Jul 20, 2025

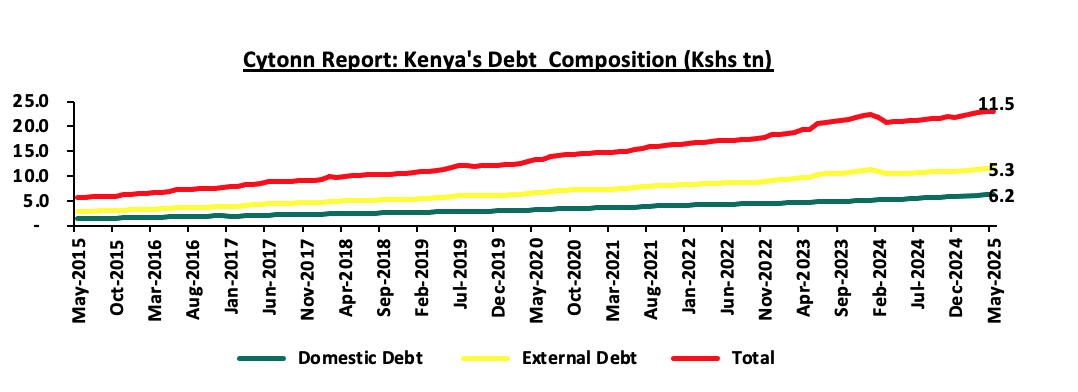

Kenya is one of the fastest growing economies in Sub-Saharan Africa, having registered a growth rate of 4.9% in the first quarter of 2025. Despite being one of the fastest growing economies in Sub-Saharan Africa with a projected economic growth rate of 4.8%, above the region’s expected average of 3.7% in 2025, Kenya is grappling with a high debt burden, facing elevated risk of debt distress and significant challenges in managing its public debt, which has increased rapidly in recent years. As per the latest data from the Central Bank of Kenya (CBK), the total public debt stood at Kshs 11.5 tn as of May 2025, compared to Kshs 10.4 tn recorded in May 2024, equivalent to an 10.3% increase. Notably, external debt increased marginally by 3.9% during the period to Kshs 5.3 tn in May 2025 from the Kshs 5.1 tn in May 2024, partly attributable to the partial buyback of the USD 900.0 mn Eurobond in February 2025 through the issuance of a new USD 1.5 bn Eurobond. Similarly, domestic debt increased by 16.6% to Kshs 6.2 tn in May 2025, from Kshs 5.3 tn in May 2024, attributable to the increased inclination towards domestic financing amid lower interest rates and constrained access to external financing. Consequently, the debt to GDP ratio stood at 67.4% as of December 2024, 17.4% points higher than the International Monetary Fund (IMF) threshold of 50.0% for developing countries, albeit lower than the 73.4% recorded as of December 2023. The rising public debt has raised concerns about its sustainability and implications for fiscal and macroeconomic stability. Kenya’s debt levels remain high with high debt servicing costs as evidenced by the B-, Caa1 and B- credit ratings by S&P Global, Moody’s and Fitch credit agencies respectively, signaling high credit risk but with ability to still meet its financial commitments. However, recent policy actions have begun to positively shift the credit trajectory. Notably, on 29th January 2025, Moody’s affirmed its Caa1 credit rating on Kenya and revised the outlook from negative to positive, indicating that there is potential for Kenya’s credit rating to improve in the future on the back of improved revenue collection and prudent debt repayments. The February 2025 Eurobond buyback and new issue helped smoothen Kenya’s external debt maturity profile and increase investor confidence. Consequently, in this week’s topical, we shall focus on the current status of Kenya’s public debt as of May 2025. We shall also give our outlook on the country’s debt sustainability.

We have been tracking the evolution of the public debt and below are the most recent topicals we have done on Kenya’s debt:

- Review of Kenya’s Public Debt 2024 - In July 2024, we highlighted the status of Kenya’s public debt in the light of the withdrawal of the Finance Bill 2024 and an outlook on the country’s debt sustainability,

- Kenya’s Public Debt Review 2023 – In October 2023, we highlighted Kenya’s public debt situation and the need for prudent fiscal management and strategic planning to ensure that the debt remains sustainable and does not compromise the country’s economic prospects,

- Kenya's Public Debt Review 2023: Is Kenya's Public Debt Level Sustainable- In April 2023, we highlighted the state of affairs concerning the country’s public debt and concluded by discussing strategies that the government could implement in order to reduce the economic consequences of high debt levels as well as mitigate the high risk of debt distress,

- Kenya’s Public Debt 2022; Debt Service Coverage- In July 2022, In December 2016, we wrote about Kenya’s debt level, questioning its sustainability, and concluded that the government needed to reduce the amount of public debt, giving suggestions as to how this could be achieved, and,

- Kenya’s Public Debt: On a path to Distress?- In October 2021, we highlighted the state of affairs concerning the country’s public debt profile and levels and concluded that Kenya’s risk of debt distress remained elevated.

In this week's topical, we will focus on the current status of Kenya's public debt at the end of May 2025. We will examine the economic consequences of high debt levels and provide our outlook on the country's debt sustainability. Additionally, the report will compare Kenya's public debt situation with that of other Sub-Saharan countries using various indicators such as the debt-to-GDP ratio and the debt service-to-revenue ratio.

This we shall cover as follows;

- The Current State of Kenya’s Public Debt,

- Kenya’s Debt Servicing Cost,

- Economic Impact of Kenya’s High Debt Levels,

- Kenya’s Debt Sustainability Analysis and Projection,

- Comparative Analysis with Regional Peers, and,

- Policy Recommendations and Conclusion.

Section I: The Current State of Kenya’s Public Debt

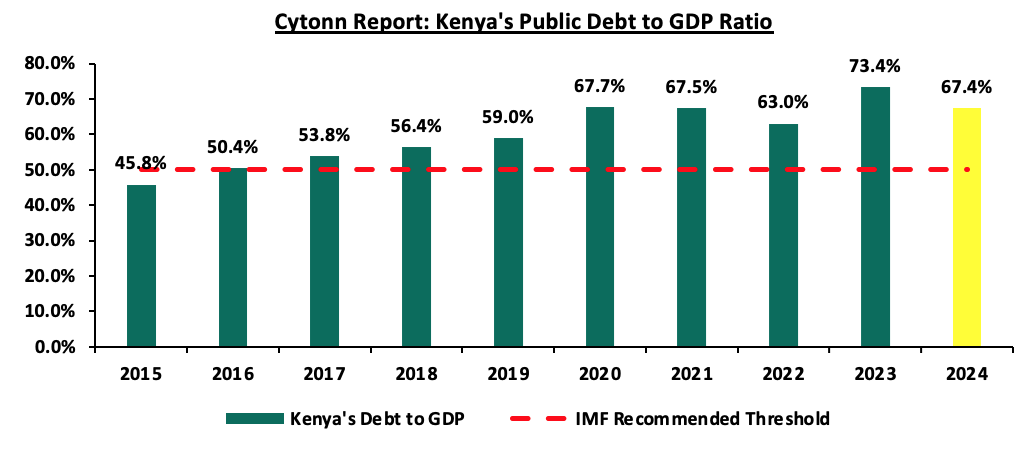

According to the Central Bank of Kenya (CBK) Weekly Bulletin Report, Kenya’s public debt reached Kshs 11.5 tn as of May 2025, marking a 10.3% increase from the Kshs 10.4 tn recorded in May 2024. Amidst the government’s fiscal consolidation efforts, the FY’2025/26 Budget Estimates reflect a faster 8.0% increase in revenue projections to Kshs 3.4 tn (equivalent to 17.5% of GDP), up from Kshs 3.1 tn in FY’2024/25 (equivalent to 17.9% of GDP), compared to a slower 7.1% increase in total expenditure projections to Kshs 4.3 tn (equivalent to 22.3% of GDP), from Kshs 4.0 tn (equivalent to 23.0% of GDP) in the FY’2024/25 Budget. These measures are aimed at stemming the escalation of debt accumulation and maintaining sustainable debt levels. Consequently, the estimated overall fiscal deficit level inclusive of grants reduced by 0.3% points to 4.8% of GDP, from the FY’2024/25 projection of 5.1% of GDP. However, we expect the government efforts to be impeded by the deteriorated macroeconomic environment as evidenced by the decline in Purchasing Manager's Index (PMI) to 48.6 in June 2025, from 49.6 in May 2025 and an average of 50.0 in H1’2025, from 50.5 in H1’2024, signaling a deterioration in the operating conditions across Kenya. This can be attributed to the recent political unrest in the country, in addition to the overall high cost of living. Additionally, the high fuel prices and slower economic growth is expected to stifle revenue collection. Below is a graph highlighting the trend in the Kenya’s debt to GDP ratio over the last 10 years:

Source: National Treasury, CBK

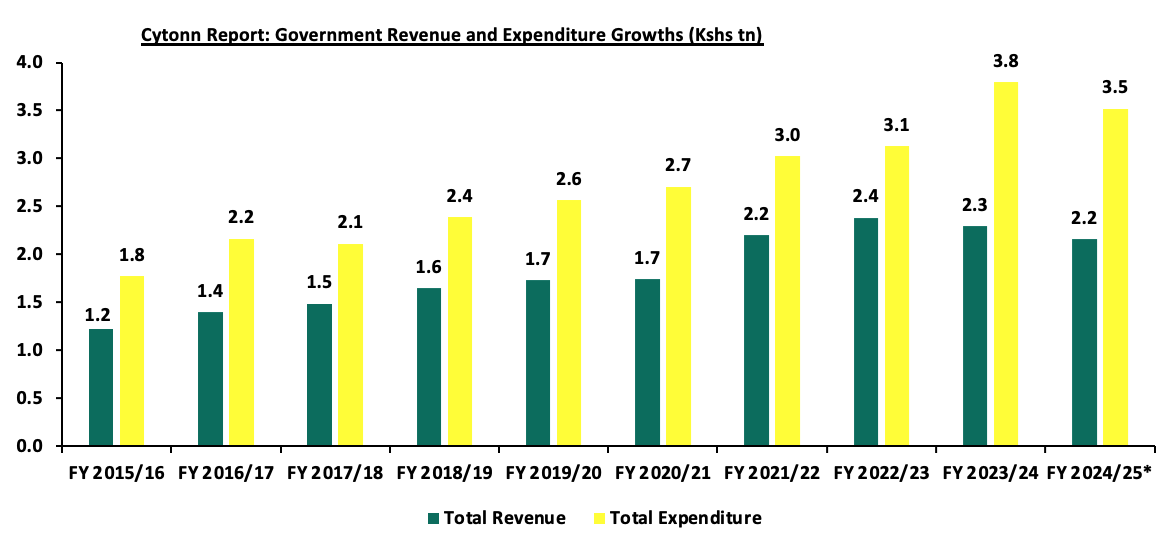

Kenya's debt levels have been rising due to persistent fiscal deficits, which have averaged 7.1% of GDP over the last 10 financial years. This increase is mainly attributed to sustained recurrent expenditures and debt servicing costs. Over this ten-year period, government revenue grew at a compound annual growth rate (CAGR) of 5.9%, reaching Kshs 2.2 tn by the end of the first eleven months of FY’2025/26, up from Kshs 1.2 tn by the end of FY‘2015/16. However, this revenue growth was outpaced by growth in government expenditure, which grew at a CAGR of 7.0%, reaching Kshs 3.5 tn by the end of the first eleven months of FY’2025/26, up from Kshs 1.8 tn in FY’2015/16. The chart below shows the growth in Kenya’s total revenue and expenditure in the last 10 fiscal years:

Source: Central Bank of Kenya, *data as of May 2025

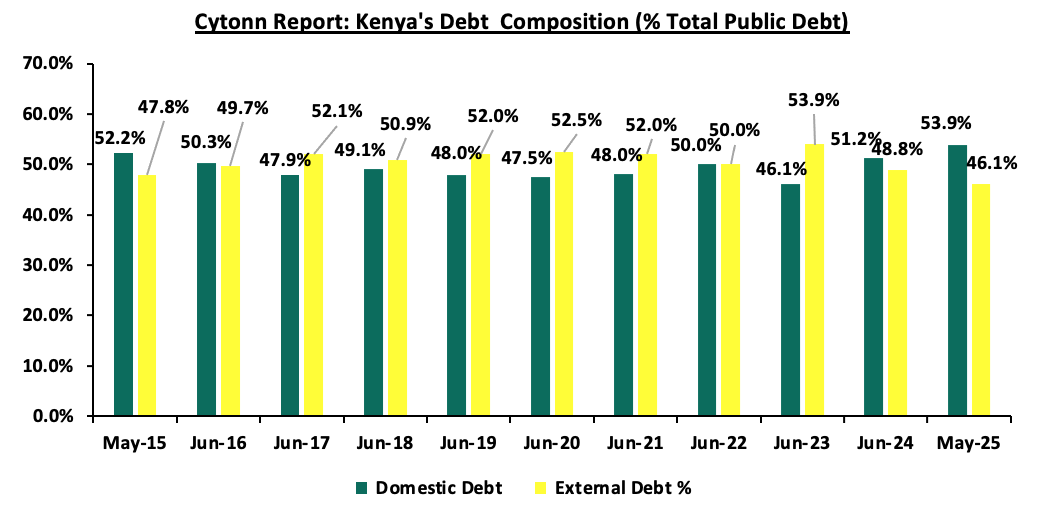

- The Nature of Kenya’s Debt Composition (Domestic vs External)

Over the years, Kenya’s debt composition has been evenly distributed between domestic and external borrowing. However, from the beginning of 2023, there was a shift towards external borrowing, with the proportion of external debt against domestic debt standing at 54.7% to 45.3% in December 2023, compared to 51.1% to 48.9% over a similar period in 2022. This increase was partly attributed to the depreciation of the Kenya Shilling during that period, which increased the valuation of foreign currency-denominated debt. In 2024, the preference shifted towards domestic borrowing, with the proportion of external debt against domestic debt adjusting to 46.3% to 53.7% in December 2024, from 54.7% to 45.3% in December 2023. The shift was supported by currency appreciation in 2024, as evidenced by the 17.6% appreciation in the Shilling against the dollar which reduced the valuation of external debt, and the gradual easing of interest rates in H2’2024, which made domestic borrowing more attractive to the government. As of May 2025, the proportion of external debt against domestic debt stood at 46.1% to 53.9%. Notably, external debt increased at a 10-year CAGR of 12.2% to Kshs 5.3 tn as at May 2025, from Kshs 1.8 tn in May 2016, albeit lower than the 13.5% CAGR recorded by domestic debt to Kshs 6.2 tn as at May 2025 from Kshs 1.7 tn in May 2016. Consequently, the total public debt has increased at a 10-year CAGR of 12.9% to Kshs 11.5 tn as at May 2025, from the Kshs 3.4 tn recorded as at May 2016. Below is a graph highlighting the trend in the external and domestic debt composition over the last 10 years;

Source: National Treasury and Central Bank of Kenya

Below is a graph highlighting the composition of domestic and external debt as a percentage of total public debt over the last 10 years:

Source: National Treasury and Central Bank of Kenya

- Public Debt Mix by Holders

- External Debt Composition by Holders (Bilateral, Multilateral, and Commercial Banks)

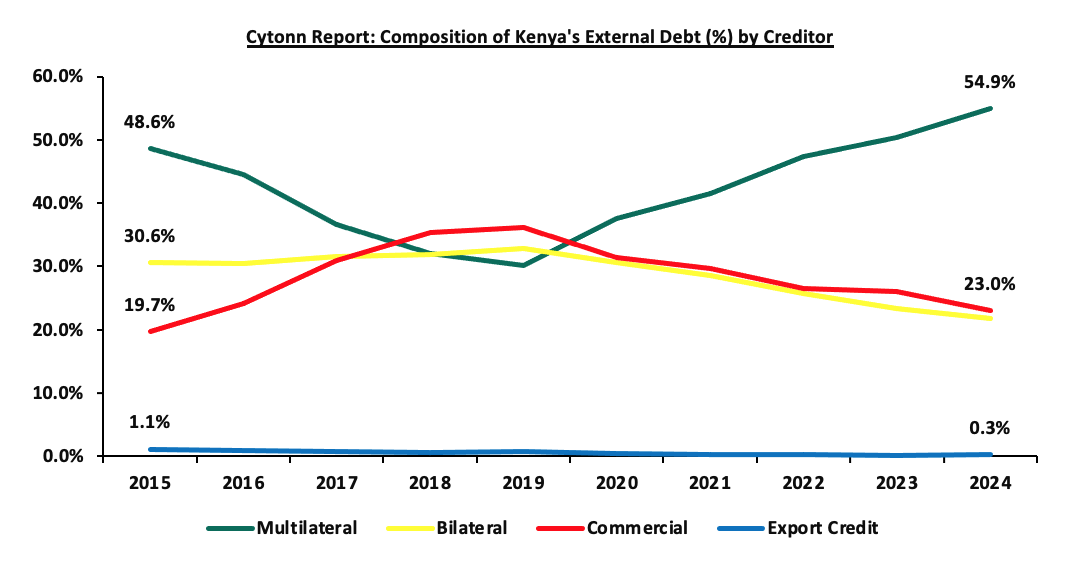

Kenya’s external debt stock is mainly composed of multilateral loans, bilateral loans and commercial loans. According to the CBK Quarterly Economic Review, in the second quarter of FY’2024/2025 ended in December 2024, Kenya’s exposure to multilateral loans recorded a 4.6% points increase to 54.9%, from 50.3% as at the end of December 2023. This was attributable to favourable terms offered in terms of low interest rates and longer repayment periods, when compared to bilateral loans and commercial loans. Notably, during the third quarter of FY’2024/25, Kenya was able to issue a new Eurobond worth USD 1.5 bn, aimed to facilitate the buyback of the USD 900.0 mn Eurobond originally issued in 2019, assuring foreign investors of the country’s broader plan to maintain debt sustainability and manage public debt efficiently. Despite, initial declines following the Eurobond buyback in February, the yields on the Eurobonds have once again shown volatility in recent months, indicating renewed investor concerns over Kenya’s economic stability and debt sustainability. This is attributable to perceived risks associated with Kenya’s economic environment, including fiscal deficits, debt sustainability concerns and the political unrest that continue to put pressure on the economy. The chart below shows external debt composition by creditors:

Source: National Treasury, CBK

It is key to note that:

- The portion of multilateral debt increased by 4.6% points to 54.9% in December 2024, from 50.7% recorded over a similar period in 2023, due to disbursements from IMF, USD 0 mn under the Extended Credit Facility arrangement (EFF/ECF) for budgetary support in October 2024. Notably, Bilateral debt decreased by 1.6% points to 21.8% in December 2024, from 23.4% in December 2023,

- Commercial debt as a percentage of external debt reduced by 3.1% points to 23.0% of total external debt in December 2024 from 26.1% in December 2023, mainly attributable to Kenya’s government shunning away from the more expensive debt due to the prevailing market conditions, and,

- According to the CBK Quarterly Economic Review as at December 2024, 62.0% of the external debt was US Dollar denominated contributing to the increasing debt servicing cost despite the stable and strengthened Kenyan Shilling, largely due to elevated global interest rates. The table below shows the currency composition of the external debt stock:

|

Cytonn Report: Currency composition of the External Debt Stock (%) |

||

|

Currency |

December-2023 |

December-2024 |

|

USD |

67.3% |

62.0% |

|

EUR |

21.4% |

24.8% |

|

Yuan |

5.1% |

5.3% |

|

Yen |

3.8% |

5.2% |

|

GBP |

2.2% |

2.5% |

|

Other Currencies |

0.2% |

0.2% |

Source: Central Bank of Kenya

- Domestic Debt Composition by Holders

Banking institutions make up for the highest percentage of domestic debt, accounting for 45.1% of government securities holdings as at 11th July 2025, largely unchanged from what was recorded at the end of the second quarter of FY’2024/25, with the slight decrease mainly attributed to the lower yields. Similarly, government securities holding by other domestic investors registered 0.3% points decrease to 12.9% as at 11th July 2025, from the 13.2% recorded at the end of December 2024. Notably, pension funds accounted for the second largest portion with 28.8% of holdings in government securities as at 11th July 2025, albeit 0.1% points lower than the 28.9% registered in December 2024. Below is a table of the composition of government domestic debt by holders:

|

Cytonn Report: Composition of Government Domestic Debt by Holder |

|||||||||||||

|

Domestic debt |

Dec-2014 |

Dec-2015 |

Dec-2016 |

Dec-2017 |

Dec-2018 |

Dec-2019 |

Dec-2020 |

Dec-2021 |

Dec-2022 |

Dec-2023 |

Dec-2024 |

Jul-2025 |

|

|

Banking institutions |

54.3% |

55.4% |

52.2% |

54.6% |

54.5% |

54.3% |

53.3% |

50.2% |

46.8% |

46.1% |

45.1% |

45.1% |

|

|

Insurance Companies |

9.9% |

8.4% |

7.3% |

6.4% |

6.1% |

6.4% |

6.4% |

6.8% |

7.4% |

7.2% |

7.3% |

7.2% |

|

|

Parastatals |

2.8% |

4.6% |

5.8% |

6.9% |

7.3% |

6.5% |

5.7% |

5.6% |

6.1% |

5.5% |

5.6% |

5.9% |

|

|

Pension Funds |

23.9% |

25.4% |

28.2% |

27.5% |

27.6% |

28.6% |

30.3% |

31.3% |

33.3% |

29.9% |

28.9% |

28.8% |

|

|

Other domestic investors |

9.0% |

6.2% |

6.5% |

4.6% |

4.6% |

4.2% |

4.3% |

6.1% |

6.4% |

11.3% |

13.2% |

12.9% |

|

|

TOTAL |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

|

Source: Central Bank of Kenya

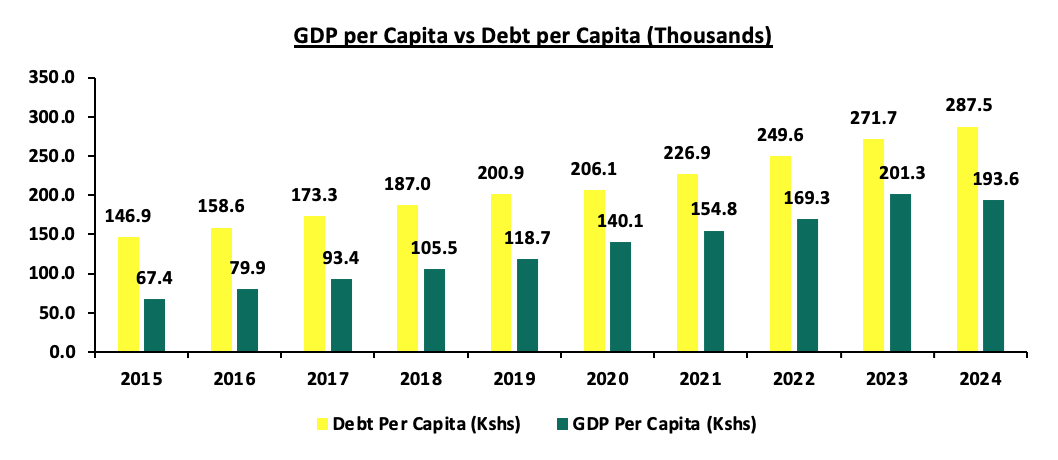

- GDP per Capita vs Debt per Capita

According to Central Bank data, Kenya’s Public Debt per Capita has increased at a 10-year CAGR of 11.1% to Kshs 193,597.9 in 2024, from Kshs 67,356.7 in 2015. Conversely, GDP per Capita has grown at a slower 10-year CAGR of 6.9% to Kshs 287,500.1 in 2024, from Kshs 146,939.1 in 2015. This discrepancy suggests that the rapid increase in public debt is not being matched by corresponding economic growth. The chart below compares Kenya’s GDP per capita to the debt per capita over the last 10 years:

Source: World Bank, CBK

Factors that have accelerated the growth in Kenya’s Public debt;

- Fiscal Deficit – Kenya has witnessed a persistent fiscal deficit averaging at 7.1% of the GDP for the last 10 financial years and is projected to ease to 4.8% of the GDP for FY’2025/26, from the 5.1% estimated for FY’2024/25. According to the Budget Estimates for FY'2025/26 the approved budget for the FY’2025/26 is estimated to be Kshs 4.3 tn against a targeted revenue collection of Kshs 3.4 tn, hence the need to borrow an additional Kshs 0.6 tn domestically and Kshs 0.3 tn externally,

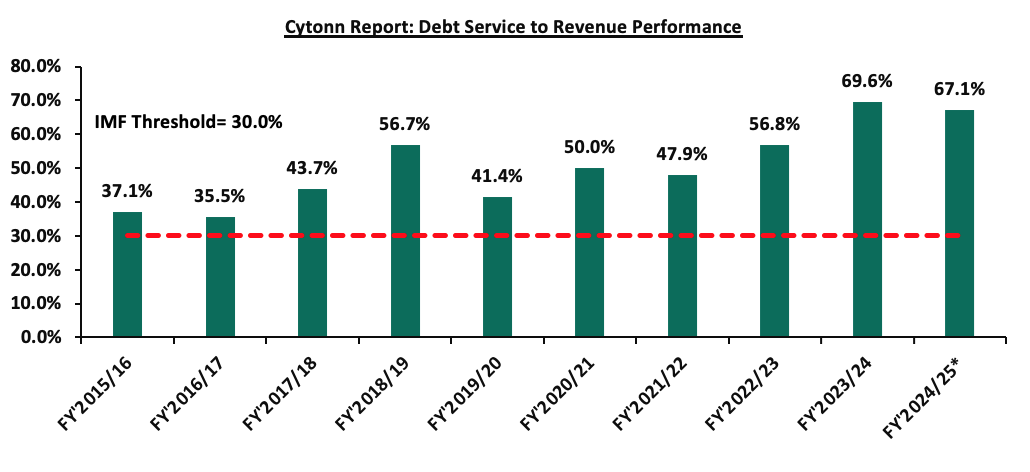

- Debt Servicing Costs – Debt servicing cost has been on the rise, with the debt service to revenue ratio averaging 50.7% over the last 10 financial years and standing at 67.1% as of May 2025. The rising debt servicing cost is attributed to the continuous accumulation of total public debt, resulting from the increased flow of international development assistance in the form of concessional loans, and,

- Guaranteed loans by the Government of Kenya – The guaranteed loans on state corporations put pressure on the need for excessive spending, despite poor performances by the said state corporations.

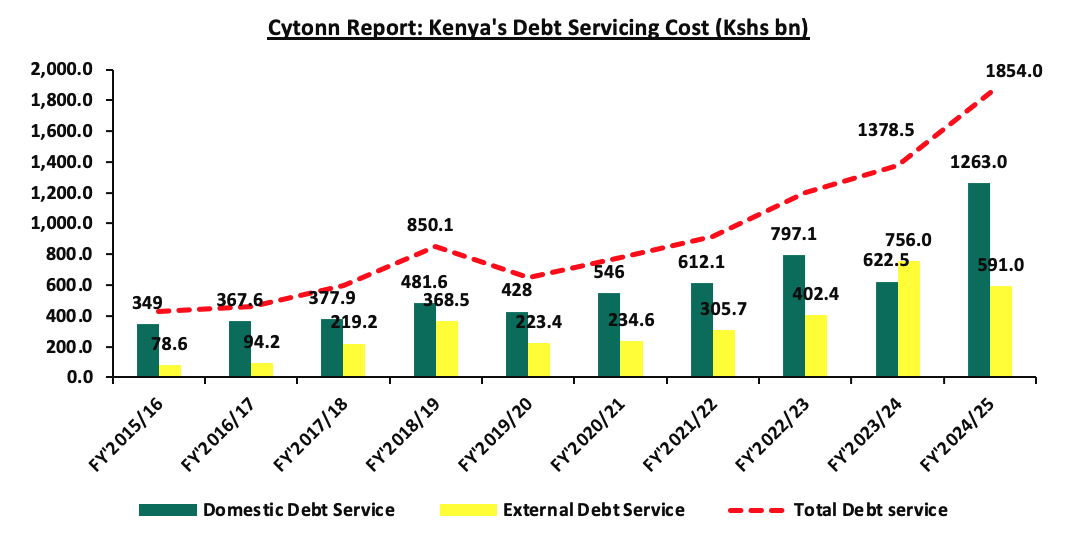

Section II: Kenya’s Debt Servicing Cost

According to the May 2025 Revenue and Net Expenditures Report for the FY’2024/25 by the National Treasury, the cumulative public debt servicing cost amounted to Kshs 1,448.1 bn which was 70.9% of the revised estimates II of Kshs 2,289.0 bn, and 77.4% of the prorated estimates of Kshs 1,871.9 bn. Notably, the Kshs 1,448.1 bn debt servicing cost was equivalent to 67.1% of the actual revenues of Kshs 2,157.8 bn collected as at the end of May 2025 and was 37.1% points above IMF’s recommended threshold of 30.0%. The sustained high debt service to revenue ratio above the recommended threshold is a worrying sign, with a large proportion of the government’s revenue being allocated to servicing debt rather than being available for other essential expenditures. A ratio of above 50.0% means that more than half of the government's revenue is being allocated to servicing debt which may leave limited fiscal space for public investments, social programs, and other critical government functions, which are essential for the long-term well-being of the country, as a significant part of the budget is pre-committed to debt repayment. Below is a chart showing the debt service to revenue ratio for the last ten fiscal years:

Source: National Treasury, FY’2024/25* data as of May 2025

Kenya’s debt servicing costs have continued to increase over time growing at a 10-year CAGR of 15.8% to Kshs 1,854.0 bn in FY’2024/25, from Kshs 427.6 bn in FY’2015/16. The graph below compares the domestic debt servicing cost to the external debt servicing cost over the last ten fiscal years:

Source: National Treasury

Section III: Economic Consequences of High Debt Levels

The COVID-19 pandemic left numerous sub-Saharan African countries grappling with a fragile global economy, escalating prices, costly loans, and a high cost of living. Many of these nations continue to face challenges like high inflation, elevated interest rates, currency fluctuations, and political instability. Consequently, many developing countries, including Kenya, have had to increase borrowing to shield their economies from additional economic shocks caused by internal geopolitical tensions and supply chain disruptions amid emerging global conflicts. However, this ongoing borrowing has led to significant debt accumulation, posing several implications for the Kenyan economy.

- Impact on currency value-High debt levels can lead to a depreciation of the national currency. Investors may lose confidence in the country's ability to manage its debt, leading to capital flight and a weaker currency. A depreciated currency can increase the cost of imports, contributing to inflationary pressures,

- Increased Debt Servicing Costs – High debt levels have led to increased costs of debt servicing given that a significant portion of the debt is in foreign currencies despite the fact that the Kenyan Shilling has been stronger and stable. The government has had to increase taxes and cut spending in other areas to meet its debt obligations and the conditions set by multilateral lenders such as the IMF,

- Higher Borrowing Costs on New Loans – Given the country’s high levels of debt, lenders perceive Kenya’s credit environment to be riskier, therefore demanding higher interest rates for new borrowing. This makes it more expensive for the government to finance its operations and investments,

- Reduced Fiscal Space – High debt levels tend to limit a government’s fiscal space, or its ability to respond to economic shocks with fiscal policy. This is because a large portion of the government’s budget gets tied up in debt servicing, leaving less money for other expenditures and development,

- Crowding Out of the Private Sector – Because of the increased domestic borrowing, the government crowds out the private sector by driving up interest rates in the economy thus making it difficult for both businesses and individuals to borrow, and,

Section IV: Kenya’s Debt sustainability Analysis and Outlook

The country’s risk of debt distress remains elevated as evidenced by the high debt service to revenue ratio of 67.1% as of May 2024. Additionally, Kenya’s debt to GDP ratio currently stood at 67.4% as of December 2024, 17.4% points above IMF’s recommended threshold of 50.0% for developing countries. Notably, Kenya’s public debt recorded a 5-year CAGR of 9.0% to Kshs 11.5 tn as of May 2025, outpacing the economic growth’s 5-year average of 4.7% as of March 2025, with the International Monetary Fund (IMF) projecting Kenya’s 2025 GDP growth to come in at 4.8% as of April 2025, a downward revision from its projection of 5.0% made in October 2024 as a result of impact of US tariffs through direct and indirect trade linkage spillovers. The persistent fiscal deficits resulting from the revenue-expenditure mismatch continue to hamper fiscal consolidation efforts as revenue continues to lag behind expenditure.

Kenya’s debt levels remain high with high debt servicing costs as evidenced by the B-, Caa1 and B- credit ratings by S&P Global, Moody’s and Fitch credit agencies respectively, signaling high credit risk but with ability to still meet its financial commitments. While Kenya still faces elevated credit risk, recent policy actions have begun to positively shift the credit trajectory. The February 2025 Eurobond buyback and new issue helped smoothen Kenya’s external debt maturity profile and increase investor confidence. Notably, on 29th January 2025, Moody’s affirmed its Caa1 credit rating on Kenya and revised the outlook from negative to positive, indicating that there is potential for Kenya’s credit rating to improve in the future. On January 31st 2025, Fitch Rating’s affirmed Kenya’s credit score of B- while maintaining a stable outlook, while S&P Global Ratings affirmed Kenya’s B- credit rating with a stable outlook on 24th February 2025. The positive credit outlook from Moody’s, along with stable ratings from Fitch and S&P, reflecting an improvement. However, maintaining this trajectory will depend on continued fiscal discipline, prudent debt management, and a careful balance between external and domestic borrowing to avoid overexposure to foreign exchange risk. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya Credit Rating Agencies Ratings |

|||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Date Released |

|

Moody's Rating |

Caa1 |

Negative |

Caa1 |

Positive |

29th January, 2025 |

|

Fitch Ratings |

B- |

Stable |

B- |

Stable |

31st January 2025 |

|

S&P Global |

B- |

Stable |

B- |

Stable |

24th February 2025 |

Source: Fitch Ratings, S&P Global

There has been a notable increase in revenue collection, with the government meeting its targets for the recently ended FY’2024/25. Revenue collection amounted to Kshs 2.6 tn, achieving 100.6% of the tax revenue target of Kshs 2.6 tn. However, with the persistent fiscal deficit and tough macro-economic environment in the country, the need for borrowing remains. The table below presents the trend of both expenditure and revenue growth over the l years and projections in the medium term.

|

Cytonn Report: Public Debt (Kshs tn) |

|||||||

|

FY'2019/20 |

FY'2020/21 |

FY'2021/22 |

FY2022/23 |

FY2023/24 |

FY2024/25 |

**FY2025/26 |

|

|

Cumulative Domestic Debt |

3.2 |

3.7 |

4.3 |

4.8 |

5.4 |

6.1 |

6.4 |

|

Cumulative External Debt |

3.4 |

3.8 |

4.3 |

5.4 |

5.2 |

5.2 |

6.0 |

|

Total |

6.5 |

7.5 |

8.6 |

10.3 |

10.6 |

11.4 |

12.4 |

|

Expenditure |

2.6 |

2.8 |

3.0 |

3.2 |

3.6 |

3.5 |

4.3 |

|

Revenue Collected |

1.6 |

1.6 |

1.9 |

2.1 |

2.6 |

2.6 |

3.4 |

|

Budget Deficit |

1.0 |

1.2 |

1.1 |

1.1 |

1.0 |

0.9 |

0.9 |

|

Domestic Borrowings |

0.5 |

0.6 |

0.6 |

0.5 |

0.6 |

0.6 |

0.6 |

|

External Borrowings |

0.3 |

0.3 |

0.1 |

0.3 |

0.3 |

0.3 |

0.3 |

|

Total |

0.8 |

1.0 |

0.7 |

0.8 |

0.9 |

0.9 |

0.9 |

|

Domestic debt service |

0.4 |

0.5 |

0.6 |

0.8 |

0.6 |

1.2 |

1.1 |

|

External debt Service |

0.2 |

0.2 |

0.3 |

0.4 |

0.8 |

0.6 |

0.7 |

|

Total Debt Service |

0.7 |

0.8 |

0.9 |

1.2 |

1.4 |

1.8 |

1.8 |

|

Debt service to Revenue |

41.4% |

50.0% |

47.9% |

56.8% |

69.6% |

62.7% |

64.4% |

Provisional data, **Projected data

Source: National Treasury (Annual Public Debt Management Report and Budget Policy Statement)

Key take outs;

- Debt servicing costs are expected to remain high in the FY’2025/26 due to the need for more borrowings. The high borrowings are expected to be channelled to debt repayment, financing the persistent fiscal deficit. Our View: Debt service is projected to grow in FY’2025/26 with debt servicing costs remaining high due to the continued local and external debt maturities,

- Revenue is expected to grow at a 5-year CAGR of 11.9% to Kshs 3.4 tn by the end of FY’2025/26, from Kshs 1.9 tn in FY’2021/22, attributable to the government’s focus to increased tax revenues. Due to the unfavourable business climate, combined with high cost of living in the country, it is anticipated that revenue collections may fail to meet the target. Consequently, the success of revenue collection is heavily reliant on the country’s economic performance and how quickly the business environment improves,

- Compared to revenue, expenditure is expected to grow at a relatively slower 5-year CAGR of 7.2% to Kshs 4.3 tn by the end of FY’2025/26, from 3.0 tn recorded in FY’2021/22, on the back of increased recurrent expenditure and persistent current account deficit, and,

- The budget deficit is expected to narrow in the projected years as revenue is projected to increase at a faster rate compared to expenditure. The persistent budget deficit in the projected financial years, is an indication of the need for further borrowing, impeding the government’s in managing the current debt level.

It is clear that the government faces challenges on how they shall finance their operations in the next couple of months as the debt servicing is high and the economic activity is much slower. However, the KRA collections for the FY’2024/25 amounted to Kshs 2.6 tn, achieving 100.6% of the tax revenue target of Kshs 2.6 tn, mainly attributed to the reduced inflation averaging at 4.5% in 2024, compared to 7.7% in 2023 coupled with the stable and stronger Shilling which boosted overall economic activity. Additionally, enhanced tax compliance through digital tools like eTIMS helped expand the tax base. Despite improved revenue collection, the government continues to face external repayment pressures amid tight global financial conditions, with 62.0% of external debt denominated in USD as of December 2024, exposing Kenya to significant exchange rate risks. Persistent fiscal deficits and a growing reliance on short-term domestic borrowing further strain the government’s ability to manage debt sustainably, raising concerns about crowding out private sector credit and elevating future refinancing risks. Consequently, the government’s capacity to meet upcoming maturities and fulfill its debt obligations remains a major concern.

Section V: Comparison with other African countries

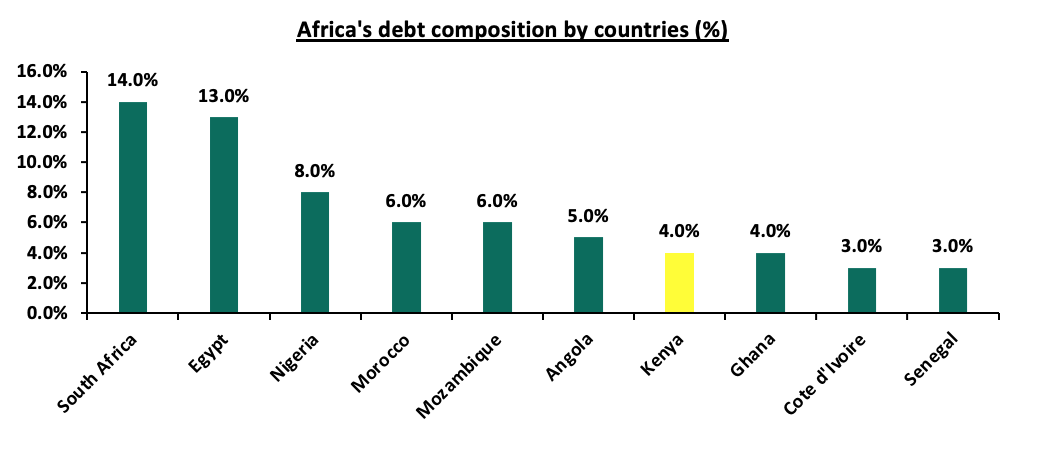

Kenya's elevated debt situation is part of a broader trend seen across the sub-Saharan region, where debt levels remain high. According to World Bank’s International Debt Statistics, Africa's debt-to-GDP ratio reached 71.7% at the end of 2023, with 75.0% of this debt being long-term. Notably, 69.0% of the continent's debt is concentrated in just ten countries. South Africa leads with 14.0% of Africa's total debt, followed closely by Egypt at 13.0%. Kenya accounts for 4.0% of the continent's debt, while Senegal, Cote d’Ivoire, and Ghana each hold between 3.0% and 4.0%. This concentration of debt among a few countries highlights the significant financial pressures faced by these economies within the region. The graph below highlights the composition of the debt by the top 10 countries as a percentage of total region debt:

Source: Afrexim Bank Research

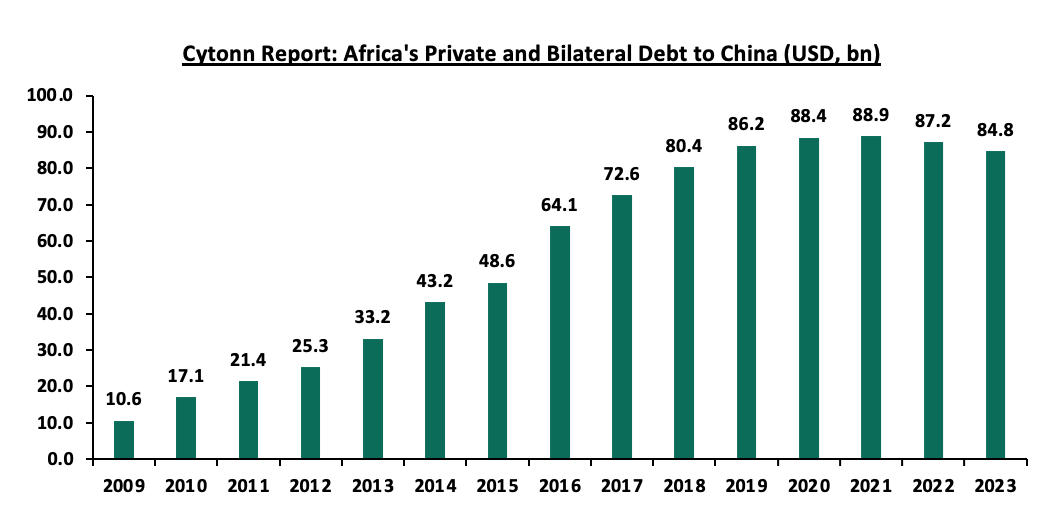

Currently, China makes up the largest portion of Africa’s debt stock, and is Africa’s biggest bilateral lender. As of 2023, China held almost USD 84.8 bn of Africa’s external debt (Private and bilateral debt). The graph below shows Africa’s debt to China in the last 15 years (Private and Bilateral):

Source: International debt statistics

Additionally, Africa’s debt to service ratio came in at 19.6% in 2023 according to the African Export-Import bank report, with 34 countries recording an increase in the ratio during the year. A high debt service to revenue ratio indicates vulnerability of the country and increased unsustainability of the country’s debt. The table below summarizes debt indicators for select countries in the region as of 2023:

|

Cytonn Report: Select African Countries Debt Ratios |

||||

|

|

Debt to GDP* |

Debt service to revenue |

Tax Revenue to GDP |

Expenditure to GDP |

|

Zambia |

114.9% |

14.0% |

16.8% |

14.3% |

|

Senegal |

111.4% |

30.5% |

18.7% |

16.3% |

|

Mauritius |

83.4% |

11.8% |

19.0% |

15.9% |

|

South Africa |

79.6% |

21.3% |

25.9% |

19.2% |

|

Rwanda |

77.6% |

15.9% |

15.0% |

17.0% |

|

Kenya |

68.3% |

62.6% |

15.2% |

24.6% |

|

Ghana |

66.4% |

43.5% |

11.3% |

6.7% |

|

Uganda |

54.0% |

18.4% |

12.5% |

9.8% |

|

Nigeria |

52.5% |

66.9% |

7.0% |

12.0% |

|

Tanzania |

47.1% |

44.6% |

11.7% |

8.3% |

|

Ethiopia |

41.8% |

31.0% |

6.2% |

7.4% |

*2025 IMF Data, Source: IMF, World bank, Afrexim Bank

From the table above,

- Zambia has the highest debt to GDP ratio of the select sub-Saharan region countries, at 114.9%, while Ethiopia has the least ratio at just 41.8%. At 68.3%, Kenya’s debt-to-GDP ratio ranks sixth of the select countries. Of these select countries, only two have a ratio below the IMF recommended threshold of 50.0%,

- On Debt service to Revenue ratio, which measures the amount of a country’s revenue that goes into payment of debt, Nigeria had the highest ratio at 66.9%, followed closely by Kenya at 62.6%. Mauritius had the lowest ratio, at 11.8%, indicating much more stability and sustainability of the country’s debt,

- South Africa recorded the highest tax revenue to GDP ratio, at 25.9%. This ratio indicates the level of taxation in a country relative to its GDP. A high ratio could indicate the country has a larger fiscal ability and can meet most of its requirements efficiently. Kenya’s ratio stood at 15.2%, while Ethiopia recorded the lowest ratio at 6.2%, and,

- On government spending to GDP ratio, Kenya led at 24.6%. This ratio measures the size of a government's expenditures relative to the overall economic output of a country. Kenya’s high ratio indicates that our government plays a larger role in the economy as compared to the other countries, with significant public sector activities and social services.

Africa’s return to the Eurobond market in 2024 and early 2025 has been marked by strong investor appetite and improving sentiment. Ivory Coast, Benin, Kenya, Senegal, and Cameroon collectively raised over USD 6.3 bn, with all issuances oversubscribed, driven by yield-seeking investors and positive regional recovery prospects. Notable deals included Ivory Coast’s USD 2.6 bn dual-tranche bond and Kenya’s USD 1.5 billion Eurobond used for a 2027 buy-back. Cameroon’s USD 550 mn issuance in July 2024 became the most expensive in recent years, with a 10.8% yield. By June 2025, bond yields declined across most issuers, including Kenya, Benin and Ivory Coast reflecting easing inflation, currency stability, and stronger investor confidence. This trend highlights improved market access for African sovereigns, though borrowing costs remain high for fiscally riskier nations like Nigeria, where the yield edged up slightly to 9.1%.

Section VI: Conclusions and Recommendations

Kenya's public debt situation underscores the need for prudent fiscal management and strategic planning to ensure that the debt remains sustainable and does not compromise the country's economic prospects. It is essential to strike a balance between funding the government's development projects and maintaining debt at manageable levels. To address the challenges posed by the high public debt in Kenya, here are some actionable steps that the Kenyan government can consider:

- Enhanced Debt Management – Implement a comprehensive debt management strategy that encompasses short, medium, and long-term objectives which regularly assess the cost and risk profile of the debt portfolio as well as Prioritizing refinancing high-cost debt with lower-cost alternatives to reduce debt service obligations,

- Capital Markets Reform – The government should strengthen the regulatory and supervisory framework for capital markets and improve the efficiency, stability, and inclusiveness of the financial sector, especially the markets for stocks, bonds, and other securities to improve capital formation and foreign direct investments (FDIs) flowing into the country,

- Improve Ease of Doing Business – The government should improve the competitiveness and attractiveness of the country for investors and entrepreneurs. This can be achieved by simplifying and streamlining the procedures and requirements for starting, operating, and closing a business. Also Promoting a conducive and competitive business environment that fosters innovation, productivity, and growth. These measures will spur business growth and improve the country’s production thus allowing the government to collect more revenue,

- Focus on Areas of Strength Such as Tourism and Diaspora - Kenya's tourism sector is a significant contributor to the economy, providing jobs, generating foreign exchange, and boosting infrastructure development. Additionally, the Kenyan diaspora plays a crucial role in remittances, which are a vital source of foreign currency. By investing in the tourism sector and fostering stronger ties with the diaspora, government can enhance its appeal as a premier travel destination and create favourable conditions for diaspora remittance flow to help diversify income sources and reduce reliance on debt.

- Fiscal Consolidation – High fiscal deficit is attributable to higher growth in expenditure volumes relative to revenue collections, creating the need for excessive borrowing levels. The government needs to implement robust fiscal consolidation through expenditure reduction by introducing austerity measures and limit capital expenditure to projects with either high social impact or have a high Economic Rate of Return (ERR), and high economic benefits outweighing costs,

- Investment in Productive Sectors – Direct investments toward sectors that have the potential for high economic growth and job creation, such as infrastructure, agriculture, and manufacturing as well as developing targeted incentive programs to attract both domestic and foreign investments in these sectors,

- Public-Private Partnerships (PPPs) – The government should identify infrastructure projects suitable for PPP arrangements and incentivize the private sector to participate in such projects, thus sharing the financial burden and transferring project risk to the private sector,

- Improving the Country’s Exports – The government should formulate export and manufacturing favourable policies to improve the current account. This would stabilize the exchange rate and stop our foreign-denominated debt from increasing as the shilling depreciates,

- Efficient Tax Collection – The government should strengthen tax collection and administration to improve revenue collection without increasing tax rates significantly. This can be done through broadening the tax base while ensuring tax policies are equitable and do not disproportionately burden the lower-income segments of the population,

- Transparency and Accountability: Maintain transparency in the utilization of borrowed funds and ensure that loans are allocated to projects with measurable returns. Better governance will help to reduce wastage and corruption levels that had impeded proper allocation of funds towards designated projects, resulting in misappropriation of funds,

- Cut Corruption and Wastage: Corruption and wastage of resources have long been significant impediments to Kenya's economic development. Addressing these issues is crucial for improving public trust and ensuring that borrowed funds and public revenues are used effectively, leading to better outcomes in public service delivery and infrastructure development, ultimately contributing to a more sustainable debt position, and,

- Monitoring and Reporting: Establish mechanisms for continuous monitoring of debt levels and fiscal health, with regular reporting to stakeholders and the public.

Addressing the public debt issue is a collective effort that requires cooperation among policymakers, stakeholders, and the general public, all working together to secure the country’s financial future and prosperity.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.