Cytonn Monthly – January 2024

By Research Team, Feb 4, 2024

Executive Summary

Fixed Income

During the month of January 2024, T-bills were oversubscribed, with the overall average oversubscription rate coming in at 133.7%, higher than the oversubscription rate of 104.1% recorded in December 2023. The overall average subscription rates for the government papers increased with the 364-day, 182-day, and 91-day papers increasing to 24.9%, 53.1%, and 607.6%, from 13.3%, 33.3%, and 507.9% respectively, which were recorded in December 2023. The average yields on the government papers were on an upward trajectory in the month, with the 364-day, 182-day, and 91-day papers yields increasing by 54.3 bps, 38.6 bps, and 43.8 bps to 16.4%, 16.2%, and 16.1% respectively from 15.8%, 15.8% and 15.7 recorded the previous month. For the month of January, the government accepted a total of Kshs 142.2 bn of the Kshs 160.5 bn worth of bids received, translating to an acceptance rate of 88.6%;

Additionally, January 2024 bonds were undersubscribed, with the overall undersubscription rate coming in at 90.6%, albeit lower than the oversubscription rate of 189.0% recorded in December 2023. The reopened bond FXD1/2023/005 and the newly issued FXD1/2024/003 received bids worth Kshs 37.2 bn against the offered Kshs 35.0 bn, translating to an oversubscription rate of 106.1%, with the government accepting bids worth Kshs 25.0 bn translating to an acceptance rate of 67.3%. The subsequent tap sales for the bonds FXD1/2023/005 and FXD1/2024/003 received bids worth Kshs 11.9 bn against the offered Kshs 15.0 bn, translating to an undersubscription rate of 79.1%, with the government accepting bids worth Kshs 11.8 bn, translating to an acceptance rate of 99.1%;

During the week, T-bills were oversubscribed for the fifth consecutive week, with the overall oversubscription rate coming in at 107.5%, higher than the oversubscription rate of 102.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 20.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 515.7%, higher than the oversubscription rate of 414.0% recorded the previous week. The subscription rate for the 182-day paper decreased to 16.6%, from 52.4% recorded the previous week, while the subscription rate for the 364-day paper increased to 35.1%, from 26.7%, recorded the previous week. The government accepted a total of Kshs 24.7 bn worth of bids out of Kshs 25.8 bn of bids received, translating to an acceptance rate of 95.9 The yields on the government papers continued to rise with the yields on the 364-day, 182-day, and 91-day papers increasing by 15.8 bps, 13.0 bps and 8.4 bps to 16.7%, 16.5% and 16.4%, respectively;

In the primary bond market, the government is seeking to raise an additional Kshs 70.0 bn for funding infrastructure projects in the current financial year by issuing an infrastructure bond IFB1/2024/8.5 with a tenor to maturity of 8.5 years. The bidding process opened on Wednesday 24th January 2024 and will close on 14th February 2024, with a market determined coupon rate. The bond's value date will be 19th February 2024, with a maturity date of 9th August 2032, and will be tax-free as is the case for infrastructure bonds as provided for under the Income Tax Act. Notably, the last infrastructure bond to be issued was the 6.5-year IFB1/2023/07 in November 2023 which sought to raise Kshs 50.0 bn. The bond registered an oversubscription rate of 177.8%, at a yield of 17.9%. Based on the trading bonds of similar nature, we expect the IFB1/2024/8.5 to price at 18.4%-19.0%;

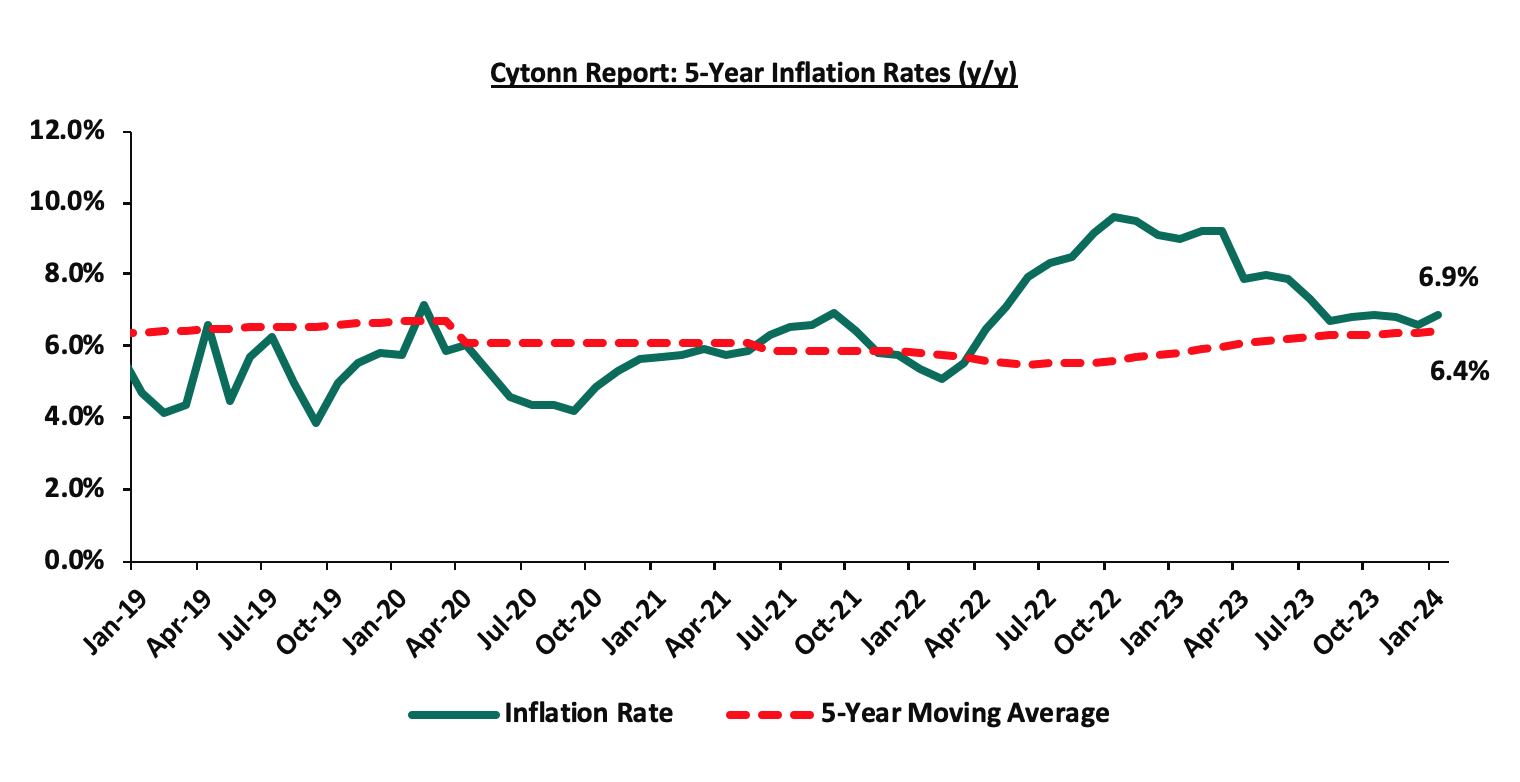

During the week, the Kenya National Bureau of Statistics (KNBS) released the year-on-year inflation highlighting that the inflation rate in the month of January 2024 increased to 6.9%, from the 6.6% inflation rate recorded in the month of December 2023, marking the seventh consecutive month that the inflation has remained within the CBK target range of 2.5%-7.5%;

Equities

During the month of January 2024, the equities market was on an upward trajectory, with NSE 25 gaining the most by 1.2%, while NSE 10, NSE 20, and NASI gained by 1.1%, 0.5% and 0.1% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Equity Group, Bamburi, and DTBK of 12.9%, 12.3%, and 9.9% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as KCB Group, EABL, and NCBA of 8.2%, 7.0%, and 3.5% respectively;

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 2.8%, while NSE 25, NASI, and NSE 20 gained by 2.3%, 2.2% and 1.0% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as DTBK, EABL, and Safaricom of 9.4%, 8.6%, and 3.1% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as Bamburi and BAT of 3.6% and 0.1% respectively;

During the month, East African Breweries Plc (EABL) released their H1’2024 financial results for the period ending 31st December 2023, recording a 22.1% decline in the Profits After Tax (PAT) to Kshs 6.8 bn in H1’2024, from Kshs 8.7 bn in H1’2023. The decline was mainly attributable to a 10.8% increase in Indirect Taxes to Kshs 52.5 bn in H1’2024, from Kshs 47.4 bn in H1’2023, coupled with the 36.6% increase in operating costs to Kshs 15.5 bn, from Kshs 11.3 bn in H1’2023 that offset the 13.8% growth in Gross Sales to Kshs 119.1 bn in H1'2024 from Kshs 104 bn in H1'2023. For more details, please see our Cytonn Weekly #04/2024.

Real Estate

During the week, Superior Homes, a leading master-planned real estate developer in Kenya and East Africa, signed a partnership deal with Absa Bank Kenya. The partnership aims to provide 90.0% mortgage financing to buyers with a payment period of up to 25 years for those seeking to purchase housing units at Pazuri, a holiday homes development located at Vipingo in Kilifi County. Additionally, President Ruto laid the foundation of Kanduyi Affordable Housing Project in Bungoma County. The project aims to develop 320 housing units, integrating social, affordable, and market-rate housing units;

In the retail sector, local retailer and budget supermarket chain Jaza opened two outlets, bringing its total number of stores countrywide to 6. The newly opened outlets are located in Chokaa in Embakasi and Gachie in Kiambu respectively;

In the infrastructure sector, Kenya National Highways Authority (KeNHA) finalized an agreement with the Japan International Cooperation Agency (JICA) for the construction of the Mombasa Gate Bridge project. Subsequently, construction of the 1.4 Km bridge project linking Mombasa Island and South Coast, valued at Kshs 47.0 bn is set to begin;

In statutory reviews, a new directive mandating all operators of short-term accommodation rentals, including Airbnb hosts, to register with the Tourism Regulatory Authority (TRA) was issued;

In the regulated Real Estate Funds sector, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.0 per share in the Nairobi Securities Exchange, representing a 4.1% decline from the Kshs 6.3 recorded the previous week;

On the Unquoted Securities Platform as at 27th October 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 25.3 and Kshs 21.7 per unit, a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, 0.8% points higher than the 17.2% yield recorded the previous week;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.84% p.a. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 18.00% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

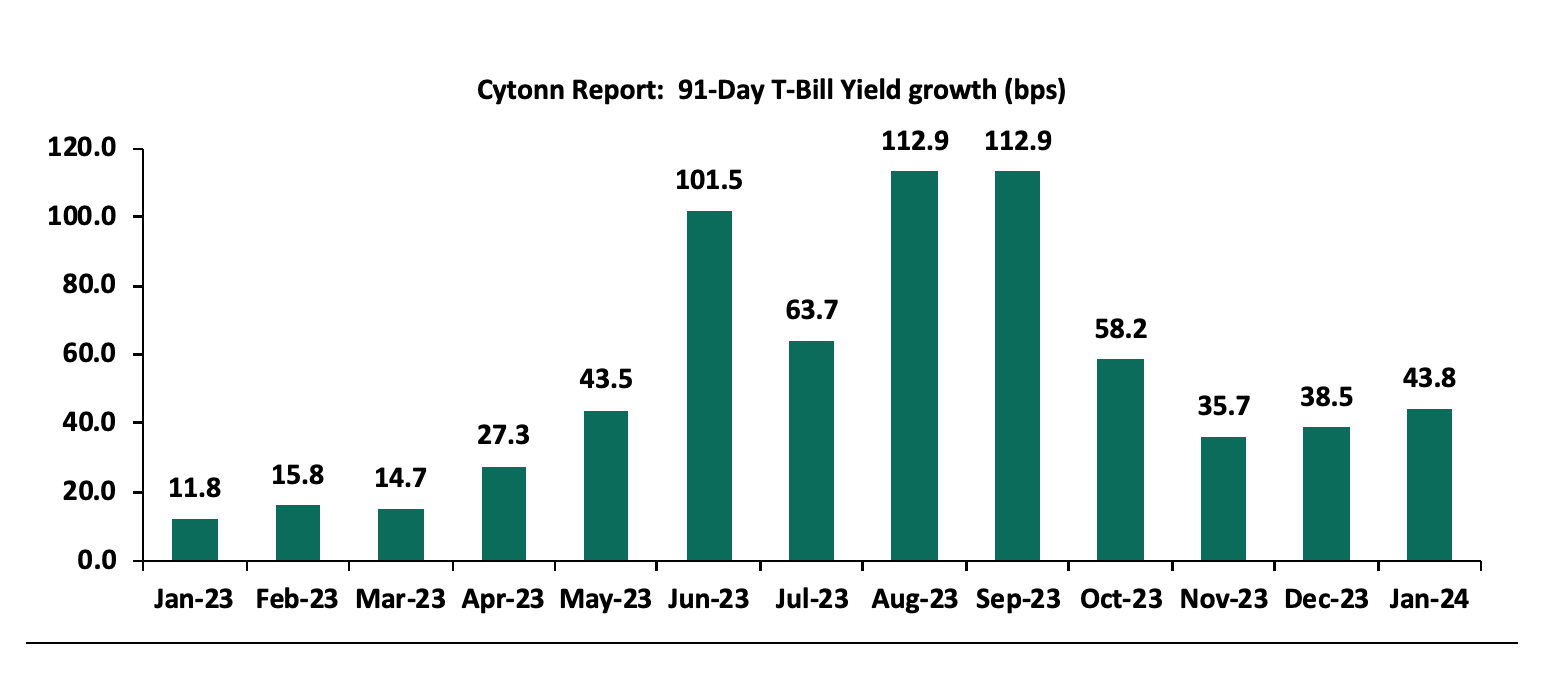

During the month of January 2024, T-bills were oversubscribed, with the overall average subscription rate coming in at 133.7%, higher than the oversubscription rate of 104.1% recorded in December 2023. The overall average subscription rates for the government papers increased with the 364-day, 182-day, and 91-day papers increasing to 24.9%, 53.1%, and 607.6%, from 13.3%, 33.3%, and 507.9% respectively, which were recorded in December 2023. The average yields on the government papers were on an upward trajectory in the month, with the 364-day, 182-day, and 91-day papers yields increasing by 54.3 bps, 38.6 bps, and 43.8 bps to 16.4%, 16.2%, and 16.1% respectively from 15.8%, 15.8% and 15.7 recorded the previous month. For the month of January, the government accepted a total of Kshs 142.2 bn of the Kshs 160.5 bn worth of bids received, translating to an acceptance rate of 88.6%. Notably, the growth in the government papers yields was faster in January compared to December, with the yields on the 91-day paper growing by 43.8 bps, compared to 38.5 bps growth that was recorded in December, as investors continue to attach a higher risk premium to the country. The chart below shows the yields growth rate for the 91-day paper during the year:

This week, T-bills were oversubscribed for the fifth consecutive week, with the overall oversubscription rate coming in at 107.5%, albeit higher than the oversubscription rate of 102.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 20.6 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 515.7%, higher than the oversubscription rate of 414.0% recorded the previous week. The subscription rate for the 182-day paper decreased to 16.6%, from 52.4% recorded the previous week, while the subscription rate for the 364-day paper increased to 35.1%, from 26.7%, recorded the previous week. The government accepted a total of Kshs 24.7 bn worth of bids out of Kshs 25.8 bn of bids received, translating to an acceptance rate of 95.9 The yields on the government papers continued to rise with the yields on the 364-day, 182-day and 91-day papers increasing by 15.8 bps, 13.0 bps and 8.4 bps to 16.7%, 16.5% and 16.4%, respectively.

So far in the current FY’2023/24, government securities totalling Kshs 1,099.0 bn have been advertised. The government has accepted bids worth Kshs 1,183.2 bn, of which Kshs 875.5 bn and Kshs 307.7 bn were treasury bills and bonds, respectively. Total redemptions so far in FY’2023/24 equal to Kshs 1,015.5 bn, with treasury bills accounting for Kshs 979.6 bn and bonds accounting for Kshs 35.9 bn. As a result, the government has a domestic borrowing surplus of Kshs 167.7 bn in FY’2023/24.

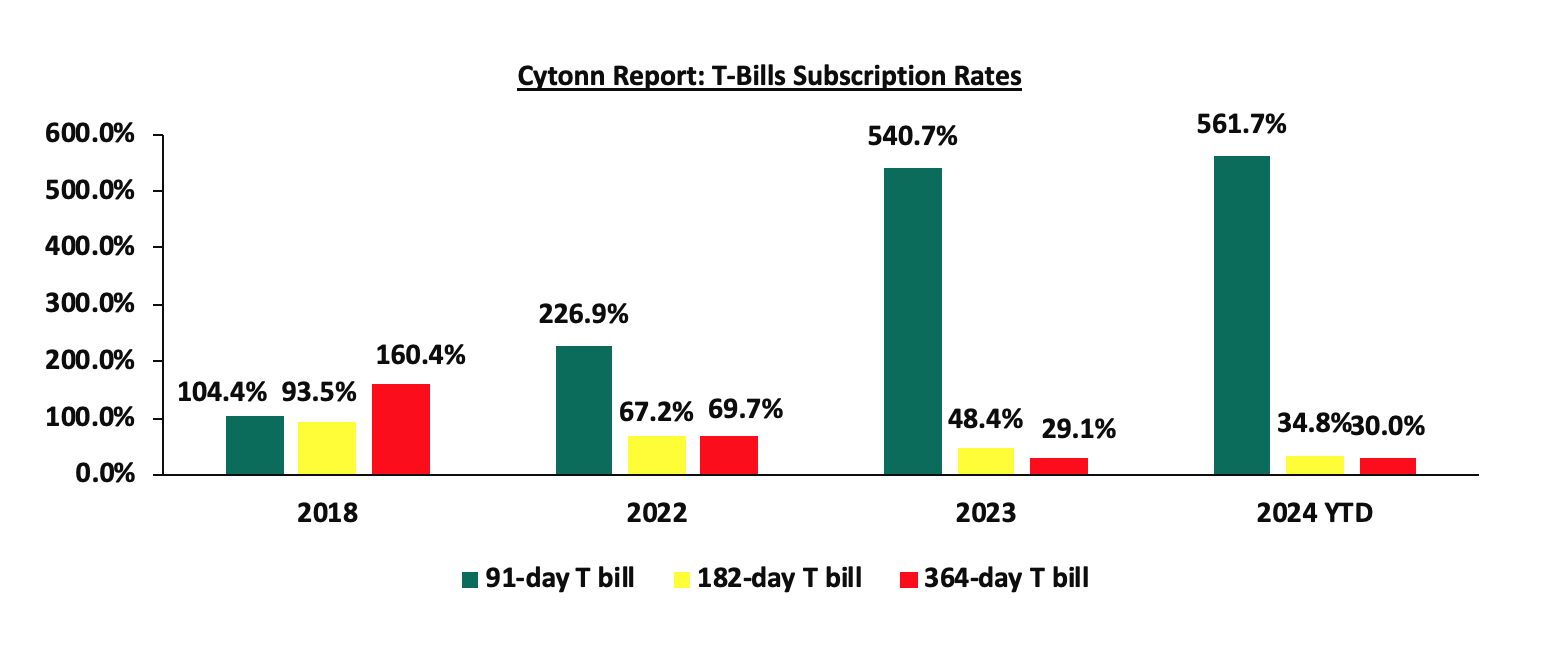

The chart below compares the overall average T- bills subscription rates obtained in 2018, 2022, 2023 and 2024 Year to Date (YTD):

Additionally, January 2024 bonds were undersubscribed, with the overall undersubscription rate coming in at 90.6%, albeit lower than the oversubscription rate of 189.0% recorded in December 2023. The reopened bond FXD1/2023/005 and the newly issued FXD1/2024/003 received bids worth Kshs 37.2 bn against the offered Kshs 35.0 bn, translating to an oversubscription rate of 106.1%, with the government accepting bids worth Kshs 25.0 bn translating to an acceptance rate of 67.3%. The subsequent tap sales for the bonds FXD1/2023/005 and FXD1/2024/003 received bids worth Kshs 11.9 bn against the offered Kshs 15.0 bn, translating to an undersubscription rate of 79.1%, with the government accepting bids worth Kshs 11.8 bn, translating to an acceptance rate of 99.1%. The table below provides more details on the bonds issued during the month of January 2024:

|

Cytonn Report: Treasury Bonds Issued in January 2024 |

|||||||||

|

Issue Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount offered (Kshs bn) |

Actual Amount Raised/Accepted (Kshs bn) |

Total bids received (Kshs bn) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

15/01/2024

|

FXD1/2023/005 - Re-opened |

4.5 |

16.8% |

35.0 |

25.0 |

37.2 |

18.8% |

106.1% |

67.3% |

|

FXD1/2024/003 |

2.9 |

18.4% |

18.4% |

||||||

|

22/01/2024

|

FXD1/2023/005 – Tap Sale |

4.5 |

16.8% |

15.0 |

11.8 |

11.9 |

18.8% |

79.1% |

99.1% |

|

FXD1/2024/003 – Tap Sale |

2.9 |

18.4% |

18.4% |

||||||

|

Jan 2024 Average |

|

5.3 |

16.0% |

100.0 |

68.3 |

90.6 |

16.9% |

90.6% |

75.3% |

|

Dec 2023 Average |

|

6.5 |

17.9% |

25.0 |

47.9 |

47.2 |

17.9% |

189.0% |

101.3% |

Source: Central Bank of Kenya (CBK)

In the primary bond market, the government is seeking to raise an additional Kshs 70.0 bn for funding of infrastructure projects in the current financial year by issuing an infrastructure bond IFB1/2024/8.5 with a tenor to maturity of 8.5 years. The bidding process opened on Wednesday 24th January 2024 and will close on 14th February 2024, with a market determined coupon rate. The bond's value date will be 19th February 2024, with a maturity date of 9th August 2032, and will be tax-free as is the case for infrastructure bonds as provided for under the Income Tax Act. Notably, the last infrastructure bond to be issued was the 6.5-year IFB1/2023/07 in November 2023 which sought to raise Kshs 50.0 bn. The bond registered an oversubscription rate of 177.8%, at a yield of 17.9%. Based on trading of bonds of similar nature, we expect the IFB1/2024/8.5 to price at 18.4%-19.0%.

Secondary Bond Market:

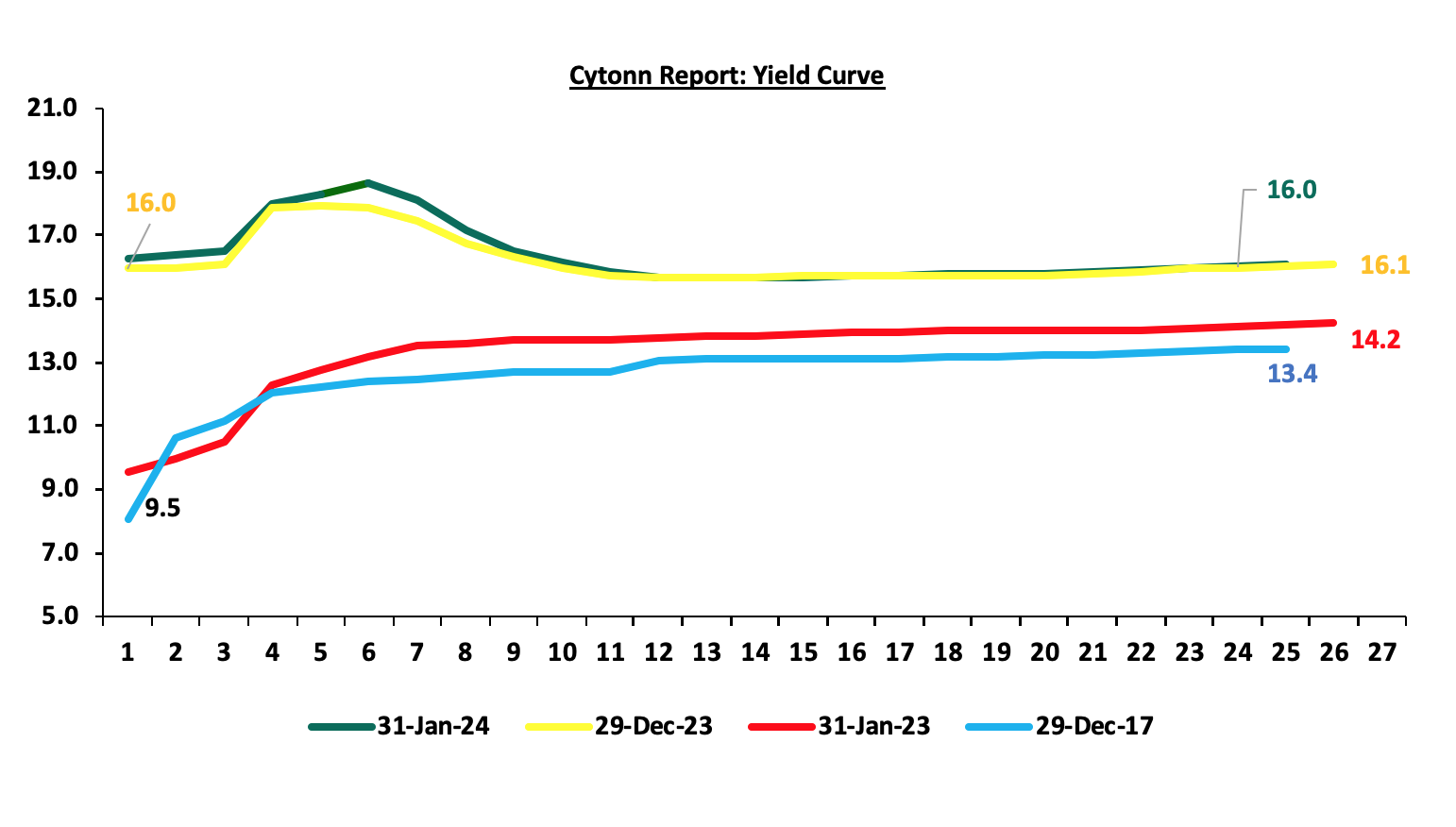

The yields on the government securities were on an upward trajectory during the month compared to the same period in 2023. We observe a humped yield curve for the medium-term bonds in the 3 to 10-year maturity range, an indication of the prevailing uncertainty in the market regarding both medium-term interest rates and inflation. Investors, apprehensive about the economic outlook in the near to medium term, are demanding higher yields for bonds in the 3 to 10-year maturity range to compensate for the perceived risks as they anticipate potential fluctuations in economic conditions in the Kenyan market on the back of government’s debt sustainability concerns. The chart below shows the yield curve movement during the period:

The secondary bond turnover increased by 12.7% to Kshs 62.7 bn, from Kshs 55.6 bn recorded in December 2023, pointing towards increased activities by commercial banks in the secondary bonds market. On a year-on-year basis, the bonds turnover increased by 42.3% from Kshs 44.0 bn worth of treasury bonds transacted over a similar period last year.

Money Market Performance:

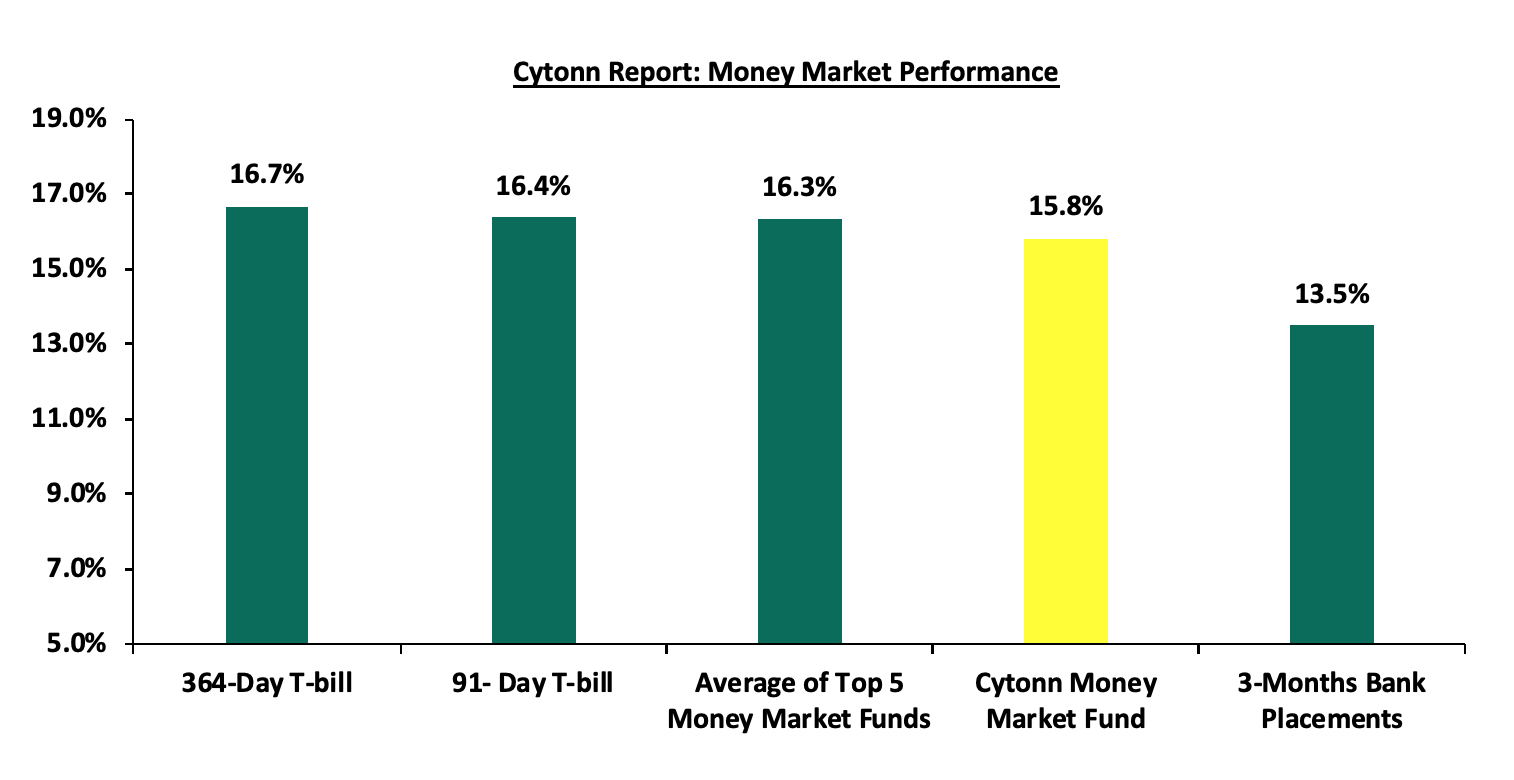

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), The yield on the 364-day paper increased by 15.8 bps to 16.7%, while that of 91-day paper increased by 8.4 bps to 16.4%. The yield of Cytonn Money Market Fund increased by 12.0 bps to close the week at 15.8% and the average yields on the Top 5 Money Market Funds increased by 5.0 bps, remaining relatively unchanged at 16.3% recorded the previous week

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 2nd February 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on February 2024 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Etica Money Market Fund |

17.2% |

|

2 |

Lofty-Corban Money Market Fund |

16.6% |

|

3 |

Nabo Africa Money Market Fund |

16.0% |

|

4 |

GenAfrica Money Market Fund |

16.0% |

|

5 |

Cytonn Money Market Fund (Dial *809# of download the Cytonn app) |

15.8% |

|

6 |

Madison Money Market Fund |

15.2% |

|

7 |

Enwealth Money Market Fund |

14.9% |

|

8 |

Apollo Money Market Fund |

14.9% |

|

9 |

Kuza Money Market fund |

14.9% |

|

10 |

Co-op Money Market Fund |

14.6% |

|

11 |

GenCap Hela Imara Money Market Fund |

14.3% |

|

12 |

Absa Shilling Money Market Fund |

14.3% |

|

13 |

AA Kenya Shillings Fund |

14.2% |

|

14 |

Sanlam Money Market Fund |

14.2% |

|

15 |

Jubilee Money Market Fund |

14.1% |

|

16 |

Mayfair Money Market Fund |

13.8% |

|

17 |

KCB Money Market Fund |

13.6% |

|

18 |

Mali Money Market Fund |

13.4% |

|

19 |

Old Mutual Money Market Fund |

13.2% |

|

20 |

Orient Kasha Money Market Fund |

12.9% |

|

21 |

Dry Associates Money Market Fund |

12.8% |

|

22 |

CIC Money Market Fund |

12.2% |

|

23 |

ICEA Lion Money Market Fund |

12.0% |

|

24 |

Equity Money Market Fund |

11.5% |

|

25 |

British-American Money Market Fund |

10.2% |

Source: Business Daily

Liquidity:

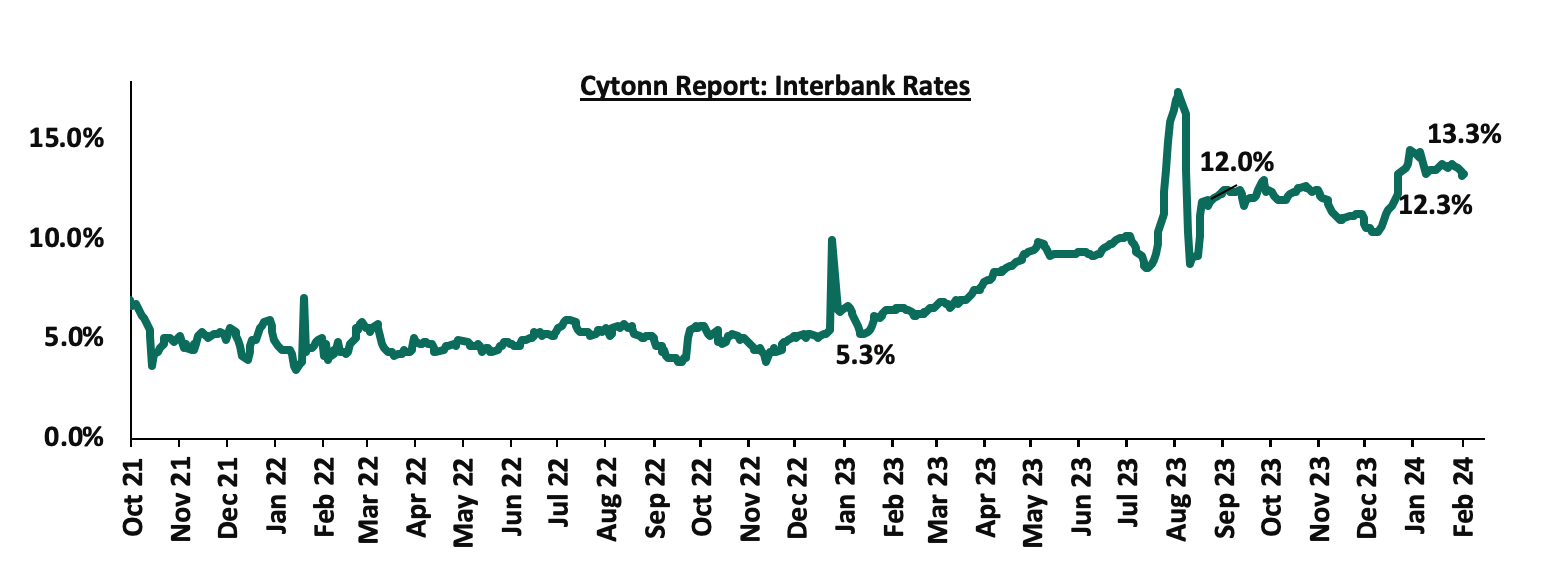

Liquidity in the money markets tightened in the month of January 2024, with the average interbank rate increasing by 2.0% points to 13.7% from 11.7% recorded the previous month. During the month of January, the average interbank volumes traded decreased by 26.5% to Kshs 19.2 bn, from Kshs 26.2 bn recorded in December. Also, during the week, liquidity in the money markets eased, with the average interbank rate decreasing to 13.3%, from 13.6% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 2.2% to Kshs 15.5 bn, from Kshs 15.8 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the month, the yields on the Eurobonds were on an upward trajectory, with the yield on the 7-year Eurobond issued in 2019 increasing the most by 1.1% points to 11.2% from 10.1% recorded at the end of December 2023. Also, during the week, the yields on Eurobonds were on an upward trajectory, with the yield on the 10-year Eurobond issued in 2014 recording the largest increase of 0.3% points to 14.6%, from 14.3%, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 30th November 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.6 |

4.3 |

24.3 |

3.6 |

8.6 |

10.6 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

01-Jan-24 |

13.6% |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

01-Feb-24 |

14.6% |

10.6% |

10.6% |

11.3% |

10.5% |

10.1% |

|

25-Jan-24 |

14.3% |

10.4% |

10.6% |

11.2% |

10.4% |

9.9% |

|

26-Jan-24 |

14.4% |

10.4% |

10.5% |

11.1% |

10.3% |

9.9% |

|

29-Jan-24 |

14.0% |

10.3% |

10.4% |

11.1% |

10.3% |

9.8% |

|

30-Jan-24 |

14.1% |

10.3% |

10.4% |

11.1% |

10.3% |

9.8% |

|

31-Jan-24 |

14.5% |

10.5% |

10.6% |

11.2% |

10.5% |

10.0% |

|

01-Feb-24 |

14.6% |

10.6% |

10.6% |

11.3% |

10.5% |

10.1% |

|

Weekly Change |

0.3% |

0.1% |

0.1% |

0.1% |

0.1% |

0.1% |

|

MoM Change |

0.9% |

0.7% |

0.4% |

1.1% |

0.6% |

0.5% |

|

YTD Change |

1.1% |

0.7% |

0.4% |

1.2% |

0.6% |

0.5% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 2.7% against the US Dollar, to close the month at Kshs 160.8, from Kshs 156.5 recorded at the end of December 2023, partly attributable to the increased US Dollar demand from importers, especially in the oil and energy sectors.

Also, during the week, the Kenya Shilling slightly gained by 0.03% against the US Dollar to close at a relatively unchanged price of Kshs 160.6. from the previous week. On a year-to-date basis, the shilling has depreciated by 2.3% against the US Dollar, adding to the 26.8% depreciation recorded in 2023. We expect the shilling to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

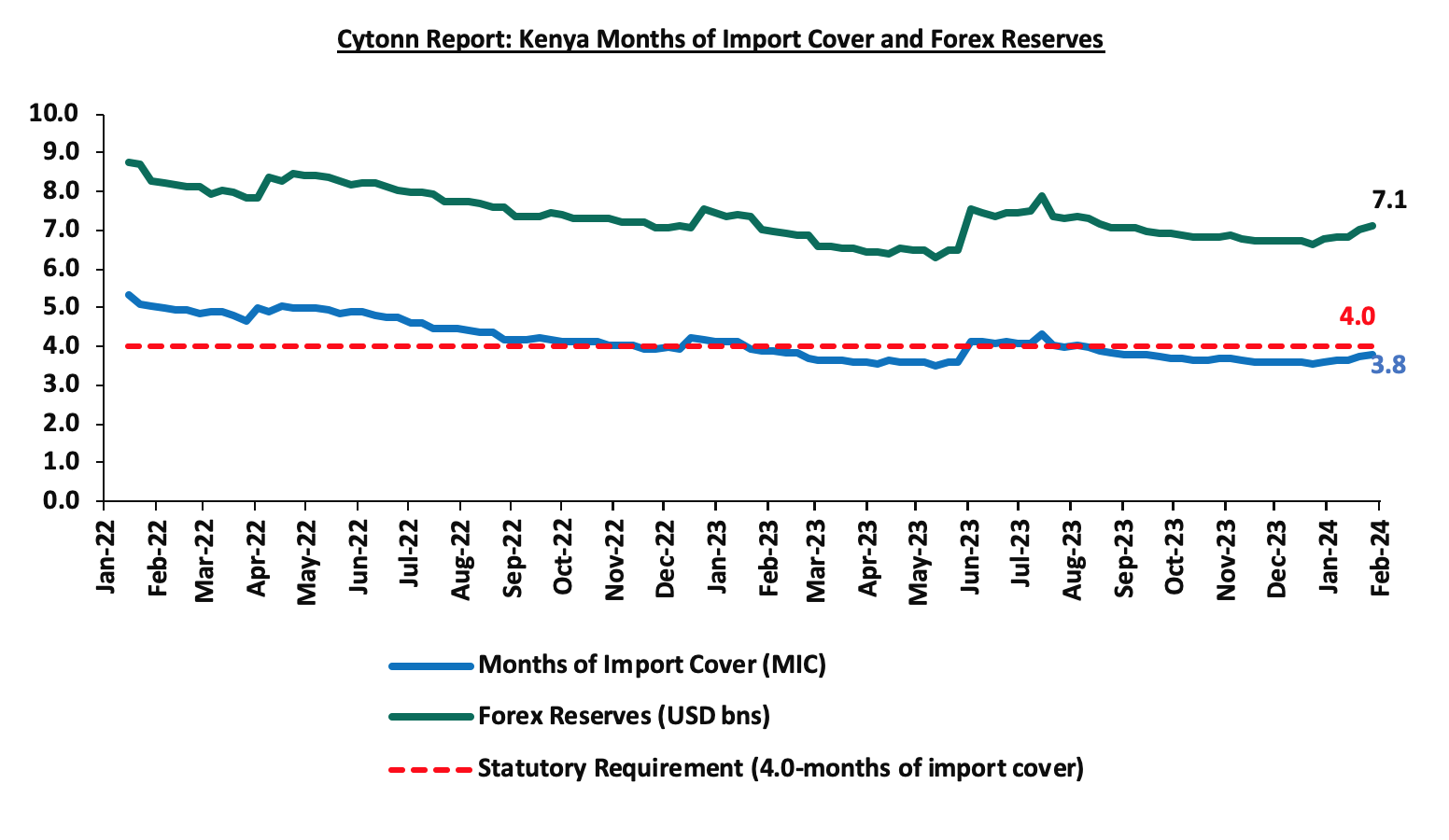

- Dwindling forex reserves, currently at USD 7.0 mn (equivalent to 3.8 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 4,189.9 mn as of December 2023, 4.0% higher than the USD 4,027.9 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the December 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 59.6% in the period, and,

- The tourism inflow receipts which came in at USD 333.9 mn in 2023, a 24.6% increase from USD 268.1 mn inflow receipts recorded in 2022, and tourist arrivals improved by 34.1% in the 12 months to October 2023, compared to a similar period in 2022.

Key to note, Kenya’s forex reserves increased by 1.7% during the week to USD 7.1, from USD 7.0 bn recorded the previous week, equivalent to 3.8 months of import cover, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya’s months of import cover over the years:

Weekly Highlights:

- Inflation:

The y/y inflation in January 2024 increased by 0.3% points to 6.9%, from the 6.6% recorded in December 2023. This was above our projections to within a range of 6.3% to 6.6%. The headline inflation in January 2024 was majorly driven by increase in prices of commodities in the following categories, transport; housing, water, electricity, gas and other fuels, and food and non-alcoholic beverages by 10.6%, 9.7% and 7.9%, respectively. The table below shows a summary of both the year on year and month on month commodity indices performance:

|

Cytonn Report: Major Inflation Changes – 2024 |

|||

|

Broad Commodity Group |

Price change m/m (January-2024/December-2023) |

Price change y/y (January-2024/January-2023) |

Reason |

|

Food and Non-Alcoholic Beverages |

0.4% |

7.9% |

The m/m increase was mainly driven by the increase in prices of commodities such as cabbages, carrots and oranges by 10.0%, 7.4%, and 3.1%, respectively. However, the increase was weighed down by decrease in prices of mangoes, tomatoes and sugar by 3.8%, 3.6%, and 2.2%, respectively. |

|

Housing, Water, Electricity, Gas and Other Fuel |

1.6% |

9.7% |

The m/m performance was mainly driven by the increase in prices of Electricity of 50kWh and 200kWh by 13.7% and 11.4% respectively. However, there was a decrease in the price of a litre of kerosene by 2.4%. |

|

Transport cost |

(0.9%) |

10.6% |

The m/m decrease in transport Index was mainly due to the decline in the prices of a litre of petrol and diesel by 2.3% and 2.5%, respectively. |

|

Overall Inflation |

0.4% |

6.9% |

The m/m increase was mainly supported by the 1.6% increase in housing, water, electricity, gas and other fuels. |

Notably, the overall headline inflation has increased for the first time in three months, however, it has remained within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the seventh consecutive month. The increase in headline inflation in January 2024 comes despite the decline in the Petrol, Diesel and Kerosene prices which decreased by 2.3%, 2.5% and 2.4% to Kshs 208.0, Kshs 197.2 and Kshs 195.0 per litre respectively, for the period between 15th January 2024 to 14th February 2024. The chart below shows the inflation rates for the past 5 years:

We expect the inflationary pressures to remain elevated in the short term, mainly on the back of high fuel prices which despite their decline in January 2024, the prices still remain elevated. With fuel being a major input in most businesses, we expect the high fuel prices to continue contributing to the elevated cost of production consequently elevating prices of commodities. Key to note is that the Monetary Policy Committee raised the Central Bank Rate to 12.50% in December 2023, from the previous 10.50% with the aim of anchoring the inflation rate. Despite the monetary stance, we still believe that the inflationary pressures are mainly due to external shocks and a decline is largely pegged on how soon global supply chains stabilize

Monthly Highlights:

- During the month, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of December 2023 improved slightly, coming in at 48.8, up from 45.8 in November 2023, signalling a modest improvement in operating conditions across Kenya. The services sector registered stronger growth while the Manufacturing and construction sectors are still facing low demand due to the high cost of living. Private sector conditions have now deteriorated for four months running, although the latest decline was the weakest in this sequence. Please see our Cytonn Weekly 01/2024,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2024 to 14th February 2024. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs. 5.0, Kshs. 5.0 and Kshs. 4.8 respectively and will retail at Kshs 207.4, Kshs. 196.5 and Kshs. 194.2 per litre respectively from the December 2023 prices of Kshs. 212.4, Kshs. 201.5 and Kshs. 199.1 respectively. Please see our Cytonn Weekly 02/2024,

- During the month, The Executive Board of the International Monetary Fund (IMF) concluded the 2023 Article IV consultation with Kenya together with the sixth reviews and augmentations of access of USD 941.2 mn (Kshs 151.3 bn) under the Extended Fund Facility (EFF) and the Extended Credit Facility (ECF) arrangements, and the first review under the 20-month Resilience and Sustainability Facility (RSF) arrangement, approved in July 2023. Please see our Cytonn Weekly 03/2024,

- The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2023/2024, ending 29th December 202 Total revenue collected as at the end of December 2023 amounted to Kshs 1,092.1 bn, equivalent to 42.4% of the revised estimates of Kshs 2,576.8 bn for FY’2023/2024 and is 84.8% of the prorated estimates of Kshs 1,288.4 bn. December’s 84.8% attainment of the revenue target is a 2.6%-points improvement from the performance in November where the government achieved 82.2% of the revenue targets. This improvement can be attributed to the improved business environment evidenced by the increase in the Purchasing Manager’s Index which came in at 48.8, up from 45.8 in November 2023. Please see our Cytonn Weekly 03/2024, and,

- During the week, Ivory Coast (Côte d’Ivoire) became the first Sub-Saharan Africa (SSA) country to tap into the international capital markets, issuing two bonds with respective maturities of 8.5 years and 12.5 years, maturing on 30th January 2033 and 30th January 2037 respectively. This was the first issue in the SSA region since 2022, when rising global interest rates and geopolitical tensions made foreign currency debt prohibitively expensive for most African borrowers. Notably, the sovereign raised a total of USD 2.6 bn from the two tranches, with the two issues recording an oversubscription of over USD 8.0 bn. The coupon rates for the 8.5-year (maturity 2033) and the 12.5-year (maturity 2037) were fixed at 7.625% and 8.250% respectively, with the coupons being payable semi-annually in arrears. Please see our Cytonn Weekly #04/2024.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 40.9% behind of its prorated net domestic borrowing target of Kshs 283.6. bn, having a net borrowing position of Kshs 167.7 bn of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to reclaim a fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the month of January 2024, the equities market was on an upward trajectory, with NSE 25 gaining the most by 1.2%, while NSE 10, NSE 20, and NASI gained by 1.1%, 0.5% and 0.1% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Equity Group, Bamburi, and DTBK of 12.9%, 12.3%, and 9.9% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as KCB Group, EABL, and NCBA of 8.2%, 7.0%, and 3.5% respectively.

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 2.8%, while NSE 25, NASI, and NSE 20 gained by 2.3%, 2.2%, and 1.0% respectively. The equities market performance was driven by gains recorded by large-cap stocks such as DTBK, EABL, and Safaricom of 9.4%, 8.6%, and 3.1% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as Bamburi and BAT of 3.6% and 0.1% respectively.

Equities turnover decreased by 21.2% in the month of January to USD 16.8 mn, from USD 21.3 mn recorded in December 2023. Foreign investors remained net sellers, with a net selling position of USD 1.2 mn, from a net selling position of USD 8.4 mn recorded in December 2023.

During the week, equities turnover increased by 53.0% to USD 5.2 mn from USD 3.4 mn recorded the previous week, taking the YTD total turnover to USD 18.3 mn. Foreign investors remained net sellers for the fourth consecutive week with a net selling position of USD 0.1 mn, from a net selling position of USD 0.5 mn recorded the previous week, taking the YTD foreign net selling position to USD 1.1 mn.

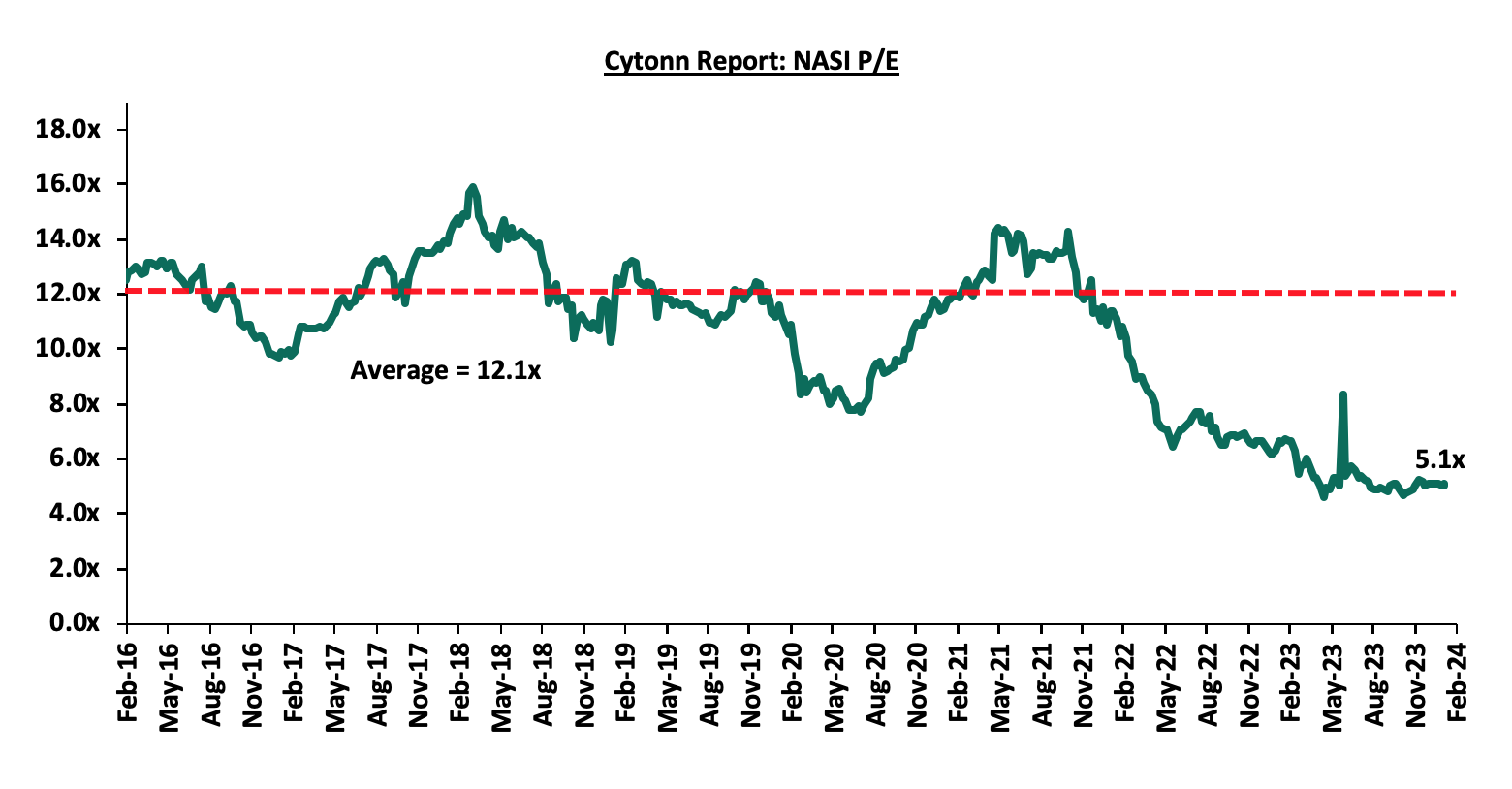

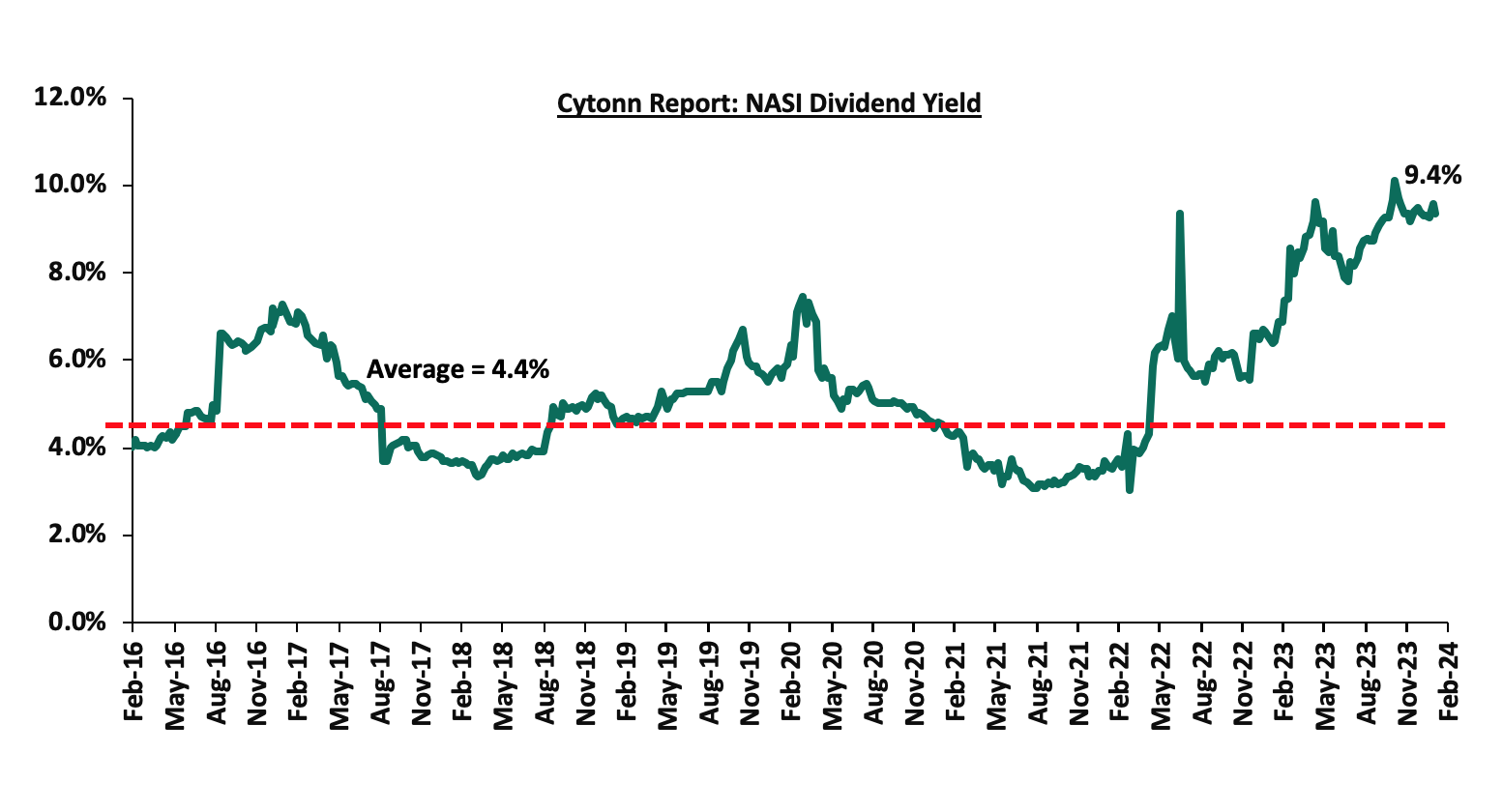

The market is currently trading at a price-to-earnings ratio (P/E) of 5.1x, 58.0% below the historical average of 12.1x. The dividend yield stands at 9.4%, 5.0% points above the historical average of 4.4%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||||

|

Company |

Price as at 26/01/2024 |

Price as at 02/02/2024 |

w/w change |

m/m change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

20.4 |

20.4 |

0.0% |

(8.2%) |

(7.1%) |

22.0 |

31.2 |

9.8% |

62.7% |

0.4x |

Buy |

|

Sanlam |

7.0 |

6.3 |

(7.6%) |

17.0% |

5.7% |

6.0 |

10.3 |

0.0% |

62.3% |

1.8x |

Buy |

|

Jubilee Holdings |

180.8 |

180.3 |

(4.9%) |

(2.2%) |

(2.6%) |

185.0 |

260.7 |

6.7% |

51.3% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.9 |

(2.7%) |

(3.2%) |

0.5% |

1.9 |

2.5 |

10.8% |

45.7% |

0.1x |

Buy |

|

NCBA*** |

37.2 |

37.7 |

(2.2%) |

(3.5%) |

(3.0%) |

38.9 |

48.3 |

11.3% |

39.4% |

0.8x |

Buy |

|

I&M Group*** |

17.5 |

17.5 |

0.0% |

0.0% |

0.3% |

17.5 |

22.1 |

12.9% |

39.1% |

0.4x |

Buy |

|

ABSA Bank*** |

11.7 |

11.9 |

1.3% |

2.2% |

2.6% |

11.6 |

14.6 |

11.4% |

34.6% |

1.0x |

Buy |

|

Stanbic Holdings |

110.0 |

110.0 |

0.0% |

1.1% |

3.8% |

106.0 |

132.8 |

11.5% |

32.2% |

0.8x |

Buy |

|

Diamond Trust Bank*** |

44.8 |

49.0 |

0.0% |

9.9% |

9.4% |

44.8 |

58.5 |

10.2% |

29.7% |

0.2x |

Buy |

|

CIC Group |

2.0 |

2.0 |

(5.2%) |

(11.2%) |

(10.9%) |

2.3 |

2.5 |

6.4% |

28.9% |

0.6x |

Buy |

|

Standard Chartered*** |

160.3 |

162.5 |

(2.3%) |

0.2% |

1.4% |

160.3 |

185.5 |

13.5% |

27.7% |

1.1x |

Buy |

|

Co-op Bank*** |

12.0 |

12.0 |

5.7% |

6.1% |

5.7% |

11.4 |

13.8 |

12.5% |

27.5% |

0.6x |

Buy |

|

Equity Group*** |

37.1 |

38.2 |

1.6% |

12.9% |

11.5% |

34.2 |

42.8 |

10.5% |

22.7% |

0.8x |

Buy |

|

Britam |

5.1 |

5.0 |

(7.3%) |

10.6% |

(2.7%) |

5.1 |

6.0 |

0.0% |

19.4% |

0.7x |

Accumulate |

|

Liberty Holdings |

5.1 |

5.3 |

(1.9%) |

35.5% |

37.3% |

3.9 |

5.9 |

0.0% |

11.7% |

0.4x |

Accumulate |

|

HF Group |

3.6 |

3.5 |

(2.4%) |

7.8% |

2.3% |

3.5 |

3.9 |

0.0% |

10.5% |

0.2x |

Accumulate |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||||

Monthly Highlights:

- East African Breweries Plc (EABL) H1’2024 Financial Performance

During the month, East African Breweries Plc (EABL) released their H1’2024 financial results for the period ending 31st December 2023, recording a 22.1% decline in the Profits After Tax (PAT) to Kshs 6.8 bn in H1’2024, from Kshs 8.7 bn in H1’2023. The decline was mainly attributable to a 10.8% increase in Indirect Taxes to Kshs 52.5 bn in H1’2024, from Kshs 47.4 bn in H1’2023, coupled with the 36.6% increase in operating costs to Kshs 15.5 bn, from Kshs 11.3 bn in H1’2023 that offset the 13.8% growth in Gross Sales to Kshs 119.1 bn in H1'2024 from Kshs 104 bn in H1'2023. For more details, please see our Cytonn Weekly #04/2024.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued to its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investor sell-offs to continue weighing down the equities outlook in the short term.

- Industry Reports

During the month, the following industry reports were released and the key take-outs were as follows;

|

Cytonn Report: Notable Industry Reports During the Month of January 2024 |

|||

|

# |

Theme |

Report |

Key Take-outs |

|

1

|

Hospitality and Construction Sectors |

The Leading Economic Indicators (LEI) November 2023 Report by National Bureau of Statistics (KNBS) |

|

|

2 |

Real Estate, Hospitality and Building and Construction sectors |

The Quarterly Economic Review Q3’2023 Report by the Central Bank of Kenya (CBK) |

|

Going forward, we anticipate positive growth and enhanced performance in Kenya's Real Estate sector. This optimistic outlook is primarily fueled by an increasing influx of visitors to the country, contributing to improved metrics in the hospitality industry, including higher room and bed occupancies. Additionally, there is expected to be sustained demand for Real Estate development. Nevertheless, challenges are foreseen in the form of escalated construction costs, attributed to the rise in inflation and more stringent lending prerequisites imposed on developers due to elevated credit risk. Financial institutions, notably banks, are likely to insist on greater collateral due to perceived credit risks within the Real Estate sector. This could impede the sector's optimal performance. Indications of such challenges are evident in the 2.0% surge in gross Non-Performing Loans (NPLs) within the Real Estate sector reported by banks, rising from Kshs 96.0 bn in Q2’2022 to Kshs 97.9 bn in Q3’2023.

- Residential Sector

- Superior Homes signed a partnership deal with Absa Kenya

During the week, Superior Homes, a leading master-planned real estate developer in Kenya and East Africa, signed a partnership deal with Absa Bank Kenya. The partnership aims to provide 90.0% mortgage financing to buyers with a repayment period of up to 25 years for those seeking to purchase housing units at Pazuri, a holiday homes development located at Vipingo in Kilifi County. Additionally, the deal seeks to create an opportunity for mutual cross-marketing between the two entities. The agreement will be instrumental in helping the country address the current housing deficit. According to the Central Bank of Kenya's (CBK) Annual Bank Supervision 2022 Report, Kenya faces an annual deficit of 200,000 units, while both private developers and government deliver only 50,000 units annually, with low-income groups allocated a mere 2.0% of the constructed units.

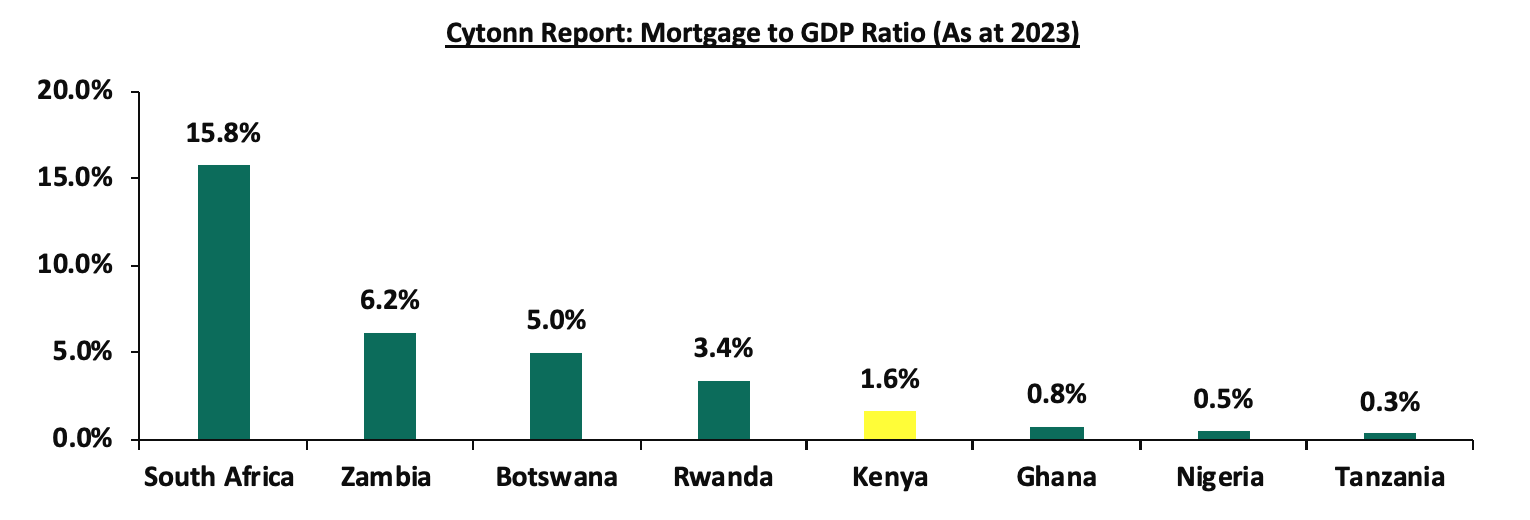

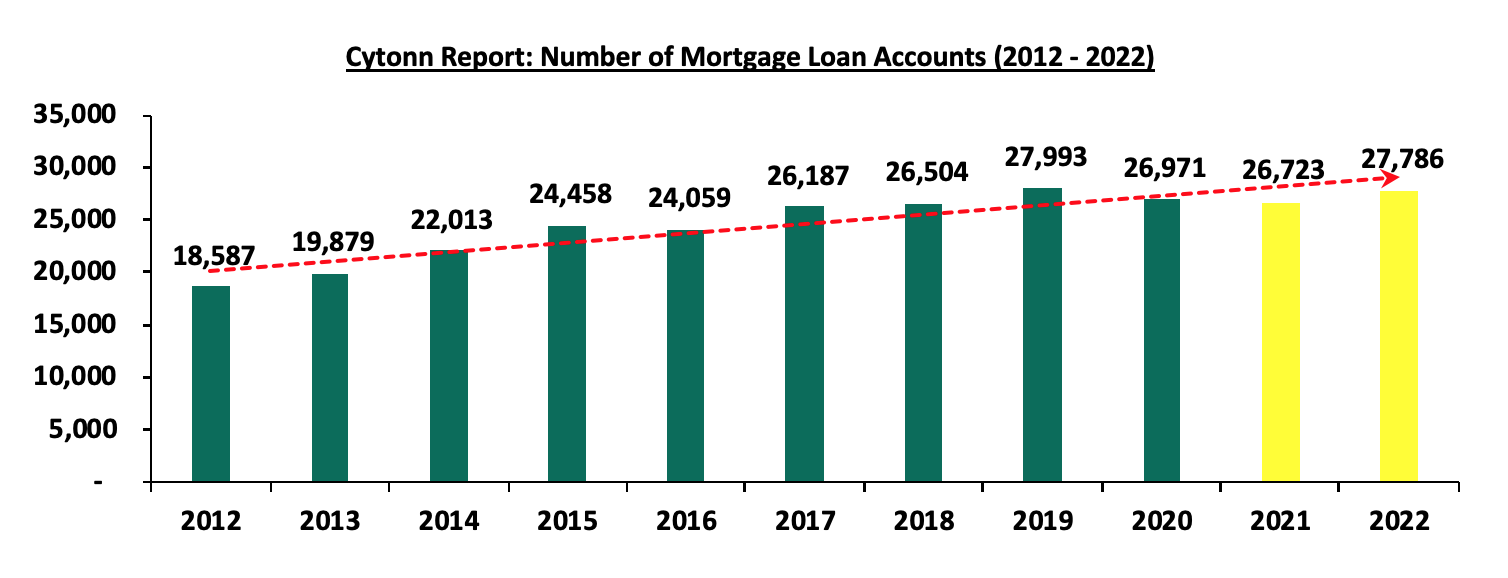

With a long-term repayment period, the deal will play a pivotal role in addressing the homeownership challenge in the country. The deal also comes at a time when the Kenyan mortgage market is severely underperforming. To put this into context, according to CBK, the number of outstanding mortgage loan accounts stands at merely 27,786 loans against an estimated annual housing deficit of 200,000 units. Consequently, Kenya’s mortgage to GDP ratio remains low, coming in at 1.6%, significantly lower than other African countries such as South Africa, Zambia, Botswana, and Rwanda at approximately 15.8%, 6.2%, 5.0%, and 3.4% respectively. The graph below shows the mortgage to GDP ratio in Kenya in comparison with other African countries;

Source: Centre of Affordable Housing Africa

The graph below shows the number of mortgage loan accounts from 2012 to 2022, and highlights the growth before and after the Kenya Mortgage Refinance Company (KMRC) came into effect in 2021;

Source: Central Bank of Kenya (CBK)

According to the Annual Bank Supervision 2022 Report, the challenges dampening the mortgage markets include a low level of income, limited access to affordable long-term finance, and a high cost of property purchase. This deal will supplement other government led initiatives aimed at providing long-term and affordable mortgage loans to Kenyans, such as the Kenya Mortgage Refinance Company (KMRC) and the National Housing Corporation (NHC).

Going forward, we expect to witness more development activities from both private entities and government in the residential sector, driven by the surge in demand for housing. This demand is evidenced by relatively higher urbanization and population growth rates at at 3.7% p.a and 1.9% p.a, respectively.

- President Ruto laid the foundation of Kanduyi Affordable Housing Project in Bungoma County

During the week, President Ruto laid the foundation of Kanduyi Affordable Housing Project in Bungoma County. The project aims to develop 320 housing units, integrating social, affordable, and market-rate housing units. The units will be distributed as follows: 60 social housing units, 160 affordable housing units, and 100 market-rate units. Additionally, the project will incorporate commercial space with 64 small shops. The project aims to directly employ 960 youths and indirectly contribute to the creation of 2,500 jobs, injecting Kshs 295.0 mn into the local economy. Local artisans from the Jua Kali industry will be engaged to deliver doors and windows with an estimated value of Kshs 35.2 mn. The tables below provide a summary of the unit types, sizes, and prices for social housing, affordable housing, and market-rate units, respectively;

|

Cytonn Report: Kanduyi Affordable Housing Project - Social Housing |

||||

|

Typology |

Size (SQM) |

Price (Kshs in mns) |

Price per SQM |

Monthly Payment |

|

1-bedroom |

20 |

0.8 |

42,000 |

3,200 |

|

2-bedroom |

30 |

1.3 |

42,000 |

4,800 |

|

3-bedroom |

40 |

1.7 |

42,000 |

6,400 |

|

Average |

30 |

1.3 |

42,000 |

4,800 |

Source: Online Research

|

Cytonn Report: Kanduyi Affordable Housing Project - Affordable Housing |

||||

|

Typology |

Size (SQM) |

Price (Kshs in mns) |

Price per SQM |

Monthly Payment |

|

Studio |

20 |

0.8 |

48,000 |

3,200 |

|

2-bedroom |

40 |

1.7 |

42,000 |

4,800 |

|

3-bedroom |

60 |

1.9 |

32,000 |

6,400 |

|

Average |

40 |

1.5 |

40,667 |

4,800 |

Source: Online Research

|

Cytonn Report: Kanduyi Affordable Housing Project - Market Rate Housing |

||||

|

Typology |

Size (SQM) |

Price (Kshs in mns) |

Price per SQM |

Monthly Payment |

|

2-bedroom |

60 |

4.3 |

72,000 |

4,800 |

|

3-bedroom |

80 |

5.8 |

72,000 |

6,400 |

|

Average |

70 |

5.1 |

72000 |

5,600 |

Source: Online Research

Going forward we expect the government to continue implementing its Affordable Housing Agenda in different counties guided by its Bottom-Up Economic Transformation Agenda (BETA) which aims at delivering 250,000 housing units annually. This project will help curb the housing shortage, create employment opportunities, stimulate economic activities and improve livelihoods. Notable highlights in the sector during the month include;

- The World Bank launched Pand Pier and Jiw Dendi slum upgrading projects aimed at benefitting residents in the two informal settlements in Migori County. The projects form part of World Bank’s initiative dubbed ‘Kenya Informal Settlement Project (KISIP)’ which envisages improving living conditions in the informal settlements in the selected areas. Additionally, President William Ruto launched the construction of the Timau affordable housing project. This ambitious project, situated in Buuri, Meru County, aims to deliver 320 housing units, contributing not only to the region's housing needs but also making substantial economic impact. For more information, please see our Cytonn 2024 Markets Outlook,

- President Ruto laid the foundation stone for the Emgwen Affordable Housing Project in Chesumei Sub-County, Nandi County. The project will comprise 220 units incorporating studio, one, two, and three-bedroom typologies, a well-designed landscape, adequate parking, an underground tank, and pavement for pedestrian use. For more information, please see our Cytonn Weekly #03/2024, and,

- President Ruto launched the Pioneer Affordable Housing project located in Uasin Gishu County. The project will comprise 1,506 housing units incorporating one, two and three-bedroom typologies, a kindergarten, mixed-use commercial spaces, a social hall, and extensive supportive infrastructure including sewer and water infrastructure. Additionally, the President launched the Kapsuswa Affordable Housing Project, also located in Uasin Gishu County. The project will sit on a 3.2-acre piece of land and aims at developing 220 housing units consisting of 60 studio apartments, 40 one-bedroom units, 100 two-bedroom units, and 20 three-bedroom units. In Laikipia County, President Ruto laid the foundation for the construction of 200 housing situated on a 2.5-piece acre of land under the Nanyuki Affordable Housing project. Furthermore, Kilifi County government, in partnership with the National government identified 11 sites for the construction of affordable housing units. The government plans to build two mini-cities in the coastal region, and has identified Mtwapa and Mariakani as suitable locations on which it intends to build 10,000 housing units. For more information, please see our Cytonn Weekly #02/2024.

We expect increased completions and the initiation of more affordable housing projects, reflecting the government's commitment to address the substantial 80.0% annual housing deficit. We also expect an uptick in the involvement of institutional investors in the affordable housing sector, traditionally overshadowed by mid to high-end developments. Furthermore, a continued rise in the popularity of Mixed-Use Developments (MUDs) is foreseen, both within Kenya and globally. This trend is attributed to the diverse amenities and social offerings that MUDs provide, aligning with the evolving preferences of modern homebuyers who seek value beyond the residential unit. However, challenges persist in Kenya's housing sector, marked by the prohibitive cost of financing and the escalating expenses in construction. These challenges contribute to elevated development costs, posing obstacles for individuals aspiring to afford homes.

- Retail Sector

During the week, local retailer and budget supermarket chain Jaza opened two outlets, bringing its total number of stores countrywide to 6. The newly opened outlets are located in Chokaa in Embakasi and Gachie in Kiambu respectively. Additionally, the retailer launched an e-commerce channel, allowing customers to order goods virtually from their homes, offices, and businesses. Jaza was launched in December 2023 with four stores in Mihango Utawala area, Kayole Soweto, Buruburu, and Githurai 44. The retailer capitalizes on friendly prices as one of its competitive advantages. This launch comes a week after the global retailer Panda Mart and Naivas Supermarket opened new outlets in Nairobi. Jaza focuses on aligning itself with the evolving market needs, allowing purchases to be made online via WhatsApp. The following table outlines the current store counts of major local and international supermarket chains operating in Kenya and international supermarket chains operating in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

||||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches as at FY’2023 |

Branches opened in FY’2024 |

Closed Branches |

Current Branches |

|

Naivas |

Hybrid* |

46 |

61 |

69 |

79 |

91 |

100 |

2 |

0 |

102 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

59 |

0 |

0 |

59 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

26 |

0 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

22 |

0 |

0 |

22 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

13 |

0 |

0 |

13 |

|

Jaza Stores |

Local |

0 |

0 |

0 |

0 |

0 |

4 |

2 |

0 |

6 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

5 |

0 |

59 |

5 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

2 |

0 |

35 |

2 |

|

Panda Mart |

International |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

1 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

0 |

3 |

0 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

0 |

15 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

0 |

4 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

0 |

65 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

22 |

5 |

181 |

236 |

|

*51% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

||||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

||||||||||

Source: Cytonn Research

Notable highlight during the month includes;

- Naivas Supermarket opened its latest outlet located at Mwanzi Road in Westlands, Nairobi. This new addition brings the retailer's total number of outlets in the country to 102. The outlet is strategically positioned, with close proximity to Westgate Mall, and comes a month after the retailer opened its 101st outlet in Kakamega County. For more information, please see our Cytonn 2024 Markets Outlook, and,

- Global retailer Panda Mart opened its first outlet in Kenya at Garden City Mall in Nairobi. The retailer invested about USD 7.0 mn (Kshs 1.1 bn) to set up the outlet, acquiring 8,956 SQM within the mall. For more information, please see our Cytonn 2024 Markets Outlook.

Going forward, we expect to continue witnessing more retailers implementing aggressive expansion strategies. These strategies aim to capitalize on opportunities created by the vacancies left by prominent retailers like Uchumi, Shoprite, Game Stores, and Choppies supermarkets. Furthermore, we foresee the retail sector's positive performance being bolstered by a surge in foreign investments entering the Kenyan retail market.

- Infrastructure Sector

During the week, Kenya National Highways Authority (KeNHA) finalized an agreement with the Japan International Cooperation Agency (JICA) for the construction of the Mombasa Gate Bridge project. Subsequently, construction of the 1.4 Km bridge project linking Mombasa Island and South Coast, valued at Kshs 47.0 bn is set to begin. The cable-powered bridge will encompass four traffic lanes and will be 69 metres high at midpoint thus allowing the passage of ships underneath it. The Mombasa Gate bridge will replace the old ferries as the main means of crossing at the Likoni channel.

The project is planned to conclude in 36 months from the commencement of the project. Financing for the project was already approved last week during a delegation meeting between Kenya and Japan. Initially set to take off in June 2021 and to be completed this year, the project was delayed due to compensation challenges.

We note that the project will be pivotal in addressing the challenges associated with frequent ferry breakdowns and congestion which have remained a major hurdle at the crossing over the years. Additionally, the project is set boost tourism in the Coastal region by facilitating the seamless movement of motorists ferrying tourists across the two areas, thus positioning the region as major investment hub and boost the area’s economy through the creation of an estimated 80,000 jobs. Notably, the second phase of the Dongo Kundu Bypass project is also expected to be completed and opened to the public during the year. With the delivery of the two above projects, ferries operating at the Likoni channel will be rendered obsolete. The Dongo Kundu Bypass will act as a link between Mombasa and Kwale Counties connecting Port-Reitz areas with Kwale mainland areas via the Mteza bridge thus eliminating the need for tourists to cross the Likoni channel to access Kwale County.

We expect to continue witnessing the government completing major development and rehabilitation projects including roads, bridges, railways, and airports among others in its agenda to increase infrastructure connectivity in the country. In support of this, according to the Draft 2024 Budget Policy Statement, the government’s allocation to the Infrastructure, Energy, and ICT sectors for the FY'2024/2025 is forecasted to increase by 8.0% to Kshs 505.7 bn from Kshs 468.2 bn FY'2023/2024.

Notable highlights during the month include;

- President William Ruto launched road construction projects spanning 43.2 kilometers in Meru County. This strategic endeavor, including the upgrading of key routes like Kwa Mumero-Kithithina Primary-Mia Moja, Timau-Rugirando-Ngusishi, and Makutano-X Lewa-Mbuju-Ngare Ndare to Bitumen standards, was unveiled during the President's three-day state tour of the region. For more information, please see our Cytonn 2024 Markets Outlook, and,

- President Ruto launched several road projects, including Lamuria-Solio-Kihara primary school road, in Laikipia County and Boiman-Kwa-Mumbi Road in Nyandarua County. President Ruto highlighted that the two projects will cover over 400-Kilometres and are poised to boost the agricultural sector in the region. For more information, please see our Cytonn Weekly #02/2024.

Moving forward, we anticipate increased completions of development, maintenance and rehabilitation projects as the government endeavours to enhance the nation's infrastructure. However, it is worth noting that there might be a potential deceleration in the initiation and completion of construction and maintenance projects within Kenya's infrastructure sector, especially in the roads category. This slowdown is attributed to an 8.0% decrease in budget allocations in the FY’2023/24 to Kshs 230.1 bn from Kshs 250.8 bn in FY’2022/23.

- Statutory Review

During the week, a new directive mandating all operators of short-term accommodation rentals, including Airbnb hosts, to register with the Tourism Regulatory Authority (TRA) was issued. The purpose of this registration is to ensure that all accommodations adhere to the highest standards of security for guests. This measure has been implemented in response to resident safety concerns arising from the increased cases of homicides occurring in Airbnbs in the country.

In addition, the Private Security Regulatory Authority (PSRA) has enforced stringent safety protocols to enhance accountability and security within short-term rentals. Moving forward, security guards will now legally be required to record the identification details of all individuals entering these premises, documenting their entry and exit times. Furthermore, operators of short-term accommodation rentals must install CCTV surveillance systems and ensuree that all footage is regularly updated.

Commencing next week, the TRA and National Government Administrative Officers (NGAO) will jointly embark on strict inspections of all registered properties. Moreover, these entities will collaborate with booking platforms to restrict unregistered properties, imposing penalties such as fines and revocation in cases of non-compliance. Last year, the Ministry of Tourism noted that only 10.0% of all listed homes had registered with the tourism fund. The move to register all short-term rentals will support Tourism Fund by collection 2.0% under tourism levy stipulated by Tourism Act, 2011 Cap.383, Section 105.

The implementation of these regulations will be pivotal especially in improving security in the short-term rental businesses which is steadily growing attributable by the changing consumer behavior where guests are more inclined towards short-term rentals than traditional hotels. In addition, the regulations will help the government consolidate more funds under Tourism Funds when more businesses comply with the tourism levy.

- Regulated Real Estate Funds

- Real Estate Investments Trusts (REITs)

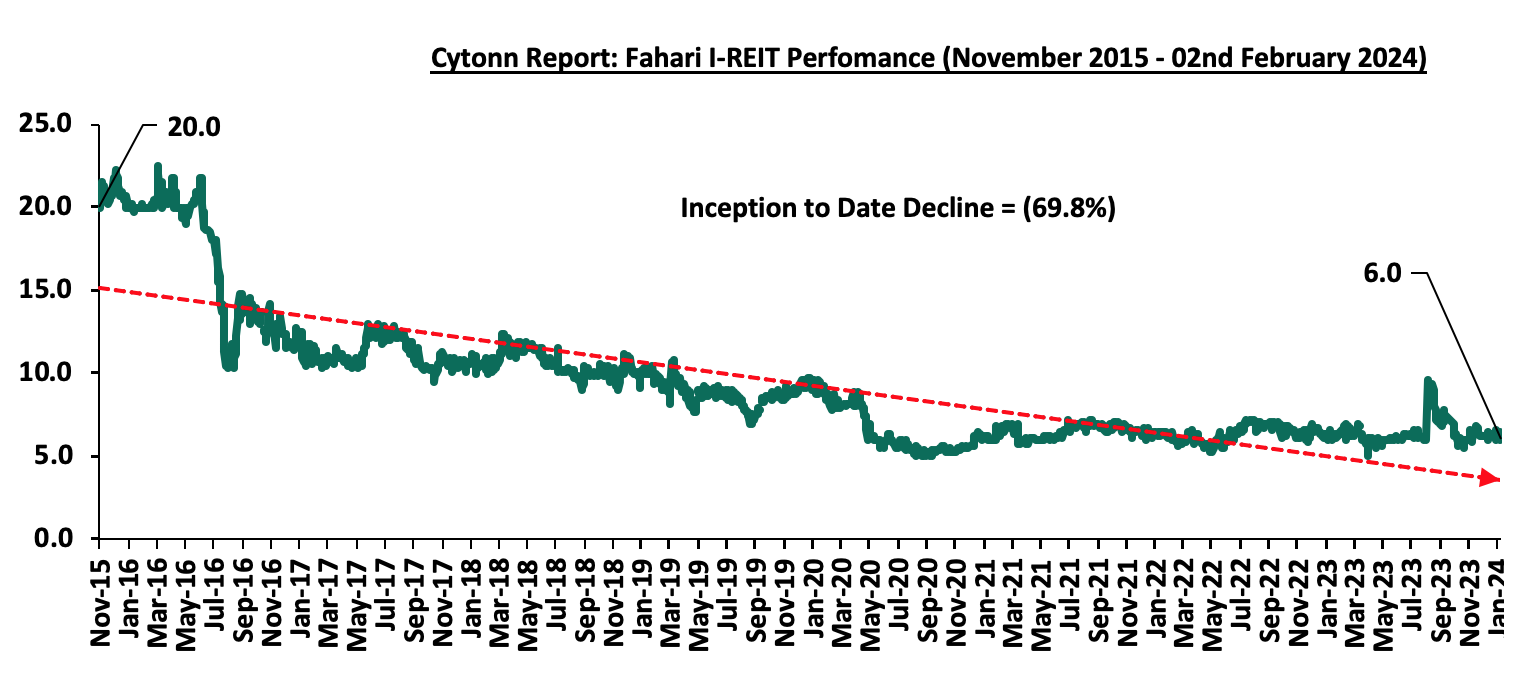

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.0 per share. The performance represents a 4.1% decline from Kshs 6.3 per share recorded last week. The performance represents a 4.1% Year-to-Date (YTD) loss from Kshs 6.3 per share recorded on 2 January 2024, taking it to a 69.8% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.8%. The graph below shows Fahari I-REIT’s performance from November 2015 to 2nd February 2024;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 2nd February 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

- Cytonn High Yield Fund (CHYF)

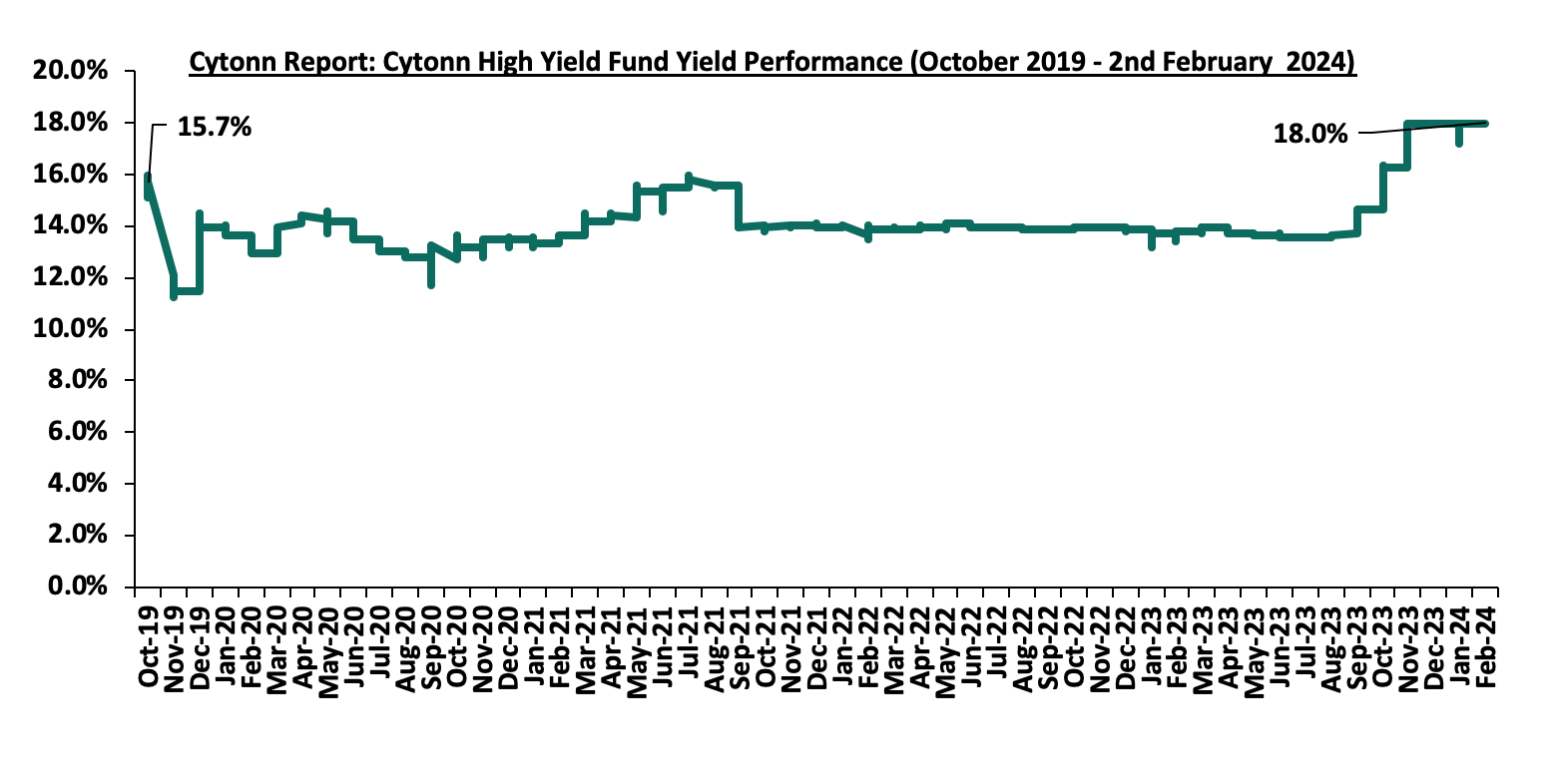

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, representing a 0.8%points increase from the 17.2% recorded the previous week. The performance remained relatively unchanged from the price recorded on 1st January 2024, and represents a 2.3% Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 2nd February 2024;

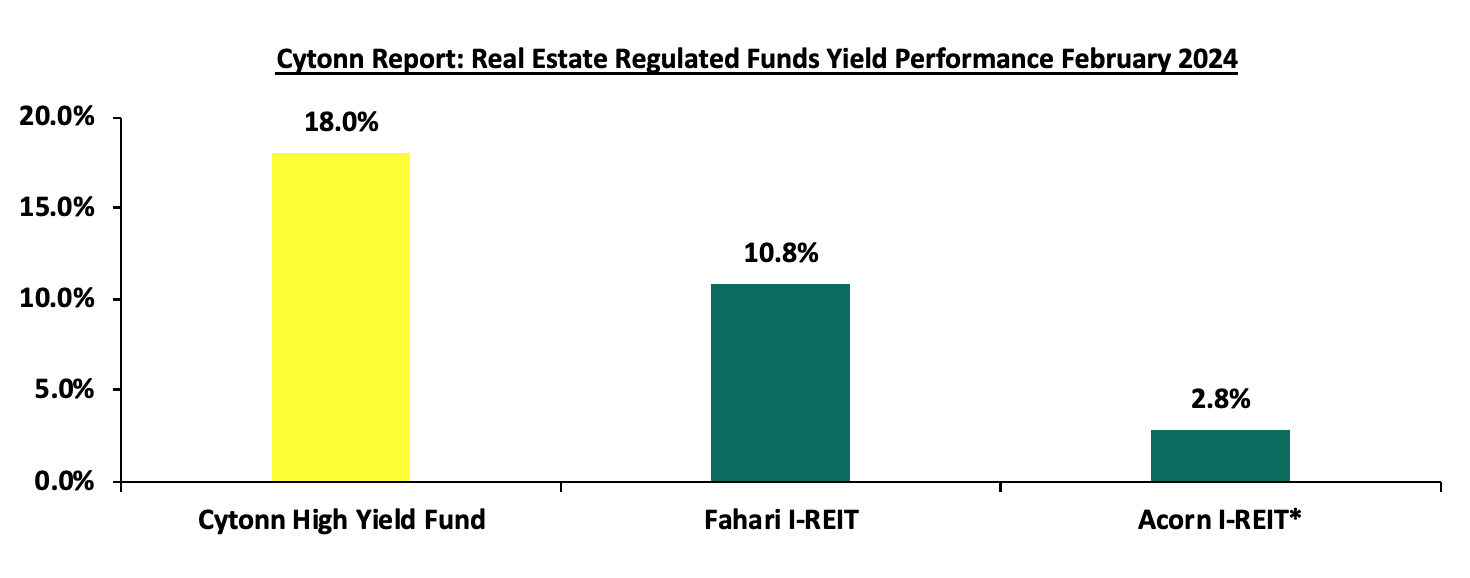

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 18.0%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.8%, and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

*H1’2023

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate sector to remain resilient, supported by factors such as; i) increased launch and completions of affordable housing projects in line with the government’s affordable housing agenda, ii) focus on mortgage financing through initiatives like the KMRC and mortgage partnerships between developers and banks, iii) relatively positive demographics in the country increasing demand for housing and Real Estate, iv) the increasing number of visitor arrivals into the country, , and, v) increased foreign investments into the country positioning Kenya as a regional hub. However, factors such as; i) rising costs of construction, ii) existing oversupply in select Real Estate sectors, and, iii) limited investor knowledge in REITs will continue to hinder optimal performance of the sector by limiting developments and investments.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.