Nov 19, 2023

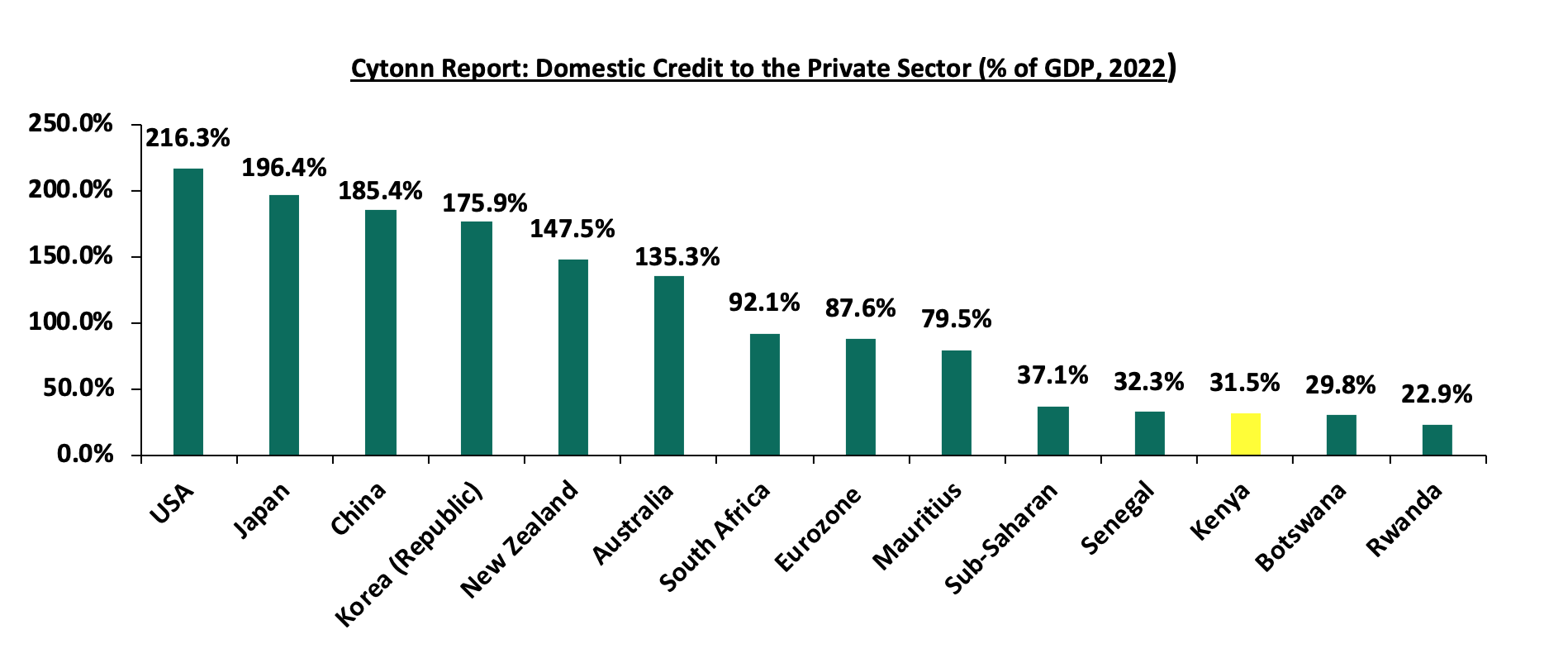

In many economies, private sector credit forms a vital component due to its ability to effectively distribute resources for investment, thereby acting as a catalyst for economic expansion. Kenya is no exception to this, as improved access to private sector credit translates to real GDP growth in the country. With the government currently seeking to narrow its fiscal deficit, creating an enabling environment to spur the growth of the private sector, especially the micro, small and medium enterprises, will go a long way in boosting its revenue collection. The government can achieve this is by formulating policihttps://cytonnreport.com/storage/research/655b1085714a53.51513556.jpeges to enhance the credit market as well as establishing sector-specific funds to stimulate business growth in key areas of the economy such as finance and insurance, agriculture, manufacturing, transport, and communication. The banking sector remains the largest contributor of credit to private businesses, contributing Kshs 3.6 tn as of July 2023, out of the total Kshs 4.4 tn extended to the private sector for the period, with the largest allocations to trade, manufacturing, and private households at 17.0%, 15.7%, and 14.5% respectively. In the year 2022, the domestic credit extended to the private sector by banks as a percentage of GDP stood at 31.5%, well above the Sub-Saharan Africa average of 27.4%, albeit lower than that of Mauritius and South Africa at 79.4% and 58.6% respectively. From the above statistics, it is evident that the country needs to work on improving credit access for the private sector as well as diversifying the sources of credit to avoid overreliance on the banking sector;

We have been tracking the evolution of Kenya’s private sector credit growth and below are the most recent topicals we have done on the subject:

- The Hustler Fund- In December 2022, we highlighted the Financial Inclusion Fund, dubbed the “Hustler Fund” launched on 30th November 2022, aimed at improving credit access to citizens at the bottom of the pyramid who have often struggled to obtain affordable credit,

- Kenya’s Credit Reference Bureau Framework- Released in November 2022, this topical sheds more light on the Credit Reference Bureau (CRB) Framework in Kenya following the announcement by the Central Bank of Kenya that it had updated the Credit Information Sharing Framework in November 2022, which mandated the Credit Reference Bureaus (CRBs) not to use negative credit scores as the only reason to deny credit, and recommended the fast implementation of the risk based pricing model by commercial banks,

- Kenya’s Private Sector Credit Growth- In November 2022, we highlighted Kenya’s state of lending to the private sector and gave our recommendations on what can be done to improve credit access to the private sector, and,

- Kenya’s Cost of Credit- Released in January 2022, the topical shed more light on Kenya’s high cost of credit remains with the big banks charging a higher cost of credit in comparison to smaller banks owing to their strong pricing power based on a wide distribution network, multiple services and well- established brands.

In this week’s topical, we shall focus on the status of Kenya’s private sector credit growth, highlighting the evolution and current state of lending to the private sector. We will provide specific recommendations on measures that can be implemented to improve credit access to the private sector. We shall do this by looking into the following:

- Introduction,

- The evolution of Kenya’s private sector credit,

- Factors influencing private sector credit growth,

- Initiatives by the Government and Central Bank to promote the private sector in Kenya,

- Comparative analysis, and,

- Conclusion and key consideration to improving private sector credit performance in Kenya.

Section I: Introduction

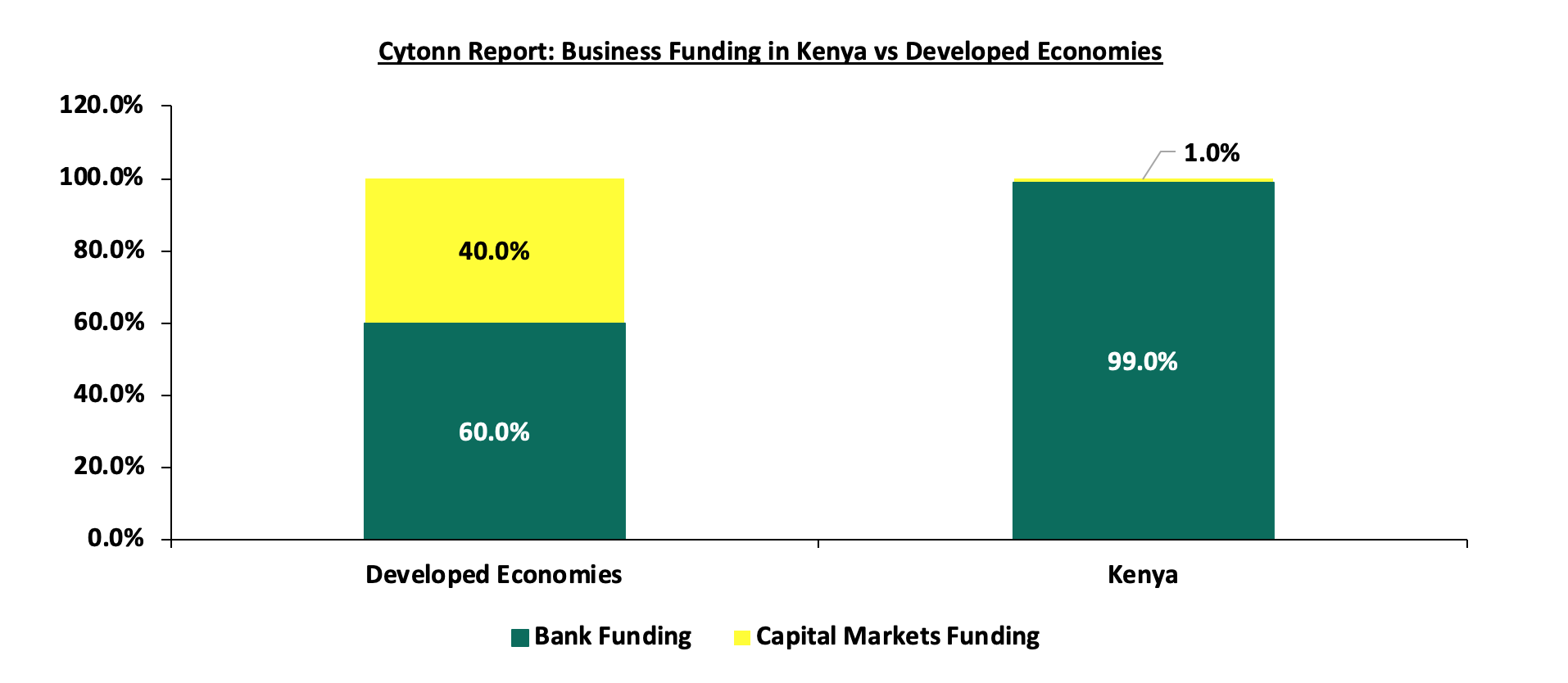

The private sector refers to the segment of the economy that is under the ownership and management of private individuals and corporations, as opposed to being governed by the state. On the other hand, private sector credit is the provision of financial resources to the private sector by entities other than central banks, in the form of loans, the purchase of non-equity securities, and trade credits or other receivables that create an obligation for repayment. In Kenya, the key players in lending to the private sector encompass commercial banks, capital markets, SACCOs, microfinance institutions, finance and leasing companies, pension funds, and insurance corporations. Despite the Kenya Financial sector being dominated by banking institutions which contribute 99.0% of the total lending, private sector credit growth remains relatively low, averaging at 10.7% for the ten years under review. Hence, in comparison to developed economies, capital markets funding in Kenya at 1.0% is underdeveloped, as the developed economies have bank and capital markets funding at 60.0% and 40.0%, respectively. The graph below shows the comparison of business funding in Kenya against developed economies;

Source: Cytonn Research

In Kenya, the private sector plays a crucial role in both economic expansion and job creation. This sector is made up of private corporations and small to medium-sized enterprises (SMEs), which make up 90.0% of all private sector businesses, and employ nearly nine out of every ten workers in the country. However, obtaining credit has been particularly difficult for the informal sector, mainly due to banks’ high-risk perception and the steep cost of credit associated with the currently available credit options.

Section II: The Evolution of Kenya’s Private Sector Credit

- Private sector credit Growth

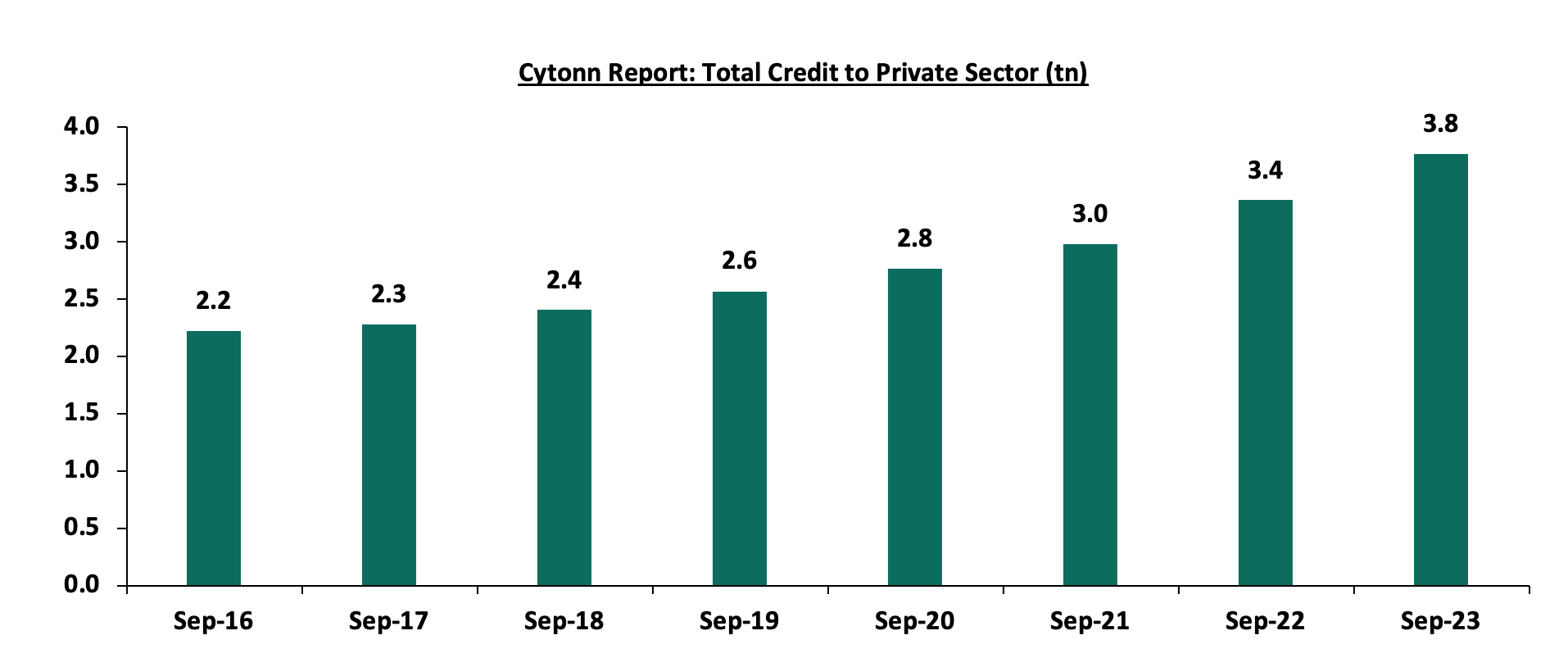

Over the period, there has been consistent growth in private sector lending, with the total credit extended to the private sector by banks increasing with an 8-year CAGR of 9.2%, to Kshs 3.8 tn in September 2023 from Kshs 2.2 tn in September 2016, in line with the relative economic growth averaging at 4.8% for the last 8 years. The graph below shows the cumulative private credit over the period under review from the banking sector;

Source: Central Bank of Kenya

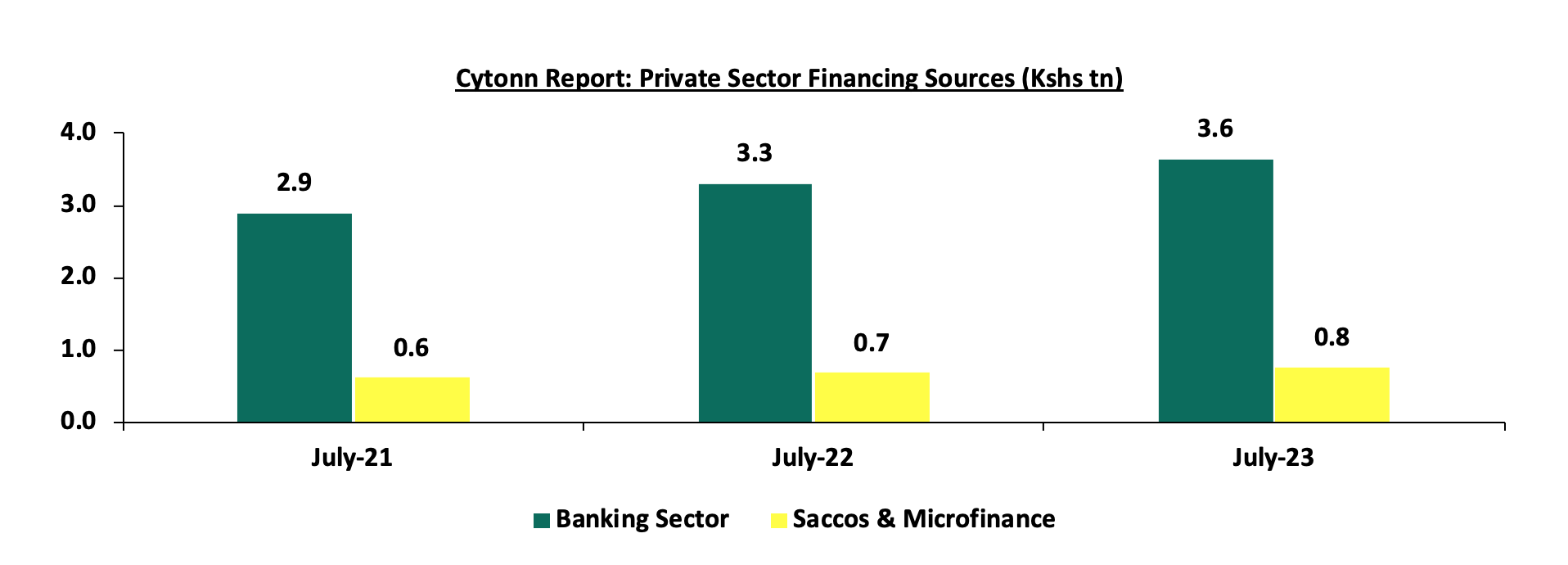

Banks dominate lending in the private sector, contributing 82.9% of the total private sector lending, translating to Kshs 3.6 tn as of July 2023, with the rest of Kshs 0.8 tn, translating to 17.1% coming from SACCOs and Microfinance. Notably, the highest allocation of total private sector credit in July 2023 was to the Private households at 1154.0 bn, equivalent to 26.3% of the total credit extended to the private sector. To note, out the Kshs 0.8 tn extended to the private sector by SACCOs and Microfinance, a whole 83.4% was to the private house-holds sector, with the rest of the sectors getting very minimal allocations. From the banking sector, the trade sector had the highest allocation at Kshs 618.0 bn, equivalent to 17.0% of the total credit from the banking industry. In terms of YTD credit growth, the Finance and Insurance, as well as Agriculture sectors grew the most at 27.0% and 7.3% to Kshs 152.7 bn and Kshs 126.9 bn in July 2023, respectively, from Kshs 120.2 bn and Kshs 118.3 bn respectively in January 2023. The positive credit uptake shows the resilience of the two segments despite increased credit risk due to the deteriorated business environment following elevated inflationary pressures. The graph below shows the cumulate private sector credit over the past three years comparing banks vs SACCOs and microfinance institutions;

Source: Central Bank of Kenya

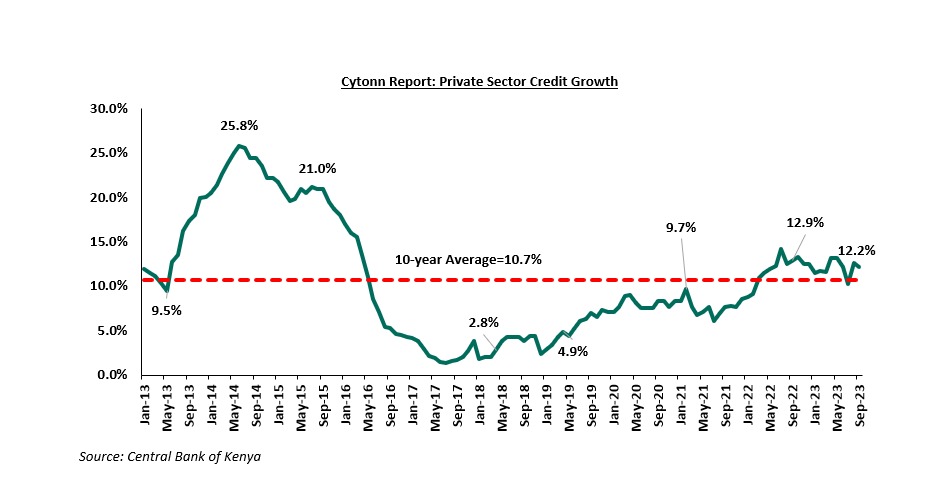

Private sector credit growth from the banking sector has been on an upward trajectory in 2023, reaching 12.2% in the 12-months to September 2023 compared to 12.9% in September 2022, attributable to increased credit demand, as most businesses try to stay afloat and cushion themselves amid a slowdown in collections and payments by customers, increased prices for raw materials mainly resulting from the depreciation of the Kenyan Shilling coupled with an increase in credit products targeting SMEs and retail segments . However, the growth slowed down to 12.2%, from the 12.9% recorded in September 2022, partly attributable to the increased lending rates that have caused banks to be more cautious in lending, to minimize the risk of default by borrowers. To note, the lending rates by banks in the 12 months leading to August 2023 averaged at 13.0%, a significant increase from the 12.2% recorded in a similar period last year. Credit growth was mainly driven by sectors such as Finance and Insurance, Agriculture, Transport and Communication and Manufacturing, which grew by 35.4%, 19.0%, 16.5% and 14.7% YoY respectively. Key to note, Real Estate as well as Building and Construction Sectors had the lowest y/y credit growth rates at 3.0% and 1.9% respectively. According to the Central Bank of Kenya, Real Estate credit uptake was relatively low with gross loans advanced to the Real Estate sector increasing by 6.0% to Kshs 495.0 bn in H1’2023, from Kshs 466.8 bn realized in H1’2022, while the Building and Construction sector recorded a 7.0% increase in gross loans to Kshs 152.0 mn in H1’2023, from Kshs 142.0 mn in H1’2022. The slow growth in the real estate sector was mainly attributed to the increased credit risk on the sector partly due to a subdued demand for property amid rising construction costs and a 20.9% increase in Non-Performing Loans (NPLs) in the Real Estate sector to Kshs 96.0 bn in H1’2023, from Kshs 79.4 bn in H1’2022. On overall, the Gross Non-Performing loans increased by 12.0%, to 576.1 bn, from 514.4 mn in H1’2022, mainly driven by the tough economic environment The table below shows the sectoral credit uptake growth on y/y and year-to-date basis from the banking sector:

|

Cytonn Report: Sectoral Credit Uptake (Kshs bn) |

|||||

|

Sector |

July-22 |

Jan-23 |

July-23 |

Last 12 Months Change (%) |

YTD change (%) |

|

Finance & insurance |

112.3 |

119.8 |

152 |

35.4% |

26.9% |

|

Agriculture |

102.5 |

113.8 |

122 |

19.0% |

7.2% |

|

Mining and quarrying |

19.9 |

22.6 |

23.2 |

16.6% |

2.7% |

|

Transport & communication |

272.5 |

301.7 |

317.4 |

16.5% |

5.2% |

|

Manufacturing |

499.1 |

523.4 |

572.5 |

14.7% |

9.4% |

|

Consumer durables |

361.2 |

381.6 |

407.7 |

12.9% |

6.8% |

|

Business services |

188.8 |

198.6 |

208.9 |

10.6% |

5.2% |

|

Trade |

575.3 |

591.4 |

618.0 |

7.4% |

4.5% |

|

Private households |

493.6 |

515 |

528 |

7.0% |

2.5% |

|

Real estate |

417.3 |

423.5 |

429.9 |

3.0% |

1.5% |

|

Building and construction |

134.1 |

132.4 |

136.7 |

1.9% |

3.2% |

|

Other activities |

127.2 |

121.9 |

127.8 |

0.5% |

4.8% |

|

Total credit growth |

3303.8 |

3445.7 |

3644.1 |

10.3% |

5.8% |

Source: Central Bank of Kenya

The Kenyan private sector credit growth remains subdued even after the removal of interest rates cap in November 2019 with average growth rate coming in at 9.7% since the removal compared to the growth rate of 10.7% for the 10-year period. While the capping of interest rates was implemented to control lending rates to the sector, there was a contraction on the supply side of credit as banks had lower profit margins attributable to a tougher lending environment. Despite the expansion in private sector credit uptake, the current growth rate of 12.2% in September 2023 is still below the historical credit growth levels. The chart below shows the movement of the private sector credit growth:

Section III: Factors Influencing Private Sector Credit Growth

Private sector credit uptake is influenced by a number of factors which include;

- Interest rates – The level of interest rates set by central banks and financial institutions significantly influences the credit market. For instance, the implementation of the Banking (Amendment) Act, in 2016 introduced interest capping following concerns raised by the public regarding the high cost of credit in Kenya, which was viewed as a hindrance to credit access by a large segment of the population. The cap, which restricted banks from charging interest rates exceeding 4.0% points above the Central Bank Rate (CBR), led to a low credit growth averaging at 3.7% for the capping period (August 2016-November 2019) as banks became more cautious in extending credit, particularly to riskier borrowers and for loans with smaller profit margins. However, on the demand side, high interest rates increase the cost of borrowing as well as the debt servicing costs which limits the ability to take additional credit. The average lending rate as at August 2023 stood at 13.8%, a 0.3%-points increase from 13.5% in July 2023. Notably, the move by the central bank to raise the CBR by 100 bps to 10.5% in June 2023 has continued to tighten liquidity within the economy forcing commercial banks to adjust their lending rates upwards as a response to the increased cost of funds for banks,

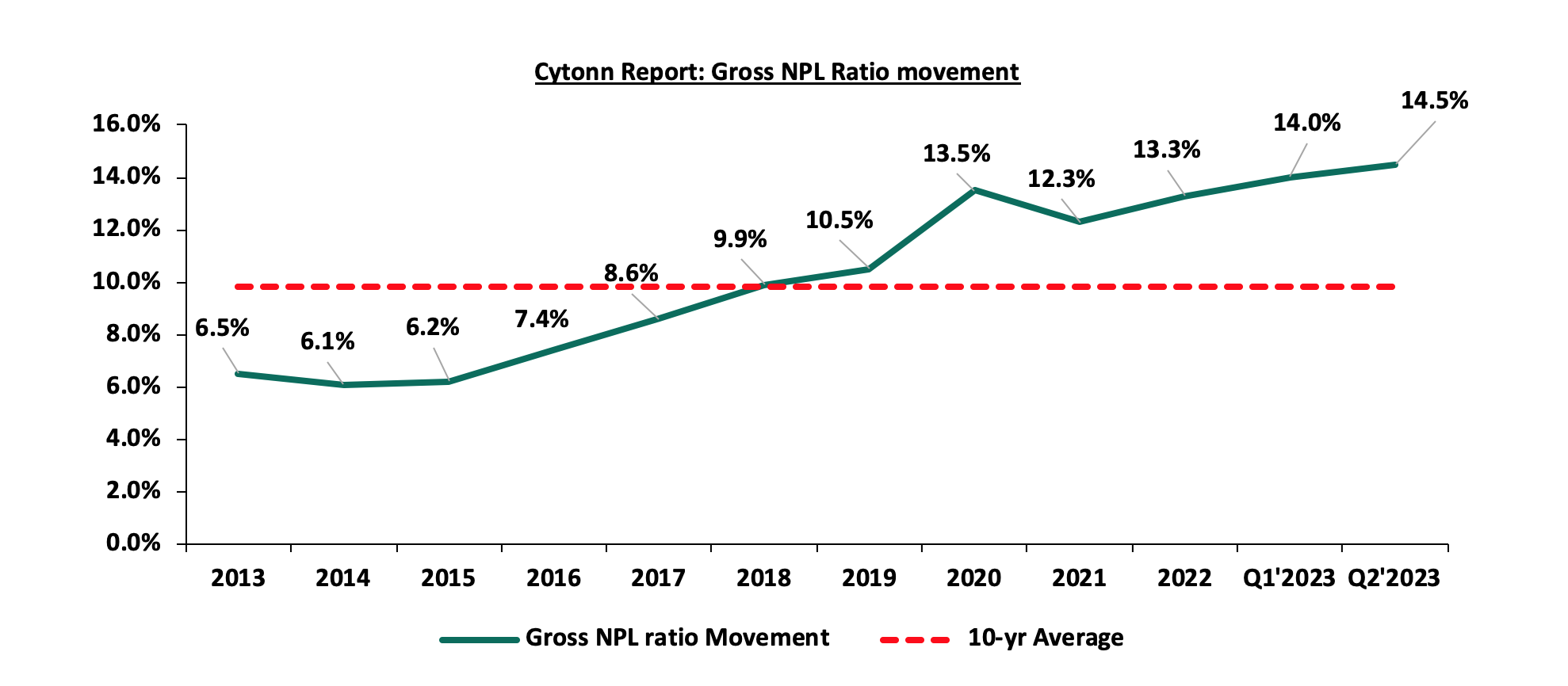

- Elevated credit risk which contributes to high risk premiums – The high-risk perception prompts lenders to incorporate risk premiums into the interest rates they charge on loans resulting in higher borrowing costs for individuals and businesses seeking credit. The risk premium acts as a cushion for lenders against potential losses, reflecting the level of uncertainty and perceived risk associated with the borrower. Additionally, according to the Central Bank of Kenya (CBK), Credit risk remained elevated with Gross Non-Performing Loans (NPLs) to Gross Loans Ratio standing at 14.5% at the end of Q2’2023, a 0.5% points increase from 14.0% recorded at the end of Q1’2023. The graph below shows the movement for the years under review;

- Government domestic borrowing - Commercial banks have continued to hold the highest proportion of Government domestic debt, coming at 44.2% as at November 2023. This is mainly attributable to banks preference to lend to the government, which is considered a risk-free investment, effectively crowding out the private sector, which is considered riskier. Though the holding of domestic debt by commercial banks has declined from a high of 55.4% in the last 10 years, this continues to inhibit credit sector credit growth. The table below shows the holders of domestic public debt for the last 10 years;

Cytonn Report: Domestic Public Debt by Holder (Percent)

Nov-13

Nov-14

Nov-15

Nov-16

Nov-17

Nov-18

Nov-19

Nov-20

Nov-21

Nov-22

Nov- 23

Banking Institutions

48.6%

52.9%

55.4%

53.4%

55.2%

54.9%

54.2%

54.3%

50.3%

47.1%

44.2%

Insurance companies

10.3%

10.1%

8.7%

7.2%

6.2%

6.1%

6.5%

6.3%

6.7%

7.4%

7.2%

Parastatals

3.6%

2.9%

4.6%

5.7%

6.5%

7.4%

6.8%

5.6%

5.4%

6.2%

5.8%

Pension funds

25.9%

24.8%

25.3%

27.3%

27.7%

27.1%

28.1%

28.8%

31.5%

33.0%

30.4%

Other investors

11.5%

9.3%

6.0%

6.4%

4.4%

4.5%

4.4%

54.2%

6.1%

6.4%

12.5%

- Technological advancements - Technological advancements such as Fintech Solutions and mobile banking systems has expanded digital lending with Mobile money platforms providing convenient access to credit, especially for individuals without traditional banking relationships, contributing to a more inclusive credit environment. Notably, in march this year, the Central Bank of Kenya announced the licensing of additional 10 Digital Credit Providers (DCPs) bringing the number of licensed DCPs to 32 following the licensing of 22 DCPs announced in January 2023. This move underscores the commitment of the government to foster a dynamic and competitive digital lending landscape, reinforcing the role of technology in shaping the future of credit accessibility in Kenya,

- Elevated inflation rates - Inflation not only erodes the purchasing power of money but also has a direct impact on interest rates. Central banks, in response to high inflation, may implement measures such as raising the benchmark interest rate which influences the overall cost of borrowing for businesses and individuals. For instance, Following the heightened inflation rate of 7.9% as of June 2023, the central Bank of Kenya revised the Central Bank Rate (CBR) to 10.5%. This adjustment has had a direct impact on interest rates set by commercial banks for loans, leading to an increase in the cost of borrowing. Moreover, the rise in inflation rate to 6.9% in October 2023, from 6.8% in September 2023, driven by high food and fuel prices in the country has negatively impacted on consumption levels leading to reduced sales. This is evidenced by the decline in the Purchasing Managers Index (PMI) to 46.2% in October 2023 from 47.8% in September 2023 depicting deterioration of the business environment which negatively impacts the credit demand by the private sector,

- Over-reliance on the banking sector - Historically, banks have held a dominant position in facilitating credit to the private sector contributing 9% as of July 2023. This over-reliance has led to limited diversification of funding sources for businesses. Exploring alternative credit channels, such as capital markets and non-banking financial institutions, is essential for building a more resilient and diverse credit ecosystem, reducing the systemic risks associated with overdependence on the banking sector. As such, the government should implement strategies to improve other sectors such as leasing, venture capital funds, development finance institutions and bonds and equity markets in order to create an environment that encourages a balanced and inclusive approach to credit facilitation, and,

- High cost of credit – There are other associated overhead costs incurred during borrowing such as bank fees, legal fees and government levies, valuation fees and insurance that are borne by the borrower, in addition to the interest charged on loans. The overhead costs increase the cost of credit, hence limits demand for credit by the private sector.

Section IV: Initiatives by the Government and Central Bank to Promote Private Sector Credit Growth

Based on the importance on private sector contribution to GDP, the Central Bank of Kenya (CBK), in collaboration with other stakeholders, has implemented various measures ranging from licensing of new products, technological innovations and public education to promote credit growth in Kenya. Some of the initiatives include;

- Licensing of Innovative Financial Products - By permitting the introduction of novel lending solutions, investment tools, and other financial products, the central bank has been instrumental in expanding the range of credit options available to businesses and individuals. Notably, in March 2023, the Central Bank of Kenya Licensed an additional 10 Digital Credit Providers (DCPs) bringing the number of licensed DCPs to 32 following the licensing of 22 DCPs announced in January 2023. This move directly aligns with the commitment of the Central Bank of Kenya (CBK) to strategically promote credit access to the private sector by enabling and expanding digital credit options,

- Diversifying Funding Strategies – Through incorporating alternative borrowing strategies, the government aims to reduce its reliance on domestic credit from commercial banks, and as a result, enhancing the ease of credit access to the private sector. Sourcing of alternative funding by the government mitigates the pressure on the local credit market, creating room for private sector entities to secure loans more easily. Notably, Eurobonds, as a form of commercial borrowing, have been a significant component of the government's debt strategy. However, by exploring concessional options, the government not only broadens its funding sources but also ensures a balance that is more conducive to a sustained economic growth,

- Boosting Liquidity in the Banking sector- In March 2022, the CBK reviewed the Cash Reserve Ratio to 4.25 %, from the existed 5.25%. This adjustment resulted in the release of an additional Kshs 35.2 bn in liquidity to commercial banks hence effectively providing commercial banks with more financial flexibility to extend credit to businesses and individuals in the private sector,

- Empowering MSMEs through the Credit Guarantee Scheme (CGS) Regulation 2020 – MSMES, being one of the largest sector in private sector play a vital role in the enhancing economic growth of the Country. The implementation of the Credit Guarantee Scheme (CGS) Regulation in 2020, facilitated 2,609 business access loans to MSMEs totalling Kshs 4.1 bn as of August 2022 surpassing its initial capital of Kshs 3.0 bn. Key to note, 60.0% of the beneficiaries were small enterprises, while micro and medium enterprises accounted for 25.0% and 15.0% respectively,

- Implementation of the Financial Inclusion Fund - The Financial Inclusion Fund, commonly known as Hustler Fund, is a government special sponsored Fund targeting Kenyans of low income to access credit conveniently through their phones. The government launched the Hustler Fund on November 2022 with the main objective of the fund being to make credit affordable to the majority of citizens who have been out of the formal credit cycle for a long duration. The introduction of the Hustler Fund aligns with the government’s commitment to fostering financial inclusion and broadening the reach of credit facilities in the country, and,

- Other government special Funds - The government under the Public Finance Management Regulations rolled out various loan facilities targeting women, youths and persons living with disabilities (PWDs) such as the Youth Development Fund, Uwezo Fund and Women Enterprise Fund in increasing credit to special groups people. These initiatives align with the broader narrative of enhancing private sector credit growth by addressing specific barriers faced by the marginalized or underserved segments of the population.

Additionally, the banking system has put in place measures to aid private sector credit growth such as;

- Tailoring Credit with Risk-Based Pricing – The Central Bank of Kenya approved risk-pricing models for 22 out of the 38 commercial banks as a measure of tailoring loans to a customer’s financial profile while helping banks and other lenders to manage their risk exposure. The initiative has continued to increase credit accessibility to the private sector based on an individual financial profile in terms of borrowing and repayment history, and,

- Digital Transformation – Most Kenyan banks have embraced digital technologies, streamlining and expediting the loan application and approval processes. The implementation of user-friendly mobile and online platforms facilitates quicker access to credit, enhancing the efficiency of transactions for businesses and individuals. Banks such as KCB and NCBA partnered with Safaricom to offer the overdraft credit facility of Fuliza towards increasing credit lending to SMEs. Additionally, KCB has the VOOMA app specifically targeting lending to small and medium enterprises.

Section V: Comparative Analysis

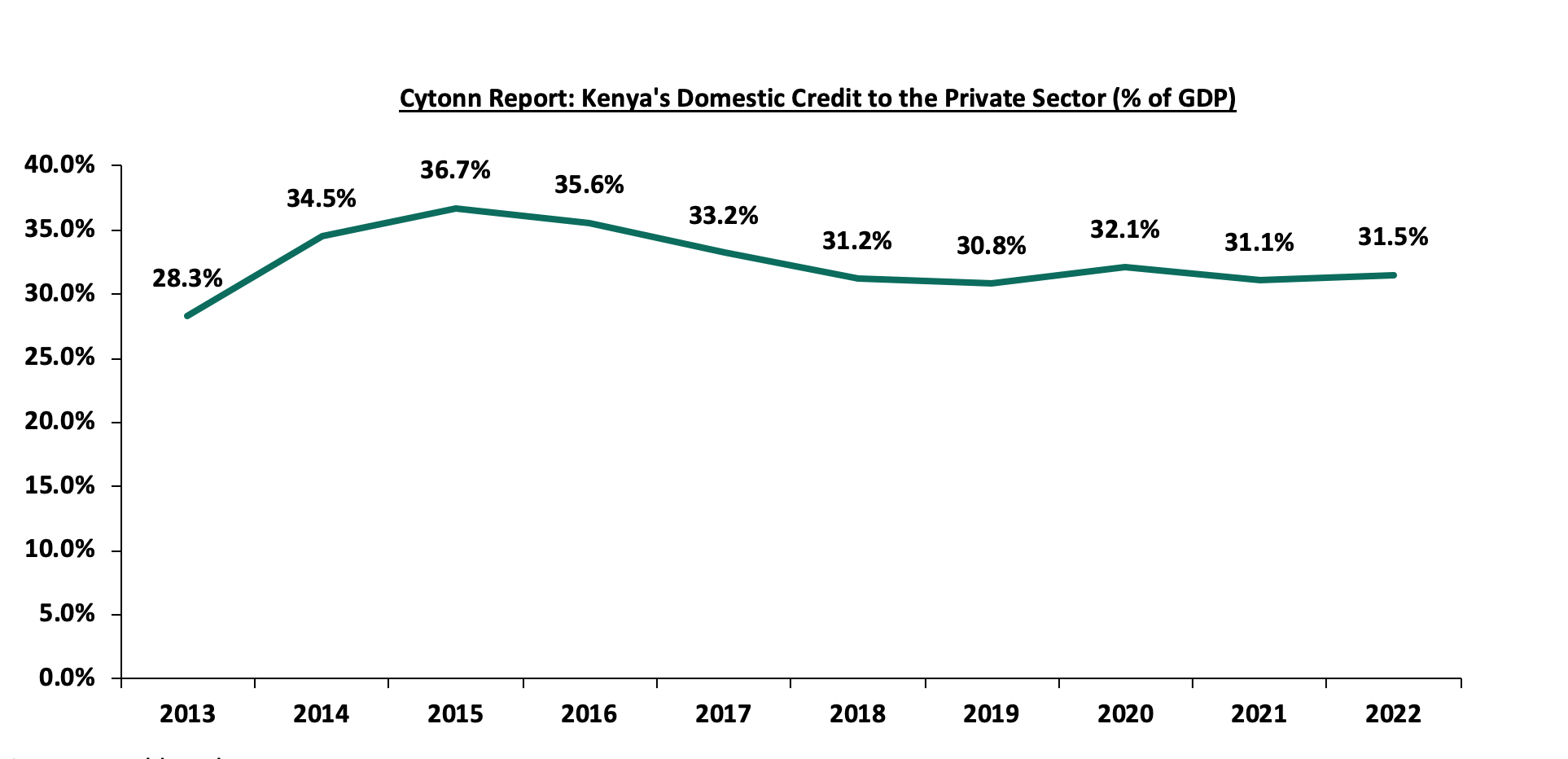

According to the World Bank, Kenya’s domestic credit extended to the private sector outperformed majority of the Sub-Saharan countries. The Kenya’s domestic credit extended to private sectors as a percentage of the GDP came in at 31.5%, 5.6% points lower than the average Sub-Saharan domestic credit to private sectors lending which stood at 37.1% in the same period. Although Kenya outperformed majority of Sub-Saharan countries in credit extended to the private sector, the country still underperformed against developed economies. The graph below shows domestic credit extended to the private sector over the years and a comparison of Kenya’s performance against selected economies;

Source: World Bank

Source: World Bank

Different developed countries have adopted different measures in enhancing private sector credit growth. Some of the successful measures include:

- Project Finance Structuring – a financing option structured around a project’s own operating cash flow and assets alleviating investments risks and raise finance at a low cost. China used the measure in 1997 to launch a local contract undertaken by Plantation Timber Products (Hubei) Ltd amounting to USD 57.0 mn greenfield project in installing modern medium-density fibreboard plants in interior China. Due to the limited-recourse financing nature of the project, IFC sourced for USD 26.0 mn in syndicated loans, at a time when foreign commercial banks remained cautious about project financing in China's interior provinces, and,

- Universal supervisory body to monitor fund disbursements – The UK has a universal monitoring organization, the British Business Bank (BBB), in charge of monitoring all fund operations of government fund initiatives such as Enterprise Finance Guarantee Scheme (EFGS), the British Growth Fund (BGF), the Funding for Lending Scheme (FLS) and the Start Up Loans Scheme (SLS). The measure helps in promoting accountability and transparency of funds disbursements.

Hustler Fund

Hustler fund is an initiative introduced by the new government to increase credit accessibility and availability to the private sector, formally launched on 30th November 2022. The fund’s objective is to extend funding to borrowers with a special attention towards low-income earners with focus on MSMEs at lower, one-digit interest rates. In addition, for all cash borrowed, 5.0% goes to mandatory savings, where 30.0% goes to short-term savings, accessible after one year, while the rest of 70.0% goes long-term savings. As of November 2023, the fund had disbursed a total of Kshs 36.9 bn to over 8.0 mn individual borrowers, whose average repayment rate stood at 73.0%, while the savings account amounted to Kshs 1.8 bn. Additionally, out of the 50,000 groups opted into the fund, 20,000 groups have benefited a total of Kshs 164.0 mn, with the Vikundi savings account amounting to Kshs 8.2 mn as of November, 2023.

Section VI: Conclusion and Key Considerations

The private sector is a significant contributor to the Kenyan GDP. However, credit availability remains a major hindrance for the sector’s growth. To offset the downside, the government of Kenya needs to adopt or emulate the funding model used by the developed economies in creating an enabling environment for two or more players to compete within the Kenyan credit market. Currently, the credit market is dominated by the banking industry while the Capital markets only contribute about 1.0% of funding to all businesses. Additionally, the government needs to adopt a consumer-centred approach for borrowing to encourage private sector credit demand. We believe that additional measures need to be implemented in order to promote private sector credit growth. Below are some of the initiatives that the government can adopt;

- Policy reforms- Through implementing policies that enhance the ease of doing businesses, reducing bureaucratic hurdles, and creating a favourable regulatory environment can encourage banks and other lending institutions to extend credit to the private sector,

- Enhance financial literacy to the public – The government needs to come up with ways of promoting financial literacy among the population and businesses can increase awareness of available credit options as well as improve creditworthiness, making it easier for businesses to access credit,

- Establish a regulatory framework to enhance consumer protection by enforcing consumer-centred financial laws, ensuring financial products are transparent and competitive, as well as handling of consumers complains and issues,

- Develop the capital markets to offer alternative sources of borrowing – The capital market in Kenya is under-developed as it contributes minimal funding to businesses in Kenya. Deeping the capital markets framework will unlock a key financing avenue that businesses can tap into. Further, the government, in conjunction, with the financial sector regulators need to come up with a sound legal framework to promote transparency of the corporate bond market bonds, as well as investor education on key legislations that apply to the specific bond market,

- Enhancing oversight on fund initiatives to promote transparency - The government needs to come up with measures or an independent institution that will oversee the running of funds such as the Hustler Fund, Uwezo Fund and Youth Development Fund in terms of timely publication of updates on amounts disbursed, disclosure of beneficiaries already covered and requirement regulations. The strategy will help in building confidence with the public, as well as preserving tax payers’ money, and,

- Adoption of concessionary loans - Allow the banking sector to provide concessionary loans to small and medium enterprises with focus on the Agricultural sector as it is the leading contributor to the GDP and accounts for 70.0% of employment of the rural population.

In conclusion, the trajectory of private sector growth in Kenya reflects a promising landscape marked by resilience, innovation, and a proactive policy environment. As the nation continues to navigate economic challenges, the private sector stands as a pivotal force, driving employment, fostering entrepreneurship, and contributing significantly to GDP. However, sustainable growth requires ongoing collaboration between the government, businesses, and stakeholders to address barriers, enhance infrastructure, and cultivate a conducive business environment. With strategic initiatives and a commitment to fostering inclusive growth, Kenya's private sector is poised to play a pivotal role in shaping the nation's economic success. we are of the opinion that the initiatives already put in place by the government to promote access to credit by the private sector coupled with creating an enabling operating business environment for alternative credit sources will come in handy in promoting credit growth in the private sector. We expect sustained growth in the lending to the private sector on the back of the existing policies aimed at enhancing credit uptake which in turn will contribute to country’s economic growth.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.