Kenya Mortgage Refinance Company (KMRC) Progress, & Cytonn Weekly #11/2022

By Research Team, Mar 20, 2022

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 82.8%, down from the 102.1% recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 9.7 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 96.6%, a decline from the 133.9% recorded the previous week. The performance is partly attributable to investors’ preference for the longer-dated paper, which offers a higher yield of 9.8% compared to the 8.1% and 7.3% yields offered by the 182-day and 91-day papers, respectively. The subscription rate for the 182-day paper increased to 82.4%, from 58.1% recorded the previous week while that of the 91-day paper declined to 49.5% from 132.4% recorded the previous week. The government continued rejecting expensive bids, accepting bids worth Kshs 18.8 bn out of the Kshs 19.9 bn worth of bids received, translating to an acceptance rate of 94.8%. In the Primary Bond Market, the Central Bank of Kenya released results for the recently re-opened bonds on tap sale; FXD1/2021/05 FXD1/2020/15 and FXD1/2021/25. The tap sale recorded a subscription rate of 79.0% with the government receiving bids worth Kshs 24.9 bn against the offered Kshs 31.5 bn;

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum fuel prices in Kenya effective 15th March 2022 to 14th April 2022 highlighting that super petrol and diesel prices increased by 3.9% and 4.5% to Kshs 134.7 per litre and Kshs 115.6 per litre, respectively, from Kshs 129.7 per litre and Kshs 110.6 per litre recorded last month. The price of Kerosene remained unchanged at Kshs 103.5 per litre, same as recorded in the previous month. Also during the week, the World Bank approved a USD 750 mn (Kshs 80.9 bn) loan facility aimed at accelerating Kenya’s ongoing inclusive and resilient recovery from the COVID-19 pandemic, and, strengthening fiscal sustainability reforms that contribute to greater transparency and the fight against corruption;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 1.4%, 0.2% and 0.5%, respectively, taking their YTD performance to losses of 6.1%, 2.8% and 4.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as Bamburi, Safaricom and EABL of 3.1%, 2.8% and 2.3%, respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Standard Chartered Bank (SCBK), Co-operative Bank and ABSA of 6.7%, 3.5% and 2.5%, respectively;

During the week, ABSA Bank, KCB Group, Standard Chartered Bank (SCBK) and Co-operative Bank released their FY’2021 financial results highlighting a 161.2%, 74.3%, 66.2%, and 53.0% increase in their core earnings per share, respectively. As of now, five out of the ten listed banks have released their FY’2021 results;

Real Estate

During the week, the Kakamega County Investment and Development Agency (KCIDA), in collaboration with Pinnie Agency Limited, a private developer, began construction of 3,000 affordable housing units in 5 estates within Kakamega and Mumias towns. Also, Unity Homes, a Kenyan-British housing developer announced plans to launch the construction of its third phase of housing units in Tatu City, Ruiru. Additionally, International Finance Corporation (IFC) announced plans to buy Kshs 4.2 bn worth of bonds in Kenya Mortgage Refinance Company’s Kshs 10.5 bn Medium Term Note Program (MTN). Lastly, South Korea Government granted Kenya Kshs 685.9 mn for the construction of transport infrastructure, planning and security installations at the Konza Technopolis City Project;

In the Retail sector, Naivas supermarket, a local retail chain, opened its 82nd outlet at Katani, along Mombasa Road, taking up 34,299 SQFT worth of space in the area. In the industrial sector, Grit Real Estate Income Group, a Mauritius based Real Estate Investment Company, completed the purchase of Orbit Products Africa, a warehouse and manufacturing facility located in Machakos County, at a cost of Kshs 6.1 bn. For the listed Real Estate, ILAM Fahari I-Reit closed the week trading at an average price of Kshs 5.8 per share;

Focus of the Week

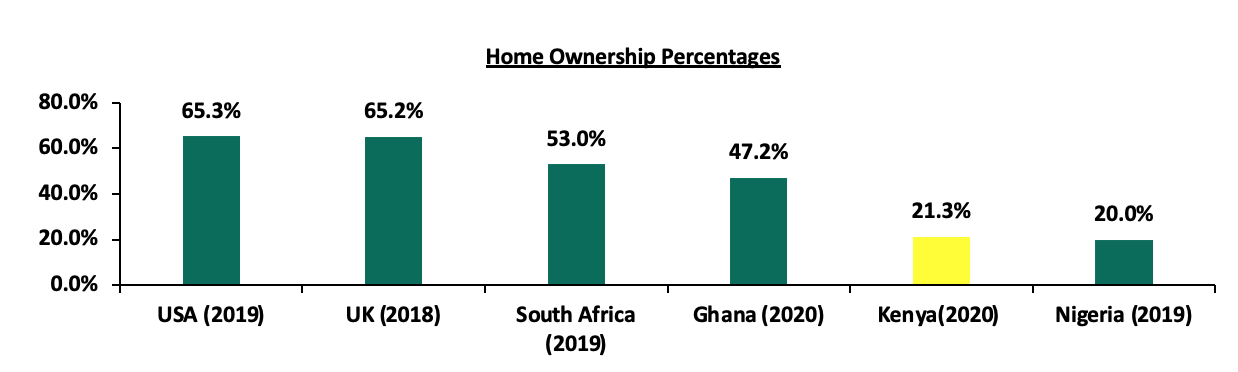

With availability of affordable mortgage finance being one of key challenge towards home ownership in Kenya, the government through the Central Bank of Kenya, established the Kenya Mortgage Refinance Company (KMRC). The company was incorporated in April 2018 as a non- deposit taking financial institution under the supervision of the Central Bank of Kenya with the single purpose of providing long-term funds to primary mortgage lenders (Banks, Micro Finance Banks and SACCOs), in order to increase the availability and affordability of mortgage loans to Kenyans. This week we update progress of KMRC by highlighting their latest initiatives to achieve their objectives and offer recommendations on how to boost finance for refinancing mortgages, based on similar initiatives from other countries.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.43%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.93% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- Justin Mwangi, a Senior Investment Analyst, was on a panel on Twitter Spaces to discuss the Performance of the Kenya Shilling and How to Reverse the Depreciation. Listen to Justin here,

- We continue to offer Wealth Management Training every Thursday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 82.8%, down from the 102.1% recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 9.7 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 96.6%, a decline from the 133.9% recorded the previous week. The performance is partly attributable to investors’ preference for the longer-dated paper, which offers a higher yield of 9.8% compared to the 8.1% and 7.3% yields offered by the 182-day and 91-day papers, respectively. The subscription rate for the 182-day paper increased to 82.4%, from 58.1% recorded the previous week while that of the 91-day paper declined to 49.5%, from 132.4% recorded the previous week. The yields on the government papers recorded a mixed performance with yields on the 182-day and 91-day papers increasing by 6.1 bps and 4.6 bps to 8.1% and 7.3%, respectively, while yields on the 364-paper declined by 0.8 bps to 9.8%. The government continued rejecting expensive bids, accepting bids worth Kshs 18.8 bn out of the Kshs 19.9 bn worth of bids received, translating to an acceptance rate of 94.8%.

In the Primary Bond Market, the Central Bank of Kenya re-opened the three recently issued bonds on tap sale; FXD1/2021/05 FXD1/2020/15 and FXD1/2021/25, with tenors to maturity of 4.7 years, 12.9 years and 24.2 years, and coupons of 11.3%, 12.8% and 13.9% respectively. The Government sought to raise Kshs 31.5 bn for budgetary support, following an undersubscription of the initial offers, which had a total subscription rate coming in at 81.9%, partly attributable to the tightened liquidity in the money markets during the bonds’ sale period, with the interbank rate averaging 5.6%, in comparison to an average rate of 4.7% in February 2022. The tap sale was undersubscribed, with the overall subscription rate came in at 79.0%, partly attributable to the short bidding period. The government received bids worth Kshs 24.9 bn, lower than the Kshs 31.5 bn offered and continued to reject expensive bids, accepting only Kshs 23.9 bn. This translated to an acceptance rate of 95.9%. The weighted average yields for the three bonds were 12.0% for FXD1/2021/05, 13.7% for FXD1/2020/15 and 14.0% for FXD1/2021/25.

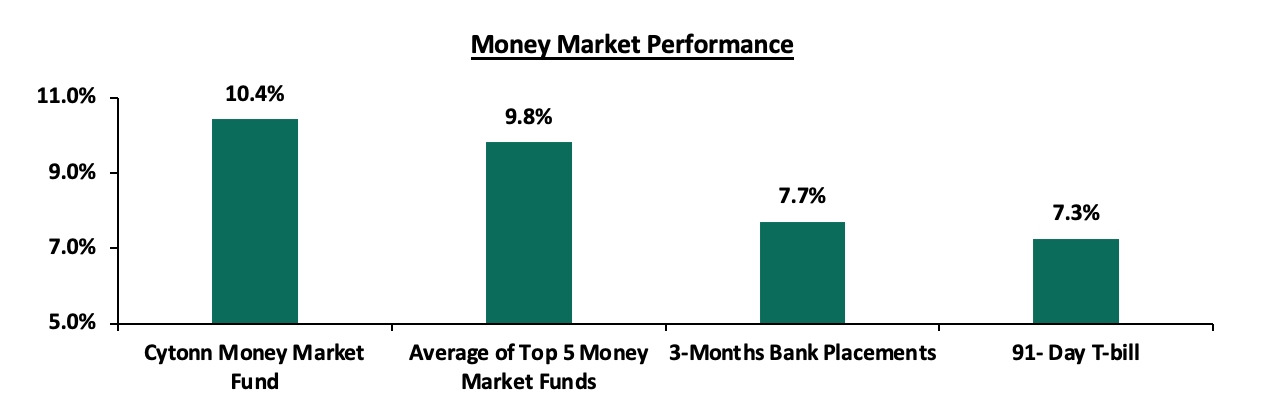

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 4.6 bps to 7.3%. The average yield of the Top 5 Money Market Funds remained unchanged at 9.8%, as was recorded the previous week while the yield on the Cytonn Money Market Fund declined by 0.2% points to 10.4%, from 10.6% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 18th March 2022:

|

Money Market Fund Yield for Fund Managers as published on 18th March 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.4% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.7% |

|

4 |

Sanlam Money Market Fund |

9.7% |

|

5 |

Madison Money Market Fund |

9.4% |

|

6 |

Apollo Money Market Fund |

9.4% |

|

7 |

GenCap Hela Imara Money Market Fund |

9.3% |

|

8 |

Dry Associates Money Market Fund |

9.1% |

|

9 |

CIC Money Market Fund |

9.0% |

|

10 |

Orient Kasha Money Market Fund |

8.7% |

|

11 |

Co-op Money Market Fund |

8.6% |

|

12 |

NCBA Money Market Fund |

8.4% |

|

13 |

ICEA Lion Money Market Fund |

8.3% |

|

14 |

British-American Money Market Fund |

8.3% |

|

15 |

AA Kenya Shillings Fund |

8.2% |

|

16 |

Old Mutual Money Market Fund |

7.4% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets eased, with the average interbank rate declining by 0.8% points to 4.3%, from 5.1%, as recorded the previous week, partly attributable to government payments which offset tax remittances. The average interbank volumes traded increased by 40.2% to Kshs 17.2 bn, from Kshs 12.3 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Kenyan Eurobonds were on a downward trajectory, partly attributable to positive investor sentiments, following the approval of a USD 750.0 mn (Kshs 80.9 bn) loan facility from the World Bank to be used for fiscal reforms. Yields on the 30-year bond issued in 2018 and 12-year bond issued in 2021 declined by 0.5% points to 9.4% and 8.4%, respectively. Similarly, yields on the 10-year bond issued in 2014 declined by 0.2% points to 6.5%, while yields on the 7-year bond issued in 2019 and 12-year bond issued in 2019 both declined by 0.7% points to 8.3% and 8.7%, respectively. Yields on the 10-year Eurobond issued in 2018 declined by 0.9% points to 8.2%. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

5.8% |

8.1% |

5.6% |

6.7% |

6.6% |

|

1-Mar-22 |

5.3% |

8.2% |

9.7% |

8.2% |

8.2% |

8.5% |

|

11-Mar-22 |

6.7% |

9.1% |

9.9% |

9.0% |

9.4% |

8.9% |

|

14-Mar-22 |

6.7% |

8.9% |

9.8% |

8.8% |

9.2% |

8.8% |

|

15-Mar-22 |

6.4% |

8.7% |

9.7% |

8.4% |

9.0% |

8.5% |

|

16-Mar-22 |

6.5% |

8.2% |

9.4% |

8.3% |

8.7% |

8.4% |

|

17-Mar-22 |

6.5% |

8.2% |

9.4% |

8.3% |

8.7% |

8.4% |

|

Weekly Change |

(0.2%) |

(0.9%) |

(0.5%) |

(0.7%) |

(0.7%) |

(0.5%) |

|

MTD Change |

1.2% |

(0.1%) |

(0.3%) |

0.1% |

0.5% |

(0.1%) |

|

YTD Change |

2.1% |

2.4% |

1.3% |

2.7% |

2.0% |

1.8% |

Source: CBK

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.2% against the US dollar, to close the week at Kshs 114.4, from Kshs 114.2 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a year to date basis, the shilling has depreciated by 1.1% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Rising global crude oil prices on the back of supply constraints and geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the emergence of the new COVID-19 variants,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.4% of GDP in 2021, having expanded by 44.6% to Kshs 127.6 bn in November 2021, from Kshs 88.3 bn recorded in November 2020, attributable to a robust increase in commercial imports by 37.1% to Kshs 185.9 bn in November 2021, from Kshs 88.3 bn in November 2020, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 8.0 bn (equivalent to 4.9-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021 coupled with the USD 972.6 mn IMF disbursement, the USD 130.0 mn World Bank loan financing received in June 2021 and USD 750.0 mn which has recently been approved by the World Bank in March 2022, and,

- Improving diaspora remittances evidenced by a 23.5% y/y increase to USD 321.5 mn in February 2022, from USD 260.3 mn recorded over the same period in 2021, which has continued to cushion the shilling against further depreciation.

Weekly Highlights:

- Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum fuel prices in Kenya effective 15th March 2022 to 14th April 2022. Notably, super petrol and diesel prices increased by 3.9% and 4.5% to Kshs 134.7 per litre and Kshs 115.6 per litre, from Kshs 129.7 per litre and Kshs 110.6 per litre, respectively, while the price of Kerosene remained unchanged at Kshs 103.5 per litre. Key to note, this is the first increase in prices for Super Petrol and Diesel since October 2021 and the prices are the highest ever recorded in the country. Below are the key take-outs from the statement:

The performance in fuel prices was attributable to:

- An increase in the average landed costs of Super Petrol by 13.3% to USD 676.4 per cubic meter in February 2022, from USD 596.8 per cubic meter in January 2022,

- An increase in the average landed costs of Diesel by 11.7% to USD 677.3 per cubic meter in February 2022, from USD 606.2 per cubic meter in January 2022,

- An increase in the average landed costs of Kerosene by 15.9% to USD 619.6 per cubic meter in February 2022, from USD 534.4 per cubic meter in January 2022, and,

- The depreciation of the Kenyan shilling during the period by 0.2% to Kshs 113.8 in February 2022, from Kshs 113.6 in January 2022.

However, the fuel prices were supported from further increase by:

- The fuel subsidy program under the Petroleum Development Fund which resulted in subsidies of Kshs 20.4 on Super Petrol, Kshs 27.6 on Diesel and Kshs 26.9 on Kerosene during the month,

- Removal of suppliers margins of Kshs 6.3 on Super Petrol, Kshs 5.5 on Diesel and Kshs 7.7 on Kerosene since October 2021, and,

- The decline in the Free on Board (FOB) price of Murban crude oil in February 2022 by 9.4% to USD 74.4 per barrel, from USD 82.0 per barrel in January 2022.

Since the beginning of the year, global fuel prices have continued to increase, recording a 34.5% rise to USD 105.0 per barrel, from USD 78.0 per barrel recorded on 1st January 2022, driven by persistent supply chain constraints worsened by the geopolitical pressures occasioned by the Russian invasion of Ukraine. Given the continuous increase in the average landed costs of fuel locally, we believe that the fuel subsidy program by the National Treasury stands at risk of being depleted and is unsustainable, as evidenced by the increased compensation amounts which further increase the possibility of depletion. Despite the additional Kshs 24.9 bn for stabilization of oil market prices and the rationalization of Capital expenditure, the National Treasury would have to disburse Kshs 15.0 bn to meet the full subsidy in the period of review. As such, the additional amount to the program would be depleted in two months. Key to note, the compensation amounts for March 2022 increased by 40.3%, 18.3% and 69.4% to Kshs 20.4, Kshs 27.6 and Kshs 26.9 per litre from Kshs 14.5, Kshs 23.3 and Kshs 15.9 for Super Petrol, Diesel and Kerosene, respectively in February 2022. Additionally, the monthly average subsidy for the past six months starting October 2021 is Kshs 14.7 per litre for Super Petrol, Kshs 19.4 per litre for Diesel and Kshs 17.2 per litre for Kerosene. Due to the supply chain constraints in the global fuel markets, we expect the sustained high fuel prices to trickle down to our economy in the near future. With fuel prices being a major input cost in majority of Kenya’s sectors such as manufacturing, transport and energy, we expect the increasing fuel prices to exert upward pressure on the inflation basket with fuel being a major contributor to Kenya’s headline inflation and an elevation in the cost of living.

- Revenue and Net Exchequer for FY’2021/2022

The National Treasury gazetted the revenue and net expenditures for the first eight months of FY’2021/2022, ending 28th February 2022. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 28th February 2022 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

- |

21.3 |

- |

- |

- |

|

Tax Revenue |

1,707.4 |

1,126.4 |

66.0% |

1,138.3 |

99.0% |

|

Non-Tax Revenue |

68.2 |

45.1 |

66.1% |

45.5 |

99.2% |

|

Total Revenue |

1,775.6 |

1,192.8 |

67.2% |

1,183.8 |

100.8% |

|

External Loans & Grants |

379.7 |

50.0 |

13.2% |

253.1 |

19.7% |

|

Domestic Borrowings |

1,008.4 |

631.1 |

62.6% |

672.3 |

93.9% |

|

Other Domestic Financing |

29.3 |

5.5 |

18.8% |

19.5 |

28.2% |

|

Total Financing |

1,417.4 |

686.6 |

48.4% |

944.9 |

72.7% |

|

Recurrent Exchequer issues |

1,106.6 |

709.3 |

64.1% |

737.7 |

96.2% |

|

CFS Exchequer Issues |

1,327.2 |

750.9 |

56.6% |

884.8 |

84.9% |

|

Development Expenditure and Net Lending |

389.2 |

191.8 |

49.3% |

259.5 |

73.9% |

|

County Governments and Contingencies |

370.0 |

193.7 |

52.3% |

246.7 |

78.5% |

|

Total Expenditure |

3,193.0 |

1,845.7 |

57.8% |

2,128.7 |

86.7% |

|

Fiscal Deficit excluding Grants |

(1,417.4) |

(652.9) |

46.1% |

(944.9) |

69.1% |

|

Fiscal Deficit as a % of GDP |

*11.4% |

5.3% |

|||

|

Total Borrowing |

1,388.1 |

681.1 |

49.1% |

925.4 |

73.6% |

|

*Projected Fiscal Deficit as a % of GDP |

|||||

The key take-outs from the report include:

- Total revenue collected as at the end of February 2022 amounted to Kshs 1,192.8 bn, equivalent to 67.2% of the original estimates of Kshs 1,775.6 bn and is 100.8% of the prorated estimates of Kshs 1,183.8 bn. Notably, the performance is a decline from the 103.8% outperformance recorded in the first seven months to January 2021, mainly attributable to a 26.9% decline in the monthly revenue collection to Kshs 117.6 bn in February 2022, as compared to a monthly average of Kshs 160.9 bn in the first seven months to January 2021. Cumulatively, tax revenues amounted to Kshs 1,126.4 bn, equivalent to 66.0% of the original estimates of Kshs 1,707.4 bn and 99.0% of the prorated estimates of Kshs 1,138.3 bn,

- Total financing amounted to Kshs 686.6 bn, equivalent to 48.4% of the original estimates of Kshs 1,417.4 bn and is equivalent to 72.7% of the prorated estimates of Kshs 944.9 bn. Additionally, domestic borrowing amounted to Kshs 631.1 bn, equivalent to 62.6% of the original estimates of Kshs 1,008.4 bn and is 93.9% of the prorated estimates of Kshs 672.3 bn,

- The total expenditure amounted to Kshs 1.845.7 bn, equivalent to 56.5% of the original estimates of Kshs 3,193.0 bn, and is 84.7% of the prorated expenditure estimates of Kshs 2,128.7 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 709.3 bn, equivalent to 64.1% of the original estimates and 96.2% of the prorated estimates of Kshs 737.7 bn, and development expenditure amounted to Kshs 191.8 bn, equivalent to 49.3% of the original estimates of Kshs 389.2 bn and is 73.9% of the prorated estimates of Kshs 259.5 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their targets of Kshs 1,327.2 bn after amounting to Kshs 750.9 bn, equivalent to 56.6% of the original estimates, and are 84.9% of the prorated amount of Kshs 884.8 bn. The cumulative public debt servicing cost amounted to Kshs 667.2 bn which is 57.1% of the original estimates of Kshs 1,169.2 bn, and is 85.6% of the prorated estimates of Kshs 779.4 bn, and,

- Total Borrowings as at the end of February 2022 amounted to Kshs 681.1 bn, equivalent to 49.1% of the original estimates of Kshs 1,388.1 bn and are 73.6% of the prorated estimates of Kshs 925.4 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The revenue performance in the first eight months of the current fiscal year point towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. We believe that the current measures such as the implementation of the Finance Act 2021 which led to the upward readjustment of the Excise Duty Tax, Income Tax as well as the Value Added Tax will continue playing a big role in expanding the tax base and consequently enhance revenue collection. However, the approval of the 2021/22 supplementary budget will increase the fiscal deficit to an estimate of 12.9% of GDP, from the earlier estimated deficit of 11.4% of GDP for FY’2021/22. We expect the government to ramp up its revenue collection initiatives in the remaining 4 months of the current year as well as look increasingly to the domestic market to plug in the deficit. The emergence of new COVID-19 variants both locally and with trading partners globally continues to pose risks to the economic recovery, should they necessitate imposition of tight containment measures.

- World Bank Loan Facility

During the week, the World Bank approved a USD 750 mn (Kshs 80.9 bn) loan facility aimed at accelerating Kenya’s ongoing inclusive and resilient recovery from the COVID-19 pandemic, coupled with strengthening fiscal sustainability reforms that contribute to greater transparency and the fight against corruption. The loan facility is the second under the Development Policy Operation (DPO) and adds to the USD 750.0 mn issued to the country in June 2021 to provide low-cost budget financing along with support to key policy and institutional reforms. The new loan facility will be offered under concessional terms, and will attract an interest cost of 3.0% p.a. The DPO will organize the multi-sector reforms into three pillars; i) fiscal and debt reforms to make spending more transparent and efficient, and enhance domestic debt market performance, ii) electricity sector and public-private partnership (PPP) reforms to place Kenya on an efficient, green energy path, and boost private infrastructure investment, and, iii) strengthening the governance framework of Kenya’s natural and human capital which includes the environment, land, water and healthcare.

Upon receipt of the USD 750.0 mn (Kshs 80.9 bn), Kenya’s external debt is expected to increase by 1.9% to Kshs 4.3 tn, from Kshs 4.2 tn and the total debt to Kshs 8.1 tn from 8.0 tn, as of December 2021. As a result, the public debt to GDP ratio will increase to by 0.7% points to 66.9%, from 66.2% in December 2021 and will be 16.9% points above the International Monetary Fund (IMF)’s recommended threshold for developing nations, which is capped at 50.0%. We expect that the facility requirements will help to accelerate fiscal reforms in the country that will help to reduce the fiscal deficit, currently at 5.3%, in order to reduce the need for Government borrowing to bridge the gap. Additionally, inflows from the facility will help to shore up and increase the country’s foreign exchange reserves which will provide adequate import cover. However, with the loan facility being US Dollar (USD) denominated, we expect pressure on the shilling especially as the debt servicing period begins. Year to date, the shilling has depreciated by 1.1% against the USD to close at 114.4, from Kshs 113.1 recorded on 3rd January 2021.

Rates in the Fixed Income market have remained stable due to the relatively ample liquidity in the money market. The government is 7.8% ahead of its prorated borrowing target of Kshs 481.2 bn having borrowed Kshs 518.5 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 1.2 tn during the first eight months of the current fiscal year, which was equivalent to 100.8% of the prorated revenue collection target. However, despite the projected high budget deficit of 11.4% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 1.4%, 0.2% and 0.5%, respectively, taking their YTD performance to losses of 6.1%, 2.8% and 4.3% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as Bamburi, Safaricom and EABL of 3.1%, 2.8% and 2.3%, respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Standard Chartered Bank (SCBK), Co-operative Bank and ABSA of 6.7%, 3.5% and 2.5%, respectively.

During the week, equities turnover declined by 37.7% to USD 13.3 mn, from USD 21.4 mn recorded the previous week, taking the YTD turnover to USD 210.9 mn. Foreign investors remained net sellers, with a net selling position of USD 1.7 mn, from a net selling position of USD 3.8 mn recorded the previous week, taking the YTD net selling position to USD 10.9 mn.

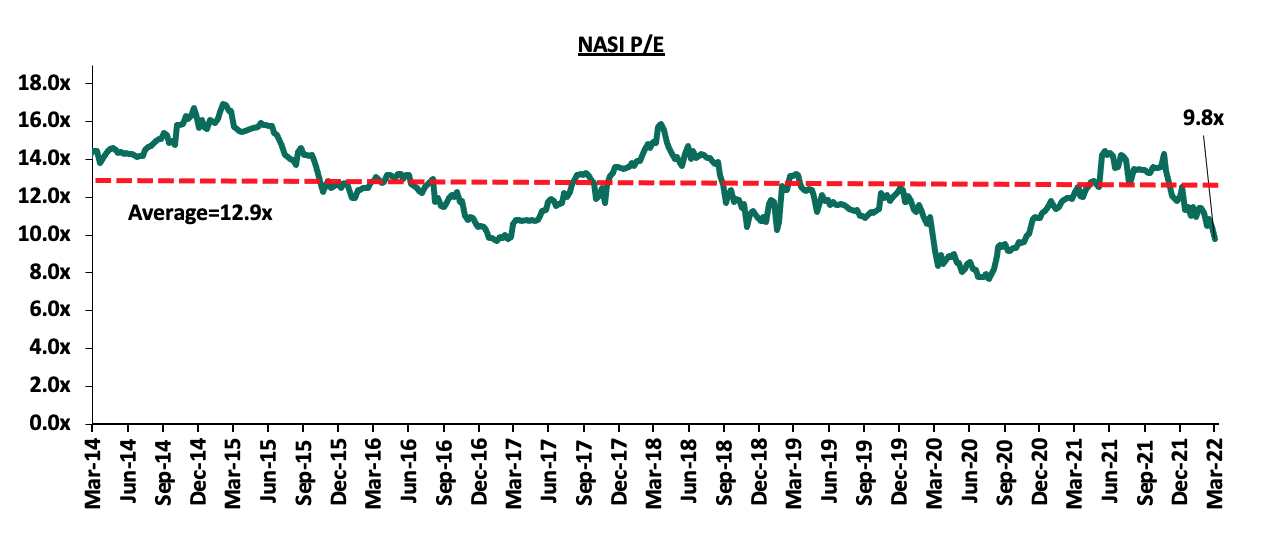

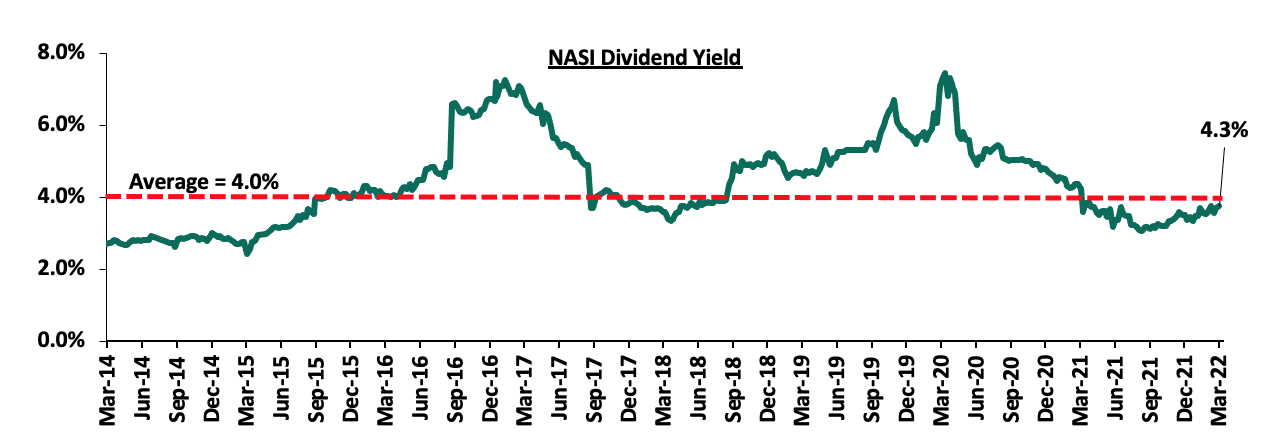

The market is currently trading at a price to earnings ratio (P/E) of 9.8x, 23.9% below the historical average of 12.9x, and a dividend yield of 4.3%, 0.3% points above the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.3x, an indication that the market is trading at a premium to its future earnings growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 9.8x is 27.4% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market:

Weekly Highlight:

Earnings Releases

During the week, ABSA Bank, Standard Chartered Bank (SCBK), KCB Group and Co-operative Bank released their FY’2021 financial results. Below is a summary of their performance;

- KCB Group

|

KCB Group FY’2021 Key Highlights |

|||||

|

Balance Sheet |

|||||

|

Balance Sheet Items |

FY'2020 (Kshs bn) |

FY'2021 (Kshs bn) |

y/y change |

||

|

Net Loans and Advances |

595.3 |

675.5 |

13.5% |

||

|

Government Securities |

208.8 |

270.8 |

29.7% |

||

|

Total Assets |

987.8 |

1,139.7 |

15.4% |

||

|

Customer Deposits |

767.2 |

837.1 |

9.1% |

||

|

Deposits per Branch |

2.1 |

1.7 |

20.4% |

||

|

Total Liabilities |

845.4 |

966.2 |

14.3% |

||

|

Shareholders’ Funds |

142.4 |

171.7 |

20.6% |

||

|

Income Statement |

|||||

|

Income Statement Items |

FY'2020 (Kshs bn) |

FY'2021 (Kshs bn) |

y/y change |

||

|

Net Interest Income |

67.9 |

77.7 |

14.4% |

||

|

Net non-Interest Income |

28.5 |

30.9 |

8.8% |

||

|

Total Operating income |

96.4 |

108.6 |

12.7% |

||

|

Loan Loss provision |

(27.5) |

(13.0) |

(52.8%) |

||

|

Total Operating expenses |

(70.7) |

(60.8) |

(13.9%) |

||

|

Profit before tax |

25.7 |

47.8 |

85.9% |

||

|

Profit after tax |

19.6 |

34.2 |

74.3% |

||

|

Core EPS |

6.10 |

10.63 |

74.3% |

||

|

Key Ratios |

|||||

|

Income Statement Ratios |

FY'2020 |

FY'2021 |

% point change |

||

|

Yield from interest-earning assets |

11.1% |

11.1% |

0.0% |

||

|

Cost of funding |

2.7% |

2.8% |

0.1% |

||

|

Net Interest Margin |

8.5% |

8.4% |

(0.1%) |

||

|

Non-Performing Loans (NPL) Ratio |

14.8% |

16.6% |

1.8% |

||

|

NPL Coverage |

59.8% |

52.9% |

(6.9%) |

||

|

Cost to Income With LLP |

73.3% |

56.0% |

(17.3%) |

||

|

Loan to Deposit Ratio |

77.6% |

80.7% |

3.1% |

||

|

Cost to Income Without LLP |

44.8% |

44.0% |

(0.8%) |

||

|

Return on average equity |

14.4% |

21.8% |

7.4% |

||

|

Return on average assets |

2.1% |

3.2% |

1.1% |

||

|

Equity to Assets |

14.4% |

15.1% |

0.7% |

||

|

Capital Adequacy Ratios |

|||||

|

Ratios |

FY'2020 |

FY'2021 |

% points change |

||

|

Core Capital/Total Liabilities |

18.7% |

18.7% |

0.0% |

||

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

||

|

Excess |

10.7% |

10.7% |

0.0% |

||

|

Core Capital/Total Risk Weighted Assets |

18.2% |

18.0% |

(0.2%) |

||

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

||

|

Excess |

7.7% |

7.5% |

(0.2%) |

||

|

Total Capital/Total Risk Weighted Assets |

21.6% |

22.1% |

0.5% |

||

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

||

|

Excess |

7.1% |

7.6% |

0.5% |

||

Key take-outs from the earnings release include;

- Core earnings per share rose by 74.3% to Kshs 10.6, from Kshs 6.1 in FY’2020, lower than our expectations of a 92.5% increase to Kshs 11.7, with the variance stemming from the 12.7% increase in total operating income, which was lower than our projection of a 16.0% increase. The performance was driven by the 12.7% growth in total operating income to Kshs 108.6 bn, from Kshs 96.4 bn in FY’2020, and a 13.9% decline in total operating expenses to Kshs 60.8 bn, from Kshs 70.7 bn in FY’2020,

- Interest income grew by 15.1% to Kshs 102.2 bn, from Kshs 88.7 bn in FY’2020, mainly driven by a 14.2% increase in interest income from loans and advances, which increased to Kshs 74.0 bn, from Kshs 64.8 bn in FY’2020, coupled with a 14.5% increase in interest income from government securities which increased to Kshs 26.5 bn, from Kshs 23.2 bn in FY’2020,

- The Yield on Interest-Earning Assets (YIEA) rose marginally by 0.02% points to 11.11%, from 11.09% recorded in FY’2020, attributable to the faster 15.1% growth in trailing interest income which slightly outpaced the 14.9% growth in Average Interest Earning Assets (AIEA),

- Interest expense rose by 17.6% to Kshs 24.5 bn, from Kshs 20.8 bn in FY’2020, following a 76.6% rise in Interest expense on deposits and placements to Kshs 3.4 bn, from Kshs 2.0 bn in FY’2020, coupled with an 8.7% increase in interest expense on customer deposits to Kshs 20.5 bn, from Kshs 18.9 bn in FY’2020. Consequently, Cost of funds (COF) increased marginally by 0.1% points to 2.8%, from 2.7% recorded in FY’2020, following a faster 17.6% increase in Trailing interest expense, which outpaced the 12.3% increase in average interest bearing liabilities,

- Net Interest Margin (NIM) therefore declined to 8.4%, from 8.5% in FY’2020 due to the faster 14.9% growth in average interest-earning assets, which outpaced the 14.4% increase in trailing Net Interest Income,

- Total operating expenses decreased by 13.9% to Kshs 60.8 bn, from Kshs 70.7 bn in FY’2020, largely driven by a 52.8% decline in Loan Loss Provisions (LLP) to Kshs 13.0 bn, from Kshs 27.5 bn in FY’2020. The reduced provisioning level was due to declining credit risk on the back of increased business activities in 2021 driven by the gradual economic recovery. Staff costs increased by 20.9% to Kshs 24.7 bn, from Kshs 20.5 bn in FY’2020,

- The balance sheet recorded an expansion as total assets grew by 15.4% to Kshs 1,139.7 bn, from Kshs 987.8 bn in FY’2020. The growth was supported by a 13.5% loan book expansion to Kshs 675.5 bn, from Kshs 595.3 bn in FY’2020, coupled with a 29.7% increase in government securities to Kshs 270.8 bn, from Kshs 208.8 bn in FY’2020. The significant expansion in the balance sheet is also partly attributable to the acquisition of Banque Populaire du Rwanda (BPR) in August 2021. BPR Rwanda contributed Kshs 48.0 bn worth of assets in FY’2021 to the Group,

- Total liabilities rose by 14.3% to Kshs 966.2 bn, from Kshs 845.4 bn in FY’2020, driven by a 125.3% increase in placements due to other banking institutions to Kshs 44.3 bn, from Kshs 19.7 bn in FY’2020. Customer deposits increased as well by 9.1% to Kshs 837.1 bn, from Kshs 767.2 bn, with customer deposits from NBK amounting to Kshs 106.1 bn in FY’2021,

- Deposits per branch decreased by 20.4% to Kshs 1.7 bn, from Kshs 2.1 bn in FY’2020, with the number of branches increasing to 492, from 359 in FY’2020. The group acquired 137 branches in Rwanda following the acquisition of BPR Rwanda during the period in addition to opening 1 branch in South Sudan. The group however closed 5 branches in Kenya during the period,

- Gross non-performing loans increased by 27.2% to Kshs 122.9 bn, from Kshs 96.6 bn in FY’2020. The group’s Asset Quality therefore deteriorated, with the NPL ratio increasing to 16.6% in FY’2021, from 14.8% in FY’2020, attributable to the faster 27.2% growth in Non-Performing loans, which outpaced the 13.5% growth in loans. The deterioration in asset quality was mainly attributable to increased defaults from manufacturing, building and construction and hospitality sectors,

- Loan Loss Provisions (LLP) decreased by 52.8% y/y to Kshs 13.0 bn in FY’2021, from Kshs 27.5 bn in FY’2020. The NPL coverage decreased to 52.9% in FY’2021, from 59.8% in FY’2020, attributable to the faster 27.2% growth in Gross non-performing loans, which outpaced the 13.9% growth in general Loan Loss Provisions, and,

- KCB Group remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 18.0%, 10.7% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio came in at 22.1%, exceeding the statutory requirement by 7.6% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 18.1%, while total capital to risk-weighted assets came in at 20.3%.

For a comprehensive analysis, please see our KCB Group FY’2021 Earnings Note

- ABSA Bank

|

ABSA Bank FY’2021 Key Highlights |

|||||

|

Balance Sheet |

|||||

|

Balance Sheet Items |

FY’2020 (Kshs bn) |

FY’2021 (Kshs bn) |

y/y change |

||

|

Net Loans and Advances |

126.1 |

132.6 |

5.2% |

||

|

Government Securities |

208.9 |

234.2 |

12.2% |

||

|

Total Assets |

379.4 |

428.7 |

13.0% |

||

|

Customer Deposits |

253.6 |

268.7 |

5.9% |

||

|

Deposits per Branch |

3.0 |

3.2 |

5.9% |

||

|

Total Liabilities |

332.9 |

372.2 |

11.8% |

||

|

Shareholders’ Funds |

46.5 |

56.4 |

21.4% |

||

|

Income Statement |

|||||

|

Income Statement Items |

FY'2020 |

FY'2021 |

y/y change |

||

|

Net Interest Income |

23.4 |

25.3 |

8.0% |

||

|

Net non-Interest Income |

11.1 |

11.7 |

4.7% |

||

|

Total Operating income |

34.5 |

36.9 |

7.0% |

||

|

Loan Loss provision |

(9.0) |

(4.7) |

(47.8%) |

||

|

Total Operating expenses |

(25.7) |

(21.4) |

(16.8%) |

||

|

Profit before tax |

8.8 |

15.5 |

75.7% |

||

|

Profit after tax |

4.2 |

10.9 |

161.2% |

||

|

Core EPS |

0.8 |

2.0 |

161.2% |

||

|

Key Ratios |

|||||

|

Income Statement Ratios |

FY'2020 |

FY'2021 |

% point change |

||

|

Yield from Interest-Earning Assets |

9.5% |

9.0% |

(0.5%) |

||

|

Cost of funding |

3.2% |

2.6% |

(0.6%) |

||

|

Net Interest Margin |

7.1% |

7.0% |

(0.1%) |

||

|

Non-Performing Loans (NPL) Ratio |

7.7% |

7.9% |

0.2% |

||

|

NPL Coverage |

71.1% |

77.7% |

6.6% |

||

|

Cost to Income With LLP |

74.4% |

57.9% |

(16.5%) |

||

|

Loan to Deposit Ratio |

82.3% |

87.2% |

4.9% |

||

|

Cost to Income Without LLP |

48.2% |

45.1% |

(3.1%) |

||

|

Return on average equity |

9.1% |

21.1% |

12.0% |

||

|

Return on average assets |

1.1% |

2.7% |

1.6% |

||

|

Equity to Assets |

12.3% |

13.2% |

0.9% |

||

|

Capital Adequacy Ratios |

|||||

|

Ratios |

FY'2020 |

FY'2021 |

% point change |

||

|

Core Capital/Total Liabilities |

17.3% |

17.9% |

0.6% |

||

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

||

|

Excess |

9.3% |

9.9% |

0.6% |

||

|

Core Capital/Total Risk Weighted Assets |

14.7% |

14.6% |

(0.1%) |

||

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

||

|

Excess |

4.2% |

4.1% |

(0.1%) |

||

|

Total Capital/Total Risk Weighted Assets |

17.5% |

17.1% |

(0.4%) |

||

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

||

|

Excess |

3.0% |

2.6% |

(0.4%) |

||

Key take-outs from the earnings release include;

- Core earnings per share increased by 161.2% to Kshs 2.0 in FY’2021, from Kshs 0.8 in FY’2020, not in line with our expectations of a 184.1% increase to Kshs 2.2. The performance was mainly driven by the lack of exceptional items in FY’2021, associated with the rebranding process and the transition from Barclays to ABSA which came in at Kshs 3.2 bn in FY’2020. Additionally, total operating income increased by 7.0% to Kshs 36.9 bn, from Kshs 34.5 bn recorded in FY’2020, coupled with a 16.8% decline in total operating expenses to Kshs 21.4 bn, from Kshs 25.7 bn recorded in FY’2020. Notably, the improved earnings were supported by a 47.8% decline in Loan Loss Provision (LLP) to Kshs 4.7 bn in FY’2021, from Kshs 9.0 bn in FY’2020 on the back of an improved business operating environment. The variance in core earnings per share increase to Kshs 2.0 against our expectation of Kshs 2.2 was largely due to the 16.8% decline in the total operating expenses to Kshs 21.4 bn in FY’2021, from Kshs 25.7 bn in FY’2020, compared to our 22.1% projected decline,

- Interest income grew by 1.9% to Kshs 32.0 bn in FY’2021, from Kshs 31.4 bn in FY’2020, mainly driven by a 3.6% increase in interest income from loans and advances to Kshs 23.1 bn, from Kshs 22.3 bn in FY’2020, coupled with a 288.3% increase in interest income from deposits and placements with banking institutions to Kshs 0.6 bn, from Kshs 0.2 bn in FY’2020,

- The Yield on Interest-Earning Assets (YIEA) however declined to 9.0%, from 9.5% recorded in FY’2020, attributable to the faster 7.3% growth in average interest earning assets which outpaced the 1.9% growth in trailing interest income,

- Interest expenses declined by 15.9% to Kshs 6.8 bn, from Kshs 8.1 bn in FY’2020, following a 65.5% decline in interest expense on deposits and placement with banking institutions to Kshs 0.7 bn, from Kshs 1.9 bn in FY’2020, coupled with a 28.6% decline in other interest expenses to Kshs 0.1 bn, from Kshs 0.2 bn in FY’2020. However, interest expense from customer deposits increased by 0.2% by Kshs 6.00 bn from Kshs 5.98 bn in FY’2020. The bank was able to mobilize cheaper deposits with the Cost of funds (COF) declining by 0.6% points to 2.6%, from 3.2% in FY’2020, owing to the 15.9% decline in the trailing interest expense coupled with a 6.3% growth in average interest-bearing liabilities. Net Interest Margin (NIM) remained unchanged at 7.0%,

- Total operating expenses declined by 16.8% to Kshs 21.4 bn in FY’2021, from Kshs 25.7 bn in FY’2020, mainly attributable to a 47.8% decline in Loan Loss Provisions (LLPs) to Kshs 4.7 bn in FY’2021, from Kshs 9.0 bn recorded in FY’2020. The reduced provisioning level was due to declining credit risk on the back of increased business activities in 2021 driven by the gradual economic recovery. Staff Costs declined by 3.3% to Kshs 9.4 bn in FY’2021, from Kshs 9.8 bn recorded in FY’2020,

- The balance sheet recorded an expansion as total assets grew by 13.0% to Kshs 428.7 bn in FY’2021, from Kshs 379.4 bn in FY’2020. This growth was largely driven by a 12.2% growth in the loan book to Kshs 234.2 bn, from Kshs 208.9 bn in FY’2020 coupled with a 5.2% increase in investments in government and other securities to Kshs 132.6 bn, from Kshs 126.1 bn in FY’2020. The performance was however weighed down by a 46.8% decline in placements in other banks to Kshs 3.0 bn, from Kshs 5.6 bn recorded in FY’2020,

- Total liabilities rose by 11.8% to Kshs 372.2 bn, from Kshs 332.9 bn in FY’2020, driven by a 5.9% increase in customer deposits to Kshs 268.7 bn, from Kshs 253.6 bn in FY’2020, coupled with a 18.0% increase in placements to Kshs 4.8 bn, from Kshs 4.1 bn in FY’2020,

- Deposits per branch rose by 5.9% to Kshs 3.2 bn, from Kshs 3.0 bn in FY’2020 with the number of branches remaining unchanged at 84,

- Gross Non-Performing Loans (NPLs) increased by 15.9% to Kshs 19.8 bn in FY’2021, from Kshs 17.1 bn recorded in FY’2020. Consequently, the NPL ratio rose to 7.9%, from 7.7% recorded in FY’2020. The asset quality deterioration is attributable to the faster 15.9% growth in Gross Non-Performing Loans (NPLs), compared to the relatively slower 13.0% increase in gross loans. The sectors that contributed to this deterioration are the Hospitality and Tourism sector which recorded a slow recovery in 2021 due to the emergence of new strains which hampered economic growth,

- The NPL coverage increased to 77.7% in FY’2021, from 71.1% in FY’2020, owing to the faster 32.8% increase in General Loan Loss Provisions, which outpaced the 15.9% growth in Gross Non-Performing Loans (NPLs), and,

- Absa Bank Kenya remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 14.6%, 4.1% points above the 10.5% statutory requirement. In addition, the total capital to risk-weighted assets ratio was 17.1%, exceeding the 14.5% statutory requirement by 2.6% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 14.7% while total capital to risk-weighted assets came in at 17.2%.

For a comprehensive analysis, please see our ABSA Bank FY’2021 Earnings Note

- Standard Chartered Bank Kenya

|

Standard Chartered Bank Kenya FY’2021 Key Highlights |

|||

|

Balance Sheet |

|||

|

Balance Sheet Items (Kshs bn) |

FY'2020 (Kshs bns) |

FY'2021 (Kshs bns) |

y/y change |

|

Net loans |

121.5 |

126.0 |

3.7% |

|

Total Assets |

325.6 |

334.9 |

2.8% |

|

Customer Deposits |

256.5 |

265.5 |

3.5% |

|

Deposits per branch |

8.6 |

12.1 |

41.1% |

|

Total Liabilities |

274.7 |

281.7 |

2.5% |

|

Shareholder's Funds |

50.9 |

53.2 |

4.6% |

|

Income Statement |

|||

|

Income Statement (Kshs bn) |

FY'2020 (Kshs bns) |

FY'2021 (Kshs bns) |

y/y change |

|

Net Interest Income |

19.1 |

18.8 |

(1.6%) |

|

Net non-Interest Income |

8.3 |

10.4 |

24.9% |

|

Total Operating income |

27.4 |

29.2 |

6.4% |

|

Loan Loss provision |

3.9 |

2.1 |

(46.4%) |

|

Total Operating expenses |

20.0 |

16.6 |

(17.2%) |

|

Profit before tax |

7.4 |

12.6 |

70.3% |

|

Profit after tax |

5.4 |

9.0 |

66.2% |

|

Core EPS (Kshs) |

14.4 |

24.0 |

66.2% |

|

Key Ratios |

|||

|

Ratios |

FY'2020 |

FY'2021 |

y/y % points change |

|

Yield from interest-earning assets |

8.5% |

7.6% |

(0.9%) |

|

Cost of funding |

1.9% |

1.3% |

(0.6%) |

|

Net Interest Margin |

6.9% |

6.4% |

(0.5%) |

|

Non- Performing Loans (NPL) Ratio |

16.01% |

15.99% |

(0.02%) |

|

NPL Coverage |

80.6% |

84.4% |

3.8% |

|

Cost to Income with LLP |

73.0% |

56.8% |

(16.2%) |

|

Loan to Deposit Ratio |

47.4% |

47.5% |

0.1% |

|

Return on average assets |

11.0% |

17.4% |

6.3% |

|

Return on average equity |

1.7% |

2.7% |

1.0% |

|

Equity to Assets |

15.6% |

15.9% |

0.3% |

|

Capital Adequacy Ratios |

|||

|

Ratios |

FY'2020 |

FY'2021 |

% point change |

|

Core Capital/Total Liabilities |

15.3% |

15.4% |

0.1% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

7.3% |

7.4% |

0.1% |

|

Core Capital/Total Risk Weighted Assets |

15.9% |

15.5% |

(0.3%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

5.4% |

5.0% |

(0.3%) |

|

Total Capital/Total Risk Weighted Assets |

18.5% |

17.8% |

(0.7%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

4.0% |

3.3% |

(0.7%) |

Key take-outs from the earnings release include;

- Core earnings per share increased by 66.2% to Kshs 24.0, from Kshs 14.4 recorded in FY’2020, not line with our projections of a 61.2% increase to Kshs 23.3. The performance was driven by a 6.4% increase in total operating income to Kshs 29.2 bn, from Kshs 27.4 bn recorded in FY’2020, coupled with a 17.2% decline in total operating expenses to Kshs 16.6 bn, from Kshs 20.0 bn recorded in FY’2020. The variance in core earnings per share increase to Kshs 24.0 against our expectation of Kshs 23.3 was largely due to the 17.2% decline in the total operating expenses to Kshs 16.6 bn in FY’2021, from Kshs 20.0 bn in FY’2020, compared to our 14.8% projected decline,

- Interest income declined by 6.1% to Kshs 22.3 bn, from Kshs 23.7 bn in FY’2020, driven by a 4.2% decline in interest income from Loans & Advances to Kshs 11.8 bn, from Kshs 12.3 bn in FY’2020, coupled with a 4.3% decline in interest income from Government Securities to Kshs 9.2 bn in FY’2021, from Kshs 9.6 bn in FY’2020. Additionally, Interest income from placements in other banks declined by 9.1% to Kshs 1.4 bn from 1.3 bn in FY’2020,

- The Yield on Interest-Earning Assets (YIEA) declined to 7.6%, from 8.5% in FY’2020, attributable to a 6.1% decline in the trailing interest income, coupled with a 5.0% increase in the average interest earning assets,

- Interest expense declined by 24.7% to Kshs 3.5 bn, from Kshs 4.6 bn in FY’2020, following a 26.0% decline in interest expense on customer deposits to Kshs 3.1 bn, from Kshs 4.2 bn in FY’2020 coupled with a 2.7% decline in other interest expenses from placements to Kshs 80.3 mn from Kshs 82.5 mn in FY’2020. The bank was able to mobilize cheaper deposits with the Cost of funds (CoF) declining by 0.6% points to 1.3%, from 1.9% in FY’2020, owing to the 24.7% decline in trailing interest expense and the 6.0% increase in the average interest-bearing liabilities,

- Total operating expenses declined by 17.2% to Kshs 16.6 bn in FY’2021, from Kshs 20.0 bn in FY’2020, mainly attributable to a 46.4% decline in Loan Loss Provisions (LLPs) to Kshs 2.1 bn in FY’2021, from Kshs 3.9 bn in FY’2020 partly attributable to the improved business environment. Additionally, Staff Costs declined to 18.3% to Kshs 6.3 bn, from Kshs 7.7 bn recorded in FY’2020,

- The balance sheet recorded an expansion as total assets grew by 2.8% to Kshs 334.9 bn in FY’2021, from Kshs 325.6 bn in FY’2020. This growth was largely driven by a 5.9% increase in placements from banking institutions to Kshs 74.4 bn, from Kshs 70.3 bn in FY’2020, coupled with a 3.7% increase in the loan book to Kshs 126.0 bn, from Kshs 121.5 bn recorded in FY’2020. The performance was however weighed down by a 4.2% decline in investments in government and other securities to Kshs 95.6 bn, from Kshs 99.8 bn recorded in FY’2020,

- Total liabilities rose by 2.5% to Kshs 281.7 bn, from Kshs 274.7 bn in FY’2020 driven by a 3.5% increase in Customer deposits to Kshs 265.5 bn, from Kshs 256.5 bn in FY’2020,

- Deposits per branch rose by 41.1% to Kshs 12.1 bn, from Kshs 8.6 bn in FY’2020 with the number of branches reducing to 22 from 30. The reduced number of branches is attributable to cost cutting measures undertaken by Standard Chartered Bank,

- Gross Non-Performing Loans (NPLs) increased by 4.2% to Kshs 23.3 bn in FY’2021, from Kshs 22.3 bn recorded in FY’2020. The NPL ratio however declined marginally to 15.99%, from 16.01% recorded in FY’2020,

- General Loan Loss Provisions increased by 14.0% to Kshs 10.1 bn, from Kshs 8.9 bn in FY’2020. The NPL coverage thus increased to 84.4%, from 80.6% in FY’2020, as the provisions (after adding back interest suspense) increased by 9.2% in FY’2021, outpacing the 4.2% rise in the Gross Non-Performing Loans during the same period. The increase in the NPL Coverage to 84.4% in FY’2021, from 80.6% in FY’2020 suggests sufficient provisioning, and,

- Standard Chartered is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 15.5%, 5.5% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 17.8%, exceeding the statutory requirement by 3.3% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 15.6% while total capital to risk-weighted assets came in at 17.8%.

For a comprehensive analysis, please see our Standard Chartered Bank Kenya FY’2021 Earnings Note

- Co-operative Bank of Kenya

|

Co-operative Bank FY’2021 Key Highlights |

|||

|

Balance Sheet |

|||

|

Balance Sheet Items |

FY'2020 (Kshs bn) |

FY'2021 (Kshs bn) |

y/y change |

|

Government Securities |

161.9 |

184.1 |

13.7% |

|

Net Loans and Advances |

286.6 |

310.2 |

8.2% |

|

Total Assets |

536.9 |

579.8 |

8.0% |

|

Customer Deposits |

378.6 |

407.7 |

7.7% |

|

Deposits per branch |

2.1 |

2.5 |

14.8% |

|

Total Liabilities |

444.9 |

479.0 |

7.7% |

|

Shareholders’ Funds |

90.7 |

100.2 |

10.5% |

|

Income Statement |

|||

|

Income Statement Items |

FY'2020 (Kshs bn) |

FY'2021 (Kshs bn) |

y/y change |

|

Net Interest Income |

36.3 |

41.0 |

12.9% |

|

Net non-Interest Income |

17.5 |

19.4 |

11.0% |

|

Total Operating income |

53.8 |

60.4 |

12.3% |

|

Loan Loss provision |

(8.1) |

(7.9) |

(2.3%) |

|

Total Operating expenses |

(39.4) |

(38.1) |

(3.3%) |

|

Profit before tax |

14.3 |

22.6 |

58.6% |

|

Profit after tax |

10.8 |

16.5 |

53.0% |

|

Core EPS |

1.6 |

2.4 |

53.0% |

|

Key Ratios |

|||

|

Income statement ratios |

FY’2020 |

FY’2021 |

% point change |

|

Yield from interest-earning assets |

11.4% |

11.5% |

0.1% |

|

Cost of funding |

3.0% |

3.2% |

0.2% |

|

Net Interest Margin |

8.5% |

8.5% |

0.0% |

|

Non-Performing Loans (NPL) Ratio |

18.7% |

14.6% |

(4.1%) |

|

NPL Coverage |

50.3% |

62.6% |

12.3% |

|

Cost to Income With LLP |

73.2% |

63.0% |

(10.2%) |

|

Loan to Deposit Ratio |

75.7% |

76.1% |

0.5% |

|

Cost to Income Without LLP |

58.1% |

49.9% |

(8.2%) |

|

Return on average equity |

12.5% |

17.3% |

4.8% |

|

Return on average assets |

2.2% |

3.0% |

0.8% |

|

Equity to assets |

16.9% |

17.3% |

0.4% |

|

Capital Adequacy Ratios |

FY'2020 |

FY'2021 |

% point change |

|

Core Capital/Total Liabilities |

19.1% |

19.6% |

0.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

11.1% |

11.6% |

0.5% |

|

Core Capital/Total Risk Weighted Assets |

15.4% |

15.6% |

0.2% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

4.9% |

5.1% |

0.2% |

|

Total Capital/Total Risk Weighted Assets |

16.9% |

17.2% |

0.3% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

2.4% |

2.7% |

0.3% |

Key take-outs from the earnings release include;

- Core earnings per share increased by 53.0% to Kshs 2.4 in FY’2021, from Kshs 1.7 in FY’2020, better than our projections of a 29.4% increase to Kshs 2.0. The performance was driven by a 12.3% increase in total operating income to Kshs 60.4 bn in FY’2021, from Kshs 53.8 bn in FY’2020, coupled with a 3.3% decline in the total operating expenses to Kshs 38.1 bn in FY’2021, from Kshs 39.4 bn in FY’2020. The variance in our projections can be attributed to our expectation of a 26.3% increase in loans loss provisions to Kshs 10.3 bn, compared to the actual performance which was a decline of 2.3% to Kshs 7.9 bn from Kshs 8.1 bn,

- Interest income rose by 13.9% to Kshs 55.6 bn in FY’2021, from Kshs 48.8 bn in FY’2020 driven by a 26.4% increase in interest income from government securities to Kshs 18.7 bn, from Kshs 14.8 bn in FY’2020, coupled with a 9.0% rise in interest income from loans and advances to Kshs 36.5 bn, from Kshs 33.5 bn in FY’2020,

- The Yield on Interest-Earning Assets increased marginally by 0.1% points to 11.5%, from 11.4% in FY’2020 due to the faster 13.9% growth in trailing interest income, which outpaced the 12.6% growth in the average interest-earning assets,

- Interest expense increased by 17.0% to Kshs 14.6 bn in FY’2021, from Kshs 12.5 bn in FY’2020, largely due to a 21.9% rise in interest expense from customer deposits to Kshs 13.3 bn, from Kshs 10.9 bn in FY’2020. The increase in interest expense was however mitigated by a 19.6% decline in other interest expenses to Kshs 1.1 bn in FY’2021, from Kshs 1.4 bn in FY’2020,

- Net Interest Margin (NIM) remained unchanged at 8.5% in FY’2021, similar to what was recorded in FY’2020,

- Total operating expenses reduced by 3.3% to Kshs 38.1 bn in FY’2021, from Kshs 39.4 bn in FY’2020, largely driven by the 2.3% reduction in Loan Loss Provisions (LLP) to Kshs 7.9 bn, from Kshs 8.1 bn in FY’2020 coupled with a 5.7% decrease in other operating expenses to Kshs 16.8 bn, from Kshs 17.9 bn in FY’2020. The reduced provisioning levels are indicative of the reduced credit risk as a result of the improved business environment. Staff costs decreased by 0.7% to Kshs 13.3 bn, from Kshs 13.4 bn in FY’2020,

- The balance sheet recorded an expansion as total assets grew by 8.0% to Kshs 579.8 bn in FY’2021, from Kshs 536.9 bn in FY’2020, mainly attributable to the 13.7% growth in government securities to Kshs 184.1 bn, from Kshs 161.9 bn recorded in FY’2020, coupled with an 8.2% growth in net loans and advances to Kshs 310.2 bn in FY’2021, from Kshs 286.6 bn in FY’2020. The faster increase in allocation to government securities highlights the bank’s cautious lending strategy considering the relatively lower asset quality, as evidenced by the bank’s NPL ratio of 14.6% in FY’2021 compared to the average 12.0% gross NPL ratio of the listed banking sector in Q3’2021,

- Total liabilities grew by 7.7% to Kshs 479.0 bn, from Kshs 444.9 bn in FY’2020, which was largely attributable to a 7.7% rise in customer deposits to Kshs 407.7 bn in FY’2021, from Kshs 378.6 bn in FY’2020,

- Deposits per branch increased by 14.8% to Kshs 2.5 bn, from Kshs 2.1 bn in FY’2020, with the number of branches reducing to 166 in FY’2021, from 177 recorded in FY’2020,

- Gross Non-Performing Loans (NPLs) decreased by 15.9% to Kshs 49.7 bn in FY’2021, from Kshs 59.1 bn in FY’2020. The NPL ratio reduced to 14.6% in FY’2021, from 18.7% in FY’2020, owing to the 15.9% decline in gross non-performing loans coupled with the 7.9% growth in gross loans. The improved asset quality is attributable to the economic recovery witnessed in Kenya in the year 2021 and improved business environment, which saw significant recovery in sectors such as Transport and Communication. Personal consumer, Trade and Transport and Communication, made up 71.4% of Cooperative Bank’s loan book as of Q3’2021,

- Gross Non-Performing Loans (NPLs) decreased by 15.9% to Kshs 49.7 bn in FY’2021, from Kshs 59.1 bn in FY’2020. The NPL ratio reduced to 14.6% in FY’2021, from 18.7% in FY’2020, owing to the 15.9% decline in gross non-performing loans coupled with the 7.9% growth in gross loans,

- The NPL coverage ratio improved to 62.6% in FY’2021, from 50.3% in FY’2020, due to a 4.7% growth in General Loan Loss Provisions coupled with the 15.9% decline in Gross Non-Performing Loans (NPLs), and,

- Co-operative Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 15.6%, 5.1% points above the statutory requirement of 10.5%. The total capital to risk-weighted assets ratio came in at 17.2%, exceeding the statutory requirement of 14.5% by 2.7% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 12.8%, while total capital to risk-weighted assets came in at 14.3%.

For a comprehensive analysis, please see our Co-operative Bank FY’2021 Earnings Note

Asset Quality

The table below is a summary of the asset quality for the banks that have released

|

|

FY'2020 NPL Ratio** |

FY'2021 NPL Ratio* |

% point change in NPL Ratio |

FY'2020 NPL Coverage** |

FY'2021 NPL Coverage* |

% point change in NPL Coverage |

|

ABSA Bank Kenya |

7.7% |

7.9% |

0.2% |

71.1% |

77.7% |

6.6% |

|

Stanbic Bank |

11.8% |

9.3% |

(2.5%) |

60.6% |

51.8% |

(8.8%) |

|

Co-operative Bank of Kenya |

18.7% |

14.6% |

(4.1%) |

50.3% |

60.6% |

10.3% |

|

Standard Chartered Bank Kenya |

16.0% |

16.0% |

(0.0%) |

80.6% |

84.4% |

3.8% |

|

KCB |

14.8% |

16.6% |

1.8% |

59.8% |

52.9% |

(6.9%) |

|

Mkt Weighted Average |

14.2% |

13.8% |

(0.4%) |

62.8% |

63.1% |

0.3% |

|

*Market cap weighted as at 18/03/2021 |

||||||

|

**Market cap weighted as at 15/04/2020 |

||||||

Key take-outs from the table include;

- Asset quality for the listed banks that have released their FY’2021 results improved during the period, with the weighted average NPL ratio declining by 0.4% points to a market cap weighted average of 13.8%, from an average of 14.2% for the listed banking sector in FY’2020. The improvement in asset quality is attributable to declining credit risk on the back of increased business activities in 2021 driven by the gradual economic recovery,

- NPL Coverage for the listed banks increased to a market cap weighted average of 63.1% in FY’2021, from 62.8% recorded in FY’2020, as the banks increased their provisioning levels to proactively manage risks brought about by the emergence of new COVID-19 variants coupled with the slow recovery of some sectors such as tourism and hospitality and,

- KCB Group recorded a decline in their NPL coverage despite the NPL ratio rising, which would suggest modest provisioning. Given the slow recovery in some sectors locally and the high NPL ratios in some of the group’s subsidiaries, we expected the group to provision more to cater for the prevailing credit risk. Key to note, If KCB’s NPL Coverage remained at the 59.8% level recorded in 2020, the bank would have had an additional provisioning of Kshs 8.4 bn, which would have reduced the earnings per share from the reported Kshs 10.6 to Kshs 8.6.

Summary Performance

The table below highlights the performance of the banks that have released so far, showing the performance using several metrics, and the key take-outs of the performance;

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

161.2% |

1.9% |

15.9% |

8.0% |

7.1% |

4.7% |

31.6% |

11.6% |

5.9% |

5.2% |

87.2% |

12.2% |

21.1% |

|

KCB |

74.3% |

15.1% |

17.6% |

14.4% |

8.4% |

8.8% |

28.0% |

9.0% |

9.1% |

29.7% |

80.7% |

13.5% |

21.8% |

|

SCBK |

66.2% |

(6.1%) |

(24.7%) |

(1.6%) |

6.4% |

24.9% |

35.5% |

19.9% |

3.5% |

(4.2%) |

47.5% |

3.7% |

17.4% |

|

Co-op |

53.0% |

13.9% |

17.0% |

12.9% |

8.0% |

11.0% |

32.1% |

18.1% |

7.7% |

13.7% |

76.1% |

8.2% |

17.3% |

|

Stanbic |

43.2% |

1.6% |

15.2% |

12.2% |

6.2% |

4.2% |

42.6% |

(8.5%) |

(5.8%) |

(17.4%) |

83.0% |

11.2% |

14.0% |

|

FY'21 Mkt Weighted Average* |

81.0% |

8.2% |

11.1% |

10.5% |

7.6% |

10.3% |

32.0% |

11.0% |

5.9% |

12.5% |

76.5% |

10.6% |

19.3% |

|

FY'20 Mkt Weighted Average** |

(26.8%) |

16.7% |

12.5% |

18.9% |

7.3% |

6.4% |

35.4% |

(2.1%) |

22.3% |

26.3% |

69.8% |

11.7% |

13.2% |

|

*Market cap weighted as at 18/03/2021 |

|||||||||||||

|

**Market cap weighted as at 15/04/2020 |

|||||||||||||

Key takeaways from the table above include:

- The listed banks that have released recorded an 81.0% weighted average growth in core Earnings per Share (EPS), compared to a weighted average decline of 26.8% in FY’2020 for the listed banking sector. The performance is however largely skewed by the strong performance from ABSA Bank,

- The Banks have recorded a weighted average deposit growth of 5.9%, slower than the 22.3% growth recorded in FY’2020,

- Interest expense grew at a slower pace, by 11.1%, compared to the 12.5% growth in FY’2020. Similarly, cost of funds declined, coming in at a weighted average of 2.6% in FY’2021, from 2.9% in FY’2020, owing to the faster growth in average interest-bearing liabilities, an indication that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 10.6%, 1.1% points lower than the 11.7% growth recorded in FY’2020. Additionally, the loan growth was lower than the 12.5% growth in government securities, an indication that banks are shying away from lending due to uncertainties surrounding the emergence of new COVID-19 variants coupled with the slow recovery of some sectors such as tourism and hospitality,

- Interest income grew by 8.2%, compared to a growth of 16.7% recorded in FY’2020 while the weighted average Yield on Interest Earning Assets (YIEA) increased to 9.9%, from the 9.5% recorded in FY’2020 for the listed banking sector, an indication of the increased allocation to higher-yielding assets by the sector during the period. Consequently, the Net Interest Margin (NIM) now stands at 7.6%, 0.3% points higher than the 7.6% recorded in FY’2020 for the whole listed banking sector, and,

- Non-Funded Income grew by 10.3%, compared to the 6.4% growth recorded in FY’2020. This can be attributable to the faster growth in the fees and commission which grew by 11.0% compared to a decline of 2.1% in FY’2020, following the expiry of the waiver on fees on mobile transactions.

Cytonn Coverage:

|

Company |

Price as at 11/03/2022 |

Price as at 18/03/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.3 |

0.0% |

(0.9%) |

2.3 |

3.2 |

8.8% |

48.8% |

0.2x |

Buy |

|

Jubilee Holdings |

275.0 |

275.3 |

0.1% |

(13.1%) |

316.8 |

381.7 |

3.3% |

42.0% |

0.5x |

Buy |

|

I&M Group*** |

20.8 |

20.7 |

(0.5%) |

(3.3%) |

21.4 |

24.4 |

10.9% |

28.6% |

0.6x |

Buy |

|

KCB Group*** |

44.7 |

44.6 |

(0.2%) |

(2.1%) |

45.6 |

51.4 |

6.7% |

21.9% |

0.9x |

Buy |

|

Liberty Holdings |

6.9 |

6.5 |

(5.2%) |

(7.9%) |

7.1 |

7.7 |

0.0% |

17.8% |

0.5x |

Accumulate |

|

Britam |

7.0 |

6.9 |

(1.4%) |

(9.0%) |

7.6 |

7.9 |

0.0% |

14.5% |

1.1x |

Accumulate |

|

Stanbic Holdings |

100.0 |

100.0 |

0.0% |

14.9% |

87.0 |

105.2 |

9.0% |

14.2% |

0.9x |

Accumulate |

|

NCBA*** |

24.6 |

25.0 |

1.6% |

(2.0%) |

25.5 |

26.4 |

6.0% |

11.8% |

0.6x |

Accumulate |

|

Sanlam |

12.8 |

11.0 |

(13.7%) |

(4.8%) |

11.6 |

12.1 |

0.0% |

9.6% |

1.2x |

Hold |

|

Diamond Trust Bank*** |

56.0 |

56.5 |

0.9% |

(5.0%) |

59.5 |

61.8 |

0.0% |

9.3% |

0.2x |

Hold |

|

Equity Group*** |

51.3 |

52.0 |

1.5% |

(1.4%) |

52.8 |

56.6 |

0.0% |

8.9% |

1.3x |

Hold |

|

Standard Chartered*** |

131.0 |

139.8 |

6.7% |

7.5% |

130.0 |

137.7 |

10.0% |

8.6% |

1.1x |

Hold |

|

Co-op Bank*** |

12.9 |

13.3 |

3.5% |

2.3% |

13.0 |

13.1 |

7.5% |

5.7% |

1.0x |

Hold |

|

ABSA Bank*** |

12.1 |

12.4 |

2.5% |

5.5% |

11.8 |

11.9 |

8.9% |

4.9% |

1.2x |

Lighten |

|

HF Group |

3.5 |

3.1 |

(10.4%) |

(18.7%) |

3.8 |

3.0 |

0.0% |

(4.4%) |

0.2x |

Sell |

|

CIC Group |

2.0 |

2.1 |

1.5% |

(4.6%) |

2.2 |

1.9 |

0.0% |

(9.0%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.3x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook. On the upside, we believe that the relaxation of COVID-19 containment measures in the country will lead to improved investor sentiments.

- Residential Sector

- Kakamega County and Unity Homes to Construct Affordable Housing Units

During the week, the Kakamega County Investment and Development Agency (KCIDA), in collaboration with Pinnie Agency Limited, a private developer, began the construction of 3,000 affordable housing units in 5 estates within Kakamega and Mumias towns. The joint venture partnership project worth Kshs 8.0 bn which was initiated on Tuesday 15th March 2022, will be implemented in three phases, with the housing units expected to range between Kshs 1.0 mn and Kshs 3.0 mn.

Also, Unity Homes, a Kenyan-British housing developer announced plans to launch the construction of its third phase of housing units in Tatu City, Ruiru. The Kshs 4.3 bn project which is part of the developer’s commitment to support the government’s Big Four Affordable Housing initiative, will comprise of 1,200 apartments. Moreover, it will mark Unity Home’s fifth project at Tatu City, with the other projects being; Unity Gardens, Unity One, Unity East, and Unity West. In terms of performance, according to Cytonn Annual Markets Review 2021, Ruiru recorded average total returns to investors at 7.8%, 0.5% points higher than the market average of 7.3%, hence the developer is leveraging on the remarkable performance as its basis of development. Other factors driving the investment decision include; i) ease of accessibility facilitated by roads such as the Eastern Bypass, ii) availability of amenities such as the Spur Mall among others, and iii) high demand for housing fuelled by Ruiru’s high population growth rate currently at 4.6%, against Kenya’s 2.3%. The table below shows the market performance of apartments within satellite towns in FY’2021;

|

Lower Mid- End Satellite Towns Apartments Performance-FY’2021 |

||||||||

|

Area |

Average of Price per SQM FY'2021 |

Average of Rent per SQM FY'2021 |

Average of Occupancy FY'2021 |

Average of Uptake 2021 |

Average of Annual Uptake FY'2021 |

Average of Rental Yield FY'2021 |

Average of Price Appreciation |

Total Returns |

|

Rongai |

60,003 |

347 |

86.3% |

74.3% |

16.1% |

6.2% |

2.6% |

8.8% |

|

Ruaka |

107,375 |

588 |

91.9% |

81.7% |

20.2% |

5.6% |

2.9% |

8.5% |

|

Ruiru |

89,260 |

493 |

84.3% |

85.9% |

21.9% |

5.6% |

2.2% |

7.8% |

|

Syokimau |

72,318 |

330 |

89.9% |

83.5% |

12.7% |

5.3% |

1.9% |

7.2% |

|

Ngong |

63,446 |

346 |

73.7% |

76.3% |

12.5% |

5.0% |

2.1% |

7.1% |

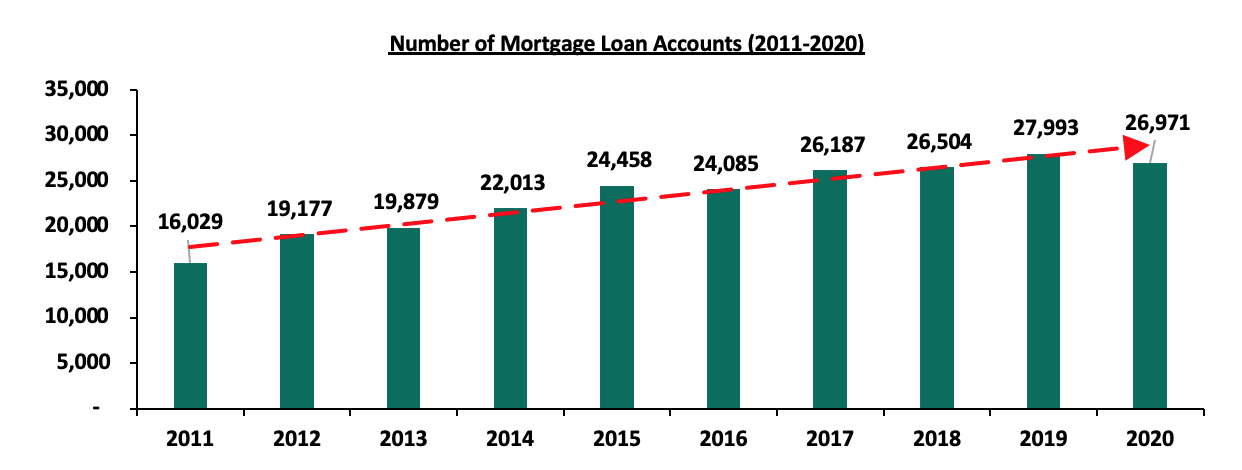

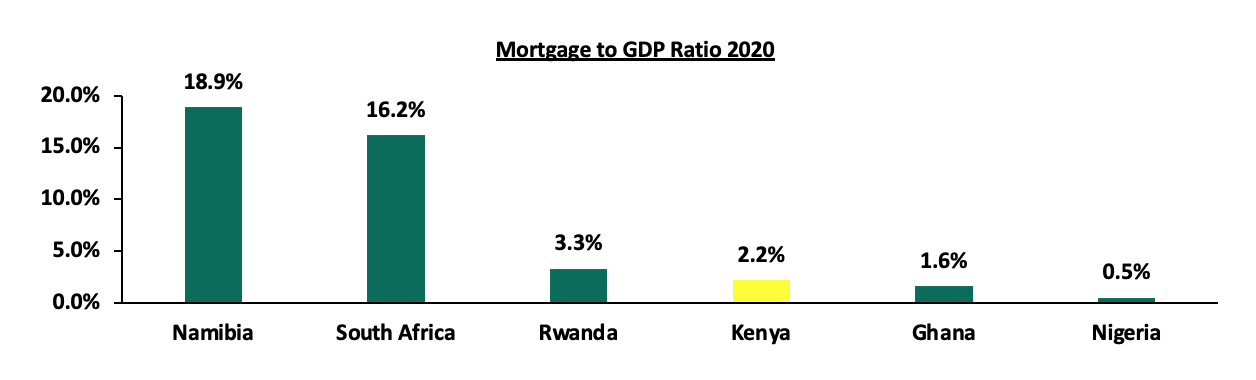

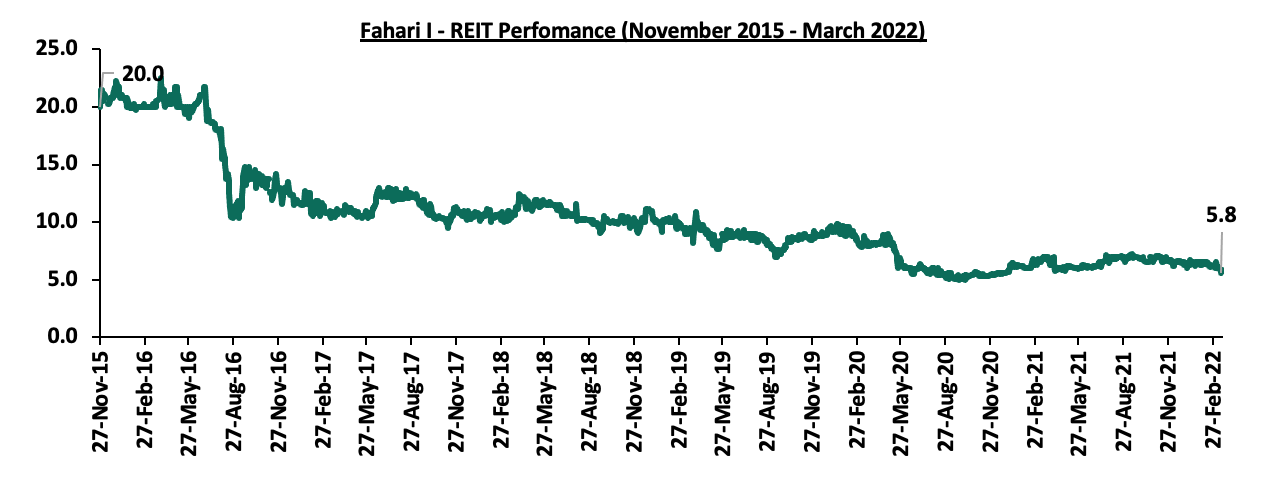

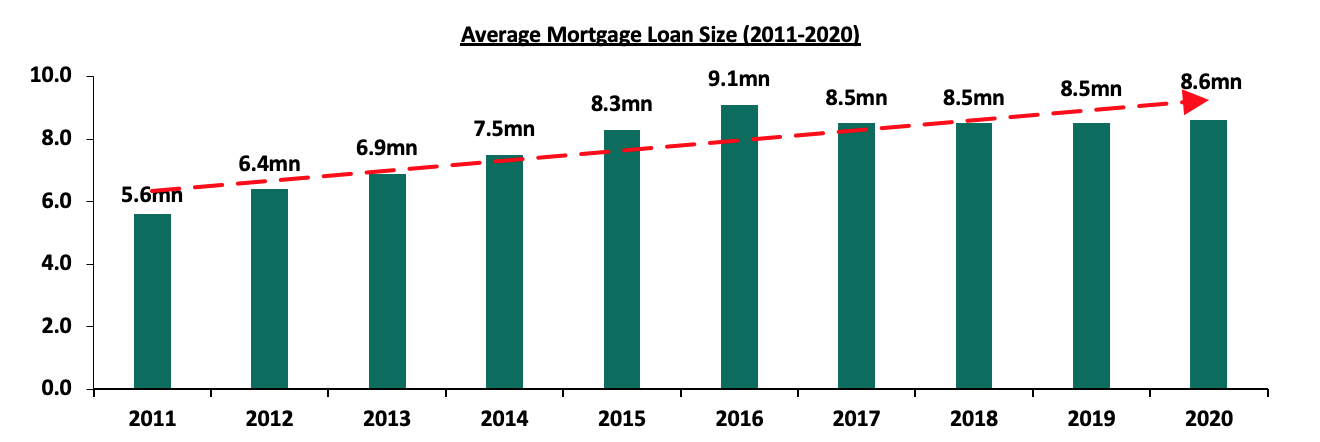

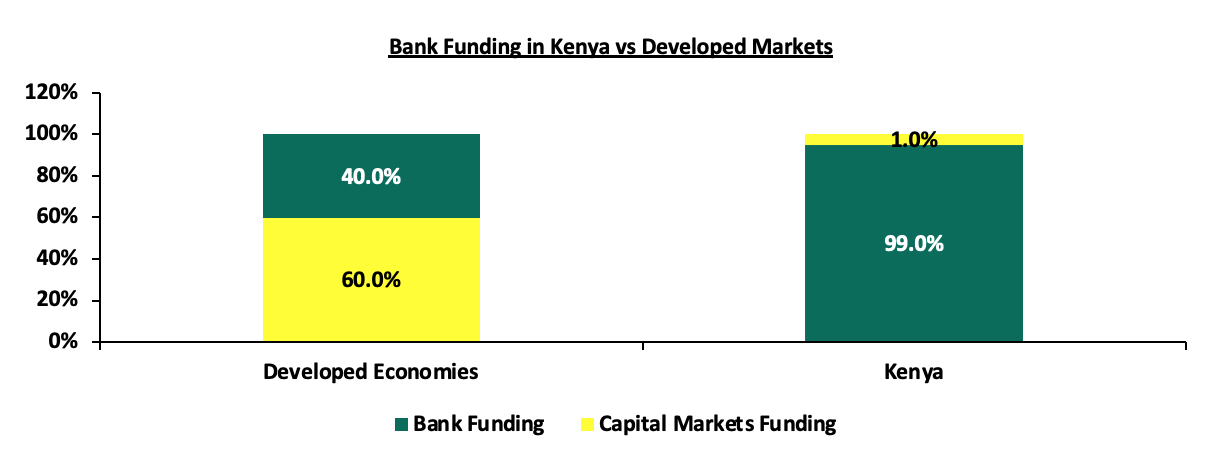

|