Cytonn H1’2025 Markets Review

By Research Team, Feb 17, 2026

Executive Summary

Global Markets Review

According to the World Bank the global economy is projected to grow at 2.3% in 2025, lower than the 2.7% growth recorded in 2024. This forecast marks a slight downward revision from earlier projection in January of 2.7%, reflecting anticipated economic slowdown, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection is 0.5% points lower than the IMF’s 2025 forecast of 2.8%, which was also revised from the January 2025 projection of 3.3%. Both the World Bank and the IMF revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, up from the 1.7% expansion recorded in 2024. However, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024;

Sub-Saharan Africa Regional Review

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, and a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. The public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support;

In H1’2025, most of the select Sub-Saharan currencies appreciated against the US Dollar, primarily due to the respective central bank efforts, increased foreign currency inflows and debt-restructuring and policy reforms which have improved forex reserves. Notably, the Ghanaian Cedi emerged as the best performer among the selected currencies, appreciating by 29.9% against the USD on a year-to-date basis, closing H1'2025 at GHS 10.3, from GHS 14.7 at the beginning of the year. The Ghanaian Cedi’s performance is majorly attributable to tight monetary policy and stronger remittance flows;

Kenya Macro-Economic Review

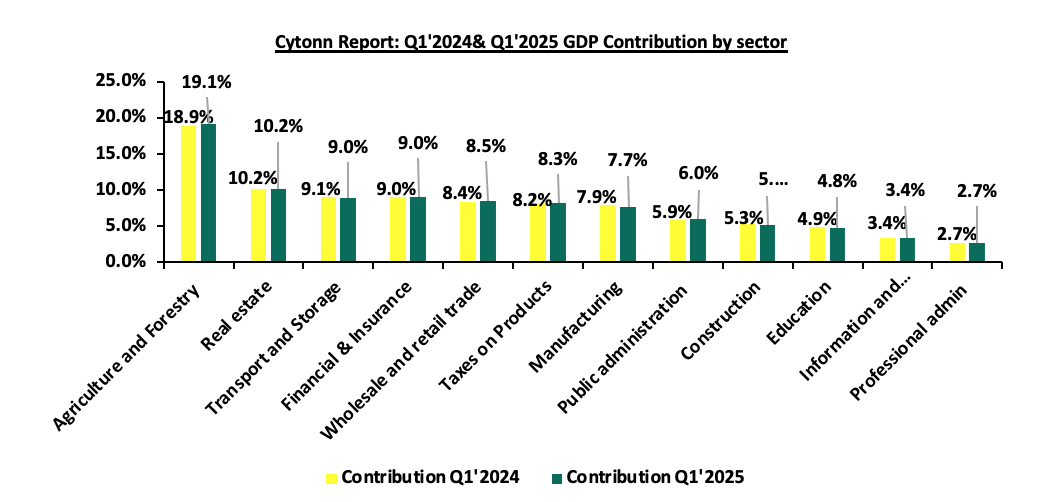

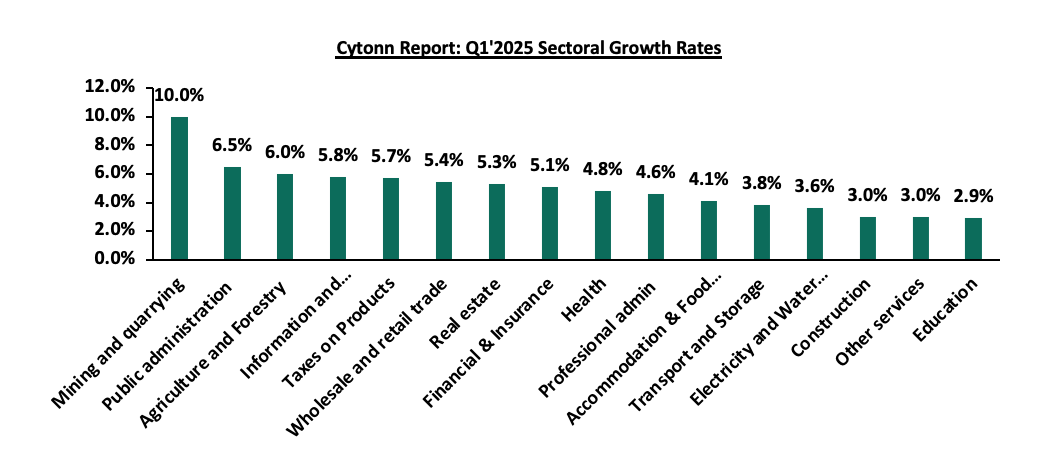

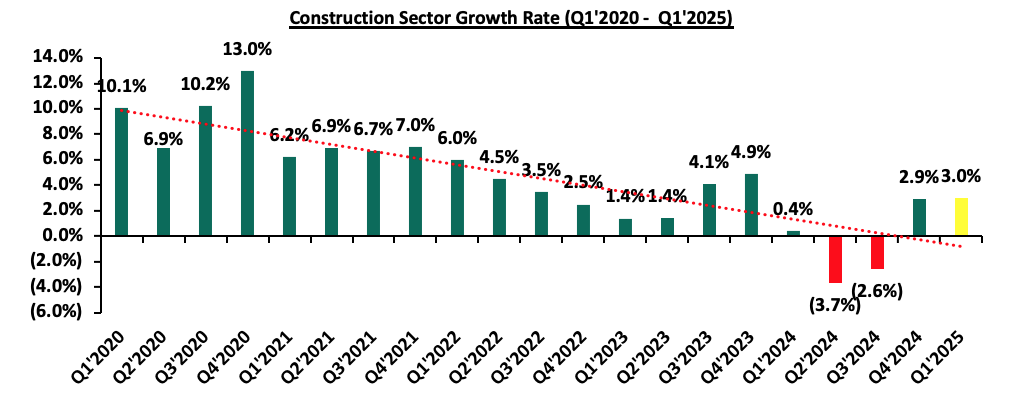

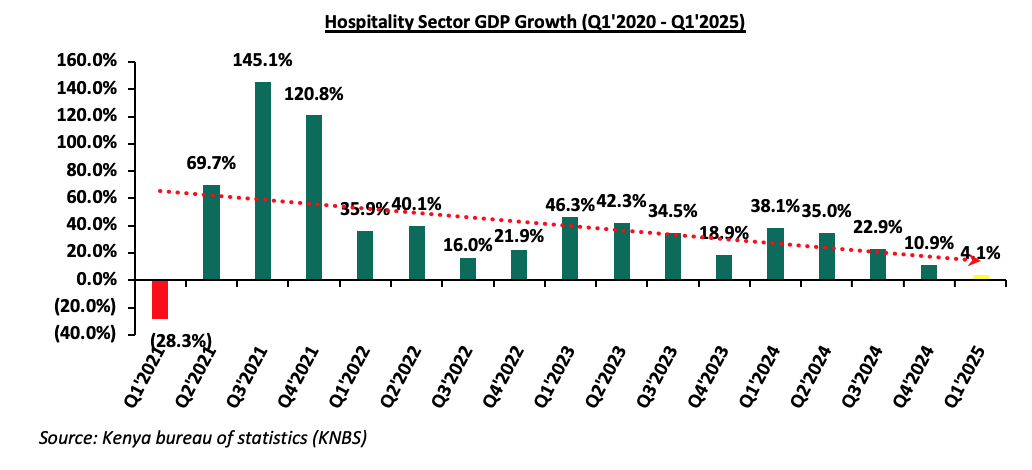

According to the Kenya National Bureau of Statistics (KNBS) Q1'2025 Quarterly GDP Report, the Kenyan economy recorded a 4.9% growth in Q1’2025, unchanged from the growth rate recorded in Q1’2024. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 6.0% in Q1’2025, higher than the 5.6% expansion recorded in Q1’2024. All sectors in Q1’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q1’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Professional Administration recording growth rate declines of 34.0%, 13.4% and 4.8% points to 4.1%, 9.0% and 4.6% from 38.1%, 15.4% and 9.4% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q1’2024, with Mining and Quarrying, Taxes on products and Construction recording the highest growths in rates of 26.0%, 2.8% and 2.6% points, to 10.0%, 5.7% and 0.4% from (16.1%), 2.9% and 3.0% respectively. Notably, the overall economic performance highlighted a slight slowdown in momentum following tough operating environment characterized by the high costs of living, and the lower private sector credit growth;

Fixed Income

During H1’2025, T-bills were oversubscribed, with the overall subscription rate coming in at 154.5%, up from 132.6% in H1’2024. Investors’ preference for the 91-day paper persisted with the paper receiving bids worth Kshs 233.7 bn against the offered Kshs 104.0 bn, translating to an oversubscription rate of 224.8%, albeit lower than the oversubscription rate of 404.4% recorded in H1’2024. Overall subscription rates for the 364-day and 182-day papers came in at 191.6% and 89.3% respectively, higher than the 80.7% and 75.7%, respectively, recorded in H1’2024. The average yields on the 364-day, 182-day, and 91-day papers decreased by 6.2% points, 7.5% points, and 7.4% points to 10.4%, 9.1%, and 8.8% in H1’2025, respectively, from 16.7%, 16.6%, and 16.2%, respectively, in H1’2024. The downward trajectory in yields is primarily driven by improved investor confidence, stemming from reduced credit risk in the country and eased inflationary pressures. This has lowered the risk premium demanded by investors. Despite the government's sustained domestic borrowing, strong demand for government securities has supported the decline in yields. During the period, the acceptance rate stood at 85.4%, down from 92.3% in H1’2024, with the government accepting Kshs 823.2 billion out of the Kshs 964.0 billion worth of bids received;

During the week, T-bills were undersubscribed for the second consecutive week, with the overall subscription rate coming in at 90.9%, higher than the subscription rate of 60.4% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 2.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 67.4%, higher than the subscription rate of 36.2%, recorded the previous week. The subscription rates for the 182-day paper increased to 111.7% from the 12.0% recorded the previous week, while the 364-day paper decreased to 79.6% from the 118.4% recorded the previous week. The government accepted a total of Kshs 21.77 bn worth of bids out of Kshs 21.83 bn bids received, translating to an acceptance rate of 99.7%. The yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing by 0.7 bps to 8.15% from the 8.14% recorded the previous week, while the yields on the 182-day and 364-day papers decreased by 1.1 bps and 0.9 bps to 8.45% and 9.71%, from the 8.46% and 9.72% respectively recorded the previous week;

During the week, the Kenya National Bureau of Statistics released the Q1’2025 Quarterly Balance of Payment Report, highlighting that Kenya’s balance of payments position deteriorated significantly by 313.8% in Q1’2025, with a deficit of Kshs 77.0 bn, from a surplus of Kshs 36.0 bn in Q1’2024;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q1’2025 Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 4.9% growth in Q1’2025, remaining unchanged from Q1’2024. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 6.0% in Q1’2025, higher than the 5.6% expansion recorded in Q1’2024;

During the week, Linzi FinCo 003 Trust announced the successful full subscription of its Kshs. 44.8 bn Infrastructure Asset-Backed Securities (IABS) issuance, with bids totaling KSh. 44.9 billion translating to a subscription rate of 100.2%. The 15-year notes, offering a fixed annual return of 15.04%, will finance the Talanta Sports Complex through receivables from the Sports, Arts and Social Development Fund (SASDF).

Equities

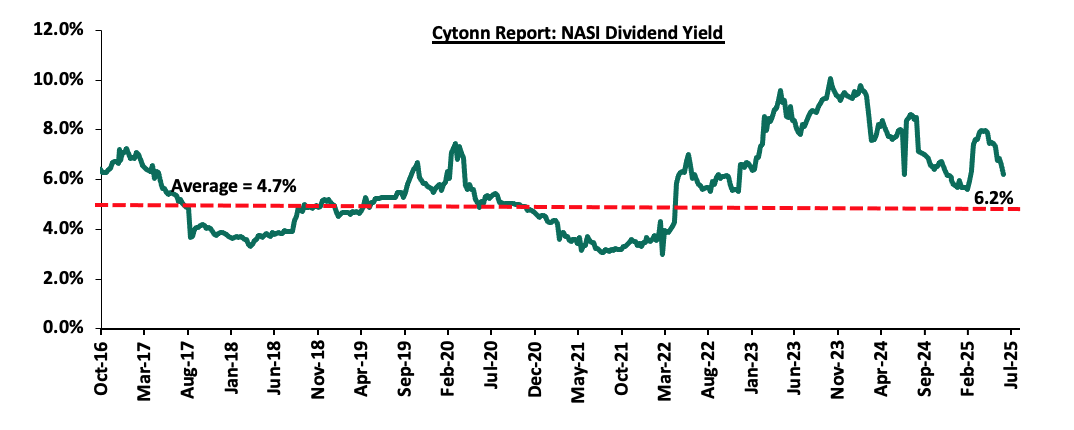

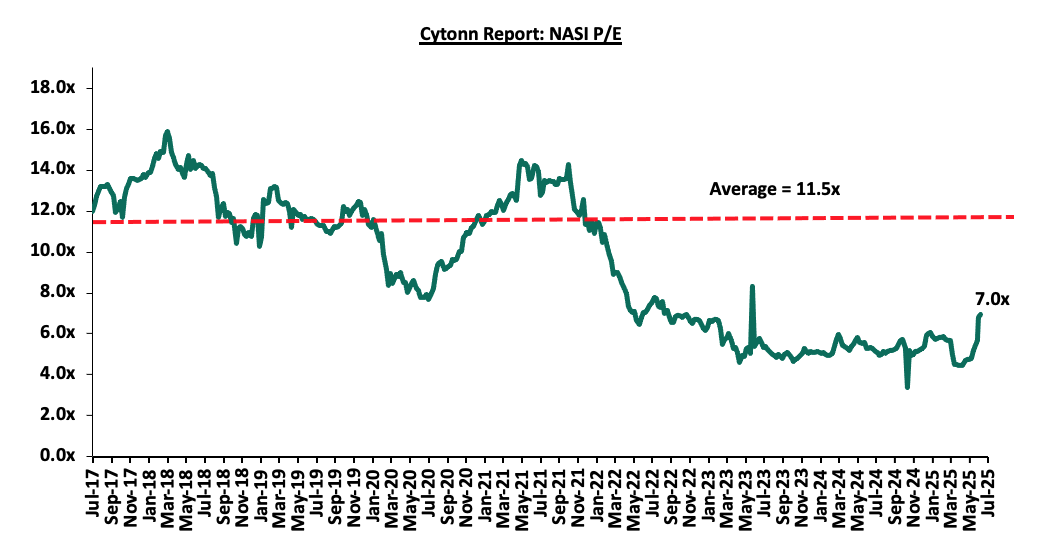

During Q2’2025, the equities market was on an upward trajectory, with NASI, NSE 10, NSE 25, and NSE 20 gaining by 17.3%, 13.0%, 11.5%, and 9.6%, respectively, taking the H1’2025 performance to gains of 22.4%, 18.5%, 14.3% and 13.9% for NASI, NSE 20, NSE 10, and NSE 25 respectively. The equities market performance during the quarter was driven by gains recorded by large caps such as Safaricom, NCBA, and Cooperative Bank of 36.6%, 13.3%, and 11.9% respectively. The gains were however weighed down by losses recorded by large cap stocks such as Bamburi and BAT of 4.4% and 2.8% respectively;

During Q2’2025, in the regional equities market, the East African Exchanges 20 (EAE 20) share index declined by 11.0 bps, attributable to decline recorded by large cap stocks such as Airtel Uganda, MTN Rwandacell and Tanzania Breweries of 13.6%, 9.1% and 2.8% respectively. The performance was however supported by gains recorded by large cap stocks such as Bank of Baroda Uganda, Safaricom and KCB Group of 1,317.9%, 42.1% and 22.1% respectively;

During the week, the equities market was on an upward trajectory, with NASI, NSE 25, NSE 10 and NSE 20 gaining by 5.7%, 5.1%, 4.8%, and 4.5%, respectively, taking the YTD performance to gains of 28.6%, 21.6%, 19.0% and 18.8% for NASI, NSE 20, NSE10, and NSE 25 respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as Stanbic Bank, Safaricom, and NCBA of 9.9%, 8.0%, and 6.8%, respectively. The gains were however weighed down by losses recorded by large cap stocks such as Cooperative Bank of 0.3%;

Additionally, in the regional equities market, the East African Exchanges 20 (EAE 20) share index ddeclined by 54.6 bps, attributable to losses recorded by large cap stocks such as Tanga Cement, Cooperative Bank and Tanzania cigarette of 33.4%, 1.6% and 1.4% respectively. The performance was however supported by gains recorded by large cap stocks such as Safaricom, Bank of Baroda Uganda and Absa of 6.1%, 4.4% and 3.5% respectively;

During the week,the Nairobi Securities Exchange (NSE) announced the inclusion of Sasini Plc as a constituent in the NSE 25 Share Index to replace TransCentury Plc following the court order placing it under receivership and subsequent suspension of trading of TransCentury Plc and its subsidiary East Africa Cables;

Real Estate

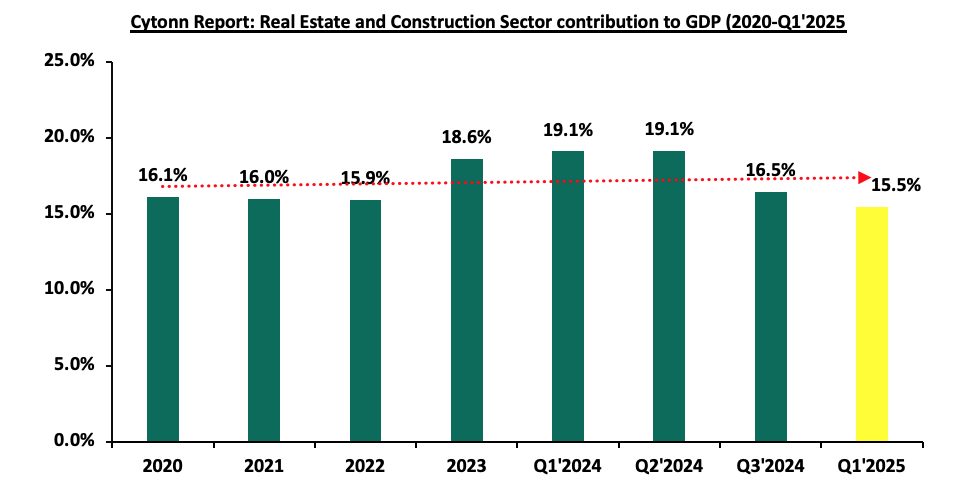

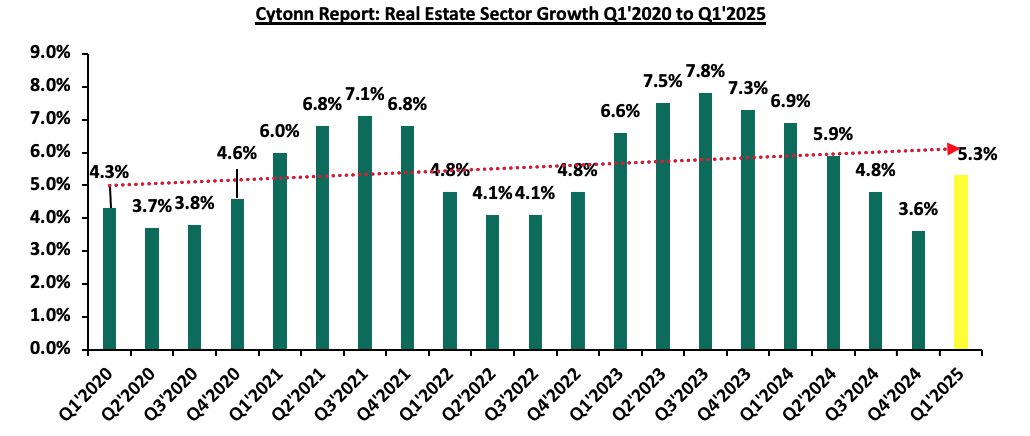

In Q1’2025, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.3 % to Kshs 358.4 bn in Q1’2025, from Kshs 334.1 bn recorded during the same period in 2024. In Q1’2025, the sector contributed 10.2% to the country’s GDP, remaining unchanged from Q1’2024. Cumulatively, the Real Estate and construction sectors contributed 15.5% to GDP in Q1’2025, 0.1% points decrease from 15.6% in Q1’2024, attributable to decline in construction contribution to GDP by 0.1% points, to 5.2% in Q1’2025, from 5.3% recorded in Q1’2024;

During the week, the Kenya National Bureau of Statistics (KNBS) released the Q1'2025 Quarterly Gross Domestic Product Report that outlined the performance of various sectors to the GDP, with real estate sector contributing 10.2% of GDP;

During the week, the National carrier, Kenya Airways inked a code-sharing pact with Qatar Airways, allowing the latter to introduce a third daily frequency between Doha and Nairobi while Kenya Airways will launch Qatar Airways-marketed flights between Mombasa and Doha during the coming winter season. This agreement makes Qatar Airways the 15th codeshare partner of the local carrier in a growing list that has seen Kenya Airways widen its global route network;

During the week, Kenya’s capital, Nairobi, was named Africa’s Leading Business Travel Destination 2025 at the 32nd World Travel Awards. This marks Nairobi’s seventh consecutive win in the category, maintaining its dominant position since first clinching the title in 2019. Nairobi was nominated in the category alongside Accra, Cairo, Cape Town and Lagos;

During the week, lifestyle hotel group, African Hotel Development, entered a management agreement with Aleph Hospitality for 26 ONOMO branded hotels across 14 African countries. This strategic move is part of African Hotel Development’s business realignment strategy;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 26.7 and Kshs 22.9 per unit, respectively, as per the last updated data on 27th June 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 20th June 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1.2 mn shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015;

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 13.4% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Global Economic Growth:

According to the World Bank the global economy is projected to grow at 2.3% in 2025, lower than the 2.7% growth recorded in 2024. This forecast marks a slight downward revision from earlier projection in January of 2.7%, reflecting anticipated economic slowdown, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection is 0.5% points lower than the IMF’s 2025 forecast of 2.8%, which was also revised from the January 2025 projection of 3.3%. Both the World Bank and the IMF revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, up from the 1.7% expansion recorded in 2024. However, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024.

The downturn in global economic growth in 2025 as compared to 2024 is majorly attributable to;

- Heightened trade tensions and rising U.S. tariffs. Escalating U.S. tariffs, particularly on imports from China and key trading partners have disrupted global supply chains and increased the cost of goods. This has led to the slowdown in international trade volumes and weakened export-driven growth in the emerging markets and developing economies. However, if the major economies settle their trade disputes, it could ease global economic pressures, and,

- Trade policy uncertainty. The global economic landscape in 2025 is clouded by unpredictable trade policies, especially from major economies such as the United States, China and the European Union. Sudden tariff hikes, retaliatory measures and inconsistent enforcement have created a volatile environment for global trade. Developing countries, particularly those reliant on exports are facing reduced trading volumes and lower commodity prices.

The global economy is expected to remain subdued in 2025, mainly as a result of rising global trade tensions as well as volatile and unclear trade policies, which are expected to slow down economic growth.

Global Commodities Market Performance:

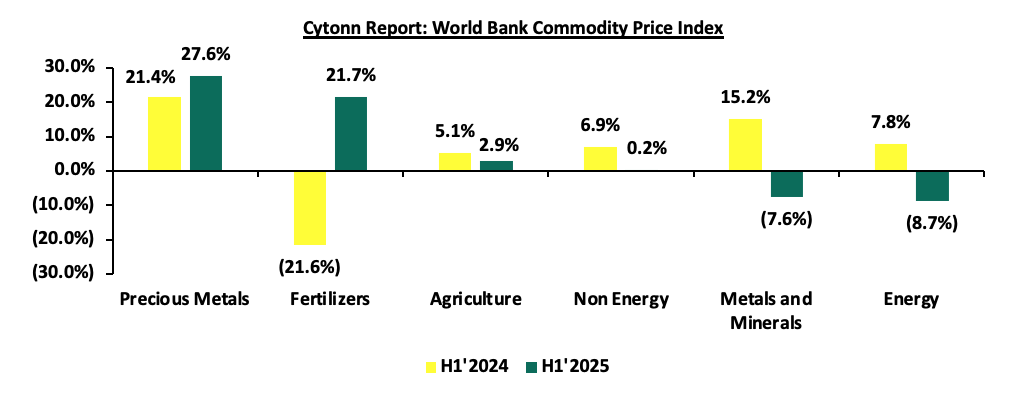

Global commodity prices registered mixed performance in H1’2025, with prices of energy declining by 8.7%, compared to the 7.8% increase recorded in H1’2024, mainly as a result of a surplus of oil supply coupled with adoption of electric vehicles. Additionally, prices of metals and minerals declined by 7.6% in H1’2025, compared to the 15.2% increase growth recorded in H1’2024, mainly due to reduced demand especially by China, which is the world’s largest metal consumer, as well as trade tensions and unexpected disruptions by suppliers. On the other hand, prices of Precious Metals, Fertilizers, Agriculture, and Non-Energy increased by 27.6%, 21.7%, 2.9%, and 0.2% respectively, on the back of geopolitical tensions (especially in the Middle East), extreme weather impacting crop yields, rising input costs for fertilizers, and strong demand from clean-energy sectors. Tariffs and supply disruptions have further fueled these increases. Below is a summary performance of various commodities;

Source: World Bank

Global Equities Market Performance:

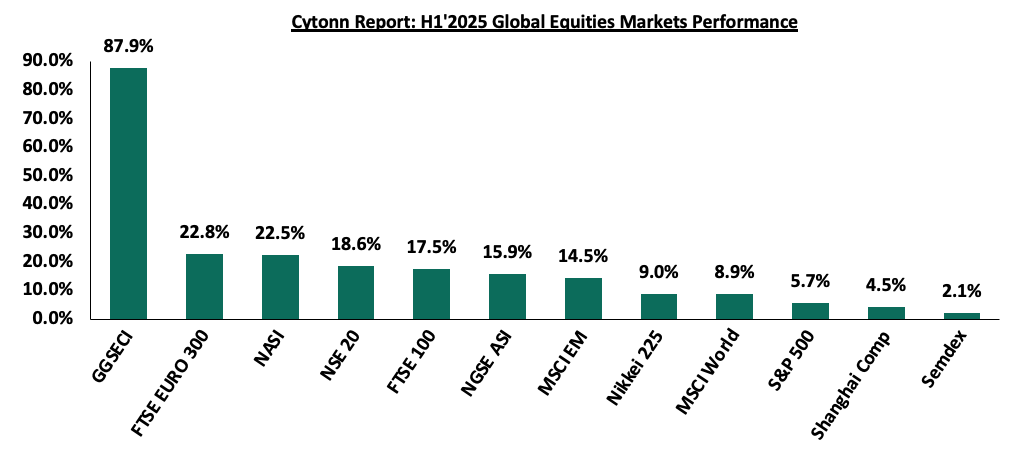

The global stock market was on an upward trajectory in H1’2025, with most indices recording gains during the period, largely attributable to improved investor sentiments as a result of strong corporate earnings, easing inflation pressures, and a weaker U.S. dollar, which has boosted international stock returns. Additionally, geopolitical tensions like tariff threats temporarily subsided and investors rotated into undervalued European and emerging markets. Notably, GGSECI was the best performer during the period, recording a gain at 87.9% in H1’2025 largely driven by gains in the large-cap stocks such as Access Bank, Standard Chartered Bank and MTN Ghana gaining by 161.5%, 21.2% and 17.2%, following improved earnings during the period, supported by easing inflation. Below is a summary of the performance of key indices as at the end of H1’2025:

*Dollarized performance

According to the World Bank, the Sub-Saharan economy is projected to grow at a moderate rate of 3.7% in 2025, which is 0.2% points higher than the 3.5% growth recorded in 2024, and a downward revision from the January 2025 projection of 4.1%. The downward revision is mainly due to the rising trade barriers coupled with the weakened global investor confidence. The expected recovery from 2024 is primarily driven by global economic stability, and easing of monetary policy rates in the region, which is expected to boost private consumption and investment. However, most countries face the risk of increased inflation due to increased food prices resulting from drought, prompting them to increase or hold off on further easing of the rates. Nevertheless, the risk of debt distress remains high with more than half of countries facing unsustainable debt burdens. The public debt is expected to remain high due to increased debt servicing costs as a result of high interest rates in developed economies and a reduction in donor support.

Currency Performance:

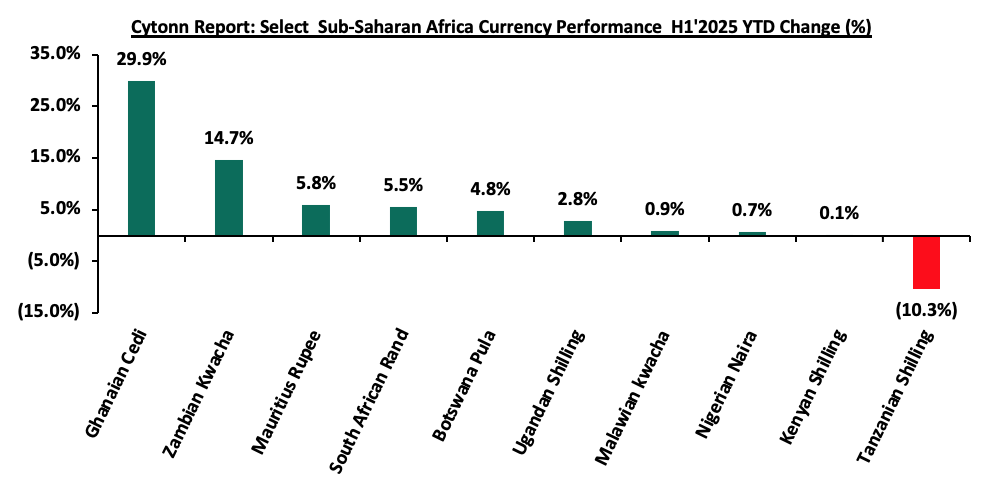

In H1’2025, most of the select Sub-Saharan currencies appreciated against the US Dollar, primarily due to the respective central bank efforts, increased foreign currency inflows and debt-restructuring and policy reforms which have improved forex reserves. Notably, the Ghanaian Cedi emerged as the best performer among the selected currencies, appreciating by 29.9% against the USD on a year-to-date basis, closing H1'2025 at GHS 10.3, from GHS 14.7 at the beginning of the year. The Ghanaian Cedi’s performance is majorly attributable to tight monetary policy and stronger remittance flows. Below is a table showing the performance of select African currencies against the US Dollar:

|

Cytonn Report: Select Sub-Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-24 |

Jan-25 |

Jun-25 |

Last 12 months |

YTD change (%) |

|

Ghanaian Cedi |

15.3 |

14.7 |

10.3 |

32.6% |

29.9% |

|

Zambian Kwacha |

24.0 |

27.9 |

23.8 |

0.8% |

14.7% |

|

Mauritius Rupee |

47.2 |

47.7 |

44.9 |

4.8% |

5.8% |

|

South African Rand |

18.2 |

18.8 |

17.7 |

2.5% |

5.5% |

|

Botswana Pula |

13.6 |

14.0 |

13.3 |

2.2% |

4.8% |

|

Ugandan Shilling |

3710.1 |

3,697.6 |

3594.4 |

3.1% |

2.8% |

|

Malawian kwacha |

1,734.0 |

1,750.3 |

1,734.0 |

(0.0%) |

0.9% |

|

Nigerian Naira |

1,535.4 |

1,540.7 |

1,529.7 |

0.4% |

0.7% |

|

Kenyan Shilling |

129.5 |

129.3 |

129.2343 |

0.2% |

0.1% |

|

Tanzanian Shilling |

2,626.9 |

2,374.7 |

2,618.3 |

0.3% |

(10.3%) |

Source: Yahoo Finance, Central Banks

The chart below shows the year-to-date performance of different sub-Saharan African countries in Q1’2025;

Source: Yahoo Finance

Key take outs from the above table and chart include:

- The Ghanaian Cedi was the largest gainer against the USD Dollar, gaining by 29.9% year to date to close at GHS 10.3 as at the end of June from the GHS 14.7 recorded at the beginning of the year. The Cedi’s strength has been supported by several factors, including increased foreign exchange reserves resulting from increased commodity prices, particularly gold, as well as reforms under the International Monetary Fund program. The IMF program (Extended Credit Program) focuses on debt sustainability and economic stabilization, following the external debt default in 2022, and includes structural reforms and monetary policy adjustments. and,

- The Tanzanian Shilling was the worst performing currency in H1’2025, depreciating by 10.3%, mainly as a result of rising imports and increased public debt linked to major infrastructure projects.

African Eurobonds:

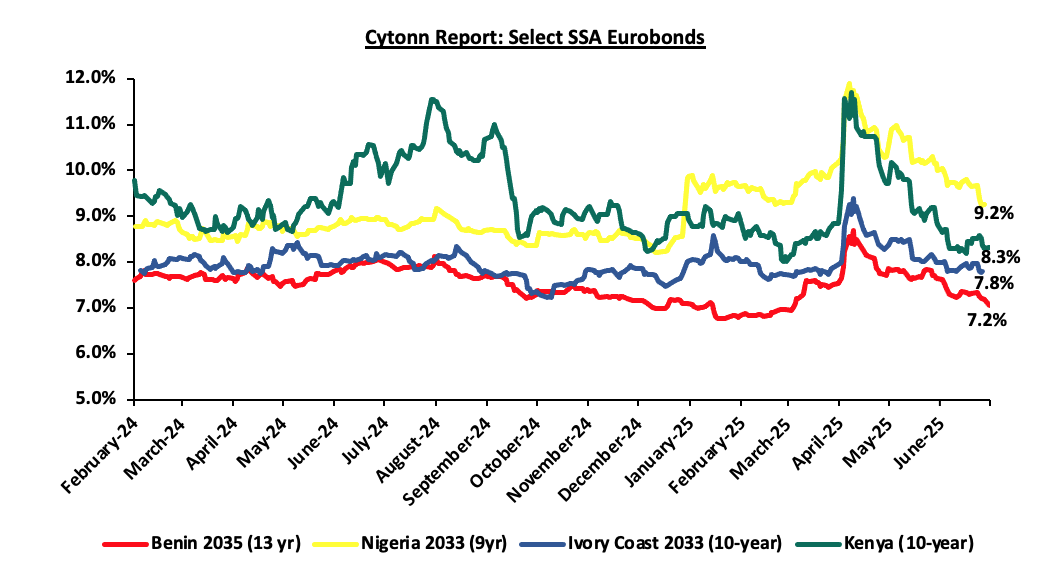

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the three months to end of Q1’2025 being Ivory Coast and Benin raising a total of USD 0.7 bn and USD 0.5 bn respectively. Additionally, 2024 issuers were Ivory Coast, Benin, Kenya, Senegal and Cameroon raising a total of USD 2.6 bn, USD 0.8 bn, USD 1.5 bn, USD 0.8 bn and USD 0.6 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from most countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The Yields of the Kenya’s 10-year Eurobond maturing in 2028 decreased by 2.0% points to 8.3% as at the end of June 2025 from 10.4% in June 2024, partly attributable to improved investor confidence following the successful buy-back in March 2025, of the 2027 Eurobond maturity, increased IMF Credit funding and the stabilizing of the Kenyan shilling against the dollar. Similarly, the yields for Benin’s 13-year and Ivory Coast’s 10-year Eurobonds maturing in 2035 and 2033 respectively decreased by 1.0% and 0.5% to 7.1% and 7.7% respectively at the end of June 2025. However, the yields of Nigerian 9-year Eurobond maturing in 2033 increased marginally by 0.2% to 9.1% from 8.9% in June 2024. Below is a graph showing the Eurobond secondary market performance of select Eurobonds issued by the respective countries:

Source: Bloomberg, CBK

Equities Market Performance:

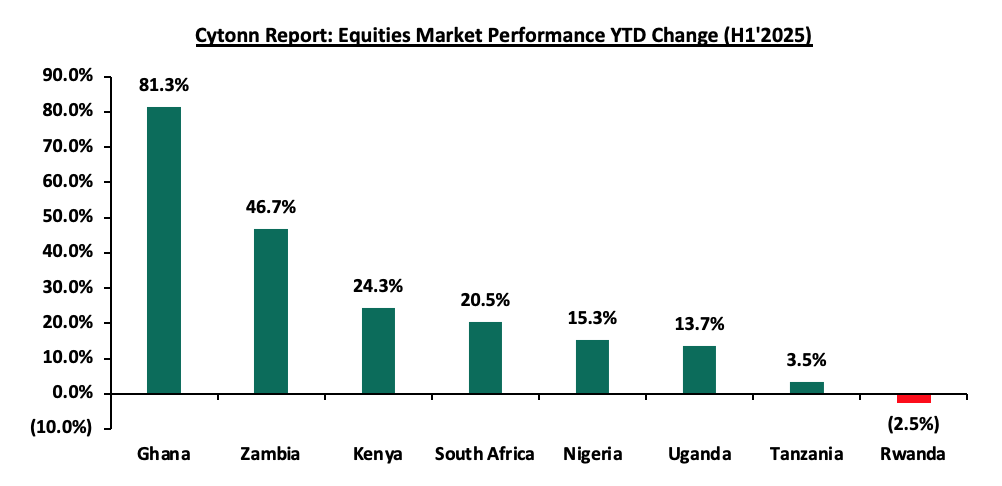

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in H1’2025, with Ghana’s stock market (GSECI) being the best performing market gaining by 81.3% YTD attributable to gains in the large-cap stocks such as Access Bank, Standard Chartered Bank and MTN Ghana gaining by 161.5%, 21.2% and 17.2%, following improved earnings during the period, additionally supported by easing inflation. Rwanda’s RSEASI was the worst performing stock market, declining by 2.5% YTD, mainly attributable to losses recorded by large-cap stocks such as MTN Rwanda of 23.1%, coupled with currency depreciation of the Rwandan Franc. Below is a summary of the performance of key indices:

|

Cytonn Report: Equities Market Performance H1'2025(Dollarized*) |

||||||

|

Country |

Index |

Jun-24 |

Jan-25 |

Jun-25 |

Last 12 months |

YTD Change |

|

Ghana |

GSECI |

252.3 |

333.8 |

605.4 |

139.9% |

81.3% |

|

Zambia |

LASILZ |

567.7 |

578.8 |

848.8 |

49.5% |

46.7% |

|

Kenya |

NASI |

0.8 |

1.0 |

1.2 |

41.1% |

24.3% |

|

South Africa |

JALSH |

4,383.5 |

4,502.1 |

5,424.8 |

23.8% |

20.5% |

|

Nigeria |

NGEASI |

66.2 |

67.5 |

77.8 |

17.6% |

15.3% |

|

Uganda |

USEASI |

0.3 |

0.3 |

0.4 |

28.9% |

13.7% |

|

Tanzania |

DARSDEI |

0.8 |

0.9 |

0.9 |

17.7% |

3.5% |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(5.7%) |

(2.5%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: Cytonn Research, Kwayisi, Yahoo Finance

The chart below shows the YTD performance of the Sub-Saharan Equities Market;

Dollarized performance

GDP growth in the Sub-Saharan Africa region is expected to improve, in contrast with the rest of the global economy. However, public debt continues to be a major headwind, with high debt levels experienced in the region on the back of continued weakening of local currencies, which will make debt servicing costlier, making the region less attractive to foreign capital.

According to the Kenya National Bureau of Statistics (KNBS) Q1'2025 Quarterly GDP Report, the Kenyan economy recorded a 4.9% growth in Q1’2025, unchanged from the growth rate recorded in Q1’2024. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 6.0% in Q1’2025, higher than the 5.6% expansion recorded in Q1’2024. All sectors in Q1’2025 recorded positive growths, with varying magnitudes across activities. Most sectors recorded contraction in growth rates compared to Q1’2024 with Accommodation & Food Services, Financial Services Indirectly Measured and Professional Administration recording growth rate declines of 34.0%, 13.4% and 4.8% points to 4.1%, 9.0% and 4.6% from 38.1%, 15.4% and 9.4% respectively. Other sectors recorded an expansion in growth rates, from what was recorded in Q1’2024, with Mining and Quarrying, Taxes on products and Construction recording the highest growths in rates of 26.0%, 2.8% and 2.6% points, to 10.0%, 5.7% and 0.4% from (16.1%), 2.9% and 3.0% respectively. Notably, the overall economic performance highlighted a slight slowdown in momentum following tough operating environment characterized by the high costs of living, and the lower private sector credit growth. In 2025, the Kenyan economy is expected to rebound, returning to its growth path, with the average projected growth estimated at 5.0% by various organizations as outlined below:

|

Cytonn Report: Kenya 2025 Growth Projections |

||

|

No. |

Organization |

2025 GDP Projections |

|

1 |

International Monetary Fund |

4.8% |

|

2 |

National Treasury |

5.3% |

|

3 |

World Bank |

4.5% |

|

4 |

Fitch Solutions |

5.1% |

|

5 |

Cytonn Investments Management PLC |

5.4% |

|

Average |

5.0% |

|

Source: Cytonn Research

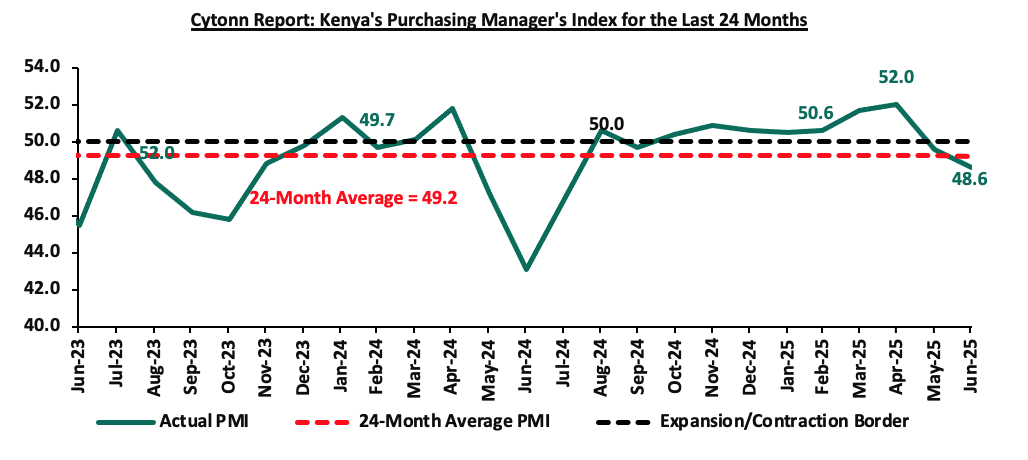

Key to note, Kenya’s general business environment improved slightly in the first half of 2025, with the average Purchasing Manager’s Index for the first six months of the year coming at 50.5, compared to 50.0 recorded in a similar period in 2024. The improvement was mainly on the back of a stronger and stable Shilling, coupled with eased inflation averaging at 3.7% in H1’2025, 1.6% points lower than the 5.6% average rate for H1’2024. Additionally, the easing monetary policy stance is expected to continue to reduce the cost of borrowing and increase spending therefore supporting business activity. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration):

Stanbic Bank’s June 2025 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of June 2025 remained in the negative territory, coming in at 48.6, down from 49.6 in May 2025, marking a second consecutive month the index fell below the 50.0 neutral mark, signalling worsening in business conditions, mainly attributable to decreased output and new orders. On a year-to-year basis, the index recorded 1.4% points increase from the 47.2 recorded in June 2024, indicating a slight improvement in business conditions compared to the same period last year. The improvement was largely driven by a slower pace of decline in output and new orders, as some firms reported gains from new marketing strategies and client acquisition efforts. Input prices rose at the fastest rate in five months, mainly due to increased purchase prices and higher taxation, while output charges rose at their slowest pace since October 2024 as firms tried to limit price hikes to support demand.

In June, business output continued to contract, marking the second consecutive monthly decline, partly attributable to the political unrest and demonstrations that limited business activity. Around 34.0% of firms reported falling output, mainly in construction, retail and services, while agriculture and manufacturing continued to show relative resilience. New orders fell for the second consecutive month since September 2024, attributed to weaker customer demand and rising prices, though some businesses reported gains from new marketing and client acquisition efforts. Despite the downturn, inventory stockpiling and some sectoral resilience helped soften the impact.

Employment levels continued to rise marginally for the fifth consecutive month in June, supported by short-term hiring to fulfil existing orders. The employment index remained above the 50.0 mark, suggesting ongoing efforts by businesses to maintain capacity despite reduced output. Meanwhile, the Backlogs of Work Index dropped slightly below the 50.0-mark threshold, implying steady levels of unfinished work and no major accumulation of operational pressure.

Purchasing activity dipped slightly, marking one of the sharpest declines in eleven months, as firms scaled back orders in response to softening demand. Despite this, inventories grew for the sixth month running, with some firms preparing for anticipated future orders or hedging against possible input shortages.

Supplier delivery times continued to improve modestly, with vendors more responsive in securing payments and maintaining faster delivery cycles.

Input prices rose at the fastest pace in five months, largely due to higher material costs, taxes, and customs fees. The purchase price index also accelerated, with manufacturers particularly affected. Staff costs increased marginally, reaching the highest level since July 2023. However, with demand under pressure, most firms avoided aggressive pricing, resulting in a modest and slowing increase in output prices, the weakest pace in seven months.

Going forward, we anticipate that the business environment will improve in the short to medium term as a result of the anticipated improvement in the economic environment driven by lower interest rates following the easing monetary policy with the CBR decreasing by 25.0 bps to 9.75% in June 2025 from 10.00%, the stability of the Kenyan Shilling against the USD, the low inflation rates currently at 3.8% and stable fuel prices. However, we expect businesses to be weighed down by the ongoing political unrest and demonstrations, high cost of living coupled with the high taxation, which are set to limit business activity and increase input costs.

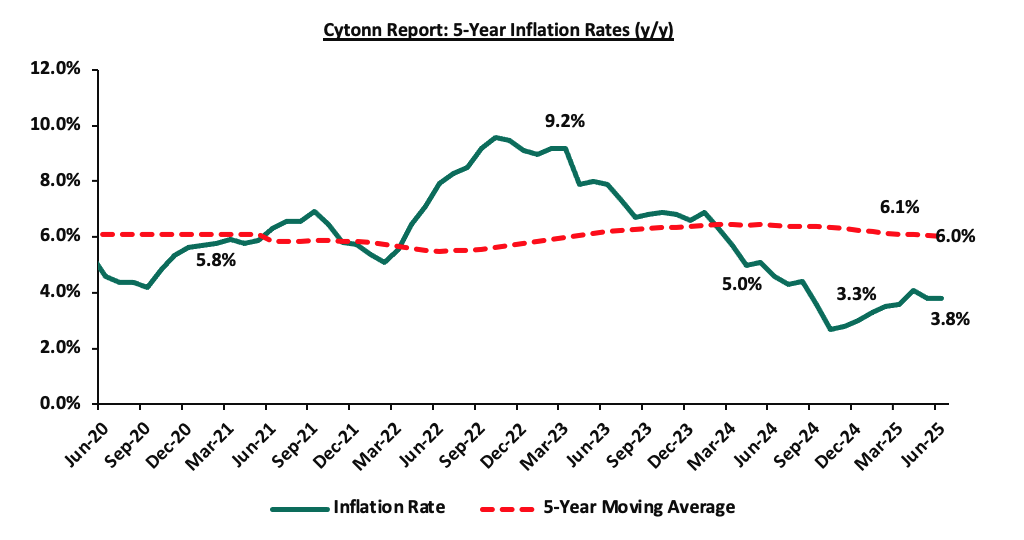

Inflation:

The average inflation rate decreased to 3.7% in H1’2025, compared to 5.6% in H1’2024, attributable to a stronger and stable Shilling, leading to reduced fuel prices. Notably, fuel prices of Super petrol, Diesel, and Kerosene decreased by 6.6%, 5.9% and 9.9% in June 2025 to Kshs 177.3 Kshs 162.9 and Kshs 146.9, from Kshs 189.8, Kshs 173.1, and Kshs 163.1 per litre in June 2024 respectively. Inflation for the month of June 2025 remained unchanged at 3.8% recorded in May 2025, mainly driven by a 1.0% increase in the food and non-alcoholic beverages index which was offset by the 0.1% decrease in the housing, water, electricity, gas and other fuels index. Below is a chart showing the inflation trend for the last five years:

For the last 24 months, Kenya’s inflation has persistently remained within the Central Bank of Kenya (CBK) target range of 2.5% - 7.5%, owing to a stronger Shilling, reduced fuel and electricity prices. With the continued easing of monetary policy following the MPC’s observation that its earlier measures had stabilized the Shilling and anchored inflation, the focus has now shifted to lowering borrowing costs, supporting the private sector, and promoting economic growth. As a result, we expect this to exert upward pressure on inflation. The Monetary Policy Committee (MPC) has lowered the Central Bank Rate (CBR) by cumulative of 325 bps since August 2024, to 9.75% in June 2025 from 13.00%, 2024. Going forward, we still expect the inflationary pressures to remain within the CBK’s preferred target range of 2.5% - 7.5%.

June 2025 Inflation

The y/y inflation in June 2025 remained unchanged at 3.8%, maintaining the same rate recorded in May 2025. The headline inflation was mainly driven by increases in prices of commodities in the following categories: Food & Non-Alcoholic Beverages at 6.6%, Transport at 3.2%, and Housing, Water, Electricity, Gas and Other Fuels at 0.2%. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – June 2025 |

|||

|

Broad Commodity Group |

Price change m/m (June-2025/ May -2025) |

Price change y/y (June-2025/June-2024) |

Reason |

|

Food and non-alcoholic beverages |

1.0% |

6.6% |

The m/m increase was mainly driven by higher prices of carrots, cabbages and sugar which rose by 11.1%, 10.8% and 5.5% respectively. However, the overall increase was moderated by declines in the prices of cooking salad oil, fresh unpacked cow milk and Irish potatoes, which dropped by 0.4%, 0.4%, and 0.2% respectively. |

|

Transport |

0.7% |

3.2% |

The transport sector recorded 0.7% price increase on a m/m basis. Petrol prices, personal vehicle operating costs and country bus fares increased by 1.6%, 1.2% and 1.0% respectively. City bus and regular matatu fares registered slight upticks of 0.2% each. However, the decline in diesel prices by 1.1% helped ease some of the pressure on fuel-related transport costs. |

|

Housing, water, electricity, gas and other fuels |

(0.1%) |

0.2% |

The m/m performance was mainly driven by the decrease in electricity costs, recording notable declines of 1.6% for a 50kWh unit and 1.5% for a 200kWh unit. Additionally, the price of gas/LPG and kerosene dropped by 0.2% and 1.2% respectively. |

|

Overall Inflation |

0.5% |

3.8% |

The m/m increase was majorly attributable to the 1.0% increase in food and non-alcoholic beverages |

In June 2025, overall inflation remained unchanged at 3.8% on y/y basis, indicating relative price stability across key sectors. This marked the twenty-fourth consecutive month that inflation remained within the Central Bank of Kenya’s preferred range of 2.5%–7.5%. The stability was supported by minimal changes in fuel prices, Petrol recorded a slight increase of 1.6%, while Diesel prices declined by 1.1% helping ease pressure on transport and energy-related costs. The Kenya Shilling also remained stable during the month of June at 129.2 against the dollar and recorded a 5.5 bps year-to-date gain to Kshs 129.2 as of 30th June, 2025, from the Kshs 129.3 recorded at the beginning of the year. This stabilization in the exchange rate and fuel prices is expected to continue anchoring inflationary pressures in the country remaining within the CBK’s preferred range of 2.5%-7.5%. However, the reduction in the CBR to 9.75% from 10.00% is likely to increase the money supply through lower borrowing costs, which may cause a gradual rise in inflation rates as the effects of the CBR gradually take hold in the broader economy.

Going forward, we expect inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a stable currency and stable fuel prices. Additionally, favourable weather conditions will also contribute to stabilizing food prices, further supporting stable inflation rates. The risk, however, lies in the fuel prices which despite their stability, still remain elevated compared to historical levels. Additionally, the progressive cuts in the CBR are likely to elevate inflationary pressures gradually as consumer spending rises from increased money supply. The committee is expected to lower rates further, though gradually, to provide further support for the economy.

The Kenyan Shilling:

The Kenyan Shilling remained stable against the US Dollar, gaining slightly by 5.5 bps in H1’2025, to close at Kshs 129.2, from Kshs 129.3 as at the beginning of the year, mainly attributable to the improved forex reserves during the period which increased by 20.6% to USD 11.1 bn as of 4th July 2025 from USD 9.2 bn recorded at the start of 2025. Additionally, the Eurobond buyback program of the USD 900.0mn tranche maturing in 2027 in February 2025 alleviated the credit risk on the country, increasing dollar supply in the market. Additionally, during the week, the Kenya Shilling appreciated slightly against the US Dollar by 1.2 bps to close at 129.2 from 129.3 recorded the previous week.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,033.0 mn in the twelve months to May 2025, 11.6% higher than the USD 4,510.0 mn recorded over the same period in 2024. These has continued to cushion the shilling against further depreciation. In the May 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.0% in the period,

- High Forex reserves currently at USD 11.1 bn (equivalent to 4.9-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover, and,

- The tourism inflow receipts which came in at Kshs 452.2 bn in 2024, a 19.8% increase from Kshs 377.5 bn inflow receipts recorded in 2023, and owing to tourist arrivals that improved by 8.0% to 2,303,028 in the 12 months to February 2025 from 2,133,612 in the 12 months to February 2024

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 1.8% of GDP in the twelve months to April 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 62.0% of Kenya’s external debt is US Dollar-denominated as of December 2024.

Monetary Policy:

The Monetary Policy Committee (MPC) met three times in H1’2025 and lowered the Central Bank Rate (CBR) in all three meetings, owing to the sustained stability of the Kenyan Shilling, anchored inflationary pressures and a dire need to support the economy. The Committee noted that economic growth slowed in 2024, creating room for further easing of monetary policy to support economic activity while maintaining exchange rate stability. in the country on the back of high fuel and commodity prices. The MPC lowered the CBR rate by 25.0 bps to 9.75%, from 10.00% in June 2025 against a backdrop of elevated uncertainties to the global outlook for growth, lower but sticky inflation in advanced economies heightened trade tensions as well as persistent geopolitical tensions. Below are some of the key highlights from the June 2025 meeting:

- The overall inflation decreased by 0.3% points to 3.8% in May 2025, from 4.1% in April 2025, remaining below the mid-point of the preferred CBK range of 2.5%-7.5%. Core inflation increased to 2.8% in May 2025, from 2.5% in April, reflecting increasing demand pressures in the economy. This increase was largely attributed to higher prices of processed foods, particularly sugar and maize flour. Conversely, non-core inflation decreased to 6.0% in May 2025, from 8.4% in April, driven by lower prices of food crops, especially vegetables, due to seasonal factors. Lower energy and utilities costs, including reduced electricity and fuel prices, continued to help moderate non-core inflation. Overall inflation is expected to stay below the mid-point of the target range in the near term, supported by low and stable core inflation, an anticipated reduction in energy prices, and a stable exchange rate.

- The recently released Economic Survey 2025, for 2024 showed a slowdown in the performance of the Kenyan economy, with real GDP growing by 4.7%, although slower than the growth of 5.7% recorded in 2023. This was attributable to deceleration in growth in most sectors of the economy. The economy is expected to continue to strengthen in 2025 with real GDP growth projected at 5.2%, from the 4.7% growth recorded in 2024 supported by resilient services sector and agriculture, expected recovery in growth of credit to the private sector and enhanced exports. However, this positive outlook is tempered by potential domestic and external risks.

- The Kenya National Bureau of Statistics (KNBS) updated the balance of payments data to better capture cross-border transactions, especially those involving petroleum imports and re-exports under government-to-government deals. The revisions also include the use of alternative data sources to enhance accuracy in reporting international trade in services, notably travel and financial services. These adjustments refine the recording of regional oil product re-exports and international travel earnings.

- Based on the revised balance of payments data goods exports increased by 3.8% in the 12 months to April 2025, compared to 2024, reflecting a rise in exports of agricultural commodities, especially horticulture and coffee. Goods imports rose by 7.6% reflecting increases in intermediate and capital goods imports. The current account deficit in 12 months to April 2025 is estimated at 1.8% of GDP, down from 2.2% in similar period in 2024, driven by stronger goods exports and robust diaspora remittance inflows. The current account deficit was fully financed by capital and financial inflows, leading to an overall balance of payments surplus of USD 2,104.0 mn. For 2025, the current account deficit is projected at 1.5% of GDP, up from 1.3% in 2024 and is expected to be fully financed by capital and financial inflows, yielding a balance of payments surplus of USD 1,107.0 mn.

- The CBK foreign exchange reserves, which currently stand at USD 10,946.0 representing 4.8 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans increased to 17.6% in April 2025 compared to 17.2% in February 2025. Increases in NPLs were noted in the trade, personal and household, tourism and hotels, and building and construction sectors. Banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed sustained optimism about business activity and economic growth prospects for the next 12 months. The optimism was attributed to the stable macroeconomic environment reflected in the low inflation rate and stability in the exchange rate, expectations of a decline in interest rates and favorable weather conditions supporting agriculture. Nevertheless, respondents expressed concerns about high cost of doing business and subdued consumer demand,

- The Survey of the Agriculture Sector for May 2025 revealed an expectation for moderate downward pressure on overall headline inflation in the next three months, on account of expected stability in food prices attributed to favorable weather conditions, stability in pump prices and the stable exchange rate,

- Global economic growth showed steady recovery in 2024 coming in at 3.3%. However, the outlook for 2025 is projected to decline to 2.8%, particularly for the United States and China, due to the impact of increased U.S. import tariffs and retaliatory measures imposed by other trading partners, as well as escalating geopolitical risks, particularly ongoing conflicts in the Middle East and the Russia-Ukraine war, which continue to threaten global growth prospects,

- Global headline inflation has eased, though uncertainty persists due to the potential inflationary effects of rising import tariffs. Central banks in advanced economies have continued to cut interest rates, albeit cautiously. International oil prices have declined amid higher production and weak demand mainly from China, yet volatility risks remain elevated due to trade tensions and ongoing geopolitical conflicts. Food inflation has also eased, largely due to lower prices of cereals and sugar, although inflation in edible oil prices remains high.

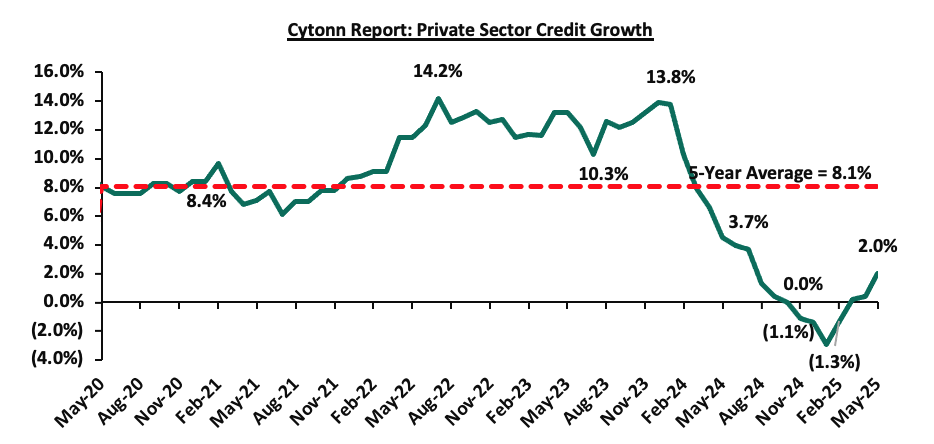

- Growth in private sector credit grew by 1.6% in May 2025 from 0.4% in April and a contraction of 2.9% in January 2025, mainly attributed to the dissipation of exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling and increased demand attributable to declining lending interest rates. Average commercial banks’ lending rates declined to 15.4% in May from 15.7% in April 2025 and 17.2% in November 2024.

- The Committee acknowledged the ongoing implementation of the FY’2024/25 Supplementary Budget II and the proposed Budget for FY’2025/26. These measures are anticipated to further support fiscal consolidation, which should reduce debt vulnerabilities in the medium-term.

The MPC noted that overall inflation is expected to remain below the midpoint of the 2.5%-7.5% target range in the near term, supported by stable core inflation, low energy prices, and exchange rate stability. Additionally, central banks in major economies have continued to lower interest rates at a cautious pace. The Committee also noted that economic growth slowed in 2024, creating room for further easing of monetary policy to support economic activity while maintaining exchange rate stability. The MPC noted that it will continue to monitor the effects of these policy measures, as well as global and domestic economic developments, and will remain ready to take additional action if necessary. Going forward, we expect the MPC to adopt a more cautious approach to rate adjustments in the coming meetings in a bid to continue supporting the private sector, while also keeping an eye on the effect on the inflation and exchange rate. The next MPC meeting is scheduled for August 2025.

Fiscal Policy:

The total Kenyan budget for the FY’2025/2026 National Budget increased by 7.1% to Kshs 4.3 tn from the Kshs 4.0 tn in FY’2024/2025 while the total revenue inclusive of grants increased by 8.0% to Kshs 3.4 tn from the Kshs 3.1 tn in FY’2024/2025. The expenditure will be funded by revenue collections of Kshs 3.4 tn and borrowings amounting to Kshs 923.2 bn. Of the Kshs 923.2 bn total borrowing, Kshs 635.5 bn is estimated to be domestic while Kshs 287.7 bn is estimated to be net foreign borrowing.

The increase in revenues is mainly due to an 6.7% increase in ordinary revenue to Kshs 2.8 tn for FY’2025/2026, from the Kshs 2.6 tn in FY’2024/2025 with the increase largely dependent on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as an increase in some of the existing taxes to meet its revenue target. The government’s efforts have seemingly resulted in improved revenue collection as evidenced by 93.2% of the revenue targets in FY’2023/24, and having attained 91.2% of the prorated revenue numbers for FY’2024/25 as of end May 2025. However, there are still concerns about the government's ability to meet its revenue collection targets in FY’2025/2026 mainly on the back of the current operating environment with the high cost of living and the political unrest in the country.

The table below summarizes the key buckets and the projected changes:

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Cytonn Report: Comparison between FY’2024/2025 and FY’2025/2026 Budgets Estimates |

|||

|

Item |

FY'2024/25 Supplementary Budget II |

FY'2025/26 Estimates |

Change y/y (%) |

|

Ordinary Revenue |

2,580.9 |

2,754.7 |

6.7% |

|

Ministerial Appropriation-in-Aid |

486.8 |

567.0 |

16.5% |

|

Total grants |

52.6 |

46.9 |

(10.8%) |

|

Total Revenue & Grants |

3,120.3 |

3,368.6 |

8.0% |

|

Recurrent expenditure |

1,705.7 |

1,805.0 |

5.8% |

|

Recurrent Consolidated Funds Services (CFS) |

1,242.7 |

1,337.3 |

7.6% |

|

Development expenditure |

624.7 |

693.2 |

13.0% |

|

County Transfer & Contingencies |

445.6 |

474.9 |

6.6% |

|

Total expenditure |

4,007.5 |

4,291.9 |

7.1% |

|

Fiscal deficit inclusive of grants |

(887.2) |

(923.3) |

4.1% |

|

Projected Deficit as % of GDP |

(5.1%) |

(4.8%) |

(0.3%) pts |

|

Net foreign borrowing |

281.5 |

287.7 |

2.2% |

|

Net domestic borrowing |

605.7 |

635.5 |

4.9% |

|

Total borrowing |

887.2 |

923.2 |

4.1% |

Source: National Treasury of Kenya, www.parliament.go.ke

For the FY’2024/2025, we do not expect the government to meet its revenue collection target having collected Kshs 2,157.8 bn, equivalent to 83.6% of the revised estimates of Kshs 2,580.9 bn for FY’2024/2025 and 91.2% of the prorated estimates of Kshs 2,365.8 bn in the eleven months of FY’2024/2025. Notably, the total expenditure amounted to Kshs 3,519.2 bn, equivalent to 78.6% of the revised estimates of Kshs 4,474.9 bn, and 85.8% of the prorated expenditure estimates of Kshs 4,102.0 bn, an indication of modest spending by the government. The total borrowings as at the end of May 2025 amounted to Kshs 1,359.0 bn, equivalent to 72.1% of the revised estimates of Kshs 1,885.4 bn and 78.6% of the prorated estimates of Kshs 1,728.3 bn.

Going forward, we believe that the persistent fiscal deficit owing to lower revenues relative to expenditure will force the government to borrow more. We therefore expect the government to cut on its expenditure, mostly the development expenditure in order to finance the growing debt maturities and the ballooning recurrent expenditure.

Money Markets, T-Bills Primary Auction:

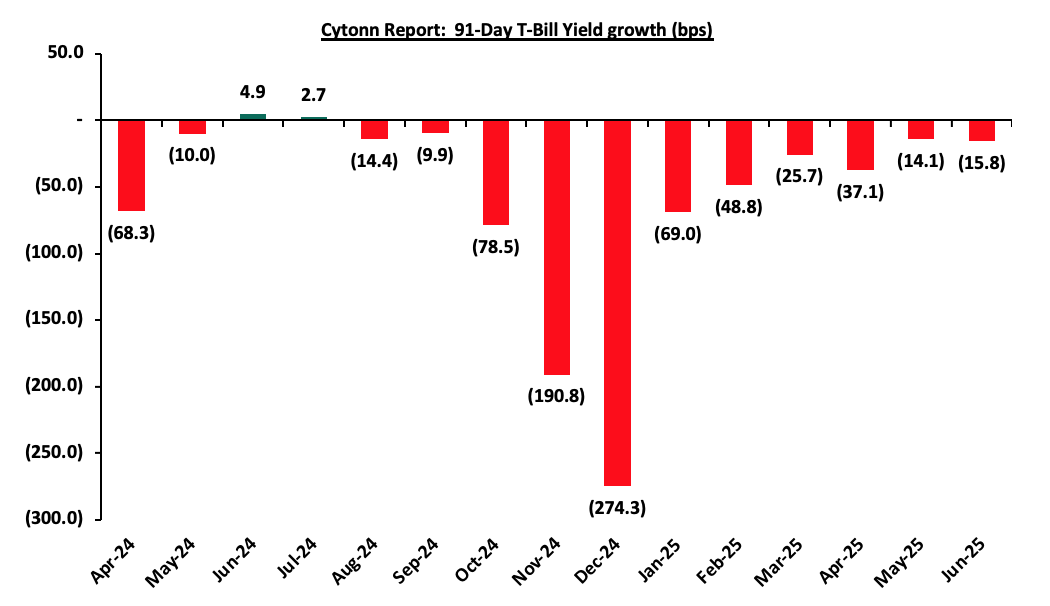

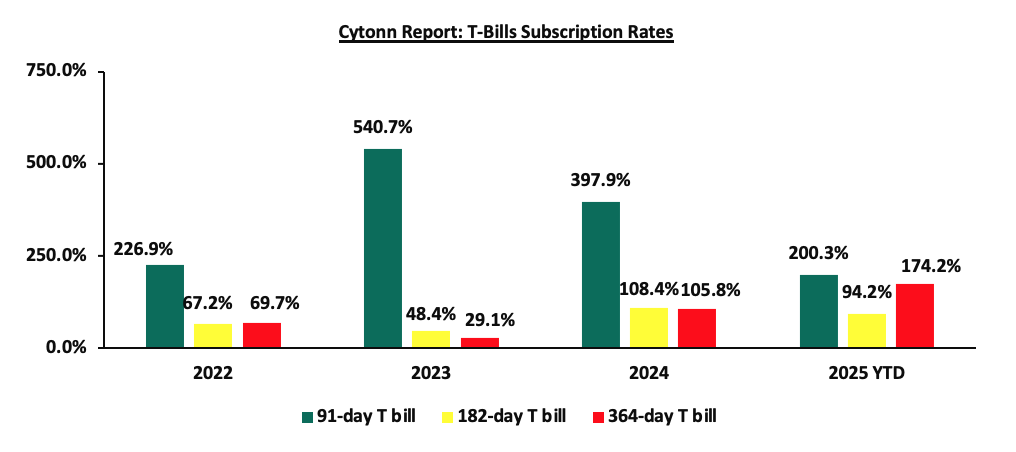

During H1’2025, T-bills were oversubscribed, with the overall subscription rate coming in at 154.5%, up from 132.6% in H1’2024. Investors’ preference for the 91-day paper persisted with the paper receiving bids worth Kshs 233.7 bn against the offered Kshs 104.0 bn, translating to an oversubscription rate of 224.8%, albeit lower than the oversubscription rate of 404.4% recorded in H1’2024. Overall subscription rates for the 364-day and 182-day papers came in at 191.6% and 89.3% respectively, higher than the 80.7% and 75.7%, respectively, recorded in H1’2024. The average yields on the 364-day, 182-day, and 91-day papers decreased by 6.2% points, 7.5% points, and 7.4% points to 10.4%, 9.1%, and 8.8% in H1’2025, respectively, from 16.7%, 16.6%, and 16.2%, respectively, in H1’2024. The downward trajectory in yields is primarily driven by improved investor confidence, stemming from reduced credit risk in the country and eased inflationary pressures. This has lowered the risk premium demanded by investors. Despite the government's sustained domestic borrowing, strong demand for government securities has supported the decline in yields. During the period, the acceptance rate stood at 85.4%, down from 92.3% in H1’2024, with the government accepting Kshs 823.2 billion out of the Kshs 964.0 billion worth of bids received. The chart below shows the yield growth rate for the 91-day paper during the year:

During the week, T-bills were undersubscribed for the second consecutive week, with the overall subscription rate coming in at 90.9%, higher than the subscription rate of 60.4% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 2.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 67.4%, higher than the subscription rate of 36.2%, recorded the previous week. The subscription rates for the 182-day paper increased to 111.7% from the 12.0% recorded the previous week, while the 364-day paper decreased to 79.6% from the 118.4% recorded the previous week. The government accepted a total of Kshs 21.77 bn worth of bids out of Kshs 21.83 bn bids received, translating to an acceptance rate of 99.7%. The yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing by 0.7 bps to 8.15% from the 8.14% recorded the previous week, while the yields on the 182-day and 364-day papers decreased by 1.1 bps and 0.9 bps to 8.45% and 9.71%, from the 8.46% and 9.72% respectively recorded the previous week

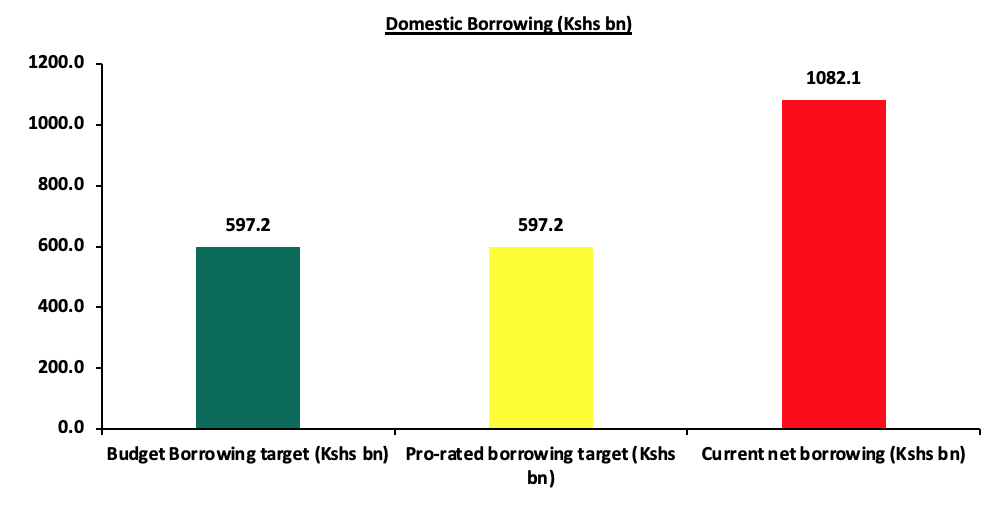

The government closed FY’2024/25, having advertised government securities totalling Kshs 1,887.0 bn. The government accepted bids worth Kshs 2,380.8 bn, of which Kshs 1,567.0 bn treasury bills and Kshs 813.8 bn were bonds. Total redemptions in FY’2024/25 amounted to Kshs 1,298.7 bn, with treasury bills accounting for Kshs 1,249.7 bn and bonds accounting for Kshs 49.0 bn. As a result, the government had a net domestic borrowing of Kshs 1,082.1 bn in FY’2024/25, with the government closing the year 81.2% ahead its net domestic borrowing target of Kshs 597.2 bn. The chart below shows the government’s domestic borrowing as at the end of FY’2023/24:

The chart below compares the overall average T-bills subscription rates obtained in 2022, 2023,2024 and 2025 Year to Date (YTD):

Primary T-Bond Auctions in H1’2025

During H1’2025, the Government did not issue any new treasury or infrastructure bonds, it however reopened thirteen, and issued one bond on tap-sale, seeking to raise Kshs 335.0 bn. The bonds were generally oversubscribed, receiving total bids worth Kshs 691.7 bn translating to an overall subscription rate of 206.5%. Importantly, there was a notable shift towards offering longer-dated bonds, aligning with the government’s objective of lengthening the maturity profile of public debt and reducing refinancing risk. The government rejected expensive bids and only accepted bids worth Kshs 464.1 bn, out of the Kshs 691.7 bn of bids received, translating to an acceptance rate of 67.1%. The table below provides more details on the bonds issued during the period:

|

Cytonn Report: H1’2025 Kenya Bond Issuances |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

23/06/2025 |

FXD1/2020/015-Reopened |

9.7 |

12.8% |

50.0 |

57.9 |

84.7 |

13.5% |

202.7% |

68.3% |

|

SDB1/2011/030-Reopened |

15.7 |

12.0% |

13.8 |

16.6 |

14.0% |

82.8% |

|||

|

12/05/2025

|

FXD1/2012/20- Reopened

|

7.6 |

12.0% |

30.0 |

43.5 |

54.4 |

13.6% |

181.3% |

80.0% |

|

05/05/2025

|

FXD1/2022/025 - Reopened

|

22.5 |

14.2% |

50.0 |

25.1 |

30.7 |

14.5% |

114.2% |

81.8% |

|

FXD1/2022/015 -Reopened |

12.0 |

13.9% |

25.3 |

26.4 |

13.9% |

95.7% |

|||

|

14/04/2025

|

FXD1/2020/015-Tapsale

|

9.9

|

12.8% |

10.0 |

12.6 |

13.2 |

13.7% |

132.4% |

95.1% |

|

07/04/2025

|

FXD1/2022/025 - Reopened |

22.6 |

14.2% |

70.0 |

32.5 |

32.7 |

14.2% |

102.5% |

99.5% |

|

FXD1/2022/015 -Reopened

|

12.1 |

13.9% |

18.0 |

18.1 |

13.8% |

99.1% |

|||

|

FXD1/2020/015-Reopened |

9.9 |

12.8% |

20.9 |

20.9 |

13.7% |

99.9% |

|||

|

10/03/2025

|

FXD1/2018/025 - Reopened

|

18.3 |

13.4% |

25.0 |

35.2 |

47.0 |

13.8% |

188.0% |

75.0% |

|

17/02/2025

|

IFB1/2022/014 - Reopened

|

11.8 |

13.9% |

70.0 |

65.3 |

93.1 |

14.0% |

411.3% |

45.4% |

|

IFB1/2023/017 - Reopened |

15.1 |

14.4% |

65.6 |

100.8 |

14.3% |

||||

|

20/01/2025

|

FXD1/2022/025 -Reopened

|

22.8 |

14.2% |

30.0 |

24.7 |

28.4 |

15.7% |

196.7% |

87.0% |

|

FXD1/2018/015-Reopened |

8.3 |

12.7% |

23.8 |

30.6 |

14.2% |

77.7% |

|||

|

H1'2025 Total |

|

|

335.0 |

464.1 |

691.7 |

|

|

|

|

|

H1’2024 Total |

|

|

385.0 |

518.2 |

657.5 |

|

|

|

|

|

H1'2025 Average |

14.6 |

13.4% |

|

|

|

14.1% |

206.5% |

67.1% |

|

|

H1'2024 Average |

6.2 |

17.1% |

|

|

|

17.6% |

170.8% |

78.8% |

|

Also, during the period, the government announced its first-ever domestic treasury bond buyback in February, aiming to buyback Kshs 50.0 bn of Kshs 185.1 bn for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 with tenors to maturity of 0.4 years, 0.3 years and 0.4 years respectively, and fixed coupon rates of 11.7%, 11.8% and 12.5% respectively. The total outstanding amounts for the FXD1/2020/005, FXD1/2022/003 and IFB1/2016/009 were Kshs 104.5 bn, Kshs 60.6 bn and Kshs 19.9 bn each respectively. The offer was oversubscribed, with the overall subscription rate coming in at 112.2%, receiving bids worth Kshs 56.1 bn against the offered Kshs 50.0 bn. The government accepted bids worth Kshs 50.1 bn, translating to an acceptance rate of 89.3%, and equivalent to 27.1% of the total outstanding amount of Kshs 185.1 bn for the three bonds. The weighted average yield for the accepted bids for the FXD1/2022/003, FXD1/2020/005 and IFB1/2016/009 came in at 9.1%, 8.9% and 9.1% respectively.

Secondary Bond Market Activity:

- Bond Turnover:

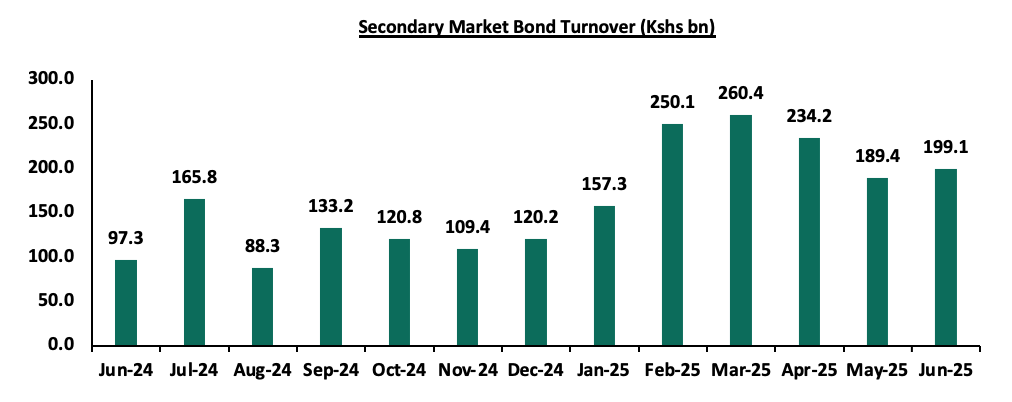

The secondary bond market recorded increased activity, with the total bond turnover increasing by 68.0% to Kshs 1,290.5 bn from Kshs 768.2 bn in H1’2024, pointing towards increased activities by commercial banks in the secondary bond market. Similarly, on a year-on-year basis, the bond turnover increased significantly by 104.7% to Kshs 199.1 in June 2025, from Kshs 97.3 bn worth of treasury bonds transacted over a similar period last year. The chart below shows the bond turnover over the past 12 months;

- Yield Curve:

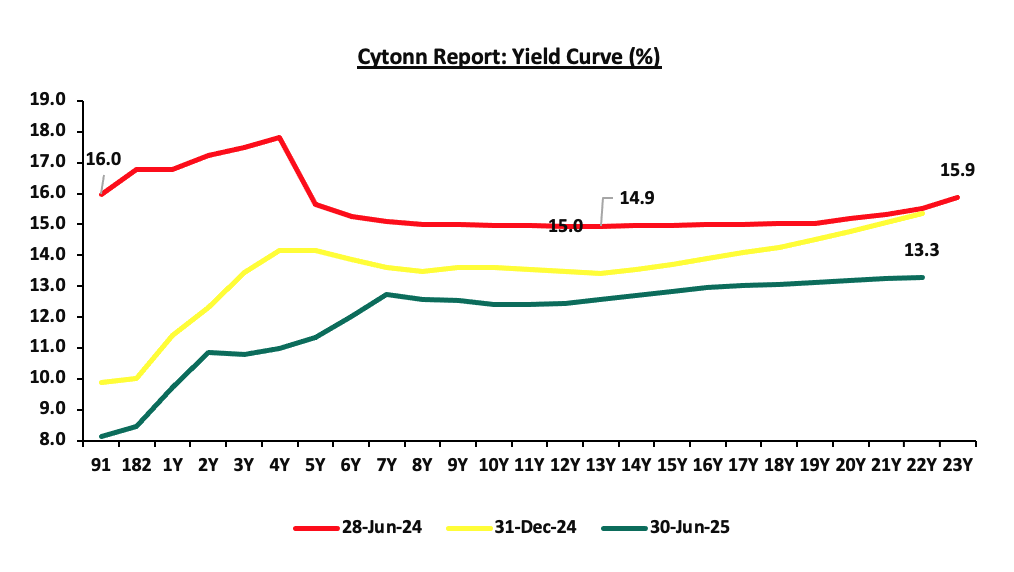

During H1’2025, yields on the government securities were on a downward trajectory compared to the same period in 2024. This was primarily driven by continued effort by the government to reject highly priced bids, local currency stabilization, and eased inflation. These factors reduced the need for investors to demand higher yields as compensation for inflation and currency depreciation risks, resulting in an overall decline across the yield curve. Notably, the yield curve has adjusted from a humped yield curve observed in 2023 and most part of 2024, towards a normal upward sloping curve, with long-term bonds registering highest yields. The shift in sentiment indicates increased confidence in the economic landscape. The chart below shows the yield curve movement during the period:

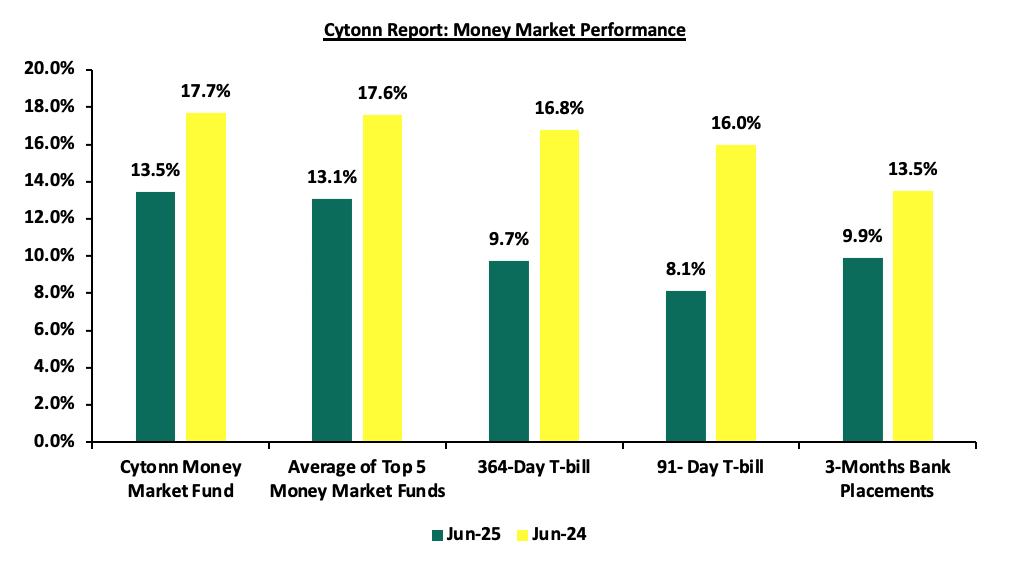

Money Market Performance

The 3-month bank placements recorded 9.9% at the end of H1’2025, 3.6% points lower than the 13.5% recorded at the end of H1’2024 (based on what we have been offered by various banks). The 91-day T-bill rate decreased by 7.8% points to 8.1% at the end of H1’2025 from 16.0% at the end of H1’2024, and the average Top 5 Money Market Funds decreased by 4.5% points to 13.1%, from 17.6% at the end of H1’2024. The yield on the Cytonn Money Market (CMMF) decreased by 4.2% points to 13.5% at the end of H1’2025, from 17.7% recorded at the end of H1’2024.

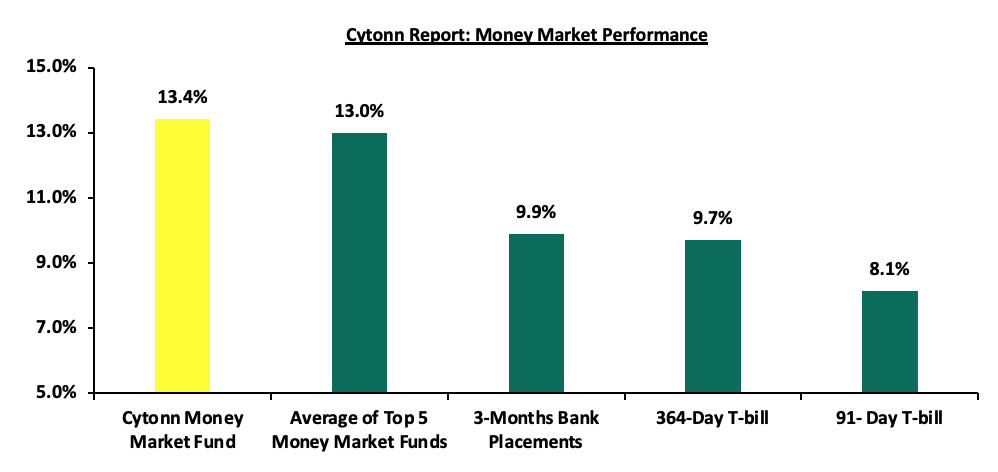

During the week, in the money markets, 3-month bank placements ended the week at 9.9% (based on what we have been offered by various banks), and the yields on the government papers registered a mixed performance with the yields on the 91-day paper increasing by 0.7 bps to 8.15% from the 8.14% recorded the previous week while the yields on the 364-day papers decreased by 0.9 bps to 9.71%, from the 9.72% recorded the previous week. The yields on the Cytonn Money Market Fund decreased by 3.0 bps to 13.4% from the 13.5% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 8.2 bps to 13.0% from the 13.1% recorded the previous week

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 4th July 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 4th Juy 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1. |

Cytonn Money Market Fund ( Dial *809# or download Cytonn App) |

13.4% |

|

2. |

Gulfcap Money Market Fund |

13.1% |

|

3. |

Ndovu Money Market Fund |

13.1% |

|

4. |

Lofty-Corban Money Market Fund |

12.8% |

|

5. |

Kuza Money Market fund |

12.7% |

|

6. |

Etica Money Market Fund |

12.5% |

|

7. |

GenAfrica Money Market Fund |

12.0% |

|

8. |

Nabo Africa Money Market Fund |

11.9% |

|

9 |

Arvocap Money Market Fund |

11.6% |

|

10. |

Jubilee Money Market Fund |

11.2% |

|

11. |

Enwealth Money Market Fund |

11.1% |

|

12. |

Old Mutual Money Market Fund |

11.1% |

|

13. |

Madison Money Market Fund |

11.1% |

|

14. |

British-American Money Market Fund |

10.9% |

|

15. |

Faulu Money Market Fund |

10.5% |

|

16. |

Apollo Money Market Fund |

10.4% |

|

17. |

Sanlam Money Market Fund |

10.3% |

|

18. |

Orient Kasha Money Market Fund |

10.1% |

|

19. |

KCB Money Market Fund |

10.1% |

|

20. |

Dry Associates Money Market Fund |

10.1% |

|

21. |

Genghis Money Market Fund |

9.9% |

|

22. |

Absa Shilling Money Market Fund |

9.6% |

|

23. |

Mali Money Market Fund |

9.5% |

|

24. |

Co-op Money Market Fund |

9.4% |

|

25. |

ICEA Lion Money Market Fund |

9.4% |

|

26. |

CIC Money Market Fund |

9.4% |

|

27. |

Mayfair Money Market Fund |

9.0% |

|

28. |

AA Kenya Shillings Fund |

8.4% |

|

29. |

Ziidi Money Market Fund |

8.0% |

|

30. |

Stanbic Money Market Fund |

7.2% |

|

31. |

Equity Money Market Fund |

7.1% |

Source: Business Daily

Liquidity:

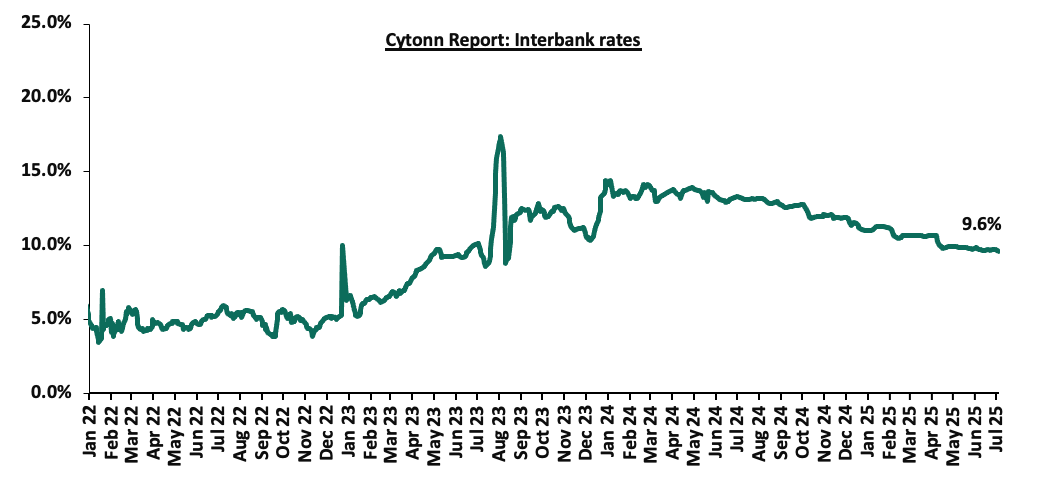

In H1’2025, liquidity in the money markets eased, as evidenced by the decrease in the interbank rate to 10.4%, from 13.5% H1’2024, partly attributable to government payments that offset tax remittances. Additionally, the average volumes traded in the interbank market decreased by 31.9% to Kshs 15.7 bn, from Kshs 23.0 bn recorded in H1’2024.

Similarly, during the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 4.2 bps to remain relatively unchanged from the 9.7% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 78.5% to Kshs 5.0 bn from Kshs 23.0 bn recorded the previous week. The chart below shows the interbank rates in the market over the years

Kenya Eurobonds:

During H1’2025, the yields on Eurobonds registered a mixed performance, with the yield on the 10-Year Eurobond issued in 2018 decreasing the most by 0.8% points to 8.3% from 9.1% recorded at the beginning of the year, while the yields on the 30-year Eurobond issued in 2018 gained the most by 0.2% points to 10.5% from 10.3% recorded at the beginning of the year. On a year-on-year basis, the yields on all Eurobonds were on a downward trend, with the yield on the 10-year Eurobond issued in 2018 declining the most by 2.1% points to 8.3% from 10.4% recorded at the end of H1’2024.

During the week, the yields on Eurobonds were on a downward trajectory, with the yield on the 7-Year Eurobond issued in 2024 decreasing the most by 30.5 bps to 9.2% from 9.5% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 3rd July 2025;

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.7 |

22.7 |

1.9 |

6.9 |

9.0 |

5.6 |

10.7 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

9.95% |

|

02-Jun-25 |

8.7% |

10.8% |

- |

10.0% |

10.1% |

9.9% |

|

|

26-Jun-25 |

8.3% |

10.6% |

- |

9.7% |

9.9% |

9.5% |

|

|

27-Jun-25 |

8.3% |

10.6% |

- |

9.7% |

9.9% |

9.5% |

|

|

30-Jun-25 |

8.3% |

10.5% |

- |

9.6% |

9.8% |

9.4% |

|

|

01-Jul-25 |

8.0% |

10.3% |

- |

9.4% |

9.7% |

9.3% |

|

|

02-Jul-25 |

8.2% |

10.4% |

- |

9.5% |

9.7% |

9.3% |

|

|

03-Jul-25 |

8.0% |

10.3% |

- |

9.4% |

9.6% |

9.2% |

|

|

Weekly Change |

(0.3%) |

(0.3%) |

- |

(0.3%) |

(0.3%) |

(0.3%) |

- |

|

Y/Y Change |

(2.1%) |

(0.5%) |

- |

(1.2%) |

(1.0%) |

(1.4%) |

- |

|

YTD Change |

(1.0%) |

0.0% |

- |

(0.6%) |

(0.5%) |

(0.9%) |

- |

Source: Central Bank of Kenya (CBK)

Q2’2025 Highlights:

- The monetary policy committee met on April 8th, 2025, to review the outcome of its previous policy decisions against a backdrop of elevated uncertainties to the global outlook for growth, lower but sticky inflation in advanced economies, heightened trade tensions as well as persistent geopolitical tensions. The MPC decided to lower the CBR rate by 75.0 bps to 10.00%, from 10.75% in February 2025 which was in line with our expectation for the MPC to lower the CBR rate to within a range of 10.00%-10.50%. For more information, please see our Cytonn weekly #15/2025

- The National Treasury gazetted the revenue and net expenditures for the ninth month of FY’2024/2025, ending 31st March 2025, highlighting that the total revenue collected as at the end of March 2025 amounted to Kshs 1,702.9 bn, equivalent to 66.0% of the revised estimates of Kshs 2,580.9 bn for FY’2024/2025 and was 88.0% of the prorated estimates of Kshs 1,935.7 bn. For more information, please see our Cytonn weekly #16/2025

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th April 2025 to 14th May 2025. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 2.0, Kshs 2.2 and Kshs 2.4 respectively. Consequently, Super Petrol, Diesel and Kerosene will now retail at Kshs 174.6, Kshs 164.9 and Kshs 150.0 per litre respectively, from Kshs 176.6, Kshs. 167.1 and Kshs 151.4 per litre respectively, representing decreases of 1.1%,1.3% and 1.6% for Super Petrol, Diesel and Kerosene respectively. For more information, please see our Cytonn weekly #16/2025

- The Central Bank of Kenya (CBK) initiated a comprehensive review of the Risk-Based Credit Pricing Model (RBCPM), five years after its implementation in 2019. The RBCPM was originally developed as a market-driven solution to address inefficiencies in Kenya’s credit market, including high lending rates and a lack of transparency in credit pricing. The aim is to have a clear pricing module for the banks. For more information, please see our Cytonn weekly #17/2025

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of April 2025 increased slightly, coming in at 52.0, up from 51.7 in March 2025, signaling another improvement in business conditions. This marked the seventh consecutive month that index fell above the 50.0 neutral mark. Increased output, new orders and increased sales supported the improvement. For more information, please see our Cytonn Weekly #19/2025

- The Kenya National Bureau of Statistics (KNBS) released the 2025 Economic Survey Report, highlighting that the Kenyan economy recorded a 4.7% growth in FY’2024, slower than the 5.7% growth recorded in FY’2023. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 4.6% in FY’2024, lower than the 6.6% expansion recorded in FY’2023. All sectors in FY’2024, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to FY’2023 with Accommodation and Food Services, Construction and Information and Communication recording the highest declines of 7.9%, 3.7% and 3.3% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in FY’2023 were Professional administration, Mining and Quarrying and Financial and Insurance services of 3.3%, 2.7% and 2.5% points respectively. For more information, please see our Cytonn weekly #19/2025

- The Kenya National Bureau of Statistics released the FY’2024 Economic Survey noting that, Kenya’s balance of payments position improved significantly by 231.0% in FY’2024, with a surplus of Kshs 176.7 bn, from a deficit of Kshs 134.8 bn in FY’2023. For more information, please see our Cytonn weekly #19/2025

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th May 2025 to 14th June 2025. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene remained unchanged at Kshs 174.6, Kshs 164.9 and Kshs 150.0 per litre respectively. For more information, please see our Cytonn weekly #20/2025

- Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of May 2025 deteriorated to negative territory, coming in at 49.6, down from 52.0 in March 2025, signaling worsening in business conditions, mainly attributable to decreased output and new orders. This marked the first time in eight months the index fell below the 50.0 neutral mark. For more information, please see our Cytonn weekly #23/2025.

- In Q1’2025, Kenya’s Unit Trust Funds (UTFs) industry recorded strong growth, with Assets Under Management (AUM) increasing by 27.5% quarter-on-quarter to Kshs 496.2 bn, up from Kshs 389.2 bn in Q4’2024, and representing a 120.2% year-on-year growth. This growth was driven by low investment minimums, rising investor awareness, fintech adoption, and competitive returns, particularly from Money Market Funds (MMFs), which comprised 64.4% of the industry’s AUM. Sanlam Money Market Fund surpassed CIC Money Market Fund to become the largest unit trust by AUM in Kenya with an 18.2% market share, signaling a shift in investor preference and competitive positioning within the industry. For more information, please see our Cytonn weekly #23/2025.

- The monetary policy committee met on June 10th, 2025, to review the outcome of its previous policy decisions against a backdrop of elevated uncertainties to the global outlook for growth, lower but sticky inflation in advanced economies, heightened trade tensions as well as persistent geopolitical tensions. The MPC decided to lower the CBR rate by 25.0 bps to 9.75%, from 10.00% in April 2025. For more information, please see our Cytonn weekly #24/2025.

- During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th June 2025 to 14th July 2025. Notably, the maximum allowed price for Super Petrol increased by Kshs 2.7, while Diesel and Kerosene decreased by Kshs 2.0 and Kshs 2.1 respectively. Consequently, Super Petrol, Diesel and Kerosene will now retail at Kshs 177.3, Kshs 162.9 and Kshs 146.9 per litre respectively, from Kshs 174.6, Kshs 164.9 and Kshs 149.0 per litre respectively, representing an increase of 1.5% for Super Petrol, and decreases of 1.2% and 1.4% for Diesel and Kerosene respectively. For more information, please see our Cytonn weekly #24/2025.

- The National Treasury gazetted the revenue and net expenditures for the eleventh month of FY’2024/2025, ending 30th May 2025, highlighting that the total revenue collected as at the end of May 2025 amounted to Kshs 2,157.8 bn, equivalent to 83.6% of the revised estimates II of Kshs 2,580.9 bn for FY’2024/2025 and is 91.2% of the prorated estimates of Kshs 2,365.8 bn. For more information, please see our Cytonn weekly #25/2025.

Weekly Highlights.

- Q1’2025 Balance of Payments

Kenya’s balance of payment (BoP) position deteriorated significantly by 313.8% in Q1’2025, to a deficit of Kshs 77.0 bn, from a surplus of Kshs 36.0 bn in Q1’2024. The y/y negative performance in BoP was mainly driven by a significant 575.7% increase in financial account deficit to Kshs 48.6 bn from a deficit of Kshs 7.2 bn in Q1’2024. The performance was however supported by a significant 1,093.8% improvement in the net errors and omissions to a surplus of Kshs 95.0 bn from a deficit of Kshs 9.6 bn in Q1’2024. The table below shows the breakdown of the various balance of payments components, comparing Q1’2025 and Q1’2024:

|

Item |

Q1'2024 |

Q1'2025 |

Y/Y % Change |

|

Current Account Balance |

(42.1) |

(66.6) |

(58.3%) |

|

Capital Account Balance |

8.5 |

- |

- |

|

Financial Account Balance |

(7.2) |

(48.6) |

(575.7%) |

|

Net Errors and Omissions |

(9.6) |

95.0 |

1093.8% |

|

Balance of Payments |

36.0 |

(77.0) |

(313.8%) |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) widened by 58.3% to Kshs 66.6 bn from Kshs 42.1 bn in Q1’2024. The y/y widening of the current account was brought about by the 16.5% decline in the secondary income/transfers to a surplus of Kshs 230.9 bn from a surplus of Kshs 276.4 bn in Q1’2024, coupled with a 1.8% decrease in services trade balance to Kshs 82.3 bn from Kshs 83.8 bn in Q1’2024,

- The capital account balance (shows capital transfers receivable and payable between residents and non-residents, including the acquisition and disposal of non-produced non-financial items), which includes foreign direct investments (FDIs), stood at 0.0 bn in Q1’2025, down from a surplus of Kshs 8.5 bn in Q1’2024,

- The financial account balance (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by foreign buyers) recorded a 575.7% increase in net inflow to a deficit Kshs 48.6 billion in Q1’2025, from a deficit of Kshs 7.2 billion in Q1’2024.