Cytonn Monthly – February 2018

By Cytonn Investments Team, Mar 4, 2018

Executive Summary

Fixed Income

During the month of February, T-bill auctions recorded an oversubscription, with the average subscription rate coming in at 133.3%, compared to 97.5% recorded in January. The yield on the 91-day paper remained flat at 8.0%, while the yields on the 182 and 364-day papers declined by 20 bps and 10 bps to 10.4% and 11.1% from 10.6% and 11.2%, respectively, the previous month. Kenya’s inflation rate for the month of February declined to 4.5% from 4.8% in January. The y/y inflation rate declined as a result of a base effect but m/m inflation rose by 1.4% mainly due to a 2.2% price increase in the food basket;

Equities

During the month, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 rising 0.7%, 0.4%, and 1.0%, respectively taking the YTD performance to 5.9%, 8.1%, and 1.2%. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 gained 45.5%, 25.3%, and 39.8%, respectively. The Treasury plans to introduce a Consumer Protection Law to replace the Banking (Amendment) Act 2016. Barclays Bank of Kenya released FY’2017 results, recording a decline in core earnings per share by 6.4%

Private Equity

During the month of February, we witnessed increased private equity activity through acquisitions in major sectors such as financial services sector, education sector, and in the real estate sector. Turner and Townsend, a UK headquartered construction and management consultant, acquired a 79.5% stake in Nairobi’s project management company, Mentor Management Limited, MML, for an undisclosed amount;

Real Estate

Real Estate sector experienced increased activity across all the themes in February i) residential theme: Lordship Africa and CIC Group launched projects in Nairobi and Kiambu, respectively, ii) retail: international retailers continued making inroads in the Kenyan market with Shoprite announcing plans to open up stores in 7 malls in Kenya, including Westgate and Garden City, iii) commercial office: Zamara Holdings launched a 46 floor Mixed Used Development in Westlands, and iv) Hospitality: Sarova Group of Hotels took over the management of Spirit of the Mara Lodge in a 15-year partnership agreement;

- Our Senior Manager, Regional Markets, Johnson Denge, discussed affordable housing as highlighted in the Government’s “Big Four” Agenda. Watch Johnson on KBC here

- Our Investment Analyst, Caleb Mugendi, discussed the latest public debt report by the Kenya National Treasury. Watch Caleb on Citizen TV here

- Our Investment Analyst, Stephanie Onchwati, discussed:

- The Eurobond II Issue and Kenya’s public debt levels. Watch Stephanie on NTV’s Press Pass here

- Barclays Bank of Kenya FY’2017 results, the Banking Sector in Sub-Saharan Africa and Kenya’s February 2018 inflation. Watch Stephanie on CNBC here

- The Government’s 2018 Budget Policy Statement. Watch Stephanie on KBC here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com or book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- With over 10 investment ready projects worth over Kshs 82.0 billon of project value, we shall be very selective on new real estate projects going forward, only focusing on Joint Ventures and real estate opportunities with deep value. We are increasingly focused on private equity deals. Should you have any deals in banking, insurance, education, hospitality, and technology sectors, kindly email a teaser to PE@cytonn.com.

- We continue to beef up the team with ongoing hires for; Clerks of Works, Financial Advisor and Unit Manager for Mt Kenya Region among others. Visit the Careers section at Cytonn’s Website to apply.

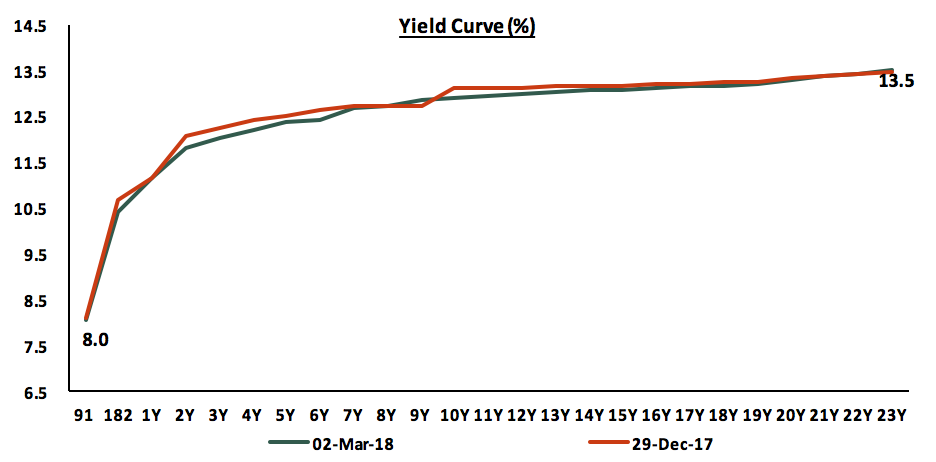

During the month of February, T-bill auctions recorded an oversubscription, with the average subscription rate coming in at 133.3%, compared to 97.5% recorded in January. The subscription rates for the 91, 182 and 364-day papers came in at 121.4%, 121.2% and 150.2% from 97.5%, 111.4% and 83.5%, previous month, respectively. The yield on the 91-day paper remained flat at 8.0%, while the yields on the 182 and 364-day papers declined by 20 bps and 10 bps to 10.4% and 11.1% from 10.6% and 11.2%, respectively, the previous month. The T-bills acceptance rate came in at 89.8% during the month, compared to 85.5% in January, with the Kenyan Government accepting Kshs 113.9 bn of the Kshs 128.0 bn worth of bids received, indicating that bids were largely within ranges the Central Bank of Kenya (CBK) deemed acceptable. The government is ahead of its domestic borrowing target for the current fiscal year, having borrowed Kshs 228.9 bn, against a target of Kshs 200.3 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn from the 2018 Budget Policy Statement (BPS) that was approved by the Cabinet during the month).

This week, T-bills were oversubscribed, with the overall subscription rate coming in at 155.8%, compared to 104.7% recorded the previous week. Subscription rates for the 91, 182, and 364-day papers came in at 192.3%, 163.3%, and 133.7% from 124.2%, 84.3%, and 117.3%, the previous week, respectively. Yields on the 91, 182 and 364-day T-bills remained unchanged during the week at 8.0%, 10.4%, and 11.1%, respectively.

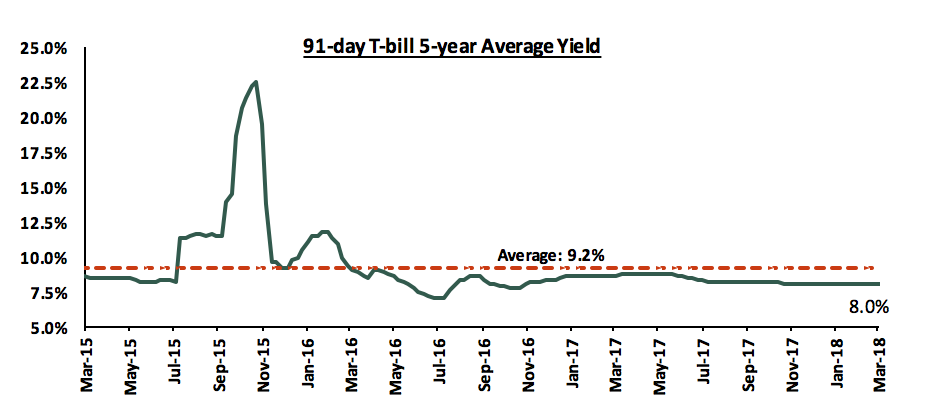

The 91-day T-bill is currently trading below its 5-year average of 9.2%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment we have been experiencing since the passing of the law capping interest rates. We expect this to continue in the short-term, given (i) the discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and (ii) the government being under no pressure to borrow from the local market as it is currently ahead of its domestic borrowing target, and from the foreign markets where it has met approx. 105.0% of its prorated target.

During the month, the Kenyan Government re-opened two bonds, FXD 1/2010/15 and FXD 2/2013/15, with effective tenors of 7.1 and 10.2 years, and coupons rate of 10.3% and 12.0%, respectively, in a bid to raise Kshs 40.0 bn for budgetary support. The overall subscription rate for the issue came in at 60.4%, with the market weighted average bid rates coming in at 12.8% and 13.0%, 10 bps above the average accepted rates of 12.7% and 12.9%, respectively, in line with our expectations. The government accepted only Kshs 13.2 bn out of the Kshs 24.1 bn worth of bids received, translating to an acceptance rate of 54.7%. This week, the government returned to the market through the issue of a tap sale to raise Kshs 27.0 bn following the low subscription rate from the initial auction. The tap sale was grossly undersubscribed, at a subscription rate of 14.1%, with the government only managing to borrow Kshs 3.8 bn. Despite this, we do not expect the government to come under pressure to borrow for the current fiscal year given they are ahead of their domestic borrowing target and have also borrowed approximately 105.0% of their pro-rated foreign borrowing target.

The yields on government securities in the secondary market remained relatively unchanged during the month and YTD. According to the FTSE NSE Bond Index, Treasury bonds listed at the Nairobi Securities Exchange (NSE) gained 1.0% during the month, bringing the YTD performance to 2.6%.

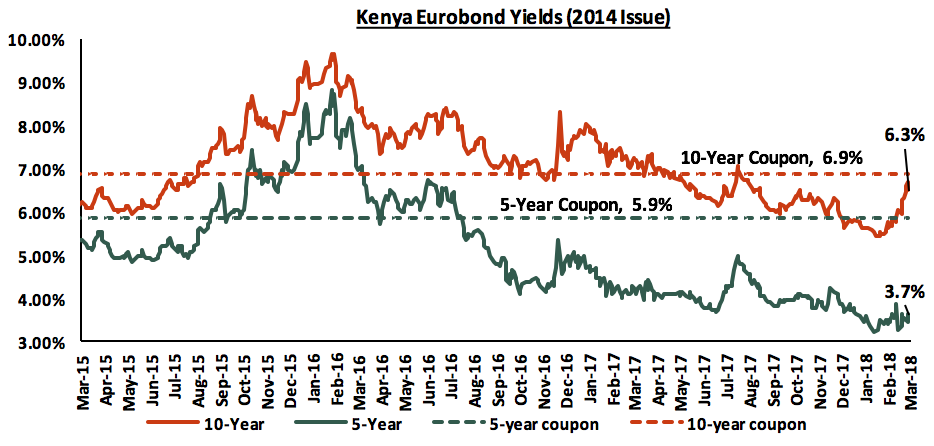

According to Bloomberg, the yield on the 5-year Eurobond issued in June 2014declined by 10 bps to 3.5% from 3.6%, while the yield on the 10-year Eurobond (2014)increased by 40 bps to close at 6.2% from 5.8%, respectively, at the close of January. During the week, yields of both Eurobonds rose by 10 bps to 3.7% and 6.3% from 3.6% and 6.2%, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 5.1% points and 3.3% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

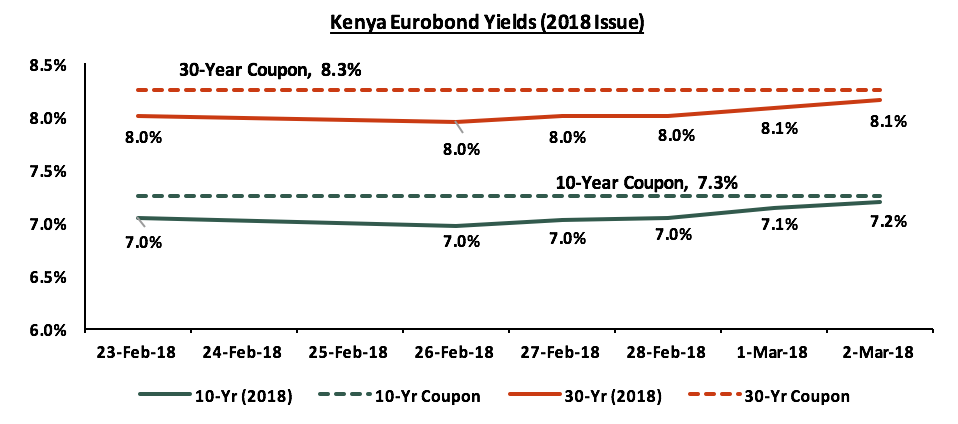

On 23rd February 2018, Kenya issued its second set of Eurobonds, a 10-year,and 30-year Eurobond at coupons of 7.3% and 8.3%, both 30 bps below 7.6% and 8.6%, respectively, which had been advised by the banks working on the deal. The issue was 7.0x oversubscribed with bids received at USD 14.0 bn as compared to the USD 2.0 bntarget despite (i) Moody’s downgrade of the government’s issuer rating to “B2” from “B1” the previous week, and (ii) the International Monetary Fund (IMF) decision to withdraw their stand-by credit facility effective March 2018. Key to note is that an IMF team still in Nairobi discussing a possible new program. Since the issue date, the yields on the 10-year and 30-year Eurobonds have increased by 20 bps and 10 bps to close the week at 7.2% and 8.1% from 7.0% and 8.0%, respectively. The proceeds will go towards development expenditure and debt liability management.

Fitch Ratings, S&P Global Ratings and Moody’s affirmed Kenya’s outlook as “stable”, with Moody’s downgrading the government’s issuer rating to “B2” from “B1”. The table below tracks sovereign credit ratings for the Kenyan Government by various global rating agencies.

|

Kenya Sovereign Credit Rating |

|||||

|

No. |

Credit Rating Agency |

Long-term External & Internal Rating |

Short-term External & Internal Rating |

Overall Issuer Rating |

Outlook |

|

1 |

Fitch Ratings |

B+ |

B |

- |

Stable |

|

2 |

S&P Global Ratings |

B+ |

B |

- |

Stable |

|

3 |

Moody's |

- |

- |

B2 |

Stable |

The Kenya Shilling appreciated by 0.5% against the US Dollar during the month to Kshs 101.6, from Kshs102.2at the end of January, mainly as a result of increased flower exports to the Eurozone in the middle of the month that saw the Shilling hit a 1-year high of Kshs 100.8 against the USD but later depreciated. During the week, the Shilling gained 0.4% against the USDto Kshs 101.3 from Kshs 101.7, the previous week, due to increased inflows from horticultural exports. On a YTD basis, the shilling has gained 1.8% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and has shed 2.3% YTD,

- Improving diaspora remittances which increased by 26.6% to USD203.8 mn in December 2017 from USD 160.9 mn in December 2016 driven by a 39.2% and 30.9% increase in remittances from North America and Europe, respectively, and,

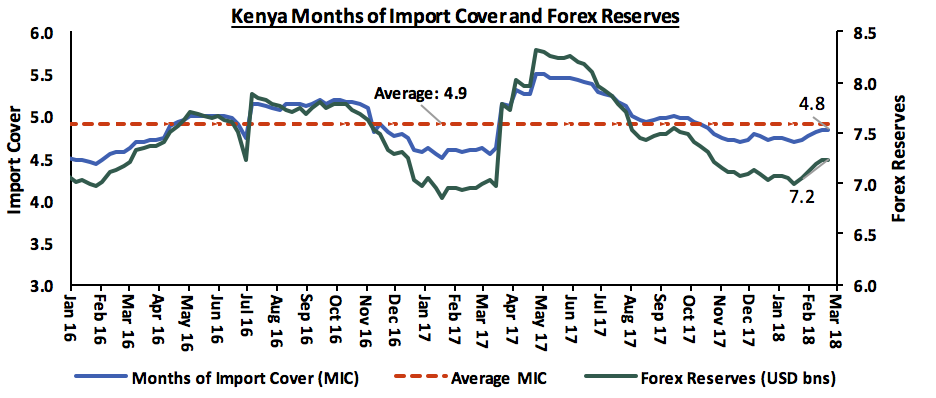

- CBK’s intervention activities, as they have sufficient forex reserves, currently at USD 7.2 bn (equivalent to 4.8 months of import cover). Key to note is that the IMF withdrew the USD 1.5 bn stand-by facility with Kenya effective March 2018 as conditions previously agreed upon for the facility to be extended had not been met. However, an IMF team is still in Nairobi discussing a possible new program. This will deprive Kenya of approx. 1 month of import cover in case of any pressure on our Balance of Payment (BOP) position. Our BOP position improved to a surplus of 1.2% of GDP in November 2017 from a deficit of 1.3% of GDP in November 2016 supported by a capital & financial account balance surplus of approx. 8.0% of GDP, despite a current account deficit of 7.0% of GDP.

The inflation rate for the month of February declined to a four-year low of 4.5%, from 4.8% in January. The y/y inflation rate declined as a result of a base effect but m/m inflation rose due to(i) a 2.2% increase in the food basket due to dry conditions experienced in some parts of the country, (ii) a 0.8% increase in the transport index, driven by increased fuel prices, and (iii) a 0.4% rise in housing, water, electricity, gas and other fuels as the price of cooking fuels rose. Below is a summary of key changes in the Consumer Price Index (CPI) in February;

|

Major Inflation Changes in the Month of February 2018 |

|||

|

Broad Commodity Group |

Price change m/m (Feb-18/Jan-18) |

Price change y/y (Feb-18/Feb-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

2.2% |

3.8% |

This was due to an increase in prices of select food basket items caused by dry weather conditions experienced in some parts of the country |

|

Transport Cost |

0.8% |

7.0% |

This was on account of an increase in pump prices of petrol, kerosene,and diesel |

|

Housing, Water, Electricity, Gas and Other Fuels |

0.4% |

5.7% |

This was attributed to marginal increases in rent and cooking fuel prices |

|

Overall Inflation |

1.4% |

4.5% |

The m/m increase was due to an increase in food prices which has a CPI weight of 36.0% |

Going forward, upward pressure on the inflation rate is likely to come from fuel and transport prices as the Treasury plans on imposing 16.0% Value Added Tax (VAT) on petroleum products, effective September 2018, as per the deal made with the IMF 2 years ago to reduce the budget deficit. We expect inflation rates for 2018 to average 7.5%, which is the upper bound of the government target range of between 2.5% - 7.5%.

During the month, the National Treasury released the Quarterly Economic and Budgetary Review for the first half of the fiscal year 2017/18. Key highlights from the report were (i) the KRA met 91.2% of their HY target, having collected Kshs 709.4 bn against a target of Kshs 777.7 bn, (ii) recurrent expenditure was above target at 105.0% while development expenditure was below target at 67.3%, and (iii) Money Supply (M3) growth was at 8.4% in November 2017, up from 6.2% in November 2016 mainly due to increased lending to the

government. As detailed in our Cytonn Weekly #8/2018, the report pointed to a more positive outlook on government borrowing, with the government now on track towards meeting both their domestic and foreign borrowing target, though concerns still remain around the rising non-concessional debt burden.

During the month, BMI Research, Citibank, Stanbic Bank and Oxford Economics projected that the Kenyan economy would grow by 5.2%, 5.6%, 5.6%, and 5.7%, respectively, generally due to (i) recovery in the agriculture sector after the end of the drought, and (ii) recovery in the business environment following easing of political risk following the prolonged political impasse over the 2017 presidential elections.

Below is a table showing that the Kenyan economy is expected to grow by an average of 5.5% as projected by various research houses, global agencies, and government organizations; it is noteworthy that the highest projection is by CBK, followed by the National Treasury. We shall continue to update this table anytime growth outlook is adjusted by these organizations, or in the event of new research houses expressing a view. At the end of the year, we shall highlight who had the most accurate projection.

|

Kenya 2018 GDP Growth Outlook |

||

|

No. |

Organization |

Q1'2018 |

|

1 |

Central Bank of Kenya |

6.2% |

|

2 |

Kenya National Treasury |

5.8% |

|

3 |

Oxford Economics |

5.7% |

|

4 |

African Development Bank (AfDB) |

5.6% |

|

5 |

Stanbic Bank |

5.6% |

|

6 |

Citibank |

5.6% |

|

7 |

International Monetary Fund (IMF) |

5.5% |

|

8 |

World Bank |

5.5% |

|

9 |

Fitch Ratings |

5.5% |

|

10 |

Barclays Africa Group Limited |

5.5% |

|

11 |

Cytonn Investments Management Plc |

5.4% |

|

12 |

Focus Economics |

5.3% |

|

13 |

BMI Research |

5.3% |

|

14 |

Standard Chartered |

4.6% |

|

Average |

5.5% |

|

Stanbic Bank released their Monthly Purchasing Manager’s Index (PMI) for January, which indicated that the business environment in the country remains stable as political tension witnessed in the last half of 2017 continues to dissipate. The index had declined marginally to 52.9 in January from 53.0 in December 2017 but is the second highest PMI score since December 2016. Firms reported growth in the value of output, new orders and new export business, despite rising labour and raw material costs that resulted in slightly higher input costs. Demand for agricultural products, mainly horticulture, is expected to increase as the Eurozone economy continues to recover; the Eurozone is Kenya’s main horticultural product export destination.

In a bid to attract investment in sustainable development initiatives, and promote the green economy development agenda, the government plans to issue Kenya’s first green bond in the fiscal year 2018/19. This comes nearly 2-years after a proposal was tabled by the Nairobi Securities Exchange (NSE) to introduce green bonds to the market in July 2016. In our view, the issuance of a green bond will serve to attract more investors into the renewable energy space, diversifying energy sources and increasing foreign direct investment volumes into the country from foreign social investment entities that support green living. However, while we commend innovation, the M-Akiba Bond introduced in Q1’2017 as a way of providing an avenue for smaller retail investors to invest in government securities and encouraging a savings & investment culture in Kenyans, might not have met its purpose. The pilot issue managed to raise Kshs 150.0 mn, 100.0% of its target but the 2nd round that had a target of Kshs 1.0 bn only managed 12.8% of this. As mentioned in our Cytonn Weekly #6/2018, prior to issuing the green bond,the government should identify viable projects that fit into the green bond objectives and educate investors, in order to appeal to the target market, for the bond to be successful in achieving its purpose.

Rates in the fixed income market have remained stable as the government rejects expensive bids. With the government under no pressure to borrow for this fiscal year as (i) they are currently ahead of their domestic borrowing target by 14.3%, (ii) have met approx. 105.0% of their pro-rated foreign borrowing target, and (iii) the KRA is not significantly behind target in revenue collection, we expect interest rates to remain stable. Given the changes to the interest rate environment, we shall review our view on fixed income investments in next week’s report.

During the month, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 rising 0.7%, 0.4%, and 1.0%, respectively taking their YTD performance to 5.9%, 8.1% and 1.2%. The performance was driven by gains in select large-cap banking stocks namely Co-operative Bank, KCB Group and Barclays Bank, which rose 8.5%, 4.4%, and 3.8%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 gained 45.5%, 25.3%, and 39.8%, respectively. For this week, the equities market was on an upward trend with NSE 25, NSE 20 and NASI gaining 1.8%, 1.2%, and 0.3%, respectively. The performance during the week was driven by gains in large caps such as Co-operative Bank, Equity Group and KCB Group, which gained 8.1%, 7.6%,and 4.9%, respectively, owing to positive investor sentiment on expectation of a review of Kenya’s interest rate cap.

Equities turnover decreased by 10.9% from USD 197.7 mn registered in January to USD 176.1 mn in February.We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations on select counters.

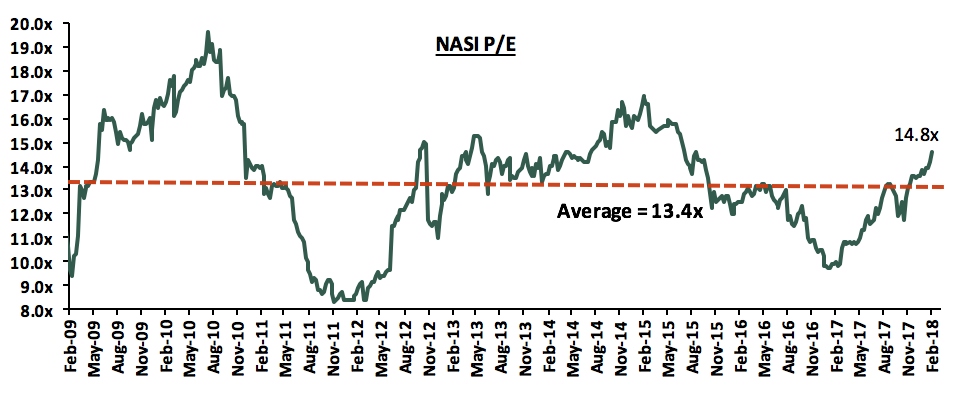

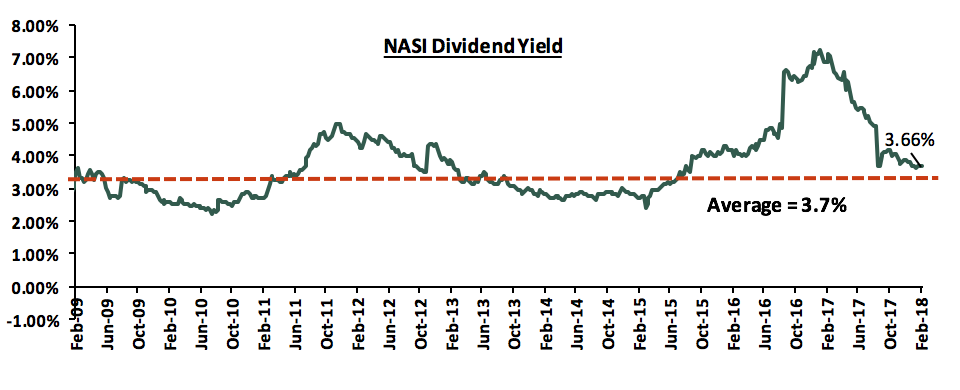

The market is currently trading at a price to earnings ratio (P/E) of 14.8x, which is 10.4% above the historical average of 13.4x, and a dividend yield of 3.7%, similar to the historical average of 3.7%. The current P/E valuation of 14.8x is 52.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 78.3% above the previous trough valuation of 8.3x experienced in December 2011.

In line with our view expressed in Cytonn Weekly # 02/2018, which advocated for the implementation of strong consumer protection framework in order to spur credit growth, the Treasury is planning to introduce a Consumer Protection Law to replace the Banking (Amendment) Act 2016, which stipulated deposit and loan-pricing framework that capped interest rates. The CBK and the Treasury confirmed that a preliminary study on the effects of the interest rate cap resulted in negative effects on the growth of credit, with private sector credit growth at a low of 2.4%. The consumer protection framework is aimed at safeguarding borrowers against expensive bank loans, and this comes after mounting pressure from the International Monetary Fund, which has also called for a review of the law as part of reforms needed in order for the Fund to extend its USD 1.5 bn stand-by credit facility to Kenya. We shall be doing an updated Focus Note to update on the status of the interest rate cap.

During the month, Moody’s downgraded the credit rating of three of the largest Kenyan banks, KCB Group, Equity and Co-operative bank. The move to downgrade stemmed from the downgrade of the Kenyan Government Issuer rating to ‘B2’ from ‘B1’ previously. A downgrade in the rating is likely to make it difficult to negotiate lower credit ratings for a corporate debt financing. However, we maintain our view that the banks still remain fundamentally strong, with capital adequacy ratios above the statutory requirements and the banks being the top 3 out of 11 listed banks by franchise value as per our research.

The CBK has given banks a 5-year waiver to meet the higher capital requirements that will arise as a result of the implementation of the IFRS 9 as at 1 January 2018. The new accounting standard will lead to an estimated 30.0% increase in Non-Performing loans(NPLs), which banks will then pass through their balance sheets, reducing the statutory reserve item in the balance sheet, before affecting the retained earnings and hence a reduction in Tier 1 capital. This waiver will allow banks that are undercapitalized time to raise capital. We maintain the view that banks have to be prudent in loan disbursement, as well as providing loans following a challenging operating environment that had been occasioned by the prolonged electioneering period. For more information, see our Cytonn Weekly #7/2018.

Barclays Bank released FY 2017 results

Barclays Bank released FY’2017 results, recording a 6.4% decline in core earnings per share to Kshs 1.3 from Kshs 1.4 in FY’2016, attributed to a 4.5% decline in operating revenue, despite a 4.5% decline in operating expenses. Key highlights for the performance from FY’2016 to FY’2017 include:

- Total operating income declined by 4.5% y/y to Kshs 30.3 bn from Kshs 31.7 bn, driven by a 9.5% decline in Non-Funded Income (NFI) to Kshs 8.5 bn from Kshs 9.4 bn in FY'2016, and a 2.4% decline in Net Interest Income (NII) to Kshs 21.8 bn from Kshs 22.3 bn,

- Interest Income declined by 3.4% to Kshs 27.2 bn from Kshs 28.1 bn in FY’2016, attributable to 98.9% y/y decline in other interest income to Kshs 0.02 bn from Kshs 1.8 bn, despite a growth in interest income from government securities, which rose by 3.4% y/y to Kshs 5.8 bn from Kshs 5.6 bn. As a result, the yield on interest-earning assets declined to 12.1% from 13.2% in FY’2016,

- Interest expense decreased by 7.2% to Kshs 5.4bn from Kshs 5.8 bn in FY’2016, leading to a decline in the cost of funds to 2.7% from 3.3% in FY’2016. The Net Interest Income declined by 2.4% to Kshs 21.8 bn from Kshs 22.3 bn in FY’2016. The Net Interest Margin thus declined to 9.7% from 10.5% in FY'2016,

- Non-Funded Income (NFI) recorded a drop of 9.5% to Kshs 8.5 bn from Kshs 9.4 bn in FY'2016. The decline in NFI was driven by a 33.7% drop in fees and commissions on loans to Kshs 0.6 bn from Kshs 0.96 bn in FY’2016, and a 3.6% decline in other fees and commissions to Kshs 4.6 bn from Kshs 4.8 bn. With the decline in NFI faster than the decline in NII, the proportion of NFI to total revenue also declined, with the current revenue mix at 72:28 funded to non-funded income from 70:30 in FY’2016,

- Total operating expenses declined by 4.5% to Kshs 19.9 bn from Kshs 15.7 bn, attributable to a 20.7% drop in loan loss provisions (LLP) to Kshs 3.1 bn from Kshs 3.9 bn in FY’2016. Staff costs rose 3.9% to Kshs. 10.1 bn from Kshs. 9.7 bn in FY’2016. The growth in staff costs is attributed to the voluntary employee buyout programme and restructuring that the bank rolled out and saw 323 employees leave the firm last year,

- Following the decline in operating revenue matched by a similar decline in operating costs, the Cost to Income ratio remained stable at 65.8%, compared to 65.7% in FY'2016. Without LLP, the Cost to Income ratio worsened to 55.5% from 53.4% in FY'2016,

- Profit before tax declined by 4.5% to Kshs 10.4 bn from Kshs 10.9 bn. Profit after tax declined by 6.4% to Kshs. 6.9 bn from Kshs. 7.4 bn in FY’2016

- Total assets increased by 4.4% to Kshs 271.2 bn from Kshs 259.7 bn in FY'2016. This growth was driven by a 20.1% growth in government securities to Kshs 58.5 bn from Kshs 48.7 bn in FY’2016. The loan book remained relatively flat at Kshs 168.4 bn compared to Kshs 168.5 bn in FY’2016,

- Total liabilities rose by 4.5% to Kshs 227.1 bn from Kshs 217.3 bn in FY'2016, driven by a 4.4% increase in deposits to Kshs 186.0 bn from Kshs 178.2 bn in FY'2016. The increase in deposits was driven by the retail and business banking segments that benefitted from an increase in transactional accounts following the launch of new products such as the Twin Account and the award-winningZidisha account. Deposits per branch grew by 18.7% to Kshs 2.1 bn from Kshs 1.8 bn in FY’2016, owing to the reduction of branches to 89 from 101 in 2016,

- The faster growth in deposits compared to the loan book led to a drop in the loan to deposit ratio to 90.5% from 94.6% in FY'2016,

- Shareholders’ funds increased by 4.0% to Kshs 44.1 bn from Kshs 42.4 bn in FY’2016, due to a 4.0% y/y increase in retained earnings to Kshs 36.6 bn from Kshs 35.2 bn in FY’2016.

Going forward, we expect BBK’s growth can be propelled by;

- Product diversification to more fee income businesses such as bank assurance, brokerage and fixed income trading to increase its Non Funded Income. The Funded to Non Funded Income ratio of 72:28 is way below peer average of 66:34 in terms of NFI contribution to total revenue,

- Cost efficiency, the cost to income ratio of 65.8% is worse than peer average of 60.8%,

- Improve deposit mobilization, with the LDR ratio of 95%, which is above peer average of 74.8%.

For a comprehensive analysis, see our Barclays Bank FY’2017 Earnings Note.

According to a report by consultancy firm McKinsey, African banks are the second most profitable globally after Latin America. Banks operating in Africa had an average return on equity of nearly 15% in 2016, with banks in Kenya ranking higher with a return on equity of 24.6%, noting that Kenyan and other African banks are doing well because they are innovating on how to meet huge unmet needs among consumers. However, owing to the capping of interest rates, the return on equity amongst Kenyan banks is set to decline by 4.0% - 4.5% going forward. A major risk to Africa’s banking sector is in credit risk management, as non-performing loans (NPLs) continue to rise and are a significant issue for Africa’s banks. This is evident in Kenya as banks’ NPL ratio stood at 10.6% as at December 2017, an increase from 9.1% recorded in FY’2016 as per the CBK’s latest Credit Officer Survey report. The increase in the NPL ratio was attributed to a slowdown in business activity on the back of a prolonged electioneering period.

Below is our Equities Universe of Banking Coverage****:

|

all prices in Kshs unless stated otherwise |

||||||||||

|

No. |

Company |

Price as at 31/01/18 |

Price as at 28/02/18 |

m/m Change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

|

|

1. |

NIC*** |

36.6 |

36.8 |

0.5% |

8.9% |

22.5% |

61.4 |

3.5% |

70.6% |

|

|

2. |

KCB Group |

45.3 |

47.3 |

4.4% |

10.5% |

87.1% |

59.7 |

6.6% |

33.0% |

|

|

3. |

DTBK |

205.0 |

210.0 |

2.4% |

9.4% |

100.0% |

281.7 |

1.3% |

35.4% |

|

|

4. |

I&M Holdings |

116.0 |

120.0 |

3.4% |

(5.5%) |

51.9% |

150.4 |

2.5% |

27.9% |

|

|

5. |

Barclays |

10.6 |

11.0 |

3.8% |

14.6% |

29.4% |

12.8 |

9.1% |

25.5% |

|

|

6. |

HF Group*** |

10.9 |

10.3 |

(5.5%) |

(1.4%) |

(6.8%) |

11.7 |

0.8% |

15.2% |

|

|

7. |

Co-op Bank |

16.6 |

18.0 |

8.5% |

12.2% |

71.6% |

18.6 |

5.4% |

9.0% |

|

|

8. |

Equity Group |

43.0 |

44.0 |

2.3% |

10.7% |

67.6% |

42.3 |

4.2% |

0.3% |

|

|

9. |

Stanchart |

203.0 |

208.0 |

2.5% |

0.0% |

1.5% |

201.1 |

4.3% |

1.0% |

|

|

10. |

Stanbic Holdings |

81.0 |

81.5 |

0.6% |

0.6% |

18.1% |

79.0 |

5.1% |

2.1% |

|

|

11. |

NBK |

9.0 |

7.9 |

(12.8%) |

(16.0%) |

31.9% |

5.6 |

0.0% |

(29.0%) |

|

|

*Target Price as per Cytonn Analyst estimates |

||||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 6th largest shareholder **** In order to expand our coverage to Sub Saharan Africa, we have dropped insurance coverage and will continue with banking coverage but expand it to SSA. |

||||||||||

We maintain a “NEUTRAL” recommendation on equities for investors with short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, and with expectations of higher corporate earnings this year, the market will be cheaper for long-term investors hence we are “POSITIVE” for investors with along-term horizon.

During the month of February, we witnessed heightened private equity activity through acquisitions in sectors such as financial services sector, theeducation sector and in the real estate sector.

In the Education sector, Dubai Investments, a private equity company listed on the Dubai Financial Market stock exchange, is set to invest USD 20 mn (Kshs 2.0 bn) in the consortium set to build a chain of Sabis-branded private schools in Africa. The consortium was previously made up of Centum Investment Company, Investbridge Capital,andSabis Education Network. Prior to the investment, 40.0% of the consortium was owned by Centum, 40% by Investbridge and 20.0% by Sabis. The value of theinvestment by each party and the new shareholding after the investment by Dubai Investments is undisclosed. The consortium, which is investing through the holding company Africa Crest Education (ACE), is building its first school in Runda, Nairobi, and is expected to have its first admission in September 2018, will offer the SABIS International curriculum for Kindergarten to Grade 12 level, and is expected to have a capacity of 2,000 students. For more information, see our Cytonn Weekly #7/2018

In the Financial Services sector, Luxembourg-based private equity (PE) firm FondsEuropéen de FinancementSolidaire (Fefisol) invested Kshs 100.0 mn in Kenya’s Musoni Microfinance Limited for an undisclosed stake. Musoni targets small-scale farmers and the informal sector and offers loans at an interest rate of 1.83% per month for group loans and 1.67% per month for individual loans. The investment by Fefisol will be used to grow their loan book, which stood at Kshs 1.2 bn as at January 2018. The investment by Fefisol will support Musoni’s objective of achieving competitive low-cost lending in the country at a time where bank funding continues to be relatively expensive (with the cheapest banks having an average Annual Percentage Rate (APR) of 15.1% while the most expensive banks having an average APR of 18.7% as at January 2018) and the private sector credit growth remains below the government target of 18.3%, having come in at 2.4% in December. For more information, see our Cytonn Weekly #7/2018

In the Real Estate sector, UK headquartered construction and management consultant, Turner and Townsend, acquired a 79.5% majority stake in Kenyan based Mentor Management Limited, MML, a project management company from private Equity firm Actis for an undisclosed amount. The management team of MML will retain the minority stake. For more information, see our Cytonn Weekly #6/2018

According to a report by the Africa Private Equity Venture Capital Association’s (AVCA) report released during the month, Africa recorded 149 private equity deals in 2017, valued at USD 3.8 bn, down from 150 deals recorded in 2016 valued at USD 3.9 bn. On fundraising, Africa recorded a total of USD 2.3 bn in funds raised for Private Equity down from USD 3.4 bn raised in 2017. The Information and Technology sector was the most active sector for PE deals in Africa in 2017, with its number of PE deals rising to 15.0% of total PE deals from 8.0% in 2016, and the value of funds raised in the sector for venture capital totaling to USD 560.0 mn compared to USD 366.8 mn in 2016, a 53.0% growth. A total of 124 tech start-ups raised funds, with South Africa, Kenya,and Nigeria taking up 76.0% of the funding. South Africa took up USD 168.0 mn of the funding (36.0% of the total), with 42 deals funded, Kenya took up USD 147.0 mn (26.3% of the total), funding 25 deals, while Nigeria took up USD 115.0 mn (20.0% of the total), funding 17 deals. For more information, see our Cytonn Weekly #8/2018

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

In our Annual Real Estate Outlook for 2018, we stated that we expect an increase in real estate development activities this year. This was evident this month with a number of developers announcing plans to launch developments and reports indicating an improvement in the sector's performance as outlined below;

Industry Reports

Deloitte released their African Construction Trends (ACT) Report 2017. The report tracked 303 projects that had broken ground by 1st June 2017, valued at USD 50.0 mn and above in Africa. The key takeouts from the report for the East African Region were:

- The East African region recorded the highest growth both in the number and value of construction projects in Africa with the value and number of projects increasing by 19.0% and 65.1% y/y, respectively. The value of projects increased to USD 32.6 bn in 2017 from USD 27.4 bn in 2016 and number of projects increased to 71 from 43 over the same period. In the whole of Africa, the number of projects increased by 5.9% with the value of projects declining by 5.2%,

- Real estate projects accounted for only 14.1% of the projects sampled in East Africa compared to energy and power that accounted for 22.5% and transport that had the bulk at 52.1%, and

- Central Governments account for the largest number of projects in East Africa at 90.1% compared to 75.0%, 60.2%, 79.7% and 57.5% for Central, South, West and North Africa. This is as private sector financing for construction in East Africa is still in its nascent stages.

In our view, investment in infrastructure and capital projects is an important aspect for enabling GDP growth and more diversified economic and private sector activity. By providing access to basic services such as water, education, and healthcare, infrastructure ensures that economic growth is sustainable and inclusive. However, these investments would yield more impact to GDP growth if they were targeted towards the largest components of our GDP contributors, such as agriculture and agro processing.

Knight Frank also released their 2018 issue of the Inside View Kenya Report that tracks the trends and performance in the real estate sector and gives an outlook for the sector. The key takeouts from the report were;

- Kenya came in 4th in Africa as the home of dollar millionaires. The number of High Net Worth individuals rose by approximately 100% over the last 10 years to approximately 9,400-dollar millionaires. The group are the main drivers of the luxury real estate as they prefer lifestyle products and capital appreciation opportunities, and

- The performance of prime residential property improved in 2017 compared to 2016 with prices increasing by 0.9% over the first nine months of 2017 compared to a 1.0% decrease over the same period in 2016 and rents declining at a slower rate of 2.8% in the first half of 2017 compared to 3.2% decline over the same period in 2016.

Despite the relatively better performance in 2017, the performance is still low and this is attributed to increased supply of prime properties for rents and budget cuts by multinational corporations reducing demand.

During the month, the performance and activities of the various real estate themes was as is outlined below:

- Residential

The residential sector witnessed increased activities in February with various developers announcing plans to undertake developments in the country. These Include;

- This month, according to the dailies Lordship Africa, a subsidiary of European international developer Lordship Group launched a 44-floor apartment complex, named the 88 Nairobi Condominium along Bishop Rd in Upperhill. The development will consist of 1,2,3 and 4-bed luxury apartments with price points of Kshs 11.5mn and Kshs 35.0mn for 1 and 2 beds. The development is set to be the tallest residential development in East and Central Africa. This is the latest launch of a luxury apartment in Nairobi with others recently launched being Cytonn Towers by Cytonn Investments in Kilimani and The Pinnacle by Hass Group in Upperhill. Luxury apartments are gaining traction in the country driven by; i) the 93.0% growth in the number of high net worth individuals between 2006 and 2016 who allocate at least 25.0% of their wealth to real estate according to the Knight Frank, Inside View Kenya Report, ii) the changing tastes and increasingly sophisticated lifestyles of consumers due to global exposure, (iii) Kenya’s positioning as a regional hub, and (iv) presence of multinational firms who create demand for up-market housing, Cytonn Weekly #45

- The National Government announced plans to spend over Kshs 1.0 bn to construct 744 houses for security officers, in a bid to address the housing deficit that is mainly driven by lack of low-cost houses, and

- CIC Group announced plans to put up a Kshs 2.8bn housing project on a 200-acre parcel of land near Tatu City. From the plan, 77 acres would be secluded for medium density, 13 acres for high-end units, whilst 10 would be for high rise developments. According to the master plan, the development would feature office developments, retail, recreational parks, ecological restoration centers and high rise apartments.

The launch of the developments by the government and the other private sector stakeholders is a testament to the attractiveness of residential real estate theme mainly supported by; i) huge housing deficit that stands at 2.0mn units with an effective annual demand of 200,000 units, ii) positive demographic trends, for instance, population growth that stands at 2.6%, 1.4% higher than global averages and a high urbanization rate of approximately 4.4% against a global average of 2.1%, and iii) affordable housing initiatives, with affordable housing being named among the four key pillars of focus by the government, which should see increased government incentives for developers of affordable units and thus increased development activities. We thus expect to continue witnessing increased development activities.

- Commercial- Office

During the month, Zamara Umbrella Solutions, a Retirements Benefits Fund Administrator, formerly Alexander Forbes, announced plans to construct a twin tower with 30 and 16 floors, respectively at the Junction of General Mathenge and Peponi Rd in Westlands, Nairobi. The Mixed Use Development will feature both commercial and retail centers with retail occupying 3 floors and the rest reserved for commercial office space. The commencement of construction is scheduled for the first half of 2018. Westlands continues to attract commercial office developments as it offers an attractive investment opportunity to investors with average rental yields of 9.5% and occupancy rates of 86.4%, in 2017 compared to a market average of 9.2% and 82.8%. Other upcoming developments in the area include the 43 Storey Avic Towers on Chiromo Lane and One Africa Place along Chiromo Road. The high returns in the market are mainly driven by i) The proximity of the area to CBD ii) Ease of access due to availability of a good road network, iii) High plot ratios in the area allowing for densification and iv) sufficient accommodation as the area is surrounded by high-end residential zones.

With the expected relaxation of the zoning regulations in Springvalley and Loresho as well as the expansion of the Waiyaki Way, we expect to continue witnessing increased development activity in the area. Developers should, however, be cautious of investment in the area especially in the commercial office segment as the area has the third largest office supply in Nairobi with a market share of 23.7% after Upperhill and CBD with market shares of 24.4% and 24.3%, respectively, and the commercial office segment in Nairobi has an oversupply of 3.9mn SQFT. The product offering should thus be differentiated either by i). developing Grade A office which have high returns with average rental yields of 10.0% compared to 9.2% for conventional officesand low supply with a market share of just 10.0% from our sample, ii) Servicing the offices, as serviced offices also have high returns with rental yields of 13.4%, compared to a yield of 9.2% for conventional offices or iii) Developing Green buildings to boost uptake, occupancy and thus returns.

- Retail

In the month of February, the retail sector recorded increased activity as both local and international retailers opened new branches as they seek to tap into the high returns in the sector as expounded below;

- French-based retailer, Carrefour announced plans to open a new retail store in the Sarit Centre Shopping Mall in April. This will mark the store’s fifth outlet in the country with the other outlets being in; The Hub opened in 2016, Two Rivers and Thika Road Mall opened in 2017, The Junction opened in 2018. In Sarit Centre, the retailer takes over space previously occupied by Uchumi,

- Naivas Supermarket, one of the largest retailers in Kenya, announced plans to open a new outlet at Freedom Height Mall in Lang’ata by May 2018. The store marks the retailer's 44th outlet and is set to occupy a GLA of 18,000 SQFT, and

- South African retailer, Shoprite announced that it had secured space in a cumulative 7 prime malls in Kenya, with lease agreements already concluded for the Westgate Mall and the Garden City Mall in Westlands and Thika Road, respectively with the stores set to be opened in 2018.

The expansion by the retailers above indicate the bullish outlook they have on the Kenyan retail market which in our opinion is driven by high demand boosted by demographics such as i) rapid population growth at 2.6% as compared to global averages of 1.2%, ii) high urbanisation rate of on average 4.4% against a global average of 2.1%, and iii) an expanding middle class with increased purchasing power due to higher disposable incomes that rose by 15.8% from Kshs 5.7tn in 2015 to Kshs 6.6tn in 2016 according to the KNBS Economic Survey 2017 that facilitates sustained demand.

- Hospitality

In the hospitality sector, Sarova Group of Hotels announced plans to take over the management of Spirit of the Mara Lodge in a 15-year partnership agreement. The hotel located in Siana Conservancy overlooking the Mara, has 10-suites each having a lounge and sleeping area. This is the latest expansion activity by Sarova Group of Hotels who recently opened Sarova Woodlands in Nakuru and announced the refurbishment of the Sarova Panafric Hotel. The move brings the groups’ cumulative room count to 1,250 in Kenya. We are of the opinion that the hotel’s expansion and refurbishment moves are driven by i) the need for the hotel to match the quality standards currently being offered in the market, and improve their facilities which have depreciated over time, so as to remain competitive in the wake of stiff competition from global brands such as Radisson Blu and Mariott which are coming into the Kenyan Market, and ii) the need to increase room capacity to meet the growing demand for accommodation as a result of an increase in tourist arrivals, with international arrivals increasing to 1.5 mn in 2017 compared to 1.3 mn in 2016

Other highlights for the sector include:

- The Kenyan Tourism Board released the 2017 Tourism Sector Report. The report noted that the hospitality sector remained resilient with earnings in the sector growing by 20.3% y/y from Kshs 99.7 bn in 2016 to Kshs 120.0 bn in 2017. The report noted that the number of international arrivals rose by 4.5% y/y to 1.4mn in 2017 from 1.3mn visitors in 2016 as a result of marketing efforts by the government especially in H1’2017, and improved security. This is in tandem with our Nairobi Hospitality Sector Report, where we had projected growth of arrivals by 6.2%, Cytonn Weekly #6,

- Kenya Airways announced plans to start operations between Kenya and Mauritius offering four weekly flights by June this year. The route is expected to complement Air Mauritius’ existing operations,Cytonn Weekly #6

- DoubleTree, a brand by Global chain Hilton Group, opened its 4-star Hotel along Ngong’ Road, following the rebranding of Amber Hotel. This marks the brand’s third hotel chain in Nairobi, with the others being Hilton Hotel in the CBD and Hilton Garden Inn along Mombasa Road, opened in 1969 and January of 2018 respectively. Cytonn Weekly #7

We expect the hospitality sector to continue witnessing increased investment and better returns in 2018 especially with the improved security in the country and conclusion of the electioneering period. The performance will also be boosted by the continued marketing efforts by the Kenya Tourism Board.

Other highlights in the Real Estate sector include:

- The government commenced the construction of four link roads that will connect the Garissa Highway to the upcoming Thika Bypass. The roads are; Broadway-Athena Link Road, Engen to Kijango Junction Road, BAT-Kiganjo Link Road, and the Kivulini-Kiganjo Road. On completion, the Bypass will ease traffic on Garissa Road, Thika Town and its environs by offering additional routes into Thika Town. This will also open up areas such as Kiganjo, Kiang’ombe, Kiandutu and Athena in Kiambu County, Cytonn Weekly #7

- Crystal Rivers, a Kshs 4.2 bn mixed-use development, comprising of a mall as well as a gated community, by Safaricom Pension Scheme in Athi River, is set to open shop in June 2018. The mixed-use-development brings to the market 138 townhouses, 260 apartments as well as 200,000 SQFT of commercial space, Cytonn Weekly #7

- The Construction of the superhighway linking Jomo Kenyatta International Airport and Rironi, Limuru is set to cost Kshs 59.0bn, 55.3% higher than the forecasted Kshs 38.0bn. This was prompted by changes in design. The new design, according to Kenya National Highways Authority (KeNHA), will incorporate underpasses and flyovers Cytonn Weekly #8

- Parliament extended the period for consideration of land regulations for a further 90 days from 14th February. The regulations, published in November 2017, are set to facilitate the implementation of the new land laws which among other items delineates the mandates of the various parties, including the ministry of lands, the National Land Commission and the county governments

Our outlook for the sector is positive given the increased traction in the sector evidenced by the entry of new retailers such as South African retailer Shoprite, increased development activities across all themes and government initiatives such as the focus on affordable housing.

Disclaimer: The views expressed in this publication, are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.