Cytonn Monthly- August 2020

By Research Team, Sep 6, 2020

Executive Summary

Fixed Income

During the month of August both T-bills and T-bonds recorded lower subscription rates than July with the subscriptions coming in at 80.1% for T-bills and 122.9% for T- Bonds down from, 243.1% and 303.0% respectively in July. The reduction in subscriptions can be attributed to lower liquidity in the money markets. The secondary bond turnover also reduced by 15.1% to Kshs 59.0 bn from the Kshs 69.4 bn seen in July. The yield on the T-bills remained unchanged at 6.2%, 6.6% and 7.5% for the 91-day, 182-day and 364-day papers respectively. The y/y inflation for the month of August remained unchanged at 4.4%, as the 2.1% increase in the transport cost was mitigated by 1.0% decline in the Food and non-alcoholic foods prices. The economy remained strong with the Stanbic PMI index coming in at 53 points, a slight decline from the 54 recorded in July. Also, during the week, Amana Capital Limited (ACL) disclosed to its shareholders that Kshs 255.0 mn which represents 59.0% of class B units had been impaired, following the losses incurred by Amana Unit Trust Scheme in the Nakumatt Holdings Limited Commercial paper program;

Equities

During the month of August, the equities market recorded mixed performance, with NASI and NSE 25 gaining by 4.8% and 5.4%, respectively, while NSE 20 declined by 0.5%. The equities market performance was driven by gains in the banking stocks: Co-operative Bank, Equity Group, ABSA and KCB Group gained by 13.3%, 12.6%, 10.6% and 7.6%, respectively. During the month, the listed banking sector released their H1’2020 financial results, recording a 33.6% decline in their Core Earnings per Share (EPS), as compared to a growth of 9.0% in H1’2019;

Real Estate

During the month, various industry reports were released namely: the Leading Economic Indicators (LEI) July 2020, KBA's Housing Price Index Q2’2020, Hass Consult Q2’2020 House Price Index and Hass Consult Q2’2020 Land Price Index. In the residential sector, Kenya Mortgage Refinance Company (KMRC), announced that it would begin lending at the end of September 2020, and disclosed plans to issue a green bond. In the retail sector, South Africa’s Shoprite announced the closure of its branch in Nyali Mombasa, while Tuskys had two of its outlets, in Kisumu and Eldoret closed down due to rent arrears. In the hospitality sector, Sankara, a 5-star hotel in Westlands, resumed operations after nearly five months of closure following the coronavirus outbreak. The Ministry of Transport, Infrastructure, Housing and Urban Development, and Public Works, through the State Department for Housing and Urban Development, published an Expression of Interest (EOI) inviting strategic partners seeking to collaborate with the government in the development of the “The Nairobi Railway City”, in the capacity of master developers and developers. In the infrastructural sector, the government started repairs on the 68.0-kilometre road linking Thika town to Magumu at a cost of Kshs 2.1 bn. Under statutory review, a committee appointed by the State Department of Housing and Urban Development on 8th June 2020 proposed the establishment of a Real Estate Developers Regulatory Board aimed at regulation and promotion of the Kenya real estate sector. In listed real estate, ILAM Fahari I-REIT continued to perform poorly, closing the month at Kshs 5.5 per share, 16.7% lower than the previous month’s closing price of Kshs 6.0.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.56%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 12.75% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#

- Cytonn Apartments Ruaka, “The Alma” has seen significant demand and we shall be raising the prices in the coming week, all those with ongoing discussions are encouraged to close them;

- David Gitau, an Investment Analyst at Cytonn Investments, was on CNBC Africa talking about Kenya’s Central Bank bond issue. Watch David here;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- Cytonn continues to inform the market on the importance of retirement planning and issues affecting the pensions industry. In this week's article we focus on the asset diversification of retirement benefits schemes here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of August, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 80.1%, compared to 243.1% recorded in the month of July. The subscription rates for the 91-day, 182-day and 364-day papers all declined to 137.8%, 64.9% and 72.2%, respectively, from 574.7%, 137.5% and 216.0%, recorded in July. The yields on the 91-day, 182-day and 364-day papers remained unchanged at 6.2%, 6.6% and 7.5%, respectively. The T-bills acceptance rate rose to 90.4% during the month, compared to 66.9% recorded in July, with the government accepting a total of Kshs 69.5 bn of the Kshs 76.9 bn worth of bids received.

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 49.6%, down from 52.3% the previous week, despite high liquidity in the money market. The subscription rates for the 91-day and 182-day papers declined to 68.5% and 31.6%, respectively, from 113.3% and 61.0%, while that of the 364-day paper increased to 60.0%, from 19.3%. The acceptance rate increased to 91.8% from 85.4% the previous week. The yields on the 91-day, and 182-day papers remained unchanged at 6.3% and 6.6%, while that of the 364-day paper rose marginally to 7.6% from the 7.5% recorded last week.

For the month of August, the Kenyan government issued an Infrastructure bond, IFB1/2020/11 which was oversubscribed with the average subscription rate coming in at 145.0%, with bids worth Kshs 101.5 bn received compared to the offered amount of Kshs 70.0 bn offered and the government only accepted 77.5% of the amounts i.e. Kshs 78.6 bn. The market weighted average rate for the bond came in at 11.4%, which was in-line with our expectations of 11.4%-11.6%.

Additionally, the treasury opened a tap sale for a 20-year bond, FXD2/2018/20, with an effective tenor of 18 years. The issue was oversubscribed with the subscription rate coming in at 100.7% and the whole amount was accepted, as the government received bids worth Kshs 40.3 bn, higher than the Kshs 40.0 bn offered, mainly attributable to the high liquidity in the money markets. The yield on the bond came in at 12.9%.

For the month of September, the Government has floated a triple issues, namely, FXD2/2010/15, FXD1/2020/15 and FXD1/2011/20 with effective tenors of 5.3, 14.5 and 10.7 years respectively, for a total value of Kshs 50.0 bn for budgetary support. The bonds have coupon rates of 9.0%, 12.8% and 10.0%, respectively with the period of sale set to end on 15th September 2020. Our recommended bidding range is 10.3% - 10.5% for FXD2/2010/15, 12.2% - 12.4% for FXD1/2020/15, and 11.7% - 11.9% for FXD1/2011/20 which is in line with the trading yields in the secondary market.

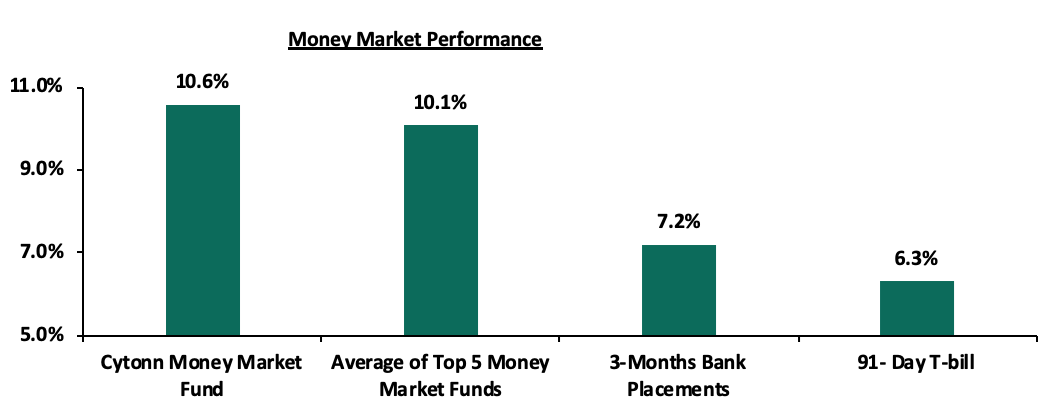

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day T-bill remained unchanged at 6.3%. The average yield of Top 5 Money Market Funds increased marginally to 10.1%, from 10.0% previously. The yield on the Cytonn Money Market remained unchanged at 10.6%, similar to what was recorded the previous week.

Secondary Bond Market:

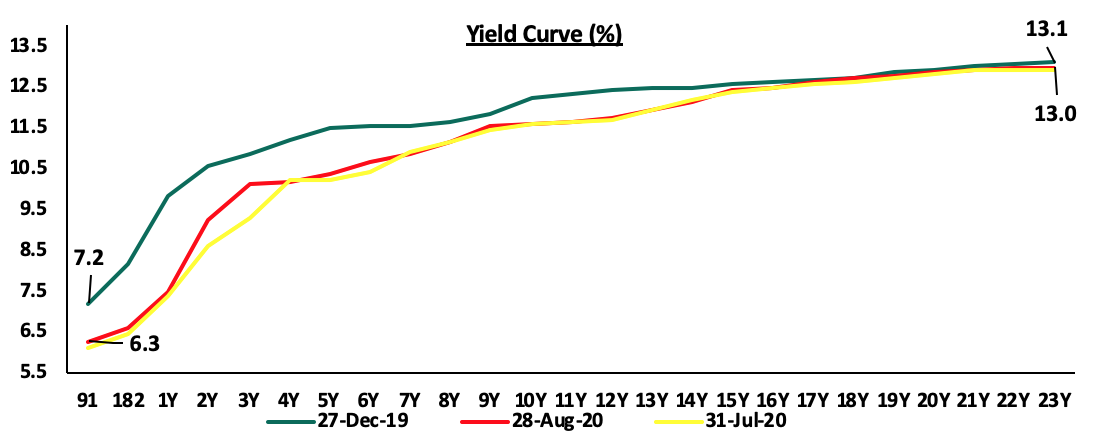

In the Month of August, the yields on government securities remained relatively stable and the bond turnover decreased by 15.1% to Kshs 59.0 bn, from Kshs 69.4 bn recorded last month. The FTSE NSE bond index declined marginally by 0.1% to close the month at 97.5 from 97.9 in July, and bringing the YTD return to 0.1%. The chart below is the yield curve movement.

Liquidity:

The money markets remained liquid in the month of August, with the average interbank rate rising marginally to 2.5%, from 2.3% recorded in July supported by government payments. During the week, the market remained liquid with the average interbank rate rising marginally to 3.2% from 3.0% recorded the previous week, which the Central Bank of Kenya in their weekly bulletin attributed this to government payments which offset tax remittances. The average interbank volumes declined by 39.4% to Kshs 10.0 bn, from Kshs 16.5 bn recorded the previous week.

Kenya Eurobonds:

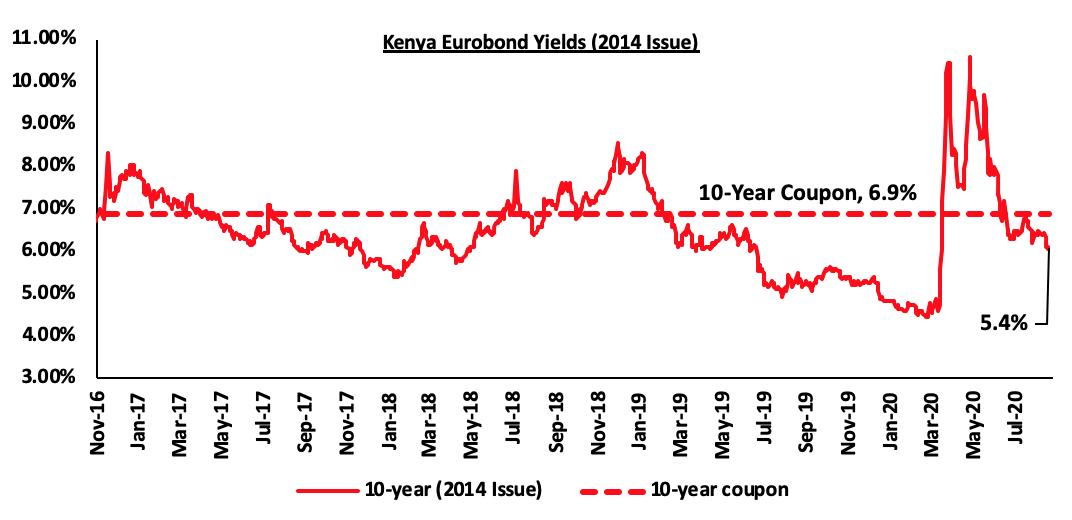

During the month of August, the yields on Kenyan Eurobonds were on a declining trend pointing to improved investor sentiments supported by the confidence in the country following the easing of movement restrictions in the country and resumption to work for most businesses. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.4% points to 6.0% in August, from 6.4% in July. During the week, the yield on the 10-year Eurobond declined by 0.6% points to 5.4%, from the 6.0% recorded the previous week.

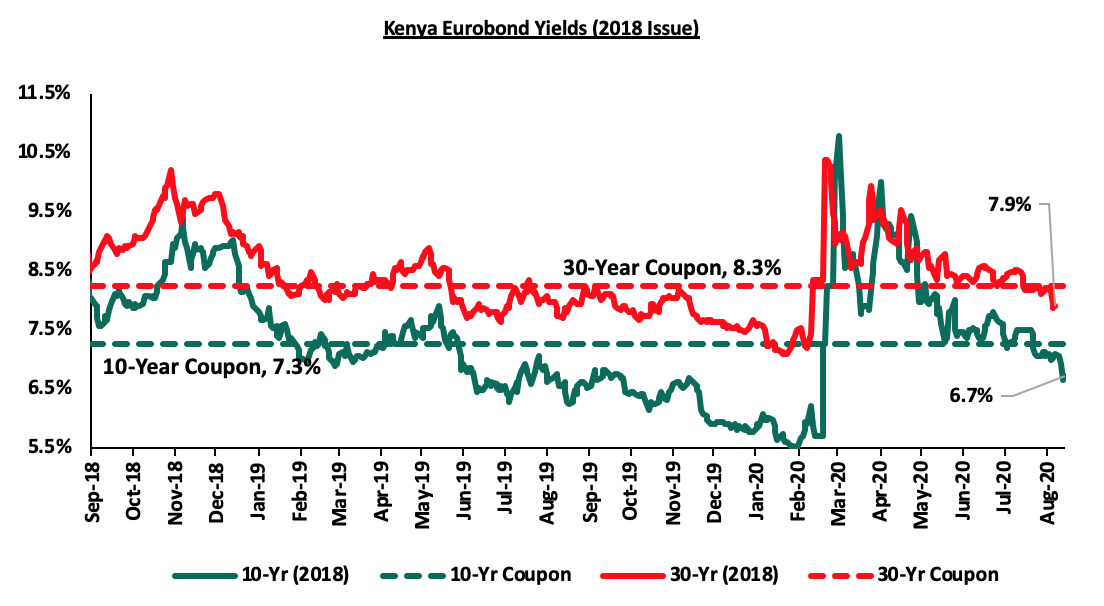

During the month, the yields on the 10 year Eurobonds issued in February 2018 declined by 0.4% points to close at 7.1% in August, from the 7.5% recorded in July. The 30 year Eurobond also declined by 0.2% points to 8.2%, from 8.4% in July. During the week, the yield on the 10-year Eurobond declined by 0.4% points to close at 6.7% from 7.1% recorded the previous week. The 30-year Eurobond declined by 0.3% point to 7.9%, from 8.2% recorded the previous week.

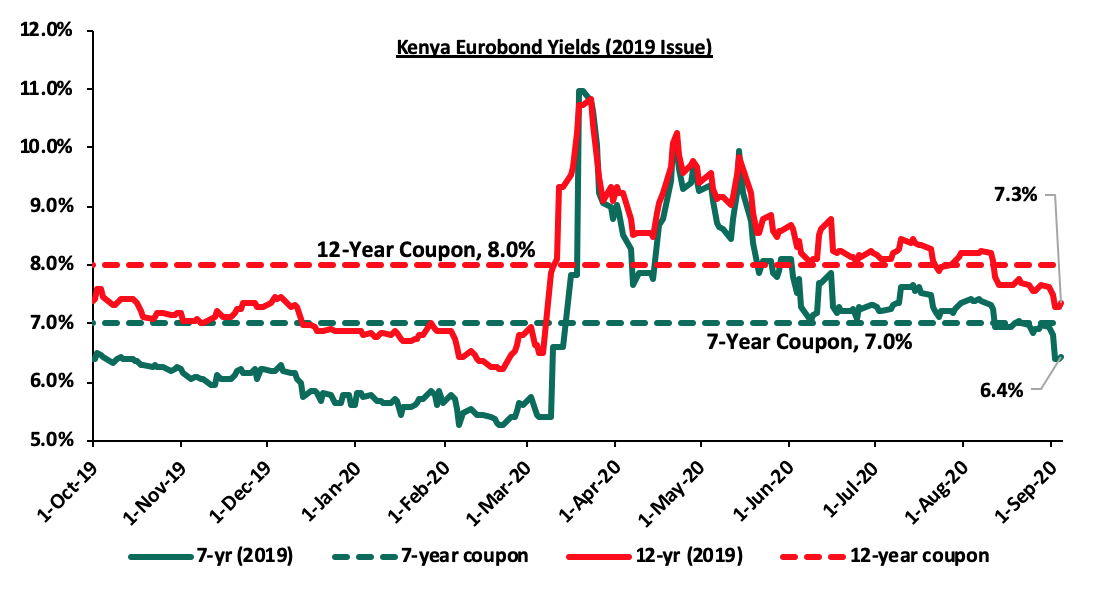

During the month, the yields on the newly issued dual-tranche Eurobond with 7-years declined by 0.4% points to 7.0% in August, from 7.4% in July. The 12-year Eurobond also declined by 0.6% points to 7.6%, from 8.2% recorded in July. During the week, the yields on both the 7-year and 12-year Eurobonds decreased by 0.6% points and 0.4% points, to 6.4% and 7.3%, respectively, from 7.0% and 7.7% recorded the previous week.

Kenya Shilling:

During the month, the Kenyan shilling remained under pressure against the US dollar, losing by 0.5%, to close the month at Kshs 108.2 from Kshs 107.7 in July, mainly attributable to increased importer dollar demand amidst lacklustre dollar inflows. During the week, the Kenya Shilling remained unchanged against the US dollar to close Kshs 108.2. On an YTD basis, the shilling has depreciated by 6.3% against the dollar, in comparison to the 0.5% appreciation in 2019.

In the short term, the shilling is expected to be supported by:

- The high levels of forex reserves, currently at USD 8.9 mn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover;

- Relatively strong Diaspora remittances that increased by 23.4% to USD 277.0 million in July compared to USD 225 million in July 2019, despite being 4.0% lower than the USD 288.5 million in June 2020, leading to the narrowing of the country’s current account deficit to 4.7% of GDP in the 12 months to July 2020, compared to 5.0% of GDP in the 12 months to June.

Weekly Highlight:

The y/y inflation for the month of August remained unchanged at 4.4%, similar to what was recorded in July 2020. Month-on-month inflation came in at 0.2%, which was attributable to:

- A 1.0% decline in the food and non-alcoholic drinks’ index,

- A 1.2% increase in the housing, water, electricity, gas and other fuels index, as a result of an increase in the cost of electricity and kerosene by 0.5% and 27.4% respectively,

- 2.1% increase in the transport index on account of an increase in the pump prices of petrol and diesel by 3.4% and 3.0%, respectively.

|

Major Inflation Changes – August 2020 |

|||

|

Broad Commodity Group |

Price change m/m (August-20/July-20) |

Price change y/y (August-20/August-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

(1.0%) |

5.4% |

The m/m decline was due to a decline in prices of some food items such as onions, tomatoes and spinach |

|

Transport Cost |

2.1% |

13.1 % |

The m/m increase was mainly on account of increases in the pump prices |

|

Housing, Water, Electricity, Gas and other Fuels |

1.2% |

2.1% |

The m/m increase was as a result of the increase in the cost of electricity and kerosene |

|

Overall Inflation |

0.2% |

4.4% |

The m/m increase was due to a 2.1% increase in the transport cost, mainly driven by the increase in fuel prices which was mitigated by the decline of 1.0% in the Food and non-alcoholic foods index |

Going forward, we expect the inflation rate to remain within the government set range of 2.5% - 7.5% as the supply-side disruption due to COVID-19 are offset by lower demand for commodities and as food prices remain low.

Weekly Highlight:

Stanbic Purchasing Manager’s Index

The Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI) for August was released, highlighting that Kenyan firms have seen improvement in economic conditions for the second month with the output and new orders rising solidly, export sales reached a new high, amid looser travel restrictions. Business expectations improved for the first time in six months leading to new investment in branches but employment continued to fall. The seasonally adjusted PMI came in at 53.0 in August, an improvement from the 54.2 recorded in July. Key to note, a PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook.

Also, during the week, Amana Capital Limited (ACL) disclosed to its shareholders that Kshs 255.0 mn which represents 59.0% of class B units had been impaired, following the losses incurred by Amana Unit Trust Scheme in the Nakumatt Holdings Limited Commercial paper program. Consequently, the scheme indicated that every unit holder in the scheme would have their investments in the Amana Shilling Fund Class B, impaired by 59.0%. (Class B shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares, depending on how the company decides to structure its stock). As highlighted in our Cytonn Weekly, the Capital Markets Authority (CMA) placed a 28-day freeze on the withdrawal of funds from Amana Capital owing to the investments lost in Nakumatt’s commercial paper. The 28-day moratorium would enable ACL to work with the Trustee, (NatBank), and Investments Services Limited to improve its liquidity position in order to meet the redemption obligations of the unitholders. Key to note, the freeze has been in place for 2 years following losses from investing in the Commercial Paper programme for Nakumatt and the reported loss on Amana Shilling Fund was at Kshs 275.0 mn equivalent to 49.6% of the Fund.

Additionally, the scheme has indicated that unit holders of Class B shares should consider the below 3 options in regards to their shares;

- Option A: Unit holders will be offered the option of recovering their investment through their acquisition of an equity stake in ACL. Unit holders who opt for this option will be subject to the terms and conditions of the Subscription Agreement which states that;

- The 59.0% funds written off in the Amana UTS Shilling Fund Class B be substituted for a 30% equity stake in ACL,

- The 30% equity shares will be issued proportionally to individual holdings of funds lost in the Amana UTS Shilling Fund Class B, and,

- The dilution of shareholding of ACL would be;

- A new investor has been identified to take up a 60.0% stake (down from 70.0%) and,

- Existing shareholders ownership will be reduced from 100.0% to 30.0% and further to 10.0%.

- Option B: If option A is rejected by the Unit Holders; then without accepting any liability whatsoever resulting from the losses incurred in the Amana Shilling fund, the ACL shareholders (i.e. the new investor and existing shareholders) would propose to dilute their shareholding to 51.0% and issue new shares worth 49.0% to the Unit Holders under the following conditions;

- Unit Holders will be eligible for a seat in the Board in ACL in proportion to their 49.0% ownership,

- The preference shares currently issued to the new investor in ACL would be redeemed and not converted into equity, resulting in the new investor’s automatic exit from ACL within a maximum period of 1 year, and,

- Unit Holders who choose this option would be required to waive the right of any legal action against ACL.

- Option C: Unit Holders who reject the above two options will be requested to either;

- Forfeit their investments in the fund in accordance with the funds Trust Deed Rules, or,

- To continue their investment in the Fund through the conversion of the available balance of their investments in the Fund into equity in ACL in the manner set out under either Option B or Option C

The move is commendable as it finally offers clarity for the investors of the fund, whose funds have been frozen for the past 2 years now. As highlighted in our Cytonn weekly, the 59.0% impairment would lead to a haircut in the value of investments for the unit holders given that for instance, an investor who had invested Kshs 10,000 in the fund stands to lose Kshs 5,900 following the impairment. We had highlighted the below as the possible remedies to settle the conundrum and unlock liquidity for the unit holders:

- Run a quick sale process of the Amana Money Market Fund to a fund manager that enjoys market confidence of money market investors,

- The new manager would write down the value of each investor’s unit to 80.0% their statement value, and then,

- Give Amana unit holders units in the new manager’s fund, equivalent to the value of the written down Amana units. This would preserve the most value for Amana unit holders, provide immediate liquidity to Amana unit holders, and prevent unnecessary market disruption. We believe freezing a fund destroys the maximum value for unit holders and brings unnecessary market jitters, and should be avoided.

We however still maintain our view that it is easier to assist a fund in distress while it is still open for business, once it closes its doors, the task becomes rather impossible

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 69.4% ahead of its prorated borrowing target of Kshs 102.9 bn having borrowed Kshs 174.2 bn. In our view, the government will not be able to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug in the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Markets Performance

During the month of August, the equities market recorded mixed performance, with NASI and NSE 25 gaining by 4.8% and 5.4%, respectively, while NSE 20 declined by 0.5%. The equities market performance was driven by the banking stocks, with the highest gains being recorded by Co-operative Bank, Equity Group, ABSA and KCB Group which were up by 13.3%, 12.6%, 10.6% and 7.6%, respectively.

During the week, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 recording gains of 0.4%, 3.4% and 1.2%, respectively, taking their YTD performance to losses of 16.3%, 30.1%, and 21.4%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance during the week was driven by gains recorded by large-cap stocks, with the highest gains being recorded in Standard Chartered, EABL and BAT, which gained by 8.0%, 7.7% and 1.8%, respectively. However, the gains were weighed down by losses recorded by other large-cap stocks, with the highest declines being recorded by Bamburi, Equity Group and Diamond Trust Bank which declined by 2.9%, 2.2% and 1.5%, respectively.

Equities turnover declined by 23.0% during the month to USD 96.6 mn, from USD 125.5 mn in July 2020. Foreign investors turned net buyers during the month, with a net buying position of USD 1.8 mn, compared to July’s net selling position of USD 49.8 mn.

During the week, equities turnover increased by 8.7% to USD 27.4 mn, from USD 25.2 mn recorded the previous week, taking the YTD turnover to USD 1.0 bn, with foreign investors remaining net buyers, with a net buying position of USD 5.9 mn, from a net buying position of USD 2.6 mn recorded the previous week, taking the YTD net selling position to USD 260.3 mn.

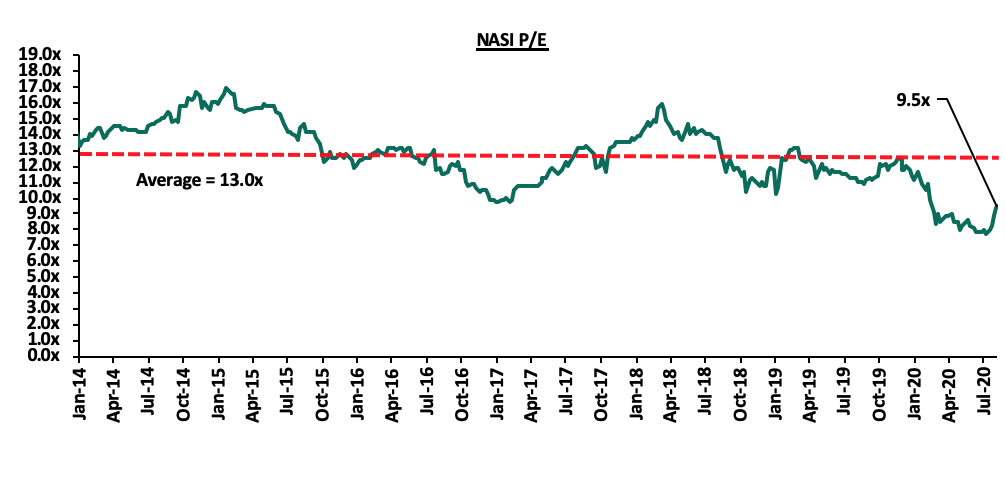

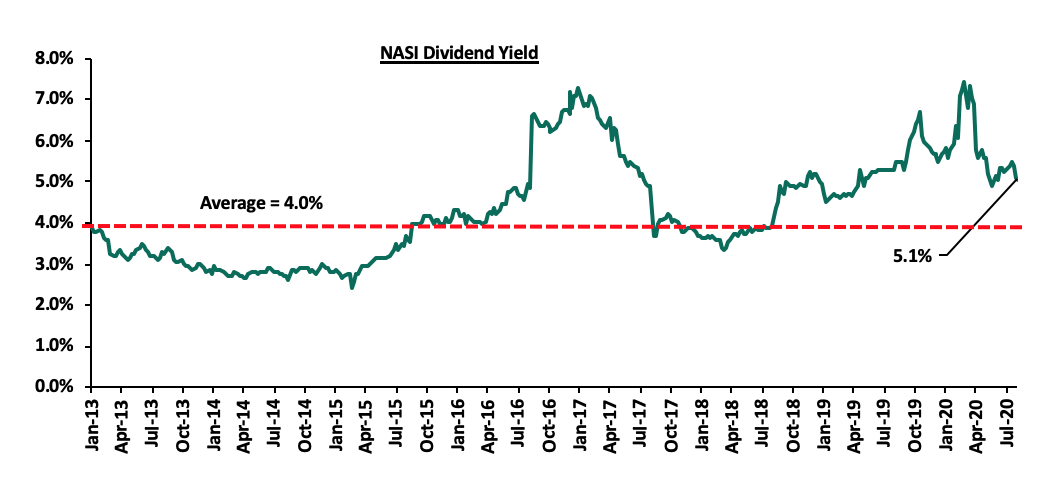

The market is currently trading at a price to earnings ratio (P/E) of 9.5x, 27.3% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.1%, unchanged from the previous week and 1.0% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.5x is 22.9% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

- The Central Bank of Kenya (CBK), directed that Banks will have to get approval before declaring dividends for the current financial year, in a bid to ensure that the banks have enough capital that will enable them to respond appropriately to the COVID-19 pandemic. The CBK has given guidance to lenders asking them to revise their ICAAP (Internal Capital Adequacy Assessment Process) based on the pandemic. For more information, please see Cytonn Weekly #35/2020,

- Co-operative Bank Kenya completed the 90.0% acquisition of Jamii Bora Bank. As highlighted in our Cytonn Weekly #32/2020, the Central Bank of Kenya approved the acquisition of a 90.0% stake of Jamii Bora’s shareholding by Co-operative Bank, which was to be completed on 21st August 2020 after the deal received all regulatory approval following approval by the National Treasury on 4th August 2020. For more information, please see Cytonn Weekly #35/2020,

- The Nairobi Stock Exchange (NSE) reviewed the constituent counters of the NSE 20 and NSE 25, incorporating the inclusion of Stanbic Holdings and Jubilee Holdings PLC in the NSE 20 share index and NSE 25 share Index respectively, and dropping Kenya Airways, effective 14th August 2020. NSE periodically reviews the indices to ensure they give an accurate representation of the performance of the market. For more information, please see Cytonn Weekly #34/2020, and,

- Equity Group Holdings completed the 66.5% stake acquisition of the Banque Commerciale Du Congo (BCDC) at a cost of USD 95.0 mn (Kshs 10.3 bn). The acquisition was first announced by the group on 18th November 2019 and was subject to approvals from the Central Bank of Kenya (CBK), Democratic Republic of Congo’s Central Bank, and the COMESA Competition Commission. Initially, the deal was to cost USD 105.0 mn (Kshs 11.4 bn), however factoring in the adverse effects of the COVID-19 pandemic on the two economies, the two parties agreed to reduce the amount to USD 95.0 mn (Kshs 10.3 bn). For more information, please see Cytonn Weekly #33/2020.

Earnings Releases

All the listed banks have now released their Half year earnings and we shall be releasing the Banking Report in the coming week. The summary of the financial performance of the banks is shown below:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

ABSA |

(84.8%) |

0.9% |

(3.3%) |

2.5% |

7.3% |

4.2% |

32.8% |

4.1% |

8.3% |

17.4% |

81.2% |

8.2% |

15.9% |

|

KCB |

(40.4%) |

23.2% |

25.7% |

22.3% |

7.6% |

6.0% |

31.0% |

4.3% |

34.6% |

54.5% |

73.8% |

17.0% |

16.0% |

|

NCBA |

(38.3%) |

9.6% |

7.7% |

11.2% |

3.4% |

28.0% |

47.3% |

61.3% |

9.1% |

24.0% |

63.6% |

4.0% |

8.9% |

|

DTBK |

(36.5%) |

(3.3%) |

(9.0%) |

1.2% |

5.6% |

5.9% |

25.3% |

24.2% |

(0.1%) |

9.8% |

75.2% |

5.6% |

9.8% |

|

SCBK |

(31.3%) |

(6.3%) |

(12.1%) |

(4.6%) |

6.9% |

6.6% |

31.9% |

(5.2%) |

12.3% |

2.1% |

52.4% |

11.9% |

13.7% |

|

Stanbic |

(31.2%) |

(4.8%) |

(3.1%) |

(0.7%) |

4.5% |

(18.8%) |

44.0% |

(36.7%) |

20.6% |

(13.4%) |

81.9% |

32.8% |

10.9% |

|

I&M |

(29.5%) |

3.4% |

9.4% |

(1.4%) |

5.5% |

(7.1%) |

37.8% |

7.7% |

6.4% |

30.1% |

73.1% |

7.2% |

15.4% |

|

Equity |

(24.4%) |

18.5% |

23.6% |

16.9% |

8.1% |

(13.0%) |

36.9% |

(10.8%) |

18.6% |

24.2% |

72.0% |

22.0% |

17.5% |

|

Co-op |

(3.6%) |

6.8% |

(4.4%) |

11.6% |

8.4% |

(5.1%) |

34.3% |

(42.5%) |

18.9% |

28.0% |

70.8% |

19.4% |

18.6% |

|

HF Group |

N/A |

(12.7%) |

(18.20%) |

(3.9%) |

4.3% |

(68.8%) |

22.4% |

42.1% |

15.8% |

13.5% |

97.4% |

(5.8%) |

(3.0%) |

|

H1'20 Mkt Weighted Average* |

(33.6%) |

10.4% |

10.0% |

10.9% |

7.0% |

(1.1%) |

35.2% |

(3.4%) |

18.5% |

26.1% |

71.5% |

16.1% |

15.4% |

|

H1'19Mkt Weighted Average** |

9.0% |

3.7% |

5.3% |

3.8% |

7.70% |

16.5% |

37.2% |

12.7% |

8.6% |

12.1% |

73.8% |

9.8% |

19.3% |

|

*Market-cap-weighted as at 28/08/2020 |

|||||||||||||

|

**Market-cap-weighted as at 06/09/2019 |

|||||||||||||

Key takeaways from the table above include:

- For the first half of 2020, the core Earnings Per Share (EPS) has declined by (33.6%) as compared to a growth of 9.0% in H1’2019,

- The sector recorded a deposit growth of 18.5% up from the 8.6% growth recorded in H1’2019. Interest expense, on the other hand, grew faster by 10.0%, compared to 5.3% in Q1’2019. Cost of funds, however, declined, coming in at a weighted average of 2.9% in H1’2020, from 3.0% in H1’2019, an indication that the sector was able to mobilize cheaper deposits,

- Average loan growth came in at 16.1%, which was faster than the 9.8% recorded in H1’2019, but slower than the 26.1% growth in government securities, an indication of the banks preference of investing in Government securities compared to lending to individuals and businesses,

- Interest income rose by 10.4%, compared to a growth of 3.7% recorded in H1’2019. The faster growth in interest income may be attributable to the 16.1% growth in loans and increased allocation to government securities. Despite the rise in interest income, the Yield on Interest Earning Assets (YIEA) declined to 9.7% from the 10.4% recorded in H1’2019, an indication of the increased allocation to lower-yielding government securities by the sector. The decline in the YIEA can also be attributed to the reduced lending rates for customers by the sector, in line with the Central Bank Rate cuts. Consequently, the Net Interest Margin (NIM) now stands at 7.0%, compared to the 7.7% recorded in H1’2019 for the listed banking sector, and,

- Non-Funded Income declined by 1.1% y/y, slower than 16.5% growth recorded in H1’2019. The performance in NFI was on the back of declined growth in fees and commission of 3.4%, which was slower than the 12.7% growth recorded in H1’2019. The low growth in fees and commission can be attributed to the recent waiver on fees on mobile transactions below Kshs 1,000 and the free bank-mobile money transfer. Banks with a large customer base who rely heavily on mobile money transactions are likely to take the biggest hit.

For more information, see our Earning notes:

- KCB Group H1’2020 Earnings Note,

- Co-operative Bank H1’2020 Earnings Note,

- Equity Group H1’2020 Earnings Note,

- SCBK H1’2020 Earnings Note,

- I&M H1’2020 Earnings Note,

- ABSA H1’2020 Earnings Note,

- NCBA H1’2020 Earnings Note,

- HF Group H1’2020 Earnings Note,

- DTB-K H1’2020 Earnings Note.

Universe of Coverage:

|

Company |

Price at 28/08/2020 |

Price at 04/09/2020 |

w/w change |

m/m change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

65.8 |

64.8 |

(1.5%) |

3.4% |

(39.7%) |

109.0 |

136.3 |

3.9% |

114.4% |

0.3x |

Buy |

|

I&M Holdings*** |

43.4 |

44.0 |

1.5% |

(0.4%) |

(20.4%) |

54.0 |

66.4 |

5.1% |

56.0% |

0.7x |

Buy |

|

NCBA*** |

23.5 |

23.2 |

(1.1%) |

(2.9%) |

(45.2%) |

36.9 |

32.1 |

1.0% |

39.2% |

0.6x |

Buy |

|

KCB Group*** |

36.4 |

36.8 |

1.0% |

7.6% |

(37.7%) |

54.0 |

46.3 |

9.9% |

35.9% |

0.8x |

Buy |

|

ABSA Bank*** |

9.5 |

9.7 |

1.7% |

10.6% |

(26.7%) |

13.4 |

11.7 |

12.0% |

32.5% |

1.2x |

Buy |

|

Co-op Bank*** |

11.5 |

11.6 |

0.9% |

13.3% |

(35.8%) |

16.4 |

14.3 |

8.4% |

31.6% |

0.8x |

Buy |

|

Standard Chartered*** |

150.3 |

162.3 |

8.0% |

0.5% |

(25.9%) |

202.5 |

177.5 |

7.8% |

17.2% |

1.2x |

Accumulate |

|

Equity Group*** |

36.5 |

35.7 |

(2.2%) |

12.6% |

(38.4%) |

53.5 |

41.1 |

0.0% |

15.2% |

0.9x |

Accumulate |

|

Stanbic Holdings |

78.0 |

85.5 |

9.6% |

(10.2%) |

(31.8%) |

109.3 |

84.9 |

9.0% |

8.3% |

0.7x |

Hold |

|

HF Group |

4.0 |

3.8 |

(5.0%) |

4.1% |

(37.0%) |

6.5 |

3.9 |

0.0% |

3.5% |

0.2x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

|||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Industry Reports

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) July 2020. The key take-outs were as follows:

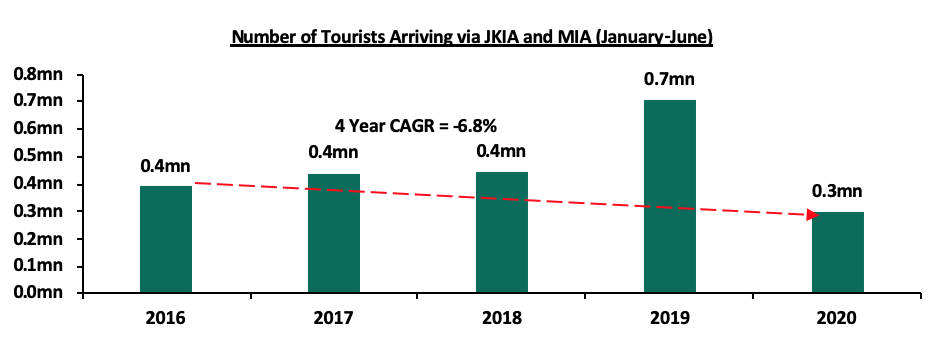

- The total number of visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) from January to June dropped by 58.1% to 0.3 mn persons in 2020, from 0.7 mn persons during the same period in 2019, attributed to the COVID-19 pandemic that led to the issuing of travel advisories by governments of key tourism markets in addition to Kenya government banning international flights in and out of the country in a bid to minimise the spread of the virus,

Source: Kenya National Bureau of Statistics

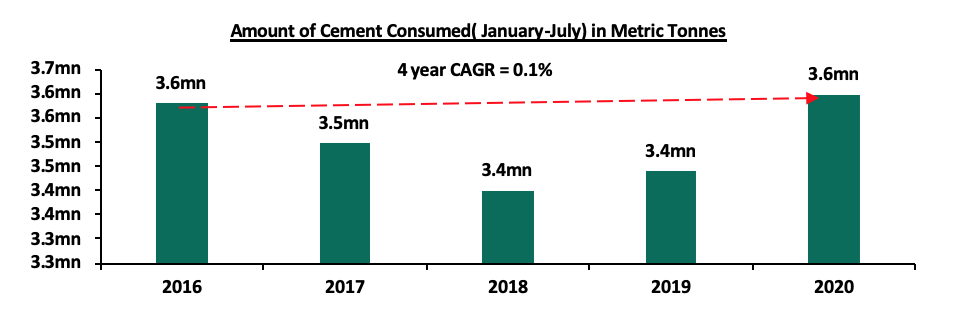

- Cement consumption rose to 3.6 mn metric tonnes for the period between January and July 2020, a 5.3% increase compared to 3.4mn metric tonnes during the same period in 2019 pointing to stable activity in the construction sector despite the Pandemic. The growth in cement consumption is attributed to an increase in the value of building approvals to Kshs 154.5 bn between January and May 2020, a 70.5% increase compared to 90.6 bn in the same period in 2019. The relatively high value of building approvals during the period is attributed to the clearing of a backlog of pending approvals following establishment of a new urban planning technical committee in Nairobi County,

Source: Kenya National Bureau of Statistics

Source: Kenya National Bureau of Statistics

Industry reports release during the month;

|

# |

Theme |

Report |

Key Take-out |

|

1. |

Residential |

· House prices dropped marginally by 0.2% q/q but increased by 2.9% y/y owing to reduced transactions as investors adopted a wait-and-see attitude in the wake of market uncertainty. For more analysis, see Cytonn Weekly #33/2020 |

|

|

|

· House prices contracted by 0.2% in Q2’2020, attributable to the economic slump which has affected both demand and supply in the residential market. The demand for apartments increased significantly accounting for 75.6% of the concluded sales during the quarter due to affordability of the same among buyers. For more analysis, see Cytonn Weekly #33/2020 |

||

|

2. |

Land |

· Land prices softened in both the suburbs and satellite towns declining by a marginal 0.7% q/q and 1.2% q/q, respectively, reflecting that investors still view land as a resilient asset class over the long term. For more analysis, see Cytonn Weekly #33/2020. |

- Residential Sector

During the month;

- Kenya Mortgage Refinance Company (KMRC), a treasury backed lender, announced that it would begin lending at the end September 2020, following approval to operate by the Central Bank of Kenya. The institution Chief Executive Officer, Mr. Johnstone Olteita confirmed that they have so far on-boarded 20 primary mortgage lenders including; Cooperative Bank, Diamond Trust Bank (DTB), Housing Finance (HF) Group, NCBA Group, Absa Kenya, Stanbic and Credit Bank, and, International Finance Corporation(IFC). Prospective buyers will qualify for mortgages of up to Kshs 8.0 mn with a repayment period of up-to 20 years. The facility also plans to issue a green bond (details are yet to be disclosed) by the end of next year with the aim of raising funds for on-ward lending to retail lenders. For more analysis, see Cytonn Weekly #33/2020 and Cytonn Weekly #34/2020,

- The National Cooperative Housing Union, (NaCHU), suspended the implementation of its housing projects citing reduced contributions and repayments by its members due to financial constraints attributed to the ongoing Covid-19 pandemic. For more information, see Cytonn Weekly #33/2020,

- Centum Investments, through its real estate arm, announced the launch of a Kshs 7.0 bn affordable housing development in Kasarani dubbed “265 Elmer One Apartment”, which will consist of approximately 268 units priced from Kshs 1.9mn. For more information, see Cytonn Weekly #35/2020, and,

- Radheshyam Transport, a local go-down and general construction company, announced plans to develop a Kshs 1.0 bn residential project within Donholm, Embakasi Constituency. The project will consist of 424 residential units targeting middle-income earners. For more information, see Cytonn Weekly #35/2020.

We expect the residential sector to record increased activities as private developers complement government efforts in driving the affordable housing initiative.

- Commercial Office Sector

On the commercial office front;

- Industrial and Development Corporation (ICDC), a Kenyan government owned development finance institution, completed the purchase of Development Bank-owned Finance House building, located along Loita Street in Nairobi’s CBD, for Kshs 1.2 bn. For more information, see Cytonn Weekly #34/2020.

We have a negative outlook for the office sector, and expect to see a slight reduction in demand with some firms having downsized due to financial constraints resulting from the current pandemic and as several others adopt working from home and may make it a permanent measure. However, we expect the sector’s performance to gradually recover once the economy picks up.

- Retail Sector

During the month;

- Shoprite Holdings, a South African based international retailer, announced the closure of its branch in Nyali Mombasa. This brings its number of remaining outlets in Kenya to 2: at Garden City and Westgate Mall in Nairobi. For more information, see Cytonn Weekly #32/2020,

- Tuskys, a local retail chain, had its Kisumu and Eldoret branch shut down by auctioneers due to rent arrears. Nevertheless, the retailer’s board of directors confirmed that they had signed terms of agreement with an undisclosed Mauritius-based private equity fund for the provision of a financing facility amounting to approximately Kshs 2.0 bn. For more information, see Cytonn weekly #34/2020 and Cytonn Weekly #35/2020, and,

- Massmart, a South Africa retail chain opened a Kshs 500.0 mn building material outlet, Builders Warehouse in Karen at the Waterfront Mall, bringing the number of its retail outlets in Kenya to 4. For more information, see Cytonn Weekly #34/2020.

The retail sector performance is expected to pick supported by; the continued entry of international retailers driving uptake of space thus heightening the returns for investors, and the securing of equity funding by retail chains in the wake of reduced revenues amid a tough economic environment. Some of the key challenges likely to affect performance of the sector include; i) the growing trend towards online shopping and deliveries which will lead to reduced uptake of retail space, and, ii) the declining disposable income among consumers.

- Hospitality

During the week, Sankara, a 5-star hotel in Westlands, resumed operations after nearly five months of closure following the coronavirus outbreak. The facility will offer room service, dinning, conference facilities and restaurant services with a lean staff of approximately 100 workers. The hotel suspended its operations in April, sending its workers on compulsory leave following the strict measures to control the spread of the novel Covid-19, which led to the suspension of domestic and international flights thus a general disruption of the hospitality sector.

We continue to see resumption of activities in the hospitality sector as easing of the movement restrictions and delay of the dusk-to-dawn curfew boost hotel business. We expect the sector to register increased activities in the medium term supported by; i) repackaging of the tourism sector’s products to appeal to domestic tourists, ii) relaxation of travel advisories by governments of key tourism markets thereby increasing international visitors, and iii) the Ministry of Tourism’s post-corona recovery strategy fund of Kshs 500.0 mn which will cushion the sector from the impact of the pandemic.

Other highlights during the month;

- Global chain International Hotels Group, announced the halting of operations and closure of the InterContinental Hotel, located along City Hall Way in Nairobi, amid the coronavirus economic tumble. For more information, see Cytonn Weekly #32/2020.

- Master- Planned Communities

During the month, Ministry of Transport, Infrastructure, Housing and Urban Development, and Public Works, through the State Department for Housing and Urban Development, published an Expression of Interest (EOI) inviting strategic partners seeking to collaborate with the government in the development of the “The Nairobi Railway City”, a multi-modal, transit-oriented, urban development in the capacity of master developers and developers. In our view, requirements such as a developer’s ability to mobilize cash or financing amounting to a minimum of Kshs 7.5 bn at any one given time, and have an annual turnover above Kshs 10.0 bn over the last five years is unfavorable for most local developers especially in the wake of a tough economic environment. For more information, see Cytonn Weekly #32/2020.

- Infrastructure

During the week, the government started repairs on the 68.0-kilometre road linking Thika town and Magumu along the Nairobi-Nakuru highway at a cost of Kshs 2.1 bn. According to the Ministry of Transport, Infrastructure Cabinet Secretary ames Macharia, the re-tarmacking and expansion of the carriageway is set for completion in December 2021. The road will link to the Nairobi - Nakuru highway which is currently under construction, thus expected to ease traffic congestion into Nairobi and open up areas such as Gatukuyu, Mangu, Kamwangi and Kanjuku, making them more attractive for investment and thus a resultant growth in property value. According to the National Budget 2020/2021, the infrastructure sector was allocated Kshs 172.4 bn in the 2020/2021 budget, the lowest allocation in the last 10 financial years, and 60.4% lower than the Kshs 435.1 bn allocated in the 2019/2020 budget, attributed to diversion of funds towards the mitigation of the spread of the pandemic. Despite the reduced allocation, we expect the government to continue with the implementation of select projects, opening up areas for development and thus boosting the real estate sector.

- Statutory Review

A committee appointed by the State Department of Housing and Urban Development on the 8th June 2020 proposed the establishment of Real Estate Developers Regulatory Board aimed at regulation and promotion of the real estate sector in Kenya. The proposed functions of the Board shall include;

- Registering and regulating housing developers,

- De-registration of rogue developers ,

- Registering housing projects intended for sale to the public by developers,

- Publish and maintain a website of records, for public viewing, of all registered developers and housing projects for which registration has been given,

- Protection of interest of the unit buyers and developers in the development process,

- Creation of a transparent and robust resolutions of disputes between developers and buyers,

- Promoting professionalism in real estate development among developers,

- Enhancing transparency and public trust on real estate development sector, and

- Collecting and analyzing data in respect of real estate development in the housing sector.

The Kenya real estate sector has continued on an upward trajectory having grown by 4.3% in Q1’2020 according to the KNBS Quarterly GDP Report Q1'2020. In line with this, the market has witnessed a growing number of developers fuelled by; the existing housing deficit, attractive and stable returns and the continued demand for property boosted by positive demographics. One of the main challenges facing the sector has been presence of a number of fraudulent developers who fail to deliver products in the wake of an upsurge of off-plan developments. In addition, some buyers fail to honour their contractual obligations of paying up their monthly deposits as agreed with the developer, thus interrupting project cash flows and cycles leading to delay or non-completion of projects. The above have resulted in legal tussles, loss of investor’s investments and lack of confidence in the sector. Therefore, in our view, the establishment of Board will play a significant role in the resolution of these challenges thus boosting the real estate sector through enhancing the ease of doing business, protecting the interest of the sector players and restoring investor confidence.

- Listed Real Estate

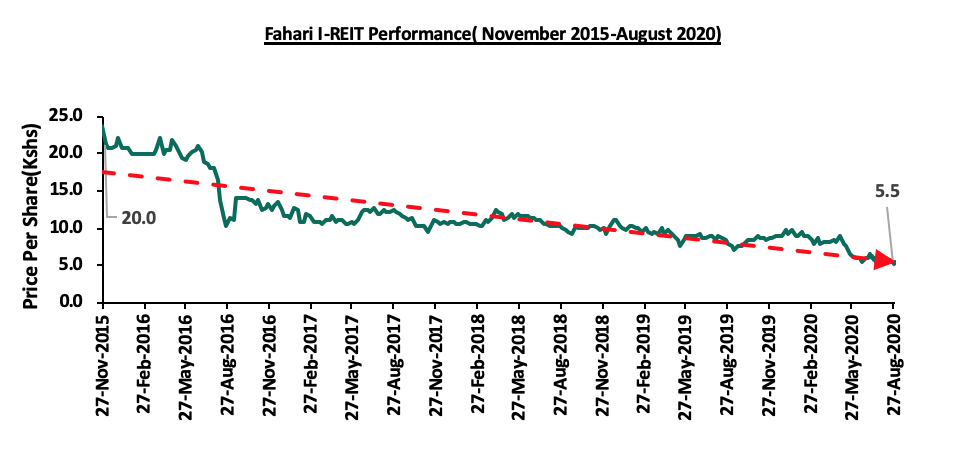

During the month, the Fahari I-REIT closed the month at Kshs 5.5 per share, 16.7% lower than the previous month’s closing price of Kshs 6.0. The instrument continued to perform poorly trading at an average of Kshs 5.6, a 42.8% decline on YTD and 72.1% drop from its initial price of Kshs 20.0 as at November 2015. During the period, the I-REIT recorded its lowest trading price of Kshs 5.1 showing continued lack of investor appetite in the instrument and the continued subdued performance of the real estate market as it continues to grapple with the effects of the COVID-19 pandemic.

The real estate market performance is expected to remain stable supported by the affordable housing sector. We expect recovery in both the retail and the tourism sector as the economy opens up.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.