Debt Relief Amidst the COVID-19 Pandemic, & Cytonn Monthly - April 2020

By Research Team, May 3, 2020

Executive Summary

Fixed Income

During the month of April, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 72.8%, compared to 151.0% recorded in the month of March. The undersubscription is partly attributable to investor’s preference to hold on to their cash due to low confidence in the market attributable to the Coronavirus pandemic. The subscription rates for the 91-day paper rose to 86.8%, from 81.6% recorded in March. The subscription rates for the 182-day and 364-day papers on the other hand declined coming in at 28.4% and 111.7%, lower than the 65.2% and 264.5% recorded in March, respectively. We note that the 364-day paper continued to receive the most interest from investors, attributable to the market currently pricing that the government will be under pressure to meet its domestic borrowing target, and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis, compared to a two year bond with a yield of 10.4%. The Central Bank remained disciplined in rejecting expensive bids in order to ensure the stability of interest rates as evidenced by the yield on the 91-day paper declining marginally to 7.2%, from 7.3% recorded in March, while the 182-day and 364-day papers remained unchanged at 8.1%, and 9.1%, respectively. The y/y inflation for the month of April declined marginally to 5.6%, from the revised figure of 5.5% recorded in March 2020 (based on the new CPI base period, February 2019), which was not in line with our projections of 6.0% - 6.2%. The Monetary Policy Committee (MPC) met on 29th April 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC lowered the CBR by 25 bps to 7.00% from 7.25%, which in line with our expectations in our MPC April 2020 Note. During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2020, indicating that the economy had grown by 5.4% in 2019, from 6.3% recorded in 2018. Despite the slower growth, it is important to note that the growth was spread across all the sectors in the economy. Also, the World Bank released the Kenya Economic Update, April 2020, highlighting that they expect the effects of the ongoing COVID-19 pandemic to further reduce growth in 2020 with significant impacts on service-based sectors (such as transport, retail trade and tourism) and industries (manufacturing and construction). According to the report, Kenya’s GDP growth for 2020 is expected to come in at (1.0%) - 1.5%, depending on how long the economic disruptions in the country last;

Equities

During the month of April, the equities market recorded mixed performances, with both NASI and NSE 25 recording gains of 5.9%, while NSE 20 declined by 0.4%. The equities market performance during the month was driven by gains recorded by EABL, Equity Group, Safaricom and KCB, of 15.6%, 10.9%, 7.8% and 5.7%, respectively. During the week, the market recorded mixed performance, with both NASI and NSE 25 recording gains of 2.9% and 3.7%, respectively, while the NSE 20 declined by 0.5%, taking their YTD performance to losses of 16.1%, 19.7% and 26.2%, respectively. The loss recorded by NSE 20 breaches the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more, from recent highs, lasting for more than two months. During the month, following the release of FY’2019 results by Kenyan banks, we analysed the performance of the 10 listed local banks (previously 11, before the acquisition of National Bank of Kenya by KCB Group Plc), identified the key factors that influenced their performance, and gave our outlook for the banking sector going forward. The Banking sector witnessed a number of consolidation activities in FY’2019 as players in the sector were either acquired or merged. During the month, Safaricom PLC and Vodacom completed the acquisition of intellectual property rights of M-PESA from Vodafone through a newly formed Joint Venture. The deal is estimated to cost approximately USD 13.4 mn (Kshs 1.4 bn) and will see both Safaricom and Vodacom gain full control of the M-Pesa brand, product development and support services;

Real Estate

During the month of April, Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2020 Report. According to the report, the real estate sector growth improved in 2019 by 1.2% points coming in at 5.3%, from 4.1% in 2018. In the residential sector, a number of regulatory and policy reforms were introduced through the Tax (Amendment) Act 2020 and the Pandemic Response and Management Bill 2020, which outline measures aimed at cushioning the real estate sector in the wake of the COVID-19 pandemic. In the retail sector, International Finance Corporation (IFC), World Bank’s Private lending arm, acquired a minority stake in Naivas International Limited for Kshs 1.5 bn; the retailer also opened a new branch in Kilimani. Shoprite Holdings, a South African based international retailer, announced the closure of its Waterfront Mall branch in Karen, while Tuskys Supermarket announced the temporary closure of three of its branches in Nairobi, Kitale, and Mombasa. In the commercial office sector, Fusion Capital, a local real estate developer, announced that it would offer a 3-month 30.0% rent relief to tenants in its Flamingo Towers development in Upperhill in the wake of the Coronavirus pandemic. In the hospitality sector, The Ministry of Health Cabinet Secretary, Mutahi Kagwe, announced that hotels and restaurants in major towns would be allowed to resume operations albeit under strict terms. In the infrastructure sector the Kenya Roads Board (KRB) disbursed Kshs 539.0 mn for maintenance of roads in the coastal region for counties such as Mombasa, Kilifi, Lamu and Taita Taveta. Finally, in listed real estate, the Fahari I-REIT closed the month at Kshs 9.0, 11.1% higher than the previous month’s closing price of Kshs 8.0. Stanlib Kenya Limited also released the Fahari I-REIT- audited results FY’2019, according to which, the I-REIT’s dividend yield came in at 8.3%, above the commercial real estate market average of 7.7% in Q1’2020;

Focus of the Week

Kenya’s public debt continues to be a topic of discussion in most macroeconomic outlook discussions, with global credit rating agencies such as Fitch Rating expecting the pandemic to halt the country’s fiscal consolidation and increase financing needs. Most recently in December 2019, Fitch affirmed Kenya’s B+ rating owing to the country’s strong and stable growth outlook, however, they cited failure to stabilize government debt to GDP levels could lead to a negative rating action. In the wake of the Coronavirus pandemic, we look at debt relief as an option available to the government in mitigating the effects of the pandemic on debt sustainability.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.03% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.4% p.a. To subscribe, email us at sales@cytonn.com;

- Shiv Arora, Chief Operating Officer at Cytonn Investments, was on NTV to talk about the impact of the COVID-19 Pandemic on the economy and businesses in Kenya. Watch Shiv here;

- Edith Kerubo, Senior Distribution Manager at Cytonn investments, was on KBC Channel 1 to talk about her career journey, gender equality, and life at the work place. Watch Edith here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information, please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of April, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 72.8%, compared to 151.0% recorded in the month of March. The undersubscription is partly attributable to investor’s preference to hold on to their cash due to low confidence in the market attributable to the Coronavirus outbreak. The subscription rates for the 91-day paper rose to 86.8%, from 81.6% recorded in March. The subscription rates for the 182-day and 364-day papers on the other hand declined, coming in at 28.4% and 111.7%, lower than the 65.2% and 264.5% recorded in March, respectively. We note that the 364-day paper continued to receive the most interest from investors, having recorded the highest subscription rate of the 3 papers, at 111.7%. This is attributable to the market currently pricing that the government will be under pressure to meet its domestic borrowing target, and as such a bias to shorter-dated papers in order to avoid duration risk, which has seen most investors still keen on the primary fixed income market, finding the 364-day T-bill more attractive on a risk-adjusted return basis, compared to a two year bond with a yield of 10.4%. The Central Bank remained disciplined in rejecting expensive bids in order to ensure the stability of interest rates as evidenced by the yield on the 91-day paper declining marginally to 7.2% from 7.3% recorded in March while the 182-day and 364-day papers remained unchanged at 8.1%, and 9.1%, respectively. The T-bills acceptance rate came in at 97.2% during the month, compared to 53.0% recorded in March, with the government accepting a total of Kshs 84.9 bn of the Kshs 87.4 bn worth of bids received.

During the week, T-bills were undersubscribed, with the subscription rate coming in at 74.6%, down from 81.7% the previous week. The subscription rate of the 91-day and 182-day papers declined to 111.8% and 26.8%, respectively, from 219.7% and 44.5% recorded the previous week, respectively. The subscription rate for the 364-day paper however improved to 107.5%, from 63.8% recorded the previous week. The yields on the 91-day, 182-day and 364-day papers remained unchanged at 7.2%, 8.1% and 9.1%, respectively, similar to what was recorded the previous week. The acceptance rate declined to 87.5%, from 99.5% recorded the previous week, with the government accepting Kshs 15.7 bn of the Kshs 17.9 bn bids received.

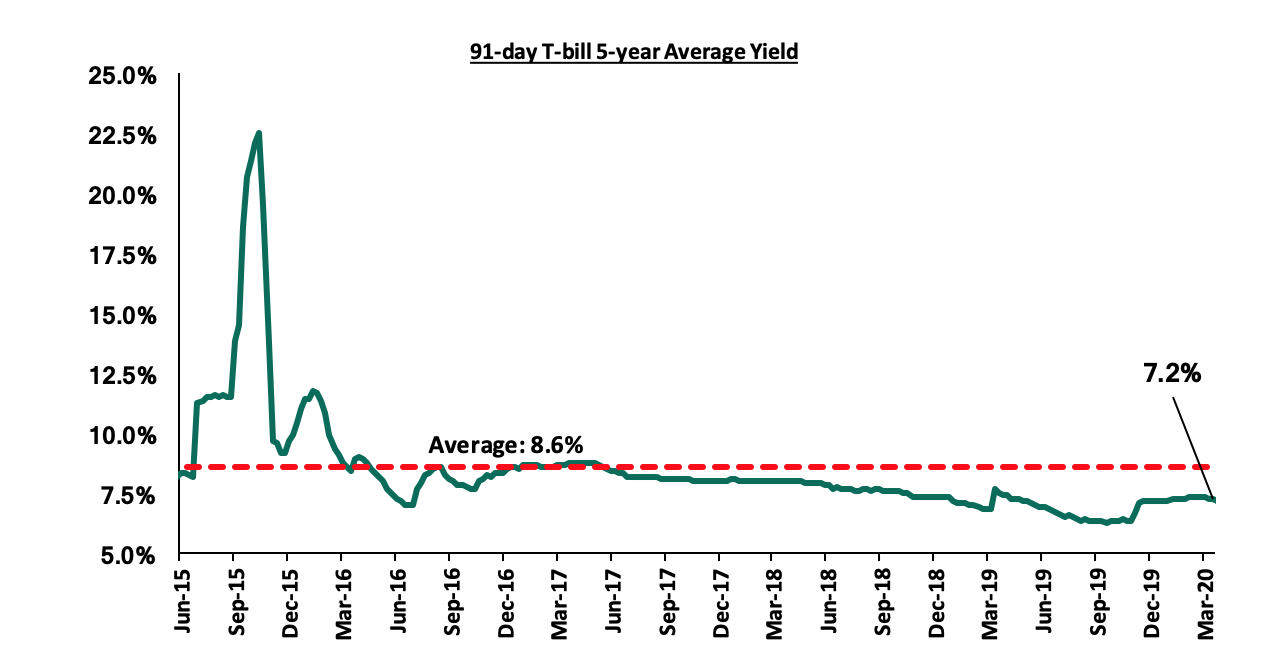

The 91-day T-bill is currently trading at a yield of 7.2%, which is below its 5-year average of 8.6%. The yield has, however, increased surpassing the 2019 average of 6.9% mainly attributable to the repeal of interest rate cap, which has seen banks prefer lending to the private sector, forcing the government to accept expensive bids in order to secure funds from investors.

For the month of April, the Kenyan Government issued a 9-year infrastructure bond, IFB1/2020/9 with an effective tenor of 9.0-years and a coupon rate of 10.9%, in a bid to raise Kshs 60.0 bn for funding of infrastructure projects in the FY’2019/20 budget estimates. The bond was oversubscribed, with the government receiving bids worth Kshs 68.4 bn, higher than the quantum of Kshs 60.0 bn, translating to a subscription rate of 114.0%. The high subscription rate is mainly attributable to the short tenor of the bond as well as the tax free incentive for infrastructure bonds which translates to a higher return. The yield on the tax-free bond came in at 12.3%, with the government accepting Kshs 39.0 bn out of the Kshs 68.4 bn worth of bids received, translating to an acceptance rate of 57.0%. During the month, the government had a tap-sale for the same bond in a bid to raise an additional Kshs 21.0 bn. The tap-sale was an oversubscribed with the government receiving bids worth Kshs 37.8 bn, higher than the issue’s quantum of Kshs 21.0 bn, translating to a subscription rate of 180.2%. The yield on the tap sale for the bond came in at 12.1%, with the government accepting Kshs 35.4 bn out of the Kshs 37.8 bn worth of bids received, translating to an acceptance rate of 93.5%. Given the tax-free nature of the bond, this is comparable to a Yield to Maturity (YTM) of 13.3%, on a normal bond with the assumption of a 15.0% withholding tax for a bond with the same effective tenor.

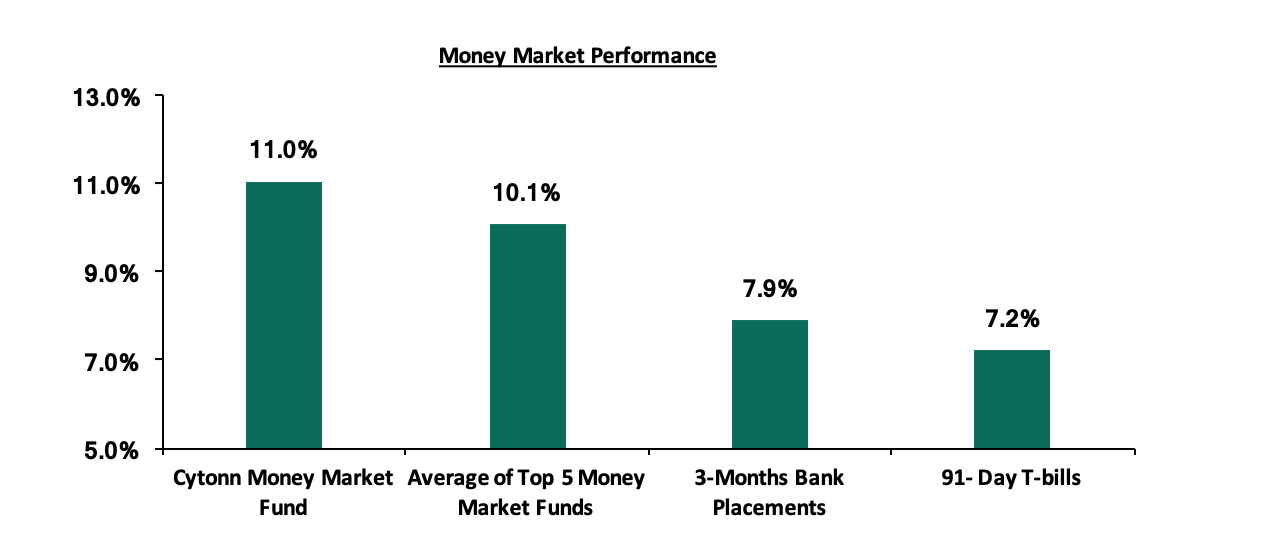

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.2%, similar to what was recorded the previous week. The average of Top 5 Money Market Funds remained unchanged at 10.1%, similar to what was recorded the previous week. The yield on the Cytonn Money Market also remained unchanged at 11.0%.

Secondary Bond Market:

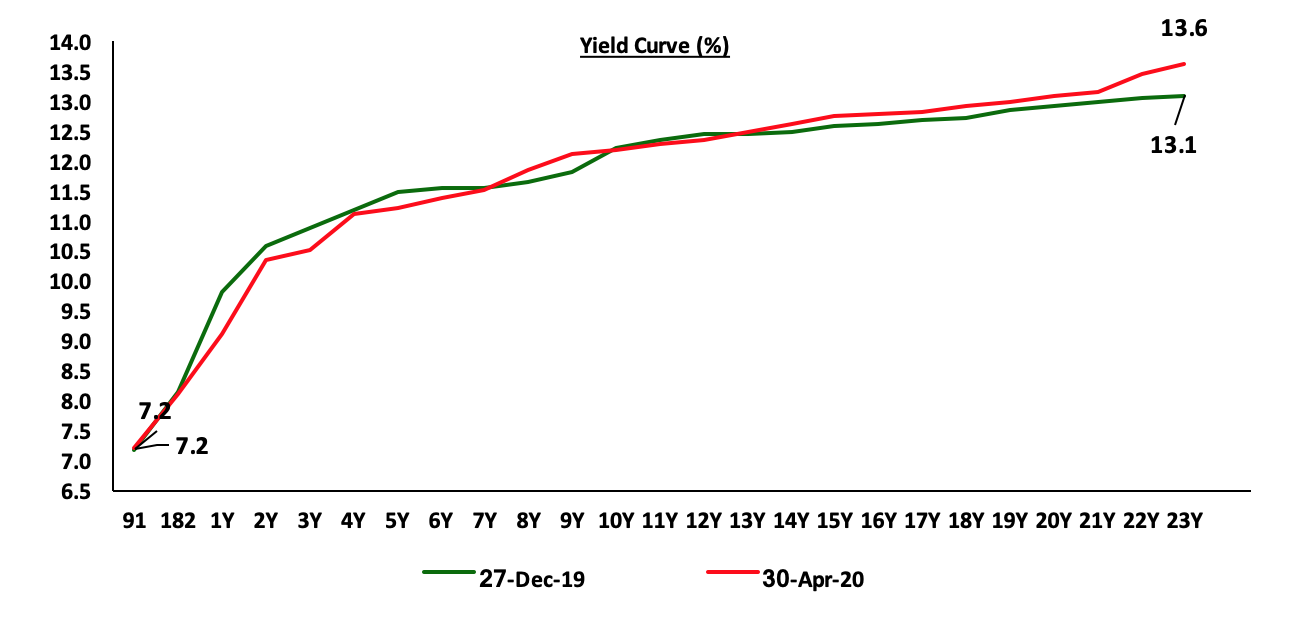

The yields on government securities in the secondary market remained relatively stable during the month of April. Most papers have declined YTD as yields readjust upwards with the exception of the 182-day paper, 1 – 7 year papers, 11-year, and 12-year papers.

Liquidity:

Liquidity in the money markets tightened during the month of April with the average interbank increasing to 5.3%, from 4.4% recorded in March as banks mobilize funds to pay for tax remittances such as corporate tax payments for the first quarter of the year. During the week, the average interbank rate declined to 4.5% from 5.5% recorded the previous week, pointing to easing liquidity in the money markets due to pending bill payments and tax refunds. The average interbank volumes rose by 88.0% to Kshs 13.6 bn, from Kshs 7.3 bn recorded the previous week.

Kenya Eurobonds:

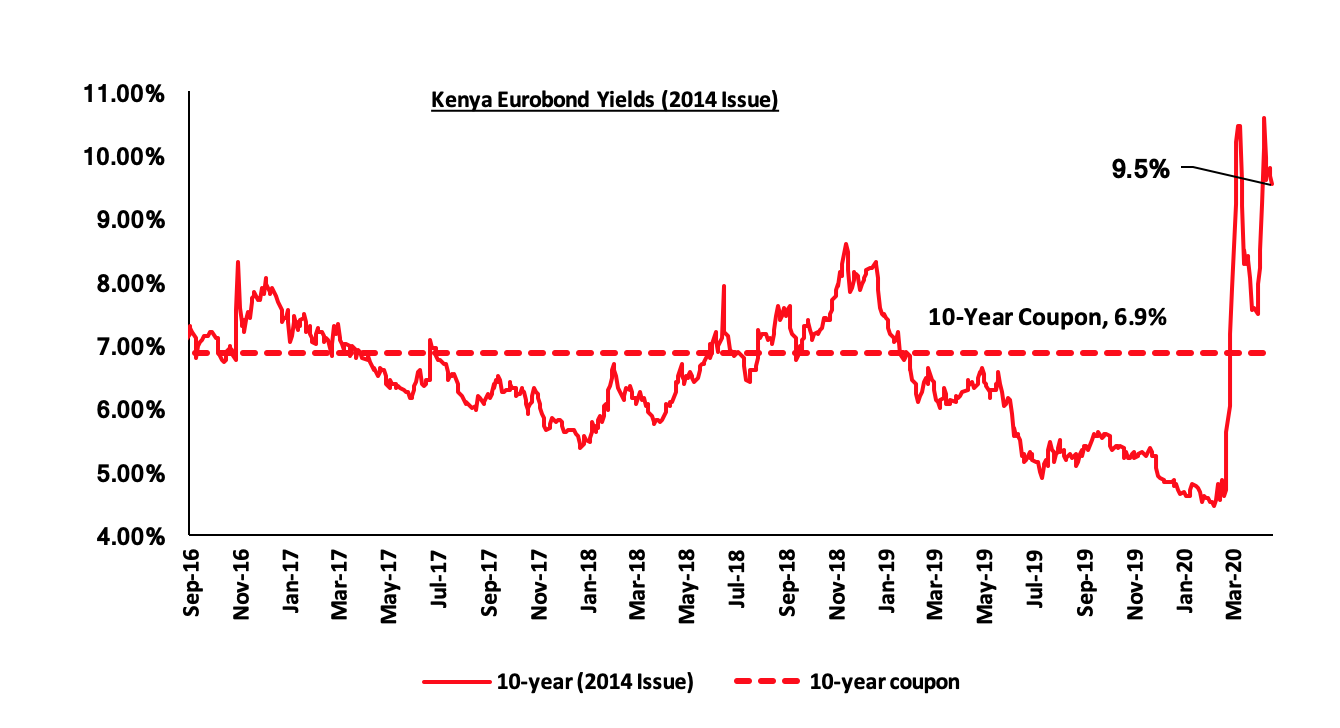

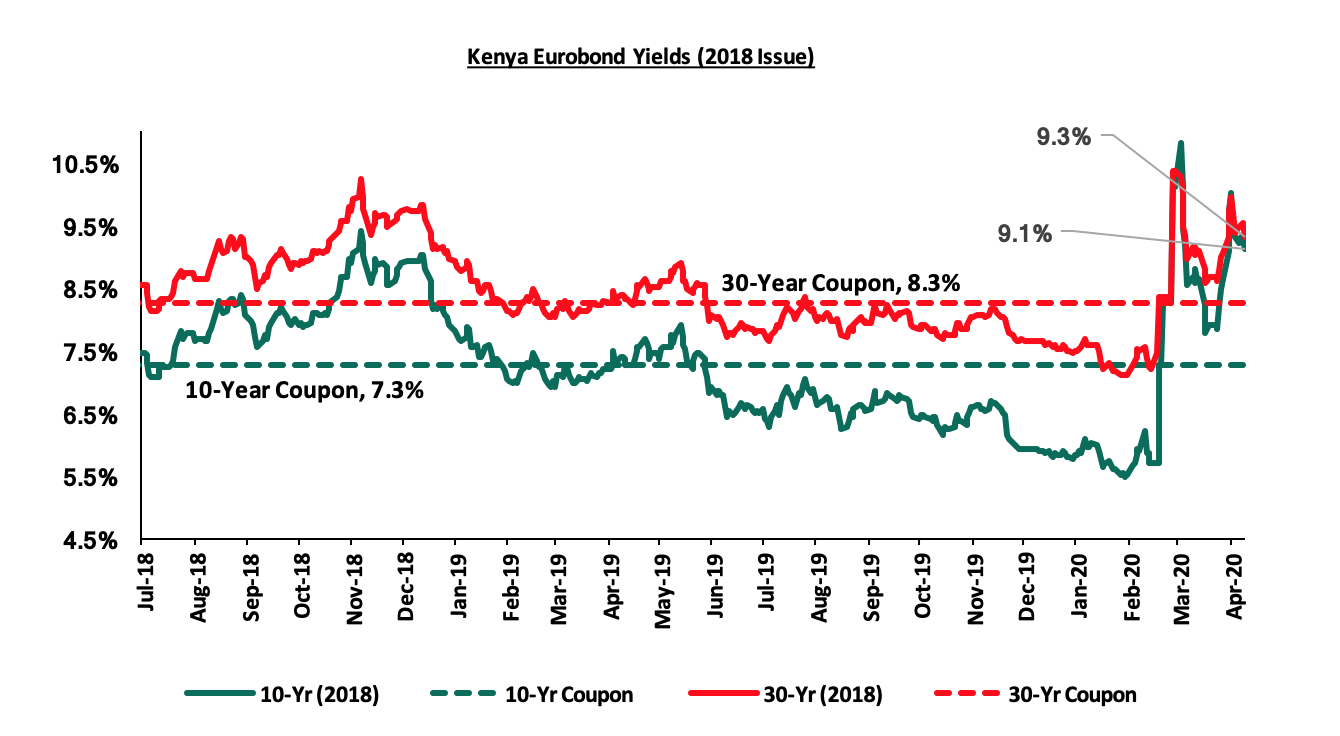

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 1.2% points to 9.5% in April, from 8.3% in March. During the week, the yield on the 10-year Eurobond declined by 0.1% points to 9.5% from 9.6% recorded the previous week. Notably however, all the Eurobonds yields increased significantly in April, an indication that investors are now attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the locust invasion, coupled with the entry of the novel COVID-19 in Kenya’s borders, further dampening the country’s economic growth prospects. Kindly see our Eurobond Note for more information

During the month, the yields on the 10 and 30 year Eurobonds issued in February 2018 increased by 0.5% points and 0.3% points to close at 9.1% and 9.3%, respectively from 8.6% and 9.0% in March. During the week, the yield on the 10-year Eurobond declined by 0.2% points to close at 9.1% from 9.3% recorded the previous week. The 30-year Eurobond declined marginally by 0.1% point to 9.3%, from 9.4% recorded the previous week

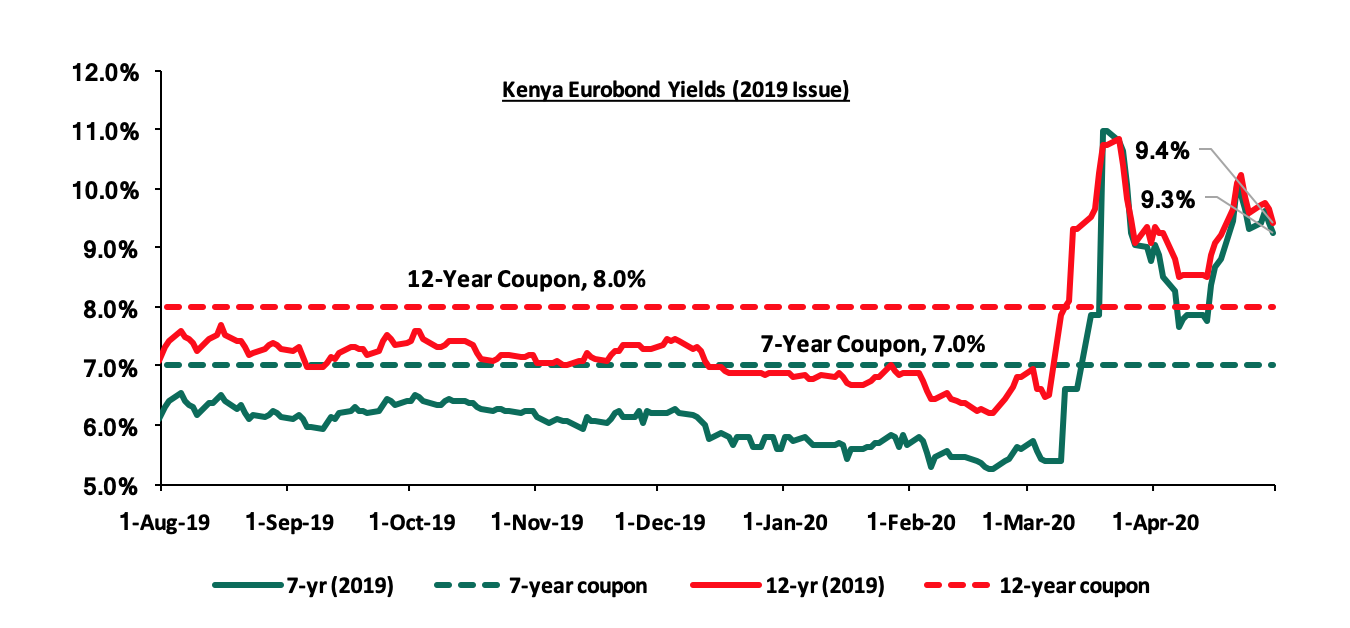

During the month, the yields on the newly issued dual-tranche Eurobond with 7-years increased by 0.5% points to 9.3% from 8.8% in March. The 12-year Eurobond increased by 0.2% points to 9.4% from 9.1% in March. During the week, the yields on the 7-year remained unchanged at 9.3% while that of the 12-year Eurobond declined by 0.2% points to 9.4% from 9.6% recorded the previous week.

Kenya Shilling:

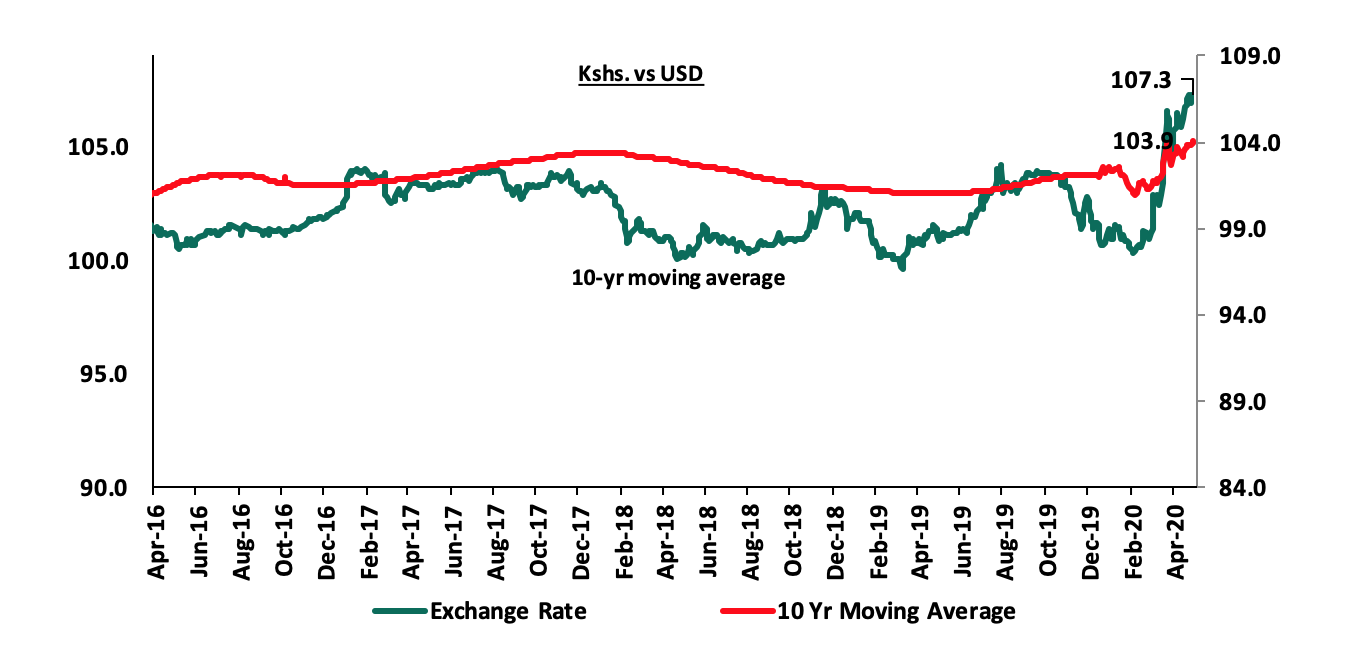

During the month, the Kenya Shilling depreciated by 2.5% against the US Dollar to close at Kshs 107.3, from Kshs 104.7 recorded at the end of March, mostly attributable to the rising uncertainties in the global markets due to the COVID-19 outbreak, which has seen the disruption of global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to cause local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers.

During the week, the Kenya Shilling depreciated marginally against the US Dollar to close at Kshs 107.3, from Kshs 107.2 recorded the previous week, attributable to a slight increase in dollar demand from merchandise and oil importers as they move to meet their end-month obligations. This was a 9-year low since Kshs 107.0 recorded in 11th October 2011. On a YTD basis, the shilling has depreciated by 5.9% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens, as well as merchandise and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows to meet the dollar demand, and,

- Subdued diaspora remittances growth, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 7.9 mn (equivalent to 4.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- CBK’s supportive activities in the money markets, with the CBK having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March 2020 to bolster the forex reserves.

Inflation

The y/y inflation for the month of April declined marginally to 5.6%, from the revised figure of 5.5% recorded in March 2020 (based on the new CPI base period, February 2019), which was not in line with our projections of 6.0% - 6.2%. Month-on-month inflation came in at 0.9%, which was attributable to:

- A 1.8% increase in the food and non-alcoholic drinks’ index, due to an increase in prices of significant food items such as loose maize-grain, kales, onions, Irish potatoes and carrots which increased by 4.0%, 4.4%, 6.9%, 6.4% and 3.6%, respectively,

- A 0.4% increase in the housing, water, electricity, gas and other fuels index, as a result of an increase in prices of electricity and cooking gas which outweighed the decreased in the cost of kerosene by 19.1%, and,

- A 1.3% increase in the transport index on account of increases in the prices of matatu and taxi fares despite the decline in petrol and diesel prices by 16.3% and 4.3%, respectively.

|

Major Inflation Changes – April 2020 |

|||

|

Broad Commodity Group |

Price change m/m (April-20/March-20) |

Price change y/y (April-20/April-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.8% |

11.6% |

The m/m increase was due to an increase in prices of some food items such as loose maize-grain, kales, onions, Irish potatoes and carrots |

|

Transport Cost |

1.3% |

5.5% |

The m/m increase was mainly on account of increases in the prices of matatu and taxi fares |

|

Housing, Water, Electricity, Gas and other Fuels |

0.4% |

2.3% |

The m/m marginal decline was as a result of an increase in prices of electricity and cooking gas |

|

Overall Inflation |

0.9% |

5.6% |

The m/m increase was due to: a 1.8% increase in the food index which has a revised CPI weight of 32.9%, a 1.3% increase in transport cost and the 0.4% increase in housing, water, electricity, gas and other fuels. |

Going forward, we expect the inflation rate to remain within the government set range of 2.5% - 7.5%. We expect inflation to remain stable despite supply side disruption due to COVID-19 as low demand for commodities compensates for the cost-push inflation, coupled with the low oil prices in the international markets.

Monetary Policy

The Monetary Policy Committee (MPC) met on 29th April 2020 to review the prevailing macroeconomic conditions and decide on the direction of the Central Bank Rate (CBR). The MPC lowered the CBR by 25 bps to 7.00% from 7.25%, which in line with our expectations in our MPC April 2020 Note. In their previous meeting held on 23rd March 2020, the committee decided to reconvene within a month for an early assessment of the impact of these measures and the evolution of the COVID-19 pandemic. In the last sitting, they lowered the CBR by 100 bps to 7.25% from 8.25% and reduced the Cash Reserve Requirement (CRR) to 4.25% from 5.25% citing that the Coronavirus pandemic was expected to adversely affect economic growth and as such, the need to cushion the economy against the effects of the pandemic and whilst preventing the COVID-19 health crisis from becoming a severe economic and financial crisis. The MPC decided to augment its accommodative monetary policy, necessitated by the continuing adverse economic outlook due to the COVID-19 pandemic. They however noted that;

- Inflation is expected to remain within the Government’s 2.5% - 7.5% target range, largely supported by lower fuel prices and favorable weather conditions,

- Taking into consideration the impact of COVID-19, the current account deficit is expected to remain at 5.8% in 2020, with the lower oil imports more than offsetting the projected reduction in remittances. However, horticulture exports and receipts from transport and tourism services are expected to decline due to the impact of COVID-19, and,

- There was an Improvement in private sector credit growth, coming in at 8.9% in the 12-months to March 2020, despite being below the 5-Year historical average, of 8.2%. Strong credit growth was observed in the Manufacturing sector (17.4%), building and construction (9.5%) and trade (7.8%).

The committee noted that the measures put in place from the previous meeting were having the intended effect on the economy and as such decided to augment their accommodative policy stance, having considered the continuing adverse economic outlook. We maintain our view that monetary policy stimulus measures may not be highly effective in combating the effects emanating from the COVID-19 pandemic especially in some sectors such as the tourism sector which have been hit by demand-side issues. We believe what businesses and the economy as a whole needs is financial relief as highlighted in our report on COVID-19 Economic Containment Policies in order to ensure survival during this period of uncertainties.

Weekly Highlights

During the week, the Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2020, indicating that the economy had grown by 5.4% in 2019, from 6.3% recorded in 2018. Despite the slower growth, it is important to note that the growth was spread across all the sectors in the economy. The slower growth can be attributed to;

- A slower 3.6% growth in the agriculture, forestry and fishing sector, compared to the 6.0% recorded in 2018. This was brought about by poor weather conditions experienced during the first half of the year resulting to reduced production of select crops. Maize production declined by 10.8% to 39.8 mn bags in 2019 from 44.6 mn bags in 2018, tea production also declined by 6.9% to 458,500 tonnes while sugar cane production decreased by 12.5% to 4.6 mn tonnes,

- Growth in the manufacturing sector was slower in 2019 recording a 3.2% growth, down from the 4.3% growth recorded in 2018. This growth is attributed to declines in some sub-sectors such as production of wood, sugar, electrical equipment and other non-metallic mineral products. These declines were mitigated by increased production of motor vehicles, trailers, plastics, animal and vegetable fats and oils, and pharmaceutical products,

- Financial and Insurance sector grew by 6.6% compared to 5.3% in 2018, while real estate activities grew by 5.3% to support the economy despite the decelerated growths in other sectors,

- Tourism earnings grew by 3.9% from Kshs 157.4 bn in 2018 to Kshs 163.6 bn as hotel bed-night occupancy expanded by 6.3% to 9,160.8 thousand. The number of international visitor arrivals increased marginally by 0.4% to 2,035.4 from a growth of 14.0% in 2018, and,

- Under money, banking and finance, the CBK reviewed the Central Bank Rate (CBR) downwards during the year to 8.5% from 9.0% to ease monetary policy and boost economic growth. Similarly, the Interest rate cap was repealed through the enactment of the Finance Act 2019 in an effort to enhance access to credit for the private sector. This saw, the Inter-bank, savings and lending rates declining by 2.2%, 1.1% and 0.3% to 6.0%, 4.0 and 12.2%, respectively from, 8.2%, 5.1% and 12.5% in 2018.

Some other key highlights from the report include:

- Employment: During the year, total new jobs created were 846,300, a marginal increase from the 840,600 recorded in 2018. Out of the total new jobs created, 78,400 were from the formal sector while 767,900 came from the informal sector,

- Money Supply: Broad money supply increased from Kshs 3,337.8 bn in December 2018 to Kshs 3,524.0 in December 2019. Total domestic credit grew by 6.1% to Kshs 3,660.5 bn compared to a growth of 5.2% seen in 2018,

- Liquidity: Overall liquidity of the banking system grew by 8.3% to Kshs 4,927.1 bn in 2019 as money outside banks declined to Kshs 157.7 bn in September 2019 from Kshs 196.9 bn seen in June 2019 due to the demonetization exercise done by the Central Bank,

- Imports & Exports: Total exports declined by 2.9% to Kshs 596.7 bn (equivalent to 6.1% of GDP) in 2019, compared to Kshs 614.4 bn in 2018. Total imports on the other hand increased by 2.4% to Kshs 1,806.3 bn (equivalent to 18.5% of GDP) in 2019, compared to Kshs 1,764.5 bn in 2018. This resulted to a deterioration in the balance of trade by 5.2% to a deficit of Kshs 1,209.7 bn (equivalent to 12.4% of GDP) from Kshs 1,150.1 bn recorded in 2018. The total value of trade transactions increased from Kshs 2,378.8 bn in 2018 to Kshs 2,403.0 bn in 2019,

- Balance of Payments: The overall Balance of Payments position improved to a surplus of Kshs 106.4 bn from a surplus of Kshs 103.4 bn in 2018. This is attributed to a build-up in official reserves, and,

- Current Account: The current account worsened to a deficit of Kshs 567.0 bn from Kshs 511.3 bn recorded in 2018. Similarly, the financial account net inflows declined by 3.9% to a surplus of Kshs 636.3 bn from a surplus of Kshs 662.0 bn, mainly occasioned by declines in net inflows of direct investment and other investment liabilities.

In our view, we expect the country’s GDP for 2020 to come in at a range of 1.4% - 1.8% depending on the severity of the effects brought about by the virus, and how fast the country recovers. The key sectors of the economy affected by the Coronavirus pandemic include the Tourism, Agricultural, and Manufacturing sectors which were hit the hardest hit due to shutdowns in major markets and the disruption of the global supply chain. Combined, the 3 sectors account for 43.8% of Kenya’s GDP in 2018.

During the week, the World Bank released the Kenya Economic Update, April 2020, highlighting that the Kenyan economy was estimated to have grown by 5.6% in 2019. Further to this, they expect the effects of the ongoing COVID-19 pandemic will further reduce growth in 2020 with significant impacts on service based sectors (such as transport, retail trade and tourism) and industries (manufacturing and construction). According to the report, Kenya’s GDP growth for 2020 is expected to come in at (1.0%) - 1.5%, depending on how long the economic disruptions in the country last. Below are some of the key take-outs from the report:

- Economic Growth: The economy will be weighed down by both external and domestic supply and demand shocks which will be transmitted to the economy through:

- Global supply chain disruptions which will reduce the availability of intermediate and capital goods brought about by the lockdowns and restrictions in various economies across the globe,

- Shocks in domestic supply and demand due to the restrictions put in place by the government in an effort to curb the spread of the novel Coronavirus,

- A reduction in the value of Kenya’s primary exports such as tea, coffee and horticulture,

- Reduced earnings from tourism, and,

- A slowdown in diaspora remittances.

- Inflation: Headline inflation for the year is projected to come in at 6.0% which is within the government’s target range of between 2.5% - 7.5%. This will be supported by a recovery in the agricultural sector and low oil prices,

- Current Account: The current account deficit is expected to widen to (4.5%) of GDP over the medium term due to the expectations of a larger decline in exports of goods and services compared to imports during the year,

- Fiscal Deficit: the World Bank projects the country’s fiscal deficit to come in at 8.0% in 2020 from a pre-COVID-19 target of 6.3%. This considers a situation where fiscal consolidation efforts are postponed until after the crisis is contained. The rise in fiscal deficit is expected to emanate from the additional fiscal stimulus directed towards containing the novel Coronavirus,

- Debt: According to the report, Kenya’s gross public debt stood at Kshs 6.4 tn (63.1% of GDP) in 2019/20. Debt vulnerabilities for the country have risen because of the increasing debt service obligations while export receipts and government revenues decrease due to the effects of the pandemic,

- Currency: Given the fact that over half of the country’s debt stock is external, exposure to foreign currency risk remains high. This means that the weakening of the local currency will exacerbate debt service obligations, and,

- Considering the above and the current uncertainties, the World Bank is projecting the country’s growth through the below two scenarios:

- In the first scenario, economic activity is assumed to be severely disrupted for two months (starting from Mid-March through to Mid-May), followed by a relatively rapid normalization. In this case, growth is projected to come in at 1.5%,

- In the second scenario, economic activity is assumed to be severely disrupted for a longer three-month period (starting from Mid-March through to Mid-June), this means that the effects will be more significant in the affected sectors and as such the growth is projected to come in at (1.0%).

Below is a table showing Kenya’s GDP growth estimates for 2020 from various organizations, having factored in the effects of the Coronavirus and the locust invasion experienced earlier during the year:

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

2020 Projections |

Revised Projections |

|

1 |

International Monetary Fund* |

6.0% |

1.0% |

|

2 |

World Bank** |

6.0% |

1.5% |

|

3 |

Cytonn Investments Management PLC* |

5.7% |

1.6% |

|

4 |

McKinsey & Company * |

5.2% |

1.9% |

|

5 |

Central Bank of Kenya* |

6.2% |

2.3% |

|

6 |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

5.5% |

|

7 |

Capital Economics |

5.9% |

5.9% |

|

8 |

African Development Bank |

6.0% |

6.0% |

|

9 |

National Treasury |

6.0% |

6.0% |

|

10 |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

11 |

Citigroup Global Markets |

6.2% |

6.2% |

|

|

Average |

5.9% |

4.2% |

|

*Organizations that have revised their projections for 2020 |

|||

|

**Figure is based on the best-case scenario according to the World Bank |

|||

Also during the month, The Finance Bill 2020 was tabled before Parliament, and some of the proposed amendments include;

With regard to Capital Markets Act;

- The Bill seeks to bring private equity and venture capital firms that access public funds (pensions scheme funds) under the regulatory oversight of the Capital Markets Authority. Currently, the private equity and venture capital firms are not regulated,

- The Bill also seeks to remove the function of payment of beneficiaries from collected unclaimed dividends when they resurface. This function is currently domiciled under the Unclaimed Financial Assets Authority.

With regard to Retirements Benefits Act;

- The Bill seeks to enhance supervisory role of the Retirements Benefits Authority on pension schemes by providing powers to charge a penalty for failure by trustees to submit actuarial valuation reports within the period specified in the Retirements Benefits Regulations. If successfully adopted, a trustee who fails to submit a copy of the accrual report to the Chief Executive Officer by the due date specified in the regulations shall pay a penalty of Kshs 100,000.0. In addition, where the report remains unsubmitted, the trustee will pay a further penalty of Kshs 1,000.0 for each day the report remains unsubmitted.

If successfully adopted and approved, we expect the amendments to enhance transparency and accountability in the case of private equity and venture capital firms, and thus additional protection of public funds; however, private equity and venture capital firms are typically unregulated, and may shy away from investing in pension funds if that will lead to their regulation. In addition, we expect the introduction of a penalty for trustees who fail to submit valuation reports in time, will enhance operational efficiency thus complement the RBA’s core mandate which is to protect the interests of its members and sponsors of the scheme, and also prompt adherence to the set Regulations on submission of actuarial evaluations which are used to measure the long term sustainability of the subject scheme.

Monthly Highlights

- World Bank released the Africa’s Pulse, April 2020. According to the report, Sub-Saharan Africa’s economic growth is projected to enter into the negative territory, with the World Bank projecting it at (2.1%) to (5.1%) from a growth of 2.4% recorded in 2019, which will be the region’s first recession in 25-years. For more information, see our Cytonn Weekly #15/2020,

- International Monetary Fund released the first chapter of the World Economic Outlook (The Great Lockdown), where they revised Kenya’s 2020 GDP growth rate for 2020 to 1.0%, from the 6.0% growth rate projected at the beginning of the year. For more information, see our, Cytonn Weekly #16/2020,

- National Assembly approved the Tax Amendment Bill 2020, which was necessitated by the Presidential directive dated 25th March 2020 to mitigate the economic effects arising from the novel COVID-19 virus. On 25th April 2020, President Uhuru Kenyatta, signed into law the Tax Laws (Amendment) Bill. Some of the key amendments include: (i) reduction of the Corporate Tax rate to 25.0% from 30.0% in an effort to increase corporate tax savings, and, (ii) a reduction of Value Added Tax (VAT) to 14.0% from 16.0% in an effort to lower the prices for basic commodities. For more information, see our, Cytonn Weekly #17/2020, and,

- National Assembly approved the supplementary budget for the fiscal year 2019/20, leading to a Kshs 9.7 bn decline in the gross total supplementary budget to Kshs 2,803.1 bn, from Kshs 2,812.8 bn. For more information, see our, Cytonn Weekly #17/2020.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 23.2% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 262.9 bn against a prorated target of Kshs 342.2 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 1.9 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the month of April, the equities market recorded mixed performances, with both NASI and NSE 25 recording gains of 5.9%, while NSE 20 declined by 0.4%. The equities market performance during the month was driven by gains recorded by EABL, Equity Group, Safaricom and KCB, of 15.6%, 10.9%, 7.8% and 5.7%, respectively. During the week, the market recorded mixed performance, with both NASI and NSE 25 recording gains of 2.9% and 3.7%, respectively, while the NSE 20 declined by 0.5%, taking their YTD performance to losses of 16.1%, 19.7% and 26.2%, respectively. The loss recorded by NSE 20 breaches the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more, from recent highs, lasting for more than two months. The performance of the NASI was driven by gains recorded by large-cap stocks such as EABL, Equity Group, Safaricom and Co-operative Bank, of 13.7%, 8.8%, 3.4%, and 2.0%, respectively.

Equities turnover declined by 39.3% during the month to USD 118.5 mn, from USD 195.2 mn in March 2020. During the month, foreign investors remained net sellers with a net selling position of USD 36.4 mn, compared to March’s net selling position of USD 100.5 mn. During the week, equities turnover declined by 62.5% to USD 15.0 mn, from USD 39.9 mn recorded the previous week, taking the YTD turnover to USD 557.1 mn. Foreign investors remained net sellers during the week, with the net selling position declining by 54.7% to USD 5.9 mn, from a net selling position of USD 13.0 mn recorded the previous week.

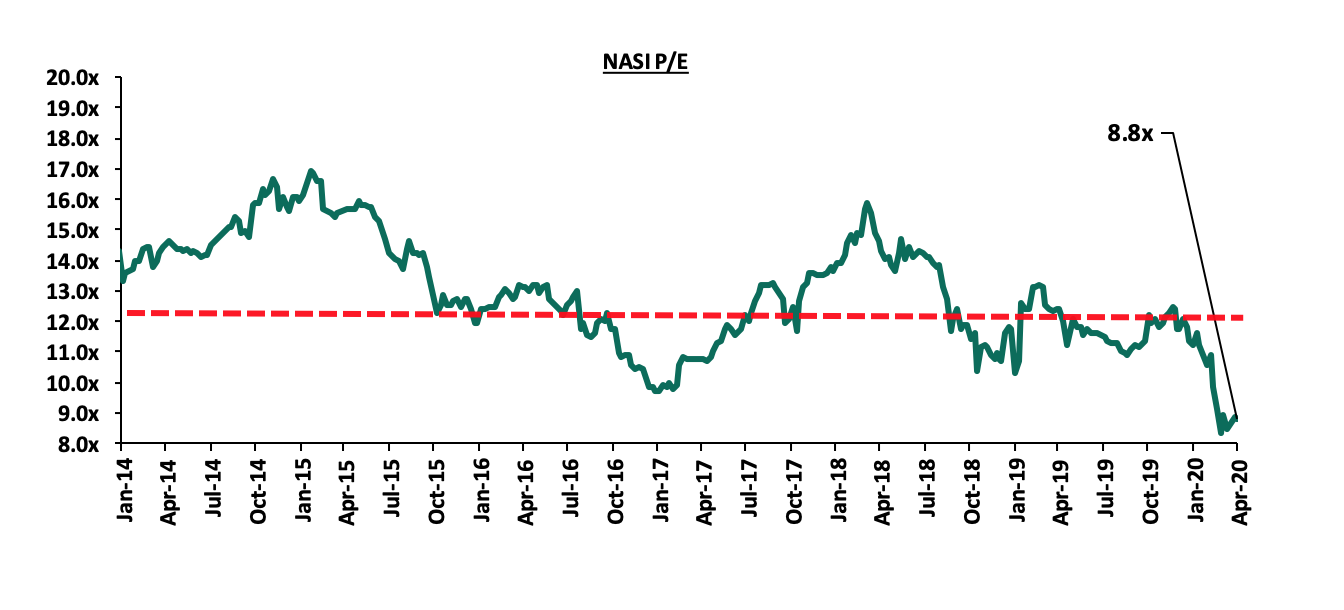

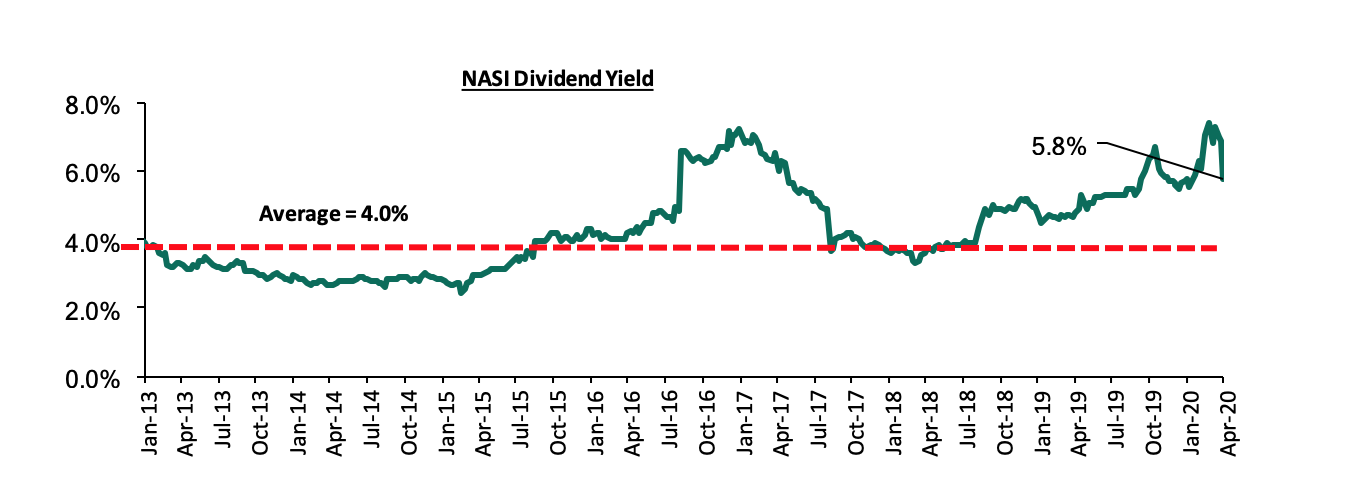

The market is currently trading at a price to earnings ratio (P/E) of 8.8x, 33.0% below the historical average of 13.2x, and a dividend yield of 5.8%, 1.8% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 8.8x is 5.0% above the most recent trough valuation of 8.4x experienced in the last week of March 2020, and 6.3% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights

- During the month, following the release of FY’2019 results by Kenyan banks, we analysed the performance of the 10 listed local banks (previously 11, before the acquisition of National Bank of Kenya by KCB Group Plc), identified the key factors that influenced their performance, and gave our outlook for the banking sector going forward. The Banking sector witnessed a number of consolidation activities in FY’2019 as players in the sector were either acquired or merged. We still maintain our view that Kenya remains overbanked as the number of banks remains relatively high compared to the population. For more information, please see Kenya Listed Banks FY'2019 Report,

- During the month, Safaricom PLC and Vodacom completed the acquisition of intellectual property rights of M-PESA from Vodafone through a newly formed Joint Venture. The deal is estimated to cost approximately USD 13.4 mn (Kshs 1.4 bn) and will see both Safaricom and Vodacom gain full control of the M-Pesa brand, product development and support services. The purchase of M-Pesa’s Intellectual Rights is expected to give more headroom to Safaricom to grow the mobile money service into new African markets and yield significant savings from royalties paid to Vodafone. For more information, please see Cytonn Weekly #15/2020,

- During the month, the Central Bank of Kenya (CBK) took regulatory action against ABSA Bank Kenya for failing to provide information about some specific foreign exchange trades conducted in March 2020. ABSA Bank Kenya failed to adhere to standard checks on anti-money laundering (AML), combating the financing of terrorism (CFT) and know-your-customer (KYC) requirements. For more information, please see Cytonn Weekly #15/2020,

- During the month, ABSA Bank Kenya announced that it had restructured loans amounting to Kshs 8.3 bn, which is equivalent to 4.3% of its net loans, which stood at Kshs 194.9 bn at the end of FY’2019, to shield its customers and provide relief from financial distress occasioned by the COVID-19 pandemic. For more information, please see Cytonn Weekly #16/2020,

- During the month, NCBA Group, the third-largest bank by assets in Kenya, with an asset base of Kshs 494.8 bn as at December 2019, announced it would withhold the final dividend payment of Kshs 1.5 per share, to shareholders totalling to Kshs 2.2 bn for FY’2019. For more information, please see Cytonn Weekly #17/2020, and,

- During the month, the Central Bank of Kenya (CBK) announced the acquisition of a 51.0% stake in Mayfair Bank Limited by Egyptian lender, Commercial International Bank (CIB), effective 1st May 2020 for an undisclosed amount following CBK’s approval on 7th April 2020. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will diversify and strengthen the resilience of the Kenyan banking sector. This is in line with our expectation of continued consolidation in the Kenyan banking sector as players with depleted capital positions become acquired by their larger counterparts or merge to form well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition, as highlighted in our FY’2019 Banking Sector Report. For more information, please see Cytonn Weekly #17/2020.

Universe of Coverage

|

Banks |

Price at 24/04/2020 |

Price at 30/04/2020 |

w/w change |

m/m change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

85.5 |

83.0 |

(2.9%) |

(5.7%) |

(23.9%) |

109.0 |

179.7 |

3.3% |

119.8% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.6 |

2.5 |

(3.1%) |

6.8% |

(16.8%) |

3.0 |

4.8 |

4.4% |

94.8% |

0.2x |

Buy |

|

Jubilee Holdings |

271.3 |

263.0 |

(3.0%) |

(1.4%) |

(25.1%) |

351.0 |

453.4 |

3.4% |

75.8% |

0.9x |

Buy |

|

KCB Group*** |

36.6 |

37.0 |

1.1% |

5.7% |

(31.5%) |

54.0 |

55.8 |

9.5% |

60.3% |

0.9x |

Buy |

|

Equity Group*** |

34.6 |

37.7 |

8.8% |

10.9% |

(29.6%) |

53.5 |

55.3 |

6.6% |

53.5% |

1.2x |

Buy |

|

Co-op Bank*** |

12.4 |

12.6 |

2.0% |

(1.9%) |

(22.9%) |

16.4 |

18.2 |

7.9% |

52.4% |

1.0x |

Buy |

|

I&M Holdings*** |

51.3 |

51.3 |

0.0% |

1.0% |

(5.1%) |

54.0 |

73.6 |

5.0% |

48.6% |

0.7x |

Buy |

|

Sanlam |

15.0 |

15.0 |

0.0% |

0.0% |

(12.8%) |

17.2 |

21.7 |

0.0% |

44.7% |

1.3x |

Buy |

|

NCBA |

28.8 |

28.5 |

(0.9%) |

0.4% |

(22.7%) |

36.9 |

39.4 |

0.9% |

39.1% |

0.7x |

Buy |

|

Standard Chartered |

193.3 |

187.5 |

(3.0%) |

5.3% |

(7.4%) |

202.5 |

223.6 |

10.7% |

29.9% |

1.4x |

Buy |

|

ABSA Bank*** |

10.6 |

10.6 |

0.0% |

5.0% |

(20.6%) |

13.4 |

12.6 |

10.4% |

29.2% |

1.2x |

Buy |

|

Stanbic Holdings |

95.0 |

92.5 |

(2.6%) |

0.5% |

(15.3%) |

109.3 |

109.8 |

7.6% |

26.3% |

1.0x |

Buy |

|

Liberty Holdings |

8.2 |

8.3 |

1.7% |

(1.2%) |

(19.4%) |

10.4 |

10.1 |

0.0% |

20.7% |

0.7x |

Buy |

|

CIC Group |

2.2 |

2.3 |

4.1% |

2.7% |

(15.7%) |

2.7 |

2.6 |

0.0% |

16.8% |

0.8x |

Accumulate |

|

HF Group |

4.1 |

3.9 |

(4.0%) |

(6.9%) |

(39.8%) |

6.5 |

4.3 |

0.0% |

10.5% |

0.2x |

Accumulate |

|

Britam |

6.7 |

6.8 |

2.1% |

5.2% |

(24.0%) |

9.0 |

6.8 |

3.7% |

2.4% |

0.7x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average and as such, we believe that investors should take advantage of the current attractive valuations in the market.

- Industry Reports

During the week, Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2020 Report which focuses on the socio-economic indicators of the Kenyan economy in 2019. The key real estate highlights from the report include;

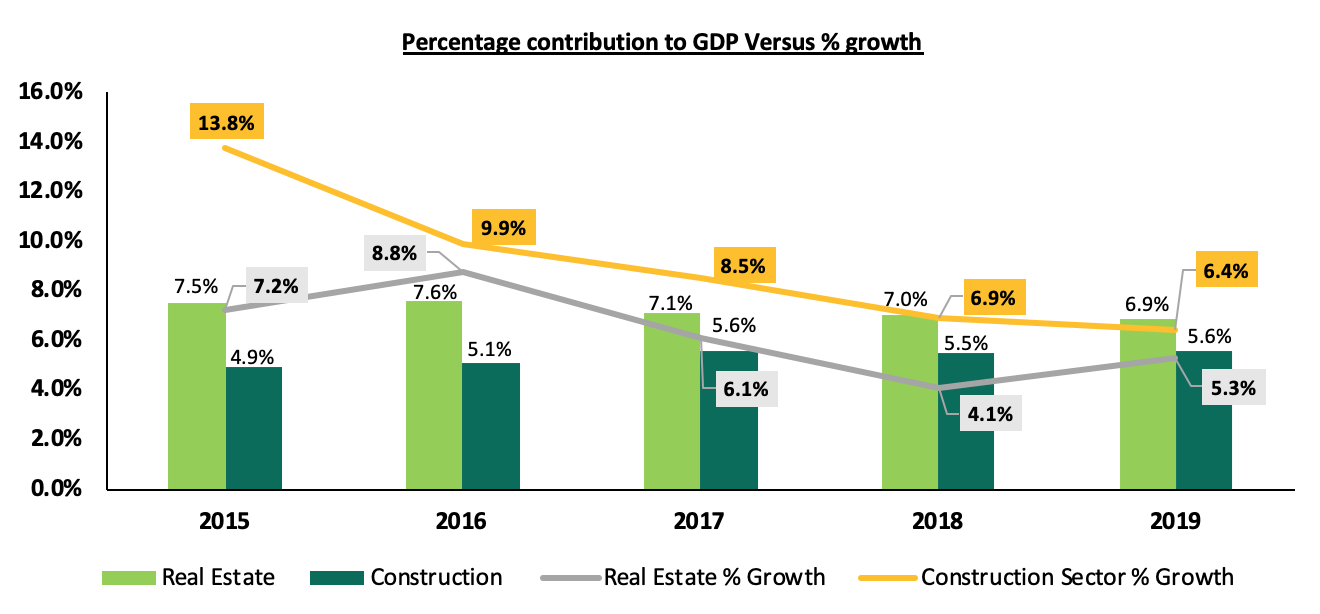

- The real estate sector grew by 5.3% in 2019 compared to 4.1% in 2018. In terms of contribution to GDP, the sector recorded a marginal decline of 0.1% points to 6.9% in 2019 from 7.0% in 2018. We attribute the improved growth of the sector to; (i) continued National Government support for the affordable housing initiative, (ii) Increased foreign investments, (iii) infrastructural improvements, and (iv) positive demographics, which continue to support demand in the sector,

- The construction sector grew by 6.4% in 2019, 0.5% points lower from 6.9% recorded in 2018, while the sector’s contribution to GDP improved slightly by 0.1% point to 5.6%, from 5.5% in 2018. Cement consumption dropped by 2.5% to 5.93 mn tons in 2019, from 5.95 mn tonnes in 2018. Reduced sector growth and the decline in cement consumption during the review period can be attributed to reduced development activities due to illiquidity in the private sector during the interest rate cap regime and delay in the processing of construction permits by counties such as Nairobi, Kisumu, Kiambu, and Mombasa,

The graph below shows the growth of the real estate and construction sectors over the last 5 years;

Source: Kenya National Bureau of Statistics

- In infrastructure, the total government expenditure on roads decreased by 2.7% to Kshs 154.5 bn in 2018/19, from Kshs 158.6 bn in 2017/18. Notable construction activities evident in 2019 were; the ongoing construction of the 19.3 km Nairobi Western Bypass that connects the Kikuyu and Ruaka towns estimated to cost Kshs 2.7 bn, James Gichuru – Rironi Road, Mombasa - Mariakani Road and the completion of Nairobi Outer Ring Road improvement project. The reduced government spending on roads is attributed to delayed completion of ongoing projects brought about by delays in obtaining approvals, financial constraints including non-payment to contractors and suspension or termination of some of the contracts,

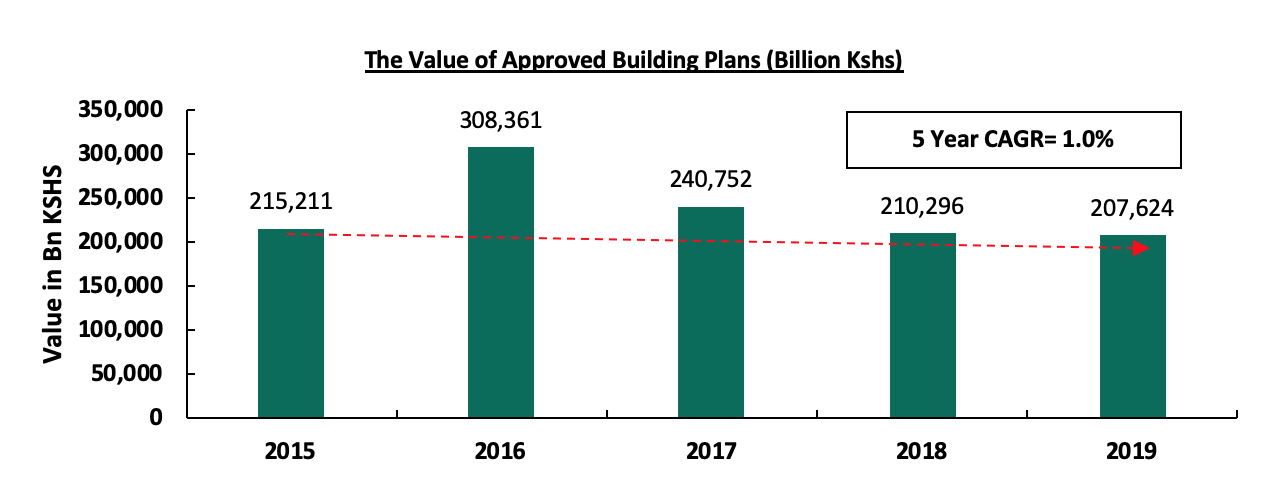

- The value of private building plans approved by Nairobi City County (NCC) decreased by 1.3% to Kshs 207.6 bn in 2019 from Kshs 210.3 bn in 2018, while the value of completed buildings issued with certificates of occupancy by the NCC increased by 4.3% to Kshs 94.0 bn in 2019 from the Kshs 90.1 bn recorded in 2018. We attribute the decrease in the value of private buildings approved to reduced activities in the real estate sector due to oversupply in select sector, evidenced by the decline in the residential sector occupancy rates and an oversupply in the commercial sector, and delayed issuance of approvals by the county government due to downtimes faced by the e-permit systems and the disbandment of the technical committee in charge of approving the permits, and,

Source: KNBS Economic Survey 2020

- Accommodation and food services contribution to GDP declined marginally to 0.7% in 2019, a 0.1% points drop from the 0.8% recorded in 2018. International visitor arrivals increased slightly by 0.4% from 2.03 mn in 2018 to 2.04 mn in 2019 while the number of international conferences held increased by 6.9% from 204 in 2018 to 218 in 2019, and that of local conferences held increasing by 14.4% to 4,743 in 2019 from 4,147 in 2018. The growth of the sector in the period under review was supported by heightened security, recognition of Kenya as a regional hub, relaxation of travel advisories by governments of key tourism markets and political stability that prevailed in the country.

In 2020, we expect the sector to be constrained by, among others, economic slowdown in the wake of the Covid-19 pandemic, oversupply in select sectors and inaccessibility and unaffordability of off-take financing. However we expect it to be cushioned by the National Government’s support for the affordable housing initiative, continued entry and expansion of local and international retailers into the country and improving infrastructure.

- Residential Sector

During the month, a number of regulatory and policy reforms were undertaken through the respective Acts as follows;

- The Tax Laws (Amendment) Bill 2020 was tabled before parliament, and later on assented by the President His Excellency, Uhuru Kenyatta. Among other amendments, most of which are set to cushion the economy in the wake of the COVID- 19 pandemic, the Act outlined a proposed amendment to the Income Tax Act (Cap 470) through the deletion of Section 22C, which provides for tax incentives to individuals saving towards purchasing of a house through a registered home ownership savings plan (HOSP). However, the amendment was not adopted as this would work against the government’s Big Four Agenda on provision of affordable housing. An amendment to the Retirement Benefits Act was passed into law under the Act, allowing the use of pension savings towards purchasing a residential home in addition to securing a mortgage loan. Previously, the law only allowed the use of up to 60.0% of accumulated pension savings as mortgage collateral. In our view, the new law is a boost to one of the Government’s Big Four Agenda, which aims to improve homeownership rates by enhancing the diversification of sources of funds to be used in the purchasing of residential homes by Kenyans. For more information, see Cytonn Weekly #15/2020 and Cytonn Weekly #17/2020, and,

- The Pandemic Response and Management Bill 2020, which outlines socio-economic protective measures in the wake of the COVID-19 pandemic, was tabled before the senate by Nairobi Senator Hon. Johnson Sakaja. The Bill, whose principal objective is to provide a framework for the effective response and management of a pandemic, contained various property measures such as; i) a moratorium on penalties during pandemic periods, ii) tenancy agreements between tenants and landlords on settlement of rent arrears accrued during a pandemic period, and, iii)preventing lenders from putting properties on auction in addition to preventing any termination of lease or license of immovable property due to non- payment of rent or other monies during the pandemic period. For more information, see Cytonn Weekly #16/2020,

We expect the government to continue adopting policy reforms geared towards cushioning the economy which continues to grapple with the impact of the COVID-19 pandemic, in addition to boosting its Big Four Agenda mainly on provision of affordable housing, which we expect to also cushion the real estate sector.

- Retail Sector

During the month, the retail sector recorded various activities such as;

- International Finance Corporation (IFC), World Bank’s Private lending arm, acquired a minority stake in Naivas International Limited for Kshs 1.5 bn. The move by IFC is an indication of investor confidence in Kenya’s retail market and the retailer, in the wake of increasing competition with the entry and expansion of international brands, even as some of its peers struggle to remain in business. The retailer also opened a new branch in Kilimani. The store, which is located at Kilimani Mall along Tigoni Road, covers 10,000 SQFT (according to online sources) and marks its 64th store and also the third to be launched this year by the retailer after Kamakis along the Eastern Bypass and Mountain View along Waiyaki Way, which were opened in the months of January and March, respectively. Plans are underway, by the retailer, to open a new branch in Imara Daima in Nairobi in the coming months. For more information, see Cytonn Weekly #16/2020 and Cytonn Weekly #17/2020,

- Shoprite Holdings, a South African based international retailer, announced the closure of its Waterfront Mall branch in Karen, where it was the anchor tenant, due to the reduced flow of shoppers. This brings the number of remaining outlets in Kenya to 3; at Garden City, Westgate Mall in Nairobi and City Mall in Mombasa. The retailer, who initially had 4 outlets has begun to scale down due to financial constraints. For more information, see Cytonn Weekly #16/2020, and,

- Tuskys announced the temporary closure of three of its branches in Nairobi, Kitale, and Mombasa. The move is aimed at consolidating the retailer’s services to other branches which are more spacious to implement social distancing and personal hygiene measures more effectively. The affected branches include Tuskys Tom Mboya branch, Tuskys Kitale Mega Branch, and Tuskys Digo Branch. For more information, see Cytonn Weekly #17/2020.

We expect occupancy rates of major retail centers to drop during this period as most retailers are shutting down their operations to cushion themselves against the impact of the Coronavirus. However, we expect to see retailers invest in their e-commerce infrastructure and also decentralize to locations that are easily accessible from people’s homes.

- Commercial Office Sector

During the month, Fusion Capital, a local real estate developer, announced that it would offer a 3-month 30.0% rent relief to tenants in its Flamingo Towers development in Upper-Hill in the wake of the Coronavirus pandemic. The office sector, like other real estate sub-sectors, is experiencing a short- term disruption due to the Coronavirus pandemic and has presented some downside risk for the sector forcing property developers to employ various creative strategies with the aim of retaining and supporting their tenants. For more information, see Cytonn Weekly #15/2020.

In the short term, we expect landlords to continue to adopt various strategies aimed at attracting and retaining tenants, which will cushion the performance of the office sector in the wake of reduced demand for commercial spaces. In the long term, we expect to see a slight reduction in demand with some firms having downsized due to financial constraints resulting from the current pandemic as several others experience working from home and may make it a permanent measure.

- Hospitality Sector

During the month, The Ministry of Health Cabinet Secretary, Mutahi Kagwe, announced that hotels and restaurants in major towns would be allowed to resume operations albeit under strict terms. Some of the measures to be observed by hotels will include; i) all staff will be subjected to a mandatory Covid-19 test and the hotels can only be opened once all the staff have tested negative for the virus, ii) customers are required to wash their hands and wear masks while inside the hotels, iii) a ban on buffets and self-service meals, iv) dining tables to be spaced at least 1.5 metres apart, v) customers to observe social distance, and, vi) workers to also observe social distance in the kitchens. The move is expected to revamp activities in the hospitality sector which has been the hardest hit by the COVID-19 pandemic. Despite being a move in the right direction, we anticipate that these hotels and restaurants will struggle to achieve previous daily customer targets with most sales expected to come from the online meal delivery market through third party delivery platforms such as Jumia food, Glovo and Uber Eats. Generally, the hospitality sector as a whole will continue to experience shocks as a result of the global pandemic and the emphasis by the government on restriction of movement.

In light of the same, the Kenyan Government further extended, by 21 days, the ban on movement in and out of the Nairobi Metropolitan Area effective Monday 6th April 2020, with an exception of cargo to curb the spread of the Corona Virus. In line with this, local airline carriers, Jambojet and Safarilink announced temporary suspension of their local flight. For more analysis, see Cytonn Weekly #15/2020.

Despite the hospitality sector being significantly hit by the COVID-19 pandemic owing to its heavy reliance on tourism and the MICE (Meetings, Incentives, Exhibitions and Conferencing) sectors, we expect the sector to be cushioned by the Ministry of Tourism’s post-corona recovery strategy fund of Kshs 500.0 mn coupled by the government’s directive to re-open hotels and restaurants in major towns.

- Infrastructure

During the month, the Kenya Roads Board (KRB) disbursed Kshs 539.0 mn for maintenance of roads in the coastal region counties such as Mombasa, Kilifi, Lamu and Taita Taveta. The fund is part of the Kshs 4.4 bn conditional grant for the maintenance of roads in all the 47 counties for the 2019/2020 financial year. Conditional grants have become the major source of development funds in counties as disbursements from equitable share mainly go into recurrent expenditure and consumption of fixed capital. For more information, see Cytonn Weekly #15/2020.

We expect a slowdown in the government’s investment on infrastructure in the short term as it seeks to implement fiscal consolidation measures such as the redeployment of funds meant for the National Development Fund towards efforts to mitigate the impact of COVID-19 on the economy.

- Listed Real Estate

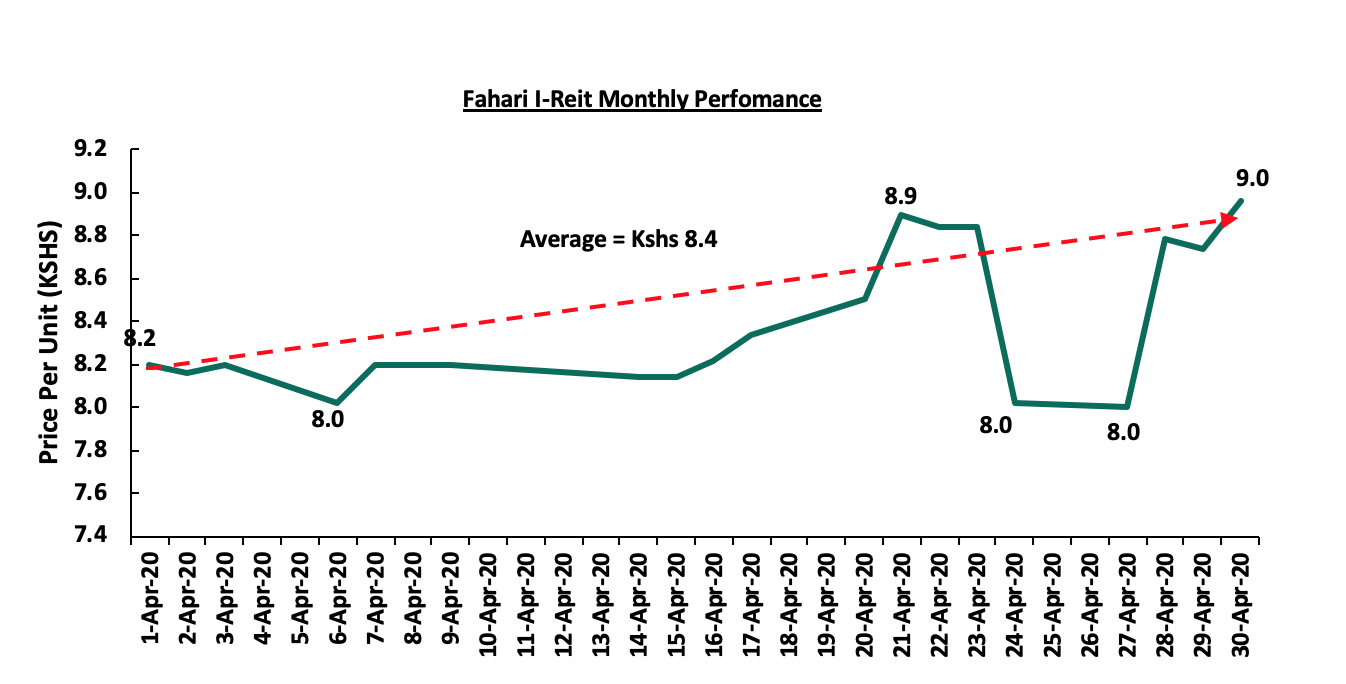

During the month, the Fahari I-REIT closed the month at Kshs 9.0, 11.1% higher than the previous month’s closing price of Kshs 8.0. It continued to perform poorly trading at an average of Kshs 8.4, a 57.5% drop from its initial price of Kshs 20.8 as at November 2015 and 12.5% lower than Kshs 9.6 recorded at the beginning of the year.

Our outlook for listed real estate is negative constrained by the declining performance of the Stanlib Fahari I-REIT as a result of continued lack of investor interest for the instrument.

In addition, Stanlib Kenya Limited released the Fahari I-REIT- Audited Results FY’2019, according to which, the I-REIT’s dividend yield came in at 8.3%, compared to the commercial real estate market average of 7.7%, with 7.5% rental yield for retail space and 7.8% yield for office space in Q1’2020. The earning per unit recorded a 9.4% decline to 0.97 from 1.07, attributed to a 9.0% decline in net profits, to Kshs 175.2 mn from Kshs 193.5 mn mainly due to the reduction in fair value gain on revaluation of investment property compared to prior year on the back of a sluggish real estate sector with continued downward pressure on rental income especially in the retail sector. Please see the Fahari I-REIT FY’2019 Earnings Note for the analysis.

We retain a neutral outlook towards the performance of the real estate sector, despite the effects of the COVID-19 pandemic on the Kenyan economy as a whole. We expect the sector to continue being supported by the continued investor confidence in sectors such as retail in addition to supportive government policies.

Introduction:

Kenya’s public debt continues to be a topic of discussion in most macroeconomic outlook discussions, with global credit rating agencies such as Fitch Rating expecting the pandemic to halt the country’s fiscal consolidation and increase its financing needs. Most recently in December 2019, Fitch affirmed Kenya’s B+ rating owing to the country’s strong and stable growth outlook, however, they cited failure to stabilize government debt to GDP levels could lead to a negative rating action. In the wake of the Coronavirus pandemic, economic effects of the virus continues to increase with the number of cases rising and the number of deaths escalating. As such, risks abound on revenue collection and increased expenditure resulting from capital required to control the pandemic leading to increased fiscal pressure given the existing huge fiscal deficit. It is for this reason that this week, we shall cover debt relief as an option available to the government in mitigating the effects of the pandemic. Therefore, we shall cover the following:

- Kenya’s Current Debt Levels and Debt Profile,

- Impact COVID-19 Has Had on The Economy, With a Focus on Debt Sustainability,

- Kenya’s Debt Servicing Levels and Why It Is Important For Kenya To Seek Debt Relief, and,

- Conclusion and Our View Going Forward.

Below is a summary of what we have written so far on the COVID-19 pandemic:

- Impact of Corona Virus on the Kenyan Economy: We analyzed the resultant effect on the Kenyan economy given the negative impact that the pandemic is having on international trade, the financial and commodity markets, and the global macroeconomic environment;

- The Potential Effects of COVID – 19 on Money Market Funds: Here we highlighted the current macro-economic environment in the country, where we analyzed the effects in the fixed-income market and how things stand, having reported the first infection on 13thMarch 2020; and,

- COVID-19 Economic Containment Policies: Here we highlighted the options available to the Kenyan Government when it comes to managing the adverse economic effects brought about by the pandemic.

Section I: Kenya’s Current Debt Levels and Debt Profile

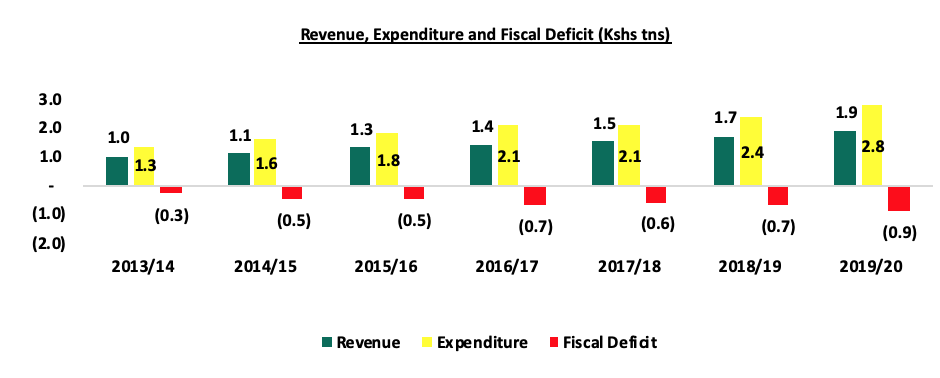

Year on year, the national budget has continued to grow, with total expenditure growing at a 6-year CAGR of 16.6% to an estimated Kshs 2.8 tn in FY’2019/20 according to the 2020 Supplementary II budget estimates, from Kshs 1.3 tn as at the end of FY’2013/14. Revenue growth on the other hand has grown at a slower 6-year CAGR of 13.1% to an estimated Kshs 1.9 tn in FY’2019/20, from Kshs 1.0 tn as at the end of FY’2013/14. The faster rise in expenses, compared to revenue collected has seen the fiscal deficit widening from Kshs 0.3 tn (equivalent to 5.6% of GDP) in FY’2013/14 to a projected Kshs 0.9 tn (equivalent to 8.0% of GDP) in FY’2019/20 as per the 2020 Supplementary II budget estimates as highlighted in the chart below:

Source: National Treasury

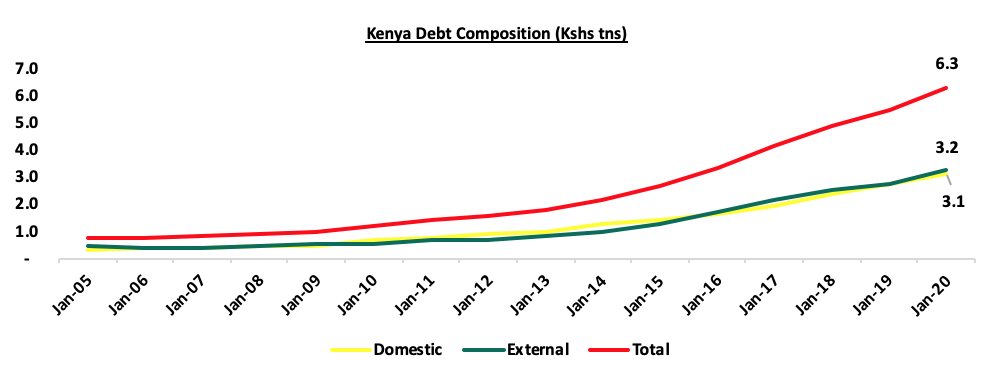

This has necessitated increased borrowing in order to fund the fiscal deficit. Consequently, this has seen the levels of debt increasing, with the debt to GDP ratio rising from 46.0% to an estimated 62.0% during a similar period of review according to the IMF, and above the IMF’s recommended threshold of 50.0%. To further facilitate more borrowing, recently, the Public Finance Management (PFM) Regulations was amended, to substitute the debt ceiling that was previously pegged at 50.0% of GDP to an absolute figure of Kshs 9.0 tn. Given that the country’s total public debt currently stands at Kshs 6.3 tn, ( Kshs 3.2 tn foreign and Kshs 3.1 tn, domestic borrowing), this gives the government a leeway of borrowing an extra Kshs 2.7 tn to reach the Kshs 9.0 tn limit.

The government uses two sources to access debt financing:

- Domestic Markets: This is through issuance of treasury bills and bonds, or can seek to borrow from

- International Markets: This is through multilateral lenders (international institutions such as the World Bank that provide financial assistance in form of loans or grants), bilateral lenders (other nations that provide debt) or through commercial lenders from the international capital markets through the issuance of sovereign bonds/Eurobonds.

The country’s debt mix currently stands at 51:49 external and domestic debt, respectively. In figurative terms, this comprises of Kshs 3.2 tn in external debt and Kshs 3.1 tn in domestic debt. This is in comparison to the 59:41, external and domestic debt structure as at the end of 2005, and against a debt strategy target mix of 60% foreign and 40.0% domestic debt. Kenya’s foreign public debt has also evolved with the exposure to bilateral and multilateral development institutions declining, to a much more commercial funding structure comprising of Eurobonds and syndicated loans. This has seen the proportion of Bilateral and Multilateral debt, which stood at 90.7% of total external debt as at June 2013, declining to approximately 66.4% as at December 2019. This has seen commercial loans, deemed more expensive because of their high interest costs compared to soft loans from bilateral and multilateral development institutions, grow from a low of Kshs 58.9 bn as at June 2013 to Kshs 1.0 tn as at December 2019, equivalent to 33.1% of total foreign debt, with suppliers credit accounting for the remaining 0.5% of the total foreign debt.

Source: National Treasury and CBK

Section II: Impact COVID-19 Has Had on the Economy, With a Focus on Debt Sustainability

Kenya’s economic growth is expected to slow down, with the International Monetary Fund (IMF) revising Kenya’s 2020 GDP growth rate for 2020 to 1.0%, from the 6.0% growth rate projected at the beginning of the year in their World Economic Outlook (The Great Lockdown). The World Bank in their Kenya Economic Update have also revised Kenya’s GDP growth rate for 2020 to 1.5% if economic activities are disrupted for 2-months or a recession of (1.0%) if economic activities are disrupted for longer than 3-months. Our in house view also indicates a lower GDP growth rate of 1.4% - 1.8% for the year 2020 depending on the severity of the outbreak and economic implications for Kenya. One of the key elements of debt sustainability in any economy is the ability to service debt, and this is usually measured by revenue collection to total outstanding payments required, both in principal and interest payments. The pandemic has so far had a negative impact on revenue collection and borrowing costs and the situation is expected to worsen as highlighted below:

- Revenue Collection: Revenue collection activities of the government has been affected due to the ongoing pandemic with major economic sectors such as tourism, manufacturing and agriculture feeling the brunt effects of the pandemic following supply side shocks, decline in export demand and reduction of tourism and remittance flows. In addition, revenue collection is also expected to be suppressed following, the president signing the Tax Amendment Bill 2020 into law in effect reducing taxes, both income tax and VAT, in order to cushion individuals from the adverse effects of the pandemic. Over the years, government has heavily relied on taxes in order to raise revenues with both VAT and income tax jointly contributing an estimated 60.8% to the FY’2019/20 total revenues as per the 2020 Supplementary II budget books,

- Expenditure: The government’s expenditure is expected to increase to an estimated Kshs 2.8 tn according to the 2020 Supplementary II budget estimates, from Kshs 2.7 tn in the FY’2019/2020 budget, following additional spending to strengthen the health care system to withstand a potential spike in COVID-19 infections, protect vulnerable households and to ease firms’ liquidity constraints. As a result, the fiscal deficit is expected to rise to 8.0% of GDP in 2020 from a pre-COVID-19 target of 6.3% of GDP therefore increasing pressure for the government to seek additional domestic borrowing in order to plug in the financing gap arising from the COVID-19 fiscal measures. This has already seen the government raising its domestic borrowing to Kshs 404.4 bn from the initial 300.3 bn as per the 2020 Supplementary II budget estimates, and,

- Increased Borrowing Costs: Kenya’s foreign debt is mostly denominated in foreign currency therefore the volatility of the exchange rate plays a key role in determining our borrowing costs. The Kenyan Shilling has been depreciating due to the uncertainty created by Coronavirus with the YTD depreciation against the US Dollar currently at 5.9% as at 30thApril 2020, in comparison to the 0.5% appreciation in 2019. The depreciation of the local currency has made external debt more expensive, with 69.0% being US Dollar denominated, 18.1% in Euro, 5.5% in Chinese Yuan, 4.5% in Japanese Yuan, 2.6% in Great Britain Pound and other currencies account for 0.3%, hence increasing the danger of rising debt-service costs. The expectations of slower revenue collection attributable to slower economic growth as a result of the ongoing pandemic, coupled with higher financing costs is likely to deteriorate the debt servicing capabilities of the country and as such presenting a higher risk of debt distress.

Section III: Kenya’s Debt Servicing Levels and Why It Is Important for Kenya to Seek Debt Relief

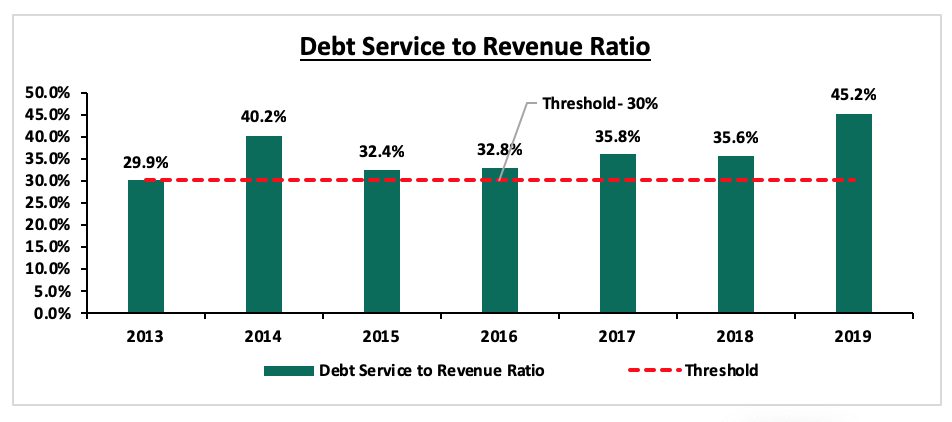

According to the National Treasury, the debt service-to-revenue ratio was estimated at 45.2% as at the end of 2019, higher than the recommended threshold of 30.0% and as such elevating the risks of repayment following shocks arising from the ongoing pandemic and low revenue collection. Below is a chart showing the evolution of the country’s debt service to revenue ratio:

Source: IMF Country Report & National Treasury Annual Public Debt Report

In the FY’2019/2020 budget, Kshs 800.0 bn had been set aside to repay loans of which Kshs 366.4 bn was expected to cover for interest payment with the largest bulk of debt repayment falling to China. As at December 2019, the amount of external debt owed to China (Kshs 693.1 bn) accounted for 67.7% of total bilateral loans, compared to 57.0% in 2016. The amount owed to China is approximately 5 times more than what is owed to the next biggest lending partner Japan, accounting for 13.4% (Kshs 137.2 bn) of the total bilateral loans. Hence, this has resulted in debt concentration risks in China.

Due to the increased debt distress risk, it is important for the Kenyan Government to seek debt relief and our focus on this week’s note is the options available on debt relief as a measure of mitigating this risk. Debt relief refers to the reorganization of debt to provide the indebted party with a measure of respite, either fully or partially. The debt relief can either be through reducing the outstanding principal amount, lowering interest rates on loans due or extending the term of the loans. In the ongoing global pandemic, the IMF executive board approved immediate debt service relief to 25 of the IMF’s member countries, 19 being African countries, under the IMF’s revamped Catastrophe Containment and Relief Trust (CCRT) as part of the Fund’s response to help address the impact of the COVID-19 pandemic. However, Kenya was not among the 25 countries that received the debt relief facility because of its per capita income, which stood at Kshs 181,260 above the Kshs 128,790 required by IMF to receive the debt facility. Kenya’s debt to the IMF is also relatively small at Kshs 36.5 bn in December 2019, accounting for a meagre 3.5% of the total multilateral debt. The World Bank, in partnership with the IMF and the international community, has over the years worked with developing countries to reduce their debt burdens, through:

- The Heavily Indebted Poor Countries (HIPC) Initiative: The program was launched by the World Bank and IMF to ensure that the poorest countries in the world are not overwhelmed by unmanageable or unsustainable debt burdens. This was in response to accumulation of unsustainable and developing country debt by most countries. The program called for voluntary debt relief from all creditors, and gave eligible countries a fresh start on foreign debt that had placed too great a burden on resources for debt service, and,

- The Multilateral Debt Relief Initiative: The debt relief program was launched to help countries that had graduated from HIPC and were struggling to make progress towards the UN Millennium Development Goals (MDGs). The program offered full debt relief for eligible debt from the World Bank's International Development Association (IDA), the IMF, the African Development Fund and the Inter-American Development Bank held by low-income countries that have completed the HIPC process.

Given that the debt service to revenue ratios are above the recommended threshold of 30.0% and the devastating effects of the pandemic, coupled with the urgent need to prevent the worsening of debt ratios, which may lead to lower social expenditures and increase poverty. It is imperative that the government seeks temporary debt moratorium or debt forgiveness so as to provide the country some breathing space and offset some of the negative effects of contracting government revenues. It is therefore important that the Kenyan Government should consider seeking debt relief through;

- Temporary Debt Stand Still: According to the 2020 supplementary budget II estimates, Kshs 131.9 bn is expected to cover for interests to external debt and therefore a temporary stand still of debt servicing will be important in providing fiscal space for the country. With a large portion, (67.7%) of Kenya’s bilateral loans being owed to China, approaching the Chinese Government for a temporary stand still of debt servicing will see Kenya save approximately Kshs 84.3 bn in FY’2020/2021, which is targeted towards debt servicing to China as per the 2020 Supplementary budget II budget books.China has a history of working with struggling borrowers in an aim to ease short-term pressure to ensure eventual repayment and in light of G20 states, of which China is part of, agreeing to postpone some of Africa’s debt by a year for Africa’s poorest countries, there already exists a precedence for relief on this front. With the country, having lost market access for our exports and a substantial loss in major revenue sources obtaining a temporary debt standstill will be important for the country. A temporary stand still from China would be the first step towards a broader debt relief, with China’s economy also expected to contract for the first time in three decades, which is a factor that makes a temporary debt stand still a realistic and immediate approach,

- Paris Club Activities: Paris Club is a group of officials from major creditor countries whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by debtor countries. Kenya’s second largest lender, Japan, accounts for 13.4% of the bilateral loans and is a permanent member of the Paris Club, therefore Kenya could approach the Paris Club to restructure the debt owed to Japan. Previously Kenya has gone to Paris Club three times for rescheduling in 1994, 2000 and 2004, managing to reschedule a debt in 2004, amounting to USD 350.0 mn. Kenya has also managed to reschedule debt amounting to Kshs 5.8 bn from Japan to help bridge its budget deficit for the 2000/2001 financial year and if a similar agreement is reached Kenya could save approximately Kshs 5.1 bn in debt servicing to Japan in FY’2020/2021 as per the 2020 Supplementary II budget books,

- Accessing IMF Emergency Financing and Raising IMF Special Drawing Rights: With the IMF Executive Board having approved the proposal to enhance the fund’s emergency financing toolkit to USD 100.0 bn (Kshs 10.7 tn), access to this fund will provide additional liquidity to the country and serve as a bridge special purpose vehicle for commercial debt servicing. The government has already received Kshs 6.0 bn from the World Bank and is in talks to receive Kshs 75.0 bn from the IMF. As at December 2019, Commercial loans accounted for 33.1% of the external debt and therefore emergency financing from the IMF to help service commercial loans will aid in addressing debt distress, and,

- Debt Swap for Sustainable Development: This is where a creditor forgives debt on the condition that the debtor makes available some specified amount of local currency funding to be used for specific developmental purposes. Debt-for-development swaps provide for win- win situations as debtors see their debt reduced and development spending increased, while creditors benefit from an increase in the value of remaining debt claims and increase their development credentials. In 2006, the Governments of Italy and Kenya signed an agreement, the Kenya- Italy Debt- for- Development Programme (KIDDP), to convert bilateral debt owed by the Kenyan Government to the Italian Government into financial resources to implement development projects aimed at poverty reduction. If the Kenyan Government was to seek a debt swap with Italy under the same terms, approximately Kshs 35.7 bn could be saved, which is what the country owed to Italy as at December 2019. On this front, the United Nations together with the World Bank, IMF and other Civil Societies have been driving his agenda in a bid to free up countries from debt payment across a resource-rich Africa.

Section IV: Conclusion and Our View Going Forward