Kenya Listed Banks Q1’2020, & Cytonn Weekly #24/2020

By Research Team, Jun 14, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 290.5%, up from 209.1% the previous week. The oversubscription is partly attributable to the favourable liquidity in the money markets as evidenced by the average interbank rate declining to 2.6% from 3.1%, recorded the previous week, as well as the continued preference for shorter-dated papers by investors. The subscription rates for the 91-day, 182-day, and 364-day papers all increased to 294.0%, 265.0%, and 314.7%, respectively, from 255.6%, 213.0%, and 186.5%, recorded the previous week. During the week, the National Treasury released the 2020/2021 fiscal year (FY) budget on 11th June 2020 themed “Stimulating the Economy to Safeguard Livelihoods, Jobs, Businesses and Industrial Recovery”;

Equities

During the week, the equities market was on an upward trajectory, with NSE 20 gaining by 3.7% while both NASI and NSE 25 gained by 2.7%, taking their YTD performance to losses of 24.2%, 14.1%, and 19.9%, for NSE 20, NASI and NSE 25, respectively. The NASI performance was driven by gains recorded by large-cap stocks such as Equity Group and Safaricom which gained 5.1% and 3.2%, respectively. During the week, the Capital Markets Authority (CMA), issued guidelines to listed companies in the Nairobi Securities Exchange (NSE) on holding virtual Annual General Meetings (AGM). As per the guidelines, all applications will be processed within 14 days from the date CMA receives the applications from the listed firms;

Real Estate

During the week, the National Treasury released the FY 2020/21 Budget statement, allocating Kshs 172.4 bn and Kshs 6.9 bn to infrastructure and the affordable housing initiative, respectively. In the residential sector, 6 banks committed Kshs 335 bn in mortgages to fund the Affordable Housing Programme. In the retail sector, Carrefour Supermarket, an international retailer, opened a new store along Uhuru Highway in Nairobi, while in the hospitality sector, Tourism Finance Corporation (TFC), a financial institution with the mandate of facilitating and providing affordable development funding and advisory services in the Kenyan tourism industry, restructured Kshs 634 mn loans to hospitality facilities affected by the Covid-19 pandemic. In the industrial sector, Tatu City, a comprehensive mixed use development and special economic zone, received approval from the National Environment Management Authority (NEMA) for the development of the second phase which will cover 2,500 acres, whereas in the listed real estate, the Cabinet Secretary to the National Treasury and Planning, Ukur Yatani, drafted rules under the Income Tax (Real Estate Investment Trusts) Rules, 2020 requiring Real Estate Investment Trusts (REITs) to apply for tax exemptions from Kenya Revenue Authority (KRA) during registration;

Focus of the Week

Following the release of Q1’2020 results by Kenyan banks, this week we analyse the performance of the 10 listed local banks (previously 11, before the acquisition of National Bank by KCB Group Plc), identify the key factors that influenced their performance, and give our outlook for the banking sector;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.6% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.9% p.a. To invest, email us at sales@cytonn.com;

- David Kingoo, Senior Investments Analyst at Cytonn Investments, was on KBC Channel 1 to discuss the Budget 2020/2021 and to give a post budget analysis. Watch David here;

- Felix Owour, Investment Analyst at Cytonn Investments, was on KBC Channel 1 to discuss the proposal by parliament to float a COVID-19 bond to source funding for the pandemic, the place of the manufacturing sector in the path to economic recovery and Infrastructure projects. Watch Felix here;

- Felix Owour, Investment Analyst at Cytonn Investments, was on NTV tonight with Ken Mijungu to discuss pending bills and what they mean for the government. Watch Felix here;

- Wacu Mbugua, Real Estate Research Analyst at Cytonn Investments, was on K24 to discuss budget expectations in the housing sector and the sectors performance this year especially during the COVID-19 pandemic. Watch Wacu here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The aim of the training is to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry players talk about matters affecting Pension Schemes and the pensions industry at large. Join us every Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 290.5%, up from 209.1% the previous week. The oversubscription is partly attributable to the favorable liquidity in the money markets as evidenced by the average interbank rate declining to 2.6% from 3.1%, recorded the previous week, as well as the continued preference for shorter-dated papers by investors. The subscription rates for the 91-day, 182-day, and 364-day papers all increased to 294.0%, 265.0%, and 314.7%, respectively, from 255.6%, 213.0%, and 186.5%, recorded the previous week. The yields on the 91-day, 182-day and 364-day papers declined marginally by 6.6 bps, 14.2 bps and 13.5 bps to 7.3%, 8.1% and 9.0%, respectively. The acceptance rate declined to 32.8%, from 35.4% recorded the previous week, with the government accepting only Kshs 22.9 bn of the Kshs 69.7 bn worth of bids received.

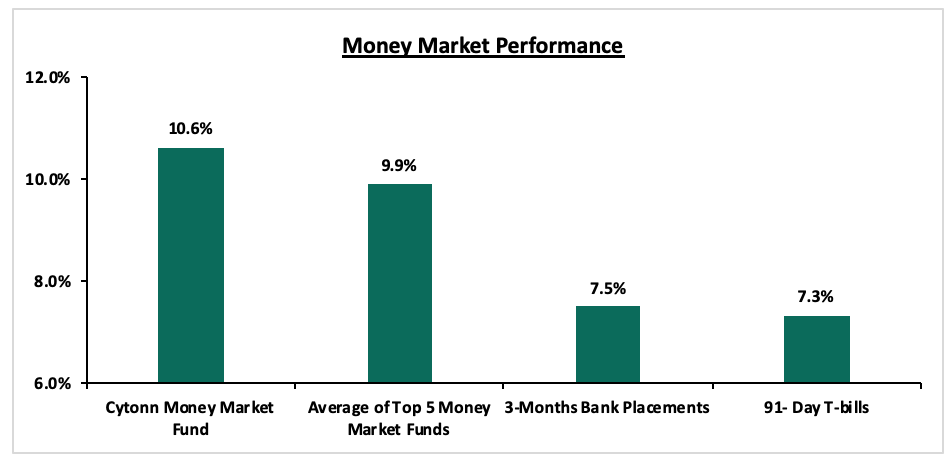

In the money markets, 3-month bank placements ended the week at 7.5% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined marginally by 6.6 bps to close the week at 7.3%, similar to what was recorded the previous week. The average yield of Top 5 Money Market Funds declined marginally to 9.9% from the 10.0%, recorded the previous week. The yield on the Cytonn Money Market declined by 0.1% points to close the week at 10.6% from 10.7% recorded the previous week.

Liquidity:

During the week, liquidity eased in the money market with the average interbank rate declining to 2.6% from 3.1% recorded the previous week supported by government payments. The week also saw the Inter-bank rate record a 10 month low of 2.6% as at 9th June 2020. With the lower interbank rate, the average interbank volumes declined by 63.6% to Kshs 3.4 bn, from Kshs 9.4 bn recorded the previous week. As per the Central Bank of Kenya weekly bulletin, commercial banks’ excess reserves came in at Kshs 32.8 bn in relation to the 4.25% cash CRR. The favourable liquidity in recent weeks has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic.

Kenya Eurobonds:

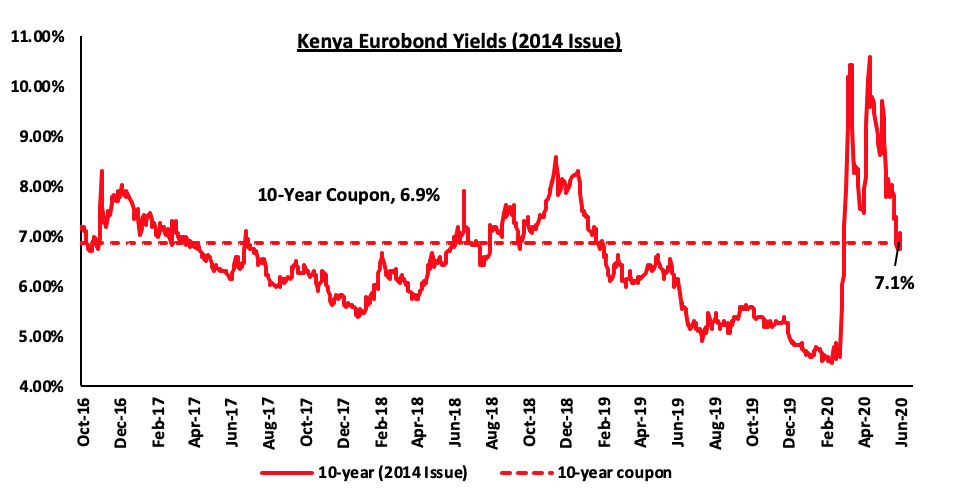

During the week, Kenyan Eurobonds recoded mixed performance with the yield on shorter dated bond reducing while the longer recent bonds saw an increase in the yields. Since the jump we saw in March, the investor sentiments have been improving following. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 declined by 0.3% points to 7.1%, from 7.4% recorded the previous week.

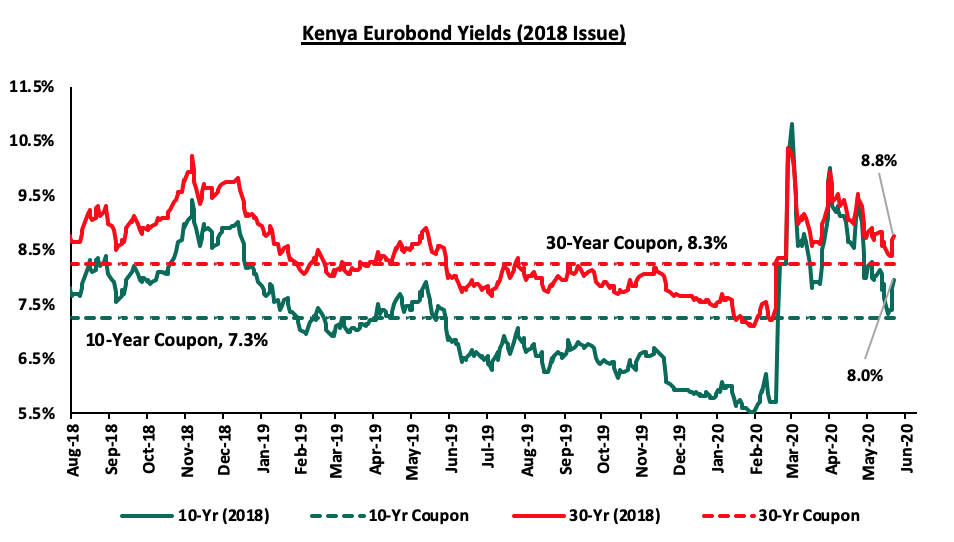

The yields on the 10-year and 30-year Eurobonds issued in 2018 on the other hand increased by 0.1% points and 0.2% points to 8.0% and 8.8%, respectively, from 7.9% and 8.6% recorded previous week, respectively.

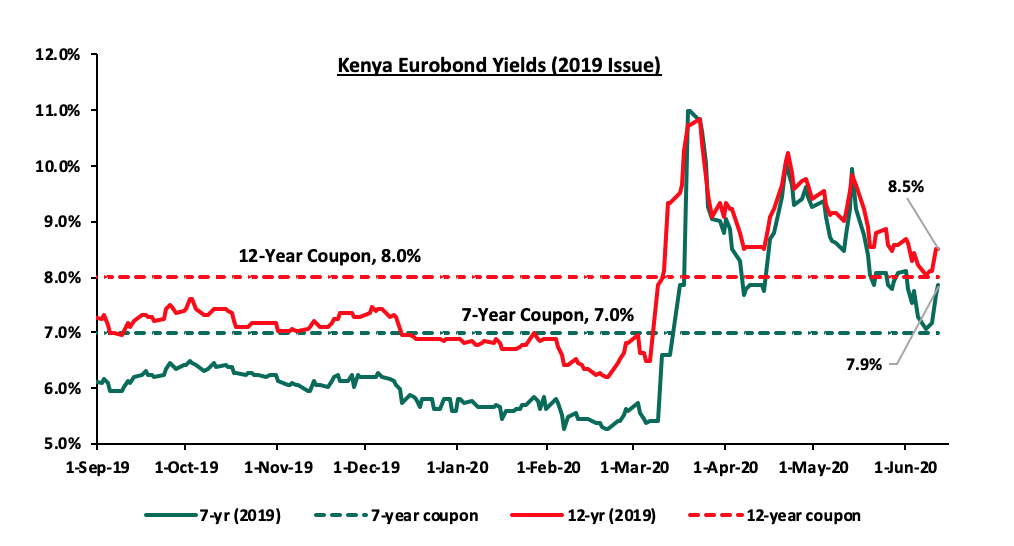

The yields on the 7-year and 12-year Eurobonds issued in 2019 also increased by 0.3% points and 0.1% points, to 7.9% and 8.5%, respectively, from 7.6% and 8.4% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 0.4% against the US Dollar to close the week at Kshs 106.5, from Kshs 106.1, recorded the previous week, which traders attributed to an increase in dollar demand from merchandise importers as the easing of coronavirus restrictions jumpstarted economic activities thus boosting demand for hard currency. On a YTD basis, the shilling has depreciated by 5.1% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- Demand from merchandise and energy sector importers as they beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances evidenced by the 9.0% decline to USD 208.2 mn in April 2020, from USD 228.8 seen the previous month, mainly due to the decline in economic activities globally, coupled with increased prices of household items leading to lower disposable income. Key to note, the Central Bank of Kenya (CBK) expects a 12.0% decline in remittances in 2020.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 9.2 mn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight: Budget Summary

The National Treasury released the 2020/2021 fiscal year (FY) budget on 11th June 2020 themed “Stimulating the Economy to Safeguard Livelihoods, Jobs, Businesses and Industrial Recovery”.

Below are some of the highlights:

|

Item |

FY'2019/2020 (Revised) |

FY'2020/2021 (Estimates) |

Change y/y |

|

Total Revenue |

1,893.9 |

1,854.1 |

(2.1%) |

|

Ordinary Revenue |

1,643.4 |

1,621.4 |

(1.3%) |

|

Grants |

44.6 |

36.1 |

(19.1%) |

|

Total Revenue & External Grants |

1,938.5 |

1,890.2 |

(2.5%) |

|

Recurrent Expenditure |

1,257.4 |

1,254.4 |

(0.2%) |

|

Development Expenditure |

617.9 |

586.5 |

(5.1%) |

|

Total Expenditure |

2,774.4 |

2,790.4 |

0.6% |

|

Fiscal Deficit including Grants |

(842.7) |

(840.6) |

(0.2%) |

|

Deficit (including grants) as % of GDP |

8.3% |

7.5% |

|

|

Net Foreign Borrowing |

333.5 |

347.0 |

4.0% |

|

Net Domestic Borrowing |

473.2 |

493.4 |

4.3% |

|

Total Borrowing |

806.7 |

836.0 |

3.6% |

|

Borrowing as a % of GDP |

6.9% |

6.5% |

|

Source Budget Statement, 2020

Key take-outs from the table:

- Total Revenue collected is expected to decrease by 2.1% to Kshs 1,854.1 bn from the Kshs 1,893.9 bn as per the revised FY’2019/2020 Budget,

- Total expenditure is set to increase by 0.6% to Kshs 2,790.4 bn (24.7% GDP), from Kshs 2,774.4 bn (27.2% GDP) as per the revised FY’2019/20 Budget,

- Recurrent Expenditure is set to decline marginally by (0.2%) to Kshs 1,254.4 bn, from the Kshs 1,257.4 tn in the 2019/20 financial year. Development Expenditure, on the other hand, is similarly set to decline by (5.1%) to Kshs 586.5 bn, from Kshs 617.9 bn as per the FY’2019/20 Budget. Notably, the other expenditure items include Interest Payments and Pensions which is set to receive Kshs 586.5 bn and Shareable Transfers to Counties which came in at Kshs 316.5 bn,

- The fiscal deficit is projected at Kshs 840.6 billion (7.5% GDP), from Kshs 842.7 billion (8.3% GDP) in the financial year 2019/20,

- The fiscal deficit is expected to be financed by Kshs 347.0 billion in terms of external financing, domestic borrowing of Kshs 493.4 billion.

While reading the budget the Minster for Finance indicated that it was formulated with the aim of jump starting the economy Post-COVID-19. He highlighted the key economic stimulus programme as follows:

- Investment in infrastructure to help maintain the roads that were initially damaged and with this he included youth employment as a key contribution through “Kazi Mtaani”

- Improving education outcomes through investments in the school infrastructure and employing of more teachers

- Improving Liquidity for businesses through Credit Guarantee Scheme

- Improving Healthcare outcomes through hiring more healthcare staff and improving the healthcare infrastructure

- Agriculture and food security which will involve provisions of subsidy for farm inputs and support of the horticulture business to reach the markets

- Support tourism through marketing of the country as a tourist destination and assisting people in conservancies who highly depend on tourism

- Support the manufacturing through purchase of the locally manufactured items like Motor vehicles and also support of the micro, small and medium enterprises in the manufacturing sector

It is key to note that to achieve the set targets, the treasury intends to enhance efforts in resource mobilization and contain growth in non-core recurrent spending. The allocation of resources was in line with the big four agenda with some of the key beneficiaries being (i) Universal Health Coverage which received Kshs 111.7 bn, and, (ii) Affordable Housing which received an allocation of Kshs 6.5 bn.

In addition to the changes that had been passed to help protect the economy from the Covid-19 the government is seeking to introduce of a minimum tax payable by all companies at the rate of 1.0% of their gross turnover. They also propose the introduction of a “digital service tax” of 1.5% of digital transactions considering the increasing number of transactions being done on digital platforms. This is aimed at bridging part of the revenue shortfall of approximately Kshs 34 bn that is estimated to arise from the initial fiscal tax measures announced by the president.

In a bid to enhance food security the government has proposed the exemption of maize and corn seeds from VAT to make them affordable to farmers. Also, some of the proposals affecting the Capital Markets include amendments in the Capital Market Act:

- To provide for regulation of Private Equity and Venture Capital companies,

- To remove the function of payment of beneficiaries from collected unclaimed dividends since this is a function currently domiciled under the Unclaimed Financial Assets Authority.

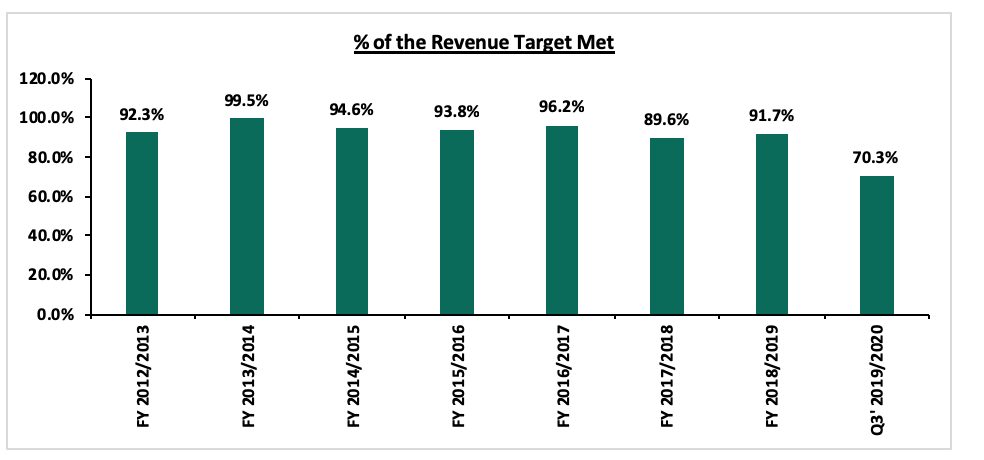

We, however, expect continued underperformance in revenue collections mainly informed by the historical underperformance in revenue collections as highlighted in the chart below, where the Government has not been able to meet its revenue target.

The government will therefore continue relying on debt to fund the budget deficit which is now projected at 7.5%.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 1.3% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 309.7 bn against a prorated target of Kshs 365.5 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on an upward trajectory, with NSE 20 gaining by 3.7% while both NASI and NSE 25 gained by 2.7%, taking their YTD performance to losses of 24.2%, 14.1%, and 19.9%, for NSE 20, NASI and NSE 25, respectively. The NASI performance was driven by gains recorded by large-cap stocks such as Equity Group and Safaricom which gained by 5.1% and 3.2%, respectively. EABL, Diamond Trust Bank (DTBK) and KCB Group also recorded gains of 0.9%, 0.4% and 0.3%, respectively.

Equities turnover increased by 44.7% during the week to USD 31.3 mn, from USD 21.6 mn recorded the previous week, taking the YTD turnover to USD 746.7 mn. Foreign investors turned net buyers during the week, with a net buying position of USD 4.7 mn, from a net selling position of USD 5.7 mn recorded the previous week, taking the YTD net selling position to USD 200.9 mn. This was the first net buying position since the week ending 7th March 2020, attributable to the regaining of investor confidence in the Kenyan market.

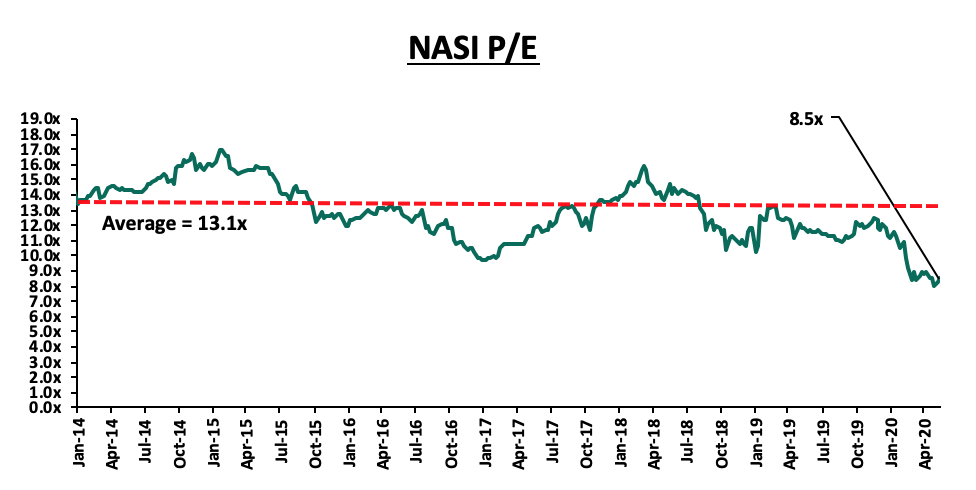

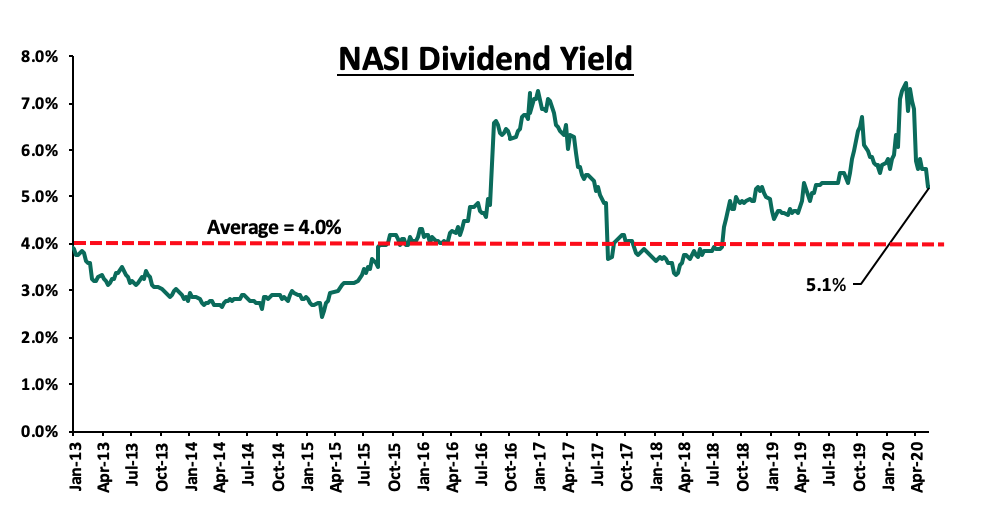

The market is currently trading at a price to earnings ratio (P/E) of 8.5x, 35.5% below the historical average of 13.1x. The average dividend yield is currently at 5.1%, 1.1% points above the historical average of 4.0%. The continued decline of the dividend yield is mainly attributable to the non-payment of dividends by most listed firms in the Nairobi Securities Exchange (NSE). With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 8.5x is 5.3% above the most recent valuation trough of 8.0x experienced in the last week of May 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Capital Markets Authority (CMA), issued guidelines to listed companies in the Nairobi Securities Exchange (NSE) on holding virtual Annual General Meetings (AGM). On the onset of the COVID-19 pandemic and the ban of all public gathering, the High Court had indicated that listed firms would hold virtual AGMs subject to the following terms; (i) obtain an approval from CMA before issuing their shareholders a notice of the upcoming AGM, (ii) share with CMA details of the how the AGM would be held, and, (iii) demonstrate to the Authority that their shareholders would be provided with information prior to the AGM.

Below are the guidelines outlined by CMA:

- All applications will be processed within 14 days from the date CMA receives the applications, and,

- Upon receipt of a no objection from CMA, issuers are at liberty to issue a twenty-one (21) day statutory notice of the intended general meeting to its shareholders

On 18th March 2020, CMA had indicated that all AGMs scheduled for March through May had been deferred to a later date. Given that dividend payments should be approved at the AGM by shareholders, listed firms such as Standard Chartered Bank postponed their dividend payment to an unknown date. We believe that these guidelines will enable firms to fast-track the decision making process such as dividend payments. We believe that CMA should extend the same allowance provided to other firms operating in the capital markets such as Fund Managers offering Unit Trusts Schemes, to assist them in updating their shareholders on the fund’s performances as well as pass special resolutions such as appointment of auditors. Through the AGM, the fund managers will be able to transact any other business of the fund.

Universe of Coverage:

|

Banks |

Price at 05/06/2020 |

Price at 12/06/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

69.8 |

70.0 |

0.4% |

(35.8%) |

109.0 |

175.0 |

3.9% |

153.9% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.3 |

2.2 |

(3.9%) |

(27.4%) |

3.0 |

4.6 |

5.0% |

114.1% |

0.2x |

Buy |

|

KCB Group*** |

34.9 |

35.0 |

0.3% |

(35.2%) |

54.0 |

56.2 |

10.0% |

70.6% |

0.9x |

Buy |

|

I&M Holdings*** |

46.0 |

50.0 |

8.7% |

(7.4%) |

54.0 |

76.3 |

5.1% |

57.7% |

0.7x |

Buy |

|

Co-op Bank*** |

12.7 |

12.2 |

(4.0%) |

(25.7%) |

16.4 |

18.0 |

8.2% |

56.4% |

1.0x |

Buy |

|

Stanbic Holdings |

78.5 |

77.0 |

(1.9%) |

(29.5%) |

109.3 |

111.2 |

9.2% |

53.6% |

1.0x |

Buy |

|

Equity Group*** |

33.2 |

34.9 |

5.1% |

(34.9%) |

53.5 |

50.7 |

0.0% |

45.5% |

1.2x |

Buy |

|

ABSA Bank*** |

10.1 |

9.9 |

(1.3%) |

(25.7%) |

13.4 |

13.2 |

11.1% |

44.2% |

1.2x |

Buy |

|

Jubilee Holdings |

252.0 |

255.0 |

1.2% |

(27.4%) |

351.0 |

334.8 |

3.5% |

34.8% |

0.9x |

Buy |

|

NCBA |

27.8 |

27.1 |

(2.7%) |

(26.6%) |

36.9 |

35.6 |

0.9% |

32.5% |

0.7x |

Buy |

|

Standard Chartered |

173.0 |

170.0 |

(1.7%) |

(16.0%) |

202.5 |

202.7 |

11.8% |

31.0% |

1.4x |

Buy |

|

Sanlam |

16.0 |

15.0 |

(6.6%) |

(13.1%) |

17.2 |

18.4 |

0.0% |

23.1% |

1.3x |

Buy |

|

Liberty Holdings |

8.2 |

8.0 |

(2.4%) |

(22.7%) |

10.4 |

9.8 |

0.0% |

22.9% |

0.7x |

Buy |

|

HF Group |

3.9 |

3.9 |

0.0% |

(39.5%) |

6.5 |

4.0 |

0.0% |

2.3% |

0.2x |

Lighten |

|

CIC Group |

2.4 |

2.3 |

(4.2%) |

(14.2%) |

2.7 |

2.1 |

0.0% |

(8.7%) |

0.8x |

Sell |

|

Britam |

6.5 |

9.7 |

49.5% |

8.0% |

9.0 |

7.6 |

2.6% |

(19.2%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

I. Industry Reports

During the week, the National Treasury read the FY 2020/21 budget statement themed, “stimulating the Economy to Safeguard Livelihoods, Jobs, Businesses and Industrial Recovery.” According to CS Treasury, Ukur Yatani, the budget seeks to implement a rapid economic stimulus programme and lay down a firm post COVID-19 economic recovery strategy. The key take outs relevant to the real estate sector were;

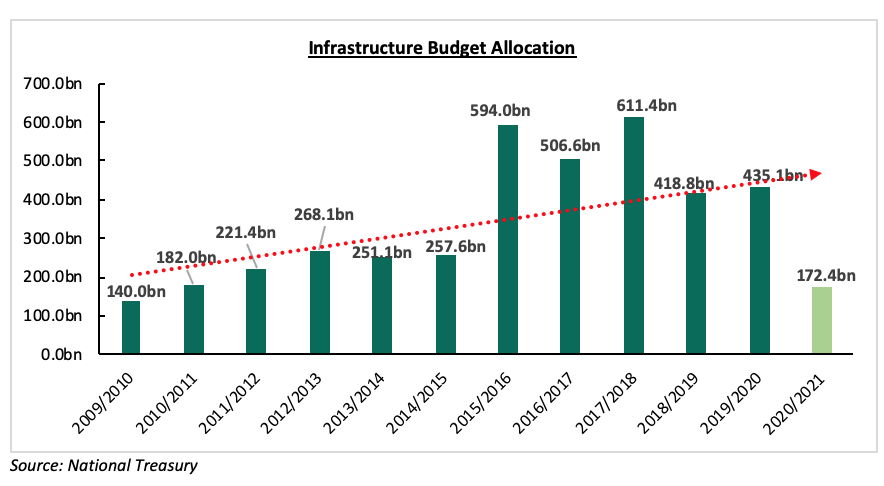

- Infrastructure: The infrastructure sector was allocated Kshs 172.4 bn, 60.4% lower than the 435.1 bn allocated in the 2019/2020 budget. This is the lowest allocation in the last 10 financial years attributed to a projected revenue shortfall in the wake of a slowdown in the economy due to disruptions by the COVID-19 pandemic. The funds will mainly be channeled towards the Standard Gauge Railway (SGR) Phase II (Nairobi-Naivasha), Lamu Port and Lamu-Southern Sudan-Ethiopia Transport Corridor Project (LAPSSET), and, Mombasa Port Development Project. The reduced allocation towards infrastructure is attributed to the constrained budgetary room that the government finds itself in as it grapples with economic effects of the COVID-19 pandemic. We expect the reduced budget allocation to result in subdued real estate development activities especially in areas that are yet to witness the much needed infrastructural development such as roads and other trunk infrastructure.

Below is the budget allocation towards infrastructure over the last 11 years:

- Affordable Housing Programme: The affordable housing sector was allocated Kshs 6.9 bn, a 34.3% reduction from the Kshs 10.5 bn allocated in 2019/2020. This coupled with the proposed removal of the home ownership savings plan tax relief, is expected to severely dent the National Government’s Big Four Agenda on improving the home ownership rate in the country, leading to slowed supply of affordable housing units,

- Removal of the House Ownership Savings Plan tax relief: The National Treasury proposed removal of the HOSP tax relief under the Income Tax Act, with the aim of boosting tax collections. Currently, depositors are allowed tax rebates of Kshs 8,000 per month maximum or Kshs 96,000 per annum (effectively reducing an individual’s taxable income by the amount of their monthly contribution). If approved, we expect this to cripple home ownership especially among low middle-income households, thus slowing down the government’s affordable housing initiative,

- Residential Income Tax: The National Treasury proposed expansion of the bracket of individuals paying rental income tax on the total annual rental income collected to up to Kshs 15 mn, up from the previous threshold of Kshs 10 mn. The monthly rental income tax was introduced in 2016 under the Income Tax Act stating that any individual collecting rental income between Kshs 140,000 – 10 mn, pays a 10.0% rental income tax on total rent collected annually. In our view, the expansion of the bracket will lead to an uptick in revenue collections by the government from landlords at a time when the government is experiencing reduced revenue collections, however, some property owners may opt to raise their rents in a bid to cover for the lost margins, and,

- Hospitality Sector: Under the 8-point stimulus programme, the hospitality sector was allocated Kshs 3 bn in support of the post COVID-19 tourism marketing and hotel refurbishment through soft loans to be channeled through the Tourism Finance Corporation (TFC). This is in addition to the Kshs 2.5 bn set aside for the Tourism Promotion Fund (TPF), and, a further Kshs 3.8 bn set aside for the Tourism Fund. We expect the funding to ease financial distress on hospitality facilities in the wake of reduced revenue inflows due to the COVID-19 pandemic.

We expect the government to sustain the real estate sector through measures such as; (i) issuance of infrastructure bonds such as the Kshs 25.6 bn infrastructure bond floated by the Central Bank of Kenya (CBK) in May this year aimed at assisting the Government in financing various infrastructure projects, and, (iii) incentives introduced by the National Government aimed at private developers who intend to undertake affordable housing projects such as reduced custom tariffs on imported inputs for construction of houses under the affordable housing scheme. For instance, Import Declaration Fee (IDF) has been reduced from 2.0% to 1.5%. Additionally NEMA and NCA levies of 0.1% and 0.05% of the cost of construction respectively, have been scrapped. Also, the government has reduced corporate tax for property developers who build a minimum of 100 low-cost units under the affordable housing programme by half, from 30.0% to 15.0%. We expect to see private sector developers undertaking affordable housing projects targeting the low and middle income earners as the segment presents an investment opportunity supported by the growing demand and the tax incentives associated with the same.

II. Residential Sector

During the week, six banks committed Kshs 335 bn in mortgages to fund the Affordable Housing Programme. The institutions include Equity Bank, Kenya Commercial Bank (KCB), NCBA, Stanbic Bank, Absa, and, Housing Finance. According to the Ministry of Housing Principal Secretary, Charles Hinga, the banks will finance potential home owners to purchase both government-built houses and units delivered by private developers registered on the Boma Yangu portal. Key to note, the government will offer partial credit guarantee that will cover up to 20.0% of the approved loans. The move is part of the ongoing efforts by the private sector to support the National Government’s goal of increasing home ownership in the country. This comes at a time when the Government struggles to raise funds geared towards implementation of the affordable housing programme which has led to a reduced budgetary allocation to the programme alongside the prolonged operationalization of the Kenya Mortgage Refinancing Company (KMRC) which seeks to create liquidity for primary mortgage lenders making it possible for mortgage originators to offer long-term mortgages, at relatively low interest rates and better terms and conditions. Home ownership in Kenya has mainly been constrained by the relatively high cost of housing units and limited access to affordable long-term finance as mortgage uptake remains low with 26,187 mortgage accounts as at December 2017 out of an adult population of 23 million. The low uptake of mortgages is mainly attributed to; (i) low-income levels that cannot service a mortgage, (ii) soaring property prices, (iii) high interest rates and deposit requirements which lock out many borrowers, (iv) exclusion of employees in the informal sector due to insufficient credit risk information, and, (v) lack of capital markets funding towards real estate purchases for end buyers. In our view, the above move will enhance availability of home loans thus resulting in an increase in mortgage uptake. It is good to note that approximately 25,000 Kenyans are actively making contributions through the Boma Yangu portal, according to online sources. In addition, we expect the partial guarantee by government to attract potential home buyers and enable self- employed and informal sector employees to access bank mortgages, hence facilitating home ownership. However, we expect to see more public private partnerships between private developers and county government aimed at producing more housing units to cure the expected demand.

III. Retail Sector

During the week, Carrefour Supermarket, an international retailer, opened a new store along Uhuru Highway in Nairobi, taking up 40,000 SQFT of space previously occupied by Nakumatt Mega, who vacated the premises last September. This marks the retailer’s 8th branch locally, with some of the other outlets being located at; The Hub in Karen, Village Market in Gigiri, Two Rivers Mall in Ruaka, Thika Road Mall (TRM) along Thika Road, Sarit Centre mall in Westlands, The Junction along Ngong road, and, Galleria Mall in Karen. The multinational retailer has continued to expand its foothold in the Kenya retail market since its first store in 2016 supported by; (i) its ability to leverage on its scale and operational know-how to become one of the leading retailers locally. The company’s revenues recorded a 28.0% rise in 2019 to Kshs 18.7 bn from Kshs 14.6 bn in 2018, (ii) availability of funding evidenced by the Kshs 3.0 bn loan from Standard Bank Group in May this year, and, (iii) availability of prime locations vacated by struggling supermarket chains such as Nakumatt and Uchumi. The continued expansion of local and international retailers such as Carrefour and Quickmart is a welcome move for retail sector investors, following the increased vacancy rates in the sector driven by retailers shutting down their operations to cushion themselves against the impact of the Coronavirus pandemic and the fall of struggling retailers namely, Nakumatt, Uchumi and Botswana’s Choppies. Despite effects of the Coronavirus pandemic, we expect the retail sector to be cushioned by the increased prevalence of e-commerce by consumers and the gradual easing of movement restrictions by the National Government, especially within Nairobi Metropolitan Area, resulting in a slight increase in footfall in the CBD and other retail nodes.

IV. Hospitality Sector

During the week, Tourism Finance Corporation (TFC), a financial institution with the mandate of facilitating and providing affordable development funding and advisory services to the Kenyan tourism industry, restructured Kshs 634 mn loans to hospitality facilities affected by the Covid-19 pandemic. The move is a measure by the National Government to ease financial distress on hospitality facilities in the wake of reduced revenue inflows attributed to the ongoing COVID-19 pandemic. The sector has been impacted due to its reliance on tourism and conferencing which has meant that the travel restrictions, social distancing rules, and, the current ban on international flights has led to reduced demand for hospitality services. TFC also initiated talks with local banks to ensure the Kshs 2 bn tourism stimulus package released by the National Government, reaches hotel operators in a deal expected to see TFC, banks and individual lenders agree on restructuring packages before the money is released to the banks. The funds are expected to be utilized in the renovation of existing facilities and the restructuring of business operations, thus boosting the sector. We expect the move by TFC, coupled with other government measures such as the formation of the National Tourism and Hospitality Protocols Taskforce meant to develop tourism and hospitality protocols and guidelines in response to COVID-19, to support the sector’s recovery.

V. Industrial Sector

During the week, Tatu City, a comprehensive mixed use development and special economic zone, received approval from the National Environment Management Authority (NEMA) for the development of its second phase, which will cover 2,500 acres. The first phase of the city also covered 2,500 acres which comprised of 520 acres designated for residential developments, commercial land, and, 457 acres of industrial land under the Tatu Industrial Park that has seen Africa Logistics Properties (ALP) launch the ALP North Industrial Park, a 49,000 SQM warehouse facility in Tatu City. The go ahead will see Kenya Wine Agencies become the first company to set up base in the city’s second phase adding to the list of 50 other companies that developed within the city’s first phase, among them; Chandaria Industries, Dormans, and, Davis & Shirtliff. In addition to the availability of high quality industrial space, the continued demand for industrial space by local and international companies has mainly been bolstered by Tatu Industrial Park’s Special Economic Status which provides companies with incentives such as;

- Business enterprises operating in SEZs are allowed a deduction of 100% investment costs on building construction, machinery purchase, and, machinery installations in the first year of utilization, and,

- Reduction of withholding tax rates for businesses in SEZs as follows; (i) management and professional fees from 20.0% to 5.0%, (ii) interests from 15.0% to 5.0%, and, (iii) royalty from 20.0% to 5.0%,

The establishment of SEZs under the Special Economic Zone Act, 2015 confirms the National Government’s commitment towards facilitating the growth of the manufacturing sector by providing a platform through which Kenya can attract Foreign Direct Investments, thus driving the growth of the economy. Other SEZs in the pipeline include; Africa Economic Zones Limited in Eldoret County, Northlands City along the Thika Super Highway, Dongo Kundu in Mombasa, Naivasha Industrial Park, and, Konza City in Athi River. SEZs are more attractive to industrial clientele due to special tax incentives and infrastructure that facilitate a wide range of activities such as storage, export and re-export.

VI. Listed Real Estate

During the week, the Cabinet Secretary for the National Treasury and Planning, Ukur Yatani, drafted rules under the Income Tax (Real Estate Investment Trusts) Rules, 2020 that will require Real Estate Investment Trusts (REITs) to apply for tax exemptions from Kenya Revenue Authority (KRA) during registration. According to the Income Tax Act, REITs in Kenya have a number of tax benefits, among them being;

- A listed REIT allows underlying owners of the real estate assets to enjoy corporate tax exemptions, currently at 30% per annum. The only taxation is on distribution of profits to the unit-holders, which is subject to withholding tax (“WHT”) at the rate of 5.0% for resident and 10.0% for non-resident unit-holders,

- The amendment of Section 20 of the Income Tax Act as per Finance Act 2019 also saw REITs’ investee companies being exempted from income tax. This will allow REITs to invest more in companies that develop real estate, rather than going through the process of transferring properties to the REIT, and,

- Transfer of properties to a REIT also attracts a stamp duty exemption, as per Section 96A (1) (b) of the Stamp Duty Act.

As per the proposed rules;

- The application for registration shall be made to the KRA Commissioner General at any time during the authorization of the REIT Scheme by the Capital Markets Authority or during the process of acquiring the REIT Controlled Entity,

- Where a REIT or a REIT Controlled Entity fails to satisfy the requirements of the Capital Markets (Real Estate Investment Trusts) (Collective Investment Schemes) Regulations, or the Income Tax Act for purposes of maintaining its exemption status;

- The exemption granted to the REIT or REIT controlled entity shall cease to apply, and,

- All the applicable taxes in accordance with the Income Tax Act shall fall due, and shall be payable, from the date of such failure.

The proposed rules seek to assure investors of the tax exemptions and seal any possible loopholes in tax collection. Previously, a REIT was only required to get the Capital Markets Authority (CMA) approval. The exemptions ensure that the objectives of REITs are fully achieved as it exempts the income of Investee Company fully controlled or owned by the REITs. However, despite the tax exemptions, the REIT market in Kenya has remained underdeveloped with only one publicly listed REIT, Fahari I-REIT, which has been recording poor performance since its listing, trading at an average of Kshs 7.5 per unit share in May 2020, a 63.9% drop from its initial price of Kshs 20.8 in November 2015. Some of the challenges facing the REIT market include; (a) the relatively high minimum subscription amount per investor at Kshs. 5 million which is too high to attract significant interest from investors, (b) inadequate investor knowledge, (c) negative investor sentiments, (d) opacity of exact returns for underlying assets, (e) shallow investment-grade asset pipeline, and, (f) lack of institutional support. We expect continued engagement of the Investors, fund managers, the developers and the regulators to help unlock capital as investors take advantage of the tax benefits. Please see our note on tax incentives for REITS as an investment alternative here.

Despite the continued negative impact of the COVID-19 pandemic on the real estate sector and the reduced budget allocation by the National Government towards infrastructure and the affordable housing programme, we expect the sector to be cushioned by the growing demand for low income housing and the National Government’s use of monetary and fiscal policies to sustain liquidity in the economy and ease financial distress for sectors such as tourism and hospitality.

Following the release of the Q1’2020 results by Kenyan listed banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

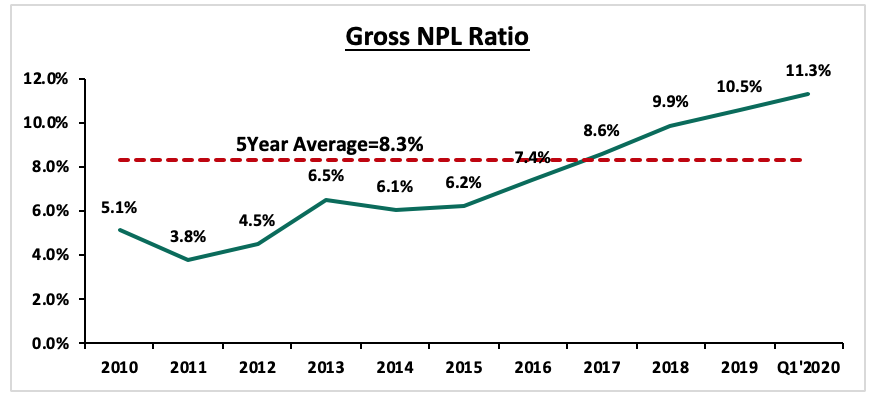

Asset quality deteriorated in Q1’2020 with the gross NPL ratio increasing by 0.9% points to 11.3% from 10.4% in Q1’2019. This was high compared to the 5-year average of 8.5%. In accordance with IFRS 9, banks are expected to provide both for the incurred and expected credit losses. Consequently, this saw the NPL coverage increase to 57.4% in Q1’2020 from 54.5% in Q1’2019 as banks adopted a cautious stance on the back of the expected impact of the COVID-19 pandemic.

The report is themed “Deteriorating Asset Quality amid the COVID-19 Operating Environment” as we assess the key factors that influenced the performance of the banking sector in Q1’2020, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of the banking sector going forward. As such, we shall address the following:

- Key Themes That Shaped the Banking Sector Performance in Q1’2020,

- Summary of The Performance of the Listed Banking Sector in Q1’2020,

- The Focus Areas of the Banking Sector Players Going Forward, and,

- Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis.

Section I: Key Themes That Shaped the Banking Sector Performance in Q1’2020

Below, we highlight the key themes that shaped the banking sector in Q1’20120 which include regulation, consolidation, asset quality, and capital conservation:

- Regulation - The impactful regulations of the banking sector included the Guidance on loan restructuring:

a) Guidance on Loan Restructuring: The Central Bank of Kenya on March 27th, 2020 provided commercial banks and mortgage finance companies with guidelines on loan reclassification, and provisioning of extended and restructured loans as per the Banking Circular No 3 of 2020. The key takeouts from the circular included:

-

- Central Bank stipulated that banks would be allowed to extend loan repayments for their customers for a period not more than one year,

- The cost of restructuring and extension of loans would be met by the banks and the banks would have to report any restructuring in relation to the COVID-19 pandemic to the Central Bank monthly,

- Banks would be required to keep a record of all restructured and extended loans with the details of how the pandemic has affected specific customers whose loans are restructured and monitoring measures adopted by the bank, and,

- Personal loans that have been extended or restructured by banks would not be subjected to the classification of renegotiated loans stipulated in CBK’s prudential guidelines meaning that banks would not have to classify the loans as non-performing loans.

Following this guideline, most commercial banks have moved to restructure loan repayments for their customers. The table below shows some of the major banks that have moved to restructure loans for their customers;

|

No. |

Bank |

Amount Restructured (Kshs bn) |

% of restructured loans to total loans |

y/y Change in Loan loss provision |

|

1 |

Kenya Commercial Bank |

120.2 |

21.7% |

149.1% |

|

2 |

Absa Bank Kenya |

8.3 |

4.1% |

75.2% |

|

3 |

Standard Chartered Bank of Kenya |

22.0 |

17.5% |

3.1% |

|

4 |

Diamond Trust Bank |

40.7 |

18.3% |

52.0% |

|

5 |

Co-operative Bank of Kenya |

15.3 |

5.5% |

79.5% |

|

6 |

Equity Group Holdings |

92.0 |

24.3% |

660.4% |

|

|

Total |

298.5 |

|

|

2. Consolidation: Consolidation activity remained one of the highlights witnessed in Q1’2020, in line with our expectations, as players in the sector were either acquired or merged, leading to the formation of relatively larger, well-capitalized, and possibly more stable entities. The following were the major M&A’s activities witnessed during the quarter:

- On 27th January 2020, Nigerian lender, Access Bank PLC completed the acquisition of a 100% stake in Transnational Bank PLC for an undisclosed amount, with Access Bank PLC targeting to enhance its corporate and retail banking business in Kenya through the acquisition. Access Bank is Nigeria’s largest lender by assets, with an asset base of USD 16.7 bn (equivalent to Kshs 1.7 tn) as at Q1’2020. The deal will see Nigerian banks deepen their presence in Kenya with the United Bank of Africa (UBA) and Guarantee Trust Bank already in the market. For more information on the transaction, see Cytonn Weekly #03/2020,

- On 7th April 2020, the Central Bank of Kenya (CBK) approved the acquisition of a 51.0% stake in Mayfair Bank Limited by an Egyptian lender, Commercial International Bank (CIB), effective 1st May 2020 for an undisclosed amount. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will diversify and strengthen the resilience of the Kenyan banking sector. Commercial International Bank, Egypt’s leading private sector bank, has an asset base of USD 24.2 bn (Kshs 2.5 tn) as of December 2019. CIB’s business model focusses on individuals, SMEs, institutions, and corporates and will be the first Egyptian bank to establish a presence in Kenya. The deal will see CIB provide Mayfair Bank Limited with the requisite skills, resources, and infrastructure to scale up its business. For more information on the transaction, see Cytonn Weekly #17/2020,

- On 4th May 2020, the Central Bank of Kenya approved the acquisition of Imperial Bank’s assets and assumption of liabilities worth Kshs 3.2 bn each by KCB Group effective 2nd June 2020. The move will see Imperial Bank depositors paid a total of Kshs 3.2 bn over a period of 4 years and will have cumulatively recovered 37.3% of the deposits since 2015 when payments commenced, with a bulk of the deposits amounting to Kshs 53.3 bn remaining with Kenya Deposit Insurance Corporation (KDIC). Imperial Bank was put under receivership (a process that can assist creditors to recover funds in default and can help troubled companies to avoid bankruptcy) in October 2015 due to inappropriate banking practices, with the CBK transferring Imperial Bank’s management and control to the KDIC. For more information on the transaction, see Cytonn Weekly #21/2020,

Other mergers and acquisitions activities announced recently include;

- Equity Group Holdings, in its expansion strategy, has various on-going acquisitions in the region having entered into a binding term sheet with Atlas Mara Limited to acquire certain banking assets in 4 countries in exchange for shares in Equity Group which are inclusive of:

- 62.0% of of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz), and;

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

These acquisitions will allow Equity Group Holdings an easy penetration into these four African countries. Successful completion of the above transactions will likely see Equity expand its regional footprint, aiding the bank’s performance. Read more information on the same here,

- Co-operative Bank of Kenya announced it has opened talks to acquire a 100.0% stake of Jamii Bora Bank Limited. The announcement came months after Commercial Bank of Africa (CBA), dropped its cash buy-out offer and instead, merged with NIC Bank to form NCBA Group. Read more information on the same here, and,

- Equity group was also given the green light by the Committee Responsible for Initial Determination (CID), a Commission mandated to monitor and investigate possible breaches of the COMESA Competition Regulations, to acquire a 66.5% controlling stake worth Kshs 10.9 bn in Banque Commerciale du Congo (BCDC), effectively valuing BCDC at Kshs 16.4 bn. The transaction will see Equity Group pay Kshs 17,430 per share to acquire 625,354 shares in BCDC, a deal inclusive of dividends issued as at 1st January 2020, from the George Arthur Forrest family, and will see Equity integrate the bank with its subsidiary, Equity Bank Congo, to create the second-largest bank in Democratic Republic of Congo (DRC). Read more on the same here

Below is a summary of the deals in the last 5-years that have either happened, been announced or expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

Undisclosed |

N/A |

May-20* |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC |

1.9 |

100.0% |

Undisclosed |

N/A |

Jan-20** |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

3.2 |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

75.7% |

1.4x |

||||

|

*Announcement date ** Deals that were dropped |

||||||

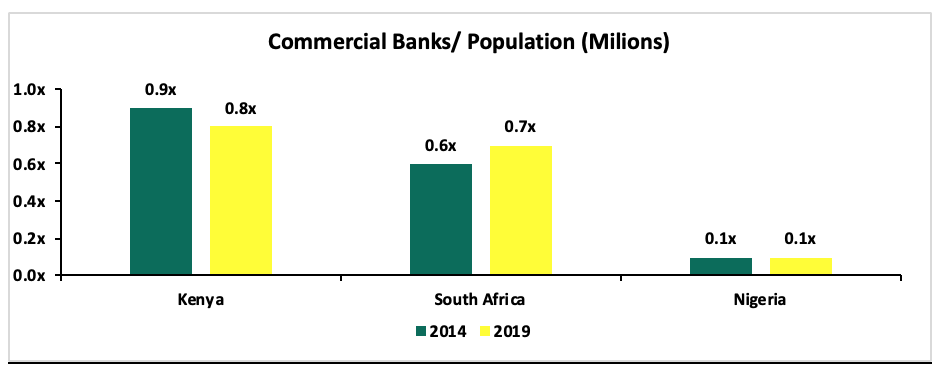

The number of commercial banks in Kenya has now reduced to 38, compared to 43 banks from 5-years ago. The ratio of the number of banks and Kenya’s 47.6 million people now stands at 0.8x, compared with a ratio of 0.9x, 5-years ago. The ratio is improving, however, Kenya still remains overbanked as the number of banks remains relatively high compared to the population. For more on this see our topical

3. Asset Quality - Asset quality deteriorated in Q1’2020 with the gross NPL ratio increasing by 0.9% points to 11.3% from 10.4% in Q1’2019. This was high compared to the 5-year average of 8.5%. In accordance with IFRS 9, banks are expected to provide both for the incurred and expected credit losses. Consequently, this saw the NPL coverage increase to 57.4% in Q1’2020 from 54.5% in Q1’2019 as banks bank adopted a cautious stance on the back of the expected impact of the COVID-19 pandemic. We expect higher provisional requirements to subdue profitability during the year across the banking sector on account of the tough business environment.

In our view, further relaxation of provisioning rules by the Central Bank, as part of the prudential guidelines would be a welcomed move. This would be in the form of adjustment to the loan classification in the different categories, (Normal and watch, Substandard, Doubtful Debts, and Loss, where the loans are now classified as being impaired). The table below highlights the characteristics of the different categories of loans;

|

Loan Classification |

Interpretation |

|

Normal |

· These are well-documented loans granted to financially sound customers. All such loans must be performing per the contractual terms and are expected to continue doing so |

|

Watch |

· Loans in this category may be currently protected and may not be past due but exhibit potential weaknesses which may, if not corrected, weaken the asset or inadequately protect the institution’s position at a future date · Principal or interest is due and unpaid for 30 to 90 days, Interest payments are outstanding for 30 to 90 days or have been refinanced, or rolled over |

|

Substandard |

· The primary sources of repayment are not sufficient to service the debt and the institution must look to secondary sources such as collateral, sale of fixed assets, refinancing, or additional capital injections for repayment. · Principal or interest is due and unpaid for more than 90 days to 180 days |

|

Doubtful |

· Loans in this category have all the weaknesses inherent in a substandard loan plus the added characteristic that the loan is not well secured. These weaknesses make collection in full, based on currently existing facts, conditions, and value, highly questionable and improbable. · Principal or interest is due and unpaid for over 180 days. |

|

Loss |

· Loans, which are considered uncollectible or of such little value that their continuance recognition as bankable assets is not warranted shall be classified |

Source: Central Bank of Kenya

Relaxation on the regulations when it comes to classification on how long before a loan is considered non-performing might see a reduction in the provisions’ requirements, consequently supporting Banks’ bottom line, as well as help conserve Bank's capital position. The NPL ratios has been on the rise over the last years partly also due to the adoption of IFRS 9. The chart below highlights the asset quality trend:

4. Capital Conservation: Some listed companies including listed banks announced that they were suspending cash dividends in a bid to conserve capital amid the current tough operating conditions emanating from the effects of the Coronavirus pandemic. A similar trend has been mirrored globally by both financial and non-financial businesses frantically seeking ways to save money with several regulators around the world encouraging companies to cease the discretionary payments of dividends to shareholders amid the COVID-19 pandemic in order to boost capital. For instance, in the United Kingdom (UK), the seven largest banks sought to cancel dividend pay-outs despite having solid capital bases, due to fears of an economic recession. Some of the banks that have already announced the deferral of dividends payments in Kenya include;

- Equity Group whose Board of Directors withdrew their recommendation to pay a first and final dividend of Kshs 2.5 per share for FY’2019, and instead recommended to shareholders that no dividend being paid. This decision was made after considering the effects of the COVID-19 pandemic and the need to conserve cash to enable the company to respond appropriately to the unfolding crisis in terms of supporting its customers through the crisis and directing cash resources to potential opportunities that may arise as economies in which the group operates begin to recover,

- NCBA Group announced it would withhold the final dividend payment of Kshs 1.5 per share, to shareholders totalling to Kshs 2.2 bn for FY’2019. The dividend was to be paid to shareholders registered on the company’s register at the close of business (book closure) on 23rd April 2020. NCBA’s board instead recommended the payment of a stock dividend (bonus Issue) and not a cash dividend, which will be issued to shareholders registered on the company’s register at the close of business on 12 May 2020. The bonus share issue will see shareholders receive one share for every ten held, creating 149.8 mn additional shares, given that the entity currently has 1.5 bn shares listed on the securities exchange. The additional shares are valued at Kshs 4.3 bn based on NCBA’s share price of Kshs 28.75 as at 24 April 2020. The stock dividend valued at Kshs 4.3 bn is more than what the lender would have paid in cash dividend of Kshs 2.2 bn. For more information on this see Cytonn Weekly # 17/2020,

- Standard Chartered Bank announced the postponement of payment of the proposed final dividend of Kshs 15.0 per share for FY’2019 that was scheduled to be paid on 28th May 2020. The lender indicated that given that their 34th Annual General Meeting (AGM) which was to take place on 28th May 2020, remained postponed, the payment of the final dividend would be delayed because approval of the final dividend payment would be at the AGM,

Section II: Summary of the Performance of the Listed Banking Sector in Q1’2020:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

Key takeaways from the table above include:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

I&M |

(29.7%) |

5.7% |

7.1% |

4.6% |

5.7% |

7.4% |

38.8% |

12.9% |

8.8% |

(2.6%) |

76.0% |

8.3% |

17.5% |

|

ABSA |

17.0% |

2.8% |

(1.9%) |

4.5% |

7.4% |

9.1% |

15.8% |

(0.2%) |

6.6% |

7.2% |

85.0% |

12.4% |

17.0% |

|

Equity |

(14.1%) |

14.3% |

26.7% |

10.6% |

8.2% |

15.8% |

41.9% |

12.5% |

16.5% |

14.2% |

75.9% |

24.1% |

20.7% |

|

COOP |

(0.3%) |

4.5% |

(4.4%) |

8.5% |

8.2% |

19.0% |

39.9 % |

28.3% |

6.9% |

11.5% |

81.3% |

9.8% |

18.5% |

|

KCB |

8.4% |

20.4% |

26.6% |

18.5% |

8.1% |

30.5% |

34.4% |

33.6% |

34.1% |

52.0% |

74.8% |

19.3% |

20.0% |

|

SCBK |

(16.6%) |

(4.3%) |

(1.3%) |

(5.1%) |

7.2% |

(6.5%) |

32.1% |

(5.2%) |

4.6% |

(13.7%) |

51.5% |

6.8% |

15.8% |

|

Stanbic |

(33.5%) |

(7.1%) |

0.5% |

(11.0%) |

5.5% |

(29.2%) |

43.2% |

(37.6%) |

6.4% |

(19.9%) |

79.8% |

11.8% |

14.1% |

|

DTBK |

3.7% |

(2.4%) |

(9.0%) |

2.9% |

5.7% |

3.4% |

25.4% |

9.6% |

(0.9%) |

1.9% |

73.8% |

6.7% |

12.6% |

|

NCBA *** |

(26.8%) |

6.8% |

8.3% |

5.5% |

3.3% |

25.9% |

49.7% |

49.7% |

9.9% |

66.2% |

63.0% |

2.2% |

10.7% |

|

HF |

N/A |

(7.8%) |

(20.9%) |

13.7% |

4.5% |

(2.0%) |

30.4% |

(3.7%) |

11.8% |

39.3% |

101.1% |

(8.5%) |

0.5% |

|

Q1’2020 Mkt Weighted Average* |

(7.4%) |

8.2% |

11.4% |

7.4% |

7.2% |

15.9% |

22.7% |

24.5% |

14.3% |

14.9% |

74.1% |

14.1% |

17.2% |

|

Q1’2019 Mkt Weighted Average** |

12.2% |

3.6% |

2.5% |

4.5% |

8.0% |

10.7% |

36.0% |

11.2% |

11.0% |

16.1% |

74.0% |

7.7% |

19.2% |

|

*Market cap-weighted as at 02/06/2020 |

|||||||||||||

|

**Market cap weighted as at 31/05/2019 ***The financial statements of the bank have been prepared on a prospective basis (assuming a continuation of CBA), representing Q1’2020 results of NCBA bank (merged bank) with prior year comparatives (Q1’2019) being those of CBA bank. Hence, the results are not comparable on a like for like basis. As such, we have used proforma-combined financials for the two entities. |

|||||||||||||

- The above ten listed Kenyan banks recorded a 7.4% average decline in core Earnings per Share (EPS) compared to a growth of 12.2% in Q1’2019, the depressed earnings recorded in the listed banking sector is partly attributed to the tough operating environment occasioned by the ongoing Coronavirus pandemic, which saw total operating expenses increase by 25.6%, outpacing the 10.3% increase recorded on total operating income,

- The 10 listed Banks, recorded a deposit growth of 14.3%, faster than the 11.0% growth recorded in Q1’2019. Interest expenses on the other hand rose by 11.4%, faster than 2.5%, recorded in Q1’2019. The cost of funds, however, declined coming in at a weighted average of 3.1% in Q1’2020 down from 3.5% in Q1’2019 owing to the faster 12.2% growth average interest-bearing liabilities indicating that the listed banks were able to mobilize cheaper deposits,

- Average loan growth came in at 14.1%, which was faster than the 7.7% recorded in Q1’2019, with the growth in loans being accelerated following the repeal of interest rate cap in November 2019, coupled with increased demand in funding, as businesses demand working capital to operate in the tough operating environment as a result of the pandemic. As of May 2020, the key sectors that had received funding by banks were tourism and hospitality sector, transport and communication sector, trade sector, real estate sector, and the manufacturing sector which received 34.5%, 13.8%, 12.4%, 12.4%, and 11.8% respectively of the total funding by banks. Government securities, on the other hand, recorded a growth of 14.9% y/y, which was faster compared to the loans, albeit slower than the 16.1% growth recorded in Q1’2019. This highlights banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns,

- Interest income rose by 8.2%, compared to a growth of 3.6% recorded in Q1’2019. The faster growth in interest income may be attributable to the 14.1% growth in loans and increased allocation to government securities. The net interest income increased by 7.4% slower than the 10.7% rise in average interest-earning assets. Consequently, the Net Interest Margin (NIM) declined to 7.2%, compared to the 8.0% recorded in Q1’2019 for the whole listed banking sector, and,

- Non-Funded Income grew by 15.9% y/y, faster than 10.7% recorded in Q1’2019. The growth in NFI was supported by the 24.5% average increase in total fee and commission income, which was faster than the 11.2% growth recorded in Q1’2019.

Section III: Outlook on the Focus Areas of the Banking Sector Players Going Forward:

In summary, the banking sector showed resilient performance despite the tough operating environment which was largely attributable to persistent revenue diversification evidenced by the 15.9% growth in NFI in Q1’2020 from 10.7% growth in Q1’2020. Growth in NFI was attributable to the growth in fees and commissions which recorded a 24.5% growth in Q1’2020. Despite this, core earnings per share declined in Q1’2020 by 7.4% as compared to the 12.2% growth witnessed in Q1’2019 pointing towards depressed earnings.

Based on the current tough operating environment, we believe 2020 performance in the banking sector will be shaped by the following key factors

i. Reduction of the Cash Reserve Ratio (CRR): The Monetary Policy Committee (MPC) during their 29th April 2020 meeting lowered the Cash Reserve Ratio (CRR), which is a fraction of total customer deposits that the commercial banks have to hold with the Central Bank, by 100 bps to 4.25% from 5.25%. The reduction is projected to have injected approximately Kshs. 35.0 bn in additional liquidity, to commercial banks for onward lending to distressed borrowers. The reduction was a first one since July 2009. In their May 7th, 2020 presentation to the Senate Ad Hoc Committee on the COVID-19 situation, the CBK disclosed that 18 commercial banks and 2 microfinance banks had been granted approval to access Kshs 29.1 bn (82.6% of the Kshs 35.2 bn), following the CRR reduction. For more information on the funding allocation by sector in May compared to April 2020 see Cytonn Weekly # 21/2020,

Some of the listed banks that have provided the credit facilities include;

- KCB Group, which announced that it had set aside a Kshs 30.0 bn credit facility, in an effort to cushion individuals and businesses grappling with the effects of the Coronavirus pandemic. The credit facility will be accessed through the lender's mobile lending platform, KCB M-Pesa, and will issue loans from Kshs 50.0 to Kshs 1.0 mn, depending on the customer’s credit rating. The loan facility offers repayment periods of 30-days, 60-days, and 90-days with interest rates of between 2.0% and 6.0%, per month,

- Diamond Trust Bank (DTB), which committed Kshs.100 mn towards cushioning Kenyans against the effects of the COVID-19 pandemic. DTBK will channel Kshs 50.0 mn directly to the COVID-19 Emergency Response Fund towards interventions for providing relief for the vulnerable families of the Kenyan Society. The other Kshs 50.0 mn will be used towards various supportive initiatives that the Bank would want to be involved in to support vulnerable members of the community, and,

- Standard Chartered Bank, which donated Kshs 122.0 mn to boost short term emergency relief to support vulnerable communities in the country. The bank has also extended Kshs 1.6 bn of additional financing to Small and Medium Entreprises (SMEs).

ii. Depressed Interest Income: With the large amount of restructuring and reclassification of loans witnessed in Q1’2020, we expect risks to crystallize in the next quarter given that the first Coronavirus case was reported in the country on 13th March 2020, just two weeks to the end of Q1’2020. Due to loan restructuring and relaxed rules on some interest payment, the bank’s core source of revenue which is interest income may be negatively affected. Banks are also not lending aggressively with the credit risk being relatively elevated with many sectors having been affected by the pandemic. We foresee a slower growth in loans in the next quarter and thereafter if the pandemic is to persist further with banks turning to less risky investments such as government securities which rose by 14.9 % faster than the 14.1% rise in loans in Q1’2020,

iii. Increased Provisioning- The risk of loan defaults remain elevated following the Coronavirus pandemic that has affected many businesses globally due to disruption in the supply chain and reduced demand due to constrained cash flows. As such, we expect higher provisioning requirements as per the IFRS guidelines, thus subdued profitability during the year across the banking sector, which is expected to be further heightened by the slow business activity in the country. As per the Stanbic Bank’s Monthly Purchasing Managers’ Index (PMI), the PMI index came in at 37.5, 34.8, and 36.7 for the month of March, April, and May 2020, respectively, lower than the 5-year average of 51.4. A reading below 50 indicates a worsening outlook.

iv. Cost Rationalization: Given the expectation of depressed revenues, banks are expected to continue pursuing their cost rationalization strategies. A majority of banks have been riding on the digital revolution wave to improve their operational efficiency. Increased adoption of alternative channels of transactions such as mobile, internet, and agency banking, has led to increased transactions carried out via alternative channels and out of bank branches, which have been reduced to handling high-value transactions and other services such as advisory. Thus banks reduced front-office operations, thereby cutting the number of staff required and by extension, reducing operating expenses and hence, improving operational efficiency,

v. Continued Revenue Diversification - The increase in NFI growth outperformed that of interest income, thus, allowing the banks to remain profitable amid a rigid regulatory environment. However, with the new regulations put in place by the Central bank to cushion citizens against the effects of the COVID-19 pandemic, banks’ non-interest income is likely to be depressed. Some measures such as waiving all charges for balance inquiry through digital platforms will see banks record lower income from the fees they charge,

vi. Expansion and Further Consolidation - With the Microfinance-Bill 2019 of increasing the minimum on core capital requirements still in its pilot stage more mergers and acquisitions would enable the unprofitable and/or smaller banks to manage the requirement and be able to increase profitability through cost efficiency and deposits growth.

Section IV: Brief Summary and Ranking of the Listed Banks based on the Outcome of Our Analysis:

As per our analysis on the banking sector from a franchise value and a future growth opportunity perspective, we carried out a comprehensive ranking of the listed banks. For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review of the banks:

|

Bank |

Loans to Deposits Ratio |

Cost to Income Ratio |

Return on Average Capital Employed |

Deposit/Branch |

Gross NPL Ratio |

NPL Coverage |

Tangible Common Ratio |

Non-Funded Income/Revenue |

|

I&M Holdings |

76.0% |

52.9% |

17.5% |

3.6 |

11.3% |

58.8% |

16.3% |

38.8% |

|

DTB Kenya |

73.8% |

52.9% |

12.6% |

2.0 |

8.0% |

42.4% |

15.6% |

25.4% |

|

KCB Group Plc |

74.8% |

61.1% |

20.0% |

2.2 |

11.1% |

61.3% |

13.7% |

34.4% |

|

Stanbic Bank |

79.8% |

59.0% |

14.1% |

7.8 |

12.1% |

59.3% |

13.0% |

43.2% |

|

Co-operative Bank |

81.3% |

58.1% |

18.5% |

2.1 |

10.8% |

54.8% |

16.9% |

39.9% |

|

Standard Chartered Bank |

51.5% |

58.1% |

15.8% |

6.8 |

14.2% |

78.1% |

15.1% |

32.1% |

|

Equity Group Holdings |

75.9% |

64.7% |

20.7% |

1.7 |

11.2% |

45.8% |

15.7% |

41.9% |

|

NCBA Group Plc |

63.0% |

76.1% |

10.7% |

4.8 |

14.5% |

54.5% |

12.3% |

49.7% |

|

Absa Bank Kenya |

85.0% |

60.1% |

17.0% |

2.8 |

8.1% |

64.5% |

11.0% |

34.5% |

|

HF Group Plc |

101.1% |

101.1% |

0.5% |

1.8 |

27.3% |

52.2% |

16.8% |

30.4% |

|

Weighted Average Q1'2020 |

74.2% |

61.4% |

17.8% |

3.2 |

11.3% |

57.4% |

14.5% |

38.2% |

The overall ranking was based on a weighted average ranking of Franchise value (accounting for 40%) and intrinsic value (accounting for 60%). The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation, while the Franchise ranking is based on banks operating metrics, meant to assess efficiency, asset quality, diversification, and profitability, among other metrics. The overall Q1’2020 ranking is as shown in the table below:

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

Q1'2020 Rank |

FY'2019 Ranking |

|

I&M Holdings |

51 |

2 |

21.6 |

1 |

2 |

|

Co-operative Bank of Kenya Ltd |

49 |

4 |

22 |

2 |

3 |

|

KCB Group Plc |

56 |

3 |

24.2 |

3 |

1 |

|

Equity Group Holdings Ltd |

60 |

5 |

27 |

4 |

4 |

|

DTBK |

67 |

1 |

27.4 |

5 |

5 |

|

ABSA |

62 |

8 |

29.6 |

6 |

7 |

|

Stanbic Bank/Holdings |

65 |

6 |

29.6 |

7 |

6 |

|

SCBK |

75 |

9 |

35.4 |

8 |

9 |

|

NCBA Group Plc |

83 |

7 |

37.4 |

9 |

8 |

|

HF Group Plc |

92 |

10 |

42.8 |

10 |

10 |

Major Changes from the Q1’2020 Ranking are:

- Co-operative Bank of Kenya Ltd whose rank improved to Position 2 from Position 3 in FY’2019 mainly due to an improvement in the Gross NPL ratio to 10.8% in Q1’2020 from 11.2% in FY’2019, in turn, improving its franchise value score, and,

- KCB Group whose rank declined to Position 3 from Position 1 in FY’2019 mainly due to a deterioration in the cost to income ratio to 61.1% in Q1’2020 from 56.2% in FY’2019 thus, in turn, worsening the franchise value score.

For more information, see our Cytonn Q1’2020 Listed Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.