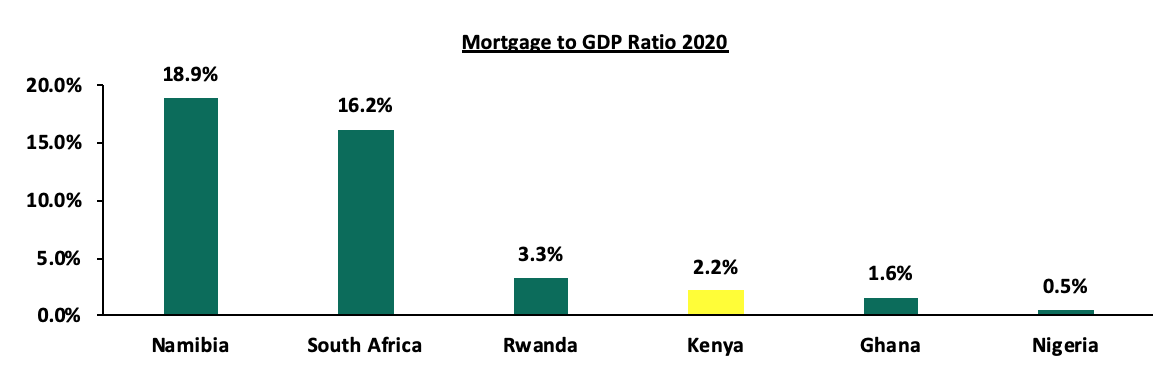

Given the above, the Kenya mortgage to GDP ratio continues to lag behind at 2.2% as of 2020, compared to countries such as Namibia and South Africa at 18.9% and 16.2%, respectively as shown in the graph below;

Source: Centre for Affordable Housing Africa

In its one year of operation, KMRC has performed well by; i) boosting liquidity to Primary Mortgage Lenders through its debut lending of Kshs 2.8 bn in FY’2020/21 and Kshs 7.0 bn budgeted in FY’2021/22, ii) increasing mortgage uptake in the country by so far refinancing 1,427 mortgages with others under review, iii) encouraging mortgage market competition for the benefit of borrowers through low rate lending, iv) increasing capital for refinancing with total Kshs 40.0 bn under management by the firm as at June 2021. However, KMRC is likely to face stiff competition from government instruments offering higher rates as the firm seeks to borrow from the market and lend at low rates. With 20-year bonds attracting an average yield of 13.2%, KMRC would have to offer a premium above this in order to attract investors in the fixed income market, which would consequently lead to a negative spread between the lending rate and borrowing rate. It is therefore not clear how the firm will borrow from the market and sustain lending at a 5.0% rate. Despite this, the residential sector is expected to improve supported by efforts being made to offer affordable mortgages to a diverse number of clients at bespoke terms.

- Retail Sector

During the week, Naivas Supermarket, a local retailer, opened a new outlet in Nairobi CBD at Uchumi City Centre along Agha Khan Walk, taking up 20,000 SQFT prime space previously occupied by Uchumi Supermarket, and bringing its total outlets to 77. The retailer has so far opened 8 branches in 2021 in an aim to maintain its retail market dominance against rivals such as QuickMart which has opened 9 branches this year. Additionally, Naivas announced plans to open four other outlets i.e. Greenspan Mall, at the space previously occupied by Tuskys, Malindi Mall, at the space previously occupied by Nakumatt, Mombasa Road and Embakasi by the end of the year. This will bring the total outlets to 81. The decision to invest in the Central Business District area is supported by; i) availability of prime retail space left by Uchumi Supermarket who closed from dwindling cash flows, ii) boosted financial muscle having sold 30% of its stake to Amethis Finance last year, iii) the need to maintain market dominance against expanding rivals such as Quickmart, iv) the population growth in Nairobi which has grown by 40.1% from 3.1 mn persons in 2009 to 4.4 mn persons in 2019 according to the Kenya National Bureau of Statistics, thereby forming part of the consumer base, and, iv) guaranteed footfall from people working and transacting in the CBD.

In terms of performance, according to Kenya Retail Report 2021, Nairobi recorded rental yields of 7.5%, 0.7% points higher than the market average of 6.8%, thus presenting a good investment opportunity for the retailer.

|

Region |

Rent (Kshs) 2021 |

Occupancy Rate 2021 |

Rental yield 2021 |

|

Mount Kenya |

128 |

81.7% |

7.9% |

|

Nairobi |

168 |

75.8% |

7.5% |

|

Mombasa |

119 |

77.6% |

6.8% |

|

Kisumu |

101 |

74.6% |

6.4% |

|

Eldoret |

131 |

80.8% |

6.3% |

|

Nakuru |

59 |

80.0% |

6.1% |

|

Average |

118 |

78.4% |

6.8% |

Source: Cytonn Research 2021

The table below shows the summary of the number of stores of the Key local and international retailer supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened |

Projected number of branches FY’2021 |

|

Naivas |

Local |

46 |

61 |

69 |

8 |

0 |

77 |

4 |

81 |

|

QuickMart |

Local |

10 |

29 |

37 |

9 |

0 |

46 |

0 |

46 |

|

Chandarana |

Local |

14 |

19 |

20 |

1 |

0 |

21 |

2 |

23 |

|

Carrefour |

International |

6 |

7 |

9 |

5 |

0 |

16 |

0 |

16 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

1 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

257 |

313 |

334 |

24 |

178 |

182 |

6 |

188 |

|

Source: Online Search

We expect increasing infrastructure developments, rapid expansion moves by retailers such as Naivas and positive demographics evidenced by population increase of 22.3% from 38.6 mn persons in 2009 to 47.2 mn persons in 2019 to cushion the performance of the retail market. However, the existing oversupply at 1.7 mn SQFT in the Kenyan retail sector and 3.0 mn SQFT in the NMA, growing popularity of e-commerce and financial constraints are factors expected to impede the performance of the sector.

- Hospitality Sector

During the week, World Travel Awards (WTA), a global institution that acknowledges, rewards and celebrates excellence across all sectors of the tourism industry yearly, announced the 28th World Travel Awards winners. On the African level, Nairobi was voted as Africa’s leading business travel destination supported by availability of conferencing facilities such as KICC, top rated accommodation facilities, infrastructure, and, stable political and macro-economic environment. The table below shows some of the key awards for Kenya and the respective winners in 2020 and 2021;

|

Award |

2021 Winner |

2020 Winner |

|

Leading Africa Business Travel Destination 2021 |

Nairobi |

Nairobi |

|

Africa’s Leading Airline 2021 |

Kenya Airways, KQ |

Ethiopian Airlines |

|

Africa’s leading Airline- Business Class 2021 |

Kenya Airways, KQ |

Kenya Airways, KQ |

|

Africa’s leading City Hotel 2021 |

Fairmont the Norfolk, Nairobi |

Fairmont the Norfolk, Nairobi |

|

Africa’s leading Hotel Brand 2021 |

Serena Hotels |

Hilton Hotels and Resorts |

|

Africa’s leading Meetings and Conference 2021 |

Kenya International Conference Centre (KICC) |

Kenya International Conference Centre (KICC) |

Source: World Travel Awards

The wide array of awards indicates continued confidence in Kenya’s hospitality industry despite the impact of COVID-19 pandemic and we expect the positive accolades to boost investor confidence in the sector coupled by reopening of the economy, political stability, and improving infrastructure.

Notable highlight during the month include;

- Jameson Valley Holdings and Actis Limited, private equity firms, announced a Kshs 1.0 bn joint venture bid to buy three hotels, namely; Nairobi’s Fairview Hotel and Town Lodge Hotel both located along Bishop Road Upperhill, and, City Lodge Hotel located in Two Rivers, Runda. For more information, please see our Cytonn Weekly #41/2021.

We expect the hospitality sector to continue on an upward trajectory in terms of overall hotels in operations, hotel bookings, and hotel occupancy following the ambitious international marketing, positive accolades, the return of international flights and the mass vaccination currently underway in the country.

- Infrastructure

Notable highlights during the month include;

- The national government through Kenya Urban Roads Authority (KURA) announced plans to revamp sections of the 9.8 Km Ngong Road starting from Dagoretti Corner to Karen Shopping Centre. For more information, please see our Cytonn Weekly #42/2021,

- The National Treasury announced that the government of Kenya will borrow Kshs 2.0 bn from an undisclosed financier to facilitate the dualling of the Eastern By-Pass which stretches from Mombasa Road to the Thika Superhighway. For more information, please see our Cytonn Weekly #41/2021, and,

- The County government of Turkana and the Eastern Equatorial State of South Sudan signed a Memorandum of Understanding (MoU) that will allow the continuation of the construction of the Nadapal River Section A1 road, which is part of the Lokichar-Nadapal/Nakodok road upgrade that links Kenya to South Sudan. Additionally, the Cabinet Secretary for Ministry of Transport, Infrastructure, Housing and Urban Development, Hon. James Macharia, announced that the construction of the 233.0 Km Rironi-Nakuru-Mau Summit Road toll highway from Nairobi to Mau Summit will begin by December 2021. For more information, please see our Cytonn Weekly #40/2021.

We expect the government to continue supporting improvement of infrastructure in an aim to open up areas for investment Kenya through provision, maintenance and management of road infrastructure, in support of Vision 2030 aspirations in order to provide safe, efficient, accessible, and, sustainable transportation services.

- Statutory Review

During the month, the government of Kenya announced plans to review property rates after every five years as contained in the proposed National Rating Bill, 2021, to ensure the government does not lose out on the current capital appreciations of land. The state seeks to have counties review their valuation rolls every five years with an allowable extension of up to 2 years, with the valuation being done under the current market prices. For more information, please see our Cytonn Weekly #41/2021

We expect the government to continue fostering progressive legislations to align with the current market requirements in order to streamline real estate transactions.

- Listed REIT

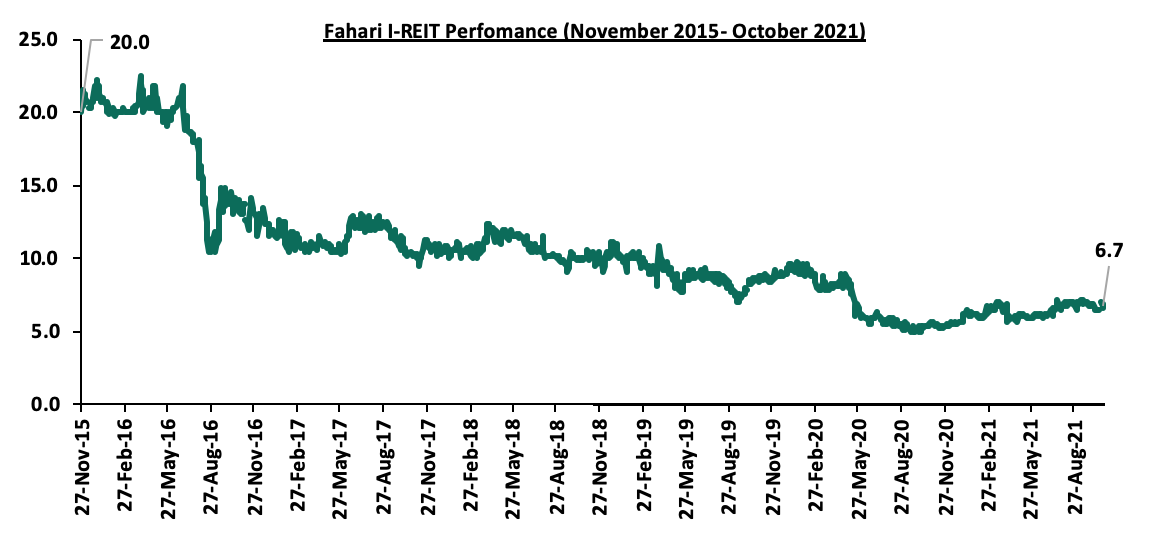

In the Nairobi Securities Exchange (NSE), the Fahari I-REIT closed the month of October trading at Kshs 6.7 per share, representing a 19.2% gain in the Year to Date (YTD) performance from Kshs 5.6 per share. However, the share price also represented a 0.9% Month to Date (MTD) loss from Kshs 6.8 per share recorded last month, and a 66.4% inception to Date (ITD) loss having listed at Kshs 20.0 per share in 2015. The REIT continues to record subdued performance due to; i) a general lack of knowledge on the instrument, ii) lack of interest of the REIT by investors, iii) high minimum investments amounts set at Kshs 5.0 mn, and, iv) lengthy approval processes discouraging investors.

The graph below shows the Fahari I-REIT performance from November 2015-October 2021;

The real estate sector is expected to be supported by efforts to avail affordable mortgages to Kenyans in an aim to boost home ownership, expansion of local retailers taking up space left by troubled retailers such as Uchumi and Tuskys and the building confidence in Kenya’s hospitality industry. However, general lack of investor interest in the listed REIT is expected to slow down the performance of the real estate sector.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.