Kenya Listed Banks FY'2019 Report, & Cytonn Weekly #16/2020

By Research Team, Apr 19, 2020

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 59.5%, up from 35.6% the previous week, attributable to tightened liquidity in the money markets as banks traded cautiously in the interbank market in order to meet their Cash Reserve Requirement (CRR) cycle ending 15th April 2020. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th April 2020 to 14th May 2020. Petrol, diesel, and kerosene prices have declined by 16.2%, 4.0% and 19.0% to Kshs 92.9, Kshs 97.6, and Kshs 77.3 per litre, respectively. During the week, International Monetary Fund released the first chapter of the World Economic Outlook (The Great Lockdown), where they revised Kenya’s 2020 GDP growth rate for 2020 to 1.0%, from the 6.0% growth rate projected at the beginning of the year. The global economy is projected to contract by 3.0% in 2020, a worse outlook than the one seen in the 2008 – 2009 financial crisis. During the week, in response to the challenges brought about by the COVID-19 pandemic, the National Treasury released the Supplementary Budget Estimates II for the 2019/20 fiscal year. The proposed budget will be tabled to the National Assembly for debate and approval on 22nd April 2020. The Treasury proposes a Kshs 9.7 bn decline in the gross total supplementary budget estimate I to Kshs 2,803.1 bn from Kshs 2,812.8 bn;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 increasing by 3.7%, 0.3%, and 2.5%, respectively, taking their YTD performance to losses of 18.3%, 25.6%, and 23.3%, for the NASI, NSE 20 and NSE 25, respectively. The losses recorded by NSE 20 and NSE 25, breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. During the week, ABSA Bank Kenya announced that it had restructured loans amounting to Kshs 8.3 bn, which is equivalent to 4.3% of its net loans, which stood at Kshs 194.9 bn at the end of FY’2019, to shield its customers and provide relief from financial distress occasioned by COVID-19 pandemic. This is in line with measures previously announced by the Central Bank of Kenya (CBK) and Kenya Bankers Association (KBA) to cushion the economy against the impact of the COVID-19 pandemic. During the week, CBK barred unregulated digital mobile lenders such as Tala, from forwarding names of loan defaulters to Credit Reference Bureaus (CRBs). In line with the same, CBK also stopped the blacklisting of borrowers owing less than Kshs 1,000;

Real Estate

During the week, the Pandemic Response and Management Bill 2020 was tabled before the senate by Nairobi Senator Hon. Johnson Sakaja, which outlines socio-economic protective measures such as tenancy agreements, social safety nets, loans and mortgages, aimed at cushioning business relationships in the wake of the COVID-19 pandemic. In the retail sector, International Finance Corporation (IFC), World Bank’s private lending arm, acquired a minority stake in retail chain, Naivas International Limited for Kshs 1.5 bn, while Shoprite Holdings, South African based international retailer, announced the closure of its Waterfront Mall branch in Karen, where it was the anchor tenant, due to the reduced flow of shoppers;

Focus of the Week

Following the release of FY’2019 results by Kenyan banks, this week we analyze the performance of the 10 listed local banks (previously 11, before the acquisition of National Bank of Kenya by KCB Group Plc), identify the key factors that influenced their performance, and give our outlook for the banking sector going forward.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.1% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.25% p.a. To subscribe, email us at sales@cytonn.com;

- Following the Kenyan Government's directive in containing the spread of COVID-19, we have adjusted our working hours to 8 am - 4 pm on weekdays and 8 am- 12 pm on Saturdays. For convenience, you can reach us online on clients.cytonn.com, WhatsApp at 0748 070 000, or email at clientservices@cytonn.com

- Rodney Omukhulu, Assistant Investment Analyst at Cytonn Investments, was on Metropol TV to discuss COVID-19 economic containment policies. Watch Rodney here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information, please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 59.5%, up from 35.6% the previous week, attributable to tightened liquidity in the money markets. The subscription rate of the 91-day and 364-day papers increased to 65.5% and 108.6%, respectively, from 14.3% and 63.4% recorded the previous week, respectively. The subscription rate for the 182-day paper, however, declined to 8.1% from 16.3% received the previous week. Investors’ participation remained skewed towards the longer 364-day paper attributable to the scarcity of shorter-dated bonds, which has seen most investors still keen to participate in the primary fixed income market finding the 364-day T-bill more attractive on a risk-adjusted return basis. The yields on the 91-day and 182-day papers remained unchanged at 7.2% and 8.1%, while the yield for the 364-day paper increased marginally by 10 bps to 9.1%, from 9.0% recorded the previous week. The acceptance rate rose to 99.7%, from 99.3% recorded the previous week, with the government accepting Kshs 14.25 bn of the Kshs 14.29 bn bids received.

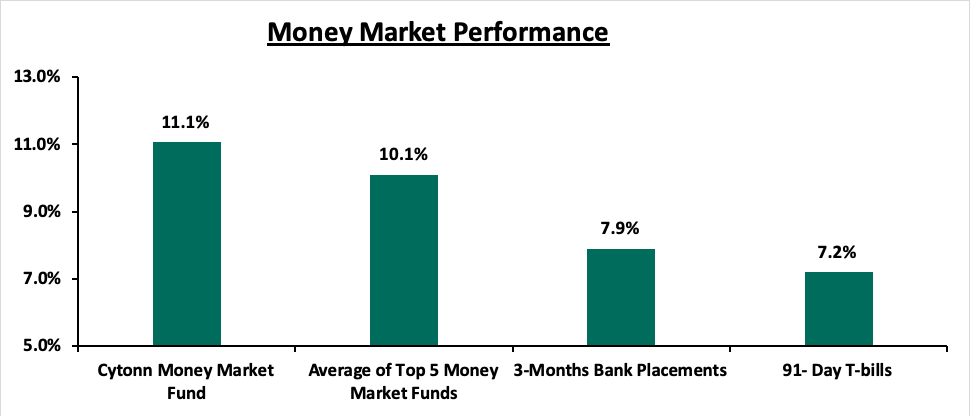

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.2%, similar to what was recorded the previous week, while the average of Top 5 Money Market Funds increased by 0.1% point to 10.1%, from 10.0% the previous week. The yield on the Cytonn Money Market increased by 0.1% point to 11.1%, from 11.0% recorded the previous week,

Liquidity:

During the week, liquidity tightened in the money markets with the average interbank rate increasing to 5.9%, from 5.3% recorded the previous week, attributable to banks trading cautiously in the interbank market in order to meet their Cash Reserve Requirement (CRR) cycle ending 15th April 2020. Commercial banks’ excess reserves came in at Kshs 50.3 bn in relation to the 4.25% cash CRR. The average interbank volumes declined by 25.9% to Kshs 5.6 bn, from Kshs 7.6 bn recorded the previous week.

Kenya Eurobonds:

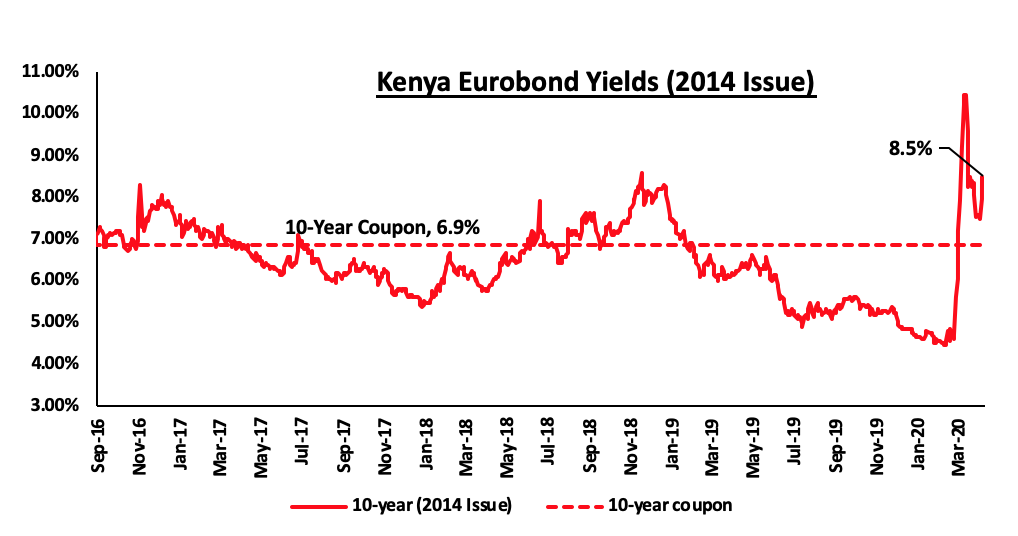

During the week, the yields on all the Eurobonds increased marginally, attributable to investors attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the coronavirus pandemic as highlighted in our Q1’2020 Eurobond Performance Note. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 0.9% points to 8.5%, from 7.6% recorded the previous week.

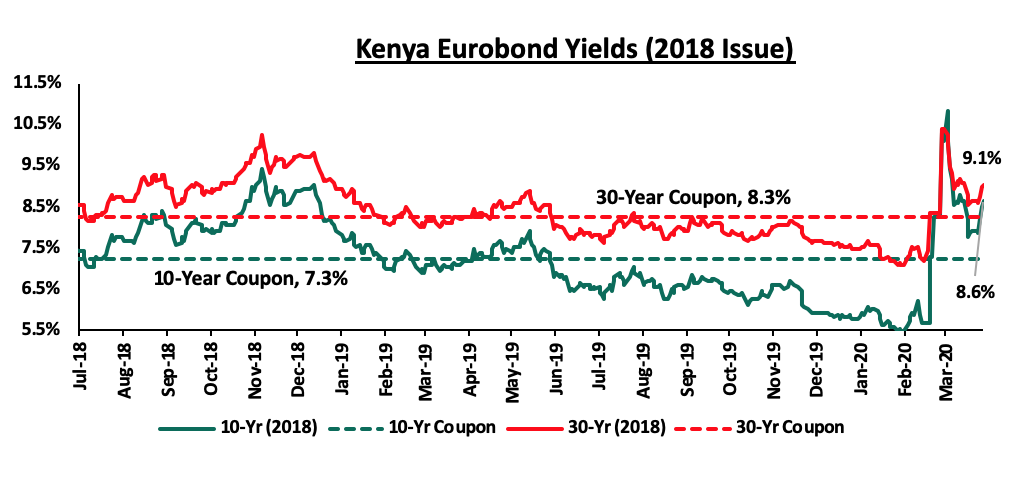

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 increased by 0.7% points and 0.4% points to 8.6% and 9.1%, respectively, from 7.9% and 8.7% recorded previous week, respectively.

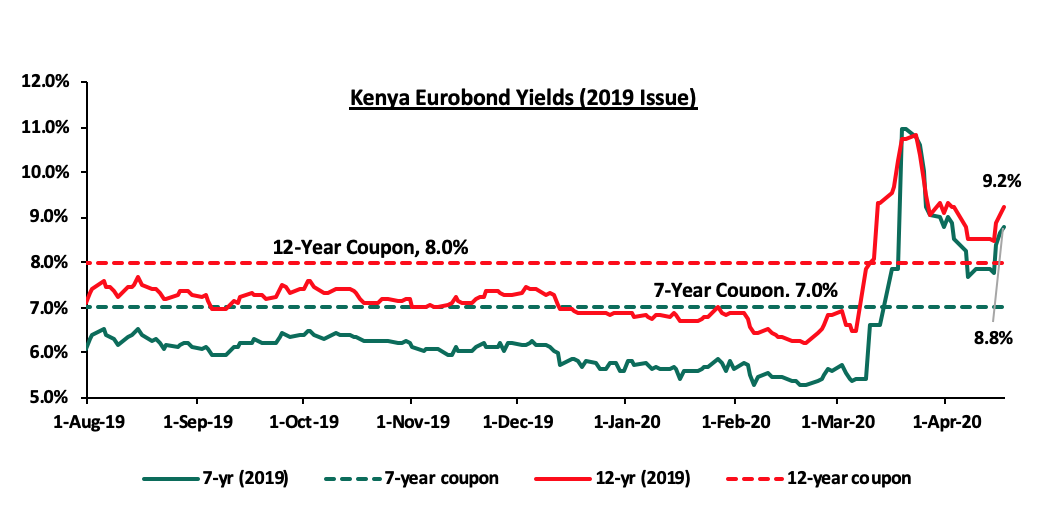

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 0.9% points and 0.7% points, to 8.8% and 9.2%, respectively, from 7.9% and 8.5% recorded the previous week, respectively. The jump can be attributed to the locust invasion and the ongoing coronavirus pandemic in the country.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.2% against the US Dollar to close at Kshs 106.2, from Kshs 106.0 recorded the previous week, due to a slowdown in foreign dollar currency inflows from diaspora remittances and fewer offshore investors to meet dollar demand. On an YTD basis, the shilling has depreciated by 4.8% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect depreciation of the shilling in 2020 as a result of:

- Rising uncertainties in the global market due to the Coronavirus outbreak, which has seen the disruption of global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to cause local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 8.0 mn (equivalent to 4.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- CBK’s supportive activities in the money markets, with the CBK having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March 2020 to bolster the forex reserves.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th April 2020 to 14th May 2020. Below are the key take-outs from the statement:

- Petrol prices have declined by 16.2% to Kshs 92.9 per litre, from Kshs 110.9 per litre previously, while diesel prices have declined by 4.0% to Kshs 97.6 per litre from Kshs 101.7 per litre. Kerosene prices declined by 19.0% to Kshs 77.3 per liter, from 95.5 per liter previously,

- The changes in prices have been attributed to the decline in the average landing cost of imported super petrol by 34.6% to USD 309.0 per ton in March 2020, from USD 472.6 per ton in February 2020. Landing costs for diesel and kerosene also declined by 9.9% and 37.7% to USD 432.7 per ton and USD 262.4 per ton in March 2020, respectively, from USD 480.2 per ton and USD 421.2 per ton in February 2020, respectively, and,

- A 36.6% decline in Free on Board (FOB) price of Murban Crude Oil lifted to USD 35.6 per barrel, from USD 56.1 per barrel in February 2020.

We expect a decline in housing, water, electricity, gas, and other Fuels as well as a decline in the transport index, which carries a weighting of 9.7% in the total consumer price index (CPI), due to the decrease in petrol and diesel prices. We will release our inflation expectations in our next weekly report.

B: IMF World Economic Outlook Report

During the week, International Monetary Fund released the first chapter of the World Economic Outlook (The Great Lockdown), where they revised Kenya’s 2020 GDP growth rate for 2020 to 1.0%, from the 6.0% growth rate projected at the beginning of the year. The global economy is projected to contract by 3.0% in 2020, a worse outlook than the one seen in the 2008 – 2009 financial crisis, and grow by 5.8% in 2021, attributable to government support and the IMF assumption that the pandemic will fade by June 2020. Below is a summary of the projections;

|

World GDP Projections |

||||

|

Economy |

Jan 2020 |

Revised 2020 Projections |

Variance (% Points) |

2021 Projections |

|

Euro Area |

1.3% |

(7.5%) |

(8.8%) |

4.7% |

|

United States |

2.0% |

(5.9%) |

(7.9%) |

4.7% |

|

United Kingdom |

1.4% |

(6.5%) |

(7.9%) |

4.0% |

|

Japan |

0.7% |

(5.2%) |

(5.9%) |

3.0% |

|

Sub-Saharan Africa |

3.5% |

(1.6%) |

(5.1%) |

4.1% |

|

Kenya |

6.0% |

1.0% |

(5.0%) |

6.1% |

|

China |

6.0% |

1.2% |

(4.8%) |

9.2% |

|

Global Growth Rate |

3.3% |

(3.0%) |

(6.3%) |

5.8% |

Analysis of trends observed in the chart above is as follows:

- GDP growth for advanced economies, United States, Japan, the United Kingdom, Germany, France, Italy, and Spain is projected to grow by (6.1%) due to the increased number of outbreaks as well as the containment policies put in place,

- Growth rate for emerging markets and developing economies, exclusive of China, is projected to grow by (1.0%) in 2020 attributable to the anticipated economic disruptions by COVID-19, health crisis and the plummeting of the commodity prices, and,

- Sub-Saharan Africa is projected to grow by (1.6%) in 2020 being attributable to the drastic decline in oil prices that has been seen during the beginning of the year. Between August 2019 and February 2020, oil prices declined by 7.3% to USD 53.4 from USD 57.6. The prices further declined by 39.6% to USD 32.3 in March due to the outbreak of COVID-19.

IMF projects the global economy to recover in 2021 and grow by 5.8% with the advanced economies, emerging markets and developing economies and the SSA economies growing by 4.5%, 6.6%, and 4.1%, respectively. The rebound of the economies will be pegged on the restoration of consumer and investor confidence and the pandemic fading by H1’2020. Currencies of commodity exporters among the emerging and developed economies have depreciated sharply with the US Dollar, Yen and the Euro appreciating by 8.5%, 5.0%, and 3.0%, respectively.

IMF proposes that the provision of adequate healthcare system resources, provision of zero-interest emergency loans, grants and medical equipment to the constrained countries by the multilateral corporations and setting up policies for the recovery phase will help cushion the global economy from the impacts of the pandemic. In our view, increased spending on health-care systems will enable countries to contain the spread of the virus setting pace for the recovery of the economy. External support provided by the multilateral corporations will preempt the decline of investors’ confidence in the economies leading to stability in the economies. Should the pandemic prove to be more persistent than anticipated, the global economic growth will contract in 2020 and recover slowly in 2021. For more information on the containment policies governments should take in order to manage the adverse economic effects brought about by the pandemic see our Cytonn Weekly#15/2020.

The key take-outs from the report were that the containment policies such as regional lockdowns, quarantines, and social distancing have led to the reduction of labor supply greatly affecting sectors that rely heavily on social interaction such as hospitality. Continued fears raised by the ongoing pandemic has seen investors’ flight to safe havens increase. Consequently, the rush to liquidity has increased pressure on borrowing costs leading to the scarcity of credit to the financially constraint persons. We are of the view that failure to contain the virus through the implementation of stringent containment policies will lead to prolonged economic distress with the global economy recovering slowly in 2021.

The table below shows GDP projections from 11 firms with the consensus GDP growth as per the 11 firms below expected to come in at 4.5%.

However, we expect this growth rate to be revised downwards as global research houses downgrade their GDP growth estimates for 2020 once they factor in the economic impact of Coronavirus.

|

Kenya 2020 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

2020 Projections* |

Revised Projections** |

|

1. |

International Monetary Fund** |

6.0% |

1.0% |

|

2. |

Cytonn Investments Management PLC** |

5.7% |

1.6% |

|

3. |

McKinsey & Company ** |

5.2% |

1.9% |

|

4. |

Central Bank of Kenya** |

6.2% |

3.4% |

|

5. |

United Nations Conference on Trade and Development (UNCTAD) |

5.5% |

5.5% |

|

6. |

Capital Economics |

5.9% |

5.9% |

|

7. |

African Development Bank |

6.0% |

6.0% |

|

8. |

World Bank |

6.0% |

6.0% |

|

9. |

National Treasury |

6.0% |

6.0% |

|

10. |

African Development Bank (AfDB) |

6.0% |

6.0% |

|

11. |

Citi Global Markets |

6.2% |

6.2% |

|

|

Average |

5.9% |

4.5% |

|

|

Median of Revised Growth Estimates |

|

1.8% |

|

As at the beginning of the year ** Revised GDP Growth |

|||

C: 2019/20 Kenya Supplementary Budget II

During the week, in response to the challenges brought about by the COVID-19 pandemic, the National Treasury released the Supplementary Budget Estimates II for the 2019/20 fiscal year. The proposed budget will be tabled to the National Assembly for debate and approval on 22nd April 2020. The Treasury proposes a Kshs 9.7 bn decline in the gross total supplementary budget to Kshs 2,803.1 bn from Kshs 2,812.8 bn. We, however, note this is still a 2.5% rise from the initial approved budget. The proposed budget rationalization is attributable to the tough economic environment brought about by the pandemic and inability of the government to raise funding through tax revenues in order to meet its domestic borrowing target.

The table below illustrates the allocation of the Supplementary Budget 2019/20, showing the components of the estimated expenditure:

|

Supplementary Gross Budget 2019/2020 ( Kshs billions) |

|

|||

|

|

Approved Estimates (Supplementary budget I) |

Supplementary II Estimates |

Change |

% Change |

|

State Department of ICT |

29.1 |

21.3 |

(7.8) |

(26.8%) |

|

Ministry of Energy |

84.0 |

62.5 |

(21.5) |

(25.6%) |

|

State Department of Vocational & Technical Training |

26.9 |

23.8 |

(3.1) |

(11.5%) |

|

State Department of Water Services |

67.2 |

59.8 |

(7.4) |

(11.0%) |

|

Ministry of Health |

115.6 |

103.4 |

(12.2) |

(10.6%) |

|

State Department of Interior |

140.6 |

133.6 |

(7.0) |

(5.0%) |

|

State Department of Agricultural Research |

6.3 |

6.0 |

(0.3) |

(4.8%) |

|

Other Ministries & State Departments |

1,245.3 |

1,190.1 |

(55.2) |

(4.4%) |

|

State Department of Basic Education |

98.2 |

94.3 |

(3.9) |

(4.0%) |

|

State Department of Infrastructure |

193.8 |

237.9 |

44.1 |

22.8% |

|

Total Expenditure |

2,007.0 |

1,932.6 |

(74.4) |

(3.7%) |

|

Consolidated Fund Services |

805.8 |

870.5 |

64.7 |

8.0% |

|

Grand Total Supplementary Budget |

2,812.8 |

2,803.1 |

(9.7) |

(0.3%) |

Key highlights in the supplementary budget include;

- The infrastructure docket has seen its budget enhanced by Kshs 44.1 bn, which was the only notable increment to Kshs 237.9 bn from the earlier approved Kshs 193.8 bn. According to the budget books as published by the National Treasury, the increase is mainly attributable to payment of outstanding pending bills which is in line with the Government’s plan of paying pending bills to suppliers and quickly process tax refunds for firms to support the economy in the face of the coronavirus crisis,

- The highest notable decline in expenditure was on the State Department of ICT, which saw a 26.8% decline in expenditure to Kshs 21.3 bn from Kshs 29.1 bn in the previously approved estimates, attributable to budget rationalization as per the budget books, which saw the major decline being recorded in ICT Infrastructure Development by Kshs 5.3 bn to Kshs 16.4 bn from the earlier approved estimate of Kshs 21.7 bn,

- The National Treasury proposes a 10.6% decline in the supplementary budget allocation for the Ministry of Health to Kshs 103.4 bn from Kshs 115.6 bn. The decline in expenditure is mainly attributable to the rationalization of the allocation to the Preventive, Promotive and Reproductive Maternal Neo-natal Child & Adolescent Health (RMNCAH) declining sharply by 48.8% to Kshs 6.3 bn from Kshs 12.3 bn. To address the COVID-19 impact on the economy, the Ministry of Health has however been allocated an extra Kshs 3.9 bn for the recruitment of health workers and to fund the proposed COVID-19 Emergency Response Project, and

- Consolidated Fund Services has seen an 8.0% increase in the estimates to Kshs 870.5 bn from the initial Kshs 805.8 bn, with the budget allocations for external and internal interest redemptions increasing by 11.8% to Kshs 778.8 bn from Kshs 696.6 bn. Notably, however, the external debt redemptions have declined by 12.6% to Kshs 131.9 bn from Kshs 150.9 bn in the previously approved estimates, with a notable decline being in the redemptions to Exim bank of China by Kshs 10.5 bn to Kshs 23.0 bn from Kshs 33.6 bn in the initial estimates.

In our view, the proposed reduction of the governments’ expenditure by Kshs 9.7 bn will do little to cushion the economy against the expected fiscal deficit following the impact from the COVID-19 pandemic. We expect the fiscal deficit to expand during the tail end of the fiscal year, attributable to revenue underperformance, which has seen the Government increase its borrowing target. We maintain our view, that with only 2 months left to the end of the current fiscal year, the Government’s fiscal consolidation plan will remain elusive.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 33.4% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 222.8 bn against a prorated target of Kshs 334.4 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 increasing by 3.7%, 0.3% and 2.5%, respectively, taking their YTD performance to losses of 18.3%, 25.6%, and 23.3%, for the NASI, NSE 20 and NSE 25, respectively. The losses recorded by NSE 20 and NSE 25, breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. The performance of the NASI was driven by gains recorded by large-cap stocks such as Safaricom, ABSA, SCBK, and EABL of 6.3%, 4.0%, 2.3%, and 2.1%, respectively.

Equities turnover decreased by 13.5% during the week to USD 22.5 mn, from USD 26.0 mn recorded the previous week, taking the YTD turnover to USD 502.3 mn. Foreign investors remained net sellers for the week, with the net selling position decreasing marginally by 0.4% to USD 8.35 mn, from a net selling position of USD 8.39 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing riskier assets in favor of safe havens.

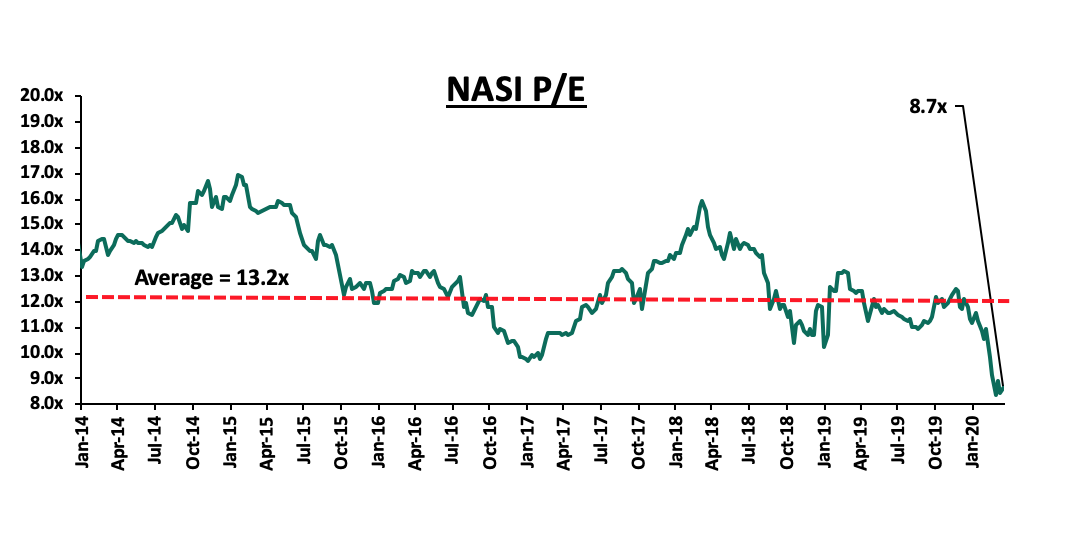

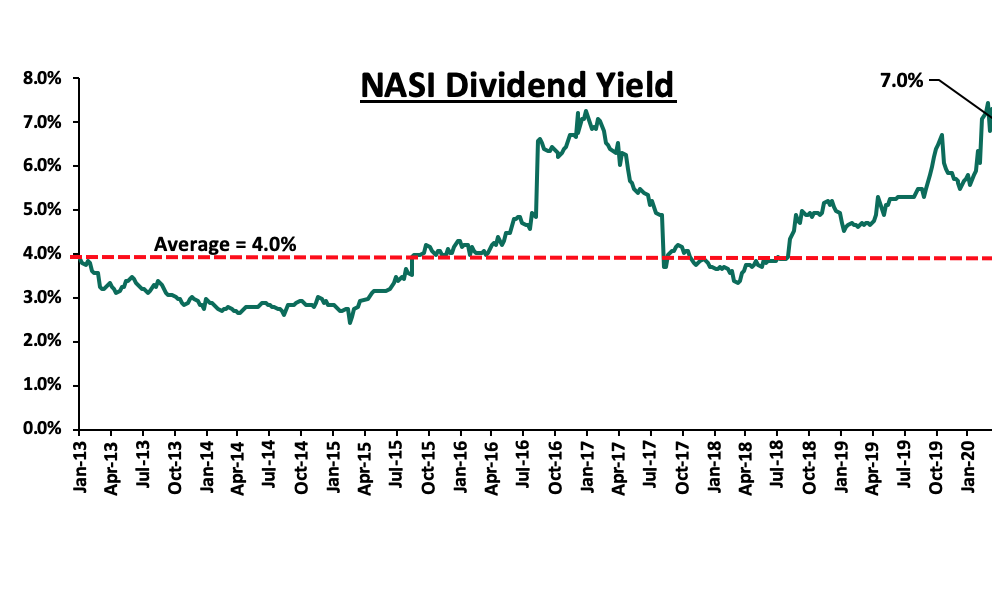

The market is currently trading at a price to earnings ratio (P/E) of 8.7x, 34.1% below the historical average of 13.2x, and a dividend yield of 7.0%, 3.0% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 8.7x is 10.3% below the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 4.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight:

During the week, ABSA Bank Kenya announced that it had restructured loans amounting to Kshs 8.3 bn, which is equivalent to 4.3% of its net loans, which stood at Kshs 194.9 bn at the end of FY’2019, to shield its customers and provide relief from financial distress occasioned by the COVID-19 pandemic. This is in line with measures previously announced by the Central Bank of Kenya (CBK) and Kenya Bankers Association (KBA) to cushion the economy against the impact of the COVID-19 pandemic. Previously, the lender had also announced that it would pay all suppliers invoices within 14 days with invoices of Kshs 1.0 mn and below being paid within 7 days. The lender also announced it would give loan breaks to the select customers who apply and are negatively affected by the pandemic. The loan moratorium will be for a period of up to three months, during which loan instalments shall not be collected. The moratorium also gives customers an option to request an extension of the relief period to a maximum of 12 months. Further, customers can extend their credit life insurance cover (a type of life insurance policy designed to pay off a borrower's outstanding debts if the borrower dies) for three months at no additional cost. This move mirrors that of Stanbic Bank that instructed large corporate customers to contact it for assessment and restructuring of their loans based on their respective industry circumstances and Standard Chartered Bank Kenya, who also announced a three-month repayment break on personal loans and mortgages to its customers. In our view, restructuring the loans will ensure working capital is available to their customers as they mitigate the tough operating environment as a result of the ongoing COVID-19 pandemic, which has impacted their customers’ normal operations. However, given the impact of the pandemic on not only the Kenyan economy but also the global economy, we expect a rise in non-performing loans because of persistent inactivity in businesses as the pandemic strains the financial health of the borrowers.

During the week, the CBK barred unregulated digital mobile lenders such as Tala, from forwarding names of loan defaulters to Credit Reference Bureaus (CRBs). Equally, the Central Bank also stopped the blacklisting of borrowers owing less than Kshs 1,000. The suspension came on the backdrop of, the Central Bank governor, Dr. Patrick Njoroge announcing the suspension of CRB listing for loans defaulted from 1st April 2020 as part of the Central Bank’s measures to cushion businesses and individuals from the impact of COVID-19. The Central Bank cited the misuse of the Credit Information Sharing (CIS) mechanism and poor responsiveness to customer complaints led to the suspension of the unregulated digital mobile lenders. The move will see approximately 1.0 mn borrowers removed from the CRB. We continue to note and applaud the recent efforts by the Central Bank to crack the regulatory whip in the financial services sector specifically the banking sector as it seeks to enhance consumer protection and enhance stability in the sector. In our view, this will enhance the borrower’s chances of being able to borrow more, however, we also expect the unregulated lenders to shy away from issuing loans.

Universe of Coverage

|

Banks |

Price at 09/04/2020 |

Price at 17/04/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

85.5 |

85.0 |

(0.6%) |

(22.0%) |

109.0 |

179.7 |

3.2% |

114.6% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.7 |

2.5 |

(4.9%) |

(16.5%) |

3.0 |

4.8 |

4.3% |

94.1% |

0.2x |

Buy |

|

Equity Group*** |

32.8 |

33.0 |

0.5% |

(38.4%) |

53.5 |

55.3 |

7.6% |

75.4% |

1.2x |

Buy |

|

KCB Group*** |

34.5 |

34.6 |

0.3% |

(35.9%) |

54.0 |

55.8 |

10.1% |

71.4% |

0.9x |

Buy |

|

Jubilee Holdings |

274.7 |

281.5 |

2.5% |

(19.8%) |

351.0 |

453.4 |

3.2% |

64.3% |

0.9x |

Buy |

|

Co-op Bank*** |

12.5 |

12.4 |

(0.4%) |

(24.2%) |

16.4 |

18.2 |

8.1% |

54.8% |

1.0x |

Buy |

|

NCBA |

28.0 |

28.2 |

0.7% |

(23.6%) |

36.9 |

39.4 |

6.2% |

46.2% |

0.7x |

Buy |

|

Sanlam |

15.0 |

15.0 |

0.0% |

(12.8%) |

17.2 |

21.7 |

0.0% |

44.7% |

1.3x |

Buy |

|

I&M Holdings*** |

51.0 |

52.8 |

3.4% |

(2.3%) |

54.0 |

73.6 |

4.8% |

44.4% |

0.7x |

Buy |

|

ABSA Bank*** |

9.9 |

10.3 |

4.0% |

(23.2%) |

13.4 |

12.6 |

10.7% |

33.7% |

1.2x |

Buy |

|

Standard Chartered |

182.3 |

186.5 |

2.3% |

(7.9%) |

202.5 |

223.6 |

10.7% |

30.6% |

1.4x |

Buy |

|

Stanbic Holdings |

93.8 |

95.0 |

1.3% |

(13.0%) |

109.3 |

109.8 |

7.4% |

23.0% |

1.0x |

Buy |

|

CIC Group |

2.3 |

2.2 |

(4.4%) |

(19.4%) |

2.7 |

2.6 |

0.0% |

22.2% |

0.8x |

Buy |

|

Liberty Holdings |

8.5 |

8.4 |

(1.2%) |

(19.2%) |

10.4 |

10.1 |

0.0% |

20.4% |

0.7x |

Buy |

|

Britam |

7.0 |

6.7 |

(4.3%) |

(25.6%) |

9.0 |

6.8 |

3.7% |

4.5% |

0.7x |

Lighten |

|

HF Group |

4.2 |

4.2 |

(1.2%) |

(35.8%) |

6.5 |

4.3 |

0.0% |

3.6% |

0.2x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Residential Sector

During the week, the Pandemic Response and Management Bill 2020 was tabled before the senate by Nairobi Senator Hon. Johnson Sakaja, which outlines socio-economic protective measures such as tenancy agreements, social safety nets, loans and mortgages, aimed at cushioning business and households in the wake of the COVID-19 pandemic. The Bill, whose principal objective is to provide a framework for the effective response to and management of a pandemic, seeks to address the gridlock between landlords and tenants offering guidelines on how both parties can resolve business relationships during pandemic times. The property related measures are outlined in Section 26- 29 of the Bill and include;

- Loans and Mortgages - The bill seeks to; (i) protect borrowers by preventing lenders from imposing penalties on defaulters during the pandemic, and (ii) protect the defaulter from being listed with a Credit Reference Bureau. It proposes that the borrower and the financial institution enter into an arrangement to review repayment modalities in such an event. Key to note, the measures would apply for a period beginning from the declaration of the pandemic up to three months after the pandemic. With regard to the same, the bill also proposes that the Cabinet Secretary responsible for matters relating to finance may, with the approval of Parliament, also provide measures to cushion lenders and borrowers,

- Moratorium on Penalties - The bill proposes that a lending financial institution shall not charge fees, interest or any other penalty for non-payment or late payment of obligations during the pandemic period,

- Contractual Obligations - The bill seeks to prevent lenders from putting properties to auction in addition to preventing any termination of lease or license of immovable property due to non- payment of rent or other monies during the pandemic,

- Tenancy Agreements - The bill proposes that tenants and landlords may enter into an agreement on how the former may settle rent arrears accumulated during a pandemic. This will give tenants the ability to defer payment of rent until a pandemic is ended, without exempting the tenants from paying rent during the pandemic.

In our view, successful implementation of the Bill would mean that in an occurrence of a pandemic, parties on the receiving end, tenants and borrowers are cushioned against adverse effects of the pandemic, mainly due to the resultant impact on socio-economic activities. However, this could render landlords and financial institutions into an economic plunge, as there are no provisions such as tax incentives to cushion their businesses over the same period.

- Retail Sector

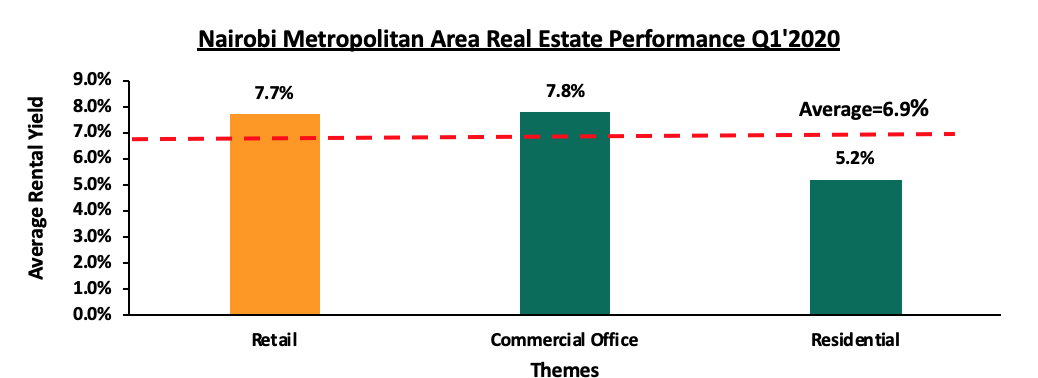

During the week, International Finance Corporation (IFC), World Bank’s Private lending arm, acquired a minority stake in Naivas International Limited for Kshs 1.5 bn. The global financier is part of a consortium of investors among them, French private equity firm Amethis, Deutsche Investitions-und Entwicklungsgesellschaft (DEG) - a German Development Finance Institution, and Mauritian Commercial Bank (MCB) Fund, investing in Naivas, a family-owned retail chain which has 62 outlets in Kenya. The move by IFC is an indication of investor confidence in Kenya’s retail market and the retailer, in the wake of increasing competition with the entry and expansion of international brands, even as some of its peers struggle to remain in business. Through gaining a stake in the company, we expect that IFC will help optimize business operations and further strengthen the retailer’s corporate governance structures, whose lack thereof previously resulted in the collapse of family-owned retail giant, Nakumatt Holdings. This will thus enhance consolidation of the retailer’s position and support further expansion. In our view, the continued investor confidence evidenced by increased focus by international institutions on Kenya’s retail sector is largely driven by; (i) strong domestic demand driven by the growing middle-class population with a high purchasing power, (ii) the rapid population growth at 2.2% compared to the global average at 0.9%, which has led to international retailers such as Mango setting up shop in the region to satiate demand for quality international products, and (iii) a general improvement in ease of doing business in the region evidenced by Kenya’s move from position #61 in 2018 to #56 in 2019 on the Ease of Doing Business Index by World Bank. We expect this to continue resulting in the entry and expansion of retailers, which will boost the retail sector performance, through fueling uptake of space thus driving investor returns. In terms of performance, according to the Cytonn Real Estate Report Q1’2020, the retail sector recorded an average yield of 7.7% in Q1’2020 compared to the office and residential sectors with 7.8% and 5.2%, respectively, with markets such as Westlands and Karen recording relatively high returns of 10.0% and 9.6%, respectively.

The figure below shows a comparison of performance of the retail, residential and commercial office themes in Q1’2020;

Source; Cytonn Research 2020

In addition, during the week, Shoprite Holdings, South African based international retailer, announced the closure of its Waterfront Mall branch in Karen, where it was the anchor tenant, due to the reduced flow of shoppers, and this brings the number of remaining outlets in Kenya to 3: at Garden City, Westgate Mall in Nairobi and City Mall in Mombasa. The retailer set up shop in Kenya, opening their first store in 2018 to take advantage of prime retail locations vacated by collapsing retailers namely, Uchumi and Nakumatt. However, the retailer, who initially had 4 outlets has begun to scale down due to financial constraints. This, in addition to the scaling down of other retailers such as Botswana’s Choppies and local retailers Uchumi and Nakumatt, a family-owned business that collapsed as a result of poor corporate governance structures, has continued to impact on the retail sector occupancy rates, which dropped by 0.3% points to 78.4% in Q1’2020, from 78.7% in Q1’2019, according to the Cytonn Real Estate Report Q1’2020. We attribute this to constrained spending power among consumers due to a tough financial environment and an introduction of 0.8 mn SQFT of retail space in 2019, with the addition of malls such as The Well in Karen and the expansion of Sarit Centre in Westlands.

The table below shows the sub-market performance in the Nairobi Metropolitan Area (NMA);

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area (NMA) Retail Submarket Performance Q1'2020 |

|||

|

Row Labels |

Rent Kshs/SQFT Q1’ 2020 |

Occupancy Q1’ 2020 |

Rental Yield Q1’ 2020 |

|

Westlands |

210.3 |

82.2% |

10.0% |

|

Karen |

220.0 |

81.9% |

9.6% |

|

Ngong Road |

186.3 |

80.5% |

8.5% |

|

Kilimani |

164.2 |

85.5% |

8.5% |

|

Kiambu Road |

175.4 |

70.3% |

7.3% |

|

Thika Road |

170.4 |

73.0% |

7.0% |

|

Eastlands |

148.2 |

71.8% |

6.8% |

|

Mombasa Road |

152.5 |

69.3% |

6.4% |

|

Satellite town |

135.0 |

74.5% |

6.0% |

|

Average |

172.7 |

76.3% |

7.7% |

Source; Cytonn Research 2020

We expect that financial boost, as in the case of international financial institutions buying into companies such as Naivas, will strengthen the retailers’ financial muscle and also enhance good corporate governance thus boosting its operations. Nevertheless, we expect the sector’s performance to continue being suppressed by the existing oversupply of space amounting to 2.8 mn SQFT as at 2019, prompting reduced development activity in the sector within the Nairobi Metropolitan Area, with developers shifting to county headquarters in some markets such as Kiambu and Mt. Kenya that have an estimated retail space demand of 0.8 mn and 0.2 mn SQFT, respectively.

Despite the effects of the COVID-19 pandemic taking a toll on the Kenyan economy, we continue to retain a neutral outlook towards the performance of the real estate sector, supported by the continued investor confidence in addition to measures such as proposals within the Pandemic Response and Management Bill which if implemented are set to cushion the sector against serious disarray from the effects of the pandemic.

Following the release of the FY’2019 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

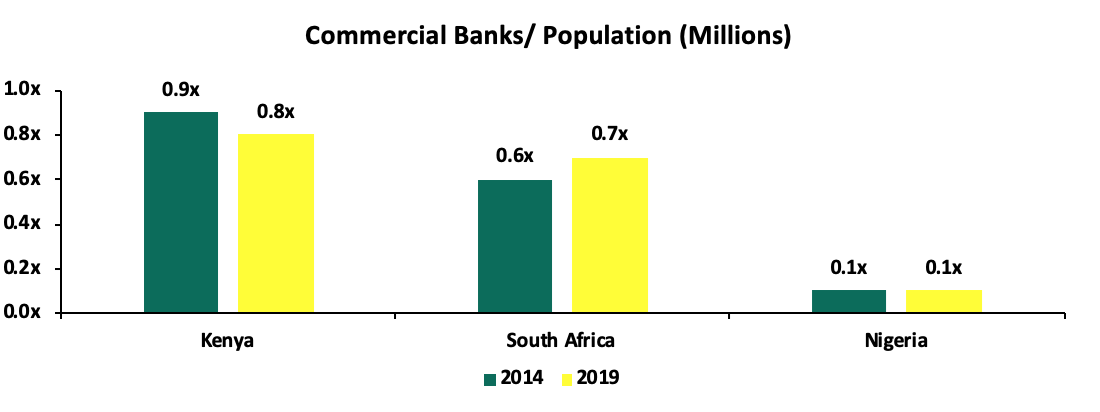

The Banking sector witnessed a number of consolidation activities in FY’2019 as players in the sector were either acquired or merged. We still maintain our view that Kenya remains overbanked as the number of banks remains relatively high compared to the population. Increased consolidation will reduce the number of banks in the country which currently stand at 38, thus reducing the commercial banks to population ratio from the current 0.8x. We expect an increase in consolidation activities going forward which will lead to the formation of relatively larger, well-capitalized and possibly more stable entities.

As such our report is themed “Increased Consolidation in the Banking Sector” as we assess the key factors that influenced the performance of the banking sector in 2019, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As such, we shall address the following:

- Key Themes That Shaped the Banking Sector Performance in FY’2019,

- Summary of The Performance of the Listed Banking Sector in FY’2019,

- The Focus Areas of the Banking Sector Players Going Forward, and,

- Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis.

Section I: Key Themes That Shaped the Banking Sector Performance in FY’2019

Below, we highlight the key themes that shaped the banking sector in FY’2019, which include regulation, consolidation, asset quality, revenue diversification, SME Focused Services, and rebranding:

- Regulation - The impactful regulations of the banking sector included the Repeal of the Interest Rate Cap (Banking (Amendment) Act, 2019), IFRS 9, Demonetization and the implementation of the Banking Sector Charter:

-

- Repeal of the Interest Rate Cap (Banking (Amendment) Act, 2019): During the year, President Uhuru Kenyatta signed the Finance Bill, 2019 into law in effect repealing Section 33B, which pertained to the interest rate cap, citing that while the purpose of the capping, introduced in September 2016 through the enactment of the Banking (Amendment) Act 2015, was to address the widespread concerns about affordability and availability of credit to Kenyans, it had instead caused unintended consequences that were significant and damaging to the economy and Micro, Small and Medium Enterprises (MSMEs). The National Assembly failed to raise a two-thirds majority to overturn President Uhuru’s memorandum to repeal the interest rate cap. Read our most recent report focusing on the interest rate cap here.

- IFRS 9 - The effects of IFRS 9 to banks continued to be seen as more banks used the 18-months to 24-months window to comply with the requirements of the new standards. With the implementation of IFRS 9, which took effect from 1st January 2018, banks were expected to provide both for the incurred and expected credit losses. The CBK had given commercial banks a one-year earnings protection window for the implementation of the IFRS 9 to charge the higher provisions against the retained earnings in the balance sheet and not on the profit and loss account. The banking industry experienced the effects in 2019, recording an increase in NPL Coverage to 58.5% in FY’19, from 54.6% in FY’18, as a result of increased provisioning,

- Demonetization: During the year, the Central Bank of Kenya concluded the withdrawal of the older Kshs. 1,000 banknotes and introduce new notes in an effort to track and curb illicit financial flows. After the demonetization exercise, which had little impact on inflation or the exchange rate, Kshs. 7.4 billion, or 3.0% of the total value in the circulation of Kshs. 1,000 notes, was rendered worthless. In some cases, this exercise tightened liquidity in the money market thus prompting people to seek alternatives on digital platforms, thus, increasing NFI from fees and commissions. The Central Bank of Kenya (CBK), under Sections 9 and 51 of the CBK Act and following approval by the CBK Board, recently announced that it had transferred Kshs 7.4 bn from its General Reserve Fund to the Government Consolidated Fund in support of the fight against Coronavirus. The transfer was executed by crediting the Ministry of Finance’s Deposit Account at CBK. As such, by issuing the Kshs 7.4 bn to the Treasury, the CBK effectively put the same amount it had withdrawn back into circulation.

- Banking Sector Charter Act: The Central Bank of Kenya (CBK) proposed to introduce a Banking Sector Charter that will guide service provision in the sector. The Charter aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. The Central Bank of Kenya set a clear vision for the banking sector guided by the four pillars, namely, risk-based credit pricing, transparency, customer centricity, and ethical culture. By May 2019, all banks had submitted their time-bound plans to implement the Banking Sector Charter Act and CBK is now monitoring implementation.

- Consolidation: Consolidation activity remained one of the key highlights witnessed in FY’2019 as players in the sector were either acquired or merged, leading to the formation of relatively larger, well-capitalized and possibly more stable entities. The following were the major M&A’s activities witnessed during the year:

-

- On 6th September 2019, KCB Group finalized the take-over of 100.0% of all the ordinary shares of National Bank of Kenya (NBK) through a share swap of 1 ordinary share of KCB for every 10 NBK shares, after the Capital Markets Authority approved the acquisition. For more information on the transaction, see Cytonn Weekly #36/2019,

- On 27th September 2019, the Central Bank of Kenya announced the merger of Commercial Bank of Africa Limited and NIC Group PLC, effective 30th September 2019, following attainment of all regulatory approvals. For more information on the transaction, see Cytonn Weekly #39/2019,

Other mergers and acquisitions activities announced recently include;

- Equity Group Holdings, in its expansion strategy, has various on-going acquisitions in the region having entered into a binding term sheet with Atlas Mara Limited to acquire certain banking assets in 4 countries in exchange for shares in Equity Group which are inclusive of:

- 62.0% of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz), and;

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

These acquisitions will allow Equity Group Holdings an easy penetration into these four African countries. Further, the lender is set to acquire a 66.5% controlling stake worth Kshs 10.9 bn in the Congo-based lender, effectively valuing BCDC at Kshs 16.4 bn. Successful completion of the above transactions will likely see Equity expand its regional footprint, aiding the bank’s performance. Read more information on the same here,

- Commercial International Bank (an Egyptian private-sector bank) sent an application to the Competition Authority of Kenya propositioning to acquire a controlling interest in Mayfair Bank, a Tier III Kenyan bank. Mayfair is the fourth-smallest lender in Kenya and it recorded a loss of Kshs. 0.4 bn in FY’2019,

- In January 2020, the Central Bank of Kenya gave a go-ahead to Nigerian lender, Access Bank PLC to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount. Read more information on the same here,

- Co-operative Bank of Kenya announced it has opened talks to acquire a 100.0% stake in Jamii Bora Bank Limited. The announcement came months after Commercial Bank of Africa (CBA), dropped its cash buy-out offer and instead, merged with NIC Bank to form NCBA Group. Read more information on the same here,

Below is a summary of the deals in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC. |

1.9 |

100.0% |

Undisclosed |

N/A |

Jan-20* |

|

Commercial International Bank |

Mayfair Bank |

1.1 |

Undisclosed |

Undisclosed |

N/A |

Dec-19* |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

75.7% |

1.4x |

||||

|

* Announcement date **Deals that were dropped |

||||||

The number of commercial banks in Kenya has now reduced to 38, compared to 43 banks from 5-years ago. The ratio of the number of banks and Kenya’s 47.6 million people now stands at 0.8x, compared with a ratio of 0.9x, 5-years ago. The ratio is improving, however, Kenya still remains overbanked as the number of banks remains relatively high compared to the population. For more on this see our topical

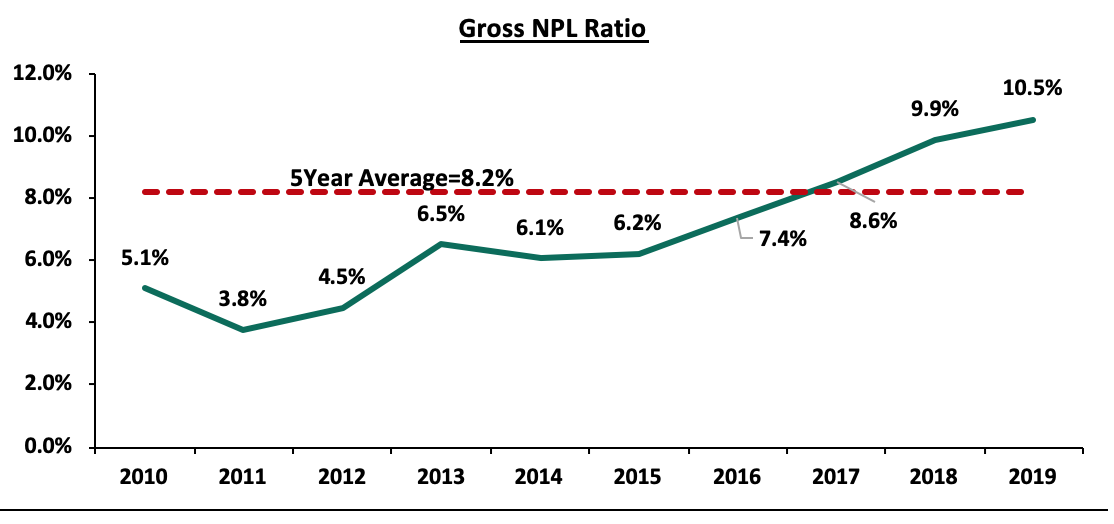

- Asset Quality - Asset quality deteriorated in FY’2019 with the gross NPL ratio increasing by 0.6% points to 10.5% from 9.9% in FY’2018. This was high compared to the 5-year average of 8.2%. The major sectors contributing largely to NPLs include real estate, retail, and manufacturing sectors, which saw lenders such as Stanbic Holdings suffer huge impairment losses from ARM, having lent the manufacturing company Kshs. 3.3 bn. Similarly, KCB Group and Co-operative Bank suffered from Uchumi Supermarket’s loans default, which translated to the lenders having to write off loans valued at Kshs. 656.0 mn with Co-operative Bank waiving 40.0% of its loan. If the asset deterioration trend persists, this will likely impact the bank’s bottom line due to the associated impairment charges, especially after the adoption of the new IFRS 9 standard

The chart below highlights the asset quality trend:

- Revenue Diversification: Listed banks continued their revenue diversification drive by growing the Non-Funded Income (NFI) segment with the average revenue mix of Funded to NFI for listed banks in FY’19 coming in at 63:37 compared to 67:33 recorded in FY’2018. The growth in NFI was supported by various banks launching several initiatives as highlighted below:

- KCB Bank deployed their Digital Customer Service platform as part of their digital transformation efforts. Aside from improved customer experience, their platforms will be able to collect real-time data on customers, then analyze and use it to make educated decisions on how to improve operations on an ongoing basis. This launch made KCB the third company in Africa to launch a WhatsApp banking solution following First Bank of Nigeria and HF Group,

- Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019,

- Co-operative Bank also highlighted its plan of growing the business of its leasing-focused subsidiary Co-op Bank Fleet. For more information, please see our report Nanyuki Real Estate Investment Opportunity, 2019, & Cytonn Weekly #23/2019,

- Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, to provide real-time cross border payments to its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019, and,

- Standard Chartered Bank Kenya (SCBK) launched an innovation hub lab in Nairobi dubbed Xcelerator in a bid to boost its revenue streams and diversify by riding on financial technology. For additional information, please see our Cytonn Weekly #15/2019.

- SME Focused Services: In FY’2019, a majority of banks began shifting their focus to SME lending among other services by providing SME targeting services with various banks focusing on SME lending as highlighted:

- In September 2019, Equity Group joined the global SME financing Forum with the goal of the forum being to promote the financial growth of SMEs. The bank offloaded Kshs. 150.0 bn worth of treasury bills and redirect the funds to SME lending, in a bid to deepen financial inclusion and boost sustainable investments in Kenya,

- Central Bank of Kenya launched a mobile loan app called Stawi in partnership with five Kenyan banks including; NCBA Group Plc, Co-operative Bank of Kenya, Diamond Trust Bank Kenya, KCB Bank, and NIC Bank. This app will give access to MSMEs ranging from Kshs. 30,000 to Kshs. 250,000. Further, it allows for a repayment period of 1-12 months at an interest of 9.0% p.a.,

- The African Guarantee Fund (AGF) set aside USD 170.0 mn (Kshs 17.1 bn) with an aim to back Kenyan Banks to enable them to lend to MSMEs. AGF committed to guarantee half the value of a loan balance to a single MSME borrower or half the value of an outstanding MSME loan portfolio, charging banks a fee ranging between 1.5%-3.0% for the risk guarantee, and,

- Credit Bank acquired a Kshs 824.0 mn loan from Africa Development Bank for onward lending to SMEs. The loan is to be accessed by companies in the construction, agriculture, renewable energy, and manufacturing sector, in a bid to enhance sustainable growth

- Rebranding: FY’2019 saw banks rebranding in a bid to capture a larger market share through improving their public image and brand recognition ;

- Barclays Africa Group – Barclays Bank of Kenya (BBK), now Absa Bank Kenya, completed its rebranding exercise to Absa Group, as the bank continued to invest in Information Technology (IT) equipment and brand modernization. The transition was completed well ahead of the bank’s strategy to transition fully to Absa by June 2020. Barclays Africa Group’s rebranding to ABSA has been ongoing since 2018 with the plan to rename all the subsidiaries in Africa and realigning the banks to their South African roots. The new identity is meant to show the bank's scalability in Africa and reflect its strategy of being forward-looking. This move also reflected a cultural transformation where they promised that their quality and extensity of services would change and improve with the new brand, and,

- NCBA Group- FY’2019 saw NIC Bank and CBA Group merger to form NCBA Group, currently the third-largest bank in Kenya in terms of assets. NCBA Group was able to amend its logo and is in the process of streamlining its services to offer better services than what was previously offered by the individual banks. They are also trying to follow suit of the other big banks by publicizing their strategy to focus on SME services and part of their goal is to close some of the overlapping branches and spread out further than the 41 counties they are currently operating to reach more SMEs especially those in marginalized areas.

Section II: Summary of the Performance of the Listed Banking Sector in FY’2019:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

I&M |

26.6% |

4.5% |

12.0% |

(0.5%) |

5.9% |

9.1% |

34.8% |

5.0% |

7.8% |

3.4% |

76.3% |

5.2% |

19.5% |

|

ABSA |

21.2% |

6.8% |

11.0% |

5.4% |

7.7% |

9.1% |

31.4% |

8.8% |

14.6% |

32.3% |

82.0% |

9.9% |

16.7% |

|

Equity |

13.8% |

12.2% |

24.8% |

8.6% |

8.5% |

19.0% |

40.6% |

16.1% |

14.2% |

6.2% |

75.9% |

23.3% |

22.0% |

|

COOP |

12.4% |

1.4% |

0.8% |

1.7% |

8.5% |

33.1% |

35.4% |

34.7% |

8.7% |

46.8% |

80.1% |

8.7% |

19.2% |

|

KCB |

4.9% |

12.2% |

4.4% |

15.0% |

8.2% |

22.6% |

33.4% |

39.0% |

27.7% |

41.0% |

78.0% |

17.4% |

20.7% |

|

SCBK |

1.7% |

(5.9%) |

(22.4%) |

0.4% |

7.4% |

0.3% |

32.2% |

(4.7%) |

1.8% |

0.9% |

56.3% |

8.5% |

17.5% |

|

Stanbic |

1.6% |

8.1% |

7.1% |

10.7% |

5.2% |

14.0% |

46.1% |

11.7% |

2.4% |

(12.7%) |

85.1% |

9.3% |

13.6% |

|

DTBK |

1.6% |

(6.9%) |

(7.3%) |

(6.5%) |

5.6% |

6.2% |

23.6% |

3.1% |

(0.9%) |

12.9% |

71.1% |

3.1% |

12.9% |

|

NCBA |

(12.4%) |

(34.1%) |

(34.0%) |

(34.2%) |

3.3% |

25.9% |

60.4% |

14.4% |

10.9% |

11.8% |

65.9% |

4.1% |

10.6% |

|

HF |

N/A |

(15.4%) |

(16.7%) |

(13.2%) |

4.3% |

6.4% |

41.6% |

91.2% |

7.7% |

43.3% |

103.1% |

(11.3%) |

(1.1%) |

|

FY'19 Mkt Weighted Average* |

8.9% |

3.2% |

3.4% |

3.4% |

7.3% |

17.4% |

37.4% |

18.4% |

12.7% |

19.4% |

75.0% |

12.8% |

18.4% |

|

FY'18 Mkt Weighted Average** |

13.8% |

6.5% |

10.6% |

2.6% |

7.9% |

3.8% |

33.2% |

(1.0%) |

10.3% |

9.1% |

75.5% |

4.3% |

19.0% |

|

*Market cap-weighted as at 09/04/2020 |

|||||||||||||

|

**Market cap-weighted as at 31/12/2018 |

|||||||||||||

Key takeaways from the table above include:

- The above ten listed Kenyan banks recorded an 8.9% average increase in core Earnings per Share (EPS), lower than the 13.8% recorded in FY’2018 for all listed banks. The Return on Average Equity (RoAE) consequently declined to 18.4%, from 19.0% recorded in FY’2018

- The banks recorded stronger deposit growth, which came in at 12.7%, faster than the 10.3% growth recorded in the sector in FY’2018. Despite the stronger deposit growth, Interest expenses increased at a slower pace of 3.4%, compared to 10.6% in FY’2018, indicating the banks have been able to mobilize relatively cheaper deposits, which saw the cost of funds decline to 3.7 from 4.1 in FY’2018

- Average loan growth came in at 12.8%, which was faster than the 4.3% recorded in FY’2018 with the growth in loans being accelerated towards the tail end of FY’2019 following the repeal of interest rate cap in November 2019. Despite the increase in net loans, the loan to deposit ratio declined marginally to 75.0% from 75.5% in FY’2018 indicating that the effects expected from the repeal of the interest rate had not yet taken effect as banks continue recalibrating their models to adjust for new loan pricing. We, however, expect banks to refocus on lending with many banks looking to target select segments such as corporate entities and Small and Medium Enterprises (SMEs). Government securities, on the other hand, recorded a growth of 19.4% y/y, which was faster compared to the loans and the 9.1% growth recorded in FY’2018. This was attributable to banks’ continued preference towards investing in government securities, which offered better risk-adjusted returns during the interest rate cap era,

- Listed Banks recorded a slower 3.2% growth in interest income compared to the 6.5% recorded in FY’2018. This may be attributable to the lower yields on interest-earning assets which declined to 9.9% from 10.7% in FY’2018. The lower yields on interest-earning assets are attributable to a decline in lending rates which were pegged to the Central Bank Rate (CBR). In FY’2019, the CBR was lowered by 50 bps from the 9.0% set in July 2018 to 8.5%. Consequently, the Net Interest Margin (NIM) in the banking sector as at FY’2019, stood at 7.3%, a decline from the 7.9% recorded in FY’2018, mainly due to the faster growth in average interest-earning assets which grew by 5.5% in FY’2019 outpacing the 3.4% growth in Net Interest Income, and,

- Non-Funded Income grew by 17.4% y/y, faster than the 3.8% recorded in the sector in FY’2018. The growth in NFI was boosted by the total fee and commission income which improved by 18.4%, compared to the (1.0%) growth recorded in the sector FY’2018. We believe the growth in total fees was due to a re-correction from the decline in 2018 which was a one-off adjustment as a result of the implementation of the effective interest rate which required banks to amortize fees and commissions on loans over the tenor of the loans.

Section III: Outlook on the Focus Areas of the Banking Sector Players Going Forward:

In summary, the banking sector showed improved performance, which was largely attributable to persistent revenue diversification evidenced by the 17.4% growth in NFI in FY’2019 from 3.8% growth in FY’2018. Growth in NFI was attributable to the growth in fees and commissions which recorded an 18.4% growth in FY’2019. Consequently, the increase in loan growth, especially toward the tail end of FY’2019, after the interest rate cap repeal, reveal that the sector was plagued by stringent regulations. We expect banks to refocus on lending once they recalibrate their models to adjust for new loan pricing, therefore, increasing the Loan to Deposit Ratio. With the loosening of the regulations particularly the repeal of the interest rate cap, the sector can focus on the following items to increase growth and profitability:

- Refocus on Core Operations - With the repeal of the interest rate cap, banks can now price loans based on customers’ risk profiles, banks and will, therefore, be able to increase interest rates with bias to credit risk rating of borrowers, which will, in turn, improve their interest income. Going forward, we expect banks to refocus on lending with many banks looking to target select segments such as corporate entities and Small and Medium Enterprises (SMEs). This strategy can be expected to persist post the interest rate cap era,

- Continued Revenue Diversification - The increase in NFI growth outperformed that of interest income, thus, allowing the banks to remain profitable amid a rigid regulatory environment. However, with the regulations having been loosened banks will need to continue diversifying their income in order to reduce their reliance on interest income, thus, decreasing the pressure on interest rates. For example, Co-operative Bank’s “Soaring Eagle Initiative” enables both channel diversification through internet banking, Mco-op cash, and merchant banking among others, as well as consultancy and capacity building,

- Expansion and Further Consolidation - With the Microfinance-Bill 2019 of increasing the minimum on core capital requirements still in its pilot stage more mergers and acquisitions would enable the unprofitable and/or smaller banks to manage the requirement and be able to increase profitability through cost efficiency and deposits growth.

- Increased Adoption of Technology - Banks have been riding on the digital revolution wave to improve their operational efficiency. Increased adoption of alternative channels of transactions such as mobile, internet and agency banking, has led to increased transactions carried out via alternative channels and out of bank branches, which have been reduced to handling high-value transactions and other services such as advisory. Thus banks reduced front-office operations, thereby cutting the number of staff required and by extension, reducing operating expenses and hence, improving operational efficiency,

Section IV: Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis:

As per our analysis on the banking sector from a franchise value and a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics in order to carry out a comprehensive review of the banks.

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess efficiency, asset quality, diversification, and profitability, among other metrics. The overall FY’2019 ranking is as shown in the table below:

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

FY'2019 Rank |

Q3'2019 Ranking |

|

KCB Group Plc |

52 |

3 |

22.6 |

1 |

1 |

|

I&M Holdings |

50 |

5 |

23.0 |

2 |

2 |

|

Co-operative Bank of Kenya Ltd |

54 |

4 |

24.0 |

3 |

3 |

|

Equity Group Holdings Ltd |

58 |

2 |

24.4 |

4 |

4 |

|

DTBK |

70 |

1 |

28.6 |

5 |

7 |

|

Stanbic Bank/Holdings |

61 |

9 |

29.8 |

6 |

5 |

|

ABSA |

67 |

7 |

31.0 |

7 |

6 |

|

NCBA Group Plc |

81 |

6 |

36.0 |

8 |

8 |

|

SCBK |

80 |

8 |

36.8 |

9 |

9 |

|

HF Group Plc |

87 |

10 |

40.8 |

10 |

10 |

Changes from the Q3’2019 Ranking are:

- Diamond Trust Bank Kenya whose rank improved to Position 5 from Position 7 in Q3’2019 mainly due to an improvement in the Gross NPL ratio to 7.6% in FY’2019 from 8.9% in Q3’2019, in turn, improving its franchise value score,

- Stanbic Holdings whose rank declined to Position 6 from Position 5 in Q3’2019 mainly due to a deterioration in the Return on Average Equity ratio to 13.6% in FY’2019 from 18.5% in Q3’2019 thus, in turn, worsening the franchise value score, and,

- Absa Bank Kenya whose rank declined to Position 7 from Position 6 in Q3’2019 mainly due to a deterioration in Net Interest Margin to 7.7% in FY’2019 from 8.5% in Q3’2019 thus, in turn, worsening the franchise value score.

For more information, see our Cytonn FY’2019 Listed Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.