Financial Planning for Education, & Cytonn Weekly #10/2021

By Research Team, Mar 14, 2021

Executive Summary

Fixed Income

During the week, T-bills recorded an undersubscription, with the overall subscription rate coming in at 94.3% down from the oversubscription of 141.0% recorded the previous week, attributable to the concurrent bond issue. The highest subscription rate was in the 364-day paper of 121.9%, but it was a decline from 190.2% recorded the previous week. Additionally, the Central Bank of Kenya released the auction results for the recently reopened bonds, FXD1/2019/10 and FXD2/2018/20 whose overall subscription rate came in at 97.4%, with the government receiving bids worth Kshs 48.7 bn compared to the Kshs 50.0 bn offered. Standard & Poor’s, lowered its long-term foreign and local currency sovereign credit ratings on Kenya to 'B' from 'B+’ and affirmed the short-term foreign and local currency rating;

Equities

During the week, the equities market recorded mixed performance, with NSE 20 declining by 0.9%, while NASI and NSE 25 gained by 0.3% and 0.9%, respectively, taking their YTD performance to gains of 6.6%, 6.1% and 2.7% for NASI, NSE 25 and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Equity Group, Diamond Trust Bank (DTB-K) and KCB Group of 5.1%, 4.9%, and 4.6%, respectively. The gains were however weighed down by losses recorded by stocks such as NCBA, Bamburi, and ABSA Bank, which declined by 4.1%, 3.0% and 1.9%, respectively;

Real Estate

During the week, the Kenya Bankers Association (KBA) released the Housing Price Index, March 2021 Report, highlighting that house prices rose by 0.2% in Q4’2020, an improvement from the 0.1% contraction recorded in Q3’2020. In the residential sector, Sycamore Pine Limited, a real estate developer announced plans to construct 1,959 residential apartments under a project dubbed Samara Estate to be located in Migaa Gold Estate in Kiambu County;

Focus of the Week

Financial planning for education is the practice and habit of managing one’s finances with the intention of saving towards the funding of their children’s’ education in the future. This week, we follow up on our previous focus on Education Investment Plans in Kenya by bringing on the financial planning aspect of it, the available options and the considerations to make when choosing the best investment avenue for education;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.50%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.87% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- Solomon Kariuki, Assistant Investments Analyst, Cytonn Investments was interviewed by CNBC as they discussed current matters affecting the economy. Watch Solomon here;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the company, see our news section here;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills recorded an undersubscription, with the overall subscription rate coming in at 94.3% down from 141.0% recorded the previous week, attributable to the concurrent bond issue coupled with the tightened liquidity in the money markets. The highest subscription rate was in the 364-day paper, which declined to 121.9% from 190.2% recorded the previous week. The subscription rate for the 91-day and 182-day papers also declined to 108.8% and 60.8%, from 176.1% and 77.7% recorded the previous week, respectively. The yield on the 91-day paper remained unchanged at 7.0%, while the yields on 364-day and 182-day papers rose by 7.3 bps and 6.7 bps to 9.1% and 7.8%, respectively. The government accepted 100.0% of bids received, amounting to Kshs 22.6 bn.

On the Primary Bond Market, there was an undersubscription for this month’s bond offers, with the overall subscription rate coming in at 97.4%, attributable to the relatively tight but recovering money market liquidity. The Central Bank of Kenya had re-opened 2 bonds, FXD1/2019/10 and FXD2/2018/20 with effective tenors of 8.0 and 17.4 years, and coupons of 12.4% and 13.2%, respectively, in a bid to raise Kshs 50.0 bn for budgetary support. The government received bids worth Kshs 48.7 bn, and accepted only Kshs 48.3 bn, translating to an acceptance rate of 99.2%. Investors preferred the 20-year bond issue i.e. FXD2/2018/20, which received bids worth Kshs 32.8 bn, representing 65.6% of the total bids received. The weighted average rate of accepted bids for the two bonds came in at 12.4% and 13.4%, for FXD1/2019/10 and FXD2/2018/20, respectively.

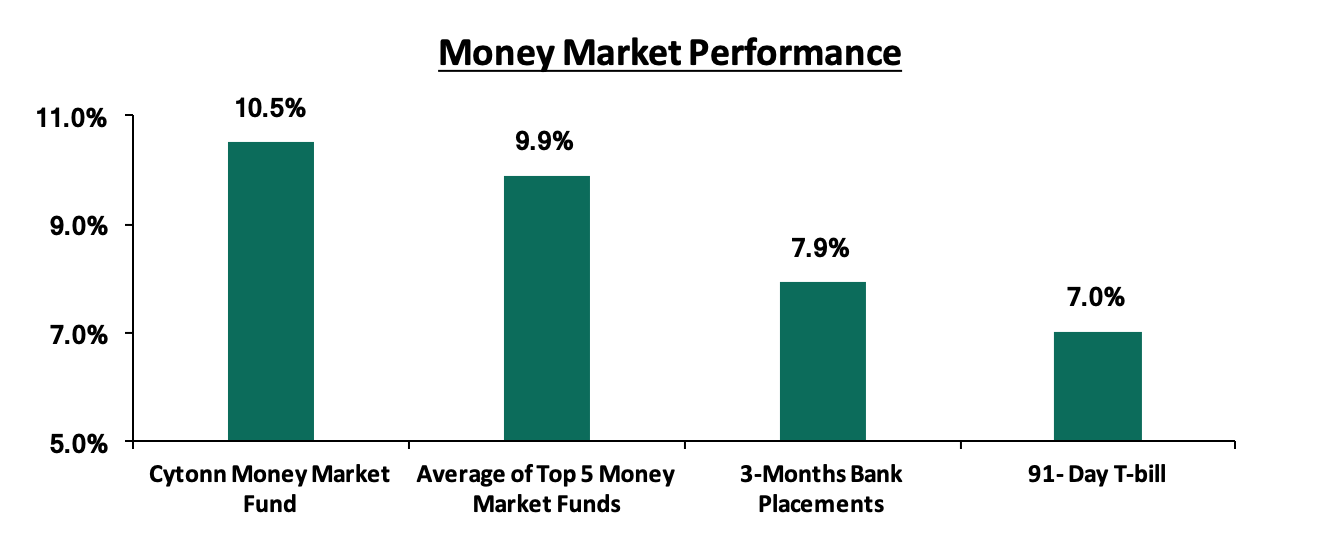

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), while the yield on the 91-day T-bill remained unchanged at 7.0%, same as recorded last week. The average yield of the Top 5 Money Market Funds declined marginally by 0.1% points to come in at 9.9%, from 10.0% recorded last week. The yield on the Cytonn Money Market also declined during the week by 0.4% points to come in at 10.5%, from 10.9% recorded the previous week.

Liquidity:

During the week, liquidity in the money market tightened, with the average interbank rate increasing marginally by 0.1% points to 5.0%, from the 4.9% recorded the previous week, attributable to the government payments which were partly offset by tax remittances. The average interbank volumes increased by 12.6% to Kshs 13.0 bn, from Kshs 11.6 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin released on 12th March 2021, commercial banks’ excess reserves came in at Kshs 11.7 bn in relation to the 4.25% Cash Reserve Ratio.

Eurobonds performance:

During the week, the yields on Eurobonds were on an upward trajectory. According to the Central Bank bulletin, the yields on the 10-year Eurobond issued in June 2014, the 10-year and 30-year Eurobonds issued in 2018 and the 7-year and 12-year Eurobonds issued in 2019 all increased by 0.1%, 0.6%, 0.3%, 0.2% and 0.3% points to 3.3%, 5.9%, 7.5%, 4.9% and 6.5% respectively, from 3.2%, 5.3%, 7.3%, 4.6% and 6.3%.

|

Kenya Eurobond Performance |

|||||

|

|

2014 |

2018 |

2019 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

|

29-Jan-2021 |

3.6% |

5.3% |

7.2% |

4.8% |

6.1% |

|

26-Feb-2021 |

3.3% |

5.4% |

7.4% |

4.7% |

6.4% |

|

5-Mar-21 |

3.2% |

5.4% |

7.3% |

4.8% |

6.4% |

|

8-Mar-21 |

3.4% |

5.7% |

7.4% |

5.0% |

6.7% |

|

9-Mar-21 |

3.4% |

5.6% |

7.5% |

5.0% |

6.6% |

|

10-Mar-21 |

3.4% |

5.7% |

7.6% |

5.0% |

6.7% |

|

11-Mar-21 |

3.3% |

5.9% |

7.5% |

4.9% |

6.5% |

|

Weekly Change |

0.1% |

0.6% |

0.3% |

0.2% |

0.3% |

|

Monthly Change |

(0.3%) |

0.2% |

0.2% |

0.0% |

0.3% |

|

YTD Change |

(0.7%) |

0.6% |

0.5% |

0.0% |

0.6% |

Source: CBK Bulletin

Kenya Shilling:

During the week, the Kenyan shilling appreciated marginally by 0.03% against the US dollar to Kshs 109.6, from Kshs 109.7 recorded the previous week. This was mainly attributable to market participants anticipating a positive economic recovery following the arrival of the Covid-19 vaccine in the country. On a YTD basis, the shilling has depreciated by 0.4% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect continued pressure on the Kenyan shilling due to:

- A slowdown in foreign dollar currency inflows due to reduced dollar inflows from sectors such as tourism and horticulture, and,

- Continued uncertainty globally making people prefer holding dollars and other hard currencies.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 7.4 bn (equivalent to 4.5-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. The Forex reserves have been declining and are now at the same level as the EAC criteria for import cover. Countries use foreign currency reserves to keep a fixed or quasi-fixed rate value, maintain competitively priced exports, remain liquid in case of crisis, and provide confidence for investors. Therefore, the dwindling in the forex reserves may mean the government of Kenya will struggle to support the local currency when it depreciates,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 19.7% y/y increase to USD 299.6 mn in December 2020, from USD 250.3 mn recorded over the same period in 2019, has cushioned the shilling against further depreciation

Weekly Highlight:

During the week, Standard & Poor’s, a US-based credit rating agency, lowered its long-term foreign and local currency sovereign credit ratings on Kenya to 'B' from 'B+’, on the back of the effects of the ongoing pandemic which resulted in GDP contraction of 5.7% and 1.1% in Q2’ and Q3’2020, respectively, and increasing debt levels, which in turn increase the country’s vulnerability to debt defaults. Below is a summary of the credit rating on Kenya so far:

|

Rating Agency |

Previous Rating |

Previous Outlook |

Date Released |

Current Rating |

Current Outlook |

Date Released |

|

S&P Global |

B+ |

Negative |

14th July 2020 |

B |

Stable |

5th March 2021 |

|

Moody’s |

B2 |

Stable |

13th February 2018 |

B2 |

Negative |

7th May 2020 |

|

Fitch Ratings |

B+ |

Stable |

9th February 2018 |

B+ |

Negative |

19th June 2020 |

The agency changed its outlook on Kenya to ‘Stable’ from ‘Negative’ in the last release in July 2020, as it expects Kenya’s GDP to grow by 4.4% in 2021, from their projected growth of 0.2% in 2020.

The table below shows Kenya’s 2021 GDP projections from 6 organizations with the consensus GDP growth expected to come in at 5.2%:

|

Kenya 2021 Annual GDP Growth Outlook |

||

|

No. |

Organization |

2021 Projections |

|

1. |

International Monetary Fund |

4.7% |

|

2. |

S&P Global |

4.4% |

|

3. |

Cytonn Investments Management PLC |

4.0% |

|

4. |

Central Bank of Kenya |

6.4% |

|

5. |

National Treasury |

7.0% |

|

6. |

World Bank |

4.7% |

|

Average |

5.2% |

|

Some of the key challenges identified included: i) Risk of delay in fiscal consolidation as the fiscal deficit remain high due to the poor performance of the economy due to the pandemic, and ii) Risk of getting worse of debt rearrangement terms of the current maturing bonds.

Other key take-outs from the press release include:

- The agency affirmed the 'B' short-term foreign and local currency ratings, as the foreign exchange market remained largely stable compared to regional and global currencies. The agency noted that the currency was however affected by the strengthening of the US Dollar in the global markets as investors preferred the harder currency,

- The pandemic has led Kenya to have large fiscal deficits with FY’2021 deficit estimated to rise to 8.7% of GDP, from a pre-pandemic plan of 6.3%, while the FY’2022 deficit is forecasted at 7.7%, pre-pandemic 4.9%. The agency expects Kenya to embark on broad fiscal consolidation given its recent deal with the International Monetary Fund (IMF) of a USD 2.4 bn facility, to help the next phase of the country’s COVID-19 response and a strong multi-year effort to stabilize and begin reducing debt levels relative to GDP, and,

- The general outlook for Kenya is stable mostly due to expectations of economic recovery and supportive foreign donor facilities.

The recovery is also likely to be supported by Kenya’s diversified economic base and high liquidity in the domestic market with domestic debt making up 47.9% of the nation’s total fiscal debt as of December 2020. Kenya also benefits from flexible monetary settings, supported by its relatively deep and dynamic domestic capital markets (with local currency debt market capitalization at over 25.0% of GDP), and relatively well developed institutional framework compared to peers. The table below shows the local currency public debt to GDP ratio of select countries for comparison:

|

Local Currency Public Debt Market Capitalization to GDP Ratio |

||

|

No. |

Country |

Local Currency Debt to GDP |

|

1. |

Kenya |

25.0% |

|

2. |

Ghana |

21.7% |

|

3. |

South Africa |

51.0% |

|

4. |

Nigeria |

16.5% |

|

Emerging Markets Economies Average |

68.4% |

|

Source: World Bank

Local currency public debt levels have remained low in some African countries and deepened significantly. A higher level of local currency public debt points to deeper capital markets while indicating a well-developed banking sector, which would facilitates trading of the debt instruments Foreign investments in local currency debts can help them to develop the markets by increasing liquidity – helping to lengthen maturities, develop secondary markets and create a more diversified investor base but they can also increase financial vulnerability as markets become more exposed to the risks of international financial contagion and sudden outflows of capital.

According to the release, Kenya enjoys more sophisticated checks and balances than other African peers, but possible ethnic tensions remain a concern amid an expected referendum on constitutional reforms to be held in 2021. The constitutional changes and the upcoming 2022 general elections could hamper the government’s efforts for fiscal consolidation.

Overall, the ratings downgrade will mean Kenya will find it harder to borrow from the international market and may have to pay more on interest to borrow money from the foreign lenders, due to the perceived higher risk.

Rates in the fixed income market have remained relatively stable but we have seen an upward trend in the short end due to increased borrowing by the government. The government is 5.4% behind its prorated borrowing target of Kshs 385.5 bn having borrowed Kshs 364.5 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021, thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance, with NSE 20 declining by 0.9%, while NASI and NSE 25 gained by 0.3% and 0.9%, respectively, taking their YTD performance to gains of 6.6%, 6.1% and 2.7% for NASI, NSE 25 and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Equity Group, Diamond Trust Bank (DTB-K) and KCB Group of 5.1%, 4.9%, and 4.6%, respectively. The gains were however weighed down by losses recorded by stocks such as NCBA, Bamburi, and ABSA Bank, which declined by 4.1%, 3.0% and 1.9%, respectively.

Equities turnover increased by 51.5% during the week to USD 29.6 mn, from USD 19.5 mn recorded the previous week, taking the YTD turnover to USD 227.8 mn. Foreign investors remained net sellers, with a net selling position of USD 2.9 mn, from a net selling position of USD 2.5 mn recorded the previous week, taking the YTD net selling position to USD 5.4 mn.

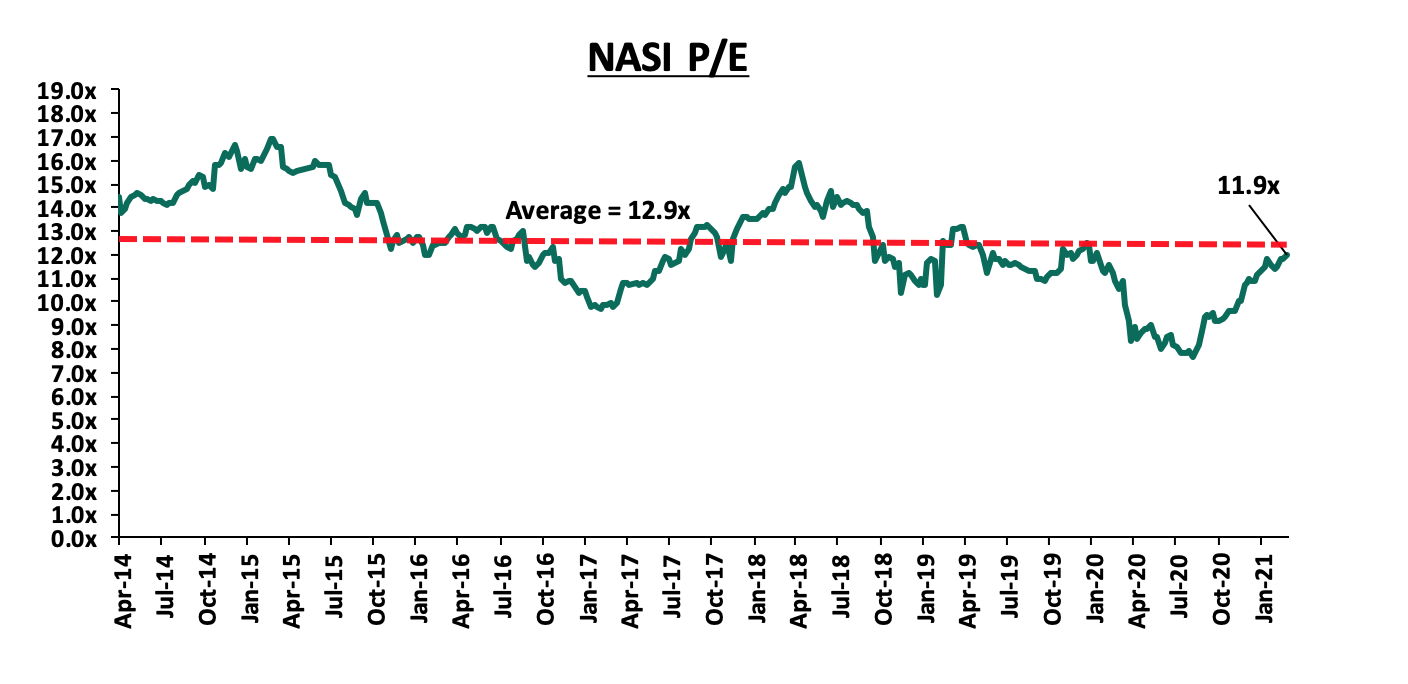

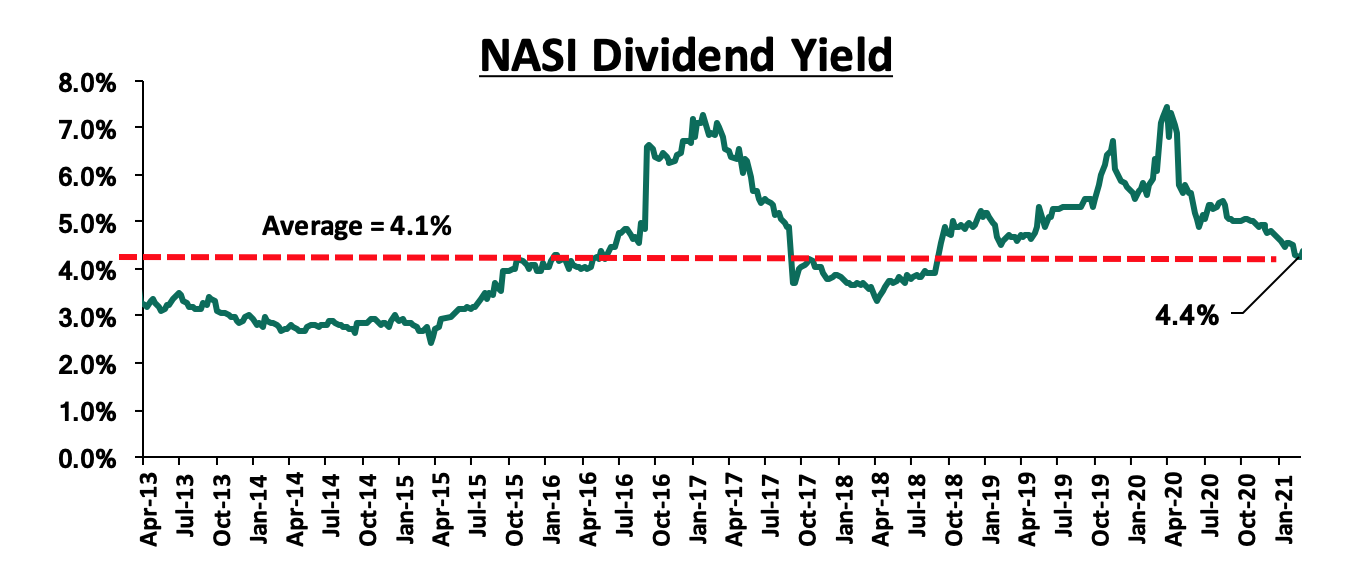

The market is currently trading at a price to earnings ratio (P/E) of 11.9x, 7.7% below the 11-year historical average of 12.9x. The average dividend yield is currently at 4.4%, unchanged from what was recorded the previous week, and 0.3% points above the historical average of 4.1%.

With the market trading at valuations below the historical average, we believe that there are pockets of value in the market for investors with a higher risk tolerance. The current P/E valuation of 11.9x, is 54.8% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the market’s historical P/E and dividend yield.

Universe of Coverage:

|

Company |

Price at 5/3/2021 |

Price at 12/3/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

Recommendation |

|

I&M Holdings*** |

44.1 |

43.0 |

(2.4%) |

(4.1%) |

44.9 |

60.1 |

6.3% |

46.0% |

Buy |

|

Diamond Trust Bank*** |

71.8 |

75.3 |

4.9% |

(2.0%) |

76.8 |

105.1 |

3.4% |

43.1% |

Buy |

|

Kenya Reinsurance |

2.6 |

2.6 |

(0.8%) |

12.6% |

2.3 |

3.3 |

4.2% |

31.2% |

Buy |

|

Equity Group*** |

38.1 |

40.0 |

5.1% |

10.3% |

36.3 |

43.0 |

22.5% |

30.0% |

Buy |

|

KCB Group*** |

38.2 |

40.0 |

4.6% |

4.0% |

38.4 |

46.0 |

8.8% |

23.9% |

Buy |

|

Standard Chartered*** |

134.5 |

134.5 |

0.0% |

(6.9%) |

144.5 |

153.2 |

9.3% |

23.2% |

Buy |

|

Sanlam |

11.2 |

12.5 |

11.7% |

(4.2%) |

13.0 |

14.0 |

8.0% |

20.5% |

Buy |

|

Co-op Bank*** |

13.0 |

13.0 |

(0.4%) |

3.2% |

12.6 |

14.5 |

8.5% |

20.5% |

Buy |

|

Jubilee Holdings |

270.0 |

261.8 |

(3.1%) |

(5.1%) |

275.8 |

313.8 |

0.0% |

19.9% |

Accumulate |

|

Britam |

7.1 |

7.2 |

0.8% |

2.6% |

7.0 |

8.6 |

0.0% |

19.8% |

Accumulate |

|

NCBA*** |

25.9 |

24.9 |

(4.1%) |

(6.6%) |

26.6 |

25.4 |

15.3% |

17.5% |

Accumulate |

|

ABSA Bank*** |

9.6 |

9.4 |

(1.9%) |

(1.1%) |

9.5 |

10.5 |

2.7% |

14.1% |

Accumulate |

|

Stanbic Holdings |

84.5 |

83.0 |

(1.8%) |

(2.4%) |

85.0 |

84.9 |

4.6% |

6.9% |

Hold |

|

CIC Group |

2.2 |

2.3 |

3.2% |

8.5% |

2.1 |

2.1 |

10.9% |

2.6% |

Lighten |

|

Liberty Holdings |

8.1 |

9.6 |

19.1% |

24.9% |

7.7 |

9.8 |

0.0% |

1.9% |

Lighten |

|

HF Group |

3.5 |

3.4 |

(1.2%) |

8.6% |

3.1 |

3.0 |

0.0% |

(12.0%) |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term. We expect the recent discovery of a new strain of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook. However, we maintain our bias towards a “Bullish” equities markets in the medium to long term. We believe there exist pockets of value in the market, with a bias on financial services stocks given the resilience exhibited in the sector. The sector is currently trading at historically cheaper valuations and as such, presents attractive opportunities for investors.

I. Industry Reports

During the week, the Kenya Bankers Association (KBA) released the Housing Price Index, March 2021 Report, highlighting that house prices rose by 0.2% in Q4’2020, an improvement from the 0.1% contraction recorded in Q3’2020. The marginal improvements in the housing prices are attributed to, preference by homeowners to newer buildings over the older ones, and, reduced private-sector lending, especially for the construction sector and this has significantly affected the incoming supply of new units consequently contributing to the rise in house prices. Other key take-outs from the report include;

- Apartments accounted for approximately 71.0% of sales while maisonettes and bungalows accounted for 23.0% and 4.0%, respectively, while townhouses accounted for 2.0% of the concluded sales in Q3’2020, and,

- Lower mid-end residential markets within the Nairobi Metropolitan Area such Ruaraka, Kasarani, and Kitengela recorded the highest activities accounting for 52.0% of the sales during the quarter, with upper-mid-end areas such as Thindigua and South B at 45.0%, and, high-end markets such as Kileleshwa and Karen at 3.0% of the sales, indicating that buyers continue to focus on affordability as the main metric for purchasing homes.

The above findings are in line with the Cytonn Annual Markets Review-2020, which highlighted that buyers continued to show a preference for apartments as opposed to detached units. In terms of annual uptake, detached units recorded an average of 16.9% compared to apartments at 21.7% indicating continued demand for apartments supported by affordability amid reduced disposable income. Investment opportunity for apartments lies in the lower mid-end market such as Ruaraka, Kasarani, and Kitengela which continues to show increased demand and continue to post above-average market returns due to the higher annual uptake. For detached units, the opportunity lies in the upper mid-end market in submarkets such as Thindigua, and, South B due to high occupancies and attractive rental yields

II. Residential

During the week, Sycamore Pine Limited, a real estate developer announced plans to construct 1,959 residential apartments under a project dubbed Samara Estate to be located in Migaa Gold Estate in Kiambu County. The Kshs 11.0 bn affordable housing development will sit on a 17.2-acre piece of land is expected to be completed in 2024. It will comprise two and three-bedroom units of 59 SQM and 76 SQM priced at Kshs 3.0mn and 4.0mn, respectively. The unit prices translate at an average of Kshs 44,408 per SQM, 40.9% lower than the satellite towns’ residential market average for apartment’s value of Kshs 75,187 according to the Cytonn Annual Markets Review-2020. In our view, the investors’ decision to focus on the affordable housing project in Kiambu is supported by i) availability of development land, ii) infrastructural development which continues to open up the area for development, iii) availability of social amenities such as the Migaa Golf Club, iv)incentives by the government on affordable housing projects, and, v) positive demographics with Kiambu town hosting a population of 147,870 as of 2019,36.0% higher than 108,698 recorded in 2009 according to KNBS. Additionally, in terms of performance, apartments in satellite towns recorded an annual uptake, rental yield, and, total returns of 22.5%, 5.0%, and, 5.5% compared to the market averages of 21.5%, 5.7%, and, 5.2%, respectively.

The table below shows the apartments performance summary FY’2020

All Values in Kshs Unless Stated Otherwise

|

Apartments Performance Summary FY’2020 |

|||||||

|

Segment |

Average Price per SQM (Kshs) |

Average Rent per SQM (Kshs) |

Average Occupancy |

Average Annual Uptake |

Average Rental Yield |

Average Price Appreciation |

Annual Total Returns |

|

Upper Mid-End |

123,608 |

697 |

83.7% |

20.3% |

5.2% |

0.0% |

5.2% |

|

Lower Mid-End |

95,310 |

530 |

88.1% |

22.3% |

5.8% |

(0.9%) |

4.9% |

|

Satellite Towns |

75,187 |

408 |

85.8% |

22.5% |

6.0% |

(0.6%) |

5.5% |

|

Average |

98,035 |

545 |

85.9% |

21.7% |

5.7% |

(0.5%) |

5.2% |

Source: Cytonn Research

The real estate sector is expected to continue recording activities particularly in the residential sector supported by the continued launch of projects by investors especially in the satellite towns of the Nairobi Metropolitan Area.

The year 2020 was marked by the occurrence of a global pandemic whose effects were felt globally. The tough operating environment during the year saw most firms scale down their operations leading to massive job losses and reduced income. With the disruptions occasioned by the pandemic, the World Bank estimates that close to 2.0 mn Kenyans were pushed into poverty in 2020 as people prioritized consumption and provision of basic needs with the little money they had. As such, most financial goals such as joining investments and savings schemes were also disrupted. These then meant that people have to go back to the drawing board and relook at their financial objectives and rework their financial plans by readjusting at the goals themselves and how the same shall be attained. For most parents Education forms an integral part of their key financial goals and In our focus on Education Investment Plans in Kenya, we analyzed various education plans, why one should invest and the factors at play when selecting a suitable plan. In order to continue sensitizing the market on the importance of personal financial planning, we found it timely to reiterate the topic on Education Investment Plans focusing on the financial planning aspect of it.

Previously, we have covered the following topicals on financial planning:

- Personal Financial Planning in Cytonn Weekly#08/2020 - We discussed the importance of financial planning, the various considerations to make based on one’s own characteristics, needs and preferences and some of the investment avenues available,

- Financial Planning Amidst COVID-19 in Cytonn Weekly#26/2020 - We covered the effects of Coronavirus on financial planning and financial planning opportunities in the coronavirus environment, and,

- Financial Planning for Retirement in Cytonn Weekly#33/2020 – We focused on how to plan your finances in preparation for retirement given its inevitability, various types of pension schemes and where pension schemes invest,

This week, we will cover the following sections:

- Introduction to financial planning,

- Financial planning for education,

- Education Investments Plans in Kenya,

- Recommendation on the improvement of Education Investment Plans in Kenya, and,

- Conclusion,

Section I: Introduction to financial planning

Personal financial planning refers to a systematic approach towards managing one’s finances in an effort to maximize the finances in a manner that will aid in the achievement of one’s financial goals and objectives. Therefore, personal financial planning involves a process that consists of the following steps:

- Assessment: In this step, an individual assesses their current financial situation by identifying various factors that could possibly affect their financial plan. At this point it is important to ask questions like; what is my current income i.e. salary, business etc., what are my financial objective? What are my spending habits? Etc. The aim of this step is to evaluate the individuals personal income, spending habits, lifestyle and see how each of them affects their financial plan,

- Goal Setting: The individual then outlines the financial goals they want to achieve in the long-run, as well as the next actionable steps which will ultimately provide a clear roadmap towards the achievement of their financial objectives,

- Execution of the financial plan: Execution of the plan refers to how best to put the created plan to action. A well laid out plan should highlight the suitable channels and instruments that will be used to achieve the goals. An inclusion of timelines is also important, but this depends on if it is a short e.g. Money Market Funds or long term investments e.g. Bonds and Real Estate, and,

- Monitoring and reassessing the financial plan: Given that goals and priorities change over time, it is important to monitor and reassess the financial plan created, leaving room for readjustments along the way if necessary. Constant reviewing allows you to analyze your individual investments and determine if they are worth keeping, as well making sure they align to any changes that might have occurred along the way.

To achieve ones’ financial goals there are some key habits that one needs to practice:

- Saving: Saving entails consuming less out of a given amount of resources in the present in order to consume more in the future by setting aside part of your income in some form of asset. Efficient saving requires discipline, where we should always treat savings as a necessary expense and not save what is left after consuming,

- Investing: Investing involves the purchase of an asset with the hope of generating some income in future or the asset appreciating hence being able to sell it at a profit. Saving is often confused with investing, but they are not the same. Saving focuses on capital preservation whereas investing focuses on capital appreciation as well as wealth generation. There are different asset classes that one can invest in and an investor will choose their preferred investment vehicles based on their risk tolerance and appetite, the returns expected and the liquidity requirement. It is important to diversify one’s portfolio through investing in different instruments in a bid to mitigate risk,

- Debt Management: Is debt good or not? Debt is only good if used towards an investment or for future financial gain such as business, education, or property. However, it is advisable to take up debt for investment only if the economic rate of return, which is simply how an investment’s economic benefits compare to its costs, is able to finance the debt repayment. Anticipating future needs and saving adequately for them can help in minimizing the need to take on debt, and,

- Budgeting: Budgeting is simply creating a plan on how to spend your money. Budgets help to guide and control expenditure. It is important that you have the discipline to create a budget around the resources you have and stick to it. When budgeting, prioritize your needs and necessary expenses and try as much as possible to cut down on unnecessary expenses to save money. Additionally, it is vital to review your budget regularly as the circumstances around you and responsibilities change.

Section II: Financial Planning for Education

Education is a key aspect in any economy, with the Kenyan government making significant allocations towards education expenditure in every fiscal year. However, over the last 10-years, the budgetary allocation towards education expenditure as a percentage of GDP has been declining to stand at 17.2% in FY’2020/21 from 20.6% in FY’2009/10. Despite the actual allocation as per the recently approved 2021 Budget policy Statement, increasing by 2.1% to Kshs 508.6 bn from Kshs 497.8 bn allocated in FY’2020/21. The allocation as a percentage of GDP is expected to decline further to 16.9% for FY’2021/22, mainly attributed to a faster increase in the total budget as compared to the increase in the actual allocation to Education.

Education plays a central part in households consumption budget with the average spend ranging from about 10% to 30% of the total income. When looking at coming up with the right plan for education there are a couple of things that one needs to look at. We shall mention a few but discuss them in details in a later section:

- The Investors Income: One should buy into a plan that they can comfortably afford so as to make sure they meet the premium payment schedule as agreed when being on boarded. Some plans usually penalize you for delayed or late submission of premiums and the penalties will eat in to your final payout. Sometimes the inability to meet premiums might see you abandon the plan half-way, which will be loss because you might not be qualified to get a refund and if you get one it might be penalized for early redemption,

- The covered risks by the policy: As a guardian you would want to ensure that your dependents are adequately covered and you will choose the plan that speaks to the risks you are trying to cover against. Most plans by insurance companies come with additional benefits “Riders” that the beneficiary can utilize. Some of these additional benefits include: medical cover for medical emergencies, life cover for just in case the contributor dies the dependents can benefit, and,

- The cost of Education the parents aspires the kids get: Quality education guarantees a brighter future for the children and hence every parent wants what is the best for their children. Therefore, the cost of the school or learning institution that you want your child to attend will inform the type of plan that you will choose. For example, if you plan to take your children abroad for their university education the type of plan will be different than the person who intends for them to study locally, as international education is expensive,

Section III: Education Investments Plans in Kenya

Education Investment Plans are medium to long-term mutual funds promoted by a financial institution, usually an Insurance company or an Asset Management firm. These plans are easily distinguishable in that they often have a lock-in period of investment whereby the guardian is required to make periodic contributions, usually monthly. The beneficiary of the funds could be a dependent or one may save for their own education. Education Investment Plans in Kenya typically have a minimum monthly contributions with the amount ranging from Kshs 1,500 to Kshs 7,000. However, the payments are flexible in that one may pay monthly, quarterly, semiannually or annually, depending on individual preferences.

Below is a list of some of the existing education plans in Kenya:

|

Education Investment Plans offered by Fund Managers |

|||||

|

Education Plan |

Minimum Investment Period |

Minimum Investment Amount |

Interest Rate per annum |

Minimum Sum Assured |

Life Cover Benefits |

|

Cytonn Education Investment Plan (CEIP) |

3 Years |

Kshs 1,000 |

10.0% |

No life cover |

N/A |

|

Cytonn Sharp Education Investment Plan (SEIP) |

3 – 10 Years |

Kshs 100,000** |

15.0% |

No life cover |

N/A |

|

Wanafunzi Investment Trust |

4 Years |

No minimum Initial investment |

8.0% |

No life cover |

N/A |

|

Average |

|

|

11.0% |

|

|

|

Education Investment Plans offered by Insurance Companies |

|||||

|

Education Plan |

Minimum Investment Period |

Minimum Investment Amount |

Interest Rate per annum |

Minimum Sum Assured |

Life Cover Benefits |

|

Liberty Educator Plan |

10 – 20 Years |

Kshs 1,000 |

No interest rate Bonuses payable |

Kshs 200,000 |

· Sum Assured · Waiver of premiums · Student Accident Cover · Disability Benefit |

|

Britam Elimu Bora Education Policy |

7 – 18 Years |

Kshs 1,500 |

10.0% |

Varies according to contributions |

· Sum Assured · Disability Benefit · Hospitalization Benefit · Family Income benefit · Last Expense |

|

Madison Uniplan |

5 – 15 Years |

Kshs 5,000* |

5.0% (Guaranteed) |

Kshs 394,000 |

· Sum Assured · Waiver of premiums |

|

Corporate Insurance Educator Plus |

6 Years |

Kshs 1,000 |

1.0% (Guaranteed) |

Not Specified |

· Sum Assured · Waiver of premiums · Policy Loans |

|

Jubilee Career Life Plan |

5 Years |

Kshs 5,000 |

5.6% |

Kshs 350,000 |

· Accidental death · Waiver of premium · Accidental hospitalization · Sum Assured · Last Expense |

|

Average |

|

|

5.5% |

|

|

|

*Kshs 5,000 minimum investment comes with a term condition of minimum of 6-years (Madison Uniplan) ** This is a privately offered and distributed product, hence the higher minimum amount to comply with Regulation 21 of the CMA Act on Private offers |

|||||

Source: Online Research

Below are the key take-outs from the above table:

- The Insurance companies listed above all provide life insurance together with their education policies, in that, they incorporate life insurance premiums into the monthly payments in order to avoid their clients making two separate payments. The sum assured in this case refers to the amount that is paid out to the client at the end of the investment period or to the nominated beneficiaries when the client passes away. For example, if you save Kshs 5,000.0 monthly at a rate of 5.5% for five years with an Education Investment Plan offered by ABCD Company, the final amount (Kshs 352,561.2) that you will be paid after the five years is the sum assured. This amount varies with the monthly contribution amount and the tenor of investment,

- The average return for the Education Investment Plans offered by the Insurance Companies listed above stands at 5.5%, which is 5.5% points lower than the 11.0% average returns for education products offered by investment managers. This is mainly because education policies in insurance companies are taken as a savings plan rather than an investment plan, and,

- The minimum investment amounts for education plans offered by insurance companies varies from Kshs 1,500 to Kshs 5,000, which is affordable for the target population. Notably, the minimum investment for Collective Investment Schemes also ranges in those amounts.

Key Things to Consider Before Joining an Education Investment Plan

A guardian or parent has to choose an education plan that can provide safety, preservation and growth, as well as fit into their investment objectives. The following are key factors to consider:

- Individual Profile of the Investor: This refers to the different and unique characteristics each parent/guardian has. The age of the beneficiary is an important factor to consider before making any investment decisions as it affects both the time horizon of an investment that you are willing to take. Time horizon refers to the time in which one intends to save with the plan, for instance a couple with a young child choosing to invest in longer education plans will be more willing to take up higher risk than individual saving to do a masters in three years. A longer tenor affords the couple the opportunity to have a more aggressive portfolio as they have more time to recover any lost potential returns. It is also key for guardians to profile themselves based on the financial goals they hope to achieve with the Education plan. If they want to invest for a short period they should consider other investment vehicles whereas if they would like a longer-term investment, then education investment plans are the best option for them,

- The Issuer of the plan: When seeking an Education plan provider, it is important for one to do their due diligence on the plan provider. This will enable the investor to not only familiarize themselves with the products offered by the issuer, but also the returns they stand to gain should they decide to invest in their Education policy. Key to note, Education plans are often long-term investments that are hard to get out of, therefore one should think about whether to buy an insurance based product or an investment manager based product. An important practice is to consult individuals who have already bought such plans and get to hear their experiences, as well as qualified financial advisors who are familiar with the product,

- The prevailing and future Inflation outlook: In order to preserve the strength of your education savings, it is important that you save in a plan that offers above-inflation interest rates, given that inflation erodes your purchasing power and will reduce the value of the final payout. Therefore, the guardians should ensure that they save their money with an issuer who offers returns significantly higher than the inflation rates,

- Additional Benefits that come with the plan: Most education plans are provided by insurance companies who offer their education policies with the additional benefits of life cover which is sometimes subject to payment of an additional premium. Life insurance serves to provide financial protection to the loved ones left behind. The guardian may also choose to have the education plan and the life cover separately with different firms,

- Early Redemption: One key area that an education policy client should note is that as a medium-long term investment, it is difficult to have frequent and easy access to all of your funds anytime you wish. In education policies offered by insurance companies, there is a term known as surrender value (the amount that one stands to be paid should they wish to withdraw early on in their policy before maturity), and this value is usually significantly less than the aggregate contributions. However, there is an option referred to as ‘Paid up’ that allows the client to halt their monthly contributions without incurring any penalties. Key to note, this is only an option if you have already built up a significant cash value in your insurance plan. To put this to perspective, we shall take an example of an Education Plan offered by a market player, ABCD education policy: For this policy, the minimum tenor is 5 years; however, for a client who has faithfully contributed either every month/ quarterly/ semiannually/ annually for 3 years, they are offered the Paid Up option. If they choose this option, for the remaining 2 years, their money will continue earning interest but they will not be required to contribute.

Alternatives to Education Investment Plans

In addition to the Education Investment Plans discussed above, there lies various investments avenues whereby individuals can take advantage of when financially planning for education. They include:

- Money Market Funds: A Money Market Fund (MMF) is a short-term investment vehicle that consists of pooled funds by investors who do so through a fund manager. The main objective for MMFs is to provide above market returns, preserve the capital invested and provide liquidity as the lock-in period is usually short and withdrawal is easy (most money market funds typically allow redemption within two to four working days). In MMFs, there are no tax benefits, however the higher rates of return more than compensate for the lack of tax benefits. Additionally, money market funds offer easy withdrawal that allow you to redeem regularly say, every term or semester or to cover educational emergencies that may arise in the course of the investment period. However, a specialized education based unit trust fund would likely limit the frequency of withdrawals, and,

- Bank Savings Accounts: Many banks in Kenya offer targeted savings account for saving for various goals including education. For example, we have KCB Goal savings account as well as other savings platforms that are provided by Banks. These accounts have seen a high uptake as many Kenyans consider banks to be safer options and fail to pay enough attention to the returns they get.

To illustrate the different returns one would get under the various alternatives, we have assumed a person who starts with an initial investment of Kshs 10,000 and makes monthly top-ups of Kshs 5,000 saves in a money market fund, with an insurance company and in a bank savings account. Below are the amounts at maturity they would get:

|

Analysis of Alternative Ways to Save for Education |

|||

|

|

Money Market Fund |

Insurance Company |

Bank Savings |

|

Initial Amount (Kshs) |

10,000.0 |

10,000.0 |

10,000.0 |

|

Monthly Top-ups (Kshs) |

5,000.0 |

5,000.0 |

5,000.0 |

|

Tenor (Years) |

7.0 |

7.0 |

7.0 |

|

Rate of Return |

9.9% |

5.5% |

4.0% |

|

Amount after Maturity (Kshs)* |

627,352.0 |

527,921.8 |

498,608.5 |

|

Sources: i. Money Market Fund Interest Rates – Effective annual interest rates (as at 11th March 2021) of the top 5 money market funds ii. Insurance Company Interest Rates – Average rates of Jubilee, CIC, Madison, Corporate and Britam education investment plans as provided in the table in Section 3 iii. Bank Savings Rate – Average of the Central Bank of Kenya published savings rates for the year 2020 *The figures at maturity are gross, that is, no taxes have been applied, and the interest rates compounded monthly |

|||

Evidently, the returns from saving in a money market fund are the highest but to note is that here you have no insurance and so one needs to look at both the risk and the return proposition. At the end of 7 years, saving in a money market fund will give returns of Kshs 627,352.0 compared to Kshs 527,921.8 and Kshs 498,608.5 when saving in an insurance education policy and in a bank savings account, respectively. It is essential that before making any investment decision to consult a reputable financial advisor in order to better understand what you are getting into, before signing any binding agreement.

Section IV: Recommendation on the improvement of Education Investment Plans in Kenya

The Education Investment Plans have faced challenges in terms of slow uptake. The muted growth can be attributed to the fact that most plans are provided by insurance companies, where their growth and acceptance is a factor of insurance sector penetration which was reported at 2.4% as per the 2019 insurance industry report. In order to accelerate the growth of Education plans, we propose the following measures to improve EIPs in Kenya;

- Tax relief for Education Investment Plans by Fund Managers: In order to improve the uptake of financial planning for education purposes in the country, fund managers who provide education investment plans should get a tax relief on those specific funds. The tax benefit should be extended to the fund itself as well as the contributor, just like the benefits accorded to pension contributors which has been a key driver of growth in the pensions industry which has seen an Assets Under Management growth by a 10-year CAGR of 15.8% to Kshs 1.3 tn as of December 2019, from Kshs 0.3 tn in 2009,

- Creation of avenues for more flexible access measures: The largest pullback for savers shying away from uptake of Education Investment Plans is the historical bad experience that previous holders of such policy have experienced. Most of the negative publicity has come from the inability of the policy issuer to timely honor the payments when they fall due. The current providers of such plans should ensure that the client is well advised on the terms and procedures before taking up a plan, and,

- Enlightening the market on education investment plans: The low uptake provides an avenue for growth and therefore Education Investment Plans providers should try and find channels to enlighten the public on the availability and the accompanying advantages of taking up an EIP to secure your child’s future. Given the increased usage of digital platforms there is an opportunity to reach masses at a low cost.

Section V: Conclusion

We often face various financial obligations in different stages of life ranging from medical expenses, education expenses, or retirement plans and sometimes these expenses arise at unexpected times. However, with proper planning and preparation, financial peace of mind is guaranteed no matter the stage of life one is in. For parents, the key priority is to secure a good future for their children through quality education. However, education has cost implications. We believe that investing in an Education Investment Plan will ensure that even in tough economic times that may affect your business or job security, individuals can be rest assured that they have the ability to provide for their dependent’s education. Saving for education from an early stage helps to minimize the need to take on debt in the future to offset education-related expenses as well. Through the variety of Education investment plans available in the market, we believe that a parent can take advantage of the available options in the market, from the higher earning fund manager backed plans to the more traditional insurance companies backed plans.

Additionally, a parent may opt to invest directly in various asset classes dependent on their goal and the age of the child. For instance, assuming the financial goal of a parent is to save for their child’s university education expenses, they may choose to save as follows;

- When the child is below 8 years the guardian can invest in more risky, less liquid and longer term products like equities, real estate and structured products,

- When the child is between 8 to 17 years the guardian can adopt a medium term product with moderate liquidity such as education plans and Treasury Bonds, and,

- When the child/individual is above 18 years, investments should be in highly liquid and short term products such as the Treasury Bills and Money Market Funds,

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.