Jun 16, 2019

Following the release of Q1’2019 results by Kenyan banks, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed banks and identified the key factors that shaped the performance of the sector, and our expectations of the banking sector for the rest of the year.

The report is themed "Consolidation and Diversification to Drive Growth”, as we assess the key factors that influenced the performance of the banking sector in the first quarter of 2019, the key trends, the challenges banks faced, and areas that will be crucial for growth and stability of banking sector going forward. As a result, we seek to answer the questions, (i) “what were the trends witnessed in the banking sector in Q1’2019?” (ii) “what influenced the banking sector’s performance?”, and, (iii) “what should be the focus areas for the banking sector players going forward?”. As such, we shall address the following:

- Key Themes that Shaped the Banking Sector in Q1’2019;

- Performance of the Banking Sector in Q1’2019; and,

- Outlook and Focus Areas of the Banking Sector Players Going Forward.

Section I: Key Themes that Shaped the Banking Sector in Q1’2019:

Below, we highlight the key themes that shaped the banking sector in Q1’2019, which include consolidation, regulation, asset quality and improved earnings:

- Consolidation – Consolidation activity remained one of the key highlights witnessed in Kenya’s banking sector, as players in the sector are either acquired or merged leading to formation of relatively larger, well capitalized and possibly more stable entities. Ongoing consolidation transactions include:

-

- KCB Group also issued its proposal to acquire 100.0% of all the ordinary shares of National Bank of Kenya (NBK) on 18th April 2019, through a share swap of 1 ordinary share of KCB for every 10 NBK shares. The swap will be after the conversion of 1.135 bn preference shares in NBK, to ordinary shares. The transaction has been ratified by the Boards of Directors of both banks, and the shareholders of both banks. The transaction will create the largest bank by assets in East Africa. Using current the Q1’2019 financial results, KCB would have a pro-forma asset base of Kshs 830.4 bn, in line with the bank’s strategy to grow its balance sheet to more than Kshs 1.0 tn by 2021. We note that this would enable KCB to increase its customer base and product offerings, which should result in a steady growth in profitability. The transaction is expected to be completed by 8th October 2019, upon which the additional shares of KCB will be issued and listed at the Nairobi Securities Exchange (NSE). Both the Central Bank of Kenya (CBK) and the Competition Authority of Kenya (CAK) are expected to grant their approvals by 30th July 2019.

- In January 2019, the directors of NIC Group and Commercial Bank of Africa (CBA) announced their agreement to a proposed merger between the two banks that was first announced on 6th December 2018, with the shareholders of both banks accepting the merger proposition during the respective Annual General Meetings (AGMs). The Competition Authority of Kenya has also granted its approval of the transaction citing that the proposed transaction is unlikely to lead to lessening of competition in the relevant product market for both the retail and corporate banking segments. The proposed merger is expected to be completed upon fulfilment of a certain set of conditions, with the merged entity expected to commence its operations at the onset of Q3’2019. The proposed transaction will be executed through a share swap in the ratio of 53:47 between CBA and NIC, implying that shareholders of CBA Group will be entitled to own 53.0% of the merged entity’s issued shares while shareholders of NIC Group will be allotted 47.0% of the combined entity. Given that NIC Group has 703.9 mn issued shares, it will have to issue 793.8 mn new shares to CBA shareholders, in order to adhere to the 53:47 share swap ratio. The merged company, is set to remain listed on the Nairobi Securities Exchange (NSE). Mr. John Gachora, who is currently the Group Managing Director of NIC Group will become the Group Managing Director and Chief Executive Officer of the combined entity, while Isaac Awuondo who is currently the Group Managing Director of CBA will become Chairman of the Kenyan banking subsidiary, and will maintain direct oversight over the Digital Business. The appointments are in line with our expectations, which we highlighted in our Cytonn January 2019 Monthly Report. With digital banking being a core aspect in the merger, a separate digital banking unit will be created, and it will be overseen by its own distinct board. We note that the transaction has been progressing with some of the requisite approvals being granted. Pending approvals include that of the Central Bank of Kenya (CBK). Both banks are preparing for a merger on the day to day operations, with an Integration Management Office having been set up and a detailed integration work plan developed. We expect the merger to be completed with the set-out timelines, with the merged entity expected to commence operations in August 2019. CBA Group issued Jamii Bora owners with a buyout offer of Kshs 1.4 bn, to acquire a 100.0% stake in the bank. With Jamii Bora’s equity position of Kshs 3.4 bn as at Q1’2018, without further injection, it would imply the transaction would happen at a P/Bv ratio of 0.4x. As highlighted in our note on the CBA Acquisition of Jamii Bora Note, we are of the view that the huge discount to equity was largely due to Jamii Bora’s deteriorating financial performance, whose genesis can be traced to the enactment of the Banking (Amendment) Act 2015 that capped interest chargeable on loans, as shown by the steep 21.0% decline in the loan book in the first full year of implementation of the Banking (Amendment) Act 2015. The declining performance impacted Jamii Bora’s liquidity, with its liquidity position declining to (11.1%) as at Q1’2017, indicating its inability to meet any short-term obligations. The performance consequently enables CBA to offer a buyout at the huge discount to the book.

- Kenyan banks continued to pursue their inorganic growth strategies beyond Kenya, with a key example being Equity Group Holdings, who entered into a binding term sheet with Atlas Mara Limited to acquire certain banking assets in 4 countries in exchange for shares in Equity Group. These include:

- 62.0% of the share capital of Banque Populaire du Rwanda (BPR);

- 100.0% of the share capital of Africa Banking Corporation Zambia (ABCZam) Ltd.;

- 100.0% of the share capital of Africa Banking Corporation Tanzania (ABCTz); and,

- 100.0% of the share capital of Africa Banking Corporation Mozambique Ltd (ABCMoz).

Equity will also pursue acquiring additional share capital in BPR from some or all of the remaining shareholders. The transaction will be funded by a share swap whereby Atlas Mara will be allotted 252.5 mn new shares of Equity Group, which translates to 6.3% of the pro-forma expanded issued share capital. This is equivalent to Kshs 10.0 bn using the closing price of Kshs 39.5 on 13th June 2019. Atlas Mara and Equity have also highlighted that there may be an additional capital injection by Atlas after the consummation of the transaction. The aggregate consideration to be paid by Equity remains subject to the completion of the confirmatory due diligence. The completion of the transaction is subject to the approval of various regulatory bodies such as the Central Bank of Kenya, Competition Authority of Kenya, and the respective central banks and competition authorities of the subsidiaries’ domicile. Atlas has its holdings spread out across Sub Saharan region. A successful completion of the transaction would likely see Equity expand its regional footprint, aiding the bank’s performance which has in the recent past been constrained by thin margins due to the existent caps on loans. By expanding into markets where credit pricing is unrestricted, Equity would be able to leverage on its strong retail banking expertise as well as its strong digital banking capability via its subsidiary-Finserve. This would enable Equity to expand both its funded and Non-Funded Income (NFI) revenue streams.

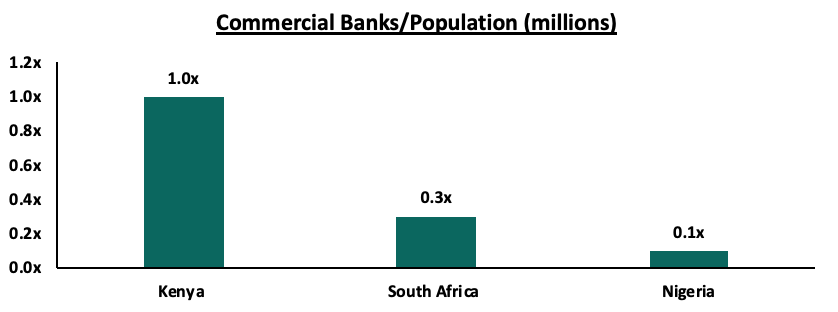

As noted in our focus note titled Consolidation in Kenya’s Banking Sector to Continue, we expect more consolidation in the banking sector, as the relatively weaker banks that probably do not serve a niche become acquired by the larger counterparts who have expertise in deposit gathering, or serve a niche in the market. Consolidation will also likely happen, as entities form strategic partnerships, as they navigate the relatively tougher operating environment that is exacerbated by the stiff competition among the various players in the banking sector. We maintain our view that Kenya continues to be overbanked when compared to other countries in Africa as shown in the chart below, necessitating a reduction in the number of players in the sector.

The table below summarises the deals that have either happened or announced and expected to be concluded:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

19-Apr* |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

19-Jan* |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

19-Jan |

|

CBA Group |

NIC Group |

33.5** |

53:47*** |

Undisclosed |

N/A |

19-Jan* |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

18-Dec |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

18-Aug |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

17-Mar |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

16-Nov |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

16-Jun |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

16-Jun |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

15-Mar |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

14-Jul |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

13-Nov |

|

Average |

|

|

78.3% |

|

1.5x |

|

|

* Announcement date |

||||||

|

** Book Value as of the announcement date |

||||||

|

*** Shareholder swap ratio between CBA and NIC, respectively |

||||||

- Regulation - Regulation remained a key aspect that affected the banking sector, with the regulatory environment evolving and becoming increasingly stringent. Key changes in the regulatory environment in Q1’2019 include:

-

- Banking Sector Charter: The Central Bank of Kenya proposed to introduce a Banking Sector Charter in 2018, which will guide service provision in the sector. The Charter which came into effect in March 2019, aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. It is expected to facilitate a market-driven transformation of the Kenyan banking sector, thereby considerably improving the quality of service provided, as well as increase the access to affordable financial services for the unbanked and under-served population. The impending implementation of the charter will likely introduce risk-based credit scoring, which requires banks to extend credit on the basis of their credit scores, as determined by licensed credit reference bureaus. The charter is largely centered on consumer protection, by requiring banks to make full disclosure on the terms of the issuance of credit. In a bid to improve credit extension to Micro, Small and Medium Enterprises (MSMEs), the Banking Sector Charter prescribes that banks should have at least 20.0% of the loans extended to MSMEs. The CBK requires strict compliance with the charter, as banks may be imposed with administrative sanctions should they fail to comply with the charter,

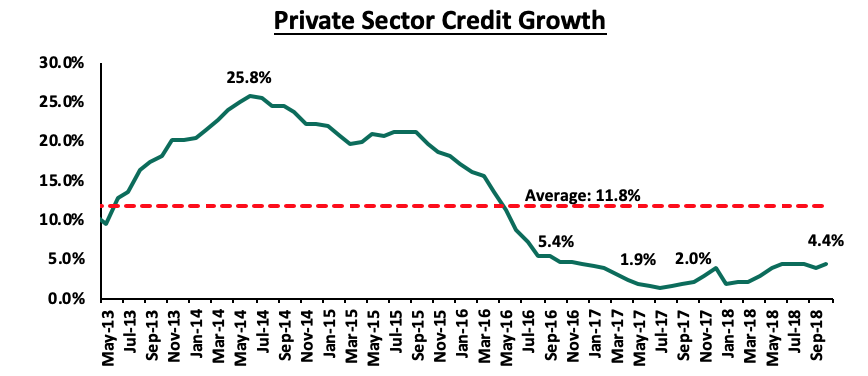

- Banking (Amendment) Act 2015: During the quarter, the High Court suspended the Banking (Amendment) Act 2015 for 1-year, terming it as unconstitutional.The court found the provisions of sections 33 b (1) and (2) of the Banking Act, which capped interest at 4.0% above the Central Bank Rate (CBR) to be vague, imprecise and ambiguous. Furthermore, in the Finance Bill 2019, there is the proposition by the Cabinet Secretary of The National Treasury to repeal the Act, citing that since its enactment, the law has failed to meet its objective of improved credit access, especially to MSMEs. As shown in the graph below, private sector credit growth has remained below 5.0% in the regime of capped interest, with banks unable to price a majority MSMEs within the set margins. We however are not optimistic that the law would be repealed, as The National Assembly has always been huge proponents of the law, and has always maintained that the law is to the benefit of the common Kenyan. At best, we expect a revision of the margins set by the law, such a 6.0% margin above the 4.0% upper limit set by the current law. We note that the CBK has been proactive in implementing policies aimed at consumer protection and increased credit access, with the policies yielding minimal results. We thus maintain our view that a repeal of the law remains the best course of action to spur credit extension to MSMEs, which should consequently spur economic growth.

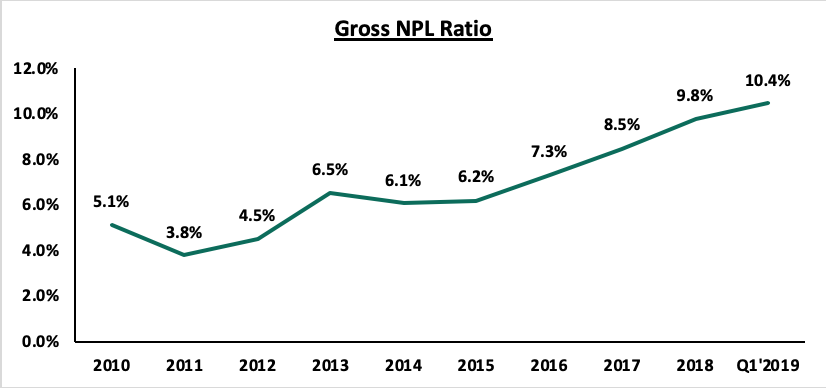

- Asset Quality – The banking sector continued to record a deterioration in its asset quality in Q1’2019, as indicated by the rise in the Gross Non-Performing Loans (NPLs) ratio to 10.4%, from 9.6% in Q1’2018, much higher than the 5-year average of 8.4%. The chart below highlights the asset quality trend:

Economic recovery from the harsh operating environment experienced in 2017 and the first quarter of 2018, has been slower than anticipated, which resulted in an increase in the number and value of bad loans. The major sectors touted by banks as leading in asset quality deterioration include trade, retail, manufacturing and real estate. Delayed payments by the government was also identified as a contributing factor, which affected various sectors, with small to mid-sized entities affected the most. Owing to the deteriorating asset quality, banks continued to implement their stringent lending policies in a bid to curb the relatively rising NPLs, and consequently the associated impairment charges. Furthermore, banks have been investing heavily in adopting the use of advanced credit scoring method to pre-identify delinquencies before they occur. In addition, several bank have set up remediation teams that help distressed clients to restructure, and consequently regain their debt-servicing capability. We however expect the industry’s asset quality to deteriorate in the near-term as businesses continue to cite a relatively tight environment. Banks will thus continue to focus largely on (i) lending to relatively larger corporate entities, (ii) secured lending and, (iii) working capital financing to financially sound businesses.

- Revenue Diversification: Listed banks continued their revenue diversification drive by growing the Non-Funded Income (NFI) segment, with various banks launching several initiatives as highlighted below:

- Co-operative Bank of Kenya launched the Co-op Bank Property Hub under its mortgage division, which will offer property sales and mortgage origination to its clients. The Property Hub intends to serve the clients who have property to sell and connect them to the Co-operative Bank clients who want to buy property. The bank will also offer mortgages to the buyers of the property as it expects to leverage on its contacts with key institutions and the cooperative movements that largely own the bank to boost the property sales for its clients. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019. Co-operative Bank also highlighted its plan of growing the business of its leasing-focused subsidiary Co-op Bank Fleet, which intends to leverage on the synergies created by Co-operative Bank’s client base to grow its business, with the main business case of the subsidiary being the easing of the cash flow constraints of acquisitions of fleets, repair and maintenance, thus allowing businesses to focus on their core business. For more information, please see our report here,

- Diamond Trust Bank Kenya (DTBK) announced that it has partnered with SWIFT, a leading provider of secure financial messaging services, in order to provide real time cross border payments to its clients. DTBK will be the first East African Bank to go live on the SWIFT global payment innovation service, a service that is carrying out over USD 30.0 bn worth of transactions a day, in over 148 currencies. For more information, please see our Kenya Mortgage Refinancing Company Update & Cytonn Weekly #17/2019, and,

- Standard Chartered Bank Kenya (SCBK) launched an innovation hub lab in Nairobi dubbed Xcelerator in a bid to boost its revenue streams and diversify by riding on financial technology. SCBK plans to allocate Kshs 10.0 bn into supporting Financial Technology (FinTech) startups to scale up and generate innovative solutions to problems in the banking sector. StanChart views FinTech firms as partners amid their growing disruption of the local financial sector, a move likely to aid the bank in generating additional revenue. For additional information, please see our Cytonn Weekly #15/2019

We expect more forays by banks into the NFI segment, as players seek to alleviate the effects of the compressed funded income regime.

Section II: Performance of the Banking Sector in Q1’2019:

The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-funded income Growth |

NFI to Total Operating Income |

Growth in Total Fee and Commissions |

Deposit Growth |

Growth in Govt Securities |

Cost to Income |

Loan to Deposit ratio |

Loan Growth |

Cost of Funds |

Return on average equity |

|

Equity |

4.9% |

6.5% |

7.4% |

6.3% |

8.6% |

6.9% |

40.8% |

3.2% |

12.1% |

13.0% |

49.8% |

71.3% |

12.7% |

2.6% |

22.8% |

|

KCB |

11.4% |

7.1% |

(4.1%) |

11.2% |

8.5% |

9.2% |

32.3% |

11.6% |

11.2% |

18.9% |

54.7% |

84.1% |

10.9% |

3.1% |

22.4% |

|

Co-op |

4.4% |

(2.9%) |

6.2% |

(6.5%) |

8.7% |

19.1% |

37.7% |

33.6% |

7.4% |

33.1% |

54.2% |

79.2% |

(0.5%) |

3.7% |

18.3% |

|

SCBK |

31.2% |

(6.4%) |

(28.8%) |

2.8% |

7.8% |

5.6% |

32.4% |

(10.0%) |

0.3% |

13.9% |

51.9% |

50.5% |

3.3% |

3.4% |

18.2% |

|

I&M |

30.5% |

8.9% |

18.2% |

2.1% |

6.1% |

9.7% |

38.2% |

(4.0%) |

28.8% |

8.2% |

44.9% |

76.4% |

10.6% |

5.0% |

17.9% |

|

Barclays |

13.8% |

7.1% |

38.8% |

(1.3%) |

8.7% |

14.0% |

32.2% |

11.6% |

15.9% |

24.0% |

61.9% |

80.6% |

9.0% |

3.6% |

16.5% |

|

Stanbic Bank |

N/A |

12.9% |

2.2% |

19.3% |

4.9% |

17.7% |

49.0% |

61.5% |

29.0% |

(8.8%) |

53.0% |

75.9% |

12.6% |

3.2% |

14.3% |

|

DTBK |

9.3% |

(5.1%) |

(3.0%) |

(6.6%) |

6.2% |

15.3% |

25.3% |

(7.4%) |

1.3% |

5.3% |

51.8% |

68.5% |

(2.9%) |

5.0% |

13.8% |

|

NIC |

(4.3%) |

1.3% |

(7.9%) |

9.4% |

5.9% |

7.2% |

29.1% |

6.2% |

5.0% |

10.3% |

65.2% |

78.3% |

2.1% |

5.1% |

12.2% |

|

NBK |

N/A |

18.7% |

(17.8%) |

41.7% |

8.2% |

(9.2%) |

22.5% |

(10.8%) |

2.6% |

15.1% |

92.9% |

51.5% |

(10.2%) |

3.3% |

11.3% |

|

HF |

N/A |

(16.2%) |

(8.3%) |

(26.7%) |

4.1% |

(8.8%) |

33.6% |

79.7% |

(5.3%) |

45.1% |

120.5% |

89.1%** |

(13.9%) |

7.4% |

(7.4%) |

|

Q1'2019Weighted Average* |

12.20% |

3.60% |

2.50% |

4.50% |

8.00% |

10.70% |

36.00% |

11.20% |

11.00% |

16.10% |

53.80% |

74.00% |

7.70% |

3.40% |

19.20% |

|

Q1'2018 Mkt cap Weighted Average |

14.4% |

9.3% |

11.4% |

8.1% |

8.1% |

9.5% |

37.1% |

12.2% |

9.4% |

25.0% |

56.6% |

76.8% |

6.1% |

3.6% |

18.4% |

*Market cap weighted as at 31st May 2019

** Loans to Loanable funds used owing to nature of the business

Key takeaways from the table above include:

- Kenya Listed Banks recorded a 12.2% average increase in core Earnings Per Share (EPS), compared to a growth of 14.4% in Q1’2018, with the relatively lower performance attributed to the base effect, as the sector was coming from a relatively poor performance in Q1’2017,

- Deposit growth came in at 11.0%, faster than the 9.4% growth recorded in Q1’2018. Despite the relatively fast deposit growth, interest expenses rose by 2.5% compared to 11.4% in Q1’2018 indicating that banks have been mobilizing relatively cheaper deposits. Furthermore, in September 2018, an implementation of the Finance Act 2018 saw the removal of the minimum interest rate payable on deposits, which stood at 70.0% of the Central Bank Rate (CBR). This helped mitigate high increments in interest expense, despite the relatively fast deposit growth,

- Average loan growth came in at 7.7%, which was faster than the 6.1% recorded in Q1’2018, indicating that there was an improvement in credit extension, with banks targeting select segments such as corporate entities, and Small and Medium Enterprises (SMEs). Government securities on the other hand recorded a growth of 16.1% y/y, which was faster compared to the loans, albeit slower than 25.0% recorded in Q1’2018. This highlights banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns. Interest income increased by 3.6%, compared to a growth of 9.3% recorded in Q1’2018. The slower growth in interest income despite the increased allocations to both loans and government securities may be attributable to the decline in yields on loans owing to the 100-bps decline in the CBR, and the decline in yields on government securities, and consequently, the Net Interest Margin (NIM) declined to 8.0% from 8.1% in Q1’2018,

- Non-Funded Income grew by 10.7% y/y, faster than 9.5% recorded in Q1’2018. The growth in NFI was supported by the 11.2% average increase in total fee and commission income, albeit slower than the 12.2% growth recorded in Q1’2018. The fee and commission income growth continues to be subdued by the implementation of the Effective Interest Rate (EIR) model under IFRS 9 in 2018, which requires banks to amortize the fees and commissions on loans, over the tenor of the loan. The relatively slower loan growth, a majority of which is to corporates, also inhibited the growth in fee and commission income loans, as corporates tend to be charged relatively lower commission rates, and,

- The sector continued to record an improvement in operating efficiency, as shown by the improvement in the Cost to Income Ratio (CIR) to 53.8%, from 56.6% in Q1’2019, indicating that the raft of cost rationalization measures adopted by banks in the onset of the capped interest rate regime, have borne fruit. Without LLP, the CIR also improved y/y, declining to 48.0%, from 49.0% in Q1’2018.

Section III: Outlook and Focus Areas of the Banking Sector Going Forward:

In summary, the banking sector had a slower growth compared to a similar period last year, largely due to base effect as the sector was coming from a relatively low base in Q1’2017, and a slower expansion of funded income segment, as NII rose by 4.5% in Q1’2019, slower than 8.1% in Q1’2018. Funded income continues to record relatively slower growth, affected by the declining yields in both loans and government securities. We maintain our view that the interest rate cap has not achieved its intended objectives of easing the access to credit and reducing the cost of credit, and thus needs to be repealed, so as to spur economic growth, as MSMEs that have continued to struggle access the much needed credit. We also continue to be proponents of promoting competing sources of financing, which should reduce the overreliance on bank funding in the economy, currently between 90.0% to 95.0% of all funding. By having various competing sources of financing, this would trigger a self- regulated pricing structure, in the event of a repeal of the law.

Thus, we expect the following:

- A review of the Banking (Amendment) Act 2015, with a proposition to repeal the law included in the Finance Bill 2019. Given that The High Court suspended the law terming it as unconstitutional, and a Member of Parliament proposing a revision of the law to include a ceiling of 6.0% above the limit set by the Banking (Amendment) Act, 2015 for the high risk borrowers, we expect parliament to maintain their stance of a no repeal, and instead opt for an amendment of the margins, as pressure from various institutions such as the National Treasury and the CBK, mounts,

- As the interest rate cap law remains in place, we continue to expect relatively low credit extension, and expect private sector credit growth to remain below 5.0%, as banks continue to skew their asset allocation in government securities that yield higher risk-adjusted returns, and,

- The ongoing demonetization exercise will likely result in a possibly stronger deposit growth for banks especially in Q4’2019, as money flows into banks, especially in the run up to the 1st October deadline. Furthermore, during the current transition period, we expect an increase in the number and value of transactions, as demand for digital transactions rises, with a majority of people prioritizing digital transactions to avoid handling fake currency. This should presumably lead to a relatively better performance of the Non-Funded Income (NFI) segment.

We expect banks to continue focusing on the following:

- Asset quality management: Banks will look to manage the industry-wide deteriorating asset quality, which may involve further tightening of credit standards as banks cherry pick low risk credit consumers and increase focus on secured, collateral-based lending,

- Revenue diversification: In the current regime of compressed interest margins focus on Non-Funded Income (NFI) is likely to continue, as banks aim to grow transactional income via alternative channels such as agency banking, internet and mobile technologies,

- Operational efficiency: Cost containment is likely to continue being a focus area. We thus expect continued restructuring, possible leading to staff layoffs, as staff headcount demands reduce, on increased usage of mobile and internet channels, and,

- Downside regulatory compliance risk management: With increased emphasis on anti-money laundering and fraudulent transactions, we expect banks to be keener on streamlining their operational processes and procedures in line with global standards and regulatory requirements.

For more information, see our Cytonn Q1’2019 Banking Sector Review

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.