Cytonn Monthly - May 2021

By Research Team, Jun 6, 2021

Executive Summary

Fixed Income

During the month of May, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 136.2%, an increase from 89.1% recorded in April. The continued high demand for the 364-day paper was reflected in the increase in its subscription rate to 144.2%, from 91.0% recorded the previous month. The subscription rate for the 182-day papers increased to 21.8% from the 20.6%, while the subscription rate for the 91-day declined to 25.0%, from 68.6% recorded in April;

During the week, T-bills remained oversubscribed with the overall subscription rate coming in at 162.5%, an increase from the 152.4% recorded the previous week. The demand for the 364-day paper persisted, as it received the highest bids of Kshs 27.6 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 276.3%, an increase from the 238.2% recorded the previous week. The continued interest in the 364-day paper is mainly attributable to investors rushing to lock in the paper’s attractive return of 9.0% given that the rates have been declining over the last few weeks. The subscription rate for the 182-day paper declined to 100.0%, from 103.1% recorded the previous week, receiving bids worth Kshs 10.0 bn. The subscription rate for the 91-day paper declined to 34.3%, from 116.1% recorded the previous week, with the paper receiving bids worth Kshs 1.4 bn against the offered amounts of Kshs 4.0 bn. The yields on the three papers ended the week at 7.1%, 7.8% and 9.0% for the 91-day, 182-day and 364-day papers, respectively;

During the month of May, the primary bond market was active with the government reopening two bonds, FXD2/2019/15 and FXD1/2021/25, which were 142.0% subscribed, having received bids worth Kshs 42.5 bn compared to Kshs 30.0 bn offered. For the month of June, the government has reopened two bonds, FXD1/2019/20 and FXD1/2012/20 with tenors of 17.9 years and 11.4 years respectively whose offer period ends on 15th June 2021.

The inflation rate for the month of May increased to 5.9%, from the 5.8% recorded in April due to the 16.6% and 7.0% year on year increase in transport index and food prices, respectively.

Equities

During the month of May, the equities market recorded mixed performance, with NASI and NSE 20 gaining by 0.5% and 0.3%, respectively, while NSE 25 declined by 0.1%. The equities market performance was driven by gains recorded by large cap stocks such as EABL, ABSA Bank Kenya, Equity Group and KCB Group, which gained by 9.1%, 8.0%, 7.8%, and 5.1% respectively. The gains were however weighed down by losses recorded by stocks such as Bamburi, Diamond Trust Bank Kenya (DTB-K) and Standard Chartered Bank Kenya, which declined by 10.5%, 8.0%, and 3.0%, respectively. Safaricom Plc announced that the Ethiopian Communications Authority (ECA) had approved a bid for an Ethiopia Telco License which was submitted by a consortium including Safaricom, Vodacom Group Ltd, Vodafone Group Plc (UK), CDC Group Plc and Sumitomo Corporation.

During the week, Nation Media Group (NMG) issued a share buyback circular to shareholders, proposing to buy back up to 10.0% (20.7 mn shares) of its issued and paid-up share capital. This would reduce the company’s outstanding shares to 186.7 mn, shares from 207.4 mn shares;

Real Estate

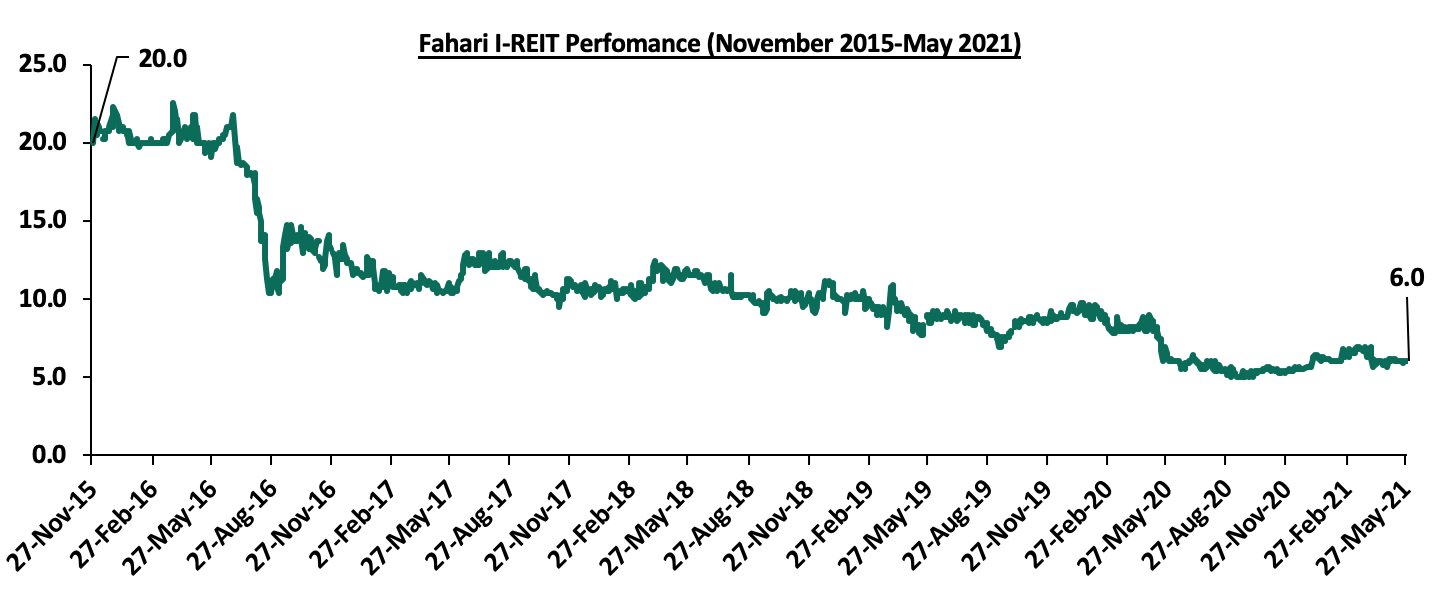

During the month, various industry reports were released, namely; the Budget Estimates 2021/22 by the National Treasury, Hass Consult’s House Price Index Q1’2021 and Q1’2021 Land Price Index, and, Central Bank of Kenya’s Bank Supervision Annual Report 2020. In the retail sector, Tuskys Supermarket sought approval from the Competition Authority of Kenya (CAK) to lease its brand through an undisclosed United Kingdom (UK)-based franchise. In Mixed-Use Developments (MUDs), Tatu City appointed Snowy Mountains Engineering Corporation (SMEC), an Australian-based firm, as the lead infrastructure consultant for the second phase of its 2,500 acre Tatu Industrial Park in Ruiru. Additionally, Hilshaw Group, a Dubai-based firm, was appointed as an adviser and financing consultant of the planned Athi River Smart Green City project in Nairobi. In infrastructure, Cabinet Secretary for Transport, Infrastructure, Housing, Urban development and Public works, Hon. James Macharia, announced that the construction of the 233-km Nairobi-Mau Summit highway is expected to begin in September 2021. In the land sector, the Central Lands Registry, whose offices are located in Ardhi House, Upperhill Nairobi, was shut down after its operations were migrated to an online platform following the official launch of the National Land Information Management System (NLIMS) last month. In listed real estate, the Fahari I-REIT closed the month of May trading at Kshs 6.0 per share, representing a 6.4% and 5.2% increase in YTD and MTD performances, respectively. However, the performance indicates a 70.0% loss when compared to its listing price of Kshs 20.0 in November 2015.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.41%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.97% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Unit Trust Scheme will hold a virtual Annual General Meeting (AGM) on Friday 11th June 2021 from 11.00 AM. Register for the AGM by dialing *483*506# or by clicking this link Here . Registration for the AGM opened on Saturday, 22nd May 2021 at 9:00 am and will close on Wednesday, 9th June 2021 at 11.00 a.m.

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupancy. To rent please email properties@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

For recent news about the group, see our news section here.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of May, T-bill auctions recorded an oversubscription, with the overall subscription rate coming in at 136.2%, an increase from 89.1% recorded in April. The continued high demand for the 364-day paper was reflected in the increased subscription rate to 144.2%, from 91.0% recorded the previous month. Investors’ continued interest in the 364-day paper, during the month, is mainly attributable to the paper’s attractive return of 9.0% which is higher than the rate being offered by most banks. The subscription rate for the 182-day papers increased to 21.8% from the 20.6%, while the subscription rate for the 91-day declined to 25.0%, from 68.6% recorded in April. The yields on the 364-day and 182-day papers declined by 31.8 bps and 12.4 bps to 9.0% and 7.8%, respectively, while the yields on the 91-day paper remained unchanged at 7.1%. For the month the government accepted a total of Kshs 104.6 bn, out of the Kshs 163.5 bn worth of bids received as they sought to contain rates.

During the week, T-bills remained oversubscribed with the overall subscription rate coming in at 162.5%, an increase from the 152.4% recorded the previous week. The demand for the 364-day paper persisted, as it recorded the highest bids worth Kshs 27.6 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 276.3%, an increase from the 238.2% recorded the previous week. The continued interest in the 364-day paper is mainly attributable to investors rushing to lock in the paper’s attractive return of 9.0% given that the rates have been declining over the past few weeks. The subscription rate for the 182-day paper declined to 100.0%, from 103.1% recorded the previous week, receiving bids worth Kshs 10.0 bn. The subscription rate for the 91-day paper declined to 34.3%, from 116.1% recorded the previous week, with the paper receiving bids worth Kshs 1.4 bn against the offered amounts of Kshs 4.0 bn. The yields on all the three papers declined; with the 91-day, 182-day and 364-day paper declining by 0.2 bps, 4.7bps and 18.3 bps, to 7.1%, 7.8% and 9.0%, respectively. The government continued to reject expensive bids, accepting Kshs 22.9 bn out of the Kshs 39.0 bn worth of bids received, translating to an acceptance rate of 58.7%.

In the Primary Bond Market, the two bonds reopened by the government for the month of May recorded an overall subscription rate of 142.0%. Investors preferred the longer dated paper, FXD1/2021/25, with a tenor of 25 years, which received bids worth Kshs 31.0 bn, against the Kshs 30.0 bn offered amount which translated to a subscription rate of 103.4%. On the other hand, FXD2/2019/15 received bids worth Kshs 11.6 bn against the Kshs 30.0 bn offered, translating to a subscription rate of 38.6%. The average yields on the two bonds were 13.0% for FXD2/2019/15 and 13.9% for FXD1/2021/25. The government continued rejecting expensive bids by accepting Kshs 20.3 bn of the Kshs 42.5 bn worth of bids received, translating to an acceptance rate of 47.6%.

During the week, the government reopened bidding for two bonds, FXD1/2019/20 and FXD1/2012/20, with tenors of 17.9 years and 11.4 years, respectively, whose offer period ends on 15th June 2021. The coupon rates are 12.9% for FXD1/2019/20 and 12.0% for FXD1/2012/20. We expect the investors to prefer the longer dated paper, FXD1/2019/20, as they consider the prevailing risks posed by the pandemic. We recommended bidding of the two bonds at 12.9%-13.2% and 12.3%-12.6% for each bond respectively.

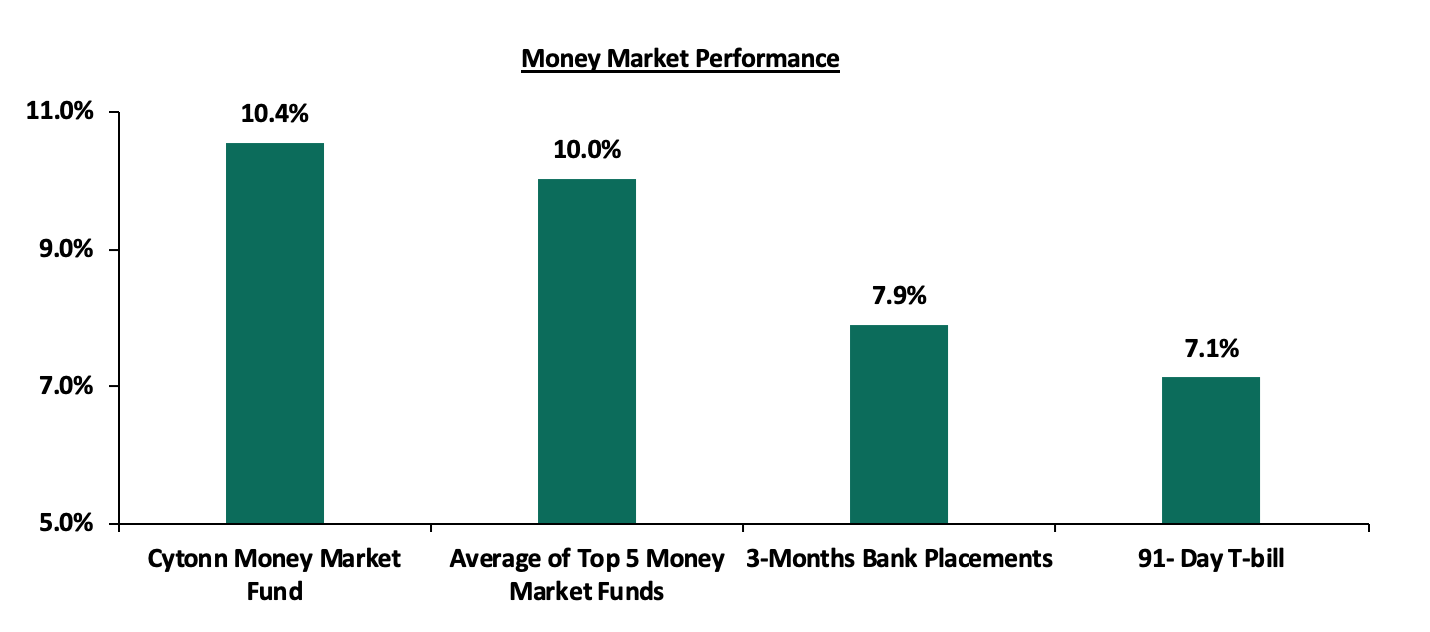

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined marginally by 0.2 bps to 7.1%. The average yield of the Top 5 Money Market Funds remained unchanged at 10.0%, similar to what was recorded the previous week. The yield on the Cytonn Money Market Fund declined to 10.4% from the 10.6%, recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 4th June 2021:

|

Money Market Fund Yield for Fund Managers as published on 4th June 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

9.91% |

10.41% |

|

2 |

Nabo Africa Money Market Fund |

9.53% |

9.96% |

|

3 |

GenCapHela Imara Money Market Fund |

9.50% |

9.96% |

|

4 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

5 |

Alphafrica Kaisha Money Market Fund |

9.22% |

9.62% |

|

6 |

CIC Money Market Fund |

9.08% |

9.40% |

|

7 |

Madison Money Market Fund |

8.97% |

9.38% |

|

8 |

Sanlam Money Market Fund |

8.82% |

9.22% |

|

9 |

Co-op Money Market Fund |

8.53% |

8.90% |

|

10 |

Dry Associates Money Market Fund |

8.29% |

8.61% |

|

11 |

Apollo Money Market Fund |

8.48% |

8.59% |

|

12 |

British-American Money Market Fund |

8.20% |

8.52% |

|

13 |

NCBA Money Market Fund |

8.03% |

8.33% |

|

14 |

ICEA Lion Money Market Fund |

8.01% |

8.33% |

|

15 |

Old Mutual Money Market Fund |

7.06% |

7.30% |

|

16 |

AA Kenya Shillings Fund |

5.99% |

6.16% |

Secondary Bond Market:

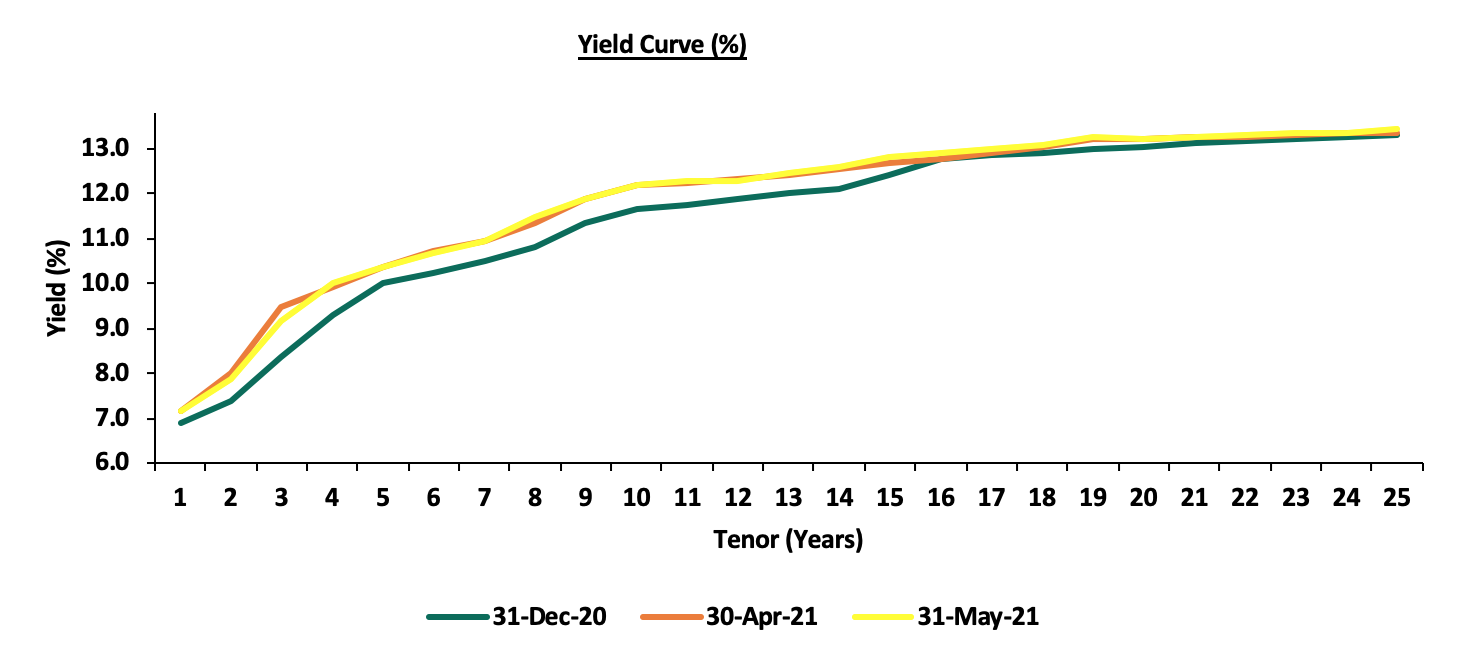

In the month of May, the yields on government securities in the secondary market remained relatively stable, while the bond turnover increased by 55.3% to Kshs 102.0 bn, from Kshs 65.2 bn recorded in April. The FTSE NSE bond index declined marginally by 0.1%, to close the month at 96.8, bringing the YTD performance to a decline of 1.2%. The chart below is the yield curve movement during the period;

Liquidity:

Liquidity in the money markets improved, with the average interbank rate ending the month at 5.0%, a 0.2% points decline from the April average rate of 5.2%. During the week, liquidity in the money market eased, with the average interbank rate declining to 4.8%, from 5.0%, recorded the previous week, partly attributable to Government payments which partly offset end of the month obligations. The average interbank volumes increased by 48.0% to Kshs 13.6 bn, from Kshs 9.2 bn recorded the previous week.

Kenya Eurobonds:

During the month, the yields on all Eurobonds were on a downward trajectory. The decline in the yields was partly attributable to improved investor confidence, following the recent announcement by the International Monetary Fund (IMF) that it had reached a staff-level agreement with Kenya to enable the nation access a loan of USD 410.0 mn (Kshs 44.4 bn) to aid in stabilizing Kenya’s economy and create a sustainable growth path. The yield on the 10-year Eurobond issued in September 2014 declined to 3.0%, from 3.2% in April. The yields on the 10 year and the 30-year Eurobond issued in 2018 declined to 5.2% and 7.3%, from 5.7% and 7.7%, recorded in April, respectively. Additionally, the yields on the 2019 issued dual-tranche Eurobond with 7-years and 12-years declined to 4.6% and 6.2% in May, from 5.0% and 6.7%, respectively in April.

During the week, the yields on Eurobonds recorded mixed performance. The yields on the 10-year Eurobond issued in June 2014, 10-year bond issued in 2018, 7-year bond issued in 2019 declined to 3.0%, 5.2% and 4.6%, from 3.1%, 5.3% and 4.7%, respectively. On the other hand, the yields on the 30-year bond issued in 2018 and the 12-year bond issued in 2019 remained unchanged at 7.3% and 6.2%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

30-April-2021 |

3.2% |

5.7% |

7.7% |

5.0% |

6.7% |

|

27-May-21 |

3.1% |

5.3% |

7.3% |

4.7% |

6.2% |

|

28-May-21 |

3.1% |

5.3% |

7.3% |

4.7% |

6.2% |

|

31-May-21 |

3.1% |

5.3% |

7.3% |

4.7% |

6.2% |

|

01-June-21 |

3.1% |

5.3% |

7.3% |

4.6% |

6.2% |

|

02-June-21 |

3.1% |

5.3% |

7.3% |

4.6% |

6.2% |

|

03-June-21 |

3.0% |

5.2% |

7.3% |

4.6% |

6.2% |

|

Weekly Change |

(0.1%) |

(0.1%) |

(0.0%) |

(0.1%) |

(0.0%) |

|

M/M Change |

(0.1%) |

(0.5%) |

(0.4%) |

(0.3%) |

(0.4%) |

|

YTD Change |

(0.9%) |

0.0% |

0.3% |

(0.3%) |

0.3% |

Source: Reuters

Kenya Shilling:

During the month, the Kenya Shilling appreciated by 0.2% against the US Dollar to close the month at Kshs 107.6, from Kshs 107.8 recorded at the end of April 2021, mostly attributable to the lackluster dollar demand from general importers.

During the week, the Kenyan shilling depreciated against the US dollar by 0.2% to close the week at Kshs 107.7, from Kshs 107.6 recorded the previous week, mainly due to dollar demand from commodity importers outweighing the supply of dollars from exporters. On a YTD basis, the shilling has appreciated by 1.3% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. Despite the recent appreciation of the shilling, we expect the shilling to remain under pressure in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 7.5 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The stable current account position which is estimated to be at a deficit of 5.2% of GDP in the 12 months to April 2021 and is projected to remain at the same level in 2021, and,

- Improving diaspora remittances evidenced by a 43.8% y/y increase to USD 299.3 mn in April 2021, from USD 208.2 mn recorded over the same period in 2020, which has cushioned the shilling against further depreciation.

Weekly Highlights:

Inflation

The y/y inflation for the month of May increased to 5.9%, from the 5.8% recorded in April, with the month on month inflation increasing by 0.2%. The increase was mainly attributable to the increase in food inflation as the increase in prices of some food items outweighed the decline in prices of other foodstuffs. From the table below, it’s clear that the transport index has had the greatest increase for both year on year and month on month.

|

Major Inflation Changes – May 2021 |

|||

|

Broad Commodity Group |

Price change m/m (May- 21/April -21) |

Price change y/y (May-21/May-20) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.3% |

7.0% |

The m/m increase was mainly contributed by increase in prices of Onion, Kale and cabbages among other food items |

|

Housing, Water, Electricity, Gas and other Fuel |

(0.2%) |

3.2% |

The m/m increase was as a result of increase in the price of charcoal and electricity

|

|

Transport Cost |

0.7% |

16.8% |

The m/m increase was mainly on account of an increase in pump prices of petrol of 2.9% between April and May |

|

Overall Inflation |

0.2% |

5.9% |

The m/m increase was due to a 0.3% increase in the food and non-alcoholic drinks’ cost, mainly driven by the increase in prices of food items |

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5% despite the recent increases in the fuel prices. Food prices are likely to remain low due to favorable rainfall received.

Monthly Highlights:

- The Cabinet Secretary for the National Treasury announced that they had presented the Finance Bill 2021 to Parliament for consideration. Overall, the Finance Bill 2021 is aimed at increasing revenue partly by encouraging manufacturing and industrial activities and increasing tax rates as seen in the case of ordinary bread. For more information, see our Cytonn Weekly#18/2021 and Cytonn Weekly #21/2021 ,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum wholesale and retail pricesfor fuel prices in Kenya effective 15th May 2021 to 14th June 2021. Super Petrol prices increased by 2.9% to Kshs 126.4 per litre, from Kshs 122.8 per litre recorded in April, while the prices of diesel and kerosene remained unchanged at Kshs 107.7 and 97.9 per litre, respectively. Notably, this is the second consecutive month that the diesel and kerosene prices have remained unchanged. For more information, see our Cytonn Weekly #19/2021,

- The International Monetary Fund (IMF) announcedthat it had reached a staff level agreement with the Kenyan authorities that would allow Kenya to access the second tranche of USD 410.0 mn (Kshs 44.4 bn) once the review is formally completed by the IMF Executive Board. The funds are part of an approved 38-month loan facility totalling to USD 2.34 bn (Kshs 253.3 bn) that was announced in April 2021, of which USD 308.0 mn (Kshs 33.3 bn) was released on 3rd April 2021, and subsequent tranches were to be released following frequent loan programme reviews. For more information, see our Cytonn Weekly #20/2021,

- The Monetary Policy Committee (MPC) met on Wednesday, 26thMay 2021 to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR) and any other policy measure like the Cash Reserve Ratio. The committee maintained the CBR at 7.0%, citing that the accommodative policy stance adopted in March 2020, and all the other sittings since, which saw a cumulative 125 bps cut, was having the intended effects on the economy. For more information, see our Cytonn Weekly #20/2021, and,

- The National Treasury gazetted the revenue and net expenditures for the first ten months of FY’2021/2021, ending on 30th April 2021. Total revenue collected as at the end of April 2021 amounted to Kshs 2.2 tn, equivalent to 74.1% of the revised target of Kshs 2.9 tn and is 88.9%, the total expenditure amounted to Kshs 2.2 tn, equivalent to 73.6% of the revised budget of Kshs 2.9 tn and is 88.3% of the prorated expenditure estimates. Additionally, Total Borrowings as at the end of April 2021 amounted to Kshs 0.8 tn, equivalent to 66.2% of the revised target of Kshs 1.3 tn. For more information, see our Cytonn Weekly #21/2021

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 4.4% behind its prorated borrowing target of Kshs 517.6 bn having borrowed Kshs 494.6 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection having collected Kshs. 1,190.6 bn in the first 10 months to April 2021, compared to Kshs 1,224.8 bn prorated target collection for FY’2020/2021, thus leading to a budget deficit of 8.7% larger than the projected 7.5% of GDP. The high deficit and the lower credit rating from S&P Global to 'B' from 'B+' will mean that the government might be forced to borrow more from the domestic market which might create uncertainty in the interest rate environment. In our view, investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the month of May, the equities market recorded mixed performance, with NASI and NSE 20 gaining by 0.5% and 0.3%, respectively, while NSE 25 declined by 0.1%. The equities market performance was driven by gains recorded by large cap stocks such as EABL, ABSA Bank Kenya, Equity Group and KCB Group, which gained by 9.1%, 8.0%, 7.8%, and 5.1% respectively. The gains were however weighed down by losses recorded by stocks such as Bamburi, Diamond Trust Bank Kenya (DTB-K) and Standard Chartered Bank Kenya, which declined by 10.5%, 8.0%, and 3.0%, respectively.

During the week, the equities market recorded mixed performance, with the NSE 20 gaining by 2.5%, while NASI and NSE 25 declined by 1.6% and 0.6%, respectively, taking their YTD performance to gains of 1.9%, 11.7% and 8.3% for NSE 20, NASI and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Bamburi, ABSA Bank Kenya and NCBA Group of 9.5%, 2.7%, and 2.6%, respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Safaricom which declined by 3.2%.

Equities turnover increased by 44.3% during the month to USD 131.9 mn, from USD 91.4 mn recorded in April 2021. Foreign investors remained net sellers during the month, with a net selling position of USD 7.3 mn, compared to April’s net selling position of USD 0.3 mn.

During the week, equities turnover decreased by 53.6% to USD 21.5 mn, from USD 46.3 mn recorded the previous week, taking the YTD turnover to USD 530.8 mn. Foreign investors turned net sellers, with a net selling position of USD 1.7 mn, from a net buying position of USD 7.2 mn recorded the previous week, taking the YTD net selling position to USD 17.5 mn.

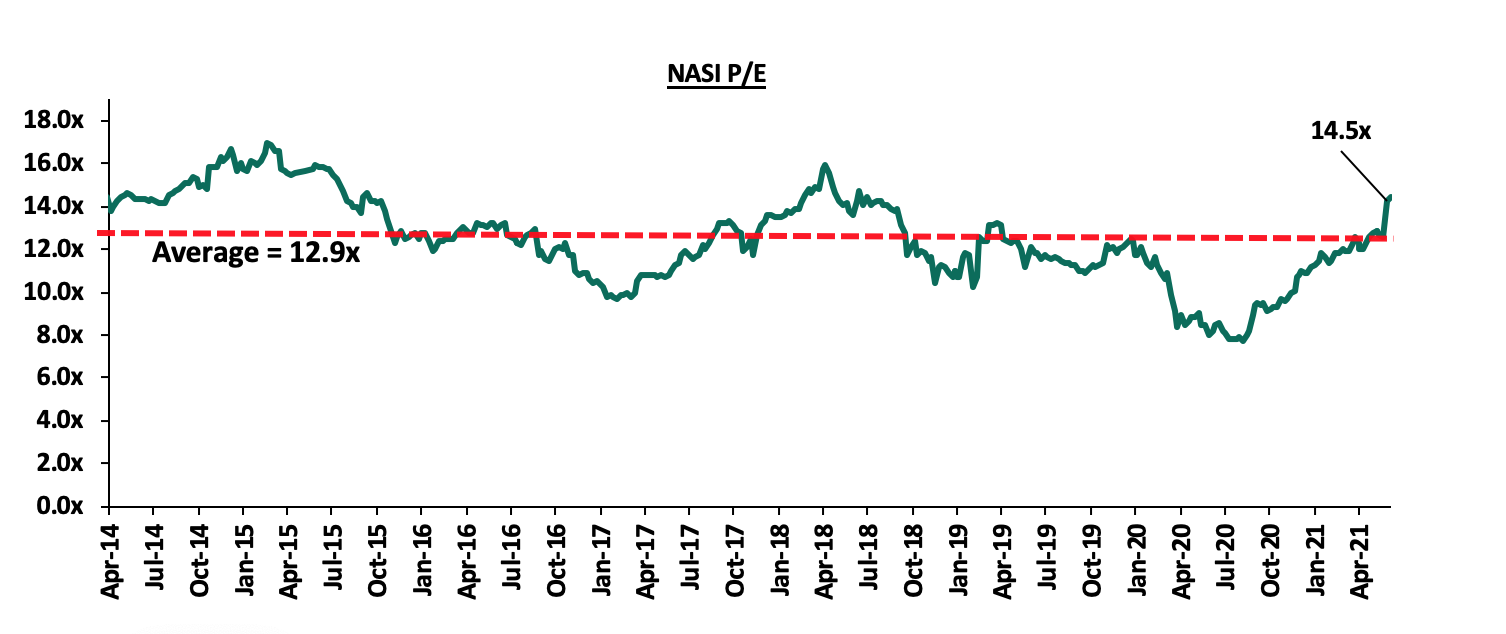

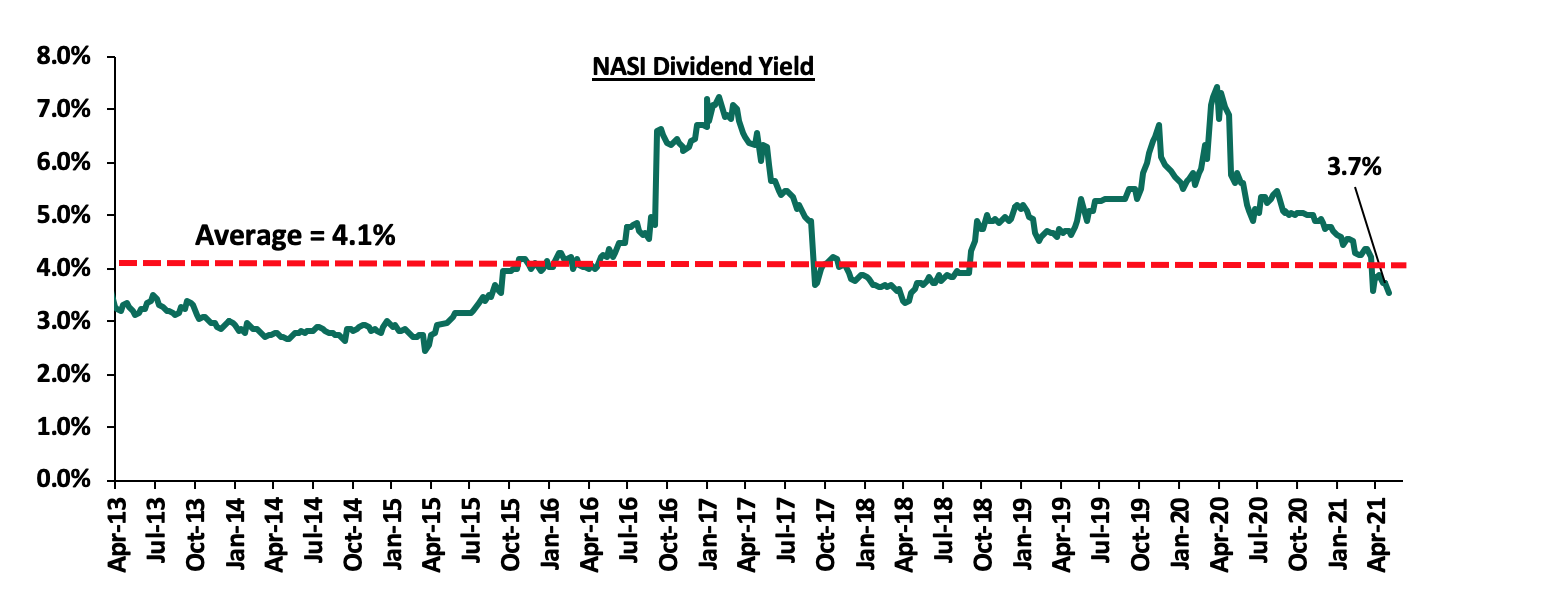

The market is currently trading at a price to earnings ratio (P/E) of 14.5x, 12.0% above the historical average of 12.9x, and a dividend yield of 3.7%, 0.4% points below the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 1.6x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, the market is trading at a P/E ratio of 12.6x and a PEG ratio of 1.4x. The current P/E valuation of 14.5x is 87.8% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

- Safaricom Plc announced that the Ethiopian Communications Authority (ECA) had approved a bid for an Ethiopia Telco License which was submitted by a consortium consisting of Safaricom, Vodacom Group Ltd, Vodafone Group Plc (UK), CDC Group Plc and Sumitomo Corporation. The consortium’s financial bid of USD 850.0 mn (Kshs 91.8 bn) will allow the consortium to operate a telecommunications network in Ethiopia, but will not include a license to operate mobile money. For more information, please see Cytonn Weekly#21/2021,

- In May 2021, Equity Group disclosed that it had acquired an additional 7.7% stake valued at Kshs 996.0 mn, in Equity bank Congo (EBC) from the German Sovereign Wealth Fund (KfW). The acquisition raised the total ownership in EBC to 94.3%, indicating that they are currently valuing the company at Kshs 14.2 bn. This follows the recent acquisition of 66.5% stake in Banque Commerciale Du Congo (BCDC) by Equity Group at a cost of Kshs 10.2 bn in August 2020. For more information, please see Cytonn Weekly#20/2021,

- KCB Group disclosed that it had made an offer to the Banque Populaire du Rwanda Plc (BPR) shareholders to raise its acquisition stake in the bank from 62.1% to 100.0%. As highlighted in our Cytonn Weekly #48/2020, the 62.1% BPR acquisition would see KCB pay a cash consideration based on the net asset value of the BPR at completion of the transaction using a price to book multiple of 1.1x. According to the latest BPR financials, the bank had a book value of Rwf 47.3 bn (Kshs 5.1 bn), and thus at the trading multiple of 1.1x, we expect KCB Group to pay Kshs 5.6 bn. Collectively, KCB will spend a total of USD 56.9 mn (Kshs 6.1 bn) in the acquisition of Banque Populaire du Rwanda Plc (BPR) Rwanda and African Banking Corporation (ABC) Tanzania. For more information on the acquisition, see our Cytonn Weekly #19/2021,

- I&M Holdings PLC announced that it completed the 90.0% acquisition of Orient Bank Limited Uganda (OBL) share capital, after receiving all the required regulatory approvals. As highlighted in our Cytonn Weekly #50/2020, I&M Holdings was set to pay Kshs 3.6 bn for the deal. Additionally, I&M Holdings will take over 14 branches from OBL, taking its total branches to 80, from 66 branches as at the end of 2020. For more information, please see Cytonn Weekly #18/2021, and,

- The Central Bank of Kenya (CBK), released the Commercial Banks’ Credit Survey Report for the quarter ended March 2021. The quarterly Credit Officer Survey is undertaken by the CBK to identify the potential drivers of credit risk in the banking sector. The report highlighted that Profit Before Tax (PBT) for the banking sector increased by 19.7% y/y to Kshs 45.9 bn in Q1’2021, from Kshs 38.3 bn in Q1’2020, attributable to the recovery of the economy as restrictions had since been eased, especially on travel and curfew times, leading to an improved business environment. For more information, please see Cytonn Weekly #18/2021.

Earnings Releases:

During the month, the listed banks released their Q1’2021 financial results. The table below highlights the performance of the banks, showing their performance using several metrics, and the key take-outs of the performance

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Stanbic |

23.1% |

0.5% |

(7.3%) |

5.0% |

6.1% |

19.3% |

46.7% |

(8.5%) |

10.6% |

42.3% |

69.5% |

(2.4%) |

13.2% |

|

KCB |

1.8% |

8.7% |

1.8% |

11.1% |

8.4% |

(20.0%) |

27.4% |

(26.5%) |

1.2% |

4.7% |

79.7% |

7.8% |

13.9% |

|

SCBK |

18.9% |

(9.0%) |

(30.2%) |

(2.8%) |

6.7% |

11.1% |

35.1% |

11.7% |

8.9% |

7.8% |

44.4% |

(6.1%) |

11.3% |

|

Equity |

63.8% |

31.9% |

42.4% |

28.4% |

7.6% |

30.7% |

42.3% |

21.5% |

58.2% |

16.1% |

61.7% |

28.6% |

18.9% |

|

Co-op |

(3.7%) |

27.6% |

19.8% |

30.7% |

8.6% |

(9.2%) |

32.0% |

(15.7%) |

16.0% |

43.4% |

75.7% |

8.0% |

12.3% |

|

DTB-K |

0.5% |

4.8% |

2.9% |

6.2% |

5.3% |

(1.9%) |

23.9% |

(20.5%) |

10.6% |

7.9% |

68.2% |

2.3% |

5.7% |

|

ABSA |

23.7% |

(0.3%) |

17.6% |

5.9% |

7.0% |

(3.9%) |

32.0% |

7.4% |

7.7% |

1.1% |

84.9% |

7.5% |

13.6% |

|

NCBA |

73.8% |

8.1% |

(5.7%) |

19.9% |

5.9% |

(3.3%) |

44.3% |

(8.1%) |

11.2% |

15.1% |

56.0% |

(1.1%) |

8.1% |

|

I&M |

13.5% |

10.2% |

(5.2%) |

23.4% |

5.4% |

(17.7%) |

29.7% |

(5.3%) |

9.3% |

89.5% |

73.4% |

5.6% |

13.3% |

|

HF |

N/A |

(18.7%) |

(19.0%) |

(18.3%) |

4.1% |

(46.7%) |

22.0% |

(36.2%) |

(2.1%) |

13.4% |

96.2% |

(6.9%) |

(20.4%) |

|

Q1'21 Mkt Weighted Average* |

28.6% |

14.7% |

13.1% |

17.3% |

7.4% |

3.3% |

35.4% |

(2.5%) |

22.0% |

18.2% |

69.1% |

11.1% |

14.1% |

|

Q1'20 Mkt Weighted Average** |

(7.4%) |

8.2% |

11.4% |

7.4% |

7.2% |

15.9% |

22.7% |

24.5% |

14.3% |

14.9% |

74.1% |

14.1% |

17.2% |

|

*Market cap weighted as at 04/06/2021 |

|||||||||||||

|

**Market cap weighted as at 02/06/2020 |

|||||||||||||

Key takeaways from the table above include:

- The listed banks recorded a 28.6% weighted average growth in core Earnings per Share (EPS), compared to a weighted average decline of 7.4% in Q1’2020 for the entire listed banking sector. The performance is largely skewed by the strong performance from NCBA and equity bank,

- The Banks have recorded a weighted average deposit growth of 22.0%, faster than the 14.3% growth recorded in Q1’2020,

- Interest expense grew at a faster pace of 13.1%, compared to the 11.4% growth in Q1’2020 while cost of funds declined, coming in at a weighted average of 2.5% in Q1’2021, from 3.0% in Q1’2020, owing to the faster growth in average interest-bearing liabilities, an indication that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 11.1%, lower than the 14.1% growth recorded in Q1’2020. The loan growth was also slower than the 18.2% growth in government securities, an indication of the banks’ preference of investing in Government securities as opposed to lending due to the elevated credit risk occasioned with the pandemic. The faster growth in government securities could also be attributed to cautious lending by banks in a bid to reduce cost of risk as well as mitigate further deterioration of the asset quality,

- Interest income grew by 14.7%, compared to a growth of 8.2% recorded in Q1’2020. Notably, the Yield on Interest Earning Assets (YIEA) increased to 10.2%, from the 9.8% recorded in Q1’2020, an indication of the increased allocation to higher-yielding government securities by the sector during the period. Consequently, the Net Interest Margin (NIM) now stands at 7.4%, 0.2% points higher than the 7.2% recorded in Q1’2020 for the whole listed banking sector, and,

- Non-Funded Income grew by 3.3%, compared to the 15.9% growth recorded in Q1’2020. This can be attributable to a slower growth in the fees and commission which declined by 2.5% compared to a growth of 24.5% in Q1’2020.

Below are links to the various Earnings notes for the Listed Banks;

- Equity Group Q1’2021 Earnings Note,

- KCB Group Q1’2021 Earnings Note,

- Co-operative Bank Q1’2021 Earnings Note,

- NCBA Group Q1’2021 Earnings Note,

- Diamond Trust Bank (DTB-K) Q1’2021 Earnings Note,

- ABSA Bank Q1’2021 Earnings Note,

- I&M Holdings Q1’2021 Earnings Note,

- Standard Chartered Bank Kenya Q1’2021 Earnings Note,

- Stanbic Bank Q1’2021 Earnings Note, and,

- HF Group Q1’2021 Earnings Note.

Weekly Highlight:

On 31st May 2021, Nation Media Group (NMG) issued a share buyback circular to shareholders, proposing to buy back of up to 10.0% (20.7 mn shares) of its issued and paid-up share capital in accordance with Part XVI, Section 447 of the Companies Act, 2015 of the laws of Kenya. This would reduce the company’s outstanding shares to 186.7 mn shares, from 207.4 mn shares. Key to note, NMG is the first company in the Nairobi Securities Exchange (NSE) to undertake a share repurchase program. The proposed buyback, which will be through the open market, shall be proposed to the company’s Annual General Meeting (AGM) that will be held on 25th June 2021 and will be subject to shareholders’ approval. The buyback is expected to run from 28th June 2021 to 24th September 2021. The board proposed a minimum buying price of Kshs 2.50, equivalent to the par value of an ordinary share and a maximum buyback price of Kshs 25.00 per share. NMG has gained 47.7% Year to Date to Kshs 22.6 from Kshs 15.3 recorded on 4th January 2021. NMG’s profit declined by 94.4% in FY’2020 to Kshs 47.9 mn, from Kshs 862.6 mn recorded in FY’2019 driven by a 26.5% decline in advertising revenue to Kshs 4.4 bn in FY’2020, from Kshs 6.0 bn in FY’2019 coupled with a 23.4% decline in circulation revenue to Kshs 1.8 bn in FY’2020, from Kshs 2.4 bn in FY’2019. Total revenue declined 24.7% to Kshs 5.7 bn in FY’2020 from Kshs 7.2 bn in FY’2019.

Share buybacks have historically led to share price rallies in the stock market due to market perceptions of management’s confidence in the company coupled with reduction in the supply of outstanding shares in the market. We therefore expect the share price of NMG to gain further, to a target price of Kshs 25.0, which is the maximum buying price that the firm will be buying back its shares. We also expect NMG’s shareholders to approve the share buyback, which will make NMG the first company in the NSE to conduct a share repurchase. More buybacks in the NSE are likely to follow, especially for companies whose prices and valuations are at historical lows. The Capital Markets Authority (CMA) issued guidelines on share buy-backs in June 2020, with the guidelines being in the process of being revised following public participation. In our view, the move by the CMA to issue guidelines on the share buybacks is commendable, and we expect more listed companies to follow NMG’s suit and initiate share repurchases if the valuations remain low. For more information on the buyback, please see our Note on Nation Media Group’s Share Buyback.

Universe of Coverage

Below is a summary of our universe of coverage and the recommendations. We are currently reviewing our target prices for the Banking Sector coverage:

|

Company |

Price at 28/5/2021 |

Price at 4/6/2021 |

w/w change |

m/m change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.5 |

8.2% |

(6.9%) |

8.2% |

2.3 |

3.3 |

4.0% |

36.0% |

0.3x |

Buy |

|

Jubilee Holdings |

280.0 |

280.0 |

0.0% |

(0.9%) |

1.5% |

275.8 |

330.9 |

3.2% |

21.4% |

0.6x |

Buy |

|

Liberty Holdings |

7.0 |

7.0 |

(0.6%) |

(4.9%) |

(9.1%) |

7.7 |

8.4 |

0.0% |

20.0% |

0.5x |

Buy |

|

Sanlam |

11.0 |

10.5 |

(4.5%) |

(4.3%) |

(19.2%) |

13.0 |

12.4 |

0.0% |

18.1% |

0.9x |

Accumulate |

|

Britam |

7.2 |

7.1 |

(1.7%) |

7.7% |

1.7% |

7.0 |

6.7 |

0.0% |

(5.9%) |

1.3x |

Sell |

|

CIC Group |

2.1 |

2.1 |

(3.3%) |

(4.6%) |

(1.9%) |

2.1 |

1.8 |

0.0% |

(13.0%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in We are currently reviewing our target prices for the Banking Sector coverage |

|||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.6x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

- Industry Reports

During the month, various industry reports were released as highlighted in the table below;

|

# |

Theme |

Report |

Key Take-out |

|

1 |

General Real Estate |

|

|

|

|||

|

2 |

Residential |

|

|

|

3 |

Land |

|

The performance of the real estate sector is expected to pick following increased budgetary allocation to roads, housing, urban development and public works, and land remaining resilient as a good investment option. However, the sector will continue being affected by poor performance of the tourism sector and decline of house prices in the residential market.

- Residential Sector

During the month;

- The County Government of Nakuru through the governor, Lee Kinyanjui, announced that the construction of 600 affordable housing units in the county had kicked off. For more information, see Cytonn Weekly 19/2021,

- Kenya Mortgage Refinance Company (KMRC), a treasury backed lender, appointed three advisors namely; NCBA Investment Bank, Lion’s Head Global Partners and Mboya Wangong’u & Waiyaki Advocates, to guide it during its planned green bond issue targeted for July to September this year whose proceeds will be channelled to banks and SACCOs to offer affordable home loans. For more information, see Cytonn Weekly 18/2021, and,

- Property developer Acorn Holdings announced plans to restrict construction of their student hostels to within a 3.0 km radius of targeted institutions in order to attract more students and to reduce students’ transport costs. For more information, see Cytonn Weekly 18/2021.

We expect an improvement in the residential sector following the increased developmental activities in affordable housing and student housing, coupled with plans to improve access to mortgage facilities through the Kenya Mortgage and Refinancing Company (KMRC).

- Commercial Sector

During the month;

- Insurance Regulatory Authority (IRA) and Capital Markets Authority (CMA) announced plans to jointly purchase office spaces within Nairobi premises, a move that will see it take up at least 55,000 SQFT of office space in Upper Hill. For more information, see Cytonn Weekly #19/2021.

The commercial office sector continues to record minimal activities and has an oversupply of 7.3 mn SQFT as at 2020 which is expected to cause a decline in both purchase and rental prices hence poor rental yields. We therefore expect subdued performance of yields in the commercial office sector until there is enough demand to meet the current oversupply of commercial office space.

- Retail Sector

During the week, Tuskys Supermarket, a local retail chain, sought approval from the Competition Authority of Kenya (CAK) to lease its brand through an undisclosed United Kingdom (UK)-based franchise, after delays in receiving Kshs 1.6 bn from an undisclosed Mauritius-based private equity firm as part of a Kshs 2.1 bn deal that would see the firm pay over 60 creditors and keep afloat. So far, only 3 of Tusky’s branches are operational after a closure of about 61 outlets; at Kenyatta Avenue outlet in Nairobi CBD, Imara outlet at Tom Mboya Street and Athi River outlet. The retailer has been facing challenges such as mounting rent arrears, unpaid employee salaries, unpaid creditors and liquidation litigations. The proposal will allow independent retailers to trade using its brand at a fee in a bid to keep the brand alive besides generating fees from partnerships and sharing of major costs such as marketing and logistics costs. This move is expected to aid the troubled retailer in its race for survival and efforts to bounce back in the competitive Kenyan retail market with a long term aim of rebuying the franchises.

The table below shows the number of outlets of key local and international retailers;

|

Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Number of branches opened in 2021 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened |

Projected number of branches FY’2020 |

|

Naivas |

Local |

46 |

61 |

69 |

3 |

0 |

72 |

3 |

75 |

|

QuickMart |

Local |

10 |

29 |

37 |

4 |

0 |

41 |

4 |

45 |

|

Chandarana Foodplus |

Local |

14 |

19 |

20 |

0 |

0 |

20 |

0 |

20 |

|

Carrefour |

International |

6 |

7 |

9 |

4 |

0 |

13 |

0 |

13 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

1 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

3 |

1 |

0 |

1 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

257 |

313 |

334 |

12 |

177 |

169 |

7 |

176 |

|

Source: Online Research

Other notable highlights during the month include;

- Naivas supermarket, a local retail chain, opened an outlet at Zion Mall in Eldoret in addition to signing a lease agreement with the Greenspan Mall to become their anchor tenant taking up 57,000 SQFT space previously occupied by Tuskys Supermarket. The retailer also announced plans to open 3 stores by mid-June 2021, in an expansion drive that will see it take up spaces previously occupied by Tuskys Supermarket, in two outlets to be located along Muindi Mbingu Street in Nairobi’s Central Business District (CBD), and Simba Club Hall in Kisumu, while the third outlet will be located at Githurai 44 on Kamiti Road. For more information see, Cytonn Weekly #18/2021, and Cytonn Weekly #20/2021,

- QuickMart supermarket, a local retail chain, announced plans to open 4 stores concurrently by mid-July, in an expansion drive that will see it take up spaces at Chania Mall in Thika, OTC within Nairobi’s Central Business District, Mtwapa Mall in Kilifi, and, Kitale Town in Trans Nzoia County. For more information, see Cytonn Weekly #19/2021.

- Tuskys supermarket announced plans to sell its brand and non-essential assets including furniture, fixes and fittings in 19 of its branches, most of which have been closed down by landlords due to rent arrears, to avoid liquidation by more than 60 creditors following a delay in receiving a Kshs 1.6 bn debt from an undisclosed Mauritius firm to settle its Kshs 1.0 bn debt. For more information see Cytonn Weekly #18/2021

The retail sector is expected to continue witnessing entry and expansion by local and international retailers taking up prime retail spaces left by troubled retailers, supported by improved infrastructure opening up areas to investment, positive demographics creating a ready market for goods and services and a growing middle class with enhanced tastes and preferences. However, we expect its performance to be affected by continued closure of troubled retailers such as Tuskys coupled with oversupply of retail space which is currently at 2.0 mn SQFT as at 2020, online shopping reducing demand for retail space, and, low income levels due to tough economic environment constraining consumer spending.

- Mixed-Use Developments

During the week, Tatu City, a mixed-use property developer in the country, appointed Australian-based construction company, Snowy Mountains Engineering Corporation (SMEC) as the lead infrastructure consultant for the second phase of its 2,500 acre Tatu Industrial Park in Ruiru. The company is expected to oversee tendering and building of roads, drainage, lighting, systems and water distribution, with a projected completion date of May 2022. The new city is expected to meet demands for new client lifestyles after a 90.0% completion rate of Phase One. In February 2021, the Kenya Wine Agencies Limited broke ground on a Kshs 4.0 bn manufacturing and distribution facility on the site with two schools namely; Crawford International and Nova Pioneer already establishing campuses on the estate to serve more than 3,000 students.

Hilshaw Group, a Dubai based firm, was appointed as the adviser and financing consultant of the planned Athi River Smart Green City project in Nairobi. The master-planned Smart City project by Jetblack Group will sit on 4,500 acres, with its development expected to commence in May 2022 and open Phase 1 by end of 2025. The project will consist of commercial offices, retail spaces, hotels and other support facilities in addition to over 4,000 residential units (details undisclosed).

Development of master-planned communities continues to gain traction in Kenya due to i) relatively higher developer returns, ii) benefits from economies of scale to the developer and the buyer, iii) proximity to various social amenities, and, iv) affordability compared to stand alone houses.

Athi River also presents itself as a good investment area supported by i) an increase in the middle income population with more disposable income and demand for convenient lifestyles ii) positive demographics supporting development in the area, iii) affordable land prices per acre in Athi River at approximately Kshs 4.1 mn for Unserviced land and Kshs 13.2 mn for serviced land compared to the market averages of Kshs 25.6 mn and Kshs 15.0 mn respectively, and, iv) improving infrastructure with various government projects such as the ongoing dualling of Mombasa Road.

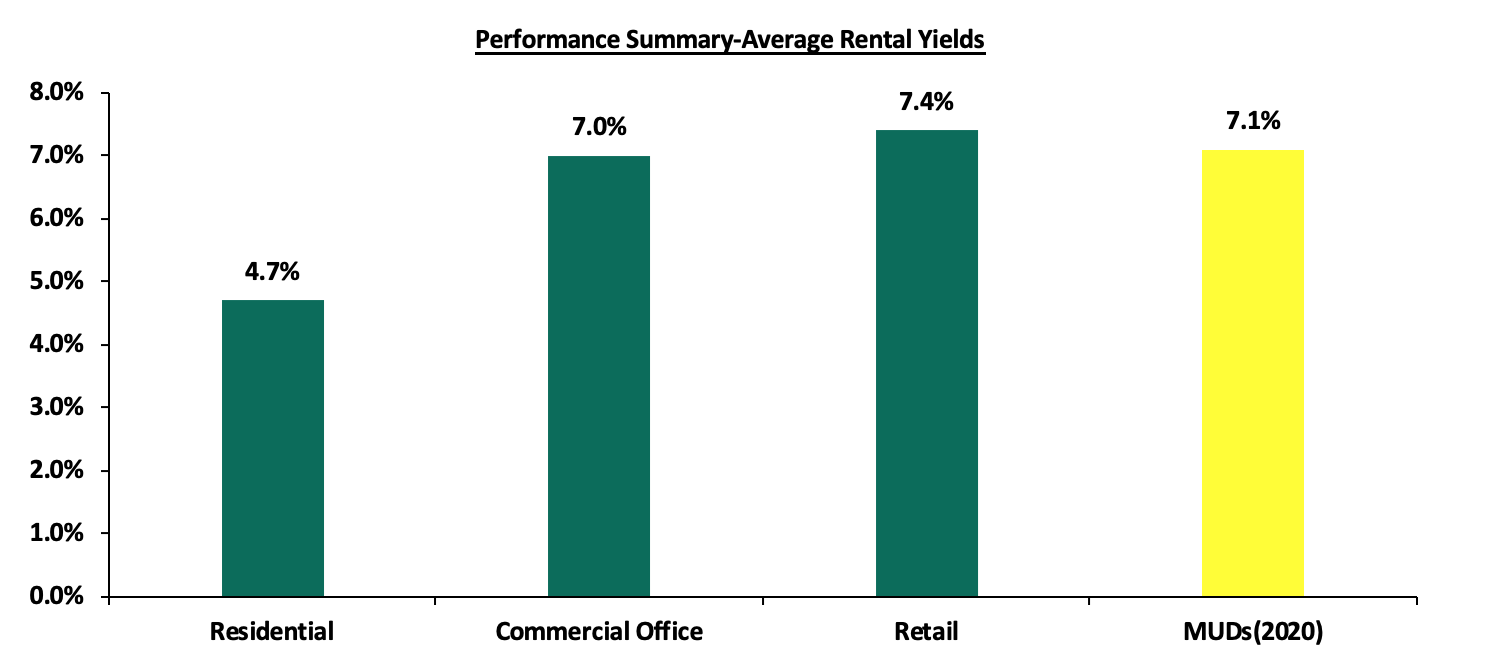

The graph below shows the average rental yields of the different real estate sectors;

Source: Cytonn research

Other notable highlights during the month include;

- Kenya Commercial Bank (KCB) Group announced that it is seeking joint venture partners to finance and develop its 153.2 acres in Juja. The firm seeks to develop a Kshs 6.0 bn mixed use development project comprising of 5,786 residential and commercial buildings in Juja. KCB’s contribution towards the venture will therefore be its prime land worth Kshs 2.3bn whereas the JV partner will provide the cash and meet other construction related costs translating to a 38.0 % and 61.0 % shareholding respectively on the successful completion of the project. For more information, please see Cytonn Weekly 19/2021.

We therefore expect the market to witness increased developments of master-planned communities as investors aim to gain higher returns with the demand of a more comprehensive lifestyle for homebuyers expected to continue fueling uptake of property in such developments.

- Hospitality Sector

During the month;

- Kenya Airports Authority announced that JKIA passenger movement registered a 24.1% decline in the month of March 2021, to 279,413 passengers from 368,279 passengers in the same period last year. For more analysis, see Cytonn Weekly #21/2021.

With the decline of international arrivals, the hospitality sector performance will continue being affected by poor performance of the tourism sector which heavily relies on Meetings, Incentives, Conferences, and Exhibitions (MICE). Moreover, the lower allocation of the government’s budget to the Ministry of Tourism from Kshs 20.4 bn in FY’2020/21 to Kshs 18.1 bn in FY’2021/22 is expected to further impede the sector’s performance.

- Land Sector

During the week, the Central Lands Registry, whose offices are located in Ardhi House, Upperhill Nairobi, was shut down after its operations were migrated to an online platform following the official launch of the National Land Information Management System (NLIMS) by President Uhuru Kenyatta last month. The launch of the digital land platform named ‘Ardhi Sasa’, first rolled out in Nairobi will be implemented in other counties in phases in an effort to contain fraud in the land sector.

The land digitization program will enable Kenyans to;

- Conduct land searches in real time thereby allowing for identification of the land’s location, ownership, size and past records,

- Apply for title deeds directly through the system unlike in the past where one had to do this physically. This will reduce delays and inconveniences that were common in the land registries,

- Sell land and conduct nearly every land transaction at the click of a button hence reducing human interaction, delays and other inconveniences Kenyans had to endure in the land registries,

- Phase out the use of brokers and hence reduce cases of fraud and exploitation by fraudsters and middlemen while carrying out land transactions, and,

- Reduce corruption and illegal transactions while assisting investigative agencies such as the Ethics and Anti-Corruption Commission (EACC) in curbing land related fraud.

The new digital platform also comes with the introduction of the Registry Index Maps (RIMs) in place of the old system that utilized deed plans and is now able to display all land parcels within an area as opposed to a deed plan used in the former system that captured data on one specific parcel hence making it easier to note any changes or alterations. This new platform is expected to help to make transactions involving land easier and more transparent while reducing fraudulent transactions such as land grabbing that have plagued the sector for decades.

- Infrastructure

During the week, the Cabinet Secretary for Transport, Infrastructure, Housing, Urban development and Public works, Hon. James Macharia announced that the construction of the 233-km Nairobi-Mau Summit highway is expected to begin in September 2021 at a cost of Kshs 160.0 bn in a build, operate and transfer (BOT) partnership. The Public Private Partnership (PPP) deal between the Kenyan government and a French consortium made up of Vinci Highways Societe par Actions Simplifee (SAS), Meridian Infrastructure Africa Fund and Vinci Concessions Societe par Actions Simplifee (SAS) will last over a period of 30 years. The four lane dual carriage highway is expected to decrease traffic in the northern corridor as well as improve transport connections for goods and services through the Eastern, Western and Rift Valley counties. The project will also see the widening of the existing Rironi-Mai Mahiu- Naivasha road to become a seven-meter carriage way with two-meter shoulders on both sides and the construction of a four-kilometer elevated highway through Nakuru Town.

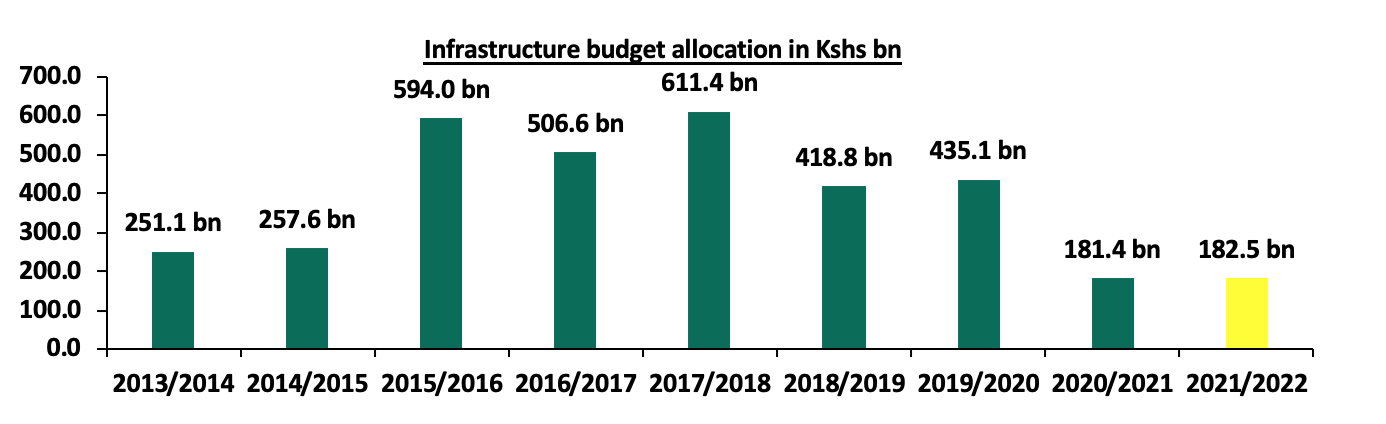

The government continues to support and implement select infrastructural projects through public-private partnerships which have proven to have benefits such as large scale investment and developments, access to finance for projects, and government access to private sector efficiencies, among many others. Moreover, in the proposed budgetary allocation, infrastructure received a 0.6% increase in allocation from Kshs 181.4 bn in FY’2020/2021 to Kshs 182.5 bn in the proposed FY’2021/2022 allocations.

The graph below shows infrastructure budgetary allocations for the last nine years;

Source: National Treasury

Notable highlights in the infrastructure sector during the month include;

- Uganda signed a Public Private Partnership deal worth Kshs 5.0 bn with China Roads and Bridge Corporation (CRBC) to renovate its century-old meter gauge railway line between Malaba and Kampala, which will link the Standard Gauge Railway (SGR) track in Kenya through Naivasha to Malaba old railway. For more information see, Cytonn Weekly #20/2021, and,

- President Uhuru Kenyatta launched the first berth of the Lamu Port-South Sudan-Ethiopia-Transport (LAPSSET) corridor, a project that targets to link Kenya to South Sudan, Ethiopia and the middle belt of Africa. More analysis can also be found on Cytonn Weekly #20/2021.

We expect the continued improvement of infrastructure through increased budgetary allocation, PPP agreements and strengthening of policy frameworks to continue helping the attainment of Vision 2030.

- Statutory Reviews

During the month;

- Nairobi’s City Hall announced plans to conduct public participation into the New Draft Valuation Roll, on 16th June 2021 in the 17 sub-counties in Nairobi, to pave way for its roll-out, since being tabled before the Nairobi County Assembly in February. The public participation forum will inform the final percentage to be charged as rates on all ratable properties in Nairobi. This announcement follows the government’s plan to replace the outdated Valuation for Rating Act of 1956 and the Rating Act of 1963, in a bid to determine new land rates and ensure inclusion of more property owners into the tax bracket. For more information, see Cytonn Weekly #21/2021

- Listed Real Estate

In listed real estate, the Fahari I-REIT closed the month of May trading at Kshs 6.0 per share, representing a 6.4% and 5.2% increase in YTD and MTD performances respectively. However, the performance indicates a 70.0% loss when compared to its listing price of Kshs 20.0 in November 2015. Even with the performance improvements, the REIT has continually been constrained by i) declining performance of the real estate market from the effects of the Covid-19, ii) insufficient institutional grade real estate assets, and, iii) lack of investor knowledge in the instrument.

The graph below shows the performance of the Fahari I-REIT from November 2015-May 2021;

The real estate sector is expected to record increased activities supported by focus on affordable housing and student housing projects, entry and expansion by local and international retailers taking up space left by troubled retailers, and, increased implementation of infrastructure projects. However, its performance will be weighed down by poor performance of the hospitality sector and listed REIT.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.