Jan 5, 2025

Economic Growth:

According to the Kenya National Bureau of Statistics (KNBS) Q2’2024 Quarterly Gross Domestic Product Report, the Kenyan economy recorded a 4.6% growth in Q2’2024, slower than the 5.6% growth recorded in Q2’2023. The main contributor to Kenyan GDP remains to be the Agriculture, Fishing and Forestry sector which grew by 4.8% in Q2’2024, lower than the 7.8% expansion recorded in Q2’2023. Most sectors recorded lower growth rates compared to Q2’2023 with Accommodation and Food Services and Financial & Insurance recording growth of 26.6%, 5.1%, compared to, 42.8%, 13.2% growth in Q2”2023 respectively. The slowed growth in the economy could be attributed to the still elevated fuel prices which made production more expensive and negatively impacted the business environment and the unrest caused by the anti-finance bill protests in June. The Kenyan Economy is projected to grow at an average of 5.3% in 2024 according to various organizations as shown below:

|

Cytonn Report: Kenya 2024 Growth Projections |

||

|

No. |

Organization |

2024 GDP Projections |

|

1 |

International Monetary Fund |

5.3% |

|

2 |

National Treasury |

5.5% |

|

3 |

World Bank |

5.2% |

|

4 |

Fitch Solutions |

5.2% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.3% |

|

Source: Cytonn Research

In 2024, the Kenyan economy is projected to grow at an average of 5.3%, lower than the growth of 5.6% observed in 2023. The slower growth is primarily attributable to reduced private sector activity and ongoing fiscal consolidation efforts by the government, which have limited public spending. Additionally, political instability during the year, fueled by anti-finance bill protests and opposition against the current regime, has undermined investor confidence and disrupted economic activities. This instability is expected to further weigh on economic growth.

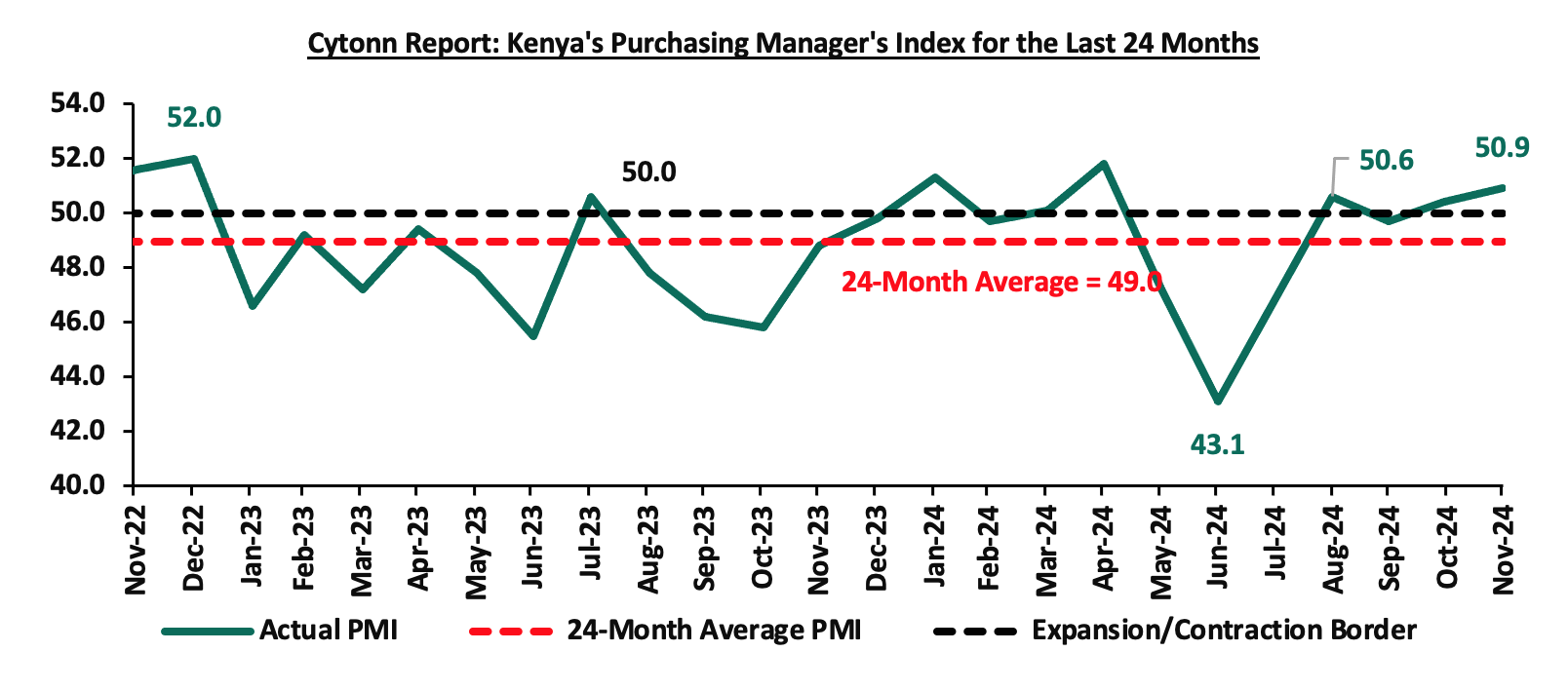

Business conditions in the Kenyan private sector recorded an improvement during the year, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eleven months averaging at 49.5, 1.5 points higher than the average of 48.0 recorded during a similar period in 2023. Similarly, PMI for the month of November 2024 came in at 50.9, up from 50.4 in October 2024 signaling an uptick of the business environment for the second consecutive month. This was majorly attributable to stable fuel prices and a decrease in borrowing costs, which resulted to the increase sales to its strongest performance in six months. The chart below shows the trend of Kenya’s Purchasing Managers index for the last 24 months;

Source: Stanbic PMI

Kenyan Shilling:

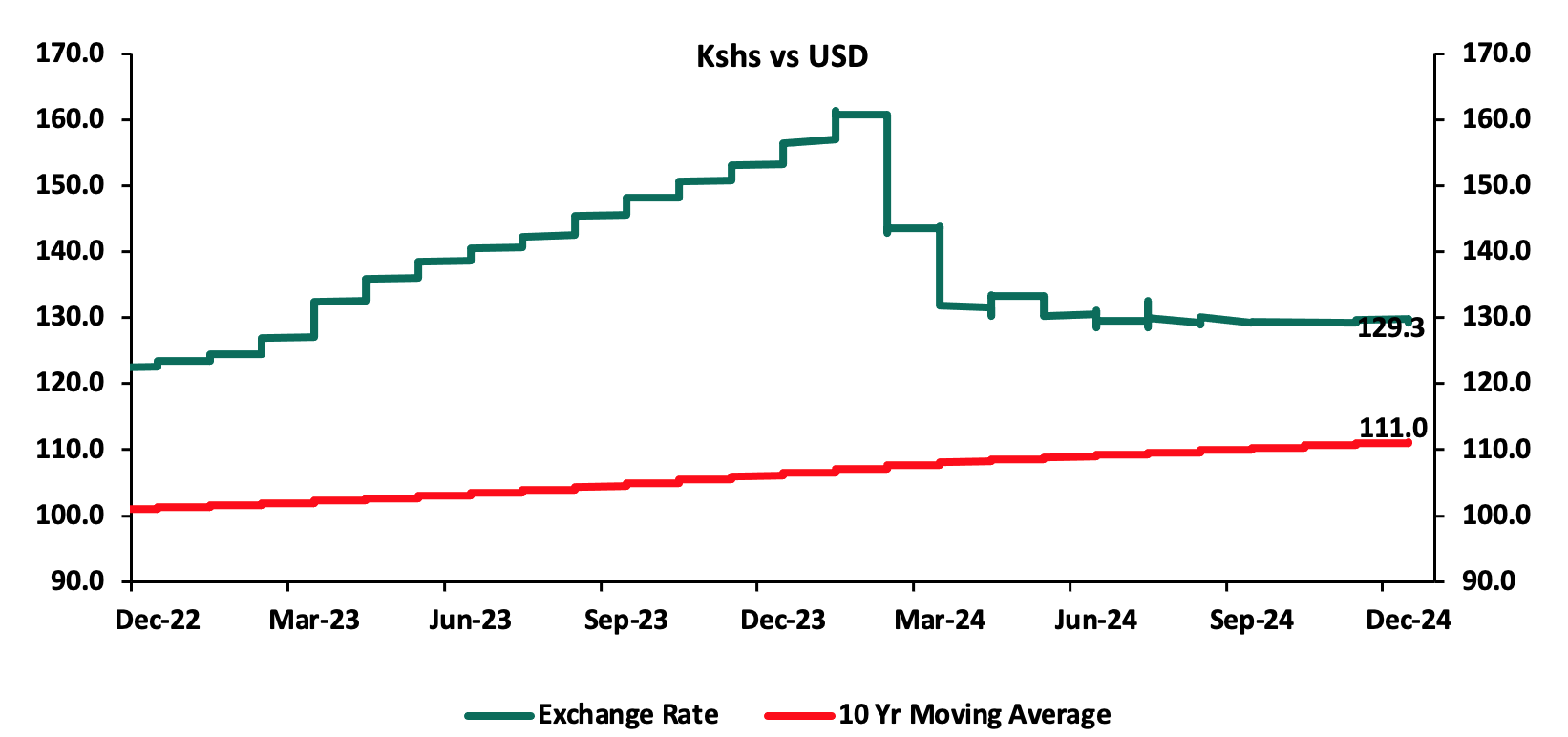

The Kenya Shilling appreciated by 17.4% against the US Dollar to close at Kshs 129.3 in 2024, compared to Kshs 156.5 at the end of 2023, a contrast to the 26.8% depreciation recorded in 2023. The chart below highlights the performance of the Kenyan Shilling against the US Dollar in 2024;

Source: Central Bank of Kenya

The appreciation of the Kenyan shilling in 2024 was driven by;

- Improved diaspora remittances standing at a cumulative USD 4,872.0 mn in the 12 months to November 2024, 16.7% higher than the USD 4,175.0 mn recorded over the same period in 2023. In the November 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.4% in the period,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars,

- Foreign loan disbursements, with the government receiving a total USD 3.1 bn out of the committed USD 3.6 bn from International Monetary Fund (IMF) as of November 2024 under the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF), as well as USD 180.4 mn out of the committed USD 541.3 mn from the Resilience Sustainability Facility (RSF) following the completion of the second review in November 2024, and,

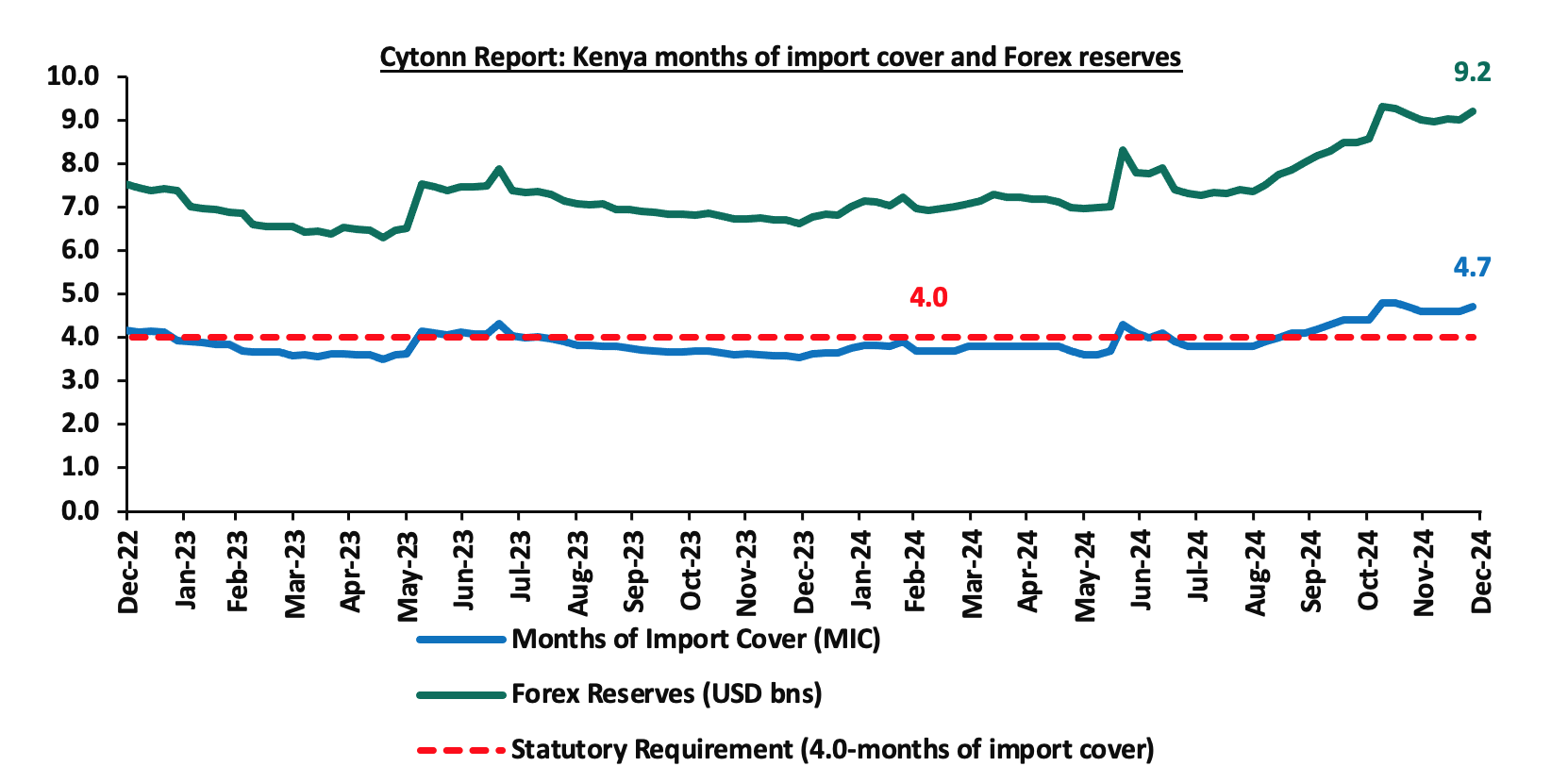

- Improved forex reserves currently at USD 9.2 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover. The following is a graph showing Kenya months of import cover and forex reserves for the last 10 years;

Source: Central Bank of Kenya

The shilling was however weighed down by:

- An ever-present current account deficit which came at 3.8% of GDP in Q2’2024 from 3.7% recorded in a similar period last year. Key to note, the current account deficit narrowed by 34.5% to Kshs 104.1 bn from Kshs 159.0 bn in Q2’2023. The y/y narrowing of the current account was brought about by the 3.7% narrowing in Merchandise trade deficit to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn in Q2’2023 driven by the 10.9% growth in merchandise exports to Kshs 276.2 bn, from Kshs 249.1 bn in Q2’2023 which outpaced the 2.3% increase in merchandise imports to Kshs 617.5 bn from Kshs 603.4 bn recorded in a similar period in 2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

The Kenyan shilling gained by 17.4% in 2024 to close the year at Kshs 129.3. We expected the shilling to remain within a range of Kshs 183.2 and Kshs 189.6 against the USD by the end of 2024 with a bias towards a 16.4% depreciation by the end of the year. The shilling’s appreciation against the USD dollar overshot our projection due to the aggressive mechanism by the CBK to allow the currency exchange rate reach an equilibrium hence hitting its true value as well the USD 1.5 bn Eurobond buyback in February. Read on our outlook on Performance of Kenya Currency. Looking ahead, we expect the currency to continue to remain steady in the short term with CBK's interventions and favorable foreign exchange inflows likely to play a crucial role in mitigating excessive volatility.

Inflation:

The inflation rate for the year 2024 averaged at 4.5%, compared to 7.7% recorded in 2023. Notably, the y/y inflation in December 2024 increased slightly by 0.2% points to 3.0%, from the 2.8% recorded in November 2024. The headline inflation in December 2024 was majorly driven by increases in prices of commodities in the following categories; Food & Non-Alcoholic Beverages, and Transport sector by 4.8% and 0.2% respectively. However, the commodity prices in Housing, Water, Electricity, Gas & other fuels declined by 0.2%.

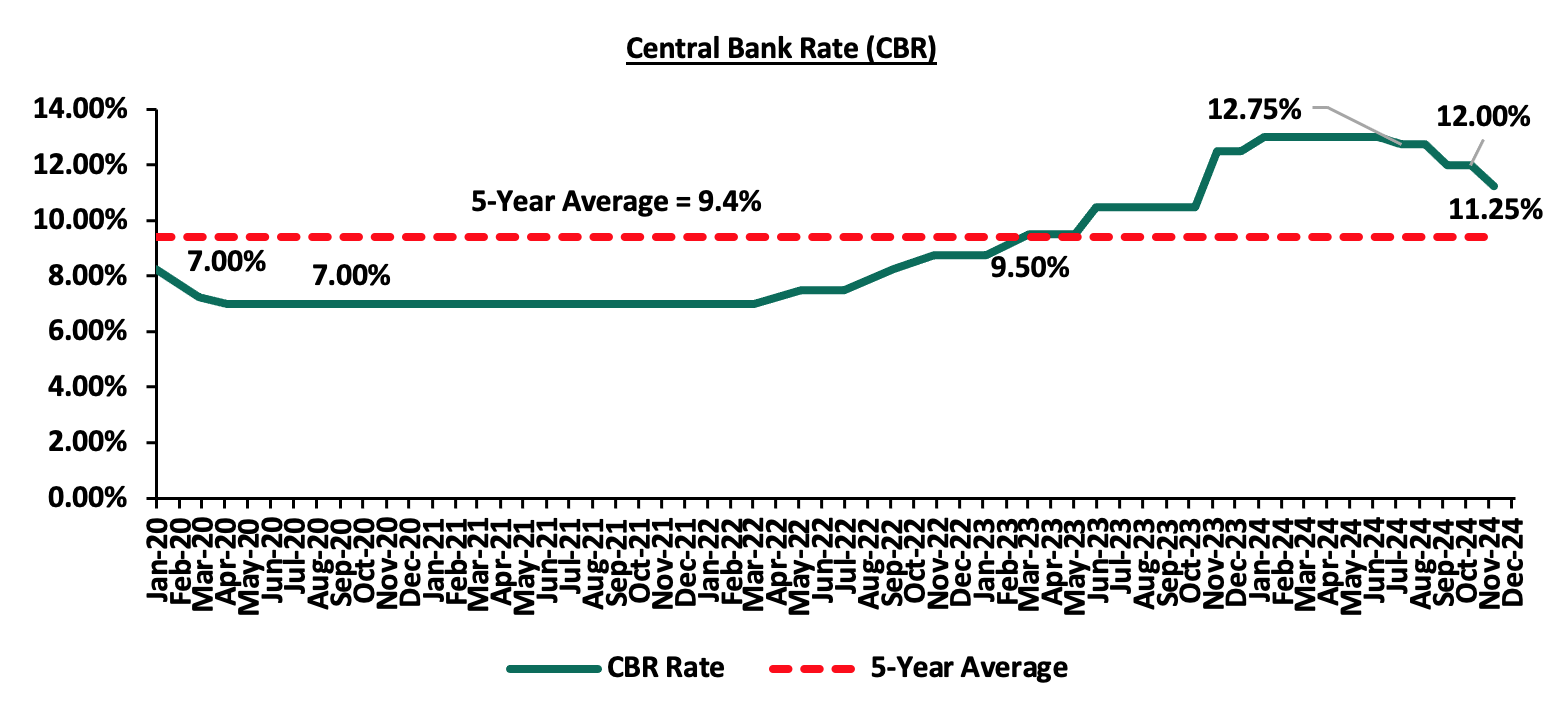

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stronger currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing of food prices, further supporting lower inflation rates. The risk, however, lies in the fuel prices which despite their decline over the last months, still remain elevated compared to historical levels. Key to note is that the Monetary Policy Committee cut the Central Bank Rate by 75.0 bps to 11.25% from 12.00% in its December 2024 meeting. This cut in the Central Bank Rate is likely to elevate inflationary pressures as consumer spending rises leading to demand- pull inflation. The committee is expected to lower rates further , though gradually, to provide further support for the economy.

Monetary Policy:

During the year the Monetary Policy Committee (MPC) met 6 times where it raised the Central Bank Rate (CBR) to 13.00% from 12.50% in the first meeting held in February. The MPC then retained the rate in its April and June sittings, in a bid to stabilize the currency and anchor inflation. In August, the MPC initiated a series of rate cuts, lowering the CBR by 25.0 bps to 12.75%, followed by a further reduction of 75.0 bps to 12.00% in October on the back of a strengthened and stable currency, easing inflation which fell below the mid-point of the CBK’s target of a range 0f 2.5% - 7.5%. In its latest meeting held in December, the MPC lowered the CBR rate by 75.0 bps to 11.25%, from 12.00% which was in line with our expectation for the MPC to lower the CBR rate. Our expectation to cut the rate was mainly on the back of rate cuts by some major economies, a stable exchange rate, anchored inflationary pressures, with inflation coming in at 2.8% in November 2024, marginally up from 2.7% in October 2024, as well as the need to support the economy by adopting an accommodative policy that will ease financing activities. In total, MPC lowered the rates in 2024 by 1.75%, from 13.00% in February to 11.25% in December. We expect the MPC to continue lowering the rates in the short to medium term therefore lowering borrowing costs, leading to increased spending and an uptick in the business environment as well as reduced debt servicing costs for the government, and anchoring private sector credit growth, noting that its previous measures have successfully reduced overall inflation to below the mid-point of the target range of 2.5% - 7.5%, stabilized the exchange rate, and anchored inflationary expectations. The following is a graph highlighting the Central Bank Rate for the last 5 years;

Source: Central Bank of Kenya

2024 Key Highlights:

- FY’2024/2025 Budget Policy Statement

- On 13 June 2024, the National Treasury presented Kenya’s FY’2024/2025 National Budget to the National Assembly highlighting that the total budget estimates for FY’2024/25 increased by 3.1% to Kshs 4.0 tn from the Kshs 3.9 tn in FY’2023/2024 while the total revenue inclusive of grants increased by 15.2% to Kshs 3.4 tn from the Kshs 2.9 tn in FY’2023/2024. The increase is mainly due to an 18.5% increase in ordinary revenue to Kshs 2.9 tn for FY’2024/2025, from the Kshs 2.5 tn in FY’2023/24. For more information, please read our Budget Review Note.

- On July 12, 2024, the National Treasury presented the Supplementary Estimates I for the Fiscal Year 2024/25 to the National Assembly. This presentation outlined plans to adjust the FY’2024/25 Budget Estimates to align with the Revised Fiscal Framework and implement expenditure cuts, following the withdrawal of Finance Bill 2024 which sought to raise Kshs 344.3 bn. The recurrent expenditure (Costs incurred to cover regular government expenses such as salaries, operational costs and maintenance costs) decreased by 2.1% to Kshs 1,598.0 bn in the Supplementary Estimates I from Kshs 1,632.1 bn in the original estimates, an indication of the government's initiative to cut expenditure cuts while still boosting public services, responding to economic growth and ensuring the well-being of its citizens. For more information please see our Supplementary Budget Estimates I Note

- Credit Facilities extended to Kenya

- The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023. Please see our Cytonn Weekly 03/2024,

- The International Monetary Fund (IMF) team and Kenyan authorities reached a staff-level agreement for the seventh reviews of Kenya’s economic program supported by the IMF’s Extended Fund Facility (EFF) and Extended Credit Facility (ECF), and the second Review under the Resilience Sustainability Facility (RSF). Notably, the discussions considered Kenya’s request for an augmentation under the EFF/ECF arrangement and the RSF, which if approved by the IMF executive board, will lead to a potential total commitment of more than USD 3.6 bn during the program's duration. Furthermore, the IMF team and Kenyan authorities agreed on a set of comprehensive policies and reforms needed to complete the seventh review, entailing corrective measures to safeguard debt sustainability, and fiscal discipline following a slip in FY’2023/24 budget, where the government in expected to miss out on its revenue targets. Please see our Cytonn Weekly 24/2024, and,

- The International Monetary Fund (IMF) Executive Board completedthe seventh and eighth reviews under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF), alongside a review under the Resilience Sustainability Facility (RSF). This decision enables the immediate disbursement of approximately USD 606.1 mn to support Kenya’s efforts to stabilize its economy, address fiscal challenges, and enhance resilience to climate-related shocks. The IMF’s approval allows Kenya to receive USD 485.8 mn under the EFF/ECF arrangements, aimed at reducing Kenya’s debt vulnerabilities, safeguarding funds for social and developmental priorities, and supporting broader economic reforms and USD 120.3 mn under the RSF, which focuses on reinforcing Kenya's climate-related initiatives and catalysing additional private sector climate finance. Please see our Cytonn Monthly October 2024 for more information.

- FY’2023/2024 KRA Revenue Performance

In July 2024, the Kenya Revenue Authority (KRA) released the annual revenue performance for FY’2023/24, highlighting that revenue mobilization for the period grew by a notable 11.1% up from 6.4% growth in the previous financial year, after KRA collected Kshs 2.4 tn compared to Kshs 2.2 tn in the previous financial year. This translates to a performance rate of 95.5% against the target. Please see our Cytonn Weekly 28/2024,

- Balance of Payments

Kenya National Bureau of Statistics released the Q2’2024 Balance of Payment Report, noting that Kenya’s balance of payments position deteriorated by 45.0% in Q2’2024 with a reduction of the surplus to Kshs 84.1 bn, from a surplus of Kshs 152.9 bn in Q2’2023 but was a significant improvement from the Kshs 36.0 bn deficit recorded in Q1’2024. Please see our Cytonn Weekly 37/2024,

- Current account

Kenya’s current account deficit narrowed by 34.5% to Kshs 104.1 bn in Q2’2024 from the Kshs 159.0 bn deficit recorded in Q2’2023. The y/y contraction registered was driven by the narrowing of the merchandise trade account deficit (the value of import goods exceeds the value of export goods, resulting in a negative net foreign investment) by 3.7% to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn recorded in Q2’2023, a 59.1% improvement in the secondary trade balance to a surplus of Kshs 43.6 bn from a surplus of Kshs 27.4 bn in Q2’2023, and, the narrowing of the primary income deficit (the earnings that residents of a country receive from their investments abroad and the compensation they receive for providing labour to foreign entities) by 34.6% to Kshs 45.6 bn in Q2’2024, from Kshs 69.8 bn recorded in Q2’2023.

- Credit Ratings

- On July 8th 2024, the global ratings agency, Moody’s announced its revision of Kenya’s credit score, downgrading it to Caa1 from a credit rating of B3 while maintaining a negative outlook, on the back of on the back of of the government's decision to forgo proposed tax increases through the Finance Bill 2024 and rely on expenditure cuts, significantly impacting Kenya's fiscal trajectory and financing needs. The downgrade of Kenya's rating indicates a greatly reduced ability to implement fiscal consolidation measures focused on revenue, which are necessary to improve debt affordability and reduce overall debt. Please see our Cytonn Weekly 30/2024.

- On 2nd August 2024 the global ratings agency, Fitch Ratings announced its revision of Kenya’s credit score, downgrading it to B- from a credit rating of B while also revising the outlook to stable, from a negative outlook affirmed on 16th February 2024. Their decision comes on the back of the government's decision to forgo proposed tax increases through the Finance Bill 2024 and rely on expenditure cuts, significantly impacting Kenya's fiscal trajectory and financing needs. The downgrade follows Moody’s downgrading Kenya’s IDR to Caa1 from a credit rating of B3 while maintaining a negative outlook on July 8th Please see our Cytonn Weekly 32/2024, and,

- On 23rd August 2024 S&P Global Ratings announced its revision of Kenya’s long-term sovereign credit rating, downgrading it to B-, and a stable outlook from a credit rating of B and a negative outlook, on the back of the government's decision to forgo proposed tax increases through the Finance Bill 2024 and rely on expenditure cuts, significantly impacting Kenya's fiscal trajectory and financing needs. Please see our Cytonn Weekly 34/2024. For more information, see our, Cytonn Q3'2024 Markets Review. Below is a summary of the credit rating on Kenya by various rating agencies;

|

Cytonn Report: Kenya’s Credit Ratings |

||||||

|

Rating Agency |

Previous Rating |

Previous Outlook |

Current Rating |

Current Outlook |

Meaning |

Date Released |

|

Moody's Rating |

B3 |

Negative |

Caa1 |

Negative |

Substantial credit risks |

8th July, 2024 |

|

Fitch Ratings |

B |

Negative |

B- |

Stable |

Highly Speculative |

2nd August 2024 |

|

S&P Global |

B |

Negative |

B- |

Stable |

Extremely high risk, very vulnerable to default |

23rd August 2024 |

Source: Fitch Ratings, S&P Global, Moody’s

2024 Returns by Various Asset Classes:

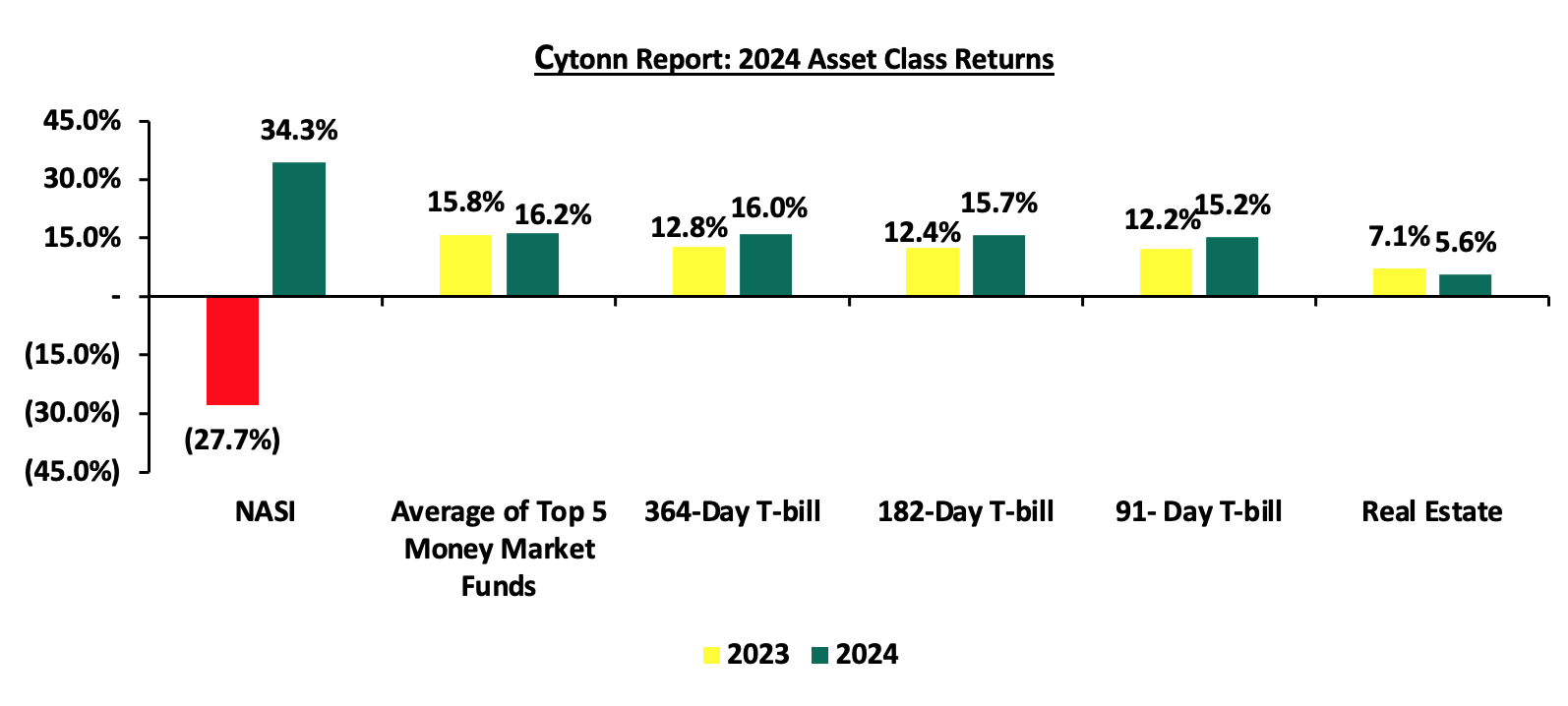

The returns by the various asset classes recorded mixed performances in 2024, in comparison to a similar period last year, with the NASI and the average of the top five money market funds (MMFs), being on upward trajectories. For the equities class, NASI registered a 34.3% gain in 2024, a significant improvement from the 27.7% loss recorded in 2023, as the average of top 5 MMFs recorded a yield of 16.2%, 0.5% points higher than the 15.8% average recorded in 2023. Additionally, the 364-day, 182-day and 91-day Government papers recorded average yields of 16.0%, 15.7% and 15.2%, respectively, higher than the average yields of 12.8%, 12.4% and 12.2%, respectively recorded in 2023, while the average Real Estate yield also decreased by 1.5% points to 5.6% in 2024, from 7.1% recorded in 2023. The graph below shows the summary of returns by various asset classes (Average top 5 MMF, Fixed Income, Real Estate and Equities).

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2024 versus the experience;

|

Cytonn Report: Macro-Economic & Business Environment Outlook |

||||

|

Macro-Economic Indicators |

2025 Outlook |

Effect |

2024 Experience |

Effect |

|

Government Borrowing |

|

Negative |

· The government’s domestic debt stood at Kshs 5.6 tn as of September 2024, 8.0% higher than external debt that came in at Kshs 5.2 tn in the same period. Notably, domestic debt recorded an 10.9% increase from the year’s opening position of Kshs 5.0 tn relative to a 14.1% decline in external debt from the year’s opening position of Kshs 6.1 tn. The higher growth in domestic debt indicates the government’s preference for domestic borrowing in line with our expectation of aggressive borrowing in the domestic front during the year, · The government is 161.6% ahead its prorated borrowing target of Kshs 212.1 bn having borrowed Kshs 554.8 bn of the Kshs 408.4 bn borrowing target for the FY’2023/24, · Kenya’s debt to GDP ratio came in at an estimated 71.8% as of June 2024, 21.8% points above the IMF recommended threshold of 50.0% for developing nations, and 1.8% points increase on a Year on year basis from 70.8% recorded in June 2023, · The government tapped into the international markets for debt, to raise cash and buy back the 10-year Eurobond of USD 2.0 bn through the issuance of a new USD 1.5 bn Eurobond successfully redeeming the 10-year Eurobond due in June 2024. · Total revenue collected as at the end of November 2024 amounted to Kshs 940.9 bn, equivalent to 35.8% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 85.8% of the prorated estimates of Kshs 1,096.4 bn, indicating an underperformance in revenue collection, · We foresee that the collected revenue will fall short of covering the government’s deficit. Consequently, we predict that the government will intensify its domestic borrowing to compensate for the fiscal deficit, projected to be 4.1% of GDP for the FY’2024/25 budget. |

Negative |

|

Exchange Rate |

|

Negative |

· The Kenya Shilling appreciated by 17.4% against the US Dollar to close at Kshs at Kshs 129.3 in 2024, compared to Kshs 156.5 at the end of 2023. We note that the continuous appreciation of the shilling during the year was caused by CBK’s aggressive efforts to support the shilling, improved diaspora remittances standing at a cumulative USD 4,872.0 mn in the 12 months to November 2024 and improved forex reserves. · The forex reserves increased by 35.8% to USD 9.2 bn from USD 6.8 bn at year opening, with the former translating to 4.7 months of import cover, meeting the CBK’s statutory requirement to endeavor to maintain at least 4.0 months of import cover

|

Positive |

|

Interest Rates |

|

Neutral |

· In the first half of 2024, yields on government securities were on an upward trajectory primarily due to the government’s amplified borrowing needs and investors’ pursuit of higher returns to mitigate the impact of the inflation rates observed in the first half of the year. The second half of the year saw a decline in yields as a result of lower interest rates. · During the year, the MPC lowered the central bank rate by a cumulative 1.7% points to 11.25% from 13.00%, with the Kenya Shilling having gained and stabilized against the USD and inflation eased closing the year at 3.0% · Notably, the government's ability to meet coupon payments and successfully redeem the 10-year Eurobond in June 2024 provided much-needed confidence in Kenya's fiscal management. |

Positive |

|

Inflation |

|

Neutral |

· Having averaged at 4.5% in 2024, the inflation rate was within the government’s target range of 2.5% - 7.5%. Notably, on a monthly basis, the inflation rate came in at 3.0% in December 2024, marking the eighteenth consecutive month that the inflation rate remained within the government’s target range, · Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting lower inflation rates. The risk, however, lies in the fuel prices which despite their decline over the last months, still remain elevated compared to historical levels. Key to note is that the Monetary Policy Committee cut the Central Bank Rate by 75.0 bps to 11.25% from 12.00% in its December 2024 meeting, with the aim of easing the monetary policy, while maintaining exchange rate stability, and will meet again in February 2025. This cut in the Central Bank Rate is likely to elevate inflationary pressures as consumer spending rises leading to demand- pull inflation. |

Positive |

|

GDP |

|

Neutral |

· With the economy having grown at average of 4.8% in the first two quarters of 2024. Given the growth momentum observed during the year, Kenya’s GDP growth is currently below the projected growth of 5.3%. The slower growth is primarily driven by reduced private sector activity and ongoing fiscal consolidation efforts by the government, which have limited public spending. Additionally, political instability during the year, fueled by anti-finance bill protests and opposition against the current regime, has undermined investor confidence and disrupted economic activities. This instability is expected to further weigh on economic growth |

Neutral |

|

Investor Sentiment |

|

Neutral |

· With the appreciation of the Kenyan shilling and reducing debt sustainability concerns, companies trading in the Nairobi Securities Exchange (NSE) have recorded relatively high trade volumes throughout the year, · The NSE has experienced capital inflows and repatriation with the NSE equity turnover increasing by 22.0% to close the year at USD 0.8 bn in 2024 from USD 0.6 bn recorded in 2023, · Further, the government's ability to meet coupon payments and successfully redeem the 10-year Eurobond in June 2024 provided much-needed confidence in Kenya's fiscal management, boosting investor confidence · Majority of companies are trading at higher prices relative to the year opening prices, signaling overvaluation |

Positive |

|

Security |

|

Positive |

· The country witnessed heightened political tensions in June and July following the mass demonstrations against the Finance Bill 2024 resulting in business disruption in several parts of the country. However, the government withdrew the Bill, restoring peace in the country in the second half of 2024. Despite this, the current regime still faces opposition fueling political instability in the country. |

Negative |

Since the beginning of the year, the notable changes we have seen out of the seven metrics that we track, fall under three metrics, namely; the GDP, investor sentiment, and Security. Key to note, economic growth remained neutral, while investor sentiments and security changed from neutral and positive respectively to positive and negative respectively. In conclusion, macroeconomic fundamentals showed mixed performance during the year with most metrics on upward trajectories. We expect a slight recovery in 2024 supported by the improving economic conditions in the country evidenced by momentum in GDP growth and declining inflation with the rate remaining within target range of 2.5% to 7.5% for the eighteenth consecutive month, driven by the improvement of the business conditions and stabilization of the Kenyan currency.