Alternative Financing for Real Estate Developments, & Cytonn Weekly #06/2022

By Cytonn Research, Feb 13, 2022

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 83.5%, a decline from the 115.8% recorded the previous week, partly attributable to the tightened liquidity in the money markets, with the interbank rates increasing marginally to 4.5%, from 4.4% recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 10.8 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 107.6%, a decline from the 161.7% recorded the previous week. The continued oversubscription witnessed for the 364-day paper is attributable to investors’ preference for the longer-dated paper which offers a higher yield of 9.7% compared to the 7.3% and 8.1% yields offered by the 91-day and 182-day papers, respectively. The subscription rate for the 91-day and 182-day papers declined to 72.3% and 64.0%, from 84.6% and 82.4%, respectively, recorded the previous week. The yields on the government papers recorded mixed performance, with the yields on the 91-day declining by 3.2 bps to 7.3%, while those of the 182-day and 364-day papers increased by 1.3 bps and 7.4 bps to 8.1% and 9.7%, respectively. The government accepted bids worth Kshs 19.9 bn, out of the Kshs 20.0 bn worth of bids received, translating to an acceptance rate of 99.3%.

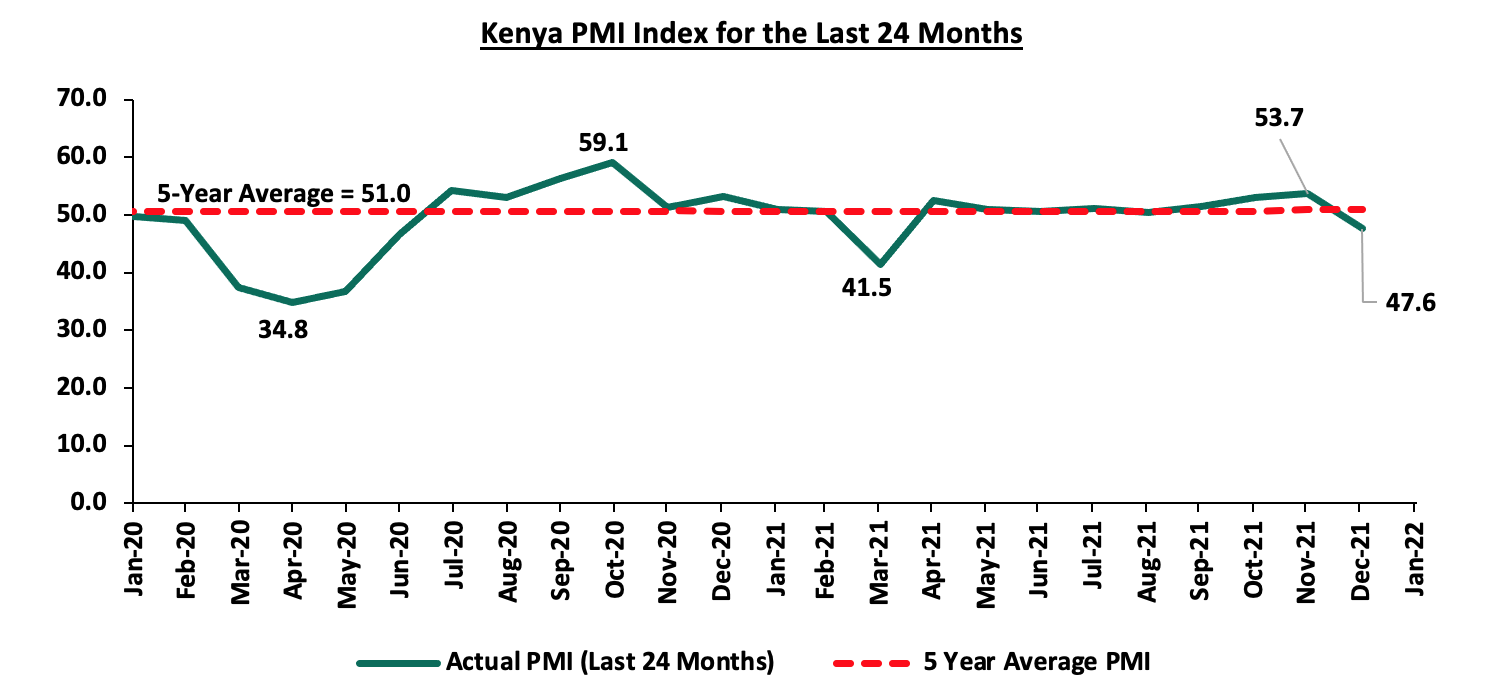

Also during the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of January 2022 declined to 47.6, from the 14-month high of 53.7 that was recorded in December 2021, pointing towards significant deterioration of the business environment in the country. Notably, this is the lowest PMI recorded in the nine months since April 2021 when the index was 41.5. The significant drop is attributable to lower domestic spending and travel stemming from strong price pressures and sustained high COVID-19 cases from the Omicron Variant at the start of the year;

Equities

During the week, the equities market recorded mixed performance, with NASI gaining by 0.6% while NSE 20 declined by 0.2%. NSE 25, on the other hand, remained unchanged. This week’s performance took the YTD performance to gains of 0.5% and 0.1%, respectively, for NASI and NSE 25, while NSE 20 recorded a loss of 0.9%. The equities market performance was driven by gains recorded by large cap stocks such as Safaricom, Standard Chartered Bank Kenya (SCBK) and Equity of 1.3%, 1.1% and 0.5%, respectively. The gains were however weighed down by losses recorded by stocks such as KCB, Diamond Trust Bank (DTB-K), ABSA and EABL which declined by 3.6%, 2.9%, 2.1% and 2.0%, respectively;

Also, during the week, Moody’s Rating Agency rated the Kenyan banking sector as stable following the banks’ impressive performance in the eleven months to November 2021 with the profits before tax coming in at Kshs 178.8 bn exceeding the pre-pandemic earnings of Kshs 150.1 bn over the same period in 2019;

Real Estate

During the week, Knight Frank Kenya released their Kenya Market Update H2’2021, highlighting that the average selling price of prime residential spaces in Nairobi improved by 1.2% in H2’2021, compared to a 1.1% decline in the same period in 2020. Additionally, prime commercial office rents increased by 9.0% in H2’2021 to Kshs 136.3 per SQFT, from Kshs 125.0 per SQFT in H1’2021. In the Residential Sector, Property developer Acorn Group, began construction of two new hostels worth Kshs 2.5 bn which will be located next to the University of Nairobi Chiromo Campus along Science Crescent Road, off Riverside Road. Royal Group Industries, a fully Kenyan-owned company, announced that approximately 202 of the 605 units at the Bondeni Affordable Housing Project in Nakuru City, has been sold to clients;

In the Retail Sector, UK fast-food chain Chicken Cottage announced a partnership deal with Express Kitchen, a subsidiary of AAH Limited to open 50 outlets at Hass Petroleum’s service stations in Kenya, Rwanda, Tanzania and Uganda this year. Naivas supermarket announced plans to open 2 new outlets by the end of February 2021 which will be located at Nairobi’s Greenspan Mall in Donholm and Imara Shopping Mall in Imara Daima, while Chadarana Foodplus Supermarket announced plans to open 4 outlets within the country over the next four months leading to June 2022. In Listed Real Estate, the ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share, and, the Acorn D-REIT closed the week trading at Kshs 20.2 per share while the I-REIT closed at Kshs 20.6 per share;

Focus of the Week

Over the years, we have witnessed some projects stall or take a longer time before completion mainly due to the financial constraints faced by developers. Real Estate investments are often capital intensive and in Kenya, there has been an over-reliance on traditional sources of financing Real Estate projects such as debt financing. As such, we seek to identify and discuss the various alternative ways by which developers and land owners can access capital for financing Real Estate projects, besides the debt and equity financing which is prominent in Kenya.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.53%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.03% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations and Valentines. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 83.5%, a decline from the 115.8% recorded the previous week, partly attributable to the tightened liquidity in the money markets, with the interbank rates increasing marginally to 4.5%, from 4.4% recorded the previous week. The 364-day paper recorded the highest subscription rate, receiving bids worth Kshs 10.8 bn against the offered Kshs 10.0 bn, translating to a subscription rate of 107.6%, a decline from the 161.7% recorded the previous week. The continued oversubscription witnessed for the 364-day paper is attributable to investors’ preference for the longer-dated paper which offers a higher yield of 9.7% compared to the 7.3% and 8.1% yields offered by the 91-day and 182-day papers, respectively. The subscription rate for the 91-day and 182-day papers declined to 72.3% and 64.0%, from 84.6% and 82.4%, respectively, recorded the previous week. The yields on the government papers recorded mixed performance, with the yields on the 91-day declining by 3.2 bps to 7.3%, while those of the 182-day and 364-day papers increased by 1.3 bps and 7.4 bps to 8.1% and 9.7%, respectively. The government accepted bids worth Kshs 19.9 bn, out of the Kshs 20.0 bn worth of bids received, translating to an acceptance rate of 99.3%.

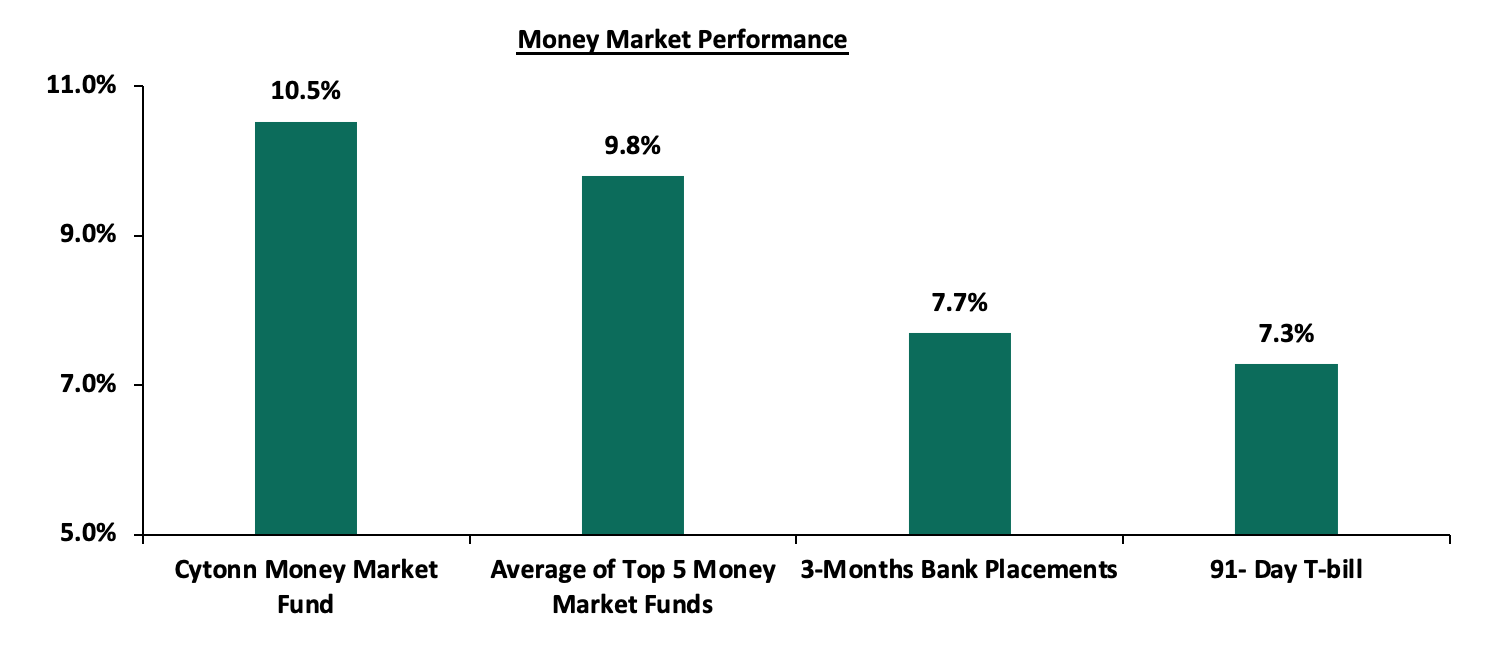

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill declined by 3.2 bps to 7.3%. The average yield of the Top 5 Money Market Funds and the yield of the Cytonn Money Market Fund increased to 9.8% and 10.5%, from 9.7% and 10.3%, respectively, as was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 12th February 2022:

|

Money Market Fund Yield for Fund Managers as published on 12th February 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.53% |

|

2 |

Zimele Money Market Fund |

9.91% |

|

3 |

Nabo Africa Money Market Fund |

9.70% |

|

4 |

Madison Money Market Fund |

9.47% |

|

5 |

Sanlam Money Market Fund |

9.38% |

|

6 |

GenCapHela Imara Money Market Fund |

8.97% |

|

7 |

Apollo Money Market Fund |

8.95% |

|

8 |

CIC Money Market Fund |

8.84% |

|

9 |

Dry Associates Money Market Fund |

8.78% |

|

10 |

Orient Kasha Money Market Fund |

8.70% |

|

11 |

Co-op Money Market Fund |

8.53% |

|

12 |

NCBA Money Market Fund |

8.35% |

|

13 |

ICEA Lion Money Market Fund |

8.32% |

|

14 |

AA Kenya Shillings Fund |

7.60% |

|

15 |

British-American Money Market Fund |

7.42% |

|

16 |

Old Mutual Money Market Fund |

7.41% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing marginally to 4.5%, from 4.4% recorded the previous week, partly attributable to tax remittances which offset government payments made during the week. The average interbank volumes traded declined by 5.4% to Kshs 10.9 bn, from Kshs 11.5 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with yields on the 10-year bond issued in 2014 remaining unchanged at 4.1%, while yields on the 10-year bond issued in 2018 and 7-year bond issued in 2019 both increasing by 0.2% points to 6.8% and 6.6%, respectively. Yields on the 30-year bond issued in 2018 increased marginally by 0.1% points to 8.7%, while the yields on the 12-year bond issued in 2019 and 12-year bond issued in 2021 both increasing by 0.3% points to 7.5% and 7.4%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

5.7% |

8.1% |

5.6% |

6.7% |

6.6% |

|

04-Feb-22 |

4.1% |

6.5% |

8.5% |

6.3% |

7.2% |

7.1% |

|

07-Feb-22 |

4.2% |

6.6% |

8.6% |

6.4% |

7.3% |

7.2% |

|

08-Feb-22 |

4.1% |

6.7% |

8.7% |

6.5% |

7.4% |

7.3% |

|

09-Feb-22 |

4.2% |

6.8% |

8.6% |

6.5% |

7.5% |

7.3% |

|

10-Feb-22 |

4.1% |

6.8% |

8.7% |

6.6% |

7.5% |

7.4% |

|

Weekly Change |

0.0% |

0.2% |

0.1% |

0.2% |

0.3% |

0.3% |

|

M/M Change |

(0.3%) |

0.8% |

0.5% |

0.8% |

0.6% |

0.6% |

|

YTD Change |

(0.3%) |

1.1% |

0.6% |

1.0% |

0.8% |

0.8% |

Source: Central Bank of Kenya

Kenya Shilling:

During the week, the Kenyan shilling remained relatively stable, depreciating marginally by 0.02% against the US dollar to close the week at Kshs 113.63, from Kshs 113.60 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a YTD basis, the shilling has depreciated by 0.4% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.4% of GDP in 2021, having expanded by 27.4% in Q3’2021 to Kshs 184.6 bn, from Kshs 145.0 bn recorded in Q3’2020, attributable to a robust increase in merchandise imports by 39.6% to Kshs 321.8 bn in Q3’2021, from Kshs 230.5 bn in Q3’2020,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound this global recovery following the emergence of the new COVID-19 variants. We are of the view that should the variants continue to spread; most nations will respond swiftly by adopting stringent containment measures to curb transmissions.

The shilling is however expected to be supported by:

- High Forex reserves, currently at USD 8.2 bn (equivalent to 5.0-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021 coupled with the USD 972.6 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June 2021, and,

- Improving diaspora remittances evidenced by a 17.0% y/y increase to USD 350.6 mn in December 2021, from USD 299.6 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlight:

- Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager’s Index (PMI) highlighting that the index for the month of January 2022 declined to 47.6, from the 14-month high of 53.7 that was recorded in December 2021, pointing towards significant deterioration of the business environment in the country. Notably, this is the lowest PMI recorded in the nine months since April 2021 when the index was 41.5, attributable to lower domestic spending and travel stemming from strong price pressures and sustained high COVID-19 cases from the Omicron Variant at the start of the year. Key to note, overall cost pressures in the Kenyan private sector remained elevated in January 2022 due to high input purchasing prices driven by higher taxes and higher fuel and raw material prices during the month. Additionally, employment growth slowed during the month resulting in a lower consumer purchasing power. The chart below summarizes the evolution of the PMI over the last 24 months:

*** Key to note, a reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration.

As a result of the decline in PMI index in January 2022, we maintain a cautious outlook in the short-term owing to the increasing cost pressures, high cost of living and political pressures ahead of the August 2022 elections. The existence and emergence of new COVID-19 variants, such as the Omicron variant, still pose economic uncertainty as it may lead to another wave of infections and consequently tighter restrictions that will further negatively affect the general business environment. In the FY'2021/2022 Supplementary Budget I, the Ministry of Health was allocated Kshs 136.0 bn, a 12.3% increase from the Kshs 121.1 bn original estimates to aid in combating the COVID-19 pandemic and curb its spread through the acquisition of more vaccines. As such, we look forward to see these efforts support the economic recovery and consequently trickle down to improving the country’s PMI. However, we note that the private sector credit growth has remained relatively muted, coming in at 8.6% in December 2021, lower than the historical average of 10.3%. Further, with fuel being a major input cost to many businesses, we expect the increasing global fuel prices to further contribute to the deterioration of business conditions in the country. We are of the opinion that the fuel subsidy under the National Treasury is unsustainable and will be depleted should average landed costs of fuel continue to rise, coupled with the diversion of funds under the program to cater for other government expenditure.

Rates in the Fixed Income market have remained relatively stable due to high liquidity in the money market. The government is 6.2% ahead of its prorated borrowing target of Kshs 392.6 bn having borrowed Kshs 443.6 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 926.3 bn during the first six months of the current fiscal year, which is equivalent to 104.3% of the prorated revenue collection target. However, despite the projected high budget deficit of 11.4% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the week, the equities market recorded mixed performance, with NASI gaining by 0.6%, while NSE 20 declined by 0.2%. NSE 25, on the other hand, remained unchanged. This week’s performance took the YTD performance to gains of 0.5% and 0.1%, respectively, for NASI and NSE 25, while NSE 20 recorded a loss of 0.9%. The equities market performance was driven by gains recorded by large cap stocks such as Safaricom, Standard Chartered Bank Kenya (SCBK) and Equity of 1.3%, 1.1% and 0.5%, respectively. The gains were however weighed down by losses recorded by stocks such as KCB, Diamond Trust Bank (DTB-K), ABSA and EABL which declined by 3.6%, 2.9%, 2.1% and 2.0%, respectively.

During the week, equities turnover declined by 16.7% to USD 23.1 mn, from USD 27.7 mn recorded the previous week, taking the YTD turnover to USD 118.3 mn. Foreign investors remained net buyers, with a net buying position of USD 2.5 mn, from a net buying position of USD 4.6 mn recorded the previous week, taking the YTD net buying position to USD 1.8 mn.

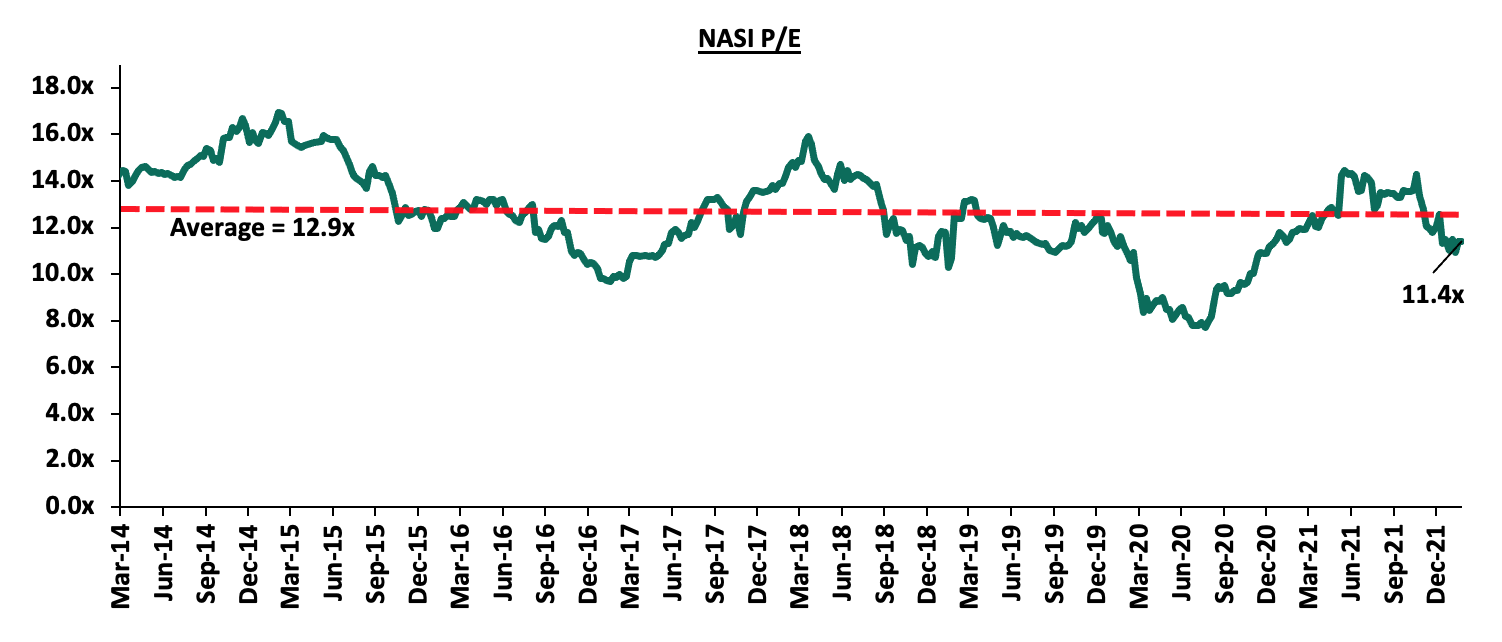

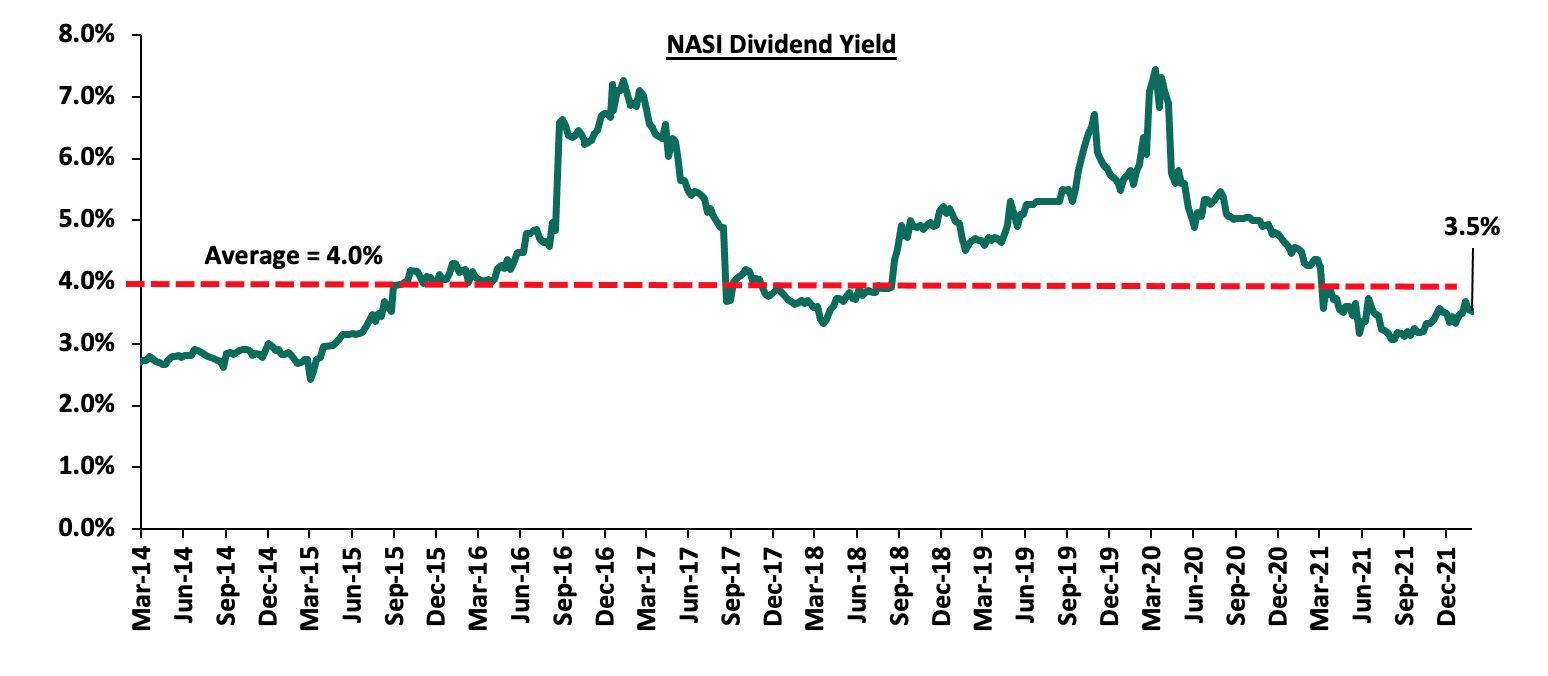

The market is currently trading at a price to earnings ratio (P/E) of 11.4x, 11.6% below the historical average of 12.9x, and a dividend yield of 3.5%, 0.5% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.5x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 11.4x is 48.3% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

Moody’s Kenyan Banking Sector Rating

During the week, Moody’s Rating Agency gave a stable rating to the Kenyan banking sector following the banks’ impressive performance in the eleven months to November 2021, with the profits before tax coming in at Kshs 178.8 bn, higher than the pre-pandemic earnings of Kshs 150.1 bn over the same period in 2019. Additionally, the agency noted that non-performing loans (NPL) will decline in the next 12 to 18 months. Earnings, on the other hand will continue improving in tandem with the economic recovery. The gradual economic recovery is also expected to support banks in improving their loan quality and profitability, while capital, funding, and liquidity will remain strong, in line with our Q3’2021 Banking Sector report. However, we note that despite the improvement seen in the Asset Quality for the listed banks in Q3’2021, with the gross NPL ratio declining by 0.4% points to 12.0%, from 12.4% in Q3’2020, the NPL ratio for the banking sector remains higher than the 10-year average of 8.1% coming in at 13.9% as of August 2021. We also anticipate a decline in loan growth in 2022 as banks reduce lending to the private sector in response to the uncertainties surrounding the August elections. This is in turn expected to have a trickle-down effect on interest income from loans and advances. Additionally, we believe that, in the medium term, banks will continue to overprovision, albeit at a lower level than in 2020, due to the uncertainty brought about by the emergence of new COVID-19 variants.

Universe of coverage:

|

Company |

Price as at 04/02/2022 |

Price as at 11/02/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.2 |

2.3 |

1.4% |

(1.7%) |

2.3 |

3.3 |

8.9% |

56.3% |

0.2x |

Buy |

|

Jubilee Holdings |

300.0 |

299.0 |

(0.3%) |

(5.6%) |

316.8 |

371.5 |

3.0% |

27.2% |

0.5x |

Buy |

|

I&M Group*** |

21.1 |

21.5 |

1.9% |

0.2% |

21.4 |

24.4 |

10.5% |

24.1% |

0.6x |

Buy |

|

Britam |

7.1 |

7.2 |

2.0% |

(4.8%) |

7.6 |

8.3 |

0.0% |

15.9% |

1.2x |

Accumulate |

|

KCB Group*** |

47.0 |

45.3 |

(3.6%) |

(0.5%) |

45.6 |

51.4 |

2.2% |

15.6% |

0.9x |

Accumulate |

|

Liberty Holdings |

6.9 |

7.0 |

1.4% |

(0.8%) |

7.1 |

7.8 |

0.0% |

11.1% |

0.5x |

Accumulate |

|

NCBA*** |

25.8 |

25.3 |

(1.9%) |

(0.8%) |

25.5 |

26.4 |

5.9% |

10.4% |

0.6x |

Accumulate |

|

Sanlam |

9.7 |

11.0 |

12.9% |

(4.8%) |

11.6 |

12.1 |

0.0% |

10.1% |

1.2x |

Accumulate |

|

Co-op Bank*** |

13.0 |

13.0 |

(0.4%) |

(0.4%) |

13.0 |

13.1 |

7.7% |

8.6% |

1.0x |

Hold |

|

Standard Chartered*** |

136.0 |

137.5 |

1.1% |

5.8% |

130.0 |

137.7 |

7.6% |

7.8% |

1.1x |

Hold |

|

Equity Group*** |

53.0 |

53.3 |

0.5% |

0.9% |

52.8 |

56.6 |

0.0% |

6.3% |

1.4x |

Hold |

|

Diamond Trust Bank*** |

60.0 |

58.3 |

(2.9%) |

(2.1%) |

59.5 |

61.8 |

0.0% |

6.0% |

0.3x |

Hold |

|

Stanbic Holdings |

87.3 |

94.0 |

7.7% |

8.0% |

87.0 |

94.7 |

4.0% |

4.8% |

0.8x |

Lighten |

|

ABSA Bank*** |

11.9 |

11.7 |

(2.1%) |

(0.9%) |

11.8 |

11.9 |

0.0% |

2.2% |

1.2x |

Lighten |

|

CIC Group |

2.3 |

2.2 |

(2.7%) |

0.9% |

2.2 |

2.0 |

0.0% |

(6.7%) |

0.8x |

Sell |

|

HF Group |

3.6 |

3.7 |

1.7% |

(3.9%) |

3.8 |

3.0 |

0.0% |

(19.1%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.5x), we believe that investors should reposition towards value stocks, with strong earnings growth, that are trading at discounts to their intrinsic value. We expect the discovery of any new COVID-19 variants, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook. On the upside, we believe that the relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

- Industry Reports

During the week, Knight Frank Kenya, a Real Estate management and consultancy firm, released their Kenya Market Update H2’2021, a report which highlights the performance of key Real Estate sectors. The following were the key take outs from the report:

- In the Residential Sector, the average selling price of prime spaces in Nairobi improved by 1.2% in H2’2021, compared to a 1.1% decline in the same period in 2020, attributed to the reopening of the economy as investment activities resumed and boosted property prices. Between July 2021 and December 2021, Knight Frank noted that the prime residential rents remained unchanged. This was a better performance as compared to H2’2020 whereby the prices had declined by 4.2% driven by the reopening of the economy, and landlords maintaining low rental rates to retain clients,

- The average prime commercial office rents recorded a 9.0% increase to Kshs 136.3 per SQFT in H2’2021, from Kshs 125.0 per SQFT in H1’2021, partly attributed to the completion of several grade A office blocks in Nairobi which attracted high rental rates. The average occupancies increased by 5.0% points to 78.0% in H2’2021, from 73.0% in H1’2021 attributed to co-working and financial service sectors taking up space. Absorption of Grade A and B office spaces increased by approximately 60.0% in H2’2021, from 13.0% in H2’2020, attributable to; i) the reopening of the economy, ii) increased roll-out of vaccines thus enabling employees to resume working from the offices, and, iii) pent-up demand from 2020, which was mainly in the grade A stock with quality finishes, and,

- The average prime retail rental rates increased by 2.6% to Kshs 466.0 per SQFT in H2’2021, from Kshs 454.0 per SQFT in H1’2021 attributed to increased activities by retailers prompting the acquisition of spaces. However, retail rental yield may be affected negatively by the shift to shorter, more flexible lease structures and turnover rents in a trend retail chains are adopting.

The findings of this report are in line with the Hass Consult’s House Price Index Q4’2021 which highlighted that average selling prices for properties within the NMA recorded a q/q increase of 3.0% and a y/y increase of 3.1%, respectively, mainly driven by the improved performance of the detached units which realized a 4.9% q/q and 5.9% y/y increase in their selling prices. It is also in line with our Cytonn Annual Markets Review-2021 report, which highlighted that the selling prices in all residential segments appreciated at an average of 1.3% in FY’2021, from a 0.2% price correction in FY’2020. Average rental rates in the commercial office sector remained flat at Kshs 93.0 per SQFT in FY’2021, with the average occupancy rates increasing marginally by 0.2% points to 77.9%, from 77.7% in FY’2020. Additionally, the asking rents in the retail sector registered a 0.6% increase to Kshs 170.0 per SQFT in FY’2021, from Kshs 169.0 per SQFT in FY’2020, while the average occupancy registered a 1.6% points increase to 76.8% in FY’2021 from 75.2% in FY’2020. We expect these sectors to record more activities attributed to the improving demand for housing, aggressive uptake of retail space previously occupied by troubled retailers, improved business environment following the lifting of the COVID-19 containment measures and roll-out of vaccines supporting resumption of businesses’ full operations.

- Residential Sector

- Property Developer Acorn Group Begins Construction of 2 Student Hostels

During the week, property developer Acorn Group, began construction of two new hostels worth Kshs 2.5 bn next to the University of Nairobi Chiromo Campus along Science Crescent Road, off Riverside Road, following an announcement they made in November 2020. The project which will be run by Acorn D-REIT, the unit which specialises in developing the hostels brands, Qwetu, which is the premium offering, and, Qejani for the mass market, is set for completion by March 2023. It will consist of 1,950 beds under the Qejani hostel brand while the Qwetu hostel will have 850 beds, bringing the total student accommodation capacity to 2,800.

The developer has continued to focus on student housing having developed other hostels under the Qwetu brand in Ruaraka, Parklands and Jogoo Road, United States International University, Nairobi West and Hurlingham. Moreover, the firm has another project in Karen that is underway and set for completion by the end of 2022. Additionally, the firm plans to develop three other hostels worth a total of Kshs 3.6 bn by March 2024 namely; i) phase II Hurlingham Qejani at a cost of Kshs 959.6 mn with 504 units to accommodate 1,440 students, ii) Qwetu and Qejani residences opposite Kenyatta University at a cost of Kshs 1.9 bn with 924 units to accommodate 2,348 students, and, iii) Qejani brand of hostel in Juja targeting students of Jomo Kenyatta University of Agriculture and Technology (JKUAT) at a cost of Kshs 712.1 mn with 378 units to accommodate approximately 1,054 students.

The focus on modern student housing continues to gain traction supported by;

- Student housing deficit which is driven by continued increase in student numbers with Kenya National Bureau of Statistics data indicating a university enrolment of 546,699 in 2021, with the exclusion of technical colleges, against an available stock of 300,000 units,

- The need to accommodate and attract international students seeking higher education thus creating a ready market for student housing, and,

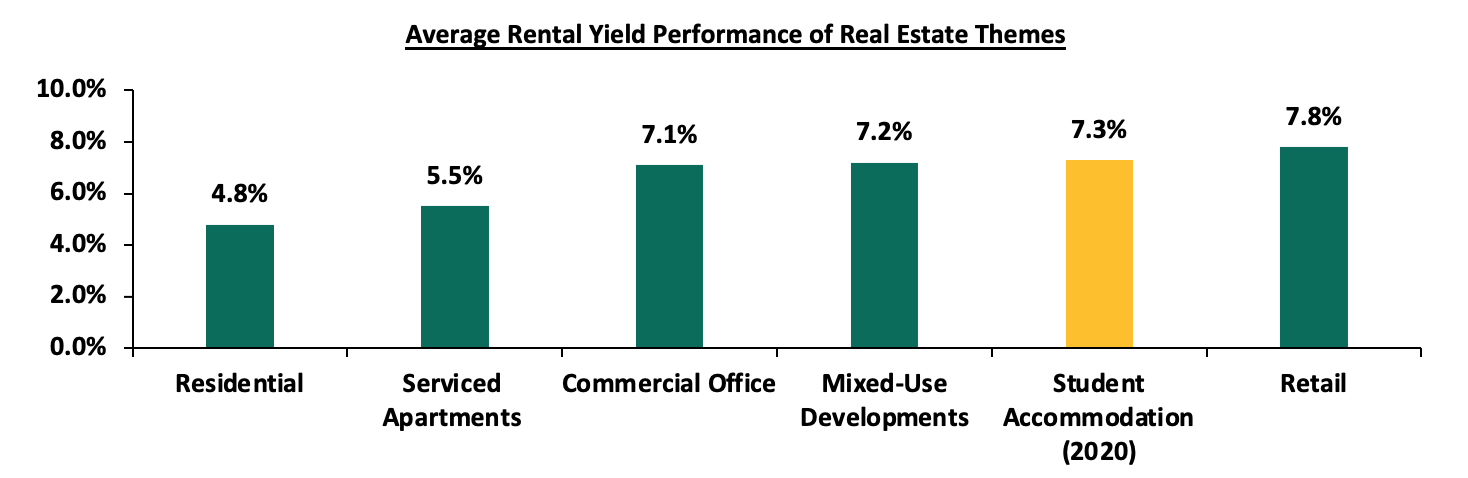

- Attractive returns evidenced by relatively high yields of 7.3% as per the Cytonn Student Housing Market Kenya Researchcompared to other Real Estate sectors like the residential and mixed-use developments which have an average rental yield of 4.8% and 7.2%, respectively.

The graph below shows the performance of rental yields in student housing compared to the different Real Estate themes in FY’2021;

Source: Cytonn Research

We expect investments in student housing to continue gaining momentum and attracting more investment opportunities further boosting their returns.

- Bondeni Affordable Housing Projects Sells a Third of its 605 Housing Units

Royal Group Industries, a fully Kenyan-owned company, through its Director Yusuf Hassanali, announced that approximately 202 of the 605 units at the Bondeni Affordable Housing Project in Nakuru City, were sold to clients. The construction of the Kshs 2.0 bn project, which is a public-private partnership (PPP) agreement between the State Department for Housing and Urban Development and Kings Sapphire LTD (a subsidiary of Roya Group Industries), started in May 2021 and is set for completion by December 2023. It will consist of one, two and three bedrooms with the following unit sizes;

|

Bondeni Affordable Housing Project |

||||

|

Typology |

No. of Units |

Unit Size |

Price (Kshs ) |

Price per SQM |

|

1 Bed |

45 |

33.3 |

1.6 mn |

46,547 |

|

2 Bed |

180 |

64.1 |

3.2 mn |

49,142 |

|

3 Bed |

380 |

85.2 |

4.4 mn |

52,727 |

|

Average |

|

|

|

49,472 |

Source: Boma Yangu

In terms of allocation, approximately 121 of the units will be purchased by civil servants, 100 units will be reserved for people living around the upcoming estate which shall be purchased on the tenancy purchase scheme through the National Housing Corporation (NHC) and, the rest shall be left to potential clients. The affordable housing initiative continues to take shape in Kenya, and other key PPP projects which are underway include:

- River Estate in Ngara by National Government and Edderman Property Limited,

- Nairobi Expressway by National Government and China Roads and Bridges Corporation, and,

- Pangani Housing Project by National Government and Tecnofin Kenya Limited which are still underway.

Despite the growing demand for affordable housing units, evidenced by the relatively high number of individuals who have registered through the Boma Yangu portal currently at 326,346; the implementation of affordable housing projects has been sluggish and the government is expected to fall short of its target of delivering 500,000 housing units by the end of 2022, having only delivered 1,832 affordable and social housing units so far. PPPs have proven to be a strategic way of delivering projects with benefits such as:

- Access to finance for projects,

- Ability to share project risks between the government and the private sectors,

- Access to private sector efficiencies such as new and improved technologies and skilled labour by the government,

- Enhancing ease of doing business, and,

- The delivery of large scale projects in a cost effective way that would otherwise cause constrains to tax payers if they are implemented by the government.

Despite the benefits of PPPs, these strategies have fallen short of achieving their developmental targets due to;

- Inadequate planning for PPP projects,

- Insufficient regulatory framework to handle complex PPP transactions,

- Irregularities in the procurement processes,

- Differing goals between the private entities and the government since the government’s main interest is to protect the interests of its citizens while the private sectors interest is to capitalize on returns,

- Bureaucracy and lengthy approval processes, and,

- High transaction costs involved in execution of projects.

However, with the new Public-Private Partnership Law that was signed in November 2021, we expect PPPs in Kenya to perform better as the law seeks to streamline project processes with clear delivery timelines, expand procurement options, and, create robust processes for privately initiated investment proposals. We expect this to promote more public-private partnership through boosting investor confidence in the projects. In our view, if the project is successfully delivered within the target timelines, it will help enhance the confidence of Kenyans in the affordable housing programmes particularly projects that involve partnership between the government and other agencies.

- Retail Sector

- Chicken Cottage, a UK fast-food food chain Enters Kenya

During the week, Chicken Cottage, a UK fast-food chain announced a partnership deal with Express Kitchen, a subsidiary of AAH Limited to open 50 outlets at Hass Petroleum’s service stations in Kenya, Rwanda, Tanzania and Uganda this year. The first outlet is scheduled to be opened in Nairobi in April 2022. The partnership with Chicken Cottage follows a similar deal announced in November 2021 by Hass with US pizza chain Papa John's. AAH Limited is the majority shareholder of Hass Petroleum Group which operates 150 petrol stations in ten African countries.

Chicken Cottage which runs 75 restaurants across Europe, Africa, Asia, and Middle East, will compete locally with fast-food chains such as Kentucky Fried Chicken (KFC) which has 22 outlets. The entry of the fast-food retail chain into the Kenyan market is supported by; i) the brand’s need to increase its geographical footprint, ii) the strategic market approach by Hass to attract customers who fuel for Chicken Cottage which will boost their revenues, iii) the vibrant youthful population in the country who are expected to form a large part of the firms targeted clientele particularly through e-commerce, and, iv) Nairobi’s rise as a hub for international corporations supported by the developing infrastructure.

The Kenyan retail sector performance is expected to be supported by the opening of new franchises such as Chicken Cottage and the rise of e-commerce through online payments and deliveries complementing sales in physical outlets.

- Naivas Supermarket to Open 2 New Outlets while Chandarana is set to open 4 New Outlets

Naivas supermarket, a local retail chain, announced plans to open 2 new outlets by the end of February 2021. The two outlets will be located at Nairobi’s Greenspan Mall in Donholm and Imara Shopping Mall in Imara Daima. Currently, Naivas operates 79 outlets, having opened 10 outlets in 2021, compared to other retailers such as Quickmart and Carrefour which opened 9 and 5 branches, respectively.

The retailer’s decision to expand in Mombasa Road and Eastlands is supported by presence of a good transport network e.g the Nairobi Expressway and Airport North Road which will enhance client and supplier accessibility, presence of the prime space left by troubled retailers such as Tuskys, and high footfall from the residents of the surrounding estates. In terms of performance, according to the Cytonn Annual Markets Review-2021, Eastlands where Donholm is classified, recorded average rent per SQFT of Kshs 133, which is 21.8% lower than the market average of Kshs 170 per SQFT. On the other hand, Mombasa Road where Imara Daima is classified recorded average rent per SQFT of Kshs 148, which is 12.9% lower than the market average of Kshs 170 per SQFT. This signifies that the retailer’s decision to invest in the area is mainly due affordability of the retail spaces.

The table below shows the submarket performance of nodes in the Nairobi Metropolitan Area (NMA);

|

Nairobi Metropolitan Area Retail Market Performance FY’2021 |

|||

|

Area |

Rent Kshs /SQFT FY’2021 |

Occupancy% FY’2021 |

Rental Yield FY’2021 |

|

Westlands |

213 |

78.8% |

10.0% |

|

Karen |

202 |

84.0% |

9.8% |

|

Kilimani |

183 |

86.0% |

9.8% |

|

Ngong Road |

171 |

79.0% |

7.7% |

|

Kiambu Road |

180 |

74.2% |

7.7% |

|

Mombasa Road |

148 |

75.0% |

6.8% |

|

Thika Road |

161 |

74.0% |

6.7% |

|

Satellite Towns |

142 |

69.0% |

6.2% |

|

Eastlands |

133 |

71.6% |

5.6% |

|

Average |

170 |

76.8% |

7.8% |

Source: Cytonn Research

Chadarana Foodplus Supermarket, a local retail chain, announced plans to open 4 outlets over the next four months leading to June 2022. Three of these will be large size convenience stores which will be located in Riverside, Thigiri, and General Mathenge in Westlands, and 1 will be located in an undisclosed mall outside Nairobi. The retail chain plans to focus its expansion in residential areas, eyeing heavy footfall in the estates and thus offering convenience to residents, as opposed to its strategy that favoured expansion in malls. This move will see Chandarana expand its footprint in the country and increase its market share having opened its 24th outlet in Westlands’ Rhapta Road early this year. It faces competition from other retail chains such as Naivas, Quickmart and Carrefour who are taking up space left by troubled retailers such as Nakumatt and Tuskys.

The table below shows the summary of the number of stores of the Key local and international retailer supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||||||

|

Name of Retailer |

Category |

Highest number of branches that have ever existed as at FY’2018 |

Highest number of branches that have ever existed as at FY’2019 |

Highest number of branches that have ever existed as at FY’2020 |

Highest number of branches that have ever existed as at FY’2021 |

Number of branches opened in 2022 |

Closed branches |

Current number of Branches |

Number of branches expected to be opened in 2022 |

Projected number of branches FY’2022 |

|

Naivas |

Local |

46 |

61 |

69 |

79 |

0 |

0 |

79 |

2 |

81 |

|

QuickMart |

Local |

10 |

29 |

37 |

47 |

2 |

0 |

49 |

0 |

49 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

1 |

1 |

24 |

4 |

28 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

0 |

0 |

16 |

0 |

16 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

Total |

|

257 |

313 |

334 |

185 |

3 |

179 |

188 |

6 |

194 |

Source: Online Research

We expect the Retail Sector to continue witnessing expansion activities by local and international retailers driven by factors such as; i) positive demographics, ii) infrastructure developments opening up areas for accessibility and investments, and, iii) the improved business environment promoting transactions and activities. However, rise of e-commerce has also led to reduced need for physical retail space hence the oversupply of 1.7mn SQFT of space in the Kenya retail market and 3.0 mn SQFT in the Nairobi Metropolitan Area is expected to weigh down performance of the Retail Sector.

- Listed Real Estate

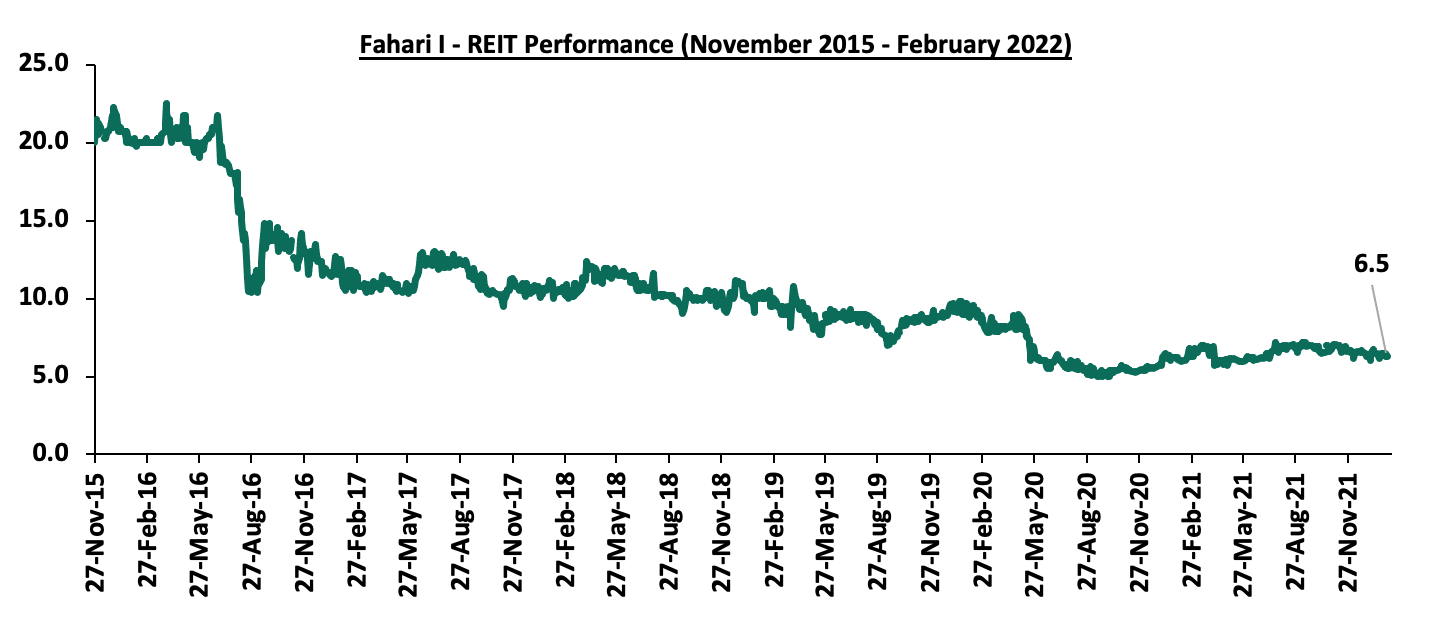

In the Nairobi Stock Exchange, the ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share. This represented a 3.2% and 1.6% Week-to-Date (WTD) and Year-to-Date (YTD) increase, respectively, from Kshs 6.3 per share and Kshs 6.4 per share, respectively. On Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having realized a 67.5% decline from the inception price of Kshs 20.0. In the Unquoted Securities Platform, the Acorn D-REIT closed the week trading at Kshs 20.2 while the I-REIT closed at Kshs 20.6 per unit. This performance represented a 1.0% and 3.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 Inception price. The Kenyan REIT market performance continues to be weighed down by factors such as; i) a general lack of knowledge on the financing instrument, ii) general lack of interest of the REIT by investors, and, iii) lengthy approval processes to get all the necessary requirements thus discouraging those interested in investing in it. The graph below shows Fahari I-REIT’s performance from November 2015 to February 2022;

The Real Estate sector is expected to record increased activities supported by focus on the affordable housing initiative, student housing, and, expansion by local retailers aiming to increase their market share in the Retail Sector. However, business uncertainties brought about by the upcoming elections and the low of investor appetite in REITs is expected to weigh down the performance of the sector.

Kenya’s Real Estate sector is one of the economic sectors that that has realized remarkable growth and improvement over the past years. However, development of projects has proven to be a challenge as evidenced by various projects stalling, and hence surpassing their stipulated timelines. Key to note, Real Estate investments are capital intensive, and as such require massive funding to complete. However, the over-reliance on traditional sources of financing Real Estate projects such as debt financing continue to be a challenge in sourcing funds for developments mainly due to difficulty in accessing credit loans, coupled with the burden of being in debt. Therefore as our focus this week, we shall do a recap of our 2019 topical on Alternative Financing for Real Estate Developments, in order to identify the various sources of financing for Real Estate developments with a keen eye on the alternative financing for Real Estate. The topical will therefore cover the following:

- Introduction to Real Estate,

- Traditional Financing for Real Estate Developments,

- Alternative Financing for Real Estate Developments,

- Case Study: South Africa’s Real Estate Investment Market (REIT) Market,

- Recommendations: Measures to Increasing Access to Real Estate Development Funding, and,

- Conclusion.

Section I: Introduction

In 2021, Kenya’s Real Estate sector recorded improved activities and performance, as a result the reopening of the economy which facilitated numerous expansion and construction activities by investors, in addition to various businesses resuming full operations. Consequently, the average rental yield for the Real Estate market came in at 6.5% in 2021, 0.4% points higher than the 6.1% recorded in 2020. Additionally, the sector grew by 5.2% in Q3’2021, 0.3% points higher than the 4.9% growth recorded in Q2’2021, according to the Q3'2021 GDP Report by the Kenya National Bureau of Statistics’ (KNBS).

Despite this, the sector continues to face various challenges which include;

- Existing oversupply in the Nairobi Metropolitan Area (NMA) office and retail market at 7.3 mn SQFT and 3.0 mn SQFT, respectively, coupled with an oversupply of 1.7 mn SQFT in the Kenya retail market,

- The shift towards online shopping and financial setbacks which continues to affect the performance of the Kenyan retail market thereby reducing demand for physical retail spaces, and,

- COVID-19 uncertainties which remains a challenge as the virus continues to mutate with the most current emerging variant being Omicron. This might lead to most tourists halting their travel plans with other countries imposing strict measures to limit the spread of the virus.

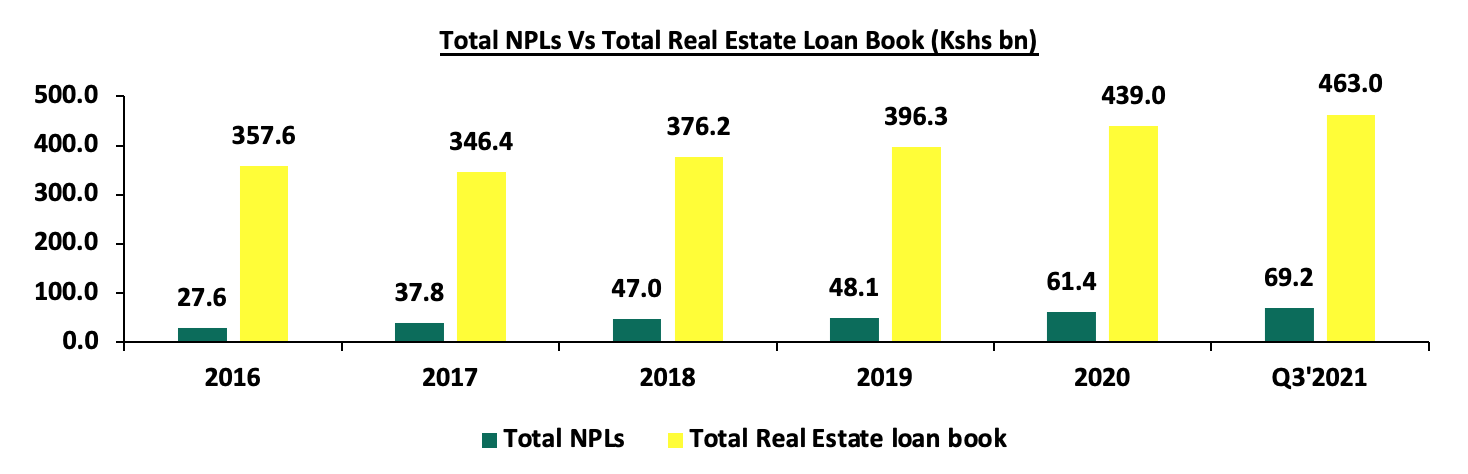

In addition to the above challenges, financial constrains continues to be a major challenge faced by developers, leading to various projects stalling and surpassing their stipulated completion timelines. This is mainly driven by; i) high construction costs currently ranging between Kshs 35,000 per SQM and Kshs 60,000 per SQM, ii) the onset of the pandemic which led to reduced cash flows and projects stalling, and, iii) difficulty accessing credit as banks continue to tighten their lending terms while requesting for more collateral from Real Estate developers due to the increasing default rates in the property sector. In support of this, the Gross Non-Performing Loans (NPLs) in the Real Estate sector increased by 16.6% to Kshs 69.2 bn in Q3’2021, from Kshs 57.7 bn realized in Q3’2020, evidenced by Central Bank of Kenya’s Q3’2021 Quarterly Economic Review. The graph below shows the number of Real Estate NPLS compared to the total Real Estate loan book from 2016 - Q3’2021;

Source: Central Bank of Kenya

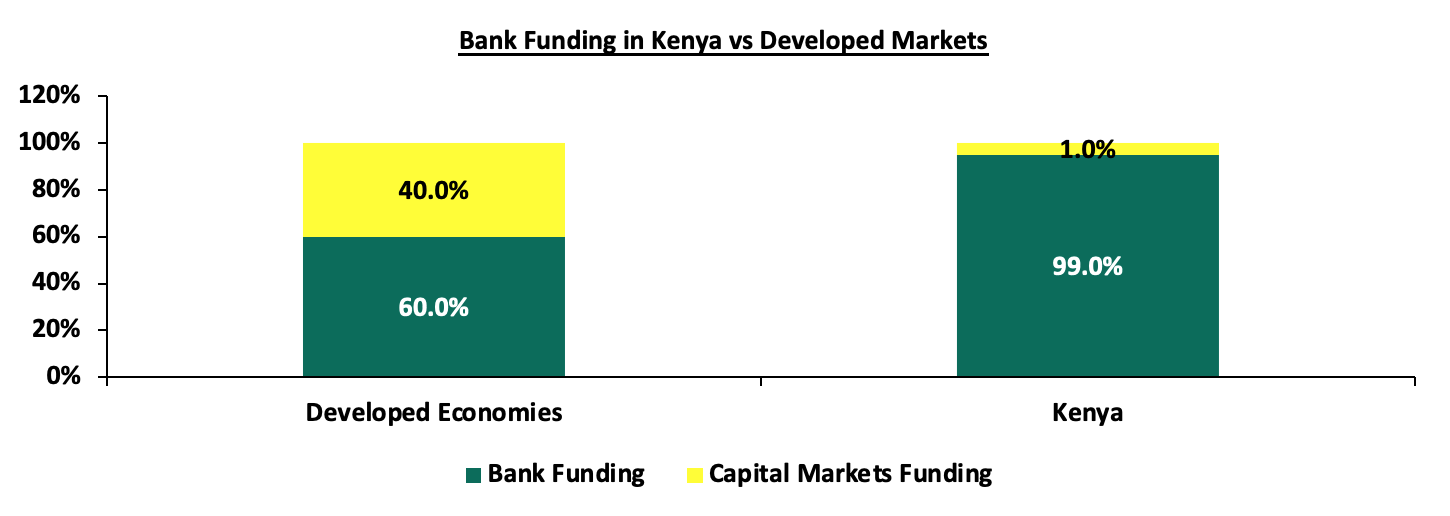

In Kenya, the main source of funding for Real Estate developments is banks which provide approximately 99.0% of funding as compared to 40.0% in developed countries, a sign of overreliance on the bank funding and minimal exposure of other alternative sources available for financing projects especially from the capital markets. This therefore also implies that capital markets contribute a mere 1.0% of Real Estate funding, compared to 60.0% in developed countries. The chart below compares bank funding in Kenya and capital markets;

Source; World Bank

With regards to financial constraints incurred by developers and land owners, we sought to identify and discuss the various forms of financing Real Estate projects, besides the debt and equity financing which is prominent in Kenya.

Section II: Traditional Financing for Real Estate Development

The three main ways of funding Real Estate developments traditionally are; debt financing, equity and personal savings;

- Debt Financing

This is the most common avenue by which developers acquire funds to develop Real Estate projects in Kenya. It entails acquisition of loans majorly from commercial banks, private lenders, or SACCOs, i.e., a saver with money takes it to the bank and gets little to no return on their deposit. The bank, in turn, lends the money to, say, a developer and charges the market rate cost of borrowing. The bank enjoys the difference between the cost of the deposit paid to the saver and the yield on loan received from the developer.

In comparison to the alternative financing method, the facts remain essentially the same, except that the intermediary is not a bank but an investment vehicle; the saver with money takes it to an investment professional, through an Investment Vehicle, who gives the money directly to the developer. The developer will still pay the usual cost of borrowing, but instead of paying it to the bank, it will be paid to the Investment Vehicle, which will pass the returns to the saver. By structuring out the bank, the saver has been able to increase the returns from the typical rate of return given on deposits, to the typical rate of borrowing paid by developers.

All in all, debt financing usually involves longer transaction timelines endured before one is granted a loan, as there are lengthy processes involved such as valuations. Additionally, given the current high Non-Performing Loans in the Real Estate sector and the high risk of defaults, banks have continued to tighten their lending to the sector and in the cases where they lend out money, it is often at higher interest rates.

- Equity

In Real Estate Development, Equity funding option can be done in three different ways;

- Joint Venture

A joint venture (JV) refers to a business arrangement under which two or more parties come together to undertake a project by pooling their resources together. In their most distinctive form, Real Estate joint ventures combine the Real Estate development expertise and financing capability of a developer with the landowner’s contribution in the form of land. A Joint venture can also be initiated between partners with capital. However, in most cases one party has limited funds and therefore the other party with more funds comes into an agreement to invest in the project. Some of the benefits of joint ventures include;

- Increased Capital Base: In a JV, partners contribute capital into the project in the form of land or cash and this is beneficial considering the capital intensive nature of Real Estate development,

- Development Expertise: The developer in a JV provides development expertise in terms of concept development, design, project management and oversees the project to completion. With the right partner, the landowner is relieved of the day-to-day hustle of supervising a project and assured of a professional workmanship,

- Access to market distribution channels: Partnering with a reputable Real Estate firm that has been in the market ensures the Real Estate product reaches its suited market and thus the partners are able to exit faster either by renting or selling, thus realize returns sooner,

- Shared risks and gains: A successful joint venture will generate the expected high returns for both partners. A partnership also enables spreading of economic and other market risks that might result from undertaking a Real Estate investment that would otherwise be borne alone, and,

- Can provide partial liquidity for landowner without having to sell the entire land: In a JV, the land owner can get some cash for their land to meet their liquidity needs and also maintain interest in the development.

Despite the benefits of this funding option, it is subject to bias perception of a developer or a firm. This therefore leads to one investing with specific developers or firms, whilst minimizing exposure of other or upcoming developers in the market. Additionally, JVs are prone to conflicts that could threaten the success of a project. The conflicts arise due to unmet expectations or if any one of the parties fails to deliver on their end. Joint ventures may also be subject to double taxation in the case where the joint venture has not been listed as a limited liability partnership, where both the partnership gets taxed as well as each of the partner’s profits. As such JV partners ought to consult and know the pros and cons of different partnership structures and register the partnership as a limited liability to avoid double taxation.

- Pre-Sales

This is in other terms also known as off-plan investments, whereby developers pool funds from investors to construct a project, by selling the various units during the construction period. According to our topical, Off-Plan Real Estate Investing, this form of financing has been gaining traction in Kenya given that it enables investors to take advantage of capital appreciation of the properties, since they are bought at a price much less than the actual cost of the property upon completion. The developer, on the other hand, gets the opportunity to access funds from the sale of units off-plan, thus enabling the completion of the developments. However, off plan investments may be disadvantageous because of; i) the possibility of capital depreciation, ii) risks of delays and failure to deliver, and, iii) payment defaults from the investors thereby leading to projects stalling or delays.

- Savings

This is the easiest funding option to finance property developments since one acquires finances from their personal savings that has accrued over time, and therefore does not need to secure other forms of finances. Some of the benefits of this funding option include; i) Full control of the day to day activities of the project, without having another party intervening, and, ii) Full ownership rights of the project even after it is complete, meaning that all the profits will go the owner. Despite the benefits, there are also disadvantages of using savings to finance Real Estate projects which include;

- Massive Capital Required: Real Estate projects are capital intensive and personal savings might not be enough to fund a project to completion. This will therefore require one to seek additional funds from other alternative sources such as bank loans which in most cases, have high interest rates as well as longer transaction timelines hence projects stalling due to limited capital, and,

- Possibility of Loss of Assets: This can happen in instances where a project fails or does not yield returns due to uncertainties. There is a possibility of loss in instances where an investor may decide to sell off their properties to recover their funds.

Section III: Alternative Financing for Real Estate Developments

Based on the financial gaps resulting from the various drawbacks of the traditional funding options, there has been the need and opportunity to tap into other forms of financing Real Estate developments. This is in order to minimize the overreliance of debt finance while also giving developers and investors diversity in funding options such as structured products that deliver higher returns to the investors, in comparison to traditional investments. Some of the alternative funding methods therefore include but not limited to:

- Real Estate Investments Trusts (REITs)

REITs are regulated collective investment vehicles which invest in Real Estate. REITs promoters source funds to build or acquire Real Estate assets, such as residential, commercial, retail, mixed-use developments among others which they sell or rent to generate income. Some of the REITs listed in Kenya include Fahari I-REIT on the Nairobi Stock Exchange (NSE), and Acorn REIT that trades both as a Development REIT (D-REIT) and Income REIT (I-REIT) on the Unquoted Securities Platform (USP). For more on the Kenyan REIT Market, click here.

The performance and growth of the Kenyan REIT market continues to be weighed down by challenges such as;

- High Minimum Investment Amounts at Kshs 5.0 mn, which is relatively high for the low and middle income class citizens,

- Inadequate Investor Knowledge on REITs hence low investment and subscription rates in the market,

- High Minimum Capital Requirements for a Trustee at Kshs 100.0 mn, and this automatically leaves only banks to be the REIT trustees, and,

- Lengthy Approval Processes.

We also note that there are only two REIT organizations in the country as opposed to 33 in South Africa, with 28 listed in the Johannesburg Stock Exchange.

- Structured Products

These are financing options provided by different organizations to investors in order to increase their financial muscle to fund property developments. They include asset based products such as Real Estate Notes (promissory notes secured by a specified piece of Real Estate), High Yield Funds (mutual fund that seeks a high level of income), and Medium Term Notes (corporate debt security offered intermittently), among others. An example is the Kshs 3.9 bn Medium Term Note (MTN) programme issuance for Urban Housing Renewal Development Limited that was approved by the Capital Markets Authority (CMA) in November 2021. The MTN which had a Kshs 600.0 mn green-shoe option, an 18-month tenor, and an interest rate of 11.0% p.a will be used to finance the construction of the ongoing Pangani Affordable Housing Project. These structured products have proven to be beneficial as they are geared towards generating high returns to investors. Some of the advantage of the structured funding methods include;

- Ease of Accessibility: Structured products offer ease of access of finance from the public compared to traditional methods such as debt financing which undergo lengthy processes and approvals,

- Minimum Investment Amounts: Some of the organizations with structured products provide favorable investment terms and requirements, with a minimal investment amount as low as Kshs 100,000, which is relatively cheaper and easy to acquire from investors, for development, and,

- Saving and Investment Mechanism: While structured products offer financing options to developers, they also act as an investment platform for most investors given their high rate of returns. Real Estate backed structured products on average provides investors high returns to as high as up to 20.0%. An example is the Cytonn Real Estate Note which provides returns of 16.0% to 20.0% depending on the tenor.

On the other hand, the downsides to this kind of financing option includes;

- Illiquidity: This mostly affects Real Estate backed up structured products. Real Estate is more of brick and mortar and as such converting them into cash takes time as well, in addition to being prone to external challenges that drive illiquidity. This causes delayed repayment of funds to investors, and in turn derailed trust in the funds, and,

- Inflation Risk: This mainly affects corporate bonds as they are prone to inflation risks which might in turn lower the value of expected investment amount in the future, as well as the possibility of low subscription of a bond in future by prospective investors resulting from lack of confidence.

- Public Private Partnerships (PPPs)

These are partnerships involving a government organization and a private entity, formed with the sole purpose of financing projects. According to our on topical on Private Public Partnership in Real Estate, we noted that PPPs continue to gain traction in Kenya as they have proven to be a cost effective measure of financing projects in the country. Some of the projects initiated under the partnership strategy include; i) River Estate project in Ngara between the national government and Edderman Property Limited, ii) Pangani Affordable Housing project between the government and Tecnofin Kenya Limited, and, iii) Hydro City project between the government and Hydro Developers Limited, among others. Below are some of the benefits of PPP funding option:

- Access to Private Capital: PPPs grants government access to private capital in order to carry out various development projects, that would otherwise have taken a long time to implement,

- Access to Private Sector Efficiencies: PPPs also grant the government access to new and improved technology as well as skilled labor, as a result of undertaking projects with well-established countries such as China and Japan, and,

- Large Scale Investment and/or Development: PPPs facilitate large scale development projects that would otherwise cause financial strain to taxpayers if implemented by the government alone.

Contrary to the above benefits, PPPs have also met setbacks in Kenya as a result of;

- Irregular Procurement Due to Corruption: The government has been in most cases accused of irregularities, raising speculation such as irregular awarding of tenders through corruption, hence causing loss of public confidence in the contracted parties and delayed delivery of PPP projects,

- Inadequate Infrastructure: Kenya has inadequate infrastructure such as sewer and drainage systems among others, to support the bulk PPP projects. This therefore causes delays in the delivery of projects, in addition to developers having to incur the cost of constructing the amenities as well, thus being discouraged, and,

- Lengthy Approval Processes: Applications require to go through different channels in order to be granted a green light. Furthermore, some delays in responding to bidders are blamed on the failure to achieve quorum at the various levels required to provide approval, which hampers expeditious decision making.

- Mezzanine Funding

This is where an organization provides subordinated financing to a Real Estate development. The financing can be structured either as debt or preferred stock, and while it is junior to bank debt and gets paid only after the funds from the bank have been exhausted, it is senior to equity thus gets paid before equity investors. Some of the benefits of mezzanine financing option are;

- Long Term Financing Solution: Whereas traditional financing options such as banks only support the borrower for a stipulated short period of time, mezzanine funding gives developers with long term projects the opportunity of accessing funds for a longer time,

- Control: Mezzanine funding ensures that the developer or firm remains in control of the business provided the success of the project is maintained,

- Extra Capital: Mezzanine capital acts as extra capital since it is subordinate to a senior debt, hence provides the developer with the opportunity to utilize and expand the project.

Some of the challenges impeding the growth of the funding option include;

- Loss of Control: In case of a default, this form of funding gives the lender the right to convert an equity interest in the company,

- Lengthy Approval Processes: Just like any other loan, processing and form of mezzanine funds takes time and this discourages borrowers from acquiring it, and,

- Restrictions: Borrower may be subjected to tight terms and conditions that they must adhere to, such as how the money will be spent, as well as where it will be spent, thus in turn discouraging developers from opting for it.

Section IV: Case Study

Out of the 54 countries in Africa, there are only 6 countries that have adopted the Real Estate Investments Trusts (REITs) namely; South Africa, Kenya, Ghana, Nigeria, Tanzania, and, Zambia. This signifies the unpopularity of the financing instrument as an alternative form of financing Real Estate Investments, with only 42 organizations having adopted it according to Housing Finance Africa. Conversely, out of the 42 organizations South Africa dominates the market with a total of 33 REITs (28 REITS listed in the Johannesburg Stock Exchange), followed by Nigeria and Kenya which currently have 4 and 2 REITS, respectively. Moreover, South African REIT market ranks position nine globally. The table below shows the distribution of REITs in Africa as at 2021;

|

Distribution of REITs in Africa as at 2021 |

||||

|

Country |

Establishment of Framework (Year) |

Registered REITs (Number) |

Size of Industry (US$ million) |

Primary Sectors |

|

South Africa |

2013 |

33 |

31,420.0 |

Residential, Commercial |

|

Nigeria |

2007 |

4 |

131.0 |

Residential, Commercial |

|

Kenya |

2013 |

2 |

35.5 |

Residential (Student Housing), Commercial |

|

Tanzania |

2011 |

1 |

40.0 |

Residential |

|

Zambia |

2020 |

1 |

N/A |

Residential, Commercial |

|

Ghana |

2018 |

1 |

(12.6) |

Residential, Commercial |

Source: Centre of Affordable Housing

South Africa adopted REITs in 2013, with a focus on investing in the residential and commercial sectors of Real Estate. Following the introduction of the REIT structure in the country, South Africa also established the SA REIT Association (SAREIT) in that year with an aim of promoting and representing the interest of the South Africa listed property sector. Since inception, the country’s REIT market has been recording remarkable performance with a total of R247.3 bn (Kshs 1.8 tn) worth of listed Real Estate assets currently existing. Some of the factors that have supported the growth and performance of South Africa’s REIT market include;

- Transparency: To promote and enhance awareness of REITS to investors and the general public, South African REIT Association (SAREIT) introduced and published the first Best Practice Recommendations (BPR) in 2016, a report reflecting the latest accounting, regulatory and reporting issues. This was in order to ensure transparency of the investment instrument, as well as improve comparability of the various listed companies,

- Developed Capital Markets: South Africa already had developed capital markets before the introduction of REITs in 2013, evidenced by JSE ranking position one in Africa and 16th globally. This made it easier to incorporate the investment instrument into the market, in addition to boosting investor confidence i.e. both local and international investors, in South Africa’s capital markets,

- No Minimum Investments: In South Africa, listed REITs are regulated by the JSE and as such there is no limitation of a minimum amount of capital needed to invest, only a minimum of one share, and therefore this attracts numerous investments in the REIT market,

- High Yields-Generating Properties: According to Knight Frank’s Africa Report 2020/21, South Africa’s property market fetches higher property prices and overall yields currently at 8.4% in comparison to other African countries such as Kenya which recorded average rental yields of 7.8% in the similar period. This in turn boosts investor confidence in South Africa’s REIT market as they are likely to generate higher returns, and,

- Governance: Good regulation practices and corporate governance have acted as an incentive to both local and foreign investors, who have the assurance that their funds are being properly administrated and utilized.

Despite the aforementioned supporting factors, South Africa faces a major challenge in its REIT market which is the high competition from other established REIT markets in countries such as United States of America, Netherlands, Mexico, and, Ireland, among others. In spite of this, there are lessons that Kenya can borrow from South Africa which include;

- Awareness: Transparency and limited information about the REIT market is a major challenge impeding the growth of Kenyan property market. Conversely, this can be rectified by Kenya establishing a better communication network through organizations, in order to promote and ensure efficiency of the investment instrument, just like South Africa came up with the BPR report to enhance transparency of the REITs, as well as improve comparability of the various listed companies,

- Lower Minimum Investment Amounts: The Kenyan government should review the minimum regulatory investment amount currently at Kshs 5.0 mn for D-REITs, which is relatively high for a country where the median income is just Kshs 50,000, hence the minimum investment is 100 times higher than the median income, and thus bring it down to a favorable amount i.e. Kshs 100,000 or leave the pricing open like in South Africa, and,

- A Review of the Capital Markets: Capital markets in Kenya only contribute a mere 1.0% to the financing of Real Estate projects, whereas developed capital markets like South Africa’s contribute as high as up to 60.0%. This is a sign of underdevelopment of capital markets locally. However, the government can review the regulations governing the Kenyan capital markets in order to improve their efficiency and contribution towards the financing of Real Estate developments.

Section V: Recommendations

In order to increase access to Real Estate development funding in Kenya particularly from alternative financing options, the following measures are recommended;

- Reduction of the Minimum D-REIT Investment Amount: The minimum investment amount in D-REITs in Kenya currently stands at Kshs 5.0 mn, which is relatively higher and thus locks out the low and middle income earners in the country. Therefore, the government should review the regulatory investment amount and reduce the it to a favorable amount i.e. Kshs 100,000,

- Expansion and Development of Structured Products: Structured products such as Projects Notes and Medium Term Notes, among others are provided by very few firms and entities in the country, and yet they provide alternative financing to Real Estate projects. This therefore calls for awareness and education of the public on the products, as there are also various myths that surround them which continue to discourage prospective investors from investing in them. In June 2021, we debunked these myths and concluded that it is important to have continuous education for current and potential investors to understand the products and the return prospects, as well as, how they fit in to the investors’ portfolio. For more on this, read our Regulated Vs Unregulated Products topical,

- Development of capital markets: This can be done by the government reviewing the regulations governing the capital markets, in order to minimize overreliance on debt for financing projects and focus on alternative financing options, just like in the developed countries which provide up to 60.0% of property financing while in Kenya only a mere 1.0% is contributed, while a bigger percentage i.e. 99.0% is sourced from banks,

- Improving Awareness of Investors on Different Alternative Financing Sources: Limited awareness on alternative project financing methods is one of the major reasons as to why investments instruments such as REITs do not perform well in Kenya. This challenge can however be overcome by transparency and awareness of property managers in order to increase investor appetite to REITs, as there are only two listed Real Estate companies in Kenya, that are also generally underperforming, and,

- Tax Incentives: Savings towards the collective investments schemes regulated by the Capital Markets Authority should be provided with tax incentives, in order to entice the public towards more savings and investments.

Section VI: Conclusion

Financial constraints continue to be a major challenge faced by developers as a result of limited financing options. The main funding options for Real Estate Investments are the traditional funding options such as debt financing, equity financing and savings. Developers can however explore alternative financing options for Real Estate developments such as Real Estate Investment Trusts, structured products, and Public Private Partnerships, among others. Moreover, the government should have a review on the Capital Markets regulations in order to expand their role in financing projects in Kenya, as they only contribute a mere 1.0% whereas in developed countries, Capital Markets contribute approximately 60.0%, leaving 40.0% to debt financing from banks.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.