Cytonn Monthly-October 2020

By Research Team, Nov 1, 2020

Executive Summary

Fixed Income

During the month of October, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 92.0%, a rise from 58.4% recorded in September. The subscription rates for the 91-day, 182-day and 364-day papers all increased to 146.9%, 51.2% and 110.8%, respectively, from 107.1%, 34.9% and 62.5%, recorded in September. The yields on the 91-day increased to 6.7% from 6.3% while the 182-day and 364-day papers to 7.0% and 7.9%, respectively from 6.8% and 7.7%, recorded the previous month. The T-bills acceptance rate declined to 91.5% compared to 94.8% recorded in September, with the government accepting a total of Kshs 101.0 bn of the Kshs 110.4 bn worth of bids received. Also, during the week, the Kenya National Bureau of Statistics (KNBS) released inflation data, revealing the y/y inflation for the month of October increased to 4.8%, from the 4.2% recorded in September 2020;

The Kenyan economy recorded a 5.7% contraction in Q2’2020 down from a growth of 5.3% recorded in a similar period of review in 2019. This was the first contraction since the Q3’2001 when the country recorded a 2.5% contraction. The overall performance was cushioned by growths in Agriculture, Forestry and Fishing activities which grew by 6.4%; Financial and Insurance activities, 1.7%; Construction, 3.9%; Real Estate Activities, 2.2% and Mining and Quarrying activities, 10.0%. Accommodation & tourism and the Education sectors were the hardest hit, declining by 83.3% and 56.2%, respectively;

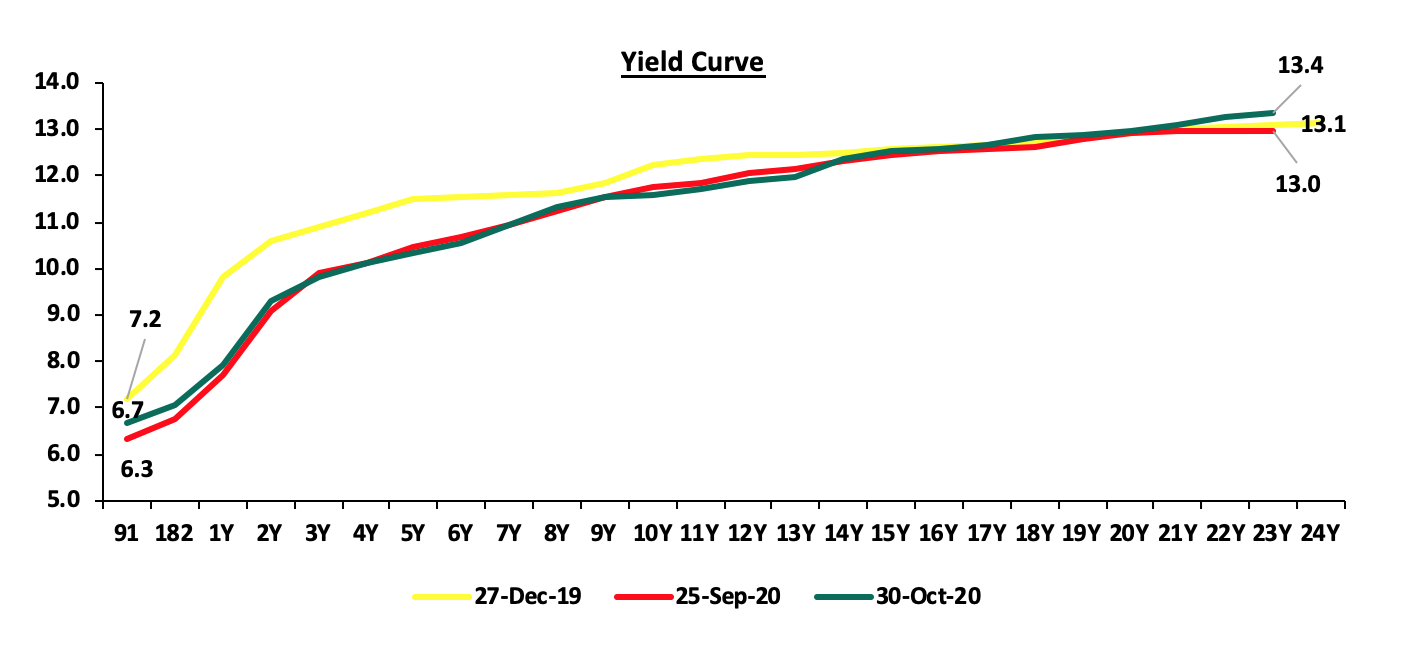

During the month, there was a continued downward readjustment on the yield curve, which saw the FTSE NSE Kenya Government Bond Index gain by 0.5%, taking the YTD performance to a 2.8% gain. The downward readjustment is mainly attributable to increased demand, due to the bias by banks towards government securities as opposed to lending due to increased credit risk;

Equities

During the month of October, the equities market recorded mixed performance, with NSE 20 and NSE 25 declining by 3.7% and 2.7%, respectively, while NASI gained marginally by 0.1%. The equities market performance was driven by losses recorded by large cap stocks, such as EABL, KCB, Equity and Cooperative Bank, which declined by 11.2%, 7.8%, 7.6% and 4.6%, respectively. During the month, the Association of Kenya Insurers (AKI) released the 2019 Kenya’s Insurance Industry Report, highlighting that the industry’s total premiums improved by 7.0% to Kshs 231.3 bn in FY’2019 from Kshs 216.1 bn recorded in 2018. During the week, ABSA Group, in association with OMFIF, released the ABSA Financial Markets Index 2020, a report that gauges the performance of African countries in the financial market, with Kenya’s rank declining to the 7th position from the 3rd position in 2019;

Real Estate

During the month, Kenya National Bureau of Statistics (KNBS), released the Quarterly Gross Domestic Product Report-Second Quarter 2020, which highlighted that real estate and construction activities grew by 2.2% and 3.9%, respectively in Q2’2020;

In the residential sector, Cytonn Investments, an investments management firm and real estate developer, handed over the Alma Phase 2 of its Kshs 5.0 bn flagship residential development located in Ruaka; Gateway Real Estate Africa, a Mauritius-based real estate developer partnered with Verdant Ventures, a United States-based real estate development company, for a new housing project in Rosslyn dubbed Rosslyn Ridge Residences; Centum Investments announced plans to issue a Kshs 4.0 bn bond with the possibility of taking up to Kshs 6.0 bn should the investors’ appetite exceed the targeted sum; Unity Homes partnered with KumKang Kind, to fast track delivery of 1,200 units in the Kshs 4.5 bn Unity West Project at Ruiru’s Tatu City; Kenya Power Pension Fund (KPPF), announced plans to put up a Kshs 2.3 bn residential apartments in Kilimani, and, Kenya Mortgage Refinance Company (KMRC) signed an agreement with African Development Bank (AfDB) to guarantee its first bond issue;

In the retail sector, Tuskys Supermarket shut down two of its branches, the Ronald Ngala branch in Nairobi CBD and Shiloah branch in Kakamega; Big Square, opened its second branch outside Nairobi, in Eldoret at Rupa’s Mall while Naivas announced plans to open 4 new retail outlets;

In the hospitality sector, Hyatt, a US-based hospitality chain announced plans to build a 225-room facility in Nairobi along Mombasa road, while the United States of America government through the United States Agency for International Development (USAID), announced plans to inject approximately Kshs 750.0 mn into Kenya’s tourism sector in support of the sector’s recovery efforts;

In the land sector, the Nairobi Metropolitan Services (NMS) unveiled a new property valuation system that will determine the land rates;

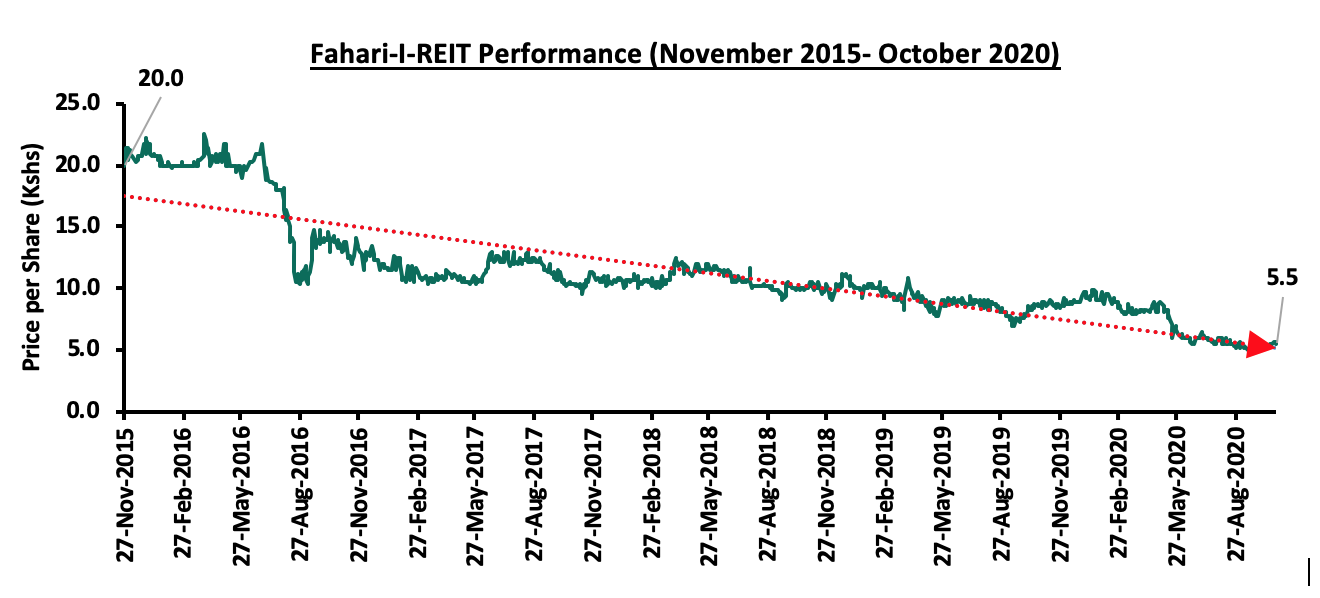

In listed real estate, ILAM Fahari I-REIT closed the month at Kshs 5.5 per share, 5.8 % higher than the previous month’s closing price of Kshs 5.2, and, Acorn holdings, announced the launch of an investor roadshow for its Acorn Students Accommodation (ASA) with the aim of establishing a D-Reit and an I-Reit in the next 3 years with an expected Internal Rate of Return of 18.0%.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.52%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.18% p.a. To invest, email us at sales@cytonn.comand to withdraw the interest you just dial *809#;

- Phase 2 of “The Alma”, Cytonn’s lifestyle apartments in Ruaka, was handed over to the respective buyers on Thursday 29th October 2020;

- Rodney Omukhulu, an Investment Analyst at Cytonn Investments, was on TV 47 discussing the importance of financial planning. Watch Rodney here;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tourand for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here;

- For Pension Scheme Trustees and members, we shall be having different industry player’s talk about matters affecting Pension Schemes and the pensions industry at large. Join usevery Wednesday from 9:00 am to 11:00 am for in-depth discussions on matters pension;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the month of October, T-bill auctions recorded an undersubscription, with the overall subscription rate coming in at 92.0%, a rise from 58.4% recorded in the month of September. The yields on the 91-day increased to 6.7% from 6.3% while the 182-day and 364-day papers all increased to 7.0% and 7.9%, respectively from 6.8% and 7.7%, recorded the previous month. The T-bills acceptance rate declined to 91.5% during the month, compared to 94.8% recorded in September, with the government accepting a total of Kshs 101.0 bn of the Kshs 110.4 bn worth of bids received.

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 72.1%, down from 81.4% the previous week. The subscription rates for the 91-day and 182-day papers declined to 74.9% and 33.1%, respectively, from 103.6% and 72.3%, while the 364-day paper rose to 110.1%, from 81.7%. The acceptance rate declined to 95.5% from 97.4% the previous week. The yields on the 91-day and 364-day papers increased marginally to 6.7% and 7.9%, respectively, from 6.6% and 7.8% recorded last week, while the 182-day paper remained unchanged at 7.0%.

During the month of October, the Central Bank of Kenya re-opened 2 bonds; FXD1/2011/20 and FXD1/2018/25 with coupons of 10.0% and 13.4%, respectively and effective tenors of 10.6 years and 22.7 years. There was high demand for the bond offer with the overall subscription rate for the entire issue coming in at 138.3%, partly supported by the favorable liquidity in the market. The government received bids worth Kshs 69.1 bn higher than the Kshs 50.0 bn offered and accepted only Kshs 60.0 bn, translating to an acceptance rate of 86.8%. Investors preferred the longer-term paper i.e. FXD1/2018/25, which received bids worth Kshs 46.0 bn, representing 66.5% of the total bids received. The weighted average rate of accepted bids for the two bonds came in at 12.0% and 13.5%, for FXD1/2011/20 and FXD1/2018/25, respectively.

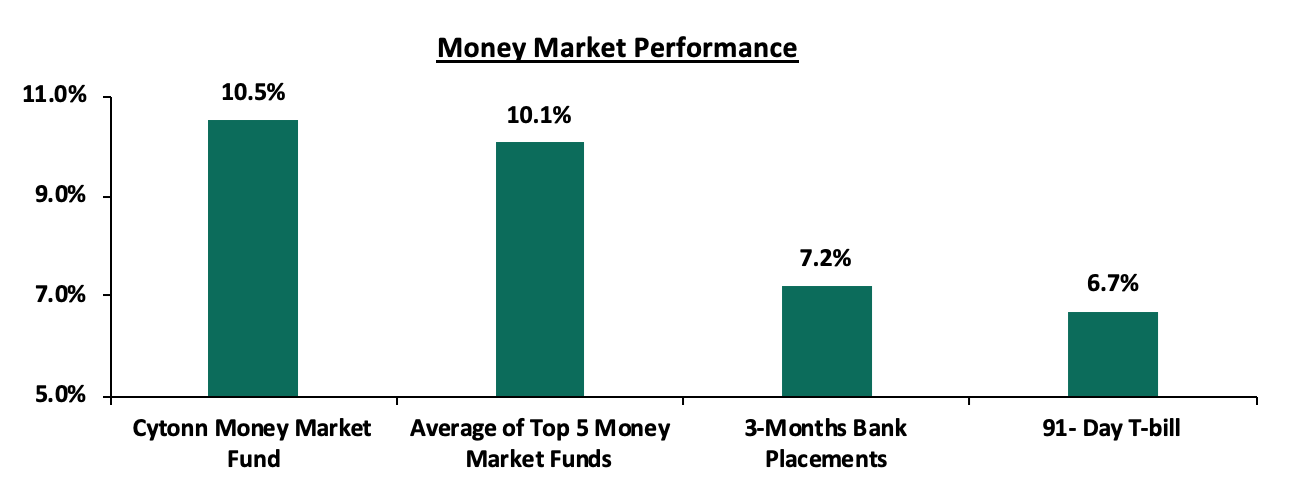

In the money markets, 3-month bank placements ended the week at 7.2% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased marginally to 6.7% from 6.6% recorded the previous week. The average yield of Top 5 Money Market Funds increased marginally by 0.1% points to 10.1% from 9.9% recorded the previous week. The yield on the Cytonn Money Market decreased marginally by 0.1% points to 10.5% from 10.6% recorded the previous week.

Secondary Bond Market:

In the Month of October, the yields on government securities in the secondary market remained relatively stable and the bond turnover declined by 30.0% to Kshs 59.3 bn, from Kshs 83.5 bn recorded last month. The FTSE NSE bond index increased marginally by 0.5% to close the month at 98.2 from 97.7 in September, and bringing the YTD return to 2.8%. The chart below is the yield curve movement during the period.

Liquidity:

Liquidity in the money markets eased during the month of October with the average interbank rate declining to 2.6%, from 3.0% recorded in September, mainly supported by government payments which offset tax remittances. During the week, the average interbank rate increased by 0.3% points, to 2.9% from 2.6% recorded the previous week. The average interbank volumes declined by 24.8% to Kshs 13.5 bn, from Kshs 17.9 bn recorded the previous week. According to the Central Bank of Kenya’s weekly bulletin, commercial banks’ excess reserves came in at Kshs 9.5 bn in relation to the 4.25% Cash Reserve Ratio.

Kenya Eurobonds:

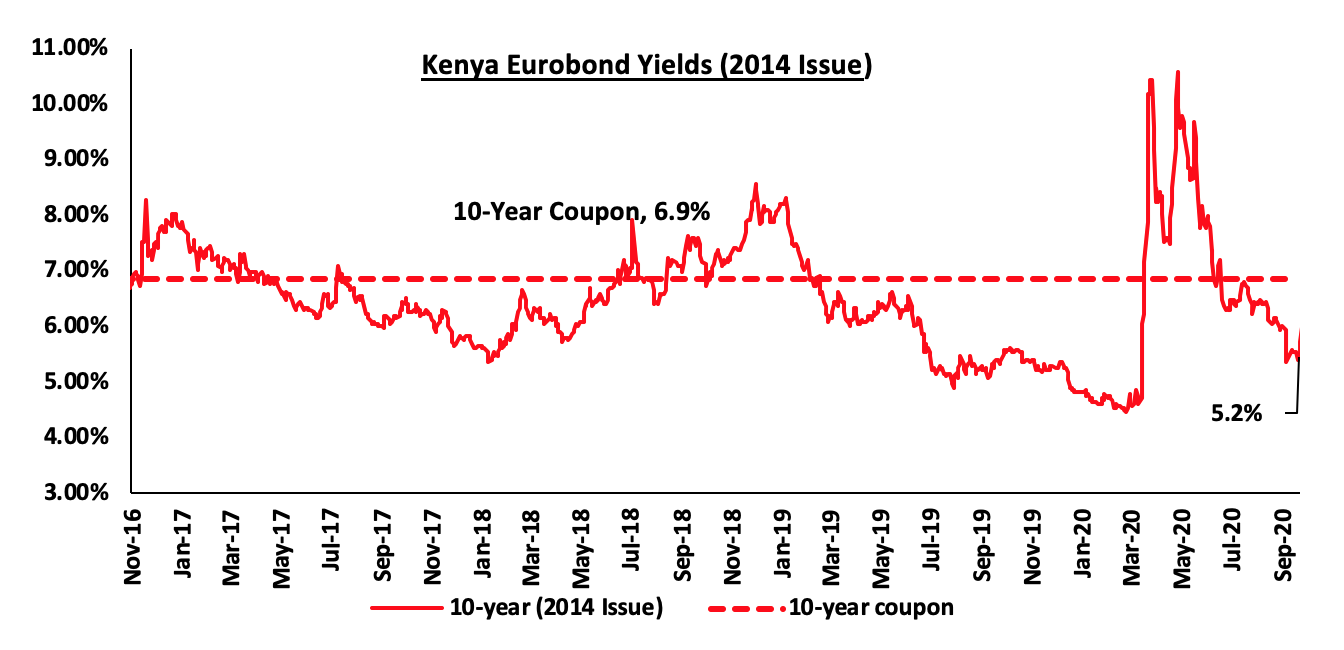

According to Reuters, the yield on the 10-year Eurobond issued in September 2014 declined by 1.2% points to 5.2% in October, from 6.4% in September, an indication of improved investor sentiment and the perception of reduced risk by foreign investors on the country’s outlook attributable to the IMF’s upward revision of Kenya’s GDP.

During the week, the yield on the 10-year Eurobond declined by 0.3% points to 5.2%, from 5.5% recorded the previous week.

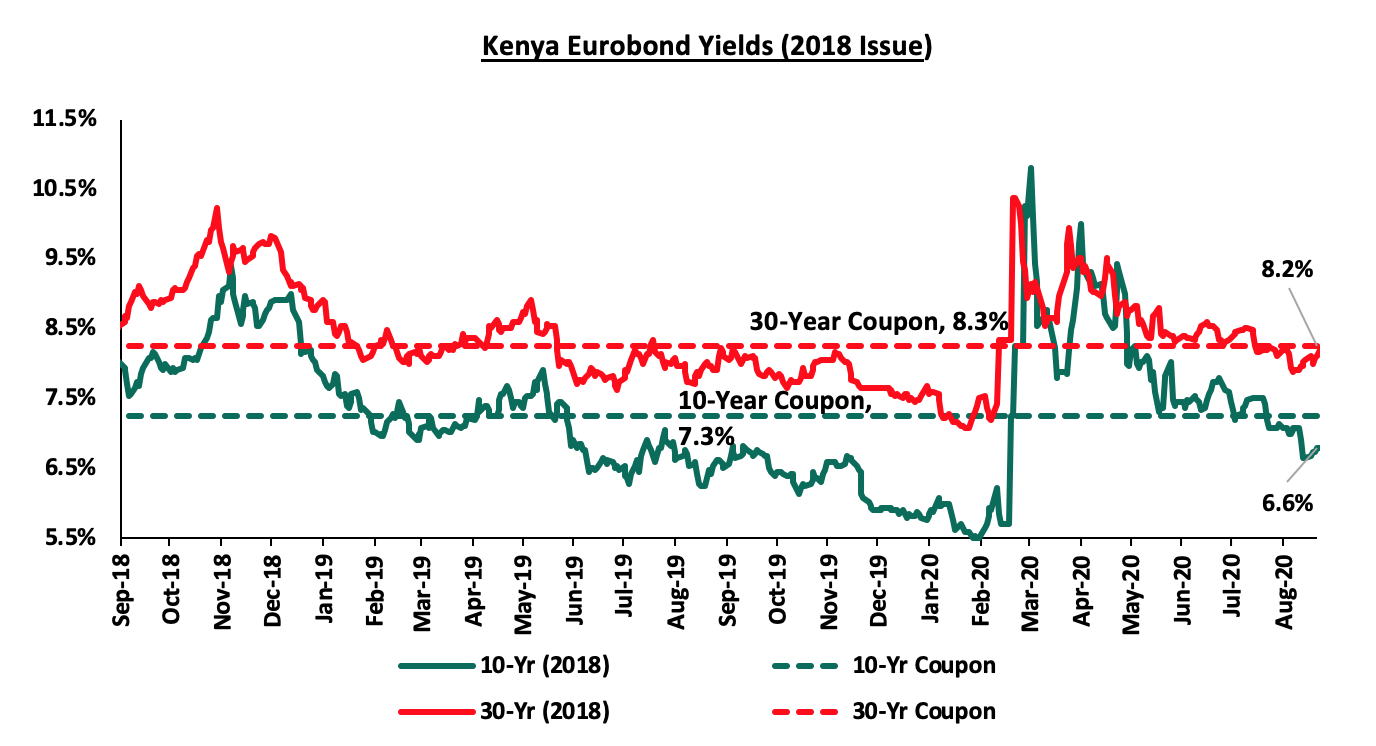

During the month, the yields on the 10 year Eurobond issued in February 2018 declined by 0.9% points to close at 7.5% in October, from the 6.6% recorded in September. The 30-year Eurobond, on the other hand, also declined by 0.5% points to close at 8.2% in October, from the 8.7% recorded in September.

During the week, the yield on the 10-year Eurobond declined marginally by 0.3% points to close at 6.6% from 6.9% recorded the previous week. The 30-year Eurobond declined marginally by 0.2% points to 8.2%, from 8.4% recorded the previous week.

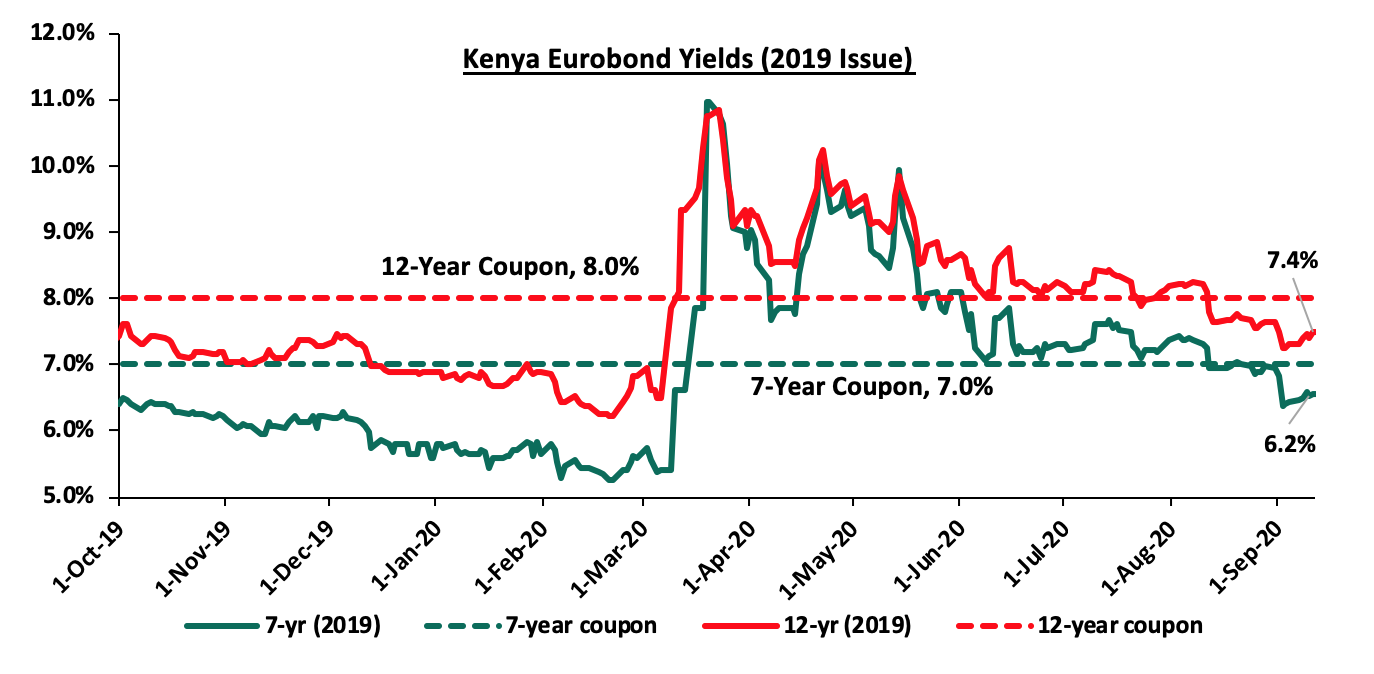

During the month, the yields on the 2019 issued dual-tranche Eurobond with 7-years declined by 1.2% points to 6.2% in October, from 7.4% in September. The 12-year Eurobond declined by 0.8% points to 7.4% in October, from 8.2% in September.

During the week, the yields on both the 7-year and 12-year Eurobonds decreased by 0.3% points and 0.2 points to 6.2% and 7.4%, respectively, from 6.5% and 7.6% recorded the previous week.

Kenya Shilling:

During the month, the Kenya Shilling depreciated by 0.3% against the US Dollar to close at Kshs 108.8, from Kshs 108.5 recorded at the end of September, mostly attributable to the increased dollar demand from oil and merchandise importers amidst lacklustre dollar inflows. During the week, the Kenya Shilling remained relatively stable to close the week at Kshs 108.8. On an YTD basis, the shilling has depreciated by 7.4% against the dollar, in comparison to the 0.5% appreciation in 2019.

However, in the short term, the shilling is expected to be supported by:

- The Forex reserves which are currently at USD 8.1 bn (equivalent to 4.9-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- Relatively strong Diaspora remittances that increased by 21.4% to USD 260.7 mn in September 2020 compared to USD 214.7 mn in September 2019. The September inflows were 5.0% lower than the USD 274.1 mn in August 2020, and,

- The improving current account position which has seen a 39.9% decline during Q2’2020, coming in at Kshs 82.2 bn, from Kshs 136.9 bn in Q2’2019, equivalent to 7.0% of GDP from the 10.9% of GDP recorded in Q2’2019.

Other Highlights:

Inflation

The y/y inflation for the month of October increased to 4.8%, from the 4.2% recorded in September 2020. The increase was due to:

- A 1.1% increase in the Food and Non-Alcoholic Drinks’ Index, mainly contributed by increase in prices of carrot, mutton and wheat flour (white) by 0.9%,0.8% and 0.8%, respectively, among other food items,

- A 0.9% increase in Housing, Water and Electricity, Gas and Other Fuels’ Index , mainly attributed to an increase in the cost of; cooking fuels, kerosene which increased by 0.7% and electricity which increased by 3.2% per 200 Kwh and,

- A 0.6% increase in the Transport Index, mainly driven by an increase in the price of petrol by 1.7%, outweighing the decline in diesel prices of 1.7%.

|

Major Inflation Changes – October 2020 |

|||

|

Broad Commodity Group |

Price change m/m (October-20/September-20) |

Price change y/y (October-20/October-19) |

Reason |

|

Food & Non-Alcoholic Beverages |

1.1% |

5.8% |

The m/m increase was mainly contributed by increase in prices of carrot, mutton and wheat flour (white) among other food items |

|

Housing, Water, Electricity, Gas and other Fuels |

0.9% |

2.8% |

The m/m increase was as a result of increase in the cost of cooking fuels, kerosene and electricity |

|

Transport Cost |

0.6% |

13.5 % |

The m/m increase was mainly on account of increase in price of petrol |

|

Overall Inflation |

1.0% |

4.8% |

The m/m increase was due to a 1.1% increase in the food and non-alcoholic drinks’ cost, mainly driven by the increase in prices of food items |

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5% despite supply-side disruption due to an anticipated second-wave of COVID-19 infections and subsequent lockdown restrictions. Food prices are likely to remain low due to favorable rainfall received.

- Stanbic Bank released the Monthly Purchasing Managers’ Index (PMI) for September 2020, which came in at 56.3, up from the 53.0 seen in August 2020. The posting was its highest since April 2018, pointing towards strong improvement in the Kenyan private sector. This comes as the government relaxed COVID-19 restrictions during the third quarter of the year. For more information, see our, Cytonn Weekly #41/2020,

- Kenya National Bureau of Statistics (KNBS), released the Quarterly GDP Q2’2020 growth rates where Kenya’s economy contracted during the second quarter of 2020. The economy recorded a contraction of (5.7%) in Q2’2020, from a growth of 5.3% in Q2’2019, this was the first contraction since the third quarter of 2001 when the country recorded a contraction of (2.5%). The contraction was manly attributed to the shrinking of the education sector, which was the biggest loser in terms of sectoral contribution; declining to 3.2% in Q2’2020 from 6.9% in Q2’2019 due to the impact of COVID 19 pandemic. For more information, see our, Cytonn Weekly #42/2020, and,

- The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q2’2020, revealing Kenya’s current account deficit contracted by 39.9% in Q2’2020, to Kshs 82.2 bn, from Kshs 136.9 bn in Q2’2019, equivalent to 7.0% of GDP from the 10.9% of GDP recorded in Q2’2019. This was mainly driven by merchandise trade deficit that declined by 32.5% to Kshs 187.4 bn from Kshs 277.8 bn in Q2’2019 driven by a 23.2% decline in merchandise imports to Kshs 326.5 bn from Kshs 425.0 bn in Q2’2019, coupled with the 5.5% decline in merchandise exports to Kshs 139.2 bn from Kshs 147.2 bn recorded in a similar period in 2019. For more information, see our, Cytonn Weekly #42/2020.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the Central Bank as they reject expensive bids. The government is 64.3 % ahead of its prorated borrowing target of Kshs 130.9 bn having borrowed Kshs 215.1 bn. In our view, the government will not be able to meet their revenue collection targets of Kshs 1.9 tn for FY’2020/2021 because of the current subdued economic performance in the country brought about by the spread of COVID-19, and therefore leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. Owing to this uncertainty in the environment, our view is that investors should be biased towards short-term to medium-term fixed income securities to reduce duration risk.

Markets Performance

During the month of October, the equities market recorded mixed performance, which saw the NSE 20 and NSE 25 shed 3.7% and 2.7%, respectively, while NASI gained marginally by 0.1%. The equities market performance was driven by losses recorded by large cap stocks, such as EABL, KCB, Equity and Cooperative Bank, which declined by 11.2%, 7.8%, 7.6% and 4.6%, respectively. The losses were however mitigated by gains recorded by other large-cap stocks such as Safaricom and Diamond Trust Bank (DTB-K) which gained by 3.9% and 2.1%, respectively.

During the week, the equities market was on downward trajectory, which saw the NASI, NSE 20 and NSE 25 shed 0.8%, 0.9% and 1.4%, respectively, taking their YTD performance to losses of 15.8%, 22.7%, and 32.8%, for NASI, NSE 25 and NSE 20, respectively. The equities market performance was mainly driven by declines recorded by large-cap stocks such as EABL, KCB and BAT, which declined by 4.3%, 2.7% and 2.1%, respectively.

Equities turnover declined by 57.9% during the month of October to USD 54.1 mn, from USD 128.2 mn recorded in September 2020. Foreign investors turned net sellers during the month, with a net selling position of USD 10.4 mn, compared to September’s net buying position of USD 7.4 mn.

During the week, equities turnover increased by 27.2% to USD 15.4 mn, from USD 12.1 mn recorded the previous week, taking the YTD turnover to USD 1.2 bn, with foreign investors turning net sellers, with a net selling position of USD 3.7 mn, from a net buying position of USD 0.1 mn recorded the previous week, taking the YTD net selling position to USD 266.8 mn.

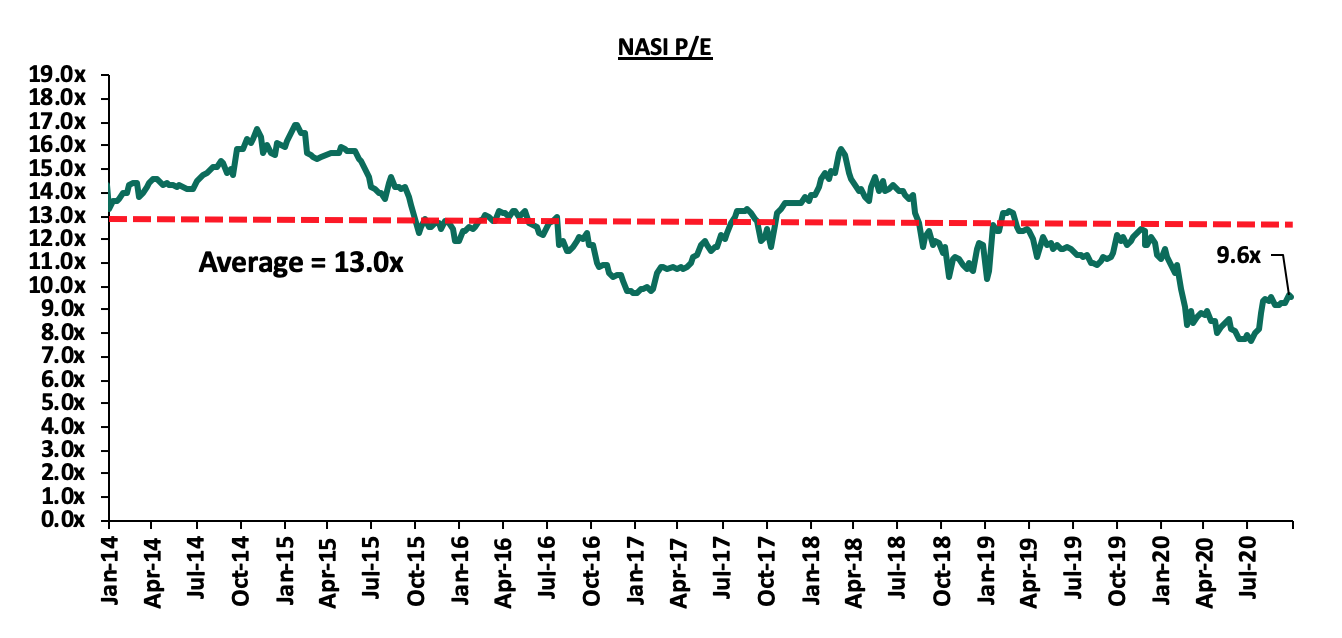

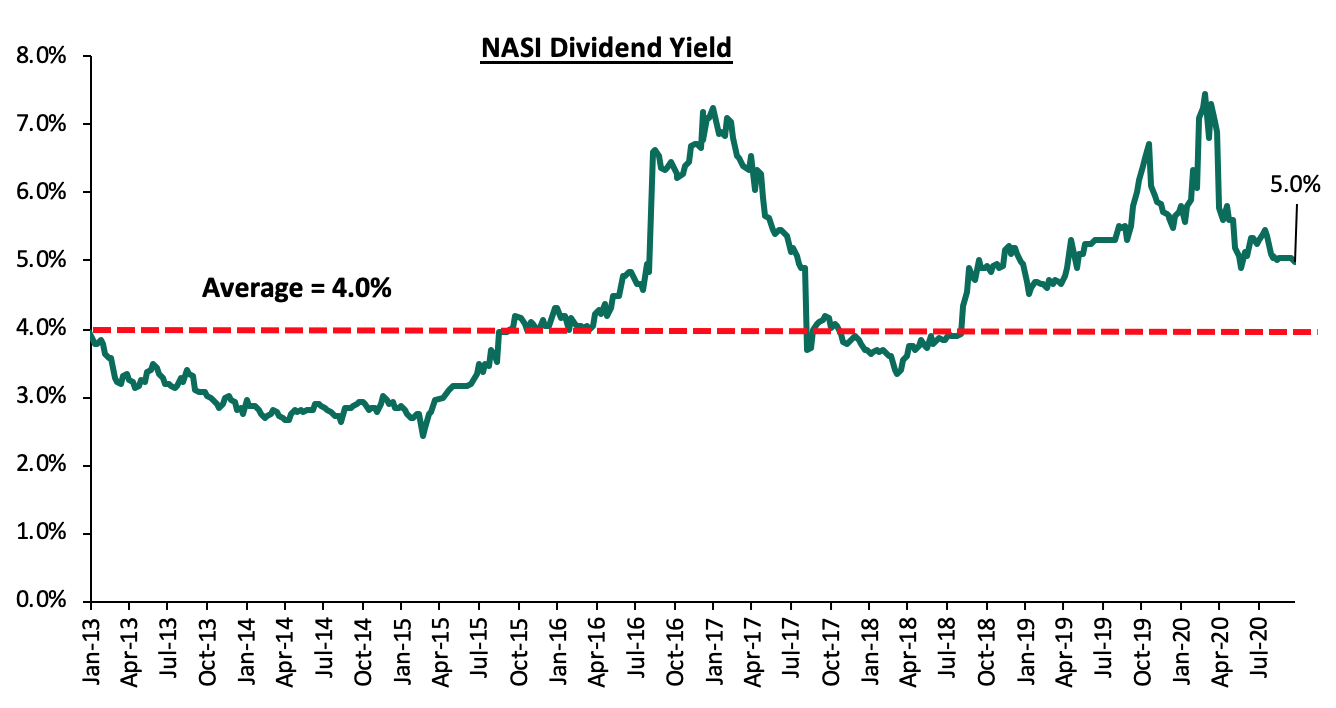

The market is currently trading at a price to earnings ratio (P/E) of 9.6x, 26.2% below the 11-year historical average of 13.0x. The average dividend yield is currently at 5.0%, unchanged from the previous week, and 1.0% points above the historical average of 4.0%.

With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait out the pandemic. The current P/E valuation of 9.6x is 24.4% above the most recent valuation trough of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Monthly Highlights:

- The Association of Kenya Insurers (AKI) released the 2019 Kenya’s Insurance Industry Report, highlighting that the industry’s total premiums improved by 7.0% to Kshs 231.3 bn in FY’2019 from Kshs 216.1 bn recorded in 2018. Additionally, general insurance continued to dominate the industry with a market share of 57.7% of the total premium income with total premiums of Kshs 133.5 bn in 2019 up from Kshs 126.6 bn in 2018. For more information, please see Cytonn Weekly#43/2020,

- The Competition Authority of Kenya authorized the proposed transfer of various assets, including outstanding deposit balance amounting to Kshs 3.2 bn, loans and security portfolios together with all rights, titles from Imperial Bank Limited (IBL) to KCB Bank Kenya Limited. To offer validity to this commercial contract, KCB had earlier indicated that it would pay Kshs 10.8 for the acquisition of part of the Imperial Bank’s business. This move mirrors that of Mauritius’ SBM Holdings, which occurred on 10th May 2017, paying Kshs 100 for the take-over of Kenya Fidelity Commercial Bank (FCB).For more information, please see Cytonn Weekly#42/2020,

- Jubilee Holdings Limited disclosed that it had entered into an agreement with Allianz Africa Holding, one of the world’s leading insurers and asset managers, to establish a strategic partnership in regards to Jubilee’s short-term insurance business operations in its countries of operations. In the press release, Jubilee discloses that Allianz will acquire a controlling stake ranging from 51.0% - 66.0% in each of Jubilee’s operating subsidiaries engaged in short-term general insurance in Kenya, Uganda, Tanzania, Burundi and Mauritius. For more information, please see Cytonn Q3’2020 Market Review, and,

- ABSA disclosed that it would be offering unsecured loans to Micro, Small and Medium Enterprises (MSMEs) in a bid to support businesses recover from the effects emanating from the COVID-19 pandemic. The bank, through the recently launched ‘ABSA One Account’ will offer unsecured loans of up-to Kshs 10.0 mn to businesses and a maximum of Kshs 5.0 mn to individuals. For more information, please see Cytonn Weekly#41/2020.

Weekly Highlights:

ABSA Group, in association with OMFIF, released the ABSA Financial Markets Index 2020, a report that gauges the performance of African countries in the financial market. The report seeks to anchor policy discussions between regulators, corporates as well as investors in a bid to promote open and transparent capital markets that will ensure mobilization of capital and promotion of investments in Africa. The report evaluates the financial development in 23 countries according to six pillars: market depth, access to foreign exchange, capacity of local investors, enforceability of financial contracts, collateral positions, insolvency frameworks and market transparency, tax and regulatory environment.

According to the report, Kenya’s rank declined to the 7th position from the 3rd position in 2019, with its score declining by 7 points to 58 points from 65 points in 2019 attributable to:

- Market depth – Kenya market depth declined from a rating of 55 in 2019 to 52 which is mainly attributed to the effect of COVID 19 pandemic on NSE market activity and capitalization with net foreign outflows amounting to Kshs 26.0 bn in the first nine months of 2020 compared to Kshs 2.2 bn in the same period last year, and,

- Access to foreign exchange – Kenya lost eight points in the foreign exchange pillar and this is because the IMF in 2018 reclassified the Kenya Shilling from floating to ‘other managed arrangement’ in response to the CBK’s intervention in the fluctuations of the Kenyan Shilling. Key to note, the reclassification of the shilling saw Kenya’s scoring in this pillar decline to a score of 65 points in 2019 from a score of 93 points in 2018. However, this decline was mitigated by the gains in the other four pillars and as such, Kenya’s comprehensive ranking remained unchanged.

On the other hand, Kenya’s score in the Regulatory Environment improved by 3 points to score 74 points from 71 points in 2019. The report indicates that the guidance issued by the Capital Markets Authority (CMA) allowing share buybacks by listed firms which would help encourage stock market activities in the country boosted the country’s score in this indicator.

In our view, in order to make Kenya an attractive destination to local and financial services sector, the CMA needs to remove conflicts of interest in the governance of capital markets and create a governance structure that is more responsive to market participants and market growth. Kenya’s capital markets remains stifled as Banks are preferred to the Capital Market as a source of funding. According to the World Bank, globally, capital markets make up 60.0% of funding for businesses, with the balance of 40.0% coming from bank funding. However, in Kenya, this is not the case as bank funding makes up 99.0% of business funding, with only 5.0% coming from the capital market, due to the dominance by banks and the stifled capital markets.

Universe of Coverage:

|

Company |

Price at 23/10/2020 |

Price at 30/10/2020 |

w/w change |

m/m change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank*** |

61.0 |

61.3 |

0.4% |

2.1% |

(43.8%) |

109.0 |

119.4 |

4.4% |

99.3% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.2 |

2.3 |

1.8% |

(6.3%) |

(25.7%) |

3.0 |

4.0 |

4.9% |

82.7% |

0.2x |

Buy |

|

Sanlam |

12.1 |

12.3 |

2.1% |

(5.4%) |

(28.5%) |

17.2 |

18.4 |

0.0% |

49.6% |

1.2x |

Buy |

|

KCB Group*** |

37.1 |

36.1 |

(2.7%) |

(7.8%) |

(33.2%) |

54.0 |

46.4 |

9.7% |

38.4% |

0.8x |

Buy |

|

Equity Group*** |

34.4 |

33.9 |

(1.3%) |

(7.6%) |

(36.6%) |

53.5 |

44.5 |

5.9% |

37.2% |

0.9x |

Buy |

|

I&M Holdings*** |

45.0 |

44.0 |

(2.2%) |

(0.6%) |

(18.5%) |

54.0 |

57.8 |

5.8% |

37.2% |

0.7x |

Buy |

|

NCBA*** |

22.8 |

22.7 |

(0.4%) |

(1.5%) |

(38.5%) |

36.9 |

30.7 |

1.1% |

36.6% |

0.6x |

Buy |

|

Co-op Bank*** |

11.4 |

11.3 |

(0.9%) |

(4.6%) |

(30.9%) |

16.4 |

14.2 |

8.8% |

34.5% |

0.8x |

Buy |

|

Standard Chartered*** |

152.8 |

158.3 |

3.6% |

(1.1%) |

(21.9%) |

202.5 |

197.2 |

7.9% |

32.5% |

1.2x |

Buy |

|

Liberty Holdings |

7.8 |

7.6 |

(2.8%) |

(0.5%) |

(26.8%) |

10.4 |

9.8 |

0.0% |

29.3% |

0.6x |

Buy |

|

ABSA Bank*** |

9.5 |

9.4 |

(0.6%) |

(3.9%) |

(29.3%) |

13.4 |

10.8 |

11.7% |

26.1% |

1.2x |

Buy |

|

Britam |

7.6 |

7.4 |

(2.6%) |

(1.1%) |

(18.0%) |

9.0 |

8.6 |

3.4% |

19.9% |

0.8x |

Accumulate |

|

Jubilee Holdings |

275.0 |

269.5 |

(2.0%) |

11.4% |

(23.2%) |

351.0 |

313.8 |

3.3% |

19.8% |

0.5x |

Accumulate |

|

Stanbic Holdings |

81.3 |

77.0 |

(5.2%) |

(5.5%) |

(29.5%) |

109.3 |

84.9 |

9.2% |

19.4% |

0.6x |

Accumulate |

|

HF Group |

4.0 |

3.7 |

(5.8%) |

(6.0%) |

(42.3%) |

6.5 |

4.1 |

0.0% |

9.9% |

0.2x |

Hold |

|

CIC Group |

2.2 |

2.3 |

2.7% |

6.6% |

(16.0%) |

2.7 |

2.1 |

0.0% |

(6.7%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are banks in which Cytonn and/ or its affiliates are invested in |

|||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Industry Reports

During the month of October, the Kenya National Bureau of Statistics (KNBS), released one industrial report;

|

# |

Theme |

Report |

Key Take-Outs |

|

|

1 |

General real estate sector |

· Growth in real estate and construction activities in Q2’2020 came in at 2.2% and 3.9%, respectively · The sectoral contribution to GDP in Q2’2020 stood at 9.2% and 6.2%, for the real estate and construction sector, respectively, compared to 8.3% and 5.5% during a similar period in 2019. For more analysis, please see Cytonn Weekly #42 |

||

- Residential Sector

During the month, Cytonn Investments, an investments management firm and real estate developer, handed over Phase 2 of its Kshs 5.0 bn comprehensive residential development, “The Alma” located in Ruaka. This follows the handing over of its Phase 1 in July 2019, bringing the total number of handed over units to 181. The Alma is a comprehensive residential development sitting on 4.7 acres with approximately 477 units of 1, 2, and 3 bedroom units. The developer’s focus on the Ruaka submarket is supported by; i) good transport network as the area is accessible through Limuru Road and Northern By-pass which links it to Kiambu Road, ii) presence of international organizations such as the United Nations (UN) in Gigiri which has attracted foreigners who not only boost the appeal of the town, but also create a market for residential and commercial real estate, iii) improved security as the area is close to blue diplomatic zones in addition to county measures, iv) availability of social amenities such as the Two Rivers Mall, Village Market and The Tribe Hotel, and, v) relaxation of zoning restrictions resulting in an increase in high density developments that have brought about improvements in the value of real estate property. In terms of performance as per Cytonn’s Nairobi Metropolitan Area (NMA) 2020 Residential Report, Ruaka was the third best performing node in the lower mid-end satellite towns recording an average yields of 5.5%, 0.1% higher than the market average of 5.4%, a price appreciation of 0.1% and total returns of 5.6%, 0.2% points higher than the market average of 5.4%.

The table below shows the performance of lower mid-end satellite tows;

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area (NMA) Apartments Performance FY’2020 |

|||||

|

Lower Mid-End Satellite Towns |

|||||

|

Area |

Average Occupancy FY’20 |

Average Annual Uptake FY’20 |

Average Rental Yield FY’20 |

Average Y/Y Price Appreciation FY’20 |

Annual Total Returns FY’20 |

|

Thindigua |

88.2% |

22.0% |

5.9% |

2.0% |

7.9% |

|

Athi River |

87.4% |

16.6% |

6.1% |

0.0% |

6.1% |

|

Ruaka |

89.5% |

22.6% |

5.5% |

0.1% |

5.6% |

|

Kitengela |

82.7% |

19.4% |

5.1% |

0.0% |

5.1% |

|

Syokimau |

84.6% |

18.2% |

5.7% |

(0.8%) |

5.0% |

|

Ruiru |

74.5% |

19.7% |

4.6% |

0.0% |

4.6% |

|

Kikuyu |

83.3% |

18.2% |

5.0% |

(1.7%) |

3.3% |

|

Average |

84.3% |

19.5% |

5.4% |

(0.1%) |

5.4% |

Source: Cytonn Research

Gateway Real Estate Africa, a Mauritius-based real estate developer partnered with Verdant Ventures, a United States-based real estate development company, in a new housing project in Rosslyn off Limuru Road, dubbed Rosslyn Ridge Residences. The project will comprise of 90 diplomatic apartments and a townhome community housing complex meant for the USA states department (other details of the project remain undisclosed). Rosslyn is an attractive area for residential developments especially diplomats supported by; i) the area being categorized as a Blue Diplomatic Zone, ii) close proximity to amenities such as Rosslyn Riviera Mall and Two Rivers Mall, and, iii) ease of accessibility as the area is served by the Limuru Road and Kiambu Road. In terms of performance, according to the Cytonn Q3’2020 Markets Review, Rosslyn was the best performing node in the high-end segment of detached units recording an average rental yield of 4.5%, 0.8% points higher than the market average of 3.7%. However, the sale prices stagnated during the period attributed to decline in demand amid reduced disposable income in the wake of a tough financial environment.

The table below shows the performance of Nairobi Metropolitan Area (NMA) -detached units in the high end areas.

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area (NMA) Detached Units Performance Q3'2020 |

||||||||

|

Area |

Average Price per SQM Q3'2020 |

Average Rent per SQM Q3'2020 |

Average Occupancy Q3'2020 |

Average Uptake Q3'2020 |

Average Annual Uptake Q3'2020 |

Average Rental Yield Q3'2020 |

Average Price Appreciation Q3'2020 |

Total Returns Q3'2020 |

|

High-End Market Segment |

||||||||

|

Rosslyn |

172,556 |

830 |

82.9% |

92.5% |

14.0% |

4.5% |

0.0% |

4.5% |

|

Runda |

200,463 |

836 |

89.7% |

98.0% |

12.6% |

4.1% |

0.4% |

4.5% |

|

Kitisuru |

204,374 |

734 |

87.5% |

85.4% |

20.4% |

4.2% |

0.0% |

4.2% |

|

Karen |

186,982 |

698 |

74.3% |

83.8% |

17.1% |

3.2% |

(0.5%) |

2.7% |

|

Lower Kabete |

149,267 |

478 |

60.6% |

77.5% |

21.0% |

2.4% |

0.3% |

2.7% |

|

Average |

182,728 |

715 |

79.0% |

87.5% |

17.0% |

3.7% |

0.0% |

3.7% |

Source: Cytonn Research 2020

Centum investments, through its real estate arm, announced plans to issue a Kshs 4.0 bn bond with the possibility of taking up to Kshs 6.0 bn should the investors’ appetite exceed the targeted sum. The bond, which will be used to finance its real estate projects, is currently undergoing the necessary approvals and it is expected to be issued in the next few weeks. According to the company’s management, the 3 year bond will be issued as a private placement with zero coupon, however, it will later be introduced at the Nairobi Stock Exchange (NSE) for trading. The yield will be competitively determined by the market. The bonds will be secured by the current projects that the company is handling with the pools of deposits collected flowing into a sinking fund as a strategy to protect the bond holder’s funds. Some of the company’s real estate projects include; Two-Rivers Mall along Limuru Road, Awali Estate at Vipingo Ridge Kilifi County, Perl Marina apartments in Entebbe, 265 Elmer One Apartments in Kasarani, and 365 Pavilion Place Apartments in Ruaraka.

The move by Centum to issue a bond is an indication that developers have continued to explore diversified sources of financing for their real estate projects. Bonds are a source of debt capital for businesses that are well established and need funds for long-term growth of the business. The company can raise funds by selling bonds to different buyers and sharing profits from the projects for which bonds are issued. An example of a developer who has also resulted to bonds to raise funds is Acorn Group, which floated a green bond in 2019. The 5-year bond whose rate stood at 12.3% received 85.0% subscription as of October 2019 raising approximately Kshs 4.3 bn. Currently, approximately 95.0% of business funding is sourced from banks compared to approximately 5.0% from the capital markets, mainly due to underdevelopment of the latter. However, the market has continued to witness emerging structured financing options such as; (i) real estate structured notes which may include project notes, real estate-backed medium term notes and other high yield loan notes, and, (ii) Real Estate Investment Trusts (REITS). We expect the trend to continue as developers seek for relatively affordable funding for their projects.

Other notable highlights in the residential sector during the month include:

- Shelter Afrique, a Pan-African housing lender and real estate developer announced that Kenya will be among six African countries expected to benefit from a multi-billion shilling affordable housing kitty targeting end users residents. The announcement came in during the approval ceremony of a 10,000-unit affordable housing project in Kinyinya Park Estate development in Rwanda’s capital, Kigali in partnership with Rwanda Social Security Board (RSSB). In Kenya, the lender is currently involved in projects such as Eden Beach in Mombasa, and, Edenvale in Nairobi,

- Unity Homes, a Kenyan-British housing developer, partnered with South Korea’s KumKang Kind, a construction materials company, to fast track delivery of 1,200 units in the Kshs 4.5 bn project dubbed Unity West at Ruiru’s Tatu City. For more information please see Cytonn Weekly #43,

- Kenya Power Pension Fund (KPPF), announced plans to put up a Kshs 2.3 bn residential apartments on its 1.67- acre plot along Kirichwa Road in Nairobi’s Kilimani area. For more information please see Cytonn Weekly #43,

- Kenya Mortgage Refinance Company (KMRC), a Treasury backed lender, signed an agreement that will see the African Development Bank (AfDB) guarantee its first bond issue, planned for the third quarter of next year. For more information please see Cytonn Weekly #43, and,

- Centum Investments handed over the first 96 units in two of its master-planned developments, Awali and Pearl Marina Estates in Kilifi and Entebe, respectively. For more information please see Cytonn Weekly #42.

We expect the residential sector to record increased activities supported by key partnerships among developers, launch of new residential projects fueled by demand amid a housing deficit, and lending by Kenya Mortgage and Refinance Company (KMRC) which is expected to boost the mortgage market.

- Retail

Tuskys Supermarket, a local retail chain, shut down its Shiloah, Kakamega branch due to mounting rental arrears and suppliers’ debts. This follows the closure of the Ronald Ngala branch along the Nairobi CBD earlier this month bringing the number of operational outlets to 54. The closure emphasizes the ongoing financial constrains by the retailer due to strained revenues as a result of reduced demand and family wrangles among the shareholders thus affecting its operations. This comes despite reports of securing financial support amounting to Kshs 2.0 bn from an undisclosed Mauritius-based private equity fund, in which Kshs 500.0 mn was allegedly injected in September 2020 to pay off landlords, suppliers, and other immediate working capital requirements. The recent closure of its outlets indicates recurrent financial woes and hence the need to mobilize more funds to stabilize its operations and ease the financial pressure.

The table below shows the summary of the number of stores of the key local and international retail supermarket chains in Kenya;

|

Main Local and International Retail Supermarket Chains |

||||||

|

Name of Retailer |

Initial number of branches |

Number of branches opened in 2020 |

Closed branches |

Current number of Branches |

Branches expected to be opened |

Projected total number of branches |

|

Naivas Supermarket |

66 |

5 |

0 |

66 |

4 |

70 |

|

Tuskys |

64 |

2 |

10 |

54 |

0 |

54 |

|

QuickMart |

32 |

3 |

0 |

32 |

0 |

32 |

|

Chandarana Foodplus |

20 |

1 |

0 |

20 |

0 |

20 |

|

Carrefour |

8 |

1 |

0 |

8 |

3 |

11 |

|

Uchumi |

37 |

0 |

33 |

4 |

0 |

4 |

|

Game Stores |

3 |

1 |

0 |

3 |

0 |

3 |

|

Choppies |

15 |

0 |

13 |

2 |

0 |

2 |

|

Shoprite |

4 |

0 |

4 |

0 |

0 |

0 |

|

Nakumatt |

65 |

0 |

65 |

0 |

0 |

0 |

|

Total |

314 |

13 |

125 |

189 |

7 |

198 |

Source: Online research

Other Key highlights in the retail sector during the month include;

- Tuskys Supermarket, shut down its Ronald Ngala outlet within Nairobi’s CBD due to mounting rent arrears and supplier debts. For more information please see Cytonn Weekly #43,

- Naivas supermarket, a local retail chain, announced plans to open 4 new retail stores to be located at Lifestyle Mall in Nairobi’s CBD, Rongai, and two other undisclosed locations. For more information please see Cytonn Weekly #42, and,

- Big Square, a fast-food retail chain, opened its second branch outside Nairobi, in Eldoret at Rupa’s Mall, bringing the total number of stores operated by the retail chain to 12. For more information, please see Cytonn Weekly #41.

Despite the continued exit by troubled retailers such as Tuskys, we expect the performance of the retail sector to be cushioned mainly by expansion of local and international retailers such as Naivas taking up prime spaces left behind by struggling retailers. Other factors expected to boost the sector include; i) changing tastes and preferences of consumers, ii) growing middle class with higher purchasing power, and, iii) positive demographics with Kenya’s current urbanization and population growth rates at 4.0% and 2.2% against a global average of 1.9% and 1.1%, respectively, according to the World Bank. The performance is however likely to be constrained by; i) the existing oversupply of 2.8 mn SQFT of retail space as of 2019, ii) competition from informal retail spaces in some submarkets, and, iii) the growing focus on e-commerce thus affecting demand for physical retail space.

- Hospitality

Hyatt, a US-based hospitality chain announced plans to build a 225-room facility in Nairobi along Mombasa road, marking the brand’s entry into the Kenya hospitality market. The development will comprise of 150 rooms and 75 residential units targeting tourists jetting into the country through Jomo Kenyatta International Airport (JKIA). The move indicates investor confidence in the Kenya hospitality industry despite being significantly hit by the COVID-19 pandemic in the past six months. Currently, the sector is undergoing gradual recovery supported by; government strategies such as the Ministry of Tourism Post-Corona recovery funds aimed at offering financial aid to hotel and other establishments in the hospitality industry through the Tourism Finance Corporation (TFC), repackaging of the tourism sector products to appeal to domestic tourists, and relaxation of travel advisories aiming at increasing the number of international tourist arrivals into the country. Others factors boosting the hospitality sector include; recognition of Kenya as a regional hub, improved security, political stability and positive accolades such as Nairobi city being crowned Africa's leading Business Travel destination while KICC was awarded the Africa’s leading meetings and conference center during the 2019 World Travel Awards.

Other highlights during the month;

- During the month, the government of the United States of America, through the United States Agency for International Development (USAID), announced plans to inject approximately Kshs 750.0 mn into Kenya’s tourism sector in support of the tourism recovery efforts. For more information please see Cytonn Weekly #41.

Despite the sector being the hardest hit by the COVID-19 pandemic given its reliance on tourism and meetings, incentives, conferences and exhibitions (MICE), the hospitality sector has continued to recover supported by financial aid from government and other international agencies aimed at supporting the recovery of the sector, repackaging the tourism sector to appeal to domestic tourists and relaxation of travel advisories. We expect this to fuel resumption of activities and resultant improved performance in the medium term thus continued investor confidence.

- Land

During the month;

- The Nairobi Metropolitan Services (NMS), announced unveiling of the new property valuation system that will determine the land rates in Nairobi County based on the market conditions, market value and rates. For more information please see Cytonn Weekly #41.

- Listed Real Estate

During the month, the Fahari I-REIT closed the month at Kshs 5.5 per share, 5.8 % higher than the previous month’s closing price of Kshs 5.2. On average during the month, the instrument continued to perform poorly trading at an average of Kshs 5.4, a 52.8% decline YTD and a 73.2% drop from the initial price of Kshs 20.0 as at November 2015. The subdued performance of the instrument is attributed to continued lack of investor appetite in the instrument and the continued subdued performance of the real estate market as it continues to grapple with the effects of the COVID-19 pandemic.

Notable highlight in the sector was;

- Acorn holdings, a real estate developer, announced the launch of an investor roadshow for its Acorn Students Accommodation (ASA) REIT with the aim of establishing a D-Reit and an I-Reit in the next 3 years with an expected Internal Rate of Return of 18.0%. For more information, please see Cytonn Weekly #41.

We expect the real estate sector to continue on an upward trajectory supported by; i) continued development activities on the residential front, ii) expansion of local retailers, iii) investor focus on Kenya’s hospitality industry and channeling of funds to support recovery of the tourism industry, and, iv) exploration of alternative sources of funding.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.