Cytonn Monthly - July 2021

By Cytonn Research, Aug 1, 2021

Executive Summary

Fixed Income

During the month of July, T-bills remained oversubscribed, with the overall subscription rate coming in at 106.6%, down from 120.5% recorded in June. Overall subscriptions for the 91-day, 182-day and 364-day papers came in at 213.4%, 119.7% and 50.8%, from 143.4%, 75.6% and 156.4% in June 2021. The yields on the 364-day, 182-day and 91-day papers declined by 29.7 bps, 36.2 bps and 38.3 bps to 7.4%, 7.0% and 6.5%, respectively. The government reopened three bonds namely; FXD1/2012/15, FXD1/2018/15 and FXD1/2021/25, during the month in a bid to raise Kshs 60.0 bn. The bonds were oversubscribed with the subscription rate coming in at 194.9% and the total acceptance rate stood at 68.3%. The high subscription rates can be attributable to the high liquidity in the market during the duration of the bond sale;

During the week, the Monetary Policy Committee (MPC) retained the Central Bank Rate (CBR) at 7.00% for the ninth consecutive time in line with our expectations. The inflation rate for the month of July increased to 6.4% from 6.3% in June, driven by the increase in the prices of food and fuel;

Equities

During the month of July, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 2.3%, 2.4%, and 3.1%, respectively, taking their year to date performance to gains of 16.8%, 5.4% and 14.1% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Diamond Trust Bank Kenya (DTB-K), Equity Group, and Bamburi, which gained by 11.0%, 9.3%, and, 8.1% respectively. The gains were however weighed down by losses recorded by Co-operative Bank, which declined by 1.8%. During the month, the Ethiopian Communications Authority (ECA) announced the formal issuance of a Telecommunications Operator License to the Global Partnership for Ethiopia (GPE) consortium which had successfully bid USD 850.0 mn (Kshs 91.8 bn) for the telco license. The GPE consortium consists of Safaricom, Sumitomo Corporation, CDC Group Plc and Vodacom with shareholdings of 55.7%, 27.2%, 10.9% and 6.2%, respectively;

Real Estate

During the month, three industry reports were released, namely; Tourism Research Institute’s International Tourism Performance Report January to June 2021, Architectural Association of Kenya’s (AAK) Status of the Built Environment Report January-June-2021, and, the Central Bank of Kenya’s (CBK) Quarterly Economic Review Report January- March 2021.

In the residential sector, Edderman Limited, a local private property developer, announced the completion of its Great Wall Gardens phase 3 project worth Kshs 3.0 bn in Mavoko, Machakos County. President Uhuru Kenyatta signed a Public Private Partnership (PPP) deal worth Kshs 5.2 bn with the United Kingdom aiming at fostering ties between the two countries as well as initiating green affordable home projects. Also, the Kenya Mortgage Refinance Company (KMRC), a state-backed mortgage refinancing firm, announced that it will triple affordable home loans to Kshs 7.0 bn in FY’2021/22, thereby increasing the loan book at 154.7% points up from the Kshs 2.7 bn offered to banks and savings and credit cooperative society (Saccos) in FY’2020/21. Acorn Holdings, a student hostels developer, signed a partnership deal with the United States International University Africa (USIU-Africa), to provide 697 of its students with accommodation, through the development of hostels at a cost of Kshs 1.0 bn. In the retail sector, Naivas Supermarket, a local retail store, opened a new store in Kisumu’s Simba Hall. Java House Africa Group, an international restaurant chain, announced plans to open 30 new Kukito outlets in various parts of Nairobi, in the next five years. In the hospitality sector, City Lodge Hotel Group announced is planning to sell its three Kenyan-based hotels namely Fairview Hotel in Nairobi, City Lodge Hotel in Two Rivers, and, Town Lodge Hotel in Upperhill, to Actis. In the listed real estate sector, ILAM Fahari I-REIT released their H1’2021 earnings, which registered a 50.9% decline in their basic earnings per unit to Kshs 0.2 from Kshs 0.5 realized in H1’2021. Additionally, Acorn Holdings released their H1’2021 financial statements for the D-REIT and I-REIT Investment arm which have been invested in student accommodation, whereby the D-REIT recorded profits of Kshs 266.9 mn in H1’2021 while the I-REIT profits came in at Kshs 141.3 mn. In the exchange, Fahari i-REIT closed the month trading at an average price of Kshs 6.7 per share, a 12.1% YTD increase from Kshs 5.8 per share, and a 6.6% MTD increase from Kshs 6.1 realized in June;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.58%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 15.85% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here.

Hospitality Updates:

- We currently have promotions for Staycations, visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of July, T-bill auctions remained oversubscribed, with the overall subscription rate coming in at 106.6%, down from 120.5% recorded in June. Investor demand shifted to the 91-day paper which had the highest subscription rate of 213.4%, up from 143.4% recorded the previous month. Investors’ continued interest in the 91-day paper during the month is mainly attributable to the paper’s higher return on a risk adjusted basis. The subscription rate for the 182-day papers also increased to 119.7%, up from 75.6%, while the subscription rate for the 364-day declined to 50.8%, from 156.4% recorded in June. The yields on the 364-day, 182-day and 91-day papers declined by 29.7 bps, 36.2 bps and 38.3 bps to 7.4%, 7.0% and 6.5%, respectively. For the month of July, the government accepted a total of Kshs 88.6 bn, out of the Kshs 102.3 bn worth of bids received as they sought to contain the rates.

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 74.2%, an increase from the 69.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.5 bn against the offered amount of Kshs 4.0 bn, translating to a subscription rate of 212.4%, a decline from the 252.1% recorded the previous week. The subscription rate for the 182-day paper increased to 65.0%, from 32.1% recorded the previous week, while the subscription rate for the 364-day paper declined to 28.1%, from 34.0% recorded the previous week. The yields on the 91-day and 182-day papers increased by 0.9 bps and 1.1 bps to 6.5% and 7.0%, respectively, while the yields on the 364-day paper declined by 0.6 bps to 7.4%. The government continued to take advantage of the low yields and the high liquidity in the market by accepting Kshs 17.7 bn out of the Kshs 17.8 bn worth of bids received, translating to an acceptance rate of 99.7%.

In the Primary Bond Market, the three bonds reopened by the government for the month of July recorded a subscription of 194.9%, attributable to the high liquidity in the market. The government sought to raise Kshs 60.0 bn in the three bonds and accepted Kshs 79.9 bn out of the Kshs 116.9 bn worth of bids received, translating to an acceptance rate of 68.4%. Investors preferred the shorter dated paper, FXD1/2012/15, with an effective tenor of 6.2 years, which received bids worth Kshs 48.8 bn, FXD1/2021/25 received bids worth Kshs 39.9 bn while FXD1/2018/15 received bids worth Kshs 28.2 bn. The three bonds had coupon rates of 11.0%, 12.7% and 13.9%, and the weighted average yields were 11.6%, 12.6% and 13.9% for FXD1/2012/15, FXD1/2018/15 and FXD1/2021/25, respectively.

During the week, the government reopened two bonds, FXD3/2019/10 and FXD1/2018/20 and a primary issue on FXD1/2021/20, with effective tenors of 7.5 years, 14.6 years and 20.0 years, respectively, whose offer period ends on 10th August 2021. The coupon rates are 11.5% for FXD3/2019/10 and 13.2% for FXD1/2018/20, while the coupon on FXD1/2021/20 will be market determined. We expect investors to prefer the longer dated papers, FXD1/2018/20 and FXD1/2021/20, as they search for higher yields given the low yields in the currently in the market. Our recommended bidding range for the three bonds are: 11.9%-12.2% for FXD3/2019/10, 12.8%-13.2% for FXD1/2018/20 and 13.1%-13.4% for FXD1/2021/20.

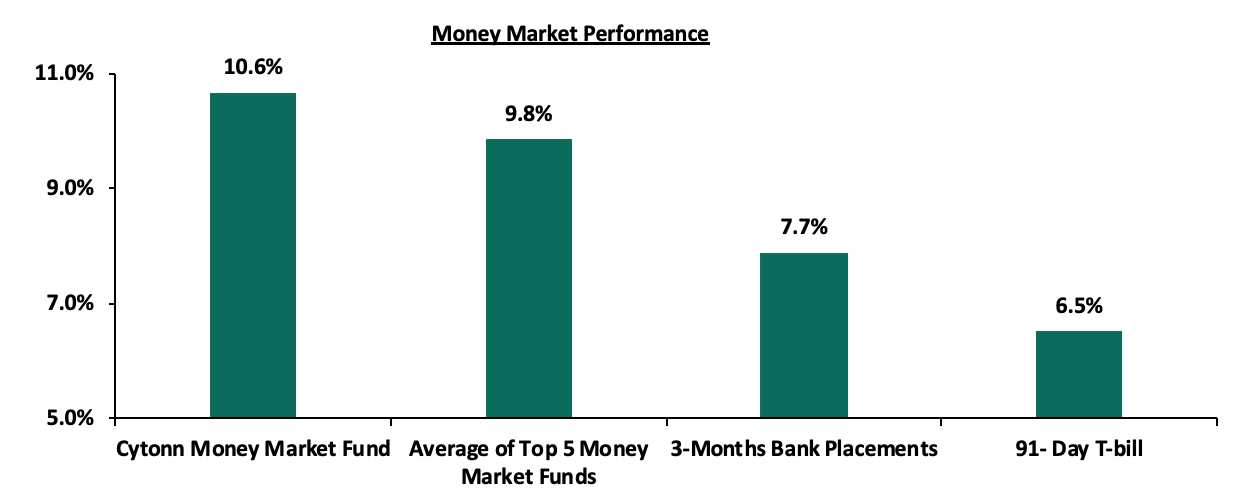

In the money markets, 3-month bank placements ended at 7.7% (based on what we have been offered by various banks), while the 91-day T-bill increased by 0.9 bps to 6.5%. The average yield of the Top 5 Money Market Funds remained unchanged at 9.8% as was recorded the previous week. Additionally, the yield on the Cytonn Money Market (CMMF) also remained unchanged at 10.6% as was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 30th July 2021:

|

Money Market Fund Yield for Fund Managers as published on 30th July 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.06% |

10.58% |

|

2 |

Nabo Africa Money Market Fund |

9.52% |

9.95% |

|

3 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

4 |

CIC Money Market Fund |

9.02% |

9.35% |

|

5 |

Sanlam Money Market Fund |

8.85% |

9.25% |

|

6 |

Madison Money Market Fund |

8.84% |

9.24% |

|

7 |

Orient Kasha Money Market Fund |

8.70% |

9.06% |

|

8 |

Co-op Money Market Fund |

8.34% |

8.70% |

|

9 |

Dry Associates Money Market Fund |

8.36% |

8.69% |

|

10 |

GenCap Hela Imara Money Market Fund |

8.20% |

8.55% |

|

11 |

British-American Money Market Fund |

8.19% |

8.50% |

|

12 |

ICEA Lion Money Market Fund |

8.05% |

8.39% |

|

13 |

NCBA Money Market Fund |

8.04% |

8.34% |

|

14 |

Apollo Money Market Fund |

8.40% |

8.27% |

|

15 |

Old Mutual Money Market Fund |

7.11% |

7.35% |

|

16 |

AA Kenya Shillings Fund |

6.63% |

6.83% |

Source: Business Daily

Secondary Bond Market:

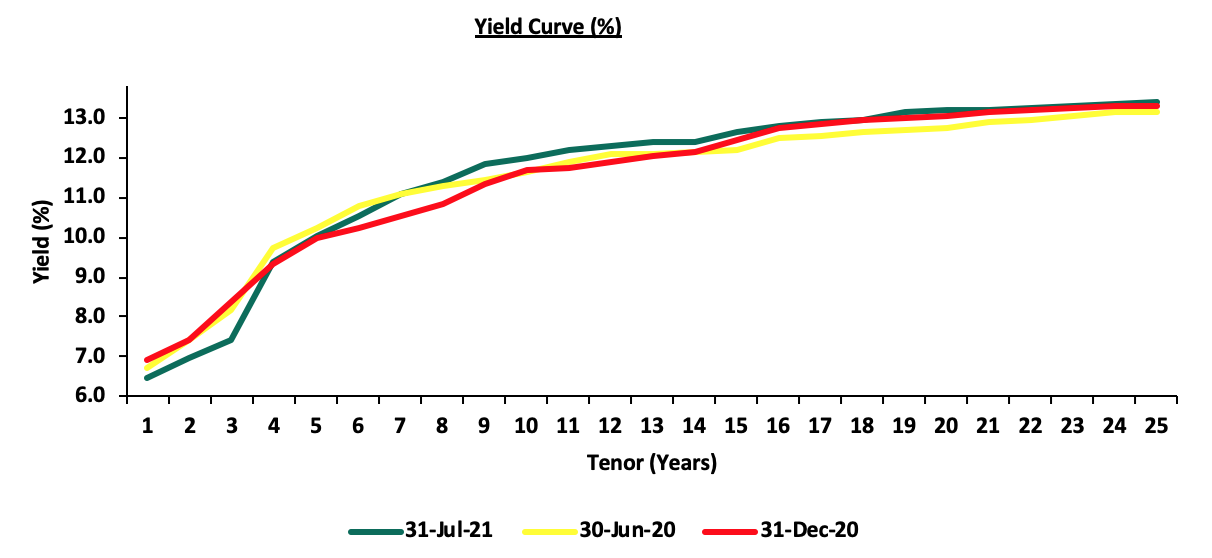

In the month of July, the yields on government securities in the secondary market remained relatively stable with the FTSE NSE bond index declining by 0.3%, to close the month at 96.5, bringing the YTD performance to a decline of 1.6%. The bond turnover declined by 0.5% to Kshs 91.4 bn, from Kshs 91.8 bn recorded in June. The total amounts of bonds transacted on a year to date basis stands at Kshs 542.4 bn compared to Kshs 355.9 bn transacted over a similar period last year. The chart below is the yield curve movement during the period;

Liquidity:

The money markets remained liquid in the month of July, with the average interbank rate declining to 4.0%, from 4.6% recorded in June supported by government payments. During the week, liquidity in the money market eased, with the average interbank rate declining to 3.2%, from 3.5% recorded the previous week, due to government payments, Term Auction Deposits (TADs) maturities worth Kshs 154.3 bn which offset the settlements of government securities and tax remittances. The average interbank volumes traded declined by 11.2% to Kshs 4.1 bn, from Kshs 4.6 bn recorded the previous week.

Kenya Eurobonds:

During the month, the yields on the Eurobonds recorded mixed performance with the 10-year Eurobond issued in 2014, 30-year issued in 2018 and 12-year issued in 2021 all declining marginally by 0.1% points to 3.2%, 7.3% and 6.2%, respectively. On the other hand, the 7-year and 12-year Eurobonds issued in 2019 and the 10-year Eurobond issued in 2018, remained unchanged at 4.8%, 6.2% and 5.4%, respectively.

During the week, the yields on the Eurobonds recorded mixed performance with the yields on the 10-year Eurobond issued in 2018 increasing marginally by 0.1% points to 5.4%. On the other hand, the yields on the 10-year Eurobond issued in 2014, 30-year Eurobond issued in 2018, 7- year Eurobond issued in 2019, 12- year Eurobond issued in 2019 and the 12- year Eurobond issued in 2021 remained unchanged at 3.2%, 7.3%, 4.8%, 6.2% and 6.2%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-20 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

- |

|

30-Jun-21 |

3.3% |

5.4% |

7.4% |

4.8% |

6.3% |

6.3% |

|

23-Jul-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.2% |

6.2% |

|

26-Jul-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.2% |

6.2% |

|

27-Jul-21 |

3.2% |

5.4% |

7.3% |

4.8% |

6.2% |

6.2% |

|

28-Jul-21 |

3.2% |

5.4% |

7.3% |

4.8% |

6.2% |

6.2% |

|

29-Jul-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.2% |

6.2% |

|

30-Jul-21 |

3.2% |

5.4% |

7.3% |

4.8% |

6.2% |

6.2% |

|

Weekly Change |

0.0% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

|

MTD Change |

(0.1%) |

0.0% |

(0.1%) |

0.0% |

0.0% |

(0.1%) |

|

YTD Change |

(0.7%) |

0.2% |

0.3% |

(0.1%) |

0.3% |

- |

Source: Reuters

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 0.7% against the US Dollar to close the month at Kshs 108.6, from Kshs 107.9 recorded at the end of June 2021, mostly attributable to increased dollar demand from general importers.

During the week, the Kenyan shilling depreciated by 0.4% against the US dollar to close the week at Kshs 108.6, from Kshs 108.2 recorded the previous week partly attributable to the build-up of dollar demand from energy importers as they meet their end of the month hard currency obligations. On a YTD basis, the shilling has appreciated by 0.5% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. Despite the recent appreciation of the shilling, we expect the shilling to remain under pressure in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- The widened current account position which increased by 0.2% points to 5.4% of GDP in the 12 months to June 2021 from 5.2% of GDP for a similar period in 2020, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.3 bn (equivalent to 5.7 months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- Improving diaspora remittances evidenced by a 6.0% y/y increase to USD 305.9 mn in June 2021, from USD 288.5 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlights:

- July MPC Meeting

The Monetary Policy Committee (MPC) met on Wednesday, 28th July 2021 to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). The MPC retained the CBR at 7.00%, in line with our expectations, for the ninth consecutive time. Below are some of the key highlights from the meeting:

- Inflation remains well anchored and within the Government’s target range of 2.5%-7.5%. The overall inflation stood at 6.3% in June 2021 compared to 5.9% in May, mainly attributable to increase in food and fuel prices,

- Private sector credit growth has been recovering having grown by 7.7% in June 2021 as compared to 6.8% in April 2021. The key sectors supporting this growth include manufacturing (8.1%), transport and communications (11.8%), and consumer durables (23.4%), and,

- The current account deficit to GDP is estimated at 5.4% in the 12-months to June 2021, a 0.2% points increase, from 5.2% recorded over a similar period in 2020. Exports of goods remained strong, growing by 11.1% in H1’2021 compared to a similar period in 2020. Receipts from exports of horticulture and manufactured goods increased by 29.4% and 45.2%, respectively, in H1’2021 compared to a similar period in 2020. However, receipts from tea exports declined by 5.5 %, partly attributable to the impact of accelerated purchases in 2020.

The MPC concluded that the current accommodative monetary policy stance remains appropriate and therefore decided to retain the Central Bank Rate (CBR) at 7.00%. The Committee will meet again in September 2021, but remains ready to re-convene earlier if necessary.

- July Inflation

The y/y inflation for the month of July increased to 6.4%, from the 6.3% recorded in June, in line with our expectations. Key to note, this is the highest reading since a similar reading of 6.4% was recorded in February, 2020. The increase was mainly attributable to the increase in the y/y food and non-alcoholic beverages, housing, utilities and other fuels and transport inflation prices.

Notably, the information and communication inflation increased the most on an m/m basis, mainly attributable to the introduction of additional taxes on mobile phone airtime, which were effective from 1st July, 2021. However, the increase was mitigated by a decline in the food inflation. The table below shows a summary of both the year on year and month on month commodity groups’ performance;

|

Major Inflation Changes – July 2021 |

|||

|

Broad Commodity Group |

Price change m/m (July- 21/June -21) |

Price change y/y (July-21/June-20) |

Reason |

|

Food & Non-Alcoholic Beverages |

(0.5%) |

8.8% |

The m/m decline was mainly contributed by decline in prices of tomatoes, white bread and oranges among other food items |

|

Housing, Water, Electricity, Gas and other Fuel |

1.3% |

6.3% |

The m/m increase was as a result of increase in the price of cooking Gas (LPG) and electricity

|

|

Transport Cost |

0.0% |

10.3% |

There was no m/m change due to the pump prices of petrol remaining unchanged between June and July |

|

Overall Inflation |

0.2% |

6.4% |

The m/m increase was due to a 1.8% increase in the information and communication cost, mainly driven by the increase in prices of mobile phone airtime |

Source: KNBS

Going forward, we expect the inflation to remain within the government’s set range of 2.5% - 7.5%. However, we also anticipate the inflation pressures to remain elevated in the short term mainly driven by increases in food and fuel prices, and the impact of the recently implemented tax measures. The rising inflation remains a concern as the IMF has already cautioned the government against exceeding the set target rate as this will increase the risk of an inability to access further credit facilities from the international lender. The increasing inflation is also eroding the real rate of return to investors given the declining yields in government securities, for example; an investor’s real return in a 364-day paper has been reduced to only 1.0% given the yield is currently at 7.4% against an inflation rate of 6.4%.

Monthly Highlights:

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on themaximum wholesale and retail prices for fuel prices in Kenya effective 15th July 2021 to 14th August 2021. The prices of Super Petrol, Diesel and Kerosene remained unchanged at Kshs 127.1 per litre, Kshs 107.7 per litre, and Kshs 97.9 per litre, respectively, despite increased landed cost of imported crude. For more information, see our Cytonn Weekly #28/2021.

- The Kenya Revenue Authority (KRA) released the FY’2020/2021 revenue performance, highlighting that the total revenue collected was Kshs 1.67 tn, against the revised target of Kshs 1.65 tn, representing an out-performance rate of 101.0%. This is despite the challenges posed by the COVID-19 pandemic on business conditions and people’s income. For more information, see our Cytonn Weekly #27/2021,

- The headline Purchasing Managers’ Index (PMI)for the month of June 2021 decreased to 51.0 from the 52.5 recorded in May 2021, indicating that the business conditions in the Kenyan private sector recorded an expansion but at a slower rate than that seen in May 2021. For more information, For more information, see our Cytonn Weekly #27/2021, and,

- The World Bank Board of Executive Directors approveda USD 130.0 mn (Kshs 14.0 bn) additional loan financing for the Kenya COVID-19 Health Emergency Response Project to facilitate affordable and equitable access to COVID-19 vaccines for Kenyans. The funding will enable Kenya to procure more vaccines through the African Vaccine Acquisition Task Team (Avatt) and the COVID-19 Vaccines Global Access (Covax) facilities in addition to supporting the deployment of the vaccines by boosting the country’s cold-storage capacity. For more information, see our Cytonn Weekly #26/2021,

Rates in the fixed income market have remained relatively stable due the sufficient levels of liquidity in the money market, coupled with the discipline by the Central Bank to reject expensive bids. The government is 34.1% behind its prorated borrowing target of Kshs 63.3 bn having borrowed Kshs 41.7 bn in FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRA collecting Kshs 1.7 tn in FY’2020/2021, a 3.9% increase from Kshs 1.6 tn collected in the prior fiscal year. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.

Markets Performance

During the month of July, the equities market was on an upward trajectory, with the NASI, NSE 20 and NSE 25 gaining by 2.3%, 2.4%, and 3.1%, respectively, bringing the year to date performance to gains of 16.8%, 5.4% and 14.1% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Diamond Trust Bank Kenya (DTB-K), Equity Group, and Bamburi, which gained by 11.0%, 9.3%, and, 8.1% respectively. The gains were however weighed down by losses recorded by Co-operative Bank, which declined by 1.8%.

During the week, the equities market was on a downward trajectory, with the NASI, NSE 20 and NSE 25 declining by 0.8%, 0.4%, and 0.1%, respectively, taking their YTD performance to gains of 16.8%, 5.4% and 14.1% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Bamburi and EABL which both declined by 2.7% and Safaricom, which declined by 2.0%. The losses were however mitigated by gains recorded by banking stocks such as Co-operative Bank, KCB Group and Equity group which gained by 3.4%, 2.6% and 2.2%, respectively.

Equities turnover declined by 33.7% during the month to USD 85.8 mn, from USD 129.4 mn recorded in June 2021. Foreign investors turned net buyers during the month, with a net buying position of USD 1.4 mn, compared to June’s net selling position of USD 11.1 mn.

During the week, equities turnover decreased by 8.2% to USD 15.6 mn, from USD 17.0 mn recorded the previous week, taking the YTD turnover to USD 727.0 mn. Foreign investors turned net sellers, with a net selling position of USD 1.3 mn, from a net buying position of USD 0.4 mn recorded the previous week, taking the YTD net selling position to USD 26.2 mn.

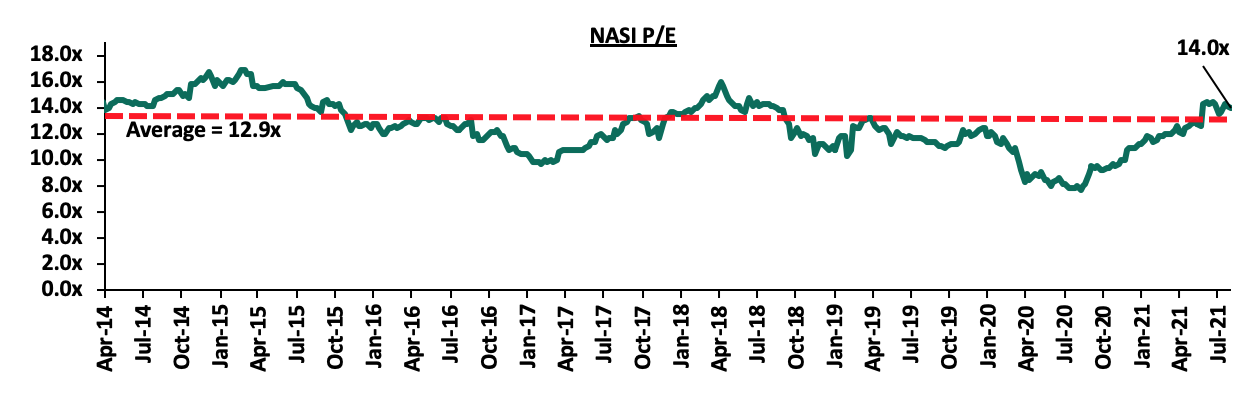

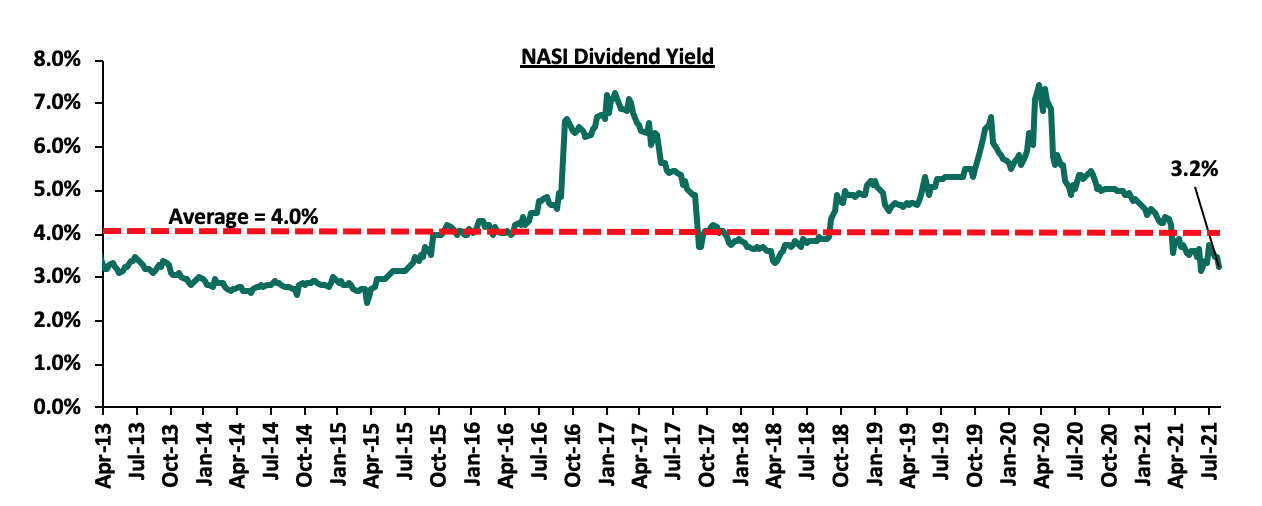

The market is currently trading at a price to earnings ratio (P/E) of 14.0x, 7.9% above the historical average of 12.9x, and a dividend yield of 3.2%, 0.8% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.6x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, the market is trading at a P/E ratio of 12.1x and a PEG ratio of 1.4x. The current P/E valuation of 14.0x is 81.2% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

- Atlas Mara Limited disclosed that the Rwandese Authorities had approved the sale of Banque Populaire du Rwanda (BPR) to KCB Group, and that the parties are now in the process of finalizing the pre-completion conditions. KCB Group and Atlas Mara Limited had signed a definitive agreement in November 2020 for KCB’s acquisition of a 62.1% stake in BPR and a 100.0% stake in Africa Banking Corporation Tanzania Limited (BancABC), subject to shareholder approval and regulatory approval in the respective countries. In May 2021, KCB Group disclosed that it made an offer to the remaining BPR shareholders to raise its acquisition stake in the bank to 100.0% from 62.1% and received shareholders’ approval for the acquisitions, with only regulatory approval pending for the finalization of the transactions. Regulatory approval is however still pending with respect to the KCB’s acquisition of BancABC from Atlas Mara. For more information, see our Cytonn Weekly #29/2021,

- The Central Bank of Kenya (CBK) released the Quarterly Economic Review for the period ending 31st March 2021, highlighting that the banking sector remained stable and resilient in the midst of a pandemic during the period. According to the report, the sector’s total assets increased by 2.0% to Kshs 5.5 tn in March 2021, from Kshs 5.4 tn in December 2020. The increase was mainly attributable to an 8.1% increase in placements coupled with a 5.2% increase in loans and advances in March 2021. For more information, see our Cytonn Weekly #29/2021, and,

- Ethiopian Communications Authority (ECA) announced the formal issuance of a Telecommunications Operator License to the Global Partnership for Ethiopia (GPE) consortium which had successfully bid USD 850.0 mn (Kshs 91.8 bn) for the telco license. The GPE consortium consists of Safaricom, Sumitomo Corporation, CDC Group Plc and Vodacom with shareholdings of 55.7%, 27.2%, 10.9% and 6.2%, respectively. GPE, which has been incorporated as Safaricom Telecommunications Ethiopia PLC, has been granted a nationwide full-service Telecommunications Service License valid for a period of 15 years, effective 9th July 2021, and is renewable for an additional term of 15 years subject to the fulfilment of all license obligations. For more information, see our Cytonn Weekly #28/2021.

Universe of Coverage

Below is a summary of our universe of coverage and the recommendations:

|

Company |

Price at 23/7/2021 |

Price at 30/7/2021 |

w/w change |

m/m change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Group*** |

22.2 |

23.0 |

3.6% |

5.0% |

(48.8%) |

44.9 |

29.8 |

9.8% |

39.7% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.6 |

2.0% |

4.0% |

11.3% |

2.3 |

3.1 |

7.8% |

28.4% |

0.3x |

Buy |

|

NCBA*** |

26.2 |

26.6 |

1.5% |

4.1% |

(0.2%) |

26.6 |

29.5 |

5.6% |

16.8% |

0.7x |

Accumulate |

|

Sanlam |

11.6 |

11.0 |

(5.2%) |

10.0% |

(15.4%) |

13.0 |

12.4 |

0.0% |

12.7% |

1.0x |

Accumulate |

|

Standard Chartered*** |

129.5 |

129.5 |

0.0% |

(0.2%) |

(10.4%) |

144.5 |

134.5 |

8.1% |

12.0% |

0.9x |

Accumulate |

|

Stanbic Holdings |

87.5 |

85.0 |

(2.9%) |

4.9% |

0.0% |

85.0 |

90.5 |

4.5% |

10.9% |

0.8x |

Accumulate |

|

Co-op Bank*** |

13.1 |

13.6 |

3.4% |

(1.8%) |

8.0% |

12.6 |

13.8 |

7.4% |

9.2% |

0.9x |

Hold |

|

KCB Group*** |

44.6 |

45.7 |

2.6% |

7.2% |

19.0% |

38.4 |

48.6 |

2.2% |

8.5% |

1.1x |

Hold |

|

ABSA Bank*** |

9.9 |

9.9 |

0.8% |

0.2% |

4.4% |

9.5 |

10.7 |

0.0% |

7.6% |

1.1x |

Hold |

|

Diamond Trust Bank*** |

65.0 |

65.8 |

1.2% |

11.0% |

(14.3%) |

76.8 |

70.0 |

0.0% |

6.5% |

0.3x |

Hold |

|

Equity Group*** |

47.9 |

48.9 |

2.2% |

9.3% |

34.9% |

36.3 |

51.2 |

0.0% |

4.7% |

1.4x |

Lighten |

|

Liberty Holdings |

9.6 |

9.1 |

(5.2%) |

4.6% |

17.7% |

7.7 |

8.4 |

0.0% |

(7.3%) |

0.7x |

Sell |

|

Jubilee Holdings |

370.0 |

379.0 |

2.4% |

8.1% |

37.4% |

275.8 |

330.9 |

2.4% |

(10.3%) |

0.8x |

Sell |

|

Britam |

7.7 |

7.9 |

2.1% |

8.6% |

12.3% |

7.0 |

6.7 |

0.0% |

(14.8%) |

1.5x |

Sell |

|

HF Group |

3.9 |

3.8 |

(1.8%) |

(2.3%) |

20.4% |

3.1 |

3.2 |

0.0% |

(15.3%) |

0.2x |

Sell |

|

CIC Group |

2.6 |

3.0 |

16.1% |

37.0% |

40.3% |

2.1 |

1.8 |

0.0% |

(39.2%) |

1.0x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to the counter trading ex-bonus issue |

|||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.6x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

- Industry Reports

During the month, the following industry reports were released and the key take-outs were as follows:

|

# |

Theme |

Report |

Key Take-outs |

|

1 |

General Real Estate |

Architectural Association of Kenya Status of the Built Environment Report January-June-2021 |

|

|

Central Bank of Kenya Quarterly Economic Review Report January- March 2021 |

|

||

|

2 |

Hospitality Sector |

Tourism Research Institute International Tourism Performance Report January to June 2021 |

|

The real estate sector is expected to register an improvement in performance supported by improved construction activities. However, the low numbers of visitor arrivals and high loan default rates is still expected to hinder performance of the sector.

- Residential Sector

During the week, Edderman Limited, a local private property developer, announced the completion of its Great Wall Gardens phase 3 project worth Kshs 3.0 bn in Mavoko, Machakos County. The affordable housing development consisting of 664-three bedroom apartments of approximately 170.0 SQM units valued at Kshs 3.7 mn was launched in August 2019 and was completed in July 2021 as per the stipulated time. The developer has been on an aggressive drive defying the pandemic effects to deliver affordable housing units with some of its projects being; i) the Great Wall Gardens phase 4, ii) Lukenya Park C project, iii) River Estate Public Private Partnership (PPP) project in Ngara, and, iv) Great Wall Gardens phase 5 which is expected to kick off in September 2021. The Great Wall Garden phase 3 project will be beneficial through; i) provision of affordable houses to the residents, ii) reduction of informal settlement in the area, and, iii) improve living standards of Kenyans around the region.

The move by the developer to deliver timely affordable housing units further supports the affordable housing initiative as part of the big four agenda by the government which has been gaining momentum despite the pandemic, evidenced by the relatively high number of individuals who have been registered in the boma yangu portal currently at 320,897. However, there are several challenges that have been impeding the successful delivery of the affordable projects including; i) financial constraints, ii) inadequate infrastructure limiting accessibility, iii) high development costs, and, iv) troubled partnership agreements. Despite the challenges, we expect the initiative to continue gaining momentum supported by various factors such as the improving infrastructure opening up areas for accessibility and investment opportunities, availability of land particularly within the satellite towns of the Nairobi Metropolitan Area, and, positive demographics.

In terms of performance, according to our Cytonn H1’2021 Markets Review, Athi River, where the project is located registered average uptake rates 96.9%, a 14.2% points higher than the market average 82.7%, thereby signifying greater demand and uptake rate for apartments in the area, coupled with their affordability rates being that the area registered average selling prices of Kshs 59,145 per SQM in H1’2021 against the market average of Kshs 77,272 SQM. The performance of Athi River is also supported by positive demographics with the area having recorded a population growth of 66.7% to 0.3 mn in 2019 compared to 0.1 mn in 2009 according to the Kenya National Bureau of Statistics (KNBS), and improving infrastructure as the area is served by Magadi Road, among other factors. The table below shows the performance of lower mid-end apartments in the satellite towns in H1’2021;

(All values in Kshs unless stated otherwise)

|

Nairobi Satellite Towns Lower Mid-End Apartments Performance H1’2021 |

||||||||

|

Area |

Average of Price Per SQM H1'2021 |

Average of Rent per SQM H1'2021 |

Average of Occupancy H1'2021 |

Average of Uptake H1'2021 |

Average of Annual Uptake H1'2021 |

Average of Rental Yield H1'2021 |

Average of Y/Y Price Appreciation H1'2021 |

Total Returns H1'2021 |

|

Ruaka |

105,633 |

514 |

63.7% |

76.0% |

19.0% |

5.5% |

2.0% |

7.5% |

|

Kikuyu |

80,766 |

529 |

79.6% |

79.4% |

17.6% |

6.4% |

0.3% |

6.7% |

|

Thindigua |

108,551 |

537 |

79.3% |

79.4% |

12.8% |

4.9% |

1.2% |

6.0% |

|

Syokimau |

67,967 |

345 |

79.0% |

77.6% |

12.0% |

5.2% |

(2.2%) |

6.0% |

|

Ngong |

58,015 |

306 |

81.4% |

72.3% |

11.8% |

5.3% |

0.7% |

5.9% |

|

Kitengela |

59,488 |

284 |

90.0% |

82.8% |

10.0% |

5.1% |

(2.8%) |

5.5% |

|

Athi River |

59,145 |

290 |

97.2% |

96.9% |

12.6% |

5.7% |

(1.2%) |

4.5% |

|

Ruiru |

86,904 |

528 |

86.4% |

85.8% |

23.8% |

6.1% |

(1.8%) |

4.3% |

|

Rongai |

68,982 |

363 |

87.3% |

94.2% |

28.6% |

6.3% |

(3.9%) |

2.4% |

|

Average |

77,272 |

411 |

82.7% |

82.7% |

16.5% |

5.6% |

(0.9%) |

4.7% |

Source: Cytonn Research

Additionally, President Uhuru Kenyatta signed a Public Private Partnership (PPP) deal worth Kshs 5.2 bn with the United Kingdom aiming at fostering ties between the two countries as well as initiating green affordable home projects. The proposal of the PPP deal which was announced in January 2021 affirms UK’s support of the big four agenda on affordable housing initiative, as the aid is expected to finance the development of 10,000 green affordable homes. PPPs have proven to be efficient strategies of delivering projects in Kenya due to ; i) easy access to finance for projects, ii) government access to private sector efficiencies, ii) exposure to large scale projects, and, iv) enhanced ease of doing business in the country. However, PPPs in Kenya have not been performing to the optimum due to; i) inadequate planning for PPP projects, ii) fraudulent procurement processes, iii) inadequate regulatory frameworks to handle PPP transactions, and, iv) high transaction costs. Despite the aforementioned challenges, the government and private sector have been aggressively initiating and implementing affordable housing projects through the PPP strategy with some of the ongoing projects being the Pangani affordable housing project, River Estate project in Ngara, and Buxton Estate project in Mombasa, among many others.

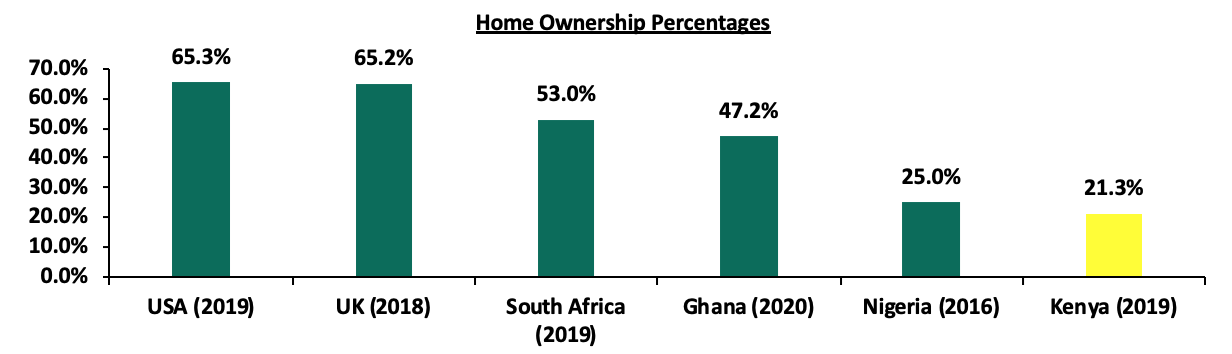

Also, the Kenya Mortgage Refinance Company (KMRC), a state-backed mortgage refinancing firm, announced that it will triple affordable home loans to Kshs 7.0 bn in FY’2021/22, thereby increasing the loan book at 154.7% from the Kshs 2.7 bn offered to banks and savings and credit cooperative society (Saccos) in FY’2020/21. KMRC began operations in September 2021 after officially getting permit, with the sole objective of providing affordable mortgages within the Nairobi Metropolitan Area (NMA) to financial institutions at an average interest rate of 5.0%, enabling the primary mortgage lenders to write them off at a rate of 7.0%, which is 8.0% points lower than the average market lending rate of approximately 15.0% as at 2020. However, it is not clear how KMRC will sustainably access funds at such low rates, yet even the government can only access 20-year funds at a 13.2% rate. The availability of funds to Primary Mortgage Lenders (PMLs) from KMRC at favorable interest rates will encourage prospective home owners to take up loans for development hence boosting current low home ownership rates in Kenya currently at 21.3% as at 2020 implying that approximately 78.7% of the urban population in Kenya are renters as opposed to the 53.0% urban home ownership percentages in South Africa.

The graph below shows the percentage of home ownership in different countries compared to Kenya;

Source: Centre for Affordable Housing Finance in Africa

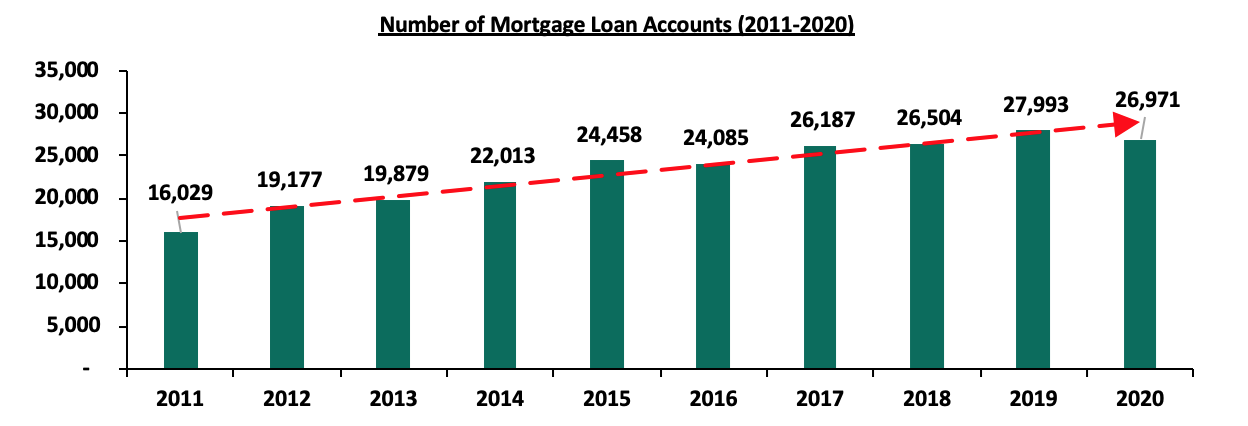

The move by KMRC to triple the affordable home loans by Kshs 4.3 mn in the FY’2021/22 to Kshs 7.0 bn is also expected to initiate an improvement in the number of mortgage loan accounts registered in the country, which realized a 3.5% decline to 26,971 in 2020 from the 27,993 recorded in 2019, attributed to the harsh economic environment that saw to it a limited spending power by prospective clients and a decline in the access to loans as creditors continue to take a conservative approach in line with giving out loan.

The graph below shows the number of mortgage loan accounts in Kenya over the last 10 years;

Source: Central Bank of Kenya

With the improved mortgage availability by the lender with Kshs 4.3 mn from Kshs 2.7 bn allocated in the FY 2020/21 to the expected Kshs 7.0 bn for the FY’2021/22, we expect that the number of mortgage accounts to increase by approximately 1,229, assuming the average affordable mortgage loan size by KMRC is Kshs 3.5 mn, with some of the factors still hindering mortgage performance in the country being; i) longer transaction timelines, ii) minimal knowledge on the financing structure, iii) relatively low income levels to service the loans, and, iv) inefficient secondary mortgage markets.

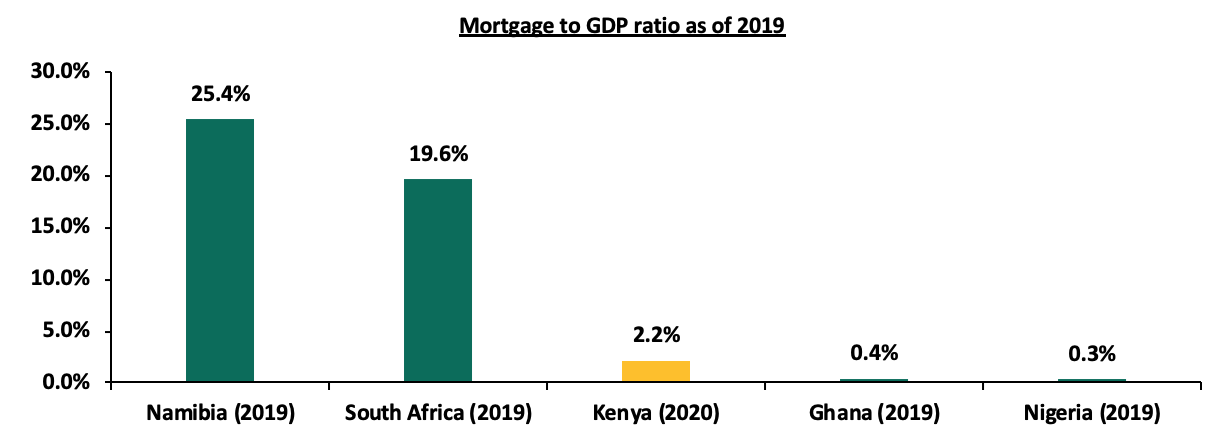

The graph below shows the mortgage to GDP ratio for Kenya compared to other countries as at 2019;

Source: Center for Affordable Housing Africa

Acorn Holdings, a student hostels developer, signed a partnership deal with the United States International University Africa (USIU-Africa), to provide 697 of its students with accommodation, through the development of hostels at a cost of Kshs 1.0 bn. The partnership deal is aimed at decongesting the university’s hostels which currently has a bed capacity of just 258 beds out of a total student population of about 7,000. Acorn Holdings has been on an aggressive path to deliver student hostels under its Qwetu and Qejani brands with the aim of providing safer, quality and affordable accommodation to the rising number students. Besides it has completed student projects in Ruaraka, Parklands, Jogoo road and, Madaraka, with others in the pipeline such as; i) the 3,591-room hostels in Nairobi’s Karen developed at a cost of Kshs 1.9 bn, ii) the Kshs 810.0 mn Nairobi West Qwetu hostels targeting Strathmore University students, and, iii) the Kshs 880.0 mn Qwetu 3 and Kshs 740.0 mn Qwetu 4 developments targeting USIU- Africa students, among many others.

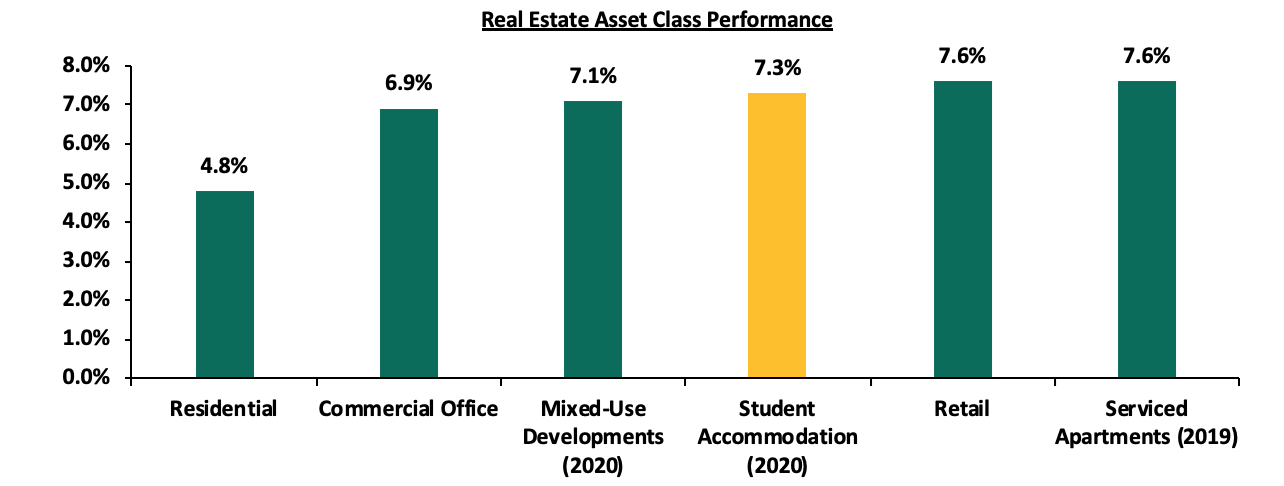

Student accommodation developments have continued to gain traction in the recent past mainly attributed to; i) the rising population of students against the low supply thus need to tap into the deficit, ii) the need to foster security of students and provide affordable student housing facilities, and, iii) higher returns as student housing facilities generated a rental yield of 7.3% as at 2020 compared to other asset classes such as the residential and commercial office spaces which recorded average rental yields of 4.8% and 6.9%, respectively, in H1’2021. We therefore expect the sector to continue gaining momentum and attracting more investment opportunities further boosting project returns. The graph below shows the performance of rental yields in student housing compared to the different real estate asset classes in H1’2021;

Source: Cytonn Research

Other notable highlights during the month include;

- Acorn Holdings, a student hostels developer, announced that it had raised Kshs 2.1 bn from a corporate bond, to develop 2 new hostels expected to avail 2,654 beds in addition to the 4,695 bed capacity currently being developed under the bond funding. For more information, see Cytonn Weekly #29/2021,

- Standard Chartered Bank of Kenya announced that it had cut the interest on new mortgages and waived legal and valuation fees for clients moving existing facilities from other banks, in a bid to grow home loans. For more information, see Cytonn Weekly #29/2021,

- The Harambee Investment Cooperative Society (HICS), the investment vehicle of Harambee Sacco, announced that it is seeking a joint venture partnership with African Development Bank (AfDB), a regional multilateral development finance institution, to develop affordable housing units for 596 of its members. For more information, see Cytonn Weekly #28/2021,

- Kenya joined 24 other African countries in signing the Yaoundé Declaration, a joint declaration that seeks to offer mass production of decent and affordable housing on the African continent for the next 40 years. For more information, see Cytonn Weekly #27/2021, and,

- Co-operative Bank of Kenya launched a pension backed mortgage facility in partnership with Enwealth Financial Services Limited, a retirement services provider, which will allow clients to own homes through mixed financing of their pension contributions, and a long term loan. For more information, see Cytonn Weekly #27/2021.

The residential sector is expected to continue registering more activities to foster its performance improvement through various ways such as; i) the improved mortgage availability, ii) government and private sector continued focus on the affordable housing initiative, iii) continued focus on the decent and affordable student housing projects, and, iv) the joint venture and PPP strategies aimed at delivering projects in an efficient way.

- Retail Sector

During the week, Naivas supermarket, a local retail chain, opened a new store in Kisumu at Simba Hall, taking up 30,000 SQFT of prime retail space previously occupied by trouble retailer, Tuskys supermarket. The aggressive move by the retailer comes barely two weeks after they opened a new store in Githurai 44 bringing their total operational outlets to 75, and the 3rd in Kisumu. Moreover, the retailer announced plans to open four more outlets in Migori, Homabay, Meru and Kakamega counties, in its expansion spree to maintain market dominance as a result of the stiff market competition from close rivals Carrefour and QuickMart. The decision by Naivas to take up space in Kisumu is supported by; i) strategic location of Simba Hall along the busy Kisumu-Kakamega Highway providing easy access, ii) exit by troubled retailer Tuskys thereby leaving prime retail space for uptake, and, iii) rapid population growth with Kisumu having registered a 33.3% population increase from 0.9 mn in 2009 to 1.2 mn in 2019 according to the Kenya National Bureau of Statistics. In terms of performance, according to our Kenya Retail Report 2020, Kisumu registered rental rates of Kshs 97.2 against the market average of Kshs 115.1, signifying that Naivas is leveraging on affordability as the main reason for choosing Kisumu as its preferred location.

The table below shows a summary of the performance of the retail sector in key urban cities in Kenya;

|

Summary Performance of Key Urban Cities in Kenya |

|||

|

Region |

Rent/SQFT 2020 |

Occupancy% 2020 |

Rental Yield |

|

Mount Kenya |

125.0 |

78.0% |

7.7% |

|

Nairobi |

168.5 |

74.5% |

7.5% |

|

Mombasa |

114.4 |

76.3% |

6.6% |

|

Kisumu |

97.2 |

74.0% |

6.3% |

|

Eldoret |

130.0 |

80.2% |

5.9% |

|

Nakuru |

55.7 |

76.6% |

5.9% |

|

Average |

115.1 |

76.6% |

6.7% |

Source: Cytonn Research 2020

The table below shows the summary of the number of stores of the Key local and international retailer supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened |

Projected number of branches FY’2021 |

|

Naivas |

Local |

46 |

61 |

69 |

6 |

0 |

75 |

4 |

79 |

|

QuickMart |

Local |

10 |

29 |

37 |

4 |

0 |

41 |

4 |

45 |

|

Chandarana Foodplus |

Local |

14 |

19 |

20 |

0 |

0 |

20 |

0 |

20 |

|

Carrefour |

International |

6 |

7 |

9 |

4 |

0 |

13 |

2 |

15 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

1 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

3 |

1 |

0 |

1 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

257 |

313 |

334 |

15 |

177 |

172 |

10 |

182 |

|

Source: Online Research

Additionally, Java House Africa Group, an international restaurant chain, announced plans to open 30 new Kukito outlets in various parts of Nairobi, in the next five years. This will bring the number of operational outlets by the restaurant chain to 32, having opened two other outlets in Nairobi’s Central Business District (CBD) and Gigiri in 2019. The decision plan by the restaurant chain to set up operational outlets in Nairobi is supported by; i) stiff market competition from closest restaurant chain rivals like Kentucky’s Finest Chicken (KFC), and Subway restaurant, ii) rapid population growth in Nairobi fostering demand for their products, thereby also improving their financial muscle and the need to expand, iii) fast growing infrastructure developments opening up various areas for investment opportunities, iv) the Nairobi region remaining one of the largest East Africa’s business hub, and, v) convenience from online food platforms that initiate easier and faster accessibility and delivery services. According to the Cytonn H1’2021 Markets Review, Nairobi registered a performance improvement in the rental yields to 7.6%, from 7.5% in FY’2020 signifying that the region continues to present a good investment opportunity for the restaurant chain despite the pandemic.

The table below shows the performance of the NMA retail market in H1’2021

All Values in Kshs unless stated otherwise

|

Nairobi Metropolitan Area Retail Market Performance H1’2021 |

|||

|

Area |

Rent/SQFT H1'2021 |

Occupancy % H1'2021 |

Rental Yield H1'2021 |

|

Westlands |

209 |

80.0% |

9.7% |

|

Karen |

217 |

80.6% |

9.5% |

|

Kilimani |

173 |

82.8% |

8.9% |

|

Ngong Road |

178 |

78.8% |

8.0% |

|

Kiambu road |

178 |

68.8% |

7.1% |

|

Thika Road |

159 |

73.3% |

6.7% |

|

Mombasa road |

139 |

73.0% |

6.3% |

|

Satellite towns |

134 |

74.0% |

6.2% |

|

Eastlands |

136 |

70.0% |

5.8% |

|

Average |

169 |

75.7% |

7.6% |

Source: Cytonn Research 2021

Other notable highlights during the month include;

- Naivas Supermarket, a local retailer, opened a new store in Githurai 44, along Kamiti Road, taking up 28,000 SQFT of space previously occupied by Tuskys Supermarket, which shut down due to cash flow setbacks. For more information, see Cytonn Weekly #29/2021.

Despite the effects of the pandemic and the existing retail space oversupply in the country at 2.0 mn SQFT, the retail market has been on an upward trajectory registering rapid development activities through uptake of space, which is expected to initiate improvement in performance of the sector, coupled by other factors such as improved infrastructure and positive demographics.

- Hospitality Sector

During the week, South African’s City Lodge Hotel Group, an international hotelier, announced plans to sell its three Kenyan-based hotels namely; the 127-room Fairview Hotel in Nairobi, the 171-room City Lodge Hotel in Two Rivers, and, the 84-room Town Lodge Hotel in Upperhill, to private equity fund Actis, a United Kingdom (UK)-based investment firm. The three hotels which have been in operation for the last seven years are to be sold at a cost of Kshs 1.0 bn amidst the overall operational loss concerns generated mainly by City and Town Lodge hotels due to a slow business environment since December 2019, coupled with the hotel group trying to minimize their existing debt through selling their above aforementioned assets. The opportunity to sell the hotels instead of closure comes at a time when private equity financing and buyoffs has also been realized to be a good alternative financial solution and source for economic development due to; i) ease of financial accessibility, ii) entrepreneurial diversification, and, iii) ability to outperform other asset classes.

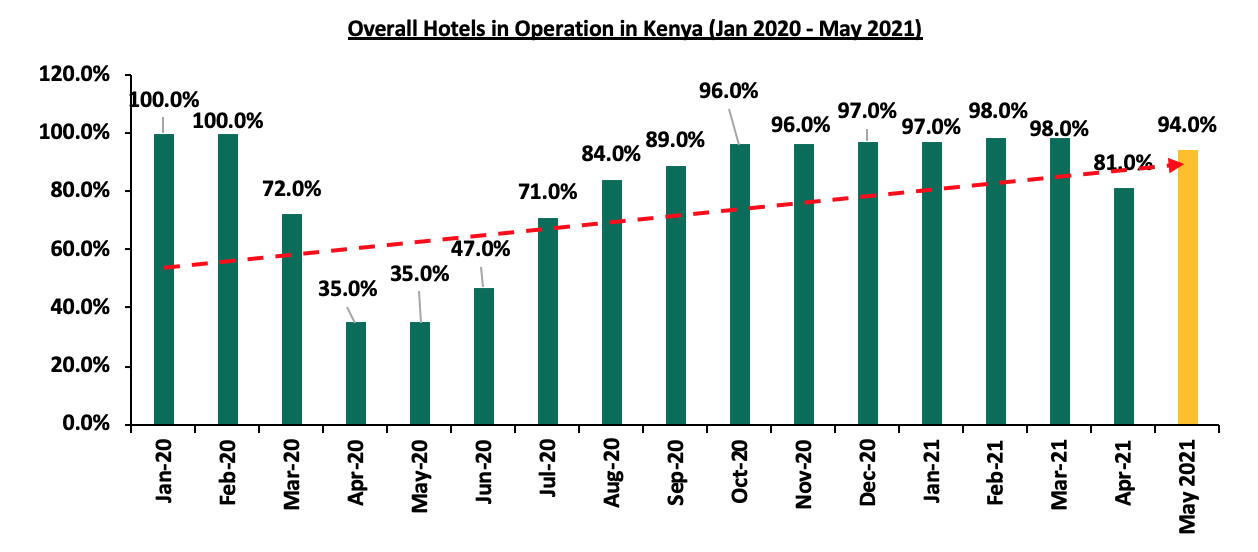

The hospitality sector has been the worst hit real estate sector since the awakening of the pandemic, attributable to the imposed restrictions, travel bans and lockdowns as its containment measures. This led to the closure of numerous hotels in the country, their overall decline in performance such as the performance decline for the aforementioned hotels by City Lodge Group among many others, as well as the decline in the performance of serviced apartments in 2020. However, the sector has made remarkable gradual improvement following the slow lifting of the restrictions and lockdowns, thereby leading to an overall improvement in their performance and number of operational hotels in Kenya. We therefore expect it continue registering more activities to boost its performance going forward.

The graph below shows the overall percentage of the number of operating hotels in Kenya between January 2020 and May 2021;

Source: Central Bank of Kenya

Additionally, during the month;

- The British government announced that the United Kingdom has retained Kenya in its ‘Red List’ of countries whose nationals are barred from entering the United Kingdom (UK) due to concerns of the Covid-19 Delta variant. For more information, see Cytonn Weekly #29/2021.

Despite some of the improved activities noted in the sector such as the improving number of hotels in operations signifying a post Covid recovery, we expect the sector’s performance will still be impeded by the low number of visitor arrivals as well as financial constraints limiting the consumers spending powers.

- Infrastructure

During the month;

- The Kenya Roads Board (KRB), the agency overseeing development of roads in Kenya, announced that the estimated value of roads in Kenya is currently stands at Kshs 3.5 tn. For more information, see Cytonn Weekly #28/2021, and,

- The Cabinet Secretary for Ministry of Transport, Infrastructure, Housing and Urban Development, Hon. James Macharia, announced that the 27.0 Km Nairobi Expressway project will be completed by February 2022 (six months ahead of its initial December 2022 completion date). For more information, see Cytonn Weekly #28/2021.

With the 0.6% improved FY’2021/22 budget allocation to the infrastructure sector to Kshs 182.5 bn, from Kshs 181.4 bn allocated in FY’2020/21, we expect the sector to register more and more construction activities coupled with government’s focus on implementing and concluding projects on the same.

- Statutory Reviews

During the month;

President Uhuru Kenyatta signed into law the Finance Bill, 2021. A key highlight in the real estate sector was the re-introduction of a 20.0% excise duty on fees and other commissions earned on loans by financial institutions which risks making credit costly for home owners and developers as lenders will transfer the burden to borrowers. For more information, see Cytonn Weekly #27/2021.

- Listed Real Estate

ILAM Fahari I-REIT released their H1’2021 earnings, which registered a 50.9% decline in their basic earnings per unit to Kshs 0.2 from Kshs 0.5 realized in H1’2021, attributed to the 18.4% decline in the total operating income to Kshs 147.1 mn, from Kshs 180.1 mn in H1’2020, coupled with a 4.3% increase in total operating expenses to Kshs 106.3 mn, from Kshs 101.9 mn recorded in H1’2020. The rental income came in at Kshs 136.7 mn, a 21.8% decline from the Kshs 174.7 mn recorded in H1’2020 mainly attributable to the low rental income generated by the retail and commercial offices struggling to attract and maintain tenants due to the impact of the pandemic, as well as the high expenses incurred from poorly performing assets such as the Greenspan mall which lost its anchor tenant Tuskys from bad debts. However, ICEA signed a deal with Naivas as its anchor tenant replacing Tuskys and hence we expect the performance to improve in the second half of the year.

For a more comprehensive analysis, please see our ILAM Fahari I-REIT H1’2021 Earnings Note.

Additionally, Acorn Holdings released their H1’2021 financial statements for the D-REIT and I-REIT Investment arm which have been invested in student accommodation. The Development Real Estate Investment Trust (D-REIT) finances the development of student hostels whereas the Investment Real Estate investment trust (I-REIT) is mainly invested in the respective properties by the firm for rental income. Acorn D-REIT recorded profits of Kshs 266.9 mn in H1’2021 while the I-REIT profits came in at Kshs 141.3 mn. The D-REIT Performance was mainly driven by the Kshs 339.0 mn increase in the fair value of Investment Property.

For a more comprehensive analysis, please see our Acorn Holdings H1’2021 Earnings Note.

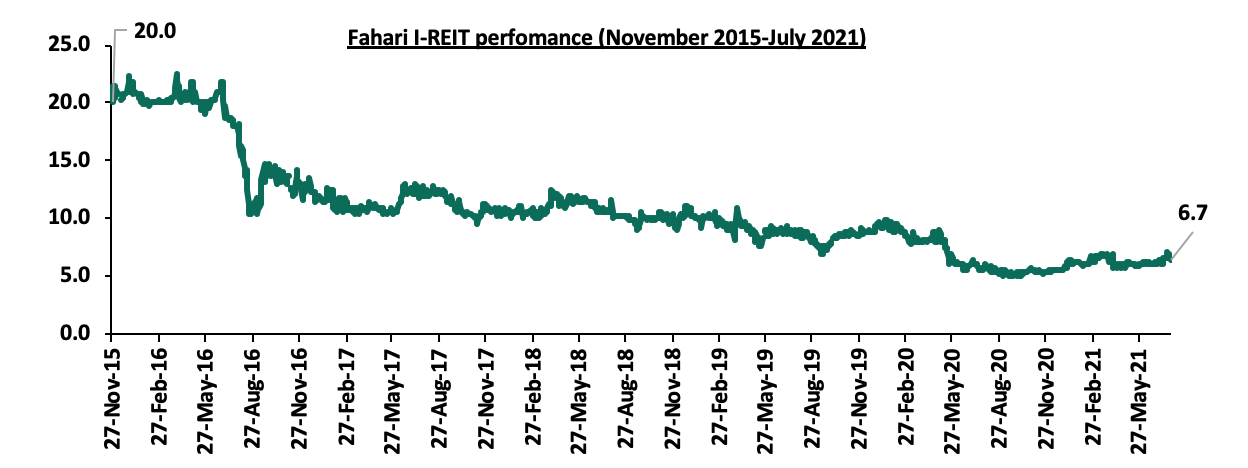

On the Exchange, Fahari closed the month trading at an average price of Kshs 6.7 per share, a 15.5% YTD increase from Kshs 5.8 per share, and a 9.8% MTD increase from Kshs 6.1 realized in June. However, the share price represents a 66.5% inception to date decline from Kshs 20.0. The REIT is expected to continue recording subdued performance due to a general lack of knowledge on the financing instrument, as well as investor lack of interest for it. The graph below shows the REIT’s performance from November 2015 to June 2021:

Other Key highlights in the real estate sector include;

- Nairobi’s City Hall announced plans to waiver submission fees on building plan approvals in addition to allowing some developments above permitted zoning regulations, in a bid to entice property developers into initiating housing projects in the county thereby boosting revenue for the county government. According to City Hall, the waiver plans is also further supported by the increasing demand for approvals by the market forces, hence need to tap into the opportunity to generate more revenue for the government and also purpose for improved building plan approvals and developments in the long run.

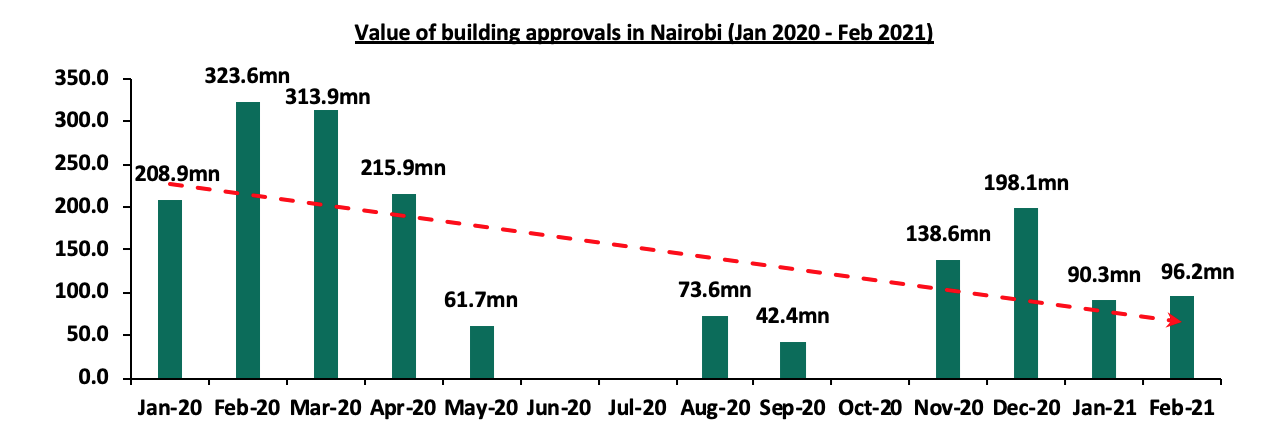

The above move by City Hall comes barely less than a month after Nairobi Metropolitan Services (NMS) announced the resumption of the upgraded e-construction permit system which includes the Quick Response (QR) Code System in August 2021, with the aim of facilitating easier and faster approval processes for building plans. According to KNBS’ Leading Economic Indicators February 2021 report, NMA registered a 70.3% decline in the value of building plan approvals to Ksh 96.2mn in February 2021, compared to Ksh 323.6mn recorded a similar period in 2020 due to the reduced development activities amidst the tough economic environment. Therefore, with the economy having picked up coupled with the implementation of the waiver plans in place and resumption of the permit system, more development plan approvals are expected to be registered in Nairobi, with more construction activities also expected to be witnessed in the real estate construction industry.

The graph below shows value of building approvals in Nairobi from January 2020 to February 2021;

Source: Kenya National Bureau of Statistics

The real estate sector continues to make remarkable improvements supported by; i) improved mortgage availability, ii) continued focus on infrastructure and affordable housing projects, iii) an expected improvement in the number of development plans for construction within Nairobi, and, iv) aggressive retail space uptake by local and international retailers. However, factors such as the low consumer spending patterns, high development costs, low tourist arrivals from top source markets such as the UK, are expected to continue hindering performance of the sector.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.