Aug 20, 2023

Following the release of the H1’2023 results by all four authorized Real Estate Investment Trusts (REITs) in Kenya, the Cytonn Real Estate Research Team undertook an analysis of the financial performance of the REITs and identified the key factors that shaped the performance of the sector. For the earnings notes of the various REITs, click the links below:

- ILAM Fahari I-REIT H1'2023 Earnings Note

- LAPTrust Imara I-REIT H1’2023 Earnings Note

- Acorn I-REIT H1’2023 Earnings Note

- Acorn D-REIT H1’2023 Earnings Note

The report is themed “Strategic Financial Sustainability of Kenyan REITs Redefining Real Estate Investment,” where we discuss the background and structure of REITs in Kenya, and assess the financial performance of the current REITs in the market during H1’2023 in terms of operational metrics, profitability metrics, leverage ratios, liquidity ratios and valuation metrics. In addition, we highlight the outlook regarding our expectations for the REITs sector going forward. This we will cover as follows;

- Overview of the REITs Sector in Kenya,

- Themes that shaped the Real Estate Sector in H1’2023,

- Summary Performance of the REITS in H1’2023, and,

- Conclusion and Outlook for the REITs sector.

Section I: Overview of the REITs Sector in Kenya

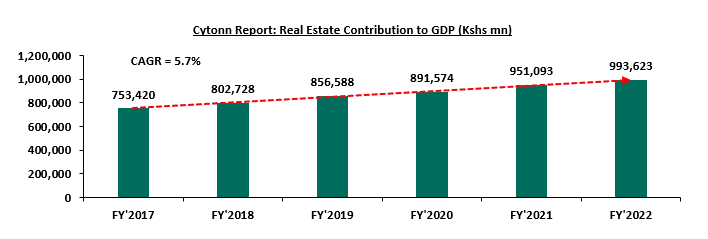

Through the years, Kenya’s Real Estate sector has continued to witness consistent growth, with the overall sectoral contribution to gross domestic product (GDP) recording a 5-year CAGR of 5.7% to Kshs 993.6 bn in 2022 from Kshs 753.4 bn in 2017. The chart below shows the Real Estate sector’s contribution to GDP from 2017 to 2022;

Source: Kenya National Bureau of Statistics (KNBS)

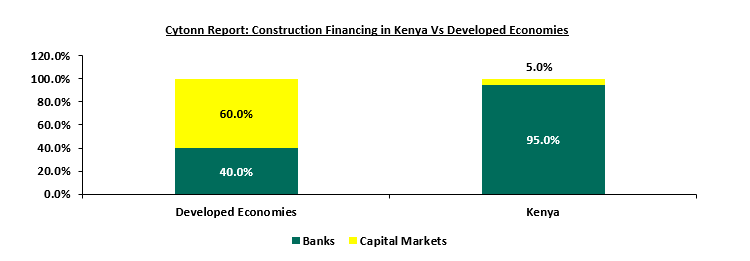

This growth of the Real Estate sector is underpinned by sustained construction activities in the country, prompted by a substantial demand for Real Estate developments. This is as the residential market bears an 80.0% housing deficit, as only 50,000 units are currently supplied annually against a demand of 200,000 units per year. In addition, the formal retail market is still nascent, with the penetration standing at approximately 30.0% according to the Nielsen Report 2018. Despite the existing demand in the Real Estate market, there exists limited funding options for developers. Banks in Kenya are the primary source of funding for Real Estate development, providing nearly 95.0% of funding for construction activities as opposed to 40.0% in developed countries. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: World Bank, Capital Markets Authority

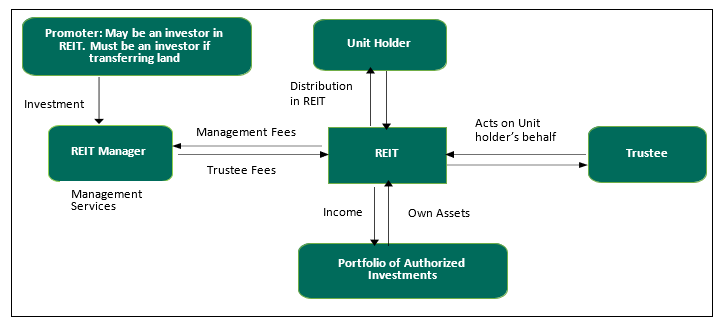

Consequently, there needs to be alternative financing solutions for developers in order to meet this funding gap. In 2013, the Capital Markets Authority (CMA) put in place a framework for the operationalization of Real Estate Investment Trusts (REITs) in Kenya. REITS are regulated collective investment vehicles that enable the contribution of money’s worth as consideration for the acquisition of rights or interests in a trust that is divided into units with the intention of a person earning profits or income from Real Estate as a beneficiary of the trust. In order to safeguard the interests of a REIT, as well as to foster transparency and accountability, there are four key entities enshrined within the REIT structure in Kenya. These entities are as follows:

- The Promoter: The promoter is responsible for initiating the establishment of a REIT scheme. They serve as the initial issuer of REIT securities and undertake the process of submitting drafts of the trust deed, prospectus, or offering memorandum to regulatory authorities for necessary approvals. Notable REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust,

- The REIT Manager: This is a company incorporated in Kenya that holds a license from the Capital Markets Authority (CMA) to offer Real Estate and fund management services on behalf of investors within a REIT scheme. REIT Managers in Kenya include; Acorn Investment Management, Stanlib Kenya Limited, Nabo Capital, ICEA Lion Asset Managers Limited, Fusion Investment Management Limited, H.F Development and Investment Limited, Sterling REIT Asset Management, Britam Asset Managers Limited, and CIC Asset Management Limited,

- The Trustee: A trustee is a corporation or company appointed under a trust deed and licensed by the CMA to hold Real Estate assets on behalf of REIT investors. The trustee plays a vital role in assessing the feasibility of investment proposals from the REIT Manager and ensuring that scheme assets are invested in line with the Trust Deed. Notable REIT trustees in Kenya include Kenya Commercial Bank (KCB), Co-operative Bank (Coop), and Housing Finance Bank, and,

- The Project/Property Manager: The project manager oversees the planning and execution of construction projects within REITs. On the other hand, the property manager's role involves the management of completed Real Estate developments acquired by REITs, with a primary focus on generating profits. Their responsibilities span both the development and operational phases of Real Estate assets within REITs.

The collaboration among these four entities within the REIT structure ensures the comprehensive management, oversight, and strategic growth of REITs, contributing to their operation as investment vehicles. The figure below illustrates the relationship between the key entities in a typical REITs structure

Source: Capital Markets Authority (CMA)

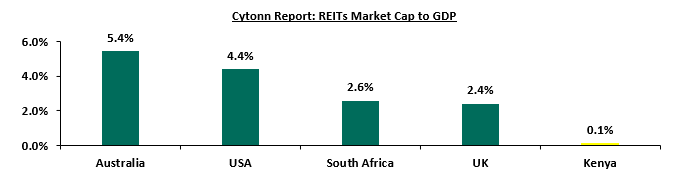

Notably, Kenya become the third African nation to launch REITs regulations and adopt a regulatory framework promoting REITs as an investment vehicle, following in the footsteps of Ghana and Nigeria, who had initiated their REIT frameworks in 1994 and 2007 respectively. Subsequently, South Africa became the fourth African country to launch REITs in 2013 after Kenya. However, despite Kenya being a relatively earlier entrant into the REIT market, its subsequent trajectory has been overshadowed by an underwhelming performance in comparison to countries such as South Africa. This is underscored by the fact that, Kenya currently only has four authorized REITs in Kenya as opposed to South Africa which boast of 33 listed REITs. Additionally, the Kenyan REITs market capitalization to Gross Domestic Product (GDP) remains low, in comparison to other countries. The dismal performance is attributable to factors such as; i) inadequate investor knowledge of the investment instrument, ii) lengthy approval procedures for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, among others which continue to limit the performance of REITs in Kenya. The graph below compares Kenya’s REIT market capitalization to GDP of other countries;

Source: World Bank, National Association of Listed REITs

Presently, all four authorized REITs in the Kenyan market are structured as closed-ended funds. Among them, ILAM Fahari I-REIT is the only one listed and trading on the Nairobi Securities Exchange (NSE) Main Investment Market, allowing its units to be transferred through the exchange. On the other hand, both Acorn Student Accommodation (ASA) I-REIT and D-REIT are not listed, but are instead traded on the Unquoted Securities Platform (USP); an over-the-counter market segment of the NSE. Additionally, LAPTrust Imara I-REIT is listed on the NSE’s Main Investment Market, under the Restricted Sub-Segment, with open trading of the securities restricted for a three-year period from March 2023. The table below highlights the REITs authorized by the CMA in Kenya;

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

|

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

October 2015 |

Main Investment Market |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

November 2022 |

Main Investment Market: Restricted Sub-segment |

Restricted |

Source: Nairobi Securities Exchange, Capital Markets Authority

Section II: Themes that Shaped the REIT Sector in H1’2023

In this section, we delve into the pivotal themes that have profoundly influenced the REITs sector to the period H1’2023. Exploring the dynamic landscape, we analyze the impact of regulations, acquisitions, and capital raising activities on the trajectory of the REIT industry as we gain insights into the broader factors impacting the performance and direction of the REIT sector during this period.

- Regulations

REITs are officially established in accordance with the REIT Regulations and granted approval by the Capital Markets Authority (CMA) under Capital Markets Real Estate Investment Trusts Collective Investment Schemes) Regulations, 2013. Instead of adopting the form of companies, they are structured as trusts. The management of investment properties falls under the responsibility of a corporate REIT manager, duly licensed by the CMA. Units of listed REITs are traded on the Nairobi Securities Exchange (NSE), similar to shares of any other company under Main Market Segment and Unquoted Security Platform (USP), offering investors a liquid stake in Real Estate. Both individual and corporate investors have the opportunity to participate in a public offer on the NSE, as exemplified under the Regulations (2013).

Furthermore, the regulations stipulate that Kenyan REITs are mandated to distribute a minimum of 80.0% of distributable earnings to their unitholders. REITs automatically qualify for several tax exemptions such as the Income Tax Act (ITA), Value Added Tax (VAT), and Capital Gains Tax (CGT) under the authorization of Kenya Revenue Authority (KRA). Some of the recent regulatory transformations in the REITs industry include;

- Exemption from Income Tax Act

The Income Tax Act's Section 20 (1) (c) and (d) state that REITs and companies that REITs invest in do not have to pay the regular 30.0% Income Tax Rate (ITR) upon being registered with the Commissioner of Kenya Revenue Authority (KRA). Furthermore, any income that REITs distribute to their investors (unitholders) are not taxed.

However, this tax exemption does not cover the withholding tax imposed on interest income and dividends received by unitholders who are not exempted according to the first schedule of the ITA. The rates for this withholding tax are outlined in paragraph 5 of the third schedule of the Income Tax Act.

- Capital Gains Tax (CGT) exemptions

A capital gain occurs when the value at which a unit is transferred exceeds the adjusted cost of that unit. The difference between these values is subject to a tax rate of 15.0%. Therefore, any profit gained by a promoter or investors of a REIT from transferring property into the REIT is now subject to CGT at the revised rate of 15.0%, replacing the previous rate of 5.0% starting from 1 January 2023. Moreover, individuals who hold units in a REIT and decide to sell their ownership stake are also obligated to pay CGT. This requirement emerged due to an amendment to Section 34(1)(j) of the Income Act via the Finance Act 2022.

However, within the REIT industry, there are certain scenarios that qualify for exemptions from CGT:

- Transfers of property from life insurance companies to a REIT are exempt from CGT, as outlined in Section 19 (6B) of the Income Tax Act (ITA),

- Indirect transfer of property into a REIT when the promoter first transfers properties to a Special Purpose Vehicle (SPV). Subsequently, the shares of the investee company held by the SPV are transferred to the REIT. This is considered a restructuring, as the property transfer does not involve a third party. This exemption is based on Paragraph 13 of the Eighth Schedule to the ITA. However, CGT is applicable on gains made during the transfer of shares from the investee company to the REIT Trustee,

- Payments received by unit holders or shareholders in a REIT for unit redemption or share sale are exempt from CGT in accordance with section 20 (2) of the ITA,

- Gains realized by the REIT from the sale of properties, whether directly or through an SPV, are also exempt from CGT.

- Exemption from Value Added Tax (VAT)

The Finance Act 2021 reintroduced a significant change regarding the exemption from Value Added Tax (VAT) for transactions involving the transfer of assets to REITs and asset-backed securities. This exemption had previously been removed by the Tax Laws Amendment Act No. 2 of 2020.

According to Paragraph 33 of Part II of the First Schedule to the VAT Act 2021, a direct transfer of property from the REIT promoter or investors is not subject to VAT. However, if the transfer of assets to the REIT is done indirectly, through the initial transfer of assets to the investee company, VAT will be applicable. Importantly, the transfer of shares from a REITs SPV to the REIT trustee will be exempt from VAT, even if the initial asset transfer involved VAT.

- Adjustment in Stamp Duty

As per the regulations set out in section 96A of the Stamp Duty Act, when the properties within a Development REIT (D-REIT) are completed and start to generate stable income, any later transfer of these stabilized properties from the D-REIT to the Income REIT (I-REIT) is not subject to stamp duty. However, it is important to highlight that this exemption was only applicable to transactions completed before 31 December 2022. Consequently, starting from 1 January, 2023, any transfers occurring is subject to stamp duty in accordance with section 96A subsection 4 of the act.

Generally, the intricate nature of these regulations within the REITs and the convoluted rules applicable to REITs are proving to be challenging for individuals to navigate and comprehend fully. As a result, potential investors and stakeholders may feel unsure about the tax implications of their actions within the REIT framework. This uncertainty can lead individuals may become skeptical about the fairness and reliability of the investment environment, hindering them from capitalizing on potentially lucrative opportunities.

Furthermore, the lack of sufficient information available to the public about these REIT regulations exacerbates the problem. When individuals are not adequately informed about the tax consequences of their investment decisions, they may avoid making investments altogether or may not make informed choices, which could impact their financial gains.

Moving forward, we expect both the government and stakeholders in REITs sector will address these regulatory concerns and foster improved transparency and trust within the REIT sector such as; i) increasingly prioritise on making information accessible and easy to understand for the broader public to gain a clearer insight into the potential impact of their investment choices, ii) initiating educational campaigns and resources dedicated to informing investors about these regulations and any adjustments in law, iii) collaboration between regulatory authorities and industry stakeholders is imperative to elevate public awareness about the advantages and potential drawbacks linked with REIT investment, iv) offering unambiguous and easily understandable documentation outlining the tax implications tied to various investment scenarios is pivotal, and, v) establishing consultation services investors to access expert advice concerning tax-related aspects of REIT investments can alleviate reservations and uncertainties.

- Acquisitions

Acquisitions play a pivotal role in the dynamic landscape of the Kenyan REITs industry. These strategic moves signify the industry's evolution, adaptability, sustainability, and growth potential. As of June 30, 2023, the industry has witnessed noteworthy acquisitions that are reshaping the sector. These acquisitions hold a promising outlook for the industry, contributing to its progress and value proposition. They exemplify how REITs are actively enhancing their portfolios, expanding their market presence, and optimizing their performance. Some of the notable acquisition as at H1’2023 include;

- LAPTrust Imara I-REIT possess a diversified portfolio of properties which include; i) Pension Towers, Metro Park, and CPF House which are commercial office buildings located in Nairobi CBD, ii) Retail centre Freedom Heights mall located in Lang’ata, iii) Nova Pioneer which is a purpose built education facility located in Eldoret, iv) Freedoms Height residential apartments and serviced plot located in Lang’ata, and, v) Man apartments located in Kilimani,

- ILAM Fahari I-REIT manages and operates several properties under their portfolio which include: i) a mixed used development (MUD) Greenspan Mall located in Donholm, Nairobi, ii) 67 Gitanga Place which is a prime office property located in Lavington, and, iii) Bay Holdings and Highway House which are industrial properties located in Industrial Area and Mombasa Road area respectively,

- Acorn Student Accommodation (ASA) I-REIT has five completed student housing properties with 3,003 beds under their management serving up to 128 universities and colleges. These properties include; Qwetu Jogoo Road, Qwetu Ruaraka, Qwetu WilsonView in Lang’ata, Qwetu Parklands, and Qwetu Aberdare Heights I along Thika Road next to United States International University Africa (USIU-A). On the other hand, Acorn D-REIT boasts of four properties which are currently operational and six other properties under development bringing to a total of ten properties with 10,060 beds under its portfolio. Operational properties include; Qwetu Hurlingham, Qwetu Abedare Heights II, Qwetu Karen, Qejani Karen whereas properties under development include; Qwetu Chiromo, Qejani Chiromo, Qejani JKUAT next to Jomo Kenyatta University of Agriculture and Technology, Qejani Hurlingham, Qwetu KU, and Qejani KU next to Kenyatta University,

- During H1’2023 period, the ASA I-REIT and ASA D-REIT entered into a legally bidding agreement for the acquisition of Qwetu Hurlingham, along Arwings Kodhek Road. The property commenced operations in January 2022 and caters to serve tertiary- education students within Hurlingham area and surrounding regions, primarily targeting Daystar University, University of Nairobi (UoN) School of Medicine, Riara University and Strathmore University students. The transaction is scheduled to be finalized in Q3’2023. The acquisition decision by ASA I-REIT was driven by the impressive performance exhibited by the property since its inception, achieving stabilization within just 11 months of operation, and consistently high monthly occupancy rate of over 90.0% since project completion, and,

- Sale proceeds from the acquisition will serve a dual purpose as a significant portion of the funds will be allocated towards repaying of Kshs 860.6 mn which was part of the Acorn Green Bond issued by Acorn Holdings in partnership with PE Fund Helios in October 2019. The planned transfer of both Qwetu Hurlingham will make it the third project acquired by Acorn I-REIT, after successful acquisitions of Qwetu WilsonView in February 2021, and Qwetu Aberdare Heights I in October 2022. Additionally, the I-REIT is on another roadmap for a planned acquisition of Qwetu Aberdare Heights II with bed capacity of 601 in Ruaraka.

Moving forward, we expect the trend of strategic acquisitions to persist, with REITs actively seeking opportunities to broaden and diversify their portfolios, cater to evolving market demands and also set standards in promoting environmental sustainability such as execution of green bonds by Acorn holding. These acquisitions can also act as catalysts for innovation, driving the industry to explore new concepts, designs, and services to meet the expectations of both investors and tenants.

- Capital Raising

Capital raising is a crucial aspect of the REITs industry, driving growth, development, and innovation. The ability to secure funds from various sources either through debt or equity empowers REITs to expand their portfolios, enhance existing properties, and tap into new investment opportunities. This practice not only benefits the REITs themselves but also plays a significant role in shaping the Real Estate landscape and offering attractive investment avenues to stakeholders. Some of the notable capital infusion in the REITs industry as of H1’2023 include;

- Through injection of Kshs 4.3 bn equity raised from investors and Kshs 6.7 bn debt secured from Absa Bank Kenya PLC in February 2023, ASA D-REIT is currently developing student accommodation properties across Kiambu and Nairobi countries at a total cost of Kshs 11.0 bn for the next three years. Some of the projects under construction include; i) Qwetu Chiromo and Qejani Chiromo projects on Riverside drive at a cost of Kshs 833.0 mn and Kshs 852.2 mn respectively set to be opened in H1’2023, with a total bed capacity of 2,695, ii) Qejani JKUAT at a cost of Kshs 639.6 mn, iii) Qejani Hurlingham at a cost of Kshs 772.2 mn to supplement supply on Qwetu Hurlingham phase one offering, with a total bed capacity of 1,280, and, iv) Qwetu KU and Qejani KU at a cost of Kshs 717.6 mn and Kshs 815.8 mn respectively, expected to deliver 2,186 beds to the D-REIT portfolio,

- In March 2023, Kenya's long-standing pension scheme, the Local Authorities Pension Trust (LapTrust) listed the inaugural Income-Real Estate Investment Trust (I-REIT) by a pension fund on the NSE, a ceremony presided over by President William Ruto. The I-REIT dubbed 'LAPTrust Imara I-REIT', holds profound importance for government pension schemes and the broader Kenyan capital markets, presenting investors with an exceptional chance to participate in a diversified collection of income-generating Real Estate assets. Furthermore, this move is expected to encourage other pension funds, particularly those heavily invested in physical assets, to unlock liquidity for the betterment of pensioners. For more information, see our Cytonn Monthly-October 2022,

- During the same period, CMA collaborated with key market stakeholders, including the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK), and the Nairobi Securities Exchange (NSE), to establish the Kenya National REIT (KNR). With a focus on affordable housing and infrastructure, this initiative falls under the purview of the Sanduku Investment Initiative. For more information, see our Cytonn weekly #06/2023, and,

- Additionally during this period, ILAM Fahari I-REIT proposed the sale of two properties valued at Kshs 200.4 mn, as part of its strategy to divest non-core assets and reorganize its operations. The properties earmarked for sale include Highway House, a three-story industrial building situated off Mombasa Road in Nairobi, currently vacant following the departure of the former tenant, and Bay Holdings, fully leased to Imperial Bank, Packard Limited, and Architecture Supply Limited, located in Nairobi's Industrial Area. The sale process is anticipated to conclude by December 2023. Fahari initially acquired these properties in 2016 for a total of Kshs 324.8 mn, resulting in a 33.8% loss on the disposals before accounting for the rental income accumulated over the years.These planned asset sales will leave the I-Reit with only two remaining properties: the Greenspan Mall, a retail center in Donholm, and the commercial office building 67 Gitanga Place in Lavington. This adjustment will lower the fund's investment property value from Kshs 3.2 bn to Kshs 2.9 bn while significantly augmenting its cash holdings. In terms of new acquisitions, Fahari has yet to initiate property purchases but is actively considering the development of a portion of the vacant land at Greenspan Mall.

Looking ahead, the trend of capital raising is set to continue shaping the trajectory of the Kenyan REITs industry. The injection of equity and debt, as well as strategic partnerships among private investors and government interaction, will remain vital drivers of expansion and unlocking new avenues such as affordable housing and infrastructure development projects, aligning with market demands and government priorities. As the industry advances, collaborations, regulatory support, and investor education will play pivotal roles in ensuring that capital raising continues to yield positive outcomes and drive the Kenyan REITs industry toward a vibrant and sustainable future.

Section III: Summary Performance of the REITs in H1’2023

The tables below highlight the performance of the Kenyan REITs sector, showing the performance using several National Association of Real Estate Investments Trusts (NAREIT) approved metrics, and the key take-outs;

(All values in Kshs mns unless stated otherwise)

|

Cytonn Report: Summary Performance Kenya REITs in H1’2023 |

||||||||||||||

|

|

Laptrust Imara I-REIT |

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

H1’2022 Total |

H1’2023 Total |

y/y |

|||||||

|

H1'2023 |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

|

change |

|||

|

Operating Metrics |

||||||||||||||

|

Net Operating Income (NOI) |

99.6 |

86.2 |

86.0 |

(0.2%) |

139.4 |

128.0 |

(8.2%) |

233.3 |

334.2 |

43.2% |

458.9 |

647.9 |

41.2% |

|

|

Profitability Metrics |

||||||||||||||

|

Funds from Operations |

99.6 |

86.2 |

86.0 |

(0.2%) |

188.8 |

149.8 |

(20.7%) |

233.3 |

334.2 |

43.2% |

508.3 |

669.7 |

31.7% |

|

|

Adjusted FFO |

99.6 |

82.8 |

84.4 |

2.0% |

188.8 |

149.8 |

(20.7%) |

233.3 |

334.2 |

43.2% |

505.0 |

668.1 |

32.3% |

|

|

Cash Available for Distribution (CAD) |

99.6 |

86.2 |

86.0 |

(0.2%) |

144.1 |

92.8 |

(35.6%) |

- |

- |

- |

230.3 |

278.5 |

20.9% |

|

|

Cash Amounts Distributed |

0.0 |

0.0 |

0.0 |

|

64.0 |

87.0 |

35.9% |

- |

- |

- |

64.0 |

87.0 |

35.9% |

|

|

Valuation Metrics |

||||||||||||||

|

Net Asset Values (NAV) |

7,024.3 |

3,538.9 |

3,392.8 |

(4.1%) |

4,720.4 |

6,342.1 |

34.4% |

5,575.6 |

6,547.7 |

17.4% |

13,834.8 |

23,306.6 |

68.5% |

|

Source: Cytonn Research

Key takeaways from the table include:

- Combined Net Operating Incomes (NOI) of Kenyan REITs recorded a 41.2% growth to Kshs 647.9 mn in H1’2023, from Kshs 458.9 mn in H1’2022. The performance during the period was mainly supported by a 43.2% growth in the reported net operating income of Acorn D-REIT, to come in at Kshs 334.2 mn from Kshs 233.3 mn realized in H1’2022 respectively. In addition, LAPTrust Imara I-REIT reported a significant NOI at Kshs 99.6 mn, which further contributed to the positive performance,

- Combined Funds from Operations (FFO) of Kenyan REITs increased by 31.7% in H1’2023 to Kshs 669.7 mn from Kshs 508.3 mn in H1’2022, whereas Adjusted FFOs for Kenyan REITs also increased by 32.3% to Kshs 668.1 mn in H1’2023 from Kshs 505.0 mn in H1’2022. This was on the back of significant increases in the reported NOIs during the period. The performance was however weighed down by an 8.2% decrease in the NOI of Acorn I-REIT to Kshs 128.0 mn from Kshs 139.4 mn in H1’2022, which consequently led to a 20.7% decrease in the I-REIT’s FFOs and Adjusted FFOs to Kshs 149.8 mn from Kshs 188.8 mn in H1’2022 respectively,

- The REITs combined Cash amounts available for paying dividends to REIT investors which we measured using the Cash Available for Distribution (CAD) metric increased by 20.9% in H1’2023 to Kshs 278.5 mn from Kshs 230.3 mn in H1’2022. The performance was propelled by Laptrust Imara I-REIT’s distributable earnings which stood at Kshs 99.6 mn, despite a notable decline in Acorn I-REITs distributable earnings. Acorn I-REIT’s distributable earnings declined by 35.6% to Kshs 92.8 mn from Kshs 144.1 mn in H1’2022,

- Notably, only Acorn I-REIT’s REIT manager recommended an interim dividend of Kshs 0.30 per unit, with the total cash distributed in H1’2023 amounting to Kshs 87.0 mn. Conversely, ILAM Fahari I-REIT, LAPTrust Imara I-REIT, and Acorn D-REIT REITs managers did not recommend interim dividends for the period H1’2023, and,

- Combined Net Asset Values for Kenyan REITs increased by 68.5% to reach an all time high of Kshs 23,306.6 mn in H1’2023, from Kshs 13,834.8 mn in H1’2022. This was attributable to 34.4% and 17.4% growths in the net asset values of Acorn I-REIT and Acorn D-REIT’s to Kshs 6,342 and Kshs 6,547.7 mn in H1’2023 from Kshs 4,720.4 and Kshs 5,575.6 mn in H1’2022 respectively.

The table below makes a comparison of the leverage and liquidity ratios of all four Kenyan REITs during H1’2023 and H1’2022;

|

Cytonn Report: Leverage & Liquidity ratios of Kenyan REITs |

||||||||||||

|

|

LAPTrust Imara I-REIT |

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

H1’2022 Weighted Average* |

H1’2023 Weighted Average** |

||||||

|

H1'2023 |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

|

||

|

Leverage Ratios |

||||||||||||

|

Debt to Equity |

0.0x |

0.0x |

0.0x |

0.0x |

0.0x |

0.0x |

0.0x |

0.6x |

0.6x |

1.0x |

0.3x |

0.2x |

|

Debt to Total Market Cap |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

59.3% |

64.0% |

4.7% |

29.2% |

19.3% |

|

Debt to Gross Book Value |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

34.1% |

35.1% |

1.0% |

16.8% |

10.6% |

|

Debt to EBITDA Multiple |

0.0x |

0.0x |

0.0x |

0.0% |

0.0x |

0.0x |

0.0% |

14.2x |

11.8x |

(16.6%) |

7.0x |

3.6x |

|

|

||||||||||||

|

Debt Service Coverage |

0.0 |

0.0 |

0.0 |

0.0% |

0.0 |

0.0 |

0.0% |

6.8% |

8.1% |

1.3% |

3.3% |

2.5% |

|

Implied Cap Rate |

1.4% |

9.6% |

12.3% |

2.6% |

3.1% |

2.0% |

(1.2%) |

2.5% |

3.2% |

0.8% |

3.4% |

2.7% |

|

*Market cap weighted as at 30/06/2022 |

||||||||||||

|

**Market cap weighted as at 30/06/2023 |

||||||||||||

Source: Cytonn Research

Key takeaways from the table include;

- Majority of the REITs remained ungeared during H1’2023, with their leverage ratios remaining at zero except Acorn D-REIT. Acorn D-REIT debt ratios increased in H1’2023 on account of a 19.5% growth in its long-term borrowings to Kshs 3.9 bn from Kshs 3.3 bn in H1’2022,

- Notably, Acorn D-REIT’s Debt to EBITDA Multiple reduced to 11.8x in H1’2023, from 14.2x recorded in H1’2022. This was on the back of a faster growth in the REIT’s EBITDA compared to its long-term borrowings. Acorn D-REIT EBITDA in H1’2023 increased by 42.3% to Kshs 334.2 mn from Kshs 233.3 mn in H1’2022, compared to a 19.5% growth in the REIT’s long-term debt, and,

- ILAM Fahari I-REIT traded at the highest implied capitalization rate of 12.3%, indicating that it offers a higher return on investment compared to all other REITs. Contrarily, LAPTrust Imara I-REIT had the lowest implied capitalization rate of 1.4%. However, despite the performance, we expect that the LAPTrust Imara I-REIT performance will improve gradually, considering that the REIT is still in its initial year of operation.

The table below presents a summary of key valuation metrics of Kenyan REITs in H1’2023;

|

Cytonn Report: Valuation Metrics for Kenyan REITs |

||||||||||

|

|

LAPTrust Imara I-REIT |

ILAM Fahari I-REIT |

Acorn I-REIT |

Acorn D-REIT |

||||||

|

H1'2023 |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

H1'2022 |

H1'2023 |

y/y Change |

|

|

Price/FFO per share multiple |

69.5x |

12.6x |

12.7x |

3.0% |

24.7x |

41.6x |

68.8% |

23.9x |

18.5x |

(22.7%) |

|

Dividend Yield |

- |

0.0% |

0.0% |

0.0% |

1.4% |

1.4% |

0.1% |

- |

- |

- |

|

Dividend Coverage/Payout Ratio |

0.0 |

0.0% |

0.0% |

0.0% |

44.4% |

93.7% |

49.3% |

- |

- |

- |

|

NAV per share |

20.3 |

19.6 |

18.7 |

(4.1%) |

21.2 |

22.0 |

3.7% |

23.9 |

25.3 |

6.0 |

Source: Cytonn Research

- LAPTrust Imara I-REIT units are trading at a premium relative to its peers, with a price to FFO per share multiple of 69.5. Comparatively, ILAM Fahari I-REIT units are trading at a discount with a price to FFO per share multiple of Kshs 12.7,

- Acorn I-REIT dividend yield currently stands at 1.4%. ILAM Fahari I-REIT, LAPTrust Imara I-REIT and Acorn D-REIT did not pay any dividends during the period. Distinctly, Imara LAPTrust Imara I-REIT has not issued any dividend distributions since it began its operation earlier this year, and Acorn D-REIT is yet to issue dividends since it began its operations in 2021. The initial strategic priority for Acorn D-REIT was centered around property development and exit upon successful stabilization. Due to this, it was envisioned that the initiation of dividend distributions for the D-REIT commence after the completion of its third year of operations,

- Imara LAPTrust Imara I-REIT, ILAM Fahari and Acorn D-REIT REIT did not pay out dividends during H1’2023 This was on account of REIT managers not recommending interim dividend distributions for LAPTrust Imara I-REIT and ILAM Fahari respectively, and Acorn D-REIT’s three-year grace period in relation to paying out dividends. Conversely, Acorn I-REIT dividend payout came in at 93.7%, in line with REITs regulation in Kenya which require that REITs distribute at least 80.0% of their net profits after tax as dividends, and,

- Acorn D-REIT recorded the highest NAV per share at Kshs 25.3, and, ILAM Fahari had the lowest NAV per share at Kshs 18.7. Notably, all REITs share prices are in line with their NAV per shares, with the exception of ILAM Fahari I-REITs shares that are trading at a discount its NAV per share.

Section IV: Conclusions, Recommendations, and Outlook for the REITs Sector

The performance of the REITs market in Kenya has been marked by a moderate trajectory, influenced by a range of contributing factors. Noteworthy, despite the overall challenges, there are positive indicators within the Kenyan REIT landscape. Notably, net operating incomes have displayed growth, reflecting improved financial performances. Additionally, leverage ratios for most REITs remained strikingly low, as majority of the REITs remain ungeared with most leaning towards short-term debt to sustain their operations. We anticipate that this trend will continue to persist going forward, in line with REITs fear of overexposure to interest rates, particularly in the current rising interest rates environment. In support of this, we expect to see more developments along financial sustainability commitment as demonstrated by key sector players such as Acorn Holdings, through the issuance of its green bond. Additionally, we anticipate that the recent regulatory proposition by the Capital Markets Authority (CMA) to reduce minimum investment amounts for professional investors to Kshs 10,000 will invigorate interest in the sector, potentially attracting a broader investor base.

Based on our research and analysis, we make the following recommendations to enhance the REITs sector through a more informed and strategic approach:

- Enhancing Stakeholder Education: All key stakeholders need to be educated on the REIT structure. within governmental bodies. For instance, there have been reported challenges pertaining to the challenge of acquiring a KRA PIN due to an agency's unfamiliarity with the intricacies of the REIT structure. As such, addressing this informational gap is crucial to streamline administrative processes,

- Expanding Legal Framework: In South Africa, REITs legal and operational framework allow for different legal entities to establish REITs as opposed to Kenya where the same is limited to trusts only. In light of this, it is prudent to introduce flexibility in the legal entities permissible for REIT establishment. While Kenya currently allows only trust-based formations, broadening the scope to encompass companies, partnerships, and trusts would promote diversity and cater to different organizational preferences,

- Introduce Hybrid REIT Vehicles: Currently, investors have to subscribe to both of the separate REIT classes, forcing them to pay duplicate costs, due to the nature of exclusivity of the two. A hybrid REIT would provide investors integrated returns, by combining the higher return from development while reducing risk exposure through the relatively stable income component of the I-REIT. In addition, an IPO with such a hybrid REIT vehicle would eliminate the duplicated costs of running two separate REITs, thereby improving subscriptions by investors. Introducing a hybrid REIT within a unified structure would thus enable investors to capitalize on the strengths of both investment types, potentially leading to more balanced risk-reward profiles,

- Gradual Public Listing Requirement: Recognizing the concerns of companies regarding an immediate transition to public listing, we advocate for a gradual, phased approach. Allowing REITs an initial period of private operation before enforcing mandatory public listing will serve to facilitate a smoother transition and conforms to the comfort thresholds of corporate entities,

- Inclusive Corporate Trusteeship: A pivotal change involves the incorporation of Corporate Trustees, akin to the practices in the pension market. Furthermore, we recommend the reduction of the minimum capital requirement which currently stands at Kshs 100.0 mn, as this financial threshold currently confines trusteeship options to banking institutions exclusively,

- Introduce Tokenization of REITs: Introducing the concept of tokenization for REITs presents an innovative solution and has the potential to amplify market participation. This would facilitate the ownership of REIT units in smaller denominations, even as low as Kshs 100.0, and,

- Diminishing Entry Barriers: Reconsideration of the steep Kshs 5.0 mn minimum for D-REITs is vital to eliminate entry barriers that inadvertently limit individual market entry. A revised minimum could promote a more inclusive investment landscape.

In conclusion, the potential of REITs remains promising despite the challenges faced by the Kenyan market. Serving as a means to amplify liquidity and diversify financing within the Real Estate sector, REITs provide an alternate avenue for development funding, while offering the potential to generate returns for investors. While Kenya's REIT journey has been marked by hurdles, the proposed changes in investment thresholds and the demonstrated resilience within the financial metrics of certain REITs suggest a potential resurgence in the sector.

For the full Cytonn Kenya’s REITs H1’2023 Report, click here

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor