Kenya's Attractiveness as an Investment Destination, & Cytonn Weekly #49/2018

By Cytonn Research Team, Dec 23, 2018

Executive Summary

Fixed Income

T-bills subscription rate improved during the week, with the overall subscription coming in at 93.9%, up from 23.8% recorded the previous week, partly attributed to improved liquidity in the money market as evidenced by the decline in the average interbank rate to 7.8%, from 10.2% recorded the previous week. The yields on the 91-day T-bill remained unchanged at 7.3%, while the yields on the 182-day and 364-day papers increased by 0.1% to 8.3% and 9.7%, from 8.2% and 9.6% recorded the previous week, respectively. The government went back to the primary market with a tap sale for the 10-year Treasury bond, issue No. FXD 2/2018/10 with similar features as the initial issue at a coupon rate of 12.5% in a bid to raise Kshs 13.8 bn;

Equities

During the week, the equities market was on a declining trend with NASI, NSE 20 and NSE 25 declining by 2.5%, 0.2% and 3.6%, respectively, taking their YTD performance to declines of 18.8%, 25.8% and 18.3%, respectively. The Nairobi Securities Exchange (NSE) this week launched an incubation and acceleration programme dubbed “Ibuka”, with the programme aimed at addressing the recent lack of listings at the NSE. Kenya Commercial Bank (KCB) will acquire some prime Imperial Bank branches following a takeover of the collapsed lender’s loan book;

Private Equity

In the FinTech investments space, London based Odey Asset Management, an investment firm that manages global capital from institutional investors, wealth managers, private banks and professional investors announced a USD 12.5 mn (Kshs 1.3 bn) equity investment in JUMO, an emerging market FinTech start-up that offers credit to individual, small businesses and banks through their mobile application. In hospitality, US based private equity firm Emerging Capital Partners (ECP) has acquired majority stake in the Kenyan based hospitality chain Artcaffé Group, for an undisclosed amount;

Real Estate

The Employment and Labor Relations Court Justice, Hellen Wasilwa, issued an interim order suspending the 1.5% levy that was to be deducted from the wages of formal industry workers, with a similar amount remitted by their employers to create the National Housing Development Fund, following the application made by the Central Organization of Trade Unions (COTU) on grounds that there was no public participation in its introduction and no guarantee of transparency in its implementation. Three developers, namely Laser Freight, Trio Properties and Salsabil Heights, presented plans to the National Environmental Management Authority (NEMA) for approval to develop 481 studio houses in Nairobi in South C, Parklands and Langata, respectively;

Focus of the Week

In this week’s focus, we review the attractiveness of Kenya as an investment destination for international investors. This follows the increased capital outflows because of the sell-offs by foreign investors due to rising interest rates in the U.S, coupled with a strengthening of the U.S Dollar. The note highlights areas of strength and areas of improvement to boost Kenya’s attractiveness as an investment destination;

- Njuguna Kimani, Financial Advisor, discussed how individuals should spend their finances during this festive season on Kameme TV. See Njuguna here

- The Ridge, a comprehensive lifestyle development at Ridgeways in Nairobi County, by Cytonn Real Estate, offers a live work play environment. To view show house images click here. The site is open to clients all week long.

- Following a successful transition to digital marketing, we shall progressively drop our outdoor advertisements, starting with the clock advertisements at Milimani, Upperhill and the Airport; we shall maintain street-pole advertisements;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects;

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers Section on our website to apply;

- Cytonn Centre for Affordable Housing (CCFAH) is looking for a 2-acre land parcel for a joint venture in; Kiambu County (Ruiru, Kikuyu, Lower Kabete), Nairobi County and its environs.

The parcel should be; i) fronting a main road, or not more than 800 metres from the main road and ii) priced at Kshs 20mn per acre or below. For more information or leads email us at affordablehousing@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills subscription rate improved during the week, with the overall subscription coming in at 93.9%, up from 23.8% recorded the previous week, partly attributed to improved liquidity in the money market as evidenced by the decline in the average interbank rate to 8.1%, from 10.2% recorded the previous week. Despite the improvement in T-bill subscription this week, T-bills remained under-subscribed for the 7th week in a row, due to the relatively tight liquidity in the money market. The subscription rate for the 91-day, 182-day and 364-day papers rose to 70.1%, 70.3% and 126.9%, from 23.3%, 16.1% and 31.7%, recorded the previous week, respectively. The yields on the 91-day T-bill remained unchanged at 7.3% while the yields on the 182-day and 364-day papers increased by 0.1% points to 8.3% and 9.7%, from 8.2% and 9.6% recorded the previous week, respectively. The acceptance rate declined to 87.3%, from 95.0% recorded the previous week, with the government accepting Kshs 19.7 bn of the Kshs 22.5 bn worth of bids received.

This week, the Kenyan Government went back to the primary market with a tap sale for the 10-year Treasury bond issue No. FXD 2/2018/10, with similar features as the initial issue floated the previous week in a bid to raise Kshs 13.8 bn. The coupon and yield are set at 12.5%. Last week, the government accepted Kshs 26.2 bn compared to a target of Kshs 40.0 bn at an average yield of 12.5%. The tap sale period is 9-days, from 18th December 2018, to 27th December 2018, or upon attainment of quantum, whichever comes first.

Liquidity:

The average interbank rate declined to 7.8%, from 10.2% recorded the previous week, while the average volumes traded in the interbank market remained unchanged at Kshs 15.4 bn. The lower interbank rate points to improved liquidity in the money market, mainly attributed to the end of the monthly Cash Reserve Requirement (CRR) cycle, on the 14th of December. The CRR is the percentage of deposits that commercial banks are required to keep with the Central Bank of Kenya. It is a mandatory requirement, and Kenya’s CRR currently stands at 5.25% of deposits held by a commercial bank. All commercial banks are required to maintain a CRR of 5.25% of their deposits for a month, ending on the 14th of every month, but can let the ratio get to a low of 3.0% during the month, as long as the average for the month gets to 5.25%. Towards the end of a cycle, banks are always under pressure to meet the requirement if they had not met it earlier on in the cycle, but after one cycle ends and another begins, the pressure on liquidity for banks reduces.

Kenya Eurobonds:

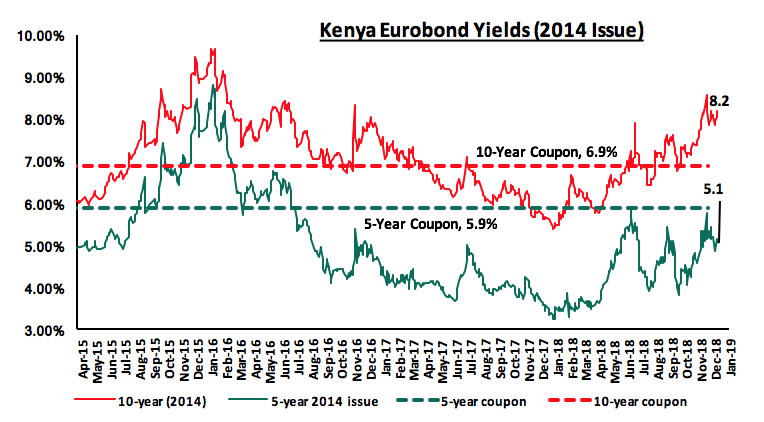

According to Bloomberg, the yields on the 5-year and 10-year Eurobonds issued in 2014 increased by 0.2% points and 0.3% points to 5.1% and 8.2%, from 4.9% and 7.9% recorded the previous week, respectively. Since the mid-January 2016 peak, yields on the Kenyan Eurobonds have declined by 1.5% points and 3.7% points for the 10-year and 5-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.5-years and 5.5-years to maturity for the 5-year and 10-year, respectively.

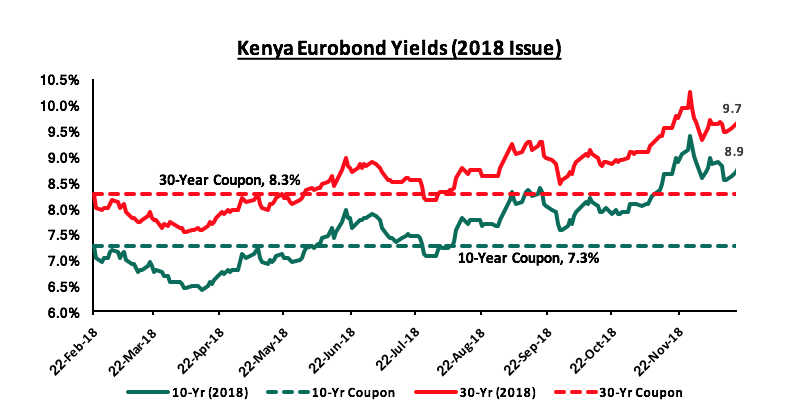

For the February 2018 Eurobond issue, during the week, the yields on both the 10-year and 30-year Eurobonds increased by 0.4% and 0.2% points, to 8.9% and 9.7%, from 8.5% and 9.5%, respectively. Since the issue date, the yields on the 10-year and 30-year Eurobonds have both increased by 1.6% points and 1.5% points, respectively.

Key to note however, yields in Eurobonds issued in the Sub-Saharan Region have been on the rise on a year to date basis, signalling higher risk perception by investors. This has partly been attributed to the increment in the Federal Funds Rate for the fourth time this year, currently at 2.25% - 2.50%, which has led to market correction in Eurobond yields in the emerging markets in the wake of rising US Treasury yields and a stronger US Dollar.

Kenya Shilling:

During the week, the Kenya Shilling gained by 1.1% against the US Dollar to close at Kshs 101.4, from Kshs 102.6 recorded the previous week, due to thin dollar demand from oil importers amidst the continued tight liquidity. The Kenya Shilling has appreciated against the US Dollar by 1.8% year to date, and in our view the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.3% in the 12-months to September 2018, from 6.5% in September 2017, attributed to improved agriculture exports, increased diaspora remittances, strong receipts from tourism, and lower food and SGR-related equipment relative to 2017,

- Improving diaspora remittances, which increased by 6.9% m/m growth in diaspora remittances in the month of October 2018 to USD 219.2 mn from USD 205.1 mn recorded in September. The y/y growth came in at 18.2% from USD 185.5 mn recorded in October 2017. Cumulatively, total diaspora remittances rose by 39.5% in the 12 months to October 2018, to USD 2.6 bn, from USD 1.9 bn recorded in a similar period in 2017. This has been attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient. For more analysis on this see our October Diaspora Remittances Note,

- CBK’s activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.0 bn, equivalent to 5.2-months of import cover, compared to the one-year average of 5.1-months and above the EAC region’s convergence criteria of 4.5-months of imports cover.

Inflation Projection:

We are projecting the inflation rate for the month of December to come in within the range of 5.3% - 5.7% compared to 5.6% recorded in November. We expect the m/m inflation for the month of December to rise mainly due to:

- The increase in Transport cost in the month of December as per historical data mainly due to higher bus fares associated with Christmas festivities, despite petrol prices declining by 3.9% to Kshs 113.5 from Kshs 118.1 per litre previously, while diesel prices have declined by 0.5% to Kshs 112.3 from Kshs 112.8, effective 15th December- 14th January 2018. The changes in prices have been attributed to the decline in average landing costs of imported super petrol by 8.5% to USD 694.2 per ton in November from USD 758.3 per ton in October. Landing costs for diesel declined by 2.6% to USD 722.2 per ton in November from USD 741.3 per ton in October, and,

- We expect the food and non-alcoholic index to rise marginally for the month of December due to a rise in prices of several food items, which outweighed the decline in others. For instance, maize flour prices have risen by 8.1% to Kshs 93.0 per 2 Kg bag from Kshs 86.0 in November. Wheat flour prices have risen by 8.9% to Kshs 122.0 from Kshs 112.0 for a two-kilo packet in August 2018.

The m/m rise in inflation for the month of December is however expected to be mitigated by a decline in housing, water, electricity, gas and other fuels index, as kerosene prices declined by 5.9% to Kshs 105.2 in December, from Kshs 111.8 in November. We also expect the effects of the lower costs in prices of electricity as from November, which saw the cost of consumption of 50 KWh of electricity declining by 31.4% to Kshs 758 from Kshs 1,105 in October 2018. Key to note, inflation for 2018 is expected to be within the government set target of 2.5%-7.5% having already averaged 4.6% for the 11-months to November, down from 8.3% in a similar period in 2017. The decline has mainly been attributed to a decline in food prices due to improved weather conditions, which has mitigated the increased fuel prices due to implementation of the 8.0% VAT on Fuel, as well as various tax amendments as per the Finance Bill 2018.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids, as it is currently 28.9% behind its pro-rated domestic borrowing target for the current financial year, having borrowed Kshs 96.6 bn against a pro-rated target of Kshs 136.0 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instrument.

Market Performance

During the week, the equities market was on a declining trend with NASI, NSE 20 and NSE 25 declining by 2.5%, 0.2% and 3.6%, respectively, taking their YTD performance to declines of 18.8%, 25.8% and 18.3%, respectively. The decline in NASI was driven by declines in large cap stocks such as EABL, Equity Group, and Bamburi, which declined by 11.1%, 7.6%, and 7.0%, respectively.

Equities turnover decreased by 31.3% during the week to USD 22.2 mn from USD 32.4 mn the previous week, taking the YTD turnover to USD 1.8 bn. Foreign investors remained net sellers for the week, with a net selling position of USD 4.2 mn, a 35.4% decrease from last week’s net selling position of USD 6.5 mn. We expect the market to remain subdued in the near-term as international investors exit the broader emerging markets due to the expectation of rising US interest rates coupled with the strengthening of the US Dollar.

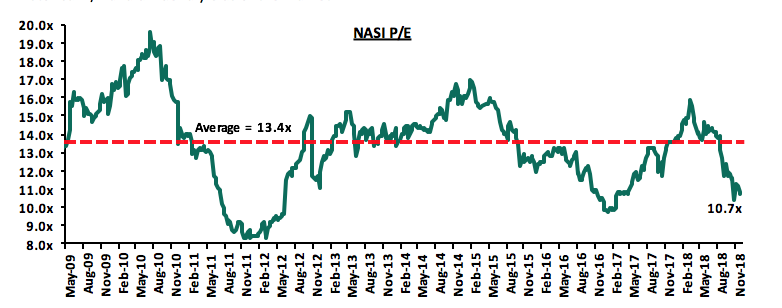

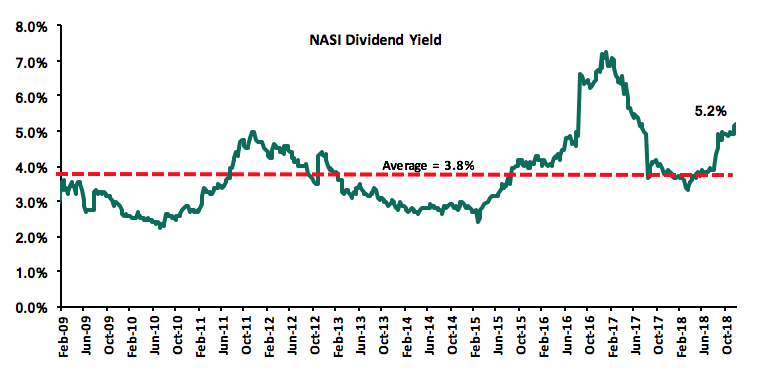

The market is currently trading at a price to earnings ratio (P/E) of 10.7x, 19.9% below the historical average of 13.4x, and a dividend yield of 5.2%, above the historical average of 3.8%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 10.7x is 9.6% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 29.2% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

The Nairobi Securities Exchange (NSE) this week launched an incubation and acceleration programme dubbed “Ibuka”, with the programme aimed at addressing the recent lack of listings at the NSE. According to the NSE, many companies share a common challenge of lack of detailed information and technical knowhow of the listing process and the opportunities available in the capital markets. The programme has attracted Expression of Interest from 13 companies including Tuskys Supermarket, while 10 other companies have shown a keen interest in participating. The programme involves two phases; the incubation phase and the acceleration phase. The incubation phase involves enhancing the participating companies financial, technical, operational,

commercial and strategic aspects of their business. This will be achieved through a panel of experts called Hosting Introducers, whose role is to take a critical look at the business model of the companies and offer a myriad of services including; restructuring the company’s financial, strategic, commercial, technical, operational and regulatory aspects, completely improving the models of these companies. The next phase of the programme is the acceleration phase, which will enable the participating companies to raise capital through debt and equity. This will be achieved through offering the companies access to a host of experienced financial advisors and consultants for expert advisory, and exposure to local and international investors. The programme, in our view, is a great initiative that will go a long way in increasing the number of listings in the NSE as the programme will sensitize companies on the importance of listing and prepare them for the process. The regulators should also focus on making the process of listing appealing to companies while still maintaining investor protection and not sacrificing minimum requirements for disclosure. For a detailed analysis on getting more companies to list on the NSE, see our topical Unlocking New Listings on the Nairobi Bourse.

Kenya Commercial Bank (KCB) will acquire some prime Imperial Bank branches following a takeover of the collapsed lender’s loan book. Imperial Bank had 27 branches when it went into receivership. Financial details of the takeover are however yet to be made public. Depositors now have access to approximately 12.7% of deposit balances through KCB. Imperial Bank went in to receivership on October 13th, 2015, with Kshs 58.0 bn in customer deposits and 52,398 deposit accounts, and operations in Kenya and Uganda. The Central Bank of Kenya (CBK) appointed KCB as an agent of Kenya Deposit Insurance Corporation (KDIC), the Imperial Bank Limited in Receivership (IBLR) manager, to disburse the funds to depositors. We expect consolidation in the sector, as smaller banks with depleted capital positions and not serving a particular niche are acquired as their performance deteriorates due to the sustained effects of the Banking (Amendment) Act 2015. We note that the industry needs fewer but stronger players to ensure the sector remains stable. We believe that the rate cap by the Banking Act has made businesses such as asset finance unattractive, probably one the reason that prompted the NIC / CBA merger, details of which we still await. Below is the list and metrics of recent bank deals:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

NIC Group |

CBA Bank |

30.6** |

Undisclosed |

Undisclosed |

N/A |

Dec-18* |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Limited Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

|

|

80.30% |

|

1.8x |

|

|

* Announcement date |

||||||

Changes in Corporate Governance

- Britam Holdings Plc announced the appointment of Mr. Christopher Minter to the Board of Directors effective 20th December 2018. Mr. Minter is the Head, Principal Investments & Acquisitions at Swiss Re. The appointment follows Swiss Re’s acquisition of 13.8% of Britam in June 2018. The appointment increased Britam’s score for Ethnic Diversity to 70.0% from 66.6%. The Proportion of Non-Executive Directors’ score also increased to 80.0%, from 77.8%. The Gender Diversity score however reduced to 20.0% from 22.2%. The appointment dropped Britam’s comprehensive corporate governance score to 70.8% from 72.9% and its rank to #24 from #21 because the appointment resulted in an increase of members to 10 from 9 previously, resulting in an even number of members, which is less favourable as it increases the risk of a deadlock in decision making

- Kengen Plc announced that three board members, Mr. Henry Rotich, Mr. Joseph Sitati and Mr. Maurice Nduranu, retired and being eligible offered themselves for re-election. Following the election, all three were re-elected. There was, however, no change in corporate governance ranking as all metric scores remained the same.

- HF Group announced the appointment of Mr. Robert Kibaara as the Group Chief Executive Officer taking over from Mr. Frank Ireri. There was, however, no change in corporate governance ranking as all metric scores remained the same.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

Banks |

Price as at 14/12/2018 |

Price as at 21/12/2018 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Equity Group |

39.0 |

36.0 |

(7.6%) |

(9.4%) |

65.8 |

5.6% |

74.5% |

1.7x |

|

KCB Group |

39.4 |

38.0 |

(3.7%) |

(11.2%) |

64.0 |

7.9% |

70.3% |

1.2x |

|

GCB Bank*** |

4.8 |

4.8 |

(0.4%) |

(5.5%) |

7.7 |

8.0% |

69.1% |

1.1x |

|

I&M Holdings |

86.0 |

85.0 |

(1.2%) |

(33.1%) |

138.6 |

4.1% |

65.3% |

0.9x |

|

Diamond Trust Bank |

148.3 |

149.0 |

0.5% |

(22.4%) |

231.0 |

1.7% |

57.6% |

0.9x |

|

Zenith Bank*** |

23.0 |

22.7 |

(1.3%) |

(11.5%) |

33.3 |

11.9% |

56.8% |

1.0x |

|

NIC Bank*** |

26.6 |

27.4 |

2.8% |

(19.0%) |

40.7 |

3.7% |

56.7% |

0.7x |

|

UBA Bank |

7.6 |

7.9 |

4.0% |

(23.8%) |

10.7 |

10.8% |

52.5% |

0.5x |

|

CAL Bank |

0.9 |

1.0 |

2.1% |

(11.1%) |

1.4 |

0.0% |

48.9% |

0.8x |

|

Co-operative Bank |

14.1 |

13.9 |

(1.4%) |

(13.1%) |

19.4 |

5.8% |

43.3% |

1.2x |

|

Ecobank0 |

7.5 |

7.0 |

(6.7%) |

(7.9%) |

10.7 |

0.0% |

43.1% |

1.5x |

|

CRDB |

150.0 |

150.0 |

0.0% |

(6.3%) |

207.7 |

0.0% |

38.5% |

0.5x |

|

Barclays |

10.8 |

11.1 |

2.8% |

15.6% |

13.9 |

9.0% |

37.7% |

1.5x |

|

Union Bank Plc |

6.1 |

5.6 |

(8.2%) |

(28.2%) |

8.2 |

0.0% |

33.6% |

0.6x |

|

Access Bank |

7.5 |

7.1 |

(5.4%) |

(32.5%) |

9.5 |

5.7% |

33.2% |

0.5x |

|

HF Group |

5.5 |

5.3 |

(2.9%) |

(48.7%) |

6.9 |

6.6% |

32.0% |

0.2x |

|

Stanbic Bank Uganda |

30.4 |

31.5 |

3.8% |

15.7% |

36.3 |

3.7% |

23.1% |

2.2x |

|

SBM Holdings |

6.0 |

5.9 |

(1.0%) |

(20.8%) |

6.6 |

5.1% |

14.4% |

0.8x |

|

Stanbic Holdings |

92.0 |

88.5 |

(3.8%) |

9.3% |

102.7 |

2.5% |

14.2% |

0.9x |

|

Guaranty Trust Bank |

35.0 |

33.8 |

(3.4%) |

(17.1%) |

37.1 |

7.1% |

13.1% |

2.1x |

|

Bank of Kigali |

279.0 |

278.0 |

(0.4%) |

(7.3%) |

299.9 |

5.0% |

12.5% |

1.5x |

|

Standard Chartered |

194.8 |

196.5 |

0.9% |

(5.5%) |

192.0 |

6.4% |

4.9% |

1.6x |

|

Bank of Baroda |

138.0 |

140.0 |

1.4% |

23.9% |

130.6 |

1.8% |

(3.6%) |

1.2x |

|

Standard Chartered |

20.3 |

20.0 |

(1.5%) |

(20.8%) |

19.5 |

0.0% |

(4.1%) |

2.5x |

|

FBN Holdings |

7.5 |

7.9 |

6.0% |

(10.2%) |

6.6 |

3.2% |

(7.8%) |

0.4x |

|

National Bank |

6.0 |

5.8 |

(3.3%) |

(38.0%) |

5.0 |

0.0% |

(16.7%) |

0.4x |

|

Stanbic IBTC Holdings |

45.6 |

46.0 |

1.0% |

10.8% |

37.0 |

1.3% |

(17.5%) |

2.4x |

|

Ecobank Transnational |

15.0 |

14.3 |

(5.0%) |

(16.2%) |

9.3 |

0.0% |

(38.1%) |

0.5x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. ****Stock prices indicated in respective country currencies |

||||||||

We are “NEUTRAL” on equities for investors with a short investment horizon. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for medium to long-term investors, and with expectations of higher corporate earnings supported by sectors such as banking sector, we are “POSITIVE” for investors with a long-term investment horizon.

JUMO, an emerging market FinTech start-up with operations in Kenya, Uganda, Tanzania, Ghana, Zambia, Pakistan, United Kingdom, Singapore and South Africa, that offers credit through their mobile application to individuals, small businesses and banks, announced that it had received a USD 12.5 mn (Kshs 1.3 bn) equity investment from Odey Asset Management, a London based investment firm that manages global capital from institutional investors, wealth managers, private banks and professional investors. The investment from Odey Asset Management marked the final close of their most recent round of funding that had earlier on, in September 2018, raised USD 52.0 mn (Kshs 5.3 bn) from Goldman Sachs, Proparco (the private sector financing arm of the French Development Agency AFD), Finnfund, Vostok Emerging Finance, Gemcorp Capital and LeapFrog Investments. For more information, see our Cytonn Q3’2018 Markets Review. This additional investment brings the total funds raised by JUMO to USD 103.0 mn (Kshs 10.5 bn). JUMO aims to use these funds to (i) further develop its technology platform, and (ii) support expansion into new Asian markets, in line with its 2019 expansion strategy. Since its launch in 2014, over 10 million people have borrowed and saved on the JUMO platform and the total loans issued are almost USD 1.0 bn.

We have seen similar deals this year that include;

- Branch International, a mobile-based microfinance institution headquartered in California, with operations in Kenya, Tanzania and Nigeria, raised Kshs 350.0 mn (USD 3.5 mn) in capital investment based on its second issued commercial paper in the Kenyan market. For more information, see our Cytonn Weekly #27/2018. Earlier on, in April 2018, Branch International raised USD 70.0 mn in Series B funding, which combined USD 50.0 mn in debt and USD 20.0 mn in equity for an undisclosed stake. For more information, see our Cytonn Weekly #15/2018,

- Lendable, a FinTech platform based in Kenya and the US, secured a Kshs 45.3 mn (USD 0.45 mn) convertible grant from the Dutch Government’s Micro and Small Enterprise Fund (MASSIF), managed by FMO, the Dutch Development Bank. In October last year, the firm announced that it had raised Kshs 671.0 mn (USD 6.5 mn) in a Series A round of investment. In April last year, the firm also secured Kshs 56.6 mn (USD 0.55 mn) debt financing for Raj Ushanga House (RUH), the Kenya distributor for Azuri Technologies Ltd, a leading provider of Pay-as-you-go (PayGo) solar energy solutions. For more information, see our Cytonn Monthly – August 2018, and,

- Musoni, a Kenyan microfinance institution, issued out Kshs 2.0 bn in debt notes with a tenor of 2 to 3-years and offering investors a chance to roll over funds instead of cashing in at maturity. The issue of the debt notes is to take place in four tranches of Kshs 500.0 mn each. The Kshs 2.0 bn debt note will be used to grow their loan book, which stood at Kshs 1.8 bn as at December 2017. For more information, see our Cytonn Weekly #26/2018.

The continued increase in investments and funding of microfinance institutions in Africa is in a bid to grow the institutions loan books to achieve competitive low-cost lending. In Kenya for instance, bank funding continues to be relatively expensive with banks having an average Annual Percentage Rate (APR) of 17.2%, (cheapest banks having an average (APR) of 13.0%, while the most expensive banks having an average APR of 24.9% as at December 2018), and as the private sector credit growth remains below the government target of 18.3%, having come in at 4.4% in September 2018. Bank funding accounts for 95% of business funding in Kenya compared to 40% business funding by banks in developed markets, which highlights the need to diversify funding sources, and enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly.

Emerging Capital Partners (ECP), a US based private equity firm has acquired a majority stake in Artcaffé Group, a Kenyan based hospitality chain. The stake acquired as well as the amount were undisclosed. This will not be the first deal that ECP has gotten into in the Kenyan hospitality sector as it had earlier on acquired Java House in 2012 and led the expansion strategy that saw the Java outlets increase from 13 to 60 by the time it sold its stake to Abraaj in 2017. Currently, Artcaffé Group operates 26 different restaurants in the country under its 5 distinctive brands; Artcaffé Coffee and Bakery, Dormans Coffee shops, OhCha Noodle Bar, Urban Burger Bar, and Tapas Ceviche Bar. The group has been operating for 10-years within the casual and quick-serve restaurant space in Nairobi. The acquisition by ECP will be beneficial to Artcaffé as; (i) the business will benefit from ECP’s experience and knowledge in running and managing multinational businesses, and (ii) it shall facilitate the business’s expansion strategy to increase its outlets and capitalize on the growing middle-class and increasing urbanisation, which has led to increased demand for international cuisine and casual, high quality dining experience.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and a stable macroeconomic environment will continue to boost deal flow into African markets.

- Retail Sector

Kenya’s retail sector has been vibrant over the past few years, attracting interest from renowned international retailers as well as the robust expansion of local retailers. The trend continues, and during the week, a leading coffee restaurant, Java House, opened its 62nd branch at Engen service station in Parklands. This is the second branch that Java House has opened in December 2018, following the opening of Lavington branch at Shell service station in Lavington. In our view, the Java House expansion in Kenya is supported by;

- Increased disposable income because of an expanding middle class thus creating demand for high-end restaurants and casual dining areas. According to KNBS Economic Survey 2018, private consumption expenditure recorded the highest growth, since 2013 when it recorded 8.4%, in 2017 by 7.0%, compared to 4.7% in 2016, 5.2% in 2015, and 4.3% in 2014,

- A positive demographic dividend, with a population growth rate of approximately 2.6% p.a. and a rapid urbanization rate of 4.3%, in comparison to the global 1.2% and 2.1%, respectively, hence an increase in demand for restaurants, and,

- Stable economic growth, with Kenya’s GDP growth averaging at 5.1% over the last five-years, and set to come in at 5.7% in 2018, according to Cytonn Research, thus, creating an enabling environment for the retailers to make desirable profits.

In our view, the Parklands area presents a viable opportunity for the business as (i) it hosts a large expatriate population who create demand for high-end restaurants, (ii) it is in close proximity to Westlands, a prime commercial hub, with several firms that regularly seek premises for business meetings, and (iii) it hosts high to middle income earners with high purchasing power, creating the restaurant’s target market. The continued expansion of Java House and other restaurants such as Mugg & Beans and Burger King in Nairobi will result in increased uptake of retail real estate developments thus improving the overall performance of the sector. For investors in retail real estate, with an average rent of Kshs 218.8 per SQFT, retail space in Parklands and Westlands records a high average rental yield of 12.4% and average occupancy rates of 90.2% compared to the market average rental yield of 9.4% and an occupancy rate of 83.7%, according to Cytonn Kenya retail sector report 2018. This therefore portrays Parklands as a viable investment destination for both retailers and retail real estate developers.

- Residential

During the week, three developers, namely Laser Freight, Trio Properties and Salsabil Heights, presented plans to the National Environmental Management Authority (NEMA) for approval to develop 481 studio houses in Nairobi in South C, Parklands and Langata, respectively. The three developers are seeking approval to develop the following concepts:

- Laser Freight seeks to develop a 12-level block hosting 143 studio apartments with 15 parking bays, a lap pool, a gym and laundry mats at Nairobi’s South C Estate,

- Trio Properties intends to develop 176 studio apartments in Langata, Nairobi on a 11-floor block, and,

- Salsabil Heights seeks to develop 162 serviced studio apartments in Parklands on a 12 floors block. (unit sizes and prices undisclosed).

The above areas are attractive to investors mainly driven by proximity to Nairobi’s main commercial business hubs, availability of social amenities, good infrastructure and relatively high demand as they host middle-income earners especially young adults seeking affordability and convenience. According to Cytonn Residential Report 2018, the target locations Langata, South C and Parklands, recorded a rental yield of 5.3%, 5.6% and 7.3%, respectively compared to the market average at 5.4%. Therefore, investors in these projects are likely to get the same returns once the projects are complete based on market trends, in addition to development return, which averages about 20% over the 3-year development period. The following table shows the performance of the above-named locations;

|

Residential Market Performance – Apartments 2018 |

||||||

|

Location |

Average Price Per SQM |

Average Rent Per SQM |

Average Annual Sales |

Average Rental Yield |

Average Price Appreciation |

Average Total Returns |

|

South B & C |

107,819 |

510 |

26.5% |

5.7% |

4.4% |

10.1% |

|

Parklands |

113,908 |

641 |

25.8% |

7.3% |

(1.3%) |

5.9% |

|

Langata |

107,374 |

462 |

23.2% |

5.3% |

0.3% |

5.6% |

|

Avg Market Performance |

99,052 |

463 |

23.9% |

5.8% |

2.9% |

8.8% |

|

· South B& C records the highest total return among the three areas, attributable to its proximity to key business nodes, thus, attracting demand especially from the young and working population in general |

||||||

|

· Parklands offers the highest rental yields at 7.3% due to relatively high rental rates, compared to the market average at 5.8%, however, it recorded a decline in price appreciation attributable to an increase in supply of apartments as investors move out of Westlands which is increasingly being commercialized |

||||||

Source: Cytonn Research 2018

In terms of serviced apartments, the Westlands & Parklands area recorded a rental yield of 10.6%, compared to a market average of 7.4% according to Nairobi Metropolitan Area Serviced Apartments Report 2018. Studio serviced apartments record the highest monthly charges at Kshs 3,965 per SQM with average occupancy rates of 82% and a rental yield of 13.5% compared to market average monthly charges of Kshs. 2,768 per SQM, occupancy rates at 75% and a rental yield of 9.5%, hence they are an attractive investment opportunity. We expect to see increased investment in residential property with investors targeting areas with demand for low to middle income housing units and with high returns in order to maximize on investors returns.

- Statutory Reviews

The Employment and Labor Relations Court Justice Hellen Wasilwa issued an interim order suspending the 1.5% levy that was to be deducted from the wages of formal industry workers with a similar amount remitted by their employers to create the National Housing Development Fund. This order holds until the hearing and determination of the application made by the Central Organization of Trade Unions (COTU). COTU had raised the application on grounds that there was no public participation in its introduction and no guarantee of transparency in its implementation. The levy, which was to take effect as from 1st January 2019, would have seen the government raise up to Kshs. 24.0 bn annually from the employees, with an additional Kshs. 24.0 bn from the employers, had it been effected. This figure is based on the Kenya National Bureau of Statistics, 2017 Statistical Index, which indicates the country’s wage bill in 2016 was Kshs 1.6 trillion. This ruling may be a setback to the government as the National Housing Development Fund (NHDF) is meant to help the government realize its goal of delivering 500,000 affordable housing units in the next four years. In our view, the National Housing Development Fund is a good initiative towards facilitating the achievement of the affordable housing initiative. Therefore, we recommend that the government should lay clear and transparent guidelines on management of the fund as well educate the public on its importance and functionality in order to win public trust. The government may also consider representation of the workers on the NHDF board to ensure proper usage of the funds. The government should also explore other avenues of funding such as the public markets and a review of the Public Private Partnerships (PPP) framework to facilitate the approvals process and to aid in establishment of Special Purpose Vehicles, thus encourage the involvement of the private sector, in order to achieve the affordable housing initiative.

In other real estate highlights, the Head of Public Service, Joseph Kinyua, suspended the demolitions of property, including those built on road reserves and riparian land buildings across the country, indefinitely. The directive comes in after a sequence of real estate property such as South End Mall along Langata road, Ukay Centre in Westlands and AirGate Mall along Outer Ring Road, among others, have been demolished in a bid to reclaim public and riparian land. In our view, while the reclamation of the public land is a prudent move, there has been lack of clarity on land earmarked as riparian land and the issuance of regulatory permits, hence there’s need for these to be aligned in order to enable developers conduct due diligence and adhere to set guidelines and approval processes. We hope that the suspension will create time for the government and other regulatory bodies to align with developers and create clarity to prevent a slowdown in the real estate sector where investors have adopted a wait and see attitude due to uncertainty of land ownership papers and regulatory permits during the sale of property.

We expect continued increase in activities in the real estate sector, particularly in the residential sector, supported by; (i) the large housing deficit mainly for the low income and lower-middle segment of the market, with a cumulative demand of 2 mn units growing by 200,000 units per year, according to National Housing Corporation, (ii) legal reforms in support of real estate, and (iii) government incentives and initiatives such as focus on affordable housing.

Africa remains an attractive investment destination for investors seeking attractive, long-term returns for a number of reasons, including abundant natural resources, improving economic indicators, and a growing population leading to a rise in consumption. GDP growth in Africa is expected to average 3.1% in 2018, higher than the 2.4% growth expected in advanced economies, according to the IMF. With West Africa generally suffering from volatility in commodity prices, and Southern African Development Community (SADC) having low GDP growth (1.6% in 2017), East Africa, whose economy grew by 5.9% in 2017, has emerged as an important and vibrant investment region in Africa due to a relatively diversified economy that contributes to stable economic growth. In addition to its strategic location as a gateway to the East African Region, Kenya hosts the largest expatriate community in the continent, has the most diversified economy in East Africa, and leads in terms of technological innovation, cementing its place as the regional hub of East Africa. This is evident from the significant number of multinationals and NGO’s that have chosen Nairobi as either their regional hub. A sample of the global brands that have selected Nairobi to set up shop include Google, General Electric, LG, Standard Chartered, Coca-Cola and Citibank NA.

With the year 2018 coming to a close, a number of factors during the year have led us to review Kenya’s attractiveness as an investment destination for foreign capital and local investors, which include:

- The Emerging Market selloff due to rising U.S Treasury yields and a strengthening U.S Dollar. Emerging markets have been on a downward trajectory during the year, with the MSCI Emerging Markets index having declined 13.4% YTD. Kenya’s capital markets have also been on a downward trend during the year, a phenomenon occasioned by the selloffs by foreign investors, which brought asset prices down. This is particularly because foreign investors account for a huge chunk of equity market turnover, though this has been declining, coming in at 60.1% in the year to December 2018, from 0% in 2017, and 70.0% in 2016,

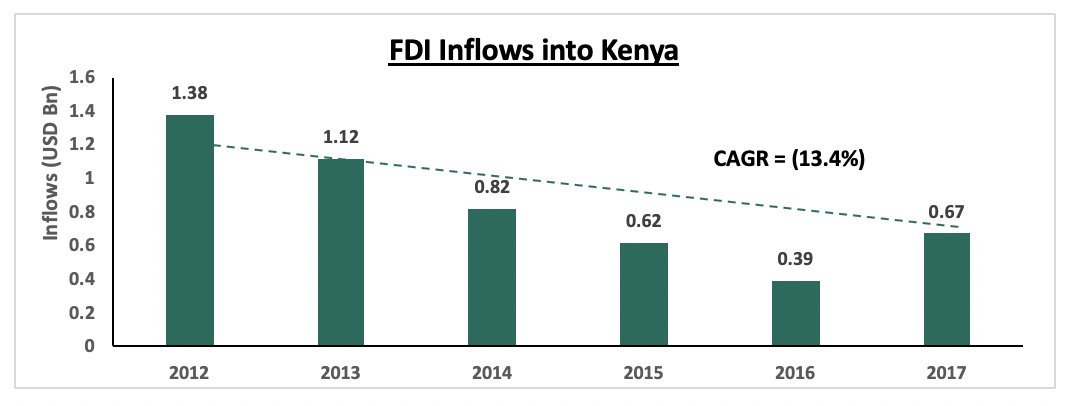

- In addition, foreign direct investment (FDI) into the country has declined at a compounded annual growth rate (CAGR) of (13.4%) in the five-year period from 2012 to 2017,

- The economy has been on a recovery trajectory, having expanded by 5.7% in Q1’2018 and 6.3% in Q2’2018, higher than the 4.8% and 4.7% growth in similar periods the previous year, respectively. The agriculture and manufacturing sectors are the main drivers of this growth, with a contribution of 23.2% and 9.6% in Q2’2018, respectively.

In this note, we analyse the Kenyan investment landscape in a bid to establish and review its attractiveness as an investment destination. The analysis will be broken down as follows:

- Macroeconomic Attractiveness,

- Foreign Direct Investments,

- Attractiveness of Kenyan Capital Markets,

- Ease of Doing Business,

- Other Investment Factors – Corruption Perceptions Index and Political Stability,

- Outlook on the Kenyan Investment Environment

Section I: Macroeconomic Attractiveness:

Macroeconomic fundamentals have remained positive during the year due to improved business environment and investor confidence. Factors contributing to the robust economic growth include:

- Macroeconomic Stability: Kenya has enjoyed relatively high GDP growth, with the economy having expanded by 5.7% in Q1’2018 and 6.3% in Q2’2018. The Central Bank has also remained disciplined in decisions relating to fiscal and monetary policy,

- Supportive Demographic Dividend: Kenya has a young population with increasing disposable income and growing demand for goods and services,

- Improvement in Governance: The Kenyan Government has enacted key political reforms that are strengthening governance. The Central Bank of Kenya adopted an expansionary monetary policy to encourage economic growth, while fiscal policies have also been expansionary as the country’s economic growth is mainly reliant on government spending, which has seen the expenditure side exceeding the revenue collections, leading to the budget deficits, which have been plugged in by borrowing.

- Inflation: Inflationary pressure has been relatively muted in 2018, with y/y inflation having averaged 4.5% in the 10-months to October, down from 8.7% recorded in a similar period in 2017, and well within the 2.5% - 7.5% government set target. The decline has mainly driven by a decline in the food prices on the back of improved food production due to improved weather conditions, which has mitigated the rise in fuel prices and other Consumer Price Index (CPI) components. Inflation in the remaining part of the year is expected to experience upward pressure due to the various tax amendments as per the Finance Bill 2018, but at a lower rate than earlier anticipated. This is due to the reduction of the VAT charge on fuel to 8.0% from 16.0% effective 21stSeptember 2018, affirming our expectations of a 7.0% inflation rate for the year from 8.0% last year, averaging within the government’s set target of 2.5% - 7.5%.

- Security: The political climate in the country has eased, with security maintained and business picking up. The handshake between the Kenyan President and the opposition leader served to calm any political tension. Kenya recently commenced direct flights to and from the USA, which is a sign of improving security in the country.

- Ease of Doing Business: It is considerably easier and quicker to do business than it was 10-years ago, with business opening up further to regional trade, and supportive infrastructure. Kenya has been improving steadily in the World Bank’s Doing Business Report, from position #136 in 2015 to position #61 in the 2019 report, with the score improving to 70.3 from 55.0, out of a possible 100 points.

- Investment in Infrastructure: There is a lot of investment in infrastructure including roads, rail, education etc.

With the above factors in play, we maintain a positive outlook on the Kenya’s macroeconomic environment.

Section II: Foreign Direct Investments

In 2017, global Foreign Direct Investment (FDI) inflows decreased by 23.0% to USD 1.43 tn, according to the World Investment Report by United Nations Conference on Trade and Development (UNCTAD). Despite the decline, Kenya saw FDI increase by 71.0% in 2017, to USD 672.3 mn, from USD 393.0 mn in 2016, buoyed by domestic demand and inflows into ICT industries, as well as additional tax incentives to foreign investors by the Kenyan Government, such as tax credit on foreign tax paid on business income. Since 2012, however, FDI into the country has been steadily decreasing at a CAGR of 13.4% since 2012. Most of the funds received by way of FDI in 2017 was channelled towards the ICT sector, with South Africa’s Naspers, MTN and Intact Software; as well as Boeing, Microsoft and Oracle from the U.S., expanding operations into Kenya. Other entrants into the Kenyan markets included UK beer company Diageo, and American pharmaceutical company Johnson & Johnson. FDI into Kenya is likely to grow, albeit at a slower pace, as the economy continues to recover from the ravages of 2017, as well as the need for foreign capital for infrastructure projects such as the Standard Gauge Railway, which will connect to East African countries when complete.

Section III: Capital Markets Attractiveness:

Kenya’s capital markets are the deepest and most sophisticated in East Africa, with 62 listed companies and a market capitalization of Kshs 2.1 tn (USD 20.0 bn) as at 18th November, 2018. Local regulators have made efforts to deepen liquidity and provide investment opportunities for foreign and domestic investors alike. Year-to-date (YTD), the Nairobi Securities Exchange All Share Index has declined by 17.0%, while the NSE 20 has declined by 25.1%, with the YTD turnover standing at USD 1.7 bn. There has been increased financial integration of the Kenyan capital market with the global financial system, which has exposed it to global liquidity and access to foreign capital. On the other hand, increased integration has rendered capital markets increasingly susceptible to global economic shocks hence increasing capital market volatility. Case in point is the trade spat between U.S and China that began in April, which prompted foreign investors to exit their holdings in emerging market assets in favour of rising U.S Treasury yields and a strengthening U.S Dollar.

Despite Kenya’s sophisticated capital markets relative to its East African peers, ease of entry and exit is hampered by restrictive regulation and low market liquidity, which contributes to high transaction costs. There is need for incremental structural improvements in order to make it more attractive as an investment destination. The Absa Africa Capital Markets Index Report, produced by Official Monetary and Financial Institutions Forum (OMFIF) in association with Absa Group Limited, provides insight into African capital markets and their strengths/weaknesses in attracting foreign investors. The report paints a picture of present positions and suggests how economies can improve market frameworks to meet yardsticks for investor access and sustainable growth. It focuses on six main pillars as a toolkit to strengthen financial markets:

- Market Depth - Examines size, liquidity and depth of markets and diversity of products in each market.

- Access to Foreign Exchange - Assesses the ease with which foreign investors can deploy and repatriate capital in the region.

- Market Transparency, Tax and Regulatory Environment - Evaluates the tax and regulatory frameworks in each jurisdiction, as well as the level of financial stability and of transparency of financial information

- Capacity of Local Investors - Examines the size of local investors, assessing the level of local demands against supply of assets available in each market

- Macroeconomic Opportunity - Assesses countries’ economic prospects using metrics on growth, debt, export competitiveness, banking sector risk and availability of macro data.

- Legality and Enforceability of Standard Financial Markets Master Agreements - Tracks the commitment to international financial market agreements, enforcement of netting and collateral positions and the strength of insolvency frameworks.

Kenya came out among the top countries in the Absa Financial Markets Index, attaining position #3 out of 20 countries ranked, behind South Africa and Botswana. The ranking, which improved from #5 in 2016, came on the back of a relaxation in capital controls, which augmented foreign investors’ ability to deploy and repatriate capital. Out of the 20 countries surveyed, Kenya comes as the second most active foreign exchange market with annual turnover of USD 34.0 bn, behind South Africa’s USD 1.2 tn in annual forex turnover. Despite the strengths, our capital markets can be improved to better attract and retain foreign capital for development purposes. Among the measures that can be taken to improve capital market attractiveness, include

- Encouraging more listings on the NSE, which may be done through privatization of state corporations, reviewing and amending restrictive rules to facilitate active participation in the capital markets, and engaging private equity firms to consider exits by listing.

- Innovation of structured products, that are tailor-made to meet different investors’ needs and expectations. There is need to reduce reliance on bank funding, currently at 95.0%, therefore structured products would assist in steering savings towards capital markets hence creating a more level playing ground and,

- Investor education to emancipate retail investors on investment products and the benefits of saving, in order to channel savings to the capital markets hence supporting market development.

Section IV: Ease of Doing Business in Kenya:

Kenya has made significant political and economic reforms that have driven sustained economic growth and social development over the past decade. Kenya’s economy remains among the most attractive business environments in Africa, according to the World Bank’s Doing Business Report 2019. In the 2018 report, Kenya’s ranking improved by 19 positions to #61 from #80 out of 190 countries ranked. In Africa, Kenya maintained its 4th position from last year’s report after Mauritius, Rwanda and Morocco. The score improved by 5.1 points to 70.3 from 65.2 in the 2018 Report. The improvement was because of improved protection of minority investors, access to credit, improved property registration and insolvency resolution. As highlighted in the report however, there exists room for Kenya to improve its business climate to attract more entrepreneurs and investors to start businesses and foreign direct investment. This can be achieved by;

- Streamlining the processes involved in starting a company by; (i) setting up a one-stop shop for all services required in starting a company, (ii) automating the processes involved, and (iii) eliminating minimum capital requirements.

- Improved sharing of credit information to facilitate lending decisions especially towards the private sector. Kenya should adopt additional sources of customer data, which generates incentives to improve borrower discipline especially following the enactment of Banking Act Amendment 2015 that effectively placed an interest rate cap on loans by commercial banks.

- The tax paying process can be made easier by (i) consolidating payments and filings of taxes, (ii) establishing taxpayer service centres, and (iii) allowing for more deductions, exemptions or lower tax rates.

- Kenya can improve on the efficiency of contract enhancement through (i) reducing the current case backlog by clearing inactive cases from the docket, (ii) automation of court and judicial procedures, (iii) complaints being filed electronically through a dedicated platform within the competent court, (iv) court fees being paid electronically within the competent court enforcing contracts, and (v) reducing the number of days taken to deliver case verdicts.

- There is need for further improvement on land and property registration, despite the marked improvements in this year’s report. For instance, the number of days required for property registration could be reduced from the current 49. The procedure should also be automated in order to reduce the complexity and timeline of registration.

- Corruption remains an adverse factor in the country and has had a great impact on the economy. We analysed this in detail in our Focus on Corruption. During the release of the Doing business report the World Bank gave a disclaimer that it does not factor in corruption in the ranking. As a result, the score does not indicate the extent to which corruption affects Kenya’s doing business environment. Comprehensive measures to handling corruption include (i) proper vetting of public officials by the Ethics and Anti-Corruption Commission, (ii) educating people on the effect corruption has on development, and (iii) independence of the judiciary in handling cases.

Section V: Other Investment Factors:

Kenya ranks position #143 in the Corruption Perception Index, out of 180 countries surveyed, with a score of 28 out of 100 possible marks. The Kenyan President, Uhuru Kenyatta, has been vocal in his appeal to Kenyans to join efforts in the fight against corruption and has also recently taken decisive steps to combat corruption. He has essentially changed leadership at all the key law enforcement agencies that are responsible for fighting corruption. Opportunities for improvement include:

- Political will, which appears as the single most important ingredient to fight corruption. The Kenyan President has demonstrated a political will to fight the vice, but the sustainability for the long haul remains important. It is also important that this political will is shared by all coalitions of the government and the opposition for it to cascade nationally,

- We need to develop and publicize a system where the public can anonymously report corrupt activities,

- Inculcate a sense of anticorruption spirit in the public, especially given that we tend to look at corruption from a tribal prism, where we look aside when our own is corrupt.

- We need to see real and high-level convictions to restore public confidence in the system and make the price high for high-ranking officials who engage in corruption.

The political climate in the country has eased, with security maintained and business picking up. The handshake between the Kenyan President and the opposition leader served to calm any political tension. Kenya recently commenced direct flights to and from the USA, which is a sign of improving security in the country. We expect security to be maintained in 2018, especially given that there is relative calm as the two principals, alongside other legislators across the political divide, work together towards combating corruption and promoting economic transformation agenda.

Section VI: Outlook on the Kenyan Investment Environment:

|

Factor |

Description |

Outlook |

|

Macroeconomic Attractiveness |

Macroeconomic fundamentals are robust, and are likely to keep improving with the continued economic recovery |

Positive |

|

Foreign Direct Investments |

FDI has been declining in Kenya since 2012, although there was an increase in FDI inflows in 2017. Concerns of slowing global growth hamper foreign investment, although robust growth is likely to keep attracting foreign capital |

Neutral |

|

Capital Markets |

Kenyan markets have improved in terms of access to foreign exchange, although more needs to be done to improve liquidity and depth |

Neutral |

|

Ease of Doing Business |

Kenya has been improving in ranking, signalling a more accommodative business environment |

Positive |

|

Other Investment Factors |

The Executive is showing commitment to the fight against corruption, there has also been relative security leading to the commissioning of direct flights between Nairobi and New York |

Positive |

Out of the factors analysed, three have a positive outlook while two are neutral. In conclusion, therefore, Kenya needs to boost capital market depth in order to attract foreign investors with the promise of more liquid markets. This may be achieved through development of new investment vehicles that suit investors’ needs, as well as encouraging more listings on the Nairobi Securities Exchange for improved liquidity and access to capital, as highlighted in our focus on Unlocking New Listings on the Nairobi Bourse. Such remedies, coupled with robust economic growth expected over the medium-term, will improve the investment landscape in the country, thereby making it more attractive to foreigners as a preferred investment destination.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, CAML is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor