Cytonn Monthly – October 2018

By Cytonn Research Team, Nov 4, 2018

Executive Summary

Fixed Income

During the month of October, T-bill auctions recorded an undersubscription, with the average subscription rate coming in at 77.8%, a decline from 157.5%, recorded in the month of September. Yields on the 91-day, 182-day, and 364-day papers declined by 0.1% points, 0.3% points and 0.2% points, to 7.5%, 8.4% and 9.5% from 7.6%, 8.7%, and 9.7% the previous month, respectively. The World Bank released the Ease of Doing Business 2019 Report, with Kenya’s ranking improving by 19 positions to #61 from #80 in the 2018 report. The Privatisation Commission of Kenya, in their privatisation programme, has approved the privatisation of 26 state-owned entities in order to supplement the National Budget deficit;

Equities

During the month of October, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.6%, 2.3% and 2.9%, respectively, taking their YTD performance as at the end of October to (15.7%), (24.3%) and (16.2%) for NASI, NSE 20 and NSE 25, respectively;

Private Equity

During the month of October, there was private equity activity in the Financial Services sector, FinTech and Fundraising, as well as the release of major reports focusing on the private equity landscape. In the financial services sector, Filimbi Limited, an investment vehicle associated with tycoon Mr. Peter Munga, reduced its investment in Britam Holdings. In fundraising, AfricInvest’s FIVE (Financial Inclusion Vehicle) announced its second close that brought in EUR 31.0 mn (Kshs 3.6 bn). In Fintech, PayPal Holdings Inc made a strategic investment in Tala for an undisclosed amount. For the released reports, the African Private Equity and Venture Capital Association (AVCA) and PwC released a report on private equity-backed IPOs in the African Region. The Retirement Benefits Authority (RBA) released a report highlighting pension schemes’ increased investments in Private Equity. African Private Equity and Venture Capital Association (AVCA) released the African Private Equity Data Tracker for H1’2018;

Real Estate

During the month, the real estate sector recorded various activities with the key highlights across various themes as follows: (i) According to World Bank’s Doing Business 2019 report, Kenya’s ranking in terms of property registration improved by three ranks to #122 in 2018 from #125 in 2017 mainly attributable to the digitization of the lands ministry; (ii) H.E President Uhuru Kenyatta signed into law the Supplementary Appropriation Bill No. 2 of 2018, with the housing department receiving Kshs 21.0 bn, which is 44.7% of the Kshs 47.3 bn supplementary budget and a 223.1% increment from the Kshs 6.5 bn allocated in Kenya National Budget 2018/19, in support of the affordable housing initiative; and (iii) The Tourism Finance Corporation, announced plans to reduce its cost of credit to 9.0% from the current 11.0%, for all local hospitality sector investors, in a bid to encourage hotel investment in counties outside Nairobi.

- The Ridge, a comprehensive and luxurious mixed-use development located in Ridgeways, Nairobi approximately 10 km from the CBD, by Cytonn Real Estate, was featured on Property Show. See the video here

- Cytonn Investments featured on CNN during Quest means Business segment. See the Twitter link here

- On 1 November 2018, Cytonn Asset Managers Limited (CAML), the regulated affiliate of Cytonn Investments Management Plc, held a Pension Trustees Training at Windsor Golf Hotel and Country Club. The training focused on educating the trustees on the investment opportunities available in the alternative investment space, especially real estate. See Event Note here . For Pension Trustee training, kindly contact us at info@cytonnasset.com

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects; and

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers section on our website to apply.

- Cytonn Centre for Affordable Housing (CCFAH) is looking for a 2-acre land parcel for a joint venture in Kiambu County (Ruiru, Kikuyu, Lower Kabete), Nairobi County and its environs. The parcel should be; i) fronting a main road, or not more than 800 metres from the main road and ii) priced at Kshs 20mn per acre or below. For more information or leads email us at affordablehousing@cytonn.com

T-Bills & T-Bonds Primary Auction:

During the month of October, T-bill auctions recorded an undersubscription, with the average subscription rate coming in at 77.8%, a decline from 157.5%, recorded in September. The average subscription rates for the 91-day, 182-day and 364-day papers came in at 108.1%, 41.8% and 101.7%, from 170.0%, 124.7% and 185.3%, in the previous month, respectively. The yields on the 91-day, 182, day and 364-day papers declined by 0.1% points, 0.3% points and 0.2% points, to 7.5%, 8.4%, and 9.5% from 7.6%, 8.7%, and 9.7% the previous month, respectively. The T-bills acceptance rate came in at 92.4% during the month, compared to 75.9% recorded in September with the Kenyan government accepting a total of Kshs 86.2 bn of the Kshs 93.3 bn worth of bids received, indicating that bids were largely within ranges the Central Bank of Kenya (CBK) deemed acceptable.

During the week, T-bills were oversubscribed, with the overall subscription rate coming in at 106.4%, up from 66.8% recorded the previous week. The improved performance was attributed to improved liquidity in the interbank market, evidenced by the declined interbank rate, which recorded a low of 2.0% as at 31st October 2018, the lowest since the 1.9% recorded in 30th March 2011. The improved liquidity was attributed to increased government payments. The yields on the 364-day paper remained unchanged at 9.5%, while the yields on the 91-day and 182-day papers declined to 7.4% and 8.3%, from 7.5% and 8.4%, the previous week, respectively. The acceptance rate remained unchanged at 100.0% from the previous week, with the government accepting Kshs 25.5 bn out of the Kshs 25.5 bn of bids received. The subscription rate for the 91-day, 182-day and 364-day papers improved to 128.4%, 59.8% and 144.3% from 61.0%, 30.3% and 105.6%, the previous week, respectively.

The 91-day T-bill is currently trading at a yield of 7.4%, which is below its 5-year average of 9.0%. The lower yield on the 91-day paper is mainly attributable to the low interest rate environment that has been experienced since the passing of the law capping interest rates. We expect this to continue in the short-term, given:

- The discipline of the CBK in stabilizing interest rates in the auction market by rejecting aggressive bids that are priced above market, for both T-bills and T-bonds, and,

- The maintaining of the Central Bank Rate at 9.0% by the Monetary Policy Committee in their September meeting.

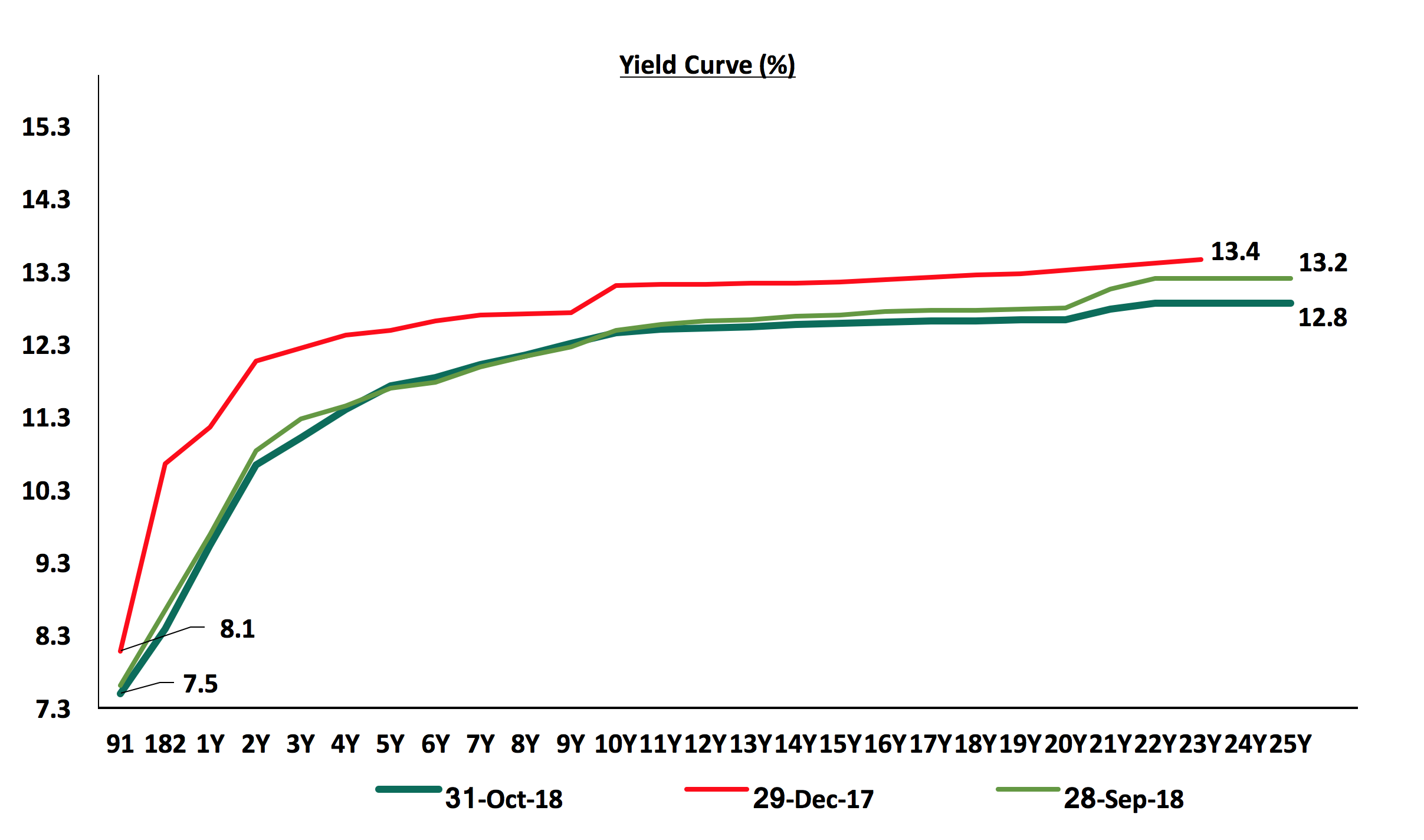

During the month, the Kenyan Government issued a 15-year Treasury bond (FXD2/2018/15) with a 12.75% coupon rate in a bid to raise Kshs 40.0 bn for budgetary support. The bond was later re-opened during the same month. Both issues were under-subscribed, with the overall subscription rate coming in at 67.6% and 79.3% for the initial issue and re-open, respectively. The weighted average rate of accepted bids for both issues came in at 12.7%, in line with our expectations of 12.6% - 12.8%. We attribute the low-performance of long-term bond to the relatively flat yield curve on the long-end as compared to the relatively steep short-end of the yield curve, making it unattractive to hold longer-term bonds. The government accepted Kshs 7.8 bn out of the Kshs 27.0 bn worth of bids received, against Kshs 40.0 bn on offer, translating to an acceptance rate of 29.0% in the initial issue. The acceptance rate on the re-open, however, improved to 83.8%, with the government accepting Kshs 21.3 bn out of the Kshs 25.4 bn worth of bonds received against Kshs 32.0 bn on offer.

Secondary Bond Market:

The yields on government securities in the secondary market continued to decline in October as the Central Bank of Kenya continued to reject expensive bids in the primary market. According to the FTSE NSE Bond Index, Treasury bonds listed at the Nairobi Securities Exchange (NSE) gained 1.6% during the month, bringing the YTD performance to 13.5%.

Liquidity:

The interbank rate declined to 2.0% at the end of October from 6.0% in September, pointing to improved liquidity during the month, which the CBK attributed to increased government payments.

During the week, the average interbank rate declined to 2.6%, from 3.6% the previous week, while the average volumes traded in the interbank market increased by 10.9% to Kshs 23.4 bn from Kshs 21.1 bn the previous week. The decline in the average interbank rate points to improved liquidity, which the Central Bank of Kenya partly attributed to increased government payments.

Kenya Eurobonds:

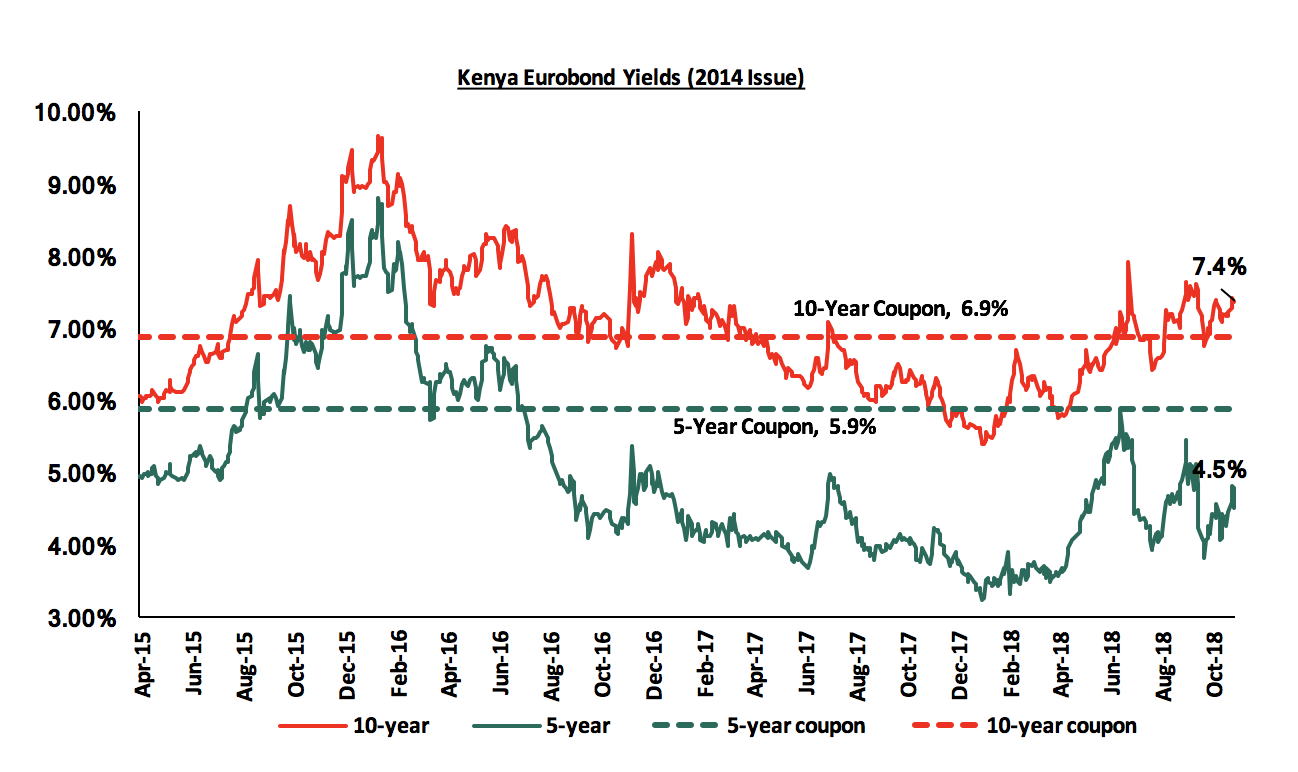

According to Bloomberg, the yield on the 5-year and 10-Year Eurobonds issued in June 2014 rose by 0.8% points and 0.6% points to 4.8% and 7.4%, respectively, from 4.0% and 6.8% in September, attributable to market corrections due to the 0.25% hike in the Fed Rate during the month. During the week, the yields on the 5-year and 10-year Eurobonds issued in 2014 rose by 0.1% points and 0.2% points to 4.5% and 7.4% from 4.4% and 7.2%, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.3% points and 2.2% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

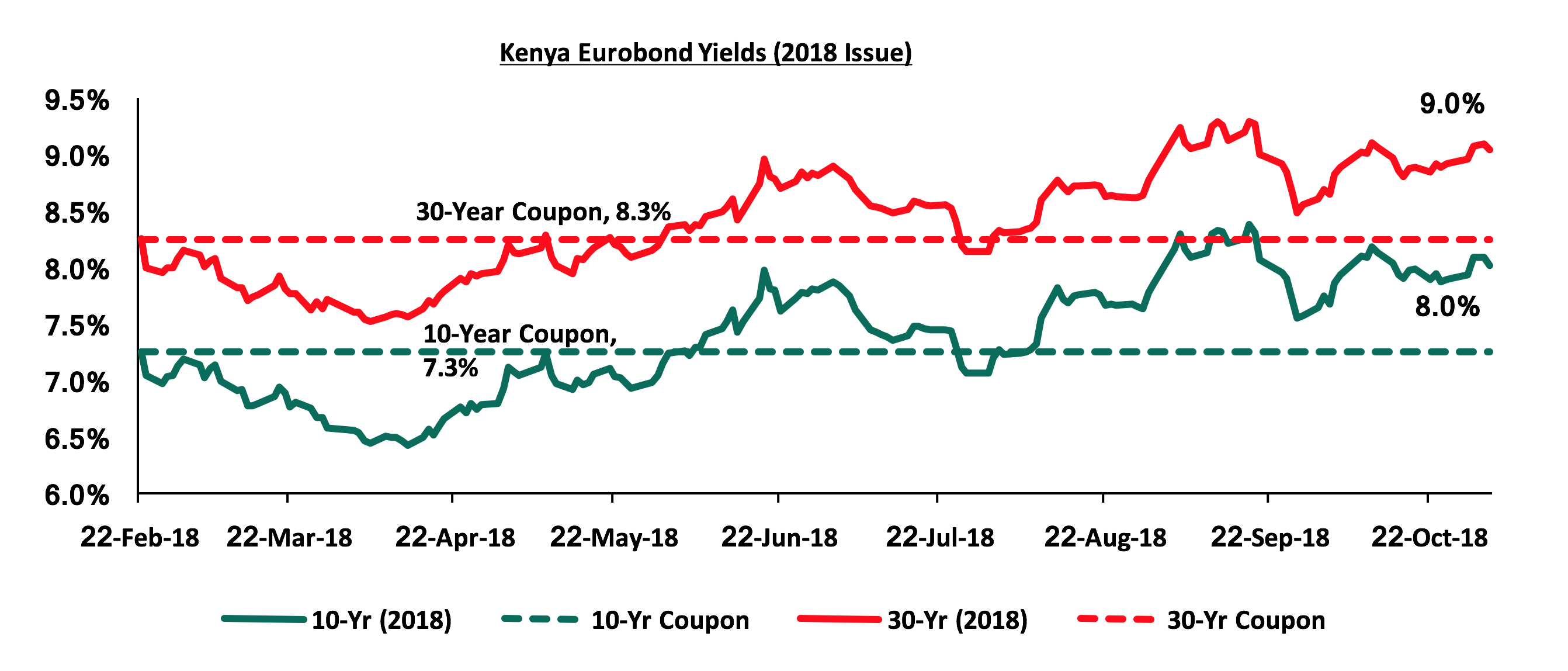

During the month, the yields on the 10-year and 30-year Eurobond issued in February 2018 both rose by 0.5% points to 8.1% and 9.1% from 7.6% and 8.6% in September, respectively. During the week, the yields on the 10-year and 30-year Eurobonds both increased by 0.1% points, to 8.0% and 9.0% from 7.9% and 8.9% recorded the previous week, respectively. Since the issue date, the yields on the 10-year Eurobond and 30-year Eurobond have both increased by 0.7% points.

The Kenya Shilling:

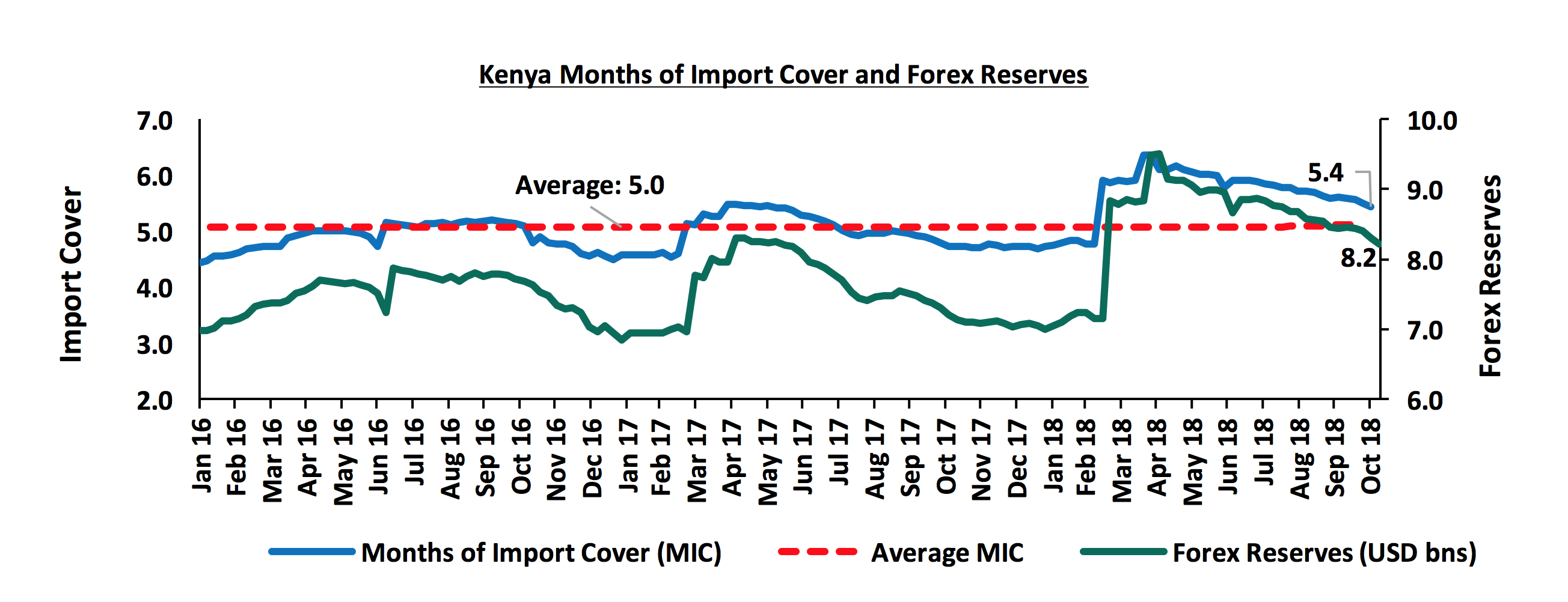

The Kenya Shilling depreciated by 0.8% against the US Dollar during the month of October to Kshs 101.8 from Kshs 101.0 at the end of September. This was driven by dollar demand from traders and oil importers coupled with subdued dollar inflows from exporters. During the week, the Kenya Shilling depreciated by 0.5% against the US Dollar to close at Kshs 101.7 from Kshs 101.2, the previous week, due to the end-month demand from oil importers and manufacturers amidst excess liquidity in the market. On a YTD basis, the shilling has appreciated by 1.4% against the US Dollar. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.8% in the 12-months to June 2018, from 6.3% in March 2018, attributed to improved agriculture exports, and lower capital goods imports following the completion of Phase I of the Standard Gauge Railway (SGR) project,

- Stronger inflows from principal exports, which include coffee, tea, and horticulture, which increased by 1.7% during the month of July to Kshs 24.7 bn, from Kshs 24.3 bn in June, with the exports from horticulture improving by 9.1%,

- Improving diaspora remittances, which increased by 71.9% y/y to USD 266.2 mn in June 2018 from USD 154.9 mn in June 2017 and by 4.9% m/m, from USD 253.7 mn in May 2018, with the largest contributor being North America at USD 130.1 mn, attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.2 bn, equivalent to 5.4-months of import cover, compared to the one-year average of 5.5 months, as highlighted below

Inflation:

The Y/Y inflation rate for the month of October recorded a decline to 5.5% from 5.7% in September. This was not in line with our projections of 5.8% to 6.2%, as highlighted our Cytonn Weekly Report #40/2018 , because of a decline in food prices, leading to a decline in the food and non-alcoholic beverages index by 1.8% as compared to our projections of 1.5%. The decline in the inflation rate was mainly attributed to a 1.8% and 0.9% decline in the food and non-alcoholic beverages index and the transport index, respectively. The 1.8% m/m decline in the food and non-alcoholic beverages index in October was mainly due to lower prices of maize and maize products compared to the previous month. The 0.9% m/m decline in the transport index was attributed to a 0.9% drop in average petrol prices. Housing, water, electricity, gas and other fuels’ Index, however, rose by 0.2% m/m, attributed to a rise in house rents. Below is a summary of key changes in the Consumer Price Index (CPI) in October:

|

Broad Commodity Group |

Price change m/m (Oct-18/Sep-18) |

Price change y/y (Oct-18/Oct-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

(1.8%) |

0.5% |

This was mainly due to lower prices of maize and maize products compared to previous month as evidenced by the drop in the price of a 2 kg packet of sifted maize flour by 14.4% to an average of Kshs 83.8 from an average of Kshs 97.9 in September |

|

Transport Cost |

(0.9%) |

15.3% |

This was on account of a 0.9% drop in average petrol prices |

|

Housing, Water, Electricity, Gas and other Fuels |

0.2% |

17.1% |

This was on account of a rise in house rents that outweighed the decline in cost of electricity during the month |

|

Overall Inflation |

(0.8%) |

5.5% |

The m/m decline was due to a 1.8% and 0.9% decline in food prices and transport costs which have a CPI weight of 36.0% and 15.3%, respectively |

Monthly Highlights:

The Privatisation Commission of Kenya will oversee the privatisation of state-owned entities in order to supplement the National Budget deficit, which currently stands at Kshs 579.9 bn, primarily by reducing the government expenditure and bringing in private capital. In the Commission’s approved privatisation programme, 26 companies are set to be privatised, among them being the National Bank of Kenya, Kenya Pipeline Company and the Eldoret Container Terminal, belonging to Kenya Ports Authority. These 26 will be part of a long-term initiative to reduce the total state-owned entities, from the current 262 to 187. The Privatisation Commission has laid out a number of secondary objectives for the sale of each entity, with some of them including improvement in governance, enhancing growth of the companies, as well as guaranteeing continued existence of these entities.

Historically, the privatisation of state-owned corporations have seen many of these companies turn around their operations, with an example of Telkom Kenya, which, before government sale of 51% stake to French mobile operator, Orange, was facing risk of closure, but has now transformed, with Helios buying Orange’s entire stake in 2015. It is expected that the entities up for privatisation will chart this same path, especially considering that some of the state-owned entities that are up for sale, such as Chemelil Sugar Company and the Kenya Meat Commission, are facing a number of challenges arising from operational inefficiencies. The Privatisation Commission has disclosed that there are initial talks with a number of foreign investors who are interested in acquiring these entities. The Commission has however not disclosed how much is expected to be raised from the sale of these entities.

Apart from raising funds to supplement the budget, we expect the privatization efforts by the government to have a number of other implications on the companies and the economy in entirety, which include;

- Improved efficiency in governance and operation of these entities,

- Reduction of costs centres for the Government, considering that as per the 2015-16 audit report on state firms, it was highlighted that at least 36 parastatals were insolvent, and would require collective capital injection of Kshs 118.7 billion to stay afloat,

- Enhancement of the capital markets, with Government exiting some of these entities through floatation of their shares in the Nairobi Securities Exchange (NSE). Historically, successful IPOs by State Owned Enterprises, in Kenya have generated significant interest in the market, attracting a good number of private companies to list immediately after, as highlighted in our Focus on Listing. The listing of KCB in 1988 for instance, immediately attracted the listing of Total Oil Company, Standard Chartered Bank and Nation Printers, and,

- Increasing foreign direct investments into the country, as was the case with the sale of Telkom Kenya to Orange, where the French firm injected USD 390.0 mn (Kshs 39.0 bn) into the Kenyan economy.

During the month, the International Monetary Fund (IMF) released a report based on bilateral discussions held with the Kenyan Government on the country’s economic developments and policies. The economic and financial information collected was used to establish the Performance Criteria for the second review under the precautionary Stand-By Arrangement (SBA), amounting to USD 985.9 mn (Kshs 99.0 bn), extended to Kenya on 14th March 2016. The program expired on 14th September 2018 after being extended from 14th March 2018, and the Treasury announced that it was not keen on renewing the precautionary credit facility with the IMF, despite having requested an extension of the same in March 2018, arguing that the country had kept macroeconomic fundamentals stable despite the country not drawing on the facility. For more information, see our focus on The IMF Precautionary Credit Facility 2018.

During the month, the World Bank released the Doing Business 2019 Report, which investigates the regulations that enhance business activity in a country and those that constrain it. Of the 190 countries, Kenya’s ranking improved by 19 positions to #61 from #80 in the 2018 report, the improvement was primarily because of (i) improved ease in the process of registering of property, (ii) increased access to credit, (iii) protection of minority investors and, (iv) simplification of the value added tax schedule on the iTax platform. Kenya ranked #4 in Africa, after Mauritius, Rwanda and Morocco, which ranked #20, #29 and #60 overall, respectively. Below is a table highlighting the 30 Top Ranking Countries in Africa as per the Ease of Doing Business Report:

|

Top 30 African Countries in Terms of Ease of Doing Business |

|||

|

Ranking |

Country |

Overall Ranking |

Ease of Doing Business Score |

|

1 |

Mauritius |

20 |

79.6 |

|

2 |

Rwanda |

29 |

77.9 |

|

3 |

Morocco |

60 |

71.0 |

|

4 |

Kenya |

61 |

70.3 |

|

5 |

Tunisia |

80 |

66.1 |

|

6 |

South Africa |

82 |

66.0 |

|

7 |

Botswana |

86 |

65.4 |

|

8 |

Zambia |

87 |

65.1 |

|

9 |

Seychelles |

96 |

62.4 |

|

10 |

Djibouti |

99 |

62.0 |

|

11 |

Lesotho |

106 |

60.6 |

|

12 |

Namibia |

107 |

60.5 |

|

13 |

Malawi |

111 |

59.6 |

|

14 |

Ghana |

114 |

59.2 |

|

15 |

Egypt |

120 |

58.6 |

|

16 |

Côte d'Ivoire |

122 |

58.0 |

|

17 |

Uganda |

127 |

57.1 |

|

18 |

Mozambique |

135 |

55.5 |

|

19 |

Togo |

137 |

55.2 |

|

20 |

Senegal |

141 |

54.2 |

|

21 |

Niger |

143 |

53.7 |

|

22 |

Tanzania |

144 |

53.6 |

|

23 |

Mali |

145 |

53.5 |

|

24 |

Nigeria |

146 |

52.9 |

|

25 |

Mauritania |

148 |

52.0 |

|

26 |

Gambia |

149 |

51.7 |

|

27 |

Burkina Faso |

151 |

51.6 |

|

28 |

Guinea |

152 |

51.5 |

|

29 |

Benin |

153 |

51.4 |

|

30 |

Zimbabwe |

155 |

50.4 |

Kenya’s overall score improved by 5.1 points to 70.3 from 65.2 in the 2018 report. Kenya was the 7th most improved country in terms of comprehensive ranking in ease of doing business, with a total of 5 reforms implemented among the 11 areas of focus. For more information, see our Doing Business Report Kenya-2019 Note.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids, as it is currently 58.7% ahead of its pro-rated borrowing target for the current financial year, having borrowed Kshs 157.6 bn against a pro-rated target of Kshs 99.3 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, with the president having assented to the Finance Bill 2018, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instrument.

Market Performance

During the month of October, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 3.6%, 2.3% and 2.9%, respectively, taking their YTD performance as at the end of October to (15.7%), (24.3%) and (16.2%) for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the month was driven by declines in the communications, consumer staples and financial services segments; with weighted declines of 5.2%, 4.1% and 3.6%, respectively. Large caps stocks such as Diamond Trust Bank (DTB), NIC Group, East Africa Breweries Ltd (EABL), Co-operative Bank and Safaricom declined by 10.9%, 6.1%, 5.9%, 5.9% and 5.1%, respectively.

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 1.4%, 0.4% and 0.5%, respectively, due to gains made in counters such as Standard Chartered, Barclays Bank and Safaricom Plc, which gained by 5.6%, 5.3% and 4.3%, respectively.

Equities turnover rose by 40.8% during the month to USD 167.1 mn from USD 118.7 mn in September, taking the YTD turnover to USD 1.6 bn. For this week, equities turnover declined by 53.0% to USD 37.8 mn from USD 80.5 mn in the previous week with foreign investors remaining net sellers. Foreign investors remained net sellers for this month, with a net selling position of USD 43.2 mn, which was a 41.9% increase from USD 30.4 mn net outflows recorded last month. We expect the market to remain subdued in the near-term as international investors exit the broader emerging markets due to the expectation of rising US interest rates coupled with the strengthening of the US Dollar.

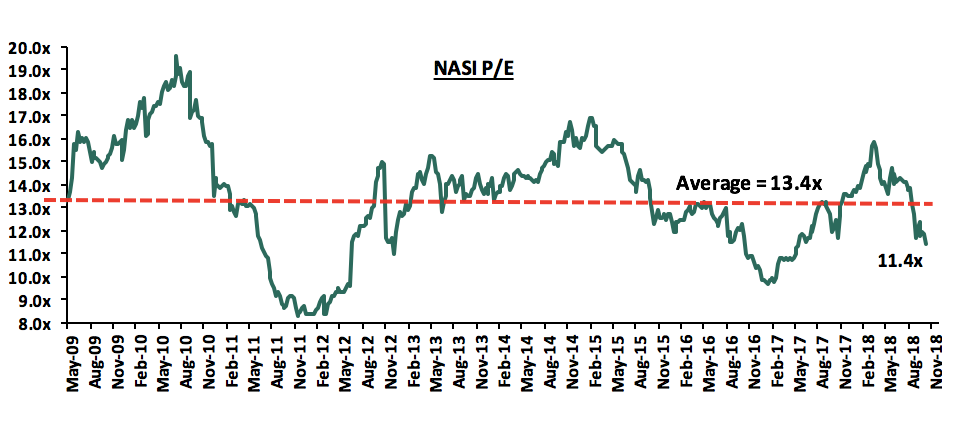

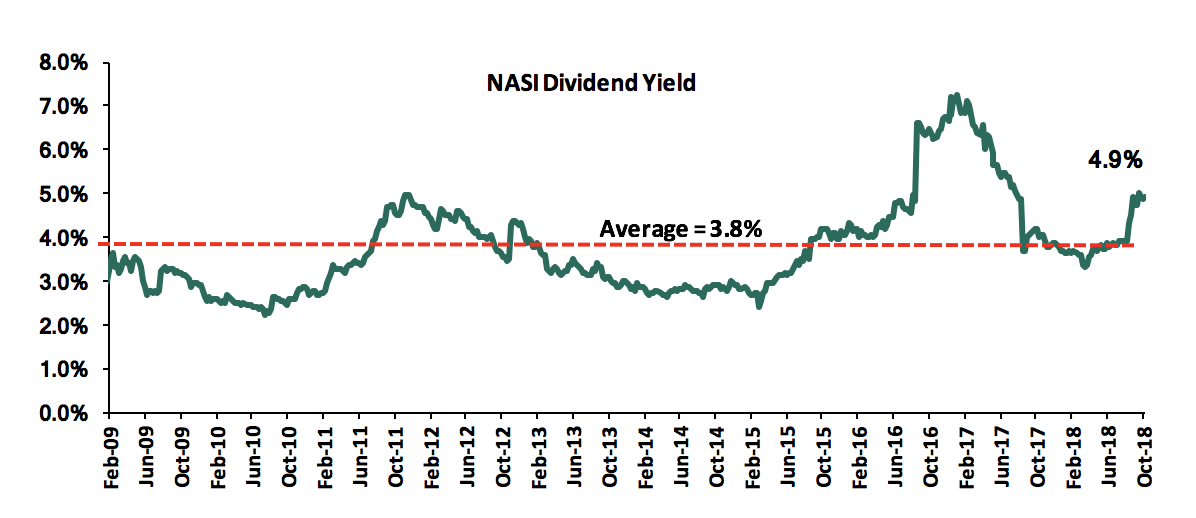

The market is currently trading at a price to earnings ratio (P/E) of 11.4x, 14.9% below the historical average of 13.4x, and a dividend yield of 4.9%, slightly above the historical average of 3.8%. The current P/E valuation of 11.4x is 16.7% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 37.7% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights

The Nairobi Security Exchange is set to admit Bank of Kigali Group Plc (BoK) after the Capital Markets Authority (CMA) granted approval for its cross listing. The Bank will be the first Rwandese firm to list its shares on the Kenyan bourse. According to the regulator, the cross listing will facilitate cross-border investments, further strengthening the Memorandum of Understanding entered into between capital markets regulators in East African countries (Kenya, Uganda, Tanzania, Rwanda and Burundi) through which a common blueprint on the integration of the East African capital markets was adopted. In our view, the listing may enhance Kenya’s position as an international financial centre and gateway for regional and international capital flows, in addition to increasing liquidity for the bank’s investors.

During the week, Athi River Mining Plc (ARM) was suspended from trading at the NSE for a further 75 working days. The extension comes on the back of expiry of the 21 days suspension issued in September that was meant to give ARM time to complete creditor meetings that were convened as part of a process aimed to give a clear picture of the financial state of the company. This follows the placement of the company under administration in August after its lenders raised concerns of insolvency by the company. In our view, the extension seems to show that ARM’s problems could take longer to resolve, hence dimming the prospects of a quick turnaround.

The Official Monetary and Financial Institutions Forum (OMFIF), in association with Absa Group Limited released the Absa Africa Financial Markets Index report 2018. The report evaluated financial market development in 20 African countries, in addition to highlighting markets with clearest growth prospects. The report mainly analyzed and ranked countries on six different pillars:

- Market depth,

- Access to foreign exchange,

- Market transparency, tax and regulatory environment,

- Capacity of local investors,

- Macroeconomic opportunity,

- Legality and enforceability of standard financial markets master agreements.

According to the report, the top five financial markets in Africa are South Africa, Botswana, Kenya, Mauritius and Nigeria, respectively. Kenya climbed two spots to position three, with a score of 65%, from position five last year, due to improved ease of access to foreign exchange as well as implementation of proper foreign trading policies such as reducing capital controls, which has boosted its performance. It ranked position 1 on access to foreign exchange with a score of 93%, position 8 on market depth with a score of 44%, position 7 on capacity of local investors with a score of 33% and position 6 on the macroeconomic opportunity with a score of 65%. For more information on the report, see our Cytonn Weekly #41/2018.

Following the enactment of the Finance Bill 2018 in September 2018, banks will no longer be mandated to pay a minimum 70% of Central Bank Rate (CBR) on interest-earning deposits as was previously required, since the enactment of Banking (Amendment) Act 2015. As a result, banks have initiated the process of revising their deposit rates downwards as they aim to reduce their cost of funding. KCB Group, Standard Chartered and National Bank of Kenya issued notices to their customers during the month, notifying them of the interest rate on deposits cuts as provided for by the newly passed legislation. The scrapping of the floor on interest payments on bank deposits will effectively serve to lower the cost of funding for local lenders as they re-price their deposits. According to data from the Central Bank of Kenya (CBK), the average cost of deposits in the banking sector has been on a decline since 2015, largely due to reclassification of bank accounts to non-interest earning accounts, effectively reducing the associated interest expense. As at December 2017, the average cost of deposits stood at 4.3%, translating to a total interest expense of Kshs 124.4 bn as indicated below;

|

Banking Sector Interest Expenses |

||||||

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

Average Cost of Deposits |

5.9% |

3.8% |

4.9% |

5.5% |

5.0% |

4.3% |

|

Total Interest Expense |

110.9 |

83.8 |

103.6 |

133.1 |

130.8 |

124.4 |

We expect other banks to follow suit and lower their deposit rates and as a result, the average cost of deposit is set to continue declining, which is likely to improve the sector’s overall Net Interest Margin (NIM). For more information, see our Cytonn Weekly #40/2018

The Central Bank of Kenya (CBK) released the Kenya Financial Sector Stability Report 2017, highlighting the stability of the banking sector over the period between January and December 2017. The report highlighted, among other issues, profitability, liquidity and asset quality of the banking sector. The data from the report indicated that commercial banks have adjusted their business models in favour of lending to large corporate borrowers and purchase of government debt, hence reducing credit to small borrowers whom lenders perceive as riskier by comparison. The report also highlighted that the banking sector had remained resilient despite interest rates caps. For more information on the report, see our Cytonn Weekly #39/2018.

I&M Bank secured a USD 40.0 mn (Kshs 4.0 bn) loan from the FMO, a Dutch Development Bank, for onward lending to small business enterprises (SMEs). The facility will support the expansion of I&M Bank’s strategy to increase its SME loan book, boosting the local economy in the process. Kenyan banks have, in recent years, taken on substantial loans from international financiers including International Finance Corporation (IFC), European Investment Bank and the African Development Bank (AfDB). Previously, Equity Group, Co-operative Bank, Diamond Trust Bank, Stanbic Holdings and KCB Group have borrowed from international financiers mainly to finance their onward lending businesses. The asset-liability mismatch by tenor due to the relatively long-term nature of loans and short-term nature of deposits exposes a gap that banks have chosen to fill with credit from the international financiers. The table below summarizes the debt issues by international institutions to local banks:

|

Issuer |

Bank |

Issue Date (Kshs bn) |

Amount of Loan |

Term of Credit |

|

|

1. |

Africa Development Bank |

Kenya Commercial Bank |

Oct-17 |

10.4 |

Not specified |

|

2. |

IFC |

I&M Holdings |

Jan-18 |

1.0 |

Not specified |

|

3. |

IFC |

Cooperative Bank |

Feb-18 |

15.2 |

7-years |

|

4. |

Africa Development Bank |

Diamond Trust bank |

Mar-18 |

7.5 |

7-years |

|

5. |

SwedFund |

Victoria Commercial Bank |

Apr-18 |

0.5 |

Not specified |

|

6. |

14 financial Institutions (syndicated) |

Stanbic Bank |

May-18 |

10.0 |

2,3 years |

|

7. |

FMO |

I&M Holdings |

Oct-18 |

4.0 |

Not Specified |

|

Total |

48.6 |

For more information, see our Cytonn Weekly #38/2018.

Corporate Governance Changes:

Liberty Holdings Ltd announced the resignation of Dr. Susan Mboya Kidero as the board chair. Following the resignation, the following are the changes on the Corporate Governance metrics for Liberty Holdings Ltd:

- The board size decreased to 5 from 6 hence an improvement of the metric score to 1 from 0.5, since the board consists of an odd number of members from an even number, raising the possibility that there will be no tie in case board members decide to vote on a decision;

- Gender diversity declined to 0% from 16.7% since there is no longer a female member in the board;

- Ethnic diversity has improved to 60% from 66.7% since there are 2 out of 5 members of the board from the same ethnic group, a change from 2 out of 6, and;

- The proportion of non-executive members changed to 80.0% from 83.3%;

Overall, the comprehensive score remained the same at 77.1% and remained joint at position 9 with BAT, EABL and Jubilee Holdings in the 2018 Cytonn Corporate Governance Index.

KCB Group announced the appointment of Mr. Andrew Wambari Kairu as the new board chair, replacing Mr. Ngeny Biwott who held the position for five years. Following the appointment to the KCB Group Board, the following are the implications on the Corporate Governance metrics for KCB Group;

- The board size remained the same at 9 since Mr. Andrew Kairu was a non-independent director of KCB Bank Kenya and now joins the KCB Group board;

- Gender diversity remained the same at 77.8%;

- Ethnic diversity also remained the same at 77.8%, since there are 2 out of 9 members of the board from the same ethnic group;

- The proportion of non-executive members remained at 77.8%;

Overall, the comprehensive score remained the same at 85.4% and remained joint at position 1 with NSE and Safaricom in the 2018 Cytonn Corporate Governance Index.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

Banks |

Price as at 26/10/2018 |

Price as at 2/11/2018 |

w/w change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield** |

Upside/Downside |

P/TBv Multiple |

|

NIC Bank*** |

23.0 |

23.0 |

0.0% |

(31.9%) |

(31.2%) |

48.8 |

4.3% |

116.5% |

0.6x |

|

Diamond Trust Bank |

158.0 |

155.0 |

(1.9%) |

(19.3%) |

(12.9%) |

283.7 |

1.7% |

84.7% |

0.9x |

|

KCB Group*** |

38.5 |

38.0 |

(1.3%) |

(11.1%) |

(0.7%) |

61.3 |

7.9% |

69.2% |

1.2x |

|

Union Bank Plc |

5.1 |

5.1 |

0.0% |

(35.3%) |

(17.6%) |

8.2 |

0.0% |

61.4% |

0.5x |

|

Ecobank |

6.9 |

6.7 |

(3.0%) |

(12.0%) |

(2.9%) |

10.7 |

0.0% |

60.4% |

1.5x |

|

I&M Holdings*** |

90.0 |

90.0 |

0.0% |

(29.1%) |

(27.4%) |

138.6 |

3.9% |

57.9% |

0.9x |

|

Ghana Commercial Bank*** |

5.3 |

5.2 |

(2.8%) |

2.0% |

22.6% |

7.7 |

7.4% |

57.3% |

1.2x |

|

Zenith Bank*** |

24.0 |

23.6 |

(1.9%) |

(8.2%) |

(8.4%) |

33.3 |

11.5% |

53.0% |

1.1x |

|

Equity Group |

40.0 |

39.5 |

(1.3%) |

(0.6%) |

9.0% |

56.2 |

5.1% |

47.3% |

1.9x |

|

UBA Bank |

8.0 |

7.9 |

(1.3%) |

(23.3%) |

(15.1%) |

10.7 |

10.8% |

46.2% |

0.5x |

|

Co-operative Bank |

14.6 |

14.4 |

(1.4%) |

(10.3%) |

(10.9%) |

19.9 |

5.6% |

44.3% |

1.3x |

|

CRDB |

150.0 |

150.0 |

0.0% |

(6.3%) |

(11.8%) |

207.7 |

0.0% |

38.5% |

0.5x |

|

CAL Bank |

1.0 |

1.0 |

0.0% |

(3.7%) |

13.2% |

1.4 |

0.0% |

34.6% |

0.9x |

|

HF Group*** |

5.5 |

5.3 |

(2.8%) |

(49.0%) |

(47.5%) |

6.6 |

6.6% |

31.1% |

0.2x |

|

Barclays |

10.4 |

11.0 |

5.3% |

14.1% |

19.7% |

12.5 |

9.1% |

23.3% |

1.5x |

|

Access Bank |

8.0 |

8.4 |

5.0% |

(20.1%) |

(12.1%) |

9.5 |

4.8% |

18.6% |

0.5x |

|

Stanbic Bank Uganda |

33.0 |

33.0 |

0.0% |

21.1% |

20.0% |

36.3 |

3.5% |

13.5% |

2.3x |

|

SBM Holdings |

6.1 |

6.2 |

0.3% |

(17.9%) |

(17.6%) |

6.6 |

4.9% |

11.4% |

0.9x |

|

Standard Chartered |

178.0 |

188.0 |

5.6% |

(9.6%) |

(12.6%) |

196.3 |

6.6% |

11.1% |

1.5x |

|

Bank of Kigali |

289.0 |

289.0 |

0.0% |

(3.7%) |

1.4% |

299.9 |

4.8% |

8.6% |

1.6x |

|

Guaranty Trust Bank |

37.0 |

37.5 |

1.4% |

(8.0%) |

(10.7%) |

37.1 |

6.4% |

5.3% |

2.3x |

|

National Bank |

5.0 |

4.7 |

(6.0%) |

(49.7%) |

(48.6%) |

4.9 |

0.0% |

4.3% |

0.3x |

|

Stanbic Holdings |

90.1 |

91.5 |

1.6% |

13.0% |

15.8% |

92.6 |

2.5% |

3.7% |

0.9x |

|

Bank of Baroda |

140.0 |

140.0 |

0.0% |

23.9% |

27.3% |

130.6 |

1.8% |

(4.9%) |

1.2x |

|

FBN Holdings |

9.0 |

7.7 |

(15.0%) |

(13.1%) |

24.4% |

6.6 |

3.3% |

(10.1%) |

0.4x |

|

Standard Chartered |

25.0 |

21.8 |

(12.8%) |

(13.7%) |

30.0% |

19.5 |

0.0% |

(10.7%) |

2.7x |

|

Stanbic IBTC Holdings |

46.0 |

47.0 |

2.2% |

13.3% |

6.7% |

37.0 |

1.3% |

(20.0%) |

2.4x |

|

Ecobank Transnational |

16.8 |

16.0 |

(4.5%) |

(5.9%) |

(5.9%) |

9.3 |

0.0% |

(42.0%) |

0.6x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder ****Stock prices indicated in respective country currencies |

|||||||||

We are “NEUTRAL” on equities since the markets are currently trading below historical P/E averages. However, pockets of value continue to exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for medium and long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

During the month of October, there was private equity activity from firms carrying out Fundraising and in the Financial Services sector, as well as the release of major private equity reports.

Financial Services Sector

- Filimbi Limited, an investment vehicle owned by Peter Munga and Jane Njuguna, sold 39.5 mn shares of Britam Holdings, a diversified financial services group with operations in Kenya, Tanzania, South Sudan, Uganda, Rwanda, Malawi and Mozambique, in the eight-months ending August 2018. This reduced its stake in the investment company to 18.9 mn shares, worth Kshs 195.6 mn, at the current market price of Kshs 10.4 per share and representing 7.8% of shareholding, from 58.4 mn shares. Using the average share price for the last eight-months ending August 2018 of Kshs 13.5 per share, the implied value of the transaction is Kshs 533.2 mn. This the second sale of Britam Holdings shares by this investment vehicle, as it initially owned 90.0 mn shares and sold off 31.6 mn in 2013 at a value of Kshs 260.0 mn implying a price of Kshs 8.2 per share at the time. For more information, see our Cytonn Weekly #39/2018

Fundraising

- AfricInvest, a leading Pan-African private equity firm with a focus on agribusiness, financial services, healthcare, education and commercial sectors, announced the second close of the Financial Inclusion Vehicle (FIVE), a platform for investing in financial services in Africa. The close brought in an aggregate commitment of EUR 31.0 mn (Kshs 3.6 bn), bringing the total commitments to EUR 61.0 mn (Kshs 7.1 bn), with the first close having brought in EUR 30.0 mn (Kshs 3.5 bn). Their target commitments for this close were not disclosed. The second close brought in Norfund (the Norwegian Development Finance Institution), IFU, (the Danish investment fund for investing in Developing Countries), and the Central Bank of Kenya Pension Fund. The individual commitments for Norfund, IFU and Central Bank of Kenya Pension Fund were not disclosed. The Fund targets to raise EUR 200.0 mn (Kshs 23.4 bn), to be attained in the next three to five-years and it aims at a third closing in the next few months that will bring in Africa Development Bank and other institutional investors who have confirmed their commitment to the Fund. For more information, see our Cytonn Weekly #39/2018

Fintech

- PayPal Holdings Inc, a California-based technology company that offers digital and mobile payments solutions to customers worldwide, made a strategic investment in Tala, a California based financial technology startup that lends to underserved consumers in emerging markets, for an undisclosed amount. The investment will help Tala bring visibility and access to underserved populations in emerging markets across the globe. Tala currently operates in Kenya, Tanzania, the Philippines, and Mexico. Tala has also launched a pilot programme in India. Tala, which can be accessed by anyone with an Android smartphone in markets where Tala operates, analyzes device and behavioral data to instantly underwrite these consumers and create a personalized loan offer. Tala offers loan amounts between Kshs 1,000.0 and Kshs 50,000.0, at weekly and monthly interest rates of 11.0% and 15.0%, respectively, to a mobile wallet or via a payment method of the customers’ choice. The company has delivered more than Kshs 50.1 bn (USD 500.0 mn) in credit. The new investment builds on Tala’s Series C financing, announced in April and led by Revolution Growth, for more information see our Cytonn Weekly #16/2018.

In Kenya, Kshs 3.4 tn was transacted via mobile cash in 2016 compared to Kshs 2.8 tn in 2015 due to the rise in the number of mobile lending apps. Kenyans, in particular small and micro entrepreneurs, are increasingly turning to these mobile lending solutions to access digital micro-loans mainly for short-term working capital.

The continued increase in investments and funding of mobile lending apps is in a bid to grow the institutions loan books and aid in their expansion. In 2017, USD 200.0 mn (Kshs 20.3 bn) was raised for Fintech businesses in East Africa, of which 98% of funds raised went to Kenyan companies. This is an indicator of the positive investor sentiment in the sector. We expect the demand for mobile loans to increase and this will be driven by; (i) rapid growth of smartphone adoption in the African market with Kenya surpassing 40 mn mobile subscriptions in 2017, (ii) affinity for mobile money in Kenya as 60% of Kenyans have a mobile banking account and receive 90% of remittances through a mobile device, (iii) the convenience and accessibility to these loans that have a fast processing time, no paperwork or collateral and no late or rollover fees and, (iv) Kenyan banks hesitance to lend to smaller, untested businesses, due to the interest rate cap.

Reports:

- The African Private Equity and Venture Capital Association (AVCA) and PwC released a report on private equity-backed IPOs (exit of private equity firms from companies through means of an Initial Public Offer) in the African region. This study spanned a period of 8-years from 2010 to 2017, and sought to analyse the growing trend of companies that have had PE backed IPOs. In the period from 2010 to 2017, there was a total of 187 IPOs, with 28 in 2017, a 17.0% increase from the 24 IPOs in 2016. However, most IPOs in the region have been non-private equity backed, with private equity backed IPOs over the period constituting 14.3% of total IPOs, compared to an average of 39.0% and 36.0% for the United States and the United Kingdom, respectively. The Johannesburg Stock Exchange tied with the Bourse de Tunis in Tunisia in terms of number of IPO exits for PE firms, each having 9 PE backed IPOs over the period, followed by the Bourse de Casablanca in Morocco, which had 4 PE-backed IPOs over the period. For more information, see our Cytonn Weekly #38/2018

- Data released by the Retirement Benefits Authority (RBA) showed that investments in alternative assets by pension schemes in Kenya gained traction, with the inclusion of Private Equity & Venture Capital and REITs as separate classes in the regulations with Private Equity constituting 0.04% of the Kshs 1.2 tn total assets under management. Over one year to June 2018, pension funds increased their investments in Private Equity by 68.0% to Kshs 0.4 bn in June 2017 from Kshs 0.3 bn in June 2016. Over the six months to June 2018, pension funds’ investment in Private Equity grew by 31.3% to Kshs 0.4 bn in June 2018 from Kshs 0.3 bn in December 2017, with the number of pensions, which have invested in PE firms growing to thirteen from two in 2015. This highlights the growing appetite for investments in the Private Equity sector as investors seek higher returns. For more information, see our Cytonn Weekly #40/2018

- African Private Equity and Venture Capital Association (AVCA) released the African Private Equity Data Tracker brief for H1’2018, which presents the African Continent’s private equity (‘PE’) activity for the first half of the year. According to the report, the total value of reported African private equity deals in H1’2018 was USD 0.9 bn, a 10.0% drop from USD 1.0 bn reported in H1’2017. In terms of the share of deal value, the utilities sector was the largest sector in H1’2018, coming in at USD 0.3 bn or 37.0% of total value of deals, up from only USD 30.0 mn (3.0% of total value of deals) in H1’2017. For more information, see our Cytonn Weekly#41/2018

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the month of October, the real estate sector recorded various activities with most geared towards the implementation of the affordable housing initiative, infrastructure development and the growth of the hospitality and tourism industry. Overall, the sector continues to grow supported by:

- Sustained demand for affordable housing, and amenities, with the current housing deficit standing at an estimated 2.0 mn units according to the National Housing Corporation,

- Growth of the middle class population with increased disposable income who continue to create demand for housing and retail facilities,

- Government initiatives and incentives particularly with respect to development of affordable housing,

- Increased foreign investment, especially in the hospitality industry from leading global brands such as Marriott International and Radisson group,

- Intensified efforts to boost the tourism and hospitality sectors, such as reduced cost of credit to hotel investors by the Tourism Finance Corporation and,

- Continued investment in infrastructure, that has created a better operating environment for private investors,

The activities during the month of October were as highlighted below:

- Industry Reports

During the month, a number of reports were released, highlighting the real estate sector performance. The various reports are as explained in the table below:

|

Coverage |

Report |

Key Take Outs |

|

Real Estate |

JLL Global Real Estate Transparency Index 2018 |

· Kenya ranked 53rd globally and 3rd in Sub Saharan Africa in transparency of the real estate market after South Africa and Botswana, which were ranked 21st and 46th globally, respectively. This is an improvement for Kenya, which was previously ranked #61 globally, and #4 in Sub-Saharan Africa, in the Global Real Estate Transparency Index 2016. According to the 2018 report, the proposed adoption of block chain technology for recording land ownership and listing websites such as Jumia and Property24, where property owners and potential buyers are able to get information on property, are key factors that have put Kenya in the map in enhancing transparency in its real estate industry. For more information, see Cytonn Weekly #38 |

|

Real Estate Financing |

Central Bank of Kenya Financial Stability Report 2018 |

· Commercial banks and pension funds were the leading sources of credit for real estate developers and homebuyers, in 2017. The sustained investment in real estate is attributable to the long-term high returns from the real estate sector averaging at a 5-year average of 24.3%, and the perpetuated demand particularly for the residential units from the growing population and the expanding middle class, especially in urban areas · Bank credit to real estate increased by 30.8% to Kshs 371.7 bn in 2017, from Kshs 284.1 bn in 2016, · Pensions funds’ portfolio allocated to real estate increased by 27.1% to Kshs 226.7 bn in 2017, from Kshs 178.4 bn in 2016, · Private equity funding to real estate reduced by 13.3% to Kshs 83.2 bn in 2017, from Kshs 95.9 bn over the same period in 2016. This is in comparison to a growth of 412.5% between 2015 and 2016, · Insurance funds retained the least portfolio of Kshs 76.0 bn, having grown by 3.8% in 2017, from Kshs 73.2 bn in 2016. For more information, Cytonn Weekly #39 |

|

Land Sector |

Hass Consult Land Price Index Q3'2018 Report |

· Land prices in Nairobi suburbs recorded a slight growth of 0.2%, with 0.4% in Q3’2017, compared to 0.2% in Q2’2018. The slow growth is attributable to; (i) a wait and see attitude by property buyers, as they await to see the direction of the affordable housing policy, that is likely to result in inclined focus to certain areas for development, and (ii) uncertainty of land ownership papers and regulatory permits during the sale of property, · Land in satellite towns recorded a quarterly capital appreciation of 0.6%, compared to 0.5% in Q2’2018, attributable to continued demand for land in these areas given their relatively affordable prices, · Among suburbs, Ridgeways recorded the highest quarterly increase of 2.9% to an average of Kshs 74.7 mn per acre from an average of Kshs 72.6 mn per acre in Q2’2018, and · Among satellite towns, Mlolongo area recorded the highest quarterly increase in land price of 4.0% during Q3’2018 to an average of Kshs 25.3 mn per acre from Kshs 24.3 mn per acre in Q2’2018. For more information, see Cytonn Weekly #40

|

|

Residential Sector |

Hass Consult House Price Index Q3'2018 |

· Asking house prices in Nairobi increased slightly by 1.1% q/q, compared to a 1.8% decline in Q3’2017, attributable to the growing investor confidence following the conclusion of the elections held last year, despite the constrained access to funds, · Asking rents in Q3’2018 recorded a 1.5% increase compared to a 0.3% decline in Q2’2018 attributable to the continued demand for rental properties, · Detached units recorded the highest change in asking price with a 1.3% growth, while apartments and semi-detached recorded a 0.8% and 0.5% increase in asking prices, respectively, and · Apartments recorded the highest rental price increase at 3.5%, while detached and semi-detached units recorded 1.1% and 0.8% respectively, driven by the high demand for rental apartments. For more information , see Cytonn Weekly #40 |

During the past week, the World Bank released its ‘Doing Business Report 2019’, a report that compares business regulation across economies from 190 countries. The following were the key take-outs:

- Kenya’s ranking in terms of property registration improved by three ranks to #122 in 2018 from #125 in 2017. In December 2017, the Ministry of Lands and Physical Planning launched its e-Citizen portal marking the end of manual and paper-based land transactions. With the digitization system, landowners are required to carry out all land-related processes through the portal including transfer of ownership, payment of land rents and rates, registration of fees, payment of stamp duty, and application of caveat and official land searches, improving transparency in the entity and streamlining the process for developers, and land owners in general. However, despite the improvement in ranking and registration process, the ranking remains mediocre and more needs to be done, as the report focuses on business regulation procedures only and fails to address other more significant microeconomic factors affecting the sector and firms especially in developing economies,

- Kenya’s ranking in terms of dealing with construction permits dropped four ranks to #128 from last year’s #124. This is due to the prolonged approval process that takes 156 days on average, compared to the Sub-Saharan average of 146 days. Elongated building approval processes lead to lengthened development periods thus, driving up construction costs for property investors, and possibly revenue loss thus discouraging investment.

Despite the drop in ranking with regard to construction permits, overall Kenya was ranked as the seventh most improved economy globally overall and ranked #61, climbing 19 points from last year #80, on account of: i) improved property registry, especially in terms of the number of days which reduced from an average of 61 days in 2017 to 49 in 2018, ii) ease of filing taxes, iii) protection of minority investors, and iii) ease of getting credit.

We expect the improvement in the ease of doing business to lead to an improvement in foreign investors’ confidence, thus, leading to increased foreign direct investments.

- Residential Sector

The residential sector continued to record increased activity, especially in line with the national efforts to bridge the housing gap. The Kenyan Government’s affordable housing initiative continued to take shape with increased support of its implementation from both private investors and the government. Key activities from the government include:

- H.E. President Uhuru Kenyatta signed into law the Supplementary Appropriation Bill No. 2 of 2018, with the housing department receiving Kshs 21.0bn, which is 44.7% of the Kshs 47.3 bn supplementary budget and a 223.1% increment from the Kshs 6.5 bn allocated in Kenya National Budget 2018/19, in support of the affordable housing initiative. For more information, see Cytonn Weekly #41

- The Cabinet approved the guidelines for the implementation of the affordable housing initiative. This is in terms of projects’ financing, cost, design, quality and affordability, and is expected to provide a pathway for private and public investment partnerships,

- Charles Hinga, Principal Secretary Ministry of Housing and Urban Planning, announced that the government would be using block chain technology to allocate the low cost housing units under the National Housing Development Fund (NHDF), in a bid to enhance transparency and efficiency in the allocation of these housing units.

In the private sector;

- Urithi Housing Co-operative Society Limited, a registered co-operative by the Ministry of Trade, Industry and Co-operatives in Kenya, launched a development of 5,000 low-cost housing units on 100-acres at Birmingham Woodlands Estate in Mang’u Area, off Thika Road. The development will consist of 130 SQM bungalows, 105 SQM maisonettes, and 80 SQM & 60 SQM 3 & 2-bed apartments, selling at an average price of Kshs 6.45 mn, Kshs 4.95 mn, Kshs 3.95 mn, and Kshs 2.95 mn, respectively, translating to an average selling price per SQM of Kshs 48,815,

Since the Affordable Housing Initiative launch, we have witnessed continued efforts by the government in delivering of the promise. The recent developments, therefore, are proof of the continued efforts towards the goal, which aims to deliver 500,000 units to the market by 2022. The adoption of new market technology will enhance transparency, make the housing transactions impenetrable to fraud, and thus ensure rightful owners live in the government funded housing units.

With the focus from both private investors and the government geared towards affordable housing, we expect the Big Four Agenda Pillar on delivering 500,000 homes under the Affordable Housing Initiative to continue taking shape over the next coming months.

- Retail Sector

During the month, the retail sector recorded activity mainly from local retailers who continued to expand their national footprint, as a result of i) expanding middle class that has continued to sustain demand for formal retail outlets, ii) vacated spaces by struggling retailers such as Uchumi, and iii) the exit of struggling local retailers, such as Nakumatt and Uchumi, leaving prime locations for occupation, creating an easy gap for the other retailers to expand

New openings;

- Botswana-based retailer, Choppies Supermarket, announced that it would take up space previously occupied by Uchumi Supermarket in Ongata Rongai Town. This move will see its number of local branches increase to 13. For more analysis, see Cytonn Weekly #38

- Local retailer, Naivas Supermarket, announced plans of setting up shop in Ruiru’s Spur Mall, increasing its foothold along the Thika Superhighway node to two stores, in addition to its Mountain Mall outlet. This follows the launch of its 18,000 SQFT Lang’ata branch located at the Freedom Heights Mall, opened in October. The new openings increase the retailer’s countrywide store count to 46. For more analysis, see Cytonn Weekly #39

Closures;

- During the month, Uchumi Supermarket was evicted from its Nairobi Industrial Area headquarters for failure to pay its rent arrears leaving the troubled local retailer with six operational branches; (i) Langata Hypermat, along Langata Road Nairobi, (ii) Ngong Hypermat, along Ngong Road Nairobi, (iii) Adams Arcade Branch, (iv) Jogoo Road Branch, (v) Nairobi West Branch, and (vi) Meru Branch. However, this week, the struggling retailer regained control of the Industrial Area premises in a debt settlement deal with Kenya National Trading Corporation (KNTC) that will require Uchumi to clear the rent arrears from December, failure to which the landlord will be at liberty to end the lease,

- Naivas Supermarket also shut down its Kitengela Mall branch, opened in June this year, relocating its merchandise to its other branch also within Kitengela Town. This is attributable to a challenging business environment at its Kitengela Mall branch, especially with the stiff competition from the informal retailers in Kitengela, as well as the presence of other formal retailers such as Tuskys and Eastmatt,

In spite of the continued expansions by retailers, the retail sector within Nairobi Metropolitan Area has generally been on a subdued performance path this year with the Cytonn Q3’2018 Markets Review, reporting a 0.3% q/q points decline retail sector rental yields from 9.7% in Q2’2018 to 9.4% in Q3’2018 as a result of 5.8% decline in rental charges, attributable to an oversupply of mall space, currently at 2.0mn SQFT.

Therefore, we expect retailers to continue expanding to other counties that have an undersupply of malls despite expanding middle class population, necessitating development of quality mall space in these regions, and boosted by the government’s provision of infrastructure to areas that have otherwise been relatively inaccessible for developers.

Hospitality Sector

During the month, various facilities in Kenya’s tourism and hospitality sector, received global accolades during the World Travel Awards (WTA), held in Durban, South Africa, including Maasai Mara as the Leading National Park, Diani as the leading beach destination, and Kenya Airways as the Leading airline for Business and Economy Classes, affirming Kenya’s status as one of the most renowned tourist destinations globally.

Kenya Airways continued to expand its continental and global market share as it resumed its daily flights to Gabon after a 6-year break. The airline also launched its direct flight to New York, a move that is bound to enhance Kenya’s tourism industry through increased international tourist arrivals, especially from the US. As at 2017, arrivals from the United States came in at 148,400, compared to the United Kingdom’s -which operates direct flights to and from Nairobi and London- with 168,000, according to KNBS Economic Survey 2018.

Also during the month, the Tourism Finance Corporation, a Development Finance Institution mandated with facilitating and providing affordable development funding for long-term investments in the Kenyan hospitality industry, announced plans to reduce its cost of credit to 9.0% from the current 11.0%, for hospitality sector investors whose businesses are registered in Kenya. This is in a bid to encourage hotel investments in counties outside Nairobi. This is in line with its goal of achieving 65,000 new hotel rooms countrywide by 2030. This offers an impetus for local hotel investors considering that hotel development requires a huge capital outlay compared to other developments, such as residential.

In terms of expansions;

- Global hotel chain, Marriott International announced plans to increase its presence in Kenya from two hotels to five. The leading global hotel group’s expansion strategy includes: i) a 365-room, 5-star JW Marriott in Westlands, Nairobi, slated to open in 2020, and ii) a 250-room facility under its Protea brand, which will be located approximately 5 KM from the Jomo Kenyatta International Airport (JKIA) and is expected to open doors in 2021,

- Radisson Hotel Group, announced plans to open its first residence in Nairobi’s Arboretum neighborhood in Q2’2019. The property, which shall be under the Radisson Blu brand as Radisson Blu Hotel and Apartments, will have approximately 123 rooms and will add onto its current operational portfolio consisting of the 140-room Park Inn Hotel in Westlands, which opened in April 2017, and the 271-room Radisson Blu Hotel in Upperhill, which opened in November 2015, and

- Sarova Hotels announced plans to refurbish its Panafric Hotel located along Valley Road, at a tune of Kshs 2.5 bn. This will see the facility number of rooms increase by 87 keys, as well as improvement in other amenities such as an addition of 140 parking spaces and a conference center.

The heightened appetite for Kenya from international hotel brands attests to the growth and viability of Kenya’s hospitality scene and thus, we expect to see continued activity in the hospitality sector in line with the government’s goal of increasing the number of inbound international investors by 16.0% in 2018 from the 1.4 mn recorded in 2017, while also increasing the hospitality sector’s contribution to the national GDP growth which came in at 1.2% in 2017 from 1.1% in 2016.

- Infrastructure

We continued to witness the government’s commitment to improving the infrastructure sector in Kenya. Various activities recorded during the month were as follows:

- During the week, President of Kenya, H.E Hon. Uhuru Kenyatta launched the upgrading of Nyaribo Airstrip located in Nyeri. The project will see the construction of a terminal and upgrading of the runway. Nyeri County is one of the richest counties in Kenya with a relatively high GDP per Capita, according to a 2015 World Bank survey, of USD 1,503, ranking 2nd county in Kenya in terms of GDP performance, after Kiambu County. The airstrip’s expansion is bound to spur trade and tourism in the county, especially with the recently launched commercial flights from Nairobi to Nyeri that have cut the travel time to 25 minutes by air as compared to three hours by road. Therefore, we expect this to open up the area for more real estate development particularly commercial, and hospitality themes. According to our research, commercial properties, in Nyeri have an average yield rate of 13.0%, in comparison to Nairobi County with an average rental yield of 9.5%, indicating a viable investment opportunity. The county which is also a major tourist destination hosting key attraction sites such as the Tafaria Castle, Mount Kenya, and the Aberdares National Park is bound to see a rise in the number of tourist arrivals after the expansion, thus, boosting its hospitality sector which as per our Nyeri Investment Opportunity 2017 report, recorded an average rental yield of 6.8% in 2017,

- Safaricom Pension Scheme received approval from Kenya Urban Roads Authority (KURA) to construct a 500-meter tarmac road that will link its Athi River development, named, Crystal Rivers, to the Nairobi-Mombasa Highway, #38

- The Kenyan Government allocated Kshs 10.0 bn to Kenyan Sub-Counties in a bid to ease communication across counties as well as improve government service delivery to the citizens through the National Optic Fiber Backbone Infrastructure, which will be an extension from the Kenyan Counties to the Sub-Counties. The project is set to take 3-5 years in institutions such as schools, hospitals, and police stations. This in turn is expected to improve monitoring of security, traffic snarl ups, and thus increasing investment opportunities, especially for residential real estate investments,

- The Bus Rapid Transit (BRT) System project, which was launched in 2015 but has been on hold due to lack of financiers, received a Kshs 5.0 bn boost from the European Union. The funds will cover 52.1% of the Kshs 9.6 bn total development costs, with the national and county governments expected to foot the remaining Kshs 4.6 bn,

- In the electricity sub-sector, the Energy Regulatory Commission raised its Lifeline Tariff threshold further to 100 kwh from the previous 10 kwh where non-fuel tariff charges for consumers of less than 100 kilowatt-hour (kwh) will be reduced to Kshs 10/kwh, from Kshs 12/kwh and Kshs 15/kwh for domestic consumers and small-scale businesses, respectively. With a market of 6.3 mn domestic consumers, the new tariff is expected to offer reprieve to approximately 91.7% of the households, and 67.3% of the estimated 177,089 small-scale businesses

The increased improvement in infrastructure is bound to facilitate real estate development activity as it eases development costs for private developers, especially in the affordable housing sub-sector. This is as infrastructure continues to be one of the key constraints towards the supply of affordable properties. Additionally, improved accessibility especially with the BRT system is likely to ease traffic congestion in various parts of Nairobi and thus, lead to increased demand for properties in these areas. Overall, we expect to continue seeing increased upgrading especially of transport systems, in a bid to attract foreign investments and aid in the delivery of affordable housing initiative.

- Listed Real Estate

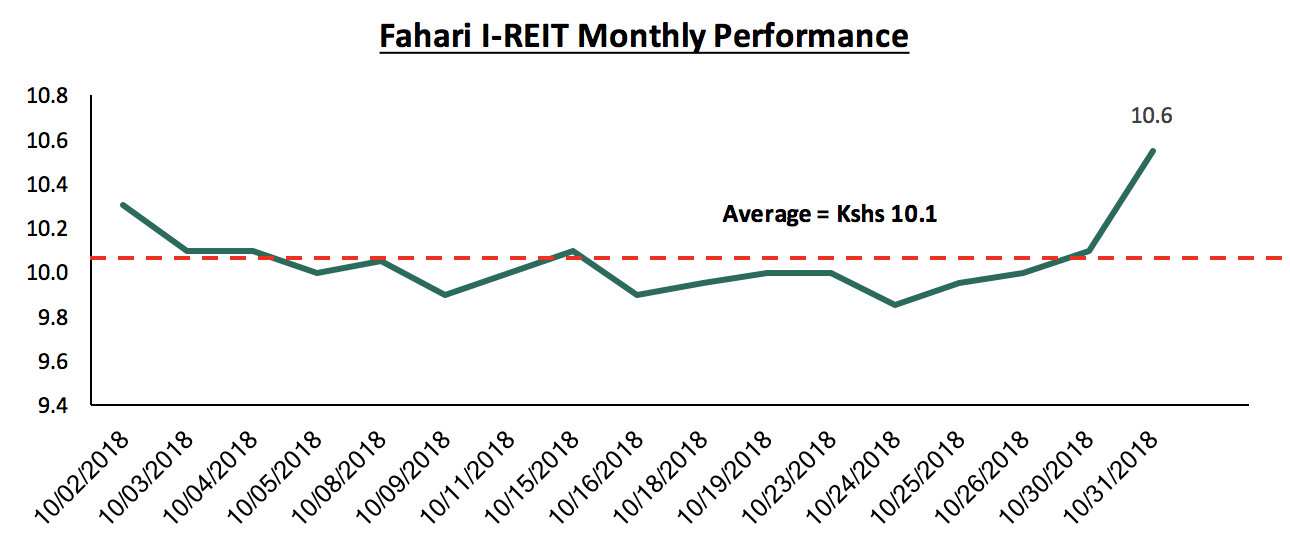

The Fahari I-REIT closed the month at a share price of Kshs 10.6, the highest achieved during the month and 4.9% higher than the monthly average trading price of Kshs 10.1. Overall, the instrument has continued to shed its value, losing 49.2% of its 2015 initial value of Kshs 20.75 up to date. The instrument’s low trading prices and volumes are attributable to: (i) the negative sentiments currently engulfing the sector given the poor performance of the Fusion D-REIT (FRED), which failed to raise the minimum capital required to list on the NSE, (ii) inadequate investor knowledge, and (iii) the poor performance of Fahari I-REIT recording a dividend yield of 5.7% compared to brick and mortar office and retail at 9.5% and 9.7%, respectively.

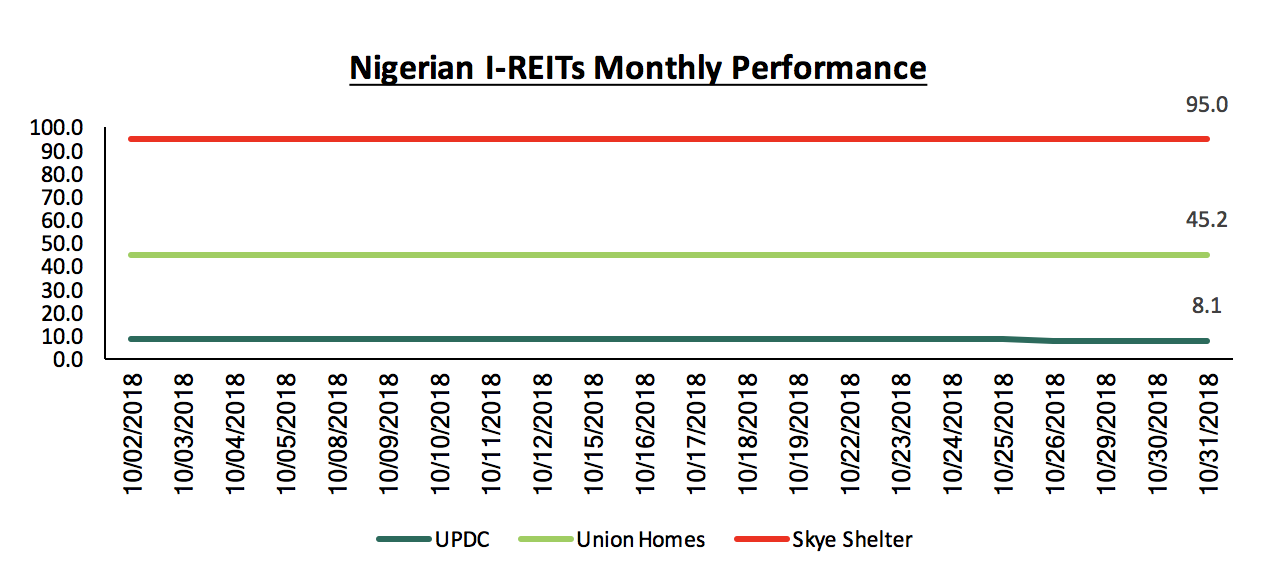

The Nigerian I-REIT market relatively stable during the week, with, Skye Shelter and Union Homes retaining an average price per share of N95 and N45.2, respectively, while UPDC recorded 2.2% decline to N8.8 from N9 the previous week. We attribute the performance to inadequate investor knowledge about the market hence low investor interest in the instrument.

We expect the real estate sector in Kenya to continue on an upward trajectory given: (i) continued improvement in infrastructure by the National Government, (ii) increased contribution from the tourism and hospitality industry, (iii) expanding middle-class, and hence growing disposable incomes, and (iv) the relatively high urbanization rate in Kenya at 4.2% compared to the global average of 2.0%, necessitating the need for adequate housing in the urban areas.