Cytonn Monthly – November 2024

By Research Team, Dec 1, 2024

Executive Summary

Fixed Income

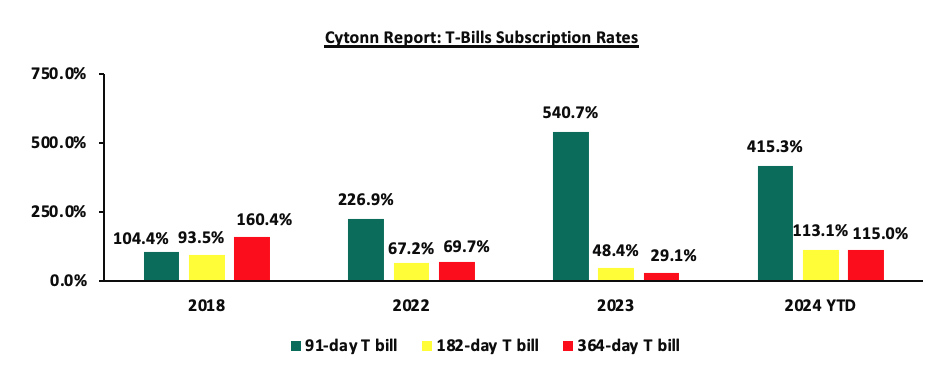

During the month of November 2024, T-bills were oversubscribed, with the overall average oversubscription rate coming in at 347.2%, higher than the oversubscription rate of 305.9% recorded in October 2024. The overall average subscription rate for the 91-day paper increased to 611.1% from 546.6%, while the overall average subscription rates for the 182-day and 364-day paper increased to 288.7% and 300.1% respectively, from 278.4% and 237.2% respectively, which was recorded in October 2024. The average yields on the government papers were on a downward trajectory during the month, with the 91-day, 182-day, and 364-day papers yields decreasing by 190.8 bps, 243.7 bps, and 196.0 bps to 13.1%, 13.4%, and 14.2% respectively from 15.0%, 15.8%, and 16.1% recorded the previous month. For the month of November, the government accepted a total of Kshs 171.3 bn of the Kshs 333.3 bn worth of bids received in T-Bills, translating to an acceptance rate of 51.4% compared to an acceptance rate of 46.5% in the month of October;

During the week, T-bills were oversubscribed for the ninth consecutive week, with the overall oversubscription rate coming in at 211.1%, albeit lower than the oversubscription rate of 321.8% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 18.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 470.4%, albeit lower than the oversubscription rate of 623.3% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 104.2% and 214.2% respectively from to 171.4% and 351.6% recorded the previous week. The government accepted a total of Kshs 34.7 bn worth of bids out of Kshs 50.7 bn bids received, translating to an acceptance rate of 68.4%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 80.5 bps, 87.2 bps and 78.4 bps to 12.5%, 11.3% and 11.3% respectively from 13.3%, 12.2% and 12.0% respectively recorded the previous week;

Additionally, November 2024 bonds were oversubscribed, with the overall average oversubscription rate coming in at 205.0%, higher than the average oversubscription rate of 139.9% recorded in October 2024. The reopened bonds FXD1/2022/015 and FXD1/2023/010 with tenors to maturity of 12.4 years and 8.2 years respectively and fixed coupon rates of 13.9% and 14.2% respectively, received bids worth Kshs 33.0 bn against the offered Kshs 25.0 bn translating to an oversubscription rate of 132.2%, with the government accepting bids worth Kshs 25.7 bn, translating to an acceptance rate of 77.7%, with the average accepted yields coming at 16.3% and 16.0% respectively. Additionally, the reopened FXD1/2024/010, with a tenor to maturity of 9.3 years and a fixed coupon rate of 16.0%, received bids worth Kshs 55.6 bn against the offered Kshs 20.0 bn translating to an oversubscription rate of 277.9%, with the government accepting bids worth Kshs 30.5 bn, translating to an acceptance rate of 54.9%, with the average accepted yield coming in at 15.9%;

In the primary bond market, the government is looking to raise Kshs 45.0 bn through the reopened two-ten years and one twenty years fixed coupon bonds; FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 with tenors to maturity of 8.2 years,9.3 years and 13.3 years respectively. The bonds will be offered at fixed coupon rates of 14.2%,16.0% and 13.2% respectively. Our bidding range for the reopened bonds are 13.20%-13.75%, 14.95%-15.35% and 16.35%-16.55% for the FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 respectively;

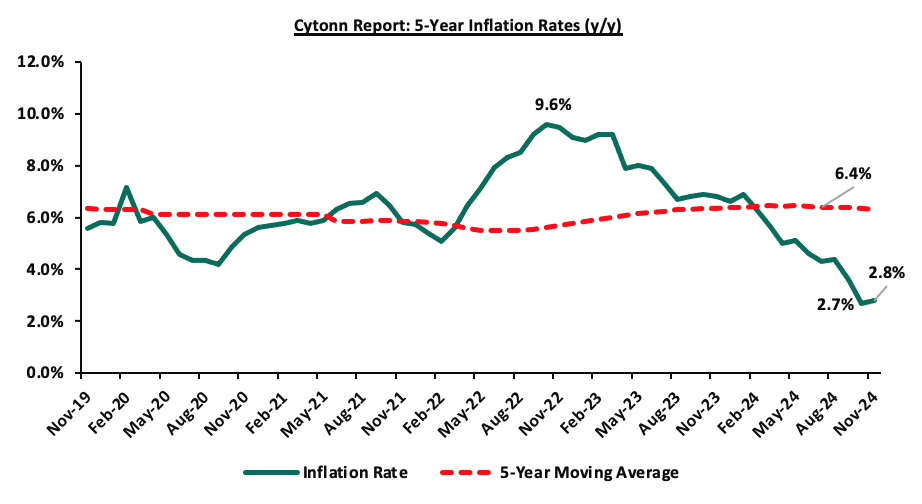

During the week, KNBS released the y/y inflation highlighting that inflation in November 2024 increased slightly by 0.1% points to 2.8%, from the 2.7% recorded in October 2024., which was in line with our projected range of 2.8% to 3.2%;

Additionally, we expect the MPC to cut the Central Bank Rate (CBR) to within a range of 11.50% - 11.75% with their decision mainly being supported by rate cuts by global economies, the need to further support the economy and the continued stability of the Shilling against major currencies.

Equities

During the month of November 2024, the equities market was on a downward trajectory, with NSE 10 declining the most by 5.5%, while NASI, NSE 25 and NSE 20 declined by 5.2%, 4.0% and 2.3% respectively. The equities market negative performance was driven by losses recorded by large-cap stocks such as Safaricom, EABL, and Equity Group of 10.4%, 9.4%, and 4.9% respectively.

During the week, the equities market was on a downward trajectory, with NSE 10 declining the most by 2.6%, while NSE 25, NSE 20 and NASI declined by 1.8%, 1.6% and 1.1% respectively, taking the YTD performance to gains of 28.4%, 28.3%, 23.4%, and 21.3% for NSE 10, NSE 25, NSE 20, and NASI respectively. The equities market performance was driven by losses recorded by large-cap stocks such as EABL, ABSA Group, and Equity Group of 7.9%, 2.6%, and 2.1% respectively. The performance was, however, supported by gains recorded by large-cap stocks such as DTB-K, Stanbic Holdings and Safaricom of 1.9%, 1.8% and 0.7% respectively;

Additionally, during the week, three of the listed banks released their Q3’2024 results.

- Diamond Trust Bank’s core earnings per share (EPS) grew by 12.3% to Kshs 26.6, from Kshs 23.6 in Q3’2023, driven by the 5.9% increase in total operating income to Kshs 31.0 bn, from Kshs 29.3 bn in Q3’2023, which outpaced the 9% increase in total operating expenses to Kshs 21.1 bn from Kshs 20.7 bn in Q3’2023,

- NCBA Group’s core earnings per share (EPS) grew by 3.1% to Kshs 9.2, from Kshs 8.9 in Q3’2023, driven by the 0.6% increase in total operating income which was outpaced by the 1.6% increase in total operating expenses, but was offset by a 3.1% decrease in effective tax rate to 18.0% from 21.8% in Q3’2024, and

- HF Group’s core earnings per share increased significantly by 104.6% to Kshs 1.3, from Kshs 0.6 in Q3’2023, mainly driven by the 5.3% increase in total operating income to Kshs 3.0 bn, from Kshs 2.8 bn in Q3’2023 which outpaced the 15.2% increase in total operating expenses to Kshs 25.7 bn, from Kshs 22.3 bn in Q3’2023;

Real Estate

During the week, In the hospitality sector, during the week, Vipingo Ridge Resort in Kilifi County was recognized as Africa’s Best Golf Real Estate Venue in 2024 during the 11th edition of the annual World Golf Awards held in Madeira, Portugal. The award highlighted the Resort’s growing reputation as a premier destination for both golf enthusiasts and other investors in the sport.

In the REITs sector, during the week, Future Construkt Investment Managers Ltd, a subsidiary of Construkt Africa LLC was granted a REIT Manager license by the Capital Markets Authority-Kenya. In line with its vision, Construkt Africa had recently launched Teja Spaces, a premier co-working office at Delta Riverside Office Park, marking the first of many planned projects as the company continues its regional expansion.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 18.03% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

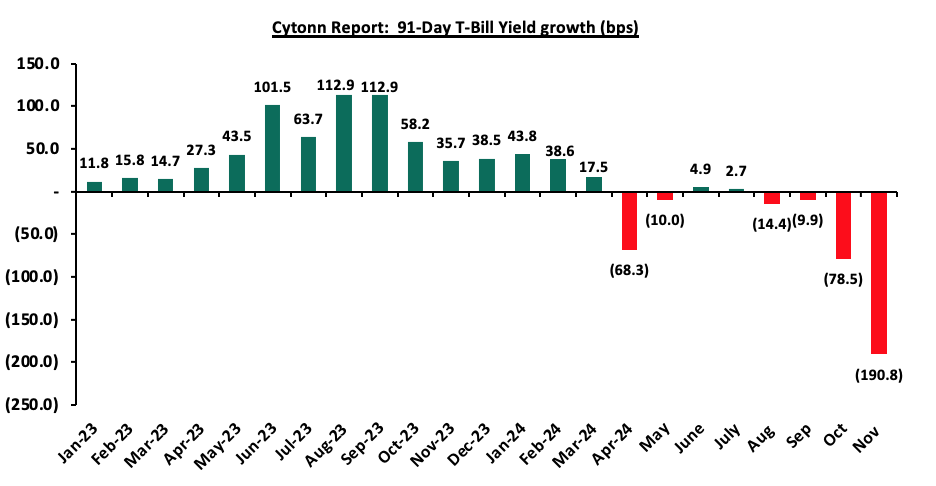

During the month of November 2024, T-bills were oversubscribed, with the overall average oversubscription rate coming in at 347.2%, higher than the oversubscription rate of 305.9% recorded in October 2024. The overall average subscription rate for the 91-day paper increased to 611.1% from 546.6%, while the overall average subscription rates for the 182-day and 364-day paper increased to 288.7% and 300.1% respectively, from 278.4% and 237.2% respectively, which was recorded in October 2024. The average yields on the government papers were on a downward trajectory during the month, with the 91-day, 182-day, and 364-day papers yields decreasing by 190.8 bps, 243.7 bps, and 196.0 bps to 13.1%, 13.4%, and 14.2% respectively from 15.0%, 15.8%, and 16.1% recorded the previous month. For the month of November, the government accepted a total of Kshs 171.3 bn of the Kshs 333.3 bn worth of bids received in T-Bills, translating to an acceptance rate of 51.4% compared to an acceptance rate of 46.5% in the month of October. The chart below shows the yield growth rate for the 91-day paper from 2023 to date:

This week, T-bills were oversubscribed for the ninth consecutive week, with the overall oversubscription rate coming in at 211.1%, albeit lower than the oversubscription rate of 321.8% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 18.8 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 470.4%, albeit lower than the oversubscription rate of 623.3% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 104.2% and 214.2% respectively from to 171.4% and 351.6% recorded the previous week. The government accepted a total of Kshs 34.7 bn worth of bids out of Kshs 50.7 bn bids received, translating to an acceptance rate of 68.4%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 80.5 bps, 87.2 bps and 78.4 bps to 12.5%, 11.3% and 11.3% respectively from 13.3%, 12.2% and 12.0% respectively recorded the previous week

So far in the current FY’2024/25, government securities totalling Kshs 787.0 bn have been advertised. The government has accepted bids worth Kshs 919.9 bn, of which Kshs 667.1 bn and Kshs 252.8 bn were treasury bills and bonds, respectively. The government has a domestic borrowing surplus of Kshs 408.4 bn in FY’2024/25, against a net domestic borrowing target of Kshs 408.4 bn for FY’2024/25.

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year to Date (YTD):

Additionally, November 2024 bonds were oversubscribed, with the overall average oversubscription rate coming in at 205.0%, higher than the average oversubscription rate of 139.9% recorded in October 2024. The reopened bonds FXD1/2022/015 and FXD1/2023/010 with tenors to maturity of 12.4 years and 8.2 years respectively and fixed coupon rates of 13.9% and 14.2% respectively, received bids worth Kshs 33.0 bn against the offered Kshs 25.0 bn translating to an oversubscription rate of 132.2%, with the government accepting bids worth Kshs 25.7 bn, translating to an acceptance rate of 77.7%, with the average accepted yields coming at 16.3% and 16.0% respectively. Additionally, the reopened FXD1/2024/010, with a tenor to maturity of 9.3 years and a fixed coupon rate of 16.0%, received bids worth Kshs 55.6 bn against the offered Kshs 20.0 bn translating to an oversubscription rate of 277.9%, with the government accepting bids worth Kshs 30.5 bn, translating to an acceptance rate of 54.9%, with the average accepted yield coming in at 15.9%. The table below provides more details on the bonds issued in October and November 2024:

|

Cytonn Report: Bond Issuances in October and November 2024 |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

14/10/2024 |

FXD1/2016/010- Re-opened |

1.8 |

15.0% |

30.0 |

31.3 |

51.0 |

17.0% |

169.9% |

61.4% |

|

FXD1/2022/010- Re-opened |

7.6 |

13.5% |

17.0% |

||||||

|

21/10/2024 |

FXD1/2022/010-Tapsale |

7.5 |

13.5% |

15.0 |

15.1 |

16.5 |

17.0% |

110.0% |

91.5% |

|

11/11/2024 |

FXD1/2022/015 – Re-opened |

12.4 |

13.9% |

25.0 |

25.7 |

33.0 |

16.3% |

132.2% |

77.7% |

|

FXD1/2023/010 – Re-opened |

8.2 |

14.2% |

16.0% |

||||||

|

18/11/2024 |

FXD1/2024/010 – Re-opened |

9.3 |

16.0% |

20.0 |

30.5 |

55.6 |

15.9% |

277.9% |

54.9% |

|

November 2024 Average |

10.0 |

14.7% |

45.0 |

56.2 |

88.6 |

16.0% |

205.0% |

66.3% |

|

|

October 2024 Average |

5.6 |

14.0% |

45.0 |

46.4 |

67.5 |

17.0% |

139.9% |

76.4% |

|

|

2023 Average |

6.1 |

14.8% |

740.3 |

735.2 |

872.4 |

15.5% |

117.8% |

82.0% |

|

Source: Central Bank of Kenya (CBK)

In the primary bond market, the government is looking to raise Kshs 45.0 bn through the reopened two-ten years and one-twenty years fixed coupon bonds; FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 with tenors to maturity of 8.2 years,9.3 years and 13.3 years respectively. The bonds will be offered at fixed coupon rates of 14.2%,16.0% and 13.2% respectively. Our bidding range for the reopened bonds are 13.20%-13.75%, 14.95%-15.35% and 16.35%-16.55% for the FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 respectively;

Secondary Bond Market:

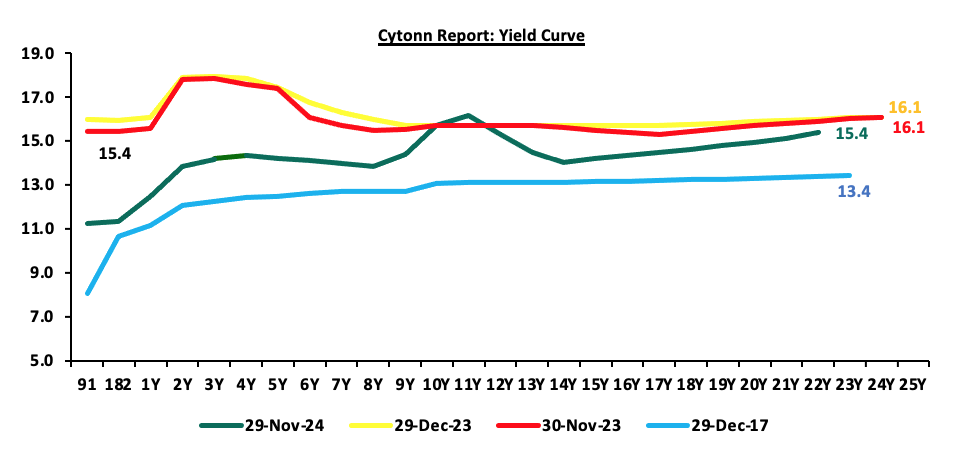

The yields on the government securities were on a downward trajectory during the month compared to October 2024, attributed to easing interest rates following the Monetary Policy Committee (MPC) decision to decrease the Central Bank Rate (CBR) by 75.0 bps to 12.00% from 12.75% earlier in the month and relatively stable inflation which came in at 2.8% in November 2024, which have fostered a more positive outlook among investors. The shift in sentiment indicates increased confidence in the economic landscape. The chart below shows the yield curve movement during the period:

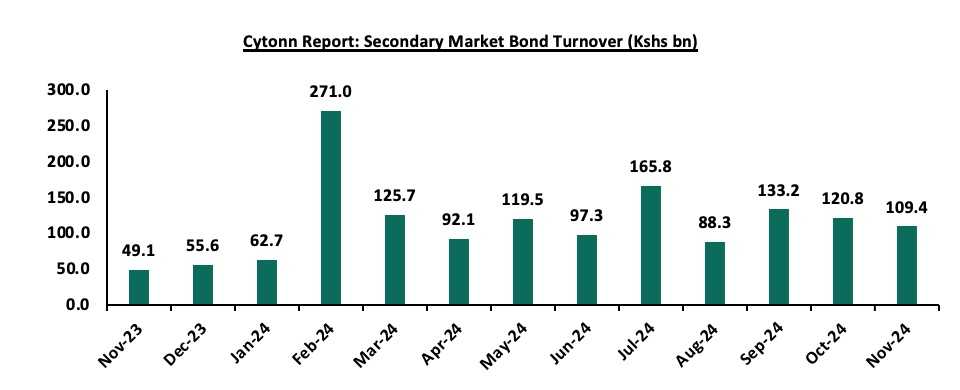

The secondary bond turnover decreased by 9.5% to Kshs 109.4 bn, from Kshs 120.8 bn recorded in October 2024, pointing towards decreased activities by commercial banks in the secondary bonds market for the month of November. However, on a year-on-year basis, the bond turnover increased by 122.7% from Kshs 49.1 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

Money Market Performance:

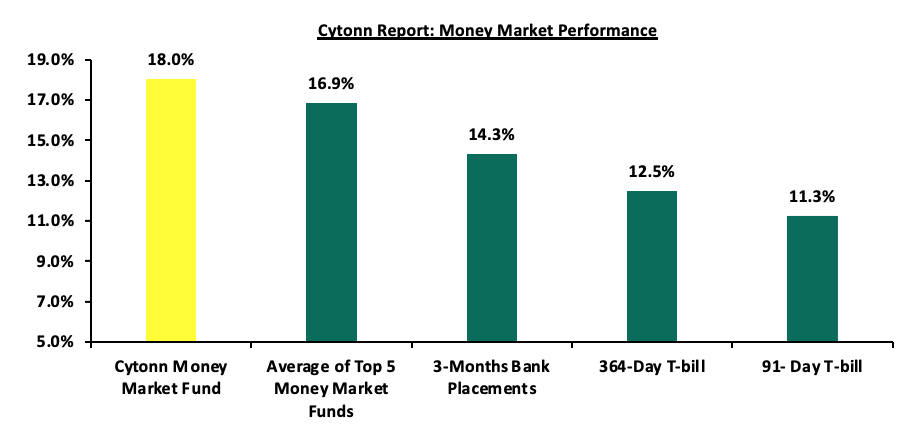

In the money markets, 3-month bank placements ended the week at 14.3% (based on what we have been offered by various banks), while the yield on the 364-day and 91-day papers decreased by 80.5 bps 78.4 bps to 12.5% and 11.3% respectively, from 13.3% and 12.0% respectively recorded the previous week. The yield of Cytonn Money Market Fund remained unchanged at 18.0% recorded the previous week, and the average yields on the Top 5 Money Market Funds decreased by 16.4 bps to 16.9% from the 17.0% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 29th November 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 29th November 2024 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

18.0% |

|

2 |

Lofty-Corban Money Market Fund |

17.0% |

|

3 |

Etica Money Market Fund |

16.9% |

|

4 |

Arvocap Money Market Fund |

16.3% |

|

5 |

Kuza Money Market fund |

16.0% |

|

6 |

Ndovu Money Market Fund |

15.5% |

|

7 |

KCB Money Market Fund |

15.4% |

|

8 |

Mali Money Market Fund |

15.2% |

|

9 |

Jubilee Money Market Fund |

14.9% |

|

10 |

Faulu Money Market Fund |

14.8% |

|

11 |

Orient Kasha Money Market Fund |

14.7% |

|

12 |

Enwealth Money Market Fund |

14.5% |

|

13 |

Nabo Africa Money Market Fund |

14.5% |

|

14 |

Genghis Money Market Fund |

14.4% |

|

15 |

Mayfair Money Market Fund |

14.4% |

|

16 |

Sanlam Money Market Fund |

14.4% |

|

17 |

Apollo Money Market Fund |

14.2% |

|

18 |

Madison Money Market Fund |

14.1% |

|

19 |

Co-op Money Market Fund |

14.1% |

|

20 |

Dry Associates Money Market Fund |

13.9% |

|

21 |

GenAfrica Money Market Fund |

13.9% |

|

22 |

ICEA Lion Money Market Fund |

13.5% |

|

23 |

Absa Shilling Money Market Fund |

13.5% |

|

24 |

British-American Money Market Fund |

13.4% |

|

25 |

Old Mutual Money Market Fund |

13.4% |

|

26 |

CIC Money Market Fund |

13.0% |

|

27 |

Stanbic Money Market Fund |

12.7% |

|

28 |

AA Kenya Shillings Fund |

12.3% |

|

29 |

Equity Money Market Fund |

10.2% |

Source: Business Daily

Liquidity:

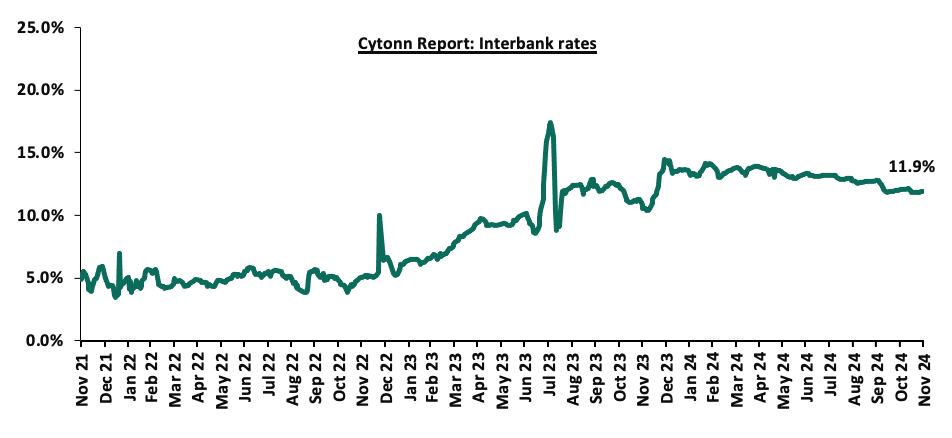

Liquidity in the money markets eased in the month of November 2024, with the average interbank rate decreasing by 19.1 bps to 12.0% from 12.2% recorded the previous month. However, during the month of November, the average interbank volumes traded decreased by 6.1% to Kshs 32.0 bn, from Kshs 34.1 bn recorded in October.

Also, during the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 4.1 bps to remain relatively unchanged from 11.9% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased by 19.4% to Ksh 22.8 bn from Kshs 28.3 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the month, the yields on the Eurobonds recorded a mixed performance, with the yield on the 7-year Eurobond issued in 2024 increasing the most by 7.2 bps to 9.9% from 9.8%, while the yield on the 10-year Eurobond issued in 2018 decreased the most by 24.6 bps to 8.7% from 8.9% recorded at the end of October 2024.

However, during the week, the yields on the Eurobonds were on a downward trajectory, with the yields on the 10-year Eurobond issued in 2018 decreasing the most by 40.9 bps to 8.7% from 9.1% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 28th November 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

2018 |

2019 |

2021 |

2024 |

|||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.2 |

23.3 |

2.5 |

7.5 |

9.6 |

6.2 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

31-Oct-24 |

8.9% |

10.1% |

8.2% |

9.9% |

9.7% |

9.8% |

|

21-Nov-24 |

9.1% |

10.3% |

8.5% |

10.1% |

10.0% |

10.1% |

|

22-Nov-24 |

9.0% |

10.2% |

8.4% |

10.0% |

9.9% |

10.0% |

|

25-Nov-24 |

8.7% |

10.1% |

8.0% |

9.8% |

9.8% |

9.9% |

|

26-Nov-24 |

8.7% |

10.1% |

8.1% |

9.9% |

9.8% |

9.9% |

|

27-Nov-24 |

8.7% |

10.1% |

8.1% |

9.8% |

9.8% |

9.9% |

|

28-Nov-24 |

8.7% |

10.1% |

8.1% |

9.8% |

9.8% |

9.9% |

|

Weekly Change |

(0.4%) |

(0.1%) |

(0.4%) |

(0.3%) |

(0.2%) |

(0.3%) |

|

m/m Change |

(0.2%) |

(0.0%) |

(0.1%) |

(0.1%) |

0.1% |

0.1% |

|

YTD Change |

(1.1%) |

(0.0%) |

(2.0%) |

(0.1%) |

0.3% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 0.4% against the US Dollar, to close the month at Kshs 129.7 from Kshs 129.2 recorded at the end of October 2024. Also, during the week, the Kenya Shilling depreciated marginally by 7.4 bps against the US Dollar to Kshs 129.7 from Kshs 129.6 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 17.4% against the US Dollar, a sharp contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,804.1 mn in the 12 months to October 2024, 15.3% higher than the USD 4,165.1 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the October 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.7% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 7.2% in the 12 months to September 2024, compared to a similar period in 2023.

- Improved forex reserves currently at USD 9.0 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.8% of GDP in Q2’2024 from 3.7% recorded in Q2’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, during the month of November 2024, Kenya’s forex reserves increased by 6.0% to USD 9.0 bn, from USD 8.5 bn recorded the previous month, and the months of import cover increased to 4.6 months from 4.4 months, recorded at the end of October 2024. However, Kenya’s forex reserves decreased by 1.5% during the week to USD 9.0 bn from USD 9.1 bn recorded the previous week, equivalent to 4.6 months of import cover, and above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- November 2024 Inflation

The y/y inflation in November 2024 increased slightly by 0.1% points to 2.8%, from the 2.7% recorded in October 2024. This was in line with our projected range of 2.8% to 3.2%, where our decision was mainly driven by the reduction in the Central Bank Rate (CBR) by 75.0 bps to 12.00% from 12.75%, which would increase the money supply, coupled with increased electricity prices. The headline inflation in November 2024 was majorly driven by increase in prices of commodities in the following categories; Food & Non-Alcoholic Beverages, Housing, Water, Electricity, Gas & other fuels by 4.5% and 0.1% respectively. However, the commodity prices in Transport sector declined by 1.1%. The table below shows a summary of both the year-on-year and month-on-month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – November 2024 |

|||

|

Broad Commodity Group |

Price change m/m (November-2024/ October -2024) |

Price change y/y (November-2024/November-2023) |

Reason |

|

Food and non-alcoholic beverages |

0.6% |

4.5% |

The m/m increase was mainly driven by the increase in prices of commodities such as sugar, maize flour sifted and tomatoes by 5.3%, 5.1% and 2.6% respectively. However, the increase was weighed down by decrease in prices of potatoes, Onion-leeks and bulbs and Cabbages by 2.8%, 2.7%, and 2.6%, respectively |

|

Transport |

0.2% |

(1.1%) |

The slight m/m increase recorded in the transport index despite prices of Super Petrol and Diesel remaining unchanged to sell at Kshs 180.7 and Kshs 168.1 respectively |

|

Housing, water, electricity, gas and other fuels |

(0.1%) |

0.1% |

The slight m/m decrease was mainly driven a decrease in prices of 50 kWh of electricity and 200 kWh of electricity by 0.3% and 0.3% respectively. |

|

Overall Inflation |

0.3% |

2.8% |

The m/m increase was mainly attributable to the 0.6% increase in Food and non-alcoholic beverages. |

Notably, November’s overall headline inflation increased slightly for the first time since August 2024, remaining within the CBK’s preferred range of 2.5%-7.5% for the seventeenth consecutive month. The increase in headline inflation in November 2024 comes amid the maximum allowed price for Super Petrol and Diesel remaining unchanged from the prices announced for the previous month. The Kenya Shilling also recorded a 0.4% month-to-date decline as of 29th November 2024 to Kshs 129.7 from Kshs 129.2, and a 17.4% year-to-date gain from the Kshs 157.0 recorded at the beginning of the year. This depreciation in the exchange rate, though slight, could increase inflationary pressures. The chart below shows the inflation rates for the past 5 years:

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting lower inflation rates. The risk, however, lies in the fuel prices which despite their decline over the last months, still remain elevated compared to historical levels. Key to note is that the Monetary Policy Committee cut the Central Bank Rate by 75.0 bps to 12.00% from 12.75% in its October 2024 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again on 5th December 2024. This cut in the Central Bank Rate is likely to elevate inflationary pressures as consumer spending rises leading to demand- pull inflation. The committee is expected to lower rates further, though gradually, to provide further support for the economy.

- December 2024 Monetary Policy Committee (MPC) Meeting

In the upcoming MPC meeting on Thursday, 5th December 2024, we expect the committee to cut the Central Bank Rate (CBR) to within a range of 11.50% - 11.75% with their decision mainly being supported by:

- Rate cuts by global giant economies. In their last sitting on November 7th 2024, the US Federal Reserve announced their decision to cut its benchmark interest rate by 25.0 bps, to a range of 4.50%-4.75% from a range of 4.75%-5.00%. The European Central Bank announced a rate cut by 25 basis points to 3.25% in October from 3.50% earlier in September 2024. As such, we expect the MPC to follow through with this set precedence of loosening the monetary policy and cut the rate further,

- The need to support the economy by adopting a more accommodative policy that will ease financing activities and support private sector financing. Private sector credit growth came in at 0.4% in September 2024, the slowest in 22 years and a slowdown from 1.3% in August 2024. A rate cut would help unlock the private sector's potential, enabling it to act as a key driver of economic recovery and sustained growth. Additionally, the business environment remains subdued, hence a cut in the CBR will help spur economic growth, increase money supply and improve business activities in the country, and,

- The continued stability of the Shilling against major currencies, despite the October rate cut in the CBR gives room for a moderate cut without reversing the Shilling’s gain. Since the last meeting, the Kenyan Shilling has depreciated marginally by 0.4% against the US Dollar to Kshs 129.7 as at 29th November 2024, from Kshs 129.2 recorded on 8th October 2024. The stability of the Shilling is expected to be supported by the improved foreign reserves which are currently at 4.6 months of import cover, above the statutory requirement of 4.0 months cover.

For more detailed analysis, please see our December 2024 MPC Note

Monthly Highlights:

- During the month, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of October 2024 improved, coming in at 50.4, up from 49.7 in September 2024, signalling a mild recovery in business conditions. This is majorly attributable to reduction in fuel prices and borrowing costs, which resulted to the increase in employment for the first time in three months, accelerated purchasing efforts and mild input cost pressures, prompting a slower increase in average price charged. For more information please see our Cytonn Weekly #45/2024,

- Additionally, during the month, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th November 2024 to 14th December 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene remain unchanged. Consequently, Super Petrol, Diesel and Kerosene will continue to retail at Kshs 180.7, Kshs. 168.1 and Kshs 151.4 per litre respectively. For more information, see our Cytonn Weekly #46/2024,

- During the month, the National Treasury released Kenya’s 2024 Budget Review and Outlook Paper detailing the fiscal performance for FY’2023/24 and fiscal projections for the FY’2025/26. Notably, total revenue including Appropriations in Aid collected grew by 14.3% to Kshs 2.7 tn in FY’2023/24, from Kshs 2.4 tn collected in FY2022/23, representing 16.9% of GDP against the target of Kshs 2.9 tn. The total expenditure and net lending amounted to Kshs 3.6 tn against a target of Kshs 3.9 tn. For more information see our Cytonn Weekly #46/2024, and,

- During the month, the National Treasury gazetted the revenue and net expenditures for the fourth month of FY’2024/2025, ending 31st October 2024, highlighting that the total revenue collected as at the end of October 2024 amounted to Kshs 768.8 bn, equivalent to 29.2% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 87.7% of the prorated estimates of Kshs 877.1 bn. For more information see our Cytonn Weekly #47/2024

Rates in the Fixed Income market have been on a downward trend given the reduced demand for cash by the government and the ease of liquidity in the money market. The government is 136.3% ahead of its prorated net domestic borrowing target of Kshs 172.8 bn, having a net borrowing position of Kshs 408.4 bn. Consequently, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium to long-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the month of November 2024, the equities market was on a downward trajectory, with NSE 10 declining the most by 5.5%, while NASI, NSE 25 and NSE 20 declined by 5.2%, 4.0% and 2.3% respectively. The equities market negative performance was driven by losses recorded by large-cap stocks such as Safaricom, EABL, and Equity Group of 10.4%, 9.4%, and 4.9% respectively.

During the week, the equities market was on a downward trajectory, with NSE 10 declining the most by 2.6%, while NSE 25, NSE 20 and NASI declined by 1.8%, 1.6% and 1.1% respectively, taking the YTD performance to gains of 28.4%, 28.3%, 23.4%, and 21.3% for NSE 10, NSE 25, NSE 20, and NASI respectively. The equities market performance was driven by losses recorded by large-cap stocks such as EABL, ABSA Group, and Equity Group of 7.9%, 2.6%, and 2.1% respectively. The performance was, however, supported by gains recorded by large-cap stocks such as DTB-K, Stanbic Holdings and Safaricom of 1.9%, 1.8% and 0.7% respectively.

Equities turnover increased by 24.1% in the month of November 2024 to USD 47.4 mn, from USD 38.2 mn recorded in October 2024. Foreign investors remained net sellers, with a net selling position of USD 5.2 mn, from a net selling position of USD 4.4 mn recorded in October 2024.

During the week, equities turnover increased significantly by 101.4% to USD 20.0 mn from USD 9.9 mn recorded the previous week, taking the YTD total turnover to USD 568.7 mn. Foreign investors remained net sellers for the eighth consecutive week with a net selling position of USD 2.8 mn, from a net selling position of USD 0.04 mn recorded the previous week, taking the YTD foreign net selling position to USD 7.5 mn.

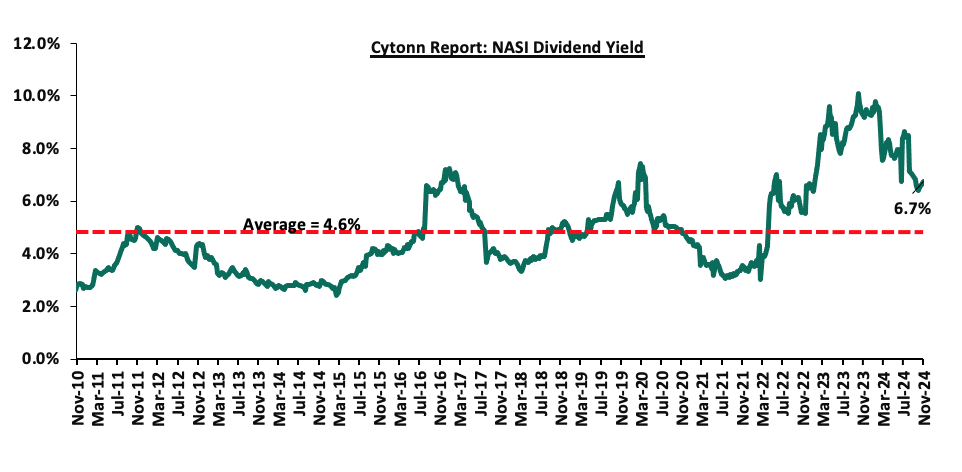

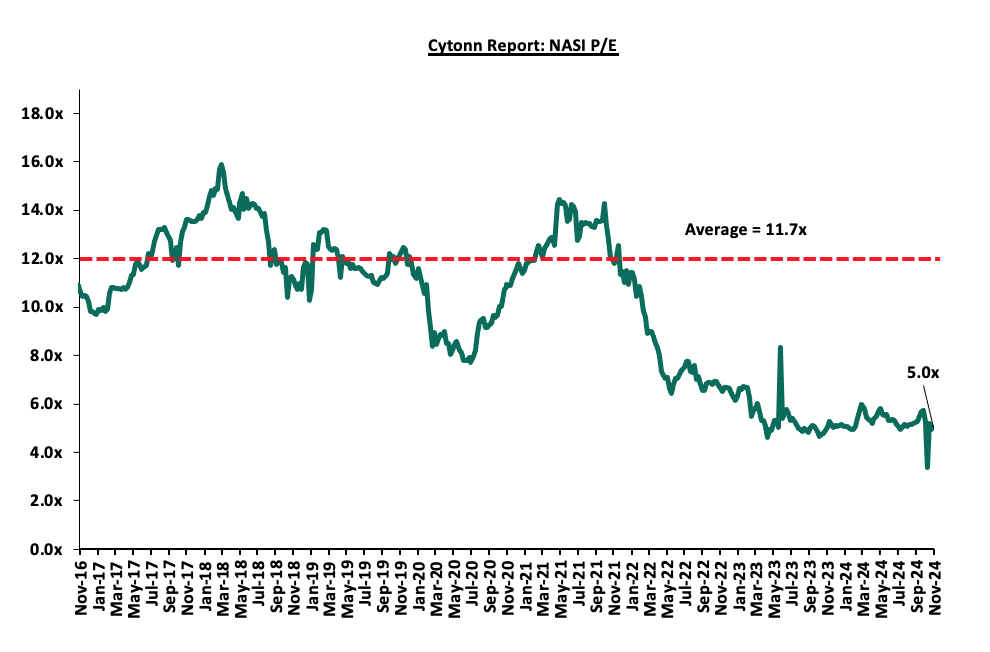

The market is currently trading at a price-to-earnings ratio (P/E) of 5.0x, 57.2% below the historical average of 11.7x. The dividend yield stands at 6.7%, 2.1% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

|

Cytonn Report: Equities Universe of Coverage |

|

||||||||||||

|

Company |

Price as at 22/11/2024 |

Price as at 29/11/2024 |

w/w change |

m/m change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Average |

|

||

|

Jubilee Holdings |

170.0 |

172.0 |

1.2% |

1.2% |

(7.0%) |

185.0 |

260.7 |

8.3% |

59.9% |

0.3x |

Buy |

|

||

|

CIC Group |

2.2 |

2.0 |

(6.4%) |

(7.3%) |

(10.9%) |

2.3 |

2.8 |

6.4% |

43.6% |

0.6x |

Buy |

|

||

|

Equity Group |

46.0 |

45.0 |

(2.1%) |

(4.9%) |

31.6% |

34.2 |

60.2 |

8.9% |

42.7% |

0.9x |

Buy |

|

||

|

NCBA |

44.1 |

43.2 |

(2.0%) |

(2.0%) |

11.1% |

38.9 |

55.2 |

11.0% |

38.9% |

0.8x |

Buy |

|

||

|

ABSA Bank |

15.4 |

15.0 |

(2.6%) |

(2.3%) |

29.4% |

11.6 |

18.9 |

10.4% |

36.8% |

1.2x |

Buy |

|

||

|

Co-op Bank |

14.1 |

13.8 |

(1.8%) |

(2.1%) |

21.6% |

11.4 |

17.2 |

10.9% |

35.5% |

0.6x |

Buy |

|

||

|

Diamond Trust Bank |

52.5 |

53.5 |

1.9% |

0.9% |

19.6% |

44.8 |

65.2 |

9.3% |

31.2% |

0.2x |

Buy |

|

||

|

KCB Group |

39.1 |

38.4 |

(1.7%) |

(0.3%) |

74.9% |

22.0 |

50.3 |

0.0% |

31.0% |

0.6x |

Buy |

|

||

|

Britam |

5.9 |

6.0 |

1.7% |

7.9% |

16.3% |

5.1 |

7.5 |

0.0% |

25.4% |

0.8x |

Buy |

|

||

|

Stanbic Holdings |

127.8 |

130.0 |

1.8% |

0.8% |

22.6% |

106.0 |

145.3 |

11.8% |

23.6% |

0.9x |

Buy |

|

||

|

Standard Chartered Bank |

241.5 |

243.3 |

0.7% |

4.8% |

51.8% |

160.3 |

260.9 |

11.9% |

19.2% |

1.6x |

Accumulate |

|

||

|

I&M Group |

29.9 |

30.1 |

0.8% |

7.1% |

72.5% |

17.5 |

31.4 |

8.5% |

12.8% |

0.6x |

Accumulate |

|

||

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||||||

Weekly Highlights

Earnings Releases

- Diamond Trust Bank Kenya Q3’2024 Financial Results

Below is a summary of DTB-K Bank’s Q3’2024 performance:

|

Balance Sheet Items |

Q3’2023 |

Q3’2024 |

y/y change |

|

Government Securities |

129.4 |

129.6 |

0.1% |

|

Net Loans and Advances |

289.1 |

275.0 |

(4.9%) |

|

Total Assets |

598.0 |

590.6 |

(1.2%) |

|

Customer Deposits |

457.7 |

441.9 |

(3.5%) |

|

Deposits per branch |

3.5 |

3.3 |

(7.1%) |

|

Total Liabilities |

515.5 |

506.6 |

(1.7%) |

|

Shareholders’ Funds |

71.8 |

74.2 |

3.3% |

|

Key Ratios |

Q3’2023 |

Q3’2024 |

% point change |

|

Loan to Deposit Ratio |

63.2% |

62.2% |

(0.9%) |

|

Government Securities to Deposit ratio |

28.3% |

29.3% |

1.1% |

|

Return on average equity |

10.0% |

11.8% |

1.8% |

|

Return on average assets |

1.3% |

1.5% |

0.2% |

|

Income Statement |

Q3’2023 (Kshs bn) |

Q3’2024 (Kshs bn) |

y/y change |

|

Net Interest Income |

20.1 |

21.3 |

6.1% |

|

Net non-Interest Income |

9.2 |

9.7 |

5.7% |

|

Total Operating income |

29.3 |

31.0 |

5.9% |

|

Loan Loss provision |

6.0 |

5.3 |

(12.3%) |

|

Other Operating expenses |

8.4 |

8.9 |

5.4% |

|

Total Operating expenses |

20.7 |

21.1 |

1.9% |

|

Profit before tax |

8.7 |

9.8 |

12.3% |

|

Profit after tax |

6.6 |

7.4 |

12.6% |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

y/y change |

|

Yield from interest-earning assets |

10.0% |

10.9% |

0.9% |

|

Cost of funding |

5.1% |

6.1% |

1.0% |

|

Net Interest Spread |

4.9% |

4.8% |

(0.1%) |

|

Net Interest Income as % of operating income |

68.6% |

68.7% |

0.1% |

|

Non-Funded Income as a % of operating income |

31.4% |

31.3% |

(0.1%) |

|

Cost to Income Ratio (CIR) |

70.6% |

67.9% |

(2.7%) |

|

CIR without provisions |

50.1% |

50.9% |

0.9% |

|

Cost to Assets |

5.1% |

5.3% |

0.2% |

|

Net Interest Margin |

5.3% |

5.3% |

0.0% |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

19.7% |

17.5% |

(2.2%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

11.7% |

9.5% |

(2.2%) |

|

Core Capital/Total Risk Weighted Assets |

18.6% |

16.3% |

(2.3%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

8.1% |

5.8% |

(2.3%) |

|

Total Capital/Total Risk Weighted Assets |

19.2% |

18.0% |

(1.2%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

4.7% |

3.5% |

(1.2%) |

|

Liquidity Ratio |

60.5% |

52.5% |

(8.0%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

40.5% |

32.5% |

(8.0%) |

For more detailed analysis, see our Diamond Trust Bank Q3’2024 Earnings Note

- NCBA Q3'2024 Financial Results

Below is a summary of NCBA Group’s Q3’2024 performance:

|

Balance Sheet |

Q3’2023 (Kshs bn) |

Q3’2024 (Kshs bn) |

y/y change |

|

Net Loans and Advances |

308.7 |

303.5 |

(1.7%) |

|

Government Securities |

200.8 |

178.4 |

(11.1%) |

|

Total Assets |

678.8 |

678.8 |

0.01% |

|

Customer Deposits |

548.1 |

515.1 |

(6.0%) |

|

Deposits per Branch |

5.0 |

4.4 |

(11.7%) |

|

Total Liabilities |

590.3 |

579.0 |

(1.9%) |

|

Shareholders’ Funds |

88.5 |

99.8 |

12.8% |

|

Key Ratios |

Q3’2023 |

Q3’2024 |

% point change |

|

Loan to Deposit Ratio |

56.3% |

58.9% |

2.6% |

|

Government Securities to Deposit ratio |

36.6% |

34.6% |

(2.0%) |

|

Return on average equity |

18.4% |

23.3% |

4.8% |

|

Return on average assets |

2.5% |

3.2% |

0.8% |

|

Income Statement |

Q3’2023 (Kshs bn) |

Q3’2024 (Kshs bn) |

y/y change |

|

Net Interest Income |

26.0 |

25.1 |

(3.1%) |

|

Net non-Interest Income |

20.7 |

21.8 |

5.2% |

|

Total Operating income |

46.7 |

47.0 |

0.6% |

|

Loan Loss provision |

6.1 |

4.1 |

(32.8%) |

|

Total Operating expenses |

28.1 |

28.6 |

1.6% |

|

Profit before tax |

18.6 |

18.4 |

(0.9%) |

|

Profit after tax |

14.6 |

15.1 |

3.1% |

|

Core EPS |

8.9 |

9.2 |

3.1% |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

y/y change |

|

Yield from interest-earning assets |

10.9% |

13.0% |

2.0% |

|

Cost of funding |

5.2% |

7.6% |

2.3% |

|

Net Interest Spread |

5.7% |

5.4% |

(0.3%) |

|

Net Interest Margin |

6.0% |

5.8% |

(0.2%) |

|

Cost of Risk |

13.0% |

8.7% |

(4.3%) |

|

Net Interest Income as % of operating income |

55.6% |

53.5% |

(2.0%) |

|

Non-Funded Income as a % of operating income |

44.4% |

46.5% |

2.0% |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

15.6% |

18.5% |

2.9% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

7.6% |

10.5% |

2.9% |

|

Core Capital/Total Risk Weighted Assets |

17.2% |

19.6% |

2.4% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

6.7% |

9.1% |

2.4% |

|

Total Capital/Total Risk Weighted Assets |

17.2% |

19.7% |

2.4% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

2.7% |

5.2% |

2.4% |

|

Liquidity Ratio |

52.5% |

53.7% |

1.2% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

32.5% |

33.7% |

1.2% |

For more detailed analysis, see our NCBA Group Q3’2024 Earnings Note

- HF Group Q3'2024 Financial Results

Below is a summary of HF Group Q3'2024 performance:

|

Balance Sheet Items (Kshs bn) |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net loans |

38.5 |

38.2 |

(0.7%) |

|

Government Securities |

9.0 |

13.2 |

45.5% |

|

Total Assets |

60.7 |

65.6 |

8.0% |

|

Customer Deposits |

43.8 |

45.0 |

2.7% |

|

Deposits Per Branch |

1.7 |

1.7 |

0.0% |

|

Total Liabilities |

52.0 |

56.2 |

8.1% |

|

Shareholder's Funds |

8.7 |

9.4 |

7.8% |

|

Balance Sheet Ratios |

Q3’2023 |

Q3’2024 |

% y/y change |

|

Loan to deposit ratio |

93.5% |

84.2% |

(9.3%) |

|

Government Securities to deposit ratio |

20.6% |

29.2% |

8.6% |

|

Return on Average Equity |

4.7% |

5.2% |

0.5% |

|

Return on Average Assets |

0.7% |

0.8% |

0.1% |

|

Income Statement (Kshs bn) |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net Interest Income |

1.91 |

1.96 |

2.6% |

|

Net non-Interest Income |

0.9 |

1.0 |

10.9% |

|

Total Operating income |

2.8 |

3.0 |

5.3% |

|

Loan Loss provision |

(0.2) |

(0.2) |

5.0% |

|

Total Operating expenses |

(2.6) |

(2.7) |

3.9% |

|

Profit before tax |

0.3 |

0.3 |

18.9% |

|

Profit after tax |

0.2 |

0.5 |

104.6% |

|

Core EPS |

0.6 |

1.3 |

104.6% |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

y/y change |

|

Yield from interest-earning assets |

10.4% |

11.6% |

1.2% |

|

Cost of funding |

5.2% |

6.8% |

1.6% |

|

Net Interest Spread |

5.2% |

4.8% |

(0.5%) |

|

Net Interest Margin |

5.3% |

5.0% |

(0.3%) |

|

Cost of Risk |

8.4% |

8.4% |

(0.0%) |

|

Net Interest Income as % of operating income |

67.8% |

66.1% |

(1.7%) |

|

Non-Funded Income as a % of operating income |

32.2% |

33.9% |

1.7% |

|

Cost to Income Ratio (with LLP) |

90.7% |

89.5% |

(1.2%) |

|

Cost to Income Ratio (without LLP) |

82.3% |

81.1% |

(1.2%) |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

5.1% |

3.7% |

(1.4%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

(2.9%) |

(4.3%) |

(1.4%) |

|

Core Capital/Total Risk Weighted Assets |

5.8% |

4.3% |

(1.5%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

(4.7%) |

(6.2%) |

(1.5%) |

|

Total Capital/Total Risk Weighted Assets |

9.6% |

7.7% |

(1.9%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

(4.9%) |

(6.8%) |

(1.9%) |

|

Liquidity Ratio |

25.1% |

26.1% |

1.0% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

5.1% |

6.1% |

1.0% |

For more detailed analysis, see our HF Group Q3'2024 Earnings Note

Asset Quality:

The table below shows the asset quality of listed banks that have released their Q3’2024 results using several metrics:

|

Cytonn Report: Listed Banks Asset Quality in Q3’2024 |

||||||

|

|

Q3'2024 NPL Ratio* |

Q3'2023 NPL Ratio** |

% point change in NPL Ratio |

Q3'2024 NPL Coverage* |

Q3'2023 NPL Coverage** |

% point change in NPL Coverage |

|

Absa Bank Kenya |

12.6% |

9.8% |

2.8% |

65.3% |

67.4% |

(2.1%) |

|

KCB Group |

18.1% |

16.1% |

2.0% |

63.8% |

62.1% |

1.7% |

|

Co-operative Bank of Kenya |

16.5% |

14.9% |

1.7% |

60.5% |

62.1% |

(1.6%) |

|

Stanbic Holdings |

10.4% |

9.0% |

1.4% |

76.5% |

66.3% |

10.2% |

|

HF Group |

24.1% |

22.8% |

1.3% |

74.4% |

74.0% |

0.5% |

|

Diamond Trust Bank |

13.5% |

12.6% |

0.9% |

39.1% |

48.7% |

(9.5%) |

|

Equity Group |

14.4% |

13.6% |

0.7% |

56.8% |

53.4% |

3.4% |

|

NCBA |

12.5% |

12.9% |

(0.4%) |

59.7% |

57.7% |

2.0% |

|

I&M Group |

11.8% |

11.8% |

(0.0%) |

61.3% |

51.8% |

9.5% |

|

Standard Chartered Bank |

7.5% |

14.4% |

(6.9%) |

85.3% |

83.0% |

2.3% |

|

Mkt Weighted Average* |

13.5% |

13.1% |

0.4% |

64.6% |

62.0% |

2.6% |

|

*Market cap weighted as at 29/11/2024 |

||||||

|

**Market cap weighted as at 22/12/2023 |

||||||

Key take-outs from the table include;

- Asset quality for the listed banks deteriorated during Q3’2024, with market-weighted average NPL ratio increasing by 0.4% points to 13.5% from 13.1% in Q3’2023, and,

- Market-weighted average NPL Coverage for the listed banks grew by 2.6% points to 64.6% in Q3’2024 from 62.0% recorded in Q3’2023. The increase was attributable to I&M Group’s coverage ratio increasing by 9.5% to 61.3% from 51.8% in Q3’2023, coupled with Stanbic Bank’s NPL Coverage ratio increasing by 10.2% to 76.5% from 66.3% in Q3’2023. The performance was however weighed down by Diamond Trust Bank’s coverage ratio decreasing by 9.5% to 39.1% from 48.7% in Q3’2023.

Summary Performance

The table below shows the performance of listed banks that have released their Q3’2024 results using several metrics:

|

Cytonn Report: Listed Banks Performance in Q3’2024 |

||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

|

HF Group |

104.6% |

23.0% |

43.6% |

2.6% |

(0.3%) |

10.9% |

33.9% |

24.0% |

2.7% |

45.5% |

84.2% |

(0.7%) |

5.2% |

|

|

Standard Chartered Bank |

62.7% |

24.0% |

91.7% |

17.0% |

10.2% |

73.5% |

36.4% |

30.4% |

(4.8%) |

22.4% |

53.2% |

5.4% |

31.6% |

|

|

KCB Group |

49.0% |

30.8% |

44.0% |

23.9% |

7.0% |

18.3% |

35.1% |

10.7% |

(7.1%) |

(2.7%) |

67.8% |

0.5% |

22.4% |

|

|

I&M Group |

21.3% |

43.5% |

51.2% |

37.4% |

7.9% |

(11.5%) |

26.5% |

15.1% |

2.8% |

13.6% |

68.0% |

(2.1%) |

16.8% |

|

|

Absa Bank Kenya |

19.8% |

24.3% |

43.8% |

17.7% |

10.5% |

13.0% |

26.2% |

1.1% |

(0.7%) |

(6.7%) |

88.5% |

(5.9%) |

26.4% |

|

|

Equity Group |

13.1% |

13.3% |

17.7% |

11.0% |

7.7% |

5.8% |

43.1% |

9.5% |

9.0% |

6.8% |

60.8% |

(5.4%) |

23.7% |

|

|

Diamond Trust Bank Kenya |

12.6% |

15.6% |

25.9% |

6.1% |

0.0% |

5.7% |

31.3% |

17.0% |

(3.5%) |

0.1% |

62.2% |

(4.9%) |

11.8% |

|

|

Stanbic Holdings |

9.3% |

48.6% |

147.4% |

4.8% |

7.0% |

(17.8%) |

35.3% |

(3.1%) |

7.3% |

47.4% |

66.7% |

(12.8%) |

22.2% |

|

|

Co-operative Bank of Kenya |

4.4% |

25.2% |

50.6% |

12.3% |

8.0% |

8.2% |

37.7% |

1.7% |

18.7% |

14.3% |

74.2% |

0.9% |

20.0% |

|

|

NCBA Group |

3.1% |

22.3% |

53.7% |

(3.1%) |

5.8% |

5.2% |

46.5% |

6.9% |

(6.0%) |

(11.1%) |

58.9% |

(1.7%) |

23.3% |

|

|

Q3'24 Mkt Weighted Average* |

24.9% |

25.5% |

52.9% |

14.7% |

7.8% |

14.7% |

36.9% |

10.1% |

2.0% |

7.9% |

66.2% |

(2.4%) |

23.5% |

|

|

Q3'23 Mkt Weighted Average** |

11.2% |

29.7% |

47.9% |

21.3% |

7.0% |

17.0% |

37.7% |

27.7% |

24.4% |

(4.3%) |

70.6% |

19.1% |

21.1% |

|

|

*Market cap weighted as at 29/11/2024 |

||||||||||||||

|

**Market cap weighted as at 22/12/2023 |

||||||||||||||

Key take-outs from the table include:

- The listed banks recorded a 24.9% growth in core Earnings per Share (EPS) in Q3’2024, compared to the weighted average growth of 11.2% in Q3’2023, an indication of improved performance despite the deteriorated operating environment experienced during Q3’2024,

- Interest income recorded a weighted average growth of 25.5% in Q3’2024, compared to 29.7% in Q3’2023. Similarly, interest expenses recorded a market-weighted average growth of 52.9% in Q3’2024 compared to a growth of 47.9% in Q3’2023,

- The Banks’ net interest income recorded a weighted average growth of 14.7% in Q3’2024, a decrement from the 21.3% growth recorded over a similar period in 2023, while the non-funded income grew by 14.7% in Q3’2024 slower than the 17.0% growth recorded in Q3’2023 despite the revenue diversification strategies implemented by most banks, and,

- The Banks recorded a weighted average deposit growth of 2.0%, lower than the market-weighted average deposit growth of 24.4% in Q3’2023.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Industry Report

During the month of November, the following industry reports were released and the key take-outs were as follows;

|

Cytonn Report: Notable Industry Reports During the Month of November 2024 |

|||

|

# |

Theme |

Report |

Key Take-outs |

|

1

|

Hospitality Sector, Real Estate, Building and construction Sector |

Leading Economic Indicators (LEI) September 2024 Report by the Kenya National Bureau of Statistics (KNBS) |

· The Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) September 2024 Reports, which highlighted that the total value of building plans approved in the Nairobi Metropolitan Area (NMA) decreased y/y basis by 8.4% to Kshs 55.9 bn in Q3’2024, from Kshs 61.1 bn recorded in Q3’2023 · The consumption of cement came in at 2.1 bn metric tonnes in Q3’2024, a 12.2% increase from 2.0 bn metric tonnes recorded in Q2’2024. On a y/y basis, the performance represented a 9.6% decrease from 2.4 bn metric tonnes recorded in Q3’2023. · In September 2024, the number of arrivals was 144,996, reflecting a 17.2% decrease from 175,113 in August 2024. On a year-on-year basis, this represented a 7.2% increase compared to 135,248 arrivals in September 2023. · For more information, please see our Cytonn Weekly #47/2024. |

Source: Kenya National Bureau of Statistics (KNBS)

- Statutory Review

There was one notable highlight during the month;

- The government proposed amendments to cap interest on land rates default. Under the proposed changes to the National Rating Bill of 2022, the interest charged on defaulted rates across the 47 counties will not exceed the prevailing Central Bank of Kenya (CBK) lending rate, currently set at 0%. This is a shift from the current framework, where counties independently determine the interest rates. For more information, please see our Cytonn weekly #46/2024

We expect that the government and the authorities will formulate bills and policies to favour and support Real Estate activities. The policies will be expected in Real Estate Investment Trusts, built environments and hospitality sectors.

- Residential Sector

There were three notable highlights during the month;

- Purple Dot International Limited, a residential and commercial property developer broke ground on a high-end residential development in Lang’ata, dubbed Marigold II. The development is situated on a 7-acre plot. Marigold II will consist of 89 townhouses, offering both duplex and triplex units designed to blend modern aesthetics with a sense of community and security. Each of the units will have 4-bedrooms and triplex homes will cost Kshs 42.8 mn while duplex units will cost Kshs 34.8 mn. The development is expected to be completed in June 2025. For more information, please see our Cytonn weekly #45/2024

- Centum Real Estate announced a strategic partnership with Gulf African Bank to offer Shariah-compliant mortgage financing to its customers. This collaboration aims to expand home financing options and drive the uptake of Centum's property portfolio. Under the agreement, customers will access up to 90.0% mortgage financing with a repayment period of up to 20 years and an expedited 48-hour approval process. For more information, please see our Cytonn weekly #46/2024

- The Controller of Budget disclosed that only 30.8% of the Kshs 54.1 bn collected through the housing levy in its first year of enforcement was utilized for affordable housing projects. This amounts to Kshs 16.7 bn, leaving a significant portion of funds idle amidst delays in project implementation. For more information, please see our Cytonn weekly #46/2024

We expect continued vibrant performance in the residential sector within the country sustained by; i) ongoing residential developments under the Affordable Housing Agenda, aiming to reduce the housing deficit in the country currently estimated at 80.0%, ii) increased investment from local and international investors in the housing sector, iii) favorable demographics in the country, shown by high population and urbanization rates of 3.7% p.a and 2.0% p.a, respectively, leading to higher demand for housing units. However, challenges such as rising construction costs, strain on infrastructure development, and limited access to financing will continue to restrict the optimal performance of the residential sector.

- Commercial Office Sector

There was one notable highlight during the month;

- Stanbic Bank Kenya announced that it had extended a Kshs 3.3 bn (USD 25.6 mn) loan to Gateway CCI Limited, a subsidiary of Mauritius-based real estate firm Grit, for the ENEO CCI project located in Tatu City. This development is part of Grit’s efforts to expand its real estate portfolio in Kenya, encompassing both commercial and residential properties. The ENEO CCI building, which serves as the headquarters for Call Centre International (CCI) Global, was commissioned on May 10, 2024. For more information, please see our Cytonn weekly #46/2024

We expect that the Commercial office sector will continue to grow impacted by several key dynamics: i) the increasing presence of multinational companies in Kenya is likely to drive up occupancy levels, ii) co-working spaces are gaining in popularity in the region. However, the sector continues to face challenges due to a significant oversupply of office space, currently standing at 5.8 mn SQFT.

- Hospitality Sector

During the week, Vipingo Ridge Resort in Kilifi County was recognized as Africa’s Best Golf Real Estate Venue in 2024 during the 11th edition of the annual World Golf Awards held in Madeira, Portugal. The award highlighted the Resort’s growing reputation as a premier destination for both golf enthusiasts and other investors in the sport. This is in line with the awards aim of recognizing and honoring excellence in golf tourism, including outstanding golf courses and golf destinations.

We expect that this award may boost Kenya’s hospitality sector by positioning Kilifi County specifically Vipingo Ridge Resort as a premier golf tourism destination attracting international tourists and investors in the sector. This may drive up demand for hotels and serviced apartments accommodations in areas near the golf course.

There was one notable highlight during the month;

- Marriott International has announced plans to invest approximately Kshs 1.2 bn in a new 180-room hotel near Jomo Kenyatta International Airport (JKIA) in Nairobi dubbed Courtyard hotel. This project aligns with Marriott's strategy to expand its footprint in Africa and cater to the rising demand for premium accommodations in Kenya, particularly targeting travelers seeking proximity to major transport hubs. This will be the second facility after the Four Points operated by Sheraton within the airport. The development is aimed to be completed within 30 months and the hotel will have 174 standard suite rooms and six junior suites. For more information, please see our Cytonn Weekly #47/2024.

We expect the hospitality industry to continue improving in performance due to factors such as i) continuous recovery of the tourism industry post COVID-19 with number of tourist arrivals increasing to 489,831 reaching the highest since 2021 in Q3’2024, ii) major international hospitality brands are investing in Kenya, signalling confidence in the country's growth potential like Marriott, Accor and pan pacific hotels, and iii) increased hotel infrastructure, which directly benefits the construction and service industries.

- Real Estate Investments Trusts (REITs)

During the week, Future Construkt Investment Managers Ltd, a subsidiary of Construkt Africa LLC was granted a REIT Manager license by the Capital Markets Authority-Kenya. It is expected that this significant milestone will position the company to attract institutional capital, aligning with its strategic goal of developing large-scale, green affordable housing projects and subsequently managing its institutional-grade commercial property portfolios. In line with its vision, Construkt Africa had recently launched Teja Spaces, a premier co-working office at Delta Riverside Office Park, offering flexible workspaces and premium amenities marking the first of many planned projects as the company continues its regional expansion.

The REITs Association of Kenya celebrated Future Construkt’s progress and reiterated its support for advancing the REITs sector in the country. They described this achievement as a testament to the innovation and resilience driving the future of real estate investment in Kenya.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

We expect the performance of Kenya’s Real Estate sector to remain resilient supported by several factors: i) heightened activities from both private and government sectors, ii) an expanding population driving the need for housing, iii) government efforts under the Affordable Housing Program and the incentives advanced to developers aligned with the program, iv) an increase in deals in the commercial office sector likely to boost occupancy, v) increased investment by international and local investors in the retail sector, and vi) increased international arrivals in the country boosting the hospitality and tourism sector. However, challenges such as rising construction costs, an oversupply in select Real Estate classes, strain on infrastructure development, and high capital demands in REITs sector will continue to impede the real estate sector’s optimal performance by restricting developments and investments.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.