Feb 13, 2022

Kenya’s Real Estate sector is one of the economic sectors that that has realized remarkable growth and improvement over the past years. However, development of projects has proven to be a challenge as evidenced by various projects stalling, and hence surpassing their stipulated timelines. Key to note, Real Estate investments are capital intensive, and as such require massive funding to complete. However, the over-reliance on traditional sources of financing Real Estate projects such as debt financing continue to be a challenge in sourcing funds for developments mainly due to difficulty in accessing credit loans, coupled with the burden of being in debt. Therefore as our focus this week, we shall do a recap of our 2019 topical on Alternative Financing for Real Estate Developments, in order to identify the various sources of financing for Real Estate developments with a keen eye on the alternative financing for Real Estate. The topical will therefore cover the following:

- Introduction to Real Estate,

- Traditional Financing for Real Estate Developments,

- Alternative Financing for Real Estate Developments,

- Case Study: South Africa’s Real Estate Investment Market (REIT) Market,

- Recommendations: Measures to Increasing Access to Real Estate Development Funding, and,

- Conclusion.

Section I: Introduction

In 2021, Kenya’s Real Estate sector recorded improved activities and performance, as a result the reopening of the economy which facilitated numerous expansion and construction activities by investors, in addition to various businesses resuming full operations. Consequently, the average rental yield for the Real Estate market came in at 6.5% in 2021, 0.4% points higher than the 6.1% recorded in 2020. Additionally, the sector grew by 5.2% in Q3’2021, 0.3% points higher than the 4.9% growth recorded in Q2’2021, according to the Q3'2021 GDP Report by the Kenya National Bureau of Statistics’ (KNBS).

Despite this, the sector continues to face various challenges which include;

- Existing oversupply in the Nairobi Metropolitan Area (NMA) office and retail market at 7.3 mn SQFT and 3.0 mn SQFT, respectively, coupled with an oversupply of 1.7 mn SQFT in the Kenya retail market,

- The shift towards online shopping and financial setbacks which continues to affect the performance of the Kenyan retail market thereby reducing demand for physical retail spaces, and,

- COVID-19 uncertainties which remains a challenge as the virus continues to mutate with the most current emerging variant being Omicron. This might lead to most tourists halting their travel plans with other countries imposing strict measures to limit the spread of the virus.

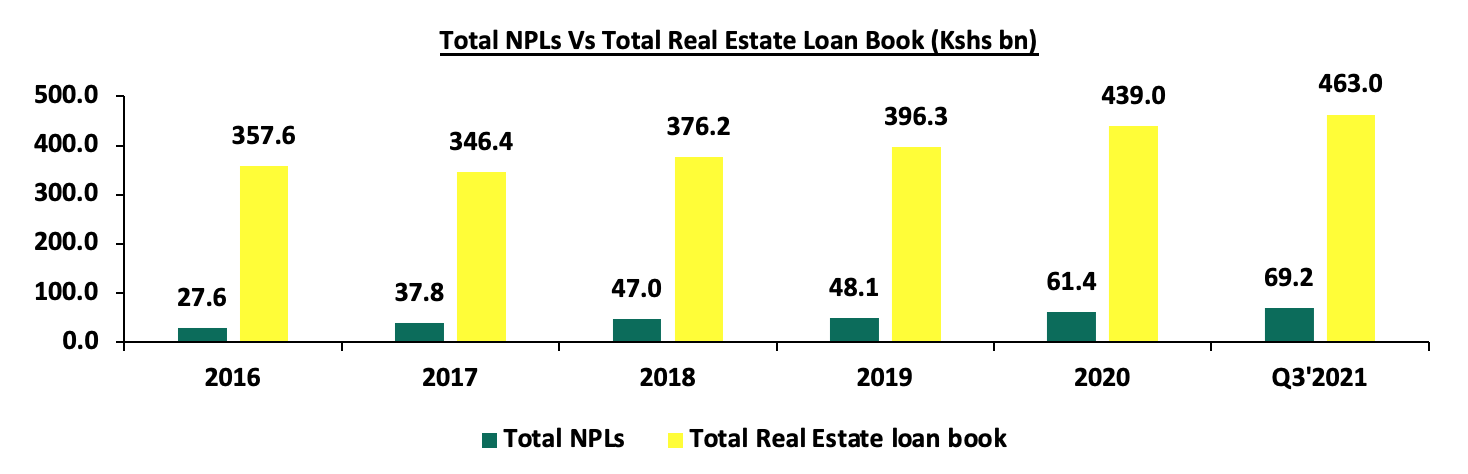

In addition to the above challenges, financial constrains continues to be a major challenge faced by developers, leading to various projects stalling and surpassing their stipulated completion timelines. This is mainly driven by; i) high construction costs currently ranging between Kshs 35,000 per SQM and Kshs 60,000 per SQM, ii) the onset of the pandemic which led to reduced cash flows and projects stalling, and, iii) difficulty accessing credit as banks continue to tighten their lending terms while requesting for more collateral from Real Estate developers due to the increasing default rates in the property sector. In support of this, the Gross Non-Performing Loans (NPLs) in the Real Estate sector increased by 16.6% to Kshs 69.2 bn in Q3’2021, from Kshs 57.7 bn realized in Q3’2020, evidenced by Central Bank of Kenya’s Q3’2021 Quarterly Economic Review. The graph below shows the number of Real Estate NPLS compared to the total Real Estate loan book from 2016 - Q3’2021;

Source: Central Bank of Kenya

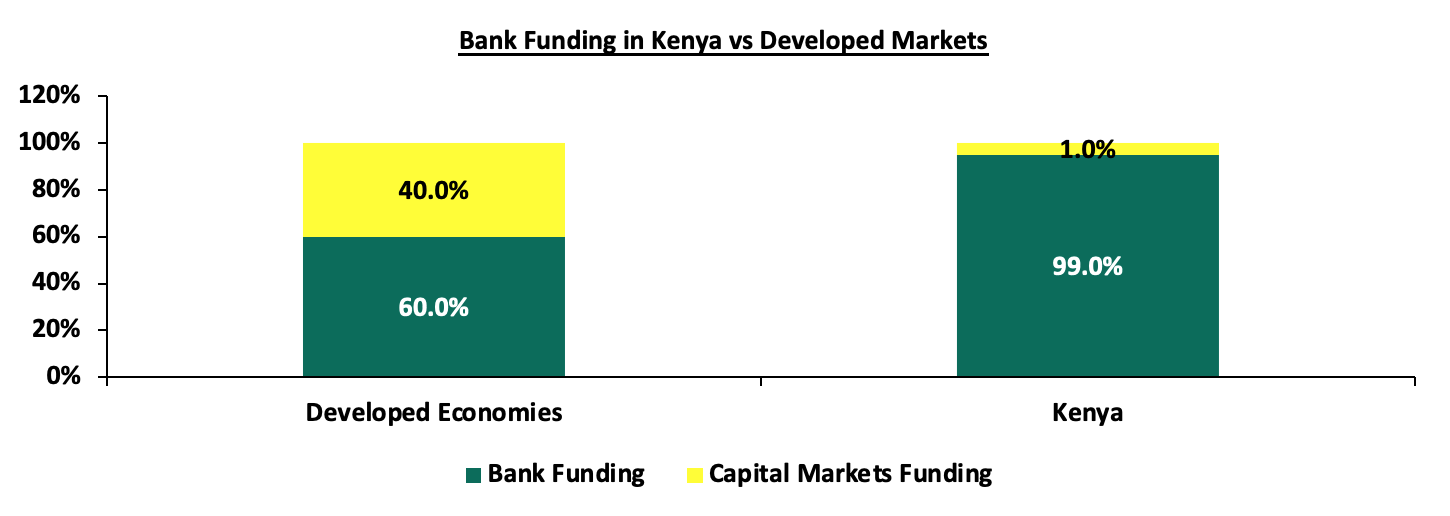

In Kenya, the main source of funding for Real Estate developments is banks which provide approximately 99.0% of funding as compared to 40.0% in developed countries, a sign of overreliance on the bank funding and minimal exposure of other alternative sources available for financing projects especially from the capital markets. This therefore also implies that capital markets contribute a mere 1.0% of Real Estate funding, compared to 60.0% in developed countries. The chart below compares bank funding in Kenya and capital markets;

Source; World Bank

With regards to financial constraints incurred by developers and land owners, we sought to identify and discuss the various forms of financing Real Estate projects, besides the debt and equity financing which is prominent in Kenya.

Section II: Traditional Financing for Real Estate Development

The three main ways of funding Real Estate developments traditionally are; debt financing, equity and personal savings;

- Debt Financing

This is the most common avenue by which developers acquire funds to develop Real Estate projects in Kenya. It entails acquisition of loans majorly from commercial banks, private lenders, or SACCOs, i.e., a saver with money takes it to the bank and gets little to no return on their deposit. The bank, in turn, lends the money to, say, a developer and charges the market rate cost of borrowing. The bank enjoys the difference between the cost of the deposit paid to the saver and the yield on loan received from the developer.

In comparison to the alternative financing method, the facts remain essentially the same, except that the intermediary is not a bank but an investment vehicle; the saver with money takes it to an investment professional, through an Investment Vehicle, who gives the money directly to the developer. The developer will still pay the usual cost of borrowing, but instead of paying it to the bank, it will be paid to the Investment Vehicle, which will pass the returns to the saver. By structuring out the bank, the saver has been able to increase the returns from the typical rate of return given on deposits, to the typical rate of borrowing paid by developers.

All in all, debt financing usually involves longer transaction timelines endured before one is granted a loan, as there are lengthy processes involved such as valuations. Additionally, given the current high Non-Performing Loans in the Real Estate sector and the high risk of defaults, banks have continued to tighten their lending to the sector and in the cases where they lend out money, it is often at higher interest rates.

- Equity

In Real Estate Development, Equity funding option can be done in three different ways;

- Joint Venture

A joint venture (JV) refers to a business arrangement under which two or more parties come together to undertake a project by pooling their resources together. In their most distinctive form, Real Estate joint ventures combine the Real Estate development expertise and financing capability of a developer with the landowner’s contribution in the form of land. A Joint venture can also be initiated between partners with capital. However, in most cases one party has limited funds and therefore the other party with more funds comes into an agreement to invest in the project. Some of the benefits of joint ventures include;

- Increased Capital Base: In a JV, partners contribute capital into the project in the form of land or cash and this is beneficial considering the capital intensive nature of Real Estate development,

- Development Expertise: The developer in a JV provides development expertise in terms of concept development, design, project management and oversees the project to completion. With the right partner, the landowner is relieved of the day-to-day hustle of supervising a project and assured of a professional workmanship,

- Access to market distribution channels: Partnering with a reputable Real Estate firm that has been in the market ensures the Real Estate product reaches its suited market and thus the partners are able to exit faster either by renting or selling, thus realize returns sooner,

- Shared risks and gains: A successful joint venture will generate the expected high returns for both partners. A partnership also enables spreading of economic and other market risks that might result from undertaking a Real Estate investment that would otherwise be borne alone, and,

- Can provide partial liquidity for landowner without having to sell the entire land: In a JV, the land owner can get some cash for their land to meet their liquidity needs and also maintain interest in the development.

Despite the benefits of this funding option, it is subject to bias perception of a developer or a firm. This therefore leads to one investing with specific developers or firms, whilst minimizing exposure of other or upcoming developers in the market. Additionally, JVs are prone to conflicts that could threaten the success of a project. The conflicts arise due to unmet expectations or if any one of the parties fails to deliver on their end. Joint ventures may also be subject to double taxation in the case where the joint venture has not been listed as a limited liability partnership, where both the partnership gets taxed as well as each of the partner’s profits. As such JV partners ought to consult and know the pros and cons of different partnership structures and register the partnership as a limited liability to avoid double taxation.

- Pre-Sales

This is in other terms also known as off-plan investments, whereby developers pool funds from investors to construct a project, by selling the various units during the construction period. According to our topical, Off-Plan Real Estate Investing, this form of financing has been gaining traction in Kenya given that it enables investors to take advantage of capital appreciation of the properties, since they are bought at a price much less than the actual cost of the property upon completion. The developer, on the other hand, gets the opportunity to access funds from the sale of units off-plan, thus enabling the completion of the developments. However, off plan investments may be disadvantageous because of; i) the possibility of capital depreciation, ii) risks of delays and failure to deliver, and, iii) payment defaults from the investors thereby leading to projects stalling or delays.

- Savings

This is the easiest funding option to finance property developments since one acquires finances from their personal savings that has accrued over time, and therefore does not need to secure other forms of finances. Some of the benefits of this funding option include; i) Full control of the day to day activities of the project, without having another party intervening, and, ii) Full ownership rights of the project even after it is complete, meaning that all the profits will go the owner. Despite the benefits, there are also disadvantages of using savings to finance Real Estate projects which include;

- Massive Capital Required: Real Estate projects are capital intensive and personal savings might not be enough to fund a project to completion. This will therefore require one to seek additional funds from other alternative sources such as bank loans which in most cases, have high interest rates as well as longer transaction timelines hence projects stalling due to limited capital, and,

- Possibility of Loss of Assets: This can happen in instances where a project fails or does not yield returns due to uncertainties. There is a possibility of loss in instances where an investor may decide to sell off their properties to recover their funds.

Section III: Alternative Financing for Real Estate Developments

Based on the financial gaps resulting from the various drawbacks of the traditional funding options, there has been the need and opportunity to tap into other forms of financing Real Estate developments. This is in order to minimize the overreliance of debt finance while also giving developers and investors diversity in funding options such as structured products that deliver higher returns to the investors, in comparison to traditional investments. Some of the alternative funding methods therefore include but not limited to:

- Real Estate Investments Trusts (REITs)

REITs are regulated collective investment vehicles which invest in Real Estate. REITs promoters source funds to build or acquire Real Estate assets, such as residential, commercial, retail, mixed-use developments among others which they sell or rent to generate income. Some of the REITs listed in Kenya include Fahari I-REIT on the Nairobi Stock Exchange (NSE), and Acorn REIT that trades both as a Development REIT (D-REIT) and Income REIT (I-REIT) on the Unquoted Securities Platform (USP). For more on the Kenyan REIT Market, click here.

The performance and growth of the Kenyan REIT market continues to be weighed down by challenges such as;

- High Minimum Investment Amounts at Kshs 5.0 mn, which is relatively high for the low and middle income class citizens,

- Inadequate Investor Knowledge on REITs hence low investment and subscription rates in the market,

- High Minimum Capital Requirements for a Trustee at Kshs 100.0 mn, and this automatically leaves only banks to be the REIT trustees, and,

- Lengthy Approval Processes.

We also note that there are only two REIT organizations in the country as opposed to 33 in South Africa, with 28 listed in the Johannesburg Stock Exchange.

- Structured Products

These are financing options provided by different organizations to investors in order to increase their financial muscle to fund property developments. They include asset based products such as Real Estate Notes (promissory notes secured by a specified piece of Real Estate), High Yield Funds (mutual fund that seeks a high level of income), and Medium Term Notes (corporate debt security offered intermittently), among others. An example is the Kshs 3.9 bn Medium Term Note (MTN) programme issuance for Urban Housing Renewal Development Limited that was approved by the Capital Markets Authority (CMA) in November 2021. The MTN which had a Kshs 600.0 mn green-shoe option, an 18-month tenor, and an interest rate of 11.0% p.a will be used to finance the construction of the ongoing Pangani Affordable Housing Project. These structured products have proven to be beneficial as they are geared towards generating high returns to investors. Some of the advantage of the structured funding methods include;

- Ease of Accessibility: Structured products offer ease of access of finance from the public compared to traditional methods such as debt financing which undergo lengthy processes and approvals,

- Minimum Investment Amounts: Some of the organizations with structured products provide favorable investment terms and requirements, with a minimal investment amount as low as Kshs 100,000, which is relatively cheaper and easy to acquire from investors, for development, and,

- Saving and Investment Mechanism: While structured products offer financing options to developers, they also act as an investment platform for most investors given their high rate of returns. Real Estate backed structured products on average provides investors high returns to as high as up to 20.0%. An example is the Cytonn Real Estate Note which provides returns of 16.0% to 20.0% depending on the tenor.

On the other hand, the downsides to this kind of financing option includes;

- Illiquidity: This mostly affects Real Estate backed up structured products. Real Estate is more of brick and mortar and as such converting them into cash takes time as well, in addition to being prone to external challenges that drive illiquidity. This causes delayed repayment of funds to investors, and in turn derailed trust in the funds, and,

- Inflation Risk: This mainly affects corporate bonds as they are prone to inflation risks which might in turn lower the value of expected investment amount in the future, as well as the possibility of low subscription of a bond in future by prospective investors resulting from lack of confidence.

- Public Private Partnerships (PPPs)

These are partnerships involving a government organization and a private entity, formed with the sole purpose of financing projects. According to our on topical on Private Public Partnership in Real Estate, we noted that PPPs continue to gain traction in Kenya as they have proven to be a cost effective measure of financing projects in the country. Some of the projects initiated under the partnership strategy include; i) River Estate project in Ngara between the national government and Edderman Property Limited, ii) Pangani Affordable Housing project between the government and Tecnofin Kenya Limited, and, iii) Hydro City project between the government and Hydro Developers Limited, among others. Below are some of the benefits of PPP funding option:

- Access to Private Capital: PPPs grants government access to private capital in order to carry out various development projects, that would otherwise have taken a long time to implement,

- Access to Private Sector Efficiencies: PPPs also grant the government access to new and improved technology as well as skilled labor, as a result of undertaking projects with well-established countries such as China and Japan, and,

- Large Scale Investment and/or Development: PPPs facilitate large scale development projects that would otherwise cause financial strain to taxpayers if implemented by the government alone.

Contrary to the above benefits, PPPs have also met setbacks in Kenya as a result of;

- Irregular Procurement Due to Corruption: The government has been in most cases accused of irregularities, raising speculation such as irregular awarding of tenders through corruption, hence causing loss of public confidence in the contracted parties and delayed delivery of PPP projects,

- Inadequate Infrastructure: Kenya has inadequate infrastructure such as sewer and drainage systems among others, to support the bulk PPP projects. This therefore causes delays in the delivery of projects, in addition to developers having to incur the cost of constructing the amenities as well, thus being discouraged, and,

- Lengthy Approval Processes: Applications require to go through different channels in order to be granted a green light. Furthermore, some delays in responding to bidders are blamed on the failure to achieve quorum at the various levels required to provide approval, which hampers expeditious decision making.

- Mezzanine Funding

This is where an organization provides subordinated financing to a Real Estate development. The financing can be structured either as debt or preferred stock, and while it is junior to bank debt and gets paid only after the funds from the bank have been exhausted, it is senior to equity thus gets paid before equity investors. Some of the benefits of mezzanine financing option are;

- Long Term Financing Solution: Whereas traditional financing options such as banks only support the borrower for a stipulated short period of time, mezzanine funding gives developers with long term projects the opportunity of accessing funds for a longer time,

- Control: Mezzanine funding ensures that the developer or firm remains in control of the business provided the success of the project is maintained,

- Extra Capital: Mezzanine capital acts as extra capital since it is subordinate to a senior debt, hence provides the developer with the opportunity to utilize and expand the project.

Some of the challenges impeding the growth of the funding option include;

- Loss of Control: In case of a default, this form of funding gives the lender the right to convert an equity interest in the company,

- Lengthy Approval Processes: Just like any other loan, processing and form of mezzanine funds takes time and this discourages borrowers from acquiring it, and,

- Restrictions: Borrower may be subjected to tight terms and conditions that they must adhere to, such as how the money will be spent, as well as where it will be spent, thus in turn discouraging developers from opting for it.

Section IV: Case Study

Out of the 54 countries in Africa, there are only 6 countries that have adopted the Real Estate Investments Trusts (REITs) namely; South Africa, Kenya, Ghana, Nigeria, Tanzania, and, Zambia. This signifies the unpopularity of the financing instrument as an alternative form of financing Real Estate Investments, with only 42 organizations having adopted it according to Housing Finance Africa. Conversely, out of the 42 organizations South Africa dominates the market with a total of 33 REITs (28 REITS listed in the Johannesburg Stock Exchange), followed by Nigeria and Kenya which currently have 4 and 2 REITS, respectively. Moreover, South African REIT market ranks position nine globally. The table below shows the distribution of REITs in Africa as at 2021;

|

Distribution of REITs in Africa as at 2021 |

||||

|

Country |

Establishment of Framework (Year) |

Registered REITs (Number) |

Size of Industry (US$ million) |

Primary Sectors |

|

South Africa |

2013 |

33 |

31,420.0 |

Residential, Commercial |

|

Nigeria |

2007 |

4 |

131.0 |

Residential, Commercial |

|

Kenya |

2013 |

2 |

35.5 |

Residential (Student Housing), Commercial |

|

Tanzania |

2011 |

1 |

40.0 |

Residential |

|

Zambia |

2020 |

1 |

N/A |

Residential, Commercial |

|

Ghana |

2018 |

1 |

(12.6) |

Residential, Commercial |

Source: Centre of Affordable Housing

South Africa adopted REITs in 2013, with a focus on investing in the residential and commercial sectors of Real Estate. Following the introduction of the REIT structure in the country, South Africa also established the SA REIT Association (SAREIT) in that year with an aim of promoting and representing the interest of the South Africa listed property sector. Since inception, the country’s REIT market has been recording remarkable performance with a total of R247.3 bn (Kshs 1.8 tn) worth of listed Real Estate assets currently existing. Some of the factors that have supported the growth and performance of South Africa’s REIT market include;

- Transparency: To promote and enhance awareness of REITS to investors and the general public, South African REIT Association (SAREIT) introduced and published the first Best Practice Recommendations (BPR) in 2016, a report reflecting the latest accounting, regulatory and reporting issues. This was in order to ensure transparency of the investment instrument, as well as improve comparability of the various listed companies,

- Developed Capital Markets: South Africa already had developed capital markets before the introduction of REITs in 2013, evidenced by JSE ranking position one in Africa and 16th globally. This made it easier to incorporate the investment instrument into the market, in addition to boosting investor confidence i.e. both local and international investors, in South Africa’s capital markets,

- No Minimum Investments: In South Africa, listed REITs are regulated by the JSE and as such there is no limitation of a minimum amount of capital needed to invest, only a minimum of one share, and therefore this attracts numerous investments in the REIT market,

- High Yields-Generating Properties: According to Knight Frank’s Africa Report 2020/21, South Africa’s property market fetches higher property prices and overall yields currently at 8.4% in comparison to other African countries such as Kenya which recorded average rental yields of 7.8% in the similar period. This in turn boosts investor confidence in South Africa’s REIT market as they are likely to generate higher returns, and,

- Governance: Good regulation practices and corporate governance have acted as an incentive to both local and foreign investors, who have the assurance that their funds are being properly administrated and utilized.

Despite the aforementioned supporting factors, South Africa faces a major challenge in its REIT market which is the high competition from other established REIT markets in countries such as United States of America, Netherlands, Mexico, and, Ireland, among others. In spite of this, there are lessons that Kenya can borrow from South Africa which include;

- Awareness: Transparency and limited information about the REIT market is a major challenge impeding the growth of Kenyan property market. Conversely, this can be rectified by Kenya establishing a better communication network through organizations, in order to promote and ensure efficiency of the investment instrument, just like South Africa came up with the BPR report to enhance transparency of the REITs, as well as improve comparability of the various listed companies,

- Lower Minimum Investment Amounts: The Kenyan government should review the minimum regulatory investment amount currently at Kshs 5.0 mn for D-REITs, which is relatively high for a country where the median income is just Kshs 50,000, hence the minimum investment is 100 times higher than the median income, and thus bring it down to a favorable amount i.e. Kshs 100,000 or leave the pricing open like in South Africa, and,

- A Review of the Capital Markets: Capital markets in Kenya only contribute a mere 1.0% to the financing of Real Estate projects, whereas developed capital markets like South Africa’s contribute as high as up to 60.0%. This is a sign of underdevelopment of capital markets locally. However, the government can review the regulations governing the Kenyan capital markets in order to improve their efficiency and contribution towards the financing of Real Estate developments.

Section V: Recommendations

In order to increase access to Real Estate development funding in Kenya particularly from alternative financing options, the following measures are recommended;

- Reduction of the Minimum D-REIT Investment Amount: The minimum investment amount in D-REITs in Kenya currently stands at Kshs 5.0 mn, which is relatively higher and thus locks out the low and middle income earners in the country. Therefore, the government should review the regulatory investment amount and reduce the it to a favorable amount i.e. Kshs 100,000,

- Expansion and Development of Structured Products: Structured products such as Projects Notes and Medium Term Notes, among others are provided by very few firms and entities in the country, and yet they provide alternative financing to Real Estate projects. This therefore calls for awareness and education of the public on the products, as there are also various myths that surround them which continue to discourage prospective investors from investing in them. In June 2021, we debunked these myths and concluded that it is important to have continuous education for current and potential investors to understand the products and the return prospects, as well as, how they fit in to the investors’ portfolio. For more on this, read our Regulated Vs Unregulated Products topical,

- Development of capital markets: This can be done by the government reviewing the regulations governing the capital markets, in order to minimize overreliance on debt for financing projects and focus on alternative financing options, just like in the developed countries which provide up to 60.0% of property financing while in Kenya only a mere 1.0% is contributed, while a bigger percentage i.e. 99.0% is sourced from banks,

- Improving Awareness of Investors on Different Alternative Financing Sources: Limited awareness on alternative project financing methods is one of the major reasons as to why investments instruments such as REITs do not perform well in Kenya. This challenge can however be overcome by transparency and awareness of property managers in order to increase investor appetite to REITs, as there are only two listed Real Estate companies in Kenya, that are also generally underperforming, and,

- Tax Incentives: Savings towards the collective investments schemes regulated by the Capital Markets Authority should be provided with tax incentives, in order to entice the public towards more savings and investments.

Section VI: Conclusion

Financial constraints continue to be a major challenge faced by developers as a result of limited financing options. The main funding options for Real Estate Investments are the traditional funding options such as debt financing, equity financing and savings. Developers can however explore alternative financing options for Real Estate developments such as Real Estate Investment Trusts, structured products, and Public Private Partnerships, among others. Moreover, the government should have a review on the Capital Markets regulations in order to expand their role in financing projects in Kenya, as they only contribute a mere 1.0% whereas in developed countries, Capital Markets contribute approximately 60.0%, leaving 40.0% to debt financing from banks.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.