The Private Sector Credit Growth in Kenya, & Cytonn Weekly #13/2025

By Cytonn Research, Mar 30, 2025

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed for the first time in seven weeks, with the overall subscription rate coming in at 61.4%, a reversal from the oversubscription rate of 129.0% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 2.8 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 69.8%, higher than the undersubscription rate of 43.2% recorded the previous week. The subscription rates for the 182-day paper decreased to 17.1% from the 84.0% recorded the previous week, while the 364-day paper decreased to 102.5% from the 208.2% recorded the previous week. The government accepted a total of Kshs 14.5 bn worth of bids out of Kshs 14.7 bn bids received, translating to an acceptance rate of 98.4%. The yields on the government papers were on a downward trajectory with the yields on the 364-day paper decreasing by 4.9 bps to 10.4%, from 10.5% recorded the previous week, while the yields on the 91-day and 182-day papers decreased by 4.9 bps and 2.8 bps to remain relatively unchanged from 8.8% and 9.1% respectively recorded the previous week;

Also, we are projecting the y/y inflation rate for March 2025 to increase marginally to within the range of 3.6% - 3.8% mainly on the back of the decrease in the Central Bank Rate (CBR) by 50.0 bps to 10.75% from 11.25%. The lower rates are expected to translate to lower borrowing costs and increasing consumer spending;

Equities

During the week, the equities market recorded mixed performance, with NASI and NSE 10 each gaining by 0.5%, while NSE 20 and NSE 25 lost by 0.8% and 0.1% respectively, taking the YTD performance to gains of 8.2%, 4.4%, 2.2% and 1.1% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Safaricom, Stanbic and Absa of 3.1%, 1.1%, and 1.1%, respectively. The performance was however weighed down by losses recorded by large cap stocks such as DTB-K, EABL and Standard Chartered of 5.0%, 2.8% and 1.6% respectively;

During the week, Equity Group released its FY’2024 financial results, Equity Group’s Profit After Tax (PAT) increased by 11.6% to Kshs 48.8 bn, from Kshs 43.7 bn in FY’2023. The performance was mainly driven by a 6.7% increase in Total Operating Income to kshs 193.8 bn, from kshs 181.7 bn in FY’2023, which outpaced the 2.5% increase in total operating expense to kshs 133.0 bn in FY’2024, from kshs 129.8 bn in FY’2023;

During the week, NCBA Group released its FY’2024 financial results, NCBA Group’s Profit After Tax (PAT) increased by 1.9% to Kshs 21.9 bn, from Kshs 21.5 bn in FY’2023. The performance was mainly driven by a 1.6% decrease in operating expenses to Kshs 37.6 bn, from Kshs 38.2 bn in FY 2023, which outpaced 1.5% decrease in total operating income to Kshs 62.7 bn, from Kshs 63.7 bn in FY’2023.The decrease in Operating expenses was largely driven by the 40.1% decrease in loan loss provisions expense to Kshs 5.5 bn, from 9.2 bn in FY’2023.

During the week, I&M Group released its FY’2024 financial results, I&M Group’s Profit After Tax (PAT) increased by 24.8% to Kshs 16.7 bn, from Kshs 13.3 bn in FY’2023. The performance was mainly driven by a 20.0% increase in Total Operating Income to Kshs 51.2 bn, from Kshs 42.7 bn in FY’2023, which outpaced the 15.2% increase in Total Operating expense to Kshs 31.3 bn in FY’2024, from Kshs 27.2 bn in FY’2023;

During the week, DTB-K released its FY’2024 financial results, DTB-K’s Profit After Tax (PAT) increased by 13.1% to Kshs 8.8 bn, from Kshs 7.8 bn in FY’2023. The performance was mainly driven by a 4.3% increase in Total Operating Income to Kshs 41.4 bn, from Kshs 39.7 bn in FY’2023, coupled with the 2.3% decrease in Total Operating expense to Kshs 30.2 bn in FY’2024, from Kshs 30.9 bn in FY’2023;

During the week HF Group released its FY’2024 financial results, HF Group’s Profit After Tax (PAT) increased by 35.2% to Kshs 0.5 bn, from Kshs 0.4 bn in FY’2023. The performance was mainly driven by a 9.9% increase in Total Operating Income to Kshs 4.2 bn, from Kshs 3.8 bn in FY’2023, which outpaced the 7.0% increase in Total Operating expense to Kshs 3.7 bn in FY’2024, from Kshs 3.5 bn in FY’2023;

During the week, CIC Group released their FY’2024 results. CIC’s Profit After Tax (PAT) increased by 98.0% to Kshs 2.9 bn from Kshs 1.4 bn, recorded in FY’2023. The performance was mainly driven by a 35.7% increase in Net investment income to Kshs 8.8 bn in FY’2024, from Kshs 2.9 bn in FY’2023, and further supported by a 14.0% decrease in Net expenses from reinsurance contracts to Kshs 1.8 bn, from Kshs 2.1 bn in FY’2023. However, the performance was weighed down by the 56.4% decrease in net income from insurance services to Kshs 0.3 bn, from Kshs 0.8 bn in FY’2024;

During the week, Britam Holdings released their FY’ 2024 results. Britam’s Profit After Tax (PAT) increased by 53.5% to Kshs 5.0 bn, from Kshs 3.3 bn recorded in FY’2023. The performance was mainly driven by a 163.4% increase in Net Investment income to Kshs 30.6 bn, from Kshs 11.6 bn in FY’2023 as well as a 35.5% increase in net insurance and investment result to Kshs 9.2 bn from 6.8 bn in FY 2023 but was weighed down by the 208.8% increase in Insurance Expenses to Kshs 26.4 bn in FY’2024, from Kshs 8.6 bn in FY’2023;

During the week, Liberty Kenya Holdings released their FY’ 2024 results, with Profit After Tax (PAT) increasing by 119.7% to Kshs 1.4 bn, from Kshs 0.6 bn recorded in FY’2023, mainly driven by a 99.8% increase in Net investment income to Kshs 2.0 bn, from Kshs 1.0 bn in FY’2023, and further supported by 5.6 % increase in Net insurance income to Kshs 1.00 bn, from Kshs 0.95 bn in FY’2023;

During the week, Kenya Airways Plc released their FY’2024 results, recording a significant 123.9% increase in Profit After Tax to Kshs 5.4 bn, from the Kshs 22.7 bn loss recorded in FY’2023. The performance was mainly driven by a 106.5% increase in forex gains on borrowings, attributable to the 17.4% appreciation of the Kenyan shilling in 2024, coupled with a 57.8% increase in operating profit to Kshs 16.6 bn, from the Kshs 10.5 bn recorded in FY’2023. The Kshs 5.4 bn profit after tax was the highest ever recorded in Kenya Airways’ history due to the recovery strategy under Project Kifaru;

During the week KCB Group Plc disclosed its plan of acquisition of a 75.0% controlling interest in Riverbank Solutions Limited, a fintech entity focused on payment systems, as part of its strategic initiative to bolster digital capabilities and reinforce its footprint in banking, agency solutions, and business services across Kenya, Uganda, and Rwanda. The integration of Riverbank’s capabilities is expected to facilitate the unification of KCB’s agent banking channels into a single platform, optimizing operational efficiency;

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) January 2025 Reports, which highlighted the performance of major economic indicators;

During the week, state-backed mortgage lender, Kenya Mortgage Refinance Company (KMRC) released its FY’2024 financial results, which reported a 55.9% increase in Profit After Tax (PAT) to Kshs 1.3 bn from Kshs 847.8 mn recorded in FY’2023 majorly attributable to 33.9% increase in interest income to Kshs 3.2 bn in FY’2024 from 2.4 bn in FY’2023;

Additionally, during the week, on the Real Estate Investments Trusts Sector, Acorn I-REIT, D-REIT, Laptrust I-REIT and ILAM Fahari I-REIT released their FY’2024 results that showed performance of these REITs;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 21st March 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 21st March 2025, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

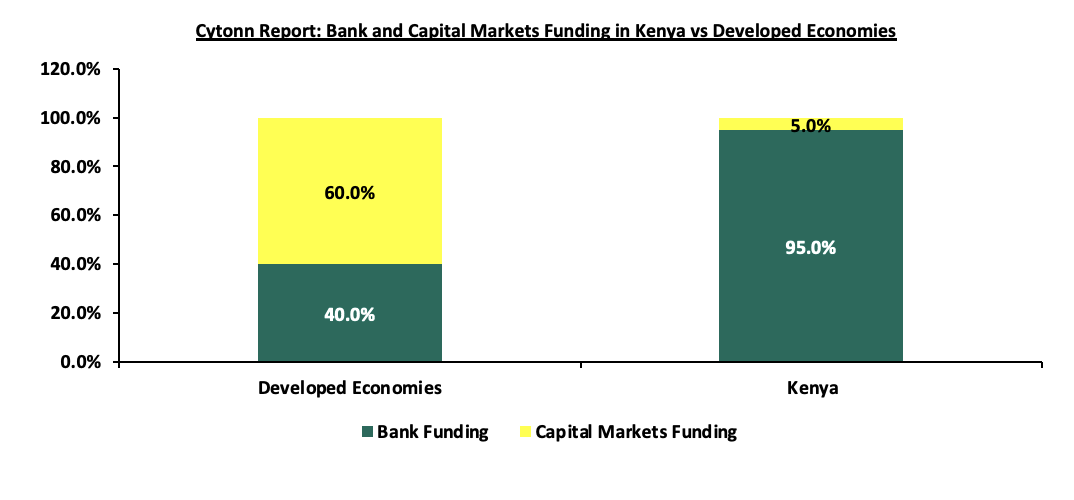

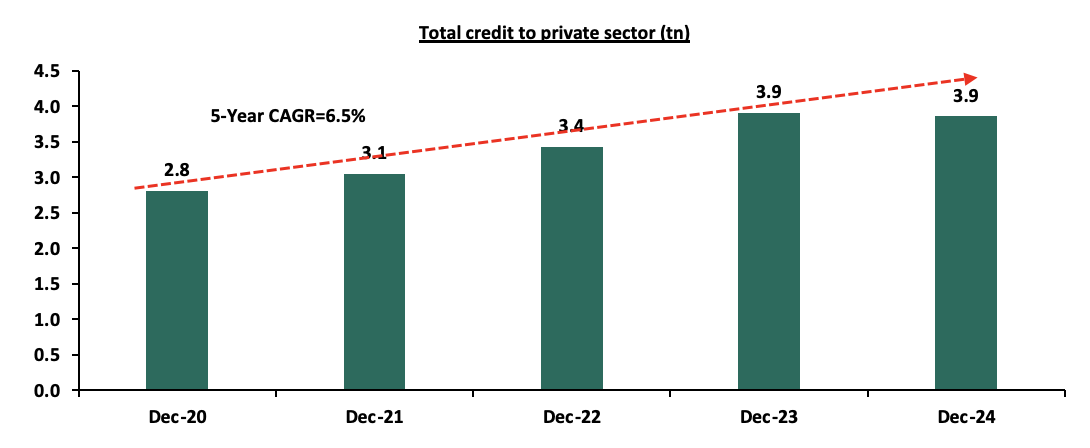

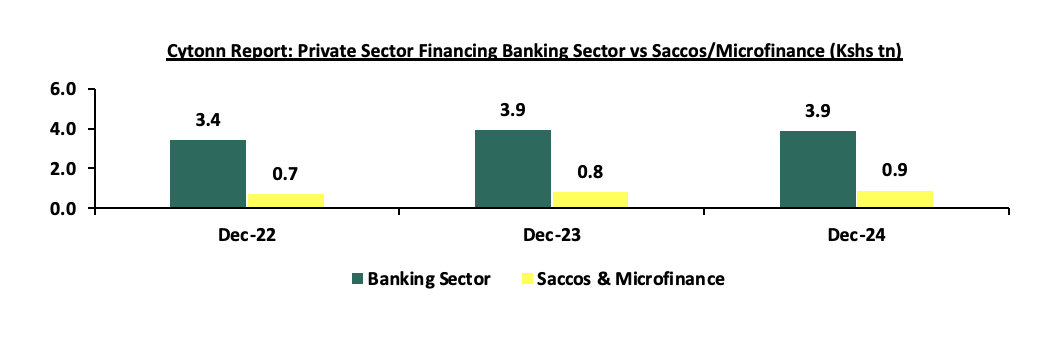

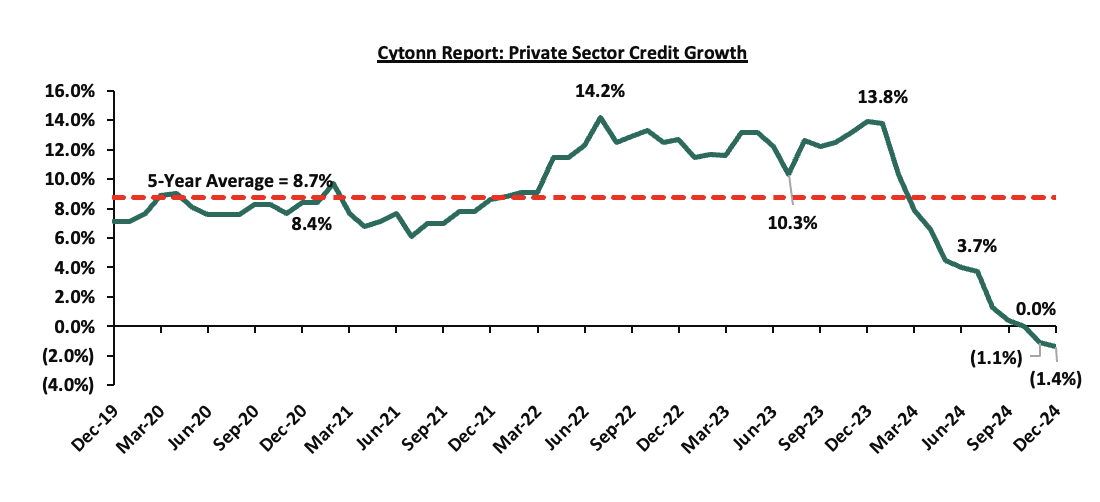

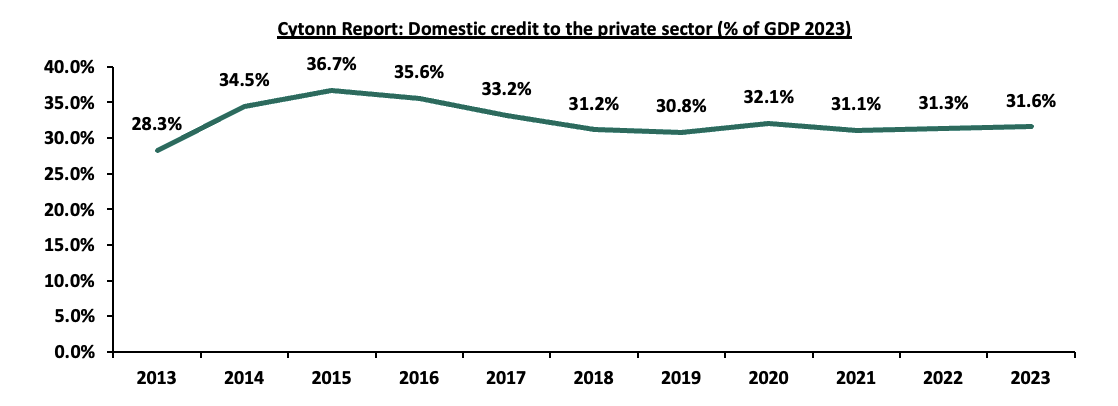

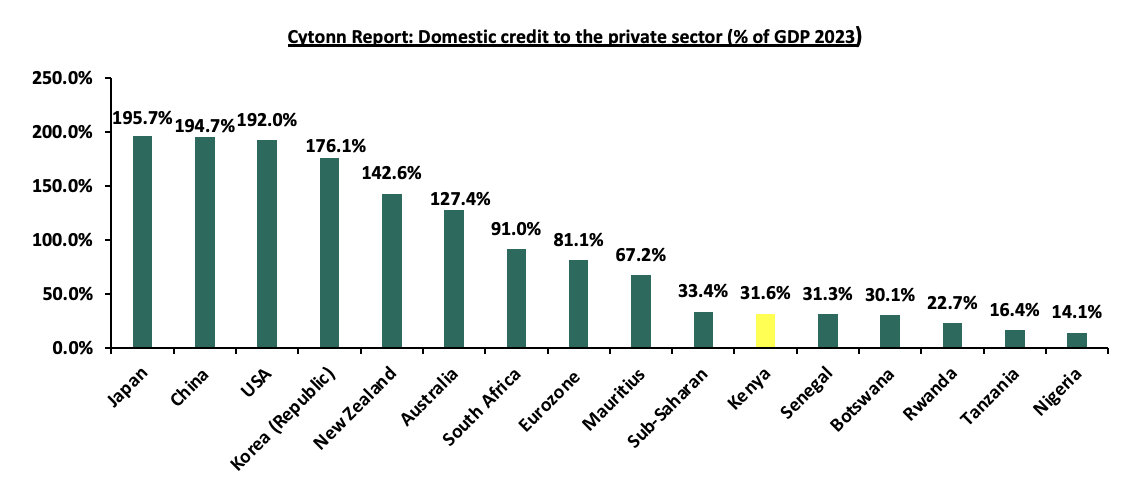

The private sector contributes significantly to Kenya's economic growth, with increased access to credit driving real GDP expansion. Credit availability is essential for businesses to expand, innovate, and stay competitive. Recent data from the Central Bank of Kenya (CBK) shows that credit to the private sector contracted by 1.4% as of December 2024, reflecting the impact of exchange rate valuation effects on foreign currency-denominated loans due to the Shilling's appreciation, along with decreased demand driven by high lending interest rates. As the government aims to reduce its fiscal deficit, fostering a supportive environment for private sector growth, especially for micro, small, and medium enterprises (MSMEs), will be crucial for increasing revenue collection. Achieving this requires policy reforms to strengthen the credit market and the introduction of sector-specific funds to drive business growth in key industries like finance, agriculture, manufacturing, and transport. Compared to developed economies, Kenya's private sector faces limited credit access, relying heavily on commercial banks with minimal availability of alternative financing options such as venture capital, equity financing, or government-backed credit programs. Banks continue to be the primary source of business credit, supplying a total Kshs 3.9 trillion extended to the private sector as of December 2024, 81.2% of the total extended to the sector (inclusive of microfinances and SACCOs), with the highest allocations directed towards trade (17.6%), manufacturing (15.0%), and private households (14.8%);

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.09% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

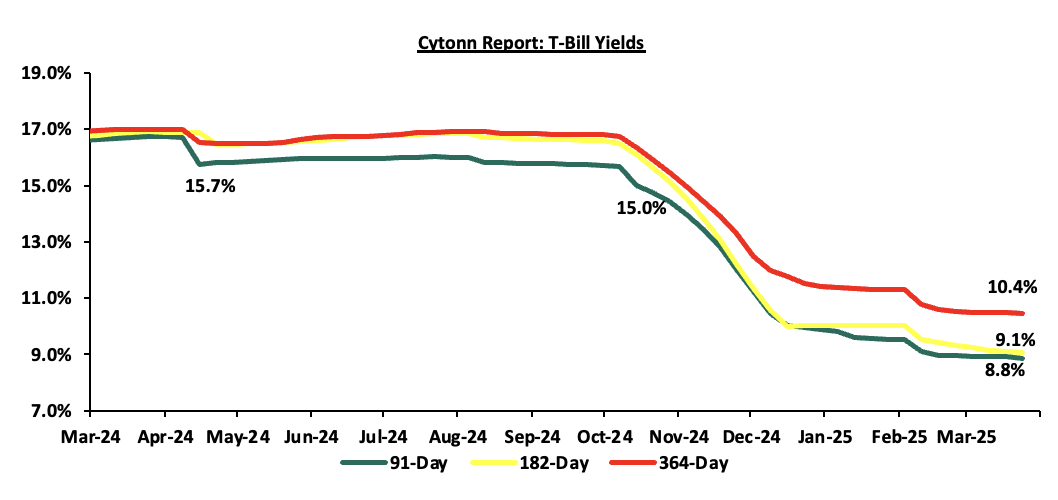

During the week, T-bills were undersubscribed for the first time in seven weeks, with the overall subscription rate coming in at 61.4%, a reversal from the oversubscription rate of 129.0% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 2.8 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 69.8%, higher than the undersubscription rate of 43.2% recorded the previous week. The subscription rates for the 182-day paper decreased to 17.1% from the 84.0% recorded the previous week, while the 364-day paper decreased to 102.5% from the 208.2% recorded the previous week. The government accepted a total of Kshs 14.5 bn worth of bids out of Kshs 14.7 bn bids received, translating to an acceptance rate of 98.4%. The yields on the government papers were on a downward trajectory with the yields on the 364-day paper decreasing by 4.9 bps to 10.4%, from 10.5% recorded the previous week, while the yields on the 91-day and 182-day papers decreased by 4.9 bps and 2.8 bps to remain relatively unchanged from 8.8% and 9.1% respectively recorded the previous week;

The charts below shows the yield performance of the 91-day, 182-day and 364-day papers from March 2024 to March 2025:

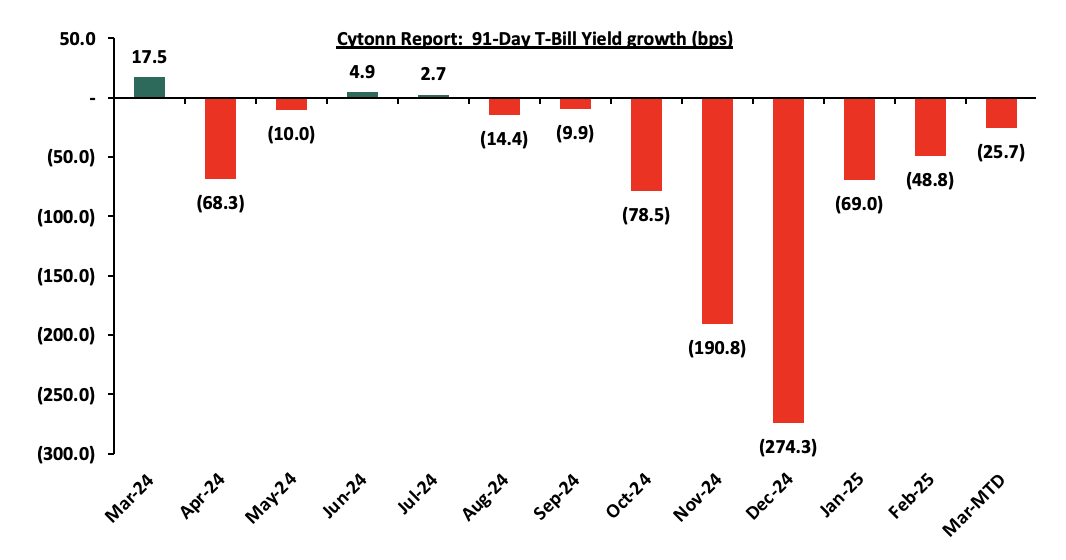

The chart below shows the yield growth for the 91-day T-bill:

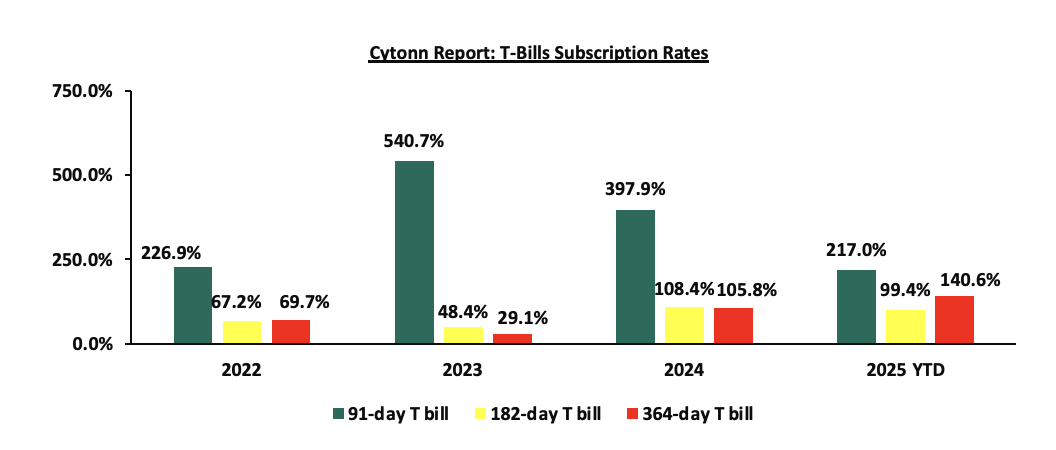

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

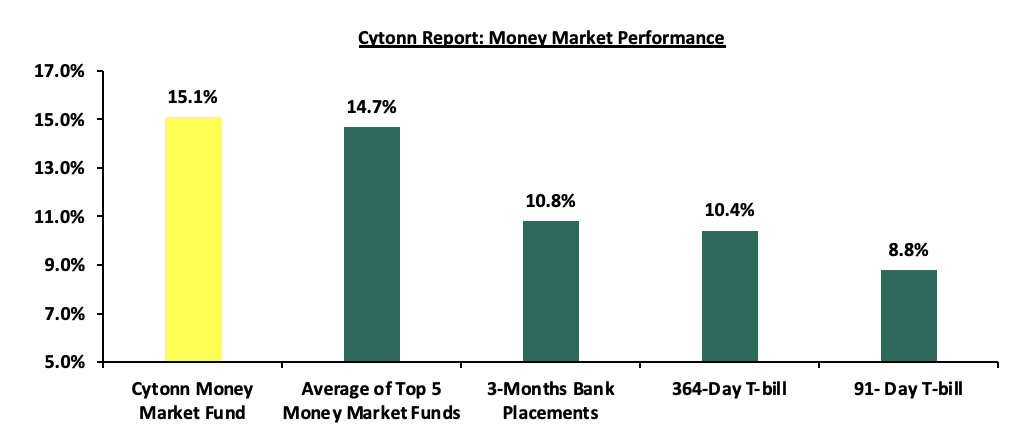

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 10.8% (based on what we have been offered by various banks), the yields on the government papers were on a downward trajectory with the yields on the 364-day paper decreasing by 4.9 bps to 10.4% from 10.5% recorded the previous week, while yields on the 91-day paper decreased by 4.9 bps to remain relatively unchanged from 8.8% recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 49.0 bps to 15.1% from the 15.6% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 12.4 bps to close the week at 14.7%, from the 14.8% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 28th March 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 28th March 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Gulfcap Money Market Fund |

16.3% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

15.1% |

|

3 |

Etica Money Market Fund |

14.1% |

|

4 |

Kuza Money Market fund |

14.0% |

|

5 |

Arvocap Money Market Fund |

14.0% |

|

6 |

Lofty-Corban Money Market Fund |

13.8% |

|

7 |

Orient Kasha Money Market Fund |

13.4% |

|

8 |

Ndovu Money Market Fund |

13.1% |

|

9 |

Enwealth Money Market Fund |

12.7% |

|

10 |

British-American Money Market Fund |

12.6% |

|

11 |

Old Mutual Money Market Fund |

12.4% |

|

12 |

Apollo Money Market Fund |

12.4% |

|

13 |

Madison Money Market Fund |

12.3% |

|

14 |

Nabo Africa Money Market Fund |

12.2% |

|

15 |

Dry Associates Money Market Fund |

12.1% |

|

16 |

Jubilee Money Market Fund |

12.1% |

|

17 |

Sanlam Money Market Fund |

11.9% |

|

18 |

Faulu Money Market Fund |

11.7% |

|

19 |

GenAfrica Money Market Fund |

11.6% |

|

20 |

Co-op Money Market Fund |

11.4% |

|

21 |

ICEA Lion Money Market Fund |

11.2% |

|

22 |

Absa Shilling Money Market Fund |

11.2% |

|

23 |

CIC Money Market Fund |

11.2% |

|

24 |

Genghis Money Market Fund |

11.0% |

|

25 |

KCB Money Market Fund |

10.9% |

|

26 |

Mali Money Market Fund |

10.8% |

|

27 |

AA Kenya Shillings Fund |

10.7% |

|

28 |

Mayfair Money Market Fund |

9.7% |

|

29 |

Stanbic Money Market Fund |

8.1% |

|

30 |

Ziidi Money Market Fund |

7.5% |

|

31 |

Equity Money Market Fund |

5.9% |

Source: Business Daily

Liquidity:

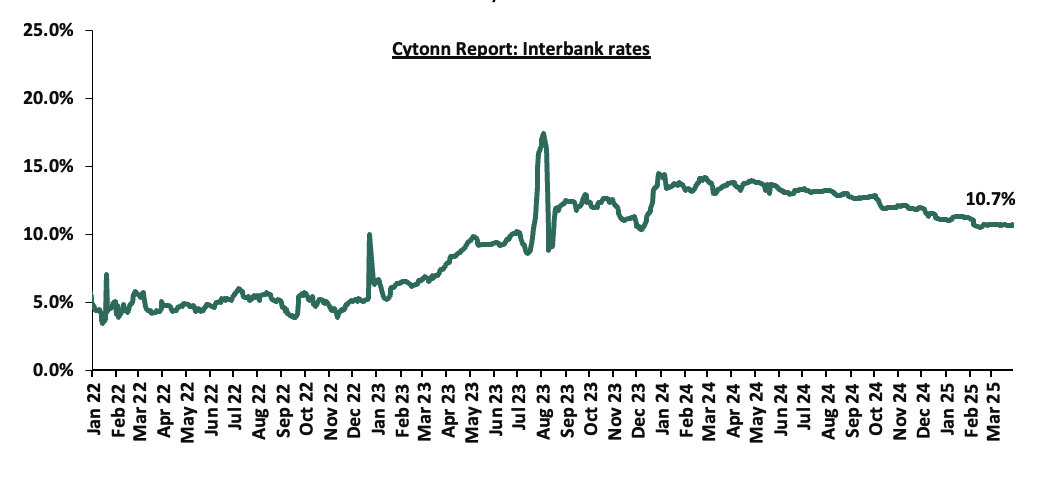

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 2.7 bps, to remain unchanged from the 10.7% recorded the previous week, partly attributable to tax remittances that were offset by government payments. The average interbank volumes traded increased by 30.1% to Kshs 12.1 bn from Kshs 9.3 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds recorded a mixed performance, with the yield on the 7-year issued in 2024 increasing the most by 46.6 bps to 10.2% from the 9.7% recorded the previous week, while the 13-year Eurobond issued in 2021 decreased the most by 1.0 bps to remain unchanged from the 10.3% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 20th March 2025;

|

Cytonn Report: Kenya Eurobonds Performance |

|

||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.3 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

3.0 |

23.0 |

2.2 |

7.2 |

9.3 |

5.9 |

11.0 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

03-Mar-25 |

8.0% |

10.0% |

7.3% |

9.5% |

9.6% |

9.4% |

|

|

20-Mar-25 |

8.5% |

10.3% |

7.2% |

9.8% |

10.3% |

9.7% |

|

|

21-Mar-25 |

8.7% |

10.5% |

7.2% |

10.1% |

10.1% |

10.0% |

|

|

02-Mar-25 |

8.6% |

10.4% |

7.2% |

10.0% |

10.1% |

10.0% |

|

|

25-Mar-25 |

8.6% |

10.4% |

7.1% |

9.9% |

10.0% |

10.0% |

|

|

26-Mar-25 |

8.7% |

10.6% |

7.2% |

10.1% |

10.2% |

10.0% |

|

|

27-Mar-25 |

8.7% |

10.6% |

7.5% |

10.2% |

10.3% |

10.2% |

|

|

Weekly Change |

0.2% |

0.4% |

0.2% |

0.4% |

(0.0%) |

0.5% |

- |

|

MTD Change |

0.7% |

0.6% |

0.1% |

0.7% |

0.6% |

0.8% |

- |

|

YTD Change |

(0.3%) |

0.4% |

(1.0%) |

0.1% |

0.2% |

0.1% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenyan Shilling appreciated marginally against the US Dollar by 6.0 bps, to Kshs 129.3 from the Kshs 129.4 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 0.8 bps against the dollar, compared to the 17.4% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,956.5 mn in the twelve months to February 2025, 14.5% higher than the USD 4,329.7 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the February 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.0% in the period,

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 14.6% to 2,394,376 in 2024 from 2,089,259 in 2023, and,

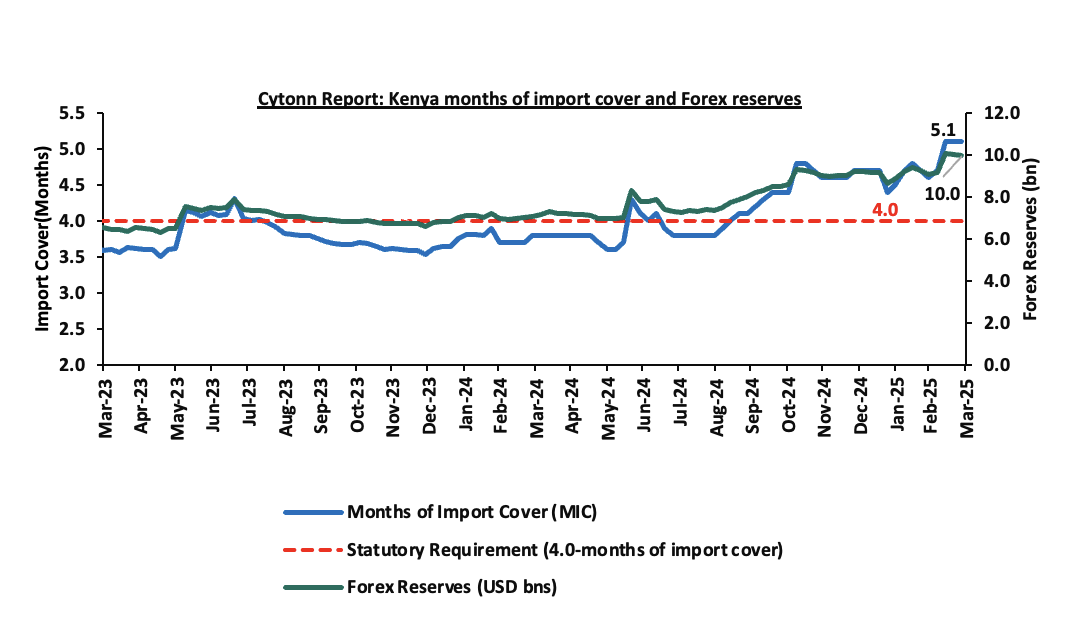

- Improved forex reserves currently at USD 10.0 bn (equivalent to 5.1-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in Q3’2024, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 62.1% of Kenya’s external debt is US Dollar-denominated as of September 2024.

Key to note, Kenya’s forex reserves decreased by 0.5% during the week, to remain relatively unchanged from the USD 10.0 bn recorded in the previous week, equivalent to 5.1 months of import cover to remain relatively unchanged from the months of import cover recorded last week, and above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- March Inflation projection

We are projecting the y/y inflation rate for March 2025 to increase marginally to within the range of 3.6% - 3.8% mainly on the back of:

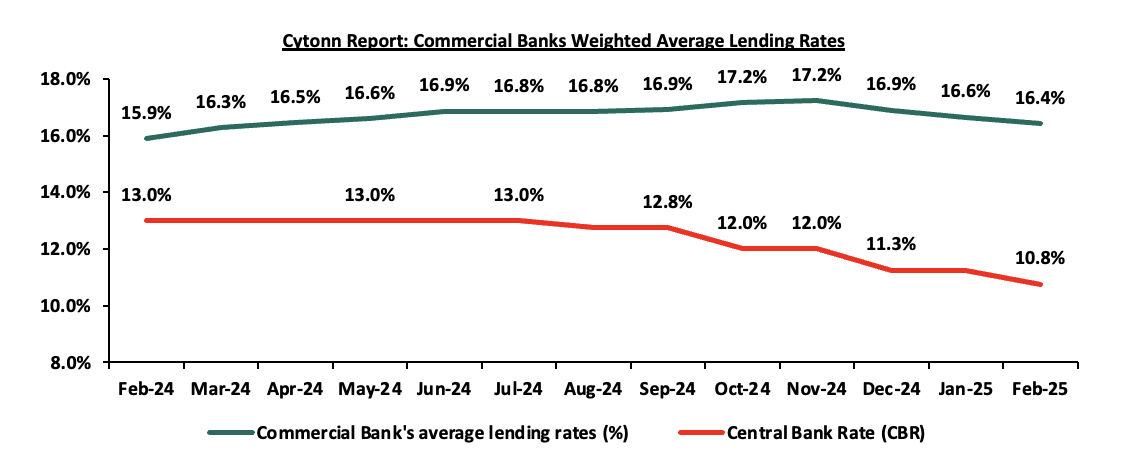

- The decrease in the Central Bank Rate (CBR) by 50.0 bps to 10.75% from 11.25% – In 2025, the CBK Monetary Policy Committee continued reducing the Central Bank Rate (CBR) with a 50.0 bps cut in February, lowering it to 10.75% in February 2025 from 11.25% in December 2024. In their previous meeting on 5th December 2024, they implemented a more significant reduction, cutting the CBR by 75.0 bps to 11.00%. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy.

- Depreciation of the Kenya Shilling against the US Dollar – The Kenya Shilling has remained relatively stable recording a slight depreciation of 12.7 bps on a month-to-date. If the shilling continues on that trend, there could be an increase in inflationary pressures.

- Increased electricity prices – In March 2025, electricity prices increased marginally on the back of a rise in fuel cost charges and forex adjustment charges. EPRA set the fuel cost charge at Kshs 3.5, up from Kshs 3.4 in February 2025, while the forex adjustment was raised to Kshs 0.8 from Kshs 0.7 in February 2025. With electricity being one the major inputs of inflation, this increase is expected to increase production costs for businesses as well as increase electricity costs for households and thus tightening inflation.

We, however, expect that inflation rate will, however, be supported by:

- Stable Fuel Prices in January– In their last fuel prices release, EPRA announced that the maximum allowed price for Super Petrol, Diesel and Kerosene remained unchanged at Kshs 176.6, Kshs 167.1, and Kshs 151.4 per litre respectively effective from 15th March 2025 to 14th April 2024. This stability in fuel prices is likely to decrease pressure on consumers’ purchasing power as well as business operational costs, since fuel is a major input cost for businesses, and,

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by the stable fuel prices, decreased energy costs and stability in the exchange rate. However, risks remain, particularly from the potential for increased demand-driven inflation due to accommodative monetary policy. The decision to lower the CBR to 10.75% during the latest MPC meeting will likely increase money supply, in turn increasing inflation, especially with further cuts expected in the coming meetings. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

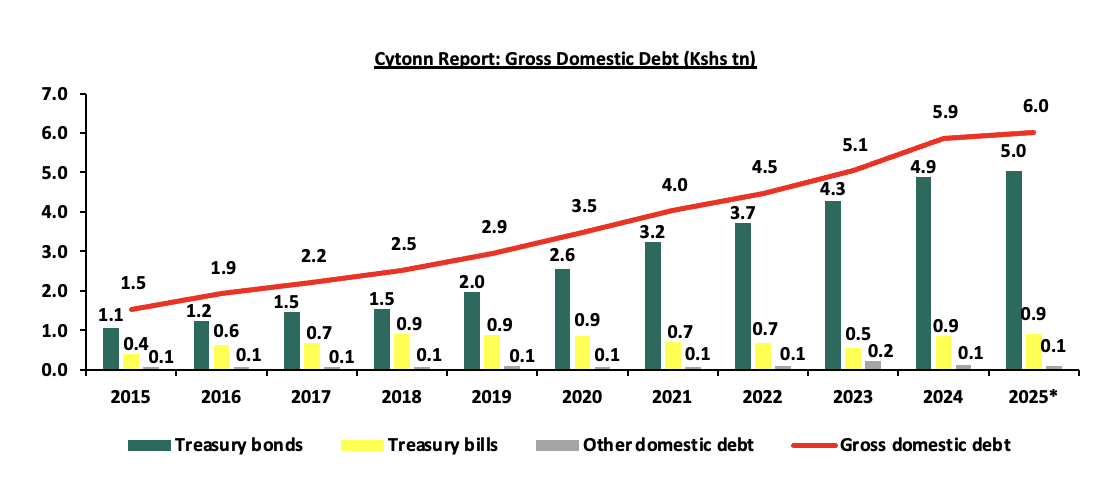

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 66.3% ahead of its prorated net domestic borrowing target of Kshs 445.3 bn, and 24.7% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 593.7 bn, having a net borrowing position of Kshs 740.6 bn (inclusive of T-bills). However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns

Market Performance

During the week, the equities market recorded a mixed performance, with NASI and NSE 10 each gaining by 0.5%, while NSE 20 and NSE 25 lost by 0.8% and 0.1% respectively, taking the YTD performance to gains of 8.2%, 4.4%, 2.2% and 1.1% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Safaricom, Stanbic and Absa of 3.1%, 1.1%, and 1.1%, respectively. The performance was however weighed down by losses recorded by large cap stocks such as DTB-K, EABL and Standard Chartered of 5.0%, 2.8% and 1.6% respectively;

During the week, equities turnover decreased by 41.9% to USD 10.3 mn, from USD 17.7 mn recorded the previous week, taking the YTD total turnover to USD 202.7 mn. Foreign investors remained net sellers for the fifth consecutive week, with a net selling position of USD 0.7 mn, from a net selling position of USD 1.2 mn recorded the previous week, taking the YTD foreign net selling position to USD 25.2 mn, compared to a net selling position of USD 16.9 mn in 2024,

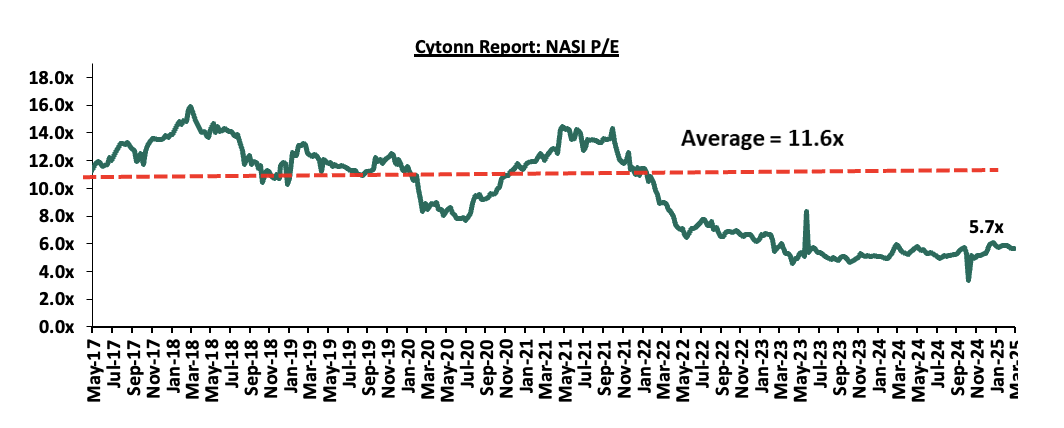

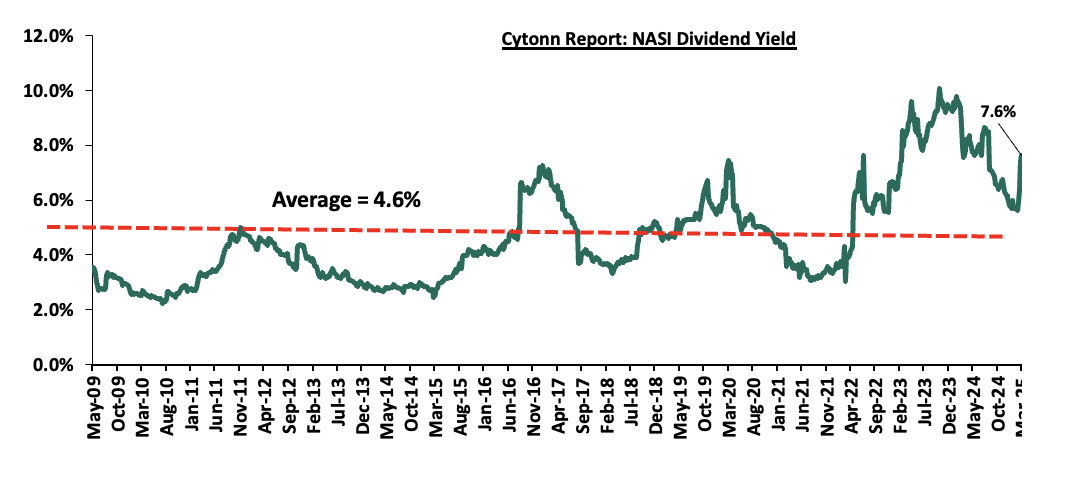

The market is currently trading at a price-to-earnings ratio (P/E) of 5.7x, 50.9% below the historical average of 11.6x. The dividend yield stands at 7.6%, 3.0% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 21/03/2025 |

Price as at 28/03/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

216.3 |

192.3 |

(11.1%) |

10.0% |

174.8 |

260.7 |

7.4% |

43.0% |

0.3x |

Buy |

|

Equity Group |

46.7 |

47.1 |

1.0% |

(1.9%) |

48.0 |

60.2 |

9.0% |

36.8% |

0.9x |

Buy |

|

ABSA Bank |

18.8 |

19.0 |

1.1% |

0.8% |

18.9 |

24.2 |

9.2% |

36.6% |

1.3x |

Buy |

|

Co-op Bank |

16.0 |

16.0 |

0.3% |

(8.3%) |

17.5 |

20.3 |

9.4% |

36.1% |

0.7x |

Buy |

|

KCB Group |

42.0 |

42.2 |

0.4% |

(0.6%) |

42.4 |

50.4 |

7.1% |

26.7% |

0.5x |

Buy |

|

Standard Chartered Bank |

304.0 |

299.3 |

(1.6%) |

4.9% |

285.3 |

328.6 |

15.0% |

24.8% |

1.8x |

Buy |

|

Diamond Trust Bank |

79.8 |

75.8 |

(5.0%) |

13.5% |

66.8 |

84.4 |

9.2% |

20.6% |

0.3x |

Buy |

|

NCBA |

52.3 |

52.5 |

0.5% |

2.9% |

51.0 |

57.4 |

10.5% |

19.8% |

0.9x |

Accumulate |

|

Stanbic Holdings |

160.0 |

161.8 |

1.1% |

15.7% |

139.8 |

171.2 |

12.8% |

18.7% |

0.9x |

Accumulate |

|

CIC Group |

2.9 |

2.8 |

(0.4%) |

32.7% |

2.1 |

3.1 |

4.6% |

13.7% |

0.9x |

Accumulate |

|

I&M Group |

35.0 |

32.4 |

(7.4%) |

(10.1%) |

36.0 |

31.4 |

9.3% |

6.3% |

0.6x |

Hold |

|

Britam |

7.7 |

8.0 |

4.2% |

37.1% |

5.8 |

7.5 |

0.0% |

(6.0%) |

1.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2024 Dividends, Jubilee using FY’2023 |

||||||||||

Weekly Highlights

- Equity FY’2024 results

During the week Equity Group released its FY’2024 financial results. Below is a summary of Equity Group’s FY’2024 performance:

|

Balance Sheet Items |

FY'2023 |

FY'2024f |

y/y change |

|

Government Securities |

246.7 |

300.9 |

22.0% |

|

Net Loans and Advances |

887.4 |

819.2 |

(7.7%) |

|

Total Assets |

1821.4 |

1804.6 |

(0.9%) |

|

Customer Deposits |

1358.2 |

1399.6 |

3.1% |

|

Deposits/Branch |

3.8 |

3.5 |

(13.0%) |

|

Total Liabilities |

1603.3 |

1557.8 |

(2.8%) |

|

Shareholders’ Funds |

207.8 |

234.0 |

12.6% |

|

Balance Sheet Ratios |

FY'2023 |

FY'2024f |

% y/y change |

|

Loan to Deposit Ratio |

65.3% |

58.5% |

(6.8%) |

|

Government Securities to Deposit Ratio |

27.8% |

36.7% |

8.9% |

|

Return on average equity |

22.8% |

22.1% |

(0.7%) |

|

Return on average assets |

2.7% |

2.7% |

0.0% |

|

Income Statement (Kshs Bn) |

FY'2023 |

FY'2024f |

y/y change |

|

Net Interest Income |

104.8 |

108.7 |

3.7% |

|

Net non-Interest Income |

76.9 |

85.1 |

10.7% |

|

Total Operating income |

181.7 |

193.8 |

6.7% |

|

Loan Loss provision |

(35.6) |

(20.2) |

(43.3%) |

|

Total Operating expenses |

(129.8) |

(133.0) |

2.5% |

|

Profit before tax |

51.9 |

60.7 |

17.1% |

|

Profit after tax |

43.7 |

48.8 |

11.6% |

|

Core EPS |

11.1 |

12.3 |

11.0% |

|

Dividend Per Share |

4.0 |

4.55 |

6.3% |

|

Dividend Payout Ratio |

36.0% |

34.5% |

(1.5%) |

|

Dividend Yield |

8.5% |

9.0% |

1.0% |

|

Income Statement Ratios |

FY'2023 |

FY'2024f |

y/y change |

|

Yield from interest-earning assets |

11.0% |

10.9% |

(0.2%) |

|

Cost of funding |

3.8% |

4.1% |

0.4% |

|

Cost of risk |

19.6% |

10.4% |

(9.2%) |

|

Net Interest Margin |

7.4% |

5.8% |

(1.7%) |

|

Net Interest Income as % of operating income |

57.7% |

56.1% |

(1.6%) |

|

Non-Funded Income as a % of operating income |

42.3% |

43.9% |

1.6% |

|

Cost to Income Ratio |

71.4% |

68.7% |

(2.8%) |

|

CIR without LLP |

51.9% |

58.2% |

6.4% |

|

Cost to Assets |

5.8% |

6.2% |

0.5% |

|

Capital Adequacy Ratios |

FY'2023 |

FY'2024f |

% points change |

|

Core Capital/Total Liabilities |

16.2% |

18.0% |

1.8% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

8.2% |

10.0% |

1.8% |

|

Core Capital/Total Risk Weighted Assets |

14.3% |

17.3% |

3.0% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

3.8% |

6.8% |

3.0% |

|

Total Capital/Total Risk Weighted Assets |

18.1% |

19.0% |

0.9% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.6% |

4.5% |

0.9% |

|

Liquidity Ratio |

53.4% |

57.4% |

4.0% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

33.4% |

37.4% |

4.0% |

Key Take-Outs:

- Increased earnings - Core earnings per share grew by 11.0% to Kshs 12.3, from Kshs 11.1 in FY’2023, driven by the 6.7% increase in total operating income to Kshs 193.8 bn, from Kshs 181.7 bn in FY’2023, which outpaced the 2.5% increase in total operating expenses to Kshs 133.0 bn from Kshs 129.8 bn in FY’2023,

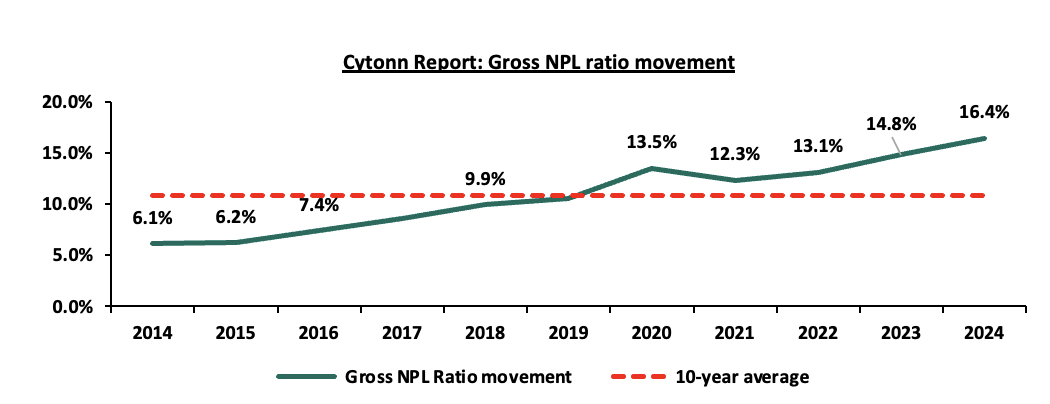

- Deteriorated asset quality – The bank’s Asset Quality deteriorated, with Gross NPL ratio increasing to 13.6% in FY’2024, from 12.1% in FY’2023, attributable to a 6.5% increase in Gross non-performing loans to Kshs 122.0 bn, from Kshs 114.6 bn in FY’2023, relative to the 5.3% decrease in gross loans to Kshs 896.9 bn, from Kshs 947.5 bn recorded in FY’2023,

- Contracted Balanced sheet - The balance sheet recorded a contraction as total assets declined by 9% to Kshs 1,804.6 bn, from Kshs 1,821.4 bn in FY’2023, mainly driven by a 7.7% decrease in net loans and advances to Kshs 819.2 bn, from 887.4 bn in FY’2023, but was supported by a 22.0% increase in government securities holdings to Kshs 300.9 bn, from Kshs 246.7 bn in FY’2023,

- Declaration of dividends - The Board of Directors declared a dividend of Kshs 4.25 per share in FY’2024, from a total dividend of 4.0 in FY’2023. The payout ratio and dividend yield came in at 34.5% and 9.2% respectively in FY’2024, and,

- Reduced lending- Customer net loans and advances decreased by 7.7% to Kshs 819.2 bn in FY’2024, from Kshs 887.4 bn in FY’2023 attributed to increased credit risk with high NPLs in the industry, with the lender preferring to limit customer lending.

For a more detailed analysis, please see the Equity Group’s FY’2024 Earnings Note

- NCBA FY’2024 results

During the week NCBA Group released its FY’2024 financial results. Below is a summary of NCBA Group’s FY’2024 performance:

|

Balance Sheet Items |

FY’2023 |

FY’2024 |

y/y change |

|

Net Loans and Advances |

337.0 |

302.1 |

(10.4%) |

|

Government Securities |

203.4 |

180.8 |

(11.1%) |

|

Total Assets |

734.6 |

665.9 |

(9.35%) |

|

Customer Deposits |

579.4 |

502.0 |

(13.4%) |

|

Deposit per Branch |

5.3 |

4.3 |

(20.0%) |

|

Total Liabilities |

638.0 |

556.2 |

(12.8%) |

|

Shareholder's Funds |

96.7 |

109.7 |

13.5% |

|

Balance Sheet Ratios |

FY’2023 |

FY’2024 |

% points change |

|

Loan to Deposit Ratio |

58.2% |

60.2% |

2.0% |

|

Govt Securities to Deposit ratio |

35.1% |

36.0% |

0.9% |

|

Return on average equity |

24.0% |

21.2% |

(2.8%) |

|

Return on average assets |

3.2% |

3.1% |

(0.0%) |

|

Income Statement |

FY’2023 |

FY’2024 |

y/y change |

|

Net Interest Income |

34.6 |

34.5 |

(0.3%) |

|

Net non-Interest Income |

29.1 |

28.2 |

(3.1%) |

|

Total Operating income |

63.7 |

62.7 |

(1.5%) |

|

Loan Loss provision |

9.2 |

5.5 |

(40.1%) |

|

Total Operating expenses |

38.2 |

37.6 |

(1.6%) |

|

Profit before tax |

25.5 |

25.1 |

(1.3%) |

|

Profit after tax |

21.5 |

21.9 |

1.9% |

|

Core EPS |

13.0 |

13.3 |

1.9% |

|

Dividend Per Share |

4.75 |

5.50 |

15.8% |

|

Dividend payout ratio |

36.5% |

41.4% |

5.0% |

|

Dividend Yield |

10.8% |

10.5% |

(0.4%) |

|

Income Statement Ratios |

FY’2023 |

FY’2024 |

% points change |

|

Yield from interest-earning assets |

11.1% |

12.5% |

1.4% |

|

Cost of funding |

5.5% |

7.4% |

1.8% |

|

Net Interest Spread |

5.5% |

5.1% |

(0.5%) |

|

Net Interest Margin |

5.9% |

5.7% |

(0.2%) |

|

Cost of Risk |

14.4% |

8.7% |

(5.6%) |

|

Net Interest Income as % of operating income |

54.3% |

55.0% |

0.7% |

|

Non-Funded Income as a % of operating income |

45.7% |

45.0% |

(0.7%) |

|

Cost to Income Ratio |

60.0% |

60.0% |

(0.0%) |

|

Cost to Income Ratio without LLP |

45.7% |

51.3% |

5.6% |

|

Capital Adequacy Ratios |

FY’2023 |

FY’2024 |

% points change |

|

Core Capital/Total Liabilities |

16.3% |

20.3% |

4.0% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

8.3% |

12.3% |

4.0% |

|

Core Capital/Total Risk Weighted Assets |

18.0% |

21.2% |

3.2% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

7.5% |

10.7% |

3.2% |

|

Total Capital/Total Risk Weighted Assets |

18.0% |

21.2% |

3.2% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

3.5% |

6.7% |

3.2% |

|

Liquidity Ratio |

52.9% |

53.7% |

0.7% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

32.9% |

33.7% |

0.7% |

Key Take-Outs:

- Increased earnings – Core earnings per share increased by 1.9% to Kshs 13.3, from Kshs 13.0 in FY’2023, mainly driven by the 1.6% decrease in total operating expenses to Kshs 37.6 bn, from Kshs 38.2 bn in FY’2023, which outpaced the 1.5% decrease in total operating income to Kshs 62.7 bn, from Kshs 63.7 bn in FY’2023,

- Improved asset quality – The bank’s Asset Quality improved, with Gross NPL ratio decreasing to 11.5% in FY’2024, from 12.3% in FY’2023, attributable to the 16.6% decrease in gross non-performing loans to Kshs 37.2 bn, from Kshs 44.6 bn in FY’2023, which outpaced the 10.4% decrease in gross loans to Kshs 324.1 bn, from Kshs 361.6 bn recorded in FY’2023,

- Decreased Lending – The bank’s loan book recorded a contraction of 10.4% to Kshs 302.1 bn from Kshs 337.0 bn in FY’2023 attributed to increased credit risk with NPLs rising to 16.4% in December 2024, from 14.8% in December 2023.

- Declaration of dividends - The Board of Directors recommended a final dividend of Kshs 3.25, in addition to an interim dividend of 25 paid during the year, bringing the total dividend to Kshs 5.50 per share compared to Kshs 4.75 per share FY’2023. This translates to a dividend payout ratio of 41.4% and a dividend yield of 10.5% as of 28th March 2025, compared to a dividend payout ratio of 36.5% and a dividend yield of 10.8% in a similar period for FY’2023.

For a more detailed analysis, please see the NCBA Group’s FY’2024 Earnings Note

- I&M FY’2024 results

During the week, I&M Group released their FY’2024 financial results. Below is a summary of the performance

|

Balance Sheet Items |

FY'2023 |

FY'2024 |

y/y change |

|

Government Securities |

78.1 |

102.3 |

31.0% |

|

Net Loans and Advances |

311.3 |

287.1 |

(7.8%) |

|

Total Assets |

579.7 |

581.3 |

0.3% |

|

Customer Deposits |

416.7 |

412.2 |

(1.1%) |

|

Deposits/Branch |

5.0 |

4.2 |

(15.4%) |

|

Total Liabilities |

484.0 |

479.6 |

(0.9%) |

|

Shareholders’ Funds |

88.2 |

94.5 |

7.1% |

|

Balance Sheet Ratios |

FY'2023 |

FY'2024f |

% y/y change |

|

Loan to Deposit Ratio |

74.7% |

69.6% |

(5.1%) |

|

Government Securities to Deposit Ratio |

18.7% |

24.8% |

6.1% |

|

Return on average equity |

15.9% |

14.9% |

(1.0%) |

|

Return on average assets |

2.6% |

2.4% |

(0.2%) |

|

Income Statement (Kshs Bn) |

FY'2023 |

FY'2024f |

y/y change |

|

Net Interest Income |

28.6 |

37.6 |

31.2% |

|

Net non-Interest Income |

14.1 |

13.7 |

(2.8%) |

|

Total Operating income |

42.7 |

51.2 |

20.0% |

|

Loan Loss provision |

(6.9) |

(7.8) |

13.8% |

|

Total Operating expenses |

(27.2) |

(31.3) |

15.2% |

|

Profit before tax |

16.7 |

20.8 |

24.6% |

|

Profit after tax |

13.3 |

16.7 |

24.8% |

|

Core EPS |

7.6 |

9.3 |

21.9% |

|

Dividend Per Share |

2.55 |

3.0 |

17.6% |

|

Dividend Payout Ratio |

31.6% |

29.8% |

(1.8%) |

|

Dividend Yield |

11.6% |

9.3% |

(2.3%) |

|

Income Statement Ratios |

FY'2023 |

FY'2024f |

% points change |

|

Yield from interest-earning assets |

13.0% |

15.4% |

2.4% |

|

Cost of funding |

5.4% |

6.7% |

1.3% |

|

Net Interest Margin |

7.4% |

8.5% |

1.1% |

|

Net Interest Income as % of operating income |

67.1% |

73.3% |

6.3% |

|

Non-Funded Income as a % of operating income |

32.9% |

26.7% |

(6.3%) |

|

Cost to Income Ratio |

63.7% |

61.2% |

(2.6%) |

|

Cost to Income Ratio without LLP |

47.6% |

45.9% |

(1.7%) |

|

Cost to Assets |

3.5% |

4.0% |

0.5% |

|

Capital Adequacy Ratios |

FY'2023 |

FY'2024f |

% points change |

|

Core Capital/Total Liabilities |

19.2% |

20.7% |

1.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

11.2% |

12.7% |

1.5% |

|

Core Capital/Total Risk Weighted Assets |

14.5% |

16.8% |

2.3% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

4.0% |

6.3% |

2.3% |

|

Total Capital/Total Risk Weighted Assets |

18.9% |

20.2% |

1.3% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

4.4% |

5.7% |

1.3% |

|

Liquidity Ratio |

44.7% |

51.6% |

6.9% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

24.7% |

31.6% |

6.9% |

Key Take-Outs:

- Increased earnings - Core earnings per share (EPS) grew by 21.9% to Kshs 9.3, from Kshs 7.6 in FY’2023, driven by the 20.0% increase in total operating income to Kshs 51.2 bn, from Kshs 42.7 bn in FY’2023, which outpaced the 15.2% increase in total operating expenses to Kshs 31.3 bn from Kshs 27.2 bn in FY’2023,

- Deteriorated asset quality –The bank’s Asset Quality deteriorated, with Gross NPL ratio increasing to 11.5% in FY’2024, from 10.7% in FY’2023, attributable to a 0.4% increase in Gross non-performing loans to Kshs 35.5 bn, from Kshs 35.4 bn in FY’2023, relative to the 6.6% decrease in gross loans to Kshs 309.2 bn, from Kshs 331.1 bn recorded in FY’2023,

- Expanded Balanced sheet - The balance sheet recorded an expansion as total assets increased by 3% to Kshs 581.3 bn, from Kshs 579.9 bn in FY’2023, mainly driven by a 31.0% increase in governments securities holdings to Kshs 102.3 bn, from 78.1 bn in FY’2023, however weighed down by a 7.8% decrease in net loans and advances to Kshs 287.1 bn, from Kshs 311.3 bn in FY’2023,

- Declaration of dividends - The Board of Directors recommended a final dividend of Kshs 1.7 per share, in addition to an interim dividend of Kshs 1.3 paid during the year, leading to a total dividend of Kshs 3.0 per share in FY’2024, from a total dividend of 2.55 in FY’2023. The payout ratio and dividend yield came in at 29.8% and 8.7% respectively in FY’2024, and,

- Reduced lending- Customer net loans and advances decreased by 7.8% to Kshs 287.1 bn in FY’2024, from Kshs 311.3 bn in FY’2023 attributed to increased credit risk with high NPLs in the industry, with the lender preferring to limit customer lending.

For a more detailed analysis, please see the I&M Group’s FY’2024 Earnings Note

- DTB-K FY’2024 results

During the week, DTB-K Group released their FY’2024 financial results. Below is a summary of the performance

|

Balance Sheet Items |

FY'2023 |

FY'2024 |

y/y change |

|

Government Securities |

120.1 |

126.2 |

5.0% |

|

Net Loans and Advances |

308.5 |

285.3 |

(7.5%) |

|

Total Assets |

635.0 |

573.9 |

(9.6%) |

|

Customer Deposits |

486.1 |

447.2 |

(8.0%) |

|

Deposits/ Branch |

3.2 |

2.8 |

(10.9%) |

|

Total Liabilities |

548.7 |

481.5 |

(12.2%) |

|

Shareholders’ Funds |

74.9 |

81.8 |

9.2% |

|

Balance Sheet Ratios |

FY'2023 |

FY'2024 |

% y/y change |

|

Loan to Deposit Ratio |

63.5% |

63.8% |

0.3% |

|

Government Securities to Deposit ratio |

24.7% |

28.2% |

3.5% |

|

Return on average equity |

10.8% |

11.3% |

0.4% |

|

Return on average assets |

1.3% |

1.5% |

0.1% |

|

Income Statement |

FY'2023f |

FY'2024f |

y/y change |

|

Net Interest Income |

27.6 |

28.4 |

3.0% |

|

Net non-Interest Income |

12.2 |

13.0 |

7.3% |

|

Total Operating income |

39.7 |

41.4 |

4.3% |

|

Loan Loss provision |

10.3 |

8.7 |

(15.6%) |

|

Other Operating expenses |

12.0 |

11.6 |

(3.2%) |

|

Total Operating expenses |

30.9 |

30.2 |

(2.3%) |

|

Profit before tax |

9.0 |

11.2 |

24.2% |

|

Profit after tax |

7.8 |

8.8 |

13.1% |

|

Core EPS |

24.6 |

31.5 |

28.2% |

|

Dividends per Share |

6.0 |

7.0 |

16.7% |

|

Dividend Payout |

24.4% |

25.6% |

1.3% |

|

Dividend Yield |

10.9% |

9.2% |

0.1% |

|

Income Statement Ratios |

FY'2023 |

FY'2024f |

y/y % points change |

|

Yield from interest-earning assets |

10.6% |

11.5% |

0.9% |

|

Cost of funding |

5.3% |

6.3% |

1.0% |

|

Net Interest Spread |

5.2% |

5.2% |

(0.0%) |

|

Net Interest Income as % of operating income |

69.4% |

68.5% |

(0.9%) |

|

Non-Funded Income as a % of operating income |

30.6% |

31.5% |

0.9% |

|

Cost to Income Ratio (CIR) |

77.7% |

72.8% |

(4.9%) |

|

CIR without provisions |

51.7% |

51.8% |

0.0% |

|

Cost to Assets |

5.3% |

5.0% |

(0.3%) |

|

Net Interest Margin |

5.5% |

5.5% |

0.0% |

|

Capital Adequacy Ratios |

FY'2023 |

FY'2024f |

% points change |

|

Core Capital/Total Liabilities |

19.7% |

17.5% |

(2.2%) |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

11.7% |

9.5% |

(2.2%) |

|

Core Capital/Total Risk Weighted Assets |

18.6% |

16.3% |

(2.3%) |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

8.1% |

5.8% |

(2.3%) |

|

Total Capital/Total Risk Weighted Assets |

19.2% |

18.0% |

(1.2%) |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

4.7% |

3.5% |

(1.2%) |

|

Liquidity Ratio |

60.5% |

52.5% |

(8.0%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

40.5% |

32.5% |

(8.0%) |

Key Take-Outs:

- Increased earnings - Core earnings per share (EPS) grew by 28.2% to Kshs 31.5, from Kshs 24.6 in FY’2023, driven by the 4.3% increase in total operating income to Kshs 41.4 bn, from Kshs 39.7 bn in FY’2023, coupled with the 2.3% decrease in total operating expenses to Kshs 30.2 bn from Kshs 30.9 bn in FY’2023,

- Improved asset quality –The bank’s Asset Quality improved, with Gross NPL ratio decreasing to 12.6% in FY’2024, from 13.4% in FY’2023, attributable to a 13.3% decrease in Gross non-performing loans to Kshs 37.9 bn, from Kshs 43.6 bn in FY’2023, which outpaced the 8.0% decline in gross loans to Kshs 300.4 bn, from Kshs 326.5 bn recorded in FY’2023,

- Contracted Balanced sheet - The balance sheet recorded a contraction as total assets declined by 9.6% to Kshs 573.9bn, from Kshs 635.0 bn in FY’2024, driven by a 7.2% decrease in net loans and advances to Kshs 285.3 bn, from 308.5 bn in FY’2023,

- Declaration of dividends - The Board of Directors recommended a first and final dividend of Kshs 7.0 per share in FY’2024, from a total dividend of Kshs 6.0 in FY’2023. The payout ratio and dividend yield came in at 25.6% and 9.2% respectively in FY’2024 from 24.4% and 10.9% respectively in FY’2023 and,

- Reduced lending- Customer net loans and advances decreased by 7.5% to Kshs 285.3 bn in FY’2024, from Kshs 308.5 bn in FY’2023 attributed to increased credit risk with high NPLs in the industry, with the lender preferring to limit customer lending.

For a more detailed analysis, please see the DTB-K’s FY’2024 Earnings Note

- HF FY’2024 results

During the week HF Group released its FY’2024 financial results. Below is a summary of HF Group’s FY’2024 performance:

|

Balance Sheet Items |

FY'2023 |

FY'2024f |

y/y change |

|

Government Securities |

9.7 |

17.0 |

75.3% |

|

Net Loans and Advances |

38.8 |

38.9 |

0.2% |

|

Total Assets |

61.6 |

70.1 |

14.0% |

|

Customer Deposits |

43.8 |

47.5 |

8.3% |

|

Deposits/Branch |

2.0 |

2.2 |

8.3% |

|

Total Liabilities |

52.7 |

54.5 |

3.4% |

|

Shareholders’ Funds |

8.9 |

15.7 |

76.9% |

|

Balance Sheet Ratios |

FY'2023 |

FY'2024f |

% y/y change |

|

Loan to Deposit Ratio |

88.5% |

81.9% |

(6.6%) |

|

Government Securities to Deposit Ratio |

22.1% |

35.7% |

13.7% |

|

Return on average equity |

4.4% |

4.3% |

(0.1%) |

|

Return on average assets |

0.7% |

0.8% |

0.1% |

|

Income Statement (Kshs Bn) |

FY'2023 |

FY'2024f |

y/y change |

|

Net Interest Income |

2.5 |

2.7 |

4.4% |

|

Net non-Interest Income |

1.2 |

1.5 |

21.2% |

|

Total Operating income |

3.8 |

4.2 |

9.9% |

|

Loan Loss provision |

(0.3) |

(0.4) |

17.8% |

|

Total Operating expenses |

(3.5) |

(3.7) |

7.0% |

|

Profit before tax |

0.3 |

0.5 |

37.5% |

|

Profit after tax |

0.4 |

0.5 |

35.2% |

|

Core EPS |

1.0 |

0.9 |

-10.8% |

|

Income Statement Ratios |

FY'2023 |

FY'2024f |

y/y change |

|

Yield from interest-earning assets |

11.0% |

10.3% |

(0.8%) |

|

Cost of funding |

5.7% |

6.4% |

0.7% |

|

Net Interest Spread |

5.3% |

3.9% |

(1.5%) |

|

Net Interest Margin |

5.4% |

4.3% |

(1.1%) |

|

Cost of Risk |

8.2% |

8.7% |

0.6% |

|

Net Interest Income as % of operating income |

67.2% |

63.9% |

(3.4%) |

|

Non-Funded Income as a % of operating income |

32.8% |

36.1% |

3.4% |

|

Cost to Income Ratio |

92.0% |

89.5% |

(2.5%) |

|

Cost to Income Ratio (without LLP) |

83.9% |

80.8% |

(3.1%) |

|

Capital Adequacy Ratios |

FY'2023 |

FY'2024f |

% points change |

|

Core Capital/Total Liabilities |

4.7% |

18.1% |

13.4% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

(3.3%) |

10.1% |

13.4% |

|

Core Capital/Total Risk Weighted Assets |

5.3% |

21.4% |

16.1% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

(5.2%) |

10.9% |

16.1% |

|

Total Capital/Total Risk Weighted Assets |

9.0% |

24.6% |

15.6% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

(5.5%) |

10.1% |

15.6% |

|

Liquidity Ratio |

24.5% |

41.8% |

17.3% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

4.5% |

21.8% |

17.3% |

Key Take-Outs:

- Decreased earnings Core earnings per share declined by 10.8% to Kshs 0.9, from Kshs 1.0 in FY’2023, 7.0% increase in total operating expenses to Kshs 3.7 bn from Kshs 3.5 bn in FY’2023,

- Deteriorated asset quality – The bank’s Asset Quality deteriorated, with Gross NPL ratio increasing to 25.3% in FY’2024, from 23.1% in FY’2023, attributable to a 10.6% increase in Gross non-performing loans to Kshs 12.0 bn, from Kshs 10.8 bn in FY’2023, which outpaced the 0.8% decrease in gross loans to Kshs 47.3 bn, from Kshs 46.9 bn recorded in FY’2023,

- Expanded Balanced sheet - The balance sheet recorded an expansion as total assets increased by 0% to Kshs 70.1 bn, from Kshs 61.6 bn in FY’2023, mainly driven by a 75.3% increase in governments securities holdings to Kshs 17.0 bn, from 9.7 bn in FY’2023 coupled with a 0.2% increase in net loans and advances to Kshs 38.9 bn, from Kshs 38.8 bn in FY’2023,

- Increased lending- Customer net loans and advances increased by 0.2% to Kshs 38.9 bn in FY’2024, from Kshs 38.8 bn in FY’2023.

For a more detailed analysis, please see the HF Group’s FY’2024 Earnings Note

Summary Performance

The table below shows the performance of listed banks that have released their FY’2024 results using several metrics:

|

Cytonn Report: Listed Banks Performance in FY’2024 |

||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

|

KCB Group |

64.9% |

26.9% |

25.0% |

28.0% |

7.8% |

16.6% |

33.0% |

0.9% |

(18.3%) |

(13.2%) |

71.7% |

(9.6%) |

24.6% |

|

|

Standard Chartered Bank |

45.0% |

20.0% |

83.4% |

13.4% |

9.6% |

40.4% |

34.4% |

11.9% |

(13.8%) |

34.7% |

51.3% |

(7.1%) |

30.1% |

|

|

Diamond Trust Bank Kenya |

28.2% |

12.0% |

21.6% |

3.0% |

5.5% |

7.3% |

31.5% |

15.8% |

(8.0%) |

5.0% |

63.8% |

(7.5%) |

11.3% |

|

|

Absa Bank Kenya |

27.5% |

15.4% |

30.1% |

15.4% |

10.5% |

10.8% |

25.8% |

27.5% |

1.2% |

30.0% |

84.2% |

(7.9%) |

27.0% |

|

|

I&M Group |

21.9% |

35.0% |

39.9% |

31.2% |

8.5% |

(2.8%) |

26.7% |

15.6% |

(1.1%) |

31.0% |

69.6% |

(7.8%) |

14.9% |

|

|

Stanbic Holdings |

12.8% |

37.8% |

105.7% |

(5.1%) |

5.9% |

(1.7%) |

38.8% |

(13.1%) |

(2.8%) |

70.6% |

71.6% |

(11.6%) |

19.1% |

|

|

Equity Group |

11.0% |

9.2% |

20.3% |

3.7% |

5.8% |

10.7% |

43.9% |

12.9% |

3.1% |

22.0% |

58.5% |

(7.7%) |

22.1% |

|

|

Co-operative Bank of Kenya |

9.8% |

24.9% |

45.7% |

13.9% |

8.4% |

24.5% |

36.1% |

3.2% |

12.1% |

15.1% |

73.8% |

(0.1%) |

19.7% |

|

|

NCBA Group |

1.9% |

16.0% |

34.5% |

(0.3%) |

5.7% |

(3.1%) |

45.0% |

5.5% |

(13.4%) |

(11.1%) |

60.2% |

(10.4%) |

21.2% |

|

|

HF Group |

(10.8%) |

23.1% |

41.0% |

4.4% |

4.3% |

21.2% |

36.1% |

36.1% |

8.3% |

75.3% |

81.9% |

0.2% |

4.3% |

|

|

FY'24 Mkt Weighted Average* |

26.2% |

20.5% |

42.6% |

12.0% |

7.6% |

13.9% |

36.1% |

9.2% |

(4.4%) |

18.9% |

66.5% |

(7.6%) |

22.8% |

|

|

FY'23 Mkt Weighted Average** |

11.4% |

30.5% |

52.4% |

20.6% |

7.5% |

16.4% |

37.0% |

25.0% |

2.2% |

69.0% |

21.2% |

9.5% |

38.3% |

|

|

*Market cap weighted as at 28/03/2025 |

||||||||||||||

|

**Market cap weighted as at 18/04/2024 |

||||||||||||||

Key take-outs from the table include:

- The listed banks that have released their FY’2024 results recorded a 26.2% growth in core Earnings per Share (EPS) in FY2024, compared to the weighted average growth of 11.4% in FY’2023, an indication of improved performance attributable to the improved operating environment experienced during FY’2024,

- Interest income recorded a weighted average growth of 20.5% in FY’2024, compared to 30.5% in FY’2023. Similarly, interest expenses recorded a market-weighted average growth of 42.6% in FY’2024 compared to a growth of 52.4% in FY’2023,

- The Banks’ net interest income recorded a weighted average growth of 12.0% in FY’2024, a decline from the 20.6% growth recorded over a similar period in 2023, while the non-funded income grew by 13.9% in FY’2024 slower than the 16.4% growth recorded in, and,

- The Banks recorded a weighted average deposit decline of 4.4%, compared to the market-weighted average deposit growth of 2.2% in FY’2023.

- CIC FY’2024 results

During the week, CIC Group released their FY’2024 results. CIC’s Profit After Tax (PAT) increased by 98.0% to Kshs 2.9 bn from Kshs 1.4 bn, recorded in FY’2023. The performance was mainly driven by a 35.7% increase in Net investment income to Kshs 8.8 bn in FY’2024, from Kshs 2.9 bn in FY’2023, and further supported by a 14.0% decrease in Net expenses from reinsurance contracts to Kshs 1.8 bn, from Kshs 2.1 bn in FY’2023. However, the performance was weighed down by the 56.4% decrease in net income from insurance services to Kshs 0.3 bn, from Kshs 0.8 bn in FY’2024

|

Cytonn Report: CIC Group Income Statement |

|||

|

Item (All figures in Bns) |

FY’2023 |

FY’2024 |

y/y change |

|

Insurance Revenue |

25.4 |

26.3 |

3.7% |

|

Insurance service expenses |

(22.5) |

(24.2) |

7.5% |

|

Net expenses from reinsurance contracts held |

(2.1) |

(1.8) |

(14.0%) |

|

Net Insurance income |

0.8 |

0.3 |

(56.4%) |

|

Net Investment Income |

2.9 |

8.8 |

35.7% |

|

Net Financial result |

2.2 |

3.8 |

74.0% |

|

Other Operating Expenses |

(1.5) |

(1.7) |

18.8% |

|

Operating Profit |

3.1 |

4.6 |

49.1% |

|

Profit Before Tax |

2.5 |

4.0 |

57.0% |

|

Profit After Tax |

1.4 |

2.9 |

98.0% |

|

Core EPS in Kshs |

0.6 |

1.1 |

98.0% |

|

Dividend Payout Ratio |

23.6% |

11.9% |

(49.5%) |

|

Dividend yield |

5.8% |

4.6% |

(21.5%) |

|

Cytonn Report: CIC Group Balance Sheet |

|||

|

Item (All figures in Bns) |

FY'2023 |

FY'2024 |

y/y change |

|

Investment assets |

7.8 |

3.7 |

(52.4%) |

|

Property & Equipment and Intangibles |

1.4 |

1.4 |

(3.0%) |

|

Total Assets |

50.3 |

61.9 |

23.1% |

|

Insurance Contract Liabilities |

0.0 |

41.8 |

- |

|

Provisions & other payables |

3.2 |

3.7 |

14.7% |

|

Total liabilities |

42.7 |

50.9 |

19.3% |

|

Shareholder funds |

7.6 |

11.0 |

44.7% |

|

Minority Interest |

(0.1) |

(0.1) |

(28.1%) |

|

Total Equity |

7.5 |

11.0 |

45.5% |

Key take outs from the results:

- Core Earnings Per share increased by 98.0% to Kshs 1.1 from Kshs 0.6 in FY’2023, mainly driven by a 35.7% increase in Net investment income to Kshs 8.8 bn in FY’2024, from Kshs 2.9 bn in FY’2023.This increase was however weighed down by a 56.4% decrease in Net income from insurance service to Kshs 0.3 bn, from Kshs 0.8 bn in FY’2023,

- Net financial result increased by 74.0% to Kshs 3.8 bn in FY’2024, from Kshs 2.2 bn in FY’2023. This was majorly attributable to the 35.7% increase in net investment income coupled with 14.0% decrease in net finance expenses from insurance contracts to Kshs 1.8 bn from Kshs 2.1 bn in FY’2023,

- Insurance revenue increased by 3.7% to Kshs 26.3 bn in FY’2024 from Kshs 25.4 bn in FY’2023, while insurance service expenses increased by 7.5% to Kshs 24.2 bn from Kshs 22.5 bn in FY’2023, and the net expenses from reinsurance contracts held decreased by 14.0% to Kshs 1.8 bn, from Kshs 2.1 bn in FY’2023. This translated to a Net insurance income decrease of 56.4% to Kshs 0.3 bn from Kshs 0.8 bn in FY’2023,

- The balance sheet recorded an expansion as total assets increased by 23.1% to Kshs 61.9 bn in FY’2024 from Kshs 50.3 bn in FY’2023 mainly driven by 35.5% increase in reinsurance contract assets to Kshs 5.1 bn from Kshs 3.7 bn in FY’2023. The increase was however weighed down by 52.4% decrease in investment assets to Kshs 3.7 bn form Kshs 7.8 bn in FY’2023, and,

- Total liabilities increased by 19.3% to Kshs 50.9 bn from Kshs 42.7 bn in FY’2023, majorly on the back of the 14.7% increase in provisions and other payables to Kshs 3.7 bn from Kshs 3.2 bn in FY’2023.

Other highlights from the release include:

- Declaration of dividends – The Group’s board of directors declared the first and final dividend of Kshs 0.13 for the FY’2024 to remain unchanged from FY’2023, translating to a dividend yield of 4.6% and a dividend payout of 11.9%.

Key to note, this was the fourth time the company was releasing their results under the new IFRS 17 reporting system. The new standard demands that insurers measure insurance contracts using updated estimates and assumptions that reflect the timing of cashflows and any uncertainty relating to insurance contracts. Going forward, the Group earnings will be boosted by digital transformation to enhance customer service delivery especially through the launch of initiatives such as EasyBima which aims to improve accessibility and convenience for clients. The company is investing in product diversification by establishing new subsidiaries including CIC Micro Insurance Limited and CIC Pharmacy Limited. These ventures are designed to tap into new markets and revenue streams such as micro-insurance and pharmaceuticals. With these strategies, CIC aims to strengthen its market presence.

Valuation Summary:

- We are of the view that CIC Group is an “Buy” with a target price of Kshs 3.1 representing an upside of 2%, from the current price of 2.8 as of 28th March 2025, inclusive of a dividend yield of 4.6%

- CIC Group is currently trading at a P/TBV of 0.9x and a P/E of 6x vs an industry average of 0.4x and 10.8x respectively.

- Britam FY’2024 results

During the week, Britam Holdings released their FY’ 2024 results. Britam’s Profit After Tax (PAT) increased by 53.5% to Kshs 5.0 bn, from Kshs 3.3 bn recorded in FY’2023. The performance was mainly driven by a 163.4% increase in Net Investment income to Kshs 30.6 bn, from Kshs 11.6 bn in FY’2023 as well as a 35.5% increase in net insurance and investment result to Kshs 9.2 bn from 6.8 bn in FY 2023 but was weighed down by the 208.8% increase in Insurance Expenses to Kshs 26.4 bn in FY’2024, from Kshs 8.6 bn in FY’2023

|

Cytonn Report: Britam Holdings Income Statement |

|||

|

Item (All figures in Bns) |

FY'2023 |

FY'2024 |

y/y change |

|

Insurance Revenue |

36.4 |

37.6 |

3.1% |

|

Insurance service expenses |

26.9 |

27.3 |

1.6% |

|

Net Insurance income |

3.8 |

5.1 |

35.1% |

|

Net Investment Income |

11.6 |

30.6 |

163.4% |

|

Net Insurance and Finance expenses |

8.6 |

26.4 |

208.8% |

|

Net Insurance and investment result |

6.8 |

9.2 |

35.5% |

|

Fund management fees |

0.6 |

0.7 |

2.5% |

|

Other Income |

0.8 |

1.3 |

72.6% |

|

Other Finance cost |

(0.2) |

(0.3) |

14.8% |

|

Other operating expenses |

(3.4) |

(4.0) |

19.2% |

|

Profit Before Tax |

4.8 |

7.3 |

52.1% |

|

Profit After Tax |

3.3 |

5.0 |

53.5% |

|

Core EPS |

1.3 |

2.0 |

53.5% |

|

Cytonn Report: Britam Holdings Balance Sheet |

|||

|

Item (All figures in Bns) |

FY'2023 |

FY'2024 |

y/y change |

|

Investment assets |

150.1 |

186.1 |

24.0% |

|

Intangible Assets |

2.0 |

2.2 |

7.5% |

|

Total Assets |

174.4 |

208.5 |

19.6% |

|

Insurance Contract Liabilities |

133.7 |

163.4 |

22.2% |

|

Provisions & other payables |

11.9 |

13.9 |

17.5% |

|

Total liabilities |

148.7 |

179.1 |

20.4% |

|

Shareholder funds |

25.4 |

29.2 |

14.7% |

|

Minority Interest |

0.2 |

0.3 |

11.6% |

|

Total Equity |

25.7 |

29.5 |

14.7% |

Key take outs from the results:

- Core Earnings Per share increased by 53.5% to Kshs 2.0 from Kshs 1.3 in FY’2023, driven by the 163.4% increase in Net Investment income to Kshs 6 bn, from Kshs 11.6 bn in FY’2023, coupled with the xx in in net insurance service result but was weighed down by the 208.8% increase in Insurance Expenses to Kshs 26.4 bn in FY’2024, from Kshs 8.6 bn in FY’2023

- Net Investment Income (NII) increased by 163.4% to Kshs 30.6 bn in FY’2024, from Kshs 11.6 bn in FY’2023. This was majorly attributable to the 24.3% increase in interest and dividend income to 19.4 bn from Kshs 9.1 bn in FY’2023, coupled with a 24.3% increase in income from investment property to 0.8 bn from the Kshs 0.6 bn in FY’2023

- Insurance revenue increased by 3.1% to Kshs 37.6 bn in FY’2024 from Kshs 36.4 bn in FY’2023, while insurance expenses increased by 1.6% to Kshs 27.3 bn from Kshs 26.9 bn in FY’2023, and net expenses from reinsurance contracts decreased by 10.8% to Kshs 5.2 bn from Kshs 5.8 bn in FY’2023, translating to a Net insurance service result increase of 35.1% to Kshs 5.1 bn from Kshs 3.8 bn in FY’2023,

- The balance sheet recorded an expansion as total assets increased by 19.6% to Kshs 208.5 bn in FY’2024 from Kshs 174.4 bn in FY’2023 mainly driven by 24.0% increase in investment assets to Kshs 186.1 bn from Kshs 150.1 bn in FY’2023, the increase was however weighed down by a 0.4% decrease in cash and bank balances assets to Kshs 7.0 bn from Kshs 10.6 bn as well as a 0.4% decrease in reinsurance contracts assets to remain relatively unchanged at 7.0 bn registered in FY 2023.

- Total liabilities increased by 20.4% to Kshs 179.1 bn from Kshs 148.7 bn in FY’2023, majorly on the back of Insurance contract liabilities 22.2% increase to Kshs 163.4 bn from Kshs 133.7 bn in FY’2023, as well as the 20.4% increase in provisions and other payables to Kshs 13.9 bn from Kshs 11.9 bn in FY’2023

Other highlights from the release include:

- Non-declaration of dividends – The Group’s board of directors declined to announce any dividends for the fifth consecutive year citing the group’s attempt to conserve capital.

Going forward, the factors that would drive the company’s growth would be:

- Microinsurance partnerships – With 43.0% market share in microinsurance, Britam continues to leverage on this segment through internal initiatives and partnerships. Partnerships such as that between the company and Bonfire adventures and Digital innovation hub Ohala to offer travel insurance, and another with Voltic Kenya to provide travel insurance and online ticketing are some notable initiatives

- Diversified Products – On top of their mainstream insurance products, Britam has innovatively introduced a number of products into the market. These diversified products, such as school personal accidents, new born baby insurance products and their unit trust products, will contribute to a continued growth of the company’s growth.

Valuation Summary:

- We are of the view that Britam Holdings Plc is a “Sell” with a target price of Kshs 5 representing a downside of 6.0%, from the current price of 8.0 as of 28th March 2025.

Britam is currently trading at a P/TBV of 1.1x and a P/E of 4.0x vs an industry average of 0.8x and 8.1x respectively.

- Liberty FY’2024 results

During the week, Liberty Kenya Holdings released their FY’2024 results, with Profit After Tax (PAT) increasing by 119.7% to Kshs 1.4 bn, from Kshs 0.6 bn recorded in FY’2023, mainly driven by a 99.8% increase in Net investment income to Kshs 2.0 bn, from Kshs 1.0 bn in FY’2023 and further supported by 5.6 % increase in Net insurance income to Kshs 1.00 bn, from Kshs 0.95 bn in FY’2023,

|

Cytonn Report: Liberty Kenya Holdings Income Statement |

|||

|

Item (All figures in Bns) |

FY'2023 |

FY'2024 |

y/y change |

|

Net Insurance Service Revenue |

1.0 |

1.0 |

5.6% |

|

Net Investment Revenue |

1.0 |

2.0 |

99.8% |

|

Total Insurance and Investment Result |

1.9 |

3.0 |

53.8% |

|

Other Operating Result |

(0.9) |

(0.9) |

(4.3%) |

|

Profit Before Tax |

1.0 |

2.1 |

106.6% |

|

Profit after tax |

0.6 |

1.4 |

119.7% |

|

Core EPS |

1.2 |

2.6 |

119.7% |

|

Dividend Per Share |

0.4 |

1.0 |

168.1% |

|

Dividend Yield |

7.4% |

9.7% |

31.2% |

|

Dividend Pay-out Ratio |

31.7% |

38.7% |

22.1% |

|

Cytonn Report: Liberty Kenya Holdings Balance Sheet |

|||

|

Item (All figures in Bns) |

FY'2023 |

FY'2024 |

y/y change |

|

Financial Investments |

20.3 |

27.6 |

35.7% |

|

Re-insurance contract assets |

5.7 |

1.9 |

-67.2% |

|

Total Assets |

43.8 |

48.1 |

10.0% |

|

Insurance contract Liabilities |

23.9 |

18.9 |

(20.6%) |

|

Shareholders’ Funds |

9.6 |

10.6 |

11.2% |

|

Total Liabilities |

34.2 |

37.5 |

9.7% |

Key take outs from the results:

- Core Earnings Per share increased by 119.7% to Kshs 2.6 from Kshs 1.2 in FY’2023, driven by the 99.8% increase in Net investment income to Kshs 2.0 bn, from Kshs 1.0 bn in FY’2023 and further supported by 5.6 % increase in Net insurance income to Kshs 1.00 bn, from Kshs 0.95 bn in FY’2023,

- Net Investment Income increased by 99.8% to Kshs 2.0 bn, from Kshs 1.0 bn in FY’2023.This was majorly attributable to a significant 872.2% increase in investment gains to Kshs. 5.7 bn from Kshs 0.6 bn in FY’2023, that outpaced the 542.8% increase in net insurance finance expenses to 8bn ,from 0.4 bn in FY’2023

- Net insurance revenue before reinsurance contracts held increased by 9.9% to Kshs 2.4 bn in FY’2024 from of Kshs 2.2 bn in FY’2023, while net expense from reinsurance contracts held increased by 13.2% to Kshs 1.4 bn from Kshs 1.3 bn in FY’2023, this translated to an insurance service result increase of 5.6% to Kshs 1.00 bn from Kshs 0.95 bn in FY’2023,

- The balance sheet recorded an expansion as total assets increased by 10.0% to Kshs 48.1 bn in FY’2024 from Kshs 43.8 bn in FY’2023 mainly driven by 35.7% increase in financial investments to Kshs 27.6 bn from Kshs 20.3 bn in FY’2023, however weighed down by 67.2% decrease in reinsurance contract assets Kshs 1.9 bn from Kshs 5.7 bn in FY’2023,

- Total liabilities increased by 9.7% to Kshs 37.5 bn from Kshs 34.2 bn in FY’2023, majorly on the back of the 55.5% increase in financial liabilities under investment contracts to Kshs 11.0 bn from Kshs 7.1 bn in FY’2023, which outpaced the 20.6% decrease in insurance contract liabilities to Kshs 18.9 bn, from Kshs 23.9bn in FY’2023,

- The Board of Directors recommended a normal dividend of Kshs 0.5 per share,and a special dividend of Kshs 0.5per share, bringing the total dividend in FY’2024 to Kshs 0 per share, compared to Kshs 0.373 per share FY’2023. This translates to a dividend payout ratio of 38.7% and a dividend yield of 9.7% as of 28th March 2025, compared to a dividend payout ratio of 31.7% and a dividend yield of 7.4% in a similar period for FY’2023.

Going forward, the factors that would drive the company’s growth would be:

- Technology Architecture – The company seeks to leverage technology to unify policy administration system for Liberty Life, enhance actuarial modeling, upgrade medical business systems, and API/digital

Valuation Summary:

- We are of the view that Liberty Kenya Holdings Plc is an “Accumulate” with a target price of Kshs 11.5 representing an upside of 7%, from the current price of 8.34 as of 25th March 2025, inclusive of a dividend yield of 12.0%

- Liberty Kenya Holdings Plc is currently trading at a P/TBV of 0.7x and a P/E of 5x vs an industry average of 0.6x and 11.3x respectively.

- Kenya Airways FY’2024 results

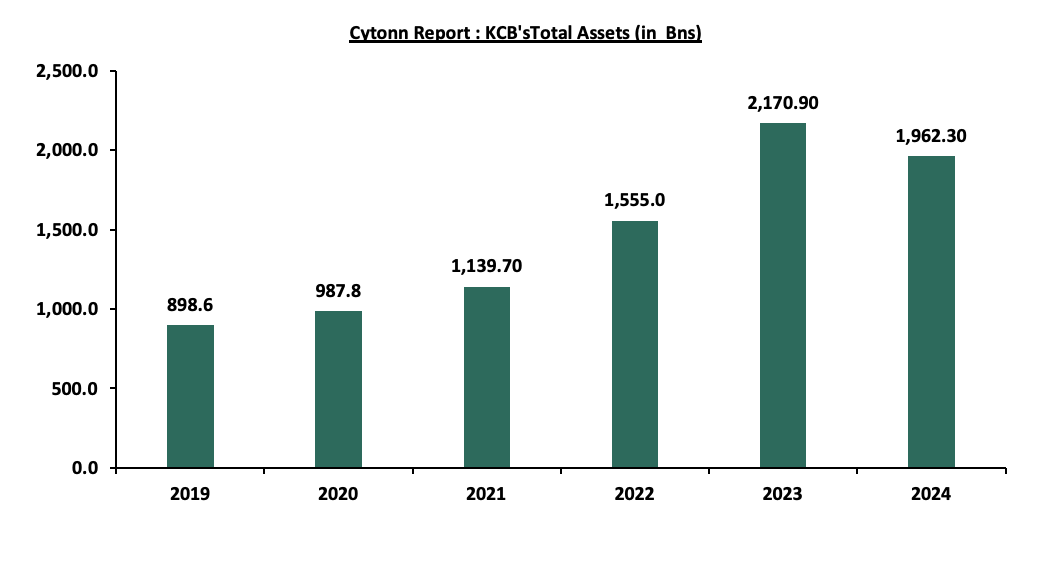

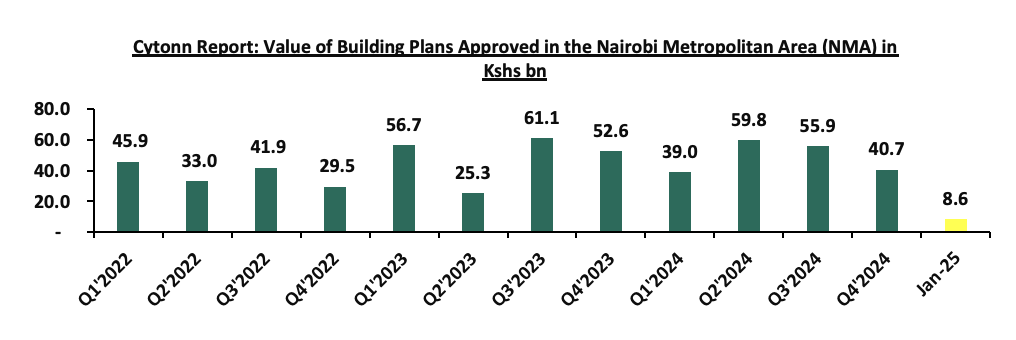

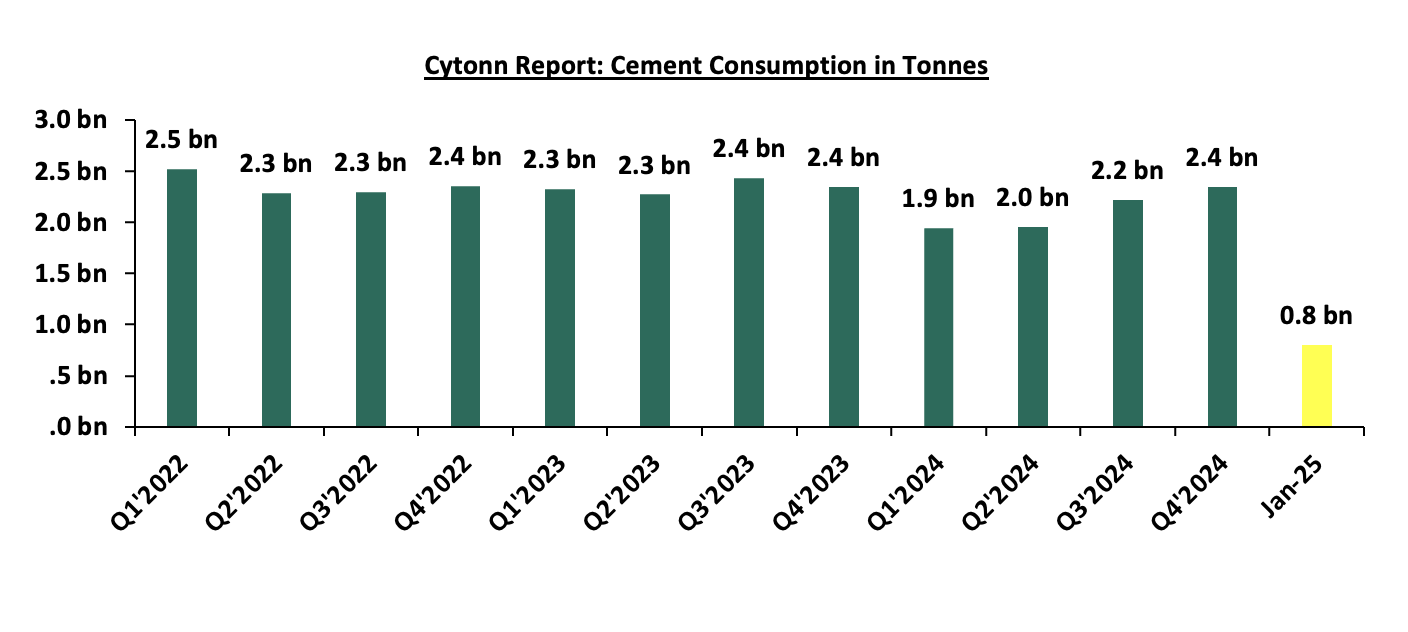

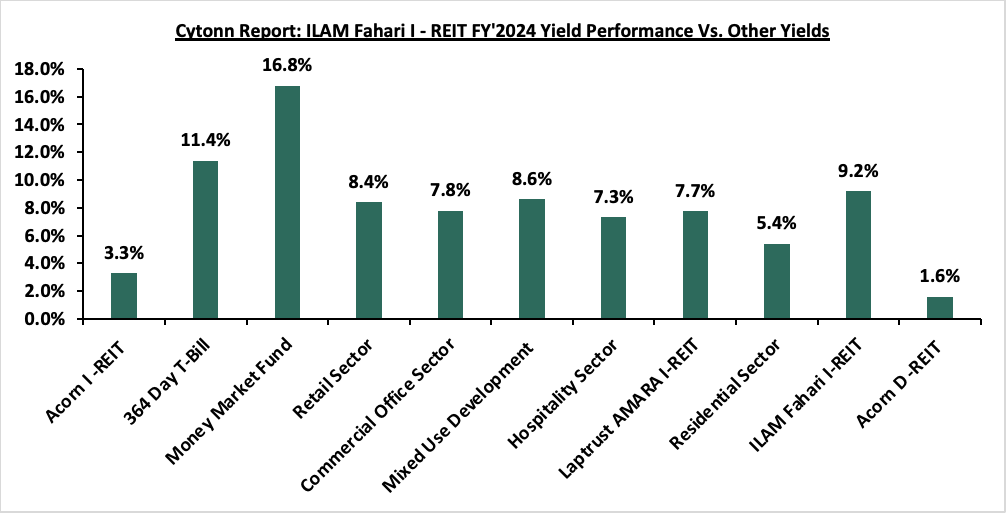

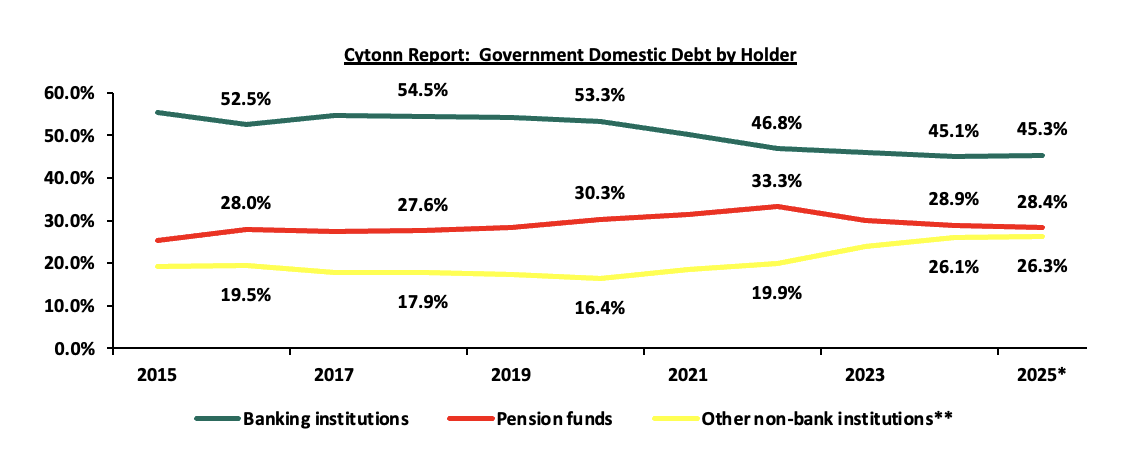

During the week, Kenya Airways Plc released their FY’2024 results, recording a significant 123.9% increase in Profit After Tax to Kshs 5.4 bn, from the Kshs 22.7 bn loss recorded in FY’2023. The performance was mainly driven by a106.5% increase in forex gains on borrowings, attributable to the 17.4% appreciation of the Kenyan shilling, coupled with a 57.8% increase in operating profit to Kshs 16.6 bn, from the Kshs 10.5 bn recorded in FY’2023. The Kshs 5.4 bn profit after tax was the highest ever recorded in Kenya Airways’ history due to the recovery strategy under Project Kifaru.