Kenya Listed Banks Q3'2019 Report, & Cytonn Weekly #49/2019

By Cytonn Research, Dec 8, 2019

Executive Summary

Fixed Income

During the week, T-bills continued to be undersubscribed, with the subscription rate coming in at 55.3%, up from 34.8% the previous week. The under subscription is attributable to reduced parastatal participation, following the directive by treasury ordering state departments to surrender surplus cash, as well reduced participation by banks following the repeal of the interest rate cap, and are now looking to lend to the private sector. According to the Stanbic Bank Kenya PMI index, Kenya’s PMI Index for the month of November came in at 53.2, unchanged from the previous month. Readings above 50.0 indicate an improvement in business conditions while readings below 50.0 show a deterioration. During the week, President Uhuru Kenyatta signed the Supplementary Appropriation Bill (No. 2) of 2019 into law, paving way for the release of Kshs 73.2 bn from the government’s consolidated fund;

Equities

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 1.5%, 0.1% and 1.2%, respectively, taking their YTD performance to gains/(losses) of 14.1%, (7.5%) and 11.7%, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as KCB Group, Safaricom, Equity Group and Barclays of 3.0%, 2.9%, 2.5%, and 1.6%, respectively. During the week, the Central Bank of Kenya released the Monthly Economic Indicators, September 2019, highlighting trends in various macro-indicators. According to the report, the average deposit rates offered by Kenyan Banks recorded a drop to a 36-month low of 7.0% in September 2019, compared to 7.8% recorded a similar period in 2018, and the peak of 8.3% seen in January 2018. Also, during the week, Safaricom announced that it plans to roll out a new savings service dubbed “Mali” to broaden its M-Pesa mobile money platform. The product, currently in the testing phase, which will allow users to invest and earn a 10.0% annual rate (accrued daily), higher than the savings rate offered by banks and the average yield of the top five Money Market Funds (MMF) currently at 9.9%;

Real Estate

During the week, Knight Frank released the Prime Global Cities Index (PGCI) Q3’ 2019, which tracks prime residential prices in 45 cities around the world. According to the report, Nairobi’s high-end residential market recorded a slower annual price decline of of 5.4% in Q3’2019 compared to 6.7% and 6.5% in Q2’ 2019 and Q1’2019, respectively. The decline in prices is attributed to an oversupply of high-end residential units and the tough economic conditions. In the residential sector, Housing Finance Company Limited, a local mortgage finance institution, announced that it will offer mortgage financing for prospective buyers of the government’s Affordable Housing Project, Pangani Heights, located along Ring Road Ngara. In the hospitality sector, Superior Homes Kenya, a local real estate developer, opened its Lake Elementaita Mountain Lodge, a 50-room luxury hotel in Nakuru County,

Focus of the Week

Following the release of Q3’2019 results by Kenyan banks, this week we analyse the performance of the 10 listed banks in the country (previously 11, however National Bank of Kenya has been acquired by KCB Group Plc), identify the key factors that influenced their performance, and give our outlook for the banking sector going forward;

- Cytonn Money Market Fund closed the week at a yield of 10.7% p.a. You can now invest and withdraw by dialing *809#; you can also redeem directly into utilities bill payment. For more information email clientservice@cytonn.com

- Beatrice Mwangi, Senior research analyst, Cytonn Investments was on Metropol TV to talk about the real estate sector. Watch Beatrice here

- David Kingoo, Senior Risk and Compliance Associate was on KBC Channel 1 to talk about the state of Small and Medium Enterprises in Kenya. Watch David here

- David Kingoo, Senior Risk and Compliance Associate was on Metropol TV to talk about the performance of the banking sector and the interest cap rate. Watch David here

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills continued to be undersubscribed, with the subscription rate coming in at 55.3%, up from 34.8% the previous week. The under subscription is attributable to reduced parastatal participation, following the directive by treasury ordering state departments to surrender surplus, as well as reduced participation by banks following the repeal of the interest rate cap, and are now looking to lend to the private sector. The yield on the 91-day, 182-day, and 364-day papers remained unchanged at 7.1%, 8.2% and 9.8%, respectively. The acceptance rate dropped to 44.7%, from 59.7% recorded the previous week, with the government accepting Kshs 5.9 bn of the Kshs 13.3 bn bids received.

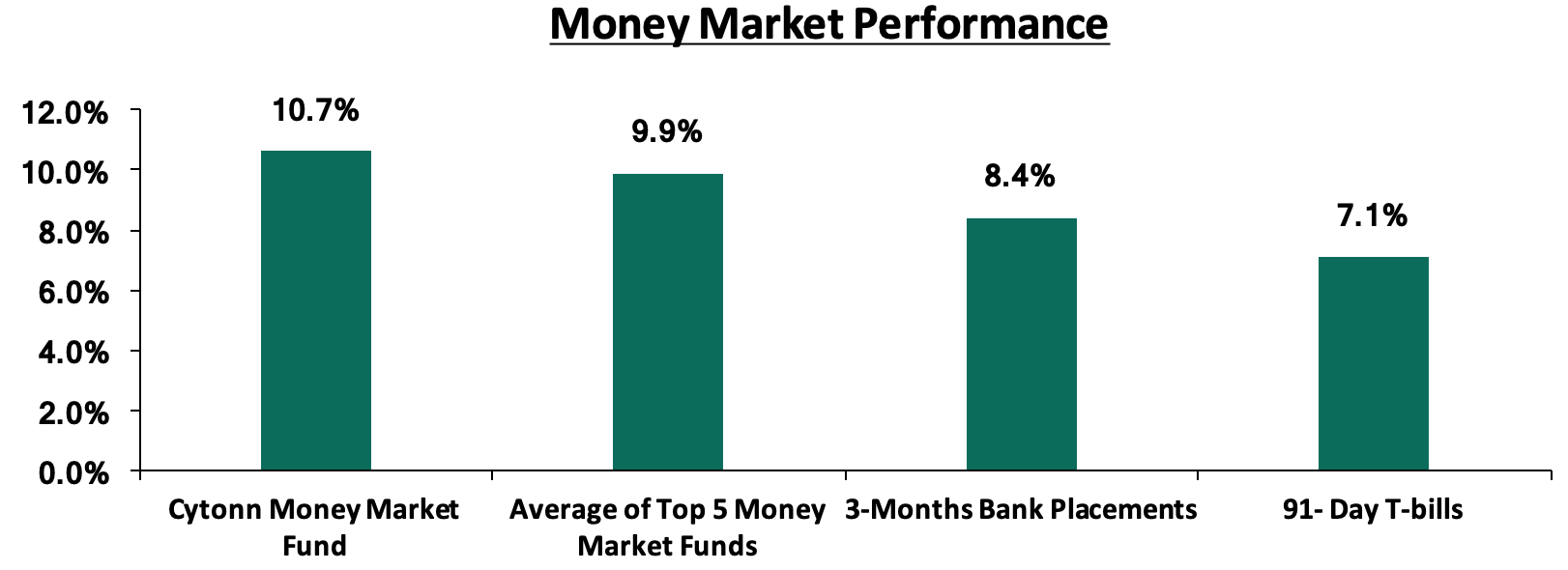

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.1%, while the average of Top 5 Money Market Funds came in at 9.9%, unchanged from the previous week. The Cytonn Money Market Fund, increased by 0.1% points to close the week at 10.7% from 10.6% recorded in the previous week.

Liquidity:

During the week, the average interbank rate increased to 6.3%, from 4.7% recorded the previous week, pointing to tightening of liquidity in the money markets, attributable to tax payments with Pay As You Earn (PAYE) due on 9th December 2019. This saw commercial banks excess reserves come in at Kshs 10.6 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes decreased by 0.8% to Kshs 23.6 bn, from Kshs 23.8 bn recorded the previous week.

Kenya Eurobonds:

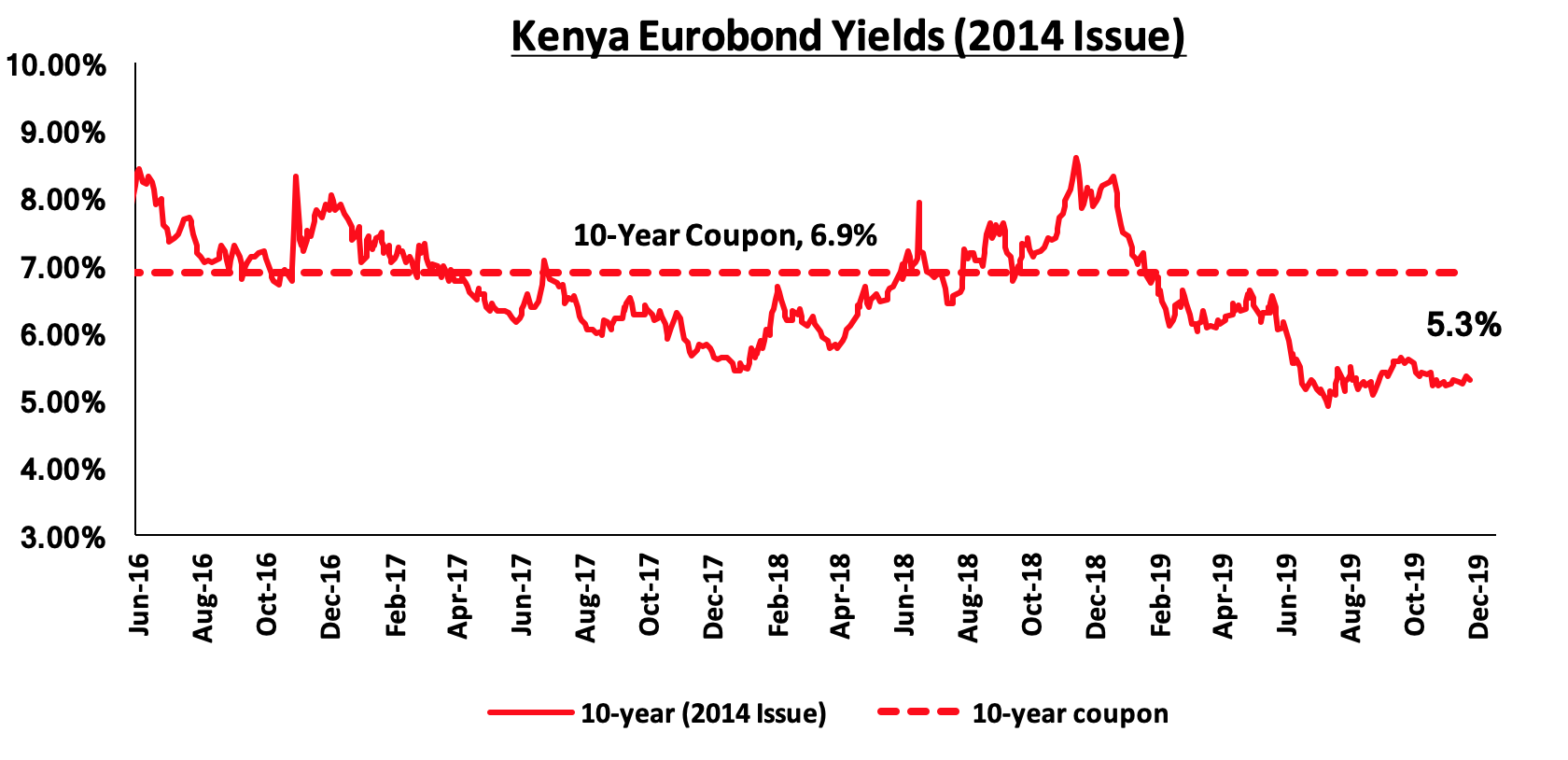

According to Reuters, the yield on the 10-year Eurobond issued in June 2014, remained unchanged at 5.3%, as recorded in the previous week

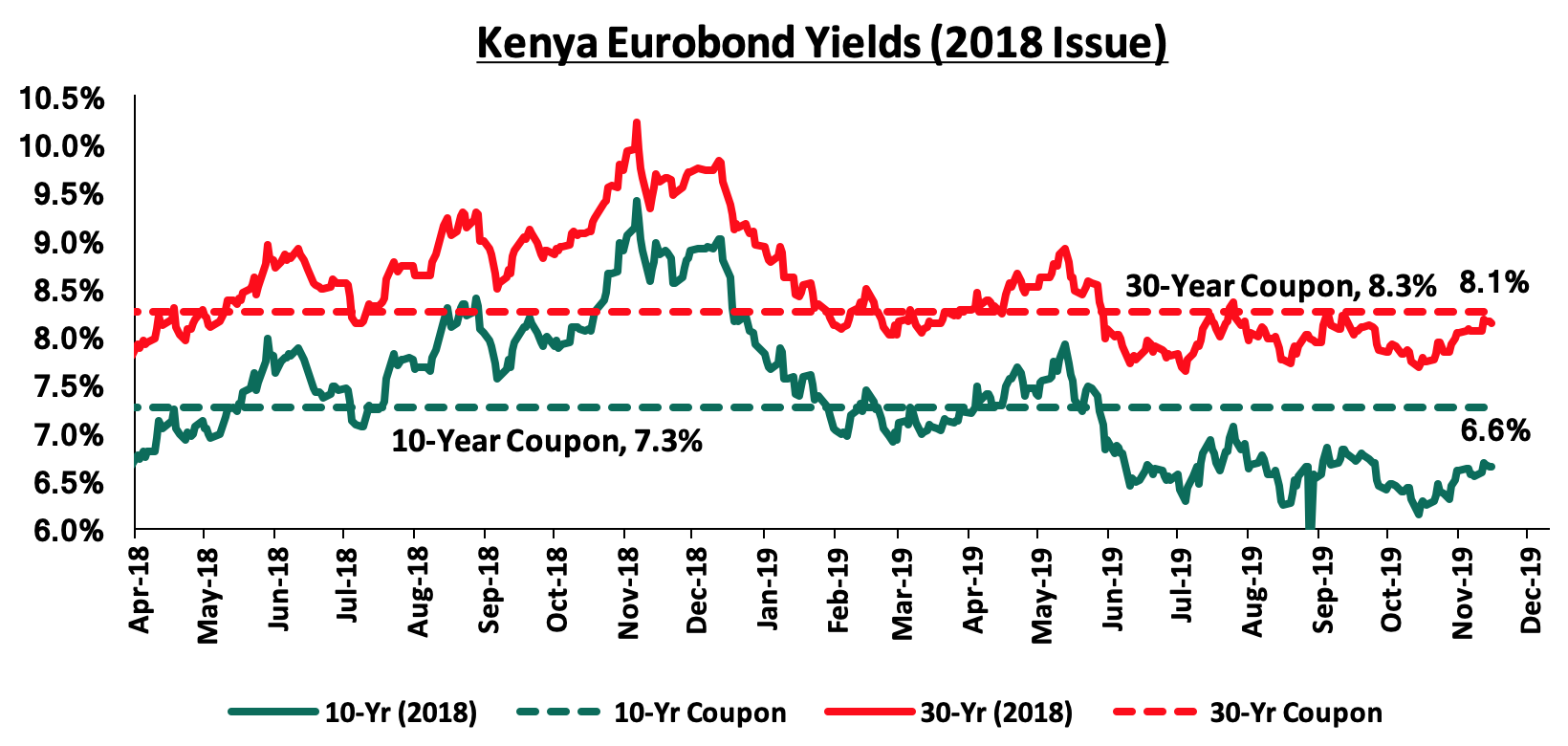

During the week, the yields on the 10-year Eurobond and 30-year Eurobond both increased by 0.1% points to 6.6% and 8.1%, from 6.5% and 8.0%, respectively.

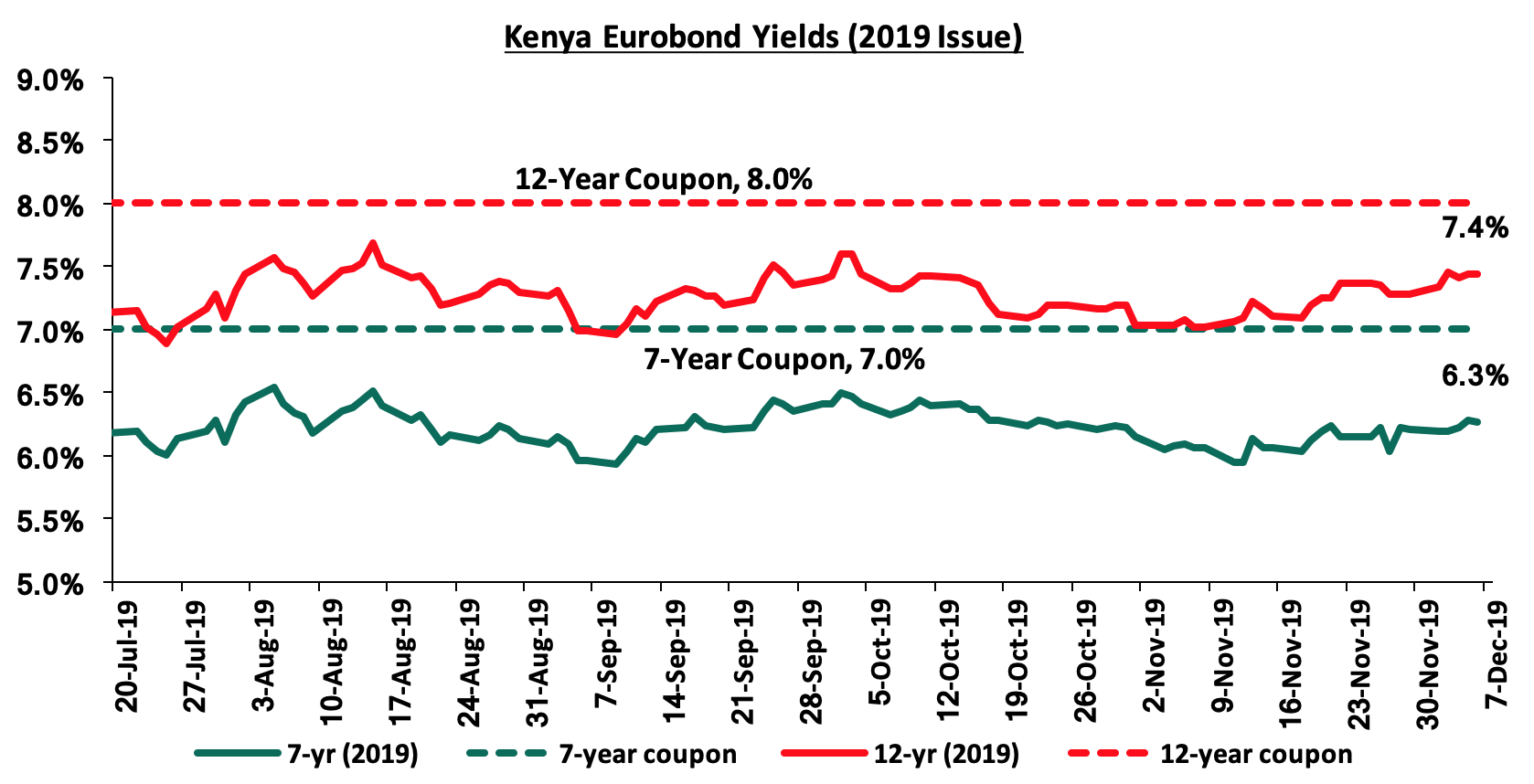

During the week, the yield on the 7-year Eurobond increased by 0.1% points to 6.3%, from 6.2% recorded the previous week, while the yield on the 12-year Eurobond increased by 0.1% points to 7.4%, from 7.3% recorded the previous week.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 1.0% against the US Dollar to close at Kshs 101.8, from 102.8 recorded the previous week, supported by hard currency inflows from offshore investors buying government debt amid tight local currency liquidity conditions. On a YTD basis, the shilling has appreciated by 0.1% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to 6.2% of GDP, from 7.6% recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit by 1.7% and a rise in secondary income (transfers) balance by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 7.0% in the 12-months to October 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018,

- Foreign capital inflows, with investors looking to participate in the equities market,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlights:

A: Supplementary Appropriation Bill (No. 2) of 2019:

During the week, President Uhuru Kenyatta signed the Supplementary Appropriation Bill (No. 2) of 2019 into law, paving way for the release of Kshs 73.2 bn from the government’s consolidated fund. The new funding is expected to impact Ministerial and State departments budgets as the government agencies register varying adjustments in allocations. However, only Kshs 54.3 bn of the Kshs 73.4 bn will be spent after the National Assembly Budget and Appropriations Committee (BAC) approved cuts amounting to Kshs 18.9 bn, as shown in the table below. Following the adjustments, the current development and recurrent expenditure is expected to remain at Kshs 2.5 tn after the supplementary budget, with recurrent expenditure at Kshs 1.7 tn and development expenditure at Kshs 759.2 bn

All figures in Kshs (Billions)

|

|

Original Approved Budget |

Adjustments as approved by the BAC |

Revised Budget |

|

Total Revenue* |

2,116.0 |

2,116.0 |

|

|

Expenditure and Net Lending* |

2,790.0 |

54.3 |

2,844.3 |

|

Fiscal Deficit (excl grants) |

(674.0) |

(728.3) |

|

|

Grants |

39.0 |

39.0 |

|

|

Fiscal Deficit (incl. grants) |

(635.0) |

(689.3) |

|

|

Fiscal Deficit as a % of GDP |

5.9% |

6.4% |

*Source:2019 BROP

The fiscal deficit is expected to widen to an estimated 6.4% from the earlier 5.9% as per the FY’2019/2020 approved budget. The increased expenditure is on the back of concerns that the Government’s revenue targets are still unrealistic and that the expected proceeds from State-Owned Enterprises (SOEs) of Kshs.78.0 bn are not likely to finance the supplementary increases that are on account of the shortfall in revenue and additional expenditures. As such the financing gap will have to be met from additional borrowing either domestically or externally. Going forward, we, however, expect the Kenya Government to struggle to access debt in the local markets following the repeal of interest rate caps as banks readjust their models with more preference to private sector lending rather than lending to the government.

The expectations of a further widening in the country’s fiscal deficit continue to raise concerns over the impact of growing debt on the fiscal framework. The stock of debt has continued to rise, with the National Assembly has voted on 9th October 2019 to amend the Public Finance Management (PFM) Regulations as proposed by the Treasury to substitute the debt ceiling that was previously pegged at 50.0% of GDP to an absolute figure of Kshs 9.0 tn. As per our Kenya’s Debt Sustainability Note, despite the reason behind the proposal by the Treasury to substitute the debt ceiling with an absolute figure of Kshs 9.0 tn being the need to provide clarity in terms of controls and real-time oversight mechanism on the growth of public debt, we believe it creates more opacity as it is not clear the time horizon in which the country is expected to hit the Kshs 9.0 tn figure, from the current debt of Kshs 6.0 tn. We are of the view that the Treasury should provide more clarity as to that effect in order to address the concerns of possible rapid debt accumulation. Factoring the current debt levels and the risks abound in the medium term, we are of the view that in order to ensure that the Country’s fiscal deficit and in turn the debt levels are sustainable, the government should:

- Incorporate fiscal discipline, transparency, accountability for accumulated assets, in order to guarantee value for money that will increase economic output and prepare the country for the repayment period,

- Enhance the capacity of the Public Debt Management Office and ensure the implementation of the Medium-Term Debt Management Strategies as outlined every financial year, and,

- Ensure an enabling environment that promotes Macro-economic stability as it is a critical component for debt sustainability.

B: Purchasing Managers' Index (PMI) for Kenya:

According to the Stanbic Bank Kenya PMI index, Kenya’s PMI Index for the month of November came in at 53.2, unchanged from the previous month. Readings above 50.0 indicate an improvement in business conditions while readings below 50.0 show a deterioration.

Kenyan businesses recorded a solid improvement in the health of the private sector in November, which was slightly stronger than the average seen throughout the series that began in January 2014. An increase in new orders allowed firms to raise output at a faster pace, however, the rate of demand growth was the slowest since May. Employment levels continued to rise, with businesses also recording growth in stock levels. Output prices fell marginally, as cost inflationary pressures weakened to a 27-month low.

Output levels improved at the quickest rate in four months, supported by increasing sales due to the increased orders coupled with good weather conditions. Cash flow issues, however, continued to hinder business activity. New orders received by Kenyan firms grew at the slowest pace in six months, with many companies finding that marketing and word of mouth continued to bring additional clients. Firms also recorded an increase in new export orders owing to greater demand from European customers. The rise in output requirements encouraged firms to increase workforce numbers for the seventh consecutive month in November. Input costs rose slowly with businesses reporting a slight increase in purchase prices and a slight rise in staffing costs. Going forward, we are positive that the improving trend in business conditions will continue, supported by the current stable macro-economic conditions and improved private sector credit growth following the repeal of interest rate caps.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 8.3% behind its domestic borrowing target, having borrowed Kshs 116.5 bn against a pro-rated target of Kshs 127.1 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 1.5%, 0.1% and 1.2%, respectively, taking their YTD performance to gains/(losses) of 14.1%, (7.5%) and 11.7%, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as KCB Group, Safaricom, Equity Group and Barclays of 3.0%, 2.9%, 2.5%, and 1.6%, respectively.

Equities turnover declined by 14.0% during the week to USD 27.7 mn, from USD 32.2 mn the previous week, taking the YTD turnover to USD 1,411.6 mn. Foreign investors became net sellers for the week, with a net selling position of USD 65,025.0, from a net buying position of USD 0.7 mn recorded the previous week.

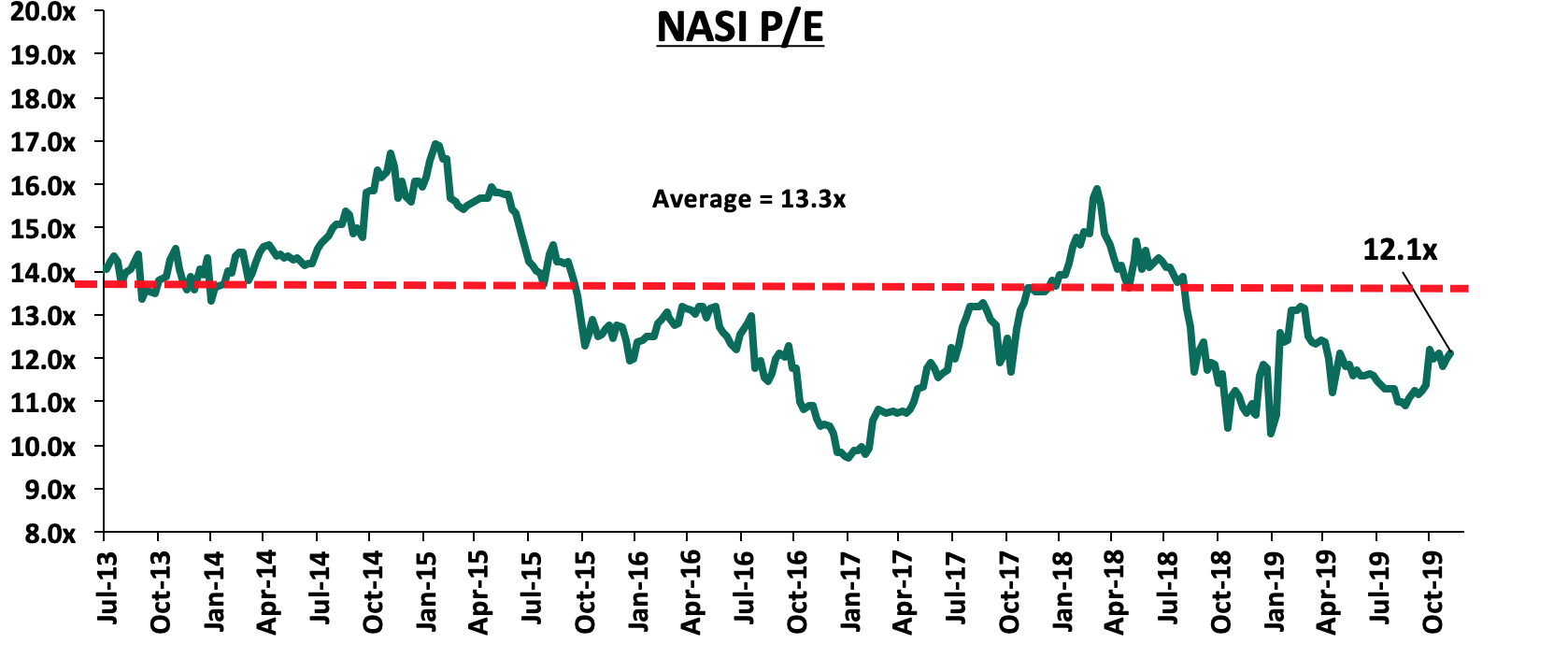

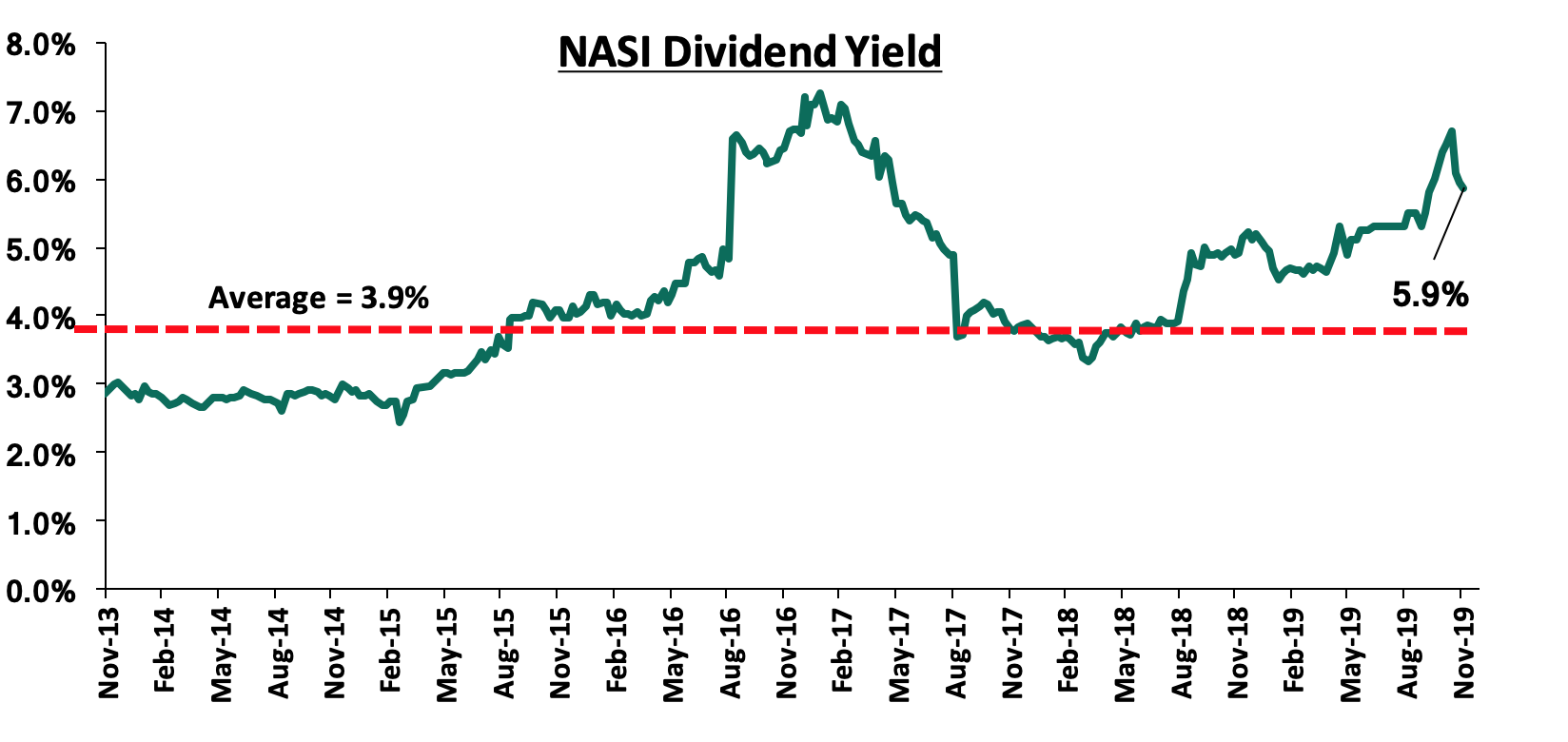

The market is currently trading at a price to earnings ratio (P/E) of 12.1x, 8.9% below the historical average of 13.3x, and a dividend yield of 5.9%, 2.0% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.1x is 24.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 46.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, the Central Bank of Kenya released the Monthly Economic Indicator September 2019 highlighting trends in various macro-indicators. Below are the key take-outs from the report:

- The average deposit rates offered by Kenyan banks recorded a drop to a 36-month low of 7.0% in September 2019, compared to 7.8% recorded a similar period in 2018 and the peak of 8.3% seen in January 2018. This was mainly been driven by the removal of the floor rate in September last year, which enabled banks to grow their profits on the back of relatively cheaper deposits,

- The average savings rate recorded a 36-month low of 4.6%, a decline from the 6.3% recorded in September 2018. To put it into perspective, in September 2018, customers earned Kshs 6.3 for every Kshs 100.0 in their savings accounts, whereas in 2019, they were only receiving Kshs 4.6 for the same Kshs 100.0, and,

- The average lending rate, on the other hand, declined marginally to 12.5%, from 12.6% recorded in September 2019. Banks have been able to significantly reduce their interest expenses which, on average, grew by 4.3% in Q3’2019, slower compared to the 12.5% recorded in Q3’2018. This has widened their interest spread and consequently, given them larger margins to increase profits.

Putting into consideration the recent removal of the interest rate cap, we are of the view that banks will continue to maximize profits at the expense of customers despite the lower cost of funding.

Also, during the week, Safaricom announced that it plans to roll out a new savings service dubbed “Mali” to broaden its M-Pesa mobile money platform. The product, currently in the testing phase, which will allow users to invest and earn a 10.0% annual rate (accrued daily), higher than the savings rate offered by banks of 4.6% as at September 2019 and the average yield of the top five Money Market Funds (MMF) currently at 9.9%. Savings will be capped at Kshs 70,000.0 and will have no exit restrictions. The product is meant to encourage saving culture and to qualify, one only needs to be a registered M-Pesa user for over 3 months. In our view, there is increased activity by tech-firms in the financial services sector leading to increased competition mainly for banks. This offering comes at a time when the average savings rate is at 4.6%, meaning that it would be a much-needed alternative to conventional savings accounts offered by banks. Similarly, this product will be a new competition for Unit Trust Funds such as Money Market Funds (MMFs).

Universe of Coverage

Below is a summary of our universe of coverage:

|

Banks |

Price at 29/11/2019 |

Price at 06/12/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.03 |

3.10 |

2.3% |

(11.2%) |

4.8 |

14.5% |

72.9% |

0.3x |

Buy |

|

Diamond Trust Bank |

115.00 |

112.00 |

(2.6%) |

(28.4%) |

189.0 |

2.3% |

66.7% |

0.6x |

Buy |

|

I&M Holdings*** |

48.95 |

51.75 |

5.7% |

21.8% |

75.2 |

7.5% |

61.2% |

0.8x |

Buy |

|

KCB Group*** |

50.00 |

51.50 |

3.0% |

37.5% |

64.2 |

6.8% |

35.2% |

1.4x |

Buy |

|

Jubilee Holdings |

350.00 |

350.00 |

0.0% |

(13.5%) |

453.4 |

2.6% |

32.1% |

1.1x |

Buy |

|

Sanlam |

16.50 |

17.00 |

3.0% |

(22.7%) |

21.7 |

0.0% |

31.5% |

0.7x |

Buy |

|

Standard Chartered |

193.25 |

195.00 |

0.9% |

0.3% |

211.6 |

9.7% |

19.2% |

1.5x |

Accumulate |

|

Co-op Bank*** |

16.05 |

15.70 |

(2.2%) |

9.8% |

18.1 |

6.4% |

19.1% |

1.3x |

Accumulate |

|

Equity Group*** |

51.00 |

52.25 |

2.5% |

49.9% |

56.7 |

3.8% |

15.0% |

1.9x |

Accumulate |

|

Barclays Bank*** |

12.45 |

12.65 |

1.6% |

15.5% |

13.0 |

8.7% |

13.1% |

1.6x |

Accumulate |

|

NCBA |

34.95 |

34.00 |

(2.7%) |

22.3% |

37.0 |

4.4% |

10.3% |

0.8x |

Accumulate |

|

Liberty Holdings |

9.96 |

10.45 |

4.9% |

(19.0%) |

10.1 |

4.8% |

5.8% |

0.8x |

Hold |

|

Stanbic Holdings |

112.00 |

105.00 |

(6.3%) |

15.7% |

108.1 |

4.6% |

1.1% |

1.2x |

Lighten |

|

CIC Group |

3.07 |

3.00 |

(2.3%) |

(22.3%) |

2.6 |

4.3% |

(9.7%) |

1.1x |

Sell |

|

Britam |

8.30 |

8.16 |

(1.7%) |

(19.6%) |

6.8 |

0.0% |

(18.6%) |

0.8x |

Sell |

|

HF Group |

6.00 |

5.52 |

(8.0%) |

(0.4%) |

4.2 |

0.0% |

(30.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industrial Reports

During the week, Knight Frank released the Prime Global Cities Index (PGCI) Q3’ 2019, a quarterly report that tracks prime residential prices in 45 cities around the world including Nairobi. The report covered the general performance of the high-end residential market. According to the report, high-end homes in the global market recorded price growth of 1.1% in Q3’2019, which was lower compared to 3.4% and 4.2% in Q3’2018 and Q3’2017, respectively attributed to weak demand driven by slow global economic growth owing to an increase in geopolitical tensions. The major take-outs highlighting the Nairobi market from the report were as follows:

- Prime residential prices in Nairobi recorded a slower annual price decline of 5.4% in Q3’ 2019 compared to 6.7% and 6.5% in Q2’ 2019 and Q1’2019, respectively, signaling a slight improvement in the market. However, the supply-demand mismatch owing to tough financial environment continues to have a negative impact on price growth,

- The rising number of distressed properties in Nairobi also affected prime residential values with lenders recovering non-performing loans through the sale of collateral, and

- In terms of outlook, the market is expected to record further price declines in the short-term due to the current credit crunch. However, the removal of the rate cap is expected to restore market liquidity leading to a recovery in the medium term.

The report is in line with the Cytonn Q3’2019 Markets Review, which recorded a 0.3% decline in high-end residential prices in Q3’2019 driven by a tough economic environment and increased stock in the market against minimal uptake. The table below shows the performance of the high-end residential market in Q3’2019:

(All Values in Kshs Unless Stated Otherwise)

|

Residential Market Performance Summary Q3’2019 |

|||||||

|

Segment |

Price per SQM Q3'2019 |

Rent Per SQM Q3'2019 |

Annual Uptake Q3'2019 |

Occupancy Q3'2019 |

Rental Yield Q3'2019 |

Annual Price Appreciation Q3'2019 |

Total Returns Q3'2019 |

|

High End |

192,801 |

796 |

19.0% |

83.6% |

4.3% |

(0.3%) |

4.0% |

|

Upper Middle |

149,259 |

650 |

19.0% |

88.7% |

4.2% |

0.1% |

4.3% |

|

Lower Middle |

82,935 |

381 |

20.6% |

83.1% |

5.3% |

0.1% |

5.2% |

|

Average |

141,665 |

609 |

19.5% |

85.1% |

4.6% |

(0.1%) |

4.5% |

Source: Cytonn Research

We expect the current economic environment and the continued focus of affordable housing to exert downward pressure on asking prices in high-end residential markets.

- Residential Sector

During the week, Housing Finance Company Limited, a local mortgage finance provider, announced that it will offer mortgage financing for prospective buyers of the government’s Affordable Housing Project, Pangani Heights, located along Ring Road Ngara. The projects, launched in December 2018, is one of the flagship projects under the affordable housing initiative that is meant to deliver 500,000 residential units by 2022. As per the affordable housing development guidelines, the mortgage gap units, whose selling price is set at Kshs 0.8 mn to 3.0 mn, are aimed at homebuyers earning between Kshs 50,000 and Kshs 149,999 per month. The increase in mortgage products offering is a step in the right direction towards the actualization of the provision of affordable housing in Kenya whose main challenge remains to be insufficient end-buyer financing, thus limiting market uptake. This is evidenced by the minimal reservations for Park Road’s phase 1 project whose allocation guidelines were published this week. As per the directive, 60% of the 1,370 units will be allocated to the general public while 40% will be allocated to civil servants and the police. The main modes of purchase are as follows:

- Outright Sale – requires 12.5% deposit with the balance paid within 90 days

- Tenant Purchase Scheme (TPS) - 12.5% deposit with monthly payments at an interest of 7.0% p.a for a period of 25 years

- Mortgage Loan- financed under the Civil Servants mortgage scheme or partner banks

The government through the Affordable Housing initiative has continued to support first-time buyers by eliminating costs such as (i) 15% tax relief up to a maximum of Kshs 108,000 p.a, (ii) exemption from stamp duty tax for first time home buyers, and (iii) enabling homeowners to make savings for purchase of a home through Money Market Funds through the inclusion of Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions which can hold deposits of a Home Ownership and Savings Plan (HOSP).

During the week, the Affordable housing initiative also received a shot in the arm as H.E President Uhuru Kenyatta signed into law the Supplementary Appropriation Bill No. 2 of 2019, which allocated Kshs 7.0 bn towards the affordable housing agenda. This is a 66.7% increment from the Kshs 10.5 bn allocated in Kenya National Budget 2019/20, in support of the affordable housing initiative. We see the increased budgetary allocation as a giant stride in ramping up supply of homes and is an indication of the government’s commitment to delivering 500,000 affordable housing units by 2022. We expect continued support towards the implementation of the affordable housing initiative by the Kenyan Government with ongoing projects such as Pangani Heights, Jevanjee, and Park Road in Nairobi, and others launched in counties such as Kiambu, Machakos, and Uasin Gishu.

- Hospitality Sector

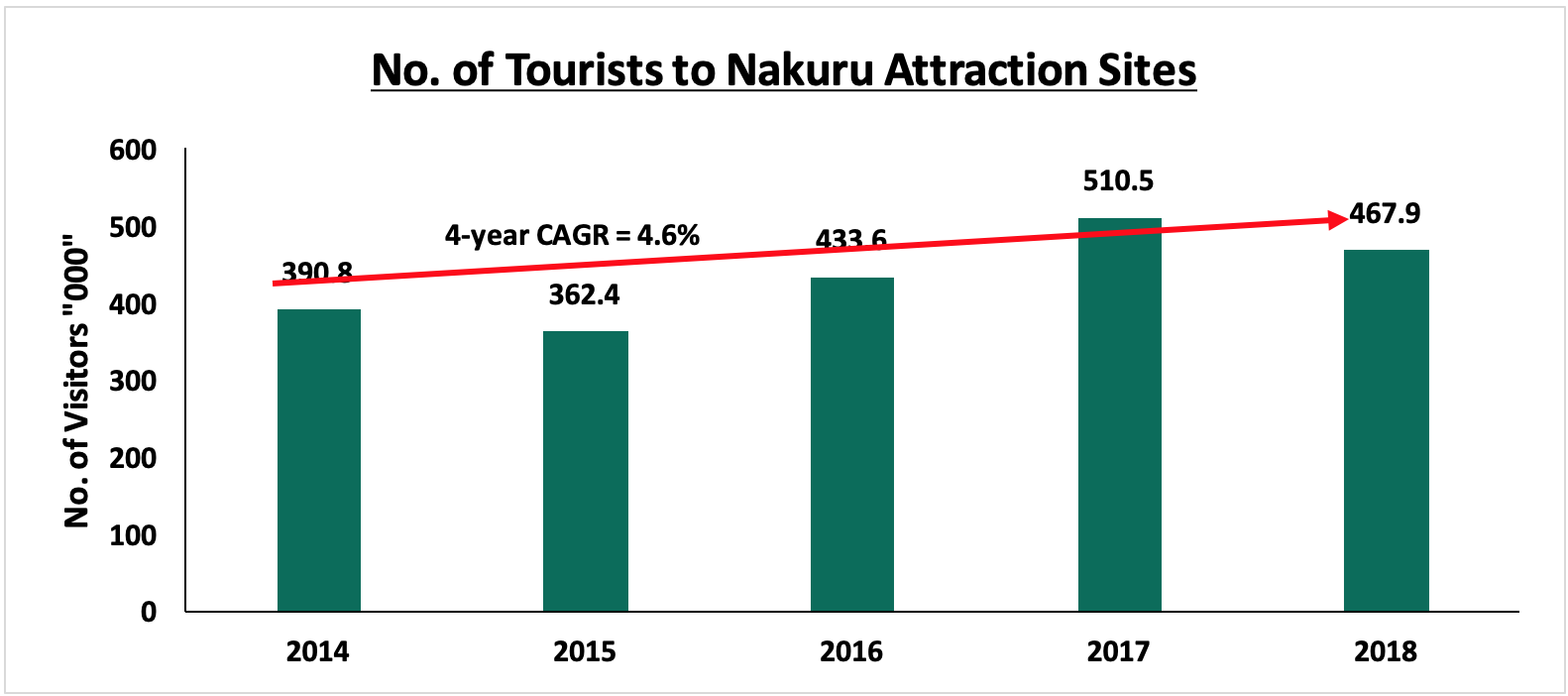

During the week, Superior Homes Kenya, a real estate developer, opened Lake Elementaita Mountain Lodge, a 50-room luxury hotel in Nakuru County. The development seated on a 12-acre plot on the shores of Lake Elementaita in Nakuru County will consist of 33 standard villas, 13 villa suites, and 4 executive villas. The vibrant tourism sector in Kenya has continued to encourage hospitality developments as investors seek to tap into growing tourist arrivals and earnings. Nakuru County remains an attractive investment node for hospitality facilities due to presence of tourist attraction sites such as the Lake Nakuru National Park, Menengai Crater and Hell’s Gate. According to the KNBS Economic Survey 2019, the number of tourists visiting major attraction sites in Nakuru increased by a four-year CAGR of 4.6% to 467,900 in 2018 from 390,800 in 2014.

Source: Kenya National Bureau of Statistics 2019

We expect increased investment in the hospitality sector by local and international investors as a result of the increased number of tourists which expected to increase revenues and returns for investors. According to the PWC Hotel Outlook 2018- 2022, hotel room revenues in Kenya are expected to grow by a 9.6%, CAGR, from 461 mn USD in 2018 to 690 mn USD in year 2022, attributable to the rising number of domestic and foreign business and leisure visitors driven by; (i) the introduction of direct flights to the United States of America by Kenya Airways, (ii) the rising tourist numbers from India, Poland, Russia, the Czech Republic and China, (iii) continued marketing of the country as a destination for experiences, and (iv) innovative measures such as the recent unveiling of Google Street View for 21 national parks in Kenya, which is expected to boost the hospitality industry by providing tourists with tools to plan for destinations of adventure and wildlife safaris.

Other highlights during the week:

STAG African, a South-African student accommodation property developer, announced plans to develop a 3,000-bed hostel for Mount Kenya University (MKU) at the university’s Happy Valley grounds in Thika. The project is aimed at providing affordable accommodation for students. Local institutions are increasingly partnering with developers to meet shortages in student accommodation. We expect the continued expansion of higher learning institutions will have a positive impact on real estate by driving the growth of new towns. Notable foreign firms who have invested in student accommodation locally include UK-based Helios, and New York-based Integras, both Private Equity Firms. According to Cytonn Research, student accommodation offers relatively high rental yields of 7.0%-10.0% in comparison to residential, office and retail sectors with 4.9%, 7.8%, and 8.0%, respectively.

We expect the real estate sector to continue recording increased activities supported by the increased support of the provision of affordable housing by the National, County governments and the private sector, and the continued investments in the hospitality sector.

Following the release of the Q3’2019 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

The report is themed “Higher Net Interest Margins and Consolidation to Drive Growth in the Post Rate Cap Era” as we assess the key factors that influenced the performance of the banking sector in the third quarter of 2019, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As such, we shall address the following:

- Key Themes That Shaped the Banking Sector Performance in Q3’2019,

- Summary of The Performance of the Listed Banking Sector in Q3’2019,

- The Focus Areas of the Banking Sector Players Going Forward,

- Brief Summary of the Outcome of Our Analysis, And

- Conclusion.

Section I: Key Themes That Shaped the Banking Sector Performance in Q3’2019

Below, we highlight the key 7 themes that shaped the banking sector in Q3’2019, which include repeal of the interest rate cap, consolidation, regulation, and asset quality:

- Repeal of the Interest Rate Cap (Banking (Amendment) Act, 2019): During the quarter, President Uhuru Kenyatta submitted a memorandum to the Speaker of the National Assembly detailing his refusal to assent to the Finance Bill 2019. The President, instead, recommended a repeal of the interest rate cap. In the memorandum, the President cited that while the purpose of the capping was to address the widespread concerns about affordability and availability of credit to Kenyans, the capping of interest rates instead caused unintended consequences that are significant and damaging to the economy and Micro, Small and Medium Enterprises (MSMEs). During the last parliamentary sitting on November 5th when the MPs were supposed to vote on the presidential memorandum on interest rate caps law there were only 161 members present, which did not provide the two-thirds majority quorum needed to debate the issue this resulted in the failure to overturn the recommendations by President Uhuru thus allowing the repeal of the interest rate cap.

With the interest rate cap repealed, we expect increased access to credit by borrowers that have been shunned under the current regulated loan-pricing framework going forward as well as increased Net Interest Margins (NIMs) due to higher yields on interest-earning assets coupled with a reduction in the cost of funds following the removal of interest rate floors in 2018, that required banks to pay lenders at least 70.0% of the base lending rate. This has seen deposit rates hit a 36-month low in September 2019, to stand at 4.6% compared to 6.3% in September 2018 as lenders continue to ride on cheaper deposits.

Read our most recent report focusing on the interest rate cap here.

- Consolidation: Consolidation remained a key highlight in Q3’2019 with the following being the major M&A’s activities witnessed during the quarter by the top three banks in the industry:

-

- On 27th September 2019, the Central Bank of Kenya approved the merger and name changes of NIC Group and Commercial Bank of Africa (CBA), which paved the way for the merged institution to officially start operating as NCBA Group PLC. Read more information on the same here, and,

- KCB Group also received approval from the regulator to acquire a 100% stake in National Bank which increased its shares from 3.07 bn units to 3.21 bn units, lifting the lenders market capitalization to Kshs. 135.6 bn from Kshs. 129.3 bn. Read more information on the same here

Other mergers and acquisitions that have happened or been announced recently include;

- Equity Group Holdings, in its expansion strategy, has various on-going acquisitions in the region which are inclusive of a 62.0% of the share capital of Rwanda’s Banque Populaire du Rwanda, and 100.0% of African Banking Corporation Mozambique, African Banking Corporation of Zambia, and African Banking Corporation of Tanzania. These acquisitions will allow Equity Group Holdings an easy penetration into these four African countries. Further, the lender is set to acquire a 66.5% stake in Banque Commerciale du Congo (BCDC), a top bank in the Democratic Republic of Congo owned by the George Arthur Forrest family. Read more information on the same here

- Commercial International Bank sent an application to the Competition Authority of Kenya propositioning to acquire a controlling interest in Mayfair Bank, a Tier III Kenyan bank. Mayfair is the fourth-smallest lender in Kenya and it recorded a loss of Kshs. 250.0 mn in Q3’2019, and,

- Access Bank Nigeria is set to acquire Transnational Bank following the approval by the Competition Authority of Kenya and Central Bank of Kenya. Access Bank is expected to acquire a controlling stake equivalent to 93.57% of Transnational Bank Ltd. Transnational Bank reported a full-year pre-tax loss of Ksh 98.5 million in 2018.

Below is a summary of the deals in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value (Kshs. Bns) |

P/Bv Multiple |

Date |

|

Access Bank (Nigeria) |

Transnational Bank Ltd. |

1.9 |

93.6% |

Undisclosed |

N/A |

Oct-2019* |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

75.2% |

|

1.4x |

|

|

* Announcement date |

||||||

- Regulation - The impactful regulations of the banking sector included IFRS 9 and demonetization:

- IFRS 9 - The effects of IFRS 9 to banks continue to be seen as more banks use the 18-months to 24-months window to comply with the requirements of the new standards. The implementation of the IFRS will force banks to report their losses through their profit and loss statements instead of through the balance sheets as was done before. This has led to decreased profitability of the banks which can be evidenced by the increase in weighted average loan loss provisions to Kshs. 2.8 bn from Kshs. 1.8 bn in Q3’2018, and,

- Demonetization: In an effort to track illicit financial flows, the Central Bank of Kenya concluded the withdrawal of the older Kshs. 1,000 banknotes and introduce new notes. After the demonetization exercise, which had little impact on inflation or the exchange rate, Kshs. 7.4 billion, or 3% of the total value in the circulation of Kshs. 1,000 notes, was rendered worthless. In some cases, this exercise has tightened liquidity in the money market that prompts people to seek alternatives on digital platforms, which ultimately encourages people to use digital banking platforms more, thus, increasing NFI from fees and commissions.

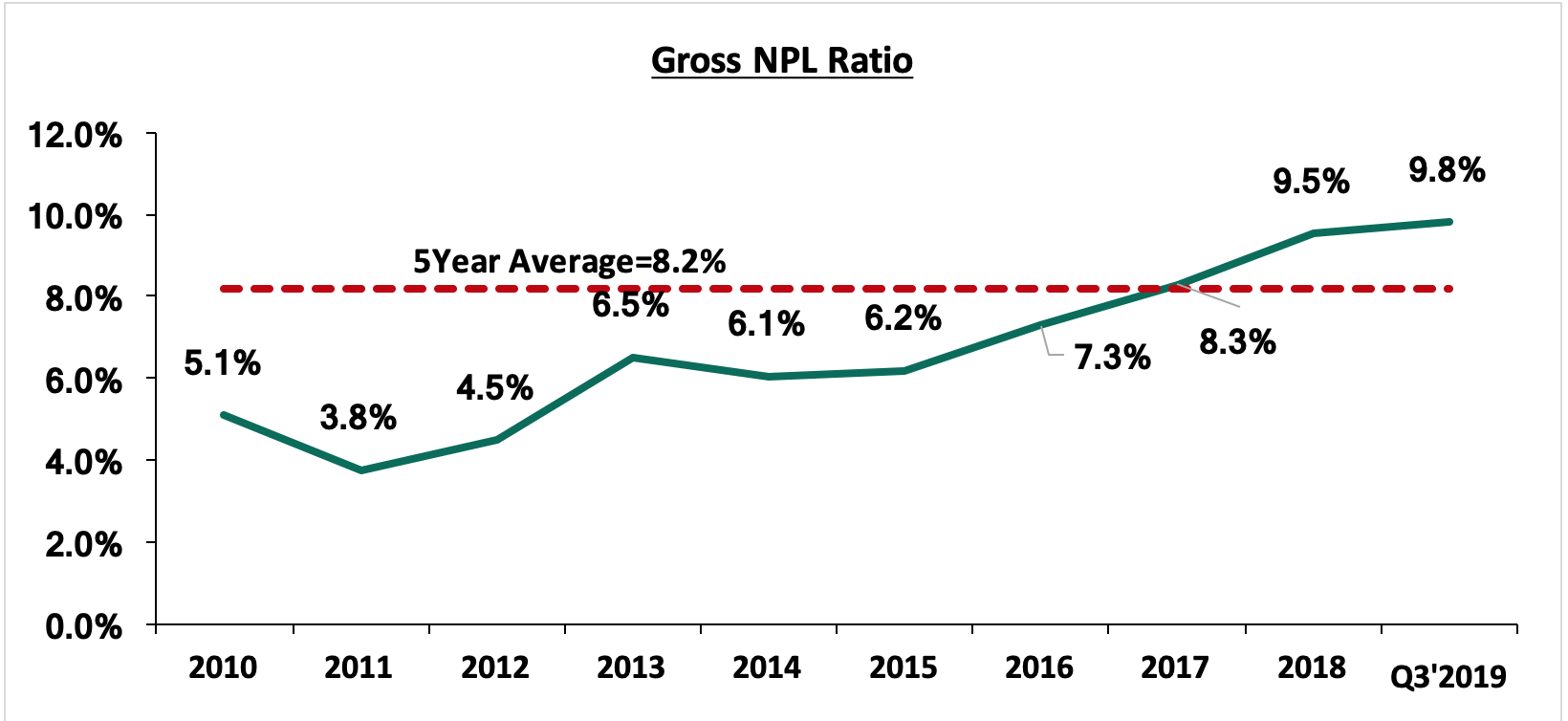

- Asset Quality - Asset quality improved in Q3’2019 with the gross NPL ratio decreasing by 10 bps to 9.8% from 9.9% in Q3’2018. However, this was still high compared to the 5-year average of 8.2%. The major sectors contributing largely to NPLs include real estate, retail, and manufacturing sectors, which saw lenders such as Stanbic Holdings suffer huge impairment losses from ARM, having lent the manufacturing company Kshs. 3.3 bn. Similarly, KCB Group and Co-operative Bank suffered from Uchumi Supermarket’s loans default which translated to the lenders having to write off loans valued at Kshs. 656.0 mn with Co-operative Bank waiving 40.0% of its loan.

The chart below highlights the asset quality trend:

- Revenue Diversification: Listed banks continued their revenue diversification drive by growing the Non-Funded Income (NFI) segment, with various banks launching several initiatives as highlighted below:

-

- KCB Bank deployed its Digital Customer Service platform as part of their digital transformation efforts. Aside from improved customer experience, their platforms will be able to collect real-time data on customers, then analyze and use it to make educated decisions on how to improve operations on an ongoing basis. This launch made KCB the third company in Africa to launch a WhatsApp banking solution following First Bank of Nigeria and HF Group,

- Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. The Property Hub intends to serve the clients who have a property to sell and connect them to the Co-operative Bank clients who want to buy a property. The bank will also offer mortgages to the buyers of the property as it expects to leverage on its contacts with key institutions and the cooperative movements that largely own the bank to boost the property sales for its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019,

- Co-operative Bank also highlighted its plan of growing the business of its leasing-focused subsidiary Co-op Bank Fleet, which intends to leverage on the synergies created by Co-operative Bank’s client base to grow its business, with the main business case of the subsidiary is the easing of the cash flow constraints of acquisitions of fleets, repair and maintenance, thus allowing businesses to focus on their core business. For more information, please see our report Nanyuki Real Estate Investment Opportunity, 2019, & Cytonn Weekly #23/2019,

- Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, in order to provide real-time cross border payments to its clients. DTBK will be the first East African Bank to go live on the SWIFT global payment innovation service, a service that is carrying out over USD 30.0 bn worth of transactions a day, in over 148 currencies. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019, and,

- Standard Chartered Bank Kenya (SCBK) launched an innovation hub lab in Nairobi dubbed Xcelerator in a bid to boost its revenue streams and diversify by riding on financial technology. SCBK plans to allocate Kshs 10.0 bn into supporting Financial Technology (FinTech) startups to scale up and generate innovative solutions to problems in the banking sector. StanChart views FinTech firms as partners amid their growing disruption of the local financial sector, a move likely to aid the bank in generating additional revenue. For additional information, please see our Cytonn Weekly #15/2019.

- SME Focused Services: Q3’2019 saw a majority of banks shift their focus to SME lending among other services by providing SME targeting services with various banks focusing on SME lending as highlighted:

-

-

- In September 2019, Equity Group joined the global SME financing Forum only after CBA and Co-operative Bank with the goal of the forum being to promote the financial growth of SMEs. This followed the move by Equity Group to offload Kshs. 150.0 bn worth of treasury bills and redirect the funds to SME lending,

- Central Bank of Kenya launched a mobile loan app called Stawi in partnership with five Kenyan banks including; NCBA Group Plc, Co-operative Bank of Kenya, Diamond Trust Bank Kenya, KCB Bank, and NIC Bank. This app will give access to MSMEs ranging from Kshs. 30,000 to Kshs. 250,000. Further, it allows for a repayment period of 1-12 months at an interest of 9.0% p.a. Clients who have paid 80.0% of the loan within a record time of 3 months receive a cash reward.

-

- Rebranding: In Q3’2019, we have seen the following banks rebranding in an effort to capture more market share by improving their public image and the brands' recognition:

- Barclays Africa Group - Barclays Africa Group’s rebranding to ABSA has been ongoing since 2018 with the plan to rename all the subsidiaries in Africa realigning the banks to their South African roots. The new identity is meant to show the banks' scalability in Africa and reflect its strategy of being forward-looking. This move also reflected a cultural transformation where they promised that their quality and extensity of services would change and improve with the new brand,

- NCBA- Following the merger of NIC Bank and CBA, the merged entity NCBA announced that it would amend its logo and streamline its services whereby what will be offered will be better than the previous offering in the individual banks. They are also trying to follow suit of the other big banks by publicizing their strategy to focus on SME services and part of their goal is to close some of the overlapping branches and spread out further than the 41 counties they are currently operating to reach more SMEs especially those in marginalized areas.

Section II: Summary of The Performance of the Listed Banking Sector in Q3’2019:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

HF Group |

74.5% |

(11.9%) |

(16.6%) |

(4.3%) |

4.5% |

78.9% |

38.4% |

129.3% |

(0.1%) |

(7.0%) |

113.3% |

(13.7%) |

(3.3%) |

|

BBK |

19.0% |

5.6% |

17.1% |

2.0% |

8.5% |

8.1% |

32.1% |

30.9% |

6.9% |

3.0% |

82.5% |

8.8% |

17.4% |

|

NCBA |

16.3% |

2.7% |

(3.7%) |

8.8% |

5.3% |

23.3% |

47.2% |

21.7% |

10.7% |

7.4% |

66.8% |

8.2% |

14.9% |

|

I&M Holdings |

13.4% |

7.2% |

12.9% |

2.9% |

6.0% |

14.0% |

37.5% |

5.1% |

13.0% |

(0.7%) |

73.7% |

6.6% |

17.2% |

|

Equity Group |

10.4% |

11.2% |

16.8% |

9.5% |

8.4% |

13.7% |

41.1% |

15.0% |

18.9% |

7.8% |

73.0% |

21.0% |

21.7% |

|

DTBK |

7.5% |

(7.3%) |

(7.0%) |

(7.5%) |

5.6% |

5.7% |

22.3% |

(2.5%) |

0.3% |

(1.2%) |

67.8% |

(2.9%) |

14.6% |

|

KCB Group |

6.2% |

4.6% |

(0.8%) |

6.5% |

8.2% |

16.9% |

35.2% |

28.5% |

11.4% |

7.5% |

82.9% |

11.7% |

22.2% |

|

Co-operative Bank |

5.5% |

(1.6%) |

0.9% |

(2.7%) |

8.3% |

33.3% |

40.0% |

46.6% |

8.9% |

13.6% |

83.4% |

5.8% |

18.4% |

|

SCBK |

(1.3%) |

(6.3%) |

(23.7%) |

0.6% |

7.5% |

(1.1%) |

32.2% |

7.0% |

2.4% |

(7.9%) |

52.7% |

6.8% |

16.9% |

|

Stanbic Bank |

N/A |

11.3% |

9.3% |

12.6% |

6.9% |

18.3% |

47.7% |

23.3% |

5.4% |

(33.2%) |

84.6% |

14.6% |

18.5% |

|

Q3'2019 Mkt Weighted Average* |

8.7% |

4.5% |

4.3% |

4.9% |

7.7% |

15.8% |

37.9% |

22.6% |

11.0% |

3.3% |

75.7% |

11.6% |

19.3% |

|

Q3'2018 Mkt Weighted Average** |

16.2% |

6.1% |

12.5% |

3.8% |

8.0% |

5.9% |

34.5% |

0.6% |

7.4% |

17.8% |

75.3% |

4.2% |

18.8% |

|

*Market cap weighted as at 29/11/2019 |

|||||||||||||

|

**Market cap weighted as at 30/11/2018 |

|||||||||||||

Key takeaways from the table above include:

- The above ten listed Kenyan banks recorded an 8.7% average increase in core Earnings per Share (EPS), compared to an increase of 16.2% in Q3’2018 for all listed banks,

- The banks recorded stronger deposit growth, which came in at 11.0%, faster than the 7.4% growth recorded in the sector in Q3’2018. Interest expenses increased at a slower pace of 4.3%, compared to 12.5% in Q3’2018, indicating the banks have been able to mobilize relatively cheaper deposits,

- Average loan growth came in at 11.6%, which was faster than the 4.2% recorded in the sector in Q3’2018, indicating that there was an improvement in credit extension by the banks. Government securities recorded a growth of 3.3% y/y, which was slower compared to loans, and a decline from the 17.8% recorded in the sector in Q3’2018. This highlights that banks are beginning to adjust their business models back to private sector lending as opposed to investing in government securities, as the yields on government securities declined during the quarter. Interest income increased by 4.5%, lower than the 6.1% growth recorded in the sector in Q3’2018. Consequently, the Net Interest Income (NII) grew by 4.9% compared to a growth of 3.8% in the sector in Q3’2018,

- The banks recorded a Net Interest Margin of 7.7%, 30 bps lower than the 8.0% recorded in the sector in Q3’2018. The decline was mainly due to a decline in yields recorded in interest earnings assets following the decline in government securities yields, coupled with the decline in yields on loans due to the 50-bps decline in the Central Bank Rate since the end of Q3’2018, and,

- Non-Funded Income grew by 15.8% y/y, faster than the 5.9% recorded in the sector in Q3’2018. The growth in NFI was boosted by the total fee and commission income which improved by 22.6%, compared to the 0.6% growth recorded in the sector Q3’2018, owing to the faster loan growth.

Section III: The Focus Areas of the Banking Sector Players Going Forward:

In summary, the banking sector showed improved performance, which was largely attributable to persistent revenue diversification evidenced by the increase in NFI, majorly the growth in fees and commissions. Correspondingly, the increase in loan growth evidenced a trend of banks refocusing on core operation in Q3’2019 albeit the sector was plagued by stringent regulations particularly the interest rate cap, which contributed to the decrease in interest income and hence, net interest margins. With the loosening of the regulations particularly the repeal of the interest rate cap, the sector can focus on the following items to increase growth and profitability:

- Continued Revenue Diversification - The increase in NFI growth outperformed that of interest income, thus, allowing the banks to remain profitable amid rigid regulatory environment. However, with the regulations having been loosened banks will need to continue diversifying their income in order to reduce their reliance on interest income, thus, decreasing the pressure on interest rates. For example, Co-operative Bank’s “Soaring Eagle Initiative” enables both channel diversification through internet banking, Mco-op cash and merchant banking among others, as well as consultancy and capacity building,

- Refocus on Core Operations - With the option of pricing loans based on risk profiles following the repeal of the interest rate cap, banks will be able to increase interest rates with bias to credit risk rating of borrowers, which will in turn improve their interest income. This was already witnessed in Q2’2019 and Q3’2019 where banks have increased SME lending which in turn increased loan growth. This can be expected to persist post the interest rate cap era, and,

- Expansion and Further Consolidation - With the Microfinance-Bill 2019 of increasing the minimum on core capital requirements still in its pilot stage more mergers and acquisitions would enable the unprofitable and/or smaller banks to manage the requirement and be able to increase profitability through cost efficiency and deposits growth.

Section IV: Brief Summary of the Outcome of Our Analysis:

As per our analysis on the banking sector from a franchise value and from a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review of the banks:

|

Bank |

Loans to Deposits Ratio |

Cost to Income Ratio |

Return on Average Capital Employed |

Deposit/Branch |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

Non-Funded Income/Revenue |

|

Co-operative Bank |

83.4% |

56.2% |

18.4% |

2.1 |

10.5% |

55.5% |

16.2% |

40.0% |

|

KCB Group Plc |

82.9% |

54.4% |

22.2% |

2.3 |

8.3% |

56.5% |

15.3% |

35.2% |

|

DTB Kenya |

67.8% |

52.2% |

14.6% |

2.2 |

8.9% |

48.0% |

15.1% |

24.1% |

|

Equity Group Holdings |

73.0% |

54.8% |

21.7% |

1.6 |

8.4% |

45.8% |

15.0% |

41.1% |

|

NCBA Group Plc |

66.8% |

62.0% |

14.9% |

4.5 |

12.4% |

60.2% |

13.6% |

47.2% |

|

Barclays Bank |

82.5% |

63.3% |

17.4% |

2.7 |

6.8% |

78.6% |

12.0% |

32.1% |

|

Standard Chartered Bank |

52.7% |

57.7% |

16.9% |

6.6 |

14.9% |

77.0% |

15.8% |

32.2% |

|

I&M Holdings |

73.7% |

48.6% |

17.2% |

5.6 |

12.7% |

62.5% |

15.5% |

37.5% |

|

HF Group Plc |

113.3% |

102.9% |

-3.3% |

1.6 |

28.2% |

44.4% |

16.9% |

38.4% |

|

Stanbic Bank/Holdings |

84.6% |

63.5% |

18.5% |

7.4 |

10.9% |

58.9% |

12.6% |

47.7% |

|

Weighted Average Q3'2019 |

75.7% |

56.6% |

19.3% |

3.1 |

9.8% |

57.8% |

14.8% |

38.0% |

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess efficiency, asset quality, diversification, and profitability, among other metrics. The overall Q3’2019 ranking is as shown in the table below:

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

Q3'2019 Rank |

|

KCB Group Plc |

46 |

3 |

20.2 |

1 |

|

I&M Holdings |

57 |

2 |

24.0 |

2 |

|

Co-operative Bank of Kenya Ltd |

55 |

5 |

25.0 |

3 |

|

Equity Group Holdings Ltd |

61 |

6 |

28.0 |

4 |

|

Stanbic Bank/Holdings |

59 |

9 |

29.0 |

5 |

|

Barclays Bank |

64 |

7 |

29.8 |

6 |

|

DTBK |

75 |

1 |

30.6 |

7 |

|

NCBA Group Plc |

70 |

8 |

32.8 |

8 |

|

SCBK |

78 |

4 |

33.6 |

9 |

|

HF Group Plc |

95 |

10 |

44.0 |

10 |

Section V: Conclusion:

In summary, the banking sector saw an improved performance albeit the core EPS growth being lower compared to that of a similar period of review in 2018. NFI income was a major highlight having grown by 15.8% compared to 5.9% the previous period supported by the increased revenue diversification which is expected to continue going forward leveraging on digital innovations. Post interest rate cap, banks’ Net Interest Margins are expected to increase on account of increased interest income following the repeal of the cap thus allowing loan pricing based on the credit risk of borrowers, coupled with low Cost of Funds aided by access to cheap deposits.

For more information, see our Cytonn Q3’2019 Listed Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.