Cytonn Monthly – May 2018

By Cytonn Research Team, Jun 3, 2018

Executive Summary

Fixed Income

During the month of May, T-bill auctions were oversubscribed, with the average subscription rate coming in at 167.5%, up from 103.1%, recorded in April, with increased interest in the 364-day paper as investors sought to lengthen duration. The yields on the 91 and 182-day papers declined by 10 bps each to 7.9% and 10.2% from 8.0% and 10.3%, respectively, while the yield on the 364-day paper remained unchanged at 11.1% during the month. The MPC met on 28th May and maintained the Central Bank Rate (CBR) at 9.5% in line with our expectations, noting that the impact of the 50 bps reduction in March had not yet been fully transmitted to the economy;

Equities

During the month of May, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.9%, 10.8% and 3.7%, respectively, taking their YTD performance as at the end of May to 0.8%, (10.8%) and 1.9% for NASI, NSE 20 and NSE 25, respectively. Listed banks released their Q1’2018 financial results, with the core earnings per share rising by an average of 14.4% y/y compared to an 8.6% decline for the same period last year;

Private Equity

During the month of May, we witnessed increased private equity activity in the financial services, hospitality, fintech and education sectors. In the financial services sector, we witnessed a capital injection in the form of a share subscription in Sanlam General. In the global hospitality sector, AccorHotels, a French multinational hotel group, signed an agreement to acquire a 100.0% stake of Mövenpick Hotels & Resorts. In the Fintech space, digital financial services companies Lidya and Cellulant both raised capital through Series A and Series C funding, respectively, and in the education sector, One Thousand & One Voices (1K1V) invested an undisclosed amount in Higher Ed Partners South Africa (HEPSA), a South African based online education company;

Real Estate

During the month, the real estate sector experienced increased activity across all the themes as follows; (i) In residential, Erdemann Property Ltd and Cool Breeze Development Limited, announced plans to develop 1,632 housing units in Ngara and 524 units along Mombasa Road in Nairobi County, while United Bank of Africa in partnership with National Housing Corporation announced plans to develop 1,000 affordable housing units in Kakamega County, (ii) In the commercial theme, Federation of Kenya Employers (FKE) announced plans to build an 8-storey office building in Upper Hill, and (iii) In Land, Fusion Capital partnered with Optiven Limited to subdivide and sell a 100-acre land parcel - Amani Ridge in Ruiru, Kiambu County.

- Cytonn Education Services (CES), Cytonn Investment’s education services affiliate, will be hosting a media briefing on Monday 4th June, 2018 on 6th Floor, Queensway House, Kaunda Street, Nairobi CBD, to introduce CES and Cytonn College of Innovation and Entrepreneurship (CCIE), ahead of the official opening of CCIE later this year

- Our Cytonn Technologies Business Manager, Daniel Mainye, discussed the effects of corruption on the economy. Watch Daniel on NTV here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Quality Control and Assurance Manager & Associate, Sales & Marketing Manager, Procurement Manager, Portfolio Manager and Investments Associate – Public Markets, among others. Visit the Careers section on our website to apply

T-Bills & T-Bonds Primary Auction Results:

During the month of May, T-bill auctions recorded an oversubscription, with the average subscription rate coming in at 167.5%, up from 103.1%, recorded in April. The subscription rates for the 91, 182 and 364-day papers came in at 130.2%, 117.8% and 232.0%, from 63.6%, 94.8% and 127.2%, the previous month, respectively. The yields on the 91 and 182-day papers declined by 10 bps each to 7.9% and 10.2% from 8.0% and 10.3%, respectively, while the yield on the 364-day paper remained unchanged at 11.1% during the month. The T-bills acceptance rate came in at 81.8% during the month, compared to 90.0% in April, with the Kenyan government accepting a total of Kshs 131.2 bn of the Kshs 160.8 bn worth of bids received, against the Kshs 96.0 bn on offer, indicating that bids were largely within ranges the Central Bank of Kenya (CBK) deemed acceptable. The government is currently ahead of its domestic borrowing target for the current fiscal year, having borrowed Kshs 374.1 bn, against a target of Kshs 274.7 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

T-bills were oversubscribed during the week, with the subscription rate coming in at 186.1% up from 184.2%, the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 230.0%, 117.1%, and 237.6% compared to 194.6%, 117.6%, and 246.7%, respectively, the previous week. Yields on the 91, 182-day and 364-day papers remained unchanged at 7.9%, 10.2% and 11.1%, respectively. The acceptance rate for T-bills declined to 47.7% from 85.4%, the previous week, with the government accepting a total of Kshs 21.3 bn of the Kshs 44.7 bn worth of bids received, against the Kshs 24.0 bn on offer. According to the CBK, the government has reduced its borrowing appetite as it is ahead of its domestic borrowing target for the current fiscal year, and will only borrow to redeem maturing debt in coming weeks, hence the low acceptance rate this week.

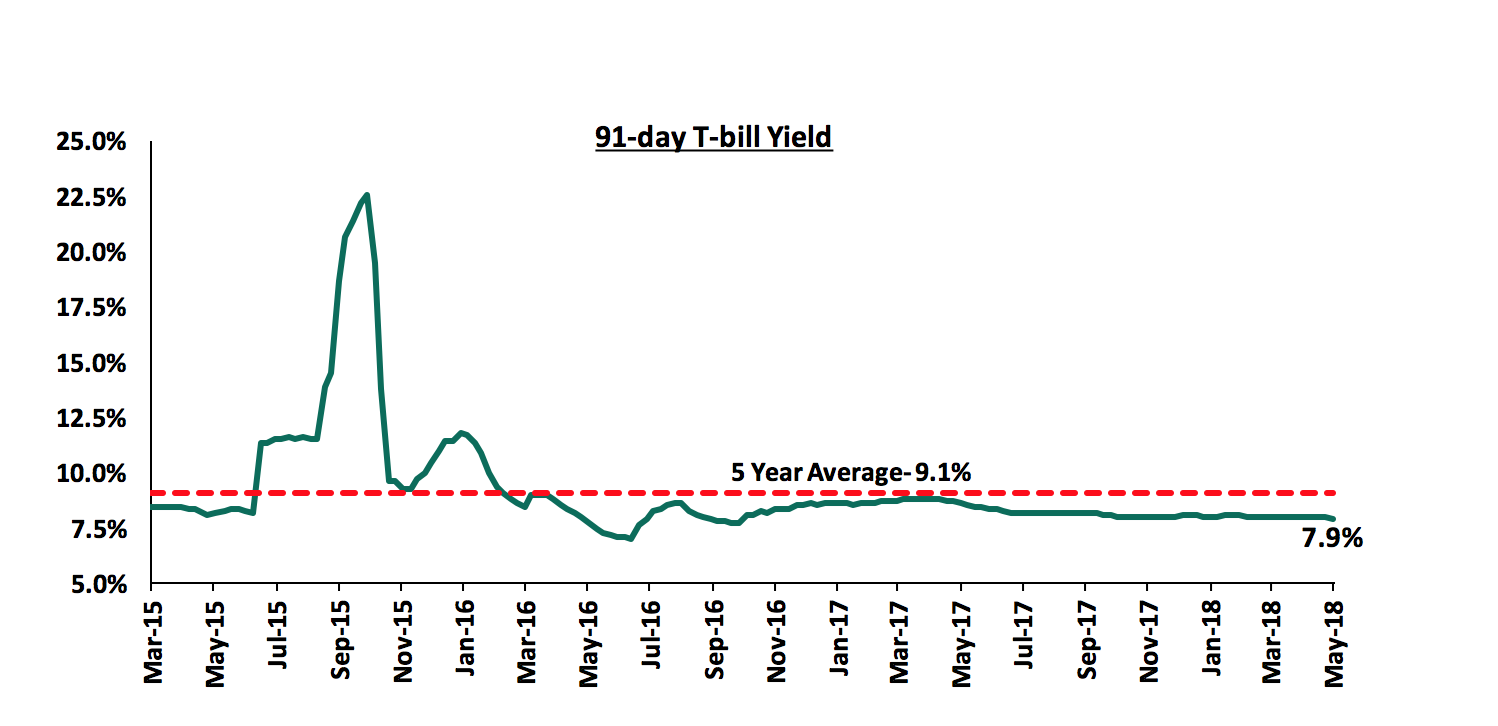

The 91-day T-bill is currently trading at 7.9%, which is below its 5-year average of 9.1%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment experienced since the passing of the law capping interest rates. We expect this to continue in the short-term, given (i) the discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and (ii) the government being under no pressure to borrow from the local market as it is currently 36.2% ahead of its domestic borrowing target, and has met 79.1% of its total foreign borrowing target.

During the month, the Kenyan government issued a new 15-year Treasury bond (FXD 1/2018/15) with the coupon set at 12.7%, in a bid to raise Kshs 40.0 bn for budgetary support. The overall subscription rate for the issue came in at 50.5%, with the market weighted average bid rate coming in at 13.2%, 10 bps above the average accepted rate of 13.1%, which was in line with our expectations of 13.0% - 13.3%. The government accepted Kshs 12.9 bn out of the Kshs 20.2 bn worth of bids received, translating to an acceptance rate of 63.6%.

The government is set to embark on a new borrowing cycle soon, with the budget for the fiscal year 2018/19 scheduled for release in June 2018. Estimates from the Budget Books by the National Treasury point to an expansionary budget, a 13.9% increase in recurrent expenditure to Kshs 2.0 tn from Kshs 1.7 tn, previously, and a 12.8% increase in development expenditure to Kshs 653.7 bn from Kshs 579.6 bn. In our view, the government is set to continue with its large borrowing appetite in the next fiscal year, considering the draft Financial Markets Conduct Bill prepared by the National Treasury does not point to a repeal or revision of the interest rate cap thus financial institutions will still be inclined to lend to the government, which will retain the ability to keep rates at low levels by rejecting bids deemed expensive in primary auctions.

Secondary Bond Market:

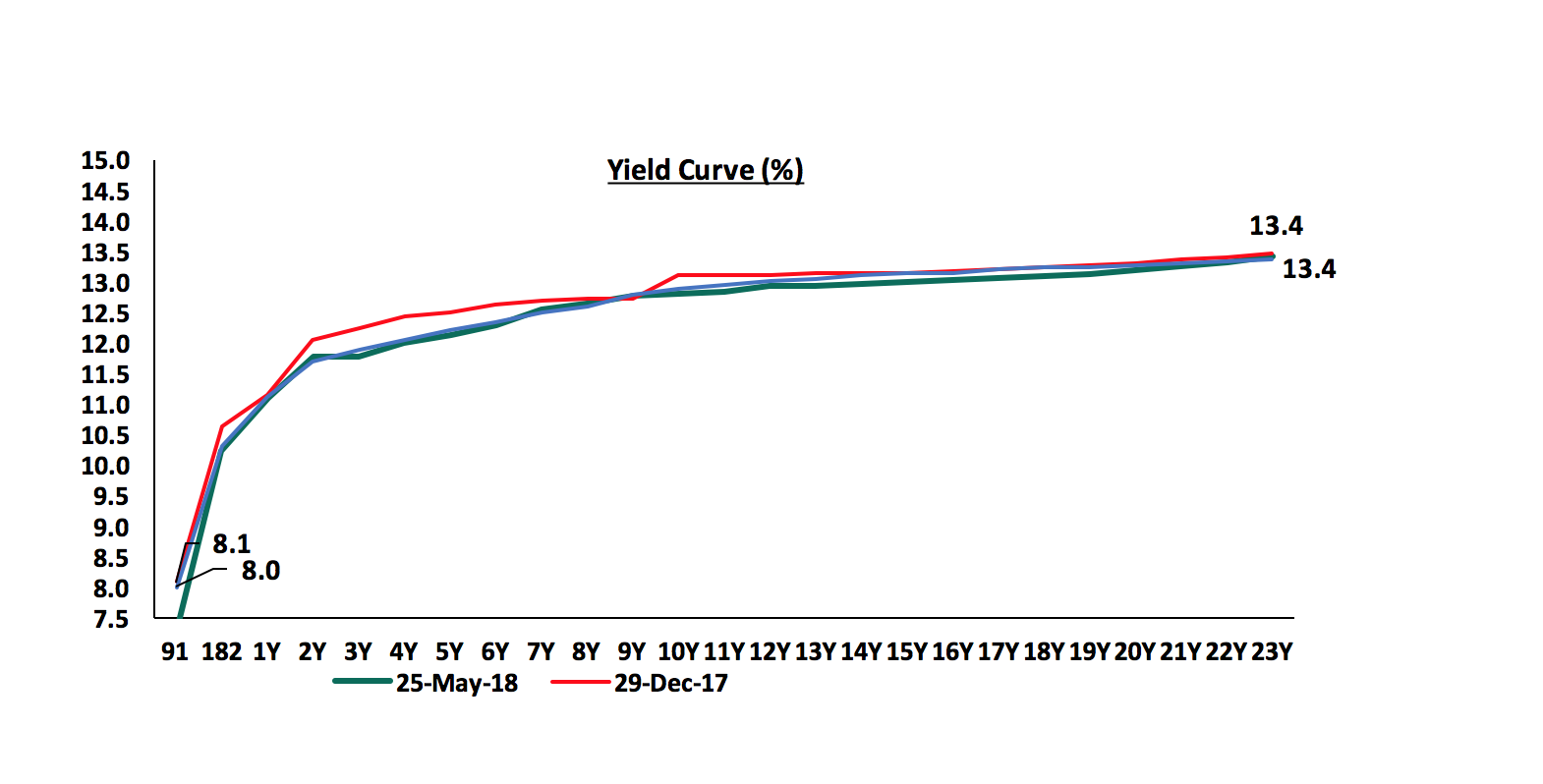

The yields on government securities in the secondary market remained relatively stable during the month as the Central Bank of Kenya (CBK) continues to reject expensive bids in the primary market. According to the FTSE NSE Bond Index, Treasury bonds listed at the Nairobi Securities Exchange (NSE) gained 1.4% during the month, bringing the YTD performance to 6.7%. Bond turnover was up by 11.3% to Kshs 44.8 bn in May from Kshs 40.3 bn in April.

Liquidity:

During the month, the average interbank rate increased to close at 5.4%, compared to 4.8% at the end of April, indicating a decline in liquidity as banks channelled funds to invest in government securities, according to the CBK Bulletin. The average volumes traded increased by 9.5% to Kshs 16.2 bn from Kshs 14.8 bn at the close of April.

Kenya Eurobonds:

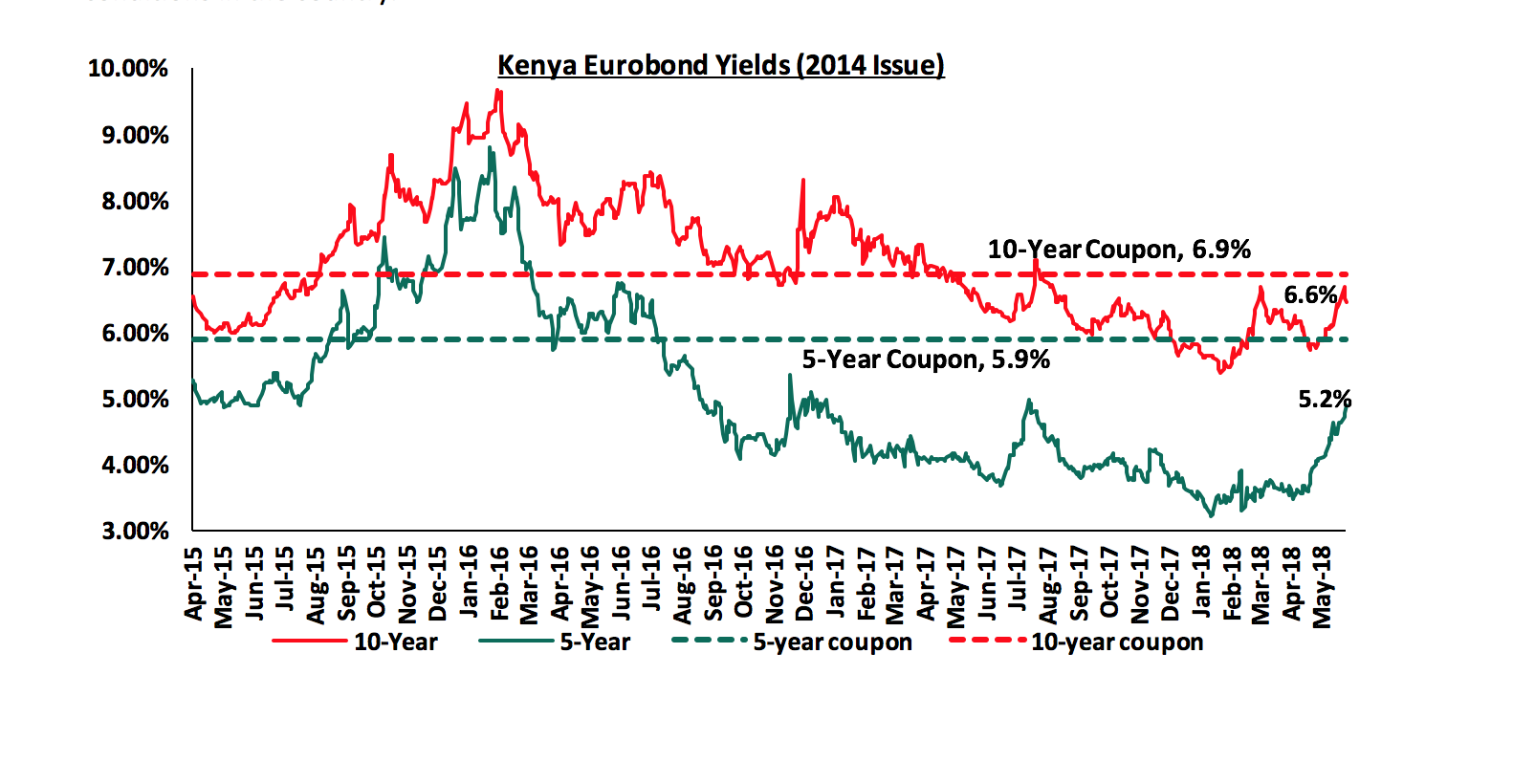

According to Bloomberg, the yield on the 5-year Eurobond issued in June 2014 increased by 1.1% points to 5.2% during the month of May from 4.1% in April, while the yield on the 10-year Eurobond (2014) increased by 50 bps to close at 6.6% from 6.1% during the same period. Yields on Kenya Eurobonds have recently been increasing on account of dampening of investor sentiments, which can be attributed to the recent unfolding of corruption scandals in the country. During the week, the yields on the 5-year and 10-year Eurobonds issued in 2014 rose by 40 bps and 20 bps to 5.2% and 6.6% from 4.8% and 6.4%, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 3.6% points and 3.1% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

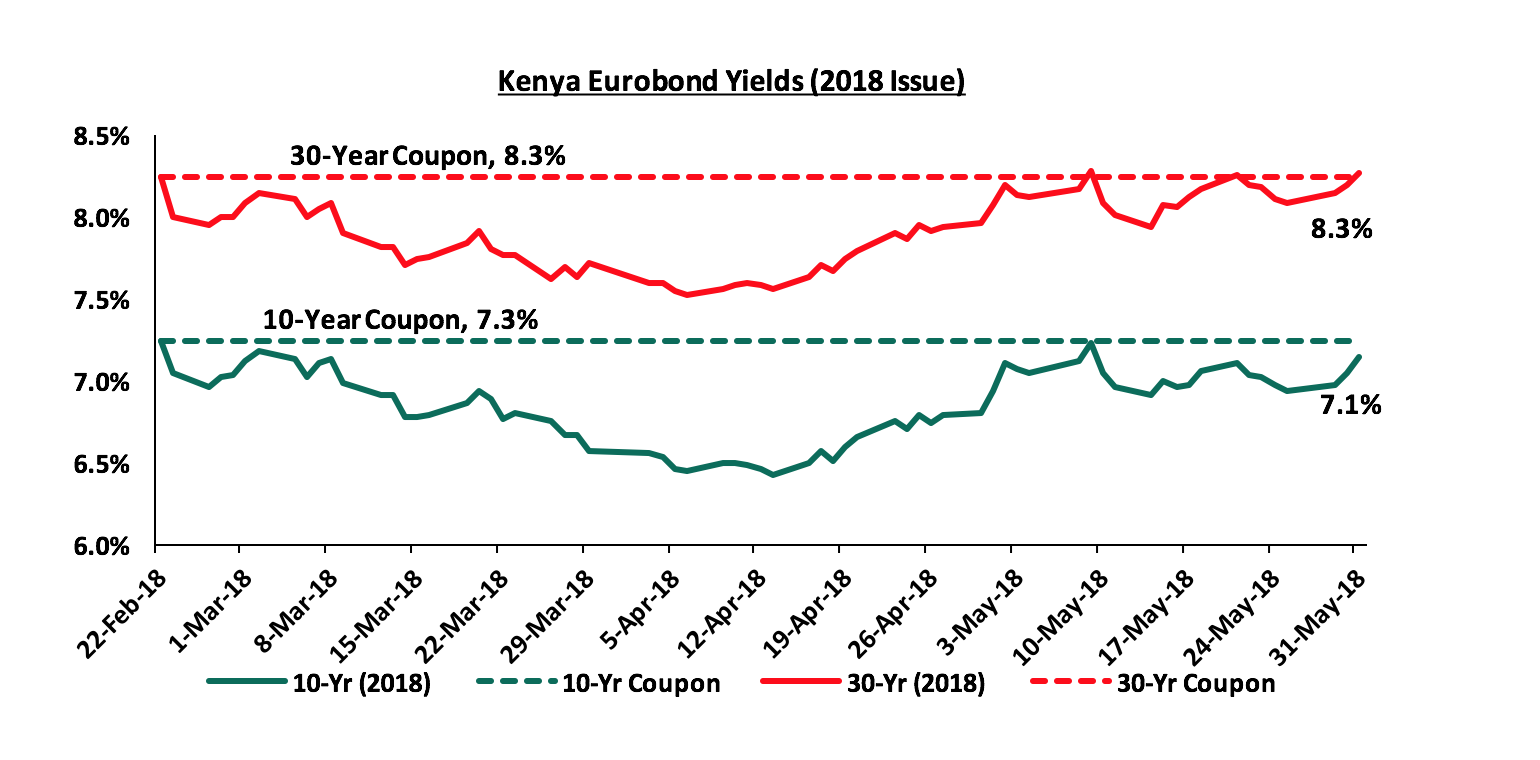

During the month, the yields on the 10-year and 30-Year Eurobond issued in February both increased by 30 bps to 7.1% and 8.3% from 6.8% and 8.0% in April, respectively. During the week, the yields on the 10-year and 30-year Eurobonds both increased by 20 bps to 7.1% and 8.3% from 6.9% and 8.1% last week, respectively. This can be attributed to a flight to quality as investors turned to developed market fixed income securities, as yields in developed markets continue to rise steadily. Since the issue date, the yield on the 10-year Eurobond has declined by 0.1% points while the 30-year Eurobond has remained flat at 8.3%.

The Kenya Shilling:

The Kenya Shilling depreciated by 1.2% against the US Dollar during the month of May to Kshs 101.6, from Kshs 100.4 at the end of April, mainly as a result of increased dollar demand by multinationals and importers towards the end of the month. During the week, the Kenya Shilling depreciated by 0.5% against the US Dollar to close at Kshs 101.6 from Kshs 101.1 the previous week, due to continued end-month dollar demand by oil importers. On a YTD basis, the shilling has gained 1.6% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Stronger horticulture export inflows driven by increasing production and improving global prices,

- Improving diaspora remittances, which increased by 50.6% to USD 222.2 mn in March 2018 from USD 147.5 mn in March 2017, attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

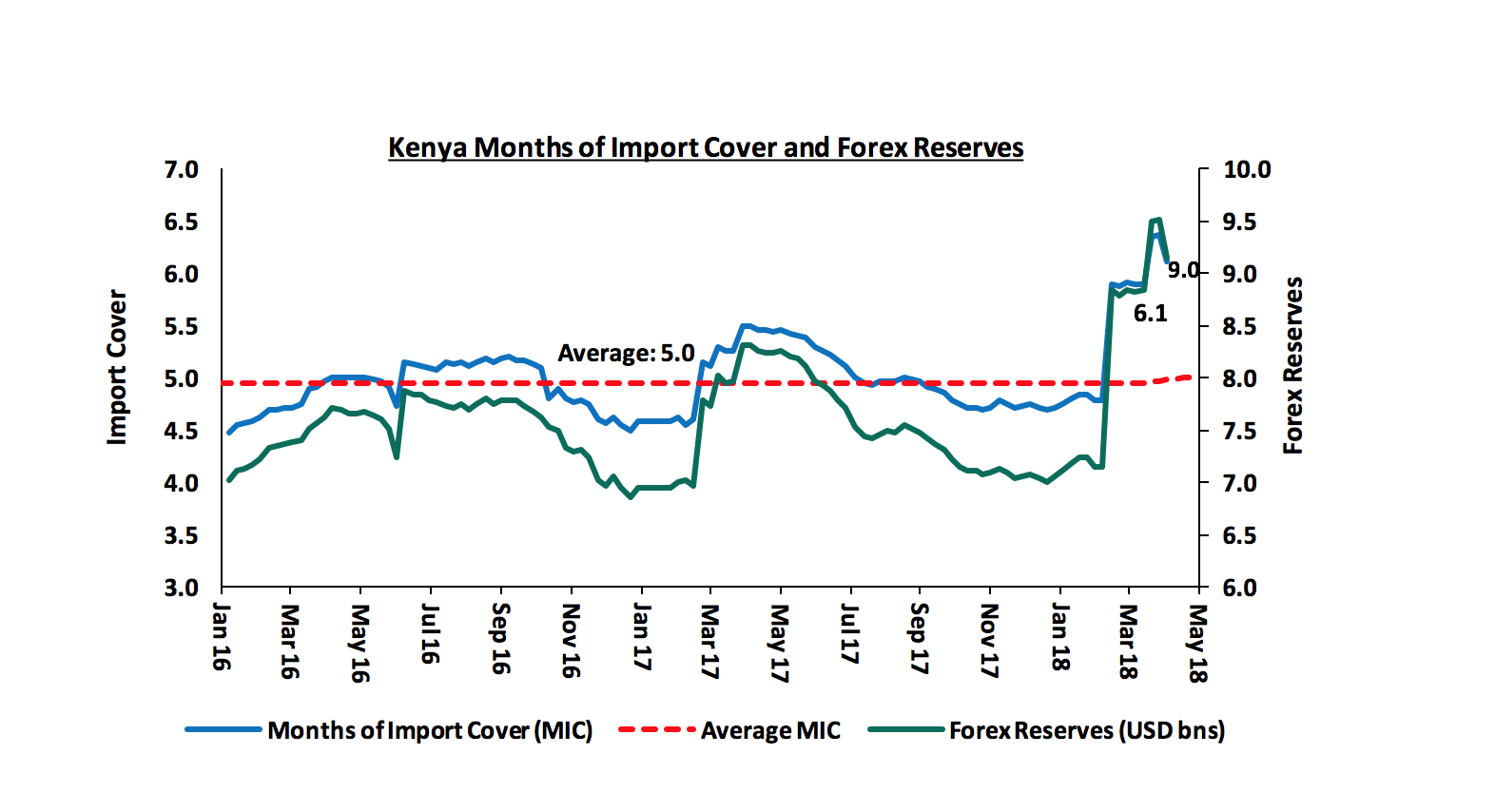

- High forex reserves, currently at USD 9.0 bn (equivalent to 6.1 months of import cover) and the USD 1.0 bn precautionary agreement by the IMF, still available until September 2018. The recent decline from a high of USD 9.5 bn in reserves was attributed to repayment of the outstanding balance of the matured USD 750.0 mn syndicated loan taken in October 2015.

Inflation:

The inflation rate for the month of May increased marginally to 4.0% from 3.7% in April, in line with our expectations, mainly attributed to a 1.4% and 1.8% rise in the food index and the housing, water, electricity, gas and other fuels’ index, respectively. The food and non-alcoholic beverages index increased by 1.4% due to increased prices of some food items outweighing a decline in others. The housing, water, electricity, gas and other fuels’ index increased by 1.8% attributed to increased prices of cooking fuels with charcoal recording the highest increase of 9.7% on account of the logging ban. The transport index also rose marginally by 0.1% driven by increased fuel prices. Below is a summary of key changes in the Consumer Price Index (CPI) in May:

|

Major Inflation Changes in the Month of May 2018 |

|||

|

Broad Commodity Group |

Price change m/m (May-18/ April-18) |

Price change y/y (May -18/May 17) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.4% |

0.3% |

The 1.4% increase was attributed to increased prices of some food items outweighing a decline in others |

|

Transport Cost |

0.1% |

7.0% |

The 0.1% increase was driven by increased fuel prices |

|

Housing, Water, Electricity, Gas and Other Fuels |

1.8% |

13.7% |

The 1.8% increase in May 2018 was mainly attributed to an increase in prices of cooking fuels with charcoal recording the highest increase of 9.7% on account of the anti-logging ban |

|

Overall Inflation |

1.0% |

4.0% |

The increase to 4.0% from 3.7% was mainly attributed to a 1.4% and 1.8% rise in the food index and the housing, water, electricity, gas and other fuels’ Index, respectively |

Monetary Policy:

The Monetary Policy Committee (MPC) met on Monday 28th May, 2018 to review the prevailing macroeconomic conditions and give direction on the Central Bank Rate (CBR). The MPC maintained the CBR at 9.5%, in line with our expectations as detailed in out MPC Note, citing that the impact of the 50 bps reduction in March had not yet been fully transmitted to the economy, despite there being room for monetary policy easing to further support economic activity, as evidenced by:

- inflation, which eased to 3.7% in April 2018 from 4.2% in March, and has remained well within the government target range of 2.5% - 7.5%. The MPC noted that the overall inflation is expected to remain within the government target range despite upward pressure from rising fuel prices,

- private sector credit growth, which grew by 2.8% in April up from 2.1% in February, with growth in lending being recorded in the manufacturing, building and construction, finance and insurance and trade sectors, and,

- increased private sector optimism as per the MPC Private Sector Market Perception Survey conducted in May 2018, which showed that the private sector was optimistic about local economic prospects in 2018. The April Stanbic Bank Kenya PMI corroborated this, having hit a 27-month high of 56.4, remaining well above 50.0, which is the mark that signals an improvement in the business environment. This was mainly attributed to a relatively stable operating environment, improving weather conditions, continued infrastructure investment by the government, the government’s focus on the Big Four Agenda, the expected direct flights to-and-from the USA, and perceived political stability that has resulted in improving investor confidence. However, concerns were raised on the negative effects of the recent floods on crop yields and tourism, but this is expected to be in the short term. See the CBK Release.

Monthly Highlights:

During the month, the National Treasury released two proposals aimed at improving credit growth to the private sector, as follows:

- a credit guarantee scheme for loans advanced to small and medium size enterprises (SMEs) in a bid to unlock private sector credit growth. With the introduction of the rate cap in 2016, private sector credit growth has been on the decline due to banks adopting a more stringent credit risk assessment framework thus limiting lending to riskier borrowers and shifting focus to government securities, which they deemed less risky. The proposal is still at an early stage and the amounts and the inception date still not in place, as stakeholder consultations continue, and,

- a draft Financial Markets Conduct Bill, 2018 that will see the establishment of the Financial Markets Conduct Authority that will (a) regulate the cost of credit with the aim of protecting consumers, (b) promote a fair, non-discriminatory environment for credit access, and (c) ensure uniformity in standards and practices in the issue of financial products and services. While the Bill seeks to promote access to credit while protecting consumers and regulating the cost of credit, we note it does not point to a repeal or revision of the interest rate cap.

If the scheme and the Bill is to be adopted, it will enable SME’s, that previously had difficulties in accessing debt financing, access credit more easily, with a guarantee in place and with improved terms and conditions, thus improving private sector credit growth and in turn, enhancing economic growth. However, with the cap still in place, the way forward for household borrowing in terms of access to credit remains uncertain. For a more comprehensive analysis of the Draft Bill, we shall release our analysis in the course of the week.

The Treasury also released the Tax Laws (Amendment) Bill, 2018 during the month, aimed at increasing revenue collected going forward, in a bid to reduce the budget deficit and Kenya’s public debt burden. The Bill had the following key points:

- 35.0% tax on individuals earning Kshs 750,000 per month and above, as well as large corporations with a monthly taxable income of more than Kshs 500 mn, and,

- Amendments to the VAT Act that include changing the status of various products such as milk and cream, maize (corn) flour, bread and wheat among others from zero-rated to exempt, meaning that producers of these products cannot claim Value Added Tax (VAT) on inputs from the government, thus increasing their retail prices.

These changes, as well as the expected 16.0% VAT on petroleum products as from September 2018, are aimed at increasing revenue collections by the KRA and reducing the budget deficit to 6.0% of GDP in the fiscal year 2018/19, and further to 3.0% of GDP by 2021/22, from 7.2% in this fiscal year. Prices of basic goods, however, will rise, as suppliers will pass on the additional tax cost burden to the final consumers, thus leading to a rise in food inflation in the period of implementation. As we continue to see significant changes to taxes, we are of the view that this should be accompanied by equally significant reduction efforts in recurrent expenditure, as only this joint effort will lead to a substantial decline in the budget deficit and in turn the public debt burden.

The government signed a loan agreement worth approximately Kshs 20 bn with the Kuwait Fund for Arab Economic Development (KFAED) during the month. The proceeds of the loan are to be used in the expansion of Modogashe- Wajir Road Project, which will cost approximately Kshs 120 bn. With the addition of this loan, the government has now met 79.1% of their foreign borrowing target and 85.7% of their pro-rated target for the current fiscal year having borrowed Kshs 255.6 bn.

During the month, the IMF released their Regional Economic Outlook report for Sub-Saharan Africa (SSA) dated April 2018, with a focus on domestic revenue mobilization and private investment. The report pointed to an improved operating environment in SSA with:

- GDP growth in SSA being projected to come in at 3.4% in 2018, up from 2.8% in 2017, supported by higher commodity prices, and improved capital markets access,

- The average current account deficit in SSA estimated to have narrowed to 2.6% of GDP in 2017, from 4.1% in 2016 driven by an increase in international receipts in about half of the region’s economies, and,

- Regional annual inflation in SSA declining to just over 10.0% in 2017, from 12.5% in 2016, and expected to fall further in 2018, driven by declining food prices due to improved weather conditions.

The report also cited the rising debt burden in 2017 as a key concern, with about 40.0% of low-income developing countries in the region being in debt distress or at a high risk of debt distress, and the median level of public debt in SSA exceeding 50.0% of GDP. It also pointed out the rise in interest payments in correlation to the rising debt levels, with the median interest payments-to-revenue ratio close to 10.0%, up from 5.0% in the period between 2013 and 2017. The IMF, however, maintained their 2018 GDP projection for Kenya at 5.5%, bringing the average of projections as at Q2’2018 to 5.5%.

The month of May saw two Eurobond issuances in SSA as follows:

- South Africa raised USD 2.0 bn through the issue of 12-year and 30-year Eurobonds at yields of 5.9% and 6.3%, respectively. The issue was 1.7x oversubscribed coming a month after Moody’s Investor Service confirmed South Africa’s sovereign long-term issuer and senior unsecured ratings of “Baa3”, and changed the outlook to “positive” from “negative” citing the potential of economic recovery with the recent change in leadership of the country, and,

- Ghana raised USD 2.0 bn through the issuance of 10-year and 30-year Eurobonds that were 4.0x oversubscribed at yields of 7.6% and 8.6%, respectively, which we attribute to their relatively higher yields as well as the continued improvement of the country’s macroeconomic conditions evidenced by a GDP growth of 8.5% in 2017, up from 3.7% in 2016. Moody’s Investor Service had affirmed Ghana’s sovereign long-term issuer and senior unsecured bond ratings at “B3” maintaining the outlook at “stable”.

From the Eurobond issuances that have taken place so far this year, we noted that governments had begun issuing more long-term Eurobonds, 30-years on average, in a bid to increase their liability tenures, a commendable debt management move; we shall be releasing our analysis of SSA Eurobonds in the coming week.

Rates in the fixed income market have remained stable as the government rejects expensive bids. The government is under no pressure to borrow for the remaining part of the current fiscal year as: (i) they are currently ahead of their domestic borrowing target by 36.2%, (ii) they have met 79.1% of their total foreign borrowing target and 85.7% of their pro-rated target for the current fiscal year, with the shortfall in foreign borrowing set to be plugged in by the excess from domestic borrowing, and (iii) the KRA is not significantly behind target in revenue collection. Come the next fiscal year, the government is likely to remain behind target for the better part of the first half as per historical data, but we do not expect this to result in a rise in interest rates with the interest rate cap still in place. Therefore, we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

Market Performance:

During the month of May, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.9%, 10.8% and 3.7%, respectively, taking their YTD performance as at the end of May to 0.8%, (10.2%) and 1.9% for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the month was driven by declines in large caps such as Diamond Trust Bank (DTB), Barclays Bank, Cooperative Bank and KCB Group, which declined by 11.2%, 10.9%, 8.4% and 8.0%, respectively, owing to the bank’s closing their books for dividend during the month.

During the week, the equities market was also on a downward trend with NASI, NSE 20 and NSE 25 declining by 1.6%, 0.9% and 1.5%, respectively, due to declines in counters such as Standard Chartered, Cooperative Bank and Safaricom, which declined by 3.8%, 3.1% and 2.6%, respectively.

Equities turnover rose by 22.0% during the month to USD 182.5 mn from USD 149.6 mn in April, taking the YTD turnover to USD 0.9 bn. Foreign investors remained net sellers for this month, as they sought to realize the capital gains on various counters, in addition to receiving dividend income. Most investors exited the market at the relatively healthy valuation, with possible re-entry at cheaper valuations in the future. We expect the market to remain supported by improved investor sentiment as the economy recovers from shocks experienced last year.

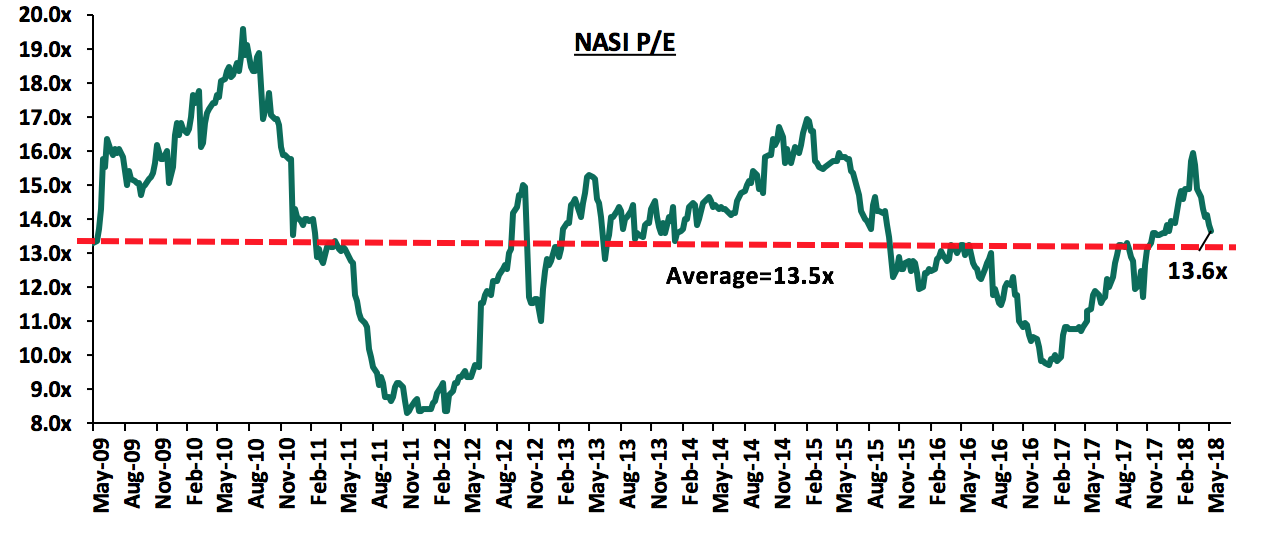

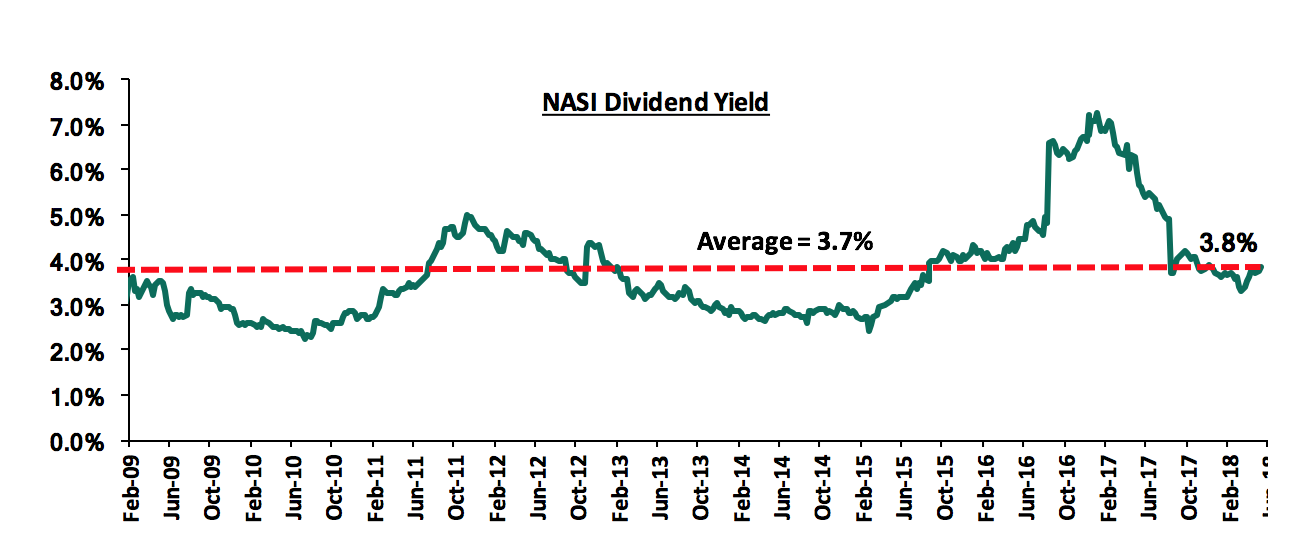

The market is currently trading at a price to earnings ratio (P/E) of 13.6x, 0.7% above the historical average of 13.5x, and a dividend yield of 3.8%, slightly above the historical average of 3.7%. Despite the valuations nearing the historical average, we believe there still exist pockets of value in the market. The current P/E valuation of 13.5x is 39.2% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 62.7% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Earnings Releases:

During the week, there were various earnings releases.

Barclays Bank of Kenya released Q1’2018 results

Barclays Bank of Kenya released Q1’2018 financial results, with its core earnings per share increasing by 7.7% to Kshs 0.35 from Kshs 0.32 in Q1’2017, in line with our expectation of a 7.1% increase to Kshs 0.34. Performance was driven by a 4.2% increase in total operating income, outpacing a 2.4% increase in the total operating expenses. The bank reported a profit after tax of Kshs 1.9 bn from Kshs 1.7 bn in Q1’2017.

For more information, see our Barclays Bank Q1’2018 earnings note.

I &M Holdings released Q1’ 2018 results

I&M Holdings released Q1’2018 results, with its core earnings per share increasing by 1.8% to Kshs 18.5 from Kshs 18.1 in Q1’2017, which was below our expectation of a 6.7% increase to Kshs 19.4. The variance in core earnings per share growth was largely due to (i) the higher than expected rise in loan loss provisions due to a spike in Non-Performing Loans (NPLs), and (ii) the slower than expected growth in NFI. Performance was driven by a 10.4% increase in total operating income, despite an 18.6% increase in the total operating expenses. The bank reported a profit after tax of Kshs 1.81 bn from Kshs 1.78 in Q1’2017.

For more information, see our I&M holdings Q1’2018 earnings note.

Standard Chartered Bank released Q1’2018 results

Standard Chartered Bank released Q1’2018 results, with its core earnings per share declining by 12.5% to Kshs 5.2 from Kshs 6.0 in Q1’2017 compared to our expectation of a 6.4% increase to Kshs 6.4. Performance was driven by a 15.4% increase in total operating expenses that outpaced the 5.4% increase in total operating income. The variance in core earnings per share growth was due to the faster increase in operating expenses, which was driven by an increase in loan loss provisioning by 37.9% to Kshs 1.1 bn from Kshs 0.8 bn in Q1’2017. The bank reported a profit after tax of Kshs 1.8 bn from Kshs 2.1 bn in Q1’2017.

For more information, see our Standard Chartered Q1’2018 earnings note.

National Bank of Kenya released Q1’2018 results

National Bank of Kenya released Q1’2018 results, with its core earnings per share increasing by 348.0% to Kshs 0.8 from Kshs 0.2 in Q1’2017, compared to our expectation of a 13.2% increase to Kshs 0.2. However, this growth in core EPS was realised after stripping out of an exceptional expense of Kshs 0.5 bn, which the bank incurred in Q1’2018. The bank registered a loss after tax of Kshs 0.3 bn in Q1’2018 from a profit of Kshs 0.1 bn in Q1’2017. Performance was driven by a 14.7% decrease in total operating income, despite a 14.9% decrease in the total operating expenses. The variance in core earnings per share growth against our expectations was largely due to (i) the unexpected exceptional expense item of Kshs 0.5 bn that the bank incurred in Q1’2018, (ii) the unexpected one-off deferred tax item of Kshs 0.2 bn.

For more information, see our National Bank of Kenya Q1’2018 earnings note

HF Group released Q1’2018 results

Housing Finance Group limited released their Q1’2018 financial results, with core earnings per share declining by 58.4% to Kshs 0.4 from Kshs 1.0 in Q1’2017. The bank recorded a profit after tax of Kshs 37.1 mn, compared to our expectation of a loss of Kshs 15.4 mn in Q1’2017. Performance was driven by a 1.1% increase in total operating income to Kshs 980.1 mn from Kshs 970.4 mn in Q1’2017, coupled with a 10.3% increase in total operating expenses to Kshs 928.0 mn from 841.1 mn in Q1’2017. The variance in performance compared to our expectation was largely due to a larger than expected decline in loan loss provisions, which declined by 43.9% to Kshs 112.7 mn from Kshs 200.7 mn in Q1’2017, despite the adoption of the IFRS 9 reporting standard that requires a forward looking approach to credit risk assessment.

For more information, see our Housing Finance Group Q1’2018 earnings note.

Below is a summary of the listed banks’ performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Cost of Funds |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Loan Growth |

Growth in Govt. Securities |

IFRS 9 Capital Ratios Effect |

|

National Bank |

348.0% |

(14.2%) |

(11.7%) |

3.3% |

(15.8%) |

7.1% |

(12.3%) |

31.0% |

91.3% |

(6.3%) |

(12.0%) |

(9.8%) |

(0.6%) |

|

Stanbic |

79.0% |

17.7% |

17.4% |

3.3% |

17.9% |

7.0% |

55.4% |

49.0% |

73.7% |

13.2% |

11.4% |

83.5% |

(0.6%) |

|

Equity Group |

21.7% |

10.5% |

10.5% |

2.7% |

10.5% |

8.4% |

6.3% |

49.0% |

7.2% |

10.0% |

3.5% |

45.5% |

(0.5%) |

|

KCB Group |

14.0% |

10.9% |

13.0% |

3.1% |

10.0% |

8.2% |

(1.1%) |

32.8% |

(2.3%) |

8.7% |

5.8% |

(10.7%) |

(0.8%) |

|

Barclays |

7.7% |

8.1% |

6.8% |

2.9% |

8.5% |

9.6% |

5.0% |

29.2% |

(6.7%) |

8.4% |

(1.9%) |

35.3% |

1.00% |

|

Co-op Bank |

6.8% |

9.1% |

5.0% |

4.0% |

10.8% |

8.6% |

3.8% |

32.0% |

9.6% |

5.7% |

2.8% |

21.3% |

(0.9%) |

|

DTBK |

3.0% |

4.9% |

4.2% |

5.1% |

5.4% |

6.4% |

4.4% |

22.0% |

8.3% |

11.6% |

3.0% |

16.0% |

(1.6%) |

|

NIC Group |

2.2% |

8.2% |

35.9% |

5.2% |

(8.3%) |

6.3% |

5.5% |

29.6% |

1.8% |

22.1% |

(0.4%) |

81.2% |

(0.8%) |

|

I&M Holdings |

1.8% |

2.5% |

10.9% |

4.8% |

(2.7%) |

7.4% |

43.9% |

37.0% |

45.9% |

3.5% |

7.6% |

(1.7%) |

(0.2%) |

|

Stanchart |

(12.5%) |

7.7% |

16.4% |

3.6% |

4.5% |

7.8% |

6.5% |

32.0% |

27.0% |

13.2% |

(2.6%) |

12.4% |

(0.5%) |

|

HF Group |

(58.4%) |

(12.8%) |

(13.0%) |

7.2% |

(12.6%) |

5.1% |

64.2% |

28.9% |

(62.7%) |

(6.1%) |

(12.5%) |

(41.4%) |

0.0% |

|

Weighted Average Q1'2018 |

14.4% |

9.3% |

11.4% |

3.4% |

8.1% |

8.1% |

9.5% |

37.1% |

12.2% |

9.4% |

3.2% |

25.0% |

(0.3%) |

|

Weighted Average Q1'2017 |

(8.6%) |

(11.6%) |

(10.3%) |

3.0% |

(10.1%) |

9.2% |

18.6% |

37.8% |

8.7% |

11.7% |

7.1% |

43.1% |

- |

Key takeaways from the table include:

- The listed banking sector recorded growth in core EPS, with the average increase coming in at 14.4%. Growth was driven by an increase in both the Net Interest Income (NII) and Non-Funded Income (NFI), which came in at 8.1%, and 9.5%, respectively;

- Average deposit growth came in at 9.4%. Interest expense paid on deposits recorded a faster growth of 11.4% on average, indicating that more interest earning accounts have been opened, which increased the cost of funds;

- Average loan growth came in at 3.2%, while investment in government securities has grown by 25.0%, outpacing the loan growth, showing increased lending to the government by banks as they avoid the risky borrowers;

- The average Net Interest Margin in the banking sector currently stands at 8.1%, a decline from the 9.2% recorded in Q1’2017, and,

- Non-funded income has grown by 9.5%, which included a Fee and Commissions growth of 12.2%. This shows that banks are charging more fee income to improve their income on loans above the rate cap maximum.

We shall be releasing our Q1’2018 Banking Sector report on 17th June 2018

Monthly Highlights:

During the month, the Nairobi Securities Exchange (NSE) announced plans to roll out a test launch of the derivatives market segment, within 6-months. The exchange has obtained the required approval from the Central Bank of Kenya (CBK). Stanbic Bank of Kenya and Cooperative Bank of Kenya have been granted approval to participate as clearing and settlement houses during the pilot testing phase. Initially, six banks were to participate in the pilot phase, including NIC Group, Commercial Bank of Africa (CBA), Barclays and Chase Bank (under receivership), however only Cooperative and Stanbic were granted approval to participate in the test. The establishment of the derivatives market will aid in enhancing the depth of the financial market as it would (i) enable trading and clearing of multi-asset classes, and (ii) create synthetic structured products, thus ultimately providing investors with new investing channels and thereby enabling them to diversifying their portfolios.

Equities Universe of Coverage:

Below is our equities universe of coverage:

|

all prices in Kshs unless stated otherwise |

||||||||||||

|

Banks |

Price as at 30/04/2018 |

Price as at 31/05/2018 |

m/m change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/(Downside)** |

P/TBv Multiple |

|||

|

NIC Group*** |

37.3 |

34.8 |

(6.8%) |

3.0% |

24.3% |

56.0 |

2.9% |

64.0% |

0.8x |

|||

|

HF Group*** |

10.1 |

8.0 |

(20.9%) |

(23.6%) |

(10.8%) |

11.7 |

4.0% |

51.2% |

0.3x |

|||

|

Union Bank |

6.3 |

5.6 |

(11.2%) |

(28.8%) |

26.1% |

8.2 |

0.0% |

46.8% |

0.6x |

|||

|

Diamond Trust Bank |

214.0 |

190.0 |

(11.2%) |

(1.0%) |

35.7% |

272.9 |

1.4% |

45.0% |

1.0x |

|||

|

I&M Holdings |

125.0 |

108.0 |

(13.6%) |

(15.0%) |

16.8% |

151.2 |

3.2% |

43.2% |

1.0x |

|||

|

KCB Group |

50.0 |

46.0 |

(8.0%) |

7.6% |

15.7% |

63.7 |

4.3% |

42.8% |

1.5x |

|||

|

Zenith Bank |

27.5 |

25.5 |

(7.1%) |

(0.5%) |

34.6% |

33.3 |

10.6% |

41.3% |

1.1x |

|||

|

National Bank |

7.9 |

6.6 |

(17.0%) |

(29.4%) |

(0.8%) |

8.6 |

0.0% |

30.2% |

0.4x |

|||

|

CRDB |

180.0 |

160.0 |

(11.1%) |

0.0% |

(15.8%) |

207.7 |

0.0% |

29.8% |

0.5x |

|||

|

GCB |

6.3 |

6.4 |

1.1% |

26.3% |

22.0% |

7.7 |

6.0% |

27.0% |

1.5x |

|||

|

Co-op Bank |

18.6 |

17.0 |

(8.4%) |

6.3% |

22.9% |

20.5 |

4.7% |

25.4% |

1.5x |

|||

|

Barclays |

13.3 |

11.8 |

(10.9%) |

22.9% |

31.8% |

13.7 |

8.5% |

24.6% |

1.5x |

|||

|

Equity Group |

49.3 |

47.3 |

(4.1%) |

18.9% |

24.3% |

54.3 |

4.2% |

19.3% |

2.4x |

|||

|

Stanbic UG |

30.8 |

31.5 |

2.4% |

15.6% |

16.7% |

36.3 |

3.7% |

18.9% |

2.0x |

|||

|

UBA Bank |

11.6 |

10.8 |

(6.5%) |

4.9% |

44.0% |

10.7 |

13.9% |

13.0% |

0.7x |

|||

|

Bank of Kigali |

290.0 |

289.0 |

(0.3%) |

(3.7%) |

18.0% |

299.9 |

4.8% |

8.6% |

1.6x |

|||

|

Stanchart KE |

209.0 |

202.0 |

(3.3%) |

(2.9%) |

0.0% |

192.6 |

6.2% |

1.5% |

1.6x |

|||

|

Guaranty Trust |

45.0 |

40.5 |

(10.0%) |

(0.6%) |

19.1% |

37.2 |

5.9% |

(2.2%) |

2.3x |

|||

|

Stanbic Holdings |

90.0 |

95.5 |

6.1% |

17.9% |

35.5% |

87.1 |

5.5% |

(3.3%) |

1.2x |

|||

|

CAL Bank |

2.0 |

1.5 |

(26.4%) |

34.3% |

88.3% |

1.4 |

0.0% |

(3.4%) |

1.2x |

|||

|

Access Bank |

11.2 |

10.4 |

(7.1%) |

(0.5%) |

30.7% |

9.5 |

3.8% |

(4.8%) |

0.7x |

|||

|

Ecobank |

11.5 |

11.6 |

1.1% |

53.0% |

60.4% |

10.7 |

0.0% |

(7.7%) |

3.3x |

|||

|

SBM Holdings |

7.7 |

7.7 |

(0.5%) |

2.1% |

3.5% |

6.6 |

3.9% |

(10.4%) |

1.1x |

|||

|

Bank of Baroda |

134.0 |

160.0 |

19.4% |

41.6% |

45.5% |

130.6 |

1.6% |

(16.8%) |

1.4x |

|||

|

Stanbic IBTC Holdings |

49.5 |

46.1 |

(6.9%) |

11.1% |

77.3% |

37.0 |

1.3% |

(18.4%) |

2.4x |

|||

|

Standard Chartered |

35.0 |

26.0 |

(25.6%) |

3.0% |

61.7% |

19.5 |

0.0% |

(25.2%) |

3.3x |

|||

|

FBN Holdings |

12.5 |

10.2 |

(18.8%) |

15.3% |

91.5% |

6.6 |

2.5% |

(32.2%) |

0.6x |

|||

|

Ecobank Transnational |

20.1 |

19.5 |

(3.0%) |

14.7% |

84.0% |

9.3 |

0.0% |

(52.4%) |

0.7x |

|||

|

*Target Price as per Cytonn Analyst estimates |

||||||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

||||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors such as Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

During the month of May, we witnessed increased private equity activity in the financial services, hospitality, fintech and education sectors as follows:

Financial Services Sector

Sanlam Kenya, a financial services company listed on the Nairobi Securities Exchange, which mainly deals in insurance, investments and retirements schemes, has invested an additional Kshs 121.7 mn in equity in Sanlam General (previously Gateway Insurance) according to their 2017 annual report. Sanlam Kenya, then Pan Africa Insurance Holdings Limited (Pan Africa), first acquired 31,948,950 ordinary shares of Gateway Insurance, a 51.0% stake, in March 2015 for Kshs 561.0 mn. It also subscribed to additional shares in Gateway amounting to Kshs 139.7 mn to increase its shareholding to 56.5% in the same year. After the transaction, it renamed Gateway Insurance to Sanlam General. The first and second transaction valued the company at Kshs 1.1 bn and Kshs 1.2 bn, respectively. The acquisitions were carried out at a P/B multiple of 1.1x. The acquisition was a strategic move for the company to re-enter the general insurance market and to enable them to offer their clients with more financial solutions. For more information, see our Cytonn Weekly #19/2018

AfricInvest, a private equity and venture capital firm based in Tunisia with a focus on agribusiness, financial services, healthcare, education and commercial sectors, completed a transaction to buy a 14.3% stake in Britam, a diversified financial services group that is listed on the Nairobi Securities Exchange, for Kshs 5.7 bn. The transaction involved the creation of 360.8 mn new shares, which AfricInvest bought at a price of Kshs 15.9 per share. Britam will use the capital to accelerate property development, inject fresh investments into its subsidiaries, and to revamp its technology to enable it deliver its products via digital channels like mobile phones, with an eye on Micro-insurance. The acquisition was carried out at a P/B multiple of 1.4x. For more information, see our Cytonn Weekly #21/2018

Hospitality Sector

AccorHotels, a French multinational hotel group, which operates in 95 countries, signed an agreement with Mövenpick Holding and Kingdom Holding to acquire a 100% stake of Mövenpick Hotels & Resorts for 560.0 mn Swiss Francs (USD 558.3 mn). According to their statement, the enterprise value of 560.0 mn Swiss Francs implies a multiple of 14.9x expected 2019 EBITDA of USD 37.5 mn. Mövenpick Hotels & Resorts is a hotel management company headquartered in Baar, Switzerland. It is currently owned by Mövenpick Holding who have a stake of 66.7%, and the Saudi based Kingdom Group who have a stake of 33.3%. Mövenpick Hotels & Resorts operates in 27 countries with 84 hotels, approximately 20,000 rooms and a particularly strong presence in Europe and the Middle East. For more information, see our Cytonn Weekly #19/2018

Fintech Sector

Lidya, a digital financial services company based in Nigeria, raised USD 6.9 mn is Series A funding. The funding was led by Silicon Valley based Omidyar Network, an impact investment firm established by Pierre Omidyar, the founder of eBay. Other investors in the round included Alitheia Capital (via the Umunthu Fund), Bamboo Capital Partners and Tekton Ventures. The round also included funding from existing investors, Accion Venture Lab and Newid Capital. Lidya focuses on providing and improving access to credit for MSMEs (Micro, Small and Medium Enterprises) in emerging markets. They extend credit to business in the following sectors, (i) farming, (ii) hospitality, (iii) logistics, (iv) retail, (v) real estate, (vi) technology, and (vii) health. Businesses can apply for loans ranging from USD 500 to USD 50,000, without the need to go to a physical location, present audited financials and projections, or provide collateral. Since inception in 2016, Lidya has disbursed 1,981 business loans and has 105,519 business registered on its platform. Lidya will use the funds raised to expand its loan book, scale up in Nigeria, enter new markets in Africa, and bring in more skilled professionals, particularly data scientists and engineers.

Lack of access to finance is a major issue for entrepreneurs and MSMEs across Africa. According to the IMF, there are 44.2 mn MSMEs in Sub-Saharan Africa with a potential demand for USD 404.0 bn in financing. The current volume of financing in Sub-Saharan Africa is estimated at USD 70.0 bn, signifying a huge financing gap of USD 331.0 bn. Nigeria, a large contributor to the enterprise count in Sub-Saharan Africa, has 37 mn MSMEs and an MSME finance gap of USD 158.1 bn. Microfinance institutions aim to bridge this gap by offering convenient access to credit.

Cellulant, a leading Pan-African digital payments service provider that prompts, collects, settles and reconciles payments in real time, has raised Kshs 4.8 bn (USD 47.5 mn) in Series C funding from a consortium of investors led by: Texas Pacific Group (TPG), through The Rise Fund, the impact fund run by the private equity group, Endeavour Catalyst, and Satya Capital, the private equity firm owned by Sudanese-British billionaire Mo Ibrahim. The USD 47.5 mn represents the largest deal of its kind dedicated solely to Africa’s FinTech and payments space. However, the stake acquired was not disclosed. Cellulant offers digital payments platforms and mobile banking services aimed at those who do not have a bank account. For more information, see our Cytonn Weekly #20/2018

Education Sector

In its first investment in the education sector in Africa, One Thousand & One Voices (1K1V), a private family capital fund backed exclusively by families from around the globe, invested an undisclosed amount in Higher Ed Partners South Africa (HEPSA), a South African online education company. Based in Johannesburg, HEPSA is an integrated provider of online program management services to the leading tertiary educational institutions in South Africa. The company assists universities in converting their on-campus degree programs into an online format, recruits qualified students for those programs, and supports enrolled students through graduation. For more information, see our Cytonn Weekly #20/2018

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the month of May, the real estate sector recorded an increase in activities from both investors and developers driven by (i) the huge housing deficit of 2 mn units according to the National Housing Corporation, (ii) high returns, with the sector recording total returns of on average 24.3% p.a. over the last 5 years, (iii) stable macro-economic environment, (iv) government incentives such as a 15% corporate tax relief to developers who construct more than 100 low cost units per annum, (v) continued infrastructural improvements, and (vi) continued government focus on affordable housing. The following were the key highlights this month in each theme;

highlights this month in each theme;

Industry Reports:

Kenya Bankers Association released its Q1’2018 Housing Price Index (KBA-HPI), which tracks both qualitative and quantitative factors that determine pricing in the housing sector. The report showed house price changes and units uptake in Q1’2018. The key takeout from the report include;

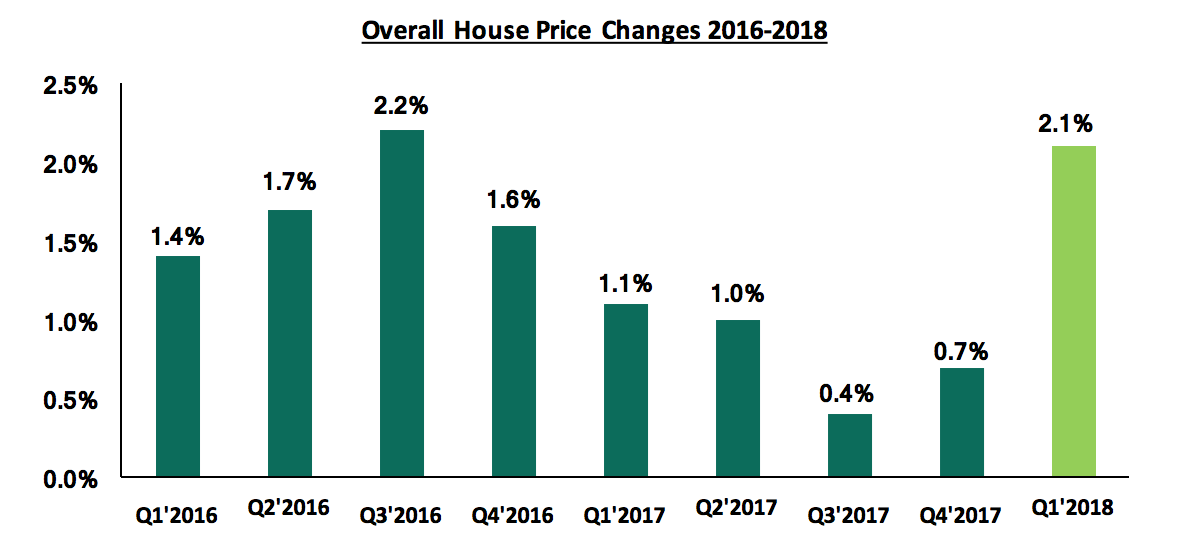

- House prices increased by 2.1% in Q1’2018 compared to 0.7% increase in Q4’2017. The increase in price appreciation is attributed to: (i) conclusion of market transactions put on hold during the prolonged electioneering period as investors adopted a wait and see approach, and (ii) improved macro-economic environment,

The graph below shows the performance of the house prices between 2016 and 2018 exhibiting the market recovery in 2018.

Source: KBA Housing Price Index (HPI) Q1’2018

- Maisonettes accounted for 56.2% of the total number of units sold in Q1’ 2018, with bungalows and apartments accounting for 39.1% and 4.7%, respectively different from the norm, where typically apartments have been accounting for bigger market share. This is attributable to the increased demand for detached units by the increasing upper middle-income segment looking for privacy and exclusivity,

- The factors that significantly impacted house prices in Q1’2018 include: (i) house plinth area, (ii) number of bedrooms, (iii) number of bathrooms, (iv) presence of backyard, (v) master ensuite, (vi) availability of a gym, and (vii) other attributes such as the type of the house, age, location, number of floors especially for apartments, and presence of parking slots.

These findings are in tandem with our Q1’2018 markets review, in which we noted that the market recorded a 1.3% point increase in price per SQM q/q, indicating a recovery of the market from the adverse effect that the electioneering period had on the real estate sector’s performance in 2017.

During the month, the activities in various real estate themes was as outlined below:

Residential:

The residential real estate sector continued to experience increased activities mainly driven by the large housing deficit of 2 mn units, growing by approximately 200,000 units per annum according to the National Housing Corporation (NHC). During the month, many developers announced their interest to venture into the low to mid – income housing segment. These included:

- Erdemann Property Ltd, a Nairobi based property development company who announced plans to construct eight, 34-storey apartment blocks on a 5.7-acre piece of land, in Ngara Estate Nairobi, with a focus on an affordable housing model. The development named “The Rier Estate“ will feature a total of 1,632 apartments (537, 3-bedroom units, 1,088, 2-bedrooms, and 7, 1-bedroom units), with 875 parking slots and a shopping complex with 60 outlets, Cytonn Weekly #19/2018

- Cool Breeze Development Limited, a Nairobi-based group of investors, announced plans to construct 5, 14-storey blocks of apartments on a 2.3-acre parcel of land acquired from Nextgen Suites behind Nextgen Mall, along Mombasa Road with a focus on middle to high income earners. The development will consist of 120 studio units, 240 1-bedroom units, 148 2-bedroom units, and 16 3-bedroom units, Cytonn weekly #20/2018

- The United Bank of Africa (UBA) announced that it had set aside Kshs 3.0 bn to be used in construction of over 1,000 affordable housing units in Kakamega County. This will be done in partnership with the National Housing Corporation (NHC), Cytonn Weekly #20/2018

- In a move to actualize the affordable housing initiative, the Housing Principal Secretary Hon. Charles Hinga announced that housing developers participating in the government's low-cost housing plan would be allocated land on which they will develop affordable housing on 70% and high-end units on 30%, thus allowing the developers to recoup their costs. This initiative will be rolled out for the first lot comprising of 36,840 housing units in Starehe, Muguga Green, Shauri Moyo, Makongeni all in Nairobi County, and Mavoko, in Machakos County. On the other hand, the High Court dismissed a case filed by civil servants blocking the Ministry of Lands and Housing from ejecting them from their houses in Starehe and Shauri Moyo estates to pave way for the construction of the new housing units. The government has been granted mandate to develop the estates as it has no legal obligation to furnish civil servants with alternative accommodation before demolishing the existing structures. The project was introduced by the government in 2016 with an aim of providing housing to the civil servants. These initiatives, and subsidies by the government in our view, are a step in the right direction towards the goal of achieving affordable housing through public private partnerships.

We expect to continue witnessing increased activities in the residential sector driven by (i) high urbanization rate which stands at 4.4% against the global average of 2.1%, (ii) a high population growth rate in the country of on average 2.6% p.a. compared to the global average which stands at 1.2% p.a., (iii) government incentives, such as the 15% corporate tax relief to developers who construct more than 100 affordable units annually, and (iv) the huge housing deficit of 2 mn units, growing by approximately 200,000 units per annum according to National Housing Corporation (NHC) creating demand for residential units.

Commercial-Office:

During the month, the Federation of Kenya Employers (FKE) announced plans to build an 8-storey office building in Upper Hill, at a cost of Kshs. 620 mn exclusive of land costs. Upperhill has the highest office supply, with a market share of 18.0%, and it is oversupplied by 700,000 SQFT, representing 14.9% of the total office space oversupply that came in at 4.7 mn SQFT in 2017, according to our Nairobi Commercial Office Report 2018. The oversupply constrained office space performance with the average occupancy rates and rents declining by 7.2% points and 3.0%, respectively, between 2016 and 2017. The continued development of office space in Upperhill will therefore lead to further decline of occupancy rates and returns. For investors seeking exposure in the commercial office space, we recommend;

- development of differentiated concepts such as green office buildings, which attract higher rents due to their use of renewable energy, and therefore cost efficiency,

- serviced offices with yields of up to 13.4% against office market average at 9.2%, and

- mixed-use developments with occupancy rate of 95.0% against market average at 88.9% due to the live-work-play-invest mix for both end users and investors.

The Hospitality Sector:

During the month, the hospitality sector recorded a number of activities likely to boost the tourism sector. The following were the key activities;

- In line with the government’s efforts of marketing Kenya as the ultimate tourist destination, 31 hotels across Nyeri, Meru, Laikipia, Isiolo, Samburu and Embu Counties were classified into respective hotel star ranks according to the East African Community Classification criteria. The ranking will improve the visibility and credibility of local hotel brands, and promote healthy competition among hoteliers in Kenya, especially in terms of quality of hospitality services offered, in a bid to attract tourists and attain better ratings, Cytonn Weekly #20/2018

- During the month, Ethiopian Airlines was granted a second frequency flight to Mombasa, meaning the airline will now fly twice a day to Mombasa. This is a move in the right direction as it will increase tourist arrivals in the general coastal region which is the main tourist destination in Kenya, Cytonn Weekly #20/2018

We expect improved performance in the hospitality sector, boosted by the improved security in the country, conclusion of the electioneering period and continued marketing efforts by the Kenya Tourism Board.

Land:

Fusion Capital partnered with Optiven Limited to sell a 100 -acre land development called Amani Ridge in Ruiru, Kiambu County. Optiven has subdivided the land plots into various sizes ranging from 0.09 acres to 0.25-acre plots with the selling price ranging between Kshs. 3.0 mn to Kshs 10.7 mn per plot. The development is controlled, and buyers will have to adhere to pre-approved plans, which consist of 3 and 4-bedroom standalone houses, a shopping centre on 1.0 acre and Education centre on 4.5 acres. Ruiru market has over the past 6 years attracted many investors and developments such as Tatu City by Rendeavour Group Holdings, and RiverRun Estate by Cytonn Real Estate driven by (i) increased housing demand in satellite towns driven by increased urbanization rate at 4.4% against a global average of 2.1%, (ii) high capital appreciation with land prices in the area growing by a 6-year CAGR of 20.0% as at 2017 compared to a market average of 17.0%, according to Cytonn Land Report, and (iii) infrastructural development in the area such as connectivity via the Eastern by-pass and sewer connection in Ruiru Town.

Infrastructure:

Kenya National Highways Authority’s (KeNHA), announced plans to open phase one of the Kshs. 11 bn Dongo Kundu By pass to the public in June, this is an 11 km stretch connecting Mombasa Port and Miritini. The opening is expected to ease traffic on the Nairobi-Mombasa Highway, and connect the North Coast with the South Coast. On completion, the By-pass will directly have an impact on the real estate sector by opening up the Coastal region for development and increasing its accessibility from Nairobi thereby boosting the hospitality industry.

The President of Kenya, H.E Uhuru Kenyatta, launched the reconstruction of 80 kilometres of roads in 11 constituencies in Nairobi’s Eastlands suburbs. The roads to be reconstructed include; Komarock Road, Harambee Estate Sacco Roads, Eastern by-pass -Kayole Spin Road, Donholm Phase V and VIII Roads, Eldoret Road and Nyasa Road. The project is part of the Nairobi Regeneration programme, which focuses on housing, infrastructure and transport, energy and water resources, among others. The repair of the above roads will ease congestion in Nairobi Eastlands and enhance accessibility, boosting the real estate performance in the region, where currently Eastlands areas such as Donholm record 18.4% annual uptake, lower than residential market average at 24.0% attributable to traffic congestion in the area.

We expect to continue witnessing increased government expenditure on infrastructure to boost economic activities, including the real estate sector in the country.

Real Estate Financing:

The real estate sector continued witnessing an increase in capital injection. Investors are attracted to the sector by; (i) high returns, which have averaged at 24.3% p.a. over the last 5 years, compared to an average of 13.2% p.a. recorded in traditional asset classes, (ii) high demand, with the sector having a deficit of 2 mn housing units, growing by approximately 200,000 houses p.a., and (iii) government incentives such as increased focus on affordable housing, and a 15% tax reduction for developers delivering at least 100 affordable units p.a. The following were the key highlights during the month;

- During the month, the Kenya Mortgage Refinancing Company (KMRC) received support of Kshs 15.1 bn from the World Bank. KMRC, which is currently being incorporated, was created to reduce the liquidity risk that commercial banks face in offering long-term credit, as well as enable potential home-buyers access financing with ease. We expect the body to result to a rise in (i) the number of mortgage lenders, (ii) the number of mortgage undertakings, and thus (iii) increased uptake of homes by the low-income population. Our topical on The Kenya Mortgage Refinancing Company, expounds more on how the facility works and the expected effect of the same on the mortgage market in Kenya,

- Consonance Kuramo Special Opportunities Fund I, a subsidiary of New York-based Kuramo Capital, bought an undisclosed equity stake in Century Developments Limited, a Nairobi based Pan-African real estate development and investments company, focusing on building affordable housing communities across Africa. Cytonn Weekly #20/2018

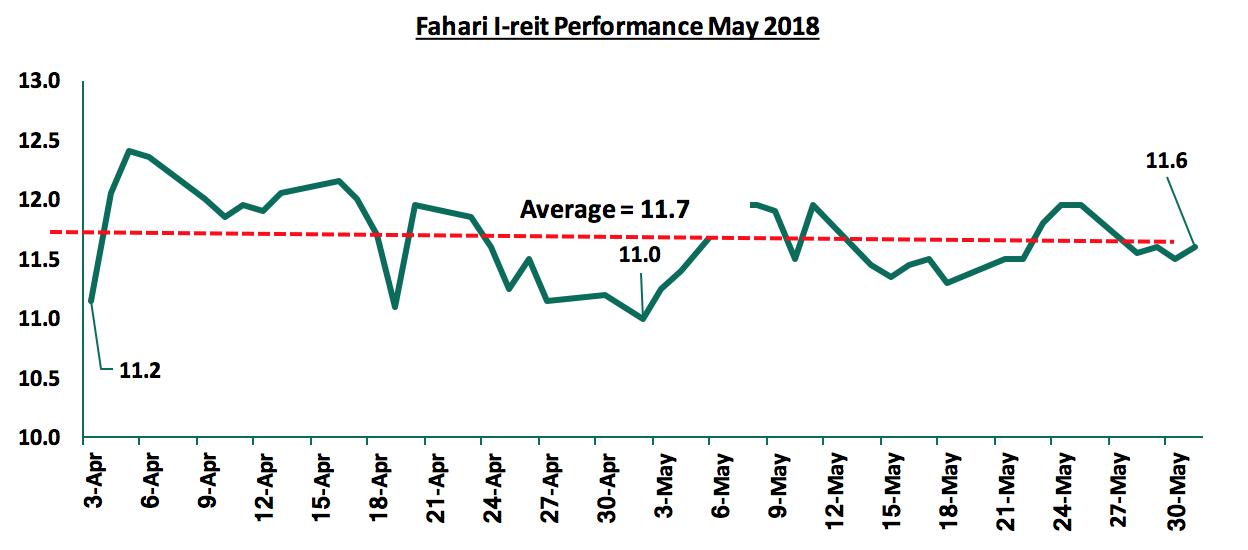

Listed Real Estate:

During the month, Stanlib’s Fahari I-REIT price rose by 3.6%, closing at Kshs. 11.6 from Kshs. 11.2 at the end of April. The REIT traded at an average unit price of Kshs. 11.6 in May 2018, 42.0% lower than the listing price of Kshs. 20.0 in November 2015. We attribute the low performance to (i) opacity of the exact returns from the underlying assets, (ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari and Fusion REIT (FRED), (iii) inadequate investor knowledge, and (iv) lack of institutional support for REITs. We expect the REIT to continue trading at low prices and in low volumes.

The graph below shows the REIT’s performance in May 2018;

Statutory Reviews:

During the month, various bodies proposed or adopted policies that affect the regulation of the real estate sector. The following are the key reviews;

- The Cabinet Secretary of the Ministry of Lands and the Law Society of Kenya (LSK) agreed to form a 15-person task force to look into the issues raised by the LSK on the inadequacies of the Land Information Management System (LIMS). The task force is tasked to recommend guidelines on how the implementation of the electronic registration and conveyancing system will be undertaken, in compliance with Regulation 90 of the Land Registration (General Regulations, 2017) that states that the register as well as documents required under the Electronic Registration and Conveyancing Act shall be maintained in an electronic format. The digitization of land registries will enhance efficiency and transparency of land dealings through improved transfers and payments and reduce conveyance related costs, Cytonn Weekly #21/2018

- The Energy Regulatory Commission (ERC) kicked off vetting of both existing buildings and those under construction to ensure that they have complied with solar heating rules, Cytonn Weekly #19/2018

- The National Construction Authority (NCA) announced that it was drafting a construction industry policy that will streamline operations in the construction and real estate sectors in the country. Cytonn Weekly #21/2018

Another real estate highlight of the month was that Saint-Gobian, a French Multinational Corporation that manufactures, designs, and distributes construction and building related materials opened its first showroom in Nairobi. The firm joins the list of multinational companies such as Betchel from USA, and Power China from China, which have their operations in the country.

We retain a positive outlook for the real estate sector in Kenya driven by: (i) positive demographic trends such as rapid urbanization that currently stands at 4.4% against a global average of 2.1%, (ii) rapid population growth rates of 2.6% against a global average of 1.2%, (iii) sustained infrastructural development, and (iv) government initiatives to tackle the huge housing deficit of 2 mn units, growing by approximately 200,000 units per annum according to National Housing Corporation (NHC).

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.