Cytonn Monthly – February 2023

By Cytonn Research, Mar 5, 2023

Executive Summary

Fixed Income

During the month of February 2023, T-bills were oversubscribed, with the overall average subscription rate coming in at 167.1%, an increase from 126.5% recorded in the month of January 2023. The average subscription rate for the 364-day, 182-day and 91-day papers increased to 62.2%, 105.3% and 583.7% from 42.5%, 92.3% and 422.1%, recorded in January 2023. The average yields on the government papers were on an upward trajectory, with the average yields on the 364-day, 182-day and 91-day papers increasing by 17.3 bps, 17.1 bps and 15.8 bps to 10.6%, 10.1% and 9.6% from 10.4%, 9.9% and 9.5%, respectively, recorded in January 2023. For the month of February, the government rejected expensive bids, accepting a total of Kshs 136.6 bn of the Kshs 160.4 bn worth of bids received, translating to an acceptance rate of 85.2%. The February 2023 bonds were undersubscribed, with the overall subscription rate coming in at 53.2% down from 99.4%, recorded in January 2023. The re-opened bond FXD1/2017/10 and the newly issued bond FXD1/2023/10 received bids worth Kshs 19.5 bn against the offered Kshs 50.0 bn, translating to an undersubscription rate of 38.9% with the government accepting bids worth Kshs 16.7 bn translating to an acceptance rate of 86.1%. Their subsequent tap sale received bids worth Kshs 12.5 bn against the offered Kshs 10.0 bn, translating to an oversubscription rate of 124.6%, with the government accepting bids worth Kshs 12.2 bn translating to an acceptance rate of 97.9%;

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 136.2%, up from the 81.0% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 22.2 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 555.7%, higher than 284.1% recorded the previous week. The subscription rates for the 364-day and 182-day papers also increased to 44.5% and 60.2% from 36.7% and 44.0%, respectively, recorded the previous week. Key to note, the government rejected expensive bids, accepting bids worth Kshs 23.8 bn out of the Kshs 32.7 bn total bids received, translating to an acceptance rate of 72.7%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.4 bps, 4.8 bps and 4.3 bps to 10.7%, 10.2% and 9.7%, respectively;

Additionally, during the week, the Kenya National Bureau of Statistics (KNBS) released the y/y inflation for February 2023, which came in at 9.2%, up from the 9.0% recorded in January 2023. This was in contrast to our expectations of an ease within a range of 8.6%-9.0%;

Recently, S&P Global Ratings downgraded Kenya’s outlook to negative from stable, signaling increased risks of defaults in debt repayments amid weakening liquidity position aggravated by sustained decline in foreign exchange reserves as well as high debt servicing obligations in the next fiscal year. Furthermore, the recent undersubscription of domestic bond issuances, as well as constrained access to international capital markets, have heightened Kenya’s medium term fiscal and external refinancing risks. However, the agency maintained the country’s long and short-term foreign and local currency sovereign credit ratings at B/B. The revision by S&P Global Ratings follows a downgrade of Kenya’s Long-Term Foreign Currency issuer default ratings to “B” from “B+” by Fitch Ratings in December 2022;

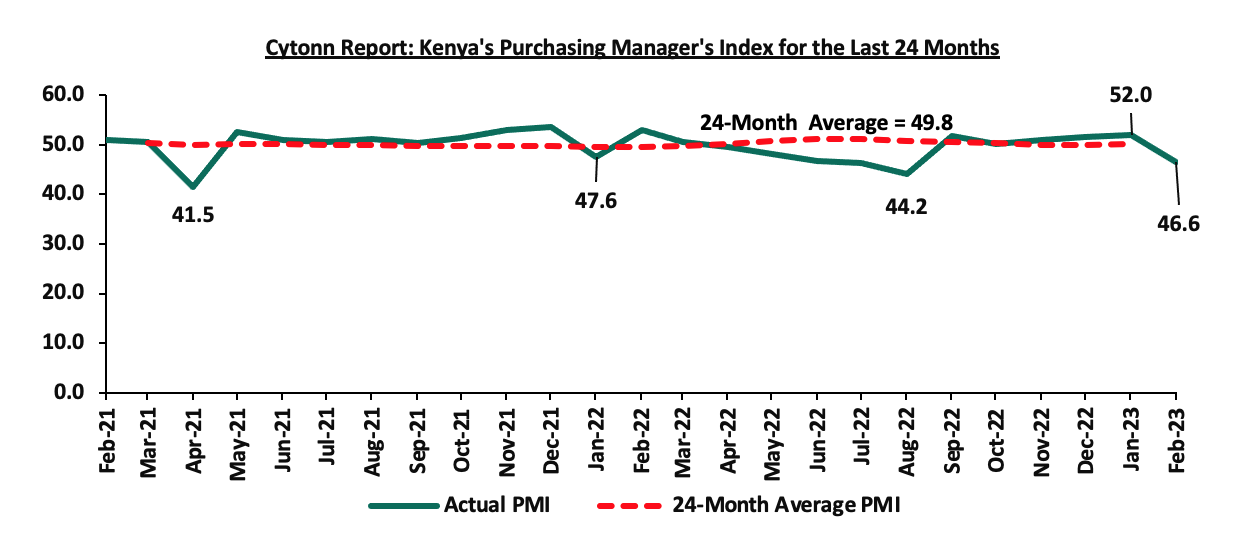

During the week, Stanbic Bank Kenya released its monthly Purchasing Managers Index (PMI), highlighting that the index for the month of February 2023 came at 46.6, down from an 11-month high of 52.0 recorded in January 2023. This is the first time in six months that the index has registered below the 50.0 no change threshold, pointing towards a solid deterioration in operating conditions;

Equities

During the month of February, the equities market recorded mixed performance, with NASI and NSE 25 gaining by 0.1% and 0.7%, respectively, while NSE 20 declined by 0.6%. The equities market performance was driven by gains recorded by large cap banking stocks such as Standard Chartered Bank of Kenya (SCBK), Equity Group, NCBA Group and Cooperative Bank of Kenya of 4.0%, 3.4%, 2.2% and 1.6% respectively. The gains were however weighed down by losses recorded by large cap stocks such as Bamburi and Stanbic Holdings of 5.2% and 4.5%, respectively;

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 0.2%, 1.3% and 0.5%, respectively, taking the YTD performance to losses of 0.9%, 2.5%, and 0.2% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as BAT Kenya, Equity Group and ABSA Bank of 5.4%, 1.7%, and 1.2% respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Diamond Trust Bank Kenya (DTB-K), NCBA Group, Bamburi and Co-operative Bank of 3.8%, 2.3%, 2.0% and 1.6%, respectively;

Real Estate

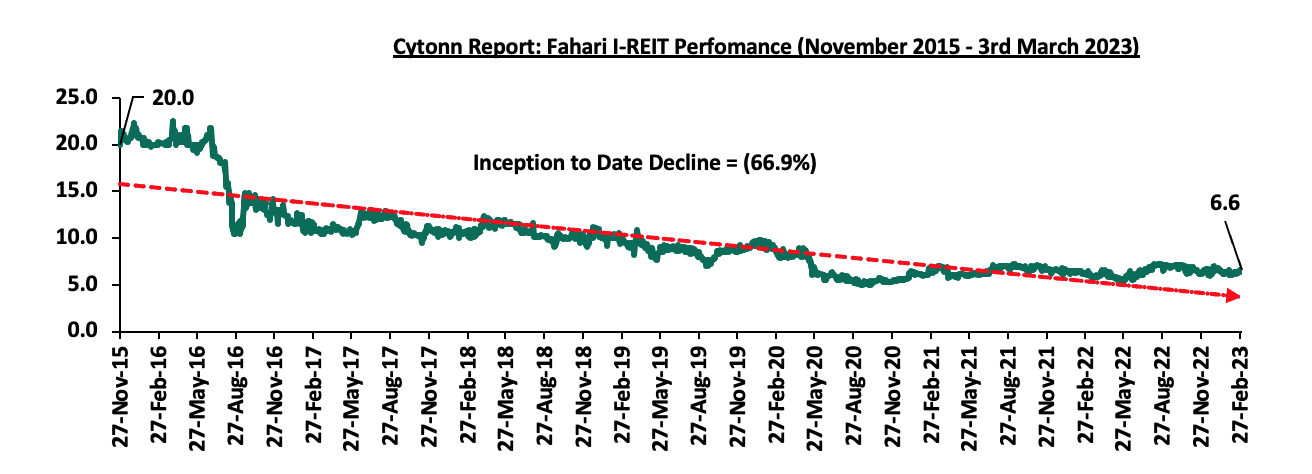

During the week, local retail chain Quickmart Supermarket opened a new outlet located in Thome, along the Northern Bypass road, bringing the retailer’s number of operating outlets countrywide to 56. In the infrastructure sector, the Northern Corridor Transit and Transport Coordination Authority (NCTTCA) announced a partnership with Superior Homes Kenya, a housing developer where Cytonn Investments is the second largest shareholder, to construct roadside stations along major highways. In the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share on the Nairobi Securities Exchange, a 2.5% gain from Kshs 6.5 per share recorded the previous week. On the Unquoted Securities Platform as at 3rd March 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.83%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.75% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the month of February 2023, T-bills were oversubscribed, with the overall average subscription rate coming in at 167.1%, an increase from 126.5% recorded in the month of January 2023. The average subscription rate for the 364-day, 182-day and 91-day papers increased to 62.2%, 105.3% and 583.7% from 42.5%, 92.3% and 422.1%, recorded in January 2023. The average yields on the government papers were on an upward trajectory, with the average yields on the 364-day, 182-day and 91-day papers increasing by 17.3 bps, 17.1 bps and 15.8 bps to 10.6%, 10.1% and 9.6% from 10.4%, 9.9% and 9.5%, respectively, recorded in January 2023. For the month of February, the government rejected expensive bids, accepting a total of Kshs 136.6 bn of the Kshs 160.4 bn worth of bids received, translating to an acceptance rate of 85.2%.

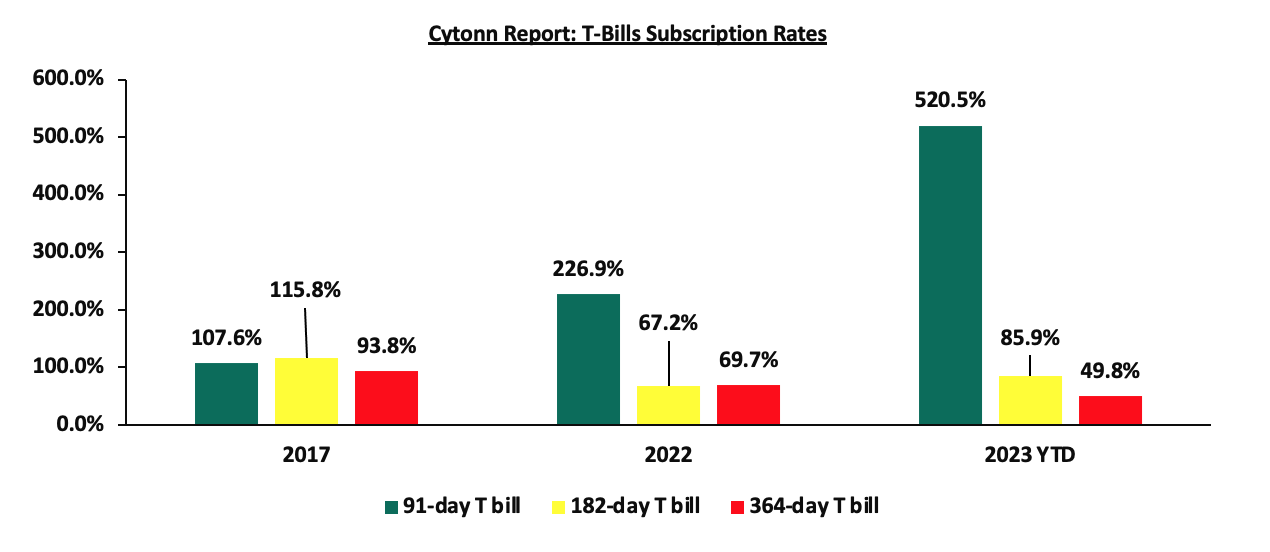

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 136.2%, up from the 81.0% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 22.2 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 555.7%, higher than 284.1% recorded the previous week. The subscription rates for the 364-day and 182-day papers also increased to 44.5% and 60.2% from 36.7% and 44.0%, respectively, recorded the previous week. Key to note, the government rejected expensive bids, accepting bids worth Kshs 23.8 bn out of the Kshs 32.7 bn total bids received, translating to an acceptance rate of 72.7%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.4 bps, 4.8 bps and 4.3 bps to 10.7%, 10.2% and 9.7%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

The February 2023 bonds were undersubscribed, with the overall subscription rate coming in at 53.2% down from 99.4%, recorded in January 2023. The re-opened bond FXD1/2017/10 and the newly issued bond FXD1/2023/10 received bids worth Kshs 19.5 bn against the offered Kshs 50.0 bn, translating to an undersubscription rate of 38.9% with the government accepting bids worth Kshs 16.7 bn translating to an acceptance rate of 86.1%. Their subsequent tap sale received bids worth Kshs 12.5 bn against the offered Kshs 10.0 bn, translating to an oversubscription rate of 124.6%, with the government accepting bids worth Kshs 12.2 bn translating to an acceptance rate of 97.9%. The table below provides more details on the bonds issued during the month of February 2023:

|

Cytonn Report: Treasury Bonds Issued in February 2023 |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Total bids received |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

13/02/2023 |

FXD1/2017/10 (re-opened) |

4.4 |

13.0% |

50 |

16.7 |

19.5 |

13.88% |

38.9% |

86.1% |

|

FXD1/2023/10 |

10.0 |

14.2% |

14.2% |

||||||

|

20/02/2023 |

FXD1/2017/10 - Tapsale |

4.4 |

13.0% |

10 |

12.2 |

12.5 |

13.9% |

124.6% |

97.9% |

|

FXD1/2023/10 - Tapsale |

10.0 |

14.2% |

14.2% |

||||||

|

Feb 2023 Average |

|

7.2 |

13.6% |

60.0 |

28.9 |

31.9 |

14.0% |

53.2% |

90.7% |

|

Jan 2023 Average |

|

8.4 |

12.8% |

60.0 |

49.1 |

59.7 |

13.6% |

99.4% |

82.4% |

Source: Central Bank of Kenya (CBK)

Secondary Bond Market:

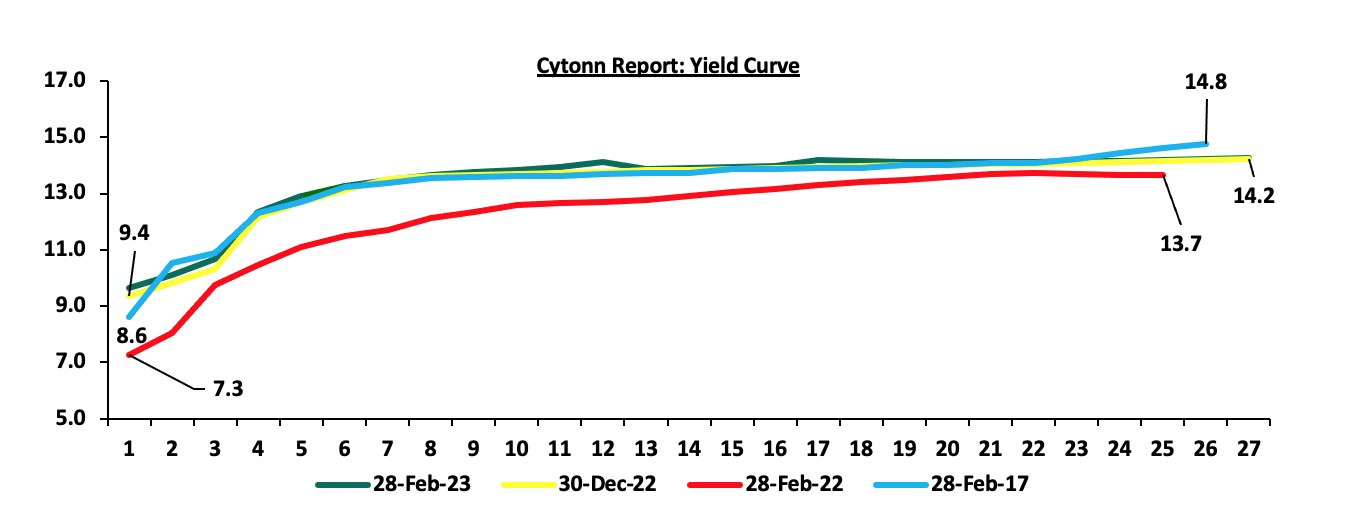

The yields on the government securities were on an upward trajectory during the month compared to the same period in 2022 as a result of the elevated inflationary pressures leading to investors attaching higher risk premiums. The chart below shows the yield curve movement during the period:

The secondary bond turnover increased by 5.9% to Kshs 46.6 bn from Kshs 44.0 bn recorded in January 2023, pointing towards increased activity by commercial banks in the secondary bonds market, attributable to increased appetite for government securities due to their higher yield. On a year on year basis, the bonds turnover declined by 13.3% to Kshs 46.6 bn from Kshs 53.8 bn worth of treasury bonds transacted over a similar period last year.

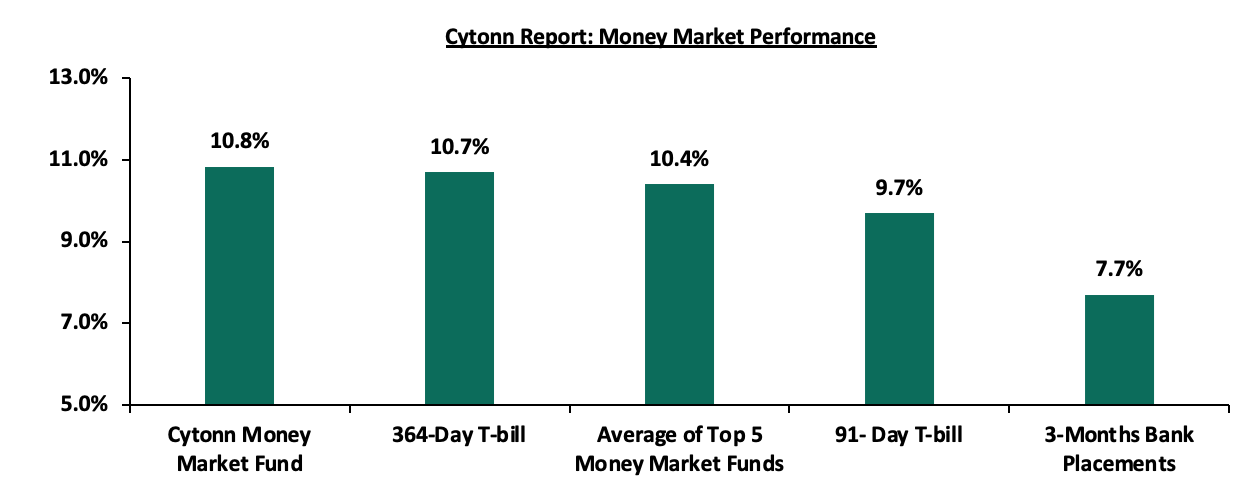

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day and 91-day T-bill increased by 1.4 bps and 4.3 bps to 10.7% and 9.7%, respectively. The average yields on the Top 5 Money Market Funds and the Cytonn Money Market Fund increased by 11.2 bps and 14.0 bps to 10.4% and 10.8% from 10.3% and 10.7% respectively, recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 3rd March 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 3rd March 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

10.8% |

|

2 |

Madison Money Market Fund |

10.6% |

|

3 |

Dry Associates Money Market Fund |

10.4% |

|

4 |

GenCap Hela Imara Money Market Fund |

10.1% |

|

5 |

Apollo Money Market Fund |

10.1% |

|

6 |

NCBA Money Market Fund |

10.0% |

|

7 |

Zimele Money Market Fund |

9.9% |

|

8 |

Old Mutual Money Market Fund |

9.9% |

|

9 |

Nabo Africa Money Market Fund |

9.8% |

|

10 |

Kuza Money Market fund |

9.7% |

|

11 |

AA Kenya Shillings Fund |

9.7% |

|

12 |

Sanlam Money Market Fund |

9.6% |

|

13 |

Co-op Money Market Fund |

9.6% |

|

14 |

Jubilee Money Market Fund |

9.5% |

|

15 |

CIC Money Market Fund |

9.2% |

|

16 |

British-American Money Market Fund |

9.1% |

|

17 |

ICEA Lion Money Market Fund |

9.0% |

|

18 |

Orient Kasha Money Market Fund |

8.7% |

|

19 |

GenAfrica Money Market Fund |

8.7% |

|

20 |

Absa Shilling Money Market Fund |

8.4% |

|

21 |

Equity Money Market Fund |

6.0% |

Source: Business Daily

Liquidity:

Liquidity in the money markets tightened in the month of February 2023, with the average interbank rate increasing to 6.4% from 6.0%, recorded in January 2023. Also during the week, liquidity in the money markets tightened, with the average interbank rate increasing to 6.7% from 6.4% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 14.1% to Kshs 21.0 bn from Kshs 24.5 bn recorded the previous week.

Kenya Eurobonds:

During the month, the yields on the Eurobonds were on an upward trajectory with the yield on the 10-year Eurobond issued in 2018 recording the largest gain, having gained by 0.6% points to 10.7% from 10.1%, recorded in January 2023, partly attributable to increased perceived risks in the economy amid the country’s dwindling forex reserves raising concerns on the country’s ability to meet its debt obligations. Additionally, the continued currency depreciation and the elevated inflationary pressures are affecting investors’ sentiments hence the need to cushion against possible losses.

During the week, the yields on Eurobonds were also on an upward trajectory partly attributable to deteriorated investors’ sentiments following the recent downgrade of Kenya’s outlook to negative from stable by S&P Global Credit Ratings. The yield on the 10-year Eurobond issued in 2014 recorded the largest gain having gained by 0.5% points to 12.4% from 11.9%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 2nd March 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

2.1* |

1.0 |

|

|

Years to Maturity |

1.2 |

4.9 |

24.9 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

31-Jan-23 |

11.2% |

10.1% |

10.7% |

10.4% |

10.4% |

9.8% |

|

23-Feb-23 |

11.9% |

10.7% |

11.0% |

10.9% |

10.8% |

10.2% |

|

24-Feb-23 |

11.9% |

10.7% |

10.9% |

10.9% |

10.8% |

10.2% |

|

27-Feb-23 |

11.8% |

10.6% |

10.9% |

10.8% |

10.6% |

10.1% |

|

28-Feb-23 |

11.7% |

10.7% |

10.9% |

10.9% |

10.7% |

10.1% |

|

1-Mar-23 |

12.1% |

10.7% |

11.0% |

10.9% |

10.8% |

10.2% |

|

2-Mar-23 |

12.4% |

11.0% |

11.1% |

11.3% |

11.0% |

10.4% |

|

Weekly Change |

0.5% |

0.3% |

0.1% |

0.4% |

0.2% |

0.2% |

|

MTM Change |

0.5% |

0.6% |

0.2% |

0.5% |

0.3% |

0.3% |

|

YTD Change |

(0.5%) |

0.5% |

0.2% |

0.4% |

0.2% |

0.5% |

*2019 aggregate amount issued for the two issues was USD 2.1 bn

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 2.0% against the US Dollar, to close the month at Kshs 126.9, from Kshs 124.4 recorded at the end of January 2023, partly attributable to the increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency.

Also during the week, the Kenya Shilling depreciated by 0.9% against the US dollar to close the week at Kshs 127.5, from Kshs 126.4 recorded the previous week, partly attributable to increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 3.3% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 4.9% of GDP in 2022, despite improving by 0.3% points from 5.2% recorded in 2021,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

The shilling is however expected to be supported by:

- Improving diaspora remittances standing at USD 349.4 mn as at January 2023, representing a 3.2% y/y increase from USD 338.7 mn recorded in a similar period in 2022.

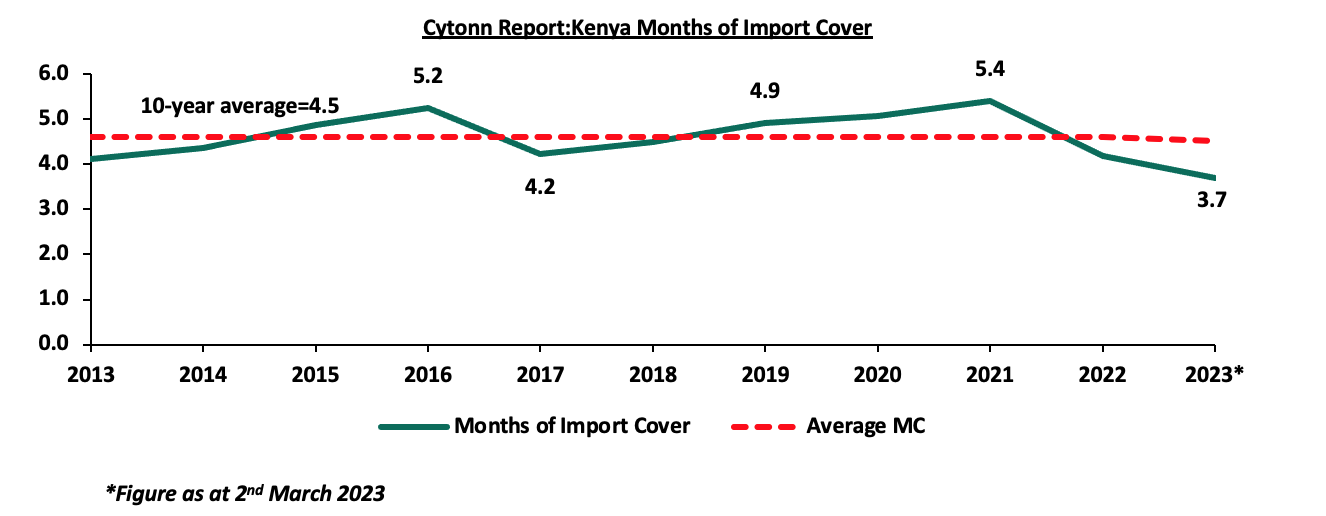

Key to note, Kenya’s forex reserves declined by 5.2% to stand at USD 6.6 bn as at 2nd March 2023 from USD 7.0 bn recorded as at 2nd February 2023. As such, the country’s months of import cover dropped to 3.7 months from 3.9 months recorded the previous month, which is below the statutory requirement of maintaining at least 4.0-months of import cover. Standing at USD 6.6 bn as at 2nd March 2023, it translates to a 3.7% decline from USD 6.9 bn recorded the previous week. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years:

Weekly Highlights:

- February 2023 Inflation

The y/y inflation in February 2023 came in at 9.2%, up from the 9.0% recorded in January 2023. This was in contrast to our expectations of an ease within a range of 8.6%-9.0%. The headline inflation in February 2023 was majorly driven by an increase in prices of commodities in the following categories, food and non-alcoholic beverages; housing, water, electricity, gas and other fuels; and transport. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – February 2023 |

|||

|

Broad Commodity Group |

Price change m/m (January-2023/February-2023) |

Price change y/y (February-2022/February-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

1.2% |

13.3% |

The m/m increase was mainly driven by increase in price commodities such as cabbages, carrots, kales, tomatoes and oranges. The increase was, however, mitigated by drop in prices of commodities such as mangoes, sugar, maize and wheat flour |

|

Housing, Water, Electricity, Gas and Other Fuel |

0.4% |

7.6% |

The m/m change was mainly due to increase in price of cooking gas. The increase was, however, mitigated by drop in prices of electricity |

|

Transport cost |

0.0% |

12.9% |

The index remained unchanged as the prices of diesel and petrol remained unchanged in February 2023. |

|

Overall Inflation |

0.6% |

9.2% |

The m/m was mainly driven by 1.2% increase in prices of food and non-alcoholic Beverages |

Source: Kenya National Bureau of Statistics (KNBS)

Despite the Monetary Policy Committee move to maintain the Central Bank benchmark lending rate at 8.75% in January 2023, citing that its effect was still transmitting into the economy, the headline inflation has remained above the CBK’s ceiling of 7.5%. The sustained inflationary pressures have been mainly driven by the increased food inflation, evidenced by the 13.3% y/y increase in the Food and Non-Alcoholic beverages index and food being a contributor to Kenya’s core inflation. Moreover, erratic weather conditions currently experienced both locally and regionally has compromised agricultural production, especially maize production. Maize being a major input under the food basket, the conditions are expected to underpin food inflationary pressures in the country. We expect recent interventions such as the importation of duty free maize and rice to ease the inflationary pressures in the short-term, but expect the Government to put in more sustainable measures and policies to address food security. Additionally, fuel prices in the country have remained elevated following the scaling down of the fuel subsidies, thus raising the cost of production since fuel is a major input in most businesses. As such, we anticipate that inflationary pressures in the country will endure in the short to medium term, provided the status quo remains unchanged.

- S&P Global Credit Ratings

Recently, S&P Global Ratings downgraded Kenya’s outlook to negative from stable, indicating heightened risks of defaults in debt repayments amid weakening liquidity position in light of high debt servicing obligations in the next fiscal year. Furthermore, the recent undersubscription of domestic bond issuances, as well as constrained access to international capital markets, have heightened Kenya’s medium term fiscal and external refinancing risks. However, the agency maintained the country’s long and short-term foreign and local currency sovereign credit ratings at B/B. The downward revision follows a downgrade of Kenya’s Long-Term Foreign Currency issuer default ratings to “B” from “B+” by Fitch Ratings in December 2022. S&P Global Ratings stated that the negative outlook was mainly due to;

- High debt servicing cost: Kenya has relatively high debt servicing obligations in the next fiscal year including servicing of the 10 year Eurobond worth USD 2.0 bn maturing in June 2024 constraining its access to international capital markets. The agency also stated that given half of Kenya debt stock is external foreign currency debt, it further exposes Kenya to financing and foreign exchange risks. The external debt stock as at October 2022, includes multilateral debt at 45.4% of total external debt followed by commercial debt at 26.2%, bilateral debt at 24.9%, and suppliers' credit and guaranteed debt at 3.5%,

- Deteriorated investor’s sentiments: Investors sentiments towards government domestic bonds has deteriorated, as evidenced by the recent undersubscription of domestic bonds. The February bonds overall subscription rate came at 53.2% against a total of Kshs 60.0 bn offered during the month. The initial bonds offered during the month recorded an undersubscription rate of 38.9% against the Kshs 50.0 bn offered, while their subsequent tap sales were oversubscribed due to the lower amount offered of Kshs 10.0 bn. Unlike the treasury bonds, the government short-term dated papers have been recording oversubscription although at higher yields, attributable to investors avoiding duration risk as well as default risk owing to the indicators that the government may be impaired to meets its obligation in the long-term, and,

- Depleted Foreign Exchange Reserves: The country’s foreign reserves have already breached the statutory minimum requirement of 4-months of import cover, with the reserve currently standing at USD 6.6 bn as at 2nd March 2023, equivalent to 3.7 months of import cover. The foreign reserves have been put under pressures partly attributable to increased dollar demand from importers, especially from oil and energy sectors against a slower supply of hard currency.

In base case scenario, the agency assumes the current administration ongoing fiscal consolidation measures will narrow the budget deficit to an average of 5.7% over fiscal years 2023-2026, with concessional external financing serving as the primary source to finance the budget deficit. In 2021 Kenya reached a staff agreement with International Monetary Fund (IMF) for a 38-month program worth USD 2.4 bn for budget support and to buffer foreign reserves. Cumulatively, the government has received a total of USD 1.6 bn disbursed in four tranches, with the most recent disbursement being USD 447.0 mn in December 2022. Additionally, the IMF is expected to increase Kenya’s Special Drawing Rights (SDR) quota, which currently stands at USD 542.8 mn, with Kenya having drawn USD 426.8 mn, equivalent to 78.6%.

The current account deficit marginally narrowed to 4.9% of GDP in 2022 from 5.2% in 2021, supported by tea and manufacturing exports, a relative rebound in international tourism, and record high remittance inflows. The sharp rise in import bill emanating from high energy prices and non-oil imports was countered by reduced capital expenditure on construction material imports tied to completion of major infrastructure projects. However, the agency stated that it could revise Kenya’s credit ratings downwards over the next 12 months if external access to finance were curtailed or the country’s foreign exchange reserves continues to drop. Furthermore, a deteriorated economic growth prospects or fiscal indicators could also lead to a downward revision of the credit ratings. On the other hand, the agency stated that the outlook might be revised to stable if the country’s external and domestic financing pressures prove to be contained with the evidence of commitment of fiscal consolidation, while economic growth and institutional mechanisms remain robust.

As part of economic turnaround, the government stated in the final Budget Policy Statement (BPS), that it will scale its revenue collection to Kshs 3.0 tn in FY’2023/2024 and to Kshs 4.0 tn in the medium term through reforms in tax policies such as; reducing Value Added Tax (VAT) gap from 38.9% to 19.8% and Corporate Income Tax (CIT) gap from 32.2% to 30.0%. In terms of spending, the government projects the total expenditures to decline to 22.3% as a share of GDP in the FY 2026/27 from 23.7% as a share of GDP in the FY 2021/22. The government stated that it will sustain its expenditure projections through, eliminating non priority expenditures, retiring expensive and unsustainable consumption subsidies, reducing tax exemptions, and, scaling up the use of Public Private Partnerships financing for commercially viable projects. However, the downward revision of the credit ratings outlook is a tip-off that the ongoing fiscal consolidation is yet to bear fruit hence the need for the government to enhance and fast-track its austerity measures. Additionally, debt vulnerabilities remain heightened due to high public debt, standing at Kshs 9.1 tn as at 24th February 2023 and projected to exceed the current Kshs 10.0 tn debt ceiling by June next year. As such, access to international capital markets will continue to be constrained due to high interest rates demanded by investors as a result of the increased perceived risks on the economy.

- Stanbic Bank Kenya February 2023 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank Kenya released its monthly Purchasing Managers Index (PMI), highlighting that the index for the month of February 2023 came in at 46.6 down from an 11-month high of 52.0 recorded in January 2023. This is the first time in six months that the index has registered below the 50.0 no change threshold, pointing towards a solid deterioration in operating conditions. The deterioration in business environment was mainly driven by subdued demand, as most companies recorded sharp decline in order volumes. The weak demand was due to the high inflation which continues to exert pressure on consumer wallet, evidenced by the February 2023 inflation rate rising to 9.2% from 9.0% recorded in January 2023. Moreover, weak consumer demand was further fueled by lack of money in circulation.

Due to the weak demand, output fell sharply for the first time in four months, while input purchases fell for the first time since last August, prompting most companies to cut activity and employment. Cost pressures intensified during the month, the highest in five months, largely attributable to higher cost of imports due to dollar shortage. The chart below summarizes the evolution of PMI over the last 24 months. (A reading above 50.0 signal an improvement in business conditions, while readings below 50.0 indicate a deterioration):

The performance in February is in line with our expectations, as we had maintained a cautious outlook in the business environment in the short to medium term, mainly due to the relentless inflationary pressures that have continued to weigh on consumer spending, as well as the sustained depreciation of the shilling against the dollar, on the back of dollar shortage. As a result, we are adamant that the status quo is yet to change in the near to medium term. Furthermore, with high fuel prices in the country following the scaling down of fuel subsidies, we expect the cost of production to remain elevated, and hence lead to weak demand as consumers cut back on spending.

Monthly Highlights:

- The National Treasury presented the Supplementary Budget for FY’2022/23 to the National Assembly highlighting that the National Treasury is seeking to slightly increase the gross total budget by 0.4% to Kshs 3,373.3 bn from the previous estimates of Kshs 3,358.6 bn driven by an increase in the recurrent expenditure by 6.6% to Kshs 1,496.9 bn in the Supplementary estimates from Kshs 1,403.9 bn in the Original estimates. On the other hand, Development expenditure is set to reduce by 14.9% to Kshs 609.1 bn in the supplementary estimates from Kshs 715.4 bn in the original estimates. For more information, please see our Cytonn weekly #06/2023,

- The National Treasury gazetted the revenue and net expenditures for the seven months of FY’2022/2023, ending 31th January 2023. Also, the National Treasury released the Final 2023 Budget Policy Statement, which was the first to be prepared under the new administration. This follows the release of the Draft of the 2023 Budget Policy Statement in January 2023. The policy statement stipulates the administration priority programs, policies and reforms to be implemented in the Medium-Term Expenditure Framework (MTEF). For more information, please see our Cytonn weekly #07/2023, and,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya effective 15th February 2023 to 14th March 2023. Notably, fuel prices remained unchanged for the third consecutive month at Kshs 177.3, Kshs 162.0 and Kshs 145.9 per litres of Super Petrol, Diesel and Kerosene, respectively. For more information, please see our Cytonn weekly #07/2023,

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 9.4% behind its prorated borrowing target of Kshs 396.3 bn having borrowed Kshs 359.2 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at January 2023 coming in at Kshs 1.1 tn in the FY’2022/2023, equivalent to 53.3% of its target of Kshs 2.1 tn and 91.4% of the prorated target of Kshs 1.2 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the month of February, the equities market recorded mixed performance, with NASI and NSE 25 gaining by 0.1% and 0.7%, respectively, while NSE 20 declined by 0.6%. The equities market performance was driven by gains recorded by large cap banking stocks such as Standard Chartered Bank of Kenya (SCBK), Equity Group, NCBA Group and Cooperative Bank of Kenya of 4.0%, 3.4%, 2.2% and 1.6% respectively. The gains were however weighed down by losses recorded by large cap stocks such as Bamburi and Stanbic Holdings of 5.2% and 4.5%, respectively.

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 0.2%, 1.3% and 0.5%, respectively, taking the YTD performance to losses of 0.9%, 2.5%, and 0.2% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as BAT Kenya, Equity Group and ABSA Bank of 5.4%, 1.7%, and 1.2% respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Diamond Trust Bank Kenya (DTB-K), NCBA Group, Bamburi and Co-operative Bank of 3.8%, 2.3%, 2.0% and 1.6%, respectively.

Equities turnover declined by 41.7% in the month of February to USD 36.7 mn from USD 62.9 mn recorded in January 2023. Foreign investors remained net sellers, with a net selling position of USD 3.0 mn, compared to January’s net selling position of USD 23.0 mn.

During the week, equities turnover increased by 22.7% to USD 7.9 mn from USD 6.4 mn recorded the previous week taking the YTD turnover to USD 103.8 mn. Foreign investors turned net buyers, with a net buying position of USD 0.8 mn, from a net selling position of USD 1.9 mn recorded the previous week, taking the YTD net selling position to USD 25.1 mn.

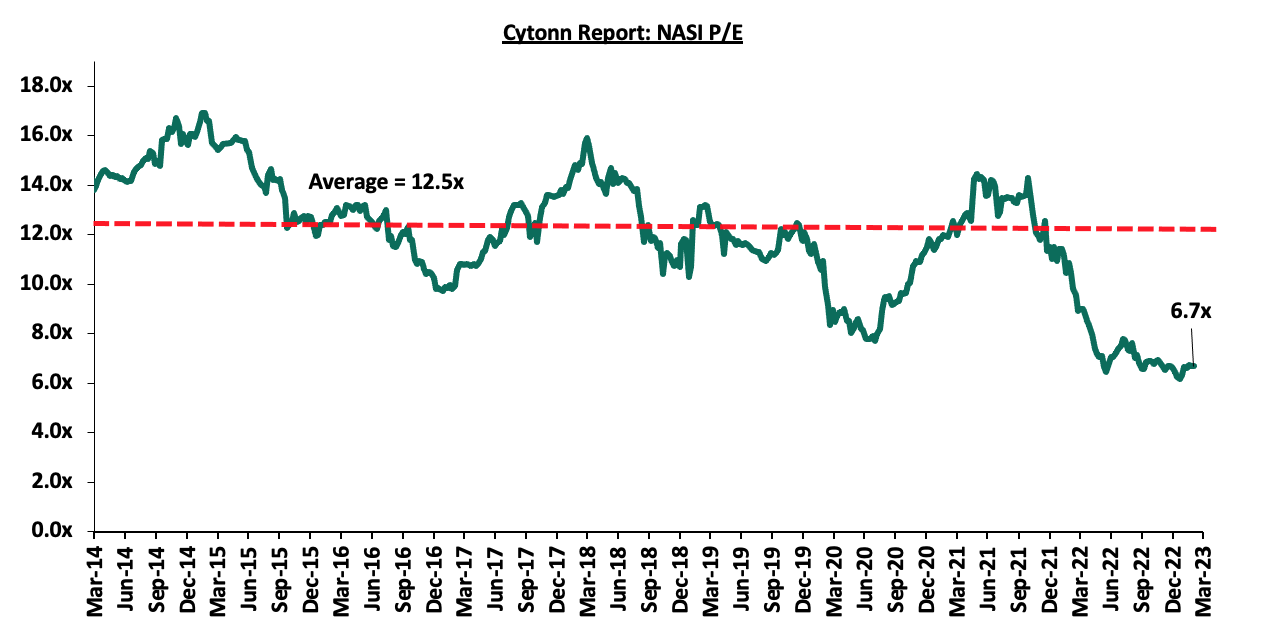

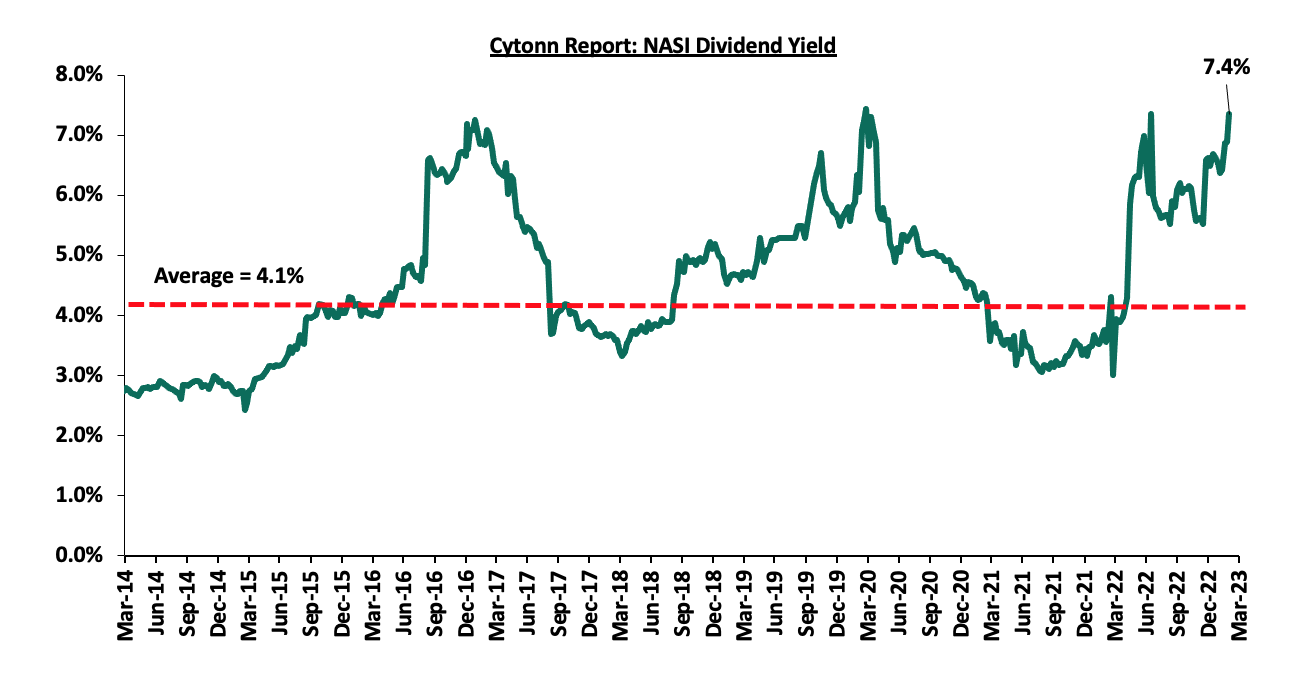

The market is currently trading at a price to earnings ratio (P/E) of 6.7x, 46.6% below the historical average of 12.5x, and a dividend yield of 7.4%, 3.3% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Monthly Highlights

- Equity Group Holdings Plc, through Equity Bank Kenya Limited (EBKL) announced that it had completed the acquisition of certain assets and liabilities of Spire Bank Limited after obtaining all the required regulatory approvals. For more information, please see our Cytonn Monthly January 2023,

- The Nairobi Stock Exchange (NSE) amended the trading rules for equity securities to allow for block trades, aimed at boosting liquidity in the bourse, after receiving approval from the Capital Markets Authority (CMA). For more information, please see our Cytonn Monthly January 2023,

- The Central Bank of Kenya (CBK) released the Commercial Banks’ Credit Survey Report for the quarter ended December 2022, highlighting that the banking sector’s loan book recorded a 15.6% y/y growth, with gross loans increasing to Kshs 3.7 tn in Q4’2022, from Kshs 3.2 tn in Q4’2021. For more information, please see our Cytonn Weekly #06/2023, and,

- British American Tobacco Kenya Plc released their FY’2022 financial results, recording a 6.3% growth in Profits after Tax (PAT) to Kshs 6.9 bn, from Kshs 6.5 bn recorded in FY’2021, majorly attributed to the 5.5% increase in Gross Sales to Kshs 42.2 bn in FY’2022 from Kshs 40.0 bn recorded in FY’2021. For more information, please see our Cytonn Weekly #07/2023.

Universe of coverage:

|

Company |

Price as at 24/02/2023 |

Price as at 03/03/2023 |

w/w change |

m/m change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield**** |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

182.3 |

184.0 |

1.0% |

0.3% |

(7.4%) |

198.8 |

305.9 |

7.6% |

73.9% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.7 |

(4.0%) |

(1.1%) |

(9.1%) |

1.9 |

2.5 |

5.9% |

53.5% |

0.1x |

Buy |

|

KCB Group*** |

38.3 |

38.4 |

0.1% |

0.4% |

0.0% |

38.4 |

52.5 |

7.8% |

44.7% |

0.6x |

Buy |

|

Britam |

5.1 |

5.0 |

(2.7%) |

1.6% |

(3.8%) |

5.2 |

7.1 |

0.0% |

42.4% |

0.9x |

Buy |

|

Sanlam |

8.7 |

8.7 |

(0.7%) |

4.6% |

(9.6%) |

9.6 |

11.9 |

0.0% |

37.5% |

0.9x |

Buy |

|

Equity Group*** |

46.0 |

45.2 |

(1.7%) |

3.4% |

0.2% |

45.1 |

58.4 |

6.6% |

35.9% |

1.1x |

Buy |

|

Liberty Holdings |

5.0 |

5.0 |

0.2% |

9.9% |

(0.8%) |

5.0 |

6.8 |

0.0% |

35.0% |

0.4x |

Buy |

|

ABSA Bank*** |

12.6 |

12.4 |

(1.2%) |

0.8% |

1.6% |

12.2 |

15.5 |

8.9% |

33.5% |

1.1x |

Buy |

|

Co-op Bank*** |

12.6 |

12.8 |

1.6% |

1.6% |

5.4% |

12.1 |

15.5 |

7.8% |

29.2% |

0.7x |

Buy |

|

NCBA*** |

36.2 |

37.1 |

2.3% |

2.2% |

(4.9%) |

39.0 |

43.4 |

8.1% |

25.2% |

0.8x |

Buy |

|

I&M Group*** |

18.0 |

18.0 |

0.0% |

5.3% |

5.6% |

17.1 |

20.8 |

8.3% |

24.0% |

0.5x |

Buy |

|

Stanbic Holdings |

109.0 |

100.0 |

(8.3%) |

(4.5%) |

(2.0%) |

102.0 |

112.0 |

9.0% |

21.0% |

0.9x |

Buy |

|

Diamond Trust Bank*** |

48.1 |

50.0 |

3.8% |

0.0% |

0.2% |

49.9 |

57.1 |

6.0% |

20.4% |

0.2x |

Buy |

|

CIC Group |

2.0 |

2.0 |

(1.5%) |

4.7% |

3.7% |

1.9 |

2.3 |

0.0% |

17.2% |

0.7x |

Accumulate |

|

Standard Chartered*** |

163.0 |

162.8 |

(0.2%) |

4.0% |

12.2% |

145.0 |

166.3 |

11.7% |

13.8% |

1.1x |

Accumulate |

|

HF Group |

3.6 |

3.3 |

(7.6%) |

6.0% |

4.4% |

3.2 |

3.4 |

0.0% |

4.3% |

0.2x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in ****FY’2021 Total dividends |

|||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Industry Reports

During the month, the following industry reports were released and the key take-outs were as follows:

|

Cytonn Report: Notable Industry Reports During the Month |

|||

|

# |

Theme |

Report |

Key Take-outs |

|

1 |

Hospitality Sector |

Annual Tourism Sector Performance Report - 2022 by the Tourism Research Institute (TRI) |

|

|

2 |

General Real Estate |

Status of The Built Environment Report January - December 2022 by the Architectural Association of Kenya (AAK) |

|

We expect Kenya’s Real Estate sector to continue recording upward performance in terms of activity, driven by the recovery of the hospitality sector supported by increased tourist arrivals and inbound earnings. Conversely, the prevailing high construction costs amid inflationary pressures from both local and global shocks are expected to weigh down the optimum performance of the sector.

- Residential Sector

Notable highlights in the sector during the month include;

- The County Government of Nairobi began the second phase of its plan of redeveloping old County estates through construction of 33,000 new low-cost units. For more information, see our Cytonn Weekly #08/2023,

- Centum Real Estate, the development affiliate of Centum Investment Company PLC, completed the construction of phase one of its 32 luxurious four-bedroom duplexes dubbed ‘Loft Residences’, which sits on 3.9 acres situated in Two Rivers. For more information, see our Cytonn Weekly #07/2023,

- Madison Insurance entered into a Joint-Venture (JV) agreement with Housing Finance Company (HFC), a subsidiary of HF Group, to develop a Master Planned Community project dubbed ‘Villakazi Homes’ in Athi River, Machakos County. For more information, see our Cytonn Weekly #07/2023, and,

- Absa Bank Kenya PLC announced that it had availed funding worth Kshs 6.7 bn to property developer Acorn Holdings Limited (AHL), for the construction of 10 Purpose-Built Student Accommodation (PBSA) projects worth Kshs 11.0 bn. For more information, see our Cytonn Weekly #06/2023.

We expect the ongoing housing development activities in the residential sector to boost Kenya’s Real Estate sector in terms of increasing homeownership percentages, and curbing the existing housing deficit. In addition, we anticipate demand for housing to grow further, owing to the country’s high urbanization and population growth rates. However, the lack of long-term, affordable development financing attributed to banks charging high interest rates, and the subdued capital markets continue to weigh down the optimum performance of the sector.

- Commercial Office Sector

During the month, JPMorgan Chase & Co, an American-based international investment bank, through State House Nairobi, announced plans to open its regional office in Nairobi, Kenya, serving as a central hub for its operations in East African region, with existing footprints in Nigeria and South Africa. Additionally, Commonwealth Enterprise and Investment Council (CWEIC), Commonwealth’s official business networking organization, opened its regional office in Nairobi, Kenya, that will serve as East Africa’s business hub for the organization which will help grow trade and investments in the region. For more information, see our Cytonn Weekly #08/2023.

We expect the expansion drive by multi-national firms seeking to conduct operations in the region will further attract more organizations into the Kenyan commercial office market, thereby bolstering performance of the sector. However, the existing oversupply of office space currently at 6.7 mn SQFT in the Nairobi Metropolitan Area (NMA) will continue to weigh down the overall performance of the sector.

- Retail Sector

During the week, local retail chain Quickmart Supermarket opened a new outlet located in Thome, along the Northern Bypass road, bringing the retailer’s number of operating outlets countrywide to 56. The retailer's decision to open a 24-hour store in Thome and surrounding areas is influenced by the desire to cater to the convenience preferences of shoppers within the residential locality. Moreover, the move is part of an aggressive expansion drive to promote the Quickmart brand as a household name among customers, thereby increasing its competitiveness against other retailers such as Naivas and Carrefour, and stamp its market dominance. This comes at a time where the formal retail penetration in Kenya is low, standing at 30.0% in 2018, coupled with gaps left by other retailers such as Nakumatt and Uchumi Supermarkets that exited the market.

The table below shows the number of stores operated by key local and international retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||

|

Name of retailer |

Category |

Branches as at FY’ 2018 |

Branches as at FY’ 2019 |

Branches as at FY’ 2020 |

Branches as at FY’ 2021 |

Branches as at FY’2022 |

Branches opened in 2023 |

Closed branches |

Current branches |

Branches expected to be opened |

Projected branches FY’2023 |

|

Naivas |

Local |

46 |

61 |

69 |

79 |

91 |

0 |

0 |

91 |

0 |

91 |

|

Quick Mart |

Local |

10 |

29 |

37 |

48 |

55 |

1 |

0 |

56 |

0 |

56 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

0 |

0 |

19 |

0 |

19 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

4 |

0 |

60 |

4 |

0 |

4 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

0 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

0 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

0 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

0 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

209 |

2 |

182 |

211 |

0 |

211 |

Source: Cytonn Research

Other notable highlights in the sector during the month include;

- Local retail chain Cleanshelf Supermarket opened a new outlet located in Greenpark Estate along Mombasa road, Athi River bringing the retailer’s number of operating outlets countrywide to 13. For more information, see our Cytonn Weekly #07/2023, and,

- International fast-food chain ChicKing, in partnership with M/s Crispy Limited, a local franchise, opened a restaurant outlet located in Mombasa along Nyerere Avenue, the first outlet in Kenya and the East African market. For more information, see our Cytonn Weekly #06/2023.

We expect performance of the Kenyan retail sector to be supported by the ongoing expansion drive by both local and international retailers, as they compete for dominance in the market. However, the fast-paced growth of e-commerce, and the oversupply of retail space standing at approximately 3.0 mn SQFT in the NMA retail sector and 1.7 mn SQFT in the non-NMA regions, will continue to hinder optimum performance of the retail sector.

- Infrastructure Sector

During the week, the Northern Corridor Transit and Transport Coordination Authority (NCTTCA) announced a partnership with Superior Homes Kenya, a housing developer where Cytonn Investments is the second largest shareholder, to construct roadside stations along major highways. Superior Homes Kenya will develop the service and rest point areas along various transit routes within the country, which will feature self-contained facilities for long-distance truckers such as; i) safe parking spaces, ii) driver accommodation features, iii) convenience stores for food and beverage options, iv) health facilities, v) truck maintenance and refueling, and, vi) cargo handling. This is meant to enhance road safety by addressing driver fatigue experienced by long-distance transit drivers across the Northern Corridor. The move forms part of the NCTTCA strategy to fulfil its mandate of facilitating interstate and transit trade between landlocked countries of the Great Lakes region and the Kenyan maritime sea port of Mombasa. The Northern Corridor road network covers a total of 12,707 Km, distributed as follows; 567.0 Km in Burundi, 4,162.0 Km in Democratic Republic of Congo, 1,328.6 Km in Kenya, 1,039.4 Km in Rwanda, 3,543 Km in South Sudan, and 2,072 Km in Uganda.

The partnership to develop the roadside stations is meant to bridge the market gap of inadequate and informal truck stop facilities along major transit points such as Sultan Hamud, and areas between Mtito Andei and Salama, which is expected to be completed in March 2024. Upon completion, the roadside stations are expected to;

- Spur economic growth of the areas supported by setting up of businesses such as shops and services to cater for truck drivers and other travelers, thereby boosting property prices within the key locations,

- Reduce fatigue related accidents by allowing drivers to rest and refresh themselves before continuing their journey, hence improving the safety and reliability of highways in the infrastructure sector, and,

- Improve transport logistics with the stations acting as logistics hubs, thereby improving efficiency of transport services and reduce transportation costs for commodities in the economy.

Other notable highlights in the sector during the month include;

- Kenya Railways Corporation (KRC) commenced construction of the first phase of the Kshs 30.0 bn Railway City project which was launched in by President William Ruto in December 2022. For more information, see our Cytonn Weekly #07/2023, and,

- The Kenya National Highways Authority (KeNHA) announced plans to begin rehabilitation and improvement of sections of Mombasa road which were damaged during the construction of the Nairobi Expressway, within the next 2 months. Additionally, two major roads; Murang’a-Kangema and Murang’a-Kiriaini-Othaya located in Murang’a County were upgraded to national status for the purpose of rehabilitation and other maintenance works. For more information, see our Cytonn Weekly #06/2023.

We expect the ongoing efforts to develop road networks and other support facilities in the infrastructure sector to promote economic activities, subsequently driving performance of the general Real Estate sector in Kenya. On the other hand, infrastructural development activities are expected to be set back by the 21.4% reduction in budgetary allocation to the State Department of Infrastructure to Kshs 174.0 bn, from the Kshs 221.3 bn previously allocated for the year ending June 2023. Consequently, we expect the sourcing of funds for more infrastructure projects in the country to further shift to alternative financing strategies such as Public-Private Partnerships (PPPs).

- Real Estate Investment Trusts (REITs)

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share. The performance represented a 2.5% gain from Kshs 6.5 per share recorded the previous week, taking it to a 2.4% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3rd January 2023. In addition, the performance represented a 66.9% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 7.6%. The graph below shows Fahari I-REIT’s performance from November 2015 to 3rd March 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 3rd March 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.4 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 600.4 mn, respectively, since inception in February 2021.

Notably, during the month, the Capital Markets Authority (CMA) in collaboration with the Sanduku Investment Initiative, the Association of Pension Trustees and Administrators of Kenya (APTAK) and the Nairobi Securities Exchange (NSE) announced ongoing plans to create a Kenya National REIT (KNR) as an accreditation body for REITs and their stakeholders within the Kenyan REITs market. For more information, see our Cytonn Weekly #06/2023.

REITs provide numerous advantages, including access to more capital pools, consistent and prolonged profits, tax exemptions, diversified portfolios, transparency, liquidity and flexibility as an asset class. Despite these benefits, the performance of the Kenyan REITs market remains limited by several factors such as; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

We expect the performance of Kenya’s Real Estate sector to remain on an upward trajectory, supported by factors such as; i) the aggressive expansion drive in the retail sector, and, ii) diversification in the infrastructure sector which is geared to increase economic activities. However, the existing oversupply of physical space in selected sectors, high construction costs to developers, and low investor appetite for REITs are expected to continue subduing the performance of the sector.