Personal Financial Planning, & Cytonn Weekly #08/2020

By Research Team, Feb 23, 2020

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 207.3%, up from 195.8% recorded the previous week. The oversubscription is partly attributable to favorable liquidity in the money market during the week following the end of the monthly Cash Reserve Requirement (CRR) cycle and government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 392.8%. During the week, Moody’s Credit Agency released an update highlighting Kenya’s international creditworthiness. Kenya’s rating by the agency was maintained at B2 with a stable outlook, on the back of relative diversification of the economy and moderate economic strength. The agency, however, warned that Kenya’s debt burden coupled with poor revenue collection may negatively affect the country’s credit rating;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 2.5%, 2.3%, and 2.2%, respectively, taking their YTD performance to losses of 4.8%, 5.9%, and 4.5%, for the NASI, NSE 20 and NSE 25, respectively. During the week, Safaricom opened talks with a consortium of undisclosed investors who would be involved in the bid for one of the two Ethiopian telecom licenses due to high entry costs expected to scale above Kshs 100.0 bn. In November 2019, the company entered into a joint bid with Vodacom (which owns a 35.0% stake in Safaricom), however, more telecommunication firms such as Vodafone (which also owns a 5.0% stake) are expected to join the partnership ahead of Safaricom’s bid, which is expected to be lodged in April this year;

Real Estate

During the week, Knight Frank released Kenya’s Market Update for H2’2019, which tracks developments in the capital markets, real estate and economic growth in Kenya. According to the report, high-end residential prices declined by 4.0% in 2019 attributed to a general oversupply in the upper spectrums of the market, while asking rents in the office sector remain unchanged as a result of the existing oversupply and a tough economic climate. Retail rents for prime nodes decreased by 4.2% in the second half of 2019 attributable to the retail market adjusting to continued oversupply in certain locations. In the residential sector, Liaison Homes, a local real estate developer, announced that they are set to begin construction of 32 bungalows in a gated community along Kenyatta Road in Nyeri Town. In the retail sector, Giordano, a Hong Kong fashion chain store, opened its first Kenyan outlet at Garden City Mall. Finally, in the hospitality sector, Kenya was ranked among the top five African destinations for tourism by the Safari Bookings, an online site that compares Africa’s safaris;

Focus of the Week

This week, we revisit the Personal Financial Planning topic, where we discuss the importance of financial planning, the various considerations to make based on one’s own characteristics, needs and preferences, and some of the investment avenues available.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.0% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.6% a. To subscribe, email us at sales@cytonn.com;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards the construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. The site is open every day from 9 to 5 pm daily for visits. For more information please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 207.3%, up from 195.8% recorded the previous week with liquidity remaining favorable following the end of the monthly Cash Reserve Requirement (CRR) cycle and government payments. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 392.8%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic target and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yield on the 91-day and 182-day papers remained unchanged at 7.3% and 8.3%, respectively, while the yield on the 364-day paper declined by 0.1% points to 9.8%, from the 9.9% recorded the previous week. The acceptance rate rose to 69.8%, from 64.2% recorded the previous week, with the government accepting Kshs 34.7 bn of the Kshs 49.8 bn bids received.

During the week, the Central Bank of Kenya released the auction results for the recently issued bond, FXD1/2020/15 and the reopened FXD1/2018/25 with effective tenors of 15.0-years and 23.3-years, respectively, and coupon rates of 12.8% and 13.4%, respectively, in a bid to raise Kshs 50.0 bn for budgetary purposes. The overall subscription rate came in at 85.0%, with the government receiving bids worth Kshs 42.5 bn, lower than the quantum of Kshs 50.0bn. The low performance is mainly attributed to the relatively long tenor periods of the two bonds with most investors trying to minimize duration risk. The yield on the 15-year bond came in at 13.0%, while the yield on the 25-year bond came in at 13.6%. The government accepted Kshs 27.9 bn out of the Kshs 42.5 bn worth of bids received, translating to an acceptance rate of 65.6%.

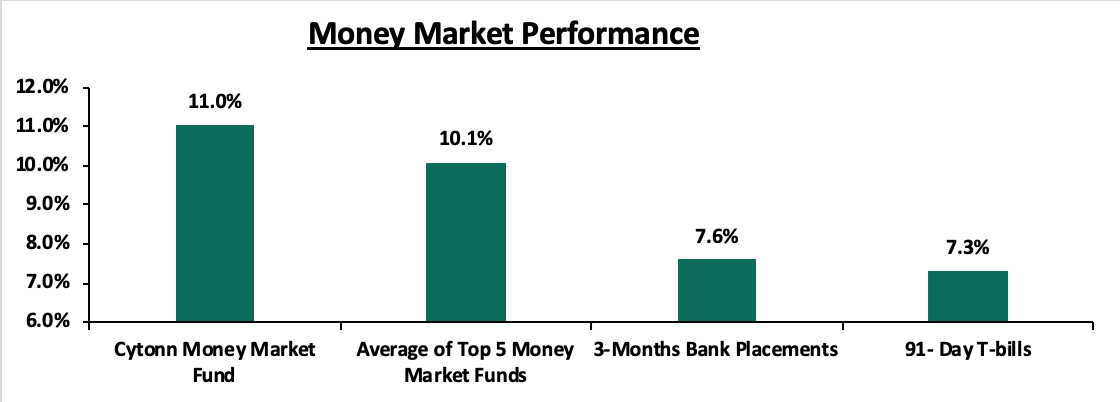

In the money markets, 3-month bank placements ended the week at 7.6% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.3%, while the average of Top 5 Money Market Funds came in at 10.1%, unchanged from the previous week. The yield on the Cytonn Money Market Fund came in at 11.0%, unchanged from the previous week.

Liquidity:

During the week, the average interbank rate decreased to 4.2%, from 4.4% recorded the previous week, pointing to increased liquidity in the money markets, which remained favourable following the end of the monthly Cash Reserve Requirement (CRR) cycle and government payments. Commercial banks’ excess reserves came in at Kshs 21.7 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes increased by 174.9% to Kshs 8.8 bn, from Kshs 3.2 bn recorded the previous week.

Kenya Eurobonds:

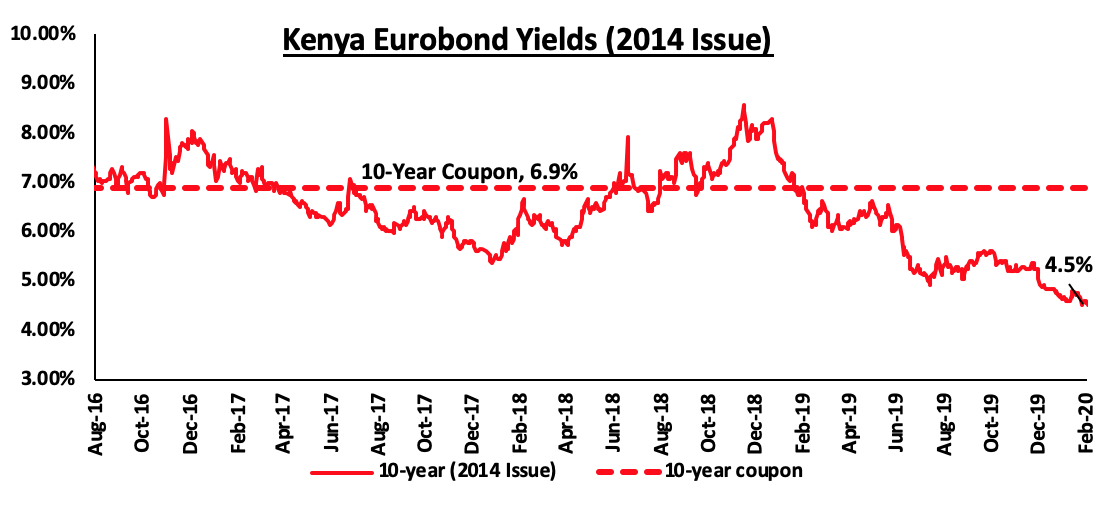

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 decreased marginally by 0.1% points to 4.5%, from 4.6% recorded the previous week. This is an indication that investors are not attaching a higher risk premium on the country.

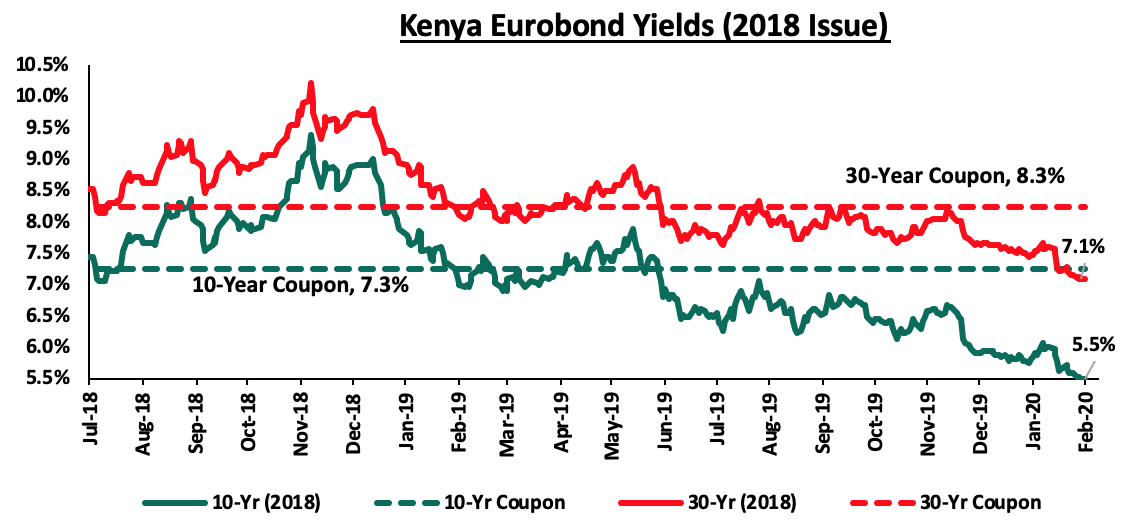

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018, decreased by 0.1% points to 5.5% and 7.1%, respectively, from 5.6% and 7.2%, respectively, recorded the previous week.

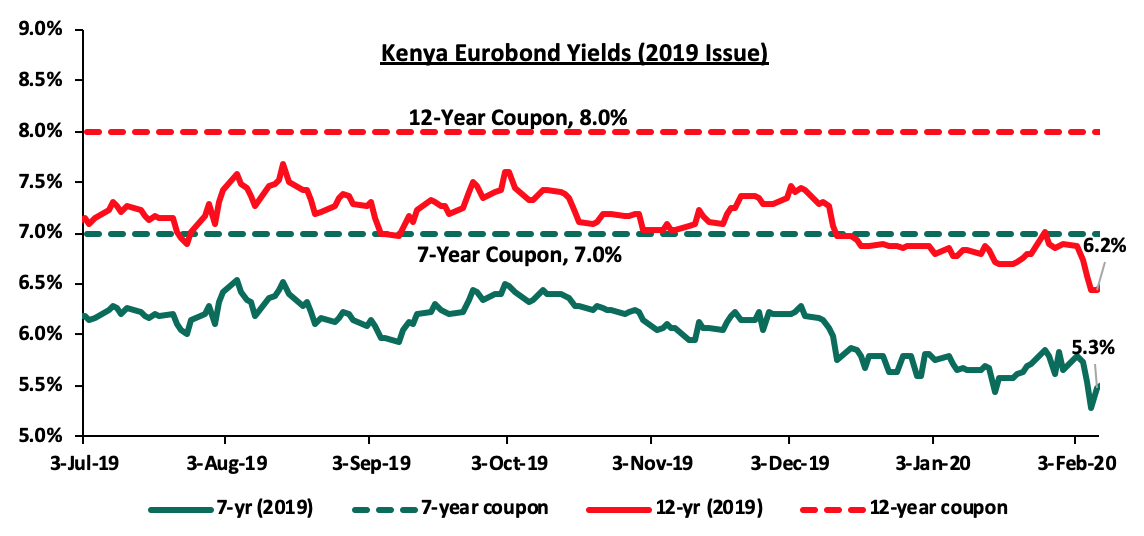

During the week, the yield on the 7-year Eurobond decreased by 0.1% points to 5.3%, from 5.4% recorded the previous week. The yield on the 12-year Eurobond decreased by 0.2% points to 6.2%, from 6.4% recorded the previous week.

Kenya Shilling:

The Kenya Shilling depreciated by 0.7% against the US Dollar during the week to Kshs 101.3, from Kshs 100.6 recorded last week, as a result of increased end-month dollar demand from multinational companies and merchandise importers. On a YTD basis, the shilling has appreciated by 0.1% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar in the short term with a bias to a 2.4% depreciation by the end of 2020, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit was equivalent to 4.6% of GDP in 2019, from 5.0% recorded in 2018. This was mainly driven by lower imports of SGR-related equipment, resilient diaspora remittances which cumulatively stood at USD 2.8 bn in December 2019, a 3.7% increase from the USD 2.7 bn recorded in December 2018, and strong receipts from transport and tourism services with preliminary data indicating that the number of tourists landing in the country stood at 132,019 in month of December 2019, which was a 9.0% increase compared to the 121,070 recorded in November 2019,

- High levels of forex reserves, currently at USD 8.5 bn (equivalent to 5.2-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Foreign capital inflows, with investors looking to participate in the domestic equities market, and,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars.

We, however, expect pressure on the shilling to arise from:

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019, which has seen cumulative diaspora remittances increase by 3.7% in the 12-months to December 2019 to USD 2.8 bn, from USD 2.7 bn in 2018.

Weekly Highlight:

During the week, Moody’s Credit Agency released an update highlighting Kenya’s international creditworthiness. Kenya’s rating by the agency was maintained at B2 with a stable outlook, on the back of relative diversification of the economy and moderate economic strength. The agency, however, warned that Kenya’s debt burden coupled with poor revenue collection may negatively affect the country’s credit rating. The country’s high reliance on commercial external debt imposes a negative impact on the country’s rating as the country’s national debt currently exceeds Kshs 5.0 tn, with the debt to GDP ratio having increased to 62.0% of the GDP, compared to 58.0% in 2018. The agency also highlighted that the locust invasion may greatly affect the agricultural sector that currently contributes 18.6% of the country’s GDP. In January alone, the insects covered approximately one million hectares of land in Kenya destroying tonnes of produce. The drop in agricultural produce is also expected in Ethiopia and other East African countries that are also being affected by the locust attack. The agency, however, predicts that the country’s diversified economy supported by the growth of private consumption and private investment sector may provide resilience to economic shocks.

The following table shows the current credit rating based on the main agencies: -

|

No. |

Rating Agency |

Rating |

Last Update |

Outlook |

|

1. |

Fitch Ratings |

B+ |

December 2019 |

Stable |

|

2. |

Moody’s Corporation |

B2 |

November 2019 |

Stable |

|

3. |

Standard & Poor’s |

B+ |

March 2018 |

Stable |

During the week, Capital Economics, an independent macroeconomic research firm based in London, downgraded the GDP growth projection for Kenya in 2020 by 0.2% points to 5.9% from the previously projected 6.1% given the locust invasion crisis, which it highlighted could lead to a fall in agricultural production in the country. The table below shows GDP projections from 10 firms with the consensus GDP growth as per the 10 firms below expected to come in at 6.0%.

|

|

Kenya 2020 Annual GDP Growth Outlook |

|

|

No. |

Organization |

Q1’2020 |

|

1. |

Central Bank of Kenya |

6.2% |

|

2. |

Citigroup Global Markets |

6.2% |

|

3. |

International Monetary Fund |

6.1% |

|

4. |

African Development Bank |

6.0% |

|

5 |

World Bank |

6.0% |

|

6. |

National Treasury |

6.0% |

|

7. |

African Development Bank (AfDB) |

6.0% |

|

8. |

Capital Economics |

5.9% |

|

9. |

Cytonn Investments Management PLC |

5.7% |

|

10 |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

|

|

Average |

6.0% |

In our view, we expect the country’s GDP growth to come in at around 5.6% - 5.8% mainly driven by an improvement in private sector credit growth, stable growth of the agricultural sector, and public infrastructural investments. The risks abound to economic growth include:

- The country’s debt sustainability with the public debt to GDP ratio currently estimated at 62.0%, efforts by the Kenyan Government to reduce country’s fiscal deficit, which is currently at 6.2% of GDP, which might adversely affect economic growth due to reduced government spending, and,

- The current locust invasion, which also poses a systematic risk to agricultural production and food security and could ultimately lead to higher inflation that could slow down economic growth.

Inflation Projection:

We are projecting the y/y inflation rate for the month of February to come in within the range of 5.9% - 6.2%, an increase compared to 5.8% recorded in January. The m/m inflation for the month of February is expected to rise due to the following factors:

- A rise in the food and non-alcoholic beverages index, which has a weighting of 36.0%, mainly driven by the rise in food prices with a significant rise being recorded in tomato mainly due to supply shortages as a result of heavy rainfall, which destroys tomatoes. Tomato prices have gone up by 36.1% to Kshs 130.2 from Kshs 95.7 per kilogram recorded in December 2019, and,

- A rise in the transport index, which has a weighting of 8.7% contribution to GDP, with petrol prices having increased by 2.4% to Kshs 113.9, from Kshs 111.2 per litre previously, while diesel prices increased by 2.1% to Kshs 104.4 per litre from Kshs 102.3 per litre, previously.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 52.2% ahead of its domestic borrowing target, having borrowed Kshs 307.6 bn against a pro-rated target of Kshs 202.1 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 2.5%, 2.3%, and 2.2%, respectively, taking their YTD performance to losses of 4.8%, 5.9%, and 4.5%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by losses recorded by large-cap stocks such as EABL, Safaricom, Bamburi and ABSA of 5.9%, 3.5%, 2.7% and 1.9%, respectively.

Equities turnover decreased by 25.5% during the week to USD 24.3 mn, from USD 32.6 mn recorded the previous week, taking the YTD turnover to USD 214.5 mn. Foreign investors turned net sellers for the week, with a net selling position of USD 12.2 mn from a net selling position of USD 9.6 mn recorded the previous week.

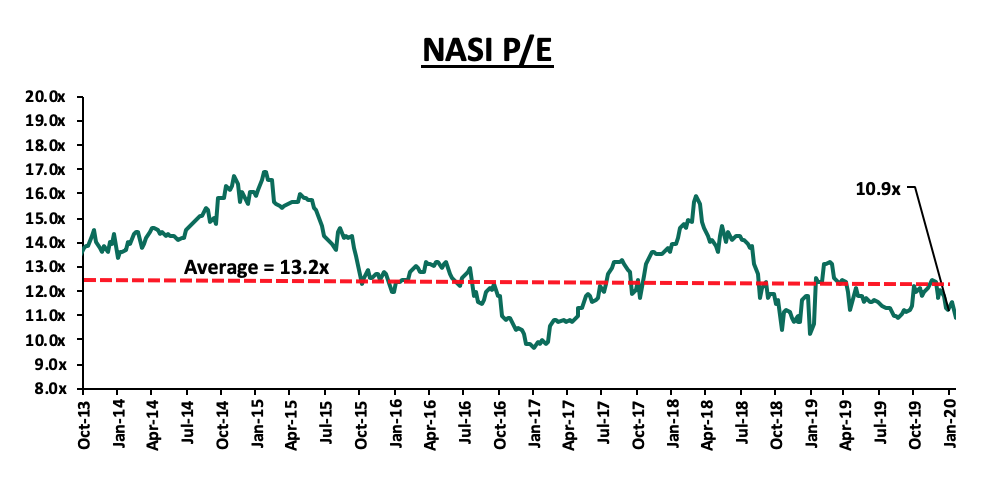

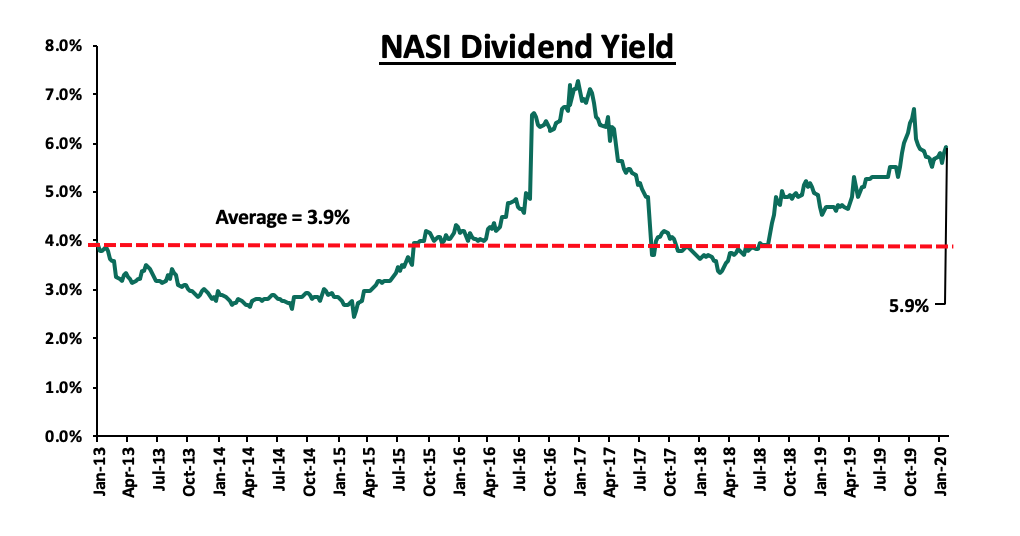

The market is currently trading at a price to earnings ratio (P/E) of 10.9x, 17.9% below the historical average of 13.2x, and a dividend yield of 5.9%, 2.0% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 10.9x is 12.1% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 31.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Safaricom opened talks with a consortium of undisclosed investors who would be involved in the bid for one of the two Ethiopian telecom licenses due to the high entry costs expected to scale above Kshs 100.0 bn. In November 2019, the company entered into a joint bid with Vodacom (which owns a 35.0% stake in Safaricom), however, more telecommunication firms such as Vodafone (which also owns a 5.0% stake) are expected to join the partnership ahead of Safaricom’s bid set to be lodged in April this year. The Ethiopian Government, which owns 100.0% of Ethio Telecom’s shares indicated that they would sell a minority stake of up to 49.0% to investors in order to improve the Ethiopian economy through an increase in private investments and competition in the government-controlled economy. Due to its high population of approximately 108.0 mn and a forecasted GDP growth rate of 10.8% for the fiscal year 2019/2020, the Ethiopian market is a hub for telecommunication investment with Ethio Telecom having an approximate 43.6 mn subscribers. As of September 2019, only commercial banks and microfinance institutions provided mobile money services in Ethiopia, and the entry of Safaricom would see to the further disruption of services offered traditionally by financial institutions. Safaricom’s plan to introduce mobile money services in the country will, in our view, help improve financial inclusion spurring more innovations in key sectors such as agriculture, promoting economic growth and development. Further, Safaricom’s entry into the Ethiopian market would diversify the group’s customer base as well as increase its revenue from mobile money services, currently the largest component of the firm’s business, as the firm moves towards globalizing M-Pesa.

Universe of Coverage

|

Banks |

Price at 14/02/2020 |

Price at 21/02/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.0 |

3.0 |

(0.3%) |

(1.7%) |

3.0 |

4.8 |

15.1% |

76.2% |

0.3x |

Buy |

|

Diamond Trust Bank |

108.3 |

112.0 |

3.5% |

2.8% |

109.0 |

189.0 |

2.3% |

71.1% |

0.5x |

Buy |

|

I&M Holdings*** |

53.3 |

54.5 |

2.3% |

0.9% |

54.0 |

75.2 |

7.2% |

45.1% |

0.9x |

Buy |

|

KCB Group*** |

50.5 |

50.0 |

(1.0%) |

(7.4%) |

54.0 |

64.2 |

7.0% |

35.4% |

1.4x |

Buy |

|

Jubilee Holdings |

355.8 |

352.5 |

(0.9%) |

0.4% |

351.0 |

453.4 |

2.6% |

31.2% |

1.2x |

Buy |

|

Sanlam |

18.0 |

16.7 |

(7.5%) |

(3.2%) |

17.2 |

21.7 |

0.0% |

30.3% |

0.7x |

Buy |

|

Co-op Bank*** |

15.0 |

14.9 |

(1.0%) |

(9.2%) |

16.4 |

18.1 |

6.7% |

28.6% |

1.3x |

Buy |

|

Equity Group*** |

50.0 |

49.5 |

(0.9%) |

(7.5%) |

53.5 |

56.7 |

4.0% |

18.6% |

1.9x |

Accumulate |

|

Standard Chartered |

200.0 |

201.8 |

0.9% |

(0.4%) |

202.5 |

211.6 |

9.4% |

14.3% |

1.5x |

Accumulate |

|

Liberty Holdings |

9.5 |

9.5 |

0.0% |

(8.0%) |

10.4 |

10.1 |

5.3% |

11.0% |

0.8x |

Accumulate |

|

ABSA Bank*** |

13.2 |

13.0 |

(1.9%) |

(3.0%) |

13.4 |

13.0 |

8.5% |

8.9% |

1.7x |

Hold |

|

NCBA |

35.9 |

35.8 |

(0.1%) |

(2.8%) |

36.9 |

37.0 |

4.2% |

7.5% |

0.8x |

Hold |

|

CIC Group |

2.6 |

2.7 |

4.3% |

0.0% |

2.7 |

2.6 |

4.9% |

3.3% |

0.9x |

Lighten |

|

Stanbic Holdings |

105.3 |

106.0 |

0.7% |

(3.0%) |

109.3 |

103.1 |

4.5% |

1.8% |

1.1x |

Lighten |

|

Britam |

8.7 |

8.1 |

(7.1%) |

(10.2%) |

9.0 |

6.8 |

0.0% |

(16.4%) |

0.8x |

Sell |

|

HF Group |

5.8 |

5.3 |

(8.0%) |

(18.0%) |

6.5 |

4.2 |

0.0% |

(20.8%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industry Report

During the week, Knight Frank released Kenya’s Market Update for H2’2019. The report tracks developments in the capital markets, real estate and economic growth in Kenya. The key take-outs from the report with a focus on real estate were as follows:

- High-end residential prices decline slowed down during the period coming in at 4.0% in 2019, compared to a decline of 4.5% in 2018, attributable to increased transaction volumes in the second half of 2019 as investors were eager to close on deals before the end of 2019,

- Residential rents decreased at a higher rate of 2.8% in 2019 compared to 1.3% in 2018. This was attributed to the oversupply of residential units as well as a decline in expatriates relocating to Kenya,

- In the office sector, asking rents in Nairobi remained unchanged in the second half of 2019 at Kshs 130 per SQFT, a result of the existing oversupply and a tough economic climate,

- Absorption of Grade A and B office space increased by 41.0% during the second half compared to the first half of 2019 indicating that the oversupply situation has begun correcting. This was attributed to the increased uptake of serviced offices, as well as various Grade A offices delivered to the market by large multinational setting up regional headquarters,

- In the retail sector, monthly rents for prime stores decreased by 4.2% to Kshs 466.4 per SQFT in the second half of 2019 attributable to the retail market adjusting to continued oversupply in certain locations, making it a tenant’s market. Overall, the retail sector registered average occupancy rates of 77.0% with established malls remaining relatively high at over 90.0%.

The report is in line with our findings. According to Cytonn Annual Markets Review 2019, high-end residential markets recorded a decline in price appreciation which came in at 1.1% in 2019 in comparison to 4.2% in 2018, which the report attributed to developers offering lower prices in a bid owing to increased supply and thus, competition, while the office and retail sectors also recorded a decline in rental yields by 0.6% and 1.2%, respectively, attributable to constrained spending amid a tough financial environment as well as an oversupply in the respective sectors by 5.6 mn SQFT and 2.8 mn SQFT, respectively. However, differentiated concepts such as mixed-used developments and serviced offices are expected to perform well due to their low market share of 0.4% as well as continued demand from affluent individuals and expatriates on short business stints.

- Residential Sector

During the week, Liason Homes, a local real estate developer, announced that they are set to begin construction of 32 bungalows in a gated community on Kenyatta Road in Nyeri Town, with phase one expected to be completed in 2021. The project dubbed ‘Orchard Park’ will consist of 3-bedroom units of 135 SQM priced at Kshs 4.9 mn and projected rent of Kshs 45,000, translating to a price and rent of Kshs 39,963 per SQM and Kshs 333 per SQM, respectively, which is 37.3% and 13.5% lower than the market average of Kshs 63,768 and Kshs 378 per SQM, respectively, as per the Nyeri Real Estate Investment Opportunity 2019.

Assuming the 3-bed market average occupancy rate of 100.0%, as per our research note, the development is projected to offer rental yields of 10.0%, 2.4% points higher than the Nyeri market average of 7.6% as of 2019. The residential market is mainly rental, in and around Nyeri town as the market, with the majority of the residential houses being owner-built, however, the area remains attractive to investors driven by:

- The improving infrastructure such as the ongoing rehabilitation of roads such as the Baden Powell – Muhoya road in Nyeri town and the proposed construction of the Kenol-Nyeri-Isiolo Highway, which is expected open up the areas for real estate development,

- Devolution has continued to open up Nyeri Town, attracting government institutions such as the Independent Policing Oversight Authority (IPOA) and private firms, thus creating demand for office space, retail space and residential units to host investors and government officials,

- Its central location in the Mt. Kenya Region, thus attracting Mt. Kenya Regional offices for both local and international companies such as the Safaricom, National Construction Authority (NCA), and Coca Cola, thus creating demand for office space, retail and in the housing sector, and,

- Relatively High Income among the population with Nyeri ranking as the 12th richest county in terms of GDP per capita in the country at USD 958, according to the Gross County Product report 2019 by the Kenya National Bureau of Statistics (KNBS).

The table below shows the performance of detached units in Nyeri:

All values in Kshs unless stated otherwise

|

Nyeri Residential Detached Units Performance (2017-2019) |

||||||||||||||||

|

Typology |

Price per SQM 2017 |

Price per SQM (2019) |

Rent (2017) |

Rent (2019) |

Rent per SQM 2017 |

Rent per SQM 2019 |

Occupancy 2017 |

Occupancy 2019 |

Annual Sales 2019 |

Rental Yield (2017) |

Rental Yield (2019) |

∆ Rental Yields 2017-2019 |

||||

|

1-bed |

76,190 |

76,190 |

10,000 |

15,000 |

238 |

357 |

80% |

80% |

20% |

3.8% |

4.5% |

0.7% |

||||

|

2-bed |

74,074 |

74,074 |

20,000 |

20,000 |

370 |

370 |

71% |

80% |

25% |

4.3% |

4.8% |

0.5% |

||||

|

3-bed |

63,768 |

63,768 |

28,000 |

28,000 |

406 |

406 |

67% |

100% |

25% |

5.1% |

7.6% |

2.5% |

||||

|

Average |

71,344 |

71,344 |

19,333 |

21,000 |

338 |

378 |

73% |

87% |

23% |

4.4% |

5.6% |

1.2% |

||||

|

· 3-bed detached units recorded average rent per SQM of 378 in 2019, 1.2% points higher than the market average of 4.4% recorded in 2017, attributed to the increase in the monthly rent charges from Kshs 338 per SQM in 2017 to Kshs 378 per SQM and occupancy rates from 73% to 87% |

||||||||||||||||

Source: Cytonn Research 2019

We expect to continue seeing increased real estate developments in other counties driven by the improving infrastructure and availability of land for development and at affordable prices. According to Cytonn Research, Nyeri registered an average price per acre of Kshs 60.9 mn, 54.5% lower compared to the Nairobi Metropolitan region with Kshs 134.0 mn per acre.

- Retail Sector

During the week, Giordano, a Hong Kong fashion chain, opened its first Kenyan outlet at Garden City Mall as it aims at targeting Kenya’s market with its casual wear and accessories. The chain has over 2,400 stores worldwide in 40 countries including Zambia and South Africa that were opened in 2015 and 2018, respectively.

The increased interest by international retailers into the Nairobi Metropolitan Area (NMA) is supported by (i) growing demand for international brands from the expanding middle class, (ii) the supply of high-quality retail spaces that meet international standards, and (iii) the expanding middle-income class population, with increasing disposable incomes creating demand for differentiated retail products. Other international retailers that have entered into the Kenyan retail market in the past year include Tendam group, Hugo Boss and Mango.

The increased entry of multinational retailers is a welcome move for developers who have been experiencing increasing vacancy rates due to the tough economic climate with occupancies declining by 4.0% to 75.9% in 2019 from 79.8% in 2018, according to the Cytonn Annual Markets Review – 2019.

The table below shows the Nairobi Metropolitan Area (NMA) retail performance over time:

(All values in Kshs unless stated otherwise)

|

Summary of NMA Retail Sector Performance 2016-2019 |

|||||

|

Item |

2016 |

2017 |

2018 |

2019 |

∆ Y/Y 2019 |

|

Average Asking Rents (Kshs/SQFT) |

186.9 |

185.3 |

178.2 |

175.5 |

(1.5%) |

|

Average Occupancy (%) |

89.3% |

80.3% |

79.8% |

75.9% |

(4.0%) points |

|

Average Rental Yields |

10.0% |

9.6% |

9.0% |

7.8% |

(1.2%) points |

|

· The retail performance softened with yields declining by 1.2% points to 7.8% in 2019 from 9.0% in FY’2018 attributed to an introduction of 0.4 mn SQFT of retail space into the Nairobi Metropolitan Area (NMA) market driving down rents and occupancy rates by 1.5% and 3.3% points, respectively, |

|||||

Source: Cytonn Research 2019

- Hospitality Sector

During the week, Kenya was ranked among the top five African destinations for tourism by Safari Bookings, an online site that compares Africa’s safaris, coming in after Botswana, Tanzania, Zambia, and Zimbabwe. The ranking is attributed to the country’s (i) excellent wildlife viewing, including the annual wildebeest migration, (ii) wide variety of habitats and scenery, and (iii) beautiful beaches with a variety of resorts.

The tourism sector’s performance over the past couple of years, which has been characterized by continued increase of tourist arrivals and tourism earnings, has continued to boost the hospitality sector’s performance owing to the increased demand for quality accommodation and other hospitality services by both local and international guests, the stable political environment and improved security, thus making Kenya an ideal destination for both business and holiday travelers. According to the Kenya National Bureau of Statistics (KNBS) Leading Economic Indicators (LEI) December 2019, total number of visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) increased by 6.2% to 1.6 mn persons in 2019, from 1.5 mn persons in 2018, attributed to the calm political environment and improved security, which has continued to boost tourists’ confidence in the country. We expect the hospitality sector’s performance to remain vibrant supported by the continued marketing efforts by the Kenya Tourism Board, improved security and improved flight operations and systems, which will make it easier and more convenient for travelers.

Other Highlights

Also during the week, the Nairobi County Government announced that it had started speeding up clearance of construction permits after having stopped their issuance in June of 2019 following the disbandment of the technical committee of the Lands, Housing and Urban Planning Department charged with the approval of permits. We expect this to have a positive impact on the real estate sector as it puts various developers back on track with their respective projects thus boosting construction activity in the sector.

We expect increased activities in the real estate sector mainly in the residential and retail themes, supported by (i) the continued entry of international retailers in the country, (ii) the improving infrastructure, (iii) positive demographics and (iv) a stable economic environment.

More often than not, we face various financial obligations in different stages of life ranging from medical expenses, education expenses, and other miscellaneous expenses. In our Cytonn Weekly #07/2020, we focused on Education Investment Plans in Kenya and elaborated on why one should invest in an education plan. This week, we revisit the Personal Financial Planning topic where we discuss the importance of financial planning, the various considerations to make based on one’s own characteristics, needs and preferences and some of the investment avenues available.

Therefore, we shall be discussing the following:

- What is Personal Financial Planning and Why is it Important?

- The Financial Planning Process,

- The Key Considerations to Make When Coming Up With a Financial Planning Strategy,

- Investment Avenues Available and the Steps or Process of Selecting the Most Suitable Avenue, and,

- Conclusion.

Section 1: What Is Personal Financial Planning and Why is it Important?

Personal Financial Planning refers to a systematic approach towards managing one’s finances by allocating resources optimally in an effort to maximize the use of these resources in order to achieve one’s financial goals and objectives. Having a sound personal financial plan is important because it helps reduce and possibly eliminate financial distress arising from various responsibilities and unexpected situations. It is key to note that financial planning largely depends on one’s age, income level, risk tolerance, the responsibilities at hand, and future objectives. These factors have led to the broad classification of investors into three phases:

- Accumulation Phase: It constitutes the young population of ages 18- 30. Their net worth is low and restricts them to low-priced investments. Nevertheless, they have a high-risk tolerance because of their long-term investment lifespan since a loss incurred during this phase can be recovered in the next investment cycle,

- Consolidation Phase: It encompasses the middle age income earners of ages 30-55. At this stage, the net worth of individuals is relatively high since payment of school loans does not burden them like those in the previous stage. They can afford a range of investment commodities. However, their risk tolerance is lower than that of individuals in the accumulation phase. They seek out ventures that would not imbalance their accumulated capital while still investing to offset inflationary rates, and,

- Spending/ Gifting Phase: Most people at this stage are retired and are of ages 55 and beyond. Their source of income is majorly from the investments held. They have a low-risk tolerance and prefer little to no risk investments.

It is critical to evaluate these three phases before launching a financial map. Once an individual identifies the appropriate classification, one should be able to determine the personal optimal plan. After this evaluation, we describe the process of creating a financial plan.

Section 2: The Financial Planning Process

Personal financial planning is a continuous process founded on four pillars namely; budgeting, saving, investing and debt management. The planning process takes into account every aspect of your financial situation and how they affect your ability to achieve your goals and objectives. Achieving financial freedom can be through the following steps:

- Assessment: This step involves identifying factors that are likely to affect one’s financial plan by evaluating his/her income, spending habits, lifestyle and see how each of them will affect their financial plan,

- Goal Setting: In this step, one should outline their financial end goal before developing financial action plans. An individual could have multiple goals, some long-term and others short-term. Usually, financial goals and priorities attached to them differ by person and change over time and therefore it influences the path one takes towards the achievement of their financial objective. Your financial planning goals should be measurable and achievable by one or a combination of the following four practices:

-

- Saving - Saving basically means deferred consumption and entails consuming less out of a given amount of resources in the present in order to consume more in the future by setting aside part of your income in some form of asset. Efficient saving requires discipline. While saving, it is important to treat savings as a necessary expense and have a plan. Here are a few tips to guide you. Firstly, save with a goal. Secondly, save first, and then spend what you have left. Thirdly, don’t just save, invest,

- Investing - Saving is often confused with investing, but they are not the same. Saving allows you to earn a lower return but with no risk involved, while investing gives a higher return but at the risk of loss. Investing involves the purchase of an asset with the hope of generating some income in future or the asset appreciating hence being able to sell it at a profit. There are different asset classes that one can consider and an investor will choose the different vehicles based on their risk appetite, the returns expected and the liquidity requirement. As you invest, it is important to diversify one’s portfolio through investing in different instruments in a bid to mitigate risk,

- Debt and Debt Management – Is debt good or not? Debt is only good if used towards an investment or for future financial gain such as business, education, or property. However, it is advisable to take up debt for investment only if the economic rate of return, which is simply how an investment’s economic benefits compare to its costs, are able to finance the debt repayment. Here are a few do’s and don’ts for debt management;

-

-

- Plan before you borrow,

- You should never use more than 1/3 of your net income in loan repayment,

- Never borrow for things you desire but don’t need,

- Avoid borrowing on consumption items, and,

- Live within your means.

-

-

- Budgeting – Budgeting is simply creating a plan on how to spend your money. It is important that you have the discipline to create a budget around the resources you have and stick to it. When budgeting, prioritize your needs and necessary expenses and try as much as possible to cut down on unnecessary expenses to save money,

- Plan Creation and Execution: The financial plan is a well-detailed process of how one intends to accomplish the goals in the step above, how long it would take to achieve said goals and the best strategy for achieving those goals. Execution refers to how best to put the created plan to action. A well laid out plan should highlight the following items:

- Suitable channels and investment instruments to achieve your goals- This involves selecting the best strategies to achieve your financial targets. This may be through saving, proper budgeting, cutting on expenses, and through investing, and,

- Timelines- Depending on whether your goals are long term or short term, your plan should indicate how long you are willing to invest in a given investment instrument. Long-term investments, such as bonds and real estate, may be most suitable for long-term goals and short-term investments, such as money markets, are suitable for short term investments, and,

- Monitoring and Reassessment: Financial planning is a continuous process because goals and priorities change over time and therefore monitoring a financial plan for possible adjustments or reassessments is necessary. A review allows you to analyze individual investments and determine if they are helping in the achievement of your goals. The following factors should prompt one to make changes on their financial plan during a review:

-

- Status of Set Goals- Achievement of pre-determined goals should prompt you to change your financial plan. If the goals are yet to be achieved it is necessary to determine if they can still be achieved, given the present circumstances,

- Change in Income- A change in income levels directly impacts your financial plan because it may require a change in priorities and may also lead to early maturity or a delay of set goals and therefore affect the set timelines,

- Number of Dependents- An increase/ decrease in the number of dependents may mean that one has less or more disposable income to put into investments, and,

- Change in Risk Appetite and Risk Tolerance- Factors such as age, number of dependents and income levels of an individual affect the risk appetite and tolerance of individuals, therefore their financial plan should adjust to suit their new risk appetite and tolerance.

Section 3: The Key Considerations to Make When Coming Up With a Financial Planning Strategy

The investment considerations made will largely depend on one’s individual risk tolerance and appetite, which largely depends on age and the level of income. Some of the factors likely to inform one’s financial plan include:

- Age- Younger people have a longer time horizon and can, therefore, make riskier investment decisions as they have time to recover if they end up making losses. Their investments are mostly in real estate and equities, which allow the investor time to grow value in their investment. For older people, the time horizon is shorter and therefore they are averse to high-risk investments. Safer investment options are preferred because they offer steady and predictable income, with their investments skewed towards government-backed assets such as bills and bonds, which offer an almost guaranteed return after a given period. They may also invest in various collective investment schemes such as fixed income or money market funds, which are professionally managed, offer liquidity, periodic income, and principal protection,

- Risk Profile- Risk is the potential threat that may affect the outcome of your investments and individuals either tolerate or avoid risk. Risk-averse individuals generally avoid riskier investment decisions. Their financial planning decisions are geared towards safer investment plans and their portfolio will most likely include investment instruments such as treasury bonds, bills, and bank deposits. They can also invest in these securities through money market funds or fixed income funds. Risk-takers, on the other hand, will channel their planning towards high-risk investments such as real estate and equities, with the aim of generating higher returns,

- Income- A change in an individual’s income affects their disposable income and the amount of money they have left to invest. The investment vehicles one uses in achieving their financial goals is dependent on their level of income. Low-income earners can gain access to various securities such as bank deposits, treasury bills, bonds and equities through the various types of collective investment schemes and structured products given the relatively lower initial investment requirement,

- Investment Goals- What an individual hopes to achieve will determine the type of investment they venture into long term or short-term investments. Investment goals address two major themes regarding money and money management. First, they generate accountability, forcing individuals to review progress from time to time and second, they help in generating motivation, and,

- Marital Status and Number of Dependents- People with few dependents have the freedom to make riskier investment decisions as compared to those with many people depending on their income. Married individuals often prioritize their families and would always look for less risky portfolios due to their responsibilities in the family.

The table below summarizes the investment allocation depending on the highlighted factors.

|

Investors Age |

Expected Risk Profile |

Income Level |

Skew investments towards |

Reasoning |

|

Below 25 |

High |

Low to Medium |

Collective Investment Schemes, Pensions, and Equities |

Has a long investment horizon to withstand volatility and get enhanced returns |

|

25- 35 |

High |

Medium to high |

Collective Investment Schemes, Pensions, Real Estate and Equities |

Few cash flow requirements. Still has time to withstand volatility |

|

35-45 |

Medium |

Medium to high |

Pensions, Collective Investment Schemes, Real Estate, Equities, and Fixed Income |

There are constant cash flow obligations. Still has time to withstand medium volatility |

|

45-55 |

Medium |

Medium to high (Generating income from prior investments) |

Real Estate, Equities, and Fixed Income |

There are constant cash flow obligations. Still has time to withstand medium volatility |

|

Above 60 |

Low |

Low or non-existent |

REITs and Fixed Income |

Stability of income is key |

Section 4: Investment Avenues Available and the Steps or Process of Selecting the Most Suitable Avenue

The achievement of long-term financial safety involves undertaking various investment projects that would not only build wealth but also secure it. As highlighted in our previous report on investment options in the Kenyan Market, numerous investment options available appeal to different classes of investors. Investors decide on different channels based on their risk appetite, the returns expected and the liquidity requirement. Investment products available are broadly categorized into two categories:

- Traditional Investments

- Alternative Investments

Traditional investments involve putting capital into well-known assets that are sometimes referred to as public-market investments. The main categories of traditional investment products under this category include:

- Equities- Equities, otherwise known as stocks, represent an ownership interest in a company. They are traditional investments that are relatively liquid, highly volatile and hence considered risky. They are suitable investment options for long-term investors and offer returns in form of dividends and capital appreciation. To invest in the equities market in Kenya, one would need to open a Central Depository and Settlement (CDS) account, which is an electronic account that holds your shares and bonds, and allows for the process of transferring of shares at the Securities Exchange, through a licensed stockbroker,

- Fixed Income- These securities offer fixed returns to investors in the form of fixed periodic interest payments and the repayment of the principal upon maturity. They are also that are moderately liquid, have low volatility and hence considered less risky. They are suitable for medium-term to long-term investors and offer returns in form of interest income and capital appreciation. They include fixed deposits, Treasury bills and bonds, and commercial papers,

- Mutual Funds / Unit Trust Funds- This is a Collective Investment Scheme that presents investors with an opportunity to participate in the various asset classes with no professional expertise and low capital by pooling money together from many investors. The funds are managed by a professional fund manager who invests the pooled funds in a portfolio of securities to achieve objectives of the trust. The funds in the mutual fund earn income in the form of dividends, interest income and/or capital gains depending on the asset class the funds are invested in. The following are the main types of funds:

-

- Money Market Fund- This fund mainly invests in short-term debt securities with high credit quality such as bank deposits, treasury bills, and commercial paper. The fund is best suited for investors who require a low-risk investment that offers capital stability, liquidity and a high-income yield. The fund is a good safe haven for investors who wish to switch from a higher risk portfolio to a low risk, high-interest portfolio, especially during times of high stock market volatility,

- Equity Fund- This type of fund aims to offer superior returns over the medium to longer-term by maximizing capital gains through investing in listed securities. This fund is suited for investors seeking medium to long-term capital growth in their portfolios and want to gain exposure to equity investments. The fund has a medium to high-risk profile. Due to the volatile nature of the stock markets, risk is usually reduced through holding a diversified portfolio of shares across different sectors,

- Fixed Income Fund – This fund invests in interest-bearing securities, which include treasury bills, treasury bonds, preference shares, corporate bonds, loan stock, approved securities, notes and liquid assets consistent with the portfolio’s investment objective. The fund is suitable for investors who are seeking a regular income from their investment, including those who intend to secure a safe haven for their investments in times of stock market instability,

- Balanced Fund – This fund invests in a diversified spread of equities and fixed income securities with the objective to offer investors a reasonable level of current income and long-term capital growth. The fund is suited to investors who seek to invest in a balanced portfolio offering exposure to all sectors of the market. It is also suitable for pension schemes, treasury portfolios of institutional clients, co-operatives and high net worth individuals amongst others. The fund is a medium risk fund and has a medium risk profile. For more information on Unit Trust Funds, see our topical on Investing in Unit Trust Funds, and,

- High Yield Fund – This type of fund invests in securities that generally pay above average interests and dividends, with the fund’s objective being delivery of high returns to investors. The fund has a high-risk profile and is suited for long-term investors who are looking for growth of their portfolios over-time.

Alternative investments are those that fall outside the conventional investment types such as publicly-traded stocks, bonds, and cash. The most common alternative investments today are:

- Real Estate - This involves investment in property and land. Real Estate is considered an alternative investment that is illiquid, relatively stable and uncorrelated to traditional investments. They are suitable for long-term investment plans, which makes them a risky investment. Real Estate can yield high returns, and is useful for diversification and as a hedge against inflation since its value increases over time. Real Estate offers returns in the form of rental yield and price appreciation, and,

- Private Equity - It generally involves buying shares in companies that are not listed on a public exchange or buying shares of public companies with the intent to make them private. Private equity can involve many strategies that may help provide money to companies at different stages of their development. The most widely used strategies are venture capital, buyouts and distressed investing.

The myriad of possibilities can leave an individual confused about the ideal product. In determining the appropriate investment option, one should consider:

- The rate of return- A rational investor seeks out a venture that would provide maximum return for a given level of risk,

- The cost of the investment- One should harbor the same sentiments in purchasing an investment as they do in buying groceries. The price of the investment is a key element. Over time, the returns received should exceed the cost of the investment,

- Liquidity needs and time horizon for investment- The liquidity varies from one asset to another. An individual must evaluate the target for the investment chosen and the length of time they for which they require illiquid assets, and,

- The regulatory and legal constraints placed on the venture- Awareness of the tax treatments that the selected investment options are subject to assists one in evaluating their longstanding returns.

Section 5: Conclusion

With proper financial planning, financial peace of mind is guaranteed no matter the stage of life one is in. Personal financial planning is important for an individual’s present and future financial stability. Financial planning is important for the following reasons:

- Income Management – It is easier to manage your income more effectively through planning. Managing incomes helps you understand your necessary expenses and also helps you to pick out wasteful expenditures and adapt quickly when your financial situation changes,

- Improving the standard of living- The savings and investments created through proper planning act as a cushion during financial times,

- Defining Financial Goals – Clear financial goals enables you to focus on execution, ultimately increasing the chances of realizing your goals and helps in avoid financial distractions, such as unnecessary expenses e.g. impulse purchases, by enhancing accountability,

- Act as a guide for Investments – One is able to choose the right investments to fit their needs since a financial plan considers their personal circumstance, objectives and risk tolerance,

- Financial Understanding – Understanding the effects of financial decisions and reviewing the results of these decisions can be achieved through measurable financial goals. One is able to understand better and take control of their financial lifestyle,

- Asset-Liability Management – Through the creation of a budget where one looks at their income versus their expenses, one is able to distinguish the real value of an asset since some of them come with liabilities attached to it and therefore understand how to settle or cancel such liabilities. For example; buying a car that needs to be serviced every 3-months, needs to fueled and requires an insurance cover in case of accidents,

- Precautionary Motive – One is able to plan for emergencies by setting aside investments of high liquidity such as a money market fund or bank deposit, that act as a safety net,

- Comfortable Retirement- Enjoying retirement is easy with a stable source of income and given that formal employment is no longer an option, it is important to sign up to a registered Retirement Benefits Scheme and make regular contributions in your employed years. Other benefits of saving through a retirement benefits scheme, aside from alleviating poverty include:

-

- Provision of regular income to replace earnings in retirement, and,

- Provision of lump-sum benefit income for surviving dependents in the event of your passing.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.