Cytonn Q3’2018 Markets Review

By Cytonn Research Team, Sep 30, 2018

Executive Summary

Global Markets Review

The global economy is expected to remain strong, with the World Bank projecting that 2018 growth will stabilize at 3.1% and ease gradually over the next 2-years to 2.9% in 2020, as major Central Banks gradually depart from accommodative monetary policies. In September 2018, the US Fed increased the Federal Funds Rate to a range of 2.0 % - 2.25% from 1.75%-2.0% set in June 2018, citing strong economic growth, which it projected at 3.1% in 2018. The key risk to global growth remains the rising trade tensions that have escalated between the US and China;

Sub Saharan Africa Regional Review

Sub-Saharan Africa is estimated to have grown by 2.8% in Q2’2018, which was an increase from 2.6% in Q2’2017; the growth was driven by a supportive external environment and the robust global demand for key commodities. Majority of the SSA stock markets recorded negative returns during Q3’2018 a trend that was also replicated in most emerging markets, attributed to uncertainties from the escalated trade disputes between world powers which saw deepening sell-offs across emerging markets by investors to realize the gains made in various sectors. In the near term, we expect the markets to remain subdued due to the exit by foreign investors

Kenya Macroeconomic Review

The Kenyan economy grew by 6.3% in Q2’2018 according to data released by the Kenya National Bureau of Statistics (KNBS), compared to 4.7% in Q2’2017. Inflation rates increased to 5.7% in September 2018 from 4.2% in June 2018, in line with our expectations of 5.3% - 5.7%. The Monetary Policy Committee (MPC) met twice during the quarter and reduced the Central Bank Rate (CBR) by 50 basis points to 9.0% from 9.5% citing that inflation expectations were well anchored within the target range, and that economic growth prospects were improving;

Fixed Income

During the third quarter of 2018, T-bills auctions recorded an oversubscription, with the average subscription rate coming in at 133.3% compared to 162.7% in Q2’2018. Overall average subscription rates for the 91, 182, and 364-day papers came in at 99.4%, 91.8% and 188.4%, respectively, from 108.5%, 127.8%, 219.4% in Q2’2018. Yields on T-bills declined by 28 bps, 110 bps and 100 bps in Q3’2017, closing at 7.7%, 9.1%, and 10.0%, from 7.9%, 10.2%, and 11.0% for the 91, 182, and 364-day papers, respectively, as at end of Q2’2018;

Equities

During the quarter, the equities market was on a significant downward trend, with NASI, NSE 25 and NSE 20 declining by 14.2%, 15.6% and 12.5%, respectively; taking their YTD performance as at the end of September to (12.6%), (22.5%), and (13.6%) for NASI, NSE 20 and NSE 25, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have declined by 8.4%, 22.6%, and 10.5%, respectively. Listed banks in Kenya released their H1’2018 results during the quarter, recording an average core earnings growth of 19.0% compared to a 14.4% decline in H1’2017;

Private Equity

During Q3’2018, we witnessed high levels of private equity activity across the sectors we cover, including Financial Services, FinTech, and Education, evidenced by increased deal activity by global investors including Old Mutual, Kuramo Capital, and Advtech Group, among others. Notable transactions during the quarter include the acquisition of a 6.0% stake in UAP-Old Mutual Holdings by Old Mutual, the successful fundraising of USD 8.0 mn (Kshs 806.3 mn) by Paystack Payments Limited and an initial injection of Kshs 205.0 mn in Kitengela International School (KISC) as part of a Kshs 400.0 mn investment by Fanisi Capital;

Real Estate

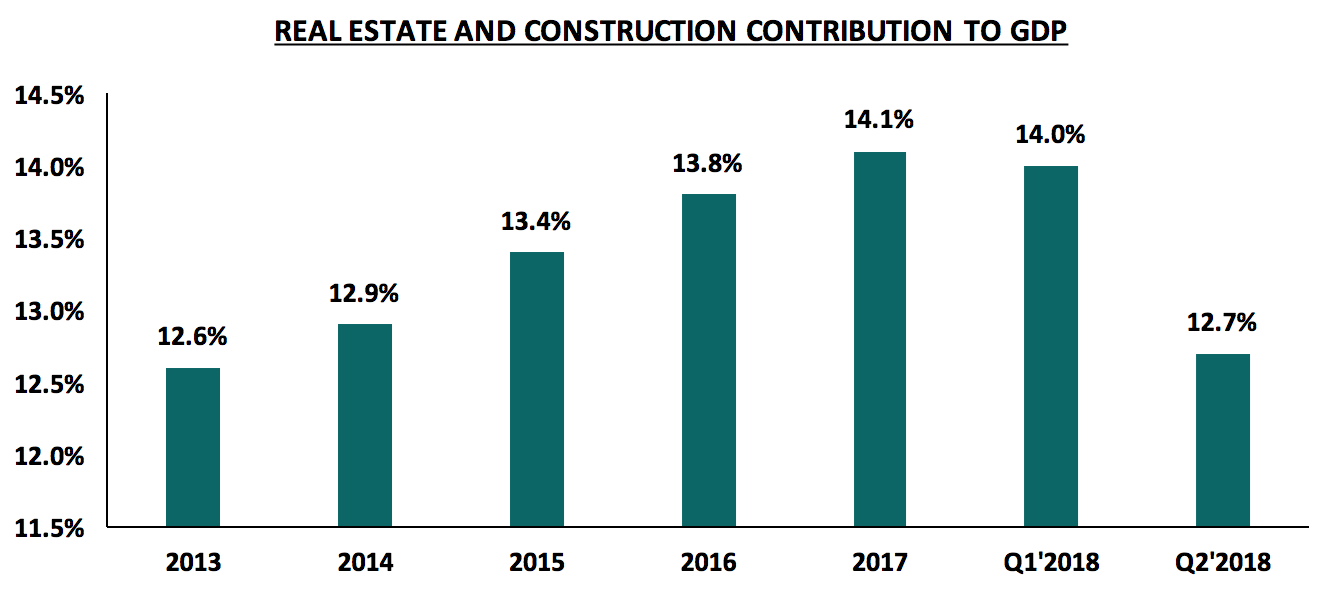

During Q3’2018, the real estate sector recorded an array of activities across of all themes bolstered by (i) continued demand for investment property from multinational individuals and the growing middle class, (ii) Kenyan Government efforts towards providing a conducive operating environment for developers through key statutory reforms such as National Land Use Policy, and initiatives such as the National Housing Development Fund set to fund public-private partnerships in delivery of affordable homes, and for end users such as the proposed stamp duty exemption for first time home buyers, (iii) the expanding middle class, and (iv) continued infrastructural improvements. In this report, we have highlighted the industry reports released during the quarter then covered the sectoral performance in the residential, commercial, hospitality, infrastructure, land and listed real estate themes;

- On 29th September 2018, Cytonn Investment Management Plc held its Company, Markets & Projects Updates Event for Quarter 3 at the Alma in Ruaka. The quarterly forums enable the company to provide updates to investors on our outlook of the economy and attractive investment opportunities, while also addressing any questions clients may have pertaining to their investment with Cytonn. See event note here

- On Thursday 27th September 2018, Patricia Wachira, Senior Research Analyst at Cytonn Investments Management Plc was a key note speaker on “Affordable Housing in Kenya” at the Multimedia University Innovation Week. See event note here

- Ian Kagiri, Investment Analyst was on Ebru TV to discuss the performance of the banking sector in H1’2018. Watch him here

- Stanley Ngugi, Financial Advisor at Cytonn Investment Management Plc was on KTN News to discuss the impact of the Finance Act 2018. Watch him here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for Business Manager-Commercialization and Unit Managers - Mt. Kenya Region. Visit the Careers section on our website to apply

- Cytonn Real Estate is looking for a 0.75-acre land parcel for a joint venture in any of the following areas, Lavington, Loresho (near Loresho Shopping Centre and its environs), Spring Valley Shopping Centre and its environs, Redhill Road (should be between Limuru Road Junction and Westlands Link Road), Lower Kabete Road (between Ngecha Road Junction and UON Campus), and Karen. The parcel should be in a good location with frontage to a tarmac road. Please note that we are not in the market for land purchase, we are looking ONLY for Joint Venture opportunities. For more information or leads, email us at rdo@cytonn.com

Introduction

According to the World Bank, the global economy grew at an estimated 3.6% in Q2’2018, compared to 3.1% in Q1’2018. Global growth is projected to stabilize at 3.1% in 2018, the same pace as last year, supported by firming investments in advanced economies, a continued recovery in commodity-exporting emerging market and developing economies (EMDEs), and a robust growth in commodity-importing economies. Global growth is projected to ease gradually over the next 2-years to 2.9% in 2020, as major Central Banks gradually depart from accommodative monetary policies that seek to stimulate growth by increasing the overall money supply in the economy. Below is the summary of the key occurrences in Q3’2018 per region:

Unites States:

The US economy grew by 4.2% y/y in Q2’2018, compared to 2.2% y/y in Q2’2017, making it the fastest growth rate in 4-years, attributable to strong gains in private consumption and capital spending. According to the World Bank, growth in Q3’2018 remains robust despite the trade deficit widening, amid rising fiscal stimulus and a strengthening US Dollar. The economy continued to add about 200,000 jobs per month while nominal wage growth reached 2.9% y/y in August, its highest level since 2009.

The Chicago Purchasing Manager’s Index (PMI) fell to a 5-month low of 60.4 in September, down 3.2% points from 63.6 in August. Consumer spending increased steadily in August, supporting expectations of solid economic growth in the third quarter, while a measure of underlying inflation remained within the Federal Reserve’s 2.0% target for a fourth straight month.

The annual GDP growth estimate for 2018 rose to 3.1% from 2.8%, according to the US Federal Reserve, with a projection of 2.5% in 2019, up from an earlier projection of 2.4%., before slowing to 2.0% in 2020 and 1.8% in 2021. The expected slowdown in economic growth will be attributable to the decline in impact of the recent tax cuts, heightened inflation and a rise in interest rates. Additionally, there is rising concern on U.S.’s imposed tariffs on Chinese goods and steel and aluminium imports from most countries. The turn towards protectionist trade policies, aimed at reducing the influence and competitiveness of foreign imports, threatens to slow growth and exert upward pressure on inflation.

The US Fed raised interest rates at its meeting on 26th September 2018, by lifting the benchmark rate by 25 basis points to a range of 2.0 % - 2.25% from 1.75% - 2.0% set in June 2018. The increase in rates was the third this year and the seventh in the last eight quarters, which has been observed as the end of the accommodative monetary policy era after the deep financial crisis.

The hikes were backed by the Fed’s sentiments that (i) the economy was growing at a faster-than-expected rate of 3.1% this year and would continue to expand moderately for at least 3-years from 2018, (ii) a sustained low unemployment rate that is estimated to rise in the fourth-quarter of 2018 from 3.6% to 3.7%, and (iii) stable inflation which is expected to remain close to its 2.0% target over the next 3-years. The U.S. Fed still foresees another rate hike in December, three more in 2019, and one increase in 2020.

The S&P 500 gained by 7.1% in the quarter and has gained 9.0% on a YTD basis, making it the biggest quarterly advance since the fourth quarter of 2013. This growth is tied to the tax overhaul passed last year. The changes, which included a cut to the corporate tax rate, sent corporate profits sharply higher through the first two quarters of the year, and analysts expect third-quarter earnings to be robust as well. Going forward, a strengthening U.S. economy is expected to keep the rally going and help investors look past the continuing trade tensions between the U.S. and China and other nations.

Eurozone:

The European Central Bank (ECB) met on 13th September 2018 and maintained the interest rate on the main refinancing operations at 0.00%, and the interest rates on the marginal lending facility and the deposit facility at 0.25% and (0.40%) respectively. The key ECB interest rates are expected to remain at their present levels through the summer of 2019 and thereafter, to ensure the continued convergence of inflation to levels that are below, but close to 2.0% over the medium term.

The Eurozone recorded a slow 0.4% growth in Q2’2018, compared to a growth of 1.5% in Q2’2017, down from an average of 2.7% in the last two quarters of 2017. According to the September 2018 European

Central Bank (ECB) macroeconomic projections, the Eurozone annual real GDP is projected to increase by 2.0% in 2018, 1.8% in 2019 and 1.7% in 2020. This is a slight downward revision from the June 2018 projections, of 2.1% in 2018 and 1.9% in 2019, reflecting the impact of weakening global trade in leading world economies, compounded by the effect of the Euro’s past appreciation.

Inflation decreased to 2.0% in August 2018 from 2.1% in July, with ECB foreseeing a further decrease to 1.7% in the remainder of 2018, 2019 and 2020. Underlying inflation is expected to pick up towards the end of the year and increase gradually over the medium term, supported by the ECB’s monetary policy measures, the continuing economic expansion and rising wage growth. The unemployment rate declined to 8.2% in July 2018 from 9.1% in July 2017, which is the lowest level observed since Q4’2008, attributable to strong economic growth.

The Euro Stoxx 600 gained by 1.3% in Q2’2018, but has however declined by 1.54% YTD. The index is currently on a declining trend, driven by a plunge in Italian bank equity prices, whose big sovereign bond portfolios make them sensitive to political risk. This was after the Italian Government significantly widened its budget-deficit target for 2019 to 2.4% of GDP, which is three times higher than the number that the previous government had planned. The higher public spending could spark negative market reactions, given that Rome holds the second highest debt pile in the Eurozone after Greece, totalling EUR 2.3 tn (USD 2.7 tn), accounting for 131.8% of its GDP.

The ECB confirmed it will half its asset purchases to EUR 15.0 bn from EUR 30.0 bn per month as of October this year, and it’s on track to end the program by year end. Thereafter, it intends to reinvest the principal payments from maturing securities, so as to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

In the medium term, we expect continued expansion of the Eurozone economy, which will be supported by (i) ECB’s very accommodative monetary policy stance, (ii) increased growth in lending to the private sector, spurred by low interest rates and favourable bank lending conditions, and (iii) lower deleveraging needs, which will drive private expenditure boosting domestic demand, the economy’s main growth driver.

China:

China’s economy grew by 1.8% q/q and 6.7% y/y in Q2’2018 compared to a 1.4 % expansion in Q1’2018. This was driven by (i) a pick-up in the pace of industrial production, (ii) an increase in private consumption, and (iii) increased investment in infrastructure. The economy is still expected to meet this year’s growth target of 6.5%, despite escalating trade tensions with the United States that worsened in September 2018. The U.S. President Donald Trump imposed a 10.0% tariff on USD 200.0 bn of Chinese imports, set to be increased to 25.0% on 1 January 2019, and China responded with duties of its own on USD 60.0 bn of U.S. products.

China's Consumer Price Index rose to a six-month high of 2.3% y/y in August of 2018 from 2.1% in the previous month and slightly above market consensus of 2.2%. The increase was driven by higher prices of food, clothing, rent, fuel and utilities, education, culture and recreation. However, it remained well below the Chinese Government’s target of around 3.0% for 2018. Annual average growth in industrial production, edged up from 6.4% in July to 6.5% in August. Despite the slight improvement in August, growth in industrial production remains sluggish and the trend could even worsen in the coming months when spill overs from the ongoing trade dispute with the United States start to kick in.

The Shanghai Composite Index retreated marginally by 0.9% during the quarter and declined by 15.6% on a YTD basis, the lowest level since 2014 amid trade policy uncertainty. This is due to the sustained effects of the ongoing trade wars with the United States. Downside risks to China’s economic outlook have increased amid escalating trade wars with the United States, a sudden slowdown in the property market and potential corporate defaults. However, the recent shift towards looser fiscal and monetary policy is expected to support domestic demand in the near term.

Commodities:

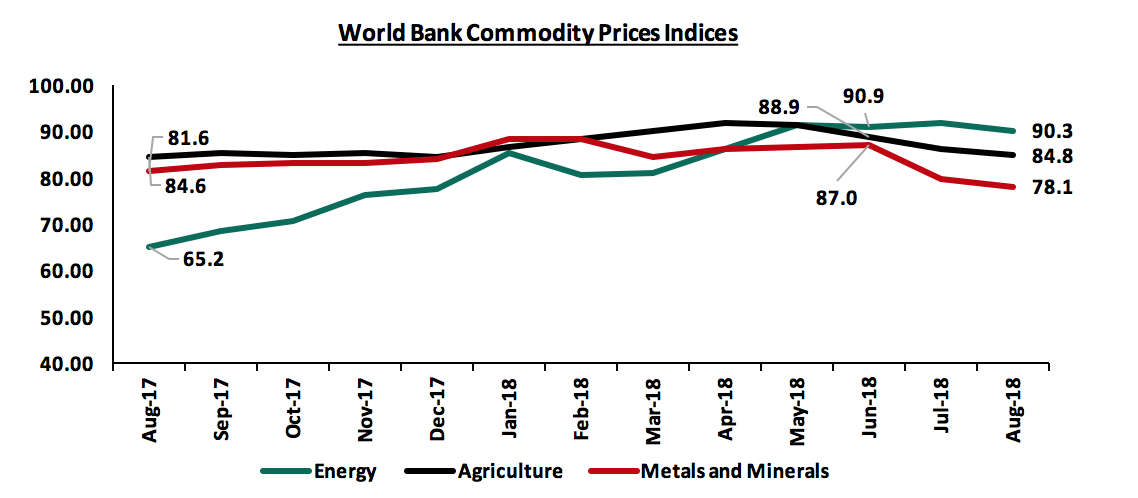

Global commodity prices declined by 2.5% y/y in August 2018 following July’s 7.3% decrease, representing the steepest fall in nearly 7-years. Prices for both Brent and WTI crude oil declined overall in August to USD 73.1 per barrel and USD 68.0 per barrel, respectively, from USD 74.4 per barrel and USD 70.8 per barrel, respectively, in July. This is attributable to the ongoing trade war between China and the U.S., and rising production by key producers including Russia and Saudi Arabia, after the relaxation of the agreed supply cuts. However, oil prices have risen steadily since mid-August following reports that Iranian oils exports had fallen ahead of the reintroduction of sanctions by the U.S., as well as concern regarding the adverse weather in the U.S.

Metals prices dropped throughout the summer by 3.0%, reflecting concerns about trade tensions and growth prospects in China. Agricultural prices fell in August by 1.8% due to ample supply for key commodities, including coffee and sugar. However, grains prices rose in August by 4.3%, driven by rising wheat prices, due to weather-hit harvests in Europe, Russia and some parts of Australia. Below is a chart showing the performance of select commodity price indices.

We expect the global economy to recover and post a better growth than that recorded in FY’2017, on account of improving commodity prices, increased income levels and by extension consumption levels. However, ongoing geopolitics are likely to dampen any growth prospects.

Regional Growth

Sub-Saharan Africa is estimated to have grown by 2.8% in Q2’2018, which was an increase from 2.6% in Q2’2017. The growth was driven by a supportive external environment and the robust global demand for key commodities. Growth dynamics were, however, far from uniform across the region’s two largest economies, Nigeria and South Africa, which are facing political tensions in the run to next year’s elections. Regional GDP is projected to grow at 3.2% in 2018, and increase to 3.5% in 2019 which will be supported by, (i) a healthy global economy, (ii) elevated commodity prices, (iii) improved agricultural output and (iv), solid government spending. However, the regional economy still faces downside risks of; (i) difficult business conditions and poor infrastructure, (ii) relatively small private sectors that have restrained the pace of the recovery, (iii) high levels of public debt in most economies in the region, and (iv) perennial security concerns which continue to negatively affect investments in the region.

Regional Currency Performance

Regional currencies registered mixed performances in Q3’2018, with majority of the currencies depreciating against the dollar. In the East African region, the Ugandan Shilling and Tanzanian Shilling depreciated by 5.9% and 2.1%, respectively, against the dollar driven by increased food imports during the drought period and increased oil imports as importers took advantage of the lower global oil prices that were expected to rise. Despite the expiry of the IMF precautionary stand-by arrangement during the quarter, the Kenyan shilling strengthened marginally by 0.1% to Kshs 101.0 from Kshs 1011.1 as at the end of Q2’2018, supported by strong dollar inflows from diaspora remittances coupled with thinner dollar demand from exporters. The Kenyan shilling however, had started declining at the tail-end of the quarter due to uncertainties regarding the IMF stand-by arrangement. Below is a table showing the performance of select African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Sep-17 |

Dec-17 |

Sep-18 |

Last 12 months |

YTD change % |

|

Zambian Kwacha |

10.5 |

10.0 |

12.0 |

(14.4%) |

(20.4%) |

|

South African Rand |

13.5 |

12.4 |

14.2 |

(4.8%) |

(14.3%) |

|

Botswana Pula |

10.2 |

9.8 |

10.6 |

(3.8%) |

(7.7%) |

|

Mauritius Rupee |

34.0 |

33.6 |

34.4 |

(1.1%) |

(2.4%) |

|

Malawian Kwacha |

726.2 |

725.5 |

727.8 |

(0.2%) |

(0.3%) |

|

Ugandan Shilling |

3,603.0 |

3,643.3 |

3,816.6 |

(5.9%) |

(4.8%) |

|

Kenyan Shilling |

103.2 |

103.2 |

100.8 |

2.3% |

2.3% |

|

Tanzanian Shilling |

2,238.6 |

2,234.6 |

2,284.9 |

(2.1%) |

(2.3%) |

|

Nigerian Naira |

355.0 |

360.0 |

362.8 |

(2.2%) |

(0.8%) |

|

Ghanaian Cedi |

4.4 |

4.5 |

5.0 |

(12.9%) |

(9.8%) |

African Eurobonds

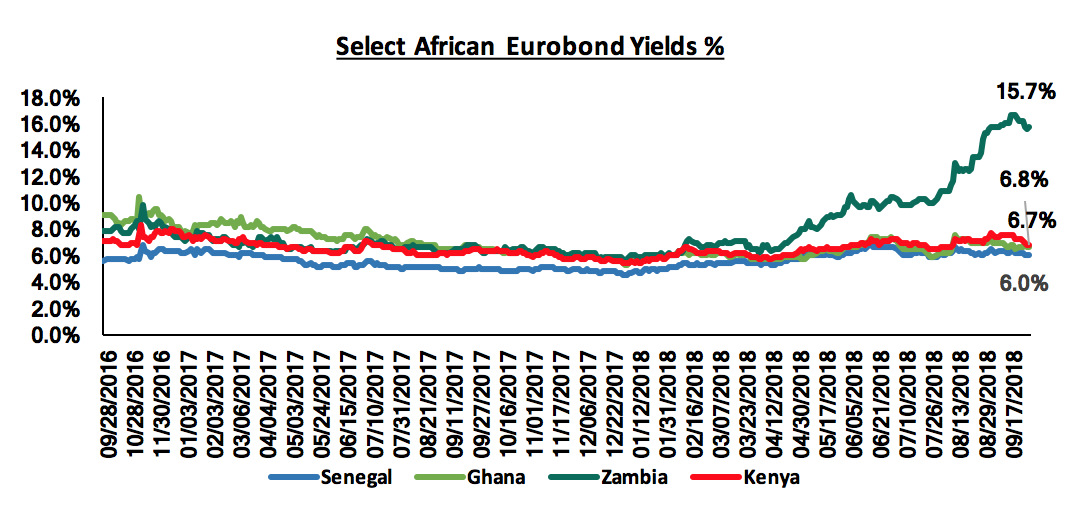

Yields on African Eurobonds have continued to rise in Q3’2018, attributed to the adjustments of global yields to normalisation of monetary policies in the advanced economies which saw the Federal Open Market Committee (FOMC) hiking the US bench mark rate by 0.25% points to a range of 2.0 % - 2.25% from 1.75%-2.0% set in June 2018. The ten-year tenor Eurobonds issued by Senegal, Ghana and Kenya ended the quarter at 6.0% and 15.7%, while the Kenyan Eurobond yield remained stable at 6.8% over the same period

Equities Markets

Majority of the SSA stock markets recorded negative returns during Q3’2018 a trend that was also replicated in most emerging markets attributed to uncertainties from the escalated trade disputes between world powers which saw deepening sell-off across emerging markets by investors to realize the gains made in various sectors. In the near term, we expect the markets to remain subdued due to the exit by offshore investors but will regain due to gains expected to be realized in full year results. Below is a summary of the performance of key bourses in SSA:

|

Equities Market Performance of selected indices( Dollarized) |

|||||||

|

Country |

Sep-17 |

Dec-17 |

June-2018 |

Sep-18 |

Last 12 Months |

YTD Change % |

Q/Q Change(%) |

|

Malawi |

27.4 |

29.8 |

42.4 |

42.3 |

54.3% |

42.1% |

(0.2%) |

|

Ghana |

518.9 |

569.7 |

600.9 |

580.5 |

11.9% |

1.9% |

(3.4%) |

|

Kenya |

1.6 |

1.7 |

1.7 |

1.5 |

(5.5%) |

(10.5%) |

(14.1%) |

|

Rwanda |

0.2 |

0.2 |

0.2 |

0.1 |

(5.0%) |

(5.4%) |

(1.6%) |

|

South Africa |

4,105.3 |

4,802.6 |

4,188.0 |

3,931.8 |

(4.2%) |

(18.1%) |

(6.1%) |

|

Uganda |

0.5 |

0.6 |

0.5 |

0.5 |

0.1% |

(13.5%) |

(11.4%) |

|

Zambia |

512.5 |

532.1 |

546.3 |

455.2 |

(11.2%) |

(14.4%) |

(16.7%) |

|

Tanzania |

0.9 |

1.1 |

1.0 |

0.9 |

(2.3%) |

(14.2%) |

(8.4%) |

|

Nigeria |

98.7 |

106.2 |

105.9 |

89.9 |

(9.0%) |

(15.4%) |

(15.1%) |

|

BRVM |

0.4 |

0.4 |

0.4 |

0.3 |

(16.3%) |

(23.0%) |

(13.0%) |

We are of the view that increased government spending on infrastructure development, improving commodity prices in the global markets, better weather conditions and relative political stability will be the key drivers for SSA growth in 2018

According to Kenya National Bureau of Statistics (KNBS), Kenya’s economy expanded by 6.3% in Q2’2018, higher than 4.7% in Q2’2017. This was due to (i) recovery of agricultural sector, which recorded a growth of 5.6% due to improved weather conditions, (ii) improved business and consumer confidence, and (iii) increased output in the real estate, manufacturing, and wholesale & retail trade sectors, which grew by 6.6%, 3.1% and 7.7% respectively. For a more comprehensive analysis see the Q2’2018 Quarterly GDP Review and Outlook note

During Q3’2018, we tracked Kenya’s GDP growth projections for FY’2018 released by 15 organizations, that comprised of research houses, global agencies, and government organizations. The average GDP growth, including our projection of 5.5% as at Q3’2018, came in at 5.5%, unchanged from average projections released in Q2’2018. The common view is that GDP growth will improve in 2018, from 4.9% in 2017, generally due to (i) recovery in the agriculture sector on the back of improved weather conditions, and (ii) improvement in the business environment following easing of political risk caused by the prolonged political impasse over the 2017 presidential elections.

|

Kenya 2018 Annual GDP Growth Outlook |

||||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

Q3’2018 |

|

1. |

Central Bank of Kenya |

6.2% |

6.2% |

6.2% |

|

2. |

Kenya National Treasury |

5.8% |

5.8% |

6.0% |

|

3. |

Oxford Economics |

5.7% |

5.7% |

5.7% |

|

4. |

African Development Bank (AfDB) |

5.6% |

5.6% |

5.6% |

|

5. |

Stanbic Bank |

5.6% |

5.6% |

5.6% |

|

6. |

Citibank |

5.6% |

5.6% |

5.6% |

|

7. |

International Monetary Fund (IMF) |

5.5% |

5.5% |

5.5% |

|

8. |

World Bank |

5.5% |

5.5% |

5.5% |

|

9. |

Fitch Ratings |

5.5% |

5.5% |

5.5% |

|

10. |

Barclays Africa Group Limited |

5.5% |

5.5% |

5.5% |

|

11. |

Cytonn Investments Management Plc |

5.4% |

5.5% |

5.5% |

|

12. |

Focus Economics |

5.3% |

5.3% |

5.3% |

|

13. |

BMI Research |

5.3% |

5.2% |

5.2% |

|

14. |

The Institute of Chartered Accountants in England and Wales |

5.6% |

5.6% |

5.6% |

|

15. |

Standard Chartered |

4.6% |

4.6% |

4.6% |

|

Average |

5.5% |

5.5% |

5.5% |

|

The Kenya Shilling:

The Kenya Shilling gained marginally against the US Dollar by 0.1% in Q3’2018 to close at Kshs 101.0 from Kshs 101.1 at the end of Q2’2018. This week, the Kenya Shilling depreciated by 0.2% against the dollar to close at Kshs 101.0 from Kshs 100.8 the previous week. In our view, the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.8% in the 12-months to June 2018, from 6.3% in March 2018, attributed to improved agriculture exports, and lower capital goods imports following the completion of Phase I of the Standard Gauge Railway (SGR) project,

- Stronger inflows from principal exports, which include coffee, tea, and horticulture, which increased by 1.7% during the month of July to Kshs 24.7 bn from Kshs 24.3 bn in June, with the exports from horticulture improving by 9.1%,

- Improving diaspora remittances, which increased by 71.9% y/y to USD 266.2 mn in June 2018 from USD 154.9 mn in June 2017 and by 4.9% m/m, from USD 253.7 mn in May 2018, with the largest contributor being North America at USD 130.1 mn attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and

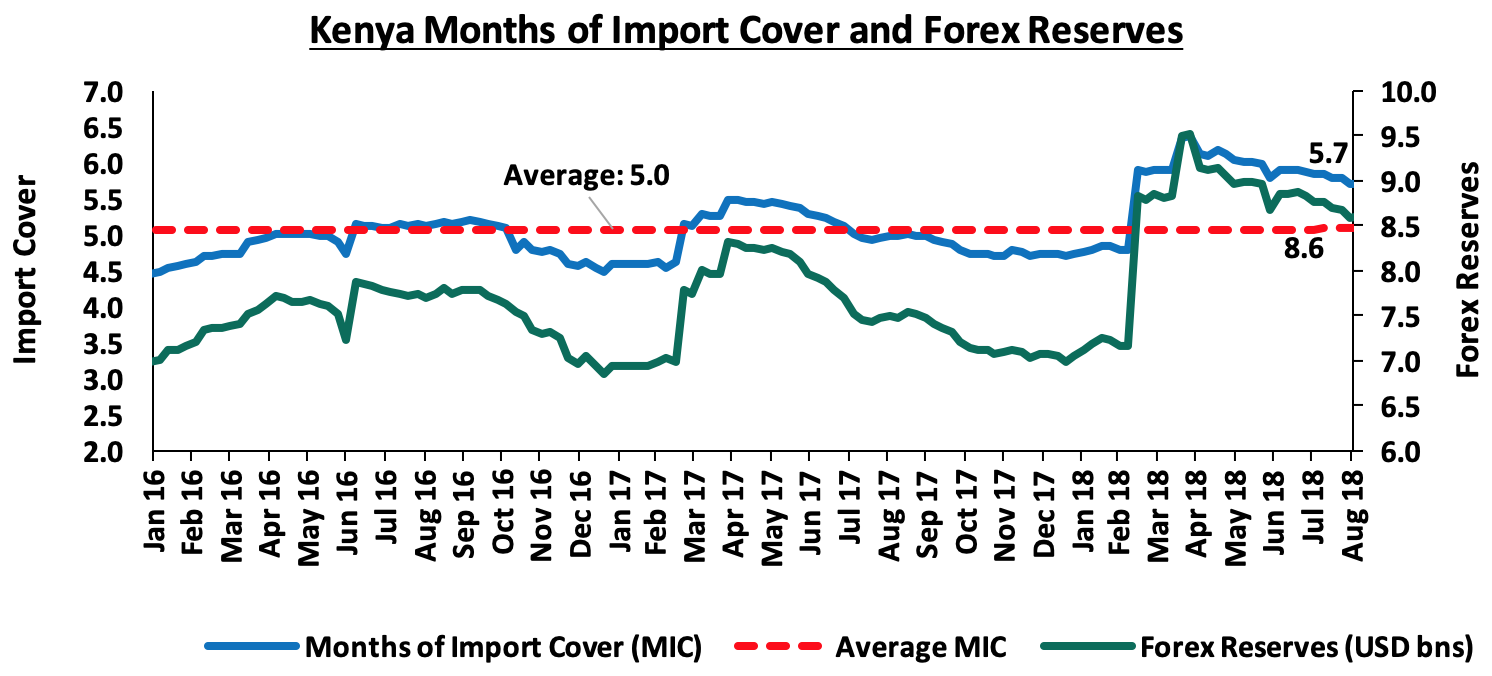

- High forex reserves, currently at USD 8.5 bn, equivalent to 5.6 months of import cover, compared to one-year average of 5.4 months.

Inflation:

The inflation rate declined significantly to an average of 4.4% YTD as compared to 9.0% in a similar period in 2017. However, inflation has been on an upward trend in Q3’2018 increasing to 5.7% in September from 4.0% in August 2018, which was in line with our expectations, with the m/m inflation increasing by 1.0% which was on account of; (i) a 0.4% increase in the Food and Non-Alcoholic Drinks Index driven by an increase in prices of some food basket items such as potatoes, sugar and cabbages outweighing decreases in others, (ii) an 8.0% increase in the Transport Index driven by a rise in the pump prices of petrol and diesel which triggered increase in prices of other transport components, and (iii) a 0.5% increase in the Housing, Water, Electricity, Gas and Other Fuels’ Index on account of the review of tariff structure for electricity.

|

Major Inflation Changes in the Month of September 2018 |

|||

|

Broad Commodity Group |

Price change m/m (Sep-18/Aug-18) |

Price change y/y (Sep-18/Sep-17) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.4% |

0.5% |

This was due to increase |

|

Transport Cost |

8.0% |

17.3% |

This was on account of increase in the pump prices of petrol and diesel which triggered increase in prices of other transport components |

|

Housing, Water, Electricity, Gas and other Fuels |

0.5% |

17.4% |

This was on account of a review of the electricity tariff structure |

|

Overall Inflation |

1.0% |

5.7% |

The m/m increase was due to an 8.0% increase in the Transport Index and a 0.5% increase in the Housing, Water, Electricity, Gas and Other Fuels’ Index which have a CPI weight of 8.7 and 18.3 respectively |

Monetary Policy:

The Monetary Policy Committee (MPC) met twice in Q3’2018. In the July 30th meeting, the committee decided to lower the Central Bank Rate (CBR) to 9.0% from 9.5%, noting that inflation expectations were well anchored within the target range of 2.5% - 7.5%, and that economic growth prospects were improving. This was evidenced by; (i) a stable foreign exchange market, with the current account deficit narrowing to 5.8% in the 12 months to June 2018 from 6.3% in March, and (ii) a stable and resilient banking sector, with average liquidity and capital adequacy ratios at 48.0% and 18.0% respectively in June 2018. The committee also noted that economic output was below its potential level, and there was room for further accommodative monetary policy. In the September 25th meeting, the MPC retained the CBR at 9.0%, citing that inflation expectations remained well anchored within the target range largely due to lower food prices and that there was sustained optimism for stronger economic growth in 2018 as per the private sector market perception survey. This was mainly attributed to a rebound in agriculture, pick up in private sector economic activity, renewed business confidence due to the ongoing war against corruption and a stable macroeconomic environment. The MPC noted that there was, however, need to monitor the second-round inflationary effects arising from the VAT on petroleum products, and any perverse response to its previous decisions.

Q3’2018 Highlights:

- The National Assembly convened for special parliamentary sittings held on 18th September and 20th September to discuss the President’s reservations against the Finance Bill through his memorandum. The President rejected the Finance Bill 2018 received from the Speaker of the National Assembly, which had amendments as voted by the National Assembly such as (i) postponing the imposition of VAT on fuel by another 2-years to September 2020, citing that its implementation would lead to a rise in inflation, and (ii) retaining of the interest rate cap citing that there was no justification for the repeal. All the proposals as per the President’s memorandum tabled in parliament were passed despite a chaotic sitting, after which the president assented to the Finance Bill 2018 on 21st September 2018. The proposals included (i) deletion of the clause which sought to postpone the imposition of VAT on fuel by another 2 years to commence in September 2020 (ii) an increase on the excise duty charged on excisable value on telephone and internet data service to 15.0% from the earlier 10.0%, and (iii) a reduction in the taxation on winnings under the betting, lotteries and gaming Act to 15.0% from the earlier proposed 20.0%. Due to assent of the Finance Bill 2018, we are of the view that imposition of some of the tax measures as introduced in the Finance Bill raise concerns in the country’s economic growth, especially on corporate earnings this year with the main focus being on the Telecommunication and Financial services industry due to the increased excise tax on both money transfers and internet charges which could slow down consumption of these services. For more information, see our Cytonn Weekly #36/2018,

- During the special parliamentary sittings, the National Assembly also discussed the supplementary estimates for FY’2018/2019 presented by the Budget and Appropriations Committee, which proposed a reduction in the total budget estimate by Kshs 55.1 bn due to the expected shortfall in revenue arising from the amendments made in the Finance Bill 2018. The National Assembly however passed an expenditure reduction of Kshs 37.6 bn, which is to be achieved through a reduction in recurrent expenditure and capital expenditure for FY’2018/2019 by Kshs 9.1 bn and Kshs 28.5 bn, respectively coupled with a reinstatement of Kshs 1.5 bn to the judiciary,

- The International Monetary Fund (IMF) paid a visit to Kenya where discussions were held with the Kenyan Government on the second review under a precautionary Stand-By Arrangement (SBA), which was extended to Kenya on 14th March 2016. For more information, see our Cytonn Weekly #30/2018. The second review however was not completed, leading to the expiry of the precautionary stand-by facility granted to Kenya on 14th September 2018 as the National Treasury was not keen on seeking to renew the facility noting that the macro-economic fundamentals of the country have continued to stabilize despite the country not drawing on the facility. We believe that access to the facility would have been useful in cushioning the Kenyan Shilling from exogenous shocks as well as maintaining the country’s fiscal discipline due to the pre-set conditions that come attached to the facility, which effectively reduces the risk perception of countries while improving investor sentiments. However, the country faces no immediate adverse risks as the country’s external position is still strong, a view which the IMF has also affirmed through their local representative, as we have adequate forex reserves currently at USD 8.5 bn, equivalent to 5.6 months of import cover, compared to a one-year average of 5.4 months, and

- According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the business environment in the country expanded at a marked pace in August 2018. The seasonally adjusted PMI recovered to 54.6 in August from a 6-month low of 53.6 in July. A PMI reading of above 50 indicates improvements in the business environment, while a reading below 50 indicates a worsening outlook. Firms reported growth in value of outputs due to the continued rise in new orders, which rose for the 9thconsecutive month. This was despite high input costs attributed to raw material shortages. In response to increased output requirements, firms also raised their staffing levels during the month though at a modest rate. The private sector has remained resilient as the PMI is still above 50; we however expect the private sector to experience increased input costs going forward should the 16.0% VAT on petroleum products be maintained.

Kenya’s current account deficit improved during Q2’2018, coming in at Kshs 85.8 bn from Kshs 130.4 bn in Q2’2017, a decline of 34.2%, equivalent to 7.1% of GDP from 11.4% recorded in Q2’2017. This was mainly due to the 57.1% increase in the Secondary Income (Transfers) Balance, largely attributed to 56.9% increase in the diaspora inflows to Kshs 74.7 bn from Kshs 47.6 bn in Q2’2017. For a more comprehensive analysis see the Q2’2018 Quarterly Balance of Payments Note

Macroeconomic Indicators Table:

The table below summarizes the various macroeconomic indicators, the expectation at the beginning of 2018, the actual Q3’2018 experience, the impact of the same, and our expectations going forward:

|

Key Macro-Economic Indicators – Kenya |

||||||

|

Indicators |

Expectations at start of 2018/2019 Fiscal Year |

YTD 2018 Experience |

Going forward |

Outlook at the Beginning of the Year |

Current Outlook |

|

|

|

GDP growth projected to come in at between 5.4% - 5.6% |

Kenya’s economy expanded by 6.3% in Q2’2018, higher than 4.7% in Q2’2017. This was due to; i. recovery in agriculture, which recorded a growth of 5.6% due to improved weather conditions, ii. improved business and consumer confidence, increased output in the manufacturing and electricity & water supply sectors which grew by 3.1% and 8.6% respectively |

GDP growth is projected to come in between 5.4% - 5.6% in 2018 driven by recovery of growth in the agriculture sector, continued growth in the tourism, real estate and construction sectors, and growth in the manufacturing sector |

Positive |

Positive |

|

|

Interest Rates |

A stable outlook on interest rates in 2018 with the CBR maintained at 9.5% |

The Monetary Policy Committee (MPC) met on September 25th and maintained the Central Bank Rate (CBR) at 9.0% citing that there was need to monitor the second-round inflationary effects arising from the VAT on petroleum products, and any perverse response to its previous decisions. |

The interest rate environment is expected to remain relatively stable, with the CBK not accepting high yields on treasury securities with the CBR rate having been lowered twice and with the interest rate cap still in place |

Neutral |

Neutral |

|

|

Inflation |

To average within the government annual target of between 2.5% - 7.5% in 2017 |

Inflation has averaged 4.4% in the first 9 months of 2018. The year on year inflation rate for the month of September increased to 5.7% from 4.0% in August and the m/m inflation rose by 1.0% due to increases in housing, water, electricity ,gas and other fuels index, coupled with an increase in the transport index. |

Inflation in H2’2018 is expected to experience upward pressure due to the various tax amendments as per the Finance Bill 2018, but at a lower rate than earlier anticipated following the reduction of the VAT charge on fuel to 8.0% from 16.0% effective 21st September 2018, affirming our expectations on inflation for the year averaging within the government’s set target of 2.5%-7.5% |

Positive |

Positive |

|

|

Exchange rate |

To remain stable supported by dollar reserves |

The Shilling has appreciated by 2.2% against the USD YTD to 101.0. The current account deficit narrowed to 5.3% of GDP in the 12 months to July 2018 from 5.6% in June 2018. It is expected to narrow further to 5.4% of GDP in 2018, with strong growth of agricultural exports particularly tea and horticulture, resilient diaspora remittances, and improved tourism receipts. IMF Standby Credit Facility expired in September 2018 |

Kenya’s forex reserves currently stand at USD 8.5 bn (equivalent to 5.6 months of import cover), sufficient to cushion the economy from unforeseen short-term shocks. Kenya’s current account deficit has also improved to 5.8% of GDP in Q1’2018, from 11.3% recorded in Q1’2017. Despite the expiry of the IMF standby credit facility, we expect the currency to remain relatively stable against the dollar, supported by, (i) stronger horticulture export inflows driven by increasing production and improving global prices, (ii) improving diaspora remittances, and (iii) the ample forex reserves |

Neutral |

Neutral |

|

|

Corporate Earnings |

Corporate earnings growth of 8.0% in 2017 due to lower earnings for commercial banks attributed to the cap on interest rates |

Listed Banks have recorded a weighted average increase in core EPS of 19.0% in H1’2018 |

We expect corporate earnings to improve in 2018, |

Positive |

Positive |

|

|

Investor Sentiment |

Investor sentiment was expected to improve in 2018 given the now settling operating environment after conclusion of the 2017 elections |

The Kenya Eurobond was 7.0x oversubscribed partly showing the appetite for Kenyan securities by the foreign community, and investor confidence in Kenya’s stable and relatively diversified economy |

We still expect investor sentiment to improve in 2018 given; (i) the now settled operating environment after the conclusion of the long electioneering period in 2017, (ii) the expectation that long term investors will continue entering the market seeking to take advantage of the valuations which are still historically low, and (iii) expectations of a relatively stable shilling |

Positive |

Positive |

|

|

Security |

Security expected to be maintained in 2018, especially given the elections were concluded and the USA lifted its travel warning for Kenya, placing it in the 2nd highest tier of its new 4-level advisory program, indicating positive sentiments on security from the international community |

The political climate in the country has eased, with security maintained and business picking up. The hand shake between the president and the opposition leader served to calm any political tension. Kenya now has direct flights to and from the USA, a possible sign of improving security in the country |

We expect security to be maintained in 2018, especially given that there is relative calm, as the two principals work together towards combating corruption and promoting economic transformation agenda |

Positive |

Positive |

|

Of the 7 indicators we track, 5 are positive and 2 are neutral. The outlook of the 7 indicators has remained unchanged from H1’2018. From this, we maintain our positive outlook on the 2018 macroeconomic environment.

T-Bills & T-Bonds Primary Auction:

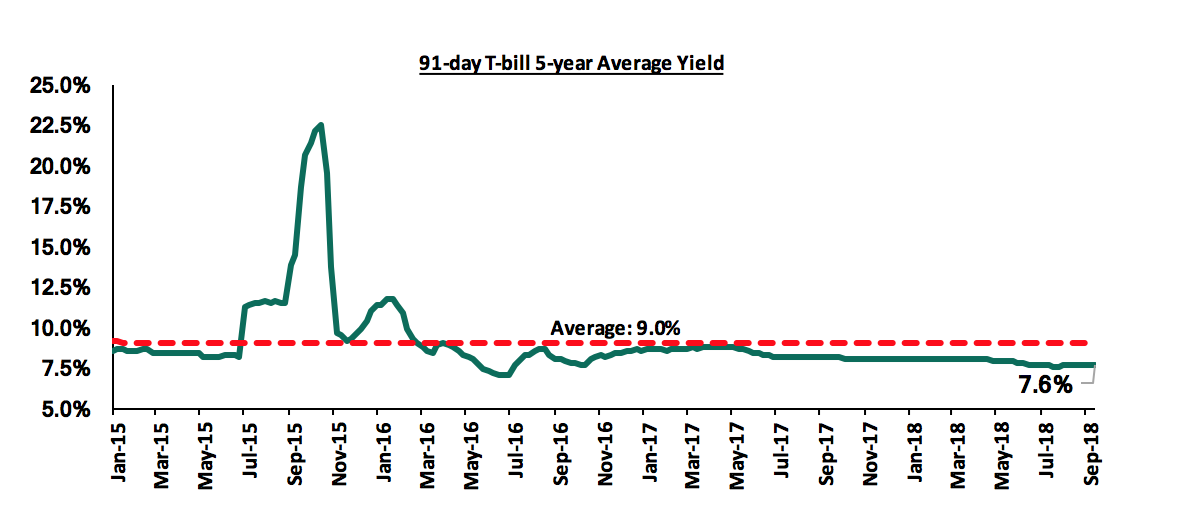

During the third quarter of 2018, T-bills auctions recorded an oversubscription attributed to improved liquidity levels, with the average subscription rate coming in at 133.3% compared to 162.7% in Q2’2018. Overall average subscription rates for the 91-day, 182-day, and 364-day papers in Q3’2018 came in at 99.4%, 91.8% and 188.4%, respectively, from 108.5%, 127.8%, 219.4% in Q2’2018. Yields on T-bills declined by 28 bps, 110 bps and 100 bps in Q3’2017, closing at 7.7%, 9.1%, and 10.0%, from 7.9%, 10.2%, and 11.0% for the 91, 182, and 364-day papers, respectively, as at end of Q2 2018, mainly due to the Central Bank of Kenya’s (CBK’s) efforts to keep rates low by rejecting expensive bids in the auction market.

During the week, T-bills were undersubscribed at a subscription rate of 85.9%, down from 123.9% recorded the previous week. The yields on the 91-day and 364-day papers remained unchanged at 7.6% and 9.7%, respectively while the yield on the 182-day paper declined to 8.6% from 8.7%, the previous week. The acceptance rate declined to 94.8% from 95.8% recorded the previous week, with the government accepting Kshs 19.5 bn of the Kshs 20.6 bn worth of bids received.

The yield on the 91-day T-bill is currently trading at a yield of 7.6%, below its 5-year average of 9.0%. The lower yield on the 91-day paper is mainly attributed to the low interest rate environment we have been experiencing, and we expect this to continue in the short-term because (i) the rate cap is still in place which will make it easier for the government to borrow from the domestic market, as institutions will continue channelling funds more actively towards government securities, which are deemed less risky, since the pricing of loans to the private sector is based on the Central Bank Rate as opposed to their risk profiles, and (ii) the government domestic borrowing requirement for the 2018/19 financial year has been reduced by 8.6%, with revenues expected to increase by 14.5% from the previous fiscal year.

|

No. |

Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount to be Raised (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

1 |

30/07/2018 |

FXD2/2018/20 |

20.0 |

13.2% |

40.0 |

10.5 |

13.4% |

34.7% |

75.8% |

|

2 |

27/08/2018 |

FXD1/2018/10 |

10.0 |

12.7% |

40.0 |

19.4 |

12.7% |

74.6% |

64.9% |

|

3 |

24/09/2018 |

FXD1/2018/10 (Reopen) |

10.0 |

12.7% |

40.0 |

21.2 |

12.7% |

81.2% |

81.8% |

|

FXD2/2018/20 (Re-open) |

20.0 |

12.9% |

5.3 |

12.9% |

Performance in the Primary T-bond auctions in Q3’2018 was varied between the various issues, with the subscription rate averaging 63.5%. The average acceptance rate in Q3’2018 came in at 74.2%, as the CBK continued to reject bids deemed expensive in order to maintain the rates at low levels.

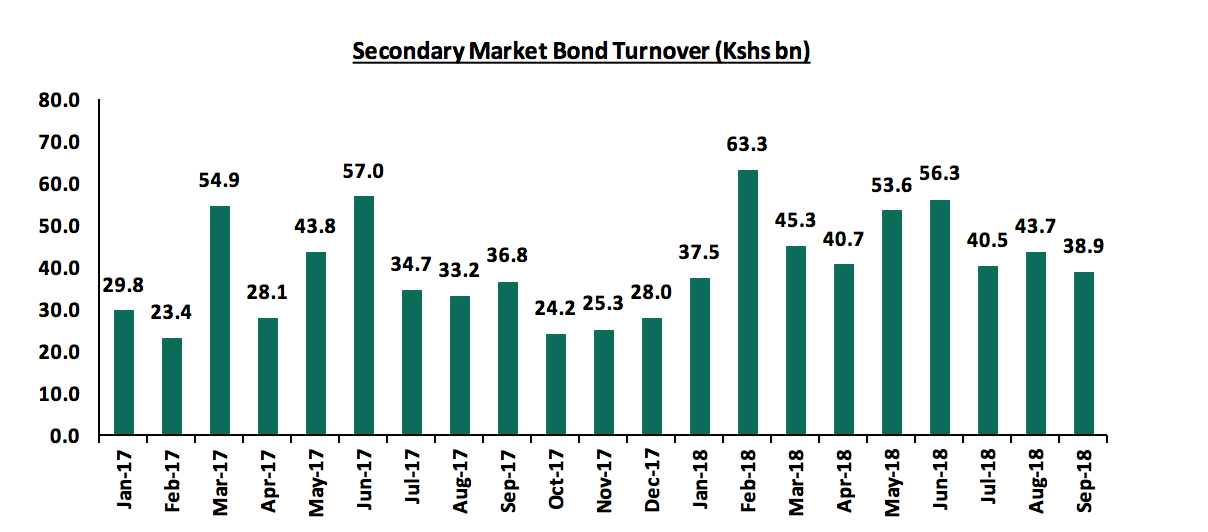

Secondary Bond Market Activity:

The NSE FTSE Bond Index gained by 3.2% during Q3’2018 while the secondary bonds market recorded reduced activity, with turnover decreasing by 22.2% to Kshs 123.2 bn from Kshs 150.6 bn recorded in Q2’2018.

Kenya Eurobonds:

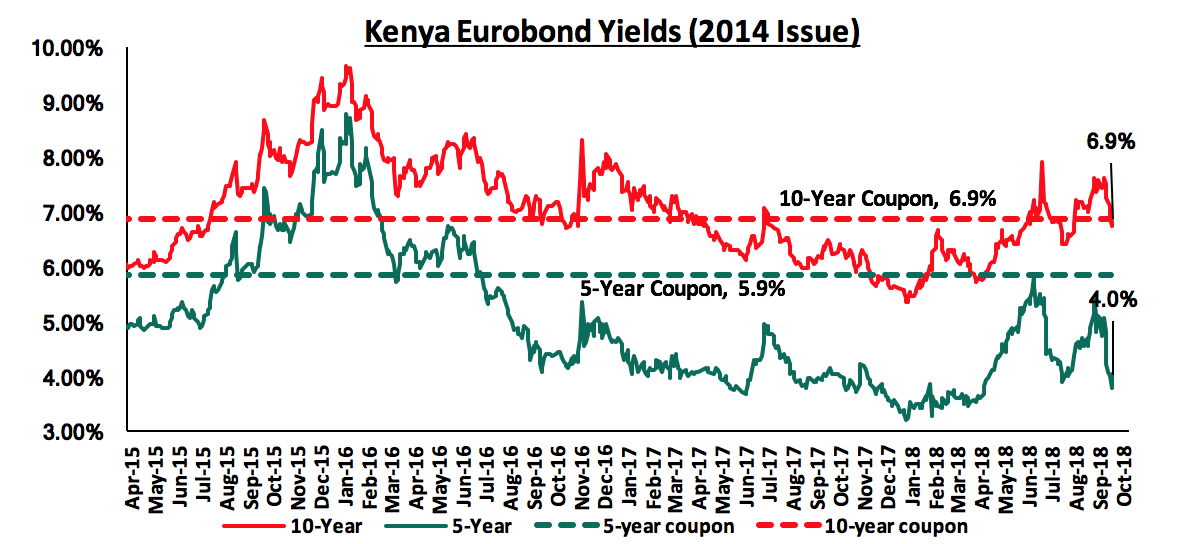

According to Bloomberg, the yield on the 5-year Eurobond issued in 2014 closed at 4.0%, a 1.3% points decline from 5.3% as at end of Q2’2018. Yield on the 10-year Eurobond closed at 6.9%, a 1.0%-point decline from 7.9% as at end of Q2’2018. By year-on-year comparison, yield on the 10-year has increased by 0.5% points from 6.4% as at end Q3’2017 while the 5- year has slightly declined by 0.1% points from 4.1% as at end of Q3’2017. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.7% points and 2.6% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.8-years and 5.8-years to maturity for the 5-year and 10-year, respectively.

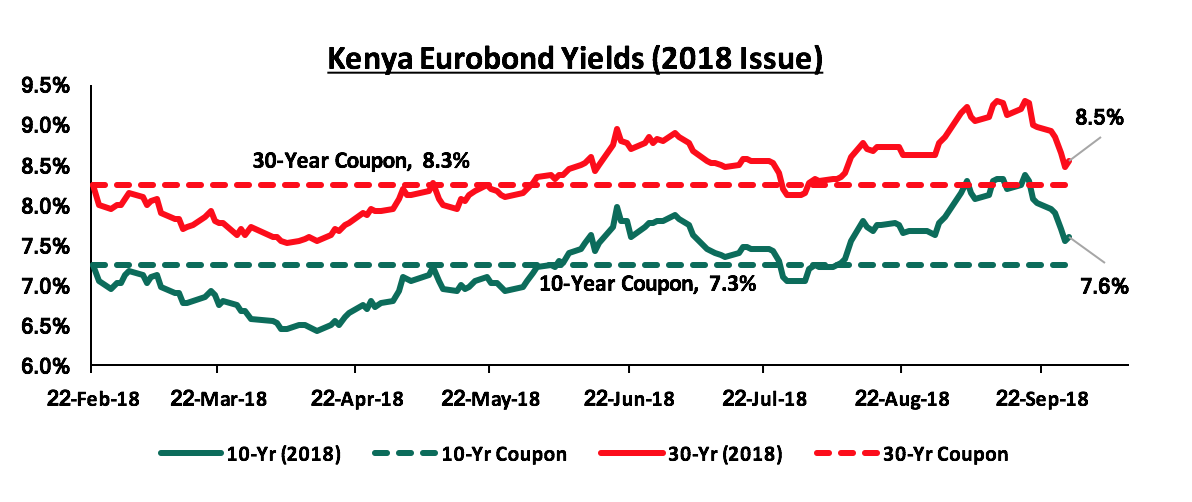

For the February 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond decreased by 0.2% points and 0.3% points to 7.6% and 8.5%, respectively in Q3’2018 from 7.8% and 8.8% as at end Q2’2018. Since the issue date, yields on the 10-year and 30-year Eurobonds have increased by 0.4% and 0.3% points respectively.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids as it is currently 82.8% ahead of its pro-rated borrowing target for the current financial year, having borrowed Kshs 133.8 bn against a pro-rated target of Kshs 73.2 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, with the president having ascended to the Finance Bill 2018, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments.

Market Performance:

During Q3’2018, the equities market was on a significant downward trend, with NASI, NSE 25 and NSE 20 declining by 14.2%, 15.6%, and 12.5%, respectively; taking their YTD performance as at the end of September to (12.6%), (22.5%), and (13.6%) for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the quarter was shaped by declines in large caps such as NIC Group, Bamburi, Safaricom, and EABL by 31.0%, 18.5%, 16.2%, and 13.6%, respectively.

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining by 2.9%, 1.5% and 2.7%, respectively, due to gains in large cap stocks such as Co-operative Bank, EABL and KCB which gained by 9.4%, 5.6% and 5.3%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have declined by 8.4%, 22.6% and 10.5%, respectively.

Equities turnover declined by 32.0% during the quarter to USD 319.5 mn from USD 469.8 mn in June, taking the YTD turnover to USD 1.4 bn. For this week, equities turnover rose by 50.5% to USD 41.0 mn from USD 27.2 mn in the previous week. Foreign investors remained net sellers this week, with a net selling position of USD 12.0 mn, which is a 48.1% increase from last week’s net selling position of USD 8.1 mn. We expect the market to remain subdued in the near-term as international investors exit the broader emerging markets due to the rising interest rates in the US, coupled with strengthening US dollar.

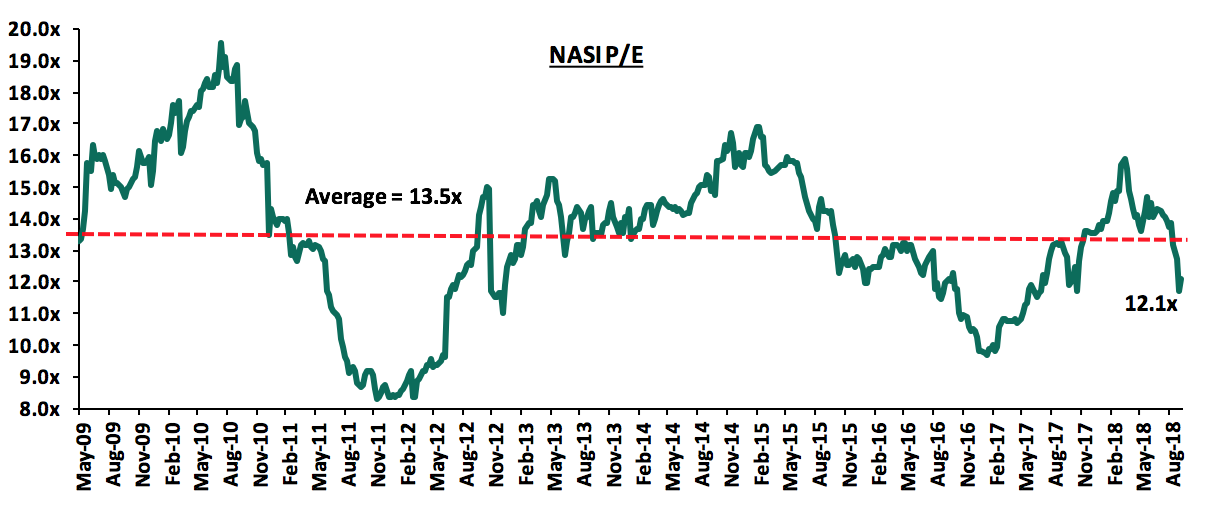

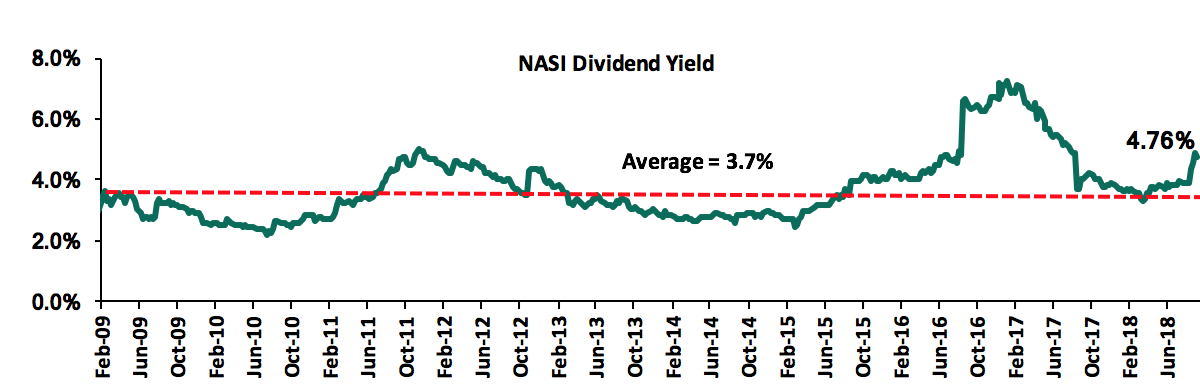

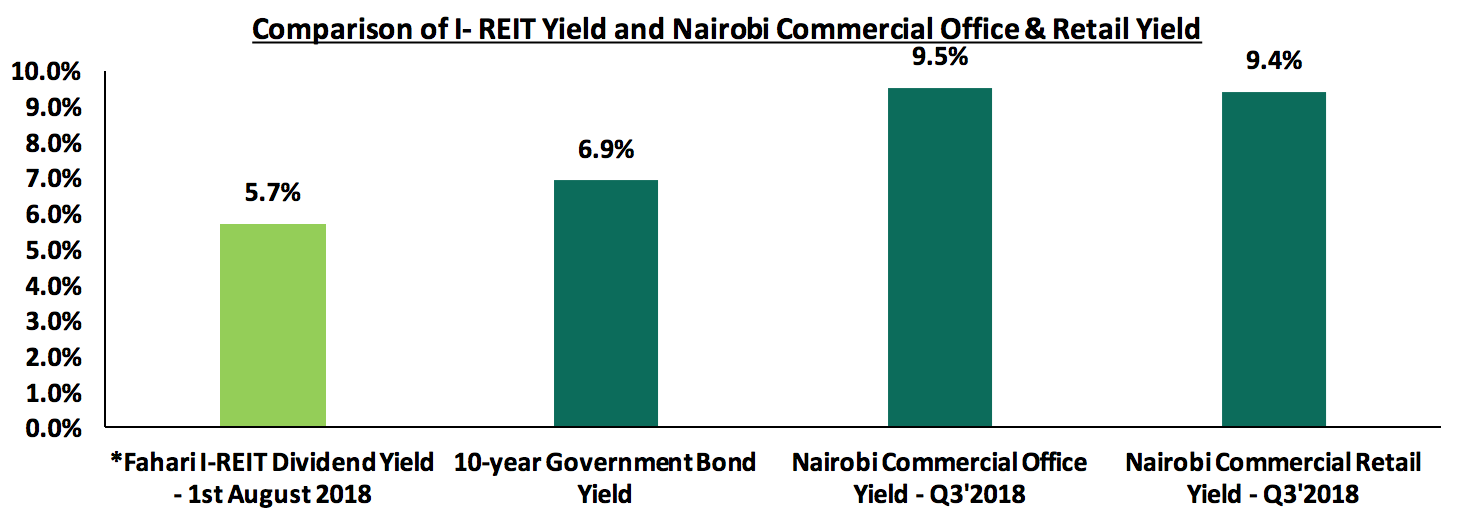

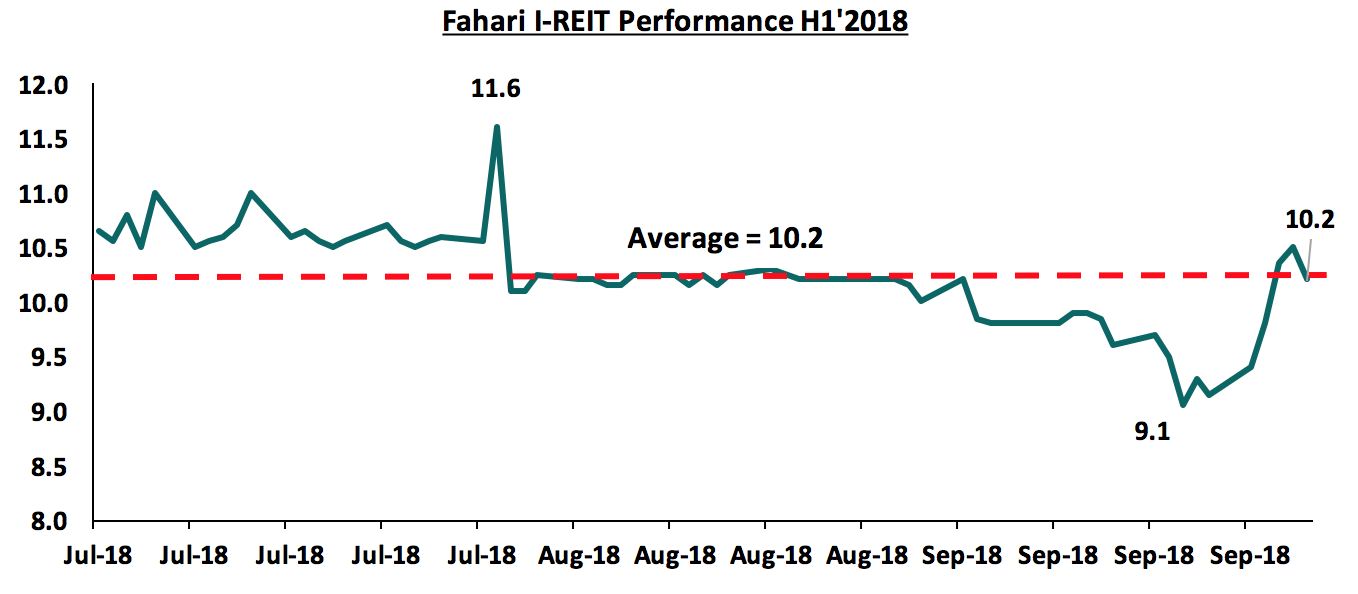

The market is currently trading at a price to earnings ratio (P/E) of 12.1x, 10.1% below the historical average of 13.5x, and a dividend yield of 4.8%, slightly above the historical average of 3.7%. Despite the current valuations being around the historical average, we believe there still exist pockets of value in the market. The current P/E valuation of 12.1x is 24.7% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 45.6% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Quarterly Highlights:

During the quarter;

- President Uhuru Kenyatta signed the Finance Bill, 2018 into law on Friday 21st September, 2018, after Members of Parliament passed the proposed amendments to the Bill as highlighted in our Cytonn Weekly #36/2018. Key to note is that the assented Finance Bill 2018 does away with the floor on deposit pricing, which was initially set at 70.0% of the Central Bank Rate (CBR) but retains the cap on loan pricing at 4.0% above the CBR. This gives lenders flexibility on deposit pricing, which may see banks reduce their cost of funds. We are of the view that the new legislation will mean increased net interest margins (NIM) for banks due to reduced interest expense on deposits going forward,

- The Central Bank of Kenya (CBK) proposed to introduce a Banking Sector Charter that will guide service provision in the sector as highlighted in our Cytonn Weekly #30/2018. The Charter aims to instill discipline in the banking sector in order to make it responsive to the needs of the banked population. The charter is expected to facilitate a market-driven transformation of the Kenyan-banking sector and bring about tangible benefits for Kenyans, specifically to increase access to affordable financial services for the unbanked and under-served population. We are of the view that, if adopted, the Banking Sector Charter will go a long way towards removing the existing opacity in loan prices and promote the adoption of the risk-based loan-pricing framework. However, we are even of the stronger view, as captured in our Focus Notes titled “Rate Cap Review Should Focus More on Stimulating Capital Markets” and Status of Rate Cap Review in Finance Bill, that the best way to bring discipline in the banking sector is to reduce banking sector dominance by promoting alternative sources of credit to the economy such as privately placed investments solutions,

- The Central Bank of Kenya (CBK) downgraded the banking sector rating to “satisfactory”, from a previous rating of “strong” in 2016 as highlighted in our Cytonn Weekly #32/2018. According to the Bank Supervision Annual Report 2017 released by the regulator, the downgrade was as a result of a decline in capital adequacy, as well as a deterioration in asset quality in the sector. Despite the decline in capital adequacy ratios, the banking sector remained well capitalized with sufficient buffers above the minimum required ratios. The deterioration in asset quality came as a result of a challenging business environment in 2017, occasioned by poor weather conditions, delayed payments from both private and public institutions and the upheavals due to the protracted electioneering period last year. The declining capital adequacy may be a signal of looming consolidation in the sector as weaker banks are absorbed by their larger, more stable counterparts in order to recapitalize as per the statutory requirements,

- KCB Group emerged as the only bidder for a stake in Imperial Bank Limited (IBL), which is under receivership, after Diamond Trust Bank (DTB), having also expressed interest, pulled out of the deal. IBL was put under receivership in August 2015, with a loan book of Kshs 41.0 bn and deposits of Kshs 58.0 bn. The Central Bank of Kenya (CBK) and KDIC is to engage KCB in discussions with the aim of maximizing the value for depositors. If successful, this would mark the second instance a bank is brought out of receivership, after the recently concluded deal that saw SBM Kenya complete the acquisition of certain assets and Liabilities of Chase Bank Limited (under Receivership). For more information, see our Cytonn Weekly #29/2018, and

- Barclays Africa Group Limited changed its name to Absa Group following the London-based Barclays Plc’s exit from the African market to concentrate on European and United States markets. Barclays Plc had acquired a majority stake of 56.4% in Absa Group in 2005, gradually increased its stake to 62.0% but reduced to 14.9% after selling to the large institutional investor Public Investment Corporation of South Africa (PIC). Its Kenyan subsidiary, however, is looking to complete the rebranding process by 2020 and will continue operating as Barclays Bank Kenya until then. We are of the view that with the exit of the London-based parent company, Barclays will be able to compete more favorably with its peers, as it plans to increase its market share in the region by 5 million customers by 2020. Thus, with more localized decision-making, the lender is well positioned to quickly exploit any opportunities that arise as well as build on their innovative profile that has seen the bank offer efficient services to its customers. For more information, see our Cytonn Weekly #27/2018.

Kenyan Listed Banks Results

During the quarter, listed banks in Kenya released their H1’2018 results, recording average core earnings growth of 19.0%. The table below highlights the performance of the banking sector, showing the performance using several metrics, and the key take-outs of the performance:

|

Listed Banking Sector Operating Metrics |

|||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Cost to Income Ratio |

Non-Funded Income (NFI) Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth In Govt Securities |

Loan Growth |

LDR |

Cost of Funds |

Return on Average Equity |

|

Stanbic |

104.5% |

15.4% |

21.7% |

11.9% |

4.9% |

50.1% |

34.0% |

50.0% |

(4.2%) |

21.3% |

26.9% |

15.4% |

71.4% |

3.1% |

14.8% |

|

NBK |

39.3% |

(9.6%) |

(10.1%) |

(8.9%) |

6.9% |

95.6% |

(13.1%) |

28.8% |

(15.7%) |

(2.8%) |

9.8% |

(16.1%) |

49.8% |

3.0% |

(0.6%) |

|

StanChart |

30.3% |

7.9% |

8.8% |

7.5% |

8.0% |

61.0% |

12.2% |

32.9% |

36.2% |

2.8% |

3.5% |

(1.1%) |

48.4% |

3.6% |

18.0% |

|

KCB Group |

18.0% |

6.1% |

11.9% |

4.3% |

8.6% |

52.0% |

(0.1%) |

32.2% |

(6.0%) |

8.7% |

8.7% |

3.6% |

80.3% |

3.0% |

21.9% |

|

Equity Group |

17.6% |

10.2% |

14.0% |

9.1% |

8.8% |

52.8% |

1.5% |

40.2% |

(1.0%) |

8.5% |

18.7% |

3.8% |

69.9% |

2.7% |

23.9% |

|

I&M |

11.7% |

5.1% |

13.2% |

0.1% |

7.1% |

53.7% |

34.4% |

35.1% |

39.5% |

30.6% |

(28.3%) |

12.6% |

77.2% |

4.6% |

17.2% |

|

Co-op Bank |

7.6% |

7.9% |

2.2% |

10.4% |

8.6% |

54.9% |

(1.6%) |

32.1% |

(2.6%) |

3.9% |

12.0% |

(0.6%) |

84.6% |

3.9% |

18.0% |

|

Barclays |

6.2% |

7.6% |

22.4% |

4.0% |

9.0% |

66.3% |

6.9% |

30.0% |

1.9% |

14.9% |

33.6% |

7.5% |

81.2% |

2.60% |

17.5% |

|

DTB |

2.5% |

3.9% |

3.0% |

4.6% |

6.5% |

57.4% |

8.0% |

21.6% |

7.2% |

9.9% |

22.5% |

3.5% |

70.4% |

5.0% |

15.5% |

|

NIC Group |

(2.1%) |

8.6% |

30.0% |

(4.9%) |

6.0% |

60.9% |

7.0% |

29.5% |

(3.0%) |

10.5% |

25.7% |

(1.5%) |

78.2% |

5.4% |

12.8% |

|

Housing Finance |

(95.7%) |

(13.2%) |

(12.7%) |

(13.9%) |

4.9% |

99.3% |

38.2% |

30.4% |

7.2% |

(3.1%) |

17.3% |

(9.8%) |

131.4% |

7.0% |

(0.2%) |

|

Weighted Average H1'2018* |

19.0% |

7.9% |

12.0% |

6.4% |

8.1% |

55.7% |

6.9% |

34.3% |

4.6% |

10.0% |

13.7% |

3.8% |

73.8% |

3.4% |

19.5% |

|

Weighted Average H1'2017** |

(14.4%) |

(7.2%) |

(6.0%) |

(6.9%) |

8.0% |

59.2% |

5.1% |

34.0% |

12.5% |

9.4% |

21.5% |

7.3% |

77.9% |

3.4% |

17.9% |

|

* 31st August 2018 ** 31st August 2017 |

|||||||||||||||

Key takeaways from the table above include:

- The listed banks recorded a 19.0% average increase in core Earnings Per Share (EPS), compared to a decline of 14.4% in H1’2017. Only NIC Group and Housing Finance Group recorded declines in core EPS, registering declines of 2.1% and 95.7%, respectively. CFC Stanbic recorded the highest growth at 104.5% y/y, supported by 21.9% increase in total operating income, coupled with a 14.0% decrease in total operating expenses. HF Group recorded the biggest decline at 95.7%, on the back of a 13.9% decline in Net Interest Income (NII), and a high cost to income ratio of 99.3%;

- The sector recorded a relatively strong deposit growth, which came in at 10.0%. The strong deposit growth led to a 12.0% growth in the interest expenses. However, the cost of funds remained flat at 3.4%, an indication that the greater proportion of deposit accounts were non-interest bearing;

- Average loan growth was anomic coming in at 3.8%, which was lower than 7.3% recorded in H1’2017, indicating that there was an even slower credit extension in the economy, due to sustained effects of the interest rate cap. Government securities on the other hand recorded a growth of 13.7% y/y, which was faster compared to the loans, albeit slower than 21.5% recorded in H1’2017. This indicates that banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns. Interest income increased by 7.2%, as banks adapted to the interest rate cap regime, with increased allocations in government securities. This, however, should be a point of concern as it points to a reduction in the banking sector’s primary function of intermediation between depositors and credit consumers, with the loan to deposit ratio declining to 73.8% from 77.9% in H1’2017. Reduced credit extension especially to the private sector comprised mainly of the MSMEs, curtails both the short and long-run economic growth;

- The average Net Interest Margin in the banking sector currently stands at 8.1%, a slight improvement from the 8.0% recorded in H1’2017. The improvement was mainly due to the increase in Net Interest Income by 6.4% y/y, aided by the 7.9% improvement in the interest income y/y; and

- Non-funded Income grew by 6.9% y/y, faster than 5.1% recorded in H1’2017. The growth included a total fee and commission’s growth of 4.6% although it was slower than 12.5% recorded in H1’2017. The growth in fee and commission income was however subdued by the slow loan growth, thus impacting the fee and commission income from loans. Banks have however been focusing on expanding the other fee and commission income, with increased focus on transactional income from alternative transaction channels. Banks have been shifting focus to this revenue space, by offering holistic banking services such as advisory. With increased focus on other NFI sources such as transaction income from mobile and online channels, bancassurance, money remittance, and payment services etc., banks will likely see expansion in NFI going forward as net interest income remains somewhat subdued under the current interest rate cap regime.

For more information on the Kenyan listed Banks H1’2018 results, see our Kenya H1’2018 Banking Sector Report.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 29/06/2018 |

Price as at 21/09/2018 |

Price as at 28/09/2018 |

w/w change |

q/q change |

YTD Change |

LTM Change |

Target Price |

Dividend Yield |

Upside/ Downside |

||

|

NIC Bank |

35.5 |

26.5 |

25.3 |

(4.7%) |

(28.9%) |

(25.2%) |

(28.3%) |

48.8 |

4.0% |

97.2% |

||

|

Zenith Bank |

25 |

20.8 |

21.5 |

3.4% |

(14.0%) |

(16.1%) |

-7.70% |

33.3 |

12.6% |

67.5% |

||

|

Diamond Trust Bank |

199 |

172 |

174 |

1.2% |

(12.6%) |

(9.4%) |

(4.9%) |

283.7 |

1.5% |

64.5% |

||

|

Union Bank Plc |

6.1 |

5.8 |

5.1 |

(12.1%) |

(16.4%) |

(34.6%) |

(11.5%) |

8.2 |

0.0% |

59.8% |

||

|

KCB Group |

46.3 |

38 |

40.5 |

6.6% |

(12.4%) |

(5.30%) |

(1.8%) |

61.3 |

7.4% |

58.8% |

||

|

Ghana Commercial Bank |

5.2 |

5.3 |

5.4 |

0.8% |

3.9% |

5.9% |

29.5% |

7.7 |

7.1% |

51.4% |

||

|

Equity Group |

46.3 |

38.8 |

40 |

3.2% |

(13.5%) |

(0.6%) |

2.6% |

56.2 |

5.0% |

45.5% |

||

|

I&M Holdings |

115 |

90 |

99 |

10.0% |

(13.9%) |

(1.0%) |

(23.3%) |

138.6 |

3.5% |

43.5% |

||

|

UBA Bank |

10.5 |

8 |

8.4 |

5.0% |

(20.0%) |

(18.4%) |

(0.7%) |

10.7 |

10.1% |

37.5% |

||

|

Co-operative Bank |

17.5 |

13.9 |

15.2 |

9.7% |

(13.1%) |

(5.0%) |

(10.1%) |

19.9 |

5.3% |

36.2% |

||

|

Ecobank |

8.5 |

8.1 |

8 |

(1.6%) |

(5.3%) |

5.3% |

25.7% |

10.7 |

0.0% |

34.1% |

||

|

CRDB |

160 |

160 |

160 |

0.0% |

0.0% |

0.0% |

(8.6%) |

207.7 |

0.0% |

29.8% |

||

|

Barclays |

11.5 |

10.2 |

10.6 |

4.4% |

(7.4%) |

10.4% |

5.0% |

12.5 |

9.4% |

27.4% |

||

|

Access Bank |

10.4 |

8.2 |

8.2 |

0.00% |

(21.3%) |

(22.0%) |

(14.3%) |

9.5 |

4.9% |

21.5% |

||

|

HF Group |

8.5 |

6.7 |

5.8 |

(13.4%) |

(31.8%) |

(44.2%) |

(39.5%) |

6.6 |

6.0% |

19.8% |

||

|

CAL Bank |

1.3 |

1.2 |

1.2 |

(0.8%) |

(8.6%) |

8.3% |

33.7% |

1.4 |

0.0% |

19.7% |

||

|

Stanbic Bank Uganda |

32 |

33 |

33 |

0.0% |

3.1% |

21.1% |

20.0% |

36.3 |

3.5% |

13.5% |

||

|

Standard Chartered |

198 |

195 |

192 |

(1.5%) |

(3.0%) |

(7.7%) |

(16.2%) |

196.3 |

6.5% |

8.8% |

||

|

Guaranty Trust Bank |

40.5 |

34.7 |

36.4 |

4.8% |

(10.2%) |

(10.8%) |

(9.1%) |

37.1 |

6.6% |

8.7% |

||

|

Bank of Kigali |

286 |

290 |

289 |

(0.3%) |

1.0% |

(3.7%) |

3.20% |

299.9 |

4.8% |

8.6% |

||

|

Bank of Baroda |

150 |

126 |

126 |

0.0% |

(16.0%) |

11.5% |

14.5% |

130.6 |

2.0% |

5.6% |

||

|

SBM Holdings |

7.3 |

6.6 |

6.5 |

(0.9%) |

(10.7%) |

(13.3%) |

(17.7%) |

6.6 |

4.6% |

5.5% |

||

|

Stanbic Holdings |

91.5 |

90 |

90 |

0.0% |

(1.6%) |

11.1% |

13.9% |

92.6 |

2.5% |

5.4% |

||

|

National Bank |

6.3 |

5.5 |

5.8 |

6.4% |

(7.2%) |

(38.0%) |

(38.3%) |

4.9 |

0.0% |

(15.5%) |

||

|

Stanbic IBTC Holdings |

52 |

42 |

46 |

9.5% |

(11.5%) |

10.8% |

15.0% |

37 |

1.3% |

(18.3%) |

||

|

FBN Holdings |

10.6 |

8.6 |

8.9 |

3.5% |

(16.0%) |

1.1% |

62.7% |

6.6 |

2.8% |

(22.7%) |

||

|

Standard Chartered |

23.1 |

26 |

26.1 |

0.3% |

12.8% |

3.4% |

54.5% |

19.5 |

0.0% |

(25.4%) |

||

|

Ecobank Transnational |

20 |

18 |

17.9 |

(0.6%) |

(10.5%) |

5.3% |

1.1% |

9.3 |

0.0% |

(48.2%) |

||

|

*Target Price as per Cytonn Analyst estimates |

|

|||||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

|

|||||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

||||||||||||

|

**** Stock prices are in respective country currency |

||||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

Financial Services Sector:

Deals in the Financial Services sector during the quarter include;

- Kuramo Capital, a New York based investment management firm focused on alternative investments in frontier and emerging markets acquired an additional 17.5% stake in GenAfrica Asset Managers Ltd from the management and staff of GenAfrica Asset Managers for Kshs 554.2 mn, effectively valuing the company at Kshs 3.2 bn. The additional investment brings Kuramo’s total shareholding in GenAfrica to 90.8%, after Kuramo completed the purchase of a 73.4% stake from Centum Investments in August this year, with the remaining 9.2% remaining in the hands of management and staff of GenAfrica. Kuramo earlier in the year also completed a transaction to acquire a minority stake in Kenyan investment bank, Sterling Capital for an undisclosed amount. For more information, see our Cytonn Weekly #36/2018,

- Old Mutual, a UK based international financial services group providing investment and savings, insurance, asset management and retirement solutions, increased its stake in UAP - Old Mutual Holdings from 60.7% to 66.7%, in a deal to purchase a 6.0% stake in UAP-Old Mutual for GBP 24.0 mn (Kshs 3.1 bn). The transaction involved the acquisition of 12.7 mn shares of UAP-Old Mutual Holdings’ Chairman Joe Wanjui (9.8 mn shares) and Director James Muguiyi (2.9 mn shares) at a price of Kshs 245.6 per share. The acquisition was carried out at a P/B multiple of 2.7x. The transaction multiple of 2.7x is a 30.3% premium on the average insurance sector transaction P/B multiple of 2.1x over the last seven-years, and almost double the last insurance transaction - the 1.3x multiple that Swiss Re paid for the Britam stake. For more information, see our Cytonn Weekly #32/2018. The table below highlights the transaction multiples in Kenya’s insurance sector over the last seven years;

|

Insurance Sector Transaction Multiples over the Last Seven Years |

|||||||

|

No. |

Acquirer |

Insurance Acquired |

Book Value (Kshs bn) |

Transaction Stake |

Transaction Value (Kshs bn) |

P/B |

Date |

|

1. |

Africa Development Corporation |

Resolution Health East Africa |

N/A |

25.1% |

0.2 |

N/A |

Dec-10 |

|

2. |

Leapfrog Investments |

Apollo Investments |

0.3 |

26.9% |

1.1 |

15.6x |

Dec-11 |

|

3. |

Saham Finances |

Mercantile Insurance |

0.5 |

66.0% |

Undisclosed |

N/A |

Jan-13 |

|

4. |

Swedfund |

AAR |

0.4 |

20.0% |

0.4 |

5.4x |

May-13 |

|

5. |

BAAM |

Continental Re Kenya |

0.7 |

30.0% |

0.3 |

1.4x |

Apr-14 |

|

6. |

Union Insurance of Mauritius |

Phoenix of East Africa |

1.8 |

66.0% |

2.0 |

1.6x |

May-14 |

|

7. |

UK Prudential |

Shield Assurance |

0.1 |

100.0% |

1.5 |

10.2x |

Sep-14 |

|

8. |

Swiss Re |

Apollo Investments |

0.6 |

26.9% |

Undisclosed |

N/A |

Oct-14 |

|

9. |

Britam |

Real Insurance Company |

0.7 |

99.0% |

1.4 |

2.1x |

Nov-14 |

|

10. |

Leap Frog Investments |

Resolution Insurance |

0.2 |

61.2% |

1.6 |

11.7x |

Nov-14 |

|

11. |

Old Mutual Plc |

UAP Holdings |

9.6 |

60.7% |

20.8 |

3.6x** |

Jan-15 |

|

12. |

Old Mutual Plc |

UAP Holdings |

9.6 |

60.7% |

11.1 |

1.9x* |

Jan-15 |

|

13. |

MMI Holdings |

Cannon Assurance |

1.7 |

75.0% |

2.4 |

1.9x |

Jan-15 |

|

14. |

Pan Africa Insurance Holdings |

Gateway Insurance Company Ltd |

1.0 |

51.0% |

0.6 |

1.1x |

Mar-15 |

|

15. |

Barclays Africa |

First Assurance |

2.0 |

63.3% |

2.9 |

2.2x |

Jun-15 |

|

16. |

IFC |

Britam |

22.5 |

10.4% |

3.6 |

1.5x |

Mar-17 |

|

17. |

AfricInvest III |

Britam |

28.5 |

14.3% |

5.7 |

1.4x |

Sep-17 |

|

18. |

Swiss Re Asset Management |

Britam |

22.6 |

13.8% |

4.8 |

1.3x |

Jun-18 |

|

20 |

Old Mutual plc |

UAP Holdings (Wanjui & Muguiyi) |

19.0 |

6.0% |

3.1 |

2.7x** |

Aug-18 |

|

|

Harmonic Mean |

|

29.9% |

2.1x |

|||

|

|

Median |

|

55.9% |

1.9x |

|||

|

*-Proforma transaction multiple after goodwill impairment write-off **-Excluded in the harmonic mean and median |

|||||||

- Mauritius based African Rainbow Capital, an investment holding company that invests in financial service entities, agreed to acquire 90.0% stake in the Commonwealth Bank of South Africa Limited (CBSA), which trades as TymeDigital, from the Commonwealth Bank of Australia. African Rainbow Capital currently holds a 10.0% stake in TymeDigital, whilst the Commonwealth Bank of Australia holds the remaining 90.0%. For more information, see our Cytonn Weekly #30/2018, and

- Badoer Investments Limited, a Dubai-based investment firm, bought a 15.6% stake in Sumac Microfinance Bank for Kshs 100.0 mn (USD 1.0 mn). The deal values Sumac Microfinance Bank at Kshs 641.0 mn (USD 6.4 mn). The funding will be mainly used as capital as it looks to grow its loan book and for expansion with plans to open offices in Eldoret, Kisumu and Meru, as the Microfinance Institution (MFI) moves to tap into the agribusiness market in Kenya. Sumac raised Kshs 330.0 mn earlier this year through debt comprising of Kshs 153.0 mn financing from Mexican fund manager Triple Jump, Kshs 102.0 mn from the Regional MSME Investment Fund for sub-Saharan Africa, Kshs 45.0 mn from the Development Bank of Kenya and Kshs 30.0 mn from the Micro Enterprise Support Programme Trust. For more information, see our Cytonn Weekly #29/2018.

We expect that investors will continue to show interest in the financial services sector, motivated by attractive valuations, growth of financial inclusion and regulation that requires institutions to increase their capital requirements across the sector.

FinTech Sector:

Deals in the FinTech sector during the quarter include;

- Paystack Payments Limited, a Nigeria-based FinTech company that processes payments for businesses in Africa, raised USD 8.0 mn (Kshs 806.3 mn) in Series A funding, the first round of financing given to a new business after the initial capital, used to start the business. The investment is expected to facilitate the expansion of Paystack across Africa and scaling up of its engineering team. This was the second time the company received funding after it received seed capital of USD 1.3 mn (Kshs 131.0 mn) in 2016 from international investors Tencent, Comcast Ventures, and Singularity Investments. For more information, see our Cytonn Weekly #34/2018,

- Jamii Africa, an InsurTech (Insurance Technology) company based in Tanzania, received an equity investment of USD 0.7 mn (Kshs 70.6 mn) for an undisclosed stake from US-based entrepreneur, Patrick Munis, drawing the enterprise a step closer to its target of USD 2.0 mn (Kshs 201.7 mn), a benchmark set to facilitate its efforts to expand into Kenya. In February this year, The Groupe Spécial Mobile (GSM) Association, an association that represents the interests of mobile operators worldwide, through its Mobile for Development Team and as part of the GSMA Ecosystem Accelerator Innovation Fund, announced that it had granted Jamii an undisclosed amount of funding as part of its start-up portfolio. Jamii Africa also closed a USD 0.75 mn (Kshs 75.6 mn) round of seed funding in early 2017, split equally between grants and venture capital. For more information, see our Cytonn Weekly #31/2018,

- Lendable, a FinTech platform based in Kenya and the US, secured a Kshs 45.3 mn (USD 0.45 mn) convertible grant from the Dutch Government’s Micro and Small Enterprise Fund (MASSIF), managed by FMO, the Dutch Development Bank. This grant is expected to unlock an additional Kshs 452.7 mn (USD 4.5 mn) from commercial investors to fund alternative lenders. In October last year, the firm announced that it had raised Kshs 671.0 mn (USD 6.5 mn) in a Series A round of investment. In April last year, the firm also secured Kshs 56.6 mn (USD 0.55 mn) debt financing for Raj Ushanga House (RUH), the Kenya distributor for Azuri Technologies Ltd, a leading provider of Pay-as-you-go (PayGo) solar energy solutions. For more information, see our Cytonn Monthly – August 2018,

- German investment firm, GreenTec Capital Partners, invested an undisclosed amount for an undisclosed stake in Bismart Insurance, a Kenyan insurance aggregator start-up. The capital investment is expected to facilitate upscaling of Bismart’s digital platform to reach more clients and secure a strong foothold as the first Pan African blockchain - powered insurance aggregator. Founded in 2017, Bismart Insurance leverages cutting-edge technology to provide a digital interface to connect their customers to the best insurance services and investment solutions in the market. The company aims to provide transparency in the insurance process in a bid to increase the insurance penetration level in Kenya and across Africa. In April this year, the company received seed capital of Kshs 1.0 mn (USD 10,000.0) from Standard Chartered’s Women in Tech Program. For more information, see our Cytonn Weekly #28/2018,